Source: Company reports

2Q 2016 RESULTS

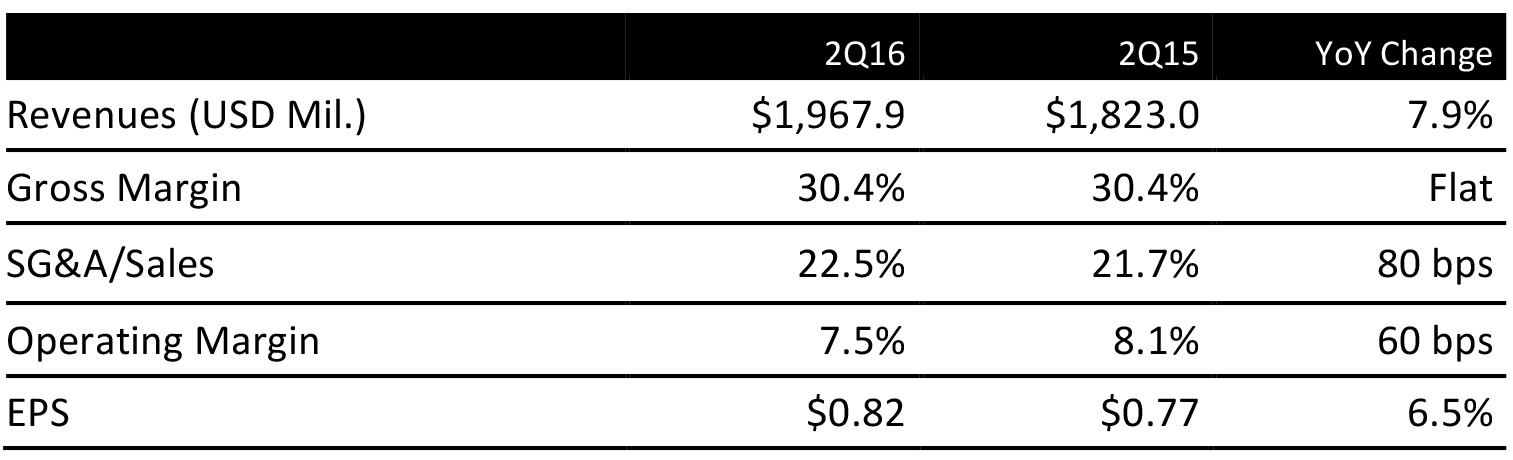

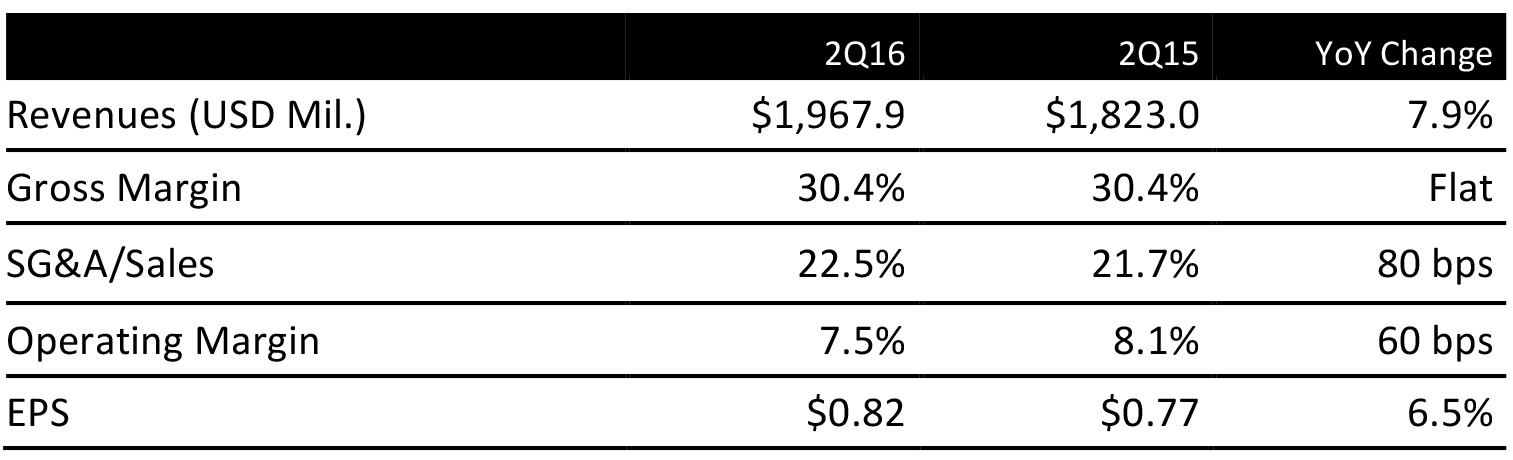

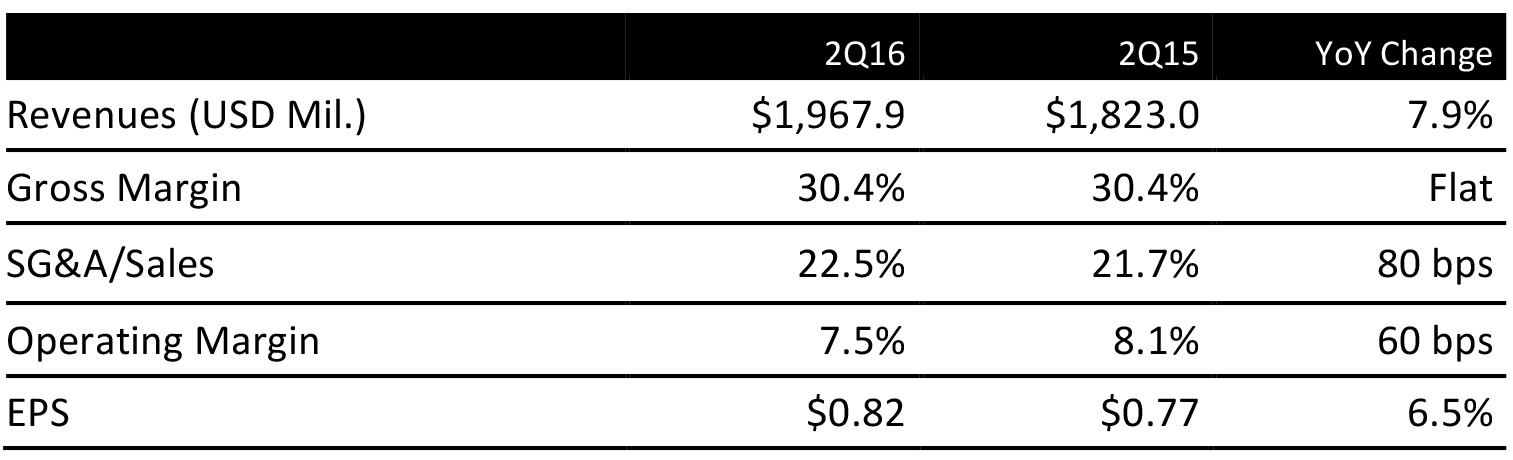

Dick’s Sporting Goods reported 2Q 2016 EPS of $0.82 compared to $0.77 a year ago, and exceeded its previous guidance of $0.62–$0.72. The result surprised analysts who expected the EPS to be $0.69.

Total revenues were $1.97 billion, up 7.9% from last year and 4.8% more than the consensus estimate of $1.88 billion. Same-store sales climbed 2.8%. The company had expected a decline between 1% and 4% and consensus was that comps would be down 2.2%.

This quarter’s performance was primarily due to lower than anticipated liquidation pressure from Sports Authority and Sport Chalet in Dick’s key markets, its strong e-commerce performance and good merchandise strategy.

The Sports Authority and Sport Chalet were selling their inventory at discount, but the liquidation, which removed about $400 million worth of inventory from the market, was completed sooner than expected and had a smaller negative impact than anticipated.

Dick’s Sporting Goods improved its e-commence penetration to 8.5% of total net sales for Q2 2016, up from 7.3% last year. E-commerce grew 26% in the quarter. Some of the newly converted online customers could have come from its previous rivals.

Most of the company’s categories grew with the exception of golf. Management highlighted the benefits of the Pittsburgh Penguins and Cleveland Cavalier championships to its license business for the quarter. Other strong performing categories included outdoor products and footwear. Footwear has been a key area of investment for the company. As of 2Q 2016, Dick’s Sporting Goods owns 117 premium full-service designated footwear display areas (which the company refers to as decks) and has seen positive early results. It will have an additional 70 decks by holiday 2016.

2016 OUTLOOK

Dicks Sporting Goods raised its FY 2016 EPS guidance to $2.90–$3.50 from $2.60–$2.90 previous guidance. Comps sales are expected to grow 2%–3%, versus the previous expectation of -1%–1% and last year’s reported 0.2% decline. The guidance does not include costs to convert former Sports Authority Stores to Dick’s Sporting Goods stores. The company purchased Sports Authority’s intellectual property which included the website, customer information, private brands, loyalty programs and 31 store leases in June 2016.

Store growth in new and underrepresented markets is a priority for Dicks Sporting Goods. It expects to open 36 new Dick’s Sporting Goods stores, relocate nine Dick’s stores, open seven Field & Stream stores and two new Golf Galaxy stores. The company plans to spend $275 million in capital expenditures on a net basis and $450 million on a gross basis for 2016 compared to $204 million and $370 million in 2015 respectively. Much of the capital will be spent on store openings and store banner changes. The company expects to complete the bulk of its 2016 store development program in the upcoming third quarter.

The company is optimistic about integration with the acquired Sports Authority assets. The acquired customer information will help Dick’s Sporting Goods gain additional share in key markets. The acquired store leases are located in new and underrepresented markets such as California and South Florida. Management is confident it will capture meaningful market share in the long term.

Sports Authority also hopes to grow its business through private label brands. It is pleased with the offerings of CALIA, Field & Stream, Quest, Umbro, Top Flite and Maxfli, and expects to generate a total of $1 billion annual sales from these brands over the next few years.