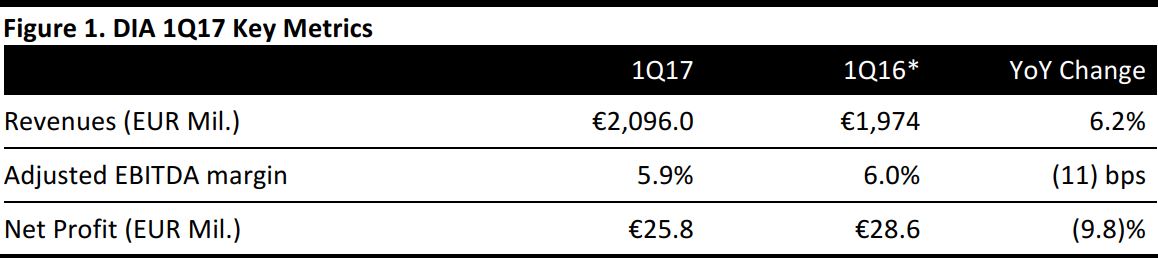

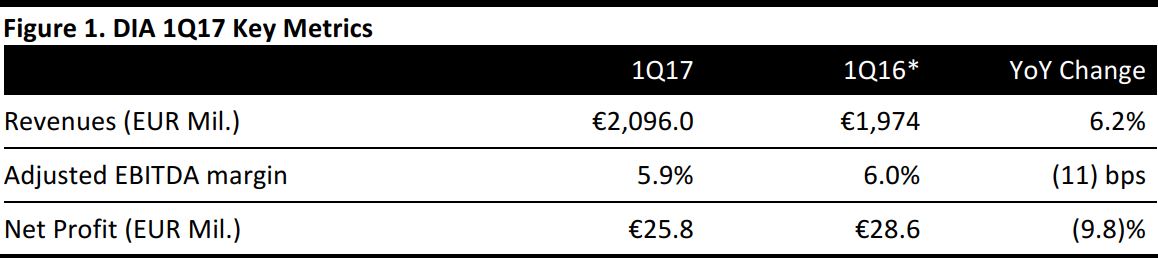

*The results of DIA China are presented as discontinued operations in 1Q17, in accordance with accounting standard IFRS 5, as the group “has initiated a process to explore strategic options for its activities in the region.” DIA did not publish the restated results for 1Q16, so our figures are inferred from growth rates.

Source: Company reports/Fung Global Retail & Technology

1Q17 Results

Spanish supermarket group Distribuidora Internacional de Alimentación (DIA) reported1Q17 net sales of €2,096.0 million, slightly below the consensus estimate of €2,161.8 million and up by 6.2% as reported (up 2.2% excluding currency effects). Comps were up by 4.1%, excluding calendar effects. Strong performance in emerging markets drove growth.

The adjusted EBITDA margin softened by 11 basis points, as it improved only slightly in Iberia and the emerging markets—the two major geographic segments it reports on.Net profit fell by 9.8% as reported (down 10.1% at constant currency), due to higher financial expenses in the emerging markets and a larger volume of taxes during the period.

Performance by Geographic Segment

Iberia

Iberia, which comprises DIA’s business in Spain and Portugal, is the company’s largest segment, contributing nearly 62.7% of net sales.In this region, net sales dropped by 2.7% to €1,319.0 million, mainly due to the closure of some underperforming stores in Spain, which reduced commercial space by 2.6%. Comparable sales grew by 0.8%.

The positive calendar effect of Easter in Spain was offset by the comparison with 2016, which was a leap year, according to DIA.

Emerging Markets

Emerging markets comprise DIA’s operations in Brazil and Argentina, and formerly included China, too. DIA has accounted for business in China as discontinued operations starting from 1Q17 and did not provide additional information other than stating that it is exploring strategic options for it.

Net sales in Brazil and Argentina bounced 25.6% as reported, to €777 million, mainly due to the sharp appreciation of the Brazilian real. Stripping out currency effects, sales jumped 12.8%.

Comparable sales growth was 10.1%, excluding calendar effects. DIA said that comparable sales growth slowed, mainly due to the significant decline in food inflation in Brazil and Argentina during the quarter.

Outlook

DIA reaffirmed its full-year financial targets for FY17. During the release of it FY16 statement, DIA had reiterated the targets it had laid out for the 2016–2018 period, of:

- €750 million of accumulated cash from operations.

- Organic gross sales, excluding currency effects, to grow by 7%.

For FY17, analysts expect net sales to grow by 6.6% to €9,455.6 million and adjusted EBITDA to rise by 2.9% to €643.5 million. The consensus estimate for FY17 adjusted EPS is €0.43, indicating 2.4% growth.