Web Developers

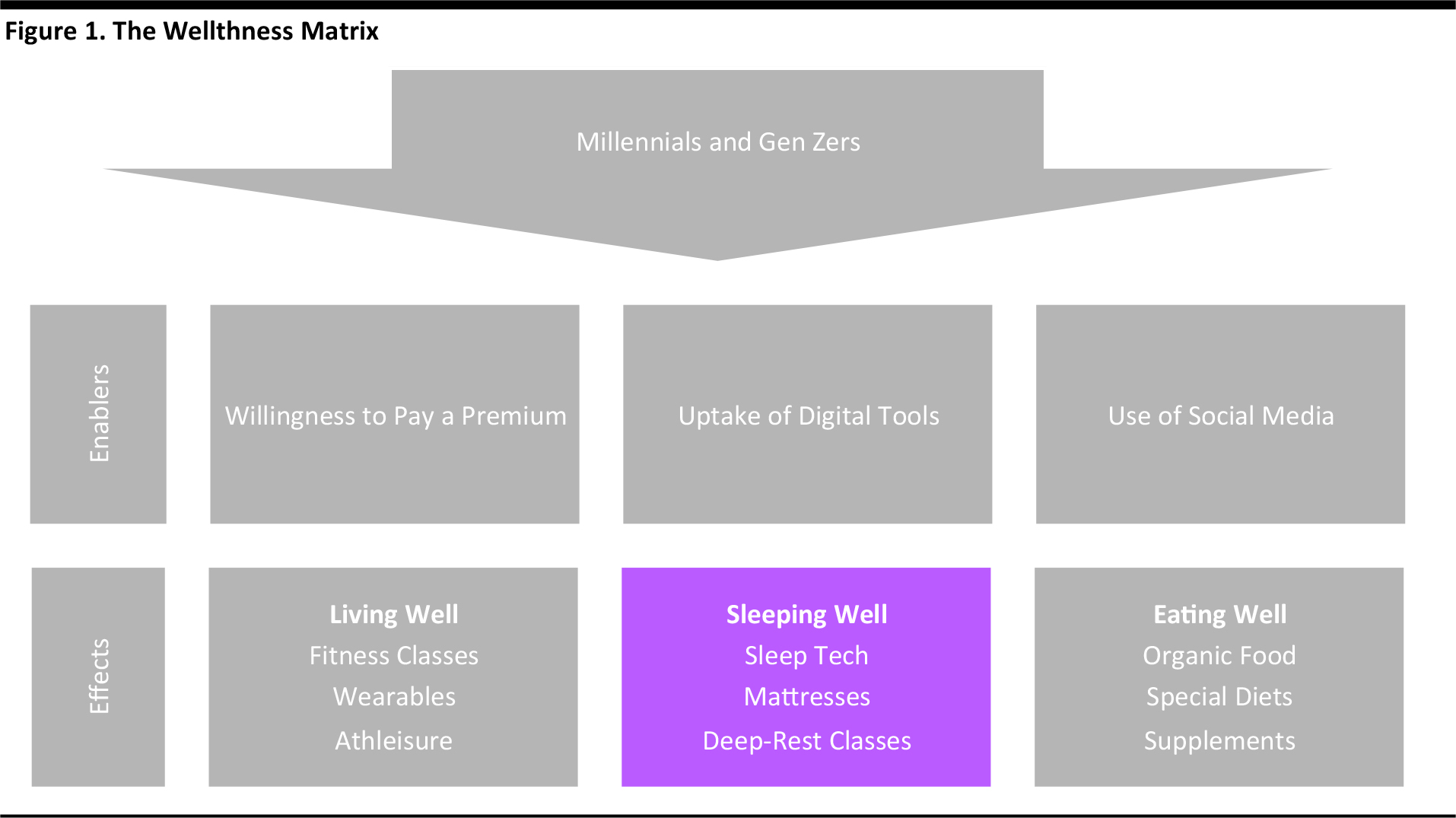

Our Wellness as a Luxury series looks at wellness as the new status symbol: “wellthness” is fast replacing other signifiers of affluence as a luxury to be enjoyed and flaunted. In this report, we look closely at three aspects of the “sleep economy”:

Many find sleep aid technology helpful. Research from the NSF and the Consumer Technology Association (formerly known as the Consumer Electronics Association) in September 2015 found that 60% of US consumers who owned some kind of sleep tech described being more mindful of their sleeping patterns, while about 51% said they had noticed an improvement in their sleep and nearly 50% reported feeling healthier. These figures are likely to change as products and technology develop further to cater to specific kinds of sleep disorders.

Most sleep tech products fall under one of three broad categories: apps, hardware or wearables. Smartphone and tablet apps range in function from helping users fall asleep to waking users up to tracking how users have slept through the night. Some even play white noise (sounds in a range of frequencies at the same intensity that simulate constant background noise) or music that fades out as the user falls asleep.

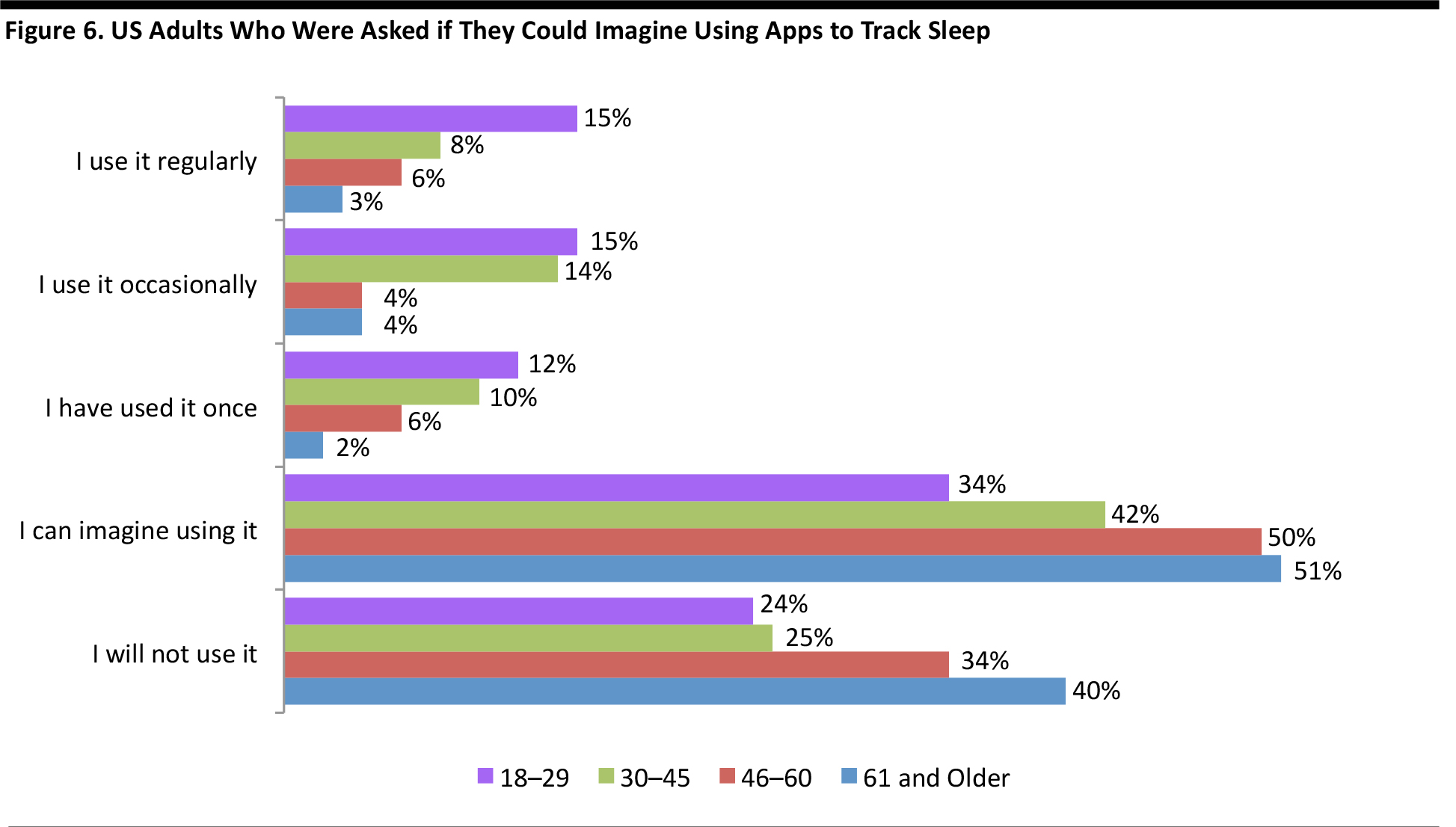

More younger adults than older adults use sleep apps in the US, according to a March 2017 survey by Statista. Among Americans surveyed (all of whom owned a smartphone, a tablet or both), 15% of those ages 18–29 said they use sleep apps regularly, while 8% of those ages 30–45 and 6% of those ages 46–60 said the same. Only 3% of those ages 61 and older said they use sleep apps regularly.

However, it appears that more older consumers than younger ones are likely to use such apps in the future, as just over a third of younger adults surveyed by Statista said that they could imagine using an app to track sleep, while more than half of those ages 61 and older said that they could imagine doing so. Meanwhile, almost a quarter of younger adults polled said that they will not use sleep apps, while just over a third of older adults said the same.

So, even though younger adults account for a higher proportion of sleep app users currently, the findings of the Statista survey indicate that the majority of consumers are unlikely to adopt such technology as a tool to promote healthful sleep anytime soon.

Many find sleep aid technology helpful. Research from the NSF and the Consumer Technology Association (formerly known as the Consumer Electronics Association) in September 2015 found that 60% of US consumers who owned some kind of sleep tech described being more mindful of their sleeping patterns, while about 51% said they had noticed an improvement in their sleep and nearly 50% reported feeling healthier. These figures are likely to change as products and technology develop further to cater to specific kinds of sleep disorders.

Most sleep tech products fall under one of three broad categories: apps, hardware or wearables. Smartphone and tablet apps range in function from helping users fall asleep to waking users up to tracking how users have slept through the night. Some even play white noise (sounds in a range of frequencies at the same intensity that simulate constant background noise) or music that fades out as the user falls asleep.

More younger adults than older adults use sleep apps in the US, according to a March 2017 survey by Statista. Among Americans surveyed (all of whom owned a smartphone, a tablet or both), 15% of those ages 18–29 said they use sleep apps regularly, while 8% of those ages 30–45 and 6% of those ages 46–60 said the same. Only 3% of those ages 61 and older said they use sleep apps regularly.

However, it appears that more older consumers than younger ones are likely to use such apps in the future, as just over a third of younger adults surveyed by Statista said that they could imagine using an app to track sleep, while more than half of those ages 61 and older said that they could imagine doing so. Meanwhile, almost a quarter of younger adults polled said that they will not use sleep apps, while just over a third of older adults said the same.

So, even though younger adults account for a higher proportion of sleep app users currently, the findings of the Statista survey indicate that the majority of consumers are unlikely to adopt such technology as a tool to promote healthful sleep anytime soon.

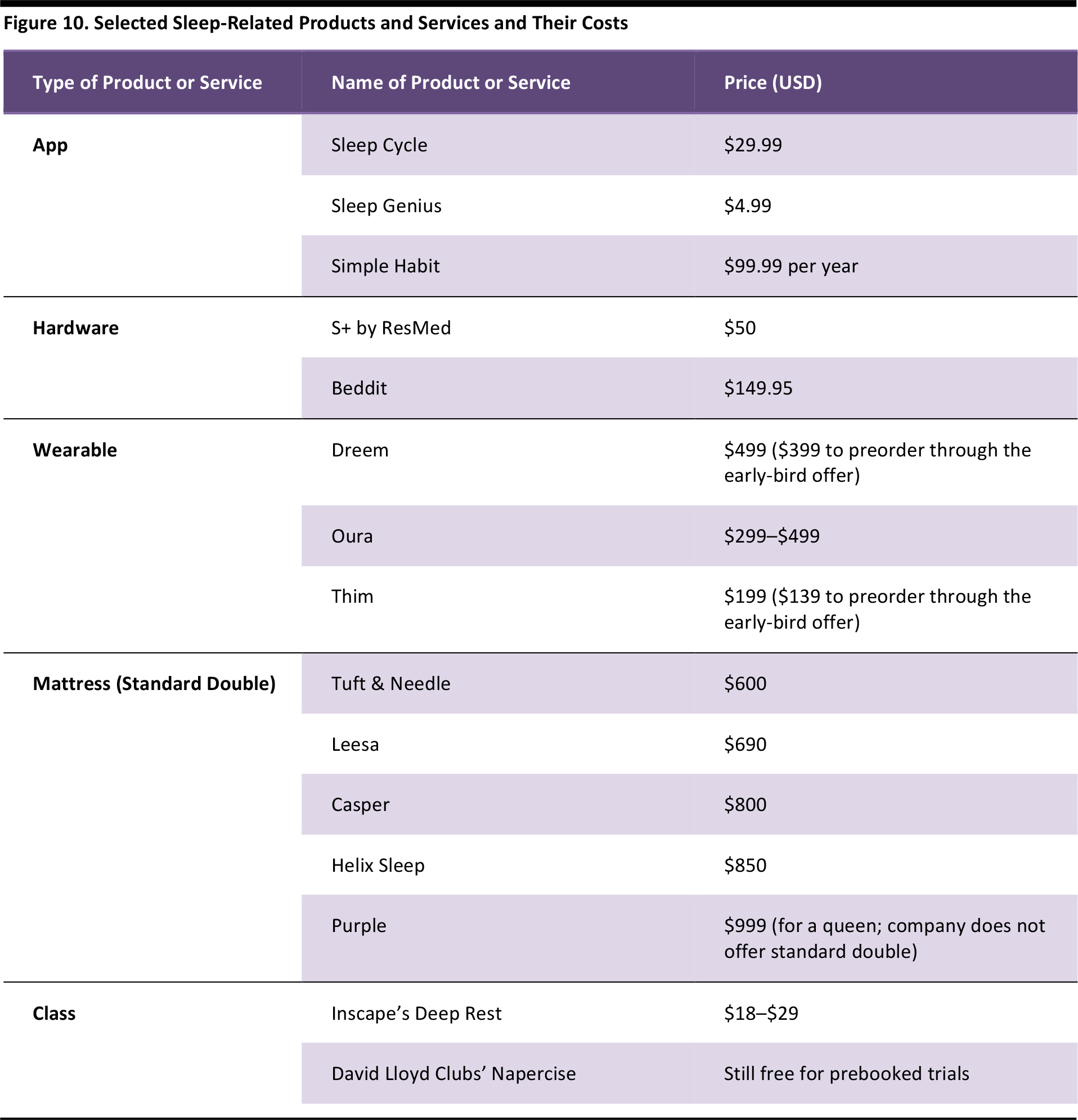

Below, we outline the prices of the products and services we discussed earlier in this report. Many of these are relatively expensive: Casper mattresses and Simple Habit apps do not come cheap.

Below, we outline the prices of the products and services we discussed earlier in this report. Many of these are relatively expensive: Casper mattresses and Simple Habit apps do not come cheap.

Executive Summary

This is the second in our Wellness as a Luxury series of reports, where we examine wellness as the new status symbol: this “wellthness” is fast replacing more traditional signifiers of affluence as a luxury to be enjoyed and flaunted. Formerly, proving to the world that one could accomplish a great deal in a day while getting little sleep was something to brag about, but many people have grown weary of such a fast lifestyle as their interest in wellness has risen. Many recent studies point to a direct relationship between getting adequate sleep and physical and mental health, and people are increasingly conscious about the quality and duration of their sleep.Tools that Help People Sleep Well

There are three major segments driving growth in the “sleep economy”:- Sleep technology: This spans applications, devices and wearables that promote sleep.

- Mattresses: New brands such as Casper and Eve are encouraging millennials to buy premium, aspirational-positioned mattresses online and to showcase their purchases on social media.

- Deep-rest classes: Consumers are attending group classes where they can sleep deeply, nap or just relax, just as they would attend an aspirational fitness class.

Three Enabling Factors

We see three factors shaping consumers’ sleep habits and health:- Millennials are willing to spend more on sleep tools. Millennials are willing to pay a premium to become and remain healthy, and many sleep products and sleep-related services are relatively expensive.

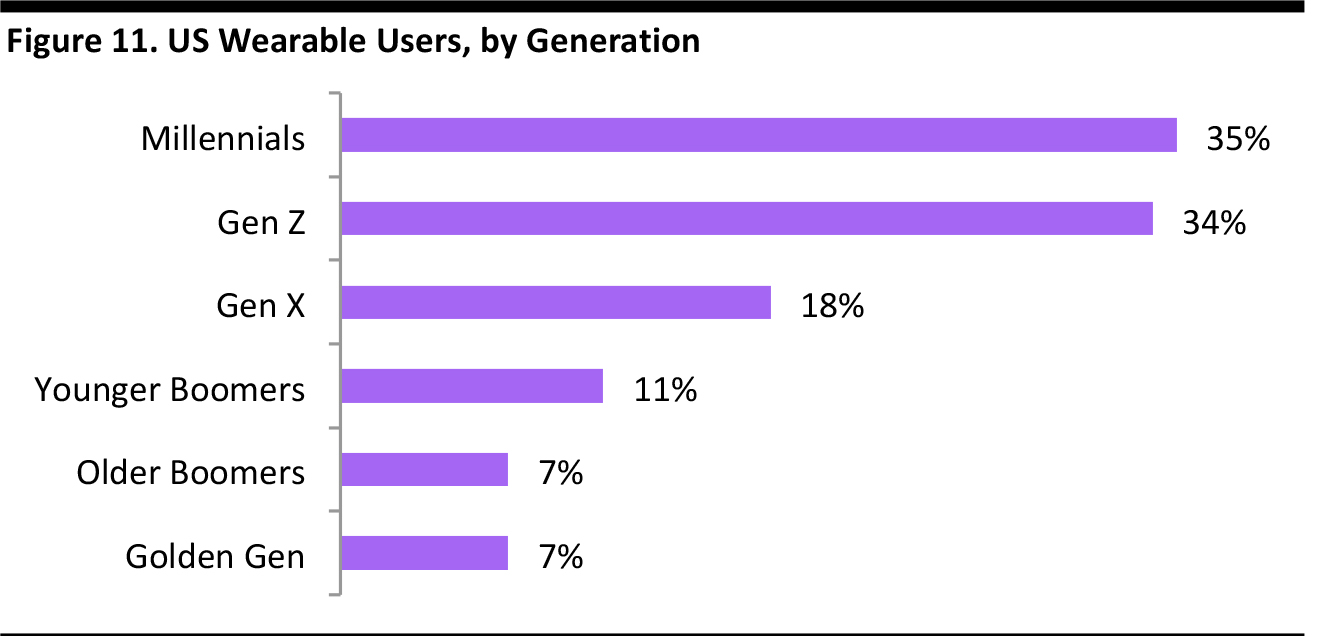

- Millennials are the largest group of wearables users. In combination, millennials and Gen Zers make up 69% of all US wearables users, according to research firm Forrester.

- Social media is a sword of Damocles in terms of driving wellness. While many health-conscious consumers are eager to display their wellthness through posts on social media platforms, studies have shown that social media use can negatively affect sleep quality, and thus impede wellness. So, social media is like the sword of Damocles in the ancient Sicilian story, representing both power and peril when it comes to wellness.

Source: iStockphoto

Introduction: Sleep Is the New Status Symbol

A little over a decade ago, living life at a furious pace and barely getting enough sleep was considered almost glamorous. Proving to the world that one could pack so much into a day while resting only a few hours a night provided certain bragging rights. But, lately, many people have been growing weary of this fast and potentially exhausting lifestyle, and focusing more on overall health and wellness. Also, many recent studies point to a direct relationship between getting adequate sleep and physical and mental health, so people are becoming increasingly conscious about sleeping well.Source: iStockphoto

In this, our second report in our Wellness as a Luxury series, we continue our examination of wellness as a status symbol, which we refer to as “wellthness.” The series identifies three specific ways that consumers are enjoying and displaying wellthness, and each of the three reports in the series focuses on a different theme:- Living well: The first report in our series analyzed the growing popularity of fitness classes and activities that improve well-being.

- Sleeping well: This second report in our series focuses on the apps, devices and products that aid sleep and, so, enhance overall well-being.

- Eating well: The third report in our series will explore the growing consumer demand for organic food, natural food, health supplements and special diets such as the Paleo Diet.

Source: Fung Global Retail & Technology

Sleep and the Evolving Definition of Wellness

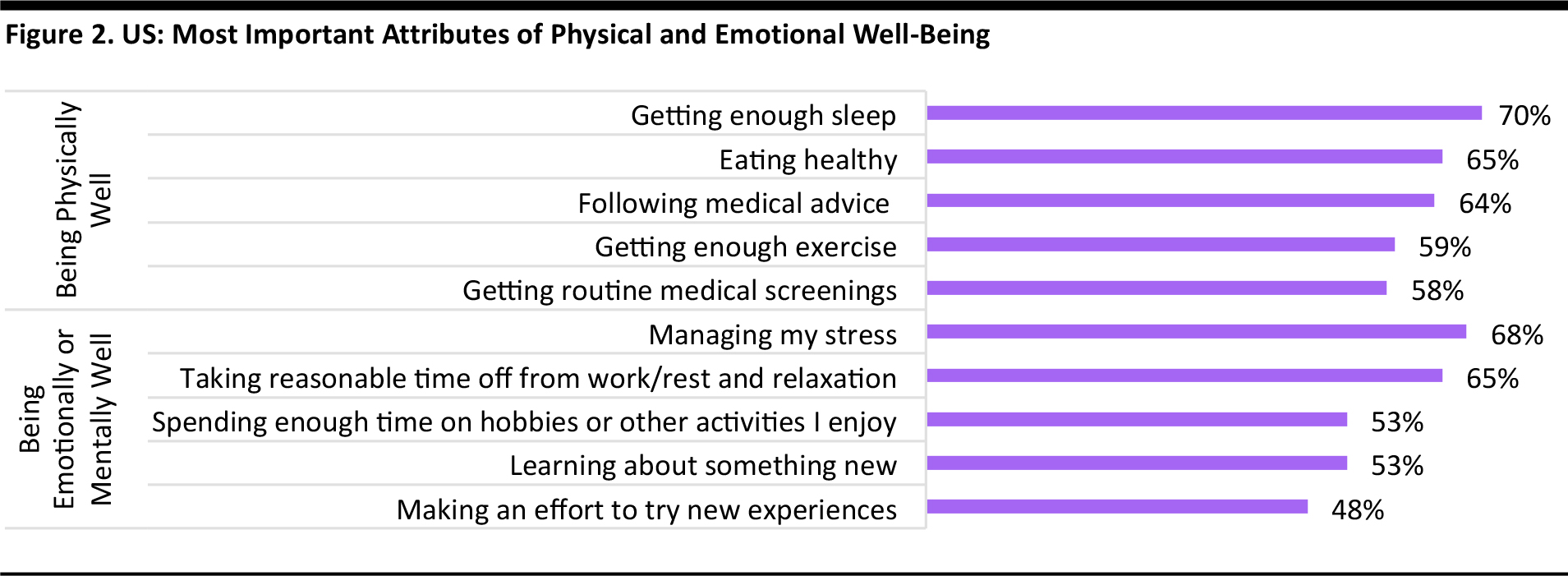

With life busier than ever before for many, and with technology creating an always-on culture, sleep is perhaps the last bastion of genuine downtime, and plenty of consumers are showing a renewed appreciation for healthy sleep. According to research from Aon Hewitt and the National Business Group on Health, 79% of US consumers feel that being physically well is important, and 70% feel that the most important aspect of being physically well is getting enough sleep. The same research found that 83% of US consumers think that being emotionally or mentally well is an important attribute of well-being and that 65% believe that taking reasonable time off from work for rest and relaxation is important.Base: 2,320 Internet users surveyed in 2016 Source: Aon Hewitt/National Business Group on Health/The Futures Company

Apart from mental fatigue and lethargy, research has uncovered more detrimental effects that sleep deprivation and poor sleep can have on the brain, body and longevity. Some of the grimmer consequences are those that can result from driving or operating heavy machinery while drowsy. But for most people, sleep deprivation and poor sleep quality simply translate to not having enough energy to accomplish all that they want to. This includes not being able to participate in fitness classes or exercise—two important aspects of living well that we described in the first report in this series. Living well means being able to look good and feel good and, for many, being able to show off their level of wellness on social media. In order to flaunt wellthness, people often participate in activities that promote it, such as sports and fitness classes. A lack of sleep can deter people from participating in such activities. While there are distinct generational differences in sleep habits, younger adults stand out in terms of getting the least sleep but attributing the most importance to it.Millennials and Gen Xers: The Most Tired Generations

In today’s increasingly competitive, “insta-everything” world, stress levels are soaring and a considerable proportion of people tend to accomplish more tasks at the cost of adequate sleep.Millennials and Gen Xers Rank Low on Sleep Duration and Quality

Younger consumers appear to suffer from the poorest sleep, perhaps reflecting the sleep-disrupting effect of technology such as smartphones or because they increasingly tend to live in urban areas. Travel and shift work may be disturbing the sleep patterns of some of these groups, too.Source: iStockphoto

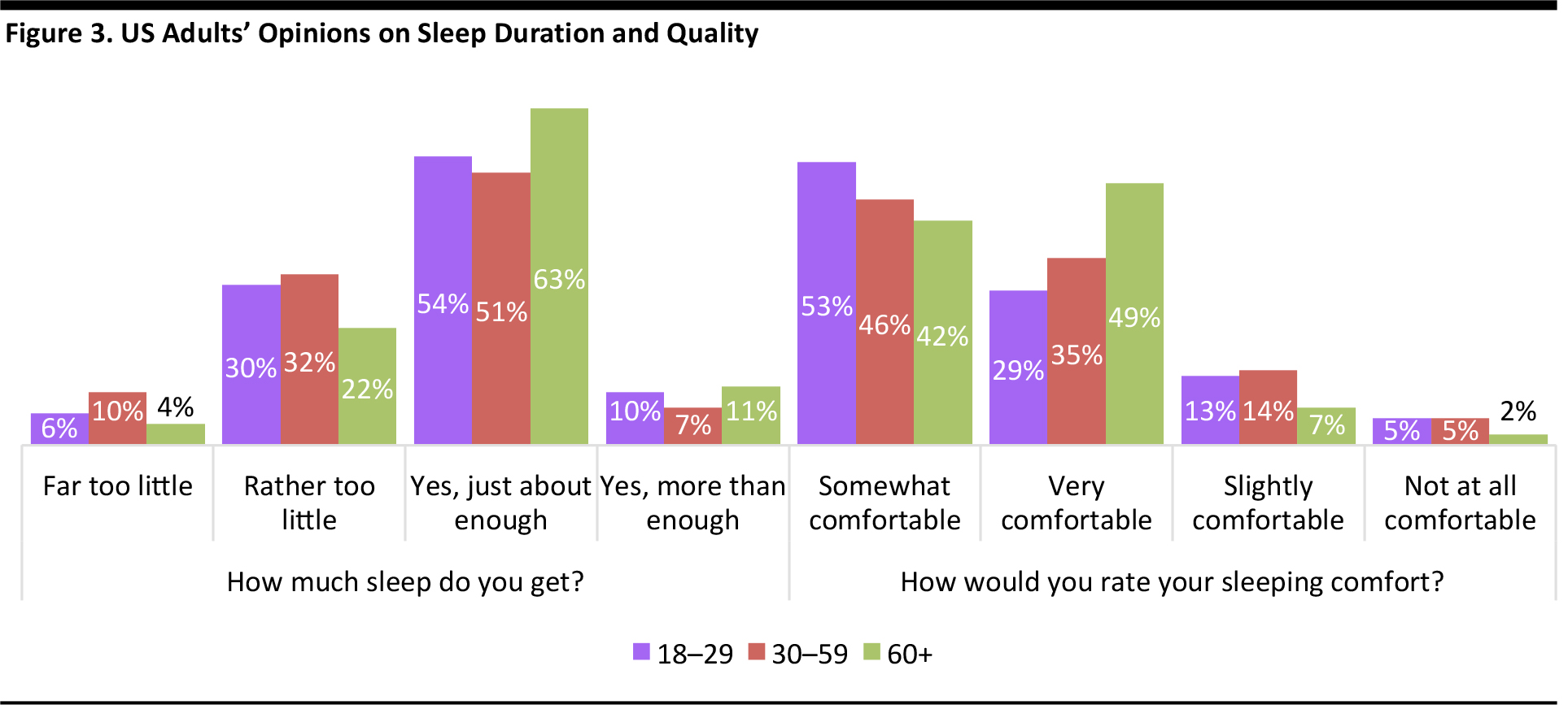

- Fewer young people than older people feel that they get enough sleep: some 54% of American 18–29-year-olds say they sleep just about enough compared with 63% of people aged 60 and over, according to a January 2017 survey of US adults by statistics company Statista.

- Even in terms of sleep quality, there is a stark difference between younger and older adults. The same Statista survey found that 49% of people aged 60 and over say that they sleep very comfortably, while only 29% of those in the 18–29 age band say the same.

Base: 1,053 US adults surveyed January 25–28, 2017 Source: Statista

Millennials and Gen Xers More Likely to Report Consequences of Unhealthy Sleeping

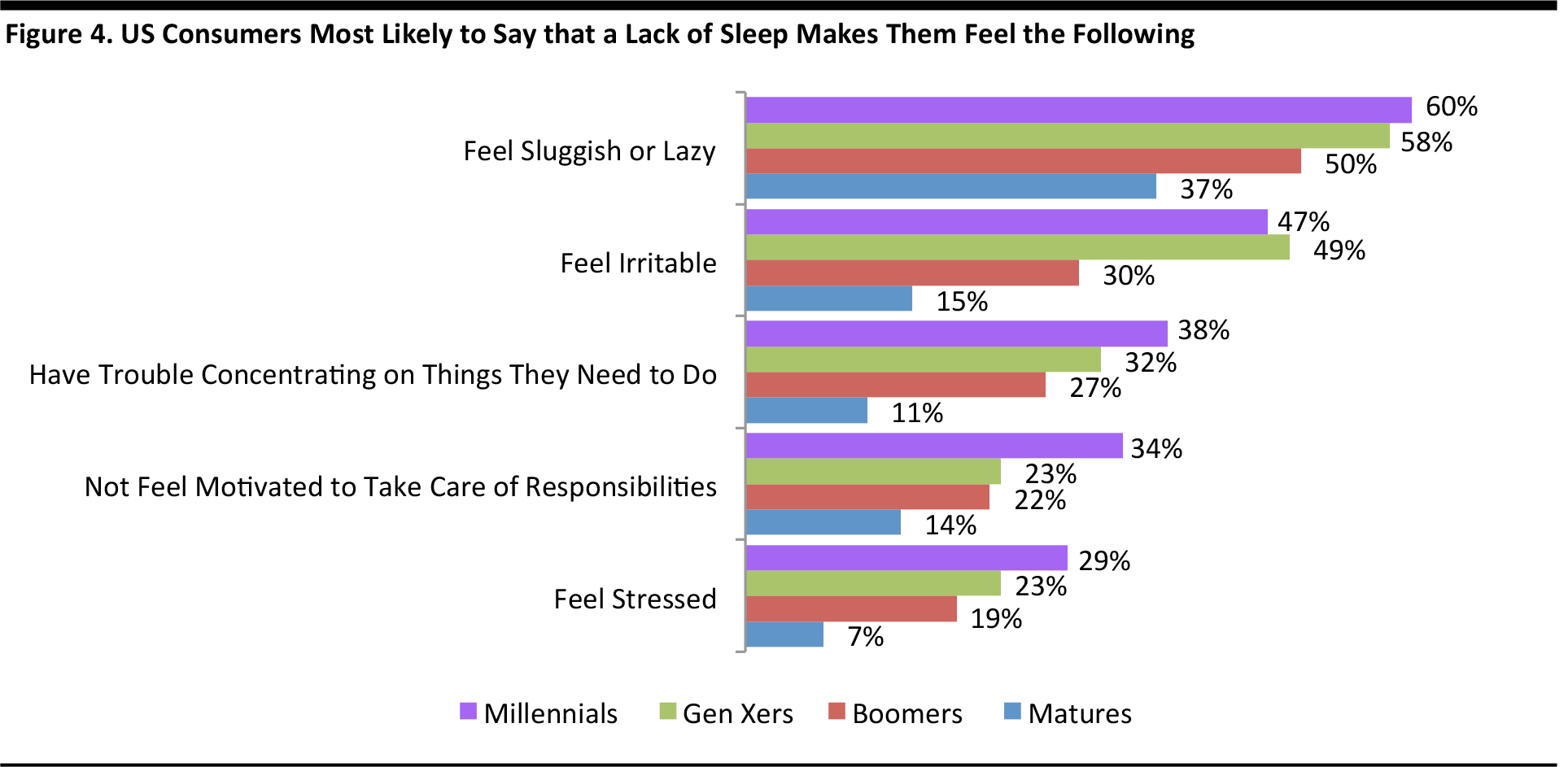

Among the generations, younger adults are more likely to report negative consequences of sleep deprivation and poor sleep quality. Approximately 60% of millennials and 58% of Gen Xers are likely to say that they feel lazy or sluggish if they have not slept well or long enough, according to research by the American Psychological Association from August 2013. Younger adults are also more likely than older generations to report experiencing other negative consequences from unhealthy sleep—such as feeling irritable, having trouble concentrating on things they need to do, not feeling motivated to take care of responsibilities and feeling stressed.Base: 1,950 US adults surveyed August 3–31, 2013 Source: American Psychological Association

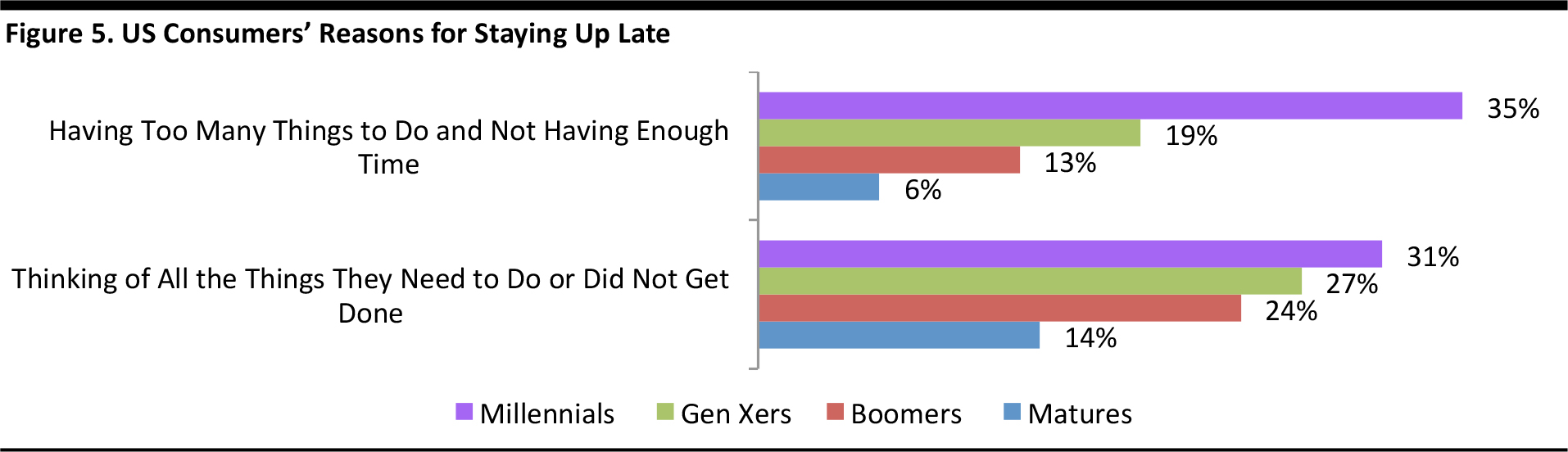

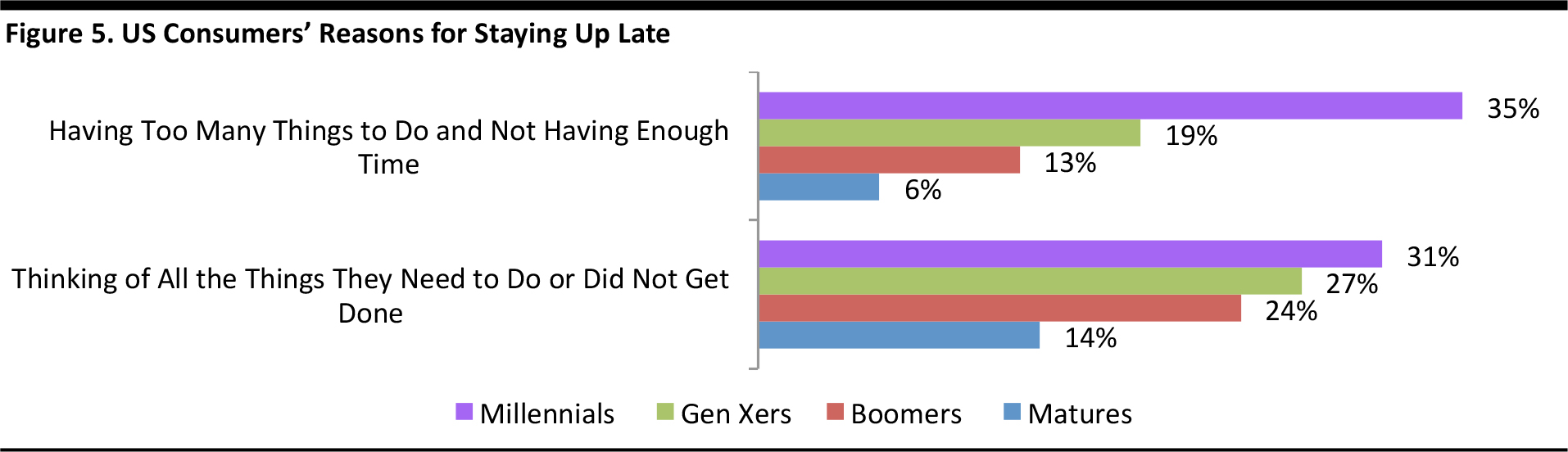

Millennials and Gen Xers More Likely to Attribute Poor Sleep to Doing a Great Many Things

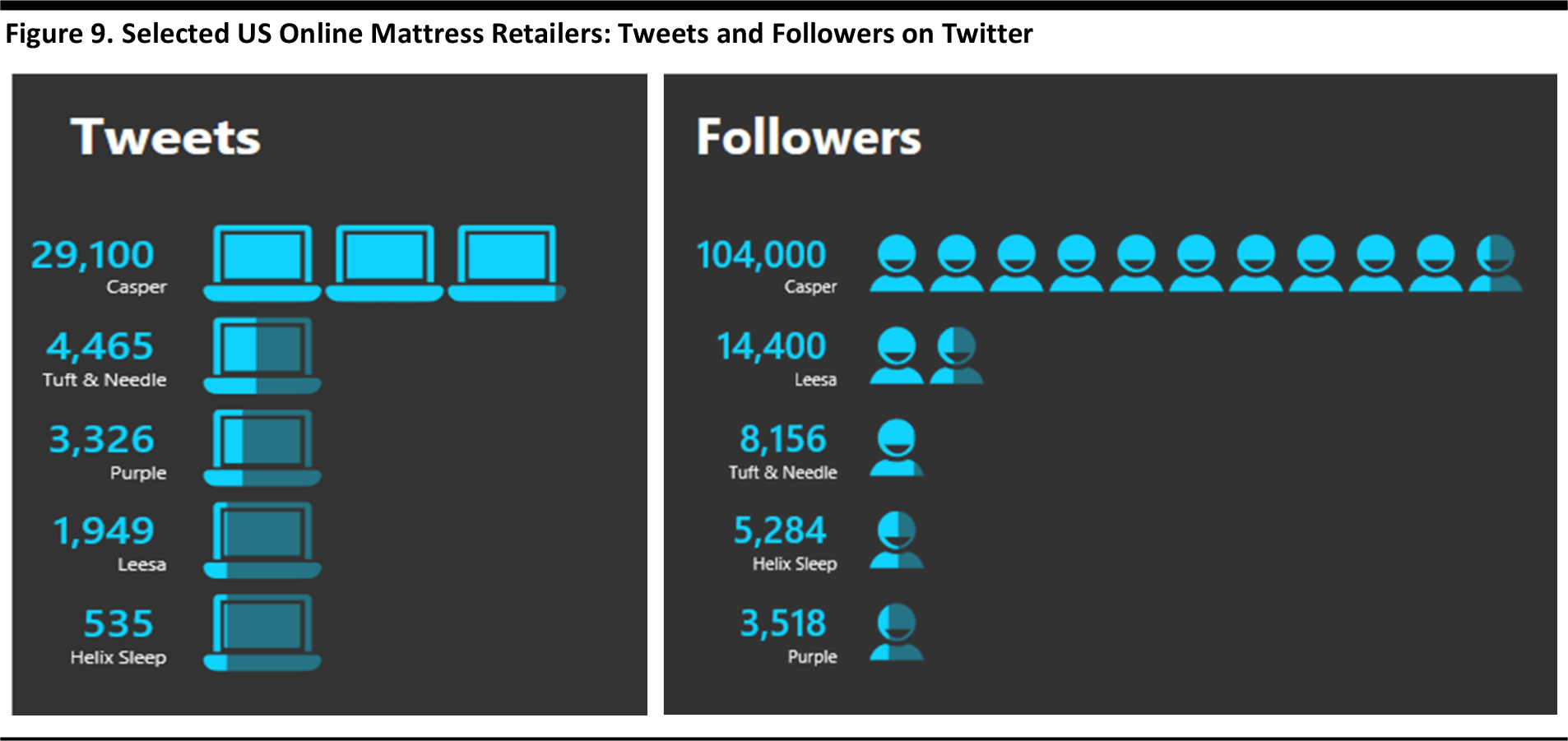

Younger adults seem to want to accomplish a lot and they are likely to sacrifice sleep in order to do so. A higher percentage of younger adults than older adults also seem to worry more about doing things or not having done them and to stay awake thinking about them, according to the American Psychological Association’s research.

Base: 1,950 US adults surveyed August 3–31, 2013 Source: American Psychological Association

Use of technology is likely to be one reason why younger consumers tend to experience sleep that is insufficient in quality or duration. While the American Psychological Association’s research did not include questions on how technology usage affects sleep, several other investigations indicate that using a mobile phone or watching television before going to sleep negatively affects sleep quality. Smartphone screens, in particular, are built to emit blue light so that the screens are visible and readable even in bright daylight. But that kind of light is known to do more harm than good when smartphones are used at night because the light imitates bright sunlight, confusing the brain and suppressing the nocturnal production of melatonin—a hormone responsible for prompting the body to fall asleep. This makes it harder for the body to go to sleep and remain restful until morning. Millennials are the most tech-reliant demographic: research from the Bank of America found that 34% of people ages 18–24 regularly sleep with their phone by their bedside and that nearly 44% of that group admits to having fallen asleep while using their phone. Despite the research indicating that viewing bright screens before bedtime can negatively affect sleep quality, some people may find it helpful to have their phone close by when falling asleep. A further likely reason for poor sleep patterns is the increase in urban living. This trend spans the migration to urban areas in fast-developing economies such as China and the choice being made by an increasing number of younger people in Western economies to opt for city living. Urban living typically means more noise—whether from traffic, neighbors or revelers. Some people will also experience disturbed sleep patterns from international travel and shift work. Jet lag denotes disturbance to the body’s internal clock due to travel across time zones, and shift workers are susceptible to experiencing symptoms similar to jet lag, as they tend to work outside of conventional work hours.Emerging Tools that Are Driving Healthful Sleeping

There are three major segments in the growing sleep economy: sleep technology, mattresses and deep-rest classes.1. Sleep Technology

Sleep technology spans applications, devices and music playlists that promote sleep and it is a category that has grown in popularity in recent years. According to BCC Research, the global market for sleep aid products is expected to reach $77 billion in 2019. Research from the National Sleep Foundation (NSF) indicates that more than 71% of US sleep tech users are under the age of 45, and millennials’ reliance on technology has led to the emergence of numerous sleep apps and devices that measure sleep time and quality. Many find sleep aid technology helpful. Research from the NSF and the Consumer Technology Association (formerly known as the Consumer Electronics Association) in September 2015 found that 60% of US consumers who owned some kind of sleep tech described being more mindful of their sleeping patterns, while about 51% said they had noticed an improvement in their sleep and nearly 50% reported feeling healthier. These figures are likely to change as products and technology develop further to cater to specific kinds of sleep disorders.

Most sleep tech products fall under one of three broad categories: apps, hardware or wearables. Smartphone and tablet apps range in function from helping users fall asleep to waking users up to tracking how users have slept through the night. Some even play white noise (sounds in a range of frequencies at the same intensity that simulate constant background noise) or music that fades out as the user falls asleep.

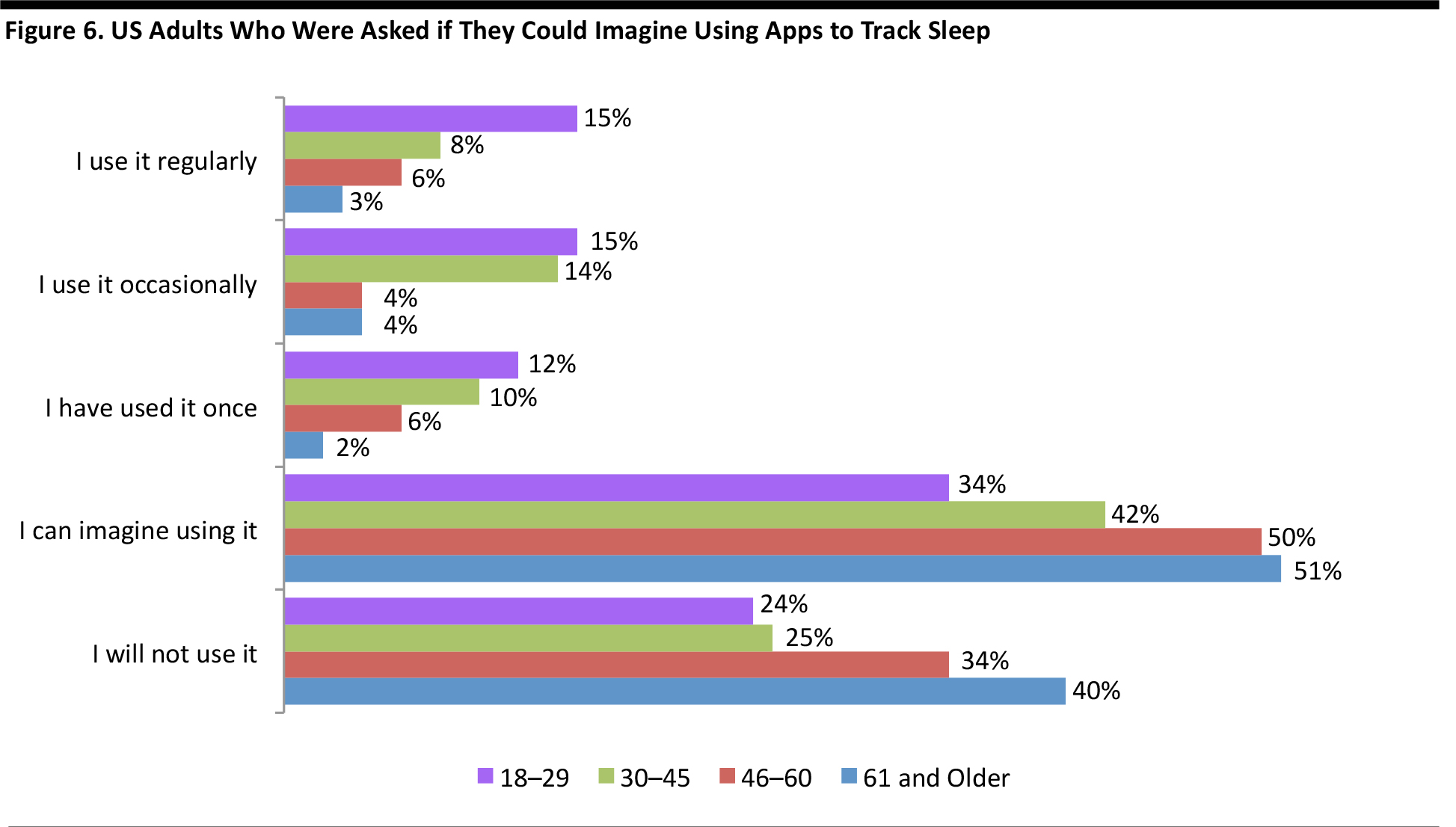

More younger adults than older adults use sleep apps in the US, according to a March 2017 survey by Statista. Among Americans surveyed (all of whom owned a smartphone, a tablet or both), 15% of those ages 18–29 said they use sleep apps regularly, while 8% of those ages 30–45 and 6% of those ages 46–60 said the same. Only 3% of those ages 61 and older said they use sleep apps regularly.

However, it appears that more older consumers than younger ones are likely to use such apps in the future, as just over a third of younger adults surveyed by Statista said that they could imagine using an app to track sleep, while more than half of those ages 61 and older said that they could imagine doing so. Meanwhile, almost a quarter of younger adults polled said that they will not use sleep apps, while just over a third of older adults said the same.

So, even though younger adults account for a higher proportion of sleep app users currently, the findings of the Statista survey indicate that the majority of consumers are unlikely to adopt such technology as a tool to promote healthful sleep anytime soon.

Many find sleep aid technology helpful. Research from the NSF and the Consumer Technology Association (formerly known as the Consumer Electronics Association) in September 2015 found that 60% of US consumers who owned some kind of sleep tech described being more mindful of their sleeping patterns, while about 51% said they had noticed an improvement in their sleep and nearly 50% reported feeling healthier. These figures are likely to change as products and technology develop further to cater to specific kinds of sleep disorders.

Most sleep tech products fall under one of three broad categories: apps, hardware or wearables. Smartphone and tablet apps range in function from helping users fall asleep to waking users up to tracking how users have slept through the night. Some even play white noise (sounds in a range of frequencies at the same intensity that simulate constant background noise) or music that fades out as the user falls asleep.

More younger adults than older adults use sleep apps in the US, according to a March 2017 survey by Statista. Among Americans surveyed (all of whom owned a smartphone, a tablet or both), 15% of those ages 18–29 said they use sleep apps regularly, while 8% of those ages 30–45 and 6% of those ages 46–60 said the same. Only 3% of those ages 61 and older said they use sleep apps regularly.

However, it appears that more older consumers than younger ones are likely to use such apps in the future, as just over a third of younger adults surveyed by Statista said that they could imagine using an app to track sleep, while more than half of those ages 61 and older said that they could imagine doing so. Meanwhile, almost a quarter of younger adults polled said that they will not use sleep apps, while just over a third of older adults said the same.

So, even though younger adults account for a higher proportion of sleep app users currently, the findings of the Statista survey indicate that the majority of consumers are unlikely to adopt such technology as a tool to promote healthful sleep anytime soon.

Base: 962 adults ages 18 and over who own a smartphone or tablet or both, surveyed March 2–7, 2017 Source: Statista

Examples of sleep apps include: Sleep Cycle: This app tracks the user’s sleep phases and wakes the user up during the phase of light sleep. It also shows the user what night he or she got the least sleep.

Source: sleepcycle.com

Sleep Genius: This app claims that it is “the most scientifically designed sound program for sleep in the world today.” It does not use white noise sounds and strongly advises against the use of white noise. The app has four programs, each of which plays sounds to “guide” the user to fall asleep. It also features a power nap function that allows the user to nap for 30 minutes, alarm tunes with gentle sounds to wake the user after a sleep program, and a relaxation program to help the user de-stress and relax.Source: sleepgenius.com

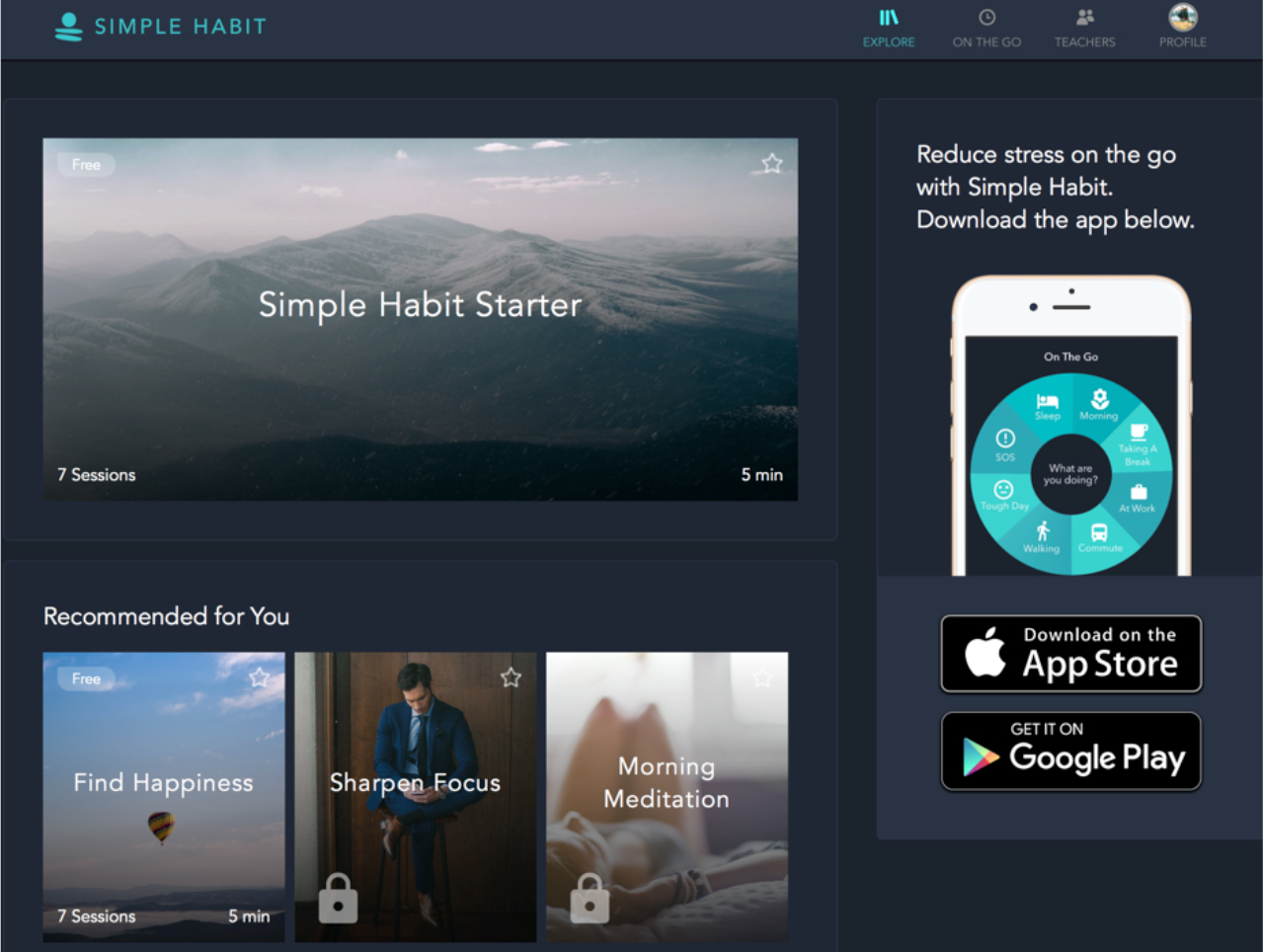

Simple Habit: This app was developed by a Harvard psychologist and features five-minute guided meditation programs for various situations through the user’s day, such as “having a tough day at work” or “trouble falling asleep.” The app also contains other mindfulness content on various topics such as stress, kindness, work and personal growth.Source: simplehabit.com

The “Bedtime” Function on iOS: Apple products such as iPhones and iPads have a built-in Bedtime function that helps users track sleep and reminds them when to go to bed. The function then charts how much sleep the user is getting, challenging the user to “keep the bars in line” by adhering to a consistent sleep routine.Source: apple.com/hk/en/ios/health

Sleep-enabling hardware includes devices that can be placed around a room, close to the user’s bed or sleep area. Some hardware even integrates with users’ smartphones. These products help measure the air and sound quality in the bedroom environment, as well as the sleeper’s movement and other factors that may affect sleep. Some devices use gentle sounds and lights to simulate sunrise when it is time to wake up. Examples of such hardware include: S+ by ResMed: This device sits on a bedside table and measures movement, breathing, noise, temperature and light. It integrates with a smartphone and allows users to view data and adjust their bedroom in order to facilitate better sleep.Source: apple.com/hk/en/ios/health

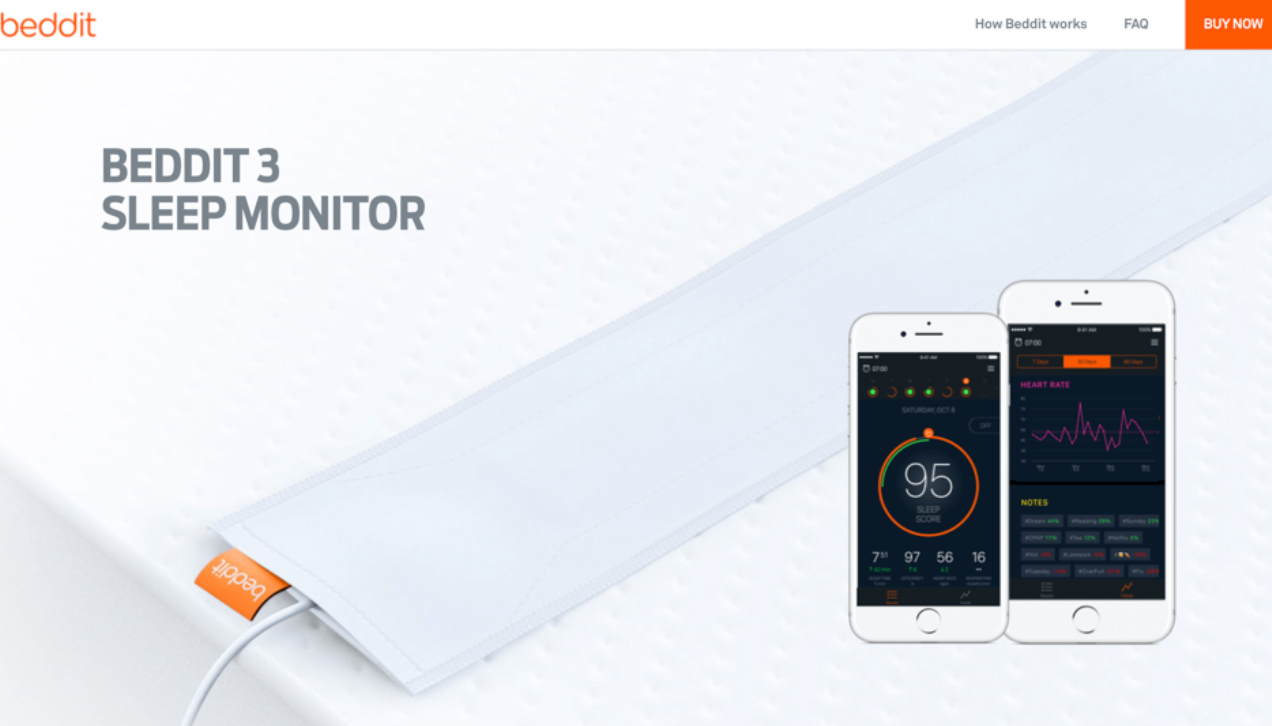

Beddit: This sleep monitor’s sensor strip is placed under the bed sheet, where it records the user’s movement, heart rate, snoring and breathing. It senses when the user goes to bed and tries to sleep, and sounds an alarm to wake the user up at the ideal point in his or her sleep cycle. The only drawbacks of the strip are that it needs to be plugged in the whole time and that results can be distorted if a second person sleeps in the same bed. Changes in the product design are highly likely, as the company was recently acquired by tech giant Apple for an undisclosed sum.

Source: beddit.com

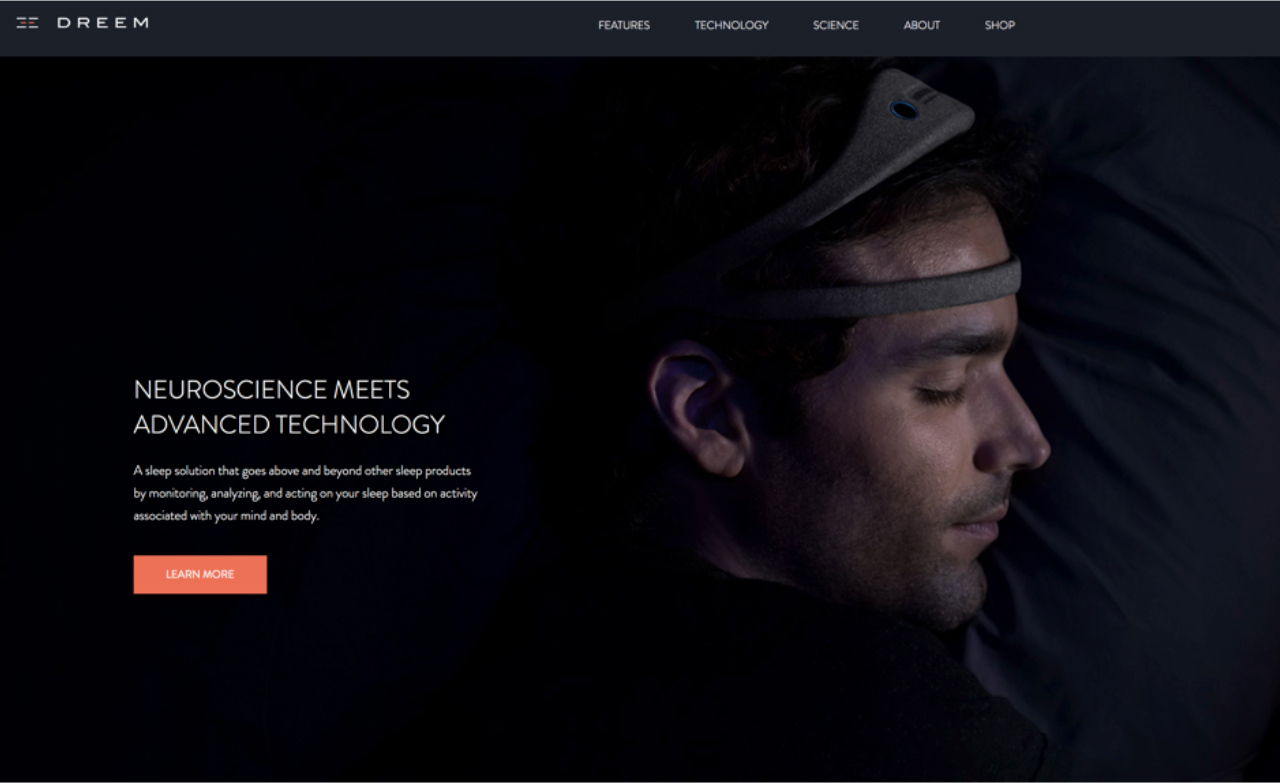

Most health wearables tend to have built-in sleep-tracking functionality, along with other features that track users’ daily activities. Some wearables that have been created specifically to track sleep include: Dreem: The Dreem device is a headband worn while sleeping. It uses neurotechnology to understand what stage of sleep the user is in to trigger the kind of sound stimulation that will help the user sleep better.

Source: dreem.com/en

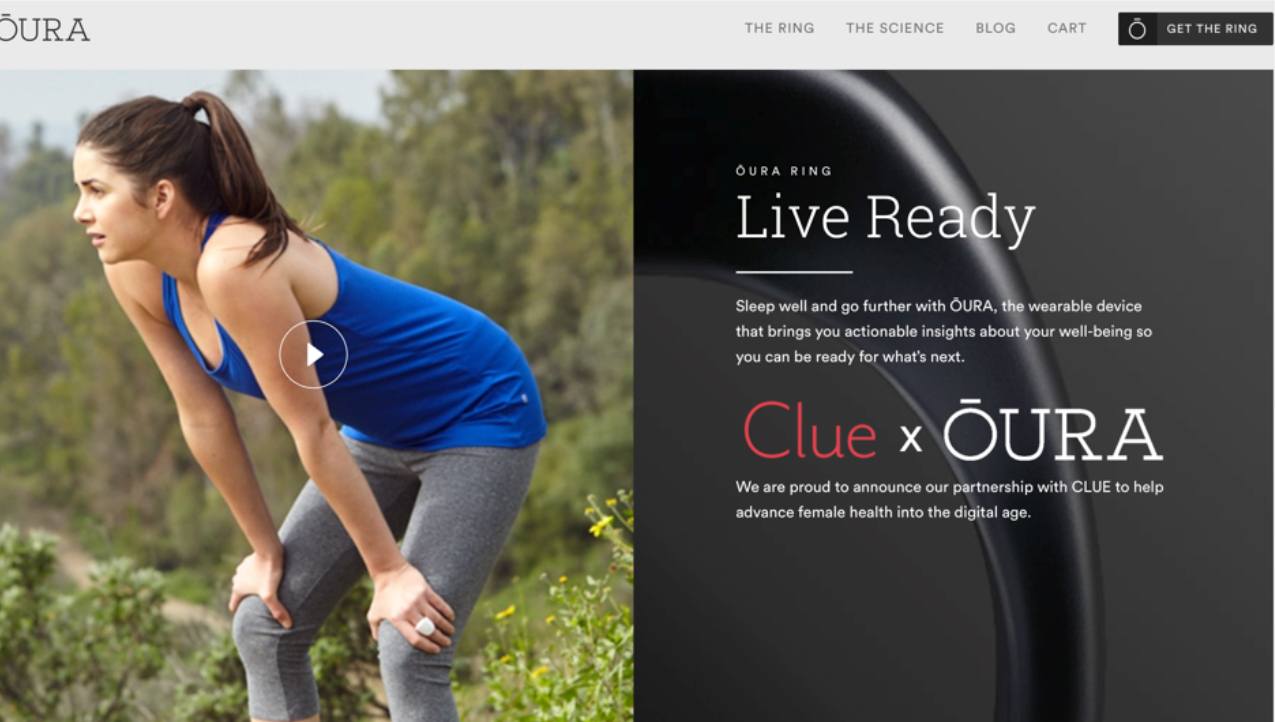

Oura: This is a finger ring marketed as a sleep and activity tracker. It works like a wristband tracker and uses tiny sensors to detect movement, heart rate and sleep. It integrates with a smartphone app via Bluetooth, allowing the user to track his or her progress.

Source: ouraring.com

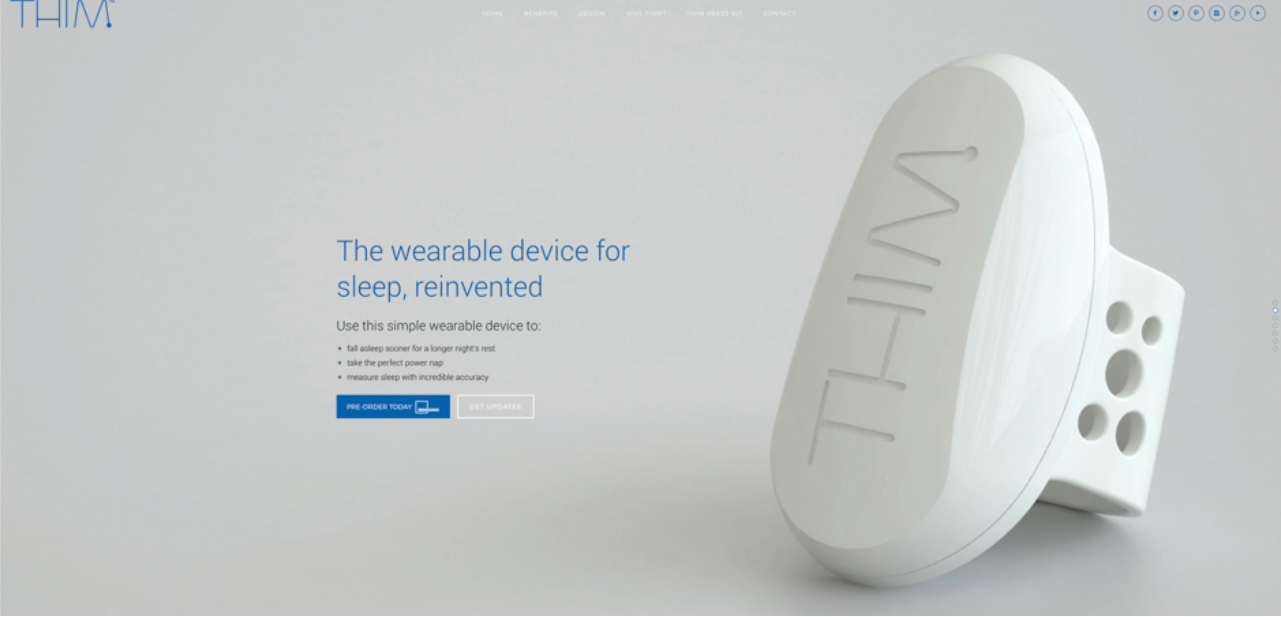

Thim: Thim is also a ring, but unlike Oura, it is meant to be worn only while sleeping. It also works in a different manner: the Thim ring detects when the wearer has fallen asleep and wakes him or her up after three minutes. It repeats this until the wearer is conditioned to fall asleep sooner. Professor Leon Lack, who codeveloped the device, had conducted earlier research with colleagues and discovered a way to help people fall asleep at least 30 minutes sooner. In research papers published in 2007 and 2012, Lack and his colleagues stated that if a person’s body is made to repeatedly experience the sensation of falling asleep, the person will fall asleep sooner and will stay asleep longer.

Source: thim.io

Several other sleep apps, devices and wearables are already on the market and more are in development.Songs, Sounds and Speech to Sleep Better

An emerging trend in relaxation and sleep is the use of videos and audio clips to elicit autonomous sensory meridian response (ASMR). As scholarly as the term may sound, Think with Google—the tech giant’s marketing research and digital trends blog—found that ASMR is a popular search term, especially on YouTube. ASMR refers to a tingling sensation that begins on the scalp and moves down the spine and neck, making the person experiencing it relaxed and calm. Videos and audio clips with people narrating soothing phrases in soft tones, perhaps with background music, fall under this category. In some clips, the narrator even guides the person to perform activities such as meditating or applying makeup. Some of the more popular “ASMRtists” on YouTube are Heather Feather and Gentle Whispering, each with over 400,000 subscribers. A few of the artists even narrate stories and fairytales, as listening to stories is soporific for many.

Source: www.youtube.com/user/HeatherFeatherASMR

There are more than 5 million videos related to ASMR on YouTube, and searches for such videos on the site grew by 200% year over year in 2015, according to Think with Google. Google’s most interesting finding was that Google searches for ASMR content tended to peak around 10:30 p.m. across time zones and that “ASMR sleep” was the top related search term. Other online media offerings, such as music-streaming service Spotify, have also seen a rise in number of sleep-related searches. According to Spotify, various versions of sleep noise have been downloaded more than 5 million times.Technology Is Not the Only Solution to Poor Sleep

While many consumers turn to technology in order to sleep better, others many find that the best way to improve their sleep is simply to change their mattress. For more and more young, urban professionals renting out small spaces in increasingly crowded cities, replacing the mattress used by previous tenants is something they do instinctively. But finding people who can help move large furniture such as beds and mattresses may not always be possible. Accordingly, several millennial-focused mattress brands have emerged that make it easy to purchase beds and bedding and have them delivered.2. Mattresses

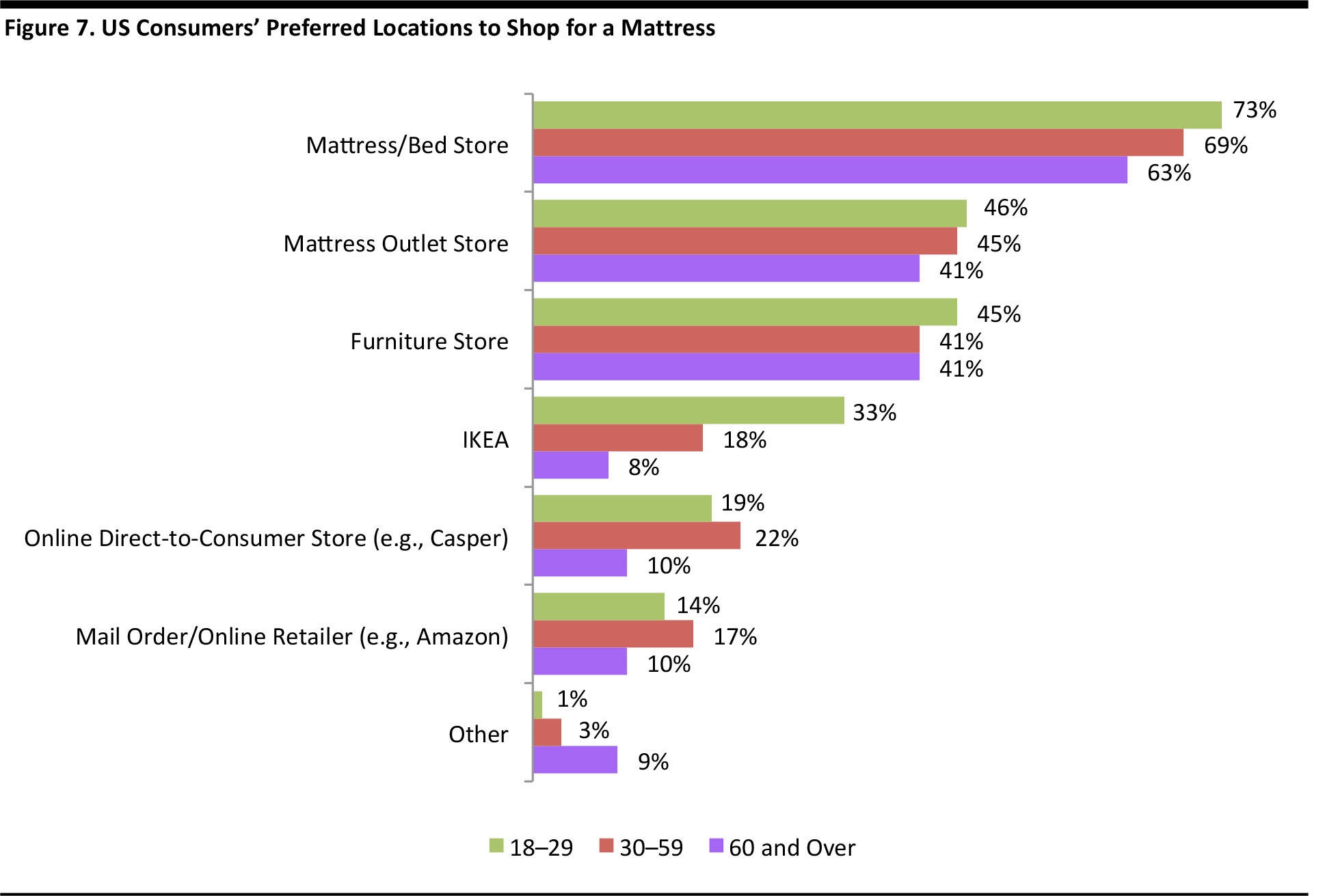

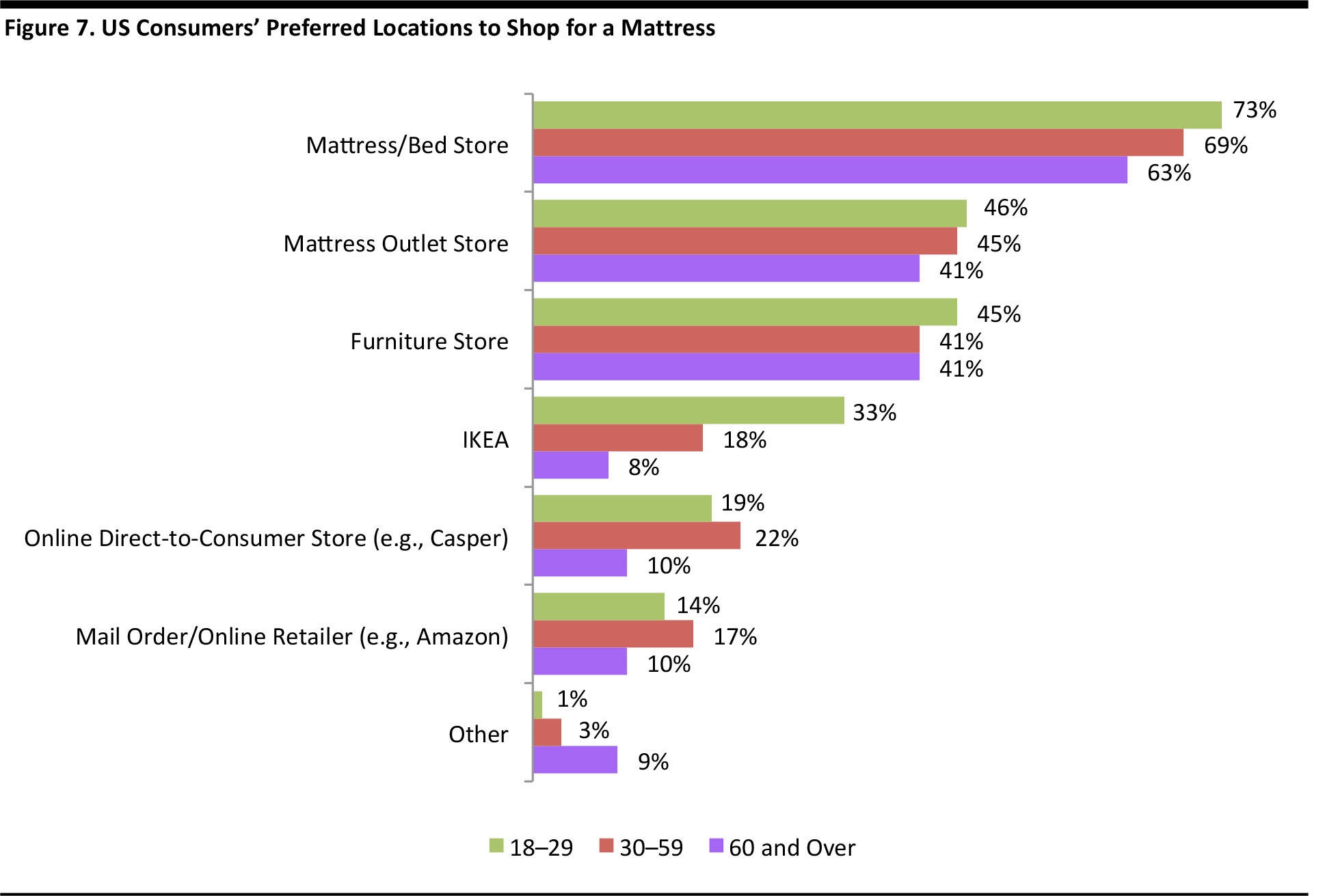

Driven by innovative, e-commerce-focused brands, mattresses are being elevated from a basic household item to an aspirational and indulgent furnishing. By targeting the always-on millennials, brands that sell luxury, customizable mattresses online and home deliver them are disrupting the mattress market in the US, which is currently estimated at $7 billion by the Statistic Brain Research Institute. The way people shop for mattresses varies by generation, and brands that offer online ordering (which most traditional mattress retailers do not) have capitalized on shoppers who prefer to buy online. We note that although younger shoppers exhibit a stronger preference for shopping online than older shoppers do, shoppers across all generations still indicate a strong preference for in-store shopping, according to a January 2017 Statista survey. The graph below, which comes from the Statista survey, shows respondents’ preferences for where they would like to shop for a mattress (respondents could choose more than one location). Stores—specialist mattress stores, outlet stores and furniture stores—stand out as the top choice for a large proportion of consumers surveyed, across generations. But IKEA stood out distinctly as a preferred choice for consumers ages 18–29, and a higher proportion of consumers in that age group and in the 30–59 age group said they prefer to shop online for mattresses compared with the 60-and-older age group.

Base: 1,053 online US adults ages 18 and over surveyed January 25–28, 2017 Source: Statista

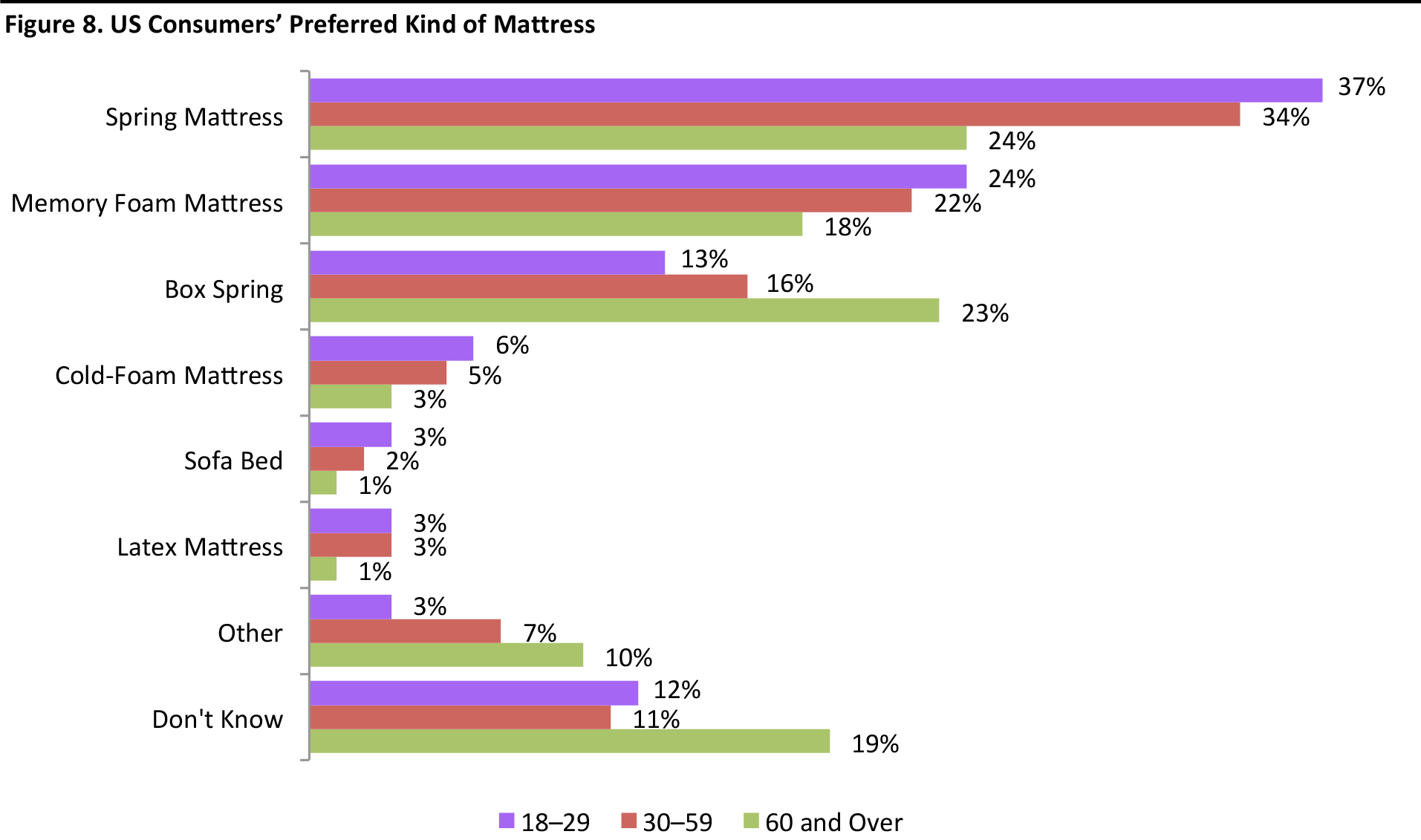

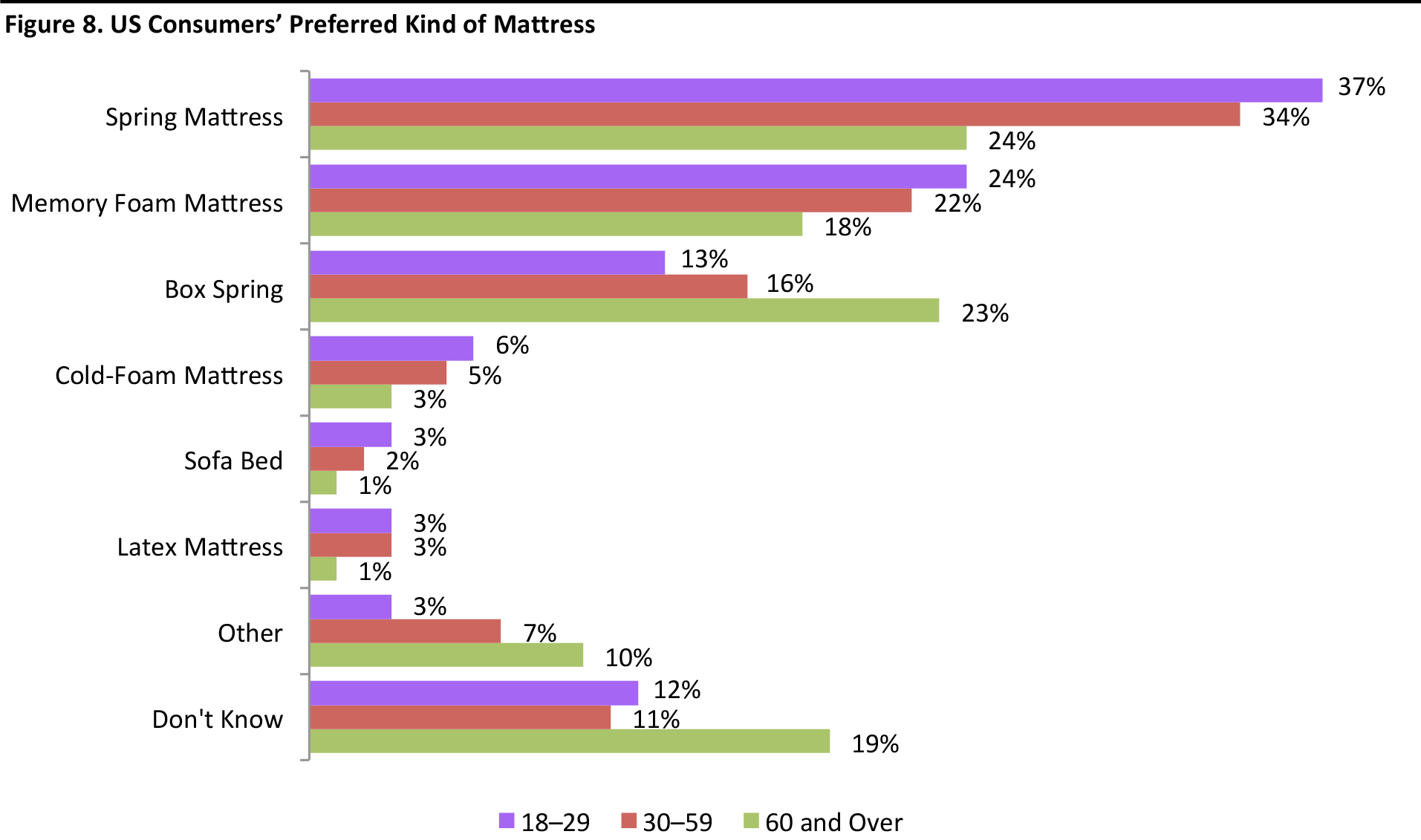

There is a stark difference even in the types of mattresses preferred among generations of consumers, according to the Statista survey. Older consumers exhibit a stronger preference than younger consumers do for traditional box spring mattresses and younger consumers show a stronger preference for the more flexible spring and memory foam mattresses.

Base: 1,053 online US adults ages 18 and over surveyed January 25–28, 2017 Source: Statista

Consumers choose mattresses based on personal preference and there is no one “best type of mattress,” but for many, their choice of mattress may have more to do with convenience than whether it provides them with the best sleep. Many younger consumers are students or early-career professionals living in temporary, rented accommodations. Because they tend to move every few years, they likely prefer memory foam mattresses over box springs because the foam mattresses can be folded and shipped more easily.

Source: iStockphoto

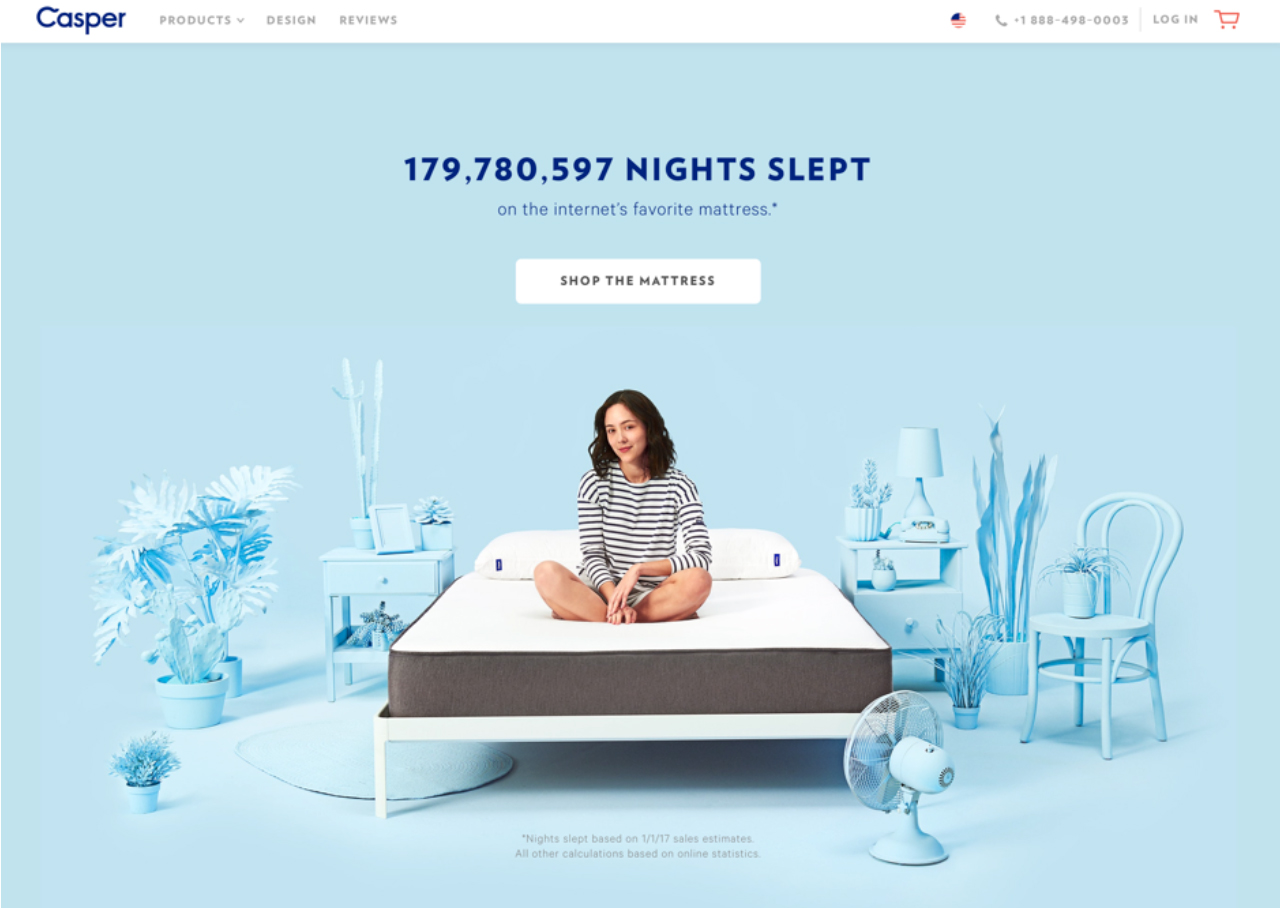

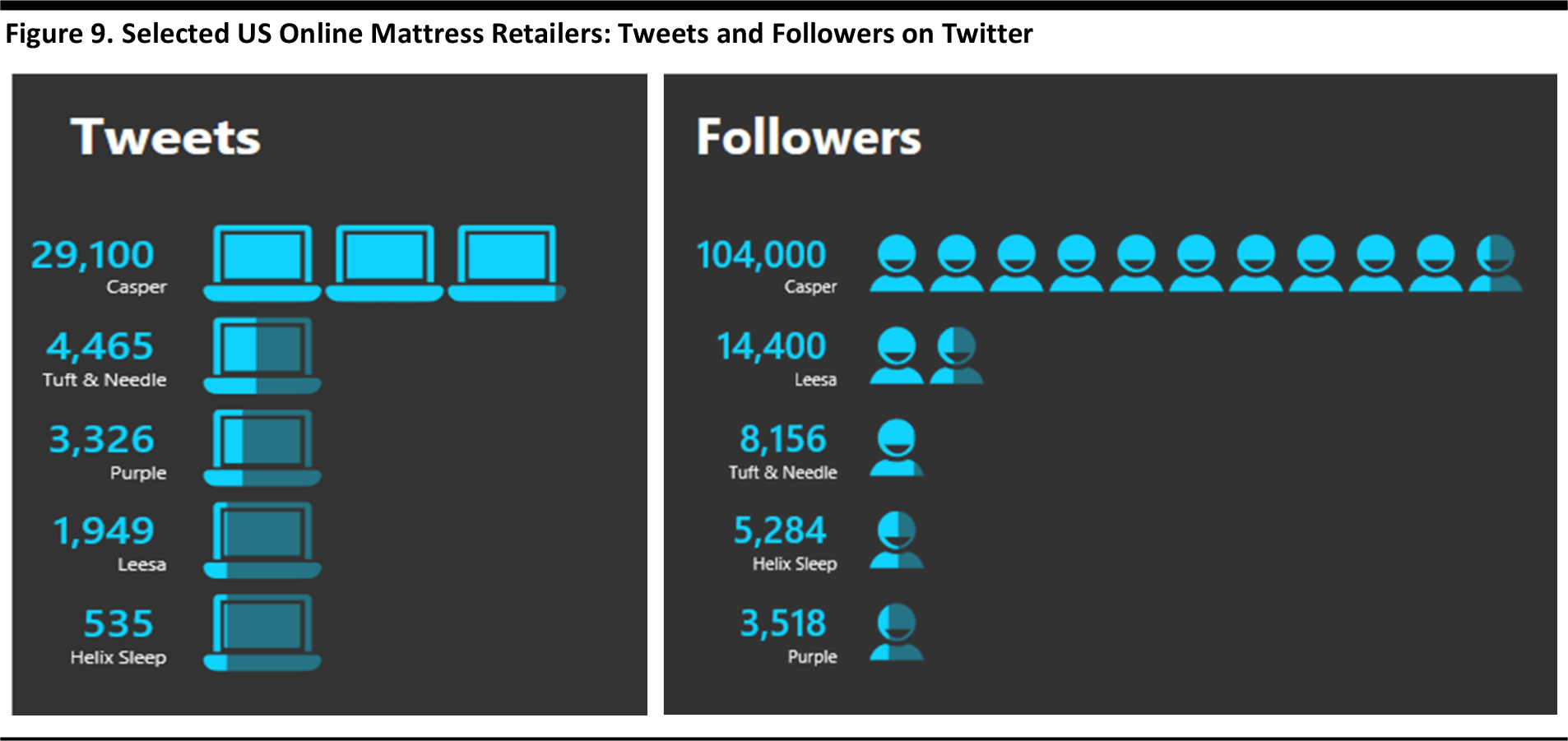

Casper is the most celebrated disruptor in the mattress category, primarily due to its marketing, its route to market and the convenience it offers in terms of purchasing. With a premium positioning, the startup has encouraged people to view mattresses as an aspirational and desirable purchase. This has, in turn, contributed to the trend of consumers investing in the quality of their sleep. The simplicity of Casper’s offering has been key to its success—it sells only one type of mattress, in varying sizes, and engages strongly with customers on social media, encouraging them to share their purchases and experiences on Twitter. In May, newspapers reported that Target had held talks to acquire Casper. A few weeks later, Casper revealed that it had raised $170 million, with Target leading the investment, and that it was planning an IPO in due course. In the UK, Eve has similarly established itself as a contemporary, aspirational mattress brand through its own direct-to-consumer website. In May, Eve raised £35 million (US$44 million) in an IPO on the UK’s AIM stock exchange; the IPO valued the business at £140 million (US$178 million). Helix Sleep, Leesa, Purple, and Tuft & Needle are some of Casper’s US competitors. However, Twitter metrics suggest that these companies generate far less social media engagement than Casper does.

As of June 27, 2017 Source: Company Twitter accounts

3. Deep-Rest Classes

The wellthness trend has coincided with a boom in fitness classes, but there has also been an increase in the number of deep-rest and napercise classes, which allow attendees to take naps in a group. As we noted in the first report in this series, millennials are more likely than older age groups to seek a social element in various activities. These classes fill that demand, as they add a social element to the individual act of sleeping. New York–based meditation studio Inscape was one of the first companies to introduce such classes, which are categorized as offering either meditation or relaxation experiences. In the deep-rest classes, which are part of the latter group, participants lay on mattresses on the floor while being guided to concentrate on each part of their body in a sequence, “letting go and recharging.”Source: inscape.life

In the UK, premium fitness club chain David Lloyd Clubs offers similar classes. Marketed as “group napping classes for exhausted mums and dads to help boost their mental and physical well-being,” the chain’s napercise sessions have people doing stretches for a few minutes followed by sleeping in a bed with a blanket and an eye mask for 45 minutes. Soft mood music plays in the background and the room temperature is set to a level that induces calorie burning. Though the classes are geared toward busy parents, they are likely to resonate with sleep-deprived, overworked millennials, too.The Enabling Forces Reshaping Sleep

In this section, we take a closer look at the enablers of growth in the sleep sector, as outlined in our wellthness matrix: younger consumers’ willingness to pay a premium, their adoption of digital technology and their use of social media.Enabler 1: Millennials Are Willing to Spend More on Wellness

Millennials are willing to pay a premium to become and remain healthy. We explored this in more detail in the first report in this series and the notion is supported by data from the Spring/Summer 2015 Cassandra Report, which is based on a 2015 survey of more than 1,700 American 18–34-year-olds. The report contained a number of details on millennials’ health-related spending:- More than 80% of this age group said they spend one-quarter of their disposable income on health products and services.

- More than 35% of those surveyed said they had reduced their spending in other areas in order to make more health-related purchases, including purchases of food, activities and apparel.

- Some 41% said they would splurge on “classes that improve their body,” while about 23% said they would spend more on fitness clothing and footwear and 36% said they would spend more on healthy foods and drinks.

Below, we outline the prices of the products and services we discussed earlier in this report. Many of these are relatively expensive: Casper mattresses and Simple Habit apps do not come cheap.

Below, we outline the prices of the products and services we discussed earlier in this report. Many of these are relatively expensive: Casper mattresses and Simple Habit apps do not come cheap.

Source: Company websites

Enabler 2: Millennials Are the Largest Group of Wearable Users

Millennials take the lead in owning wearable devices, according to a number of sources:- This demographic is the largest user group for wearables, according to a 2017 study by research and advisory firm Gartner.

- Forrester’s 2015 survey of US wearable users found that 35% of them were millennials and 34% were Gen Zers.

Base: 952 online adults surveyed in 2015 Source: Forrester

Wearable sleep devices, such as the Oura and Dreem, are likely to see strong uptake among millennials, as the NSF states that more than 71% of American sleep tech users are under the age of 45.Enabler 3: Social Media, a Sword of Damocles in Driving Wellness

While many health-conscious consumers are eager to display their wellthness through posts on social media platforms, studies have shown that social media use can negatively affect sleep quality, and thus impede wellness. So, social media is like the sword of Damocles in the ancient Sicilian story, representing both power and peril when it comes to wellness. Researchers at the University of Pittsburgh investigated the relationship between social media use and sleep among 1,788 adults ages 19–32, and found that:- Among those who spent the most minutes per day on social media, the top 25% had nearly twice the risk of experiencing disturbed sleep as the bottom 25%.

- Among those who made the most social media visits per week, those in the top 25% faced nearly triple the risk of experiencing disturbed sleep as those in the bottom 25%.

What We Think

As the demand for quality, restful sleep rises, we believe the market for innovative products and services that promote healthful sleep will grow. We also think that many consumers have an increasing desire to cocoon in peaceful havens in busy urban locations, which will further promote demand for sleep-related products and services. With millennials and younger adults driving growth in wellness, we think demand for rest and meditation classes will also rise, especially since such classes offer a social element. Although the online mattress market is buoyant now, we think that it may slow down, as consumers need only replace a mattress once every several years. Therefore, it may be difficult for the mattress startups to sustain consumers’ excitement about improving their sleep by buying a new mattress. However, companies such as Casper have set a precedent for the way millennials will shop for furniture in the future, and these companies may incorporate other sleep-related products and services into their offerings that will help them further build their brands.