Source: Company reports/Fung Global Retail & Technology

FY16 Results

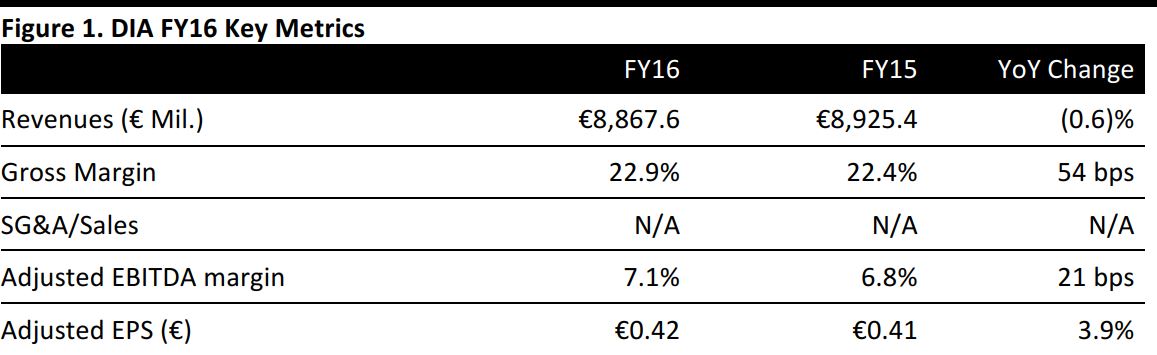

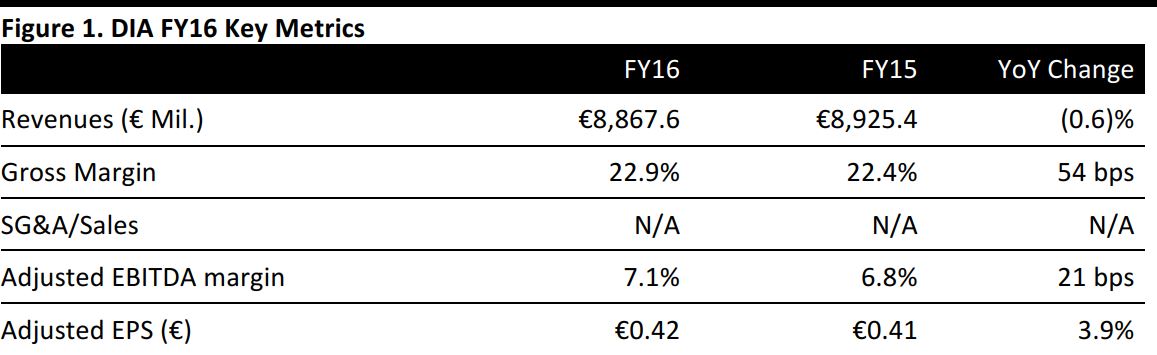

Spanish discount grocer Distribuidora Internacional de Alimentación (DIA) reported net sales of €8,867.6 million for FY16, slightly behind the consensus estimate of €8,953.9 million and up by 9.0% excluding currency effects, but down 0.6% as reported. Gross sales grew by 10.2% excluding currency effects to €10.6 billion, as forecast by the company.

Gross margin grew by 54 basis points to 22.9%, above analysts’ estimate of 22.4%, and comps were +8.7% at constant currency, with positive growth across all countries in which it operates.

Adjusted EBITDA grew by 7.0% as reported and by 8.6% excluding currency effects to €625.1 million, exceeding its forecast of 4%–5% growth excluding currency effects for FY16. The adjusted EBITDA margin expanded by 21 bps to 7.1%, which DIA attributed to cost-savings from purchasing synergies and due to economies of scale from its business in the emerging markets.

Adjusted EPS increased by 3.9% to €0.42, ahead of the €0.39 consensus.

4Q16 Results

In 4Q17, DIA’s net sales increased by 1.0% as reported and by 6.1% excluding currency effects to amount to €2,304.0 million, but came in below the consensus estimate of €2,409.4 million.

Performance by Geographic Segment

Iberia

Iberia, which comprises DIA’s business in Spain and Portugal, is the company’s largest segment, contributing to nearly 65% of net sales. Net sales in FY16 declined by 0.2% to €5,064.0 million in Spain, and in Portugal, edged up by 0.6% to €681.9 million. Comparable sales in the region grew by 1.0%.

The firm ascribed the soft performance to the closure of some underperforming stores in Spain, improvements to some stores throughout the year and the ongoing transfer of stores under the COCO banner to the franchised network.

Emerging Markets

In the emerging markets of Brazil, Argentina and China where DIA operates, FY16 sales declined by 1.5% as reported, but jumped by 25.7% excluding currency effects to €3,121.7 million. Comparable sales growth was 19.1% at constant currency.

Excluding currency effects, sales in Argentina grew the most (+36.5%) to €1,310.9 million. Sales in Brazil grew by 17.3% to €1,611.9 million and sales in China increased by 3.4% to €198.9 million. DIA said that its market share in Argentina and Brazil continued to grow during the year, as the private label offer was improved across stores.

Outlook

DIA expects “mid-single-digit growth in gross sales” for the coming fiscal year, as it intends to downsize its selling area in Spain and anticipates lower inflation in the emerging markets where it operates. The company expects adjusted EBITDA to grow and the margin to remain stable in FY17, and will budget capital expenditure to decline.

DIA reiterated the targets it had laid out for the 2016–2018 period, of:

- €750 million of accumulated cash from operations.

- Organic gross sales, excluding currency effects, to grow by 7%.

For FY17, analysts expect net sales to grow by 8.4% to €9,616.3 million and adjusted EBITDA to climb by 2.0% to €637.4 million. The consensus estimate is for FY17 adjusted EPS of€0.41. Note that these consensus figures were collated before the FY16 results.