Web Developers

On May 15 and 16, beauty industry executives from around the world gathered in Palm Beach, Florida, for the WWD Beauty CEO Summit 2018. Coresight Research CEO and Founder Deborah Weinswig was among those attending. Here, we summarize our top takeaways from the event.

Alexandra Keith, President of Global Hair Care and Beauty Sector at rival consumer-goods giant Procter & Gamble, presented on the theme of natural beauty. Keith pointed to her company’s acquisition of natural deodorant brand Native in 2017 and natural skincare brand Snowberry earlier this year. “You can tell by the two acquisitions we have made that we intend to be more serious about the naturals space,” Keith said.

Tata Harper, Co-CEO and Cofounder of Tata Harper Skincare, a premium beauty brand that promises “100% natural” products, outlined how she took a fresh approach when creating her brand. The firm’s products, which have no synthetic chemicals, are designed in its own labs and manufactured in its own factories.Some ingredients are even grown on the company’s own farm. Customers can use a feature on the website to trace their product back to who manufactured it and when. Most of the company’s products are packaged in glass bottles in order to help reduce the impact of packaging.

So, what does Dr. Jart do differently?

First, it seeks to understand millennials and their demands. “When we study the way millennials live, there is a different speed of action that is more important than anything,” said Lee. Second, the company structure incorporates a network of labs (for planning products, design and marketing) and camps (for operations such as sales and HR). The labs and camps are united by a think tank that focuses on strategy.

Takeaways from Target

Target is one of America’s biggest beauty retailers and is especially popular with younger consumers. At the WWD event, Christina Hennington, SVP of Merchandising, Essentials, Beauty and Wellness at Target, shared the following insights:- Target remodeled 100 stores in 2017 to feature new guest service technologies and make beauty an easier, more fun and more inspiring category to shop.

- Target’s customers “really care about”chemical transparency in beauty products. Consumer demand for more natural products came up in discussions throughout the summit, and Hennington noted that Target has been trying to drive the beauty industry to a single set of standards that will define what is “natural.”

- Target expects the US men’s grooming market to double between 2016 and 2020.

- Target is looking to stock localized assortments in a number of categories, including beauty, in its urban and small-store formats.

- Beginning May 20, Target stores will feature startup brands that cater to the beauty demands of a diverse customer base. The retailer offers more than 100 beauty brands in total.

Natural Beauty Spans Premium to Mass-Market Retail

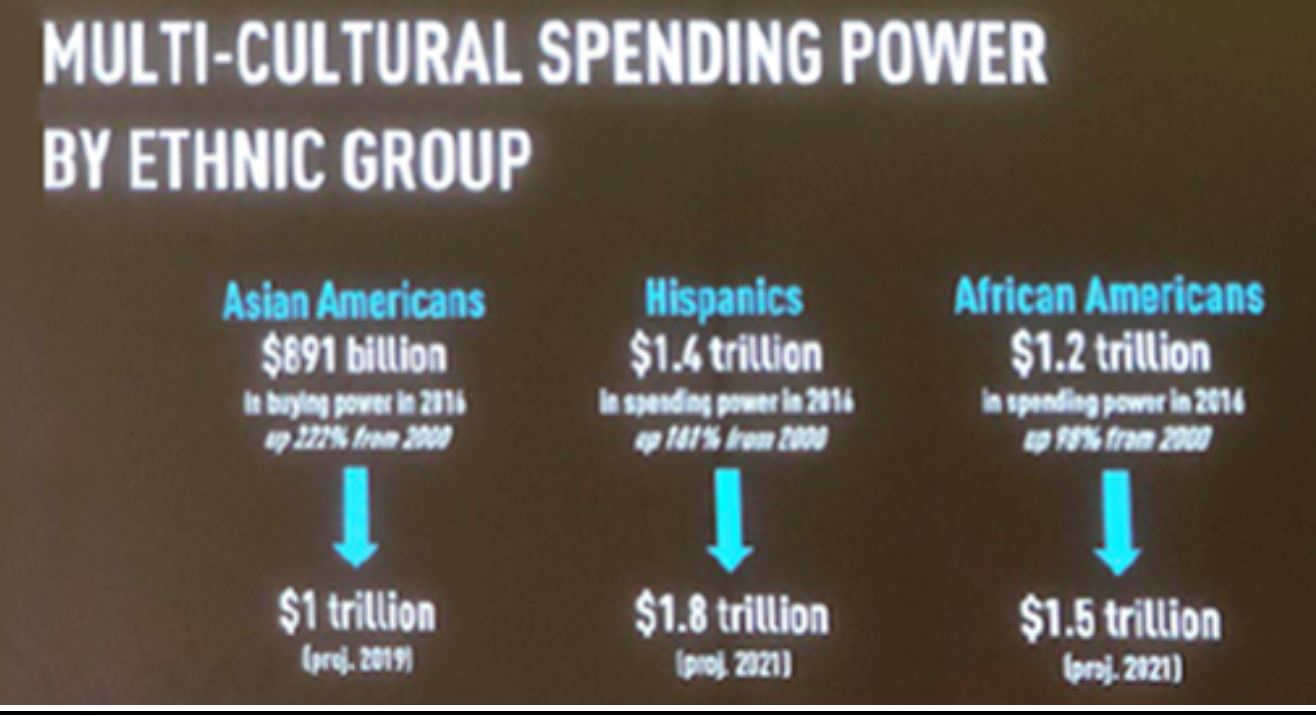

Target is not alone in its attempts to better cater to diverse consumer segments and tap demand for more natural products.Unilever is also focused on serving multicultural communities, according to Esi Eggleston Bracey, EVP and COO, Personal Care, at Unilever North America. Bracey said that all communities want to be embraced and spoken to in an authentic way,not be exploited, and see investment in their communities. Bracey pointed specifically to the substantial and high-growth spending power of selected ethnic minority consumer segments. Unilever presentation on multicultural spending power

Source: Coresight Research

Unilever presentation on multicultural spending power

Source: Coresight Research

Alexandra Keith, President of Global Hair Care and Beauty Sector at rival consumer-goods giant Procter & Gamble, presented on the theme of natural beauty. Keith pointed to her company’s acquisition of natural deodorant brand Native in 2017 and natural skincare brand Snowberry earlier this year. “You can tell by the two acquisitions we have made that we intend to be more serious about the naturals space,” Keith said.

Tata Harper, Co-CEO and Cofounder of Tata Harper Skincare, a premium beauty brand that promises “100% natural” products, outlined how she took a fresh approach when creating her brand. The firm’s products, which have no synthetic chemicals, are designed in its own labs and manufactured in its own factories.Some ingredients are even grown on the company’s own farm. Customers can use a feature on the website to trace their product back to who manufactured it and when. Most of the company’s products are packaged in glass bottles in order to help reduce the impact of packaging.

Taking a Korean Beauty Brand to the US

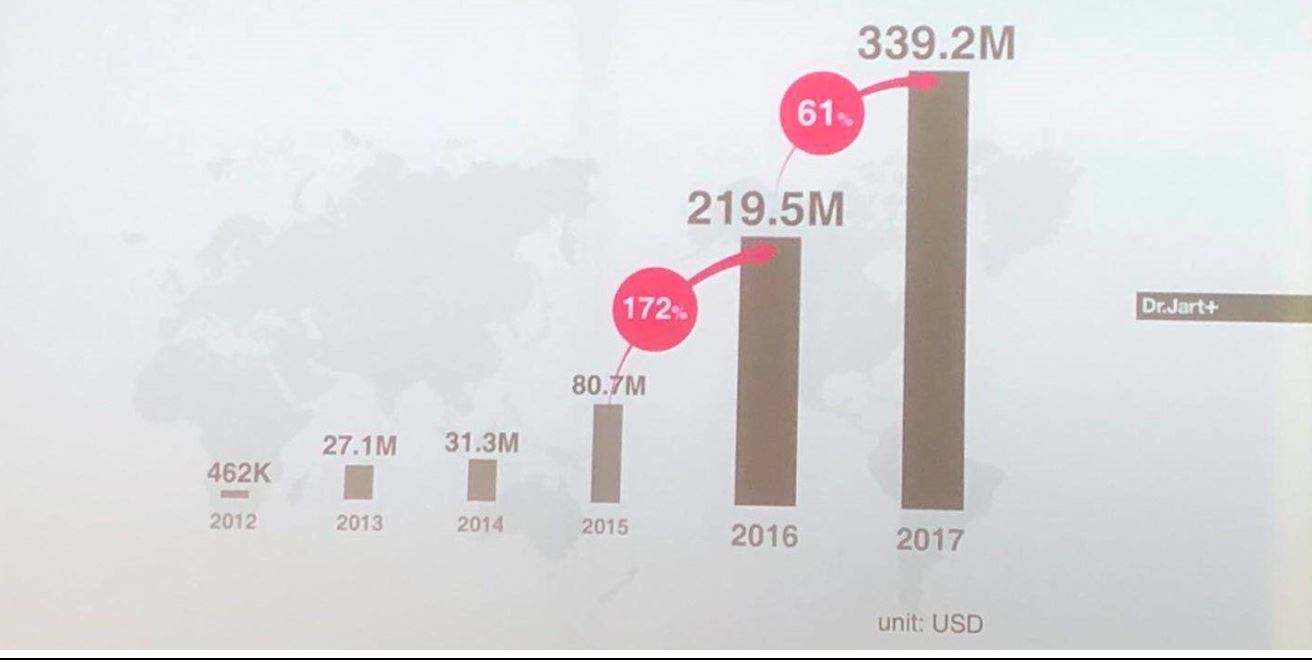

Chin Wook Lee, CEO and Founder of beauty brand Dr. Jart, discussed how he took his Korean beauty brand global. Many Korean beauty brands head first to China, Lee noted, but he aimed for the US market instead. In 2011, Dr. Jart entered Sephora stores with just two products; today, 50 of the brand’s lines are present in 1,000 Sephora stores. Dr. Jart sells through 5,523 stores in 36 countries in total and is now a $339 million brand. Dr. Jart presentation showing the company’s revenue growth

Source: Coresight Research

Dr. Jart presentation showing the company’s revenue growth

Source: Coresight Research

So, what does Dr. Jart do differently?

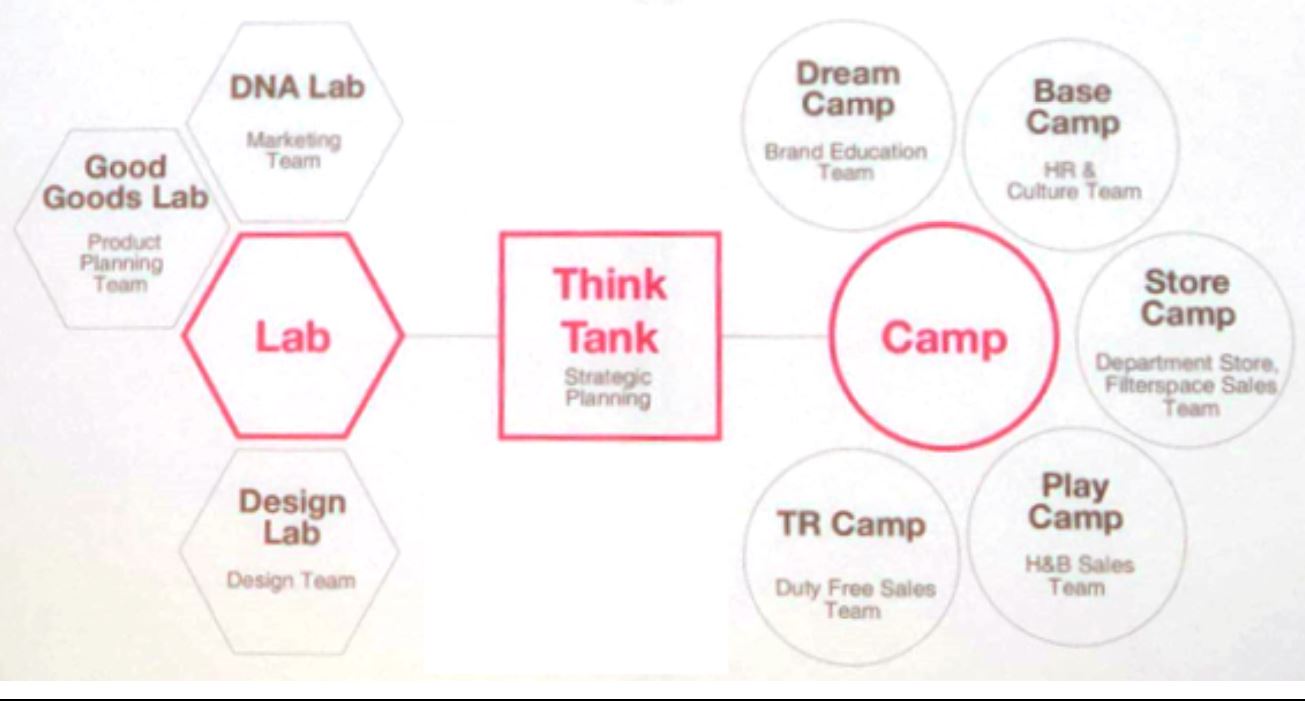

First, it seeks to understand millennials and their demands. “When we study the way millennials live, there is a different speed of action that is more important than anything,” said Lee. Second, the company structure incorporates a network of labs (for planning products, design and marketing) and camps (for operations such as sales and HR). The labs and camps are united by a think tank that focuses on strategy.

Dr. Jart presentation showing the company’s organizational structure

Source: Coresight Research

Dr. Jart presentation showing the company’s organizational structure

Source: Coresight Research

Experiences Create a Beauty Mecca

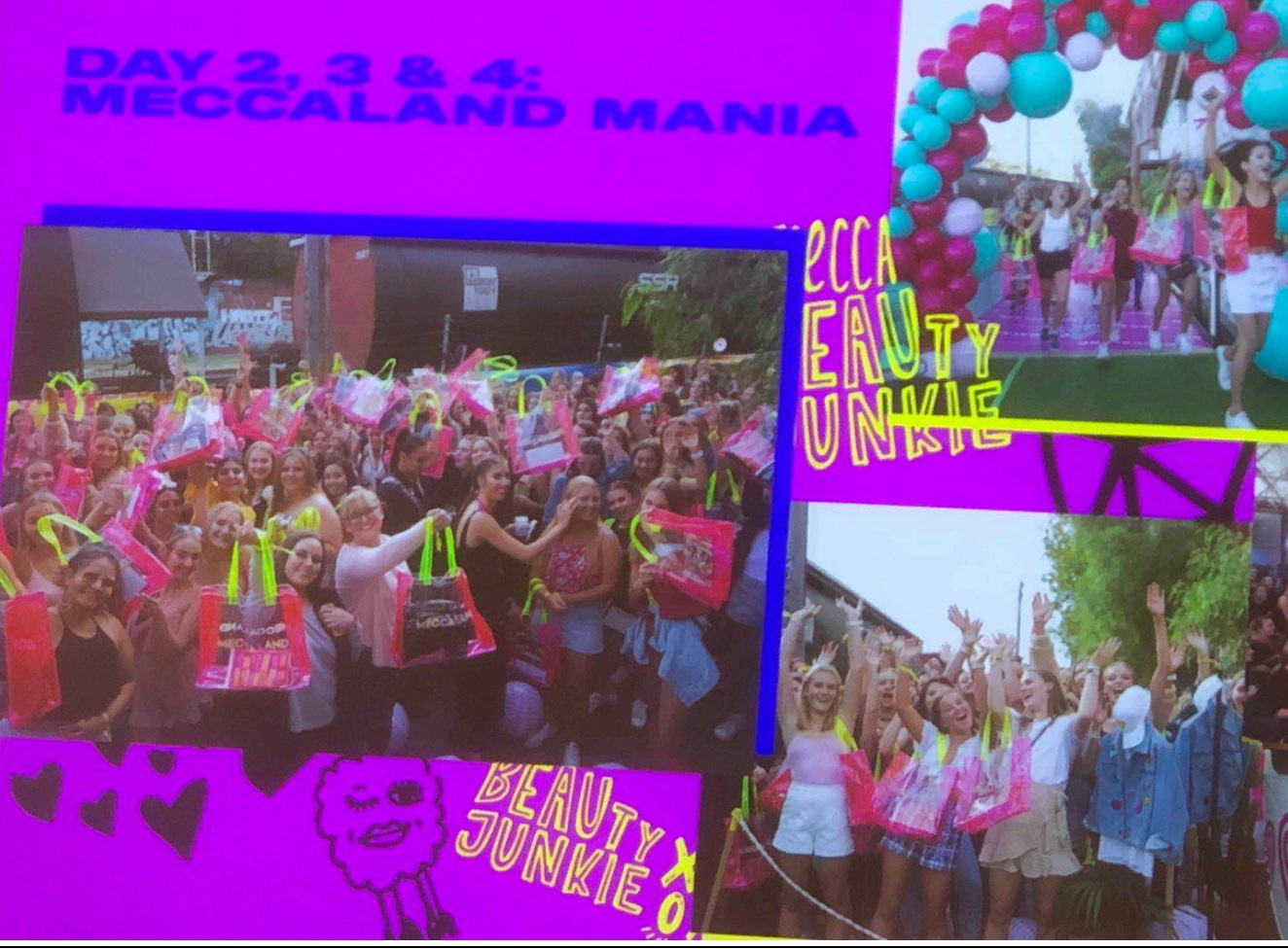

Jo Horgan, Co-CEO and Founder of Australian beauty retailer Mecca Brands, underlined the importance of experiences to the beauty market. Mecca has 90 stores, and making sure physical retail wins shoppers over e-commerce is crucial to the company’s success, Horgan said.- Mecca puts a focus on fun and festivals, such as its Meccaland beauty festival, which was held in April 2018.

- Meccaland saw a 91% conversion rate and average spend that was double that of regular in-store spend.

- The beauty festival’s impact was amplified by social media: the company saw a “posting frenzy” on social channels and tripled its social-media engagement versus its regular engagement rate.

Mecca Brands presentation showing “Meccaland Mania”

Source: Coresight Research

Mecca Brands presentation showing “Meccaland Mania”

Source: Coresight Research