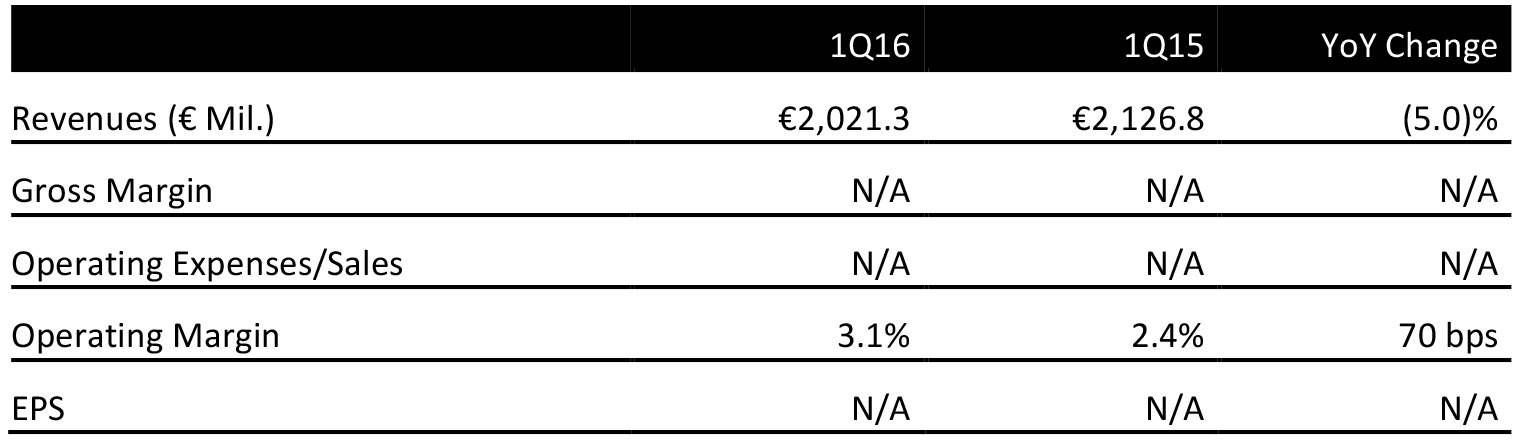

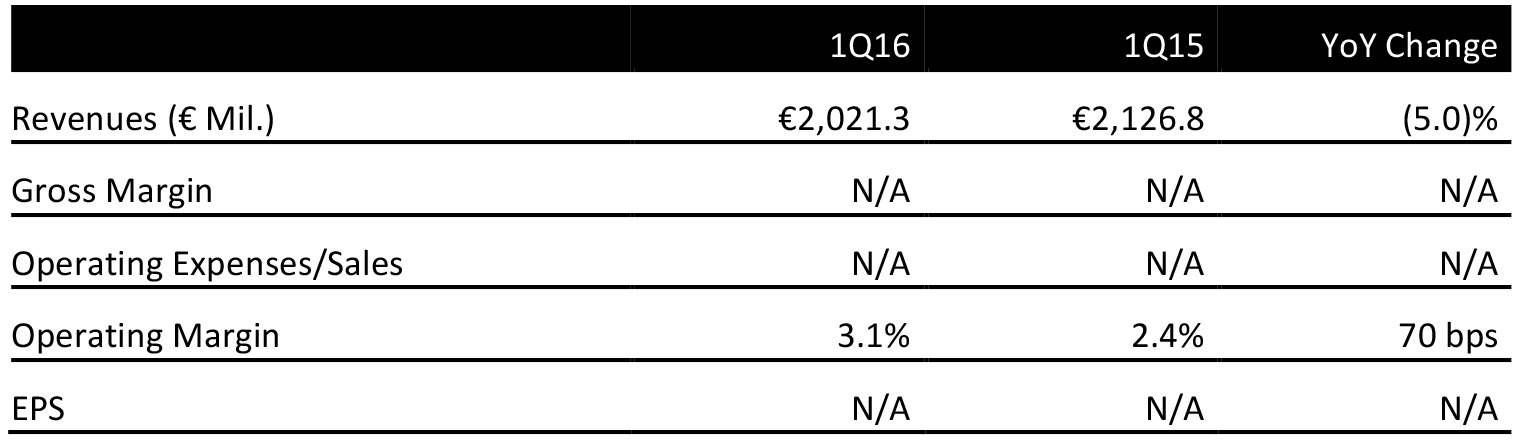

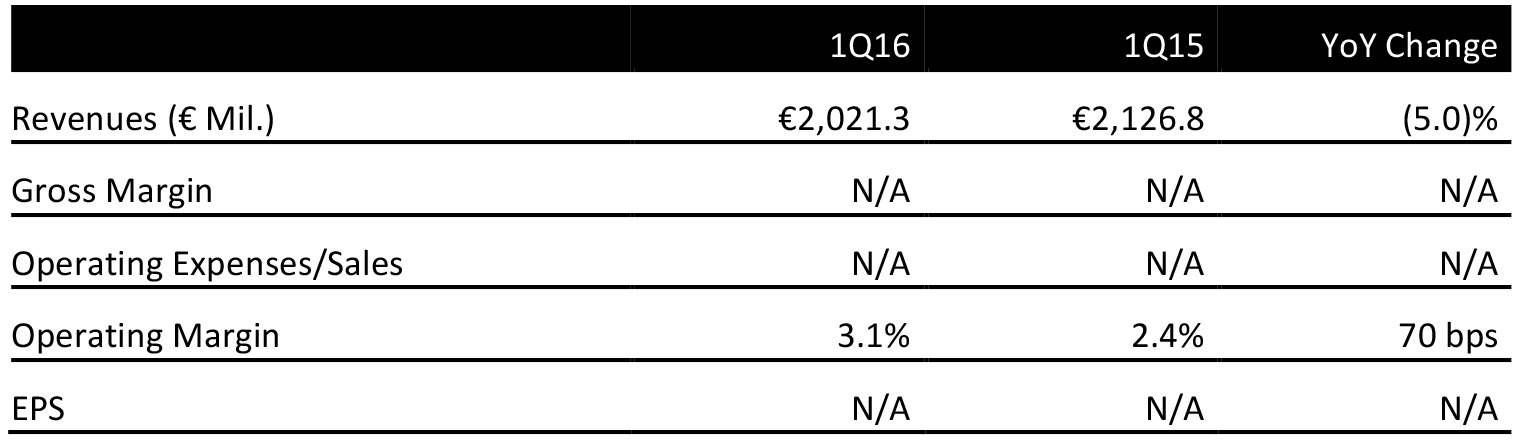

Fiscal quarters ended March 31

Source: Company reports

1Q16 RESULTS

Madrid-listed grocery retailer DIA reported a 1Q16 revenue decline of 5.0%, to €2.0 billion, which was below the consensus estimate of €2.1 billion. Comparable sales excluding calendar effects grew by 7.0%. Adjusted EBITDA was down 1.2%, to €117.0 million, just below consensus of €117.8 million. Adjusted operating profit decreased by 7.9%, to €62.3 million, also below consensus, which was for €63.3 million.

Revenue and profitability were hit by unfavorable currency effects, due to the depreciation of the Argentine peso and the Brazilian real. Currency depreciation had an impact of (13.9)% on net sales and of (6.9)% on adjusted EBITDA. Excluding currency effects, sales were up 8.9% and adjusted EBITDA was up 5.7%, but operating profit remained negative, declining by 2.5% versus 1Q15.

In Iberia, revenue was up 0.6%, to €1.4 billion, but comparable store sales decreased by 0.3%. The integration of recently acquired outlets from Eroski and El Arbol contributed to performance in the region, but caused depreciation to increase by 12.4%.

In the Emerging Markets segment, sales declined by 14.6%, to €665.8 million, and were heavily affected the abovementioned currency effects. In local currencies, revenue for the segment was up 23.3% and comparable store sales increased by 15.6%.

2016 OUTLOOK

For FY16, DIA expects gross revenue at constant currency to post high-single-digit growth. The company expects adjusted EBITDA in constant currency to grow and the EBITDA margin to be stable. DIA expects its rate of depreciation and amortization growth to slow in the second half of FY16 as it further integrates its Eroski and El Arbol assets.

Analysts expect the company to achieve €9.0 billion in revenue, €612.0 million in EBITDA and €388.2 million in operating profit in FY16.