EXECUTIVE SUMMARY

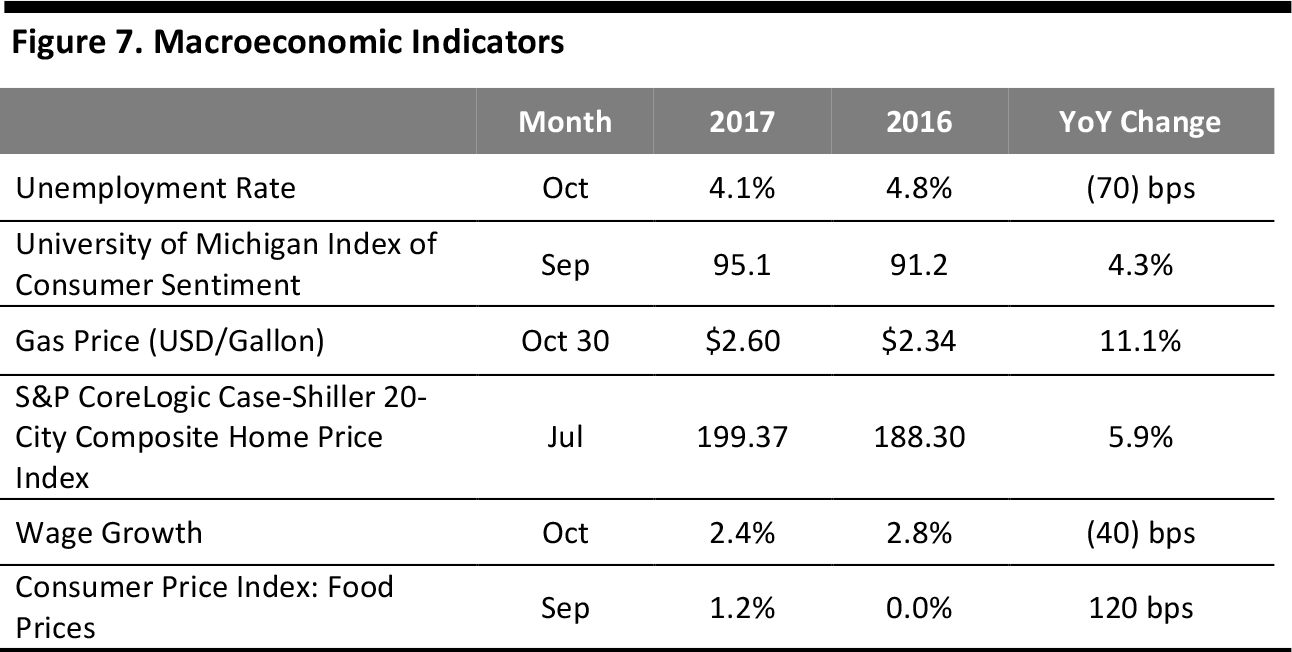

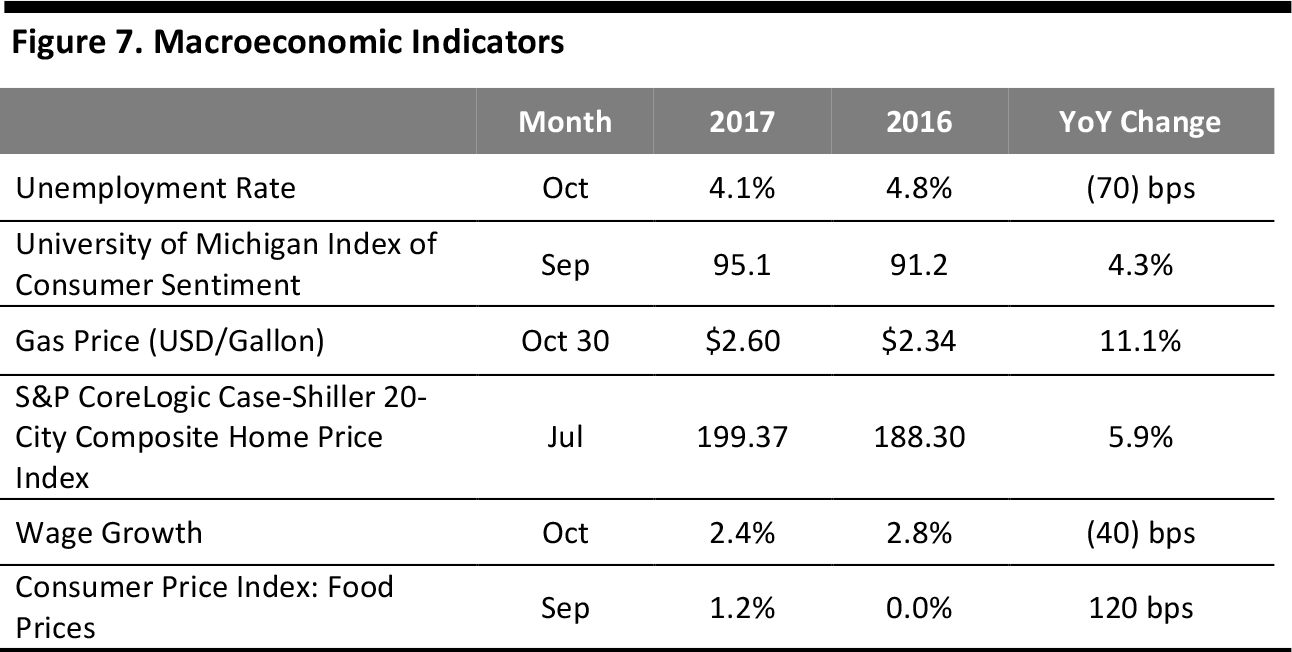

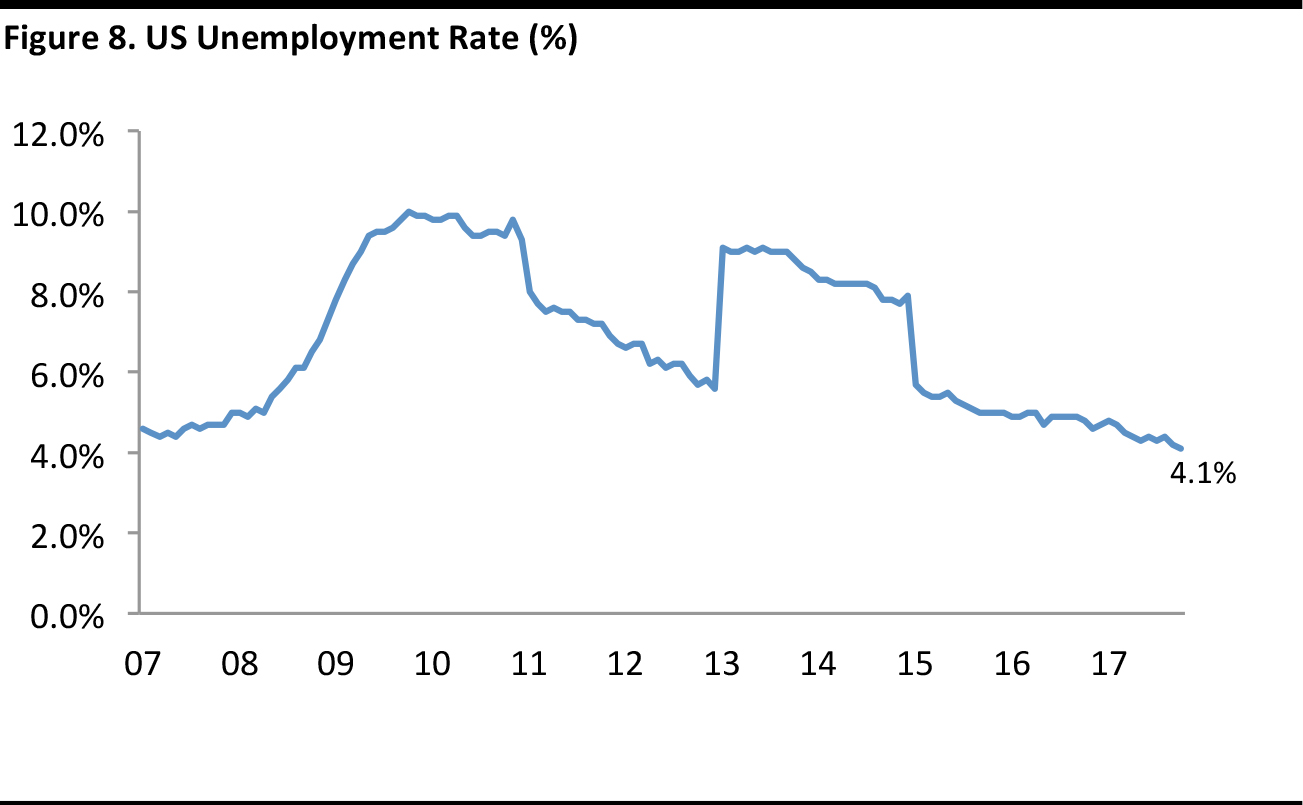

There are several positive macroeconomic tailwinds that point to a healthy holiday shopping season in the US this year. The US unemployment rate recently fell to 4.1%, the lowest rate in 17 years, providing firm support for consumer spending. In addition, consumer sentiment is up by more than four points from a year ago, which is not surprising since the S&P CoreLogic Case-Shiller Home Price Index is up nearly six points year over year. The “wealth effect” of consumers having more valuable homes makes them more comfortable spending on other things.

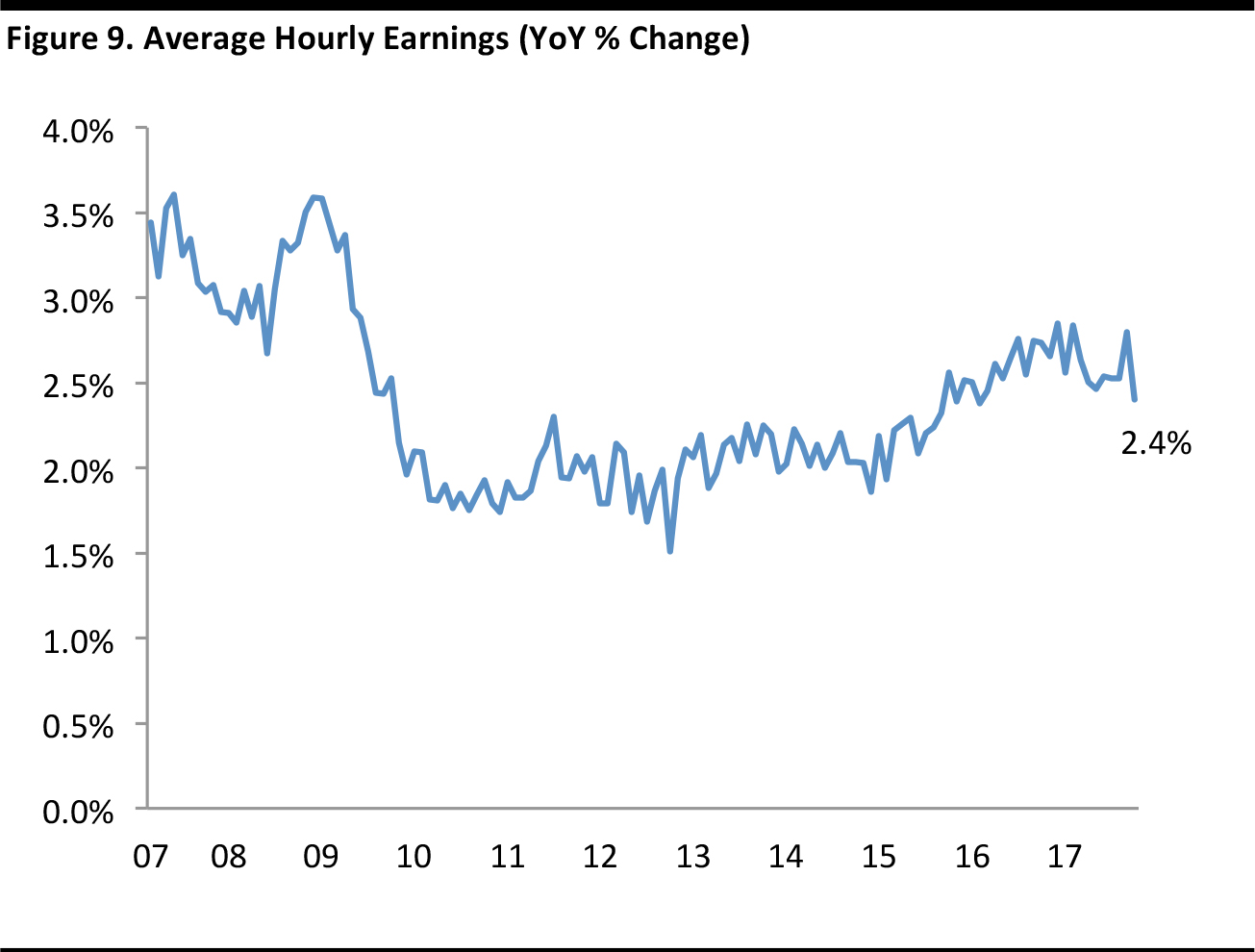

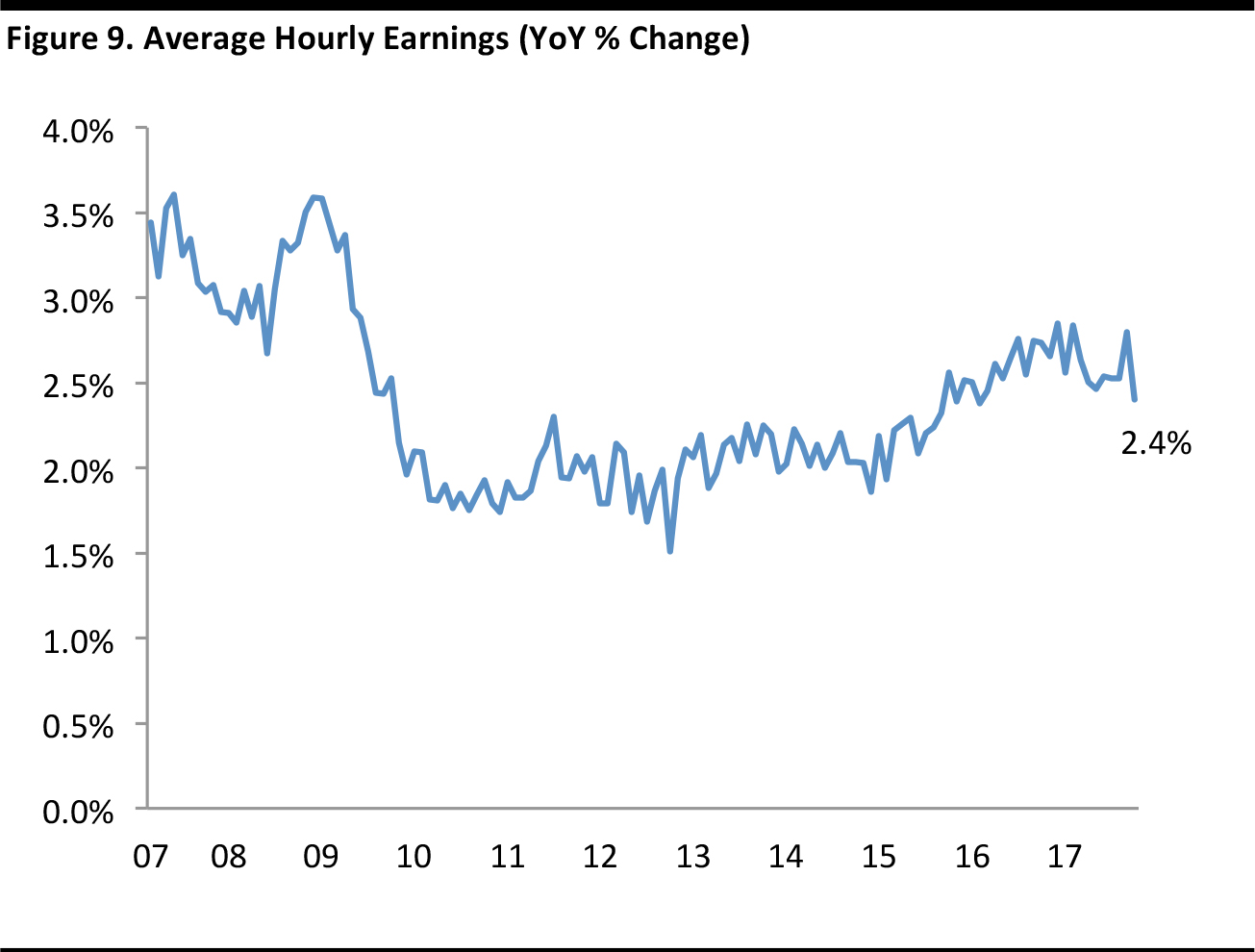

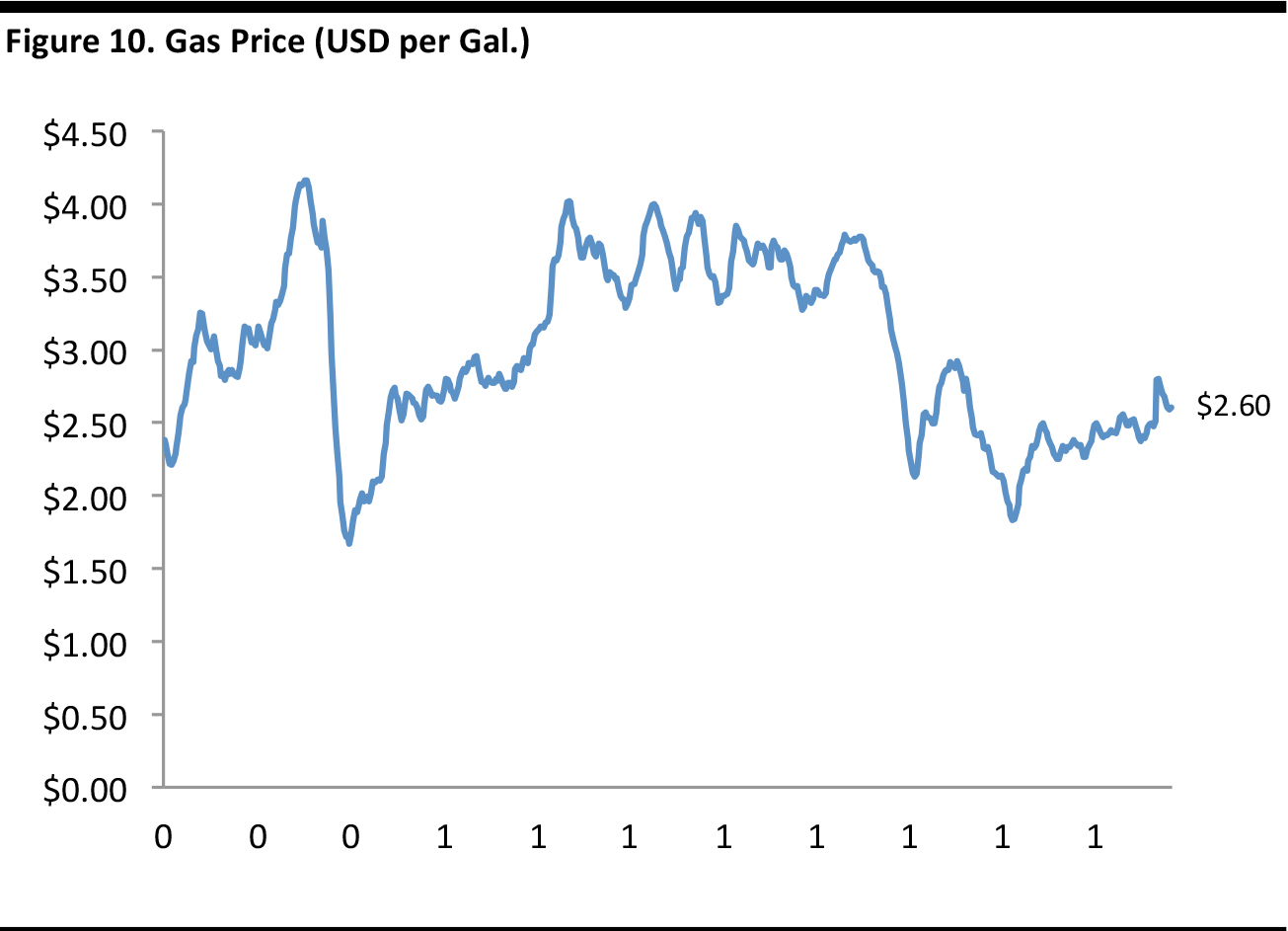

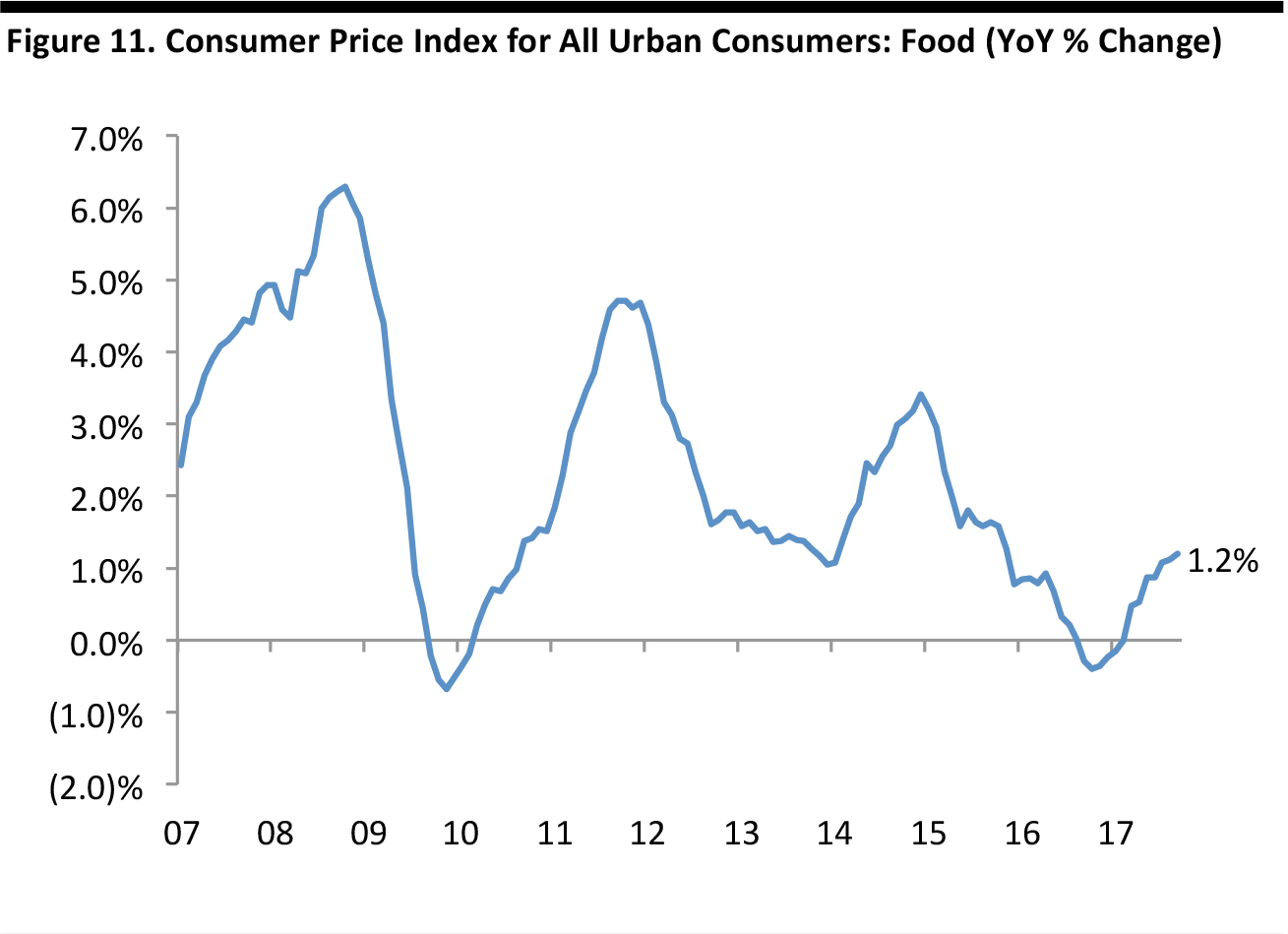

Although wage growth is down nearly half a point from this time last year, the drop represents just a blip in a nice two-year run. The same goes for gas and food inflation. Prices for both gas and food have increased year over year, yet gas prices are still lower than they were three years ago and food price inflation remains near 1%. Taken together, the news is much more positive than negative for holiday spending.

Retailers are in firefighting mode, still adjusting store counts downward to match current demand, and are thus likely to be running their businesses conservatively and leanly going into the holiday season. Although retail employment reflects store closures, one bright note is that retailers that consistently report holiday hiring figures plan to increase their number of holiday workers by 4% this year.

Despite these factors, retail competition is likely to be particularly fierce in toys following Toys“R”Us’s bankruptcy filing—a filing that is likely to confuse consumers even though the company’s stores remain open. We also expect other recent trends, such as consumers preferring to spend on experiences rather than on physical goods, to continue to affect retail sales this holiday.

Consumers are expected to continue to increase their spending on electronic goods this holiday season, and the CTA projects that total US electronics spending will grow by 15%. The launch of the first new iPhone form factor in three years—the iPhone X—will spur demand for cases, wireless chargers and headphones. Apple AirPods, which are wireless headphones priced below $200 that also work with non-Apple devices, are likely to launch an army of copycats and me-too devices.

And let us not forget the upcoming next installment in the Star Wars series—The Last Jedi—which arrives on December 15, just in time for the franchise to launch a barrage of new toys, fast-food deals and other retail partnerships before the holidays.

This year also represents an easy comparison to last year’s holiday season, when US retail experienced a dip in traffic ahead of the presidential election. With that behind us, shoppers now have an idea of the White House agenda, and its pro-business sentiment has accompanied a run in stock markets worldwide, again leading consumers to feel more affluent.

Finally, temperatures relative to last year’s holiday season should provide a boost for holiday sales. In 2016, we saw unusually warm temperatures in November and December, and if the weather reverses to more normal patterns this holiday, retailers should see higher demand for winter hats and jackets.

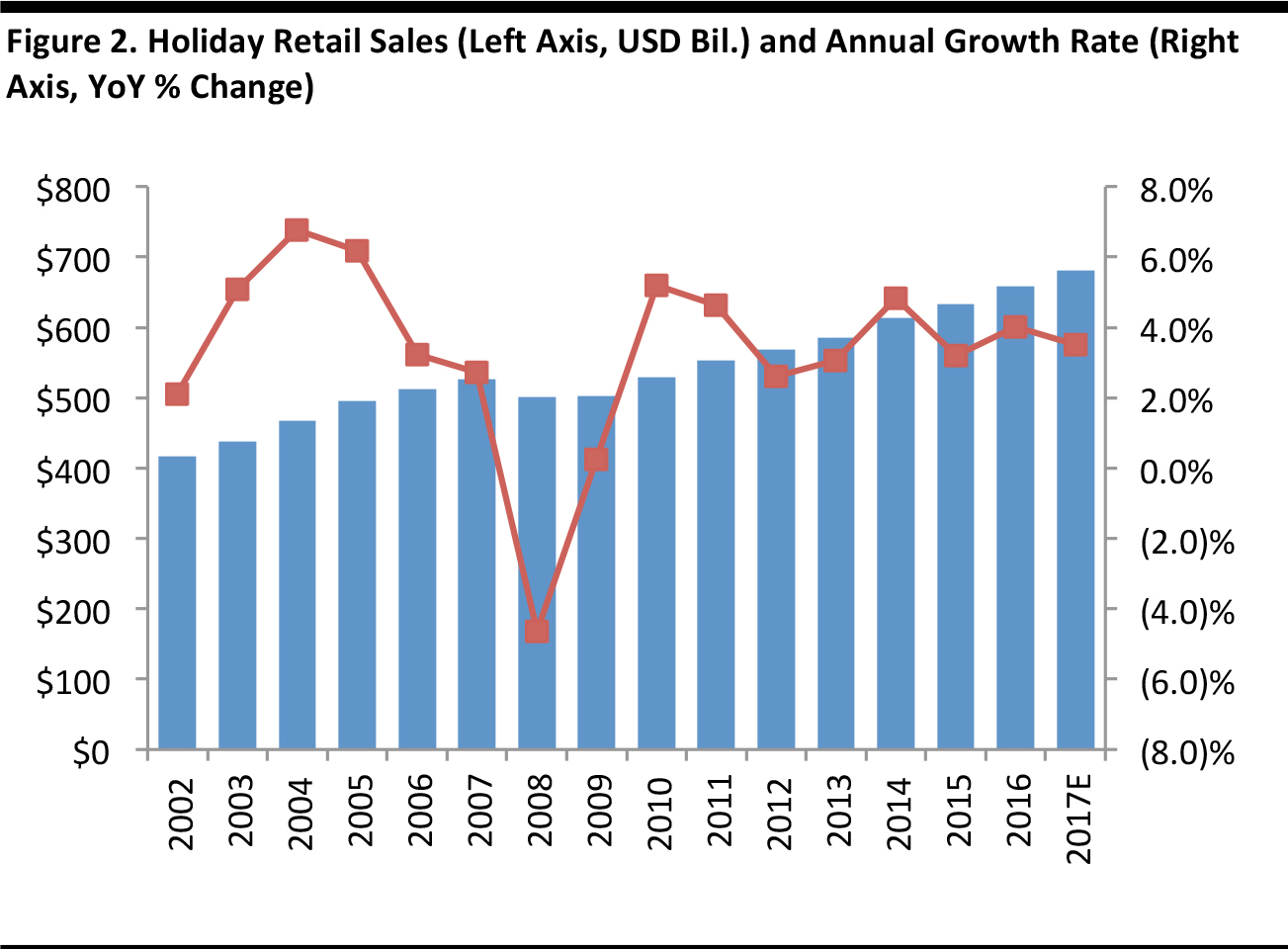

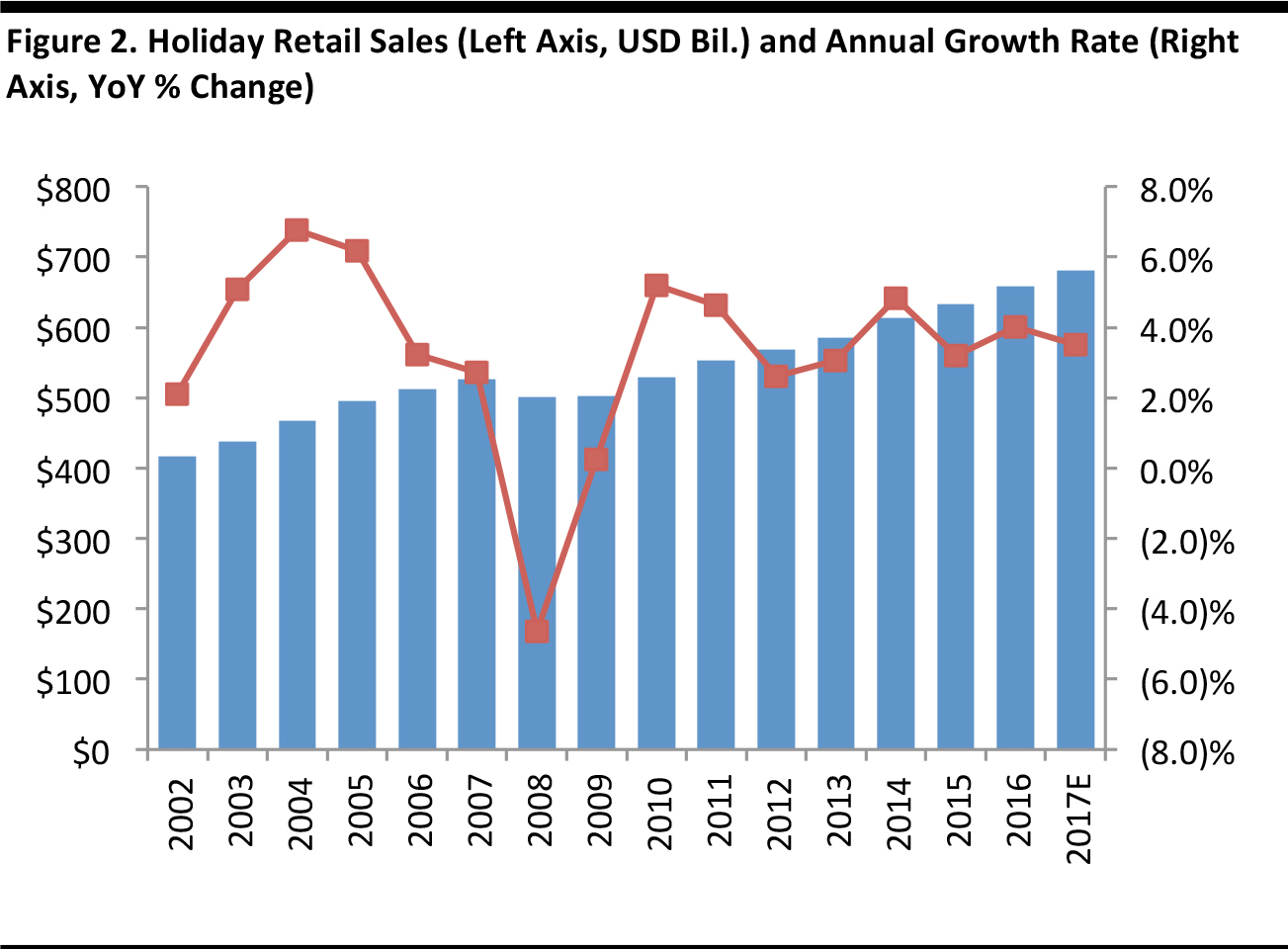

We are generally optimistic about the prospects for holiday sales this year, and we estimate growth of 3%–4%. This is versus 4.0% growth last year and is well above the 2.6% average seen over the last 10 years (the 10-year average includes the Global Financial Crisis and is based on NRF data).

HOLIDAY PROJECTIONS

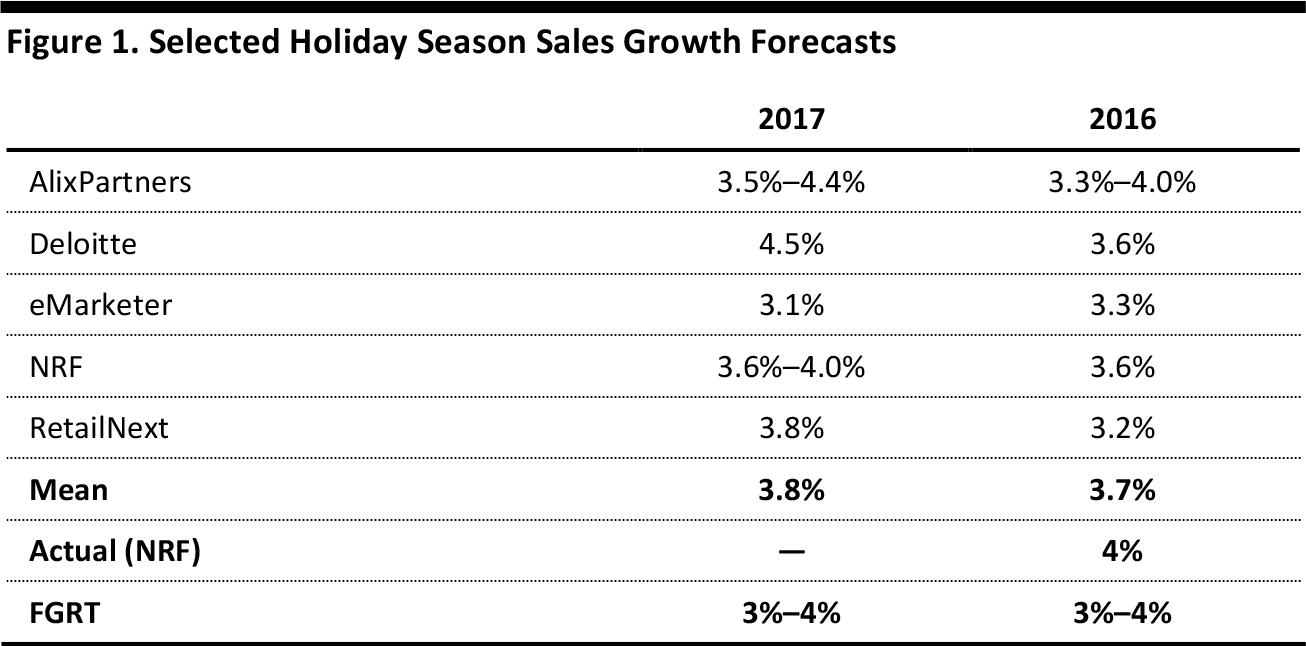

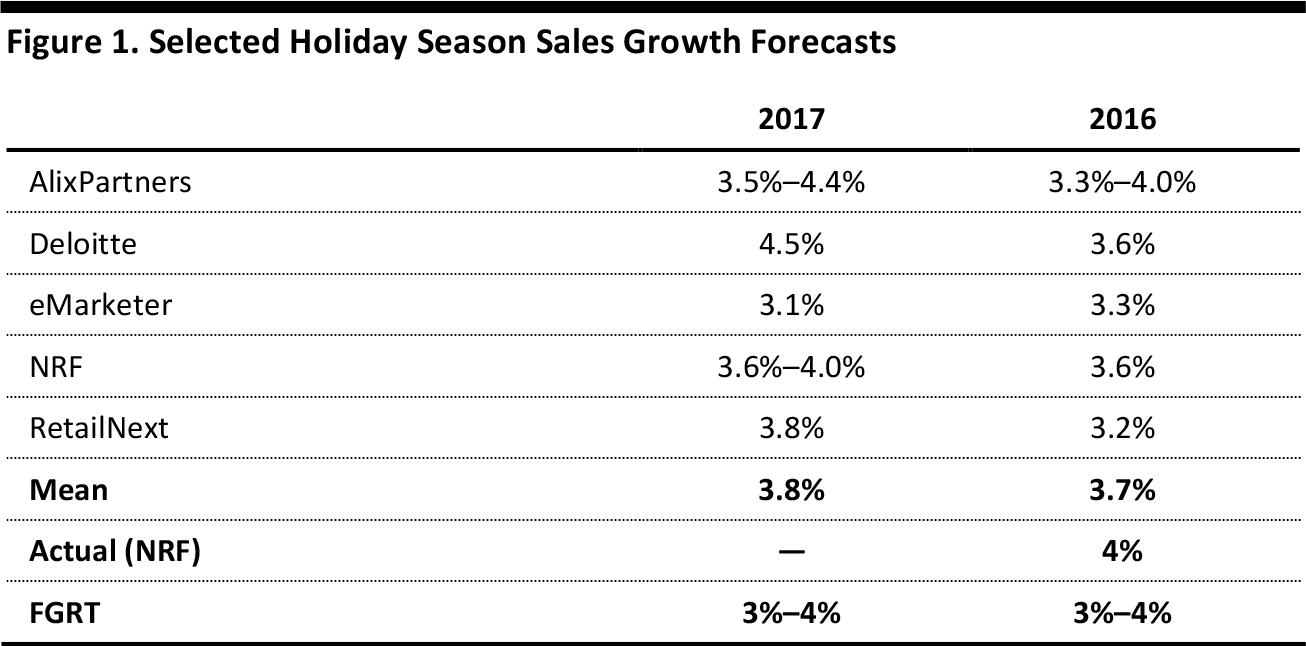

Several other retail research firms and trade groups have already released their forecasts for sales growth this holiday season. The projections, on average, call for 3.8% growth this year, which is 20 basis points higher than last year’s average estimate of 3.6% growth. The NRF expects retail sales in November and December to increase by 3.6%–4%, to $678.75–$682 billion, up from $655.8 billion last year, with the impact of this year’s hurricanes making it difficult to derive a more precise forecast. Still, this forecast range represents an increase from last year’s estimates, which averaged 3.6%.

Despite a substantial number of announcements of US store closures this year, initial data appear positive for brick-and-mortar retailers. An AlixPartners survey of more than 1,000 US consumers found that 71% plan to do half or more of their holiday shopping in stores this season, the same percentage as a year ago. Moreover, 88% of those surveyed said they plan to at least visit physical stores this holiday season.

Source: AlixPartners/Deloitte/eMarketer/NRF/RetailNext/FGRT

- AlixPartners bases its forecast methodology on retail sales data that show that year-to-date sales through the back-to-school season over the past seven years has accounted for 66.1%–66.4% of annual retail sales and that the holidays have accounted for 16.9%–17.0% of annual retail sales.

- Deloitte raised its holiday sales forecast to 4.5% for 2017 from 3.6% for 2016 based on increasing disposable personal income and a high level of consumer confidence in the US.

- eMarketer expects 3.1% total holiday sales growth this year due to heavy discounting during the core holiday shopping months and an ever-widening gap between holiday season e-commerce sales growth and total retail sales growth.

- The NRF’s forecast is based on an economic model that analyzes indicators such as consumer credit, disposable personal income and previous monthly retail sales and includes the nonstore category (e.g., direct-to-consumer, kiosks and online sales).

- RetailNext’s forecast is based on current retail trends and broader macroeconomic data. The firm expects a repeat of the 2016 trend that saw consumers shifting some of their spending from October into November and December.

The graph below shows annual holiday spending according to the NRF as well as the annual change in spending. It assumes that actual 2017 spending will fall in the middle of the NRF’s projected range.

Source: NRF/FGRT

Source: iStockphoto

HOLIDAY HIRING

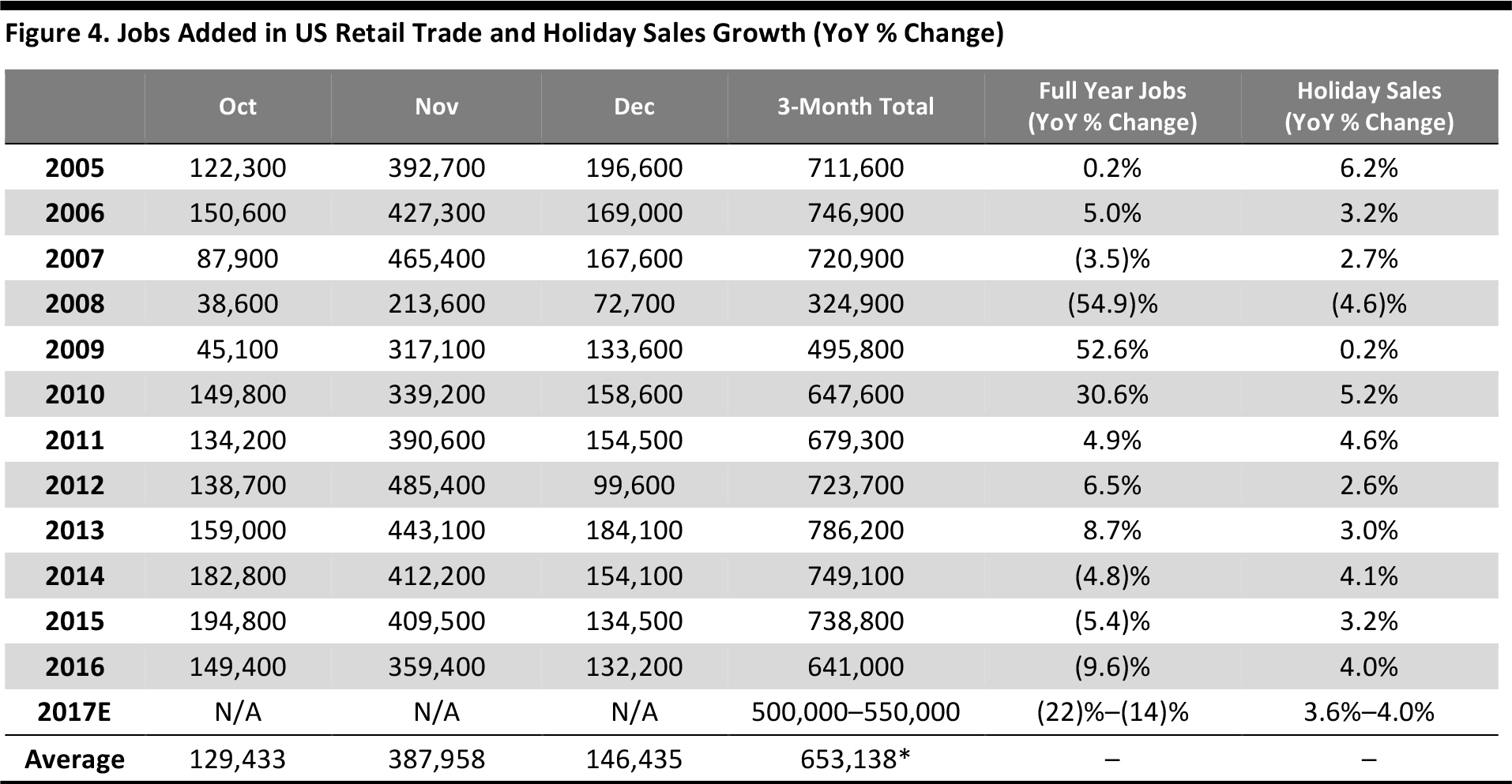

Total holiday hiring is expected to increase by 4% this year, based on data from retailers that disclosed their hiring expectations both last year and this year.

*Includes Harry & David and Cheryl’s cookies.

**Includes 2,000 seasonal workers helping to fulfill online orders

***Includes 7,500 seasonal workers in distribution facilities and for the spring and summer season

Source: Company reports

Walmart is taking a different approach this holiday season: the company is offering extra hours to existing employees rather than hiring seasonal workers. While Kohl’s hired 69,000 seasonal employees last year, the company decided not to disclose its holiday hiring figure this year. Notwithstanding its bankruptcy filing, Toys“R”Us is hiring seasonal workers this year. Although the company did not disclose how many temporary workers it would hire for the holidays, Business Insider reported that Toys“R”Us had 12,000 openings for part-time jobs.

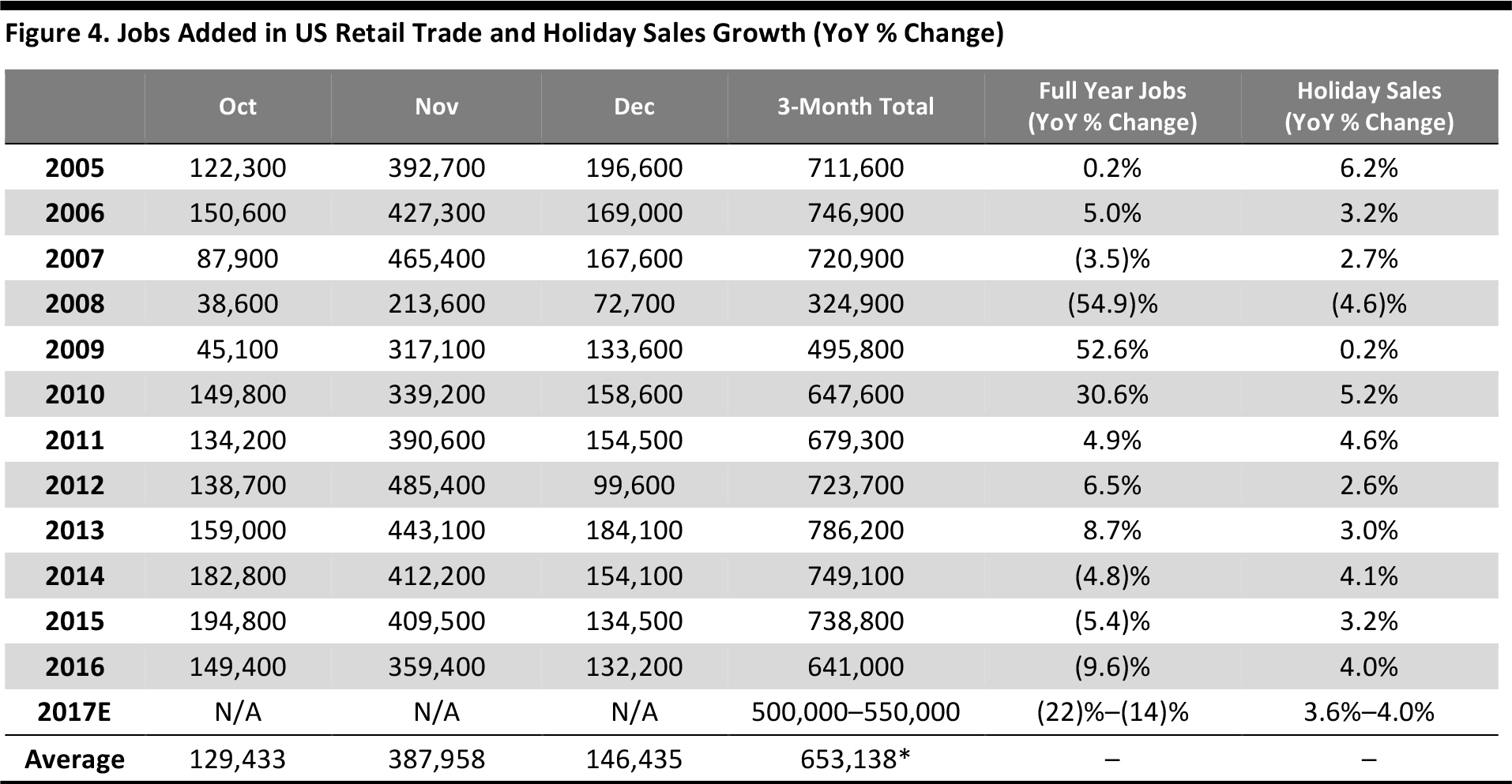

Source: NRF/Challenger, Gray & Christmas/US Bureau of Labor Statistics

* Using midpoint of 2017E range.

The NRF expects retailers to hire 500,000–550,000 temporary workers this holiday season, compared with 575,000 last year (the NRF’s forecast is lower than the Challenger, Gray & Christmas forecast of 641,000).

E-COMMERCE CONTINUES TO ENCROACH ON BRICK-AND-MORTAR

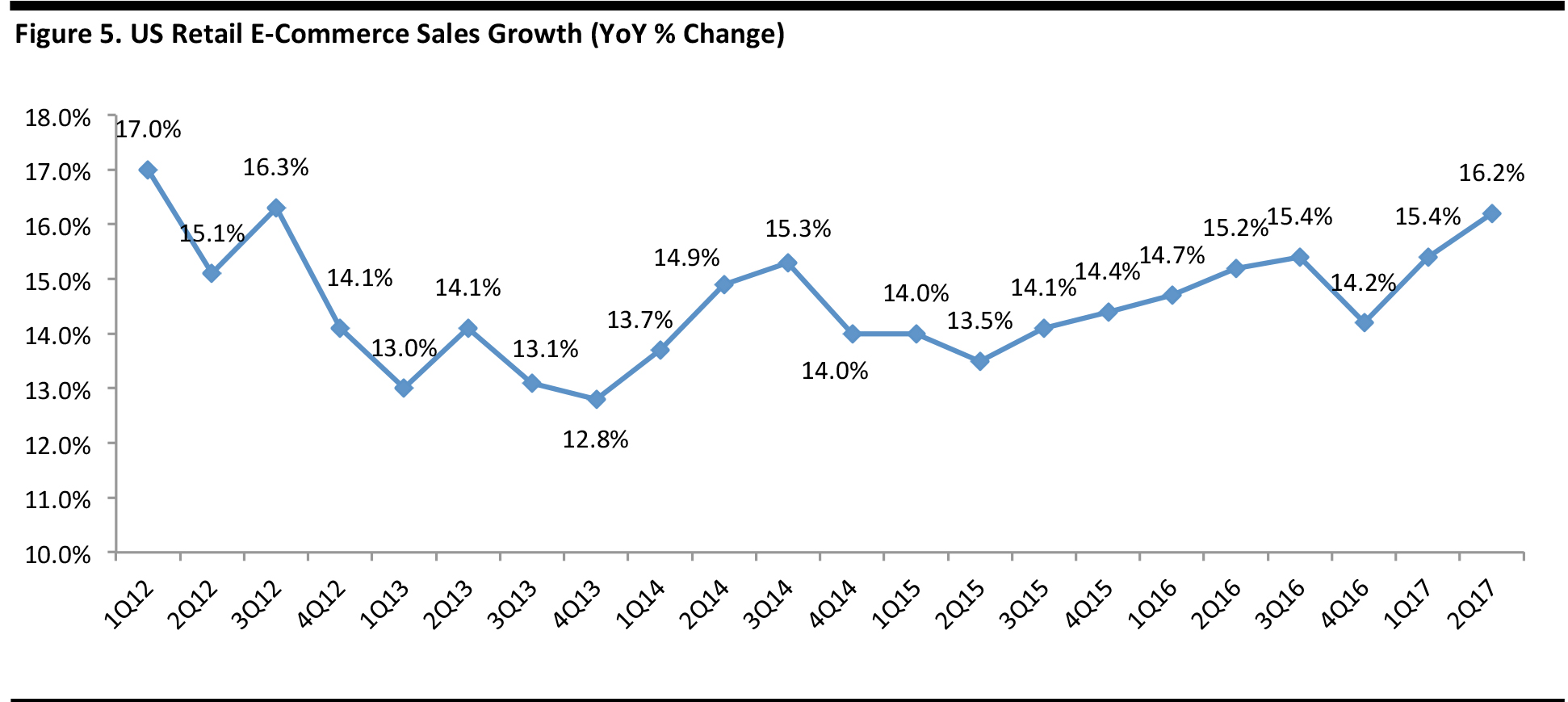

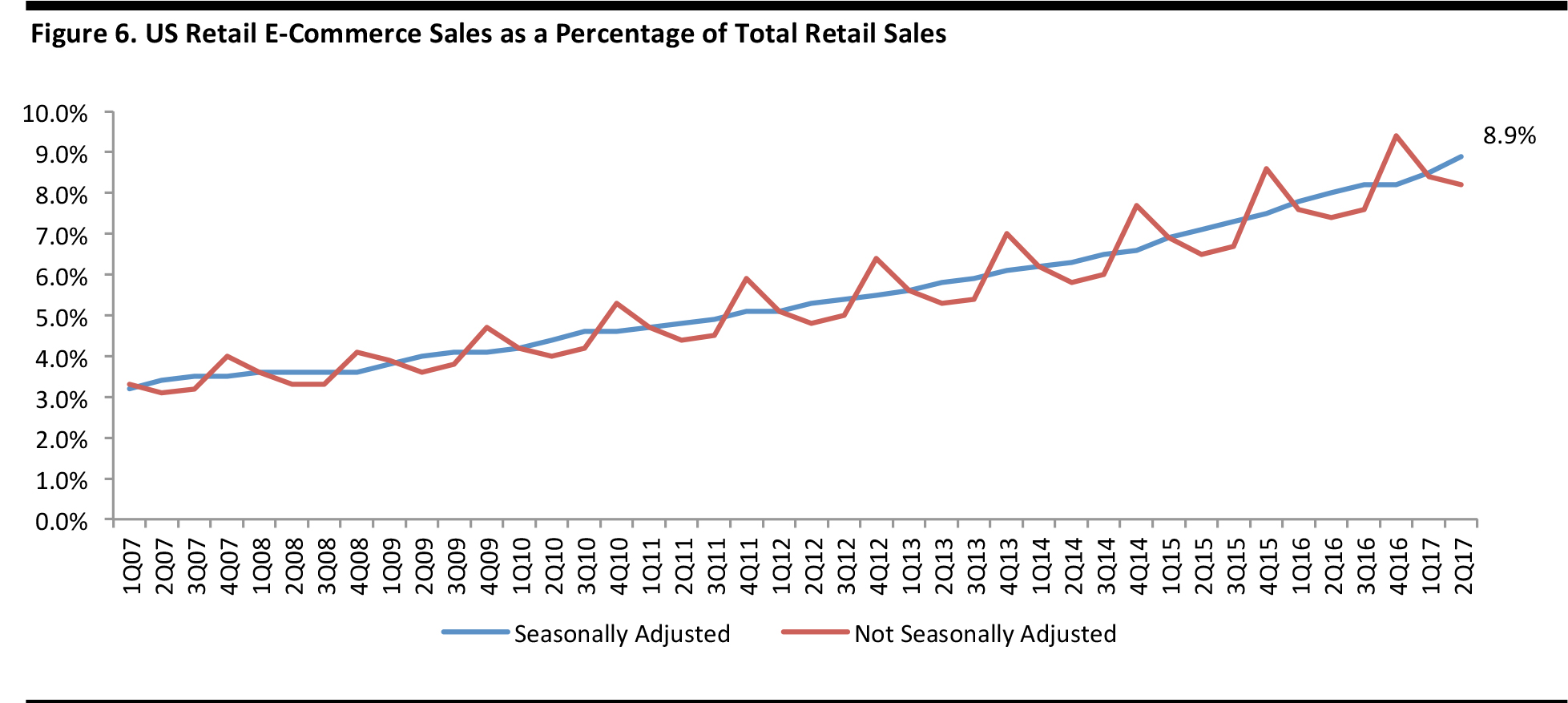

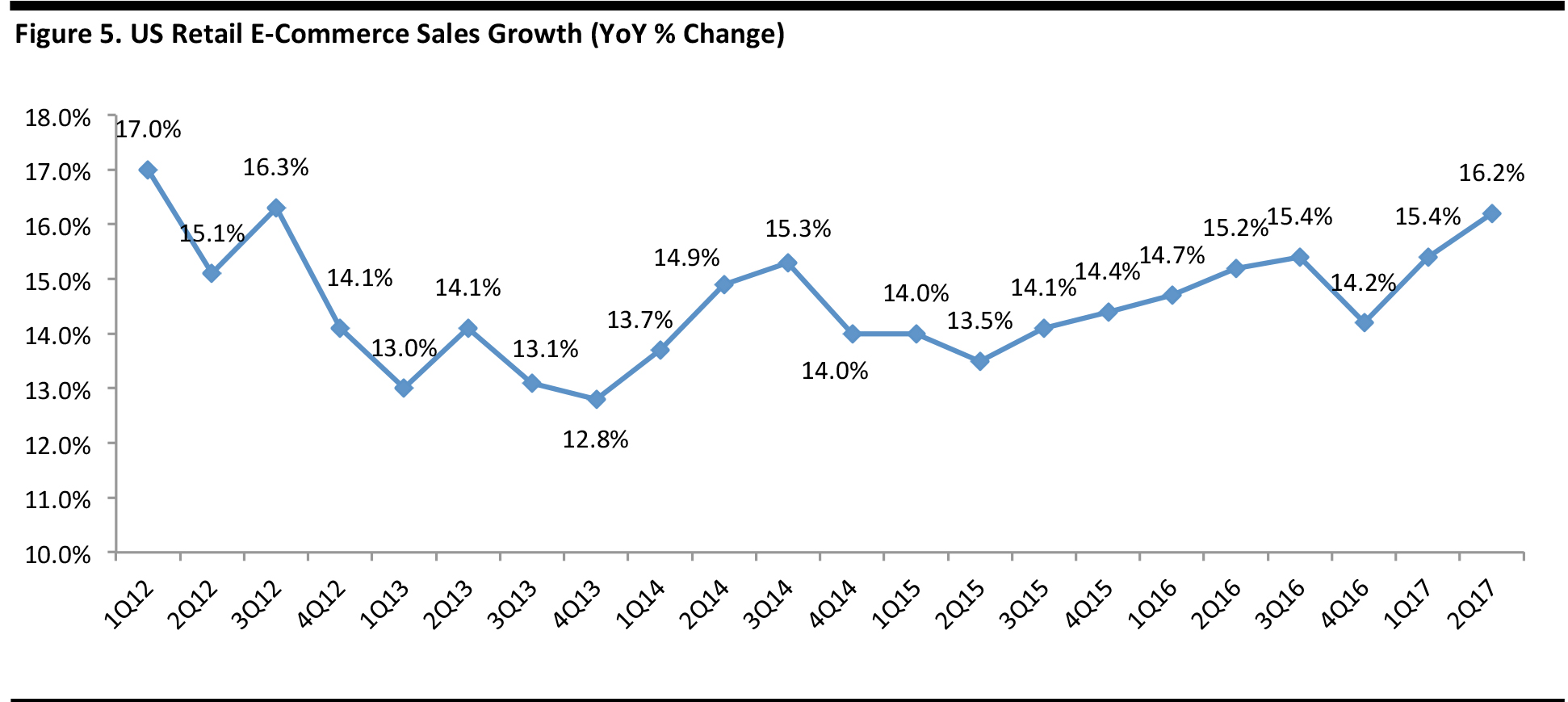

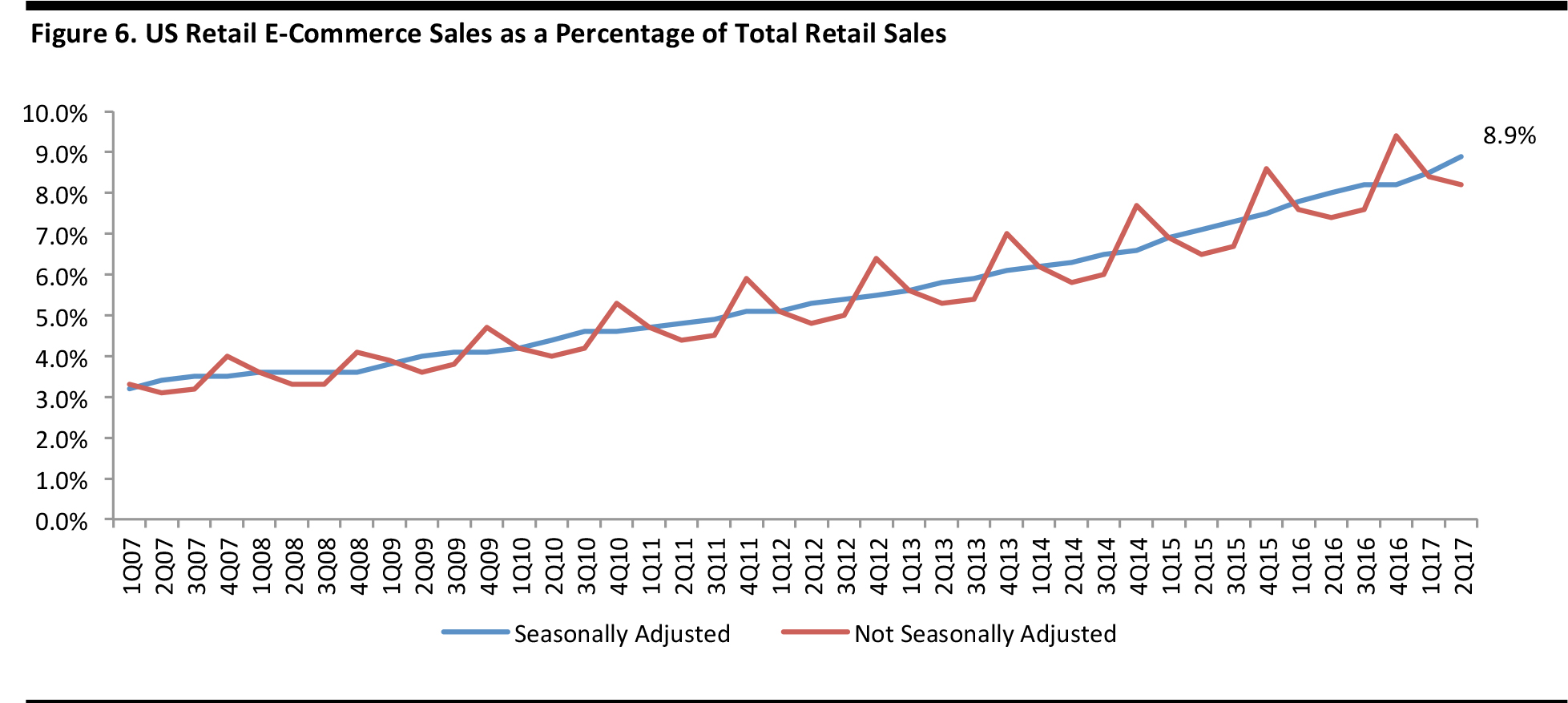

E-commerce has continued its relentless encroachment on brick-and-mortar retail, accounting for nearly 9% of total sales in the second quarter of 2017. In addition, the growth rate of e-commerce has accelerated during the past three quarters as part of a generally upward trend that began in the second quarter of 2015, as depicted in the following two figures.

Seasonally adjusted

Source: US Census Bureau

The figure below shows the advance of e-commerce over a longer time span.

Source: US Census Bureau

MACROECONOMIC INDICATORS ARE GENERALLY POSITIVE

Economic indicators have generally improved during the last 12 months, with the exception of inflation in gas and food prices. During this period, the unemployment rate has dropped by more than half a percentage point, consumer sentiment has improved by more than four points and home prices have improved by nearly six percentage points. While gas prices have picked up by nearly three percentage points in the last 12 months, prices are still 27% below their mid-2014 levels, and food-price inflation is relatively mild, having outpaced nonexistent wage growth in the period.

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information

Administration/S&P Dow Jones/US Bureau of Economic Analysis

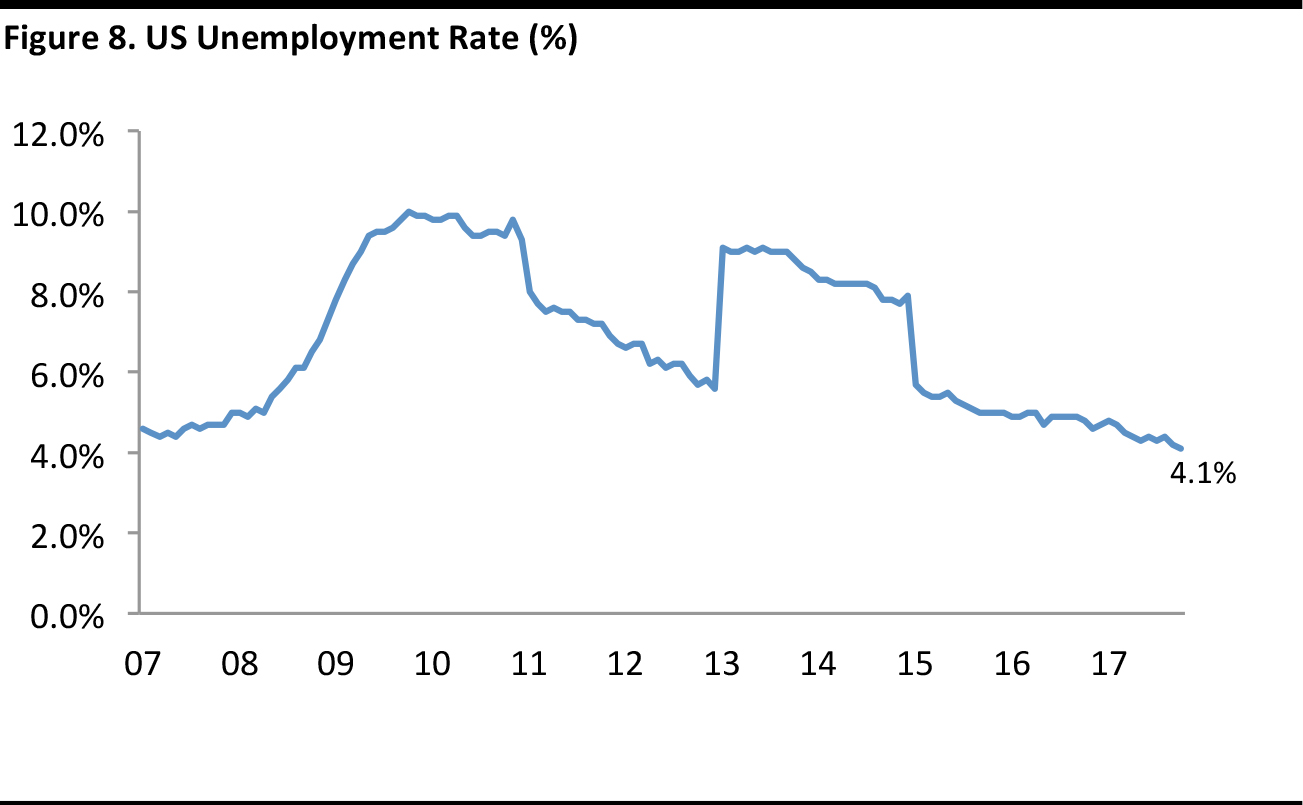

In October, the US unemployment rate declined to 4.1%, a 17-year low.

Through October 2017

Source: US Census Bureau

In October, average hourly earnings increased by 2.4% year over year.

Through October 2017

Source: US Census Bureau

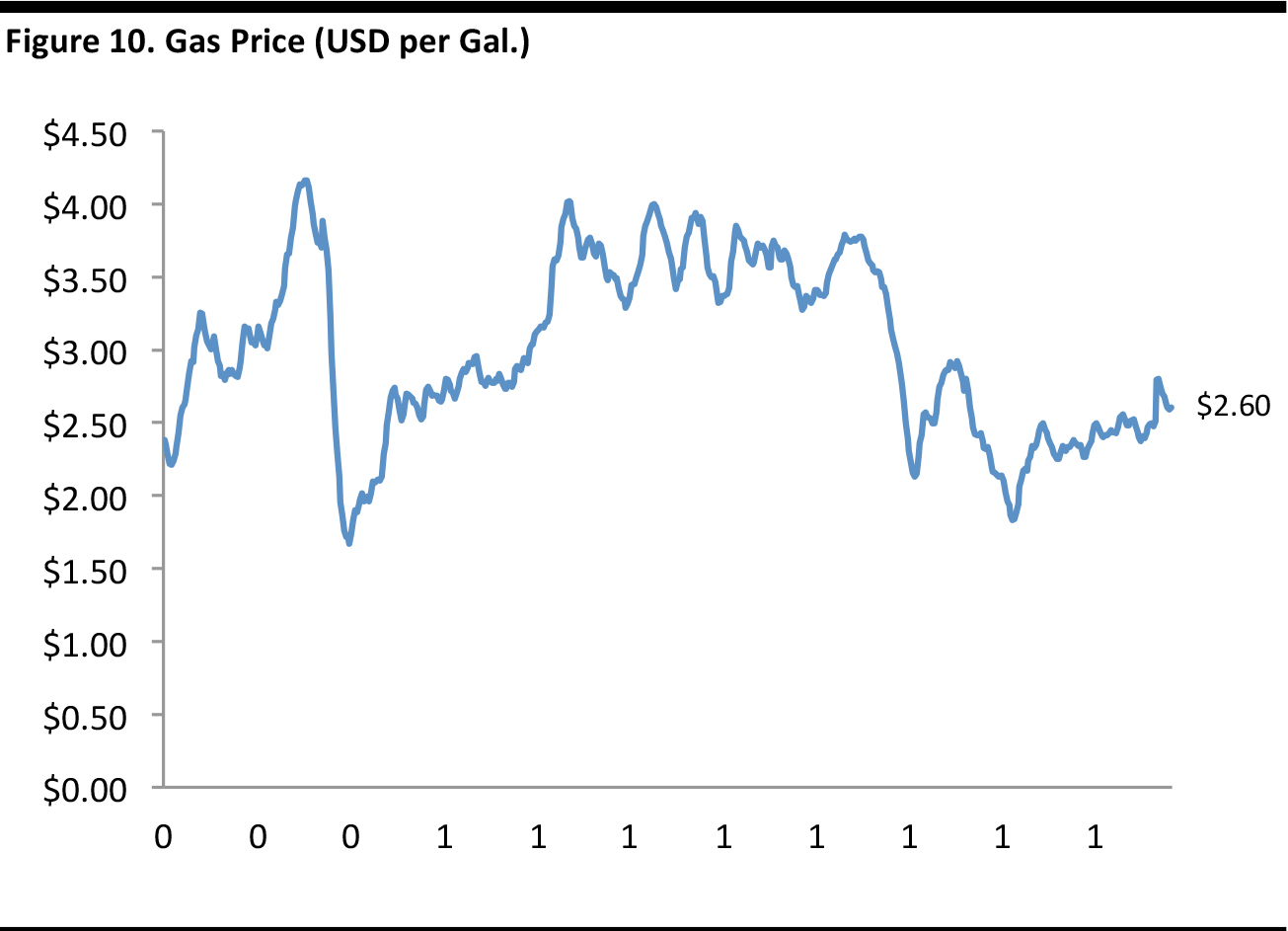

The average US gas price was $2.60 per gallon at the end of October.

Through October 30, 2017

Source: US Energy Information Administration

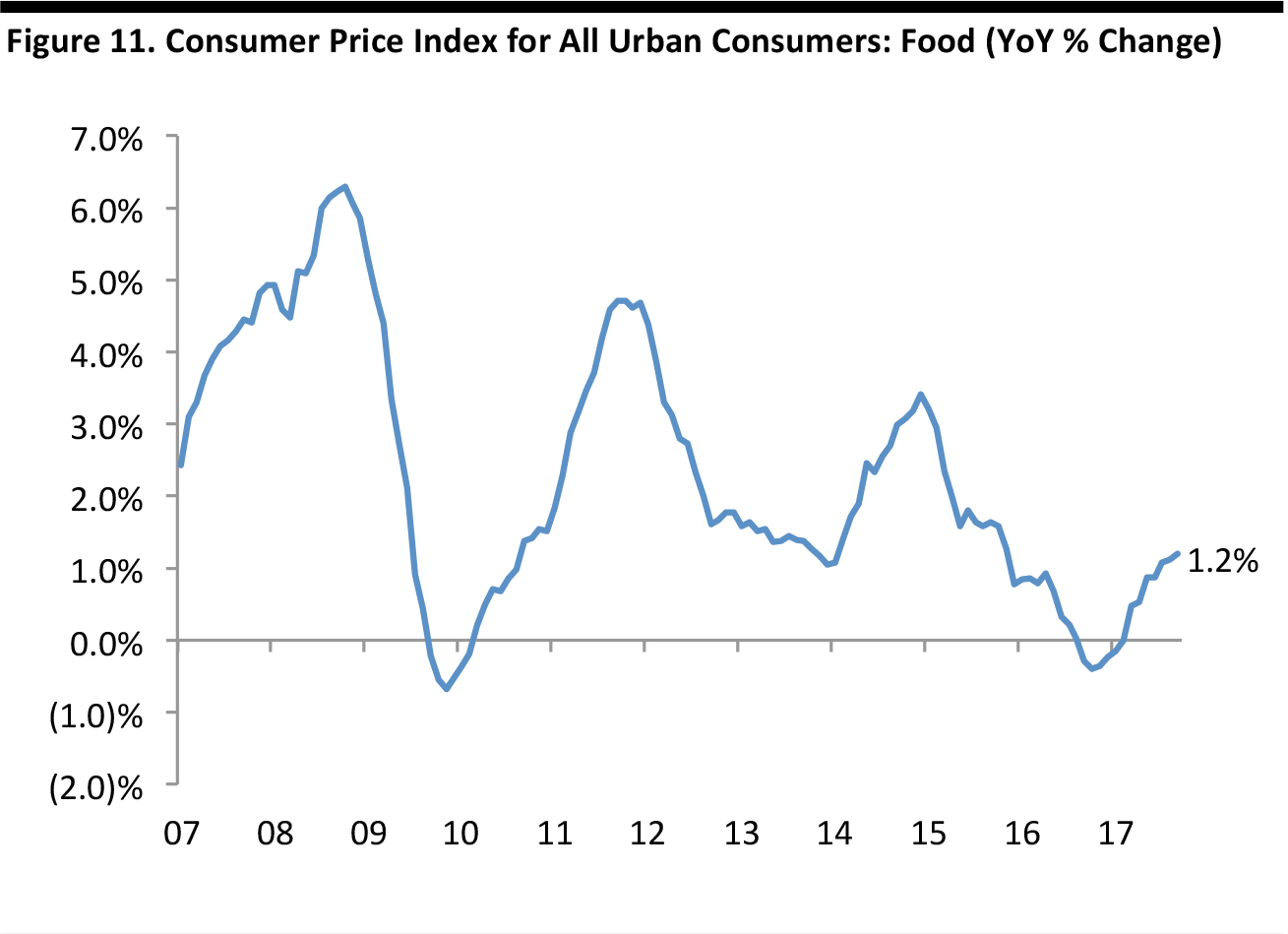

Food-price inflation remains benign, coming in at 1.2% year over year in September.

Through September 2017

Source: Federal Reserve Bank of St. Louis

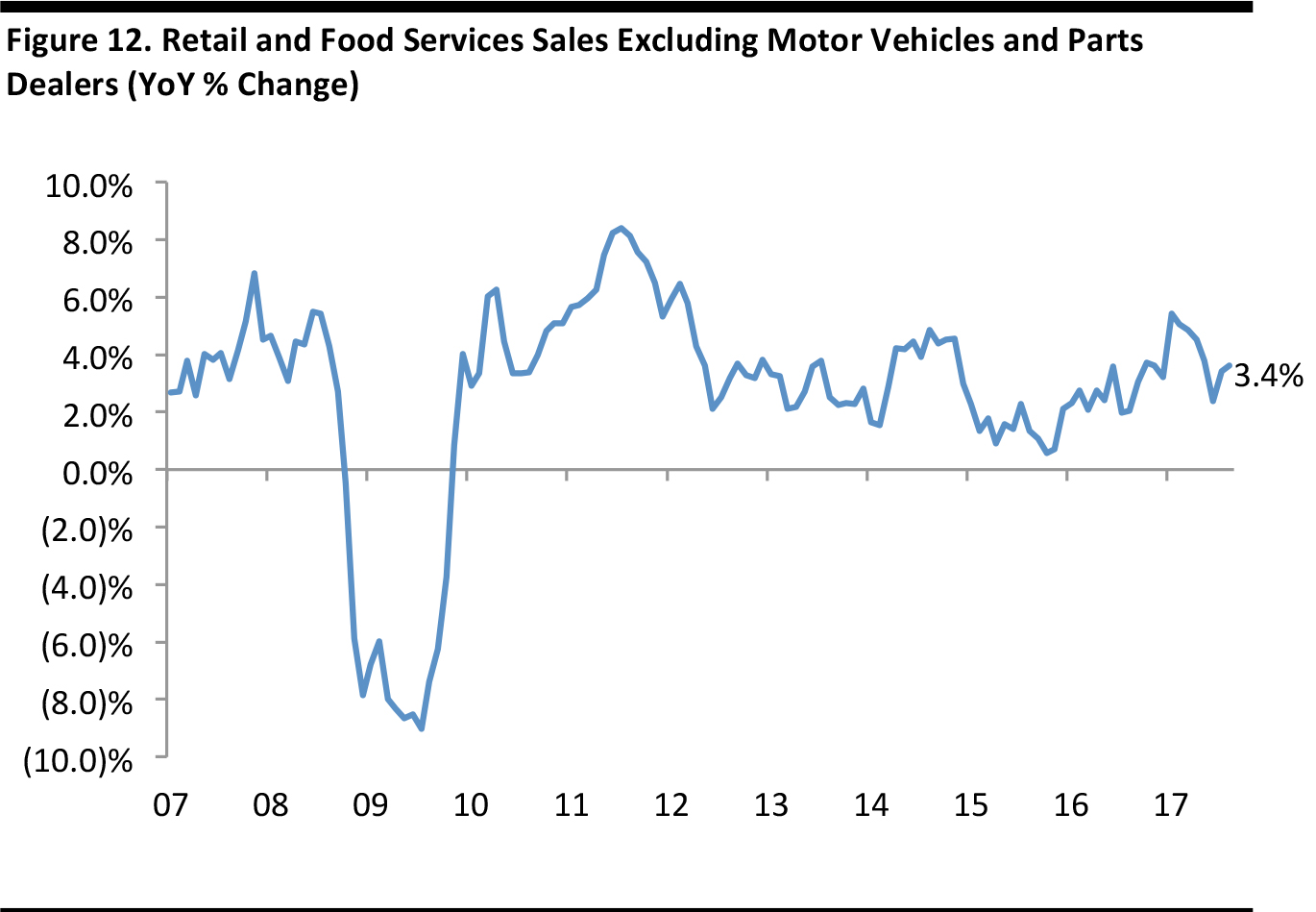

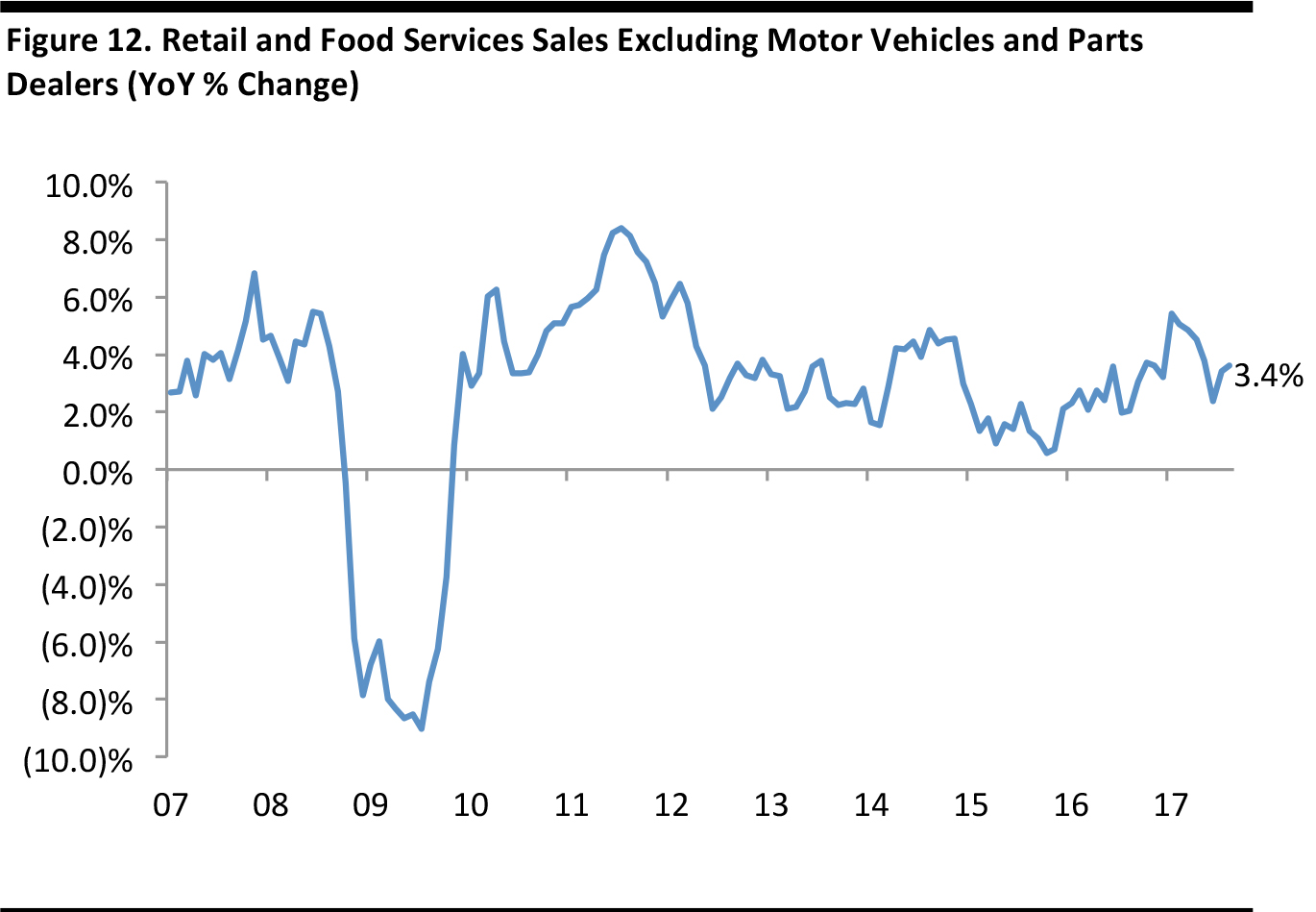

Retail sales and food services sales remain solid, and were up 3.4% in September.

Through September 2017

Source: Federal Reserve Bank of St. Louis

HOT HOLIDAY APPAREL, FOOTWEAR, ACCESSORIES AND GIFTS: “WHAT’S OLD IS NEW” AGAIN

Clothing is at the top of consumers’ shopping lists this season, according to both the National Retail Federation (NRF) and digital savings destination, RetailMeNot. The NRF reported clothing and accessory purchase plans for 2017 are at the highest levels they have seen in 12 years.

It appears that 2017 is seeing an increase in self-gifting: consumers are also shopping for themselves this holiday. Holiday shopping has become so convenient due to e-commerce and quick shipping that consumers have time to purchase a little something for themselves while shopping for others. According to a RetailMeNot survey, many consumers are seeking deals in categories such as health and beauty this year, which are likely to be purchases for themselves, rather than others.

Source: Anthropologie

This season, what is old is new again. Brands like Gucci, Coach, and the Gap are on the 2017 gift list, vintage styles are back, and on everyone’s list, somewhere, is something metallic, velvet, fur, and sequined.

2017 Apparel, Footwear, and Accessories Gifts:

- “Gucci” is hotter than ever, for all ages. For those who cannot afford the real deal, they can head to H&M and Zara for derivative knock-offs that will rock the season.

- “Preppy trends” include Fair Isle sweaters, knitted intarsia, puffer jackets, high knee socks, and berets. Retailers include Burberry, Tory Burch, Anthropologie, Madewell, The Gap, and Zara.

- Denim is a big trend this season and jeans are a typical self-gifting item. New fashions span high waist, bell bottoms, applique and embroidery—all with the benefit of tech-textiles that stretch to increase comfort.

- “Ugly” holiday sweaters are back with a vengeance. Whoopi Goldberg debuted her own line which includes oversized, fun, colorful, holiday sweaters available exclusively on Zappos.

Source: Zappos

- Standout brands for this season’s accessories and fashion jewelry include Kendra Scott, Alex and Ani, and Swarovski. Kendra Scott has a new line of jewelry for the home--picture frames, trays and decorative geodes— a perfect gift for the millennial’s first home.

- Rhinestone Shoe Clips make great gifts and transform a pair of plain pair of flats or heels into Manolo Blahnik competitors and are available at Aldo Shoes.

- Throwbacks to the sixties are alive with metallic, short ankle boots in funky colors and textures including velvet, metallic, and sequins. Retailers include Anthropologie, Nordstrom, and Urban Outfitters.

Source: Urban Outfitters

8. No list is complete without a nod to handbags. This year the consumer can have a hand in personalization at Coach, where a resurgence in logo product is driving sales. Logos and emojis are the coin of the day.

Source: Coach

HOT HOLIDAY TECH GIFTS

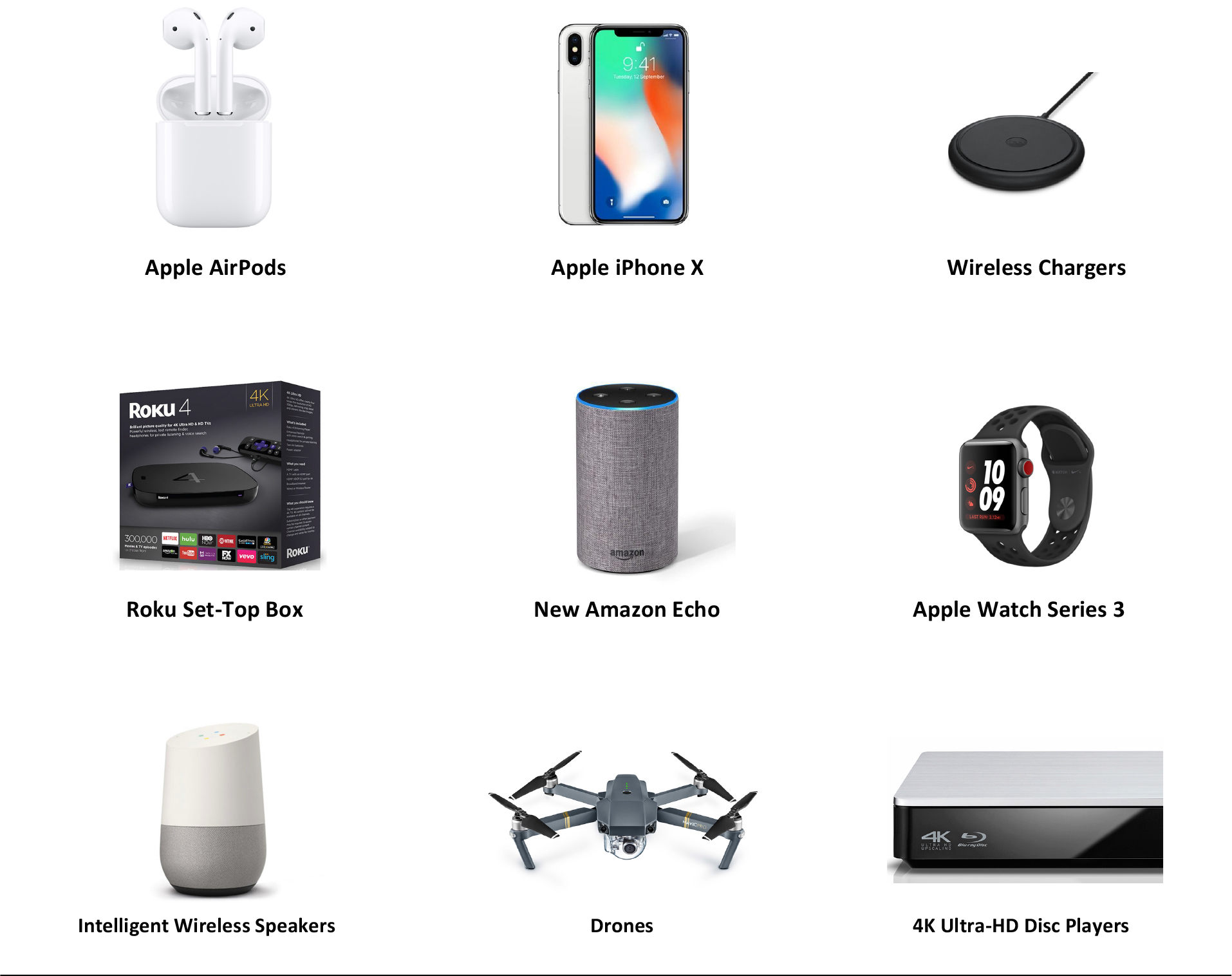

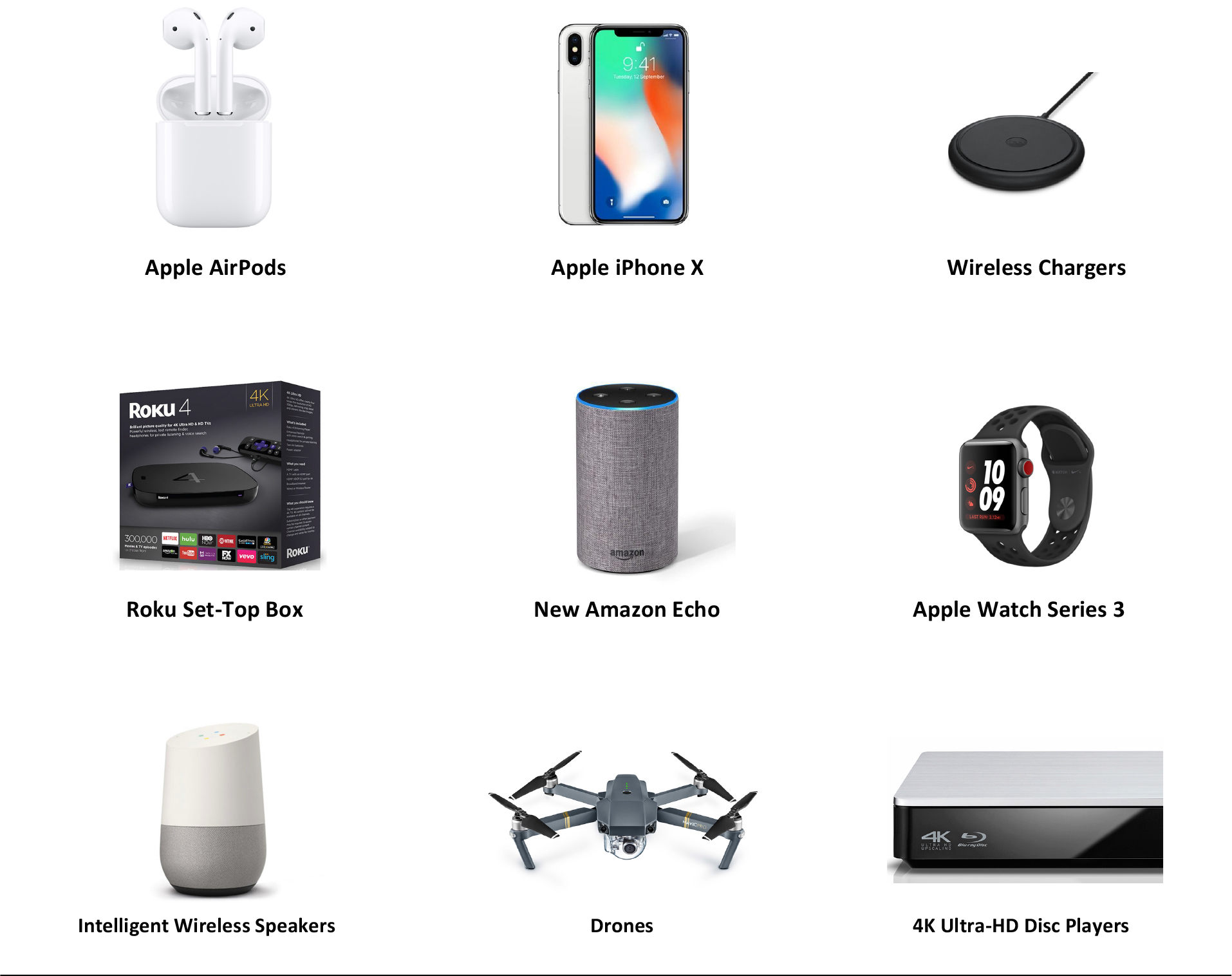

Technology gifts are not just for nerds anymore; rather, they have become essential appliances and cornerstones of our culture. Holiday sales from electronics and appliance stores amounted to nearly $22 billion last holiday season and accounted for 22% of annual sales at such stores, according to the US Census Bureau. The most-wanted tech gifts last year were (in decreasing order) headphones, smartphones, portable Bluetooth speakers, laptops, tablets, TVs, game consoles and virtual reality headsets, according to Business Insider.

This year’s hot tech gifts represent an evolution rather than a revolution, and the list reflects an unconscious bias toward Apple’s products due to the timing of recent product launches. It seems that just about every electronics manufacturer, from Amazon to Apple to Google to several Chinese manufacturers, is offering an intelligent speaker this year. Also, prices for 4K TVs came down substantially last year, and this year’s crop of hot tech products includes peripherals that support 4K and high dynamic range (HDR) video.

Hot Tech Gifts for Holiday 2017

Source: Apple.com/Roku.com/Amazon.com/Google.com/DJI.com/TrustedReviews.com

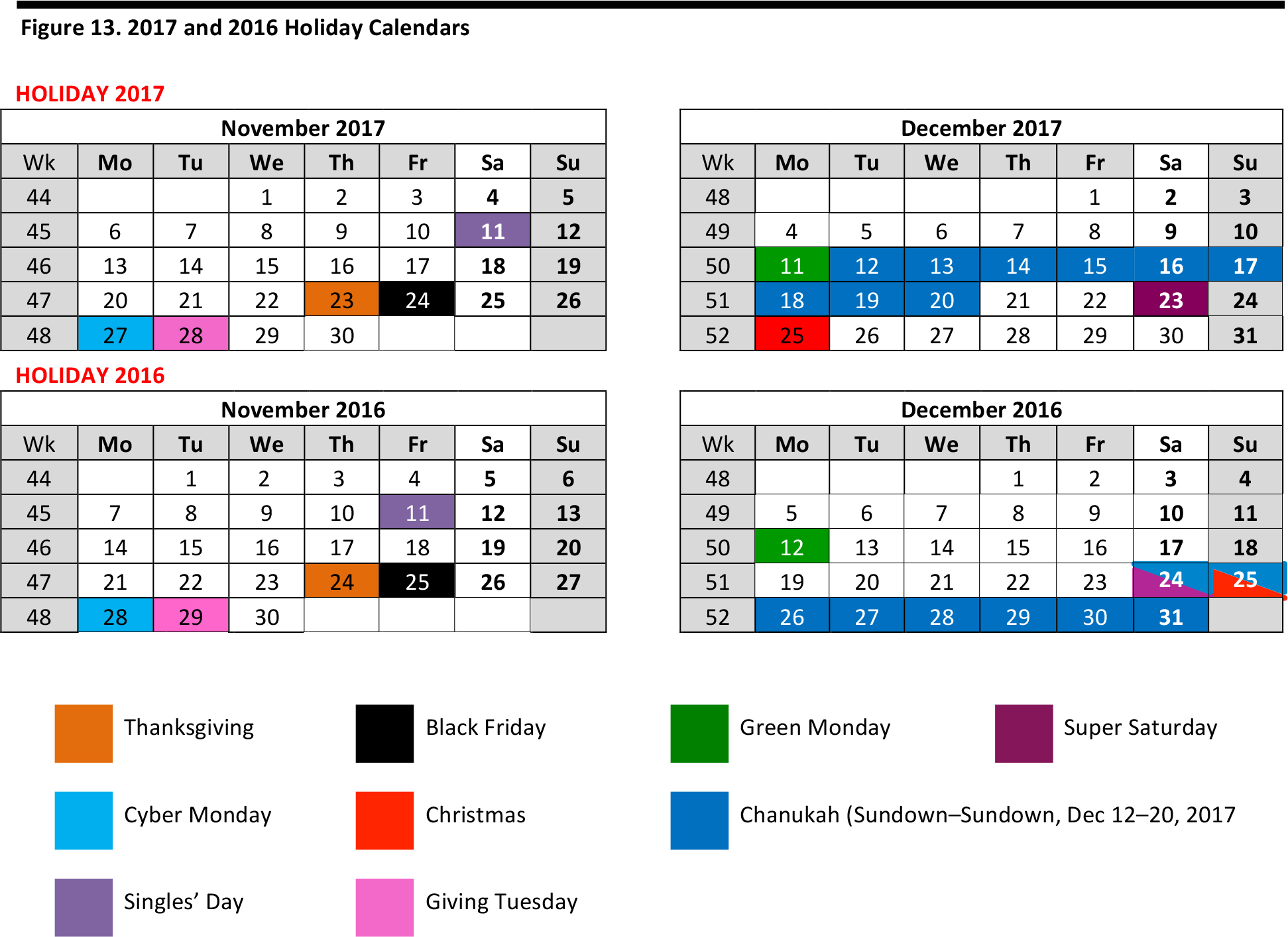

FAVORABLE HOLIDAY CALENDAR MEANS AN EXTRA SHOPPING DAY VERSUS LAST YEAR

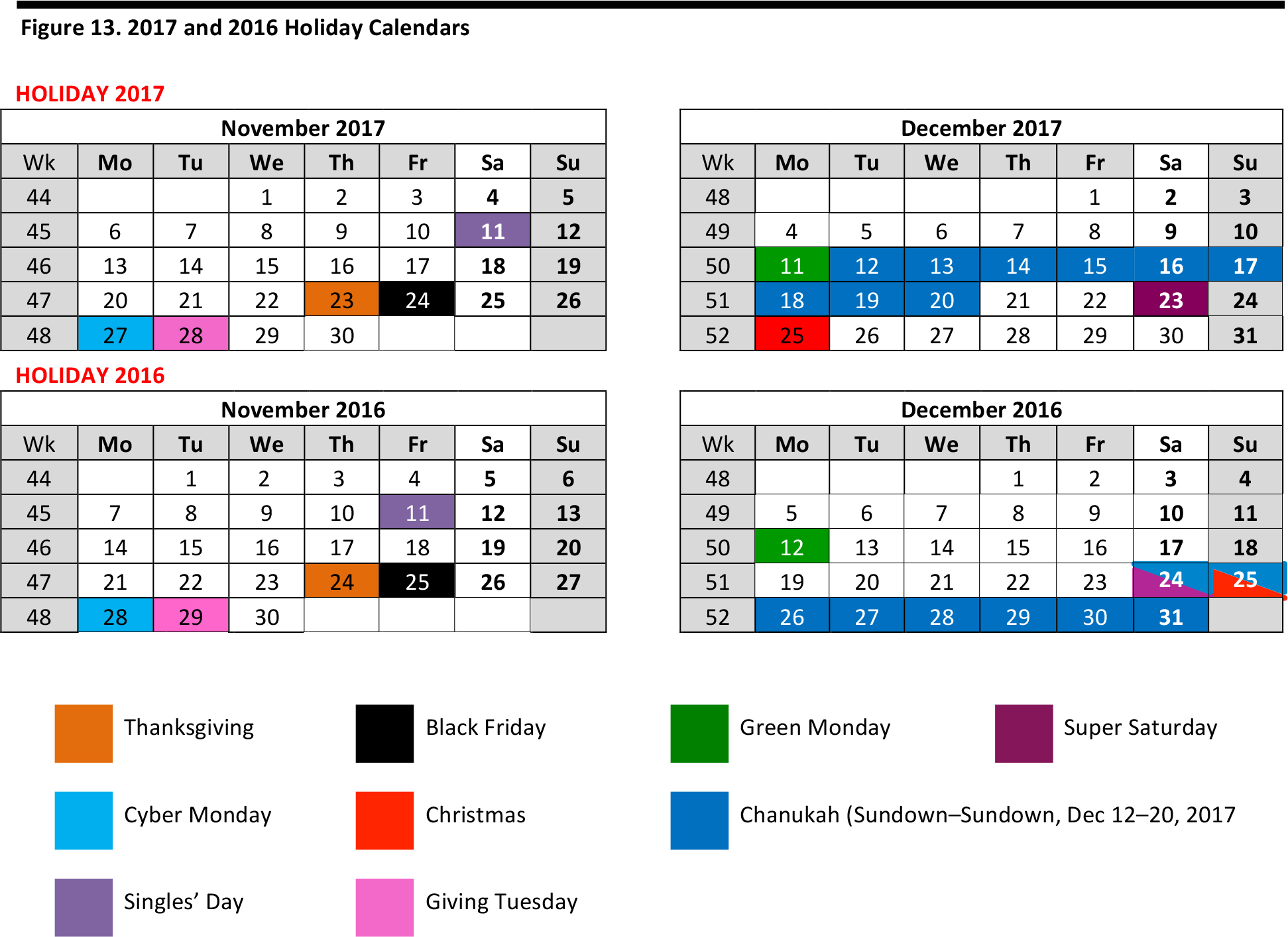

This year, there is one more shopping day between Thanksgiving and Christmas than there was last year: there are 31 days between the holidays this year versus 30 last year. The number of days between Thanksgiving and Christmas varies between 26 (as in 2013) and 32 (which will be the case in 2018).

The first major global shopping holiday on the fall calendar is Singles’ Day, which falls on November 11, or 11.11 (where the ones represent single people). Students at Chinese universities in the 1990s invented the day as a special occasion for single people to celebrate their independence and treat themselves by buying themselves gifts. In 2009, Alibaba started offering significant Singles’ Day discounts online to increase awareness of the holiday and transform it into an international shopping event.

Thanksgiving in the US always falls on the fourth Thursday in November (it is on November 23 this year). Black Friday (November 24) is the day after Thanksgiving and it represents the day when retailers traditionally became profitable for the first time during the year (they went “in the black” on Black Friday). Cyber Monday falls on the following Monday (November 27 this year). Giving Tuesday, now in its sixth year, falls on the day after Cyber Monday (November 28 this year). The global event, designed to encourage charitable giving, relies heavily on social media and word of mouth.

“Green Monday” was coined by retailers to represent the best shopping day in December, or the last Monday that is at least 10 days before Christmas. This year, Green Monday falls on December 11. The Saturday before Christmas is called Super Saturday, and it is one of the most important shopping days for retailers before the end of the holiday shopping season. Super Saturday falls on December 23 this year.

Chanukah starts on Tuesday, December 12, and runs through Wednesday, December 20, this year.

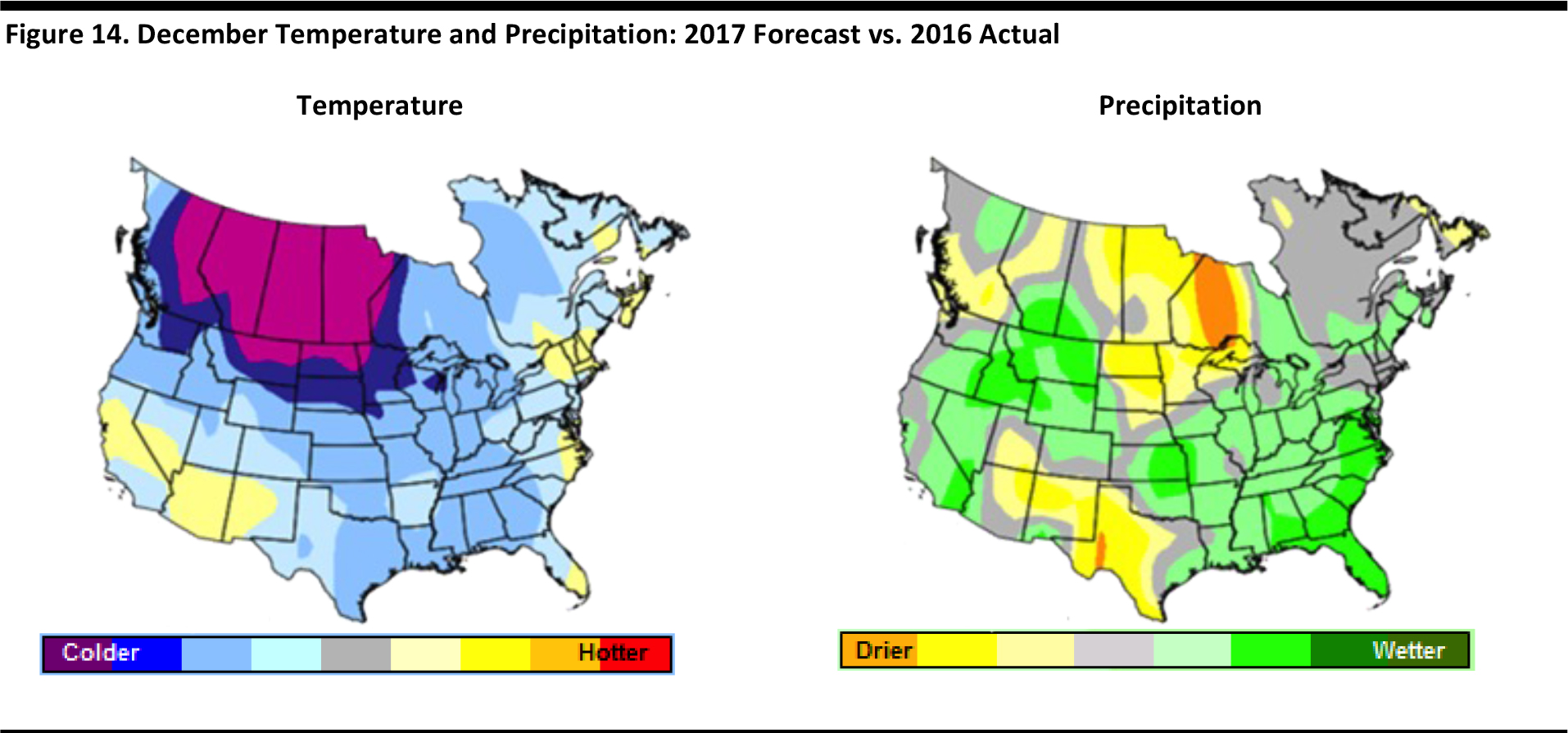

HOLIDAY WEATHER FORECAST: 2017 IS AN EASY COMPARISON VERSUS 2016

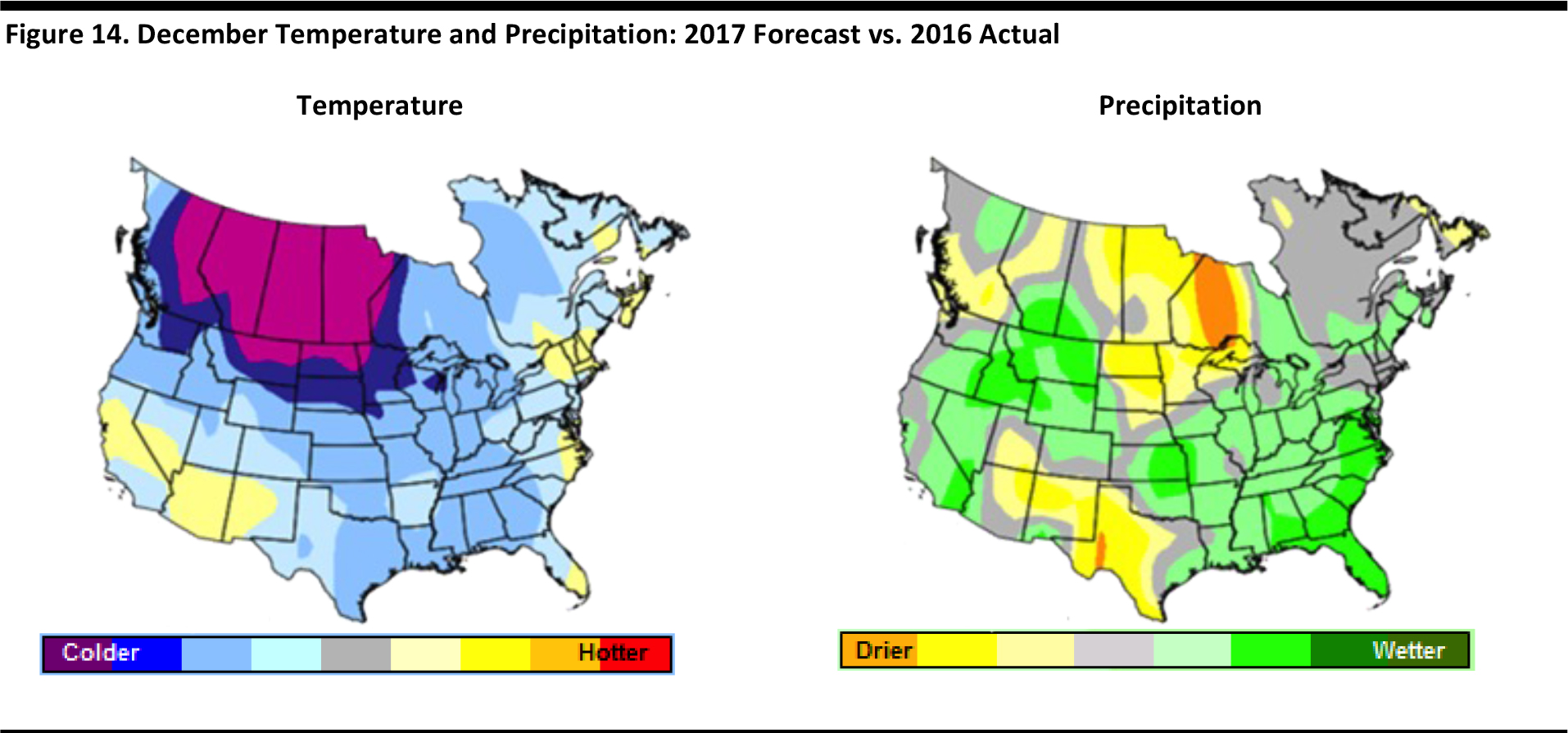

Weather analytics firm Planalytics projects that weather in the US this November and December will likely be cooler than last year, which was unusually warm, particularly on the East Coast and in the South. There is room for improvement this November especially, as November 2016 was the warmest November in 120 years.

On a national scale, a relatively colder November and December should be positive for seasonal apparel categories such as coats, boots, scarves, hats and gloves. Demand for winter apparel is expected to be strongest up and down the East Coast. Cooler weather would also bring more opportunities for retailers to sell snow removal gear. However, the arrival of snow could shift consumer demand from physical stores to e-commerce.

Demand is expected to be strong, especially in December, and the cooler weather is expected to lift seasonal categories. Yet hurricane season is not yet over, and another storm could result in needs-based purchasing hampering future purchases in hurricane-prone areas.

Lower temperatures are expected to generate strongly positive weather driven demand for sporting goods stores and positive demand for specialty apparel stores. The precipitation outlook is wetter than last year, which could generate weather-driven demand for blankets foremost, then for scarves, hats and gloves, followed by fleece items and soup.

Source: Planalytics

CONCLUSION

We expect US holiday retail spending to increase by 3%–4% in 2017, as several positive data points suggest a healthy shopping season this year. On average, retail research firms and industry groups are forecasting growth of 3.8% for the holiday period. The macroeconomic environment features a lower unemployment rate, stronger consumer sentiment and stronger housing prices, all amid benign inflation. E-commerce is also set to continue to account for a healthy portion of total US retail sales. All of these factors point to consumers being ready to shop this holiday season