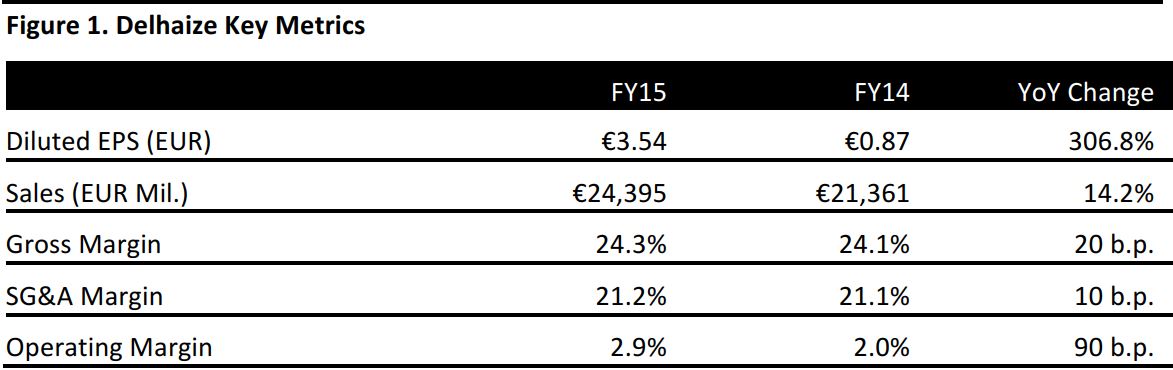

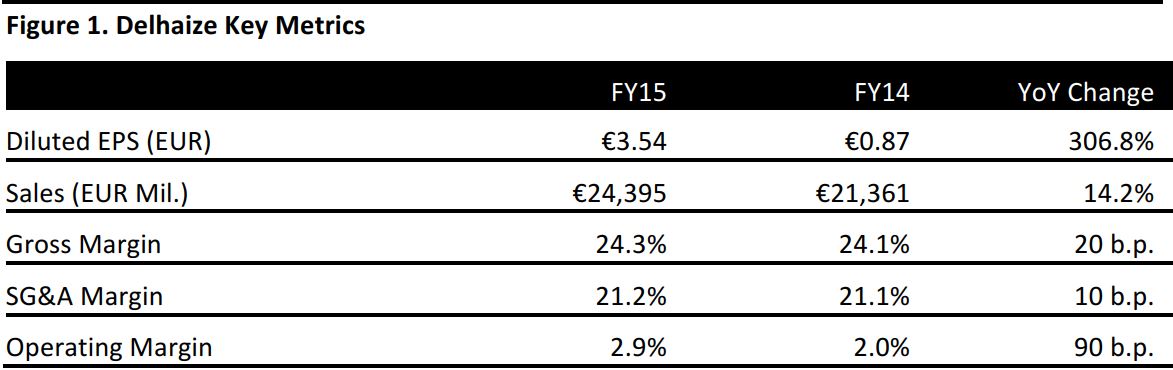

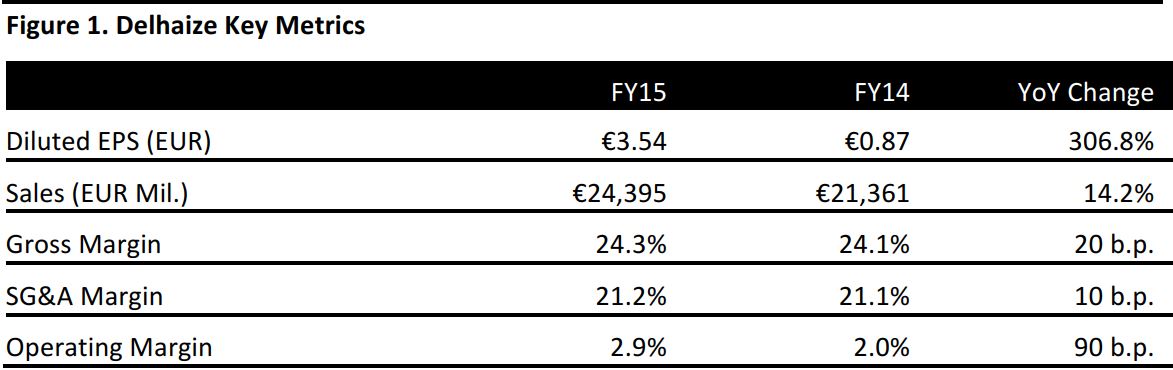

Source: Company reports

Delhaize, a Belgium-based food retailer, reported a FY15 revenue increase of 14.2% at actual exchange rates (1.9% at constant exchange rates), to €24.4 billion, just below the consensus estimate.

Net income increased by 312.5%, to €366.0 million, below consensus of €432.6 million. Diluted EPS was €3.54, an increase of 306.8% versus FY14 but below consensus of €4.37.

Delhaize reported an increase of 14.4% in underlying EBIT, to €872.0 million, above the consensus estimate of €854.0 million. EBIT was up 64.5%, to €696 million.

The company’s management commented that, in 2015, Delhaize was able to stabilize or grow its market share in all the markets in which it operates. Revenue growth was the result of positive performance in all three main geographies, the US, Belgium and Southeastern Europe. At the same time, the company managed to invest in differentiating its banners, improving its infrastructure and expanding its networks.

4Q15 Results

In 4Q15, revenue was up 9.1% at actual exchange rates (0.2% at constant exchange rates), to €6.3 billion, slightly ahead of consensus. Underlying EBIT was up 14.5%, to €258.0 million, ahead of the consensus estimate of €253.2 million.

Sales by Geography

Sales in the US reached US$17.8 billion in FY15, up 2.2% year over year in local currency, excluding the 53rd trading week in 2014, and up 20% in reporting currency and including the 53rd trading week in 2014. The scale of the US growth in euros shows how the company’s group results benefited from a strong US dollar. Comps grew by 2.2% in the US during FY15. 4Q15 sales in the US grew by 2.6% (in local currency and excluding the 53rd trading week in 2014), to US$4.4 billion, driven by investment in the company’s two US banners—Food Lion and Hannaford—and by mild weather. The US segment was the only one impacted by a 53rd week in 2014.

In Belgium, sales grew by 1.3%, to €5.0 billion, in FY15, driven by positive comps of 0.9% and network growth. In its home market, Delhaize implemented a lower-prices strategy that was reflected in a gross margin decrease of 17 basis points, to 18.8%. However, the company’s implementation of its “Transformation Plan”—a cost optimization initiative announced on June 11, 2014—enabled it to cut costs and consequently decrease its SG&A margin by nine basis points, to 17.5%. In 4Q15, sales in Belgium grew by 5.6%, to €1.3 billion, while comps grew by 5.1%.

In Southeastern Europe—Greece, Serbia and Romania—revenue increased by 9.5%, to €3.4 billion, in FY15, mainly due to expansion in Greece and Romania and favorable comps of 3.5%. 4Q15 saw revenue in the region up 13.3%, to €942 million. Comps were up 7.8% and the company continued to increase its store numbers in all three countries during the quarter.

Guidance

Delhaize’s top priority for FY16 is to complete its merger with Ahold. Management expressed confidence in the merger, given the complementarity of and synergies between the two retailers’ store networks and the opportunity for further innovation.

In FY16, the company will also focus on three other initiatives: remodeling 142 Food Lion stores in the US as part of its “Easy, Fresh and Affordable” strategy, which aims to increase the budget and healthy options offered in stores; remodeling 15 stores in Belgium as part of the Transformation Plan; and continuing to expand its number of stores in Southeastern Europe. Management also announced that it plans to spend €825 million on capex in the new fiscal year.

Analysts estimate that Delhaize will generate €25.2 billion in sales in FY16, with €917.6 million in EBIT and €570.3 million in net income.