Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

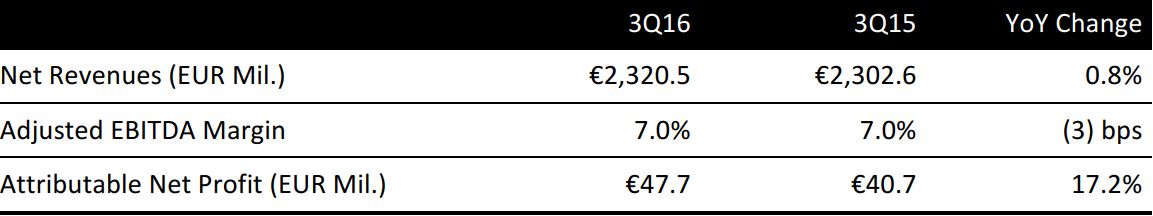

Spanish discount grocer Distribuidora Internacional de Alimentación (DIA) reported net revenues of $2,320.5 million in 3Q16, up 0.8% year over year and below the consensus estimate of €2,349.4 million. Revenues increased 8.7% at constant currencies.

Comps were up by 10.0%, excluding calendar effects. For the period, the adjusted EBITDA margin remained mostly flat at 7.0%, but EBITDA grew by 0.4% in reporting currency and by 5.8% at constant currencies.

Attributable net profit grew by 17.2% year over year, to €47.7 million. After adjusting for non-recurring items, the underlying net profit was €61.1 million, down by 4.4% year over year, and by 0.6% excluding currency effects.

BY GEOGRAPHIC REGION

Iberia

In the quarter, net sales in Iberia (Spain and Portugal) declined by 1.7%, to

€1,479.5 million. The contribution from the consolidation of the new Eroski stores was €10.1 million. The company noted that sales in the region were impacted by some store closures, the remodeling of 67 stores and the ongoing transfer of stores to the franchised model. It also said that the performance in Portugal outpaced that of Spain.

Comps were up 1.3% in the quarter, excluding a negative calendar effect of 0.1%. Adjusted EBITDA declined by 0.2%, to €130.9 million. DIA noted that total operating expenses were beginning to ease as it completed the consolidation of acquired stores. CEO Ricardo Currás mentioned that DIA continues to reinvest synergies from purchasing and integration into product-pricing and services.

Emerging Markets

In the emerging markets of Brazil, Argentina and China, DIA saw sales climb by 28.5% in 3Q16 at constant currency, to €841.0 million. But in reporting currency terms, sales grew by 5.5%. The company noted that sales growth in Brazil accelerated, while Argentina maintained “good growth momentum.”

Comps bounced by 22.5%, excluding a calendar effect of +0.1%. This is the highest comparable sales growth the company has reported for the region since it listed on the stock market in 2011.

Adjusted EBITDA grew by 32.4%, excluding currency effects. Including currency effects, it grew by 3.1%. The company noted that the 8% appreciation of the Brazilian Real against the euro impacted the performance in reporting currency.

Other Notable Developments

DIA noted that it has successfully launched its app in Spain and has over 275,000 users. Another development highlighted was its partnership with Amazon’s Prime Now one-hour grocery delivery service. The company noted that its “La Plaza del DIA” fascia on Prime Now has seen “very good reception among customers.” It added that there has been a higher adoption of private-label products through this channel than through its physical stores.

OUTLOOK

The company expects to achieve 10% growth in gross sales and 4–5% growth in adjusted EBITDA, both at constant currencies, in FY16. Currás stated that top-line growth and cash-flow generation are top priorities for DIA, so there will be no further capital expenditure in remodeling stores for the rest of the fiscal year. He added that the company may look at potential acquisitions next year.

Analysts estimate FY16 net revenue to be €8,997.7 million, with an EBITDA of €611.0 million and net profit of €216.2 million.