Executive Summary

This is our seventh monthly report based on Prosper Insights and Analytics’ Amazon Shopper Intelligence service.

In June 2017, Amazon announced that it would offer a 45% discount for its Prime membership to all government assistance recipients, a move that aims to lure more consumers away from competitors such as Walmart. In this report, we examine why Amazon could appeal to these lower-income shoppers, as well as discuss the challenges the company may face in acquiring these consumers.

Key Findings

- In 2016, 44.2 million Americans participated in the Supplemental Nutrition Assistance Program (SNAP)—more commonly known as food stamps—the largest government assistance program, in which approximately 14% of the US population is enrolled. Amazon’s latest initiative of offering a 45% discount on Prime membership to recipients of SNAP could lure more lower-income consumers away from Walmart. In 2013, Walmart received 18% of SNAP redemptions, which is equivalent to approximately $13 billion in sales, or about 4% of Walmart’s total US sales for that year.

- As of July 2017, 29% of lower-income consumers had a Prime membership, less than the national average of 44% of all consumers. Amazon’s Prime membership discount could boost the penetration rate among this consumer group, which appears ready for e-commerce. In 2016, 79% of lower-income consumers were online, up from 58% in 2007. Apart from Amazon’s competitive pricing, perks such as two-day free delivery would likely appeal to those consumers who might have reduced mobility (i.e., no car, limited access to public transportation, or no stores nearby).

- However, Amazon still faces a number of challenges to capture these lower-income consumers. Survey data shows that this group is 47% more likely to shop at Walmart than the average American consumer, making them the retailer’s most loyal customers. In addition, difficulties in terms of online payment (for example, lack of a credit card) remain a barrier for these consumers to shop regularly on Amazon.

About Amazon Shopper Intelligence Service

The

Amazon Shopper Intelligence Service provides members with monthly data on consumer shopping patterns and preferences, drawing on more than 10 years of data on Amazon shoppers as well as on shoppers at other leading retailers. The data are instructive in helping users make informed business decisions.

�

Background and Market Overview

In June 2017, Amazon announced a new initiative—all recipients of government assistance programs can subscribe to Amazon Prime membership for a monthly rate of $5.99, a 45% discount from the regular membership fee of $10.99 a month, or $99 a year, as of August 2017. The discounted Prime membership comes with the same benefits as those enjoyed by regular members, including unlimited free two-day delivery, access to the Prime video- and music-streaming platform, as well as discounts on selected items.

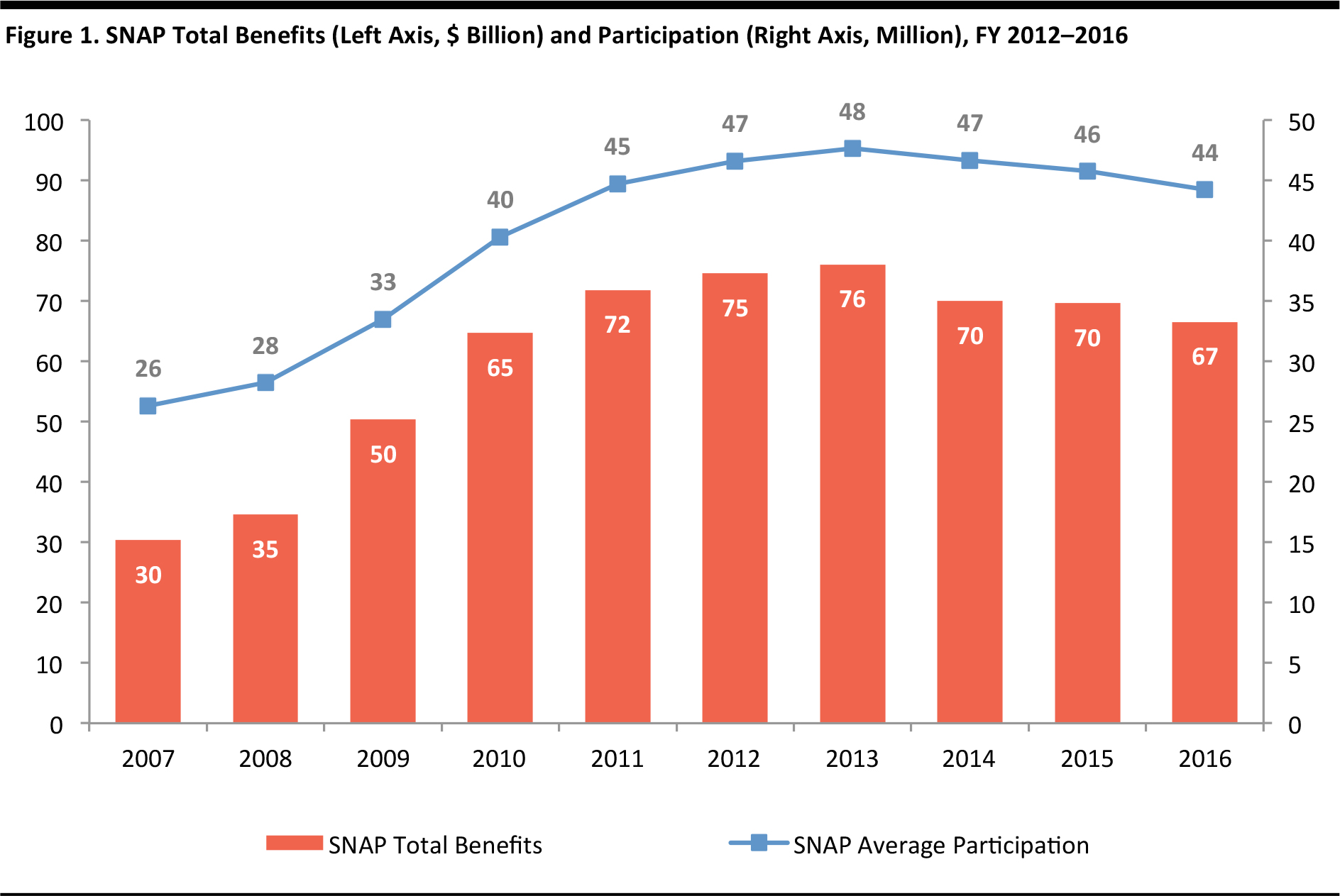

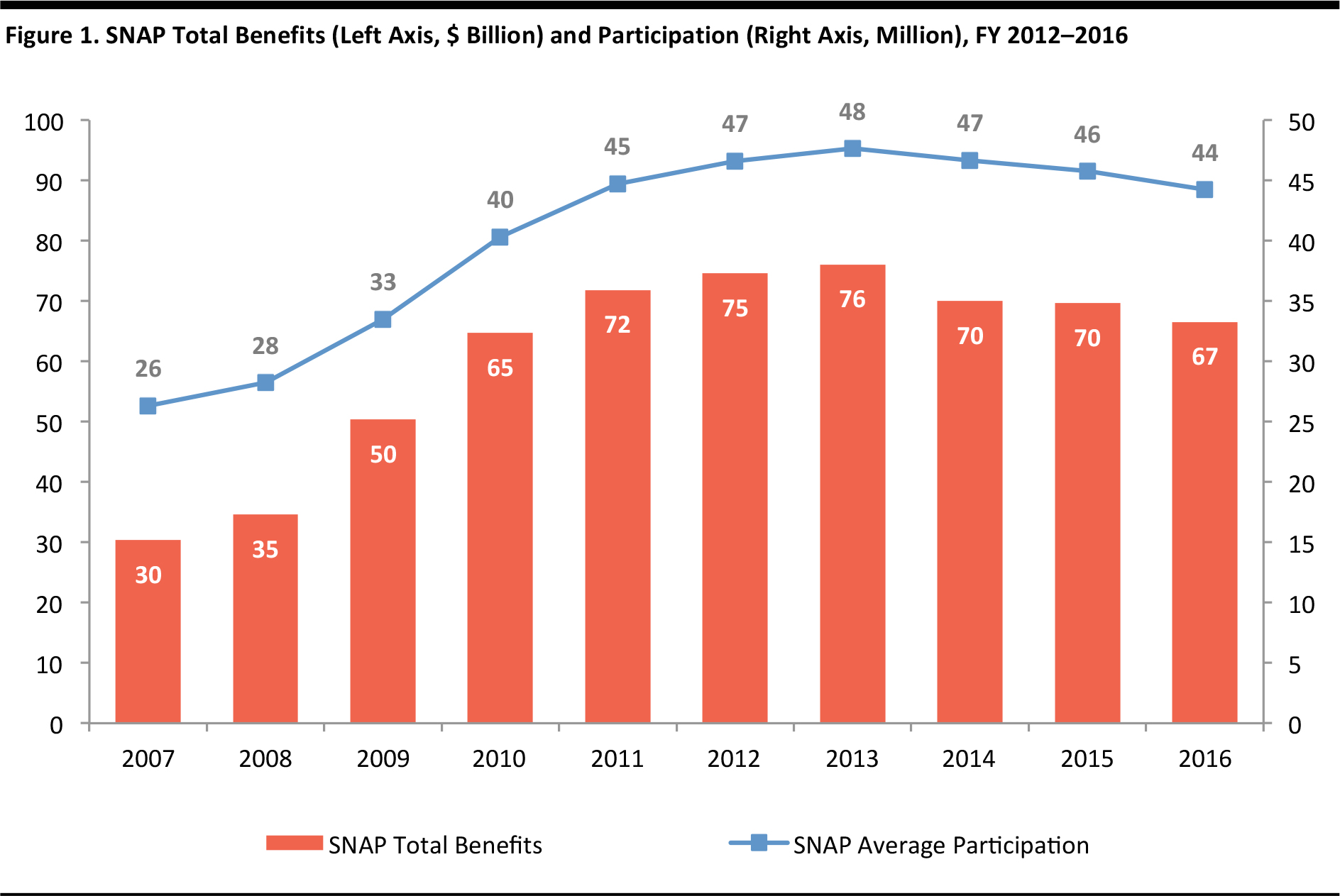

44.2 Million Americans Received Food Stamps in 2016

As of 2016, 44.2 million Americans received SNAP benefits (commonly known as food stamps). They comprise the largest group of benefit recipients in the country, and represent approximately 14% of the US population. Each SNAP recipient receives, on average, $125 per month, which can be redeemed for food items at grocery stores. This translates into $66.5 billion of spending through the SNAP program, according to the US Department of Agriculture (USDA).

In addition, recipients of the Special Supplemental Nutrition Program for Women, Infants and Children (WIC), as well as the Temporary Assistance for Needy Families (TANF) are also eligible for the Prime membership discount. As of 2016, there are 7.7 million and 2.8 million Americans who receive benefits from these two programs, respectively, and in some states, it is possible to enroll in both WIC and SNAP.

Source: Food and Nutrition Service, US Department of Agriculture (USDA)

Taking Direct Aim at Walmart

Amazon’s move to offer discounted Prime membership to government assistance recipients is taking a direct aim at Walmart, a popular destination among lower-income shoppers.

Source: Walmart.com

Indeed, Walmart took 18% of SNAP redemptions in 2013 (latest disclosed figure), which is equivalent to approximately $13 billion in sales, or about 4% of Walmart’s total US sales for that year. It is believed that Walmart accounts for most SNAP redemptions, according to a report by Slate.

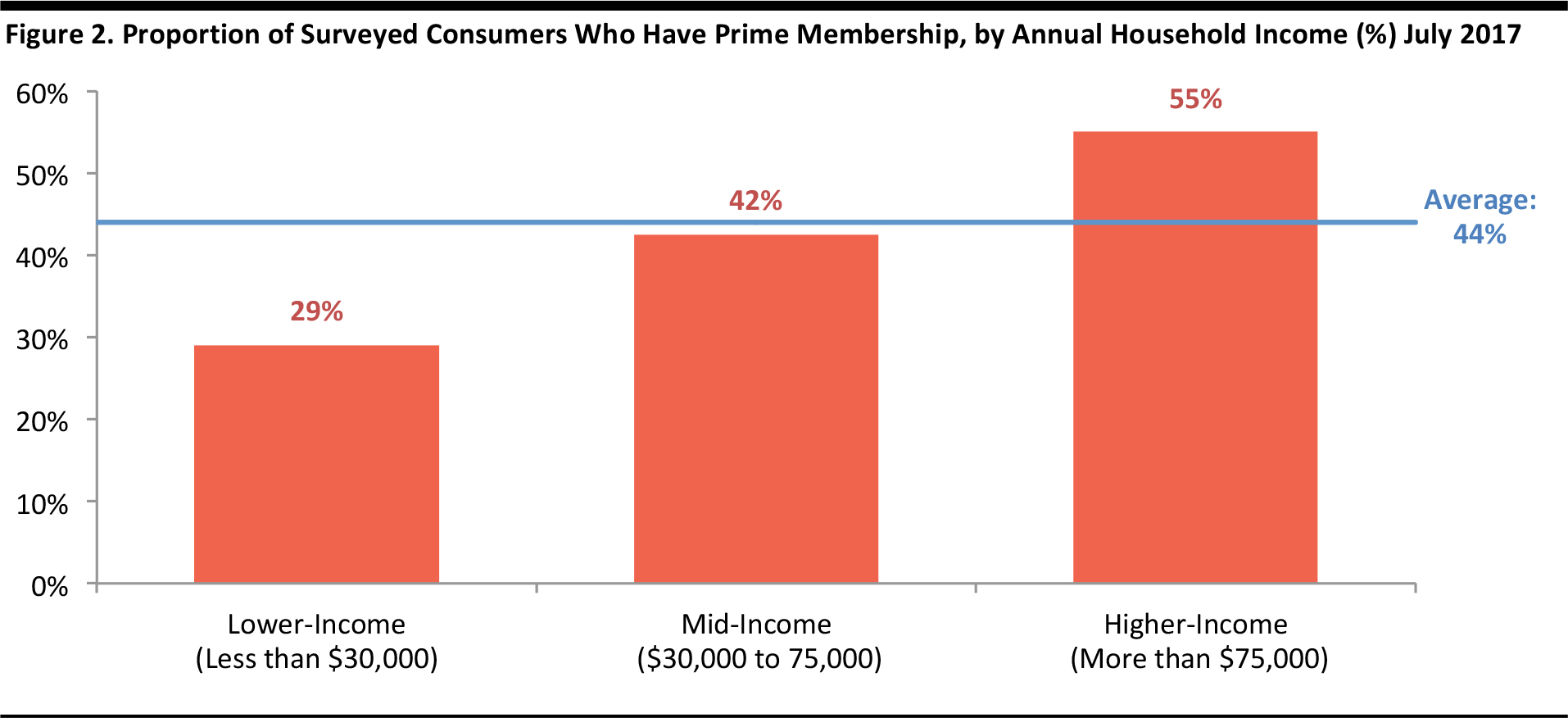

Prime Is Less Popular Among Lower-Income Shoppers

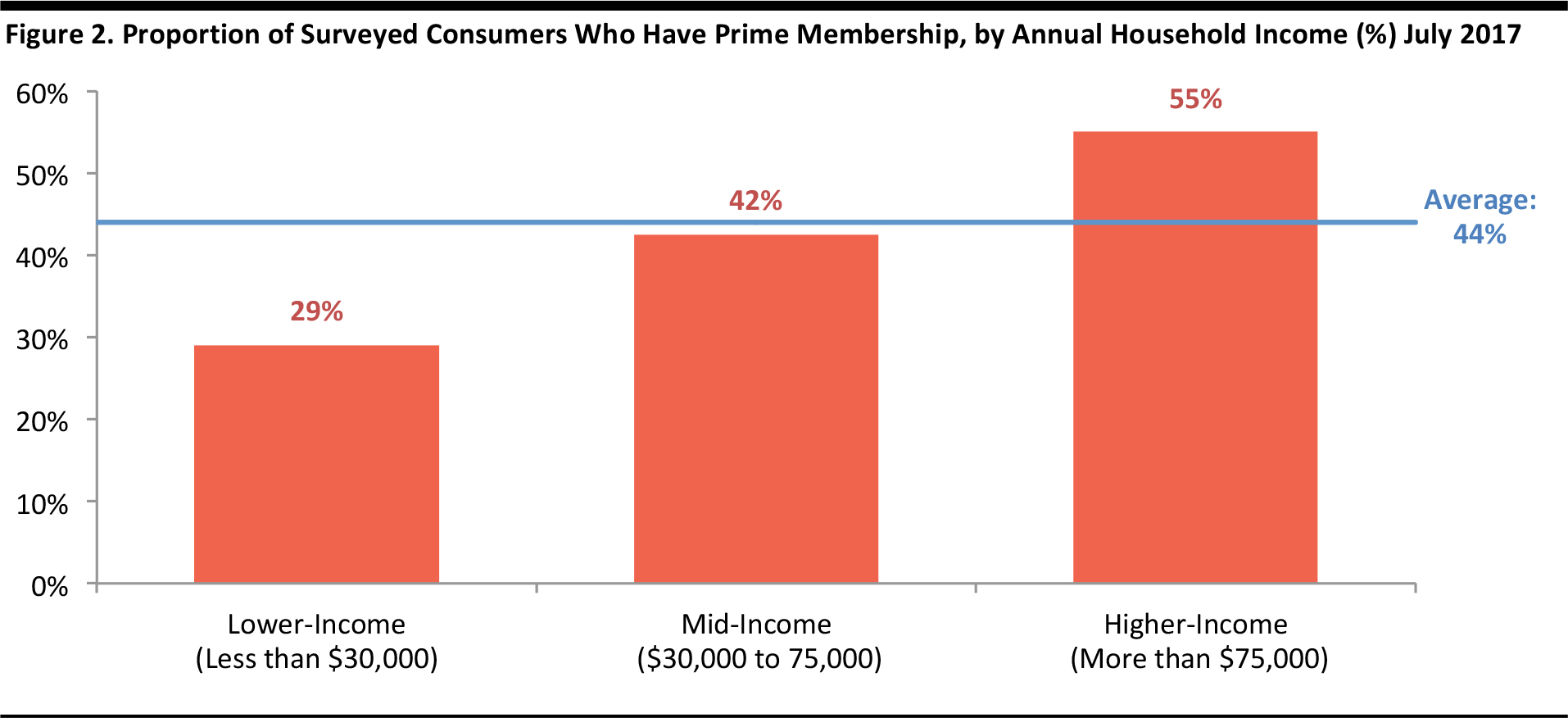

To understand what impact a discounted Prime membership fee would have for recipients of government assistance programs, we examine Prime’s penetration rate by annual household income. We focus on the income group with an annual income of less than $30,000, which is comparable to the SNAP income limit for a four-person household with $31,596.

According to Prosper’s monthly consumer survey, 44% of surveyed US consumers reported having a Prime membership, as of July 2017. Prime’s penetration rate is correlated with affluence; the survey shows that only 29% of the lower-income consumers have a Prime membership, which is below the national average of 44%.

Base: Adults aged 18+ (N = 7,266).

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Why Could Prime Attract Lower-Income Shoppers?

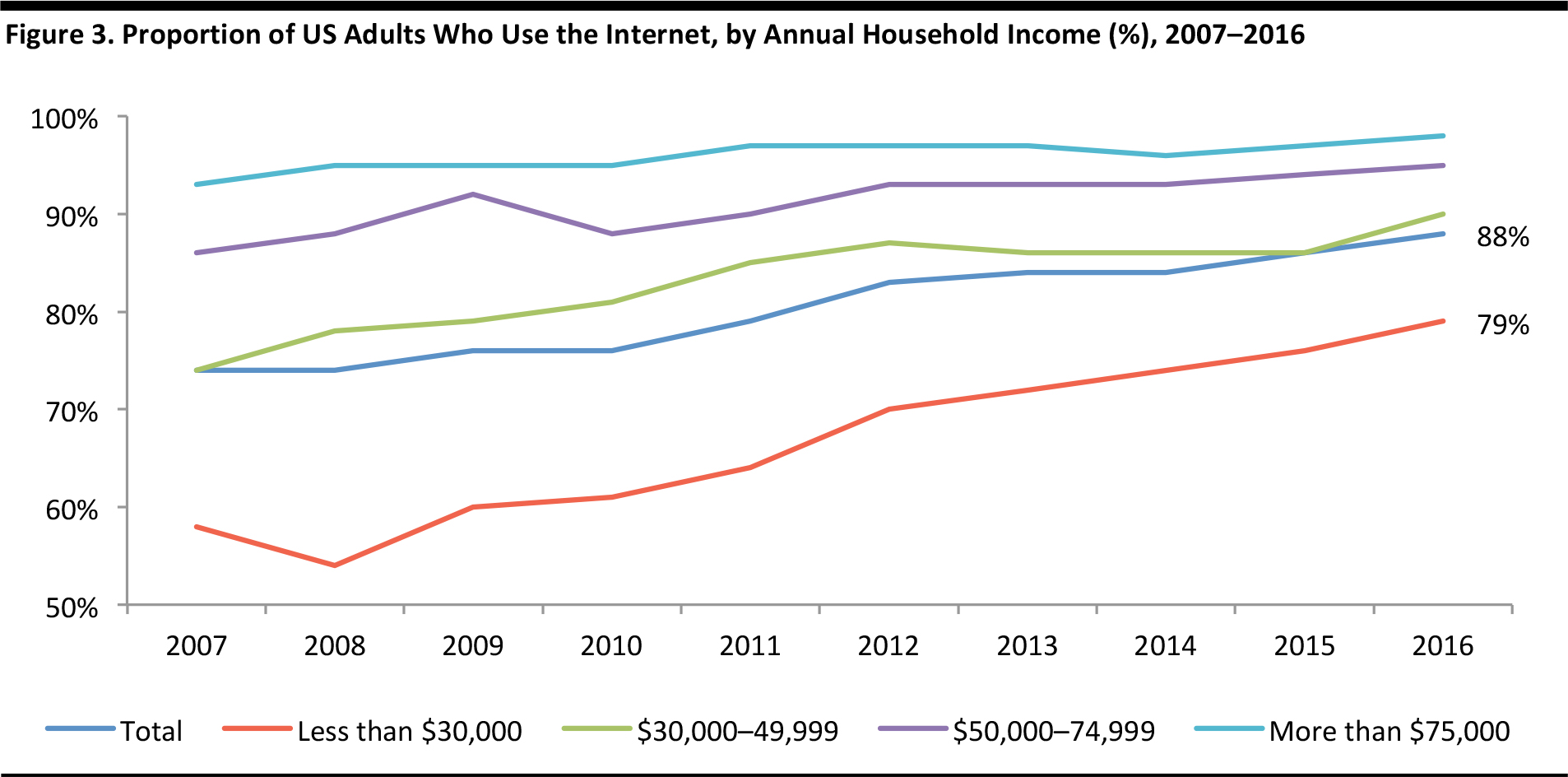

Lower-Income Shoppers Are Ready for E-Commerce

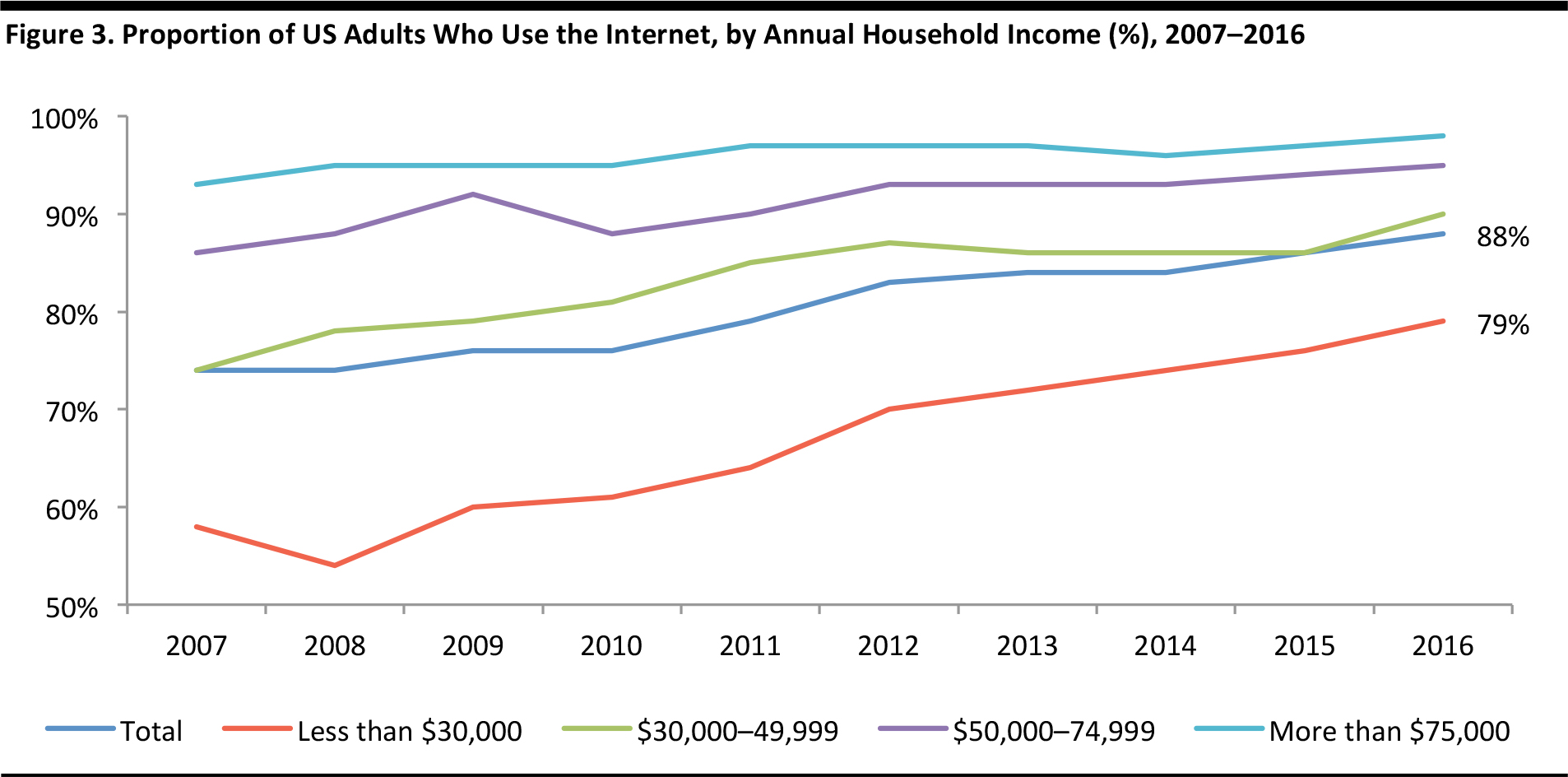

Internet connectivity is the core prerequisite to shop online, however, only 58% of lower-income Americans had used the Internet in 2007, significantly lower than the national average of 74%, according to the PEW Research Center. In 2016, this figure improved significantly, increasing to 79%, closer to the national average of 88%.

Source: PEW Research Center

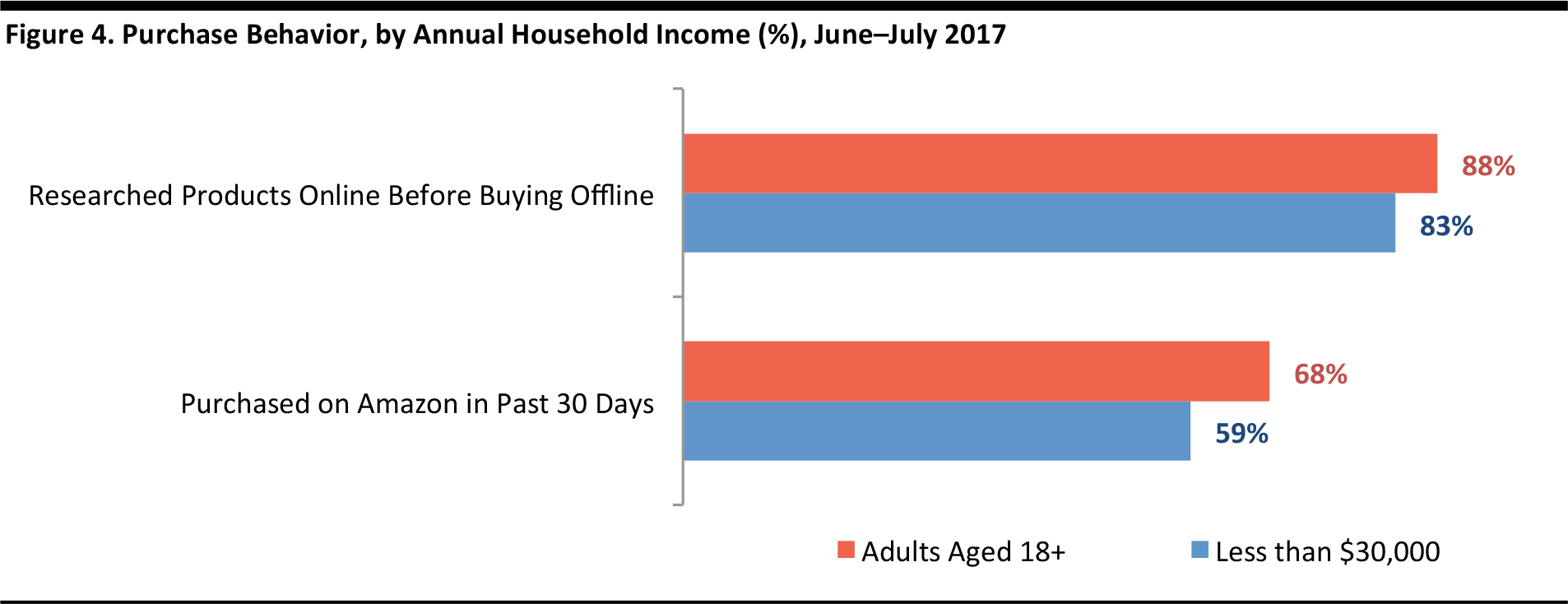

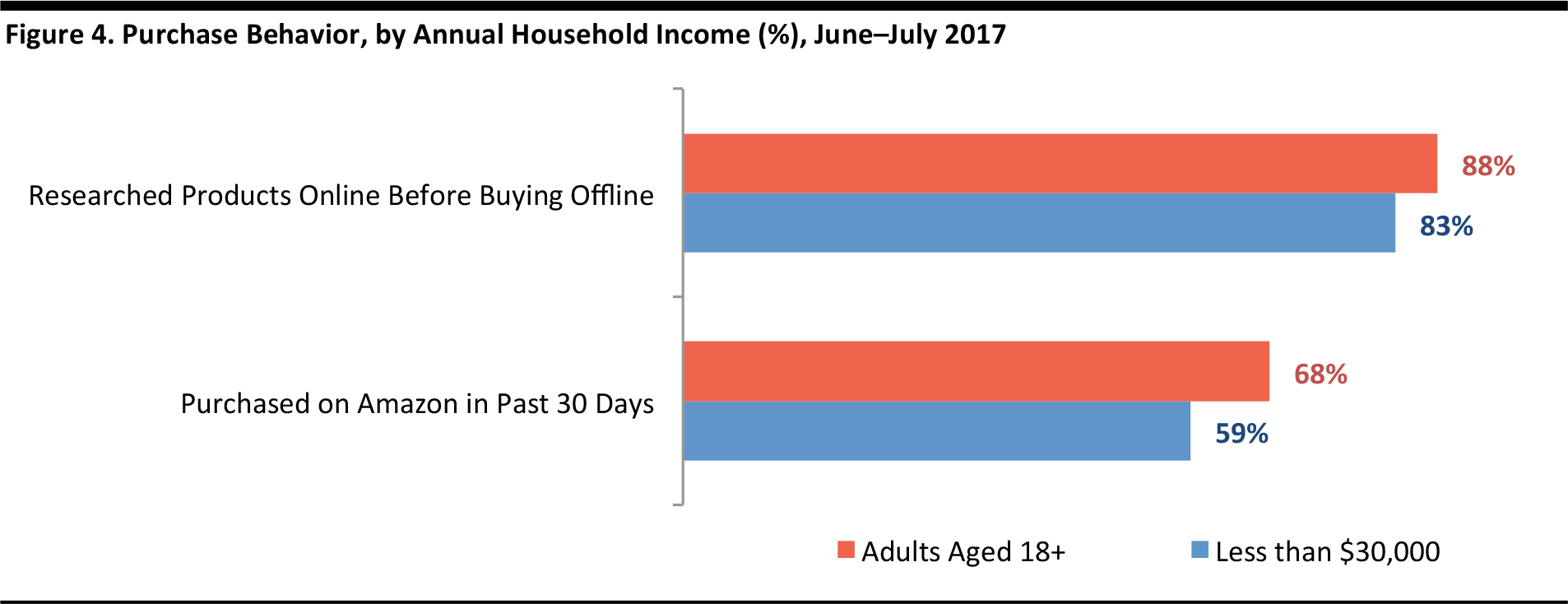

Among lower-income Internet users, the majority have already partly or fully engaged in e-commerce: 83% had researched products online before buying them offline in July 2017, only 5 percentage points lower than the national average. Moreover, over half of the surveyed lower-income respondents had shopped on Amazon in the past 30 days prior to June 2017

Base: Adults aged 18+ (N = 7,258–7,266).

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Amazon Offers Competitive Pricing

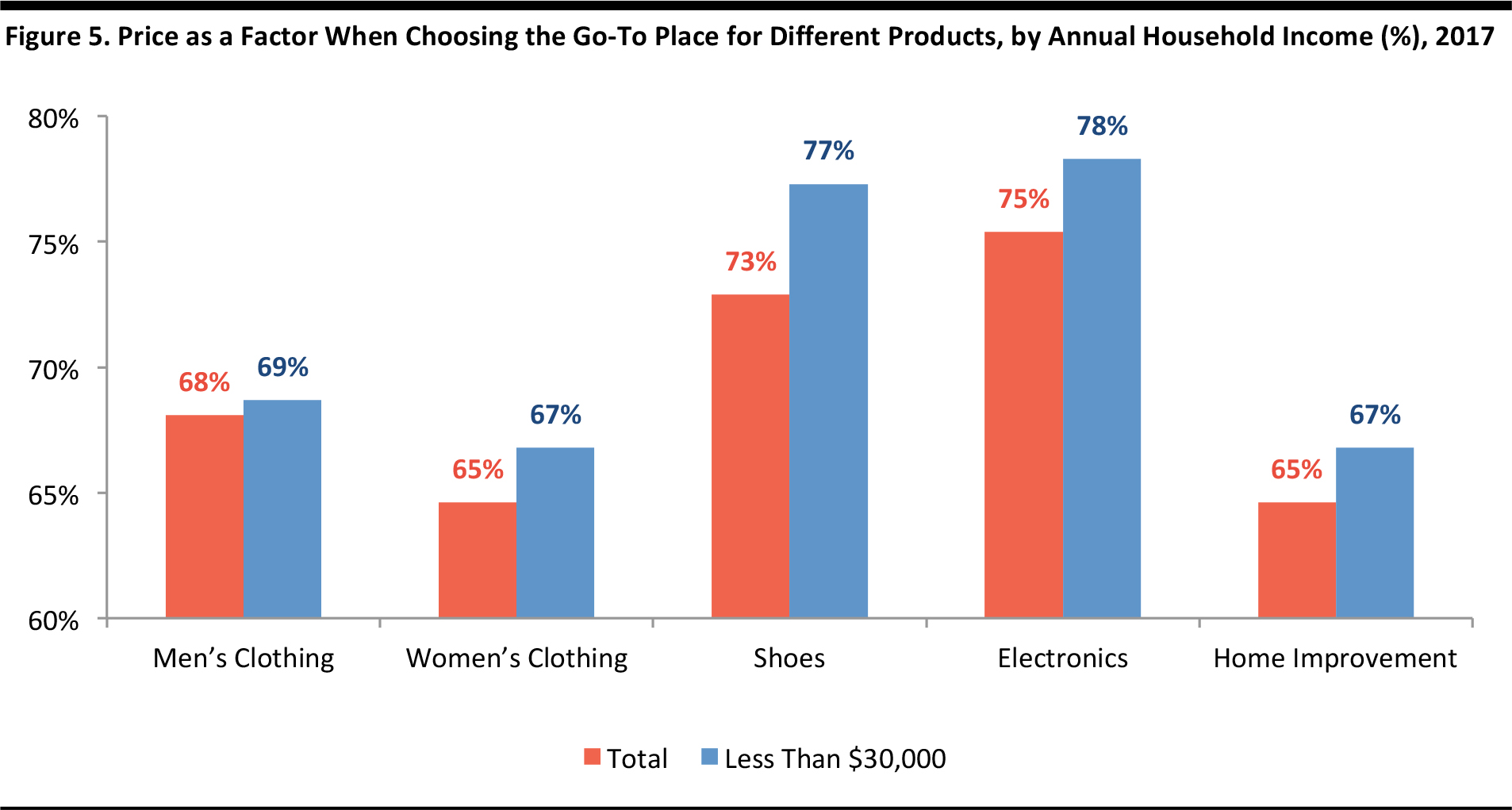

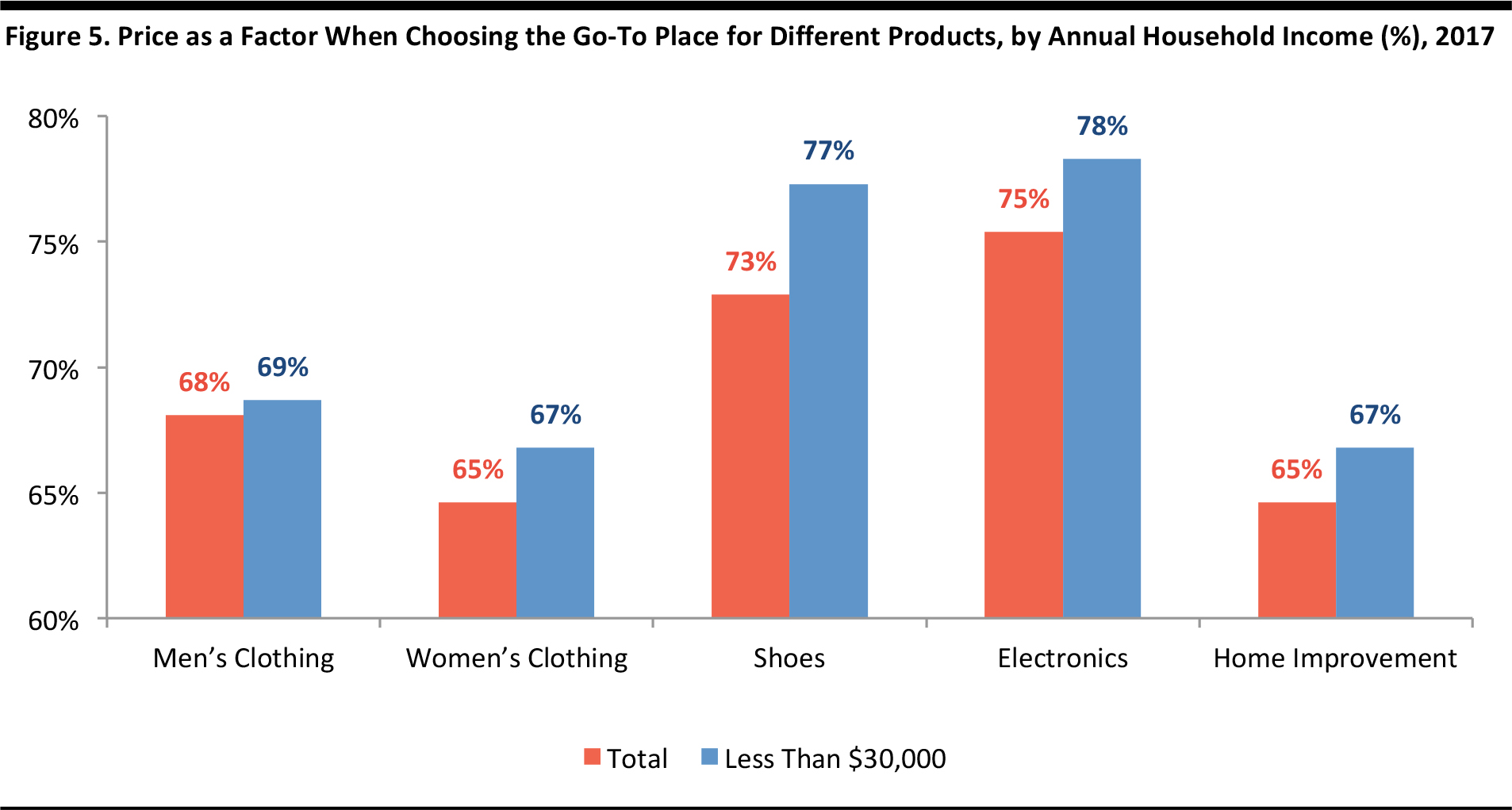

Lower-income consumers are more price sensitive, as they often have a tighter budget to spend. When asked about factors in choosing the go-to place for various product categories, price stands out as one of the most-mentioned factors among lower-income consumers.

Source: iStockphoto

According to Prosper’s monthly consumer survey, 78% of lower-income consumers mentioned price as a factor when choosing their go-to electronics retailer, higher than the average of 73%. This difference is more significant in electronics than in other categories such as clothing and home improvement products.

Base: Adults aged 18+ (N = 7,266).

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Similar to Walmart, Amazon has also been offering some of the most competitive pricing among US retailers. For instance, the average toy prices of Amazon and Walmart were a respective 3% and 7% lower than other US retailers, according to research conducted by e-commerce analytics firm Profitero in November 2016.

The Prime Discount Addresses Issues Faced by Lower-Income Consumers Lump-Sum Annual Fee Barrier

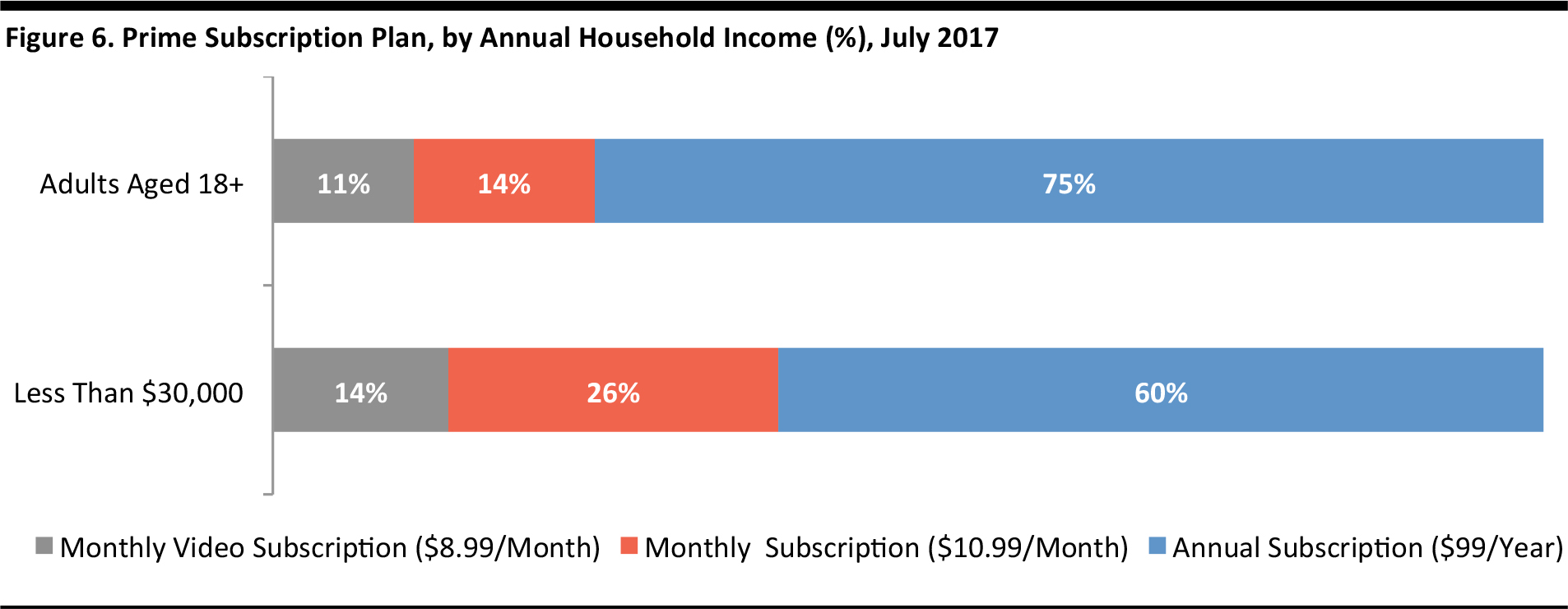

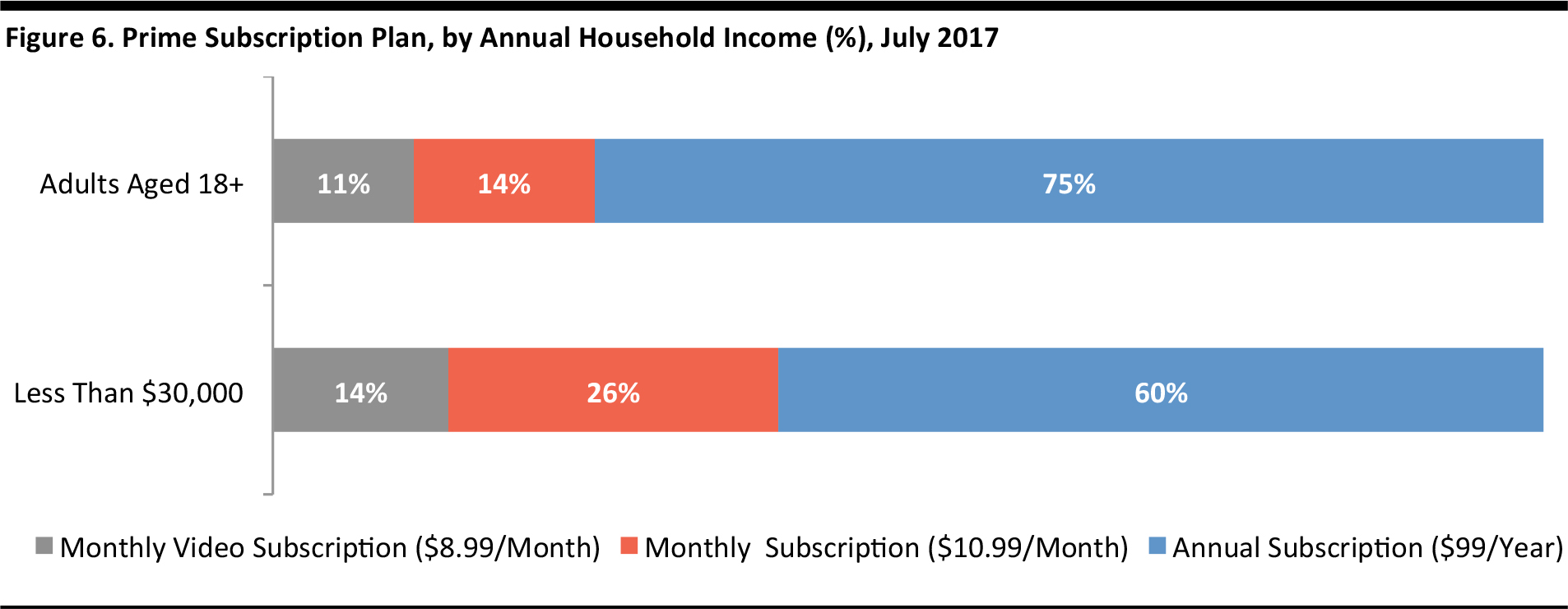

Amazon’s annual subscription plan is the most popular Prime membership, with 75% of surveyed Prime members enrolled, as of July 2017. The higher popularity of the annual plan can be attributed to its lower cost, which is 25% cheaper than subscribing to the monthly plan for a full year.

Source: Amazon.com

However, the survey shows that 26% of lower-income consumers subscribe to the monthly plan, significantly higher than the average of 14% for consumers overall. As lower-income consumers often have a tighter budget, they may not be able to afford the lump-sum payment for the $99 annual fee. While some of these consumers may resort to the monthly plan, others may simply give up the Prime membership altogether.

Hence, the discounted Prime membership charged on a monthly basis could appeal to lower-income consumers, as it removes the barrier of making a lump-sum payment in order to enjoy the lower Prime membership fee.

Base: Adults aged 18+ (N = 7,266).

Source: Prosper Insights & Analytics, Monthly Consumer Survey

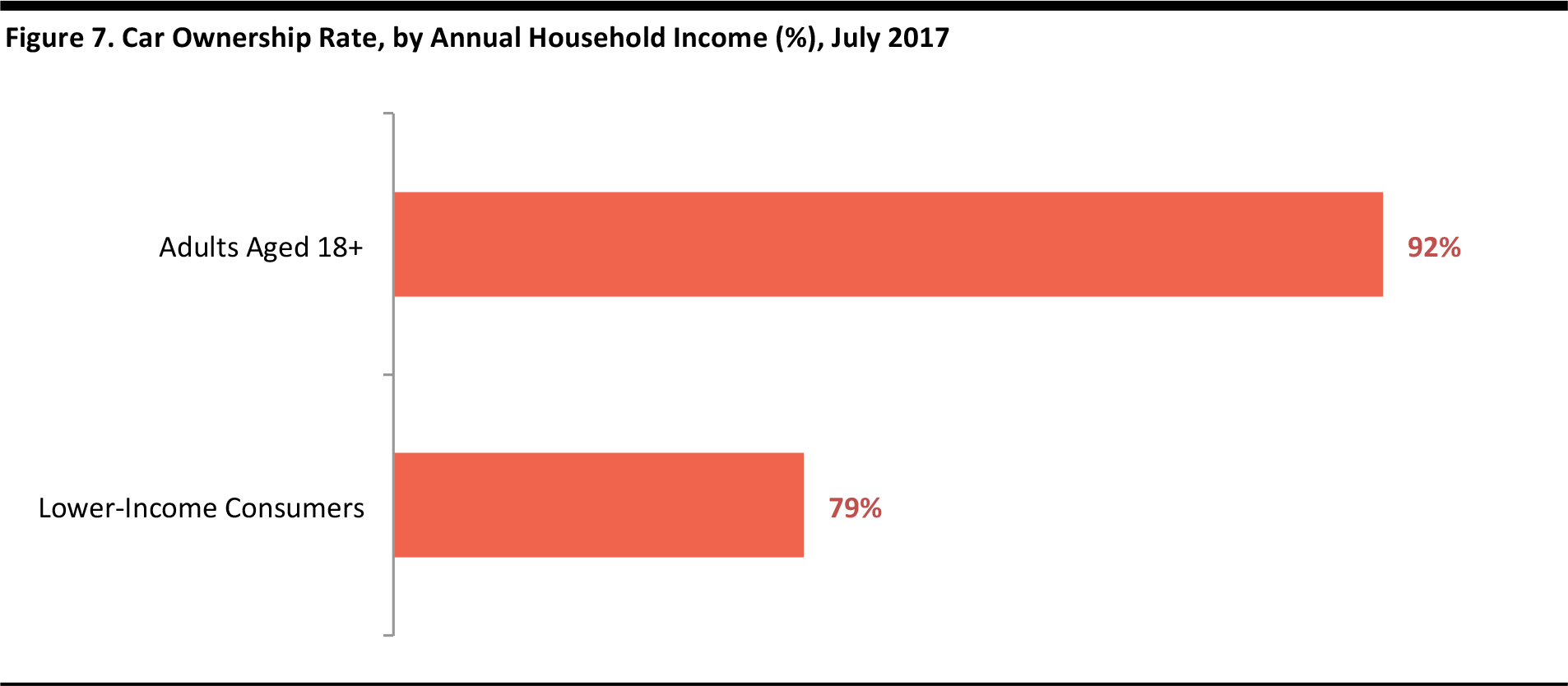

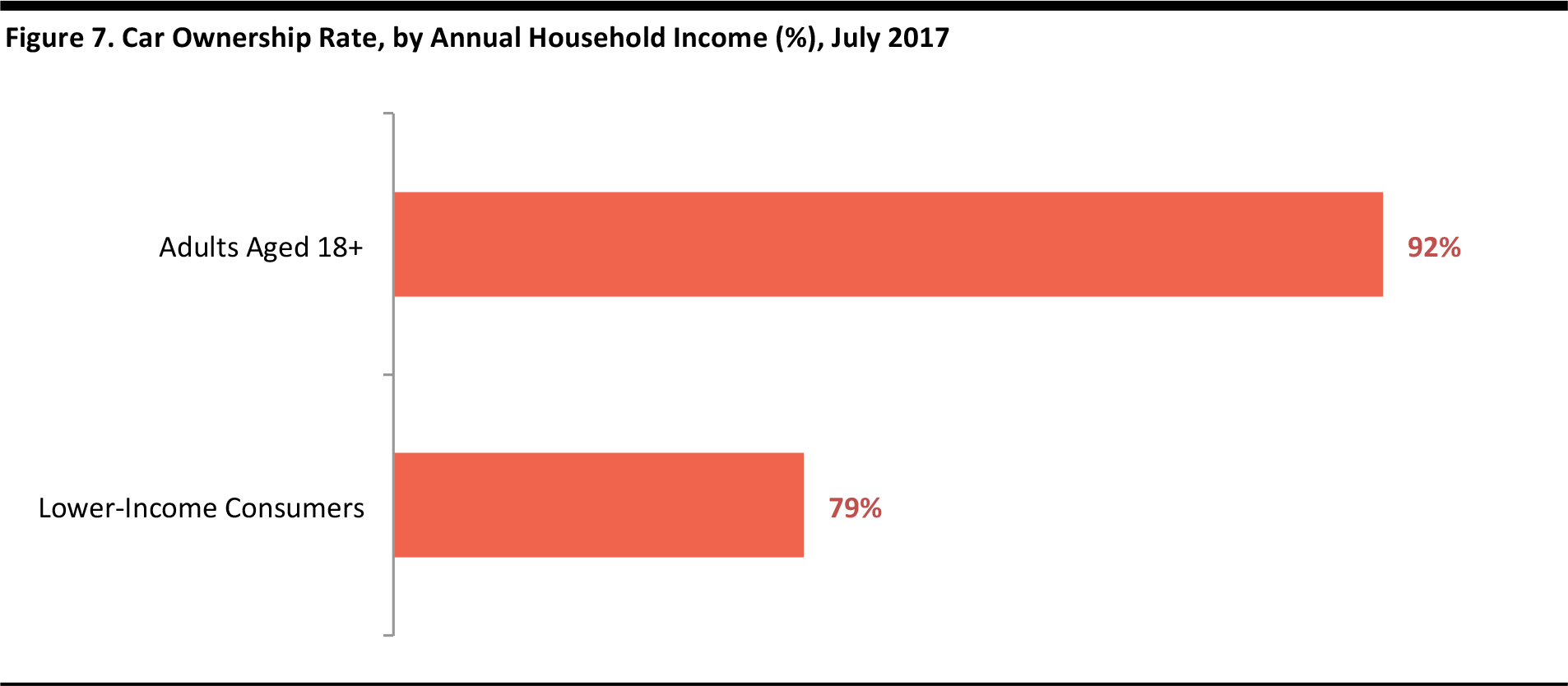

The unlimited two-day free-delivery that comes with Prime membership could appeal to lower-income shoppers too, especially for those living in rural areas where retail outlets require longer commutes, where they might have reduced mobility due to the cost of gas for shopping trips, or in some cases, not be able to afford a vehicle. The Prosper monthly consumer survey shows that 72% of lower-income shoppers own a car, truck or SUV, significantly lower than the average of 92% for all consumers.

Source: Amazon.com

Base: Adults aged 18+ (N = 7,266).

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Challenges Faced by Amazon

While lower-income consumers are ready for e-commerce, Amazon still faces a number of challenges to attract these consumers, despite its latest initiative of a discounted Prime membership.

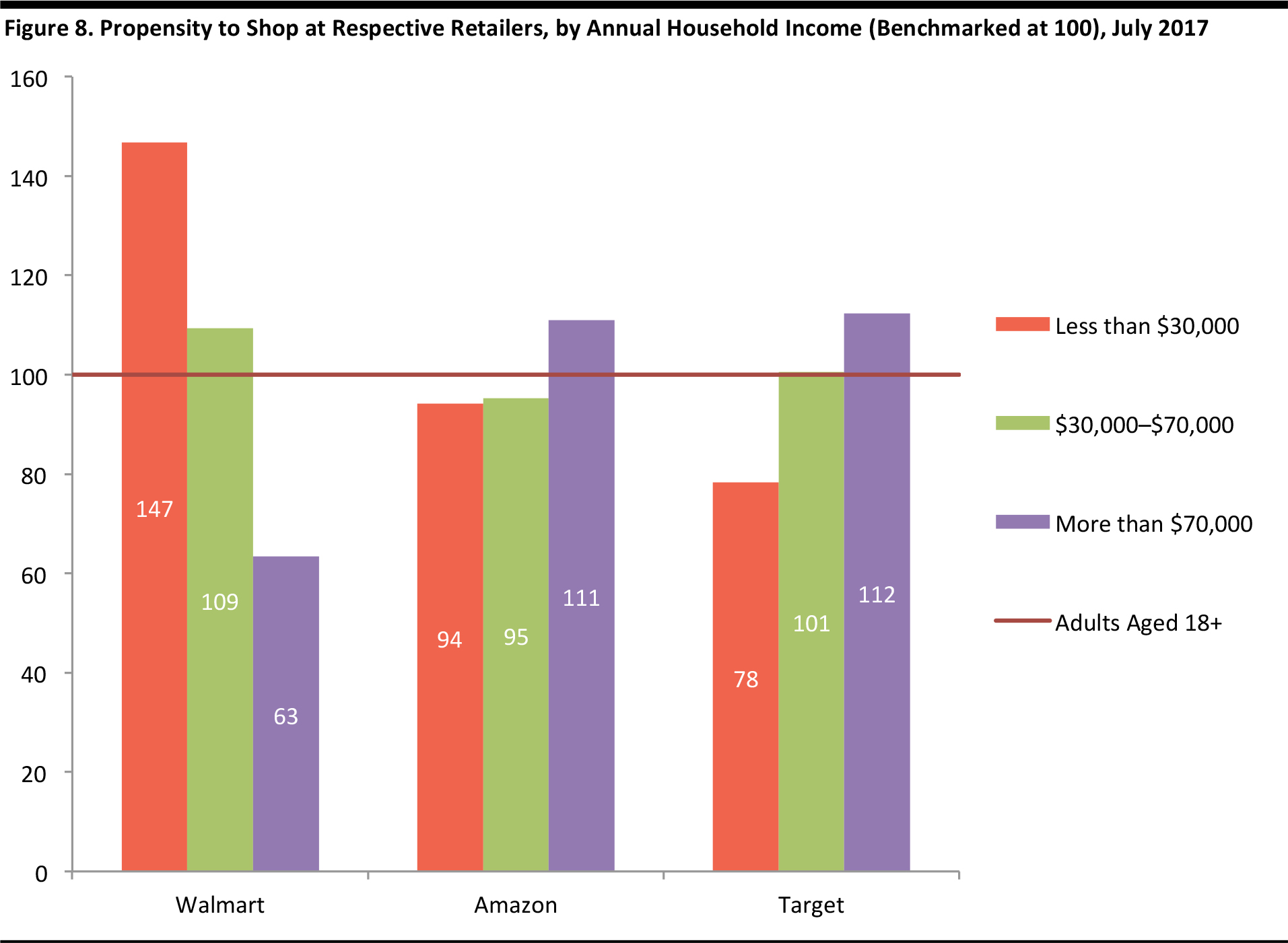

Lower-Income Shoppers Are Walmart’s Loyal Customers

As mentioned earlier, over half of the lower-income shoppers had shopped at Amazon in the past month prior to July 2017, yet their relationship with Walmart is much closer than it is with Amazon.

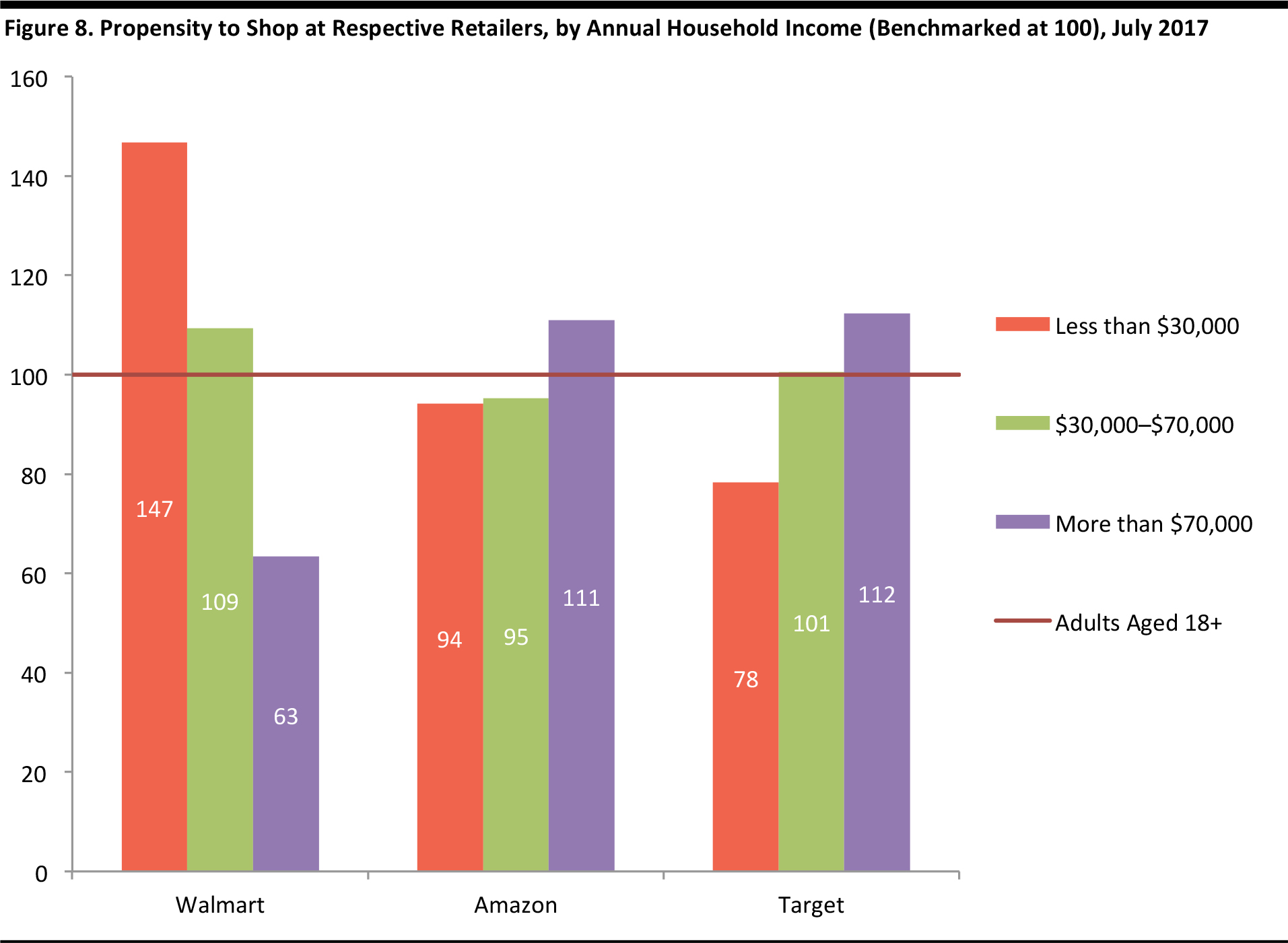

Prosper’s Shopper Composite Preference Index, which benchmarks shopper loyalty based on unaided questions in different product categories, reveals that lower-income shoppers are 47% more likely to shop at Walmart than the average American.

In addition, Walmart serves as a convenient, one-stop shop for consumers, with its wide range of product offerings, including groceries. Lower-income consumers can spend their SNAP benefits at Walmart on grocery items, but to do the same on Amazon would require an additional fee of $14.99 to pay for the Amazon Fresh service.

Base: Adults aged 18+ (N = 7,266).

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

Payment Options Remain the Main Barrier

In January 2017, Amazon announced it would participate in a two-year pilot program to accept SNAP benefits for online grocery orders. However, for other purchases, a credit card or checking account would still be required, which might be a barrier for some lower-income shoppers.

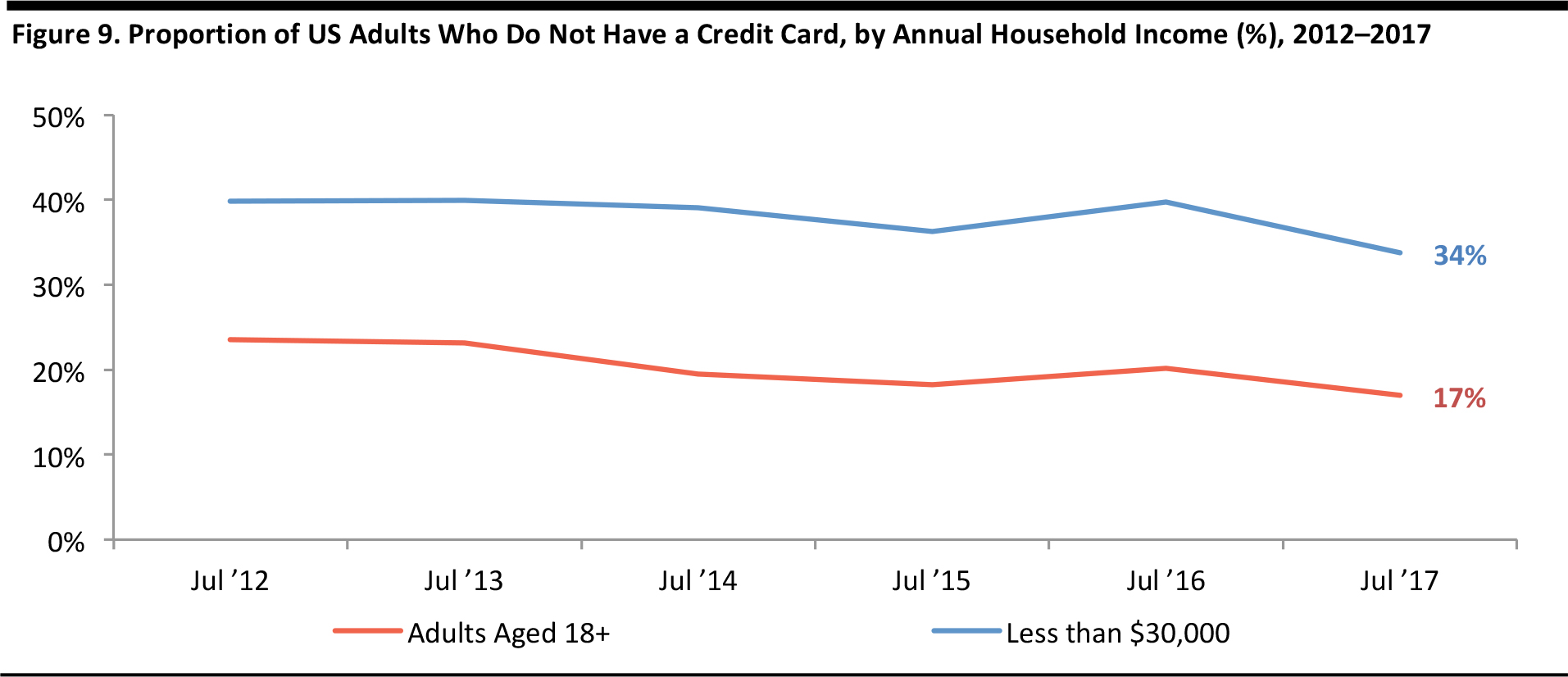

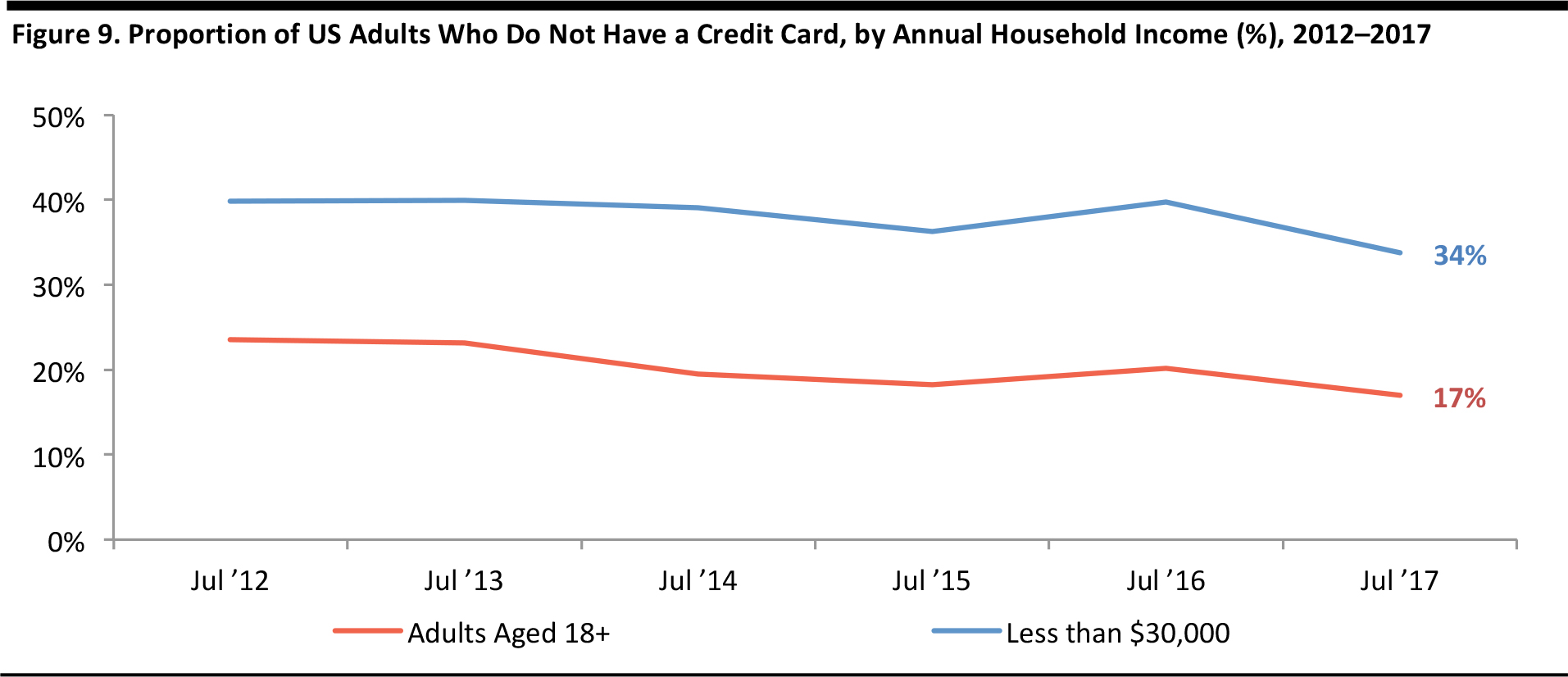

According to Prosper’s monthly consumer survey, 34% of lower-income consumers did not have a credit card, as of July 2017, down from 40% in July 2012, but still significantly higher than the average consumer at 17%.

Base: Adults aged 18+ (N = 5,635–9,009).

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

In April 2017, Amazon introduced Amazon Cash—another way that it can cater to the needs of those customers who do not have a bank account or credit card. Amazon Cash allows customers to top up their account using cash at over 10,000 retail outlets, including CVS, Speedway, D&W Fresh Market and other retailers.

Source: Amazon.com

One negative is that these consumers may not want to tie up their money in a holding account. In addition, users may find using Amazon Cash a challenging experience, according to Joe Kleinwaechter, VP of Innovation and Design at Worldpay.

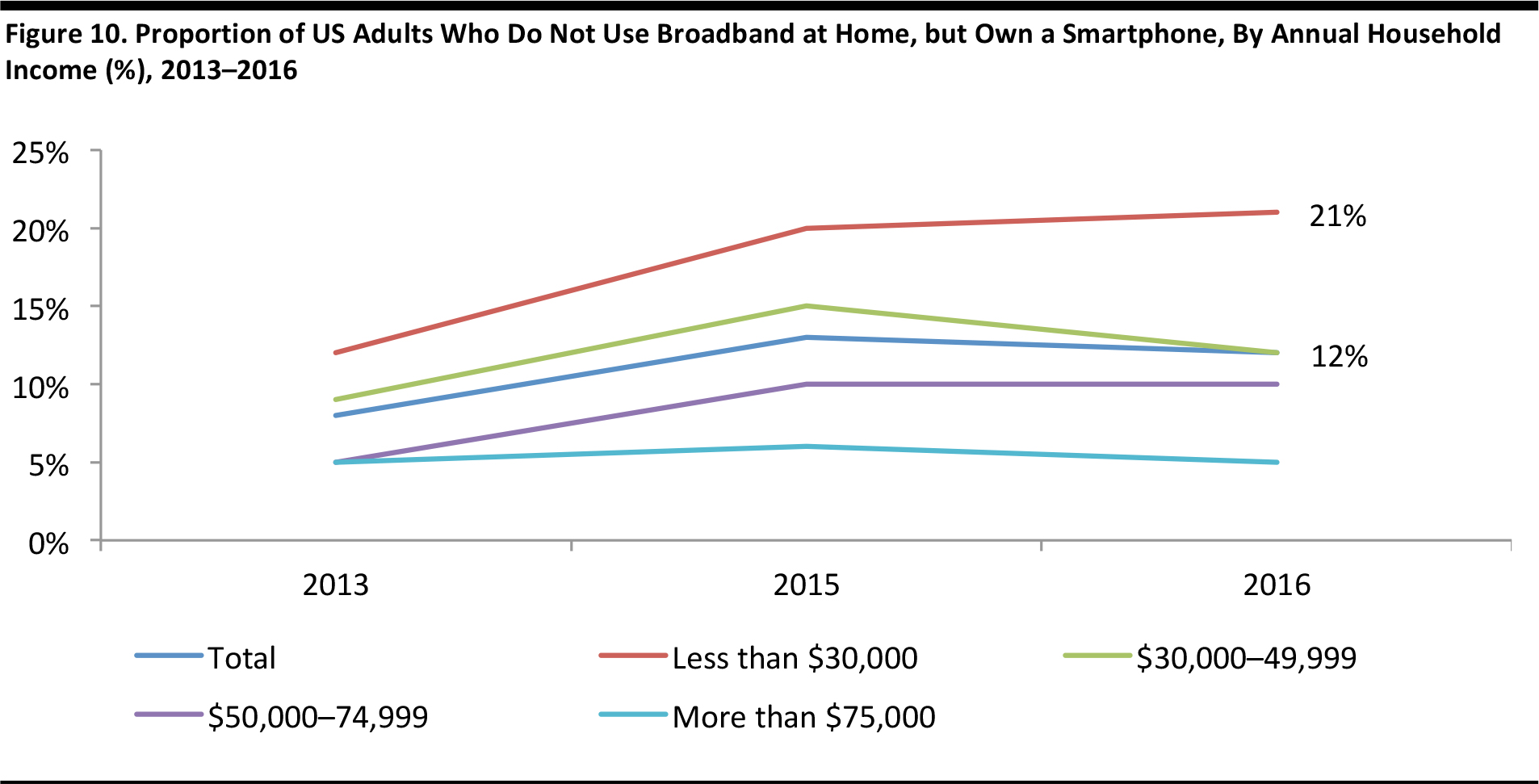

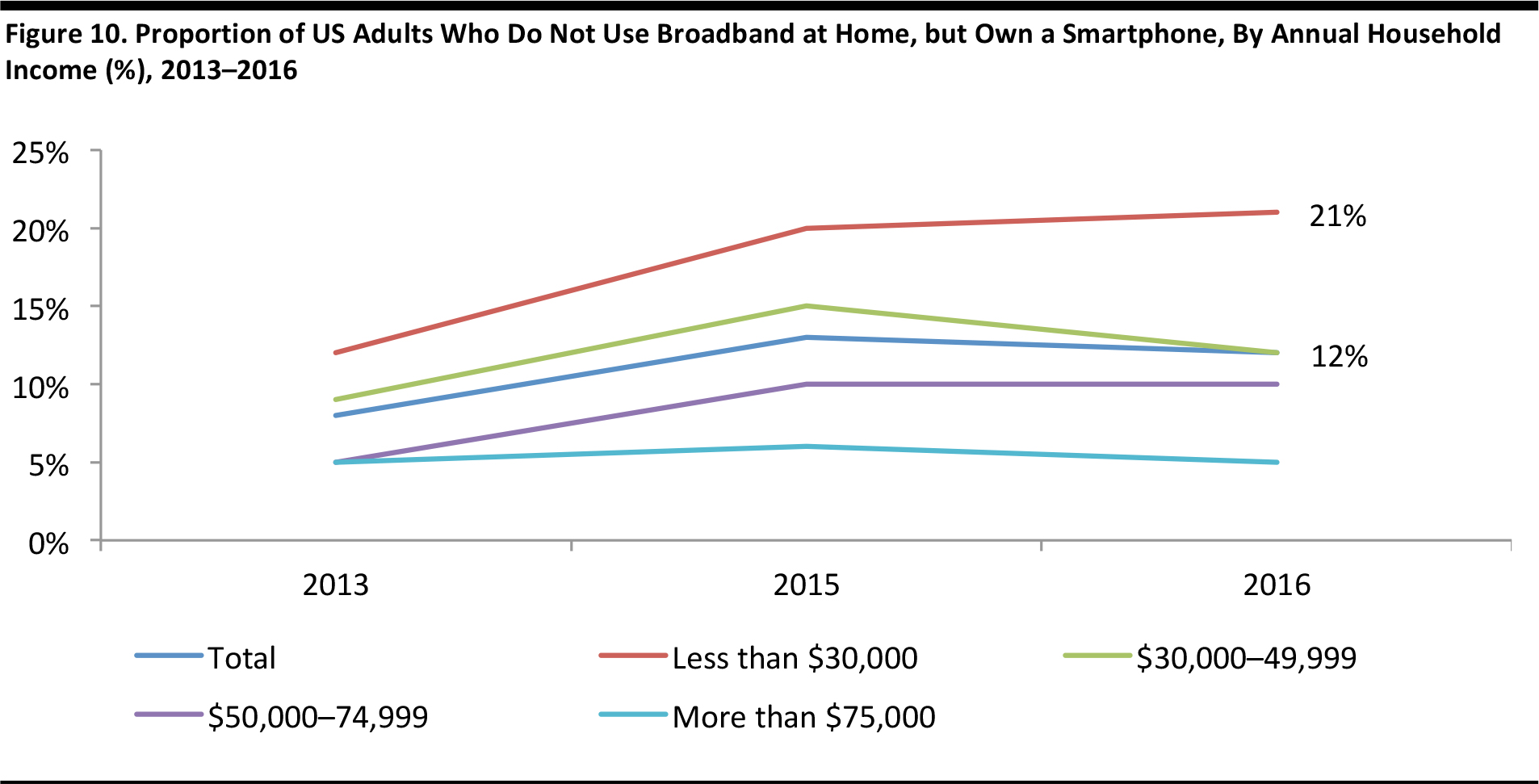

Lower-Income Shoppers Tend to Be Smartphone-Only Users

While more lower-income Americans are now online, 21% of them are “smartphone-only” Internet users, higher than the average American at 12% in 2016, according to the PEW Research Center. As this consumer group primarily use a smartphone to go online without a traditional home broadband service, this might be a barrier for them to shop online.

Source: PEW Research Center

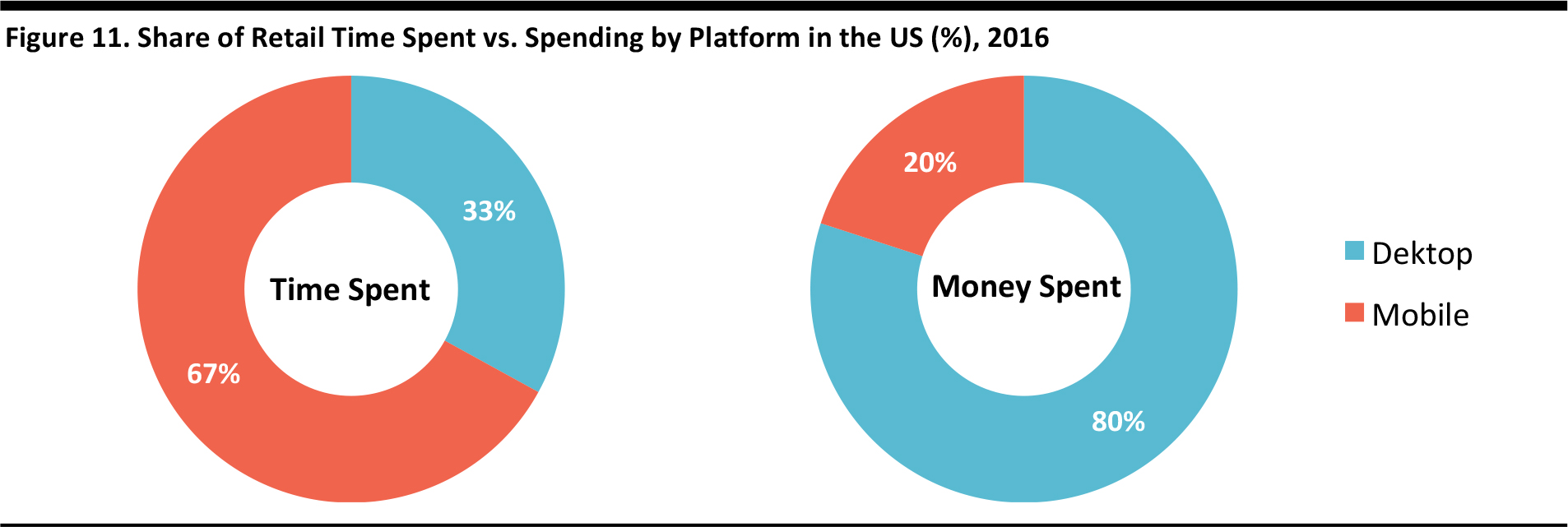

Those who shop on mobile are often less satisfied with the experience, according to PwC’s Total Retail consumer survey—40% of global consumers cited screen size as the greatest obstacle to shopping on mobile, and 26% mentioned that mobile sites are simply not easy to use.

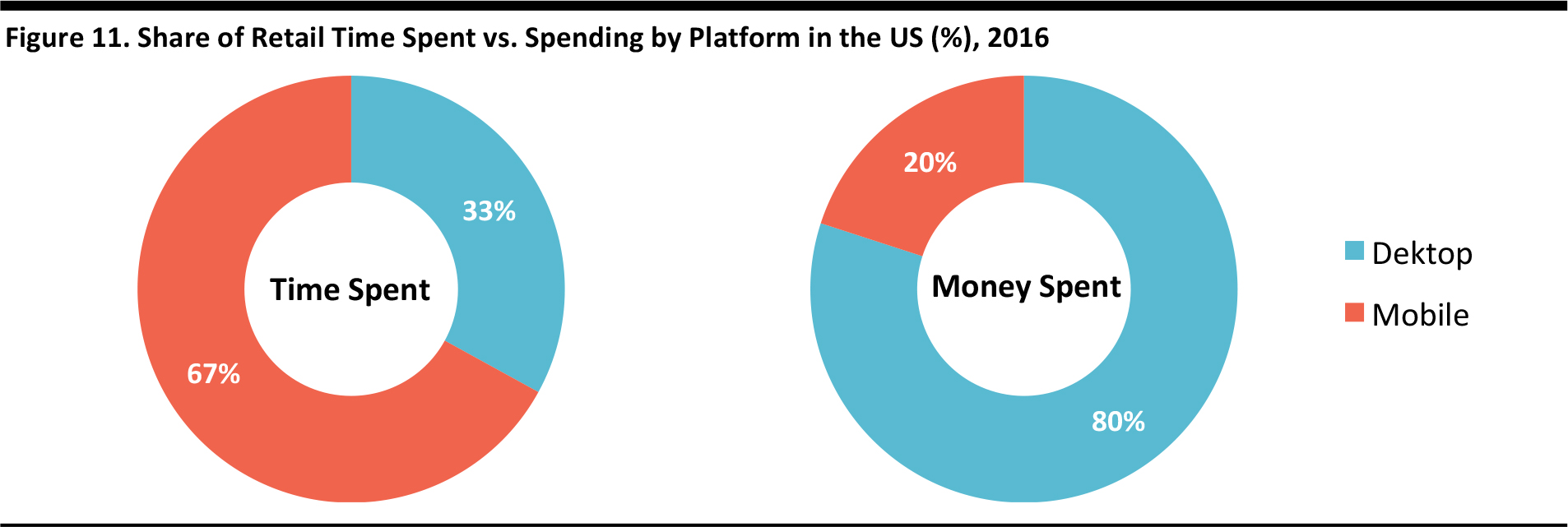

Compared with those using a desktop to shop, it is more difficult to convert sales on mobile shopping platforms. In 2016, mobile accounted for 67% of time spent shopping online, yet accounted for only 20% of total e-commerce spend in the US, according to comScore’s M-Commerce and E-Commerce measurement.

Source: comScore US M-Commerce and E-Commerce measurement, 2016

Key Takeaways

- Despite having weaker spending power, the lower-income consumer group in the US still represents a significant opportunity for Amazon to generate growth in the long term, and means that Amazon will have every income segment in the US covered.

- However, we believe the discounted Prime membership will not drive up sales for Amazon in the near term. Key competitors such as Walmart offer a convenient, one-stop shop location for these consumers to spend their SNAP benefits on groceries, as well as on a wide range of items at a competitive price.

- In the long term, once Amazon is able to reap the benefits of the synergies from its acquisition of Wholefoods and further expand into grocery, together with other initiatives assisting these lower-income consumers to shop online, we believe Amazon will become a viable competitor to Walmart in this segment.

About the Amazon Shopper Intelligence Service

The

Amazon Shopper Intelligence Service combines Fung Global Retail & Technology analysis and commentary with input on thousands of US shoppers from Prosper. It includes:

- Over 10 years of data on Amazon shoppers as well as on leading retailers’ shoppers

- Prosper Shopper Preference Share (indicates how Amazon is growing as a preferred retailer for 11 different merchandise categories, and the reasons why)

- Retail positioning maps (plot retailers and their competitors based on the percentage of their shoppers who shop there for particular reasons)

- Net promoter scores

- Key demographics