EXECUTIVE SUMMARY

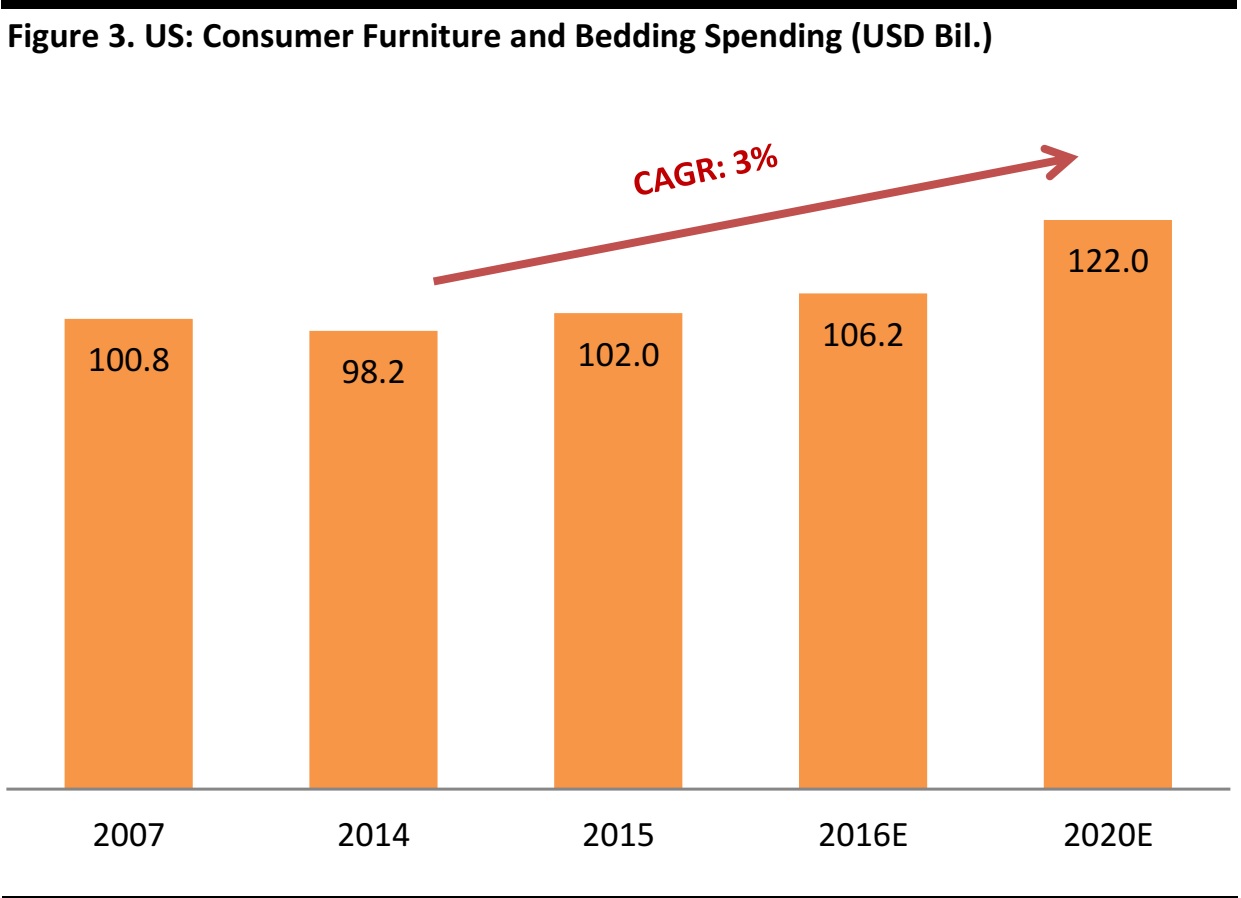

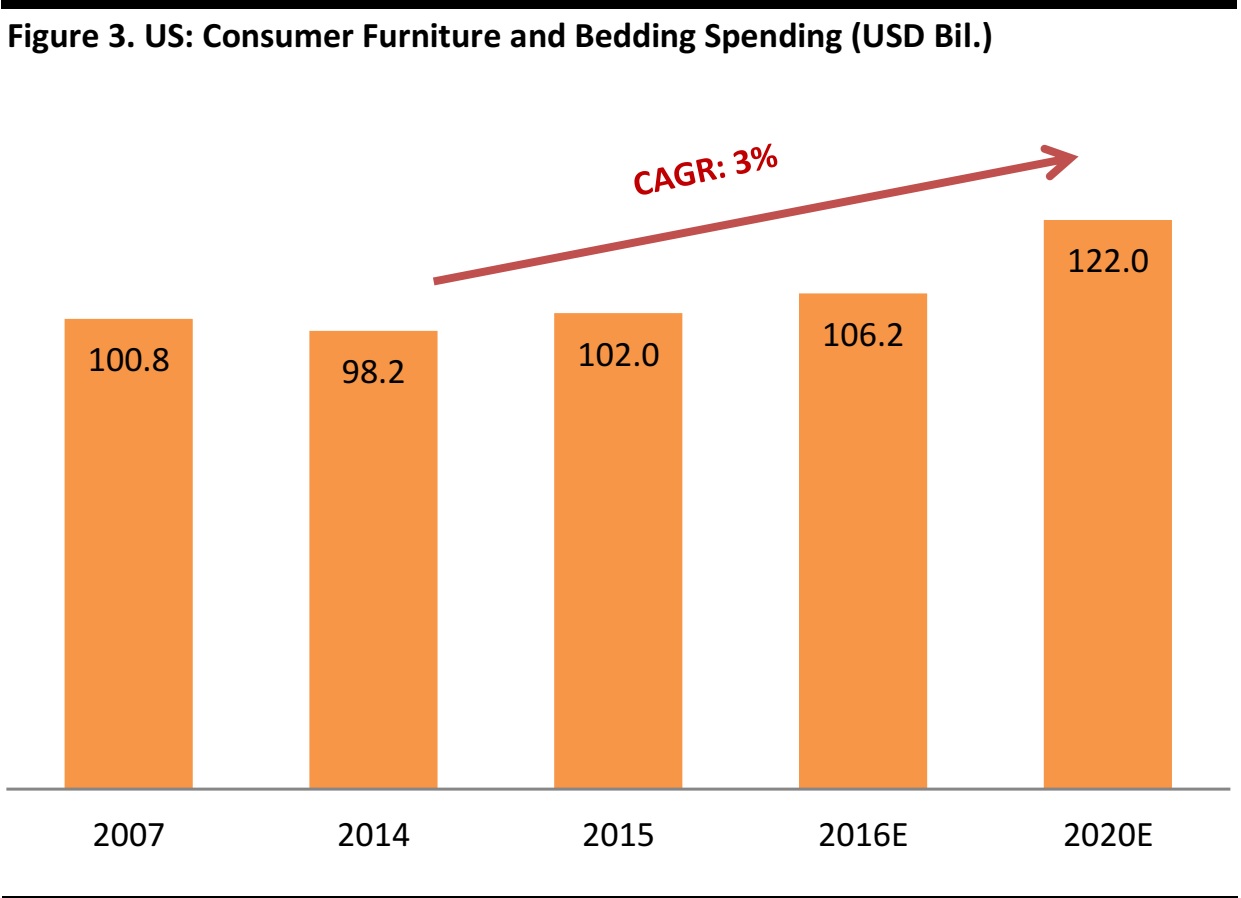

Consumer furniture and bedding expenditure in the US reached US$102 billion in 2015 and we expect that the category will continue to grow at a compound annual growth rate (CAGR) of 3% until 2020 on the back of healthy fundamentals.

This year the back-to-school shopping season is expected to have a favourable impact on sales of furniture, which are forecast to reach US$6.23 billion according to National Retail Federation.

Source: Shutterstock

Source: Shutterstock

Survey data shows that US consumers show a preference for quality and durability when purchasing furniture. They show a growing appetite for outdoor furniture while also appreciating vintage pieces as well as environmental conscious options.In addition, US consumers necessitate short delivery times and look to furniture of US origin,which favors domestic players who nonetheless occupy 9 out of the 10 top positions on the market based on revenue.

Though US consumers value going online as a way to search and find information on products,furniture e-commerce is still in a nascent stage. That being said, the channel is developing robustly with the adoption of technologies such as VR and AR.

In this report we also introduce three innovative furniture retailers. MicroD provides online solutions for furniture retailers, HUMBlab combines technology with furniture design, and e15 cooperates with fashion designers to cater to a more savvy consumer.

Earlier this year we published

A Deep Dive into the US Furniture Market. In this report, we update the analysis of trends and drivers that will shape the market for furniture going forward.

We look at the macroeconomic outlook that impacts the sector, prevailing consumer preferences, the competitive environment and future consumer and technology trends that will underpin the development of the US furniture industry.

MACROECONOMIC OUTLOOK

The macroeconomic environment is favorable for the US furniture market. Increasing home sales and improved unemployment rates are all positive developments for sales of furniture.

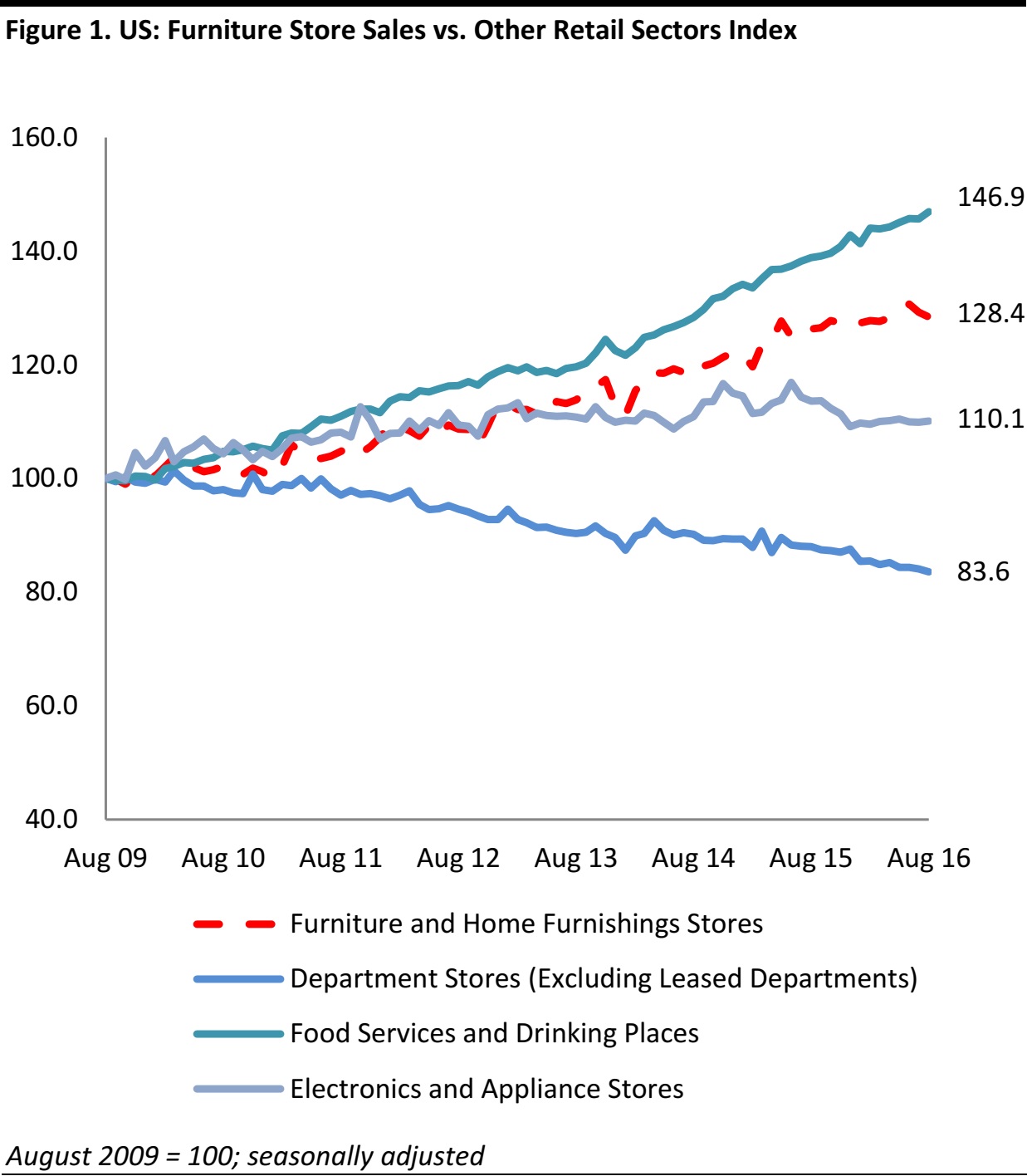

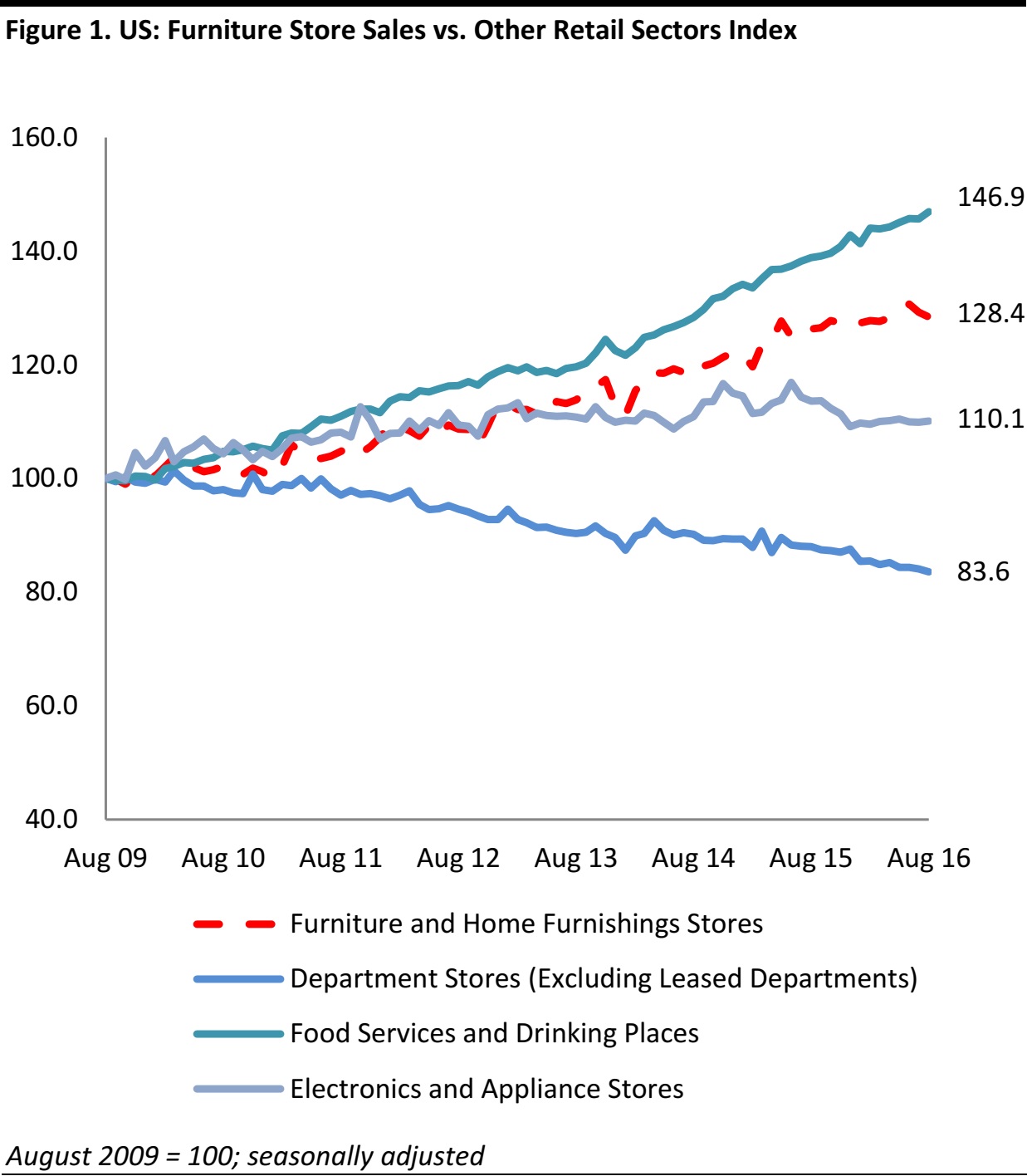

Furniture store sales have increased continuously since the economic recession in 2009. This upward trend indicates US consumers are shifting back to furniture. Adjusted furniture and home furnishings store sales in the US increased 1.6% year over year to $8,986 million in August 2016, according to the US Census Bureau.

Source: US Census Bureau/Fung Global Retail & Technology

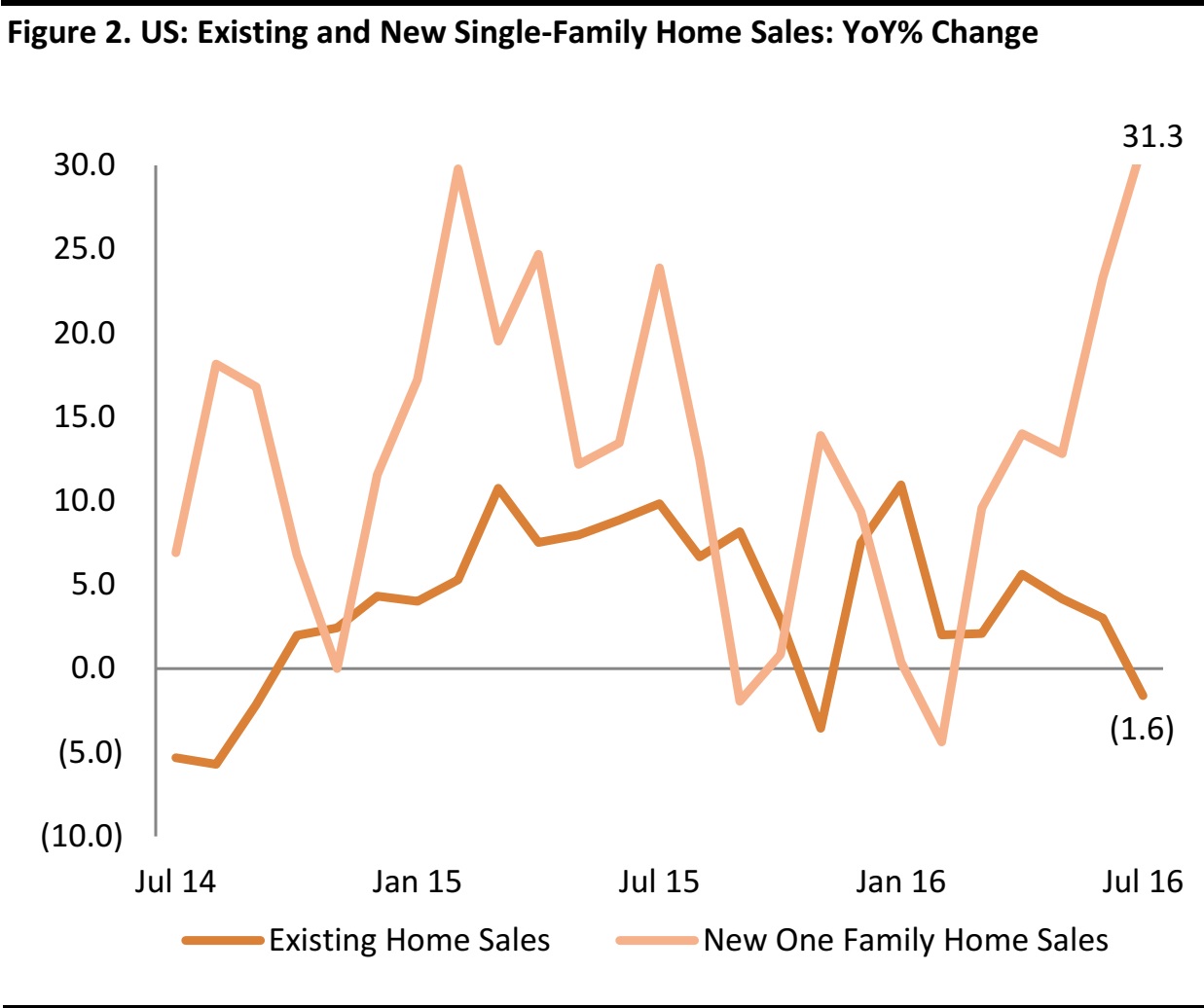

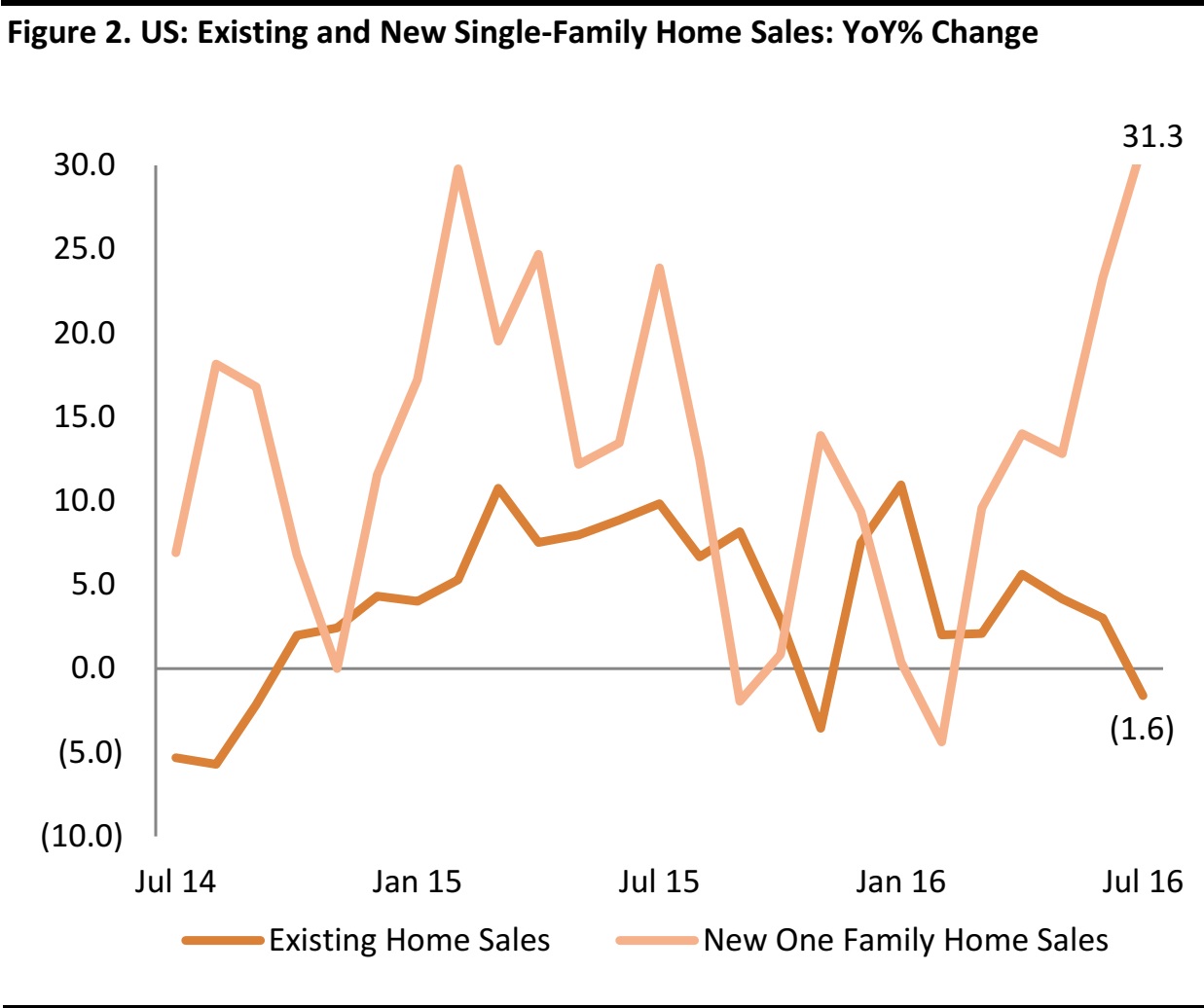

A strong housing market is good news for the furniture sector. And recent figures show an improving real estate market across the US. New single-family home sales in the US surged by 31.3% year over year in July 2016, seeing double-digit rate for a fourth consecutive month. Existing home sales saw 7 months of positive growth, even though the indicator slipped to a (1.6)% year over year decline in the most recent period, according to the National Association of Realtors. Despite the moderate slowdown in existing home sales, the market still poses a positive environment for furniture retailing overall.

Source: National Association of Realtors/Federal Reserve Economic Data (FRED)

Consumer sentiment strengthened as disposable income increased, which is favorable for the furniture market. The online furniture industry news source,

Furniture Today, forecast furniture sales in the US will continue to grow in the next five years and reach $122 billion by 2020, a 3% compound annual growth rate (CAGR).

Source: Furniture Today/Fung Global Retail & Technology

CONSUMER PREFERENCES

Key takeaways from consumer surveys are that US shoppers care about quality more than price levels when they purchase furniture, but millennials have shown they are more price-sensitive than other age cohorts.

Quality and Durability

According to a survey conducted by

Furniture Today in 2016, US consumers want quality and durability when they choose furniture products.

- The majority of the respondents preferred home furnishings that can last 5 to 9 years.

- Among sofa-buyers, 91% said quality and durability are very important when they make a purchase; 36% revealed they expect to keep a newly purchased sofa for 5 to 9 years and 28% intend to keep it for 15 years or more.

- Consumers expect wall décor and wood furniture to have a longer comparative life span,of more than 15 years.

Delivery Time

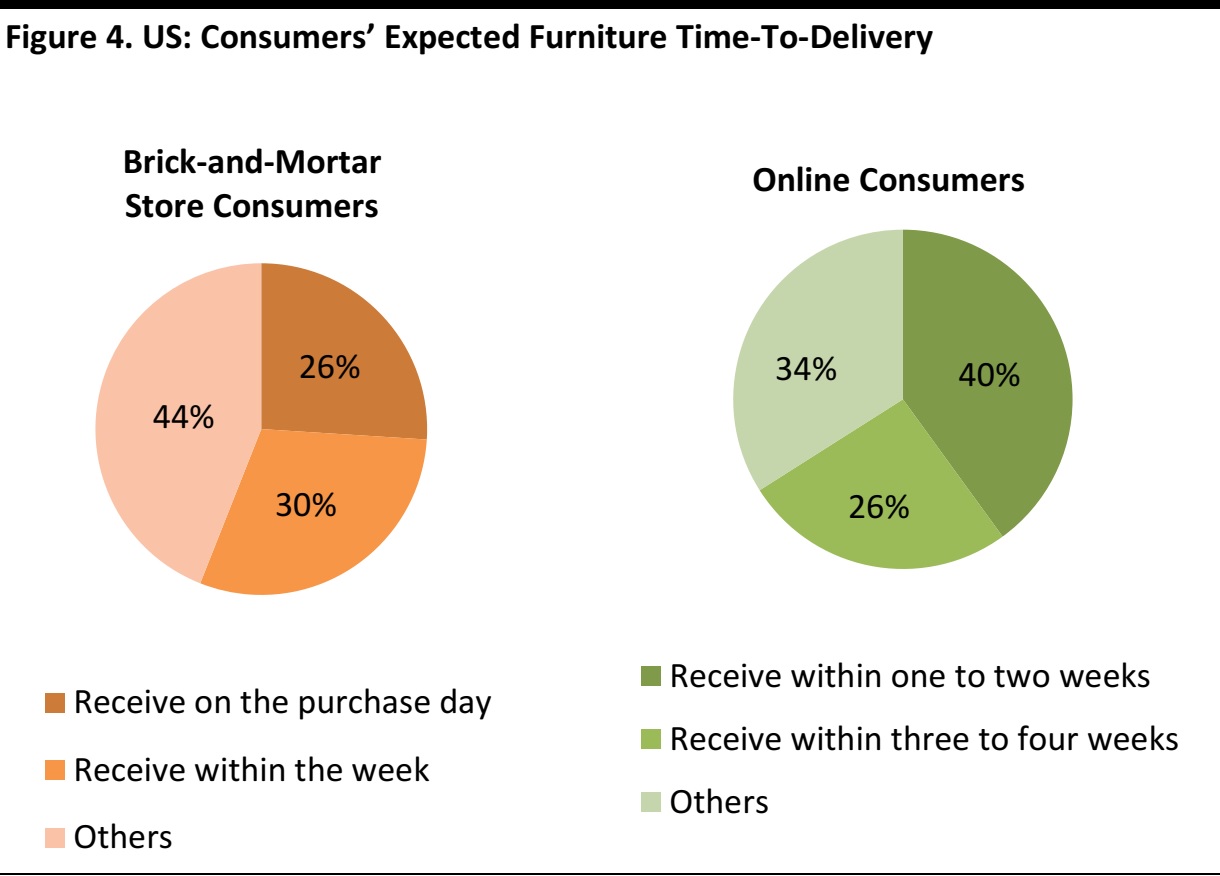

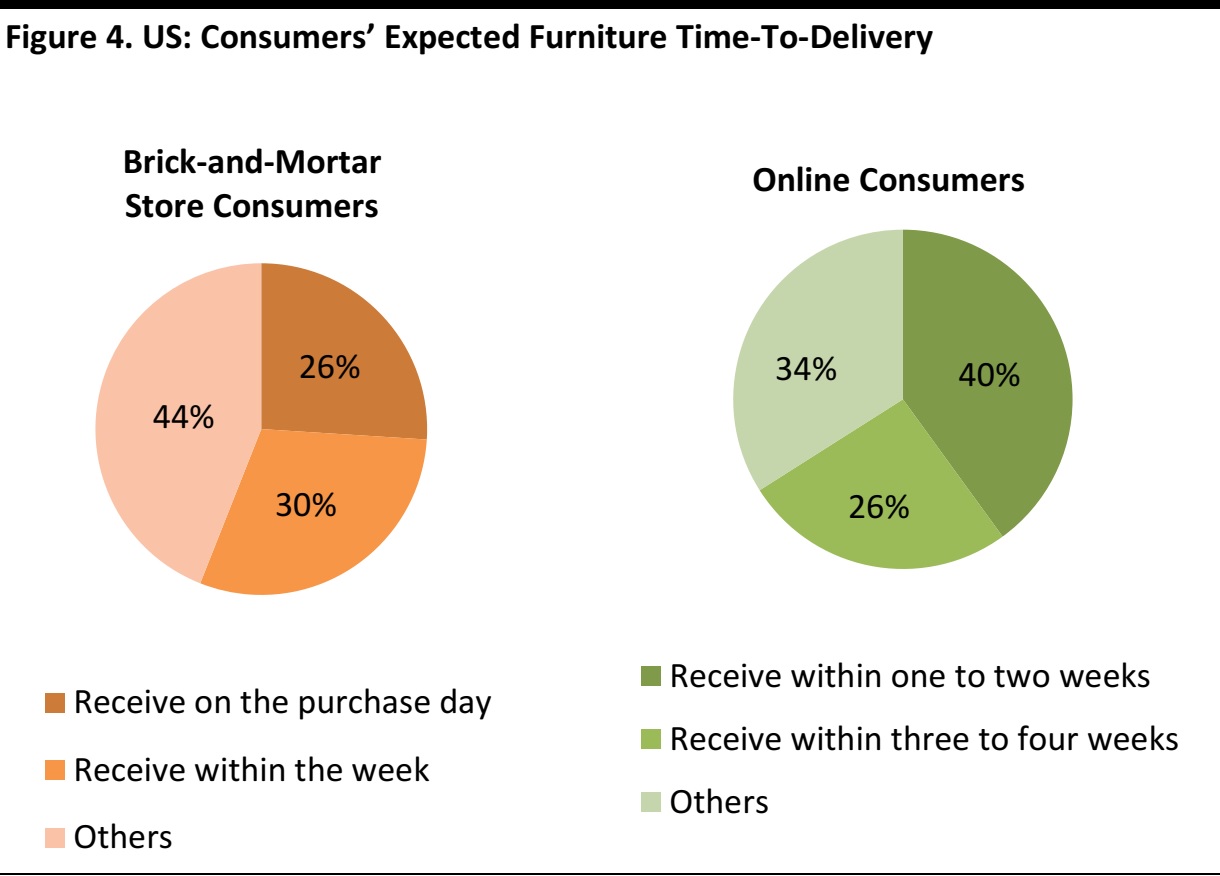

Another 2016

Furniture Today survey found both brick-and-mortar and online consumers expect to take delivery of purchased furniture within one month. However, online buyers bear longer delivery times than brick-and-mortar store buyers. When furniture consumers shop in stores, they expect to find a larger inventory in the stores so goods are available immediately upon their purchase.

Source: Furniture Today/Fung Global Retail & Technology

In addition to short delivery times, customers also expect transparency and the ability to track orders throughout the delivery process. They want to know where the product is stored and how long it will take to arrive.

Preference for US Origin

According to a 2015 survey by

Furniture Today, US consumers prefer furniture made in the US because they think American furniture is of higher quality. They also believe US furniture is more easily customized.

- Of those surveyed, 59% expressed their willingness to spend more on furniture made in the US, up from 33% in the previous year’s survey.

- Most respondents said they would pay 20% more for products of US origin.

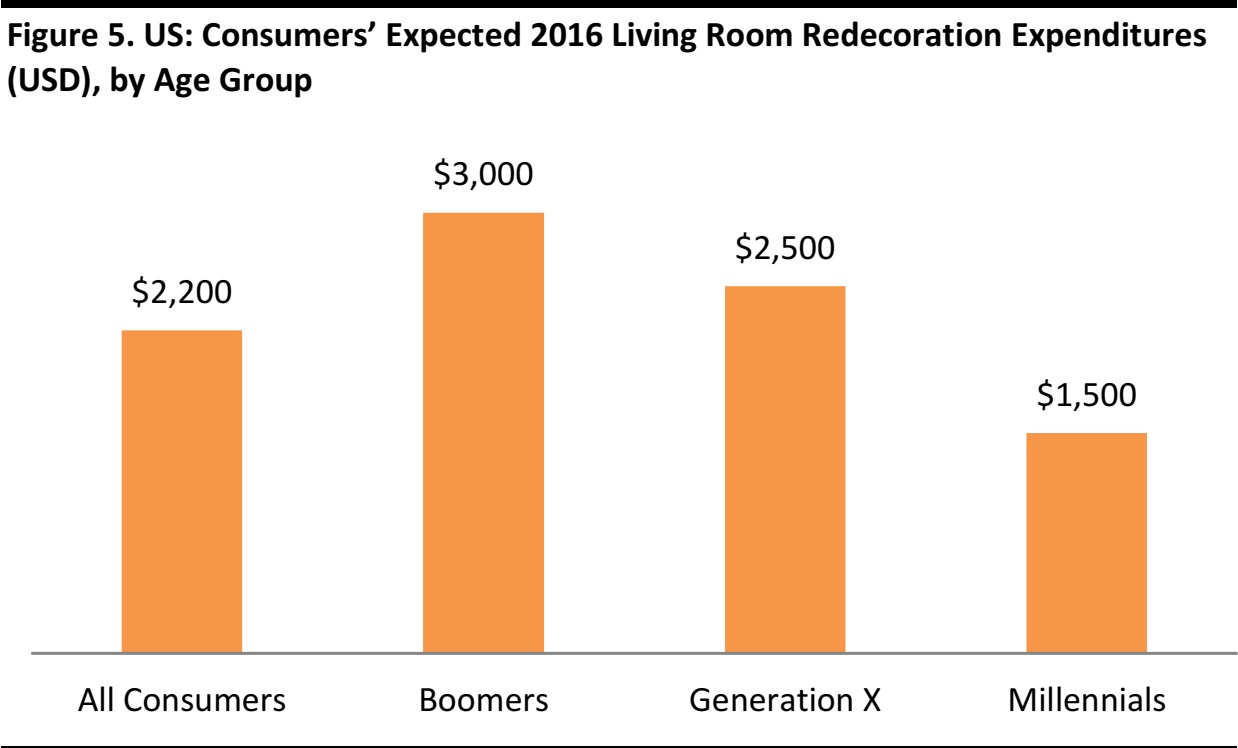

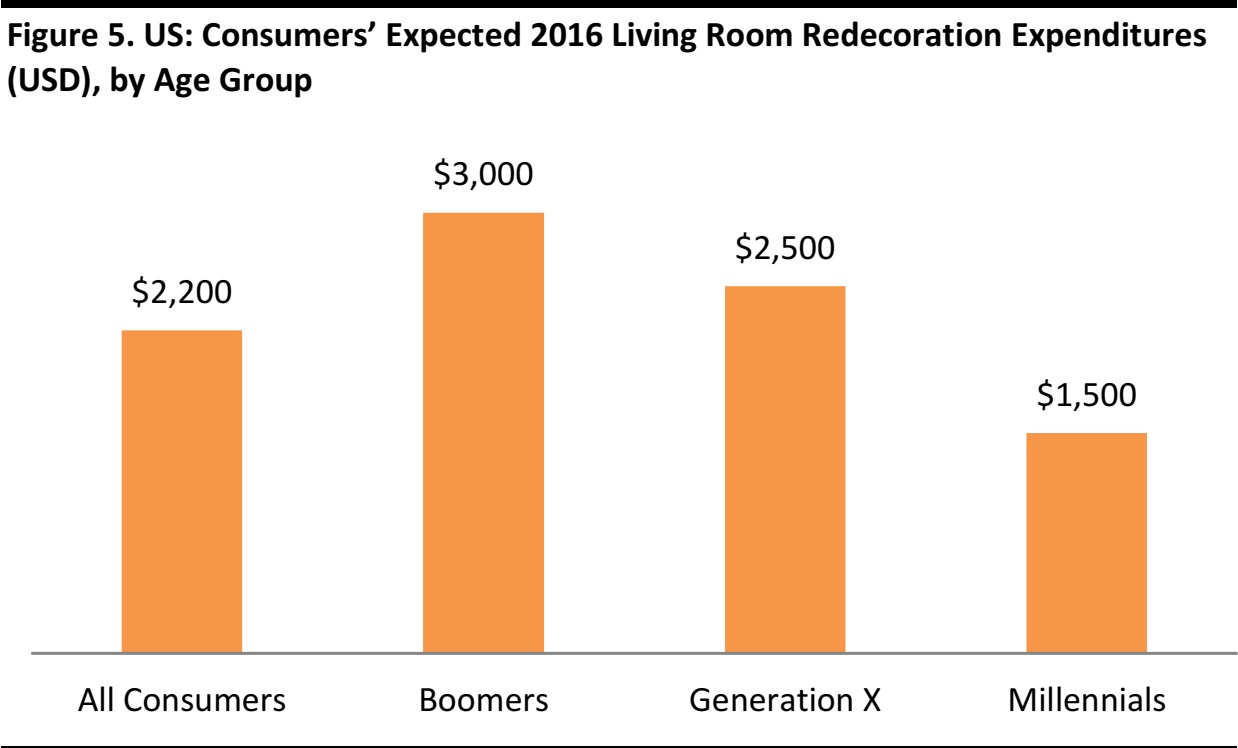

Living Room Redecorations

According to the 2016 Home Decorating Survey conducted by

Furniture Today, the living room is the first stop for US consumers who plan to redecorate, and the first product on their shopping list is the sofa, followed by entertainment furniture and area rugs. Additional items consumers may purchase when they redecorate their living rooms include occasional tables, and lamps and decorative accessories, such as vases, candle holders and sculptures.

- On average, US consumers are willing to spend $2,200 for living room redecoration.

- Boomers are likely to spend the most on redecoration, with a budget of $3,000, followed by budgets of $2,500 for Generation X and $1,500 for millennials.

Source: Furniture Today/Fung Global Retail & Technology

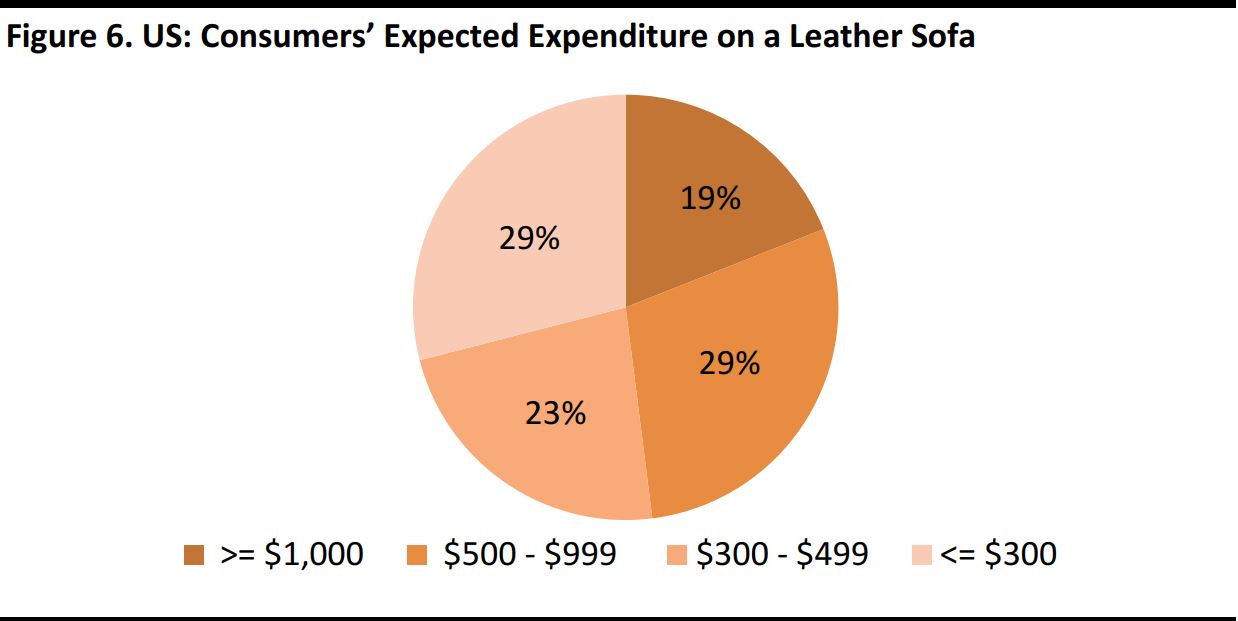

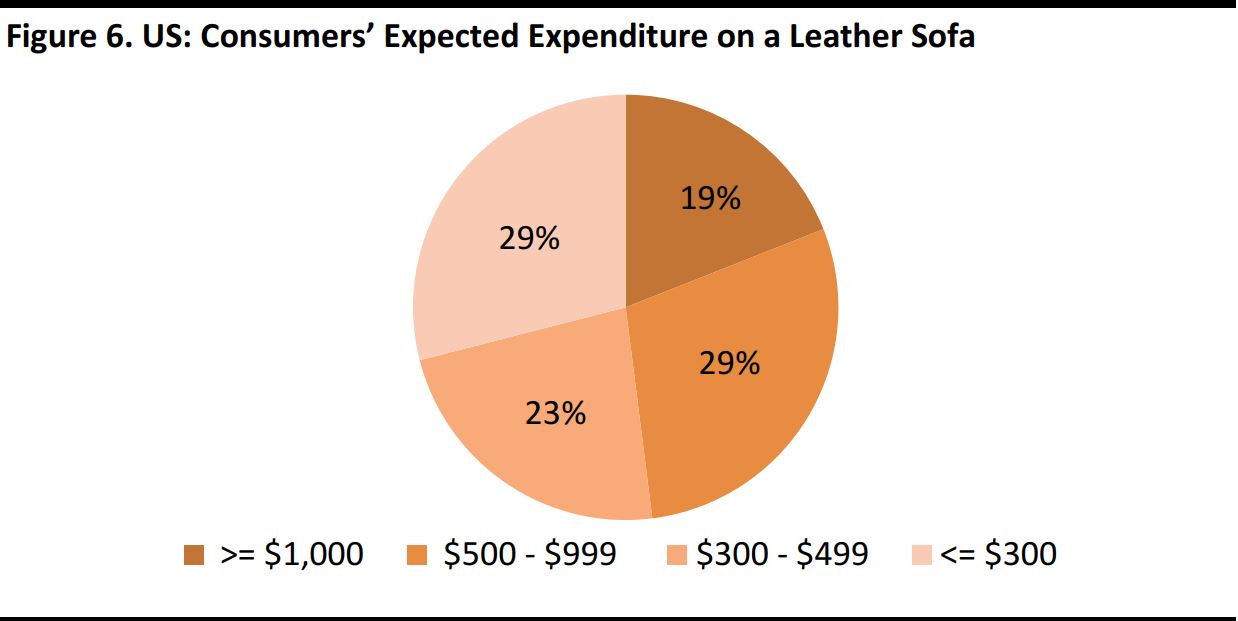

A majority of those surveyed said when they redecorate a living room, the first thing they replace is the sofa, according to

Furniture Today.

- Of those surveyed, 60% said they design their living room around a sofa.

- Nearly half of the respondents said they were willing to spend more than $500 on a leather sofa and 19% would spend more than $1,000.

Source: Furniture Today/Fung Global Retail & Technology

MARKET SNAPSHOT

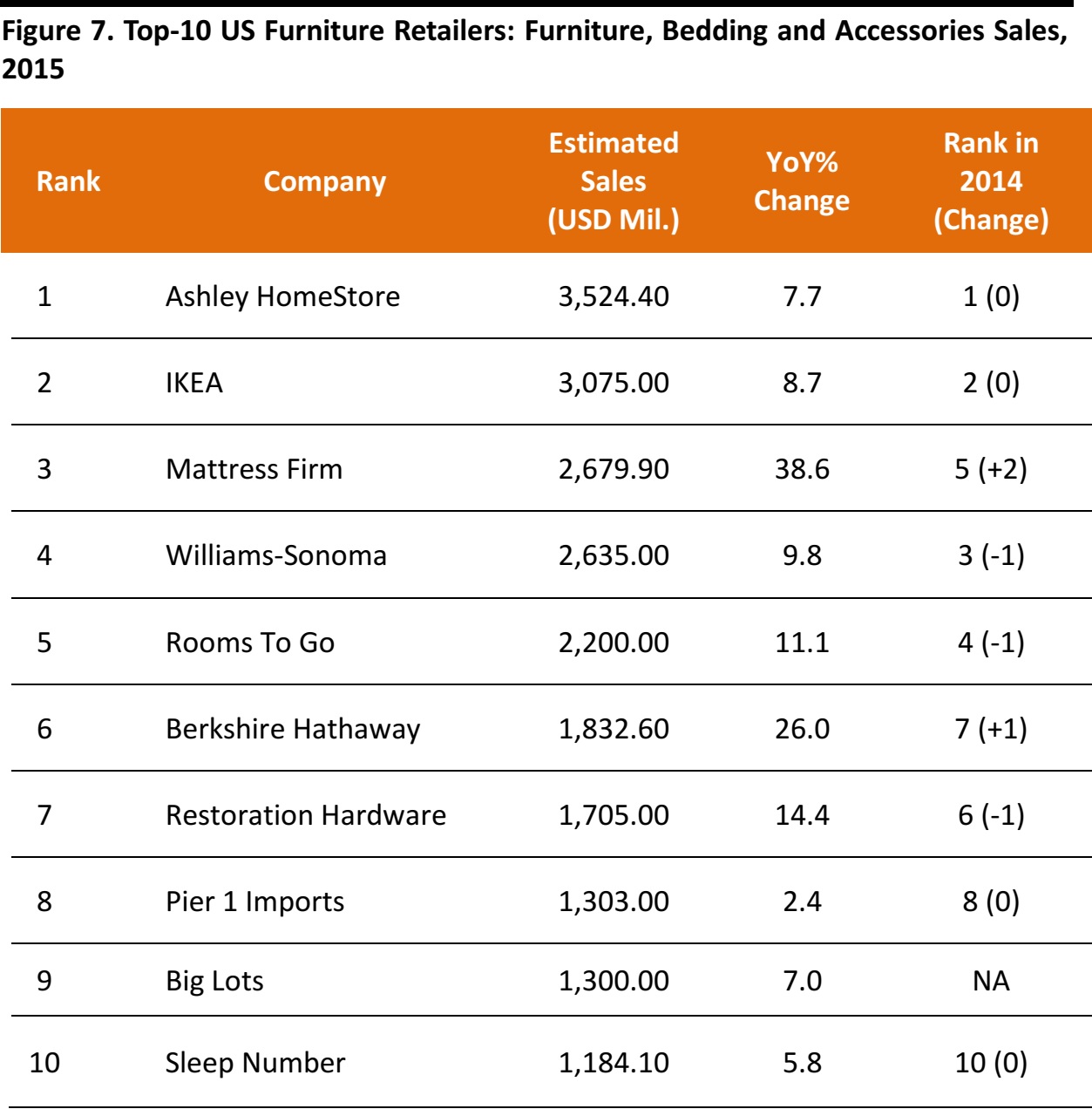

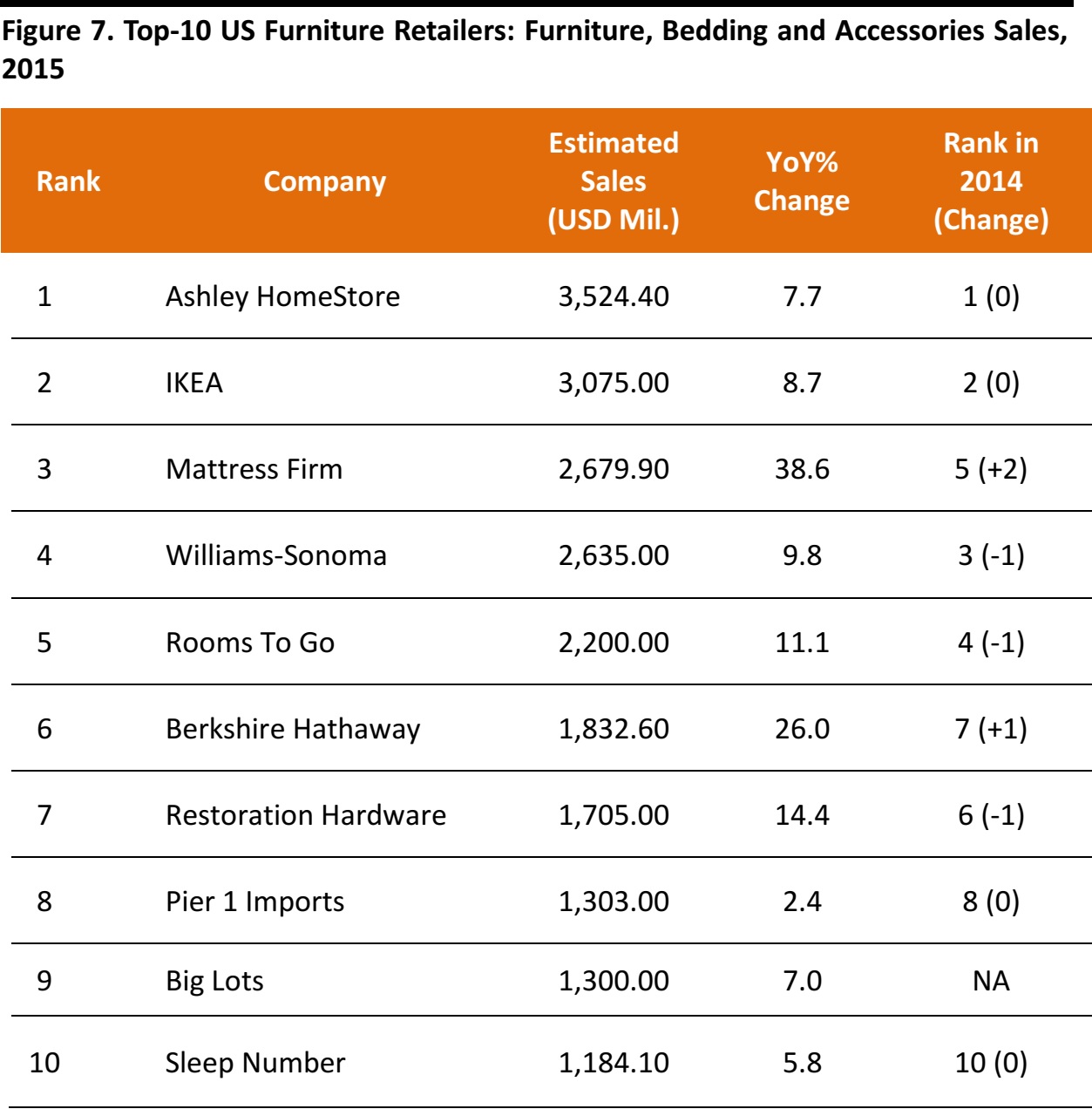

The US furniture market is led by domestic players;nine out of the top-10 furniture retailers are American companies. This is in line with US consumers’ preference for furniture produced in the country.

Source: Shutterstock

Ashley HomeStore and IKEA are ranked first and second place by sales,respectively,the same spots they held in 2014. The US’s largest specialty mattress retailer, Mattress Firm,had a 38.6% year-over-year increase in sales on the back of its acquisitions of Back to Bed, Bedding Experts, Mattress Barn and Sleep Train in 2014. The company maintained its acquisitive strategy by merging with Sleepy's, the second-largest specialty mattress retailer in the US, in 2016. The acquisition added approximately 1,050 stores to Mattress Firm’s store footprint.In turn, the acquisition of Mattress Firm by South African retail group Steinhoff was announced in August 2016.

Also, impressively, sales increased 26% at Berkshire Hathaway’s furniture division in 2015, fueled by the new Nebraska Furniture Mart store in Dallas, TX, that opened last year.Although it missed expectations, Restoration Hardware still saw 14.4% year-over-year sales growth supported by the launch of RH Modern and RH Teen.

Source: Furniture Today/Fung Global Retail & Technology

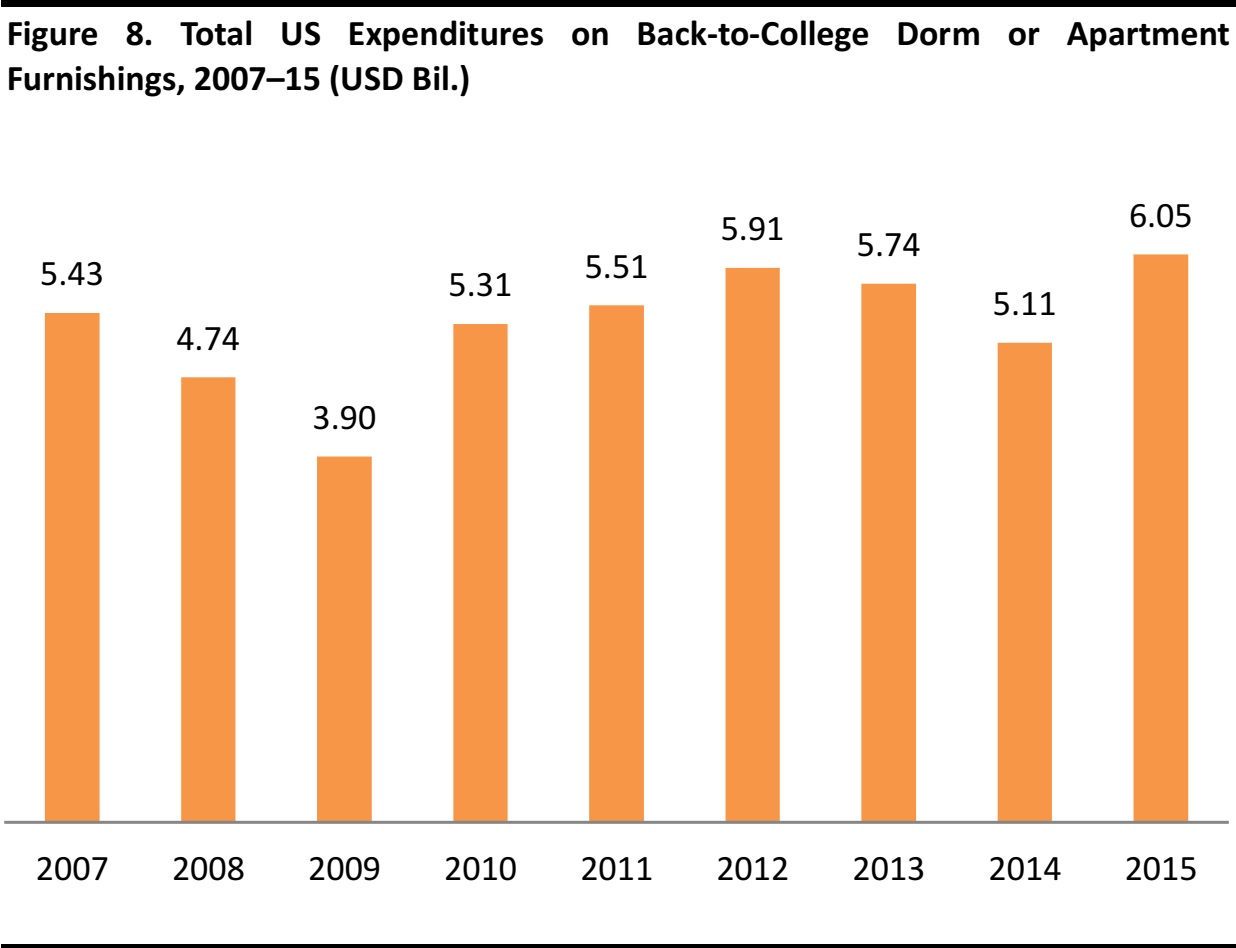

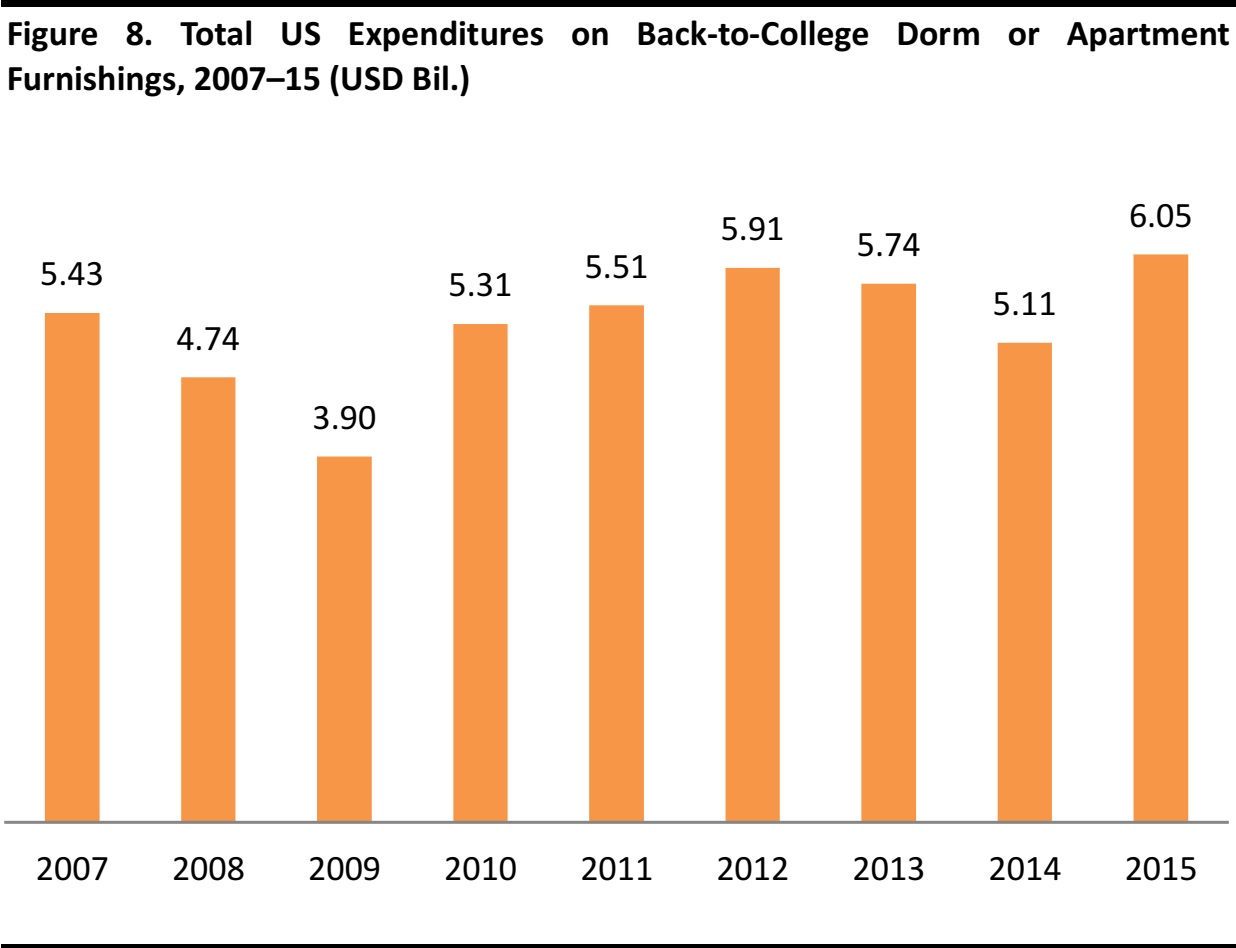

Back-to-School Drives Furniture Sales

Perhaps surprisingly, the back-to-school season is an important one for US furniture retailers: American consumers spent more than $6 billion on dorm or apartment furnishings during the back-to-school season in 2015, according to the National Retail Federation (NRF). The NRF expects this to reach $6.23 billion in 2016, behind electronics at $11.54 billion, and clothing at $7.49 billion.

Source: Shutterstock

Source: NRF/Fung Global Retail & Technology

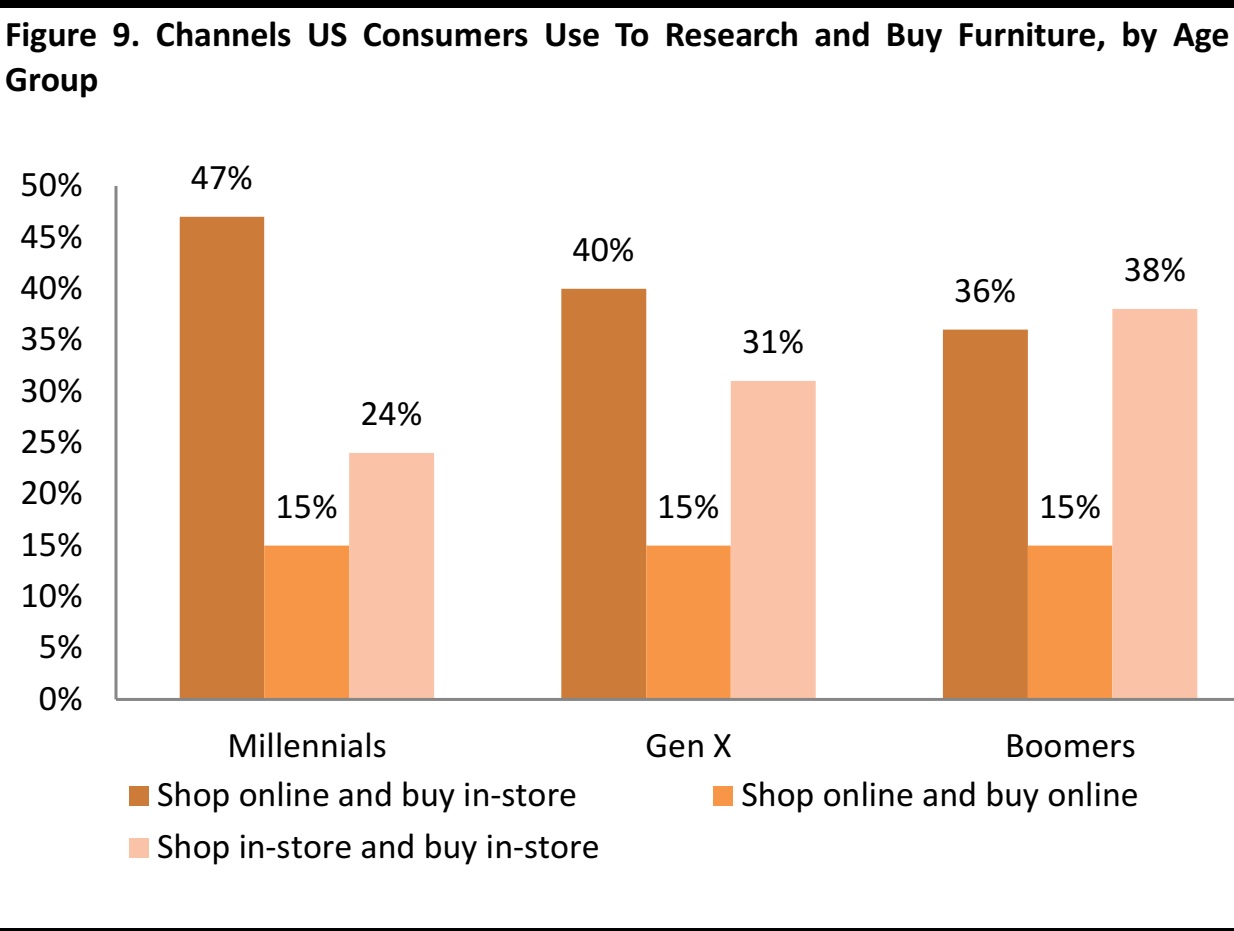

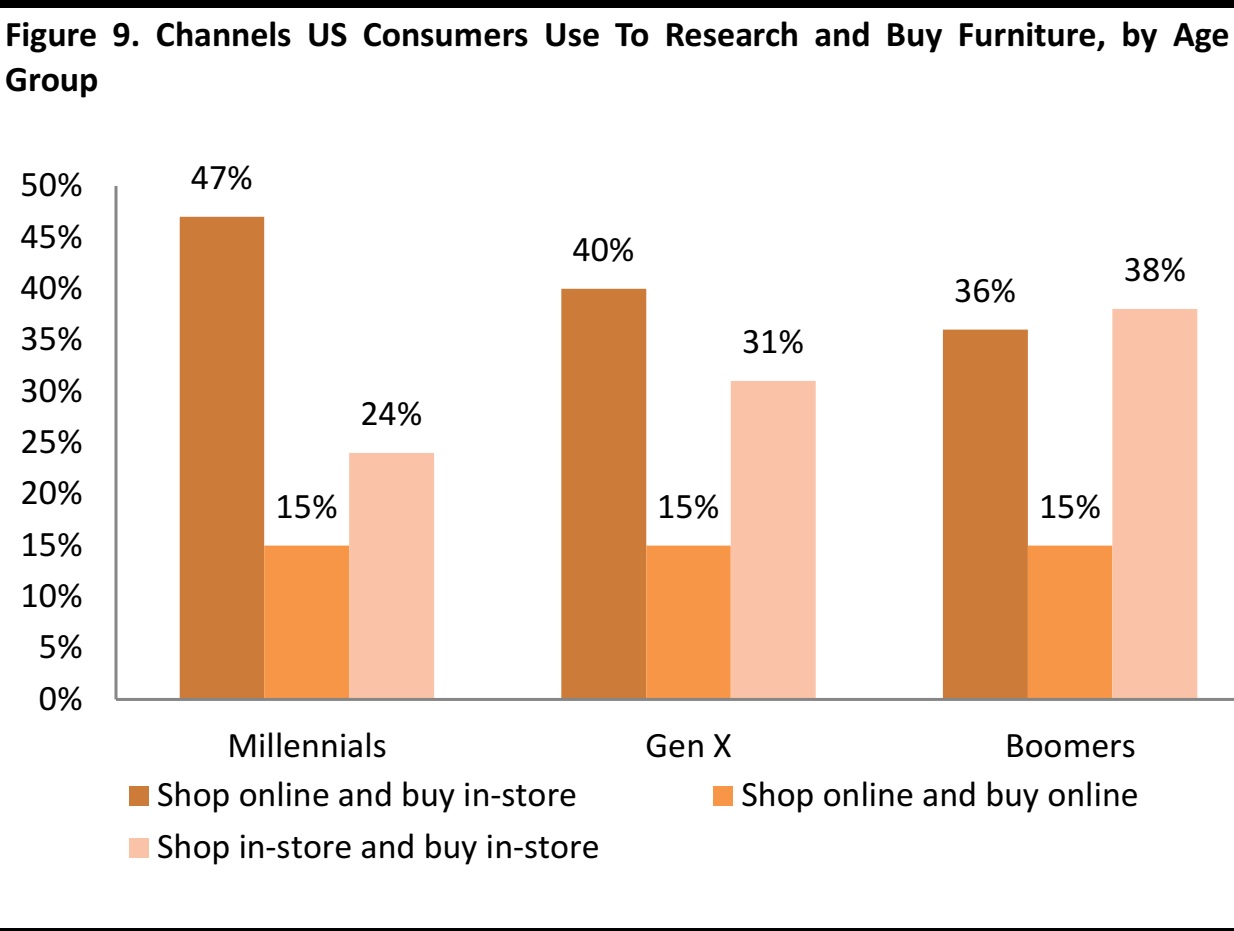

Online Research Is Becoming More Important

Consumers increasingly use online tools to research buying options with different age groups showing different online behaviors. For example, millennials and Generation X consumers embrace online research more than in-store research when they purchase a furniture item, but baby boomers showed equal interest in online and brick-and-mortar research, according to a

Furniture Today survey in 2016.

Source: Furniture Today/Fung Global Retail & Technology

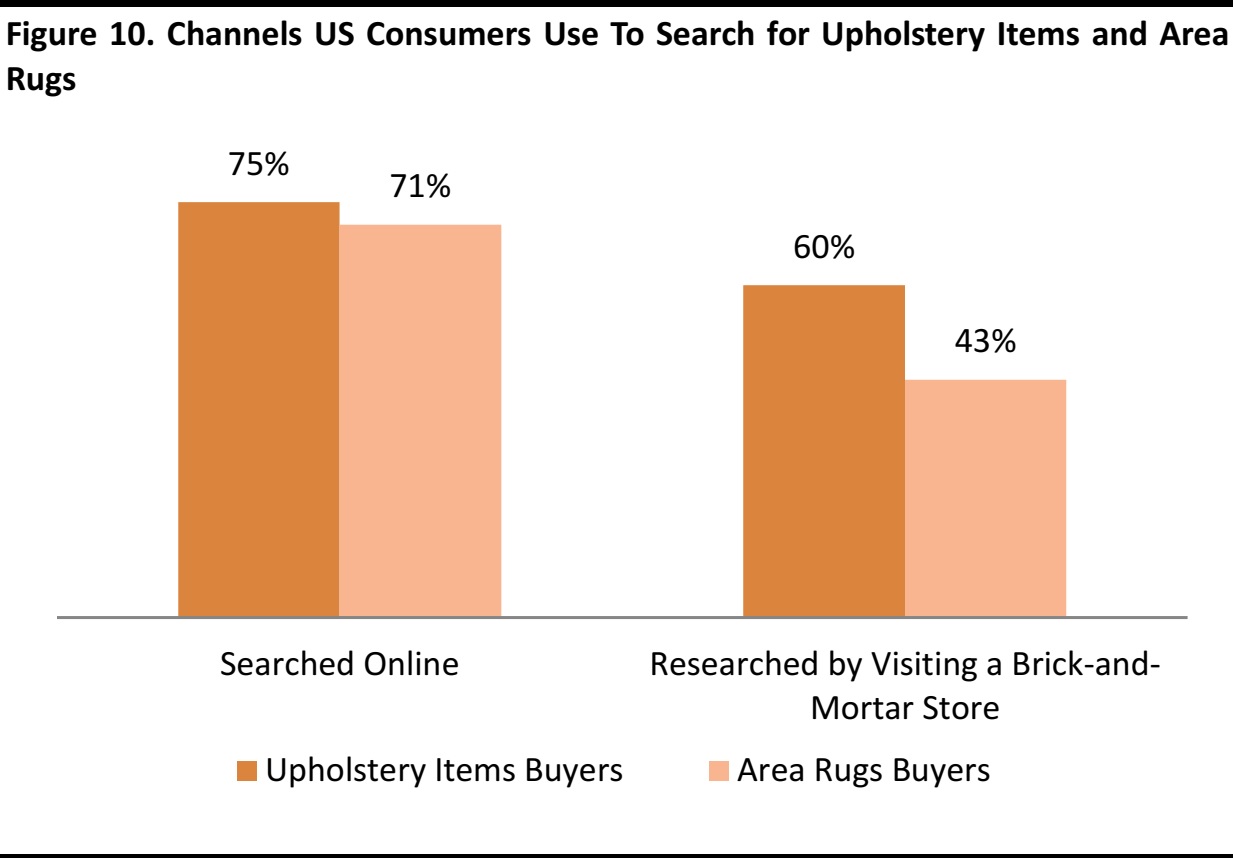

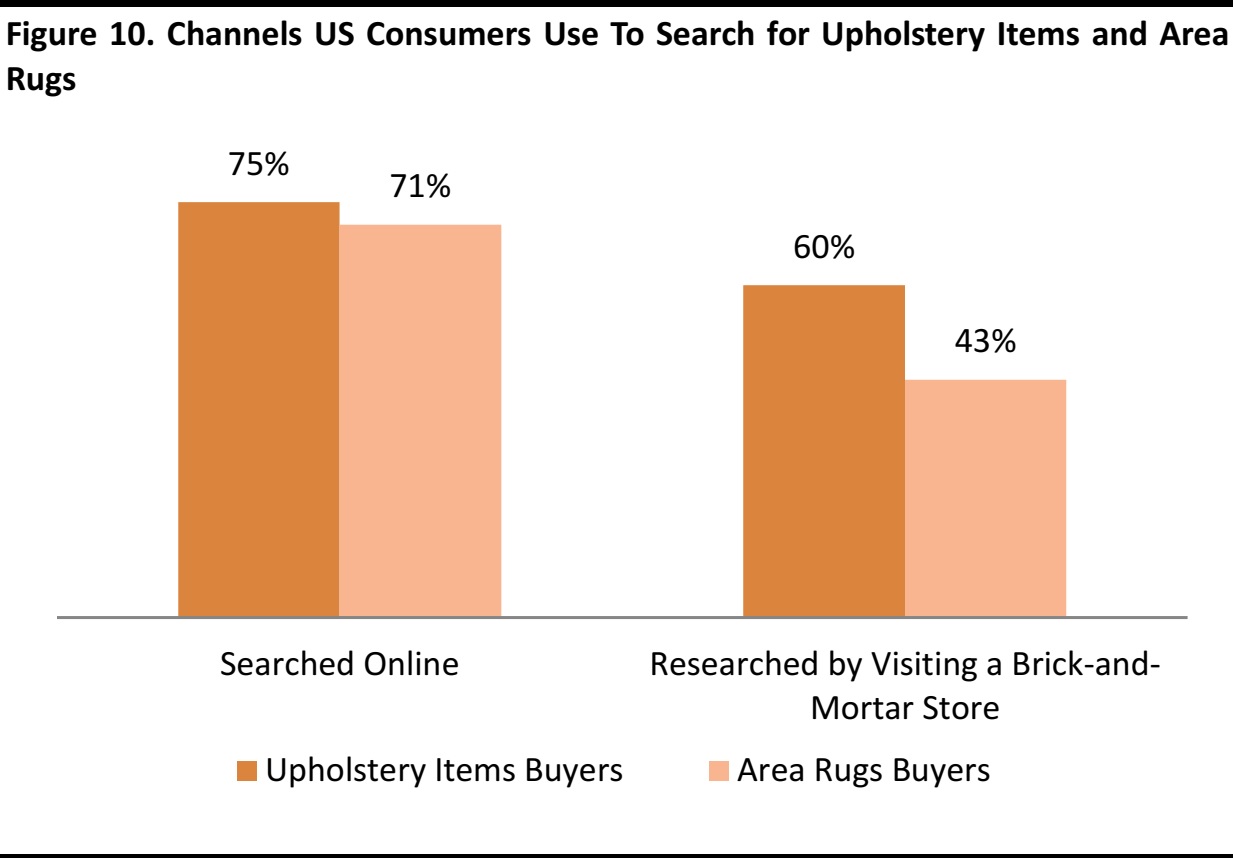

When it comes to specific furniture items such as upholstery and rugs, online is an important channel for product research. According to a 2015

Furniture Today survey, buyers for upholstery items and area rugs researched online much more often than they researched by visiting a brick-and-mortar store.

Source: Furniture Today/Fung Global Retail & Technology

Although 75% of upholstery buyers searched online, 54% of them said they would never buy upholstery online.

This tendency differs among products. For lamps, only 7% of the respondents would not purchase online, according to a 2016

Furniture Today survey.

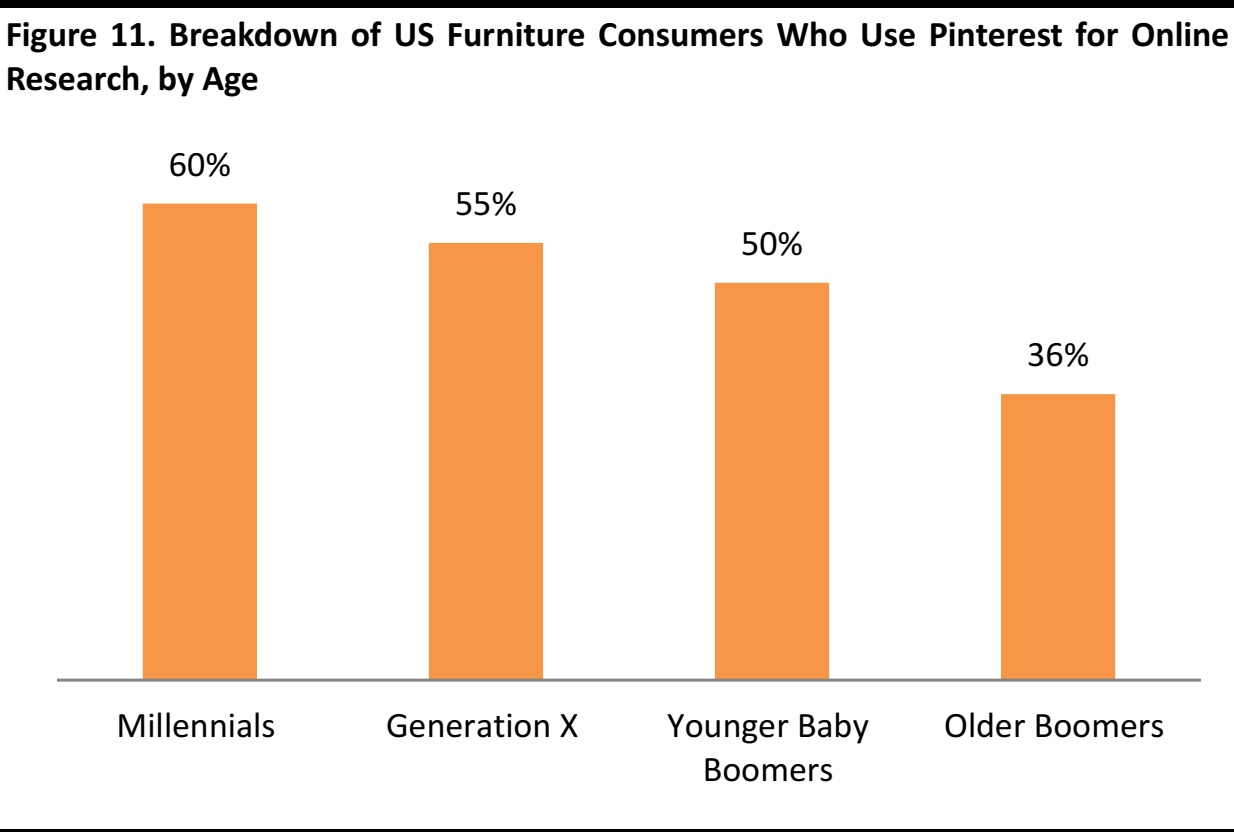

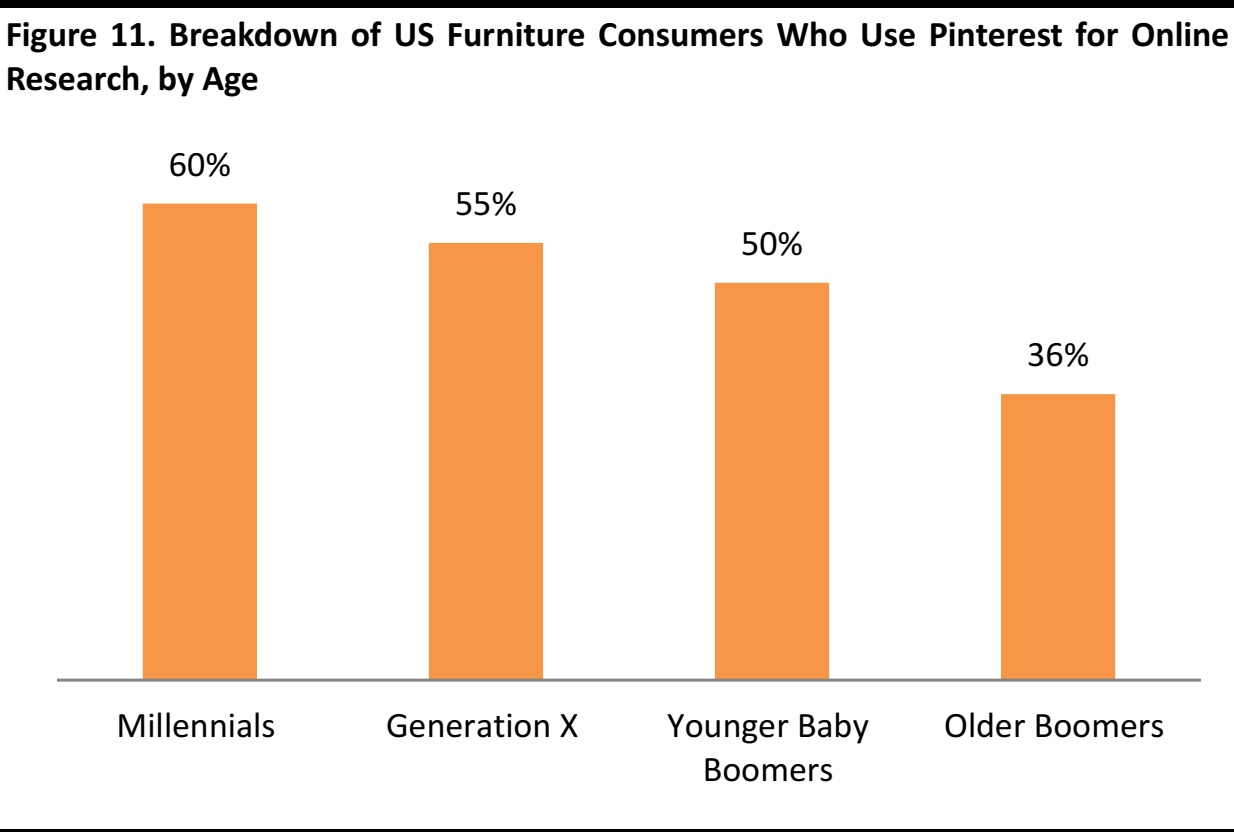

Social media is also becoming a more popular channel for online product research and sharing. Pinterest is the leading social media site US consumers use to research furniture products, and the popularity for the site is the strongest among millennials, according to Furniture Today.

Source: Shutterstock

Source: Furniture Today/Fung Global Retail & Technology

E-commerce is Growing, But Its Impact Is Still Modest

The surveys from

Furniture Today show there is still a gap between online research and online purchase. US consumers increasingly utilize online sources as research tools, but that does not necessarily lead to purchasing the products online—most consumers still prefer to purchase furniture in-store.

Even so, the percentage of furniture sold through online channels has increased.

- The online channel accounted for an estimated 10% of US furniture and bedding retail sales in 2015, according to Furniture Today.

- According to Statista, furniture and homewares e-commerce revenues in the US totaled US$21 billion in 2015. Revenues are expected to grow at a five-year CAGR of 7.6% to US$31 billion in 2020.

- International e-commerce solutions provider, PFSweb, forecast retail e-commerce sales of furniture will rise by roughly 16% in 2016.

The share of furniture sold through mobile devices is also increasing.

- Of online furniture shoppers who purchased through FurnitureDealer.net, an internet marketing solutions provider for the furniture industry, 52% used a mobile device in 2015, a drastic increase from the 5% who did so in 2010.

We expect the growth of online sales to continue a pace in the coming years, considering the rapid growth in m-commerce and the impact of new technologies such as virtual reality (VR) and augmented reality (AR), which bridge the digital and physical worlds.

- For more on the online channel, see our report, Global Furniture and Homewares E-Commerce.

FUTURE TRENDS

In this section, we note several developments and trends that are likely to impact the future shape of the furniture market. These are: the growth of the outdoor furniture category, the popularity of vintage furniture and interest in sustainability.

Outdoor Furniture

The outdoor furniture category is growing fast:outdoor furniture retail sales climbed from $3.7 billion in 2010 to $4.39 billion in 2015, according to

Casual Living. This represents a CAGR of 3.48%. Market research company Technavio's analysts forecast the outdoor furniture market in the US will grow at CAGR of 4% over the period to 2019.

A survey by

Furniture Today conducted in 2016 showed that 37% of respondents with outdoor space at their homes would purchase chat group furniture‒furniture of four or more chairs placed around a central table or fire pit.

Source: Shutterstock

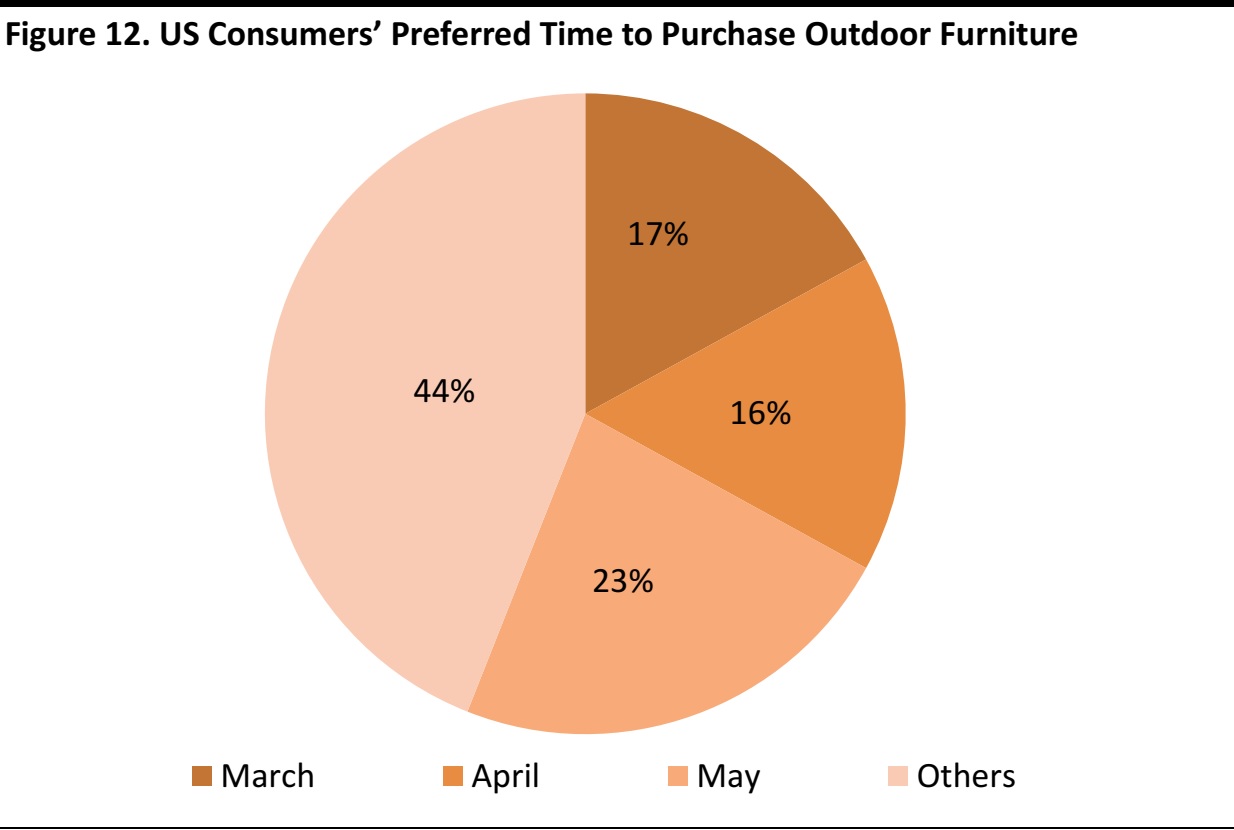

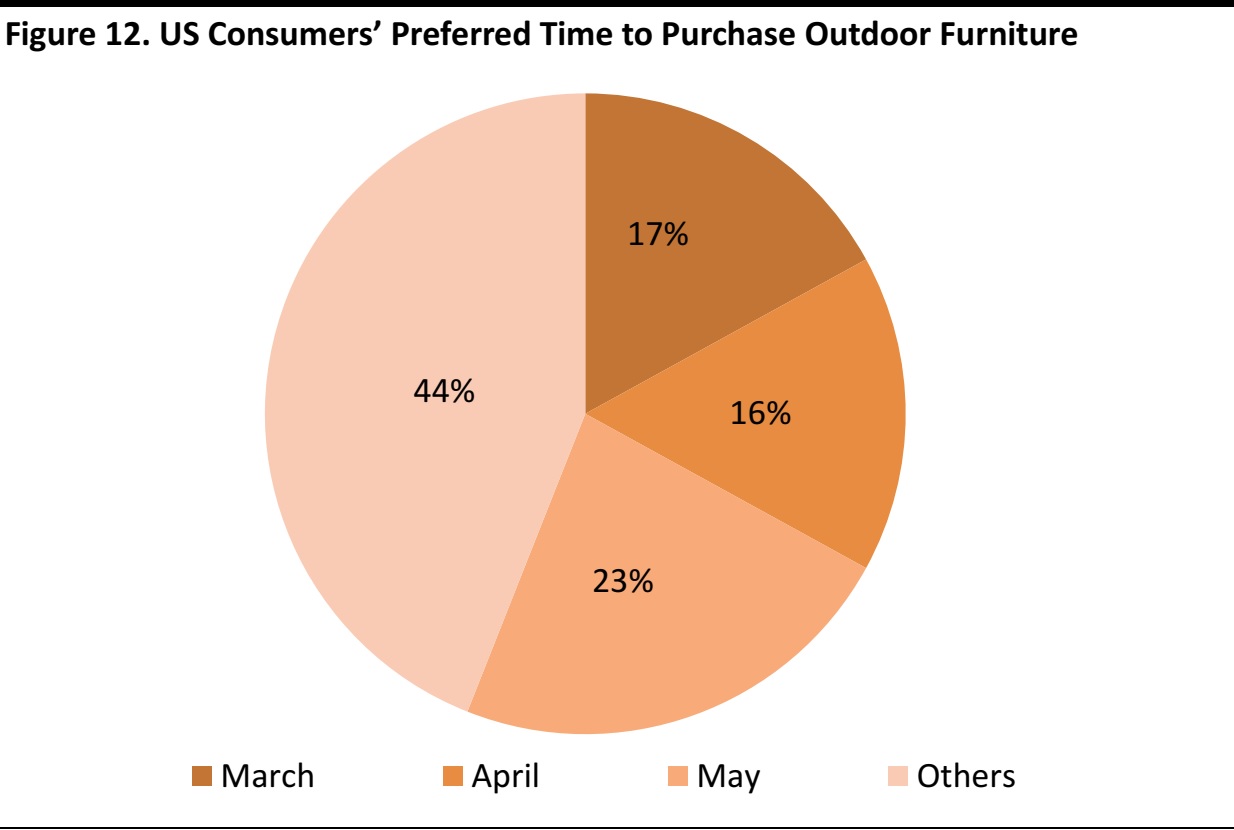

According to

Casual Living, consumers expect an approximate 6-year-lifespan when they choose outdoor furniture. More than 70% of US owners prefer cushions made from performance fabrics; this number jumps to 82% for those who live in the Northeast.

Furniture retailers should note that March to May is the most popular time for American consumers to purchase outdoor furniture. Of those surveyed, 23% said they purchase in May, followed by 17% who said March and 16% buy in April, according to

Furniture Today.

Source: Furniture Today/Fung Global Retail & Technology

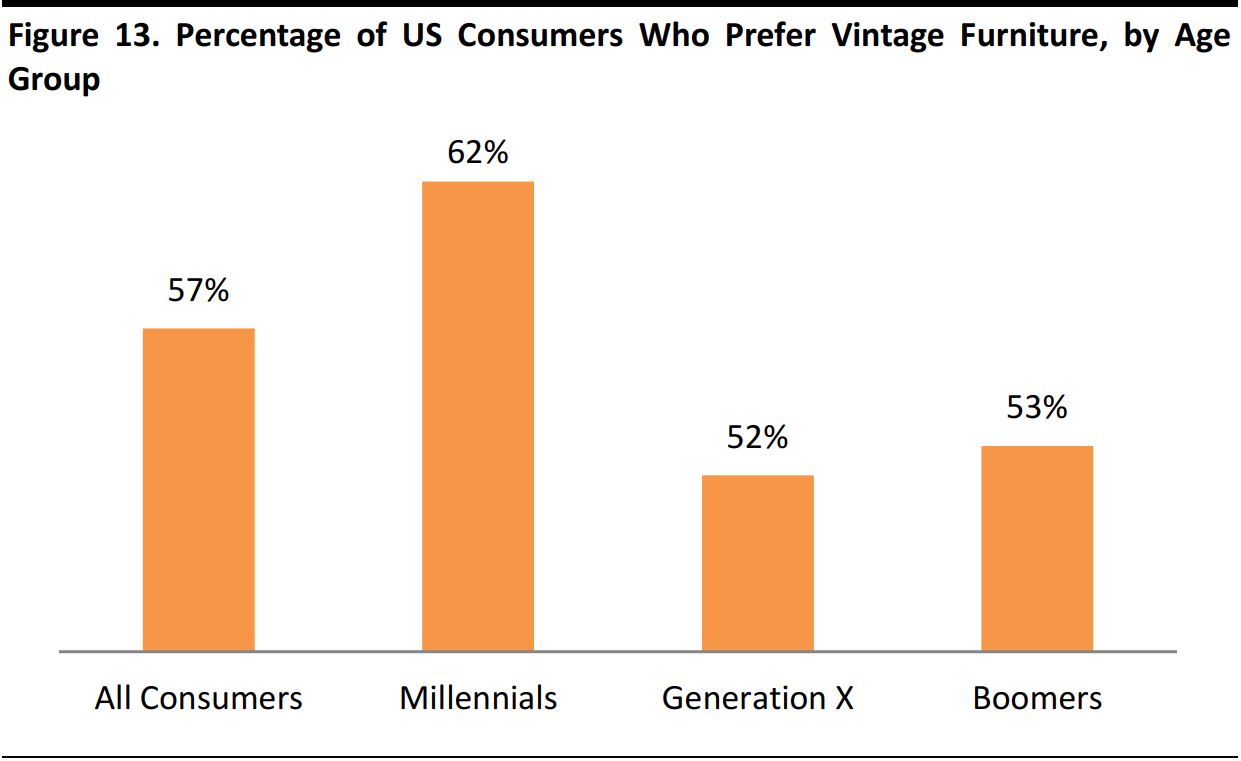

Vintage

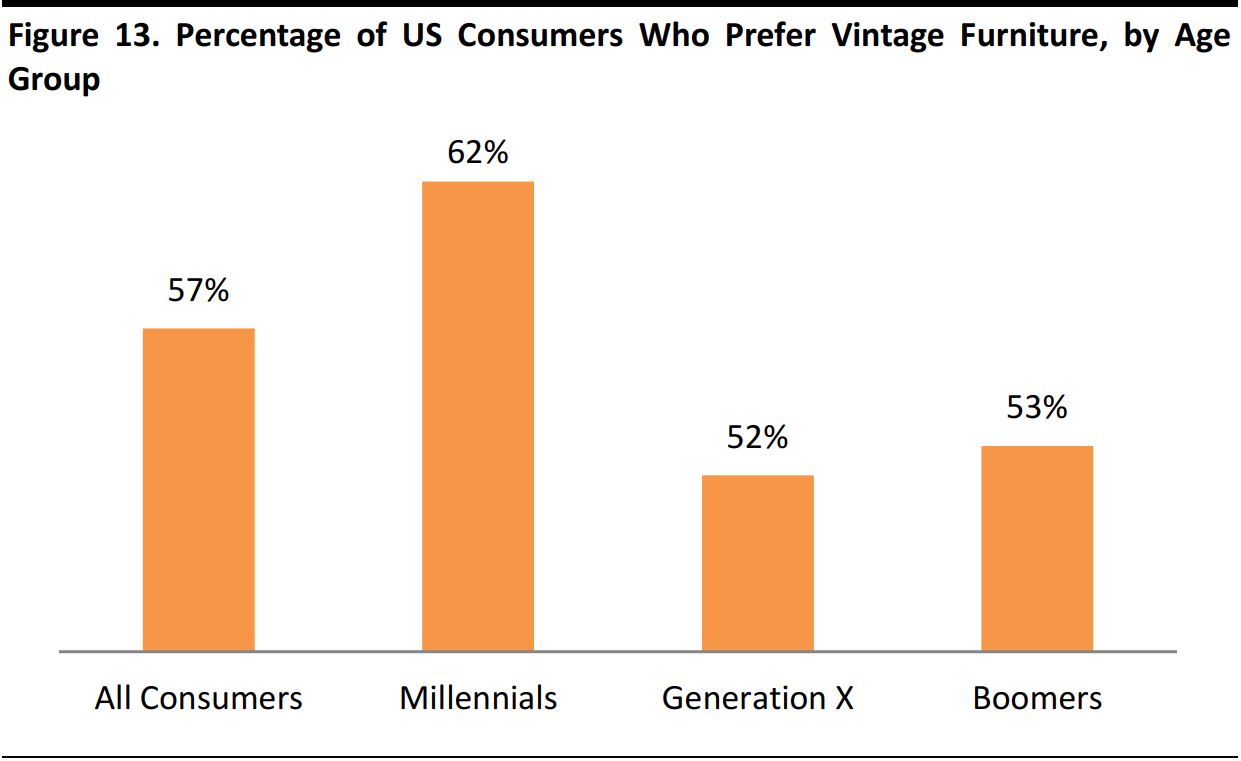

Vintage furniture is popular among US consumers. An average of 57% of those surveyed expressed a preference for vintage pieces, according to a 2016

Furniture Todaystudy.

Source: Furniture Today/Fung Global Retail & Technology

Source: Shutterstock

This preference for vintage furniture leads to the popularity of second-hand and used outlets. Sales in these two sectors accounted for an estimated 4% of furniture and bedding sales in 2015 according to

Furniture Today, and this represents more than $4 billion in retail sales.

Environmental Sustainability

Both consumers and furniture retailers are paying more attention to environmental issues. According to a 2015

Furniture Today survey, 70% of consumers are willing and prepared to spend more for eco-friendly materials, and the majority of them are willing to pay an additional 20%.

As a result, leading US furniture retailers are likely to focus on environmentally friendly business practices, products and packaging.

TECHNOLOGY AND INNOVATION

Furniture retailers are using technology to reach more customers and to create innovative products and new business models that help open more market opportunities.

MicroD: Online Solutions for Furniture Retailers

MicroD provides furniture merchandising solutions that give manufacturers and retailers the ability to build their brand online. It gives customers a more personalized virtual shopping experience. For example, its Room Planner feature enables customers to arrange furniture in a virtual floor plan and see what the products will look like in their rooms before they buy.

Source: MicroD

Source: MicroD

HUMElab: Furniture with Technology

HUMElab provides high-tech furniture. One of their key products is the TABATA touch table, an interactive coffee table. In addition to serving as an ordinary coffee table, TABATA enables users to play video games on it, handle documents, send emails and watch videos. It can be connected to users’ smartphones, tablets, internet boxes, TVs, home automation systems and other equipment.

Source: HUMElab

e15: Cooperation with Fashion Designers

Frankfurt-headquartered company, e15, works with designers, architects and artists to develop products that merge furniture and fashion design. Collaborating with fashion designers, e15 provided furniture for the Gothic Heiliggeistkirche in Germany. The chairs were designed to match the modern and minimal church interior. Materials, colors and the shapes of the chairs were specially designed to fit the setting.

Source: e15

CONCLUSION

Considering the favorable macroeconomic environment, we feel positive about the US furniture market. US consumers want quality and durability when they purchase furniture. They also expect short delivery times and products made in the US. Although e-commerce is still a nascent channel for the product category, brick-and-mortar furniture retailers should embrace its development and grasp the opportunities emerging in the market.

Source: Shutterstock

Source: Shutterstock

Source: MicroD

Source: MicroD