Web Developers

Spanish grocery retailer DIA hosted its third Capital Markets Day in London on June 21, and the Fung Global Retail & Technology team was in attendance.

DIA focused on the following themes:

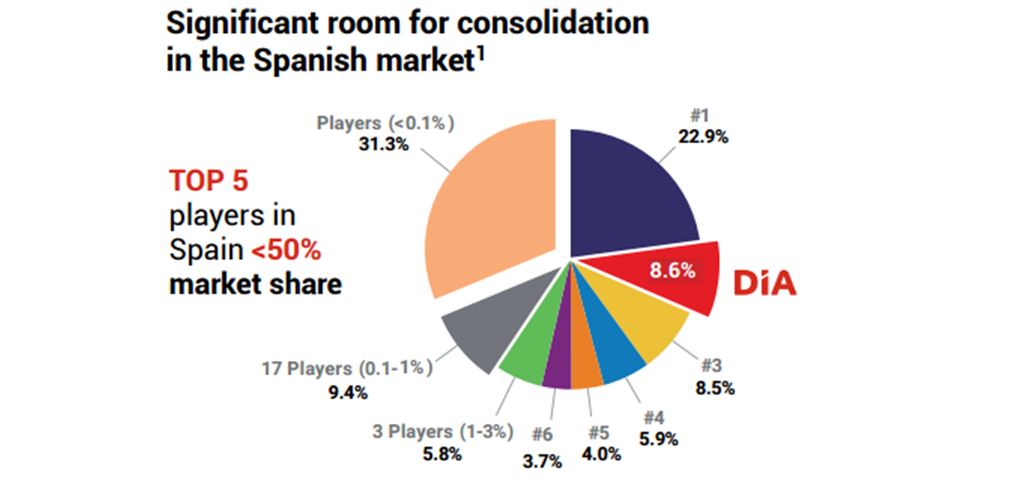

In addition, DIA sees scope for consolidation in the Spanish grocery sector, which remains relatively fragmented. In the Q&A section of the meeting, an attendee asked management if the company has plans to drive this consolidation, and executives responded that they expect this process to occur naturally as smaller independent players fall out of the market. Management cited the investments needed in technology as one reason smaller operators may struggle to compete with larger retailers such as DIA.

- Customer centricity is driving decision making.

- Dynamic growth in emerging markets in Latin America is supporting top-line expansion.

- Operational efficiencies are enabling low prices.

- The company will be “100% customer centric” within 18 months.

- It will use digital channels to interact with customers, develop new channels through which to sell and communicate, and gain efficiency.

Customer Centricity Drives Decision Making

Management strongly emphasized that the company has been following a strategy of customer centricity since 2012. The strategy puts customer data and views at the heart of decision making. DIA has captured customer data through its loyalty card, which has a 90% adoption rate, as well as through focus groups and online customer feedback tools. One takeaway from this customer focus has been that, while price remains the number one reason for choosing a retailer, shoppers’ expectations have increased in terms of product ranging, in-store experience and omnichannel services. DIA has been refitting and reformatting stores in its legacy Iberian business. It has also used data to reduce out-of-stocks and improve ranging.Dynamic Growth in Emerging Markets to Fuel Revenue Increases

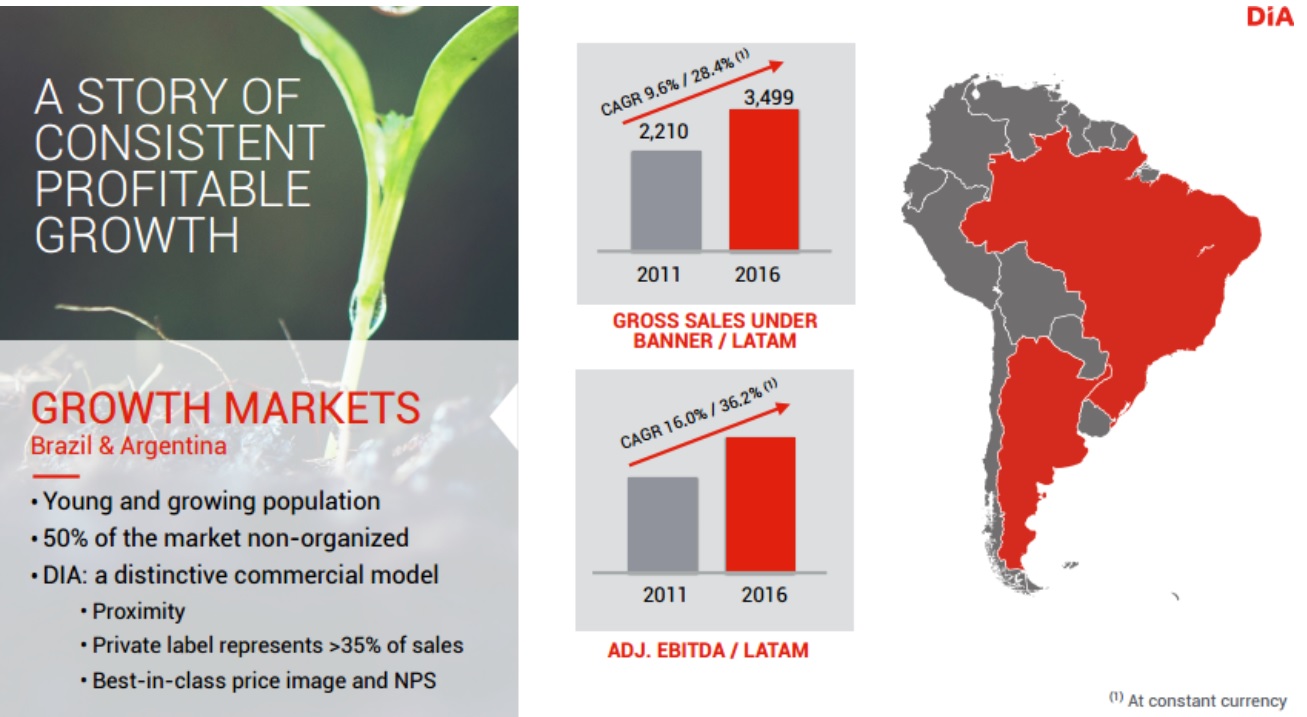

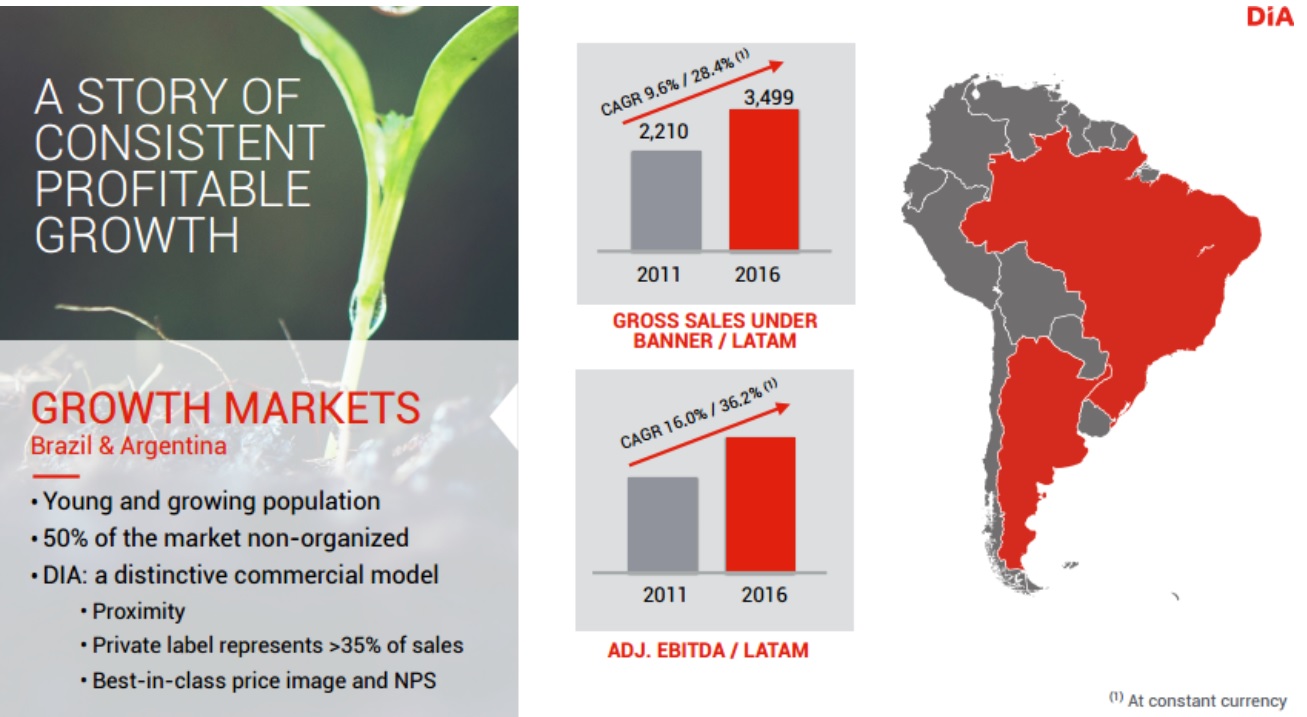

DIA’s growth has been fueled by two elements: acquisitions in its traditional markets of Spain and Portugal and strong growth in Latin America. From 2011 through 2016, DIA grew sales in Brazil and Argentina by a compound annual growth rate (CAGR) of 28% at constant exchange rates and grew EBITDA by a CAGR of 36%.

Revenue and EBITDA growth in Brazil and Argentina Source: DIA 2017 Capital Markets Day presentation

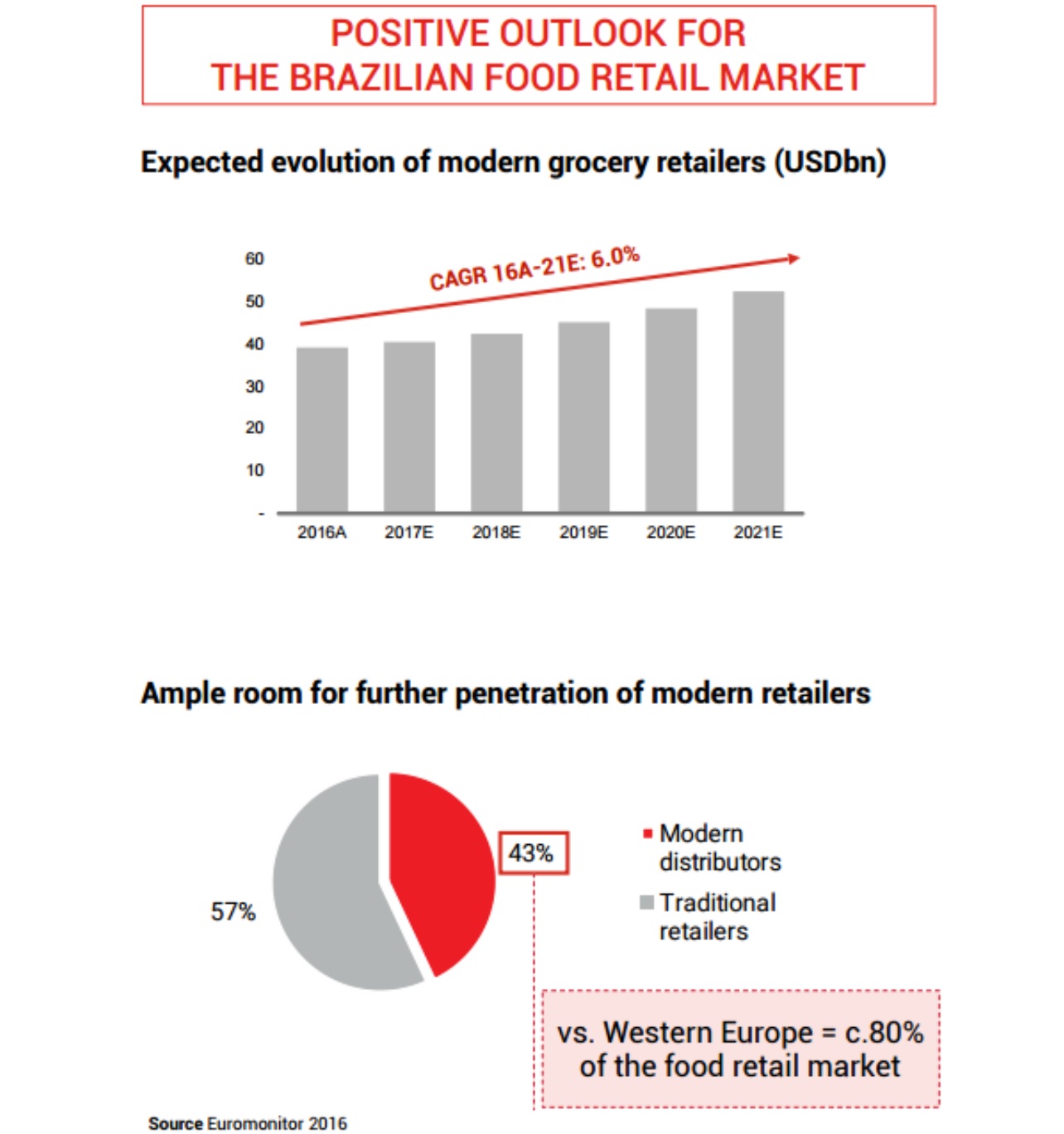

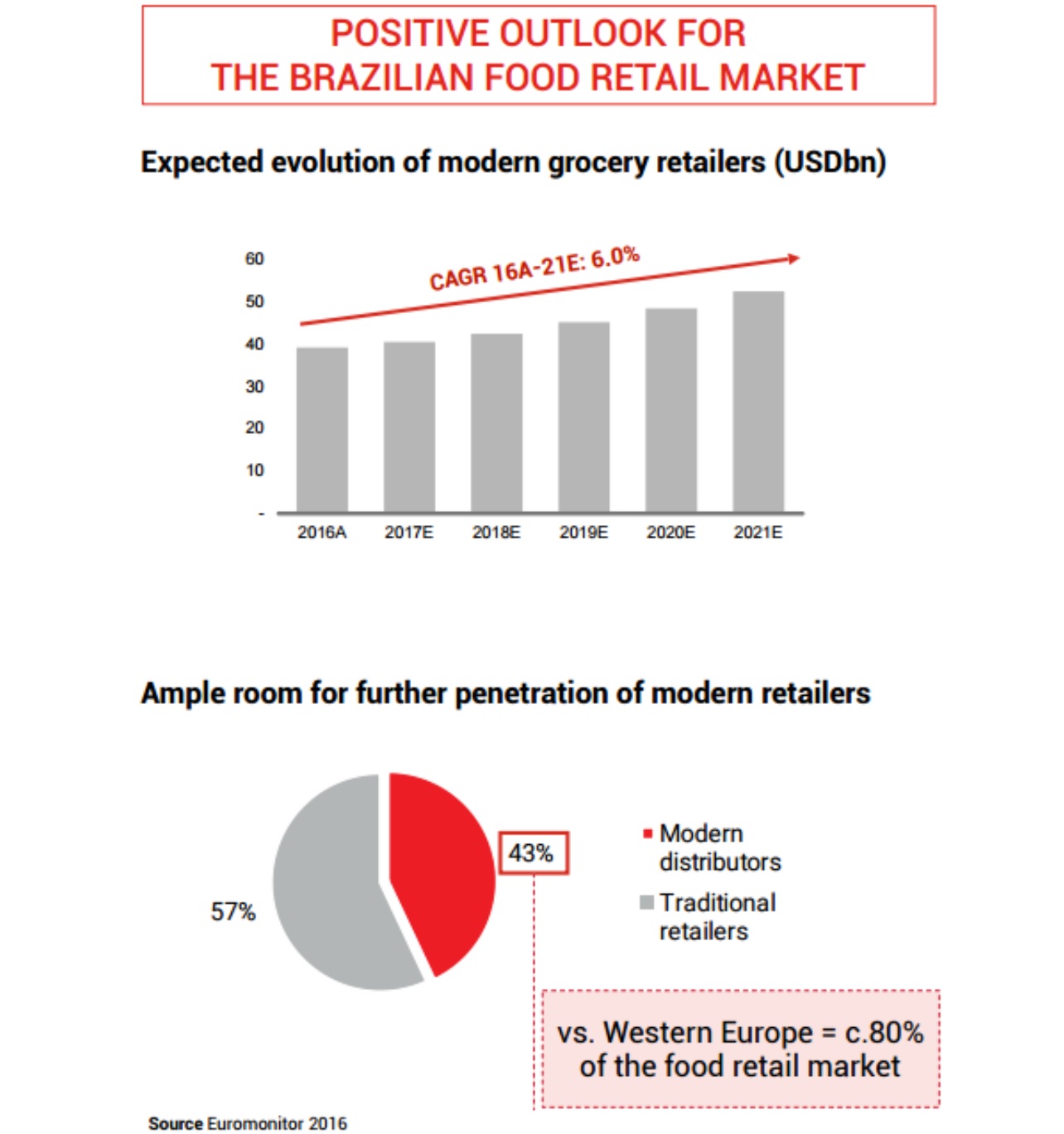

Looking ahead, the company sees the following opportunities:- In Brazil, robust market growth and low penetration rates for modern retail formats provide opportunities for DIA to grow. The company plans to expand its store estate in the country from 1,050 at the end of 2016 to more than 1,500 by 2020.

Brazil’s food retail market Source: DIA 2017 Capital Markets Day presentation

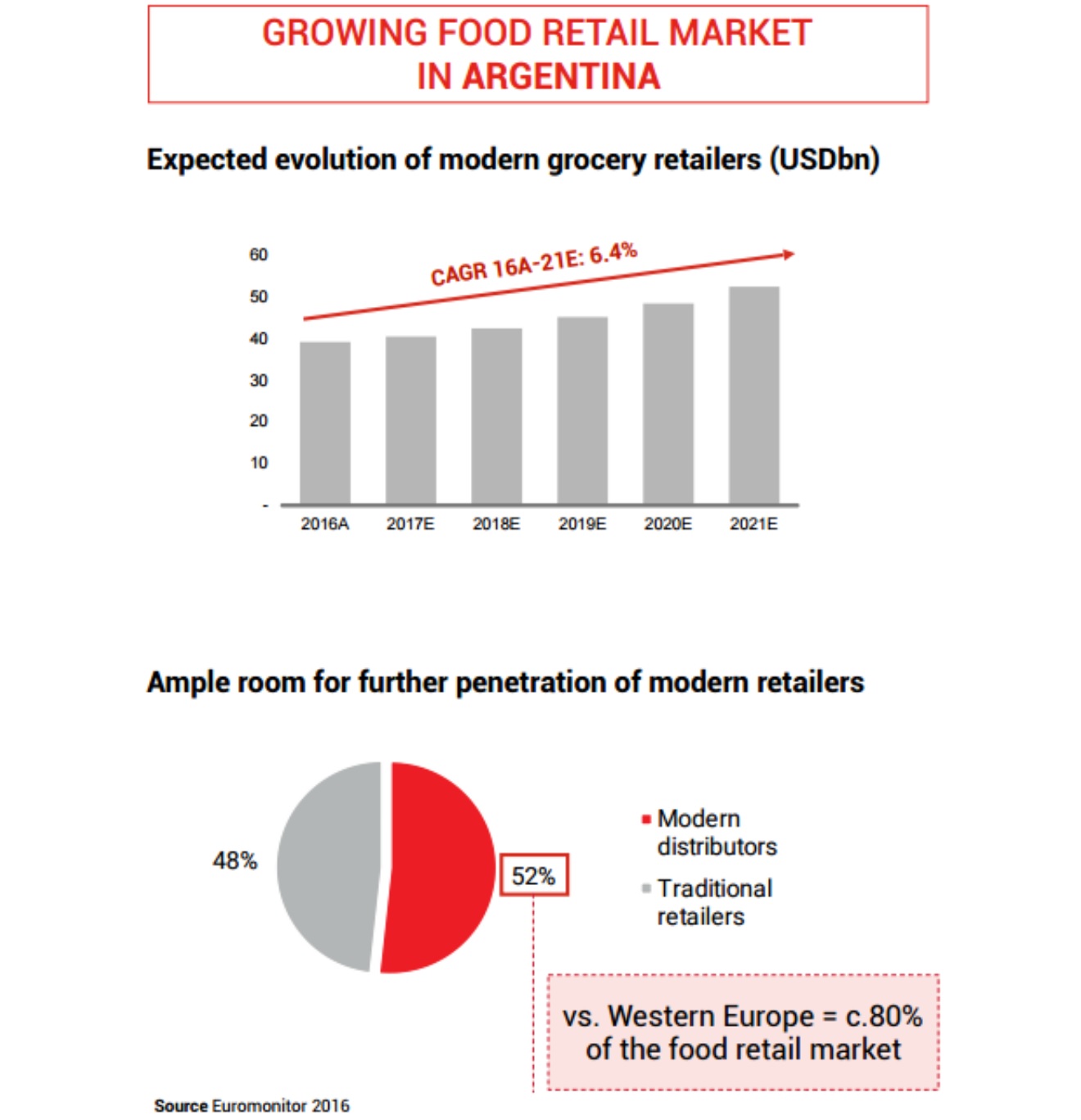

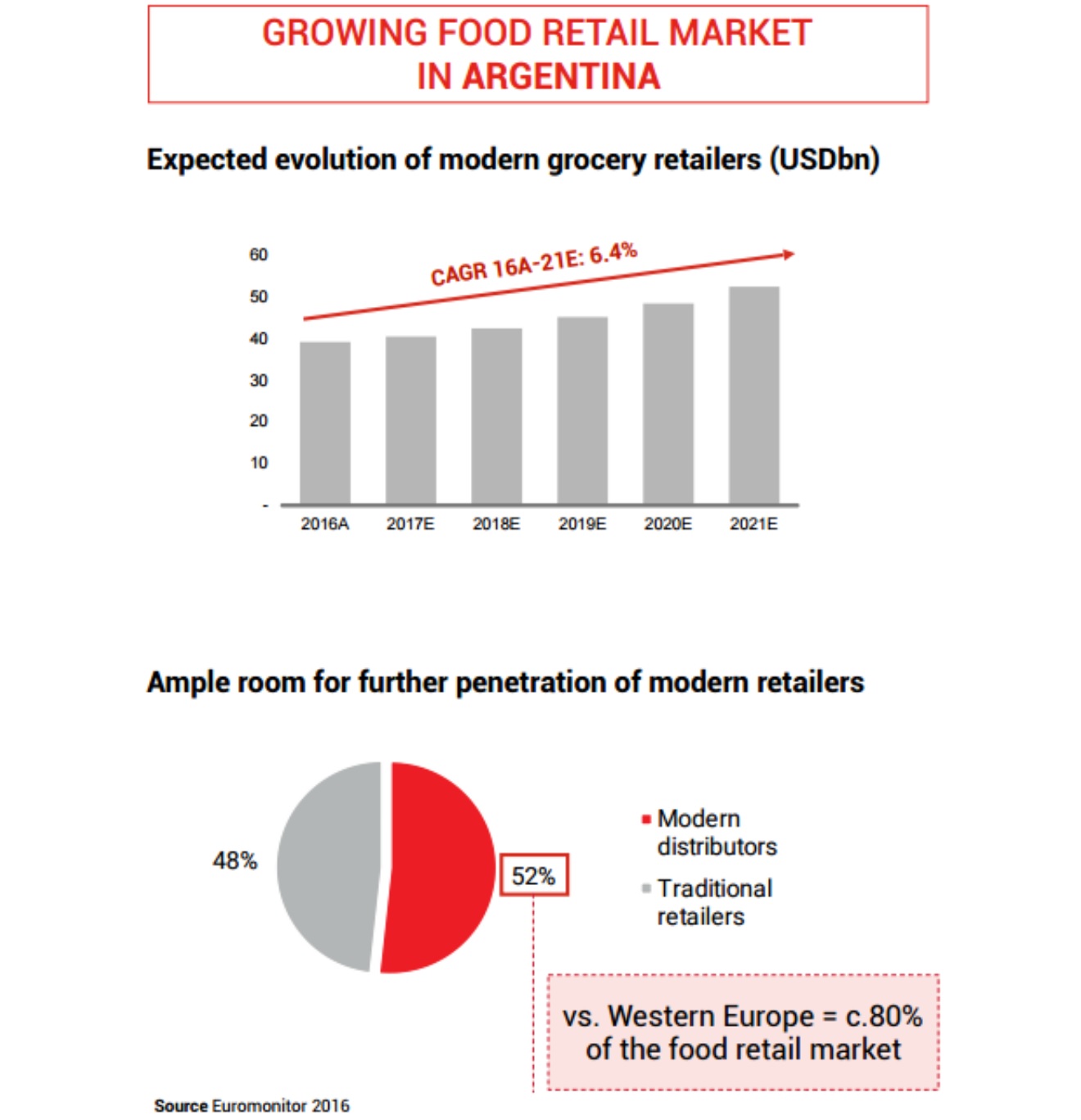

- In Argentina, DIA expects consumer prices inflation to moderate from its current, very high level to approximately 5% by 2021. As in Brazil, market growth and a strong presence of traditional retailers provides opportunities in Argentina, and DIA plans to grow its number of stores in the country from 872 at the end of 2016 to more than 1,100 by 2020.

Argentina’s food retail market Source: DIA 2017 Capital Markets Day presentation

Spanish grocery market sharebreakdown

Source: DIA 2017 Capital Markets Day presentation

Spanish grocery market sharebreakdown

Source: DIA 2017 Capital Markets Day presentation

In addition, DIA sees scope for consolidation in the Spanish grocery sector, which remains relatively fragmented. In the Q&A section of the meeting, an attendee asked management if the company has plans to drive this consolidation, and executives responded that they expect this process to occur naturally as smaller independent players fall out of the market. Management cited the investments needed in technology as one reason smaller operators may struggle to compete with larger retailers such as DIA.

Lower Prices Come from Lower Costs

DIA’s proposition is based on low prices, and it continues to pursue efficiencies, including through technology, to enable this focus. The company achieves cost savings through a number of means, including:- Renegotiating one-quarter of rental contracts each year, yielding an average 15% rent reduction.

- Driving productivity in logistics, including using productivity profit sharing to incentivize staff and big data analysis to reduce supply chain costs. Real-time logistics dashboards and store-management apps leverage technology to drive efficiencies.

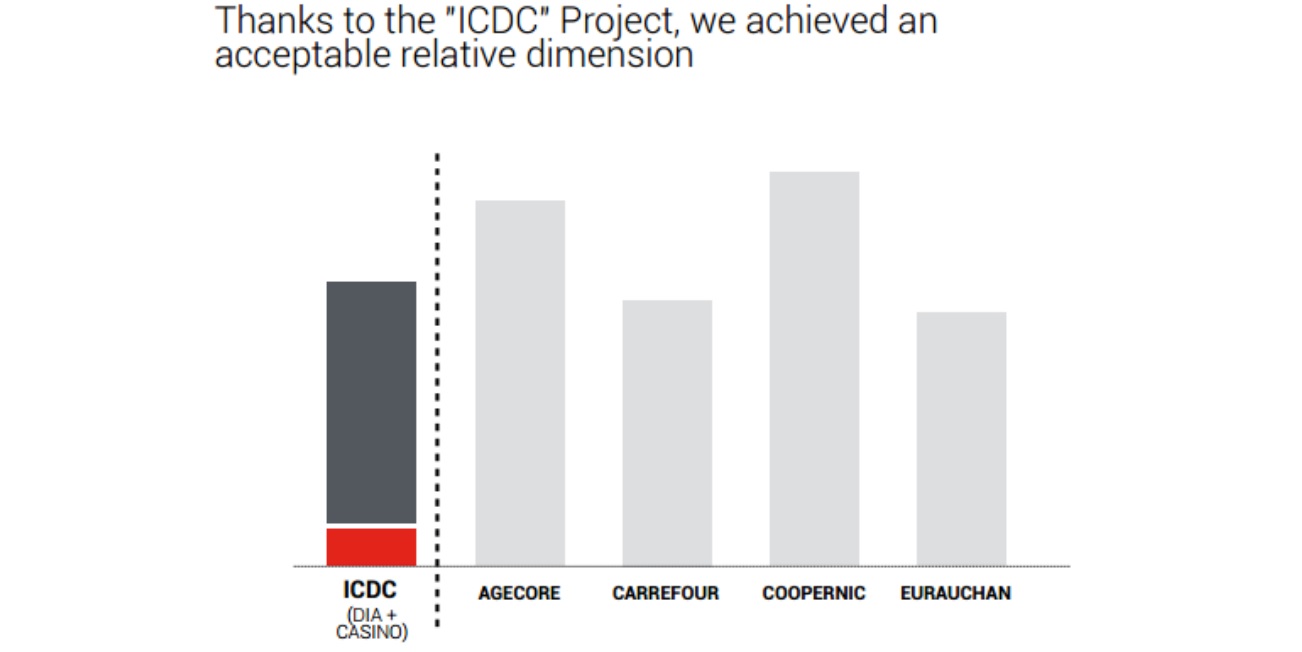

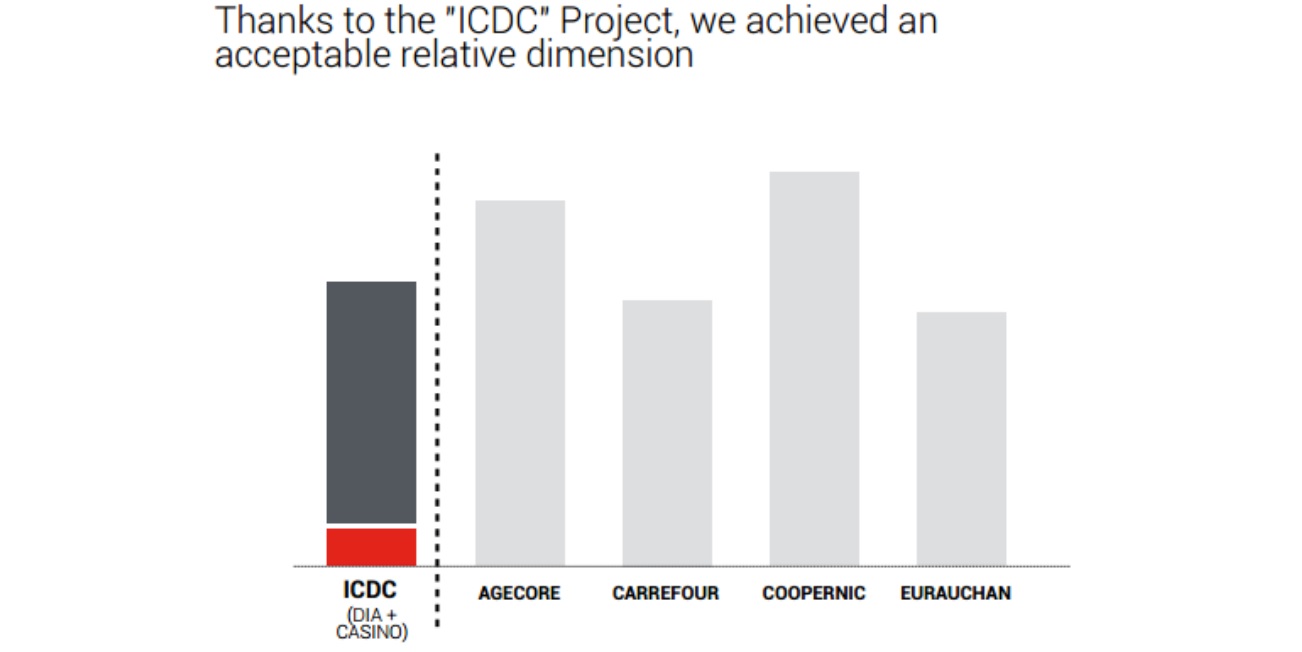

- Establishing national and international commercial alliances. An international alliance with Groupe Casino and national alliances with Eroski and Intermarché increase DIA’s scale in sourcing branded products, private label goods, and assets and supplies. The chart below shows how DIA’s buying scale is boosted by its alliance with Casino.

DIA’s buying scale is boosted by its alliance with Casino Source: DIA 2017 Capital Markets Day presentation

E-Commerce Opportunities

DIA is a “soft discounter,” meaning it combines traditional “hard discount” elements such as low prices and small stores with softer features such as neighborhood locations, big-name brands and couponing. A further sign of its softer positioning is its embrace of e-commerce, and management pointed to opportunities in this space. DIA expects to grow its online sales by six times, to more than €120 million, by 2020. We think that e-commerce could be a significant competitive advantage for DIA in a Spanish market that is relatively fragmented and still in a nascent phase of grocery e-commerce development. Juan Pedro Agustín, Head of Digital, noted that DIA.es has more than 90,000 customers and that it sees a typical basket size five times larger than the average in-store purchase. He also said that DIA.es has a catchment area that represents 60% of the Spanish population. Additionally, the brand’s nongrocery site, Oportunidades.DIA.es, attracts 135,000 customers and offers 5,000 SKUs across general merchandise. DIA’s online shoppers are younger than its in-store shoppers and represent 2.25 times the value of in-store shoppers. Management also emphasized the importance of the DIA app for e-commerce as well as services such as digital coupons.Guidance and Targets

DIA’s management reiterated its 2017 outlook and 2016–2018 targets:- For 2017, the company expects mid-single-digit growth in total sales, adjusted EBITDA growth and margin stability.

- For 2016–2018, the company expects to see an organic sales CAGR of 7% and total accumulated cash from operations of €750 million (this is adjusted EBITDA less nonrecurring cash items less capital expenditures, on an organic basis).