Executive Summary

Launched in 2011, WeChat is the flagship mobile instant-messaging platform and social network of China’s internet services giant Tencent. Within just six years, WeChat has grown to become one of the largest communication platforms in the world, rivaling other popular apps such as WhatsApp and Facebook Messenger.

During Tencent’s 2016 annual result announcement, management reiterated “Connection” as the strategy for 2017, with six initiatives to expand the ecosystem around its core social and communication platforms: 1) adding more services within its social platforms; 2) increasing the popularity of its games; 3) expanding its market share of advertisements; 4) growing digital content; 5) boosting the usage frequency of its payment system; and 6) developing cloud and machine-learning technology. As such, WeChat will remain at the core of Tencent’s business development strategy.

Three Key Differentiators

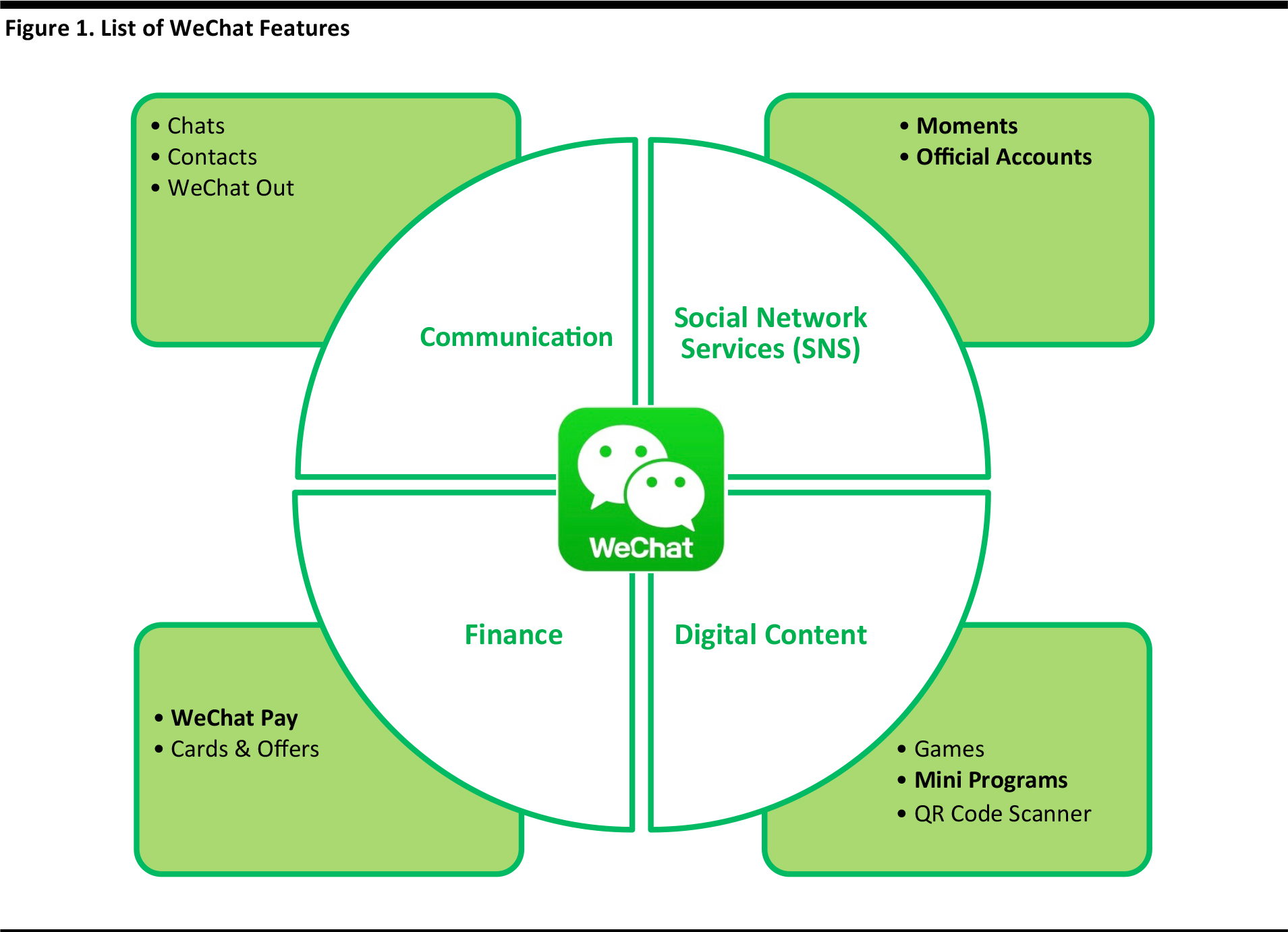

In this report, we highlight three key differentiators that have led to WeChat’s dominance as a connectivity platform:

- Social media: Moments and Official Accounts allow users to share their stories or to follow influencers and companies that they like.

- Mobile payments: WeChat Pay allows e-wallet, P2P transactions as well as e-payment.

- Mini apps: Dubbed “Mini Programs,” mini apps allow users to directly access mobile services in-app on WeChat, without the need to download a native app.

Challenges

As it expands further, both in China and overseas, we believe WeChat could face the following challenges:

- Capacity threshold of its app: Like a “Swiss army knife” app, WeChat’s numerous features could eventually drag down the user experience because of the huge computing memory demand.

- Decelerating growth of the user base of its core instant-messaging product: As WeChat nears the saturation point in China, it seeks to grow its user base by targeting lower-tier cities and overseas markets.

WeChat for Retail

WeChat acts not only as a source of news and promotional information for its users, but also allows customers to check out items via mobile payment rather than wait in a long check-out queue. Thanks to WeChat’s all-around functionality, it acts as a channel for mobile advertisements, as well as loyalty program management. In addition, WeChat enables a C2C e-commerce ecosystem through the support of third parties such as Weidian and Youzan. Similar to Shopify, users can open an online store through the Youzan or Weidian platforms, and the websites can then be accessed through WeChat browser and WeChat Official Accounts.

Understanding WeChat

As an instant-messaging platform, WeChat has a dominant position in China with no apparent competitors in sight. Coupled with differentiable features such as Moments and WeChat Pay, its payment platform, WeChat should easily be able to increase user engagement and retention.

Differentiable Features Have Led to Dominance in China

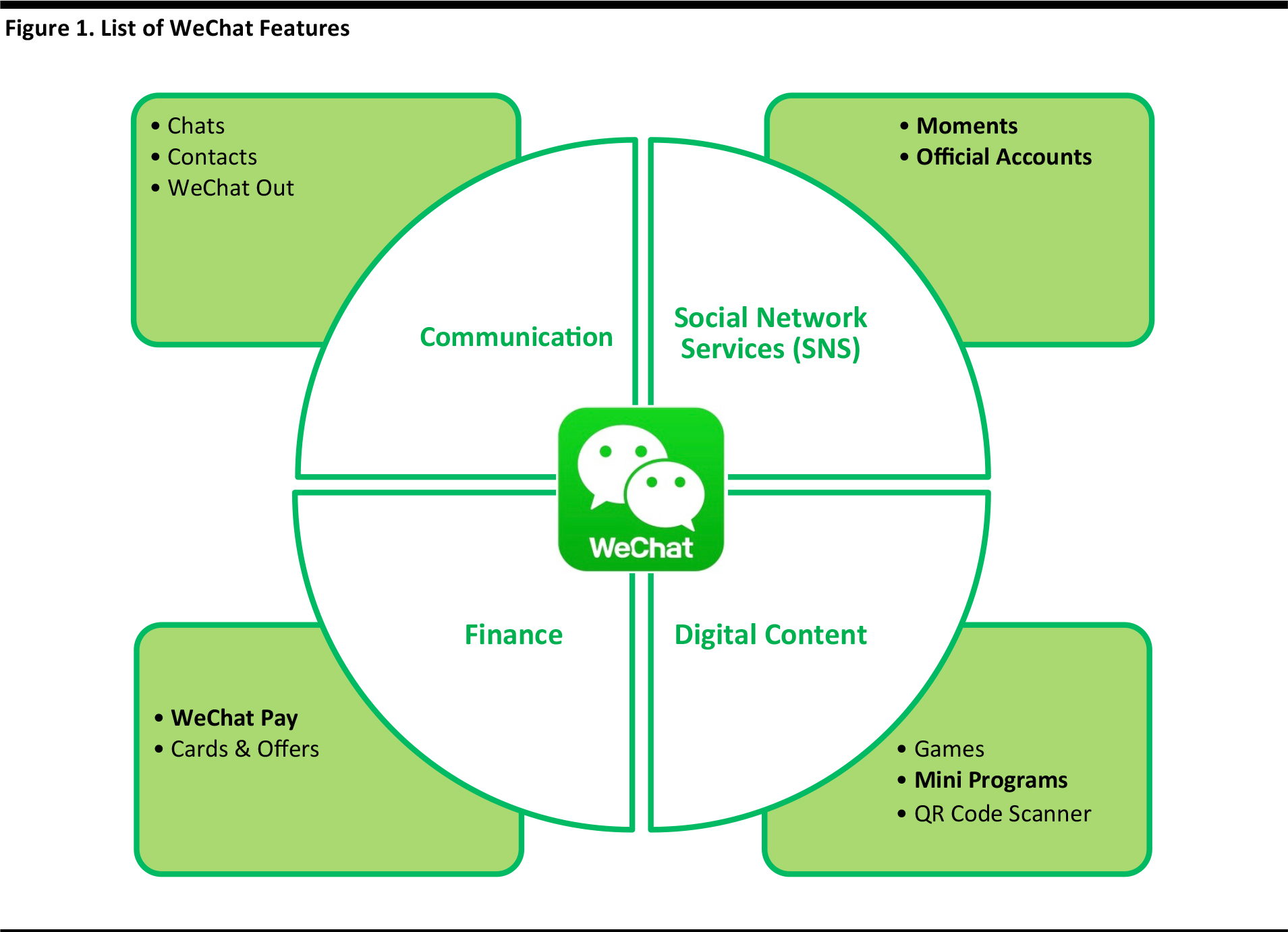

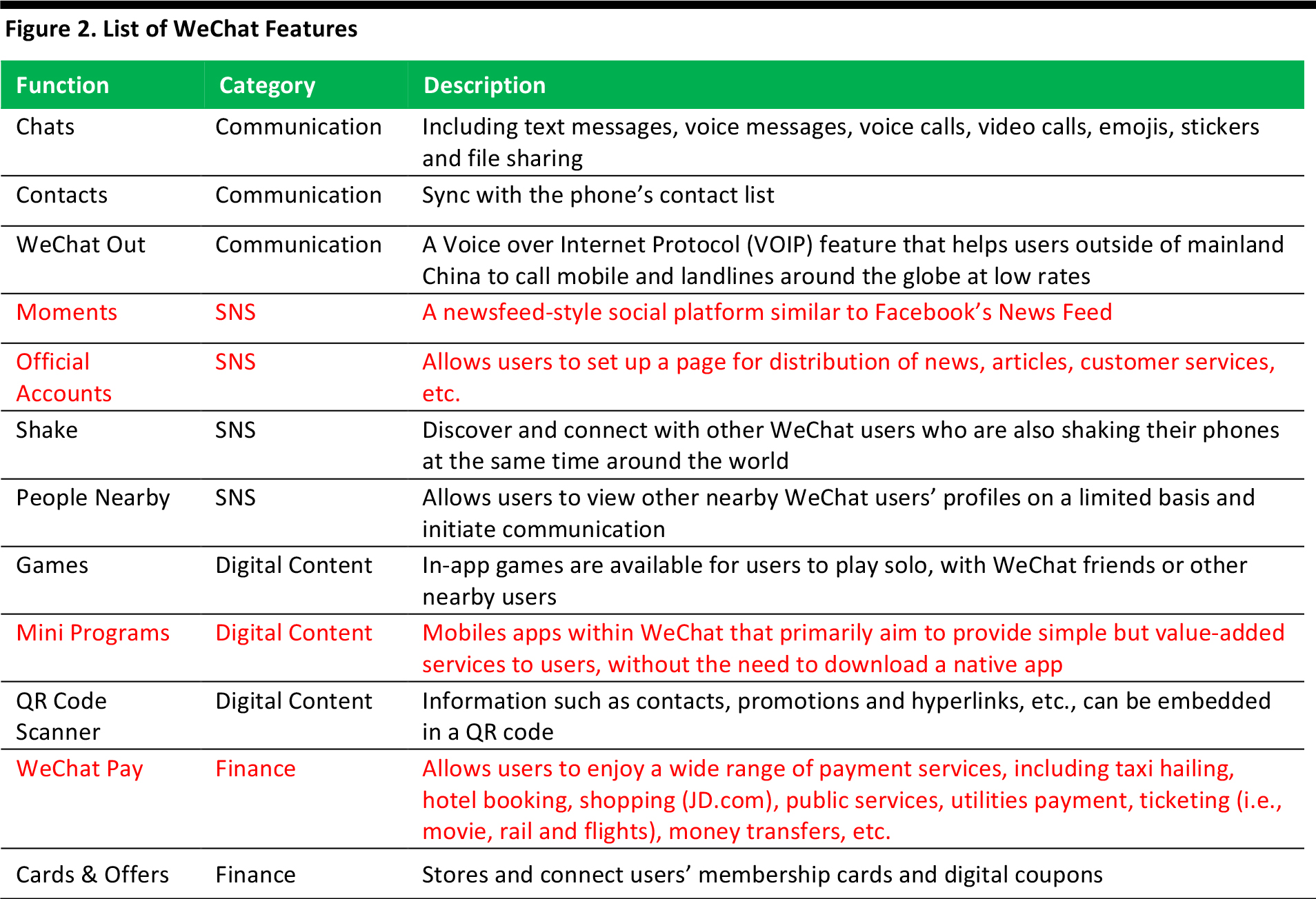

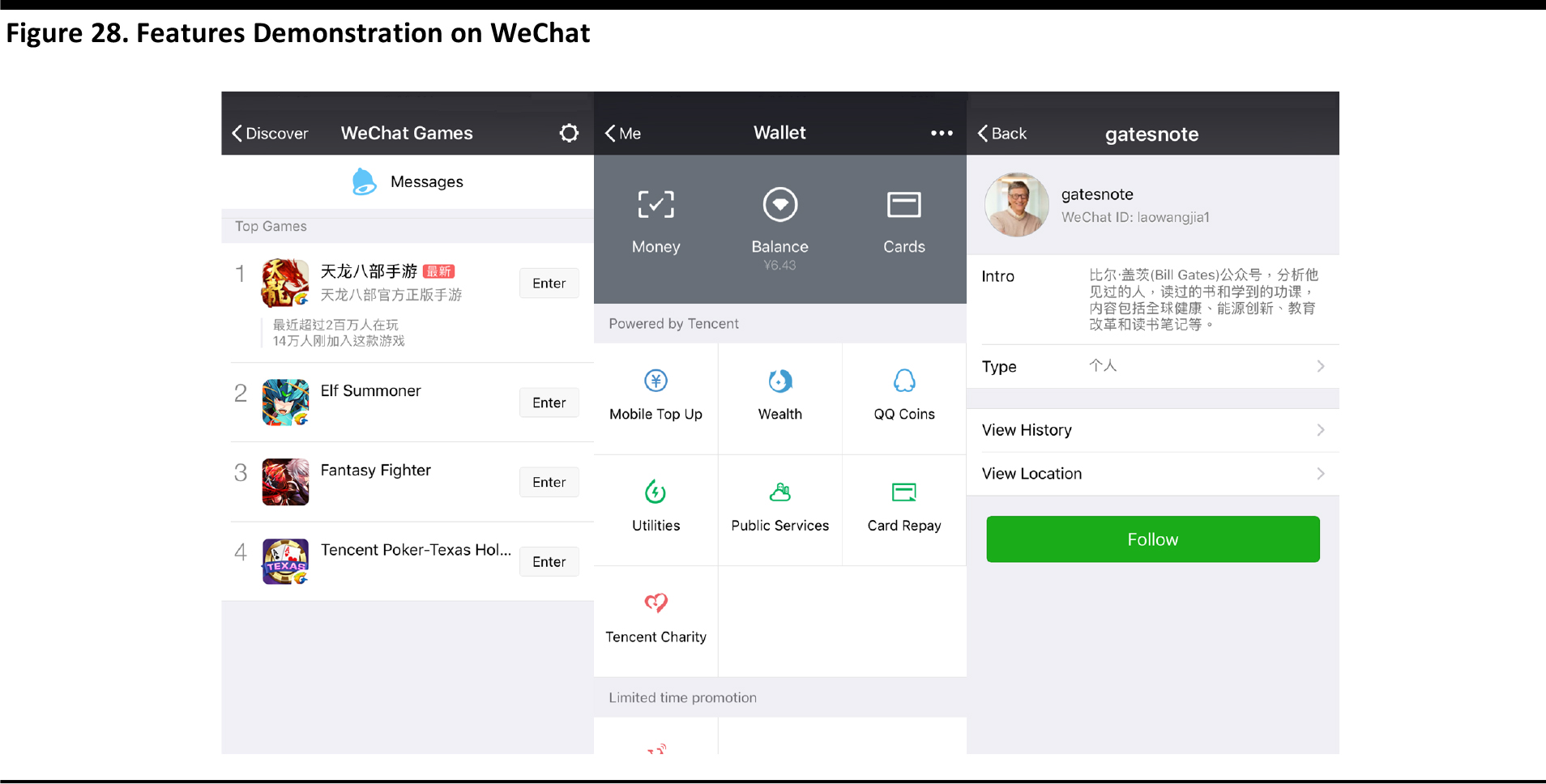

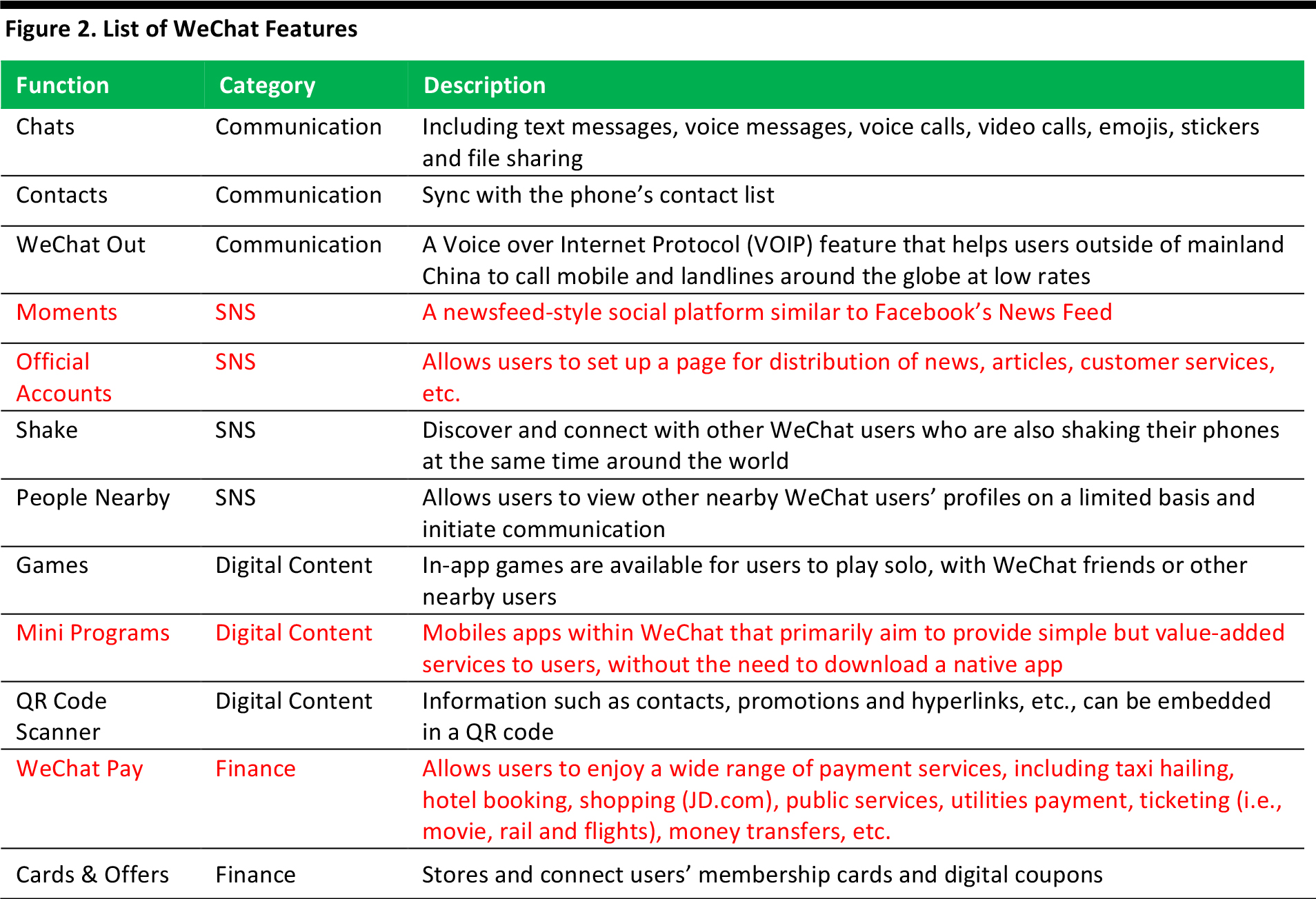

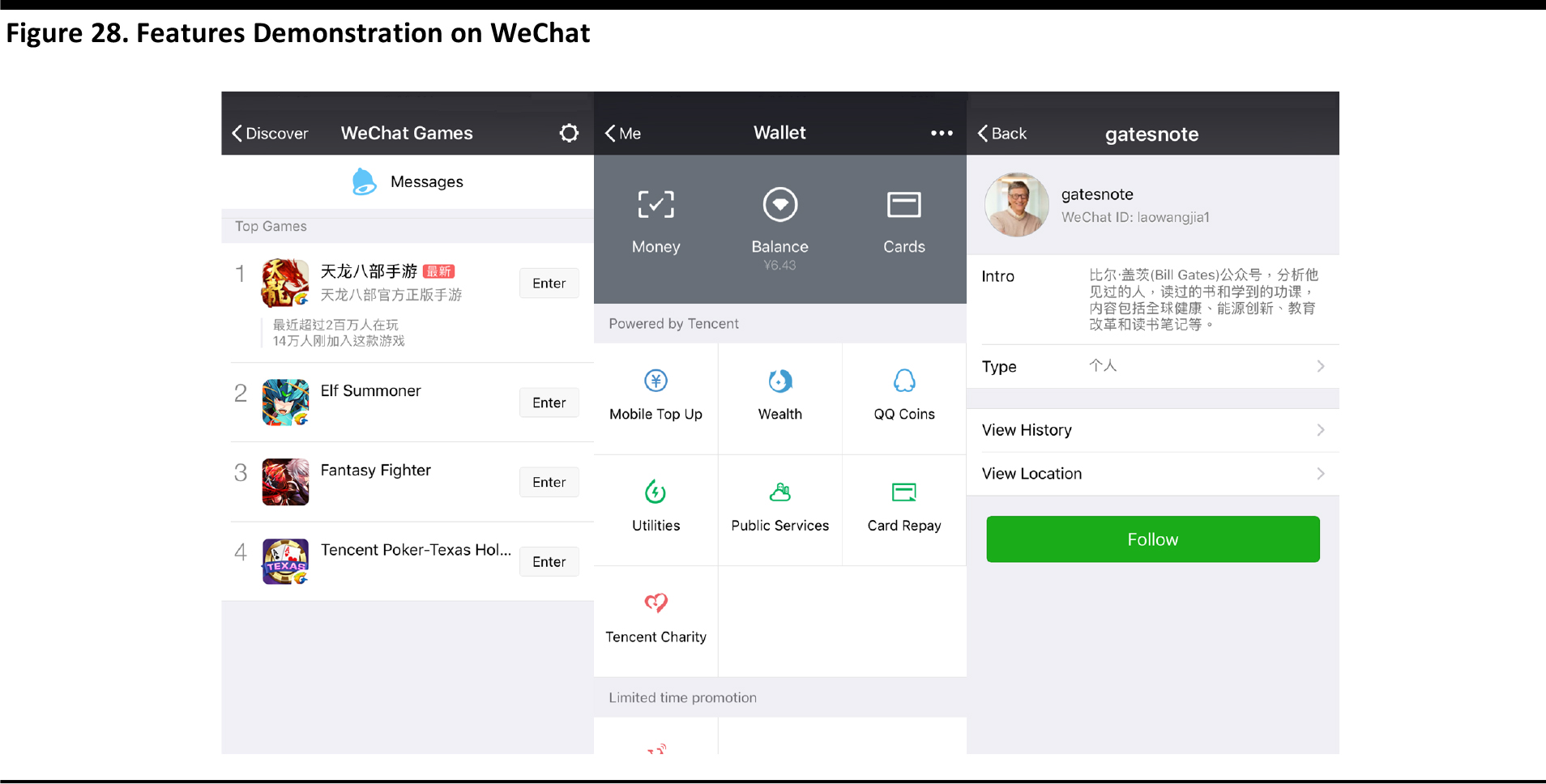

Although WeChat started off as a communication tool in China, it has since evolved into a platform with multiple features, including gaming, social networking and bill payment. Those features help differentiate WeChat from its peers in the global arena and enrich the users’ experiences. For example, WeChat allows users to play Tencent’s mobile games without having to install or download the games. WeChat Pay, WeChat’s mobile payment feature, offers P2P transactions and e-wallet.

Source: Fung Global Retail & Technology

Source: Company data/Fung Global Retail & Technology

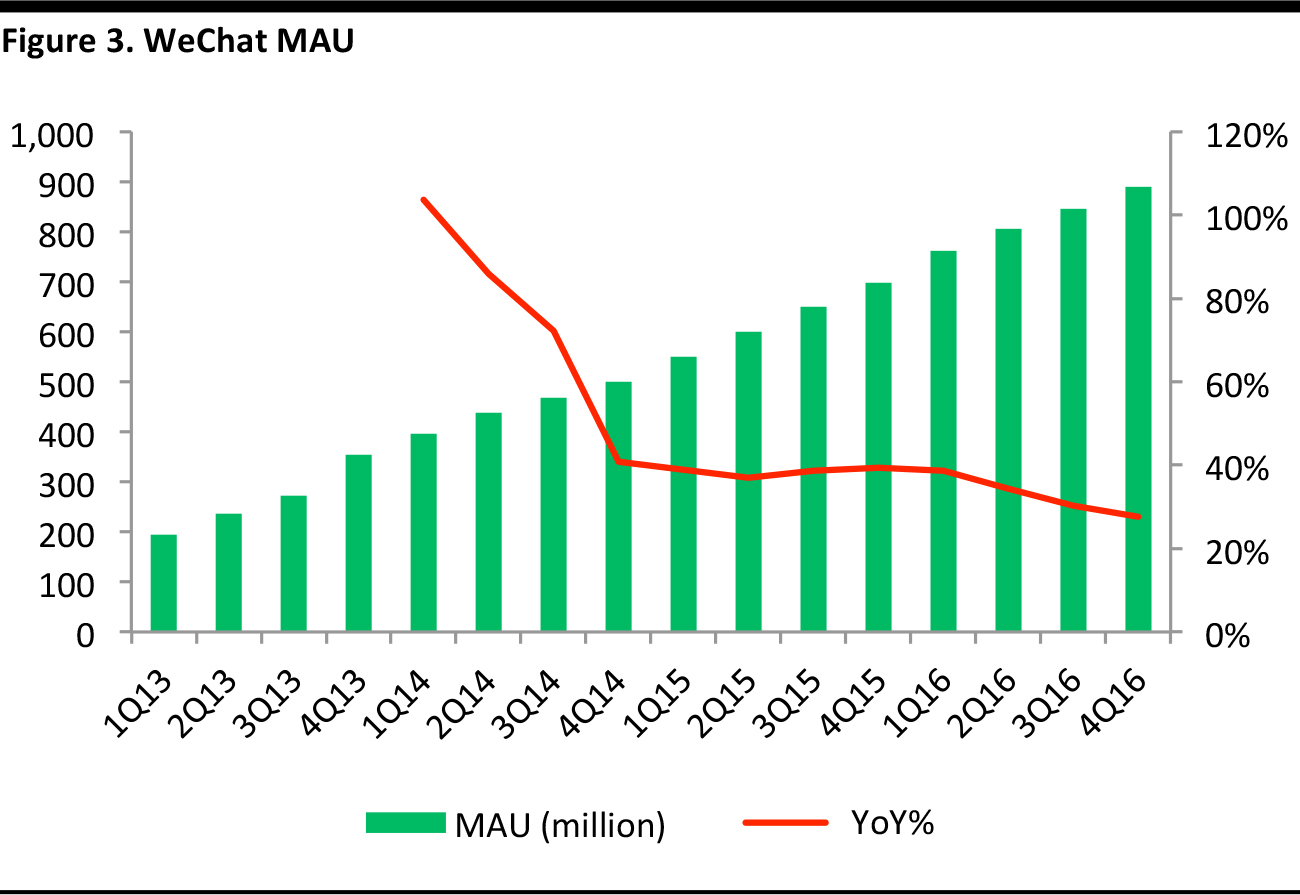

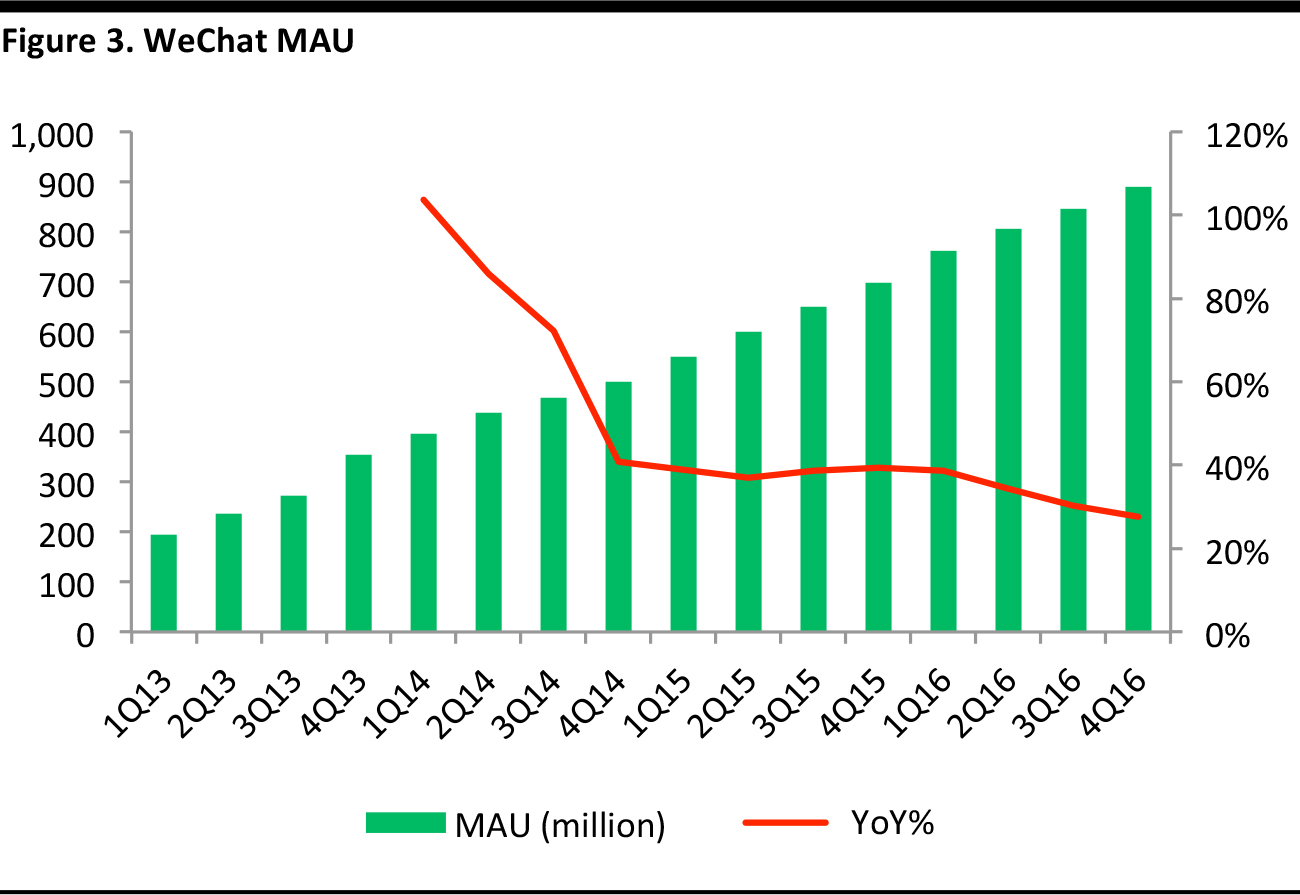

In terms of monthly active users (MAU), WeChat reached 889 million in the fourth quarter of fiscal 2016, an increase of 28% year over year. According to data from Tencent Penguin Intelligence and the China Academy of Information and Communications Technology (CAICT), over 55% of users use WeChat for at least 60 minutes a day.

Source: Company data/Fung Global Retail & Technology

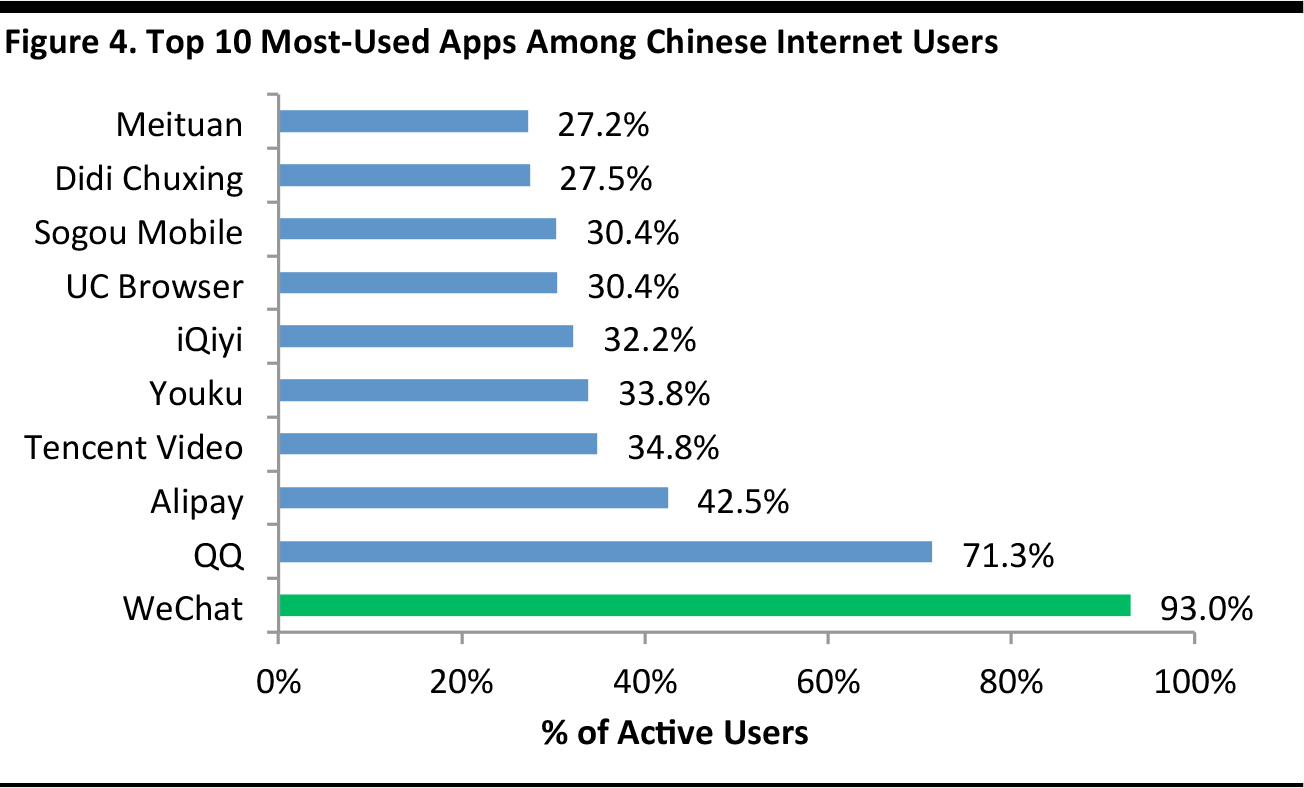

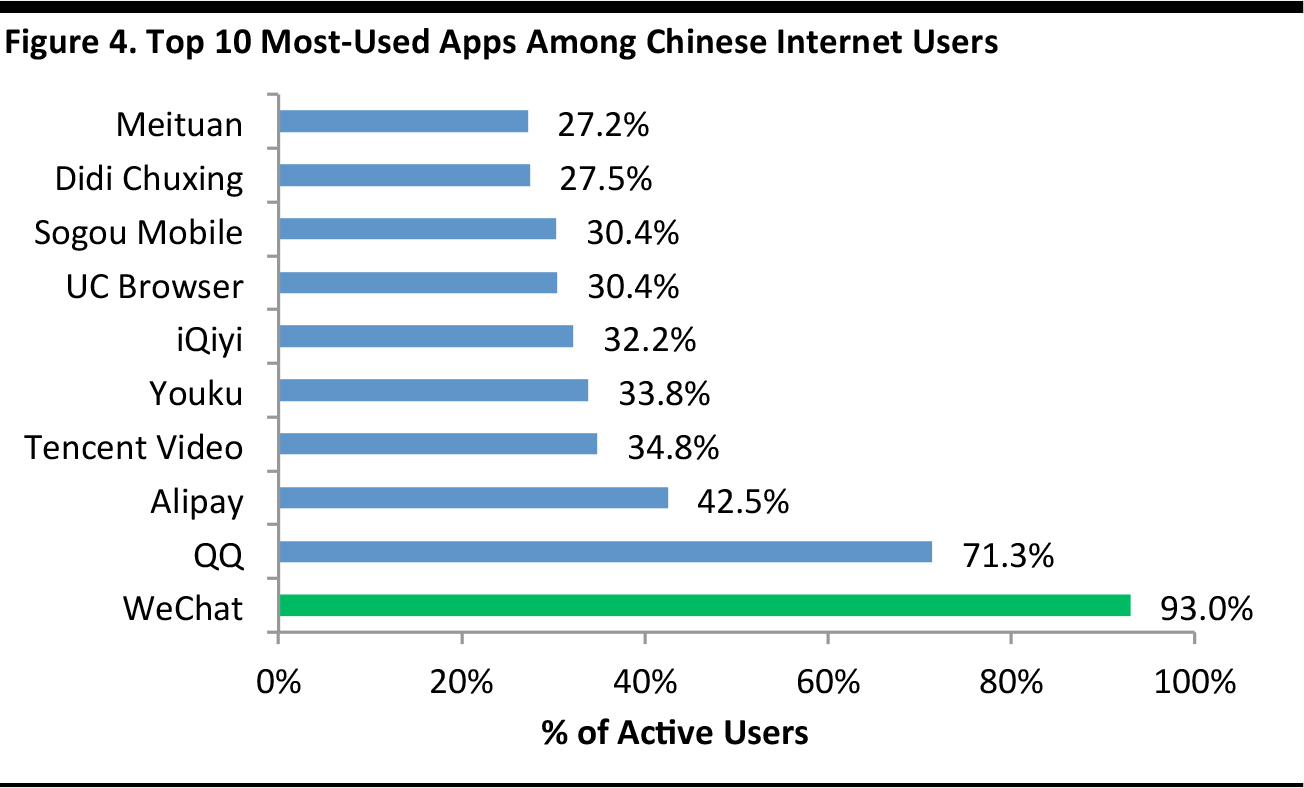

WeChat has absolute dominance in the domestic Chinese market, with no notable competitors in sight—over 90% of its MAU comes from China, according to Quest Mobile. It is also the most-used app in China, with the highest number of active users, at 93%, as pointed out by a survey by the China Internet Network Information Center (CNNIC).

Source: CNNIC/Fung Global Retail & Technology

WeChat and its Global Peers

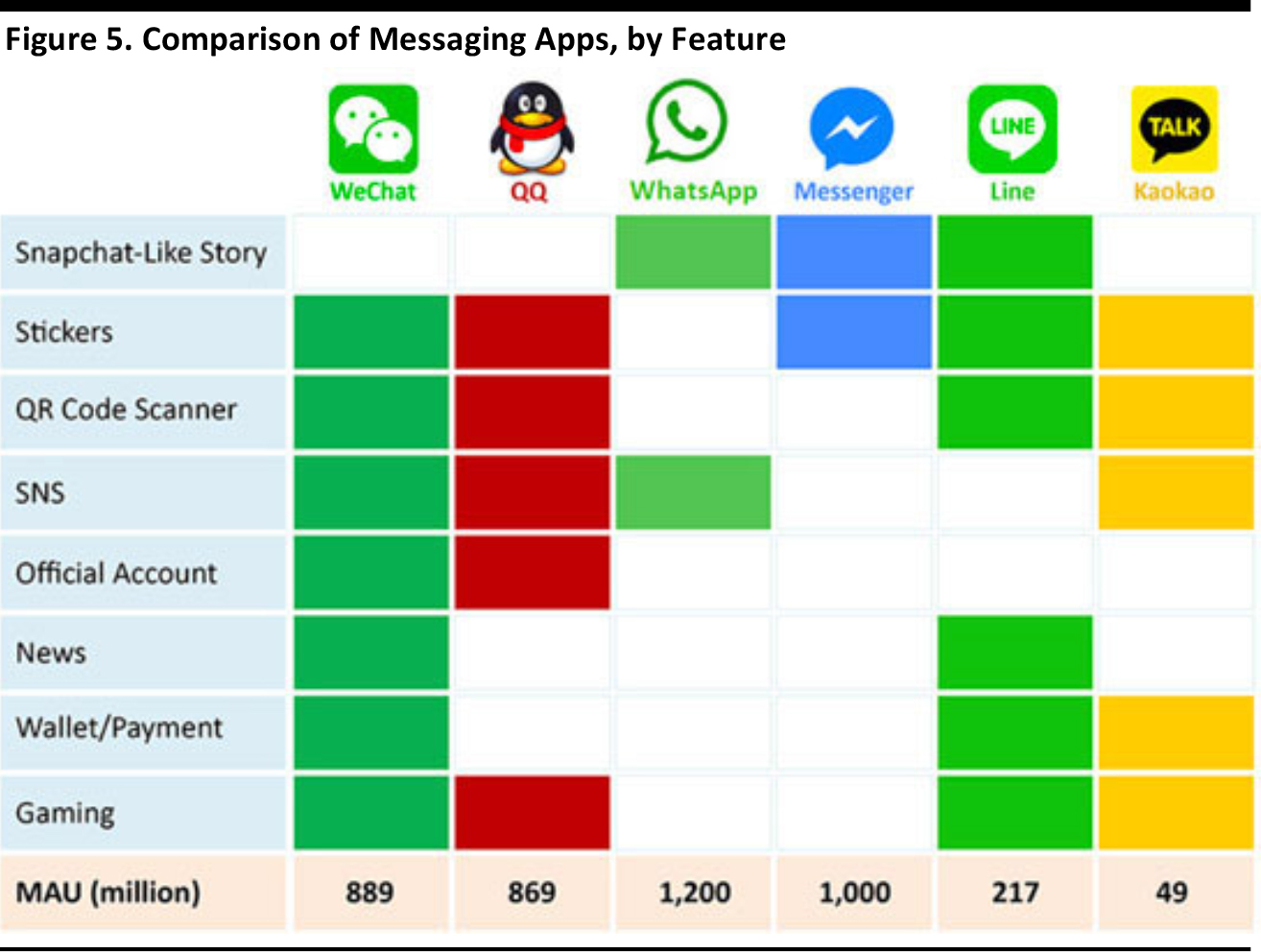

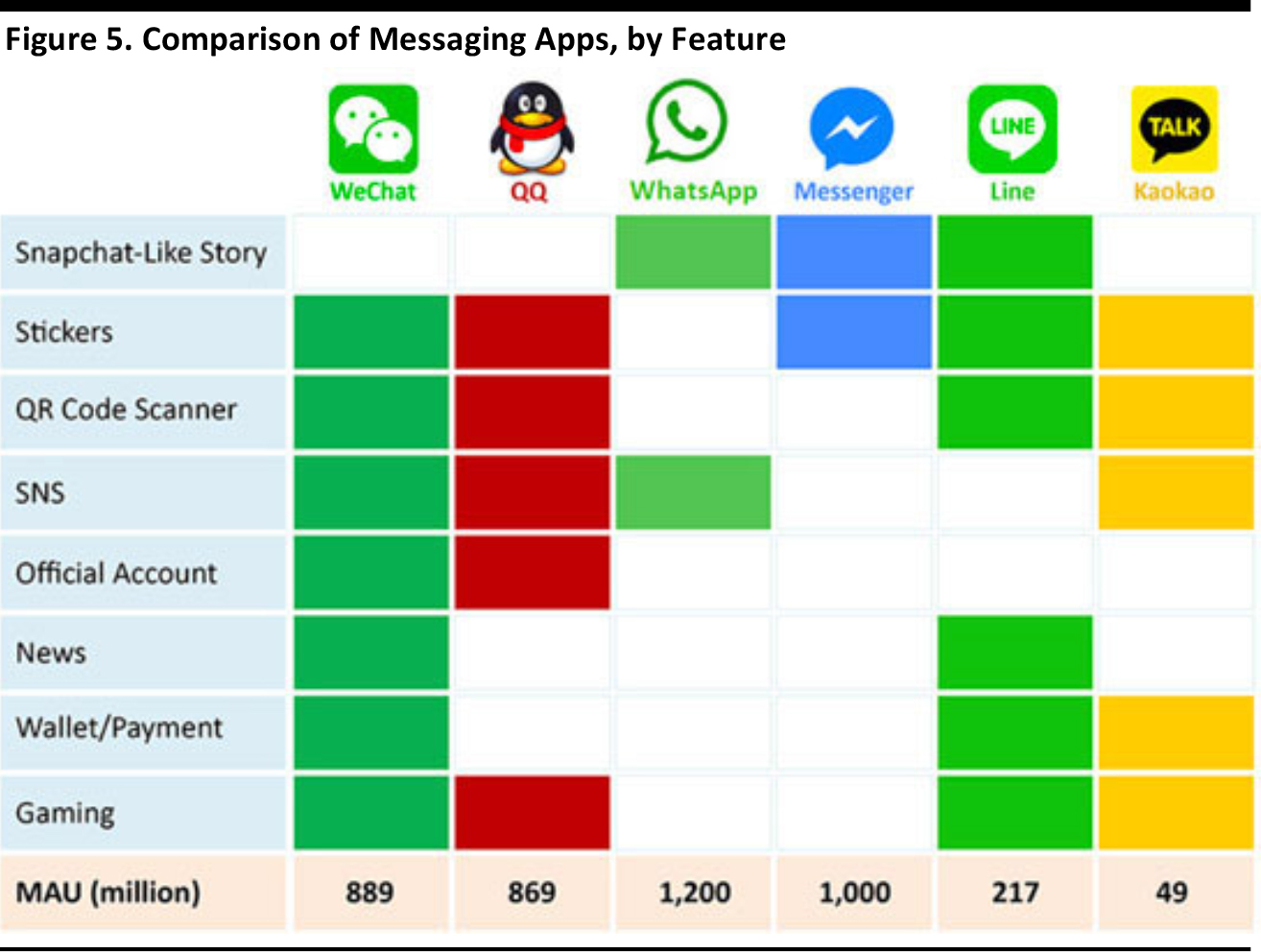

WeChat’s peers in the international arena include WhatsApp, Facebook Messenger, Line and Kakao. Although these foreign players pose no substantial threat to WeChat’s China market share, they could pose a significant obstacle to Tencent’s global expansion plan.

* As of January 2017

** As of July 2016

Data as of 4Q16

Source: Company data/Fung Global Retail & Technology

WeChat is a One-Stop App

Compared to other popular messaging apps, WeChat offers a more integrated social media platform than any other application globally. For example, WeChat users have access to transaction functionalities such as booking a taxi, ordering food and even managing a personal wealth fund. Notable features include Moments for SNS, Official Accounts for news and WeChat Pay for payment. In this sense, the company is ahead of its peers when it comes to its ability to monetize above and beyond its messaging service—a strategy highlighted by Tencent’s push into payments, advertising and gaming. Because of WeChat’s all-in-one DNA, its users are more likely to adopt new transaction features than users of any of the other messaging service globally.

Engagement and Retention are Key

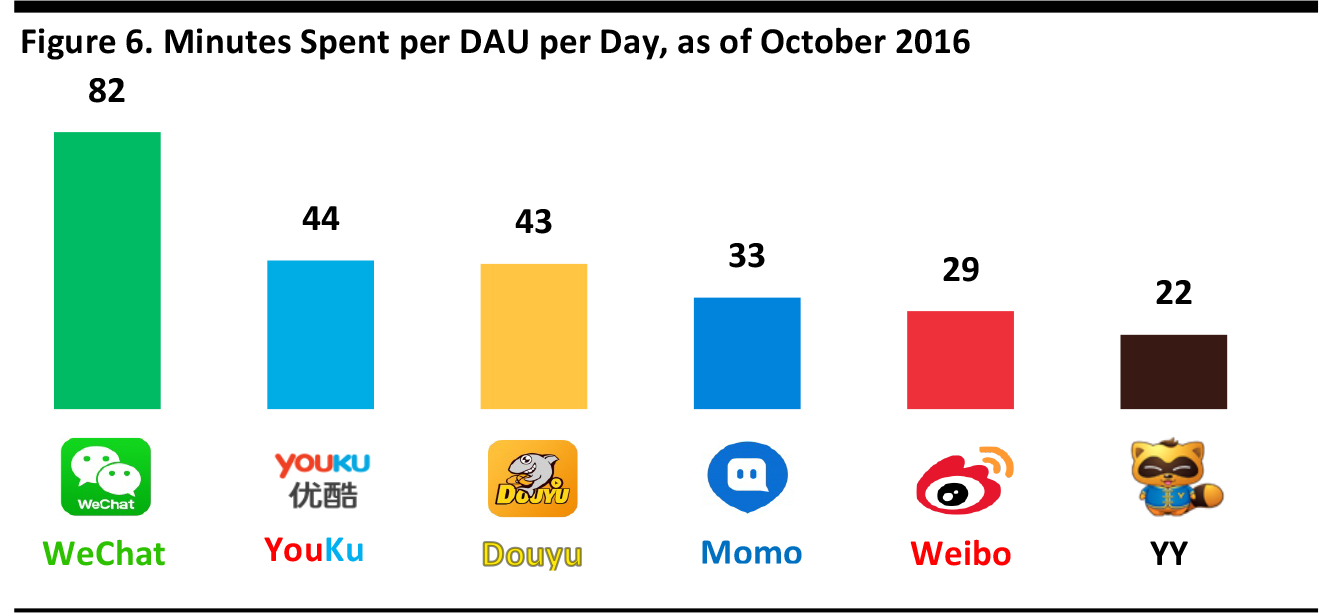

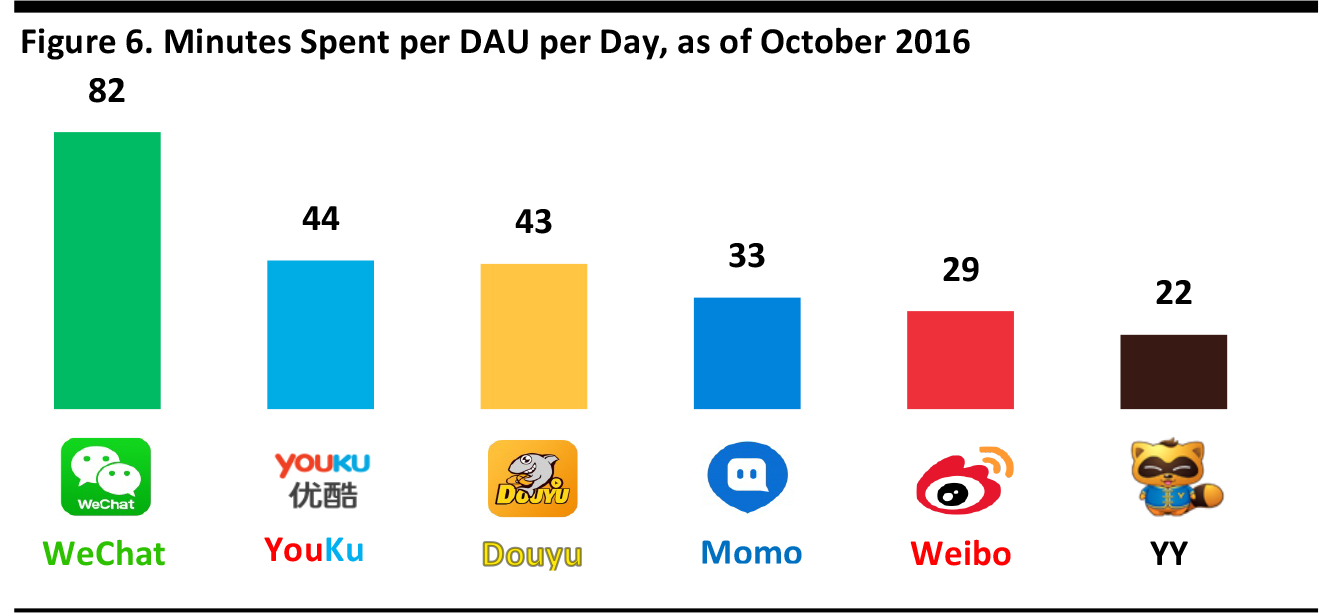

User engagement and retention are critical success factors of any online platform. They become increasingly important as the growth in MAU continues to slow down. Daily average users (DAU) on average spend 82 minutes per day on WeChat, while the total number of messages sent per day has grown by 67% year over year. WeChat is by far the most attention-grabbing app in China, and that creates an enviable environment for future monetization through more sophisticated advertising.

Source: Quest Mobile/Fung Global Retail & Technology

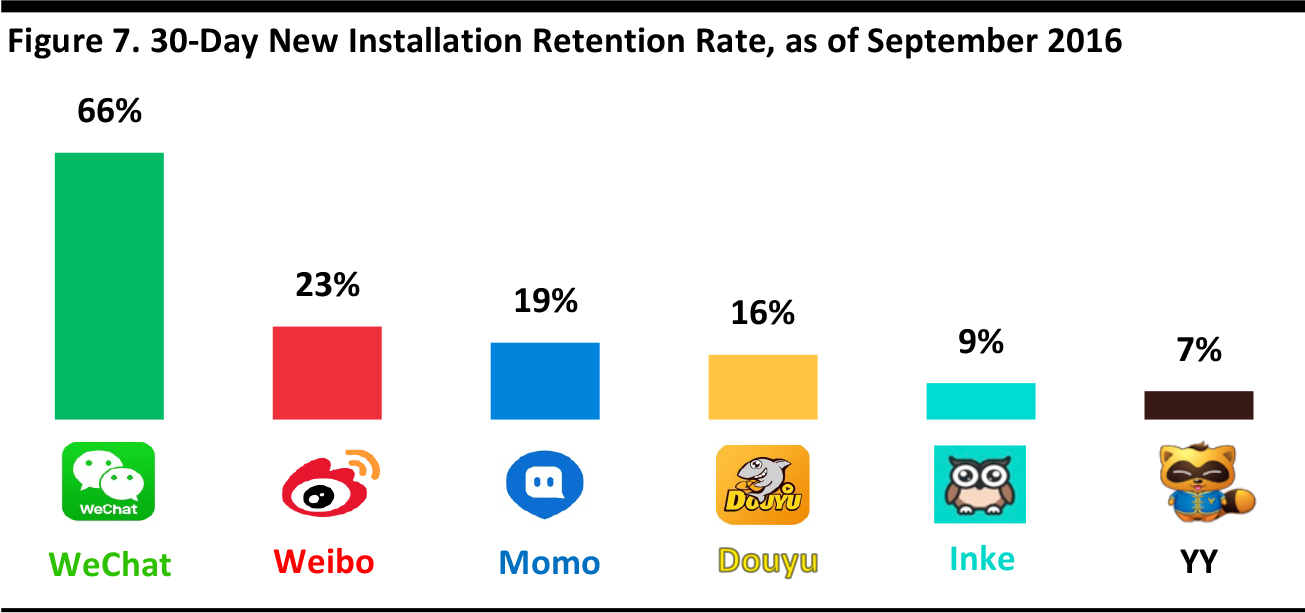

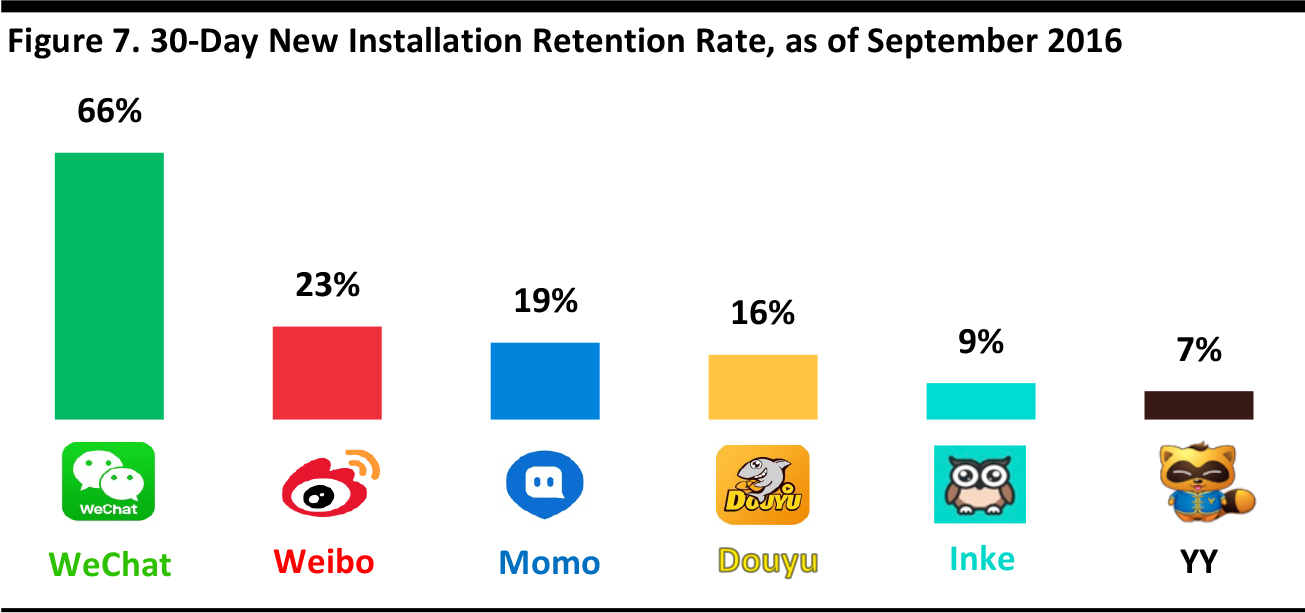

WeChat also has a relatively strong retention rate when compared to other major online applications/platforms in China.

Source: Quest Mobile/Fung Global Retail & Technology

We believe WeChat has the capability and infrastructure to dominate the Chinese instant-messaging (IM) market in the future. Its high platform stickiness created by many add-ins and differentiable functionalities have all helped to retain users and increase their time spent on WeChat’s related ecosystem.

Differentiable Features of WeChat’s All-In-One-Platform

In the second part of our report, we analyze three key features that WeChat incorporates to build its all-in-one platform.

- Social media: Moments and Official Accounts

- Mobile payment: WeChat Pay

- Replacing native apps: Mini Programs

1. Social Media: Moments and Official Accounts

Moments and Official Accounts to WeChat are like news feeds and pages are to Facebook. The major difference is that WeChat has no “follow” function. Users can comment or react to other users’ stories only if they are connected as friends. We believe this closed ecosystem leads to a smaller social circle, but higher stickiness, given the content is more relatable to the user.

Sharing Status, News and Information Subscriptions

According to data from Tencent Penguin Intelligence and the China Academy of Information and Communications Technology (CAICT), more than 60% of users said they check their Moments feed every time they open WeChat, while the other 23% said they often browse it.

Moments

Moments allows users to share their photos, videos, articles and even websites on a real-time basis. Their friends can “like” or comment on the post to interact with other users.

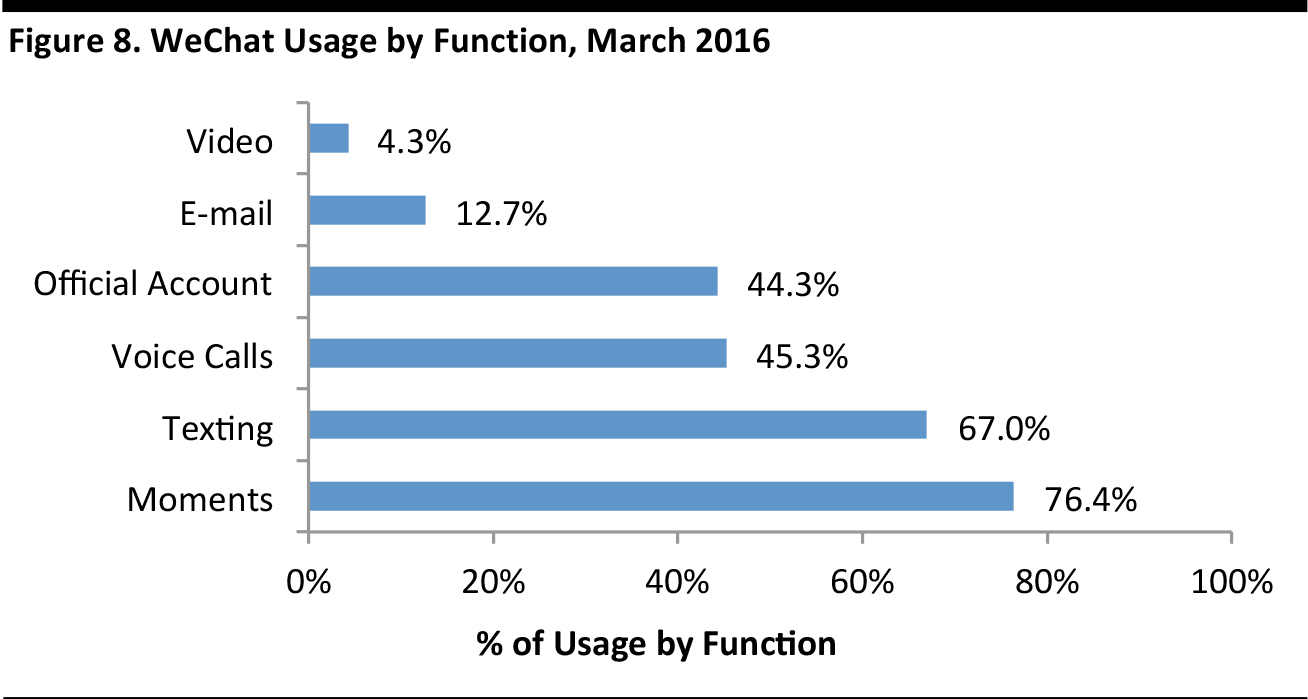

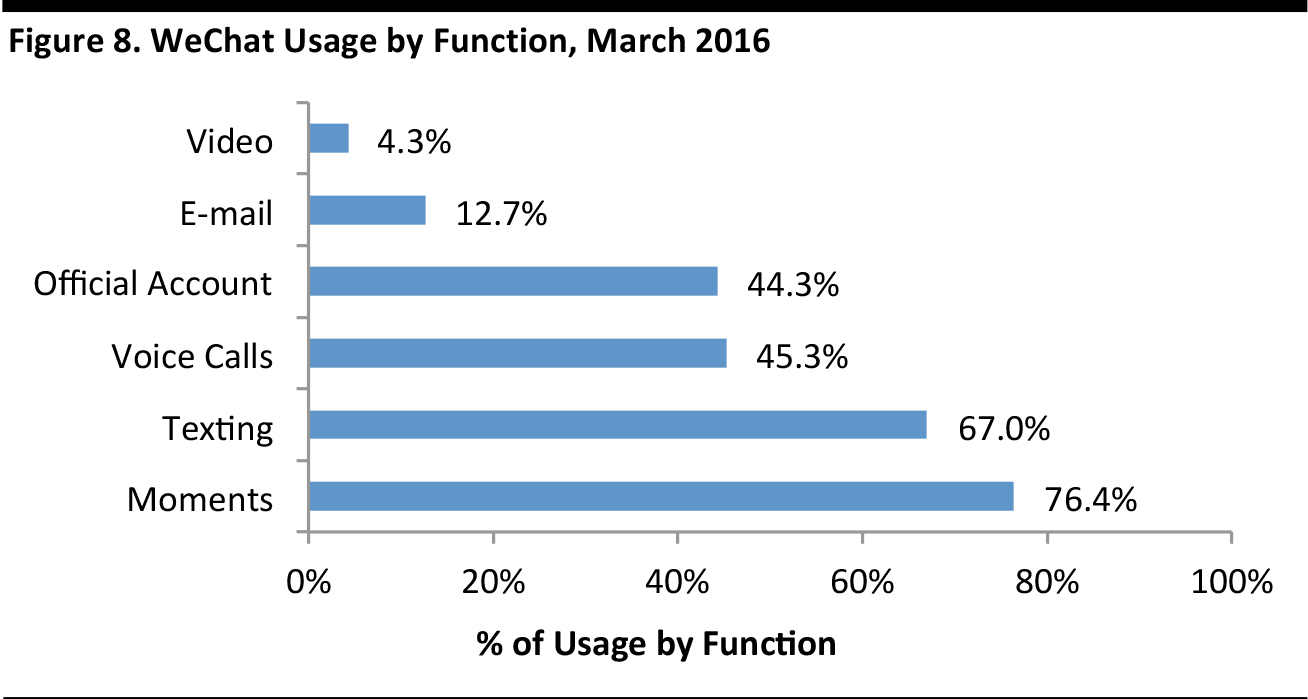

According to WeChat data, 76.4% of accounts use Moments to share experiences and catch up with their friends’ stories on a daily basis. This figure does not include texting, which WeChat was originally designed for.

Source: Company data/Fung Global Retail & Technology

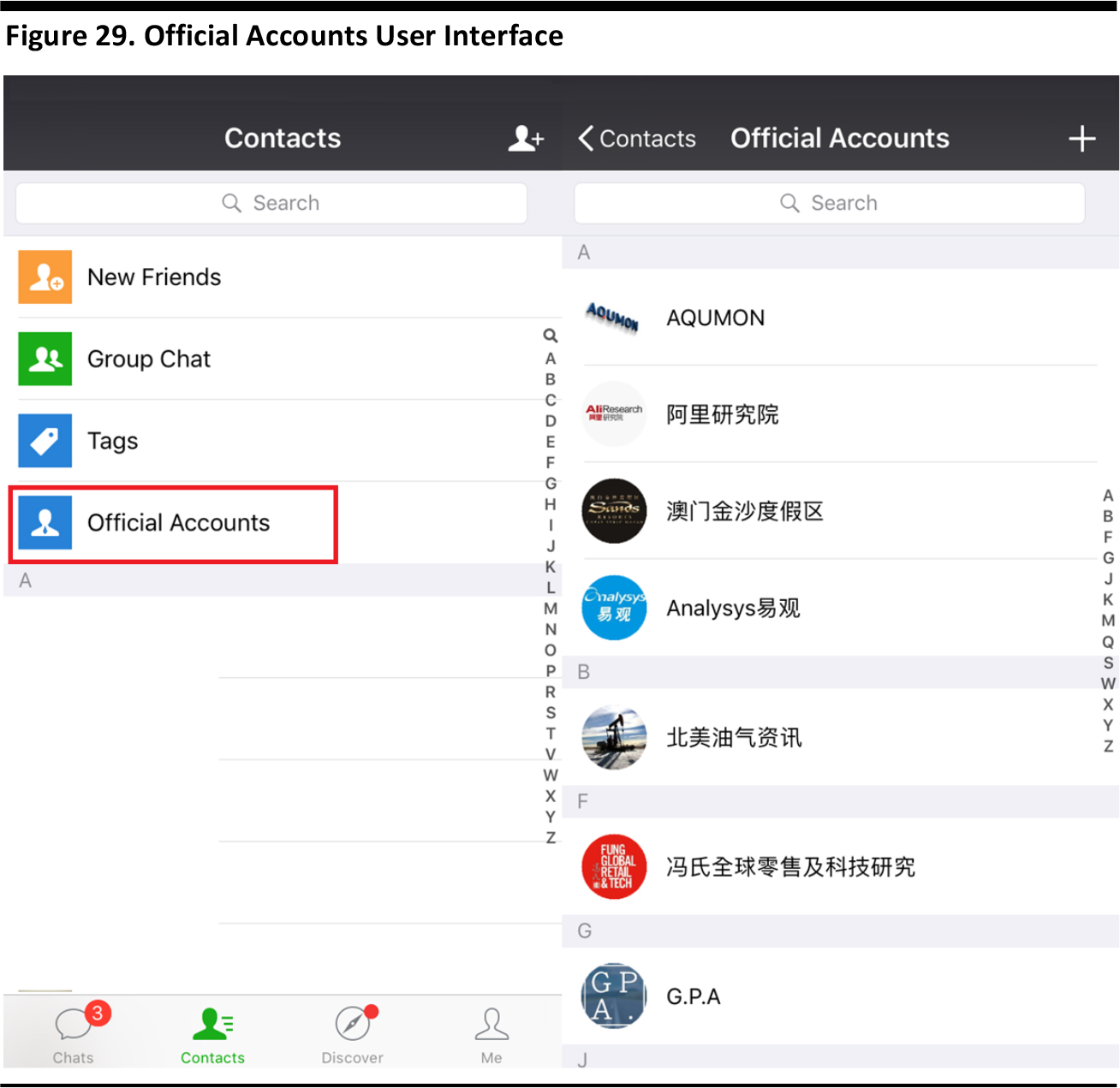

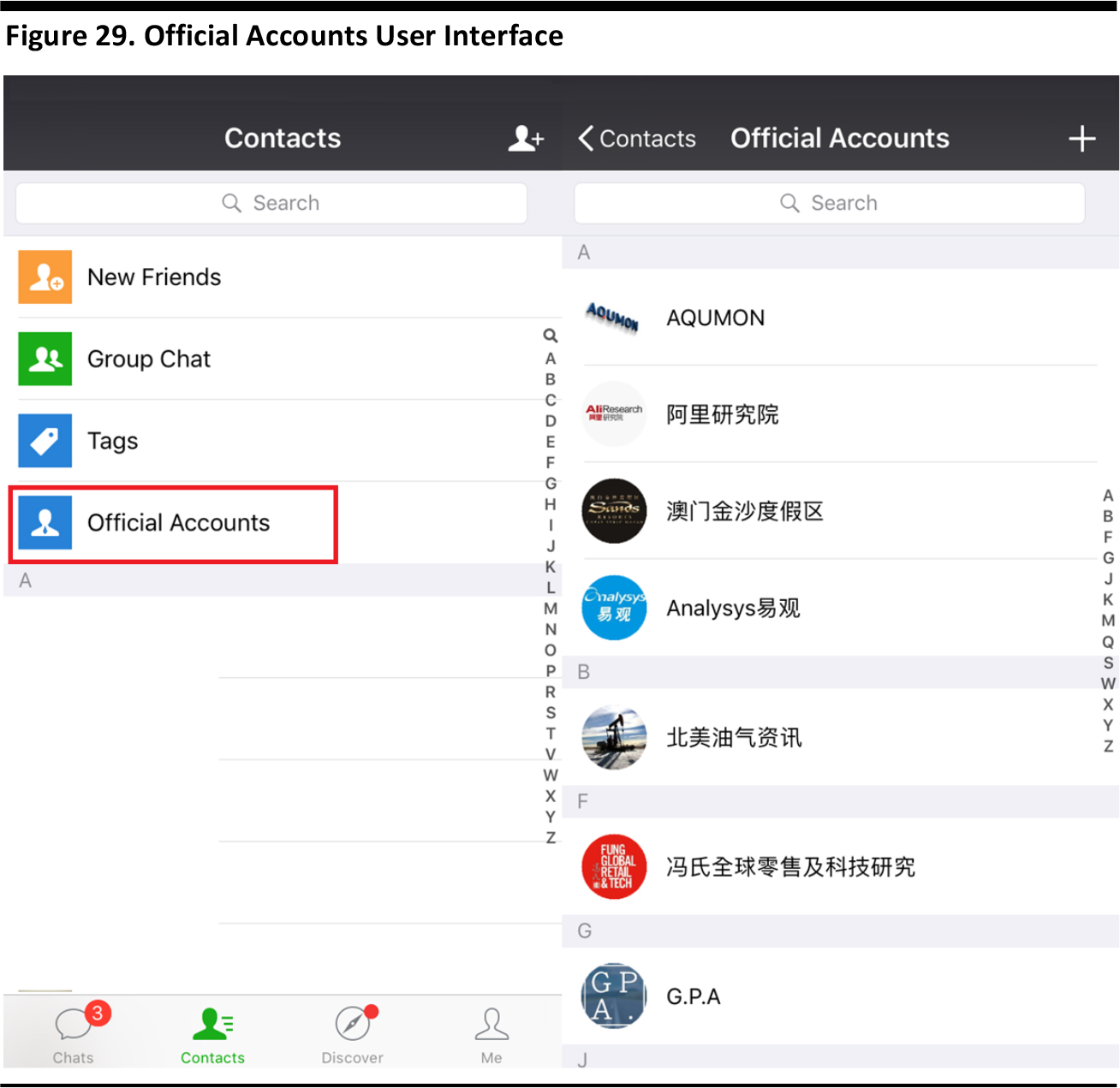

Official Accounts

Official Accounts allow users to set up a page for distribution of news, articles, customer services, etc. All users can follow any public account they want to stay on top of issues. There are three types of Official Accounts:

- Subscription: Used to distribute information, news or articles to generate publicity, for example, newspapers and magazines. The account is only allowed to send one message per day to all users.

- Service: Used for customer services and service inquiries, for example, banks. The account is only allowed to send four messages per month to all users.

- Enterprise: Used for internal communications and management.

Shanghai city government has a public account on WeChat. Its purpose is to provide real-time info on traffic, public transportation, weather, air quality, etc.

Source: WeChat/Fung Global Retail & Technology

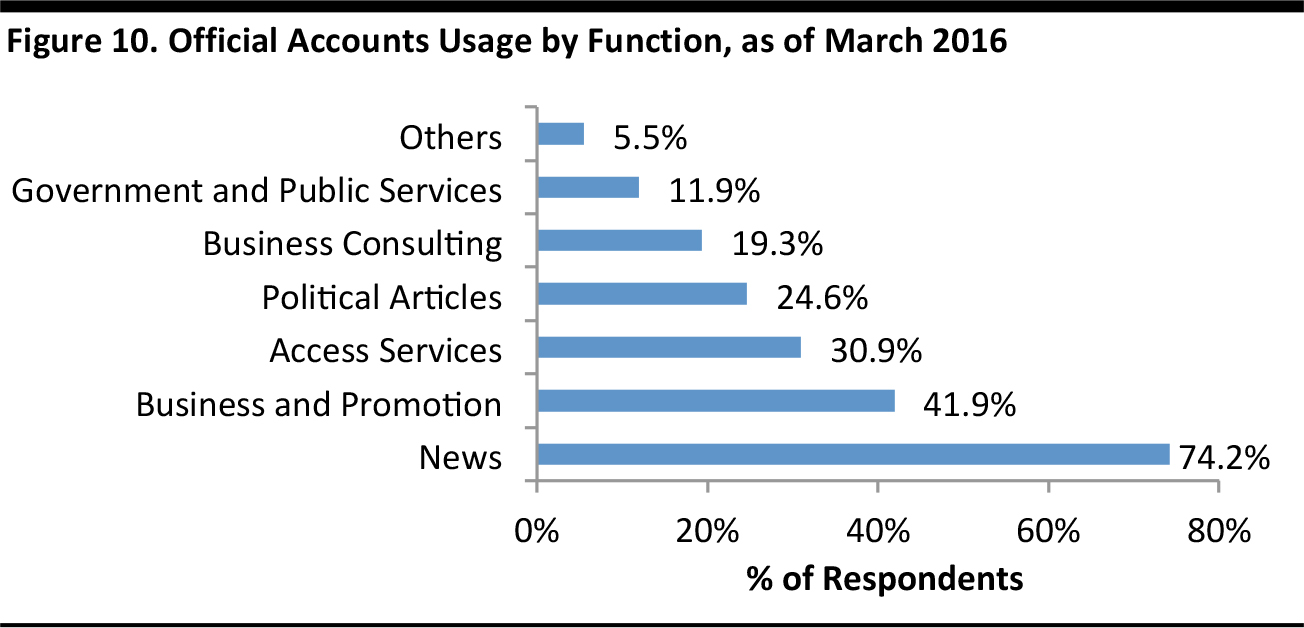

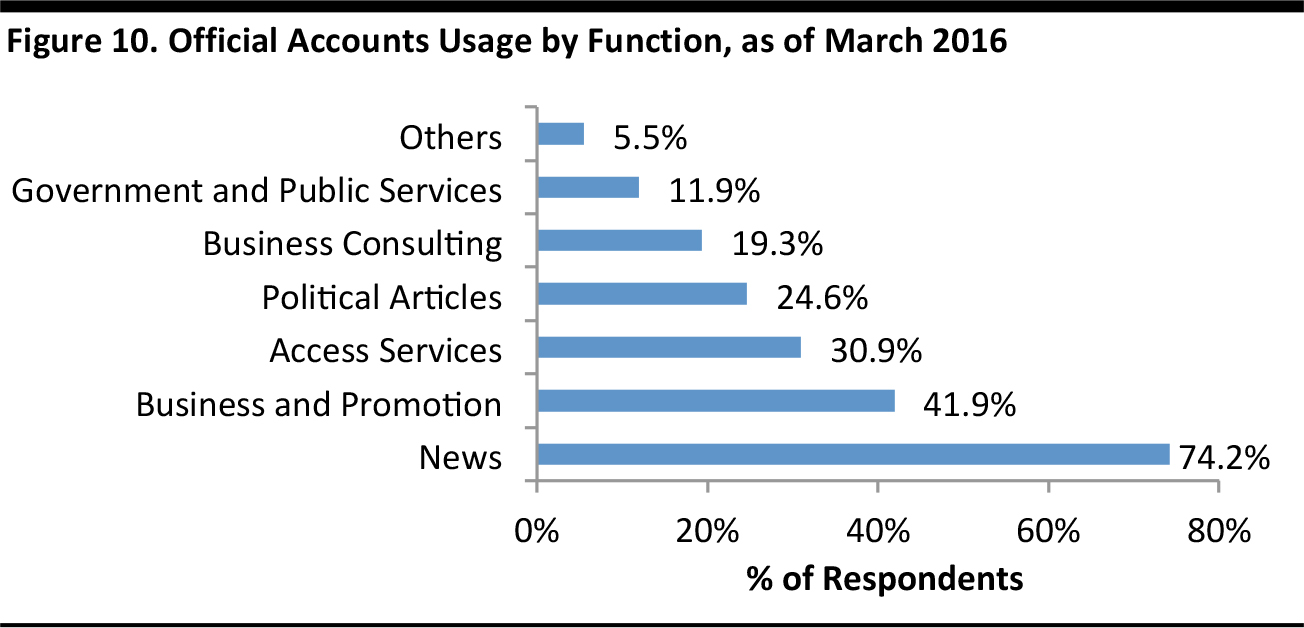

According to data from the CAICT, news and promotions are the two main reasons people follow WeChat accounts.

Source: Company data/Fung Global Retail & Technology

Monetization Through Artificial Intelligence (AI)

All of the aforementioned functions embedded in WeChat make it essentially a one-stop solution that enables a seamless experience for day-to-day updates, and hence strengthens the user retention rate compared to other social media and messaging tools.

As the number of WeChat friends, content on Moments and information posted by Official Accounts continues to grow, WeChat faces the bigger-than-ever challenge to filter and personalize the information to suit users’ needs.

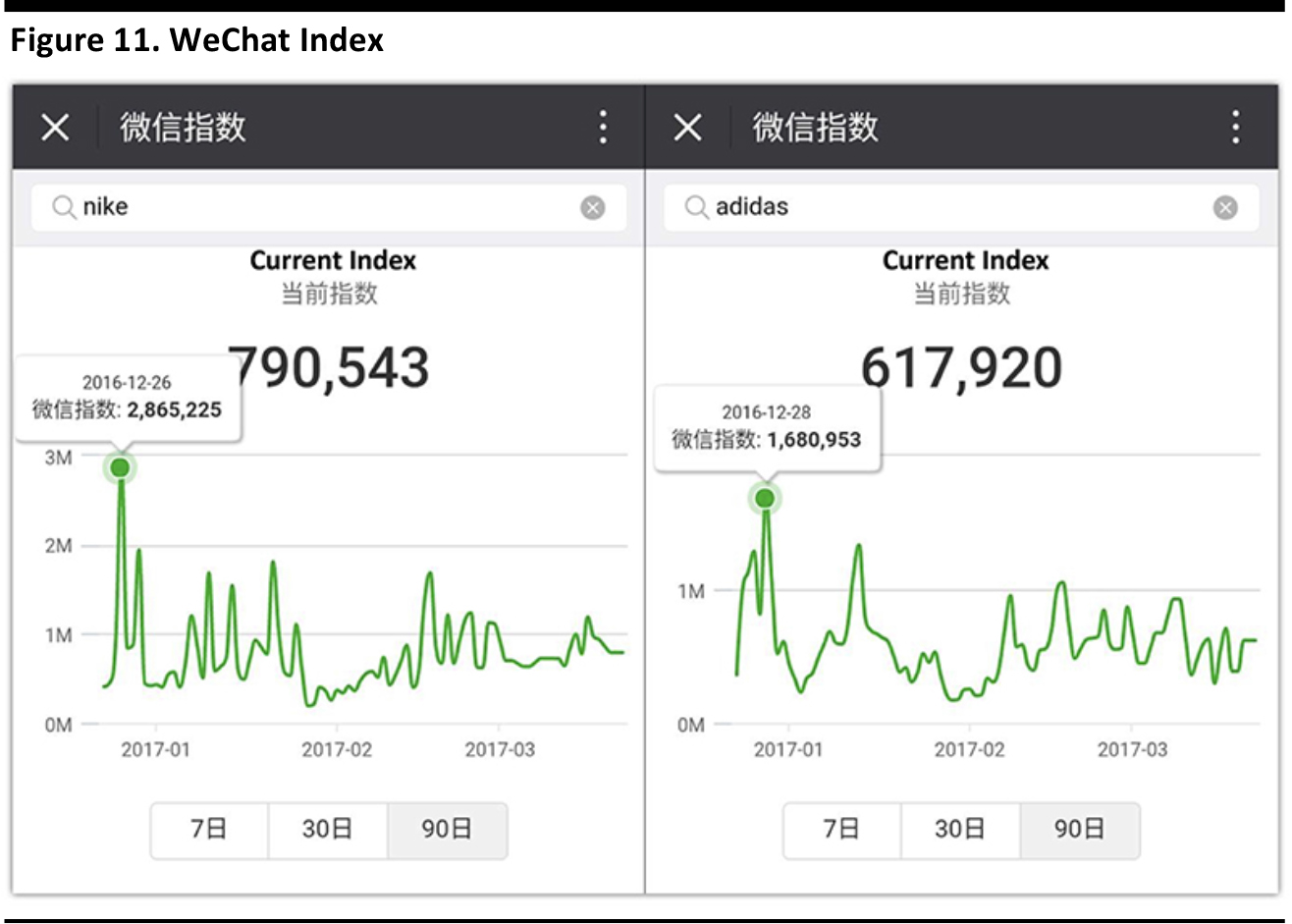

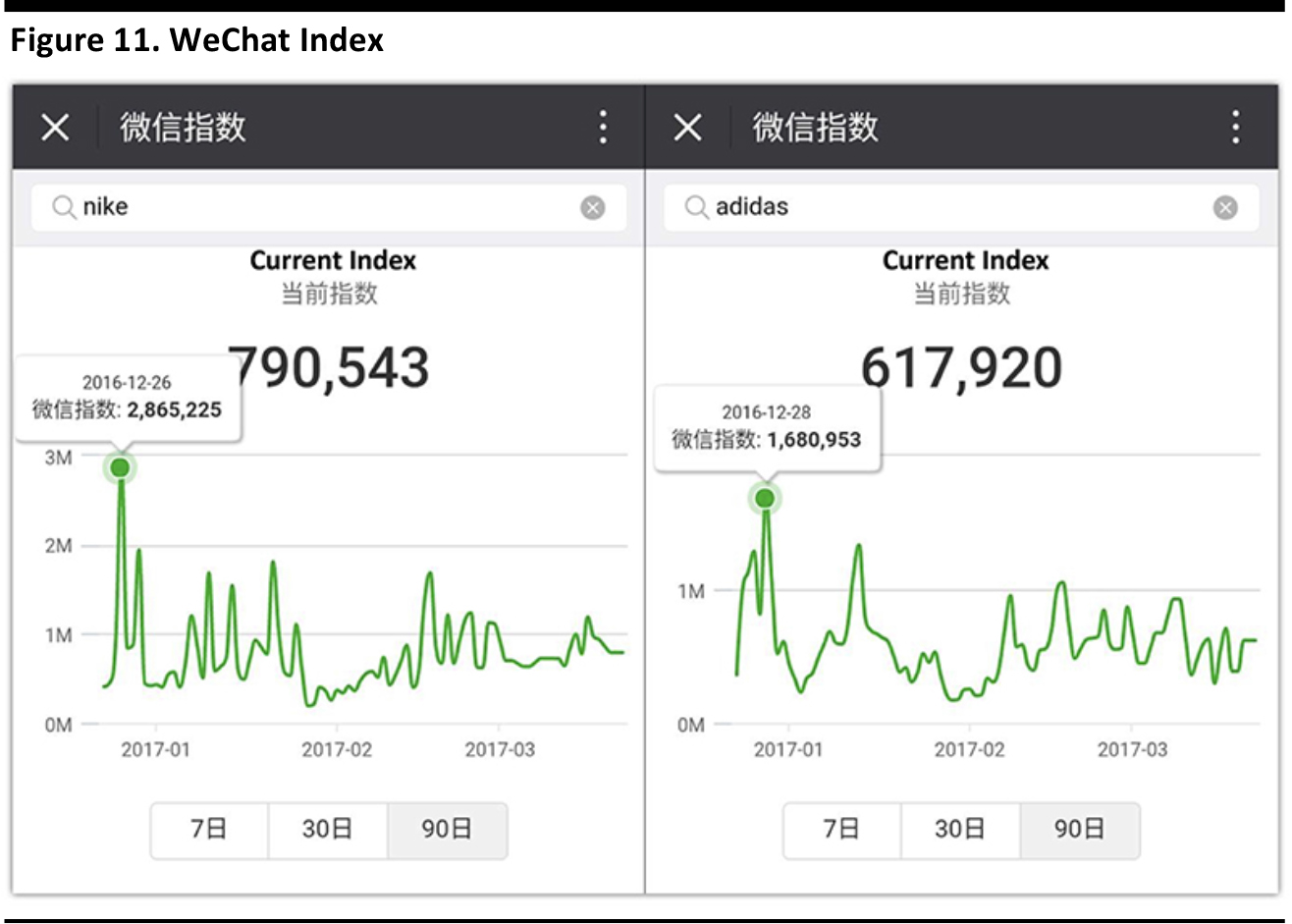

Tencent has begun research on artificial intelligence (AI)—including sentiment analysis, tracking the spreading of rumors or scams and software to convert voice messages to text—so advertisements can be personalized, and hence create more value to both end users and enterprises. WeChat Index, is one of the applications that tracks sentiment analysis. Similar to Google Trends, it can show the popularity of different keywords that are searched on WeChat.

The core value of WeChat is in the conversation data generated by the enormous user base, which Tencent can monetize through advertisements. By leveraging technology such as natural language processing (NLP) and machine learning, advertisements can be personalized, and hence create more value to both end users and enterprises.

Source: Chuansong

Official Accounts that Use AI Technology

Not only does Tencent leverage AI technology in WeChat, but some companies also integrate AI into their WeChat Official Accounts. Below, we include two examples of how AI can add value to the messaging tool: Chumen Wenwen and Xiao Bing.

出门问问 (Chumen Wenwen): Founded by former Google engineers, Chumen Wenwen has raised $20 million in funding so far through investors such as Sequoia Capital. The concept is simple: it combines “Siri-style” voice recognition, AI software and WeChat. The user tells Chumen Wenwen what they want, for example, a nearby Italian restaurant, a movie ticket or a massage, and it will send the user a list of all the matches around them via a third-party app like Dianping.

Source: Walkthechat

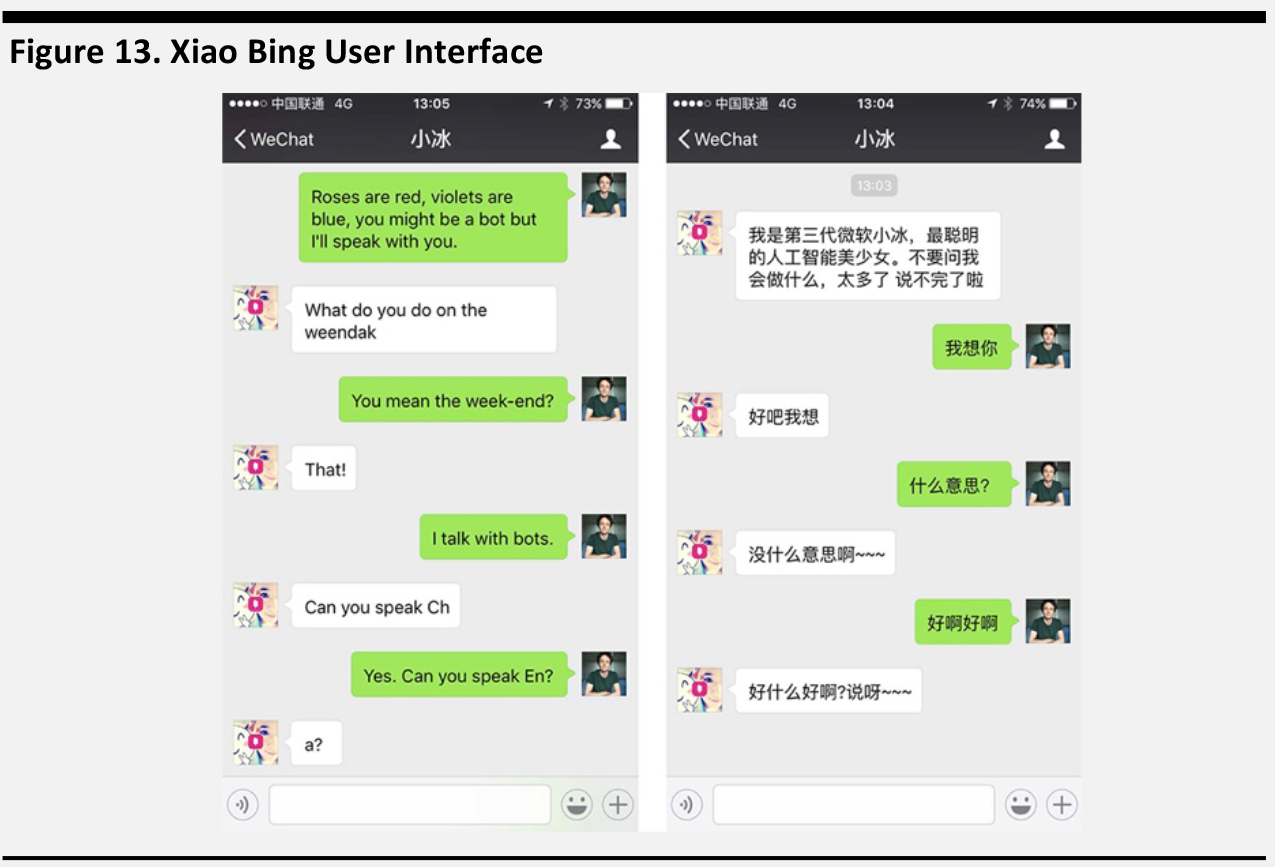

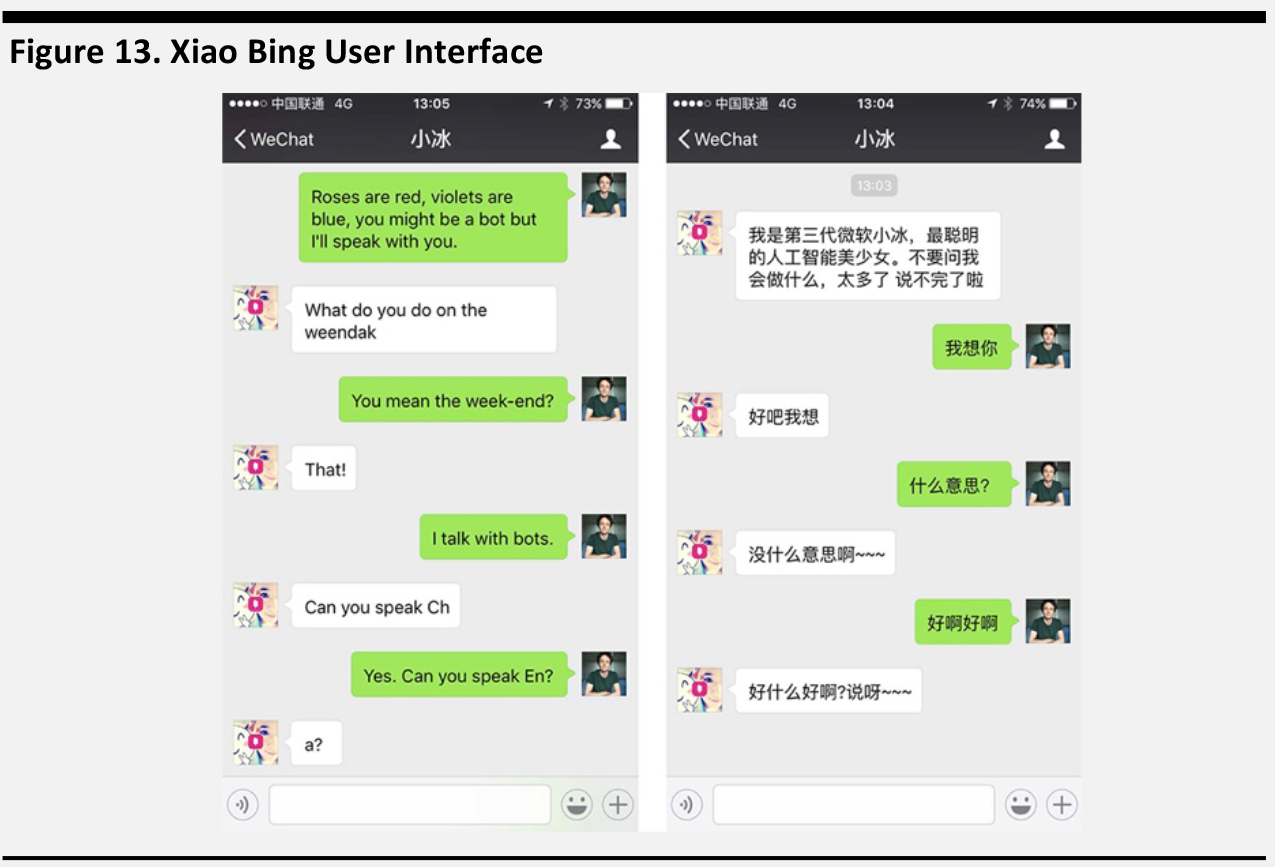

Xiao Bing: Powered and developed by Microsoft, Xiao Bing can analyze user messaging through NLP.

Source: Walkthechat

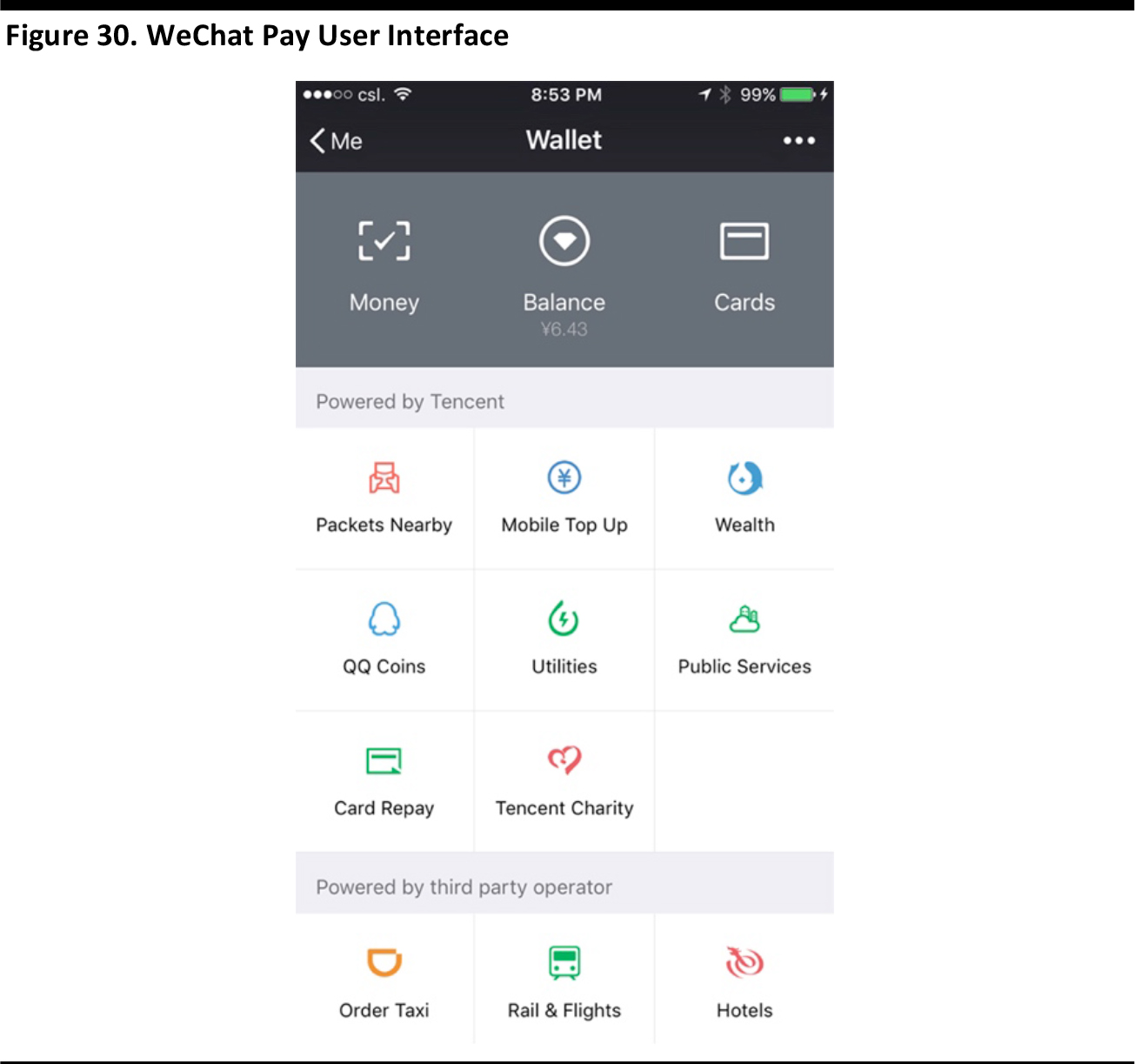

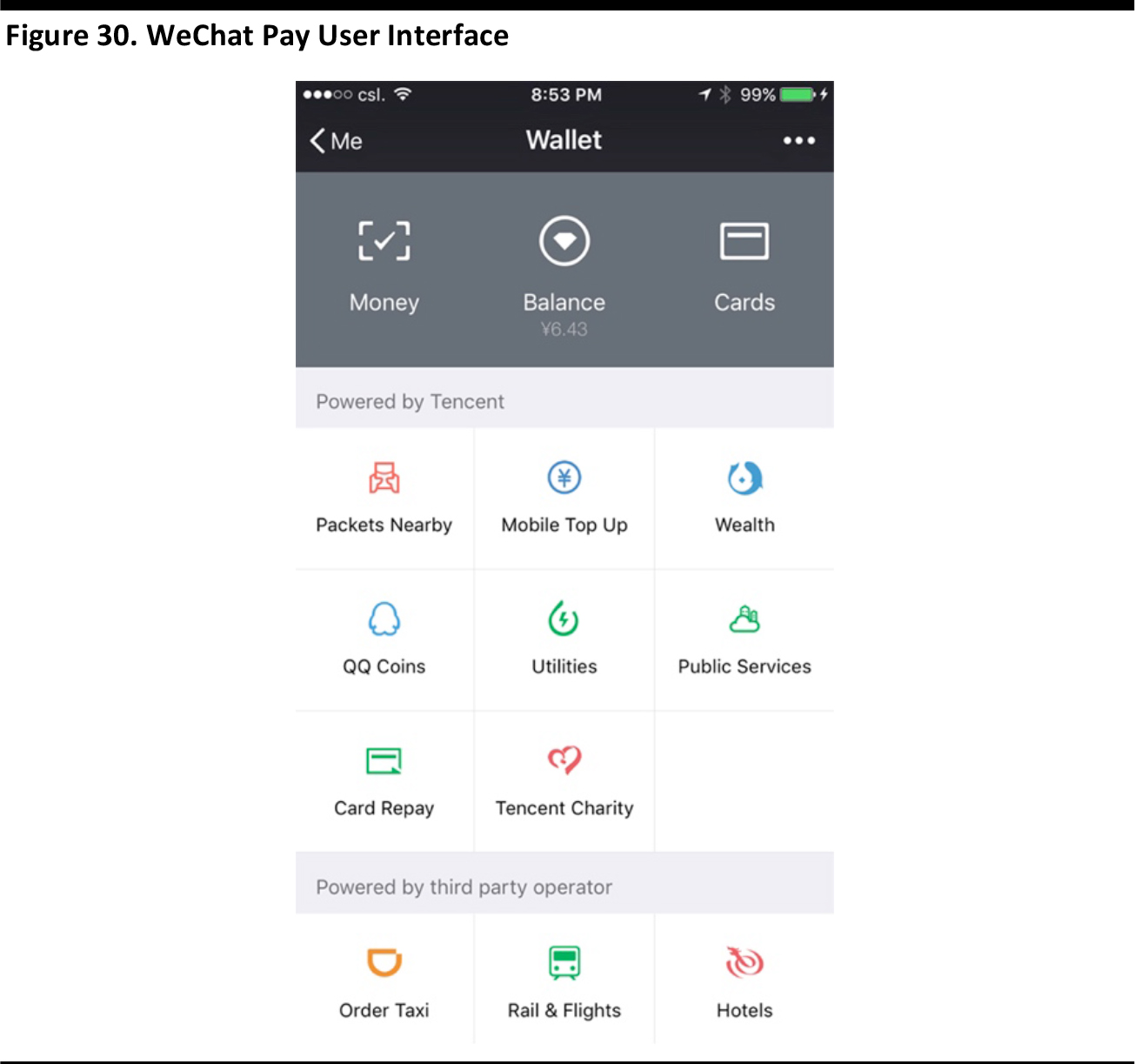

2. Mobile Payment: WeChat Pay

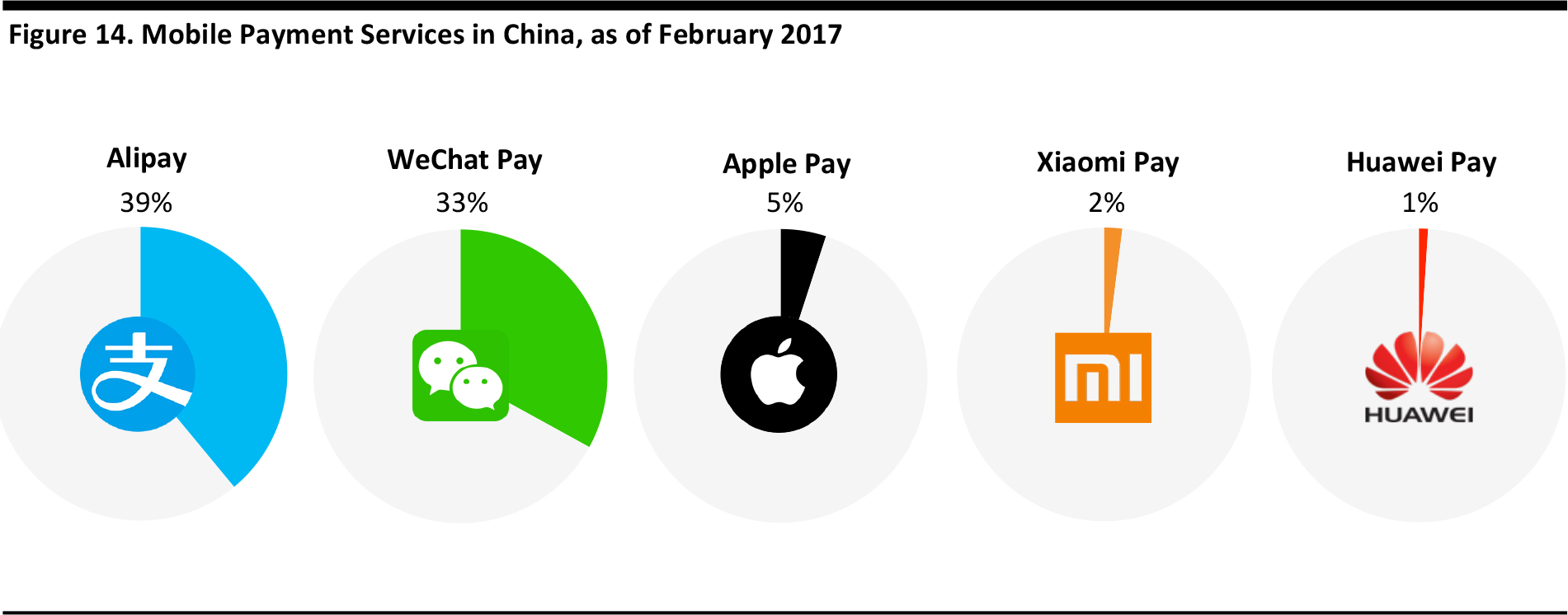

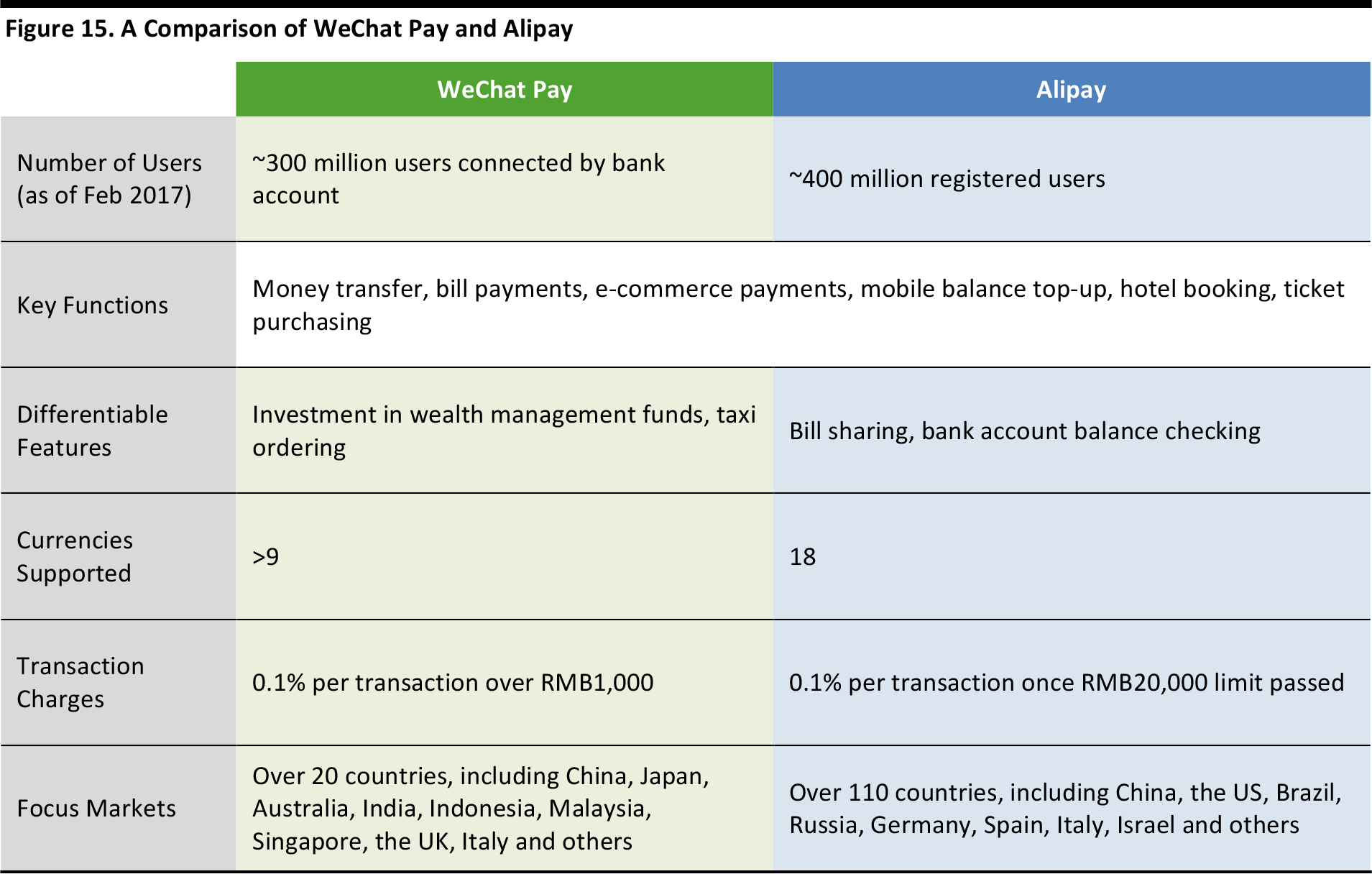

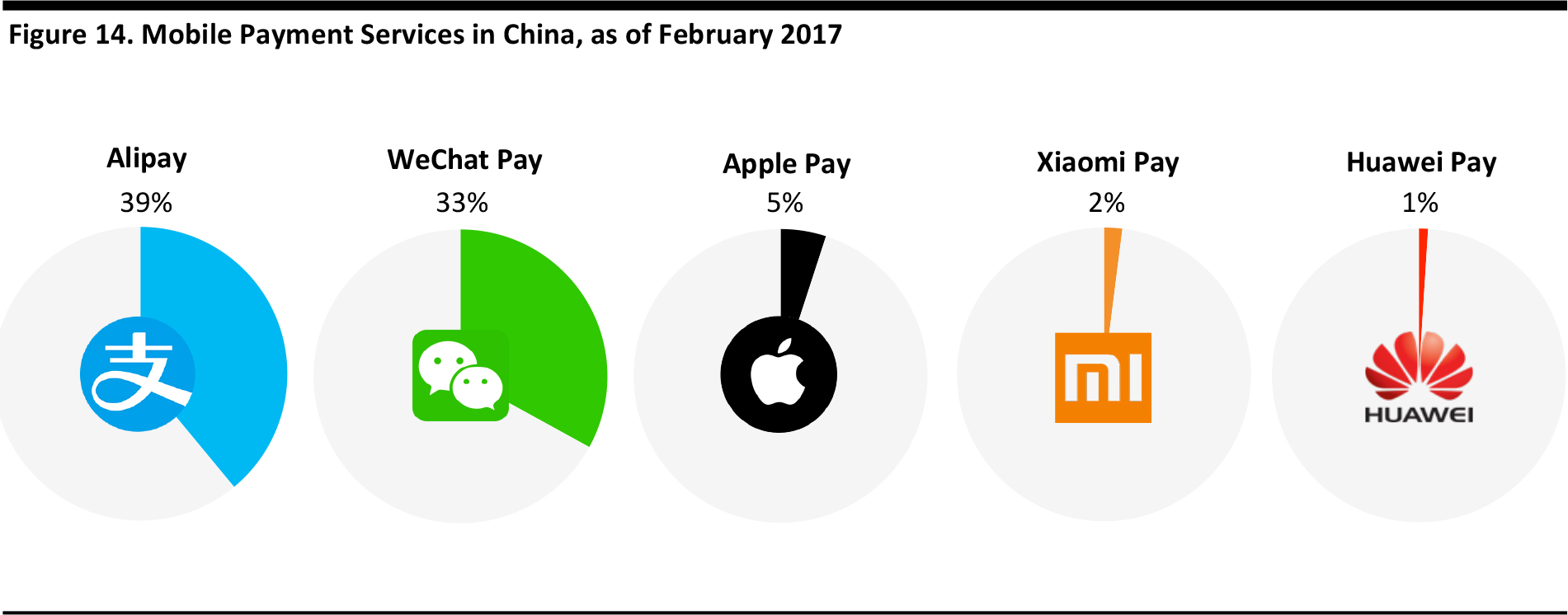

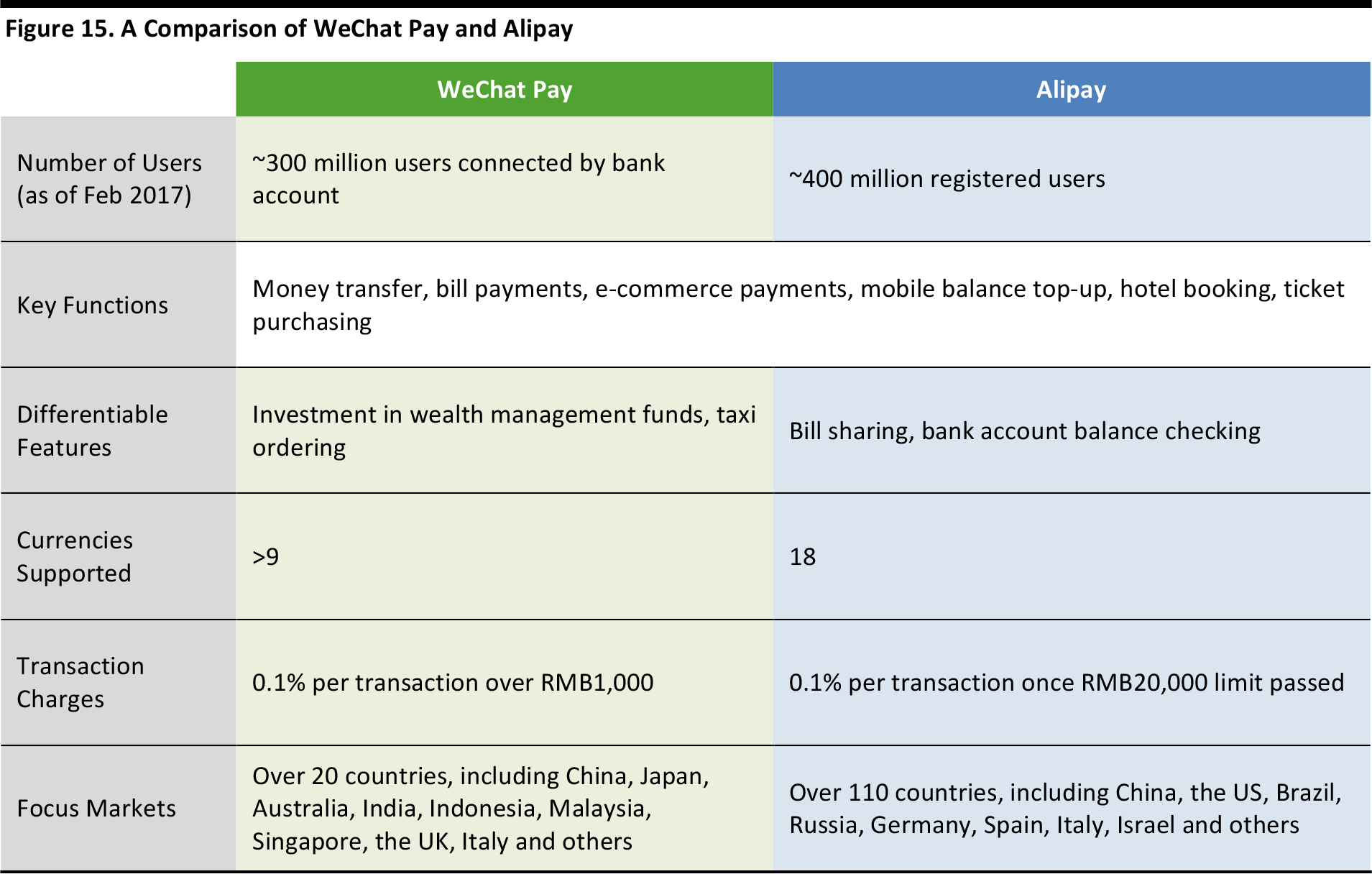

WeChat Pay was launched in 2013. Based on data from the CAICT, more than 300 million users have tied their bank cards to their WeChat account. The combination of WeChat Pay and QQ Wallet is the #2 payment platform in China.

WeChat Pay provides an easy and convenient solution to B2C (business-to-consumer) and C2C (consumer-to-consumer) payment. Consumers can pay with their phone, so can go cashless, with no need to carry change. WeChat occasionally has promotional discount campaigns, which also create incentives for users to adopt WeChat Pay.

According to Global Web Index, 33% of Chinese users have used WeChat to pay for an item, which is comparable to Alipay—the #1 payment platform in China—which is owned by Ant Financial Services Group. That WeChat Pay has managed to catch up with Alipay in only three years is remarkable. Tencent does not have an e-commerce ecosystem at its disposal like Alibaba does. For a more detailed analysis on

mobile payments in China, please refer to our previous

Note: Percentage of internet users who have used mobile payment

Source: Global Web Index/Fung Global Retail & Technology

WeChat Pay is Catching Up with Alipay

Alipay is the largest competitive threat to WeChat Pay in the China mobile payment space. As one of the largest e-commerce platforms in the world, Taobao drives the rapid adoption of Alipay among consumers.

Although WeChat Pay was late to enter the mobile payment market, it offers similar functions to Alipay and entered into a strategic cooperation with JD.com in order complement the company’s e-commerce payment functionalities.

The key functions of the two companies—Alipay and WeChat Pay—are similar: they both offer money transfer, bill payments, e-commerce payments, etc.

Source: AllChinaTech/ASEAN Today/Alipay/Fung Global Retail & Technology

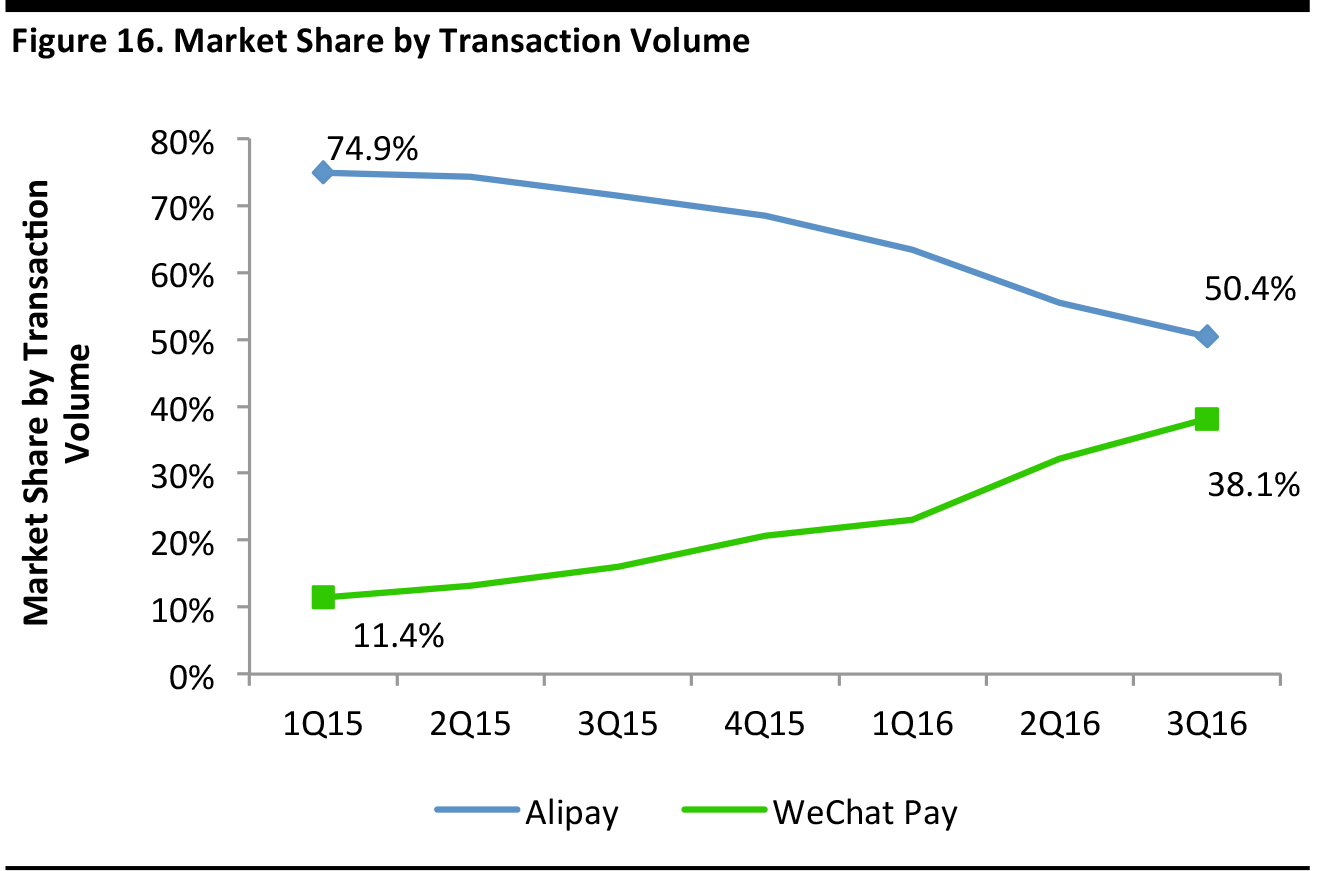

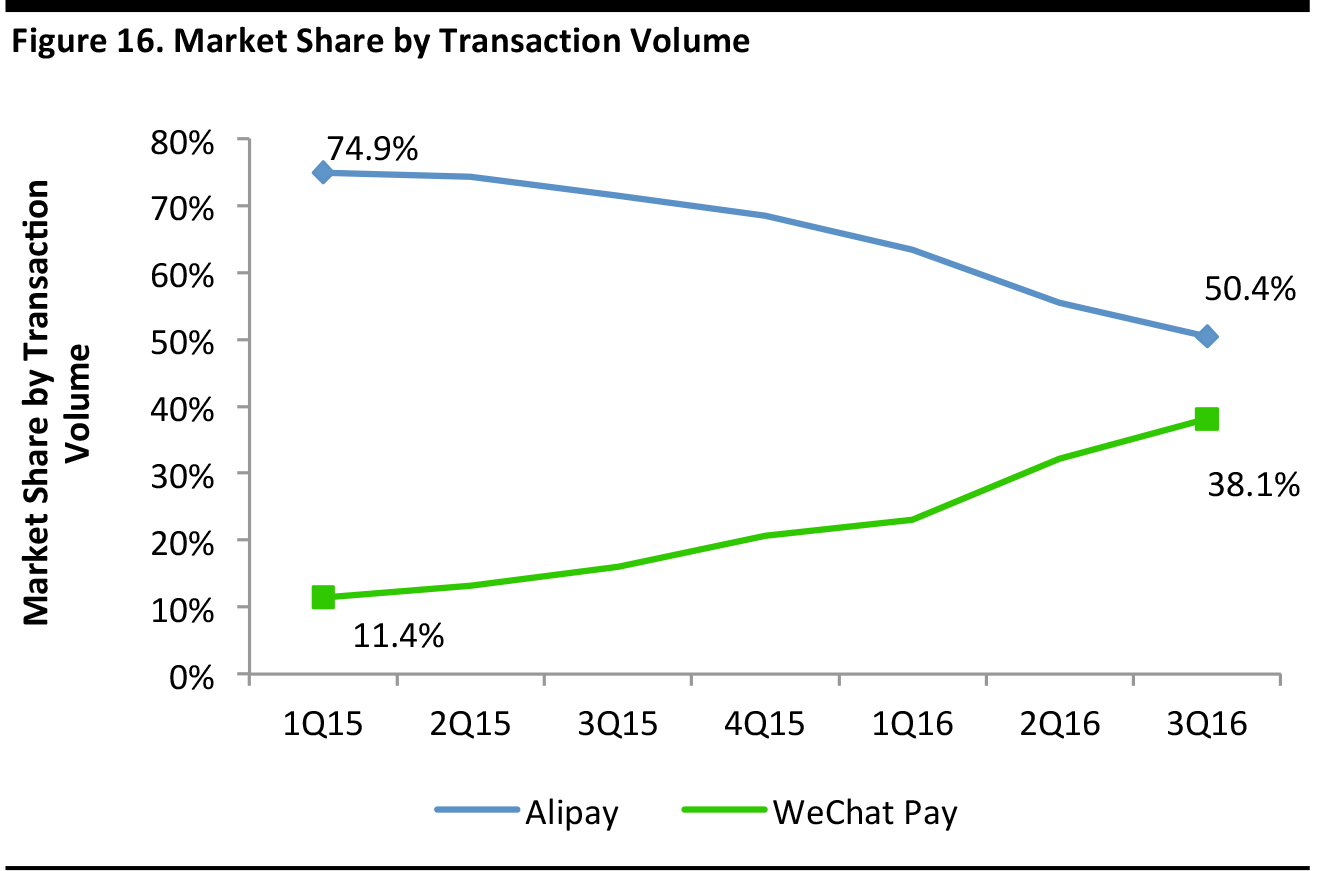

WeChat Pay accounted for only 11.4% of total mobile payment transaction volume compared to Alipay, which had a 74.9% market share in the first quarter of 2015. In only six quarters, WeChat Pay’s share increased to 38% in the third quarter of 2016, according to Analysys. The increase in adoption was mainly due to its integration with JD.com in May 2016 and the introduction of P2P (person-to-person) money transfers.

Source: Analysys/Fung Global Retail & Technology

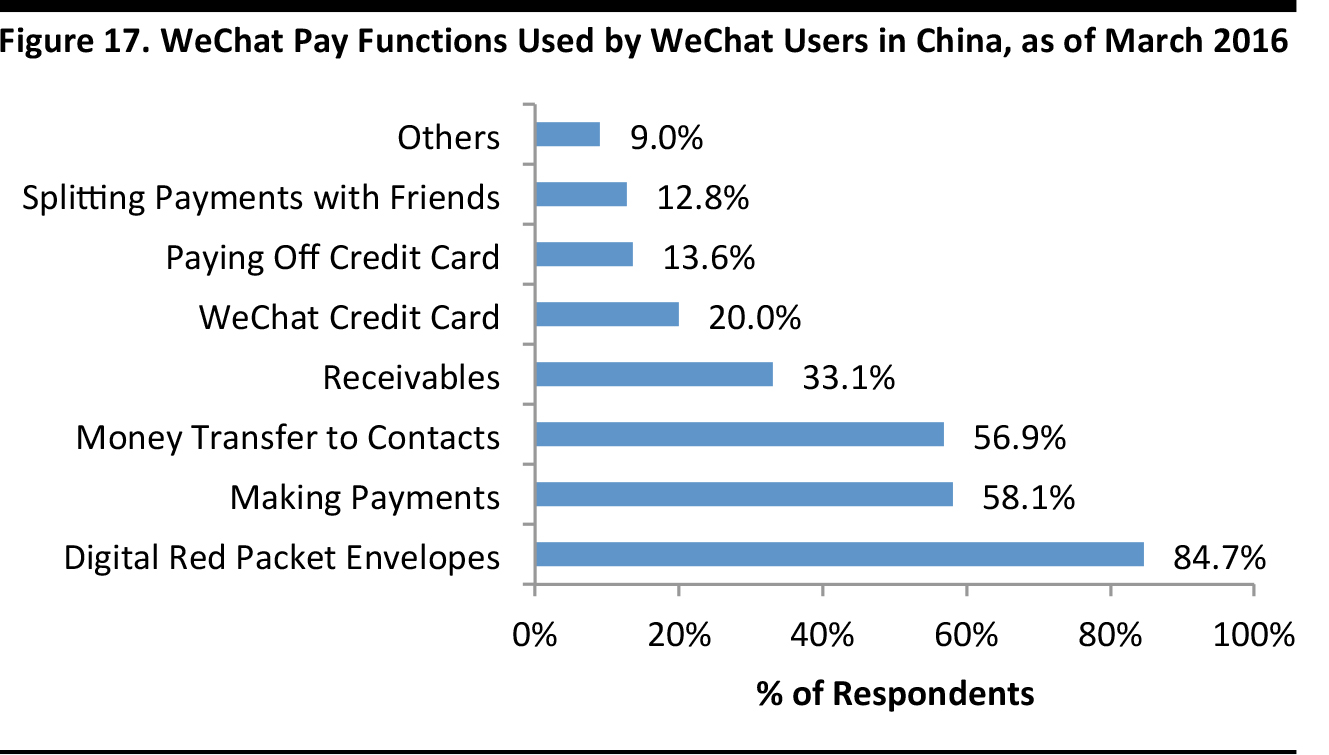

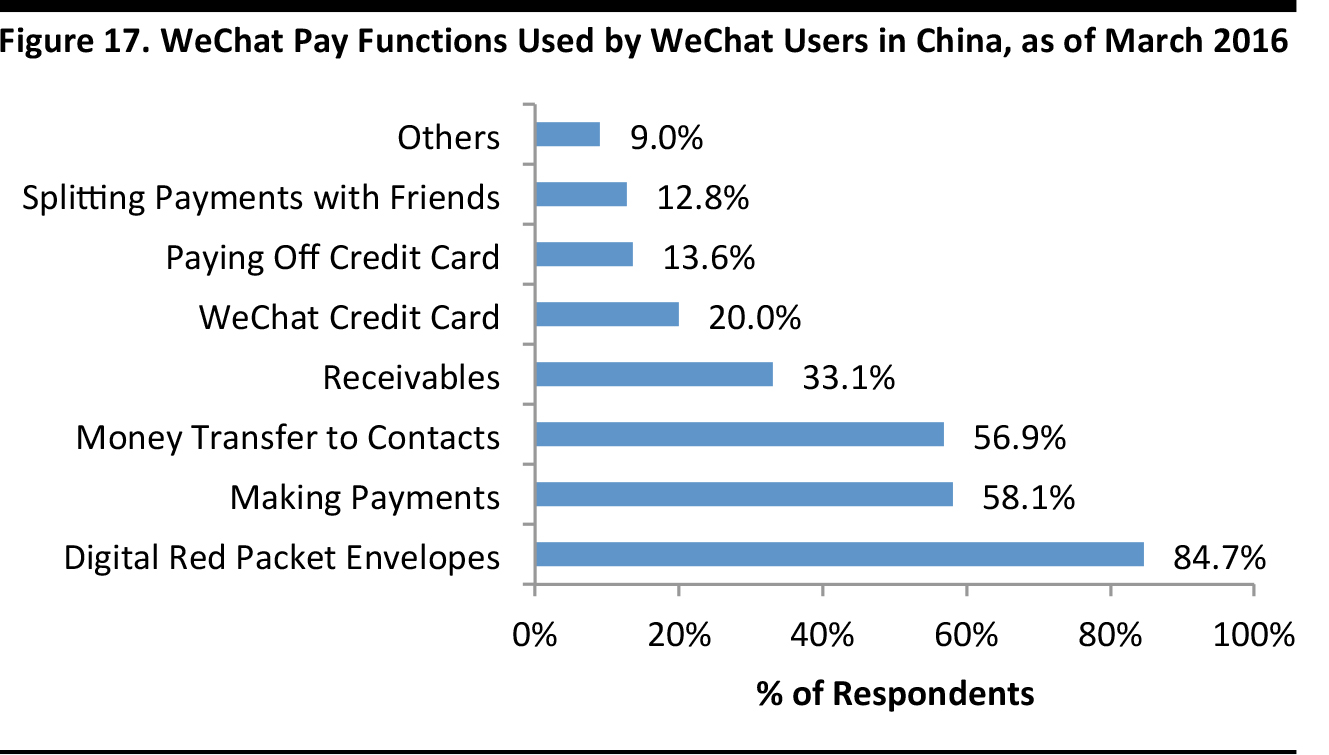

According to WeChat data, the sending and receiving of digital hongbao (the red packet envelopes stuffed with money that family members give to younger relatives and friends during Chinese New Year) is the most-used feature of WeChat. The second- and third-most used features are payments and money transfers, respectively. The red envelope packets, coupled with the discount coupons merchants give out around the holiday period, provide sales opportunities, as consumers can use the money and coupons that are given to spend within the WeChat system.

Source: Shutterstock

Source: Tencent Penguin Intelligence and China Academy of Information and Communications

Technology (CAICT)

Growing Adoption of Mobile Transactions

WeChat’s online-to-offline (O2O) opportunities are being recognized by merchants. According to a Tencent press release in February 2016, more than 300,000 offline stores worldwide accepted WeChat Pay. WeChat has also begun to charge users a fee when they transfer money from their WeChat Pay account to their bank account, and as a result, users will be more likely to keep their money within the WeChat ecosystem.

E-commerce: E-commerce is likely to play a bigger role in driving WeChat Pay’s monetization efforts. In May 2016, Tencent and JD.com said they would offer a WeChat marketing and branding data analytics tool to marketers worldwide. With the tool, Tencent will provide data to marketers about which public WeChat accounts users follow and which brands and celebrities they like. JD.com will offer sales data about users’ product purchases. The data could help marketers target specific demographics most likely to buy certain products.

Cross-border payments: WeChat Pay allows user to pay in renminbi without worrying about the exchange rate when they buy products overseas via the app. WeChat automatically settles the payment with retailers in the local currency.

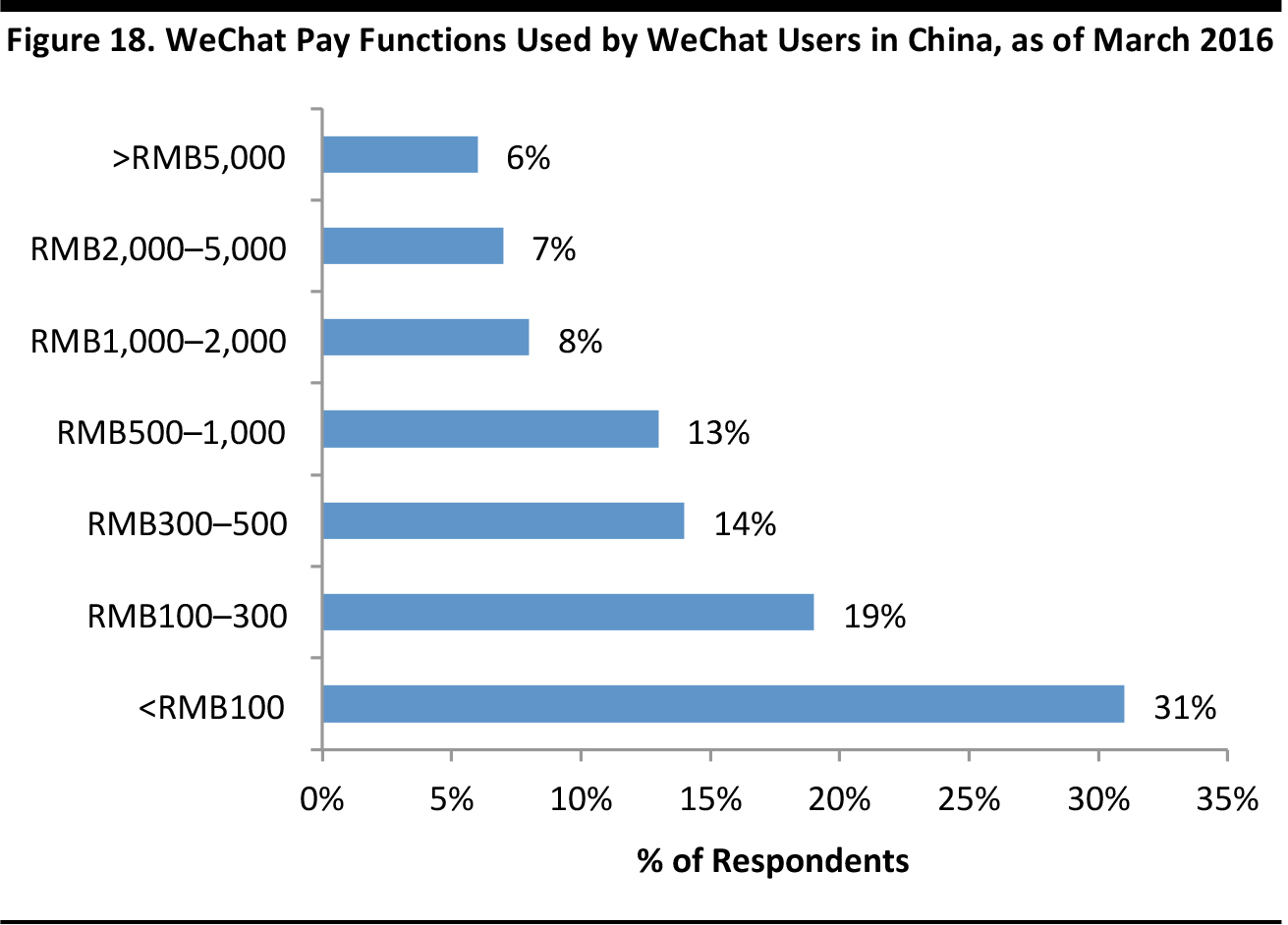

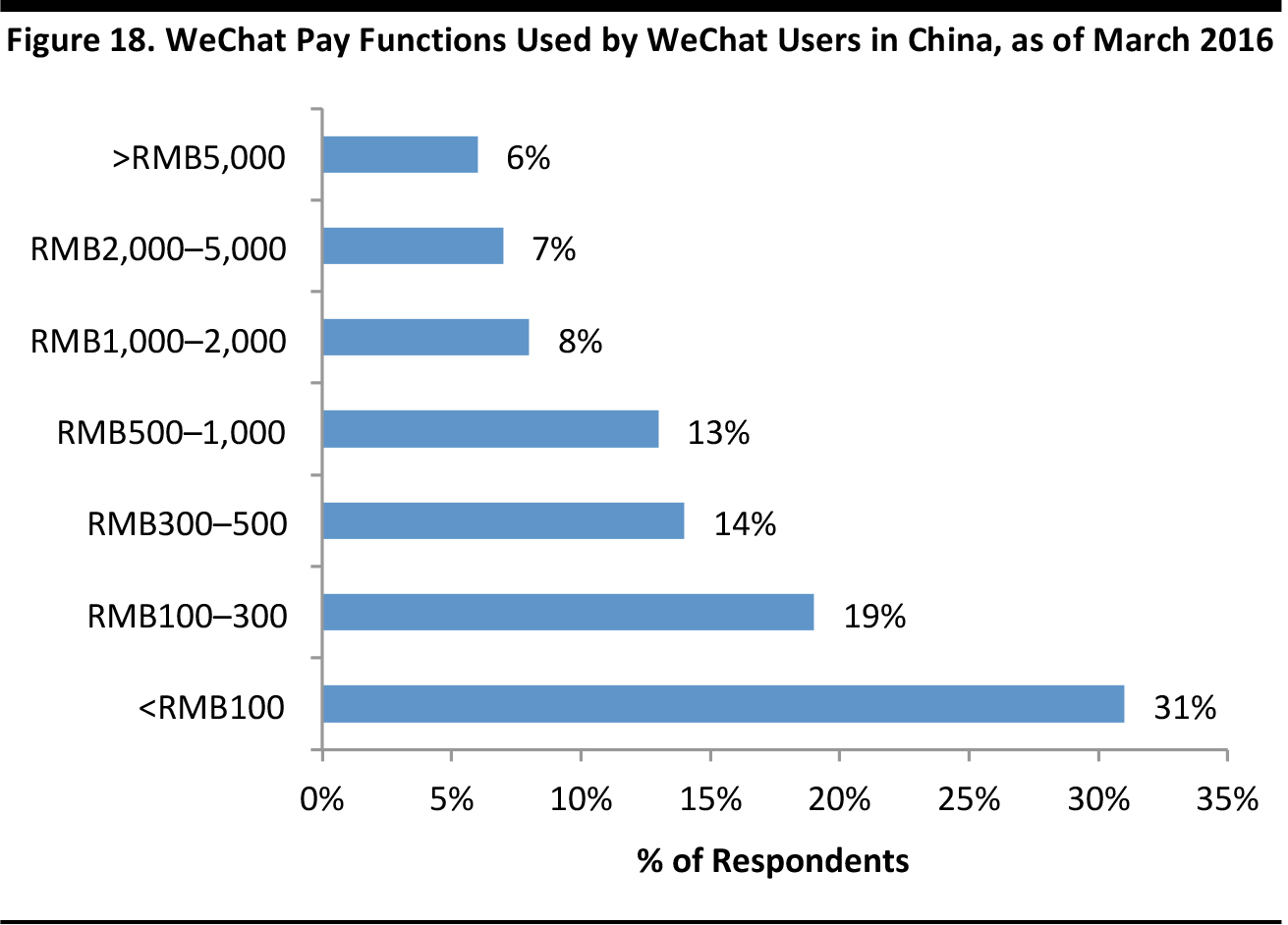

According to data from the CAICT, 67% of users spent over ¥100 per month in March 2016, more than double last year’s figure; and 34% spent over ¥500 per month, six times more than last year’s 5%. We believe this is an early sign that users are starting to use WeChat payment for larger transactions, beyond small-payment transfers such as digital red packets.

Source: Tencent Penguin Intelligence and China Academy of Information and Communications

Technology (CAICT)

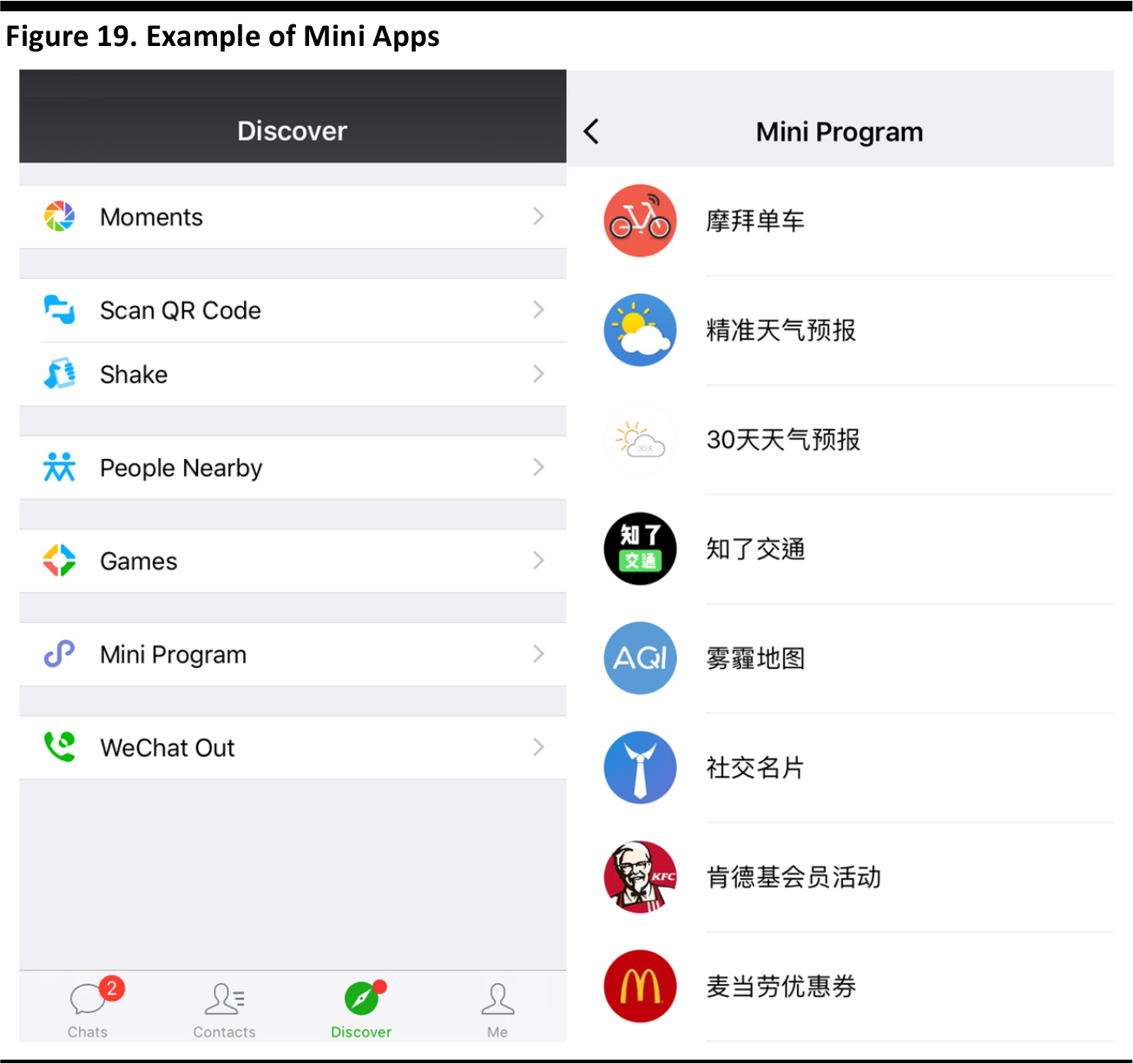

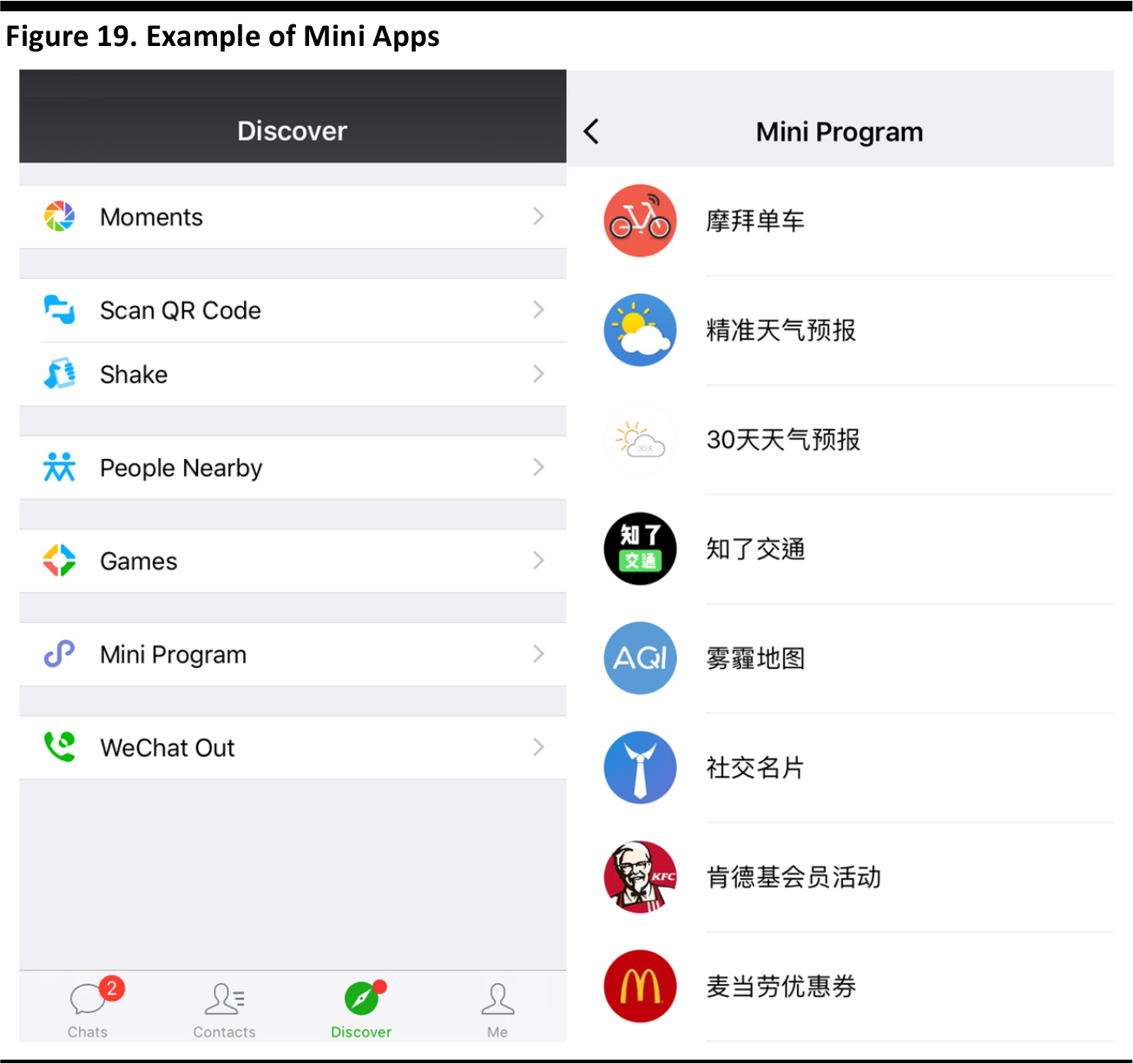

3. Replacing Native Apps: Mini Programs

“No installation required,” “at your fingertips” and “easy come, easy go” are three characteristics of WeChat mini programs. By offering native app-like experiences within WeChat, mini programs should empower small- and medium-sized enterprises (SME) to have more flexibility in providing engaging content. Users should also benefit, as they will not have to leave WeChat to enjoy a seamless experience. For a more detailed analysis on WeChat mini programs, please refer to our previous publication in January 2017:

A Preview of WeChat Mini Programs.

Examples of existing mini programs include:

- Online-to-offline (O2O): Meituan Waimai, a food ordering platform with delivery service.

- E-commerce: JD.com, an e-commerce platform for consumer electronics, apparel, jewelry and more.

- Taxi ordering: Didi Chuxing, a taxi-hailing and ride-sharing online platform, providing transportation services for over 400 cities in China.

- OTA: Ctrip, a travel agent providing accommodation, transportation ticketing, packaged tours and travel management.

- Utility tools: XCurrency, which provides real-time foreign exchange rate information.

Source: WeChat

WeChat management has stressed that the function of its mini programs is to help offline merchants establish a presence online, and that mini programs as a whole will grow at a measured pace to ensure the user experience is not compromised. Rather than focusing on monetization, mini programs are more similar to an ecosystem with infrastructure support to enhance overall user stickiness and service usage on WeChat. Mini programs are positioned as a sustainable go-to app for business partners and users.

Restrictions of Mini Programs

Even though mini programs can provide a seemingly one-stop solution, they cannot entirely replace native apps. The downside includes:

- Closed system: As a feature within WeChat, the development of mini programs is overseen strictly by Tencent. Apps such as Taobao, Uber and Xiami Music will not be allowed on mini programs.

- Stripped-down functions: Most big companies such as JD.com use their native apps, which have high data tariffs, to generate valuable operational data for future development. Thus, mini programs are likely to serve only as a supplement to the original applications, given that only limited functions are available.

- Decentralized: Mini programs advocate “no installation required, at your fingertips and easy come, easy go,” which can be a double-edged sword. Currently, mini programs do not have an app store, do not support sharing on Moments and do not have a fuzzy search function either. As a result, it may be difficult for companies to promote and market their proprietary mini programs.

Not Alone, but Not the First Either

Although mini programs can help to connect SMEs with internet users, they are not the only app that offer this.

- Baidu’s “Light App” was unveiled in 2013. It enables search results to show app-powered displays with rich information. Although Baidu hasn’t officially discarded “Light App,” the technical support including software and customer services from Baidu was stopped last year, due to lack of a sufficient number of developers.

- Alibaba’s UC web browser and Qihoo’s 360 web browser allow users to add HTM5-based web applications without having to install any program. Although both apps are still up and running, they act as an alternative browser to Chrome, Safari and Firefox, rather than as a direct competitor to mini programs.

- Google’s Instant Apps allows Android apps to run instantly without installation via social media, search, messaging and other links. Google launched Instant Apps in January 2017, and the first couple of Instant Apps are ready for limited testing. Given that Google’s app store is not yet available in China, Instant Apps is unlikely to pose any immediate threat to mini programs.

With over 889 million MAU, WeChat has an unprecedented large platform for mini programs to grow compared to its Chinese peers. The low development cost of mini programs relative to that of native apps could eventually be an incentive for SMEs.

Challenges

As it seeks further growth, both in China and overseas, WeChat could face the following challenges: 1) the capacity threshold of the apps; and 2) decelerating growth of its user base.

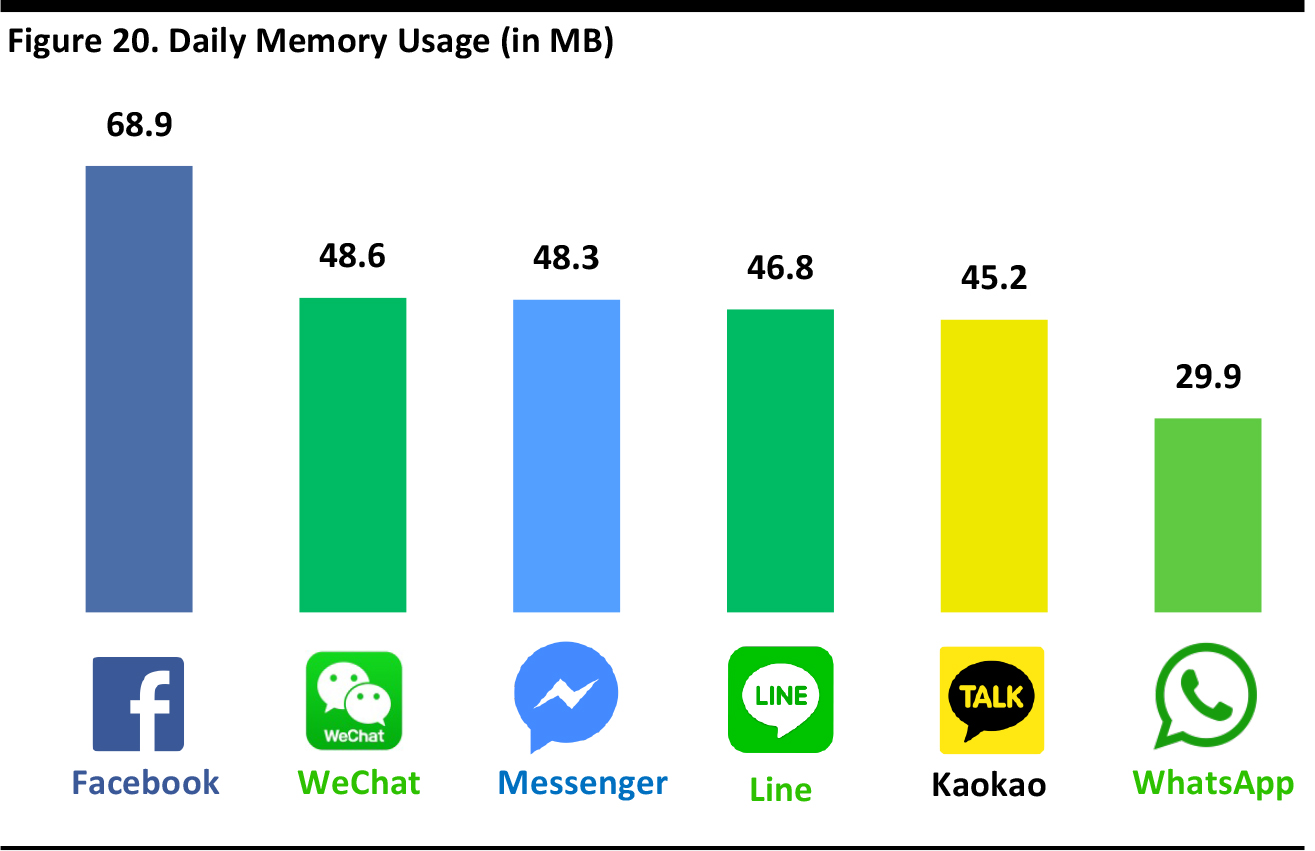

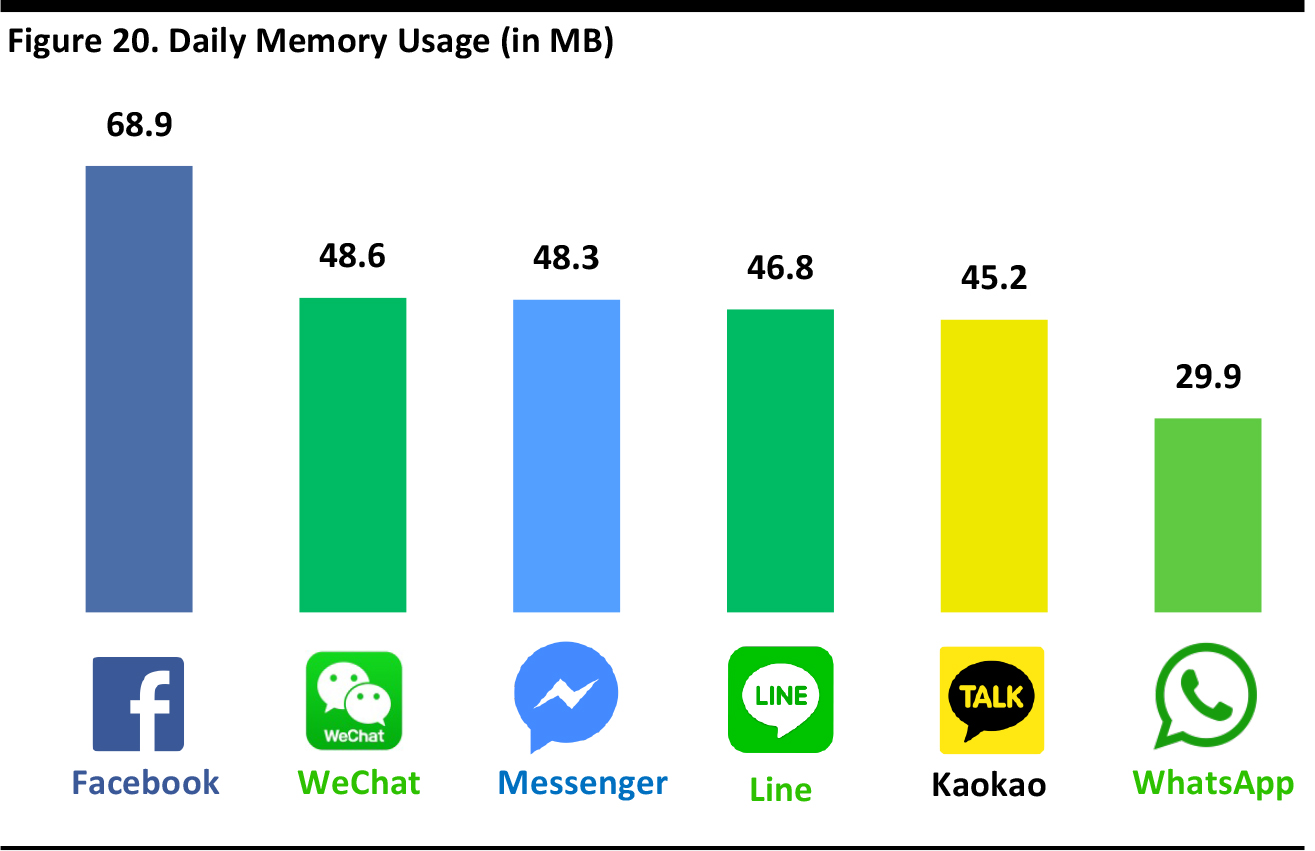

1. Capacity threshold of the apps: As Tencent continues to add more features to WeChat, such as mobile payment and video ads, the capacity of the app could potentially reach a threshold. Competitors, like Kakao Talk and LINE, have already developed some out-linked apps to support their ecosystem. For example, Kakao Taxi for taxi hailing, KakaoTopic for news, LINE Maps for navigation, LINE SHOP for e-commerce, etc. By spinning off computing-power demanding functions, the messaging apps could focus on increasing the user experience on social networks. Mini programs could mitigate this downside to some degree, but it will be difficult for Moments to perform exactly like Facebook does. According to App Quest, WeChat memory usage is already the highest among the different messaging apps, so performance, especially on low-end smartphones, could be a concern if Tencent fails to strike a balance between functionality and value-added content.

Source: App Quest

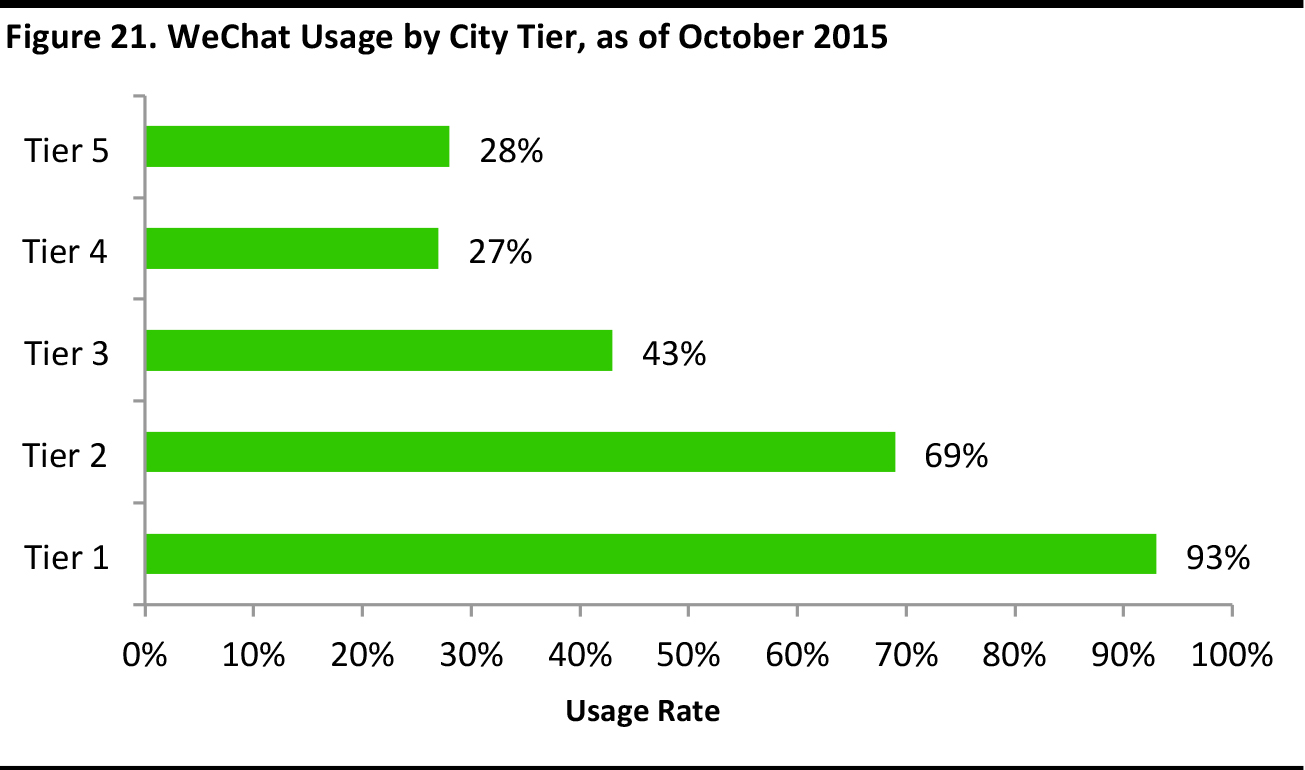

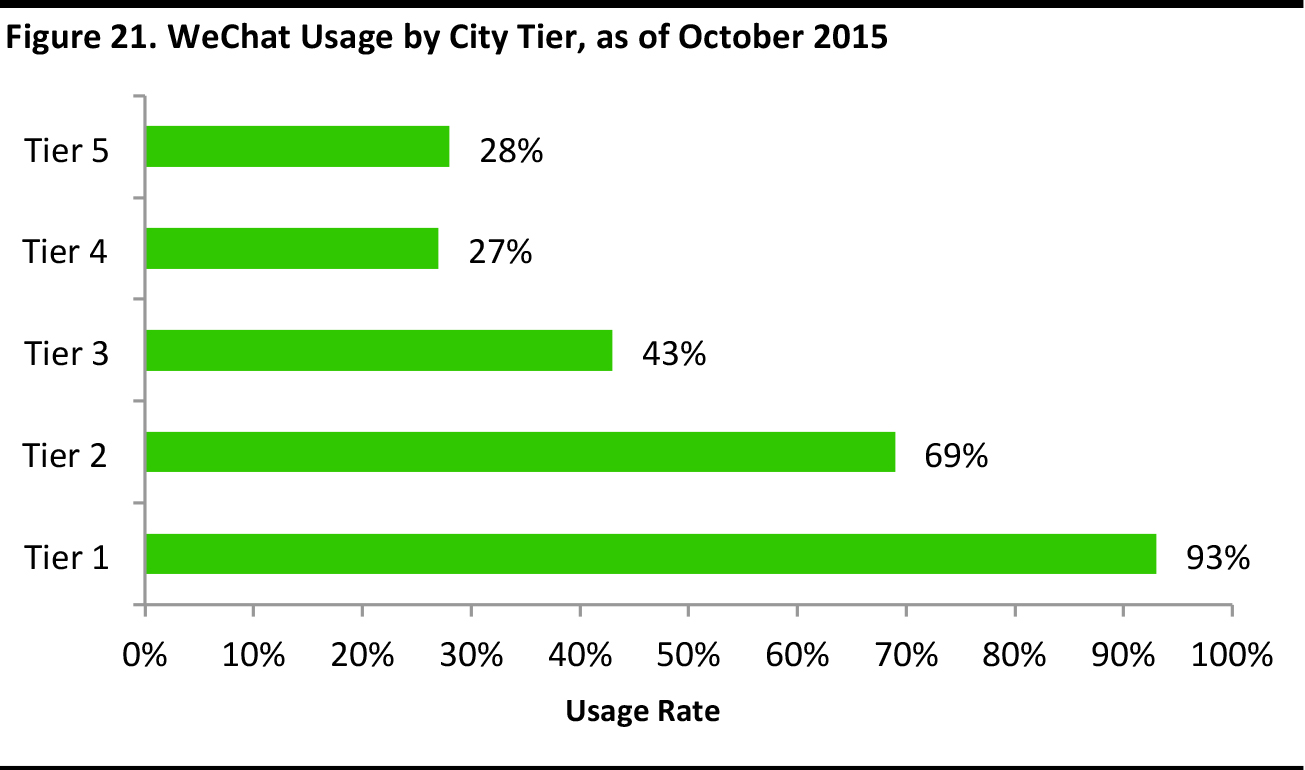

2. Decelerating growth of the user base: Due to the strong presence of competitors in other markets, such as LINE, Kakaotalk, WhatsApp and Facebook Messenger, Tencent is struggling with its global expansion plans. Back in 2015, Tencent President, Martin Lau, said that overseas user acquisition would soon come to an end. Yet, WeChat is already seeing decelerating growth of its user base (28% year-over-year growth in the fourth quarter of 2016 compared to 30% year over year in the third quarter of 2016), with 93% usage in tier-1 cities, according to Tencent data. Further growth will likely come from tier-3 or lower cities where the internet and smartphone penetration has room to grow.

Source: Company data/Fung Global Retail & Technology

Applications in Retail

WeChat has become a core part of the disruptive force in retail. While it helps bridge the gap between social media and e-commerce, through actual engagement with customers, it also creates a new way of shopping in physical stores.

WeChat provides several functions that increase the efficiency of business operations and enhance consumers’ shopping experiences, such as:

- Barcode scanner: Lists the Chinese e-commerce sites that stock the product in search.

- Mobile payment: Allows consumers to pay either online or at the physical store.

- Official Accounts: Allow corporates to engage with customers through customer service, news and promotions.

- Membership cards: Enable management of loyalty programs.

Department Stores Can Leverage WeChat Both Online and Offline

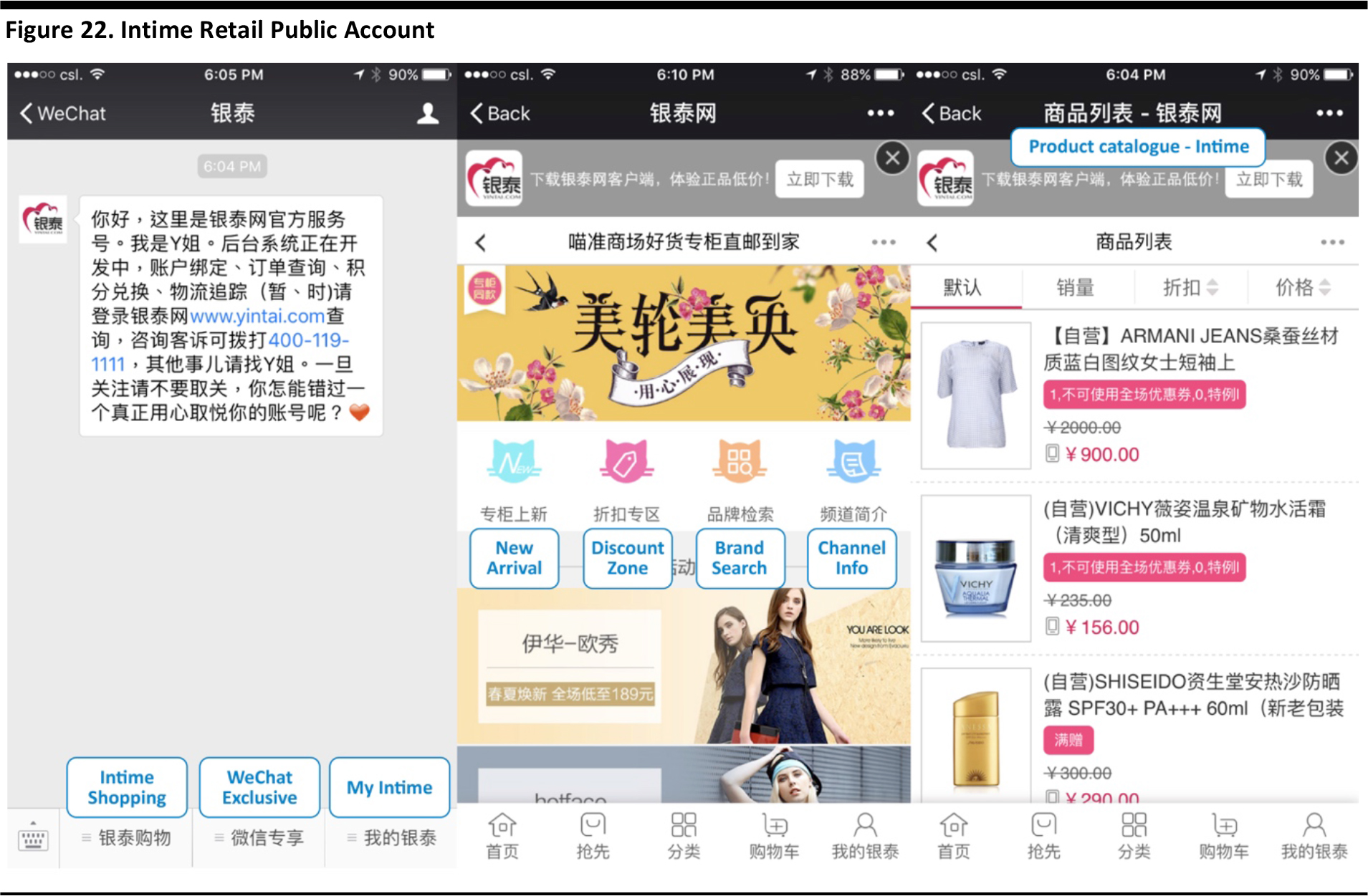

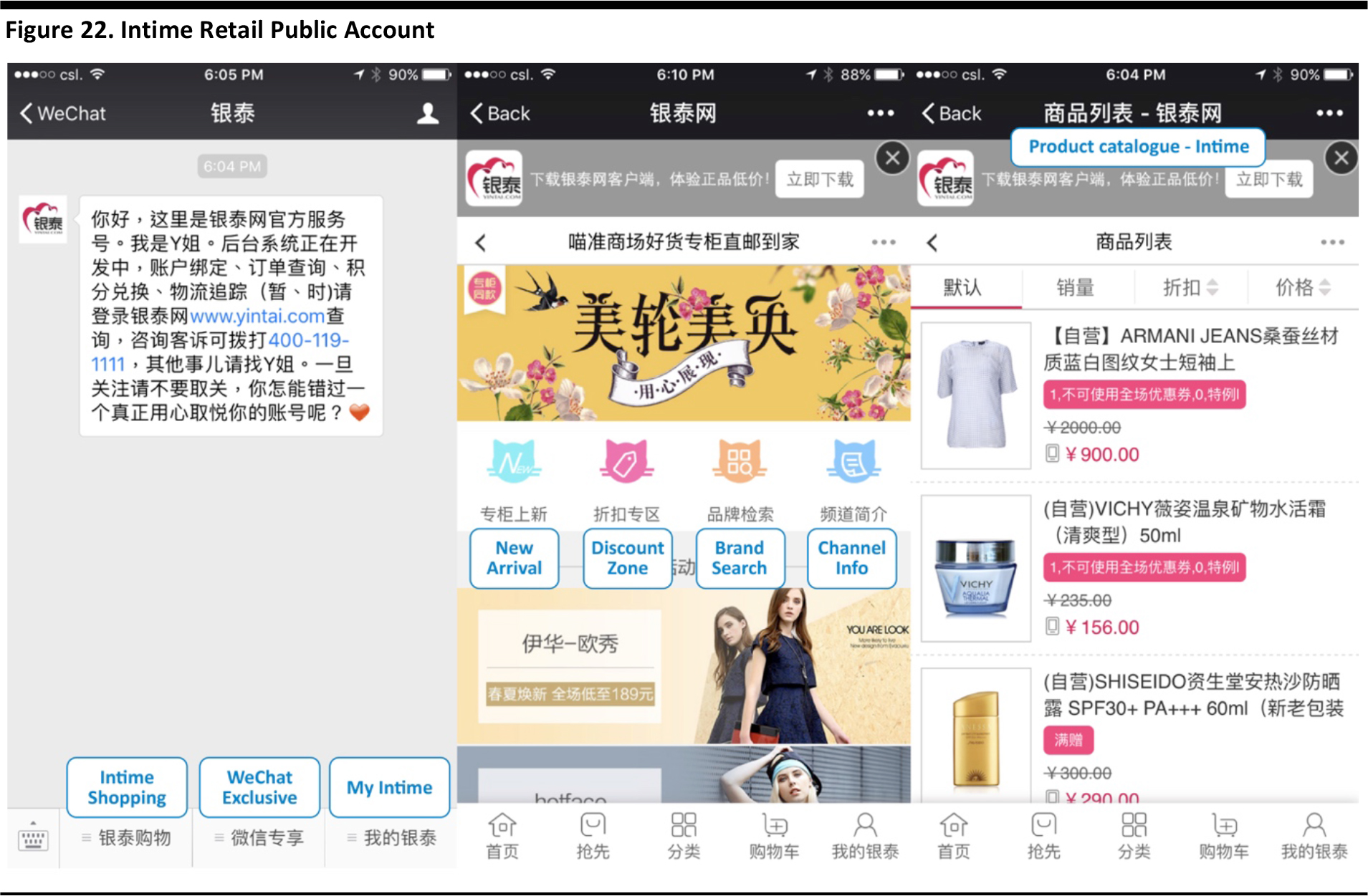

The public accounts of Chinese department stores not only provide news and promotional information, they also allow customers to check out items they want to purchase by simply using WeChat to scan the barcode provided at the cashier.

Intime Retail, one of the leading department store and mall operators in China, does exactly that. It allows user to pay for purchases through WeChat Pay—a process that takes less than two minutes. Leveraging on the functions of WeChat, Intime can effectively shorten the long queues for the cashier in the store and, in turn, improve the customer shopping experience and conversion rate. Customers can also order specific products on the Intime Retail Public Account, with the guarantee that the online and in-store price are the same, and choose any nearby store for pickup.

Source: WeChat

WeChat is a Channel for Mobile Advertisements

During Chinese New Year this year, WeChat launched a native video advertisement campaign, selecting a group of advertisers for the trial. According to data from WeChat Ad Assistant, the results were very positive.

For example, Chinese electronics company Xiaomi saw a 27% increase in purchase intention; luxury French perfumes and cosmetics giant Lancôme saw a 352% jump in the number of searches for the brand and a 114% increase in the browse rate for the web page; and Yili, a leading Chinese milk producer, saw a 305% leap in orders on e-commerce sites.

Foreign luxury brands have begun to advertise on WeChat to drive sales in China. According to Jing Daily, the digital publication on luxury consumer trends in China, out of 25 luxury brands—including Chanel, Coach, Dolce & Gabbana and Louis Vuitton, among others—92% have a WeChat official account and 64% have a WeChat service account. A service account is an upgrade of an official account that can better complement a company’s basic content broadcasting activities. Below, are some examples for brands that use WeChat to engage with customers.

- Coach: In September 2016, Coach decided to exit Tmall, although it still uses WeChat to reach consumers in China. In contrast to the mass-market image of Tmall, WeChat allows brands to reach consumers on a more personal level.

- Kate Spade created a flying lantern game for the Mid-Autumn Festival whereby customers could customize a lantern and send it into the sky with their wishes. They could even scan QR codes to share with friends and win prizes.

- Zara’s site uses the customer’s current location to show nearby stores. Location-sharing allows brands to push promotions to customers at nearby stores.

- Louis Vuitton’s admin accounts allow for chat-based, pre-programmed customer service.

- H&M’s “Little Shop” service account allows for shopping and one-click payment.

WeChat Enables a C2C E-Commerce Ecosystem

Youzan and Weidian are two of the leading Software as a Service (SaaS) providers for online stores in China. Similar to Shopify, users can open an online store through the Youzan or Weidian platforms. The websites can then be accessed through WeChat browser and WeChat Official Accounts.

By connecting to WeChat, store owners can use WeChat Pay for transactions and Official Accounts for advertisements. Consumers can browse goods online before buying them, forward them to friends or groups using WeChat, or publish them in Moments.

Source: TMO/Fung Global Retail & Technology

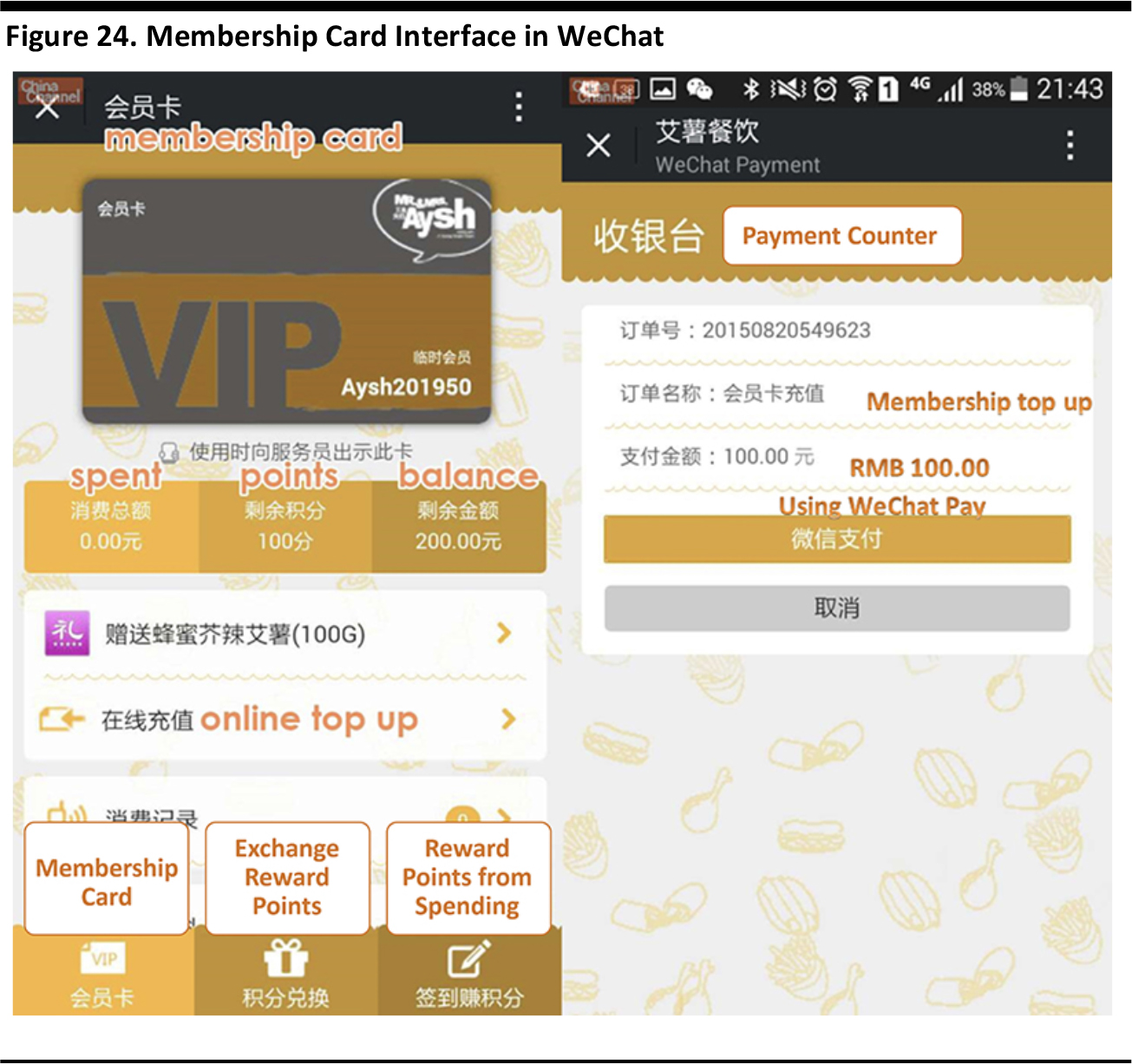

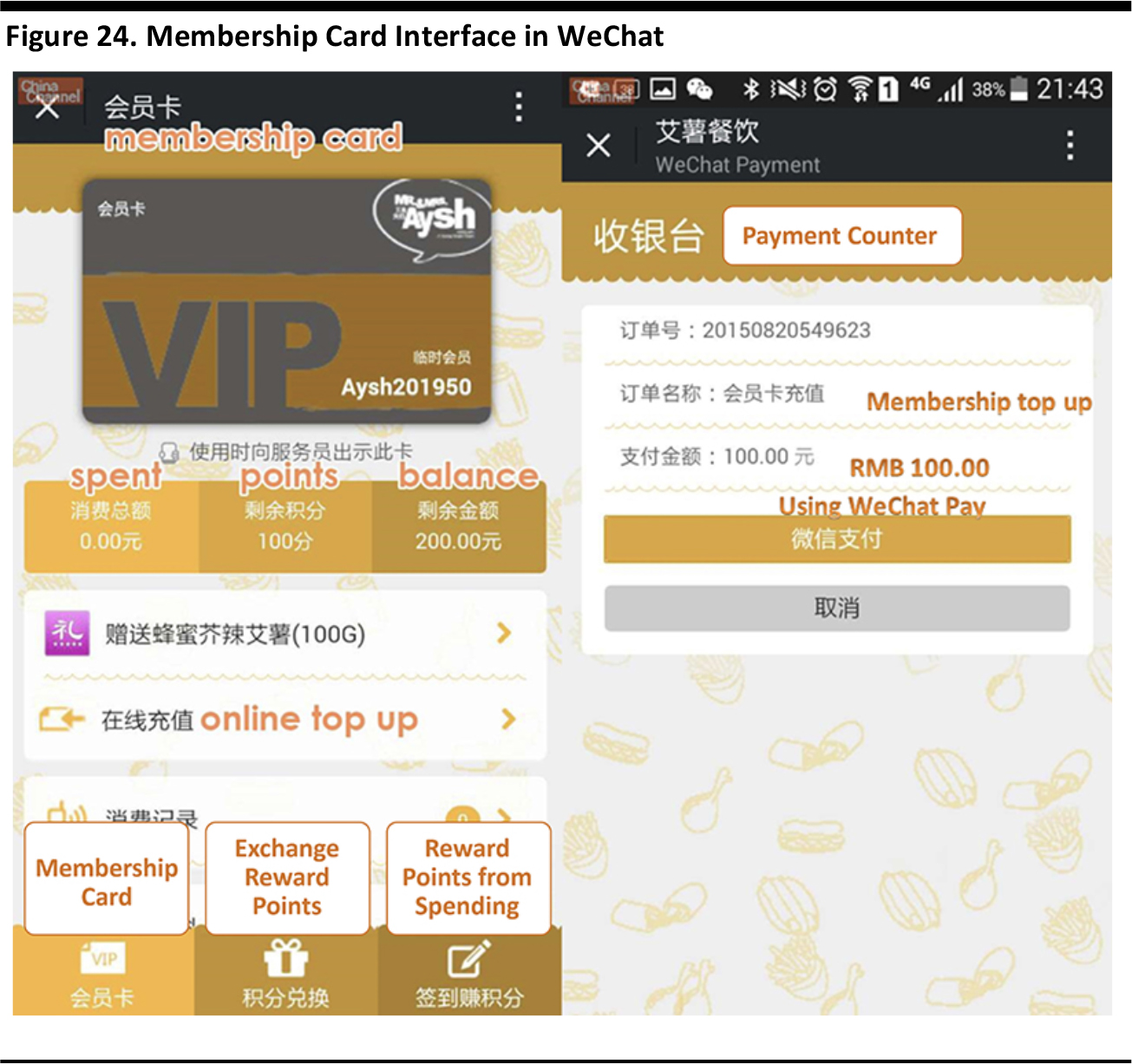

Loyalty Program Management

By integrating its mobile payment solution, WeChat can synchronize with members’ shopping cards to give, for example, extra discounts for future cashless payments. There are several benefits to taking a physical membership card and making it a “virtual card” on WeChat:

- Virtual cards cannot get lost.

- Consumers can easily check their points balance or purchase history at any time on their mobile phone.

- Consumers can easily get and share discounts and special offers with friends through WeChat.

The advantage of WeChat’s loyalty program over standalone mobile loyalty programs is the high stickiness of WeChat users. In other words, users are more willing to receive notifications in WeChat compared to standalone mobile loyalty programs.

Source: Chinachannel.co

Conclusion

Thanks to its differentiable features, such as Moments and its payment platform WeChat Pay, WeChat has a dominant position in China, with no apparent competitors in sight. Although there are challenges to expanding overseas, Tencent will likely focus on monetization of WeChat in China through advertisements and online transactions in the next few years.

On the retail side, WeChat is an enabler of disruptive e-commerce, as it bridges the gap between social marketing and actual engagement with customers. There is an increasing trend for traditional brands to adopt WeChat as part of their marketing platform. WeChat can be the key to access China, and potentially the first step to establishing an O2O channel.

Appendix

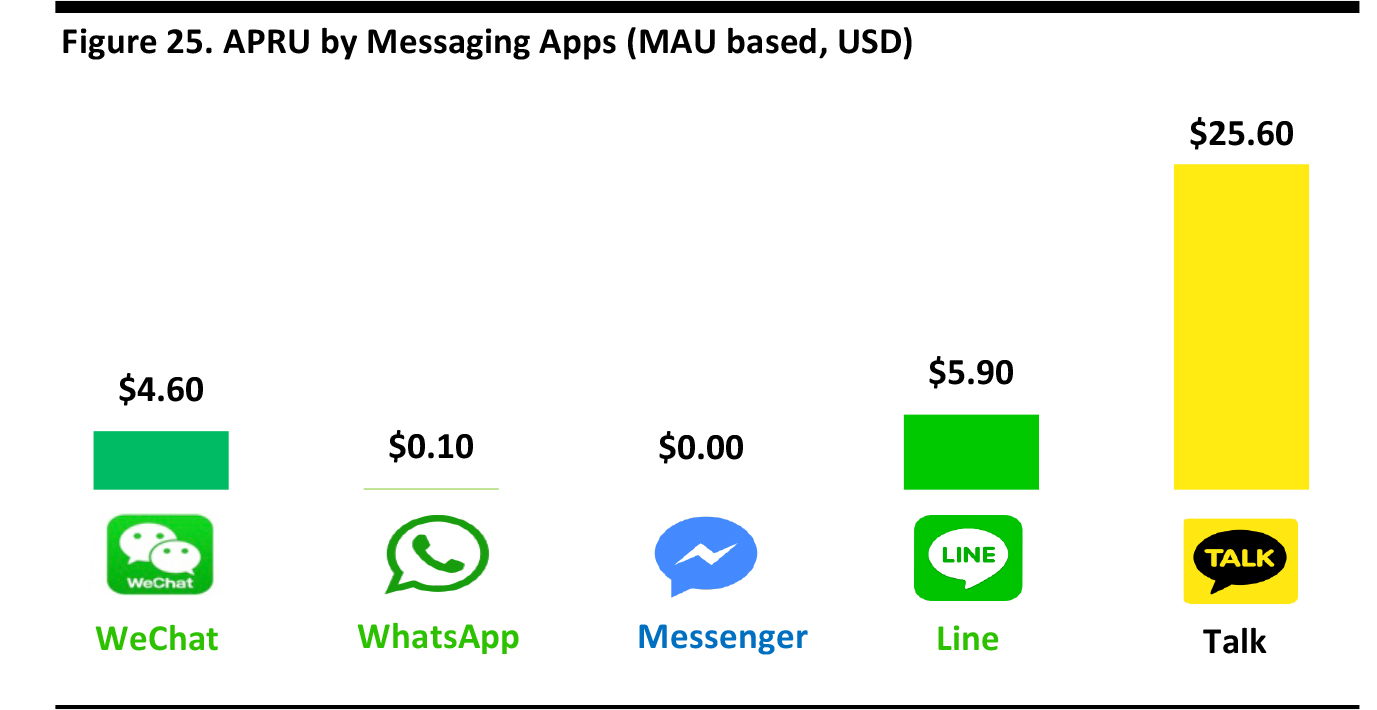

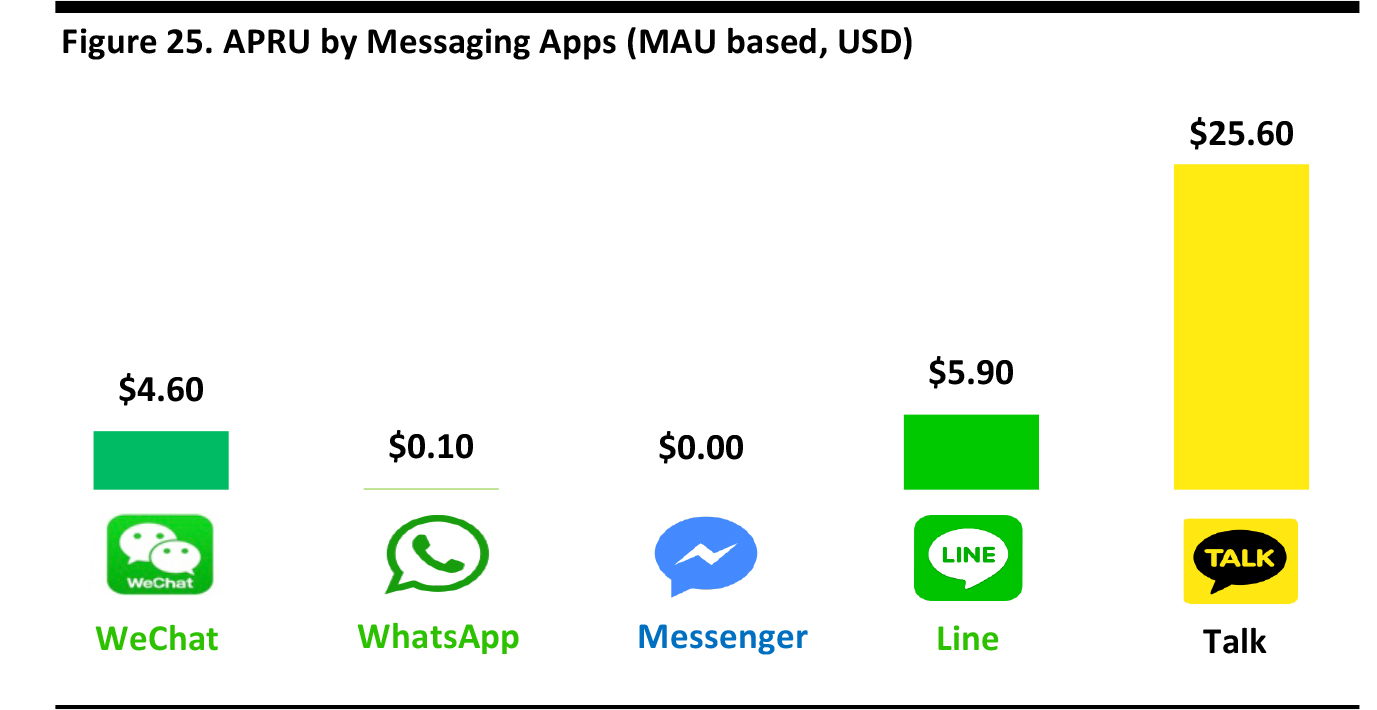

ARPU Analysis of Messaging Apps

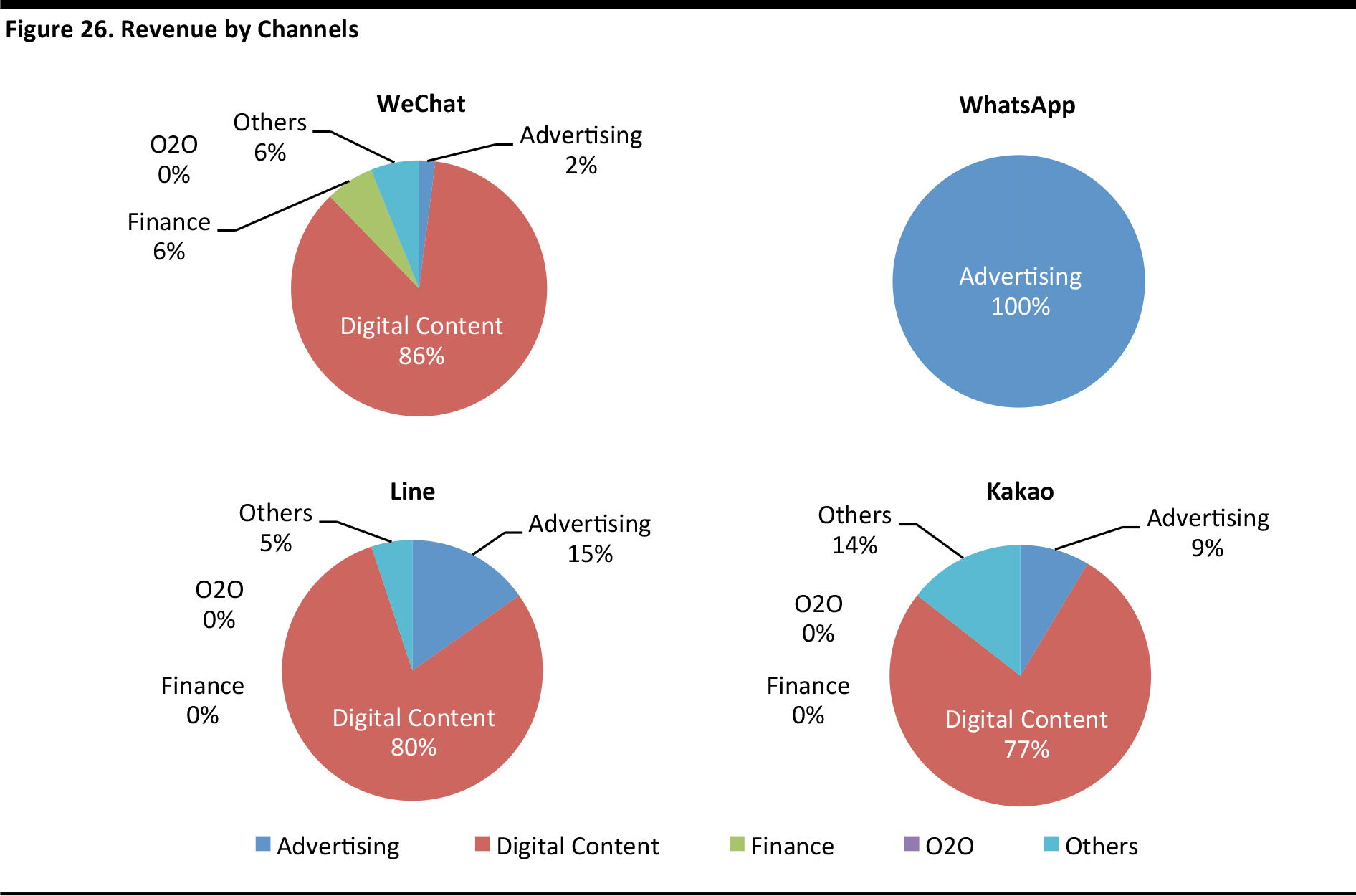

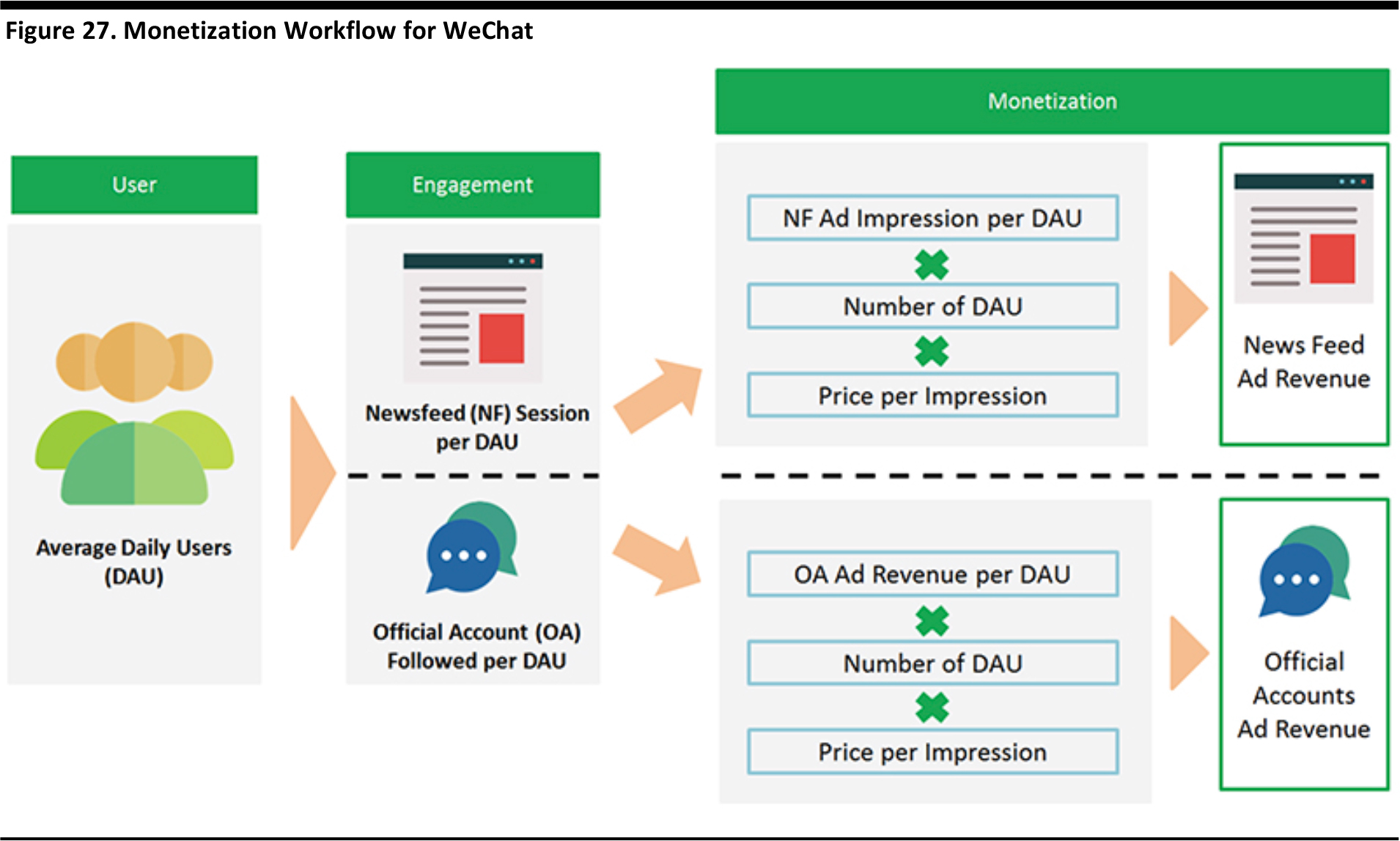

By breaking down average revenue per user (ARPU), we can get a better understanding of the monetization of messaging apps.

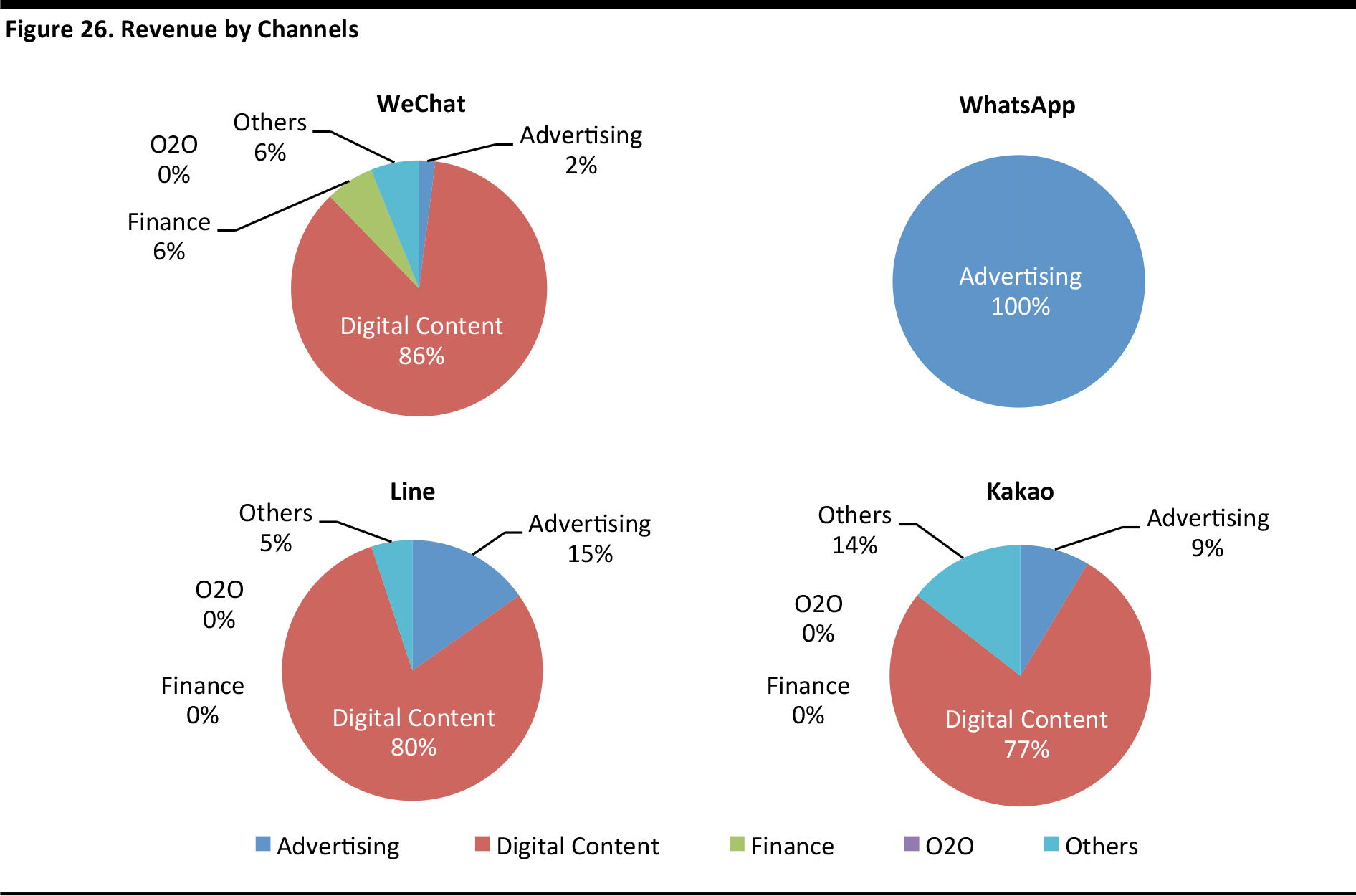

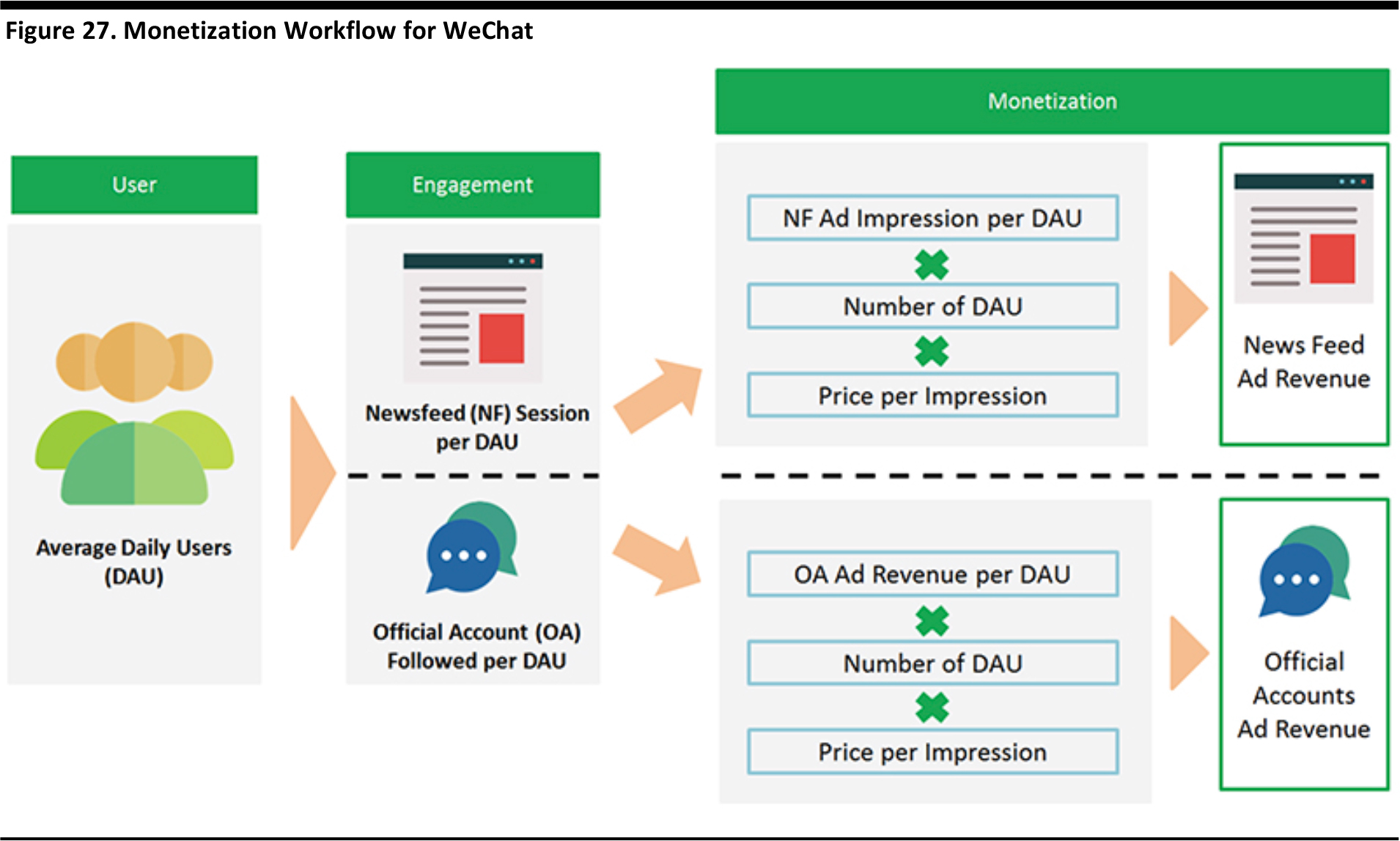

We categorize four major monetization models: 1) advertising (promoted content, accounts or products); 2) digital content (games, stickers, emoji, music and video); 3) finance (P2P payment, e-wallet and loans); and 4) O2O services (food delivery, restaurant reservations and taxi services).

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

As the above data shows, digital content is the most common way to generate revenue. User can buy stickers to chat with friends, or virtual coins to boost their performance when playing games. Yet, in the longer term, we believe finance and O2O services will take over as being the core contributor to revenue.

Source: Company data/Fung Global Retail & Technology

User Interface

Source: WeChat

Source: WeChat

Source: WeChat