Executive Summary

Across the globe, more and more people are turning to city-center living. This migration encompasses rural to urban movement in fast-developing economies such as China, younger people moving to city areas in Western economies, and a resurgence in city-center living among more affluent consumers in major cities such as New York and London.

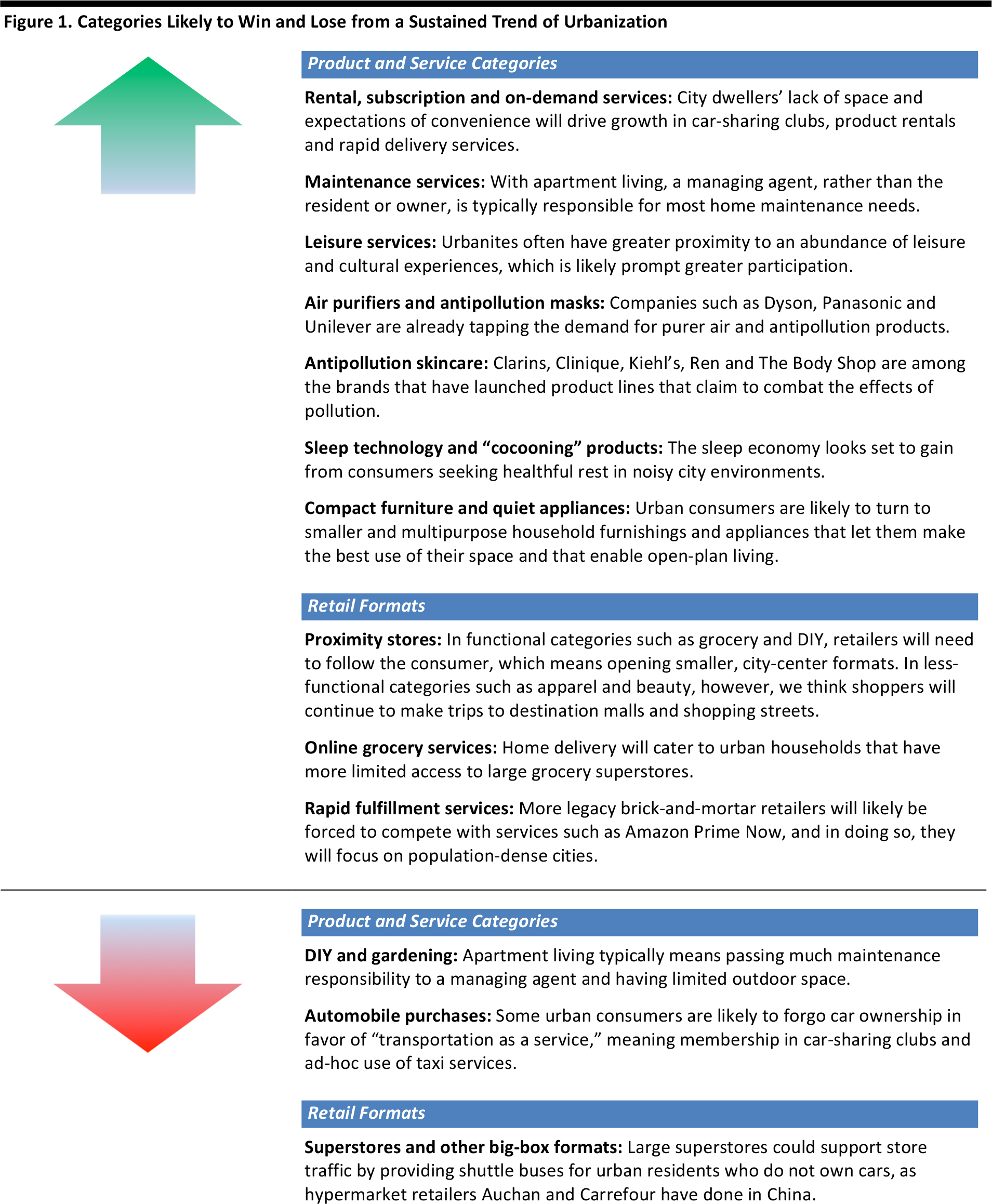

Perhaps urban living’s greatest impact on consumer goods industries will be that it drives an incremental shift from spending on retail to spending on services. Emerging service categories such as car-sharing clubs, product rentals, subscriptions and on-demand fulfillment stand to gain, as do more established categories such as home maintenance and leisure services. Factors supporting the shift to services include the limited space available in many urban residences; the critical mass of population, on which the feasibility of many of these services depend; and the typically connected nature of urban populations.

Source: iStockphoto

We see any sustained shift toward spending on services as a threat to retailers. A second threat is that retailers will need to make changes in order to cater to the demands of urban consumers. When urban shoppers do spend at retail, they will increasingly expect retailers to offer greater convenience at minimal additional cost. We are moving from a retail model where consumers put in much of the effort—including driving to a store, browsing the aisles in a large-format shop, and picking and packing their own purchases—to one where consumers expect retailers to put in the legwork, including getting products to them quickly.

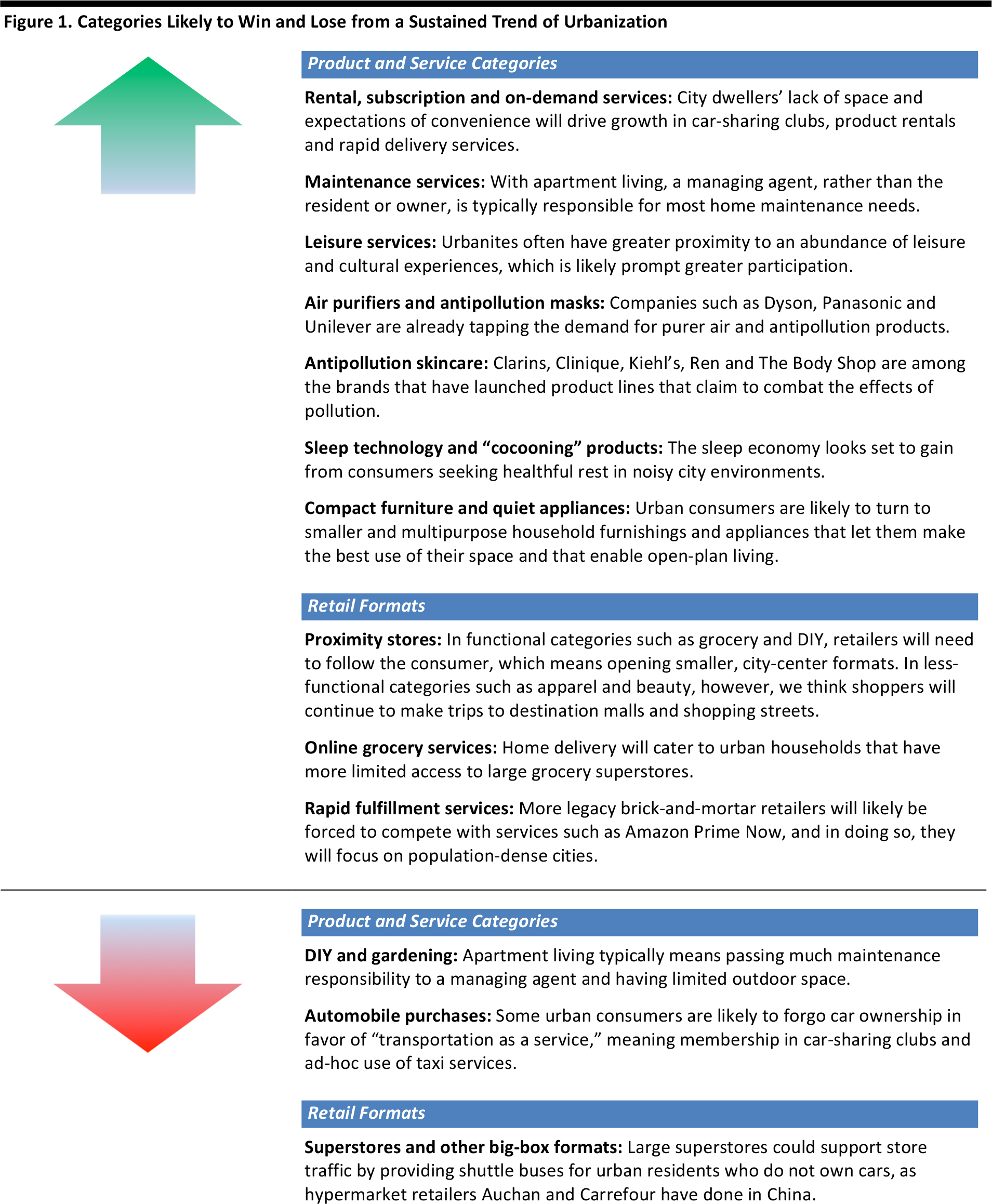

Below, we summarize the major product categories and retail formats that are likely to gain and lose from a sustained trend of urbanization.

Source: FGRT

Introduction

Worldwide, more and more people are turning to city-center living. This shift encompasses several subtrends:

- Urbanization is increasing in fast-developing economies such as China as workers migrate from rural areas to cities.

- An increasing number of younger people are opting to live in cities in Western economies such as the US and Europe.

- Affluent consumers are driving a resurgence in city living, as evidenced by the boom in high-end urban apartment blocks in cities such as New York and London. In some cases, older consumers are choosing to return to cities from the suburbs.

In this report, we outline the product and service categories that are enjoying growth on the back of these population shifts, and we examine the retail formats and services that are likely to see stronger demand if the urbanization trend continues. Our observations focus particularly on the US and the UK. Supporting data on urbanization are included in an appendix.

1. More Spending on Services

Perhaps urban living’s greatest impact on consumer goods industries will be that it drives an incremental shift from spending on retail purchases in favor of spending on product rentals, subscription services, on-demand fulfillment and leisure services. Factors supporting this shift in spending include the space limitations urban dwellers face; the critical mass of population that urbanization brings, which makes many of these services feasible; and the connected nature of urban populations.

Urbanization looks set to benefit a number of emerging service categories that are based on paying for something only when it is needed and on consumer demand for immediacy and convenience, including:

- Transportation-as-a-service: Some urban consumers are likely to forgo car ownership in favor of membership in car-sharing clubs such as Zipcar and ad-hoc use of taxi services such as Uber and Lyft. A lack of off-road parking and an infrequent need for access to a car in big cities will help drive the transportation-as-a-service market, where consumers rent a car or hail a cab only when they need one. A 2016 study by the University of California, Berkeley, recorded a 65% leap in global membership numbers for car clubs in 2014 (latest data). A UK study by Frost & Sullivan for Zipcar predicted that car-club memberships in London will more than quadruple, to 800,000, between 2014 and 2020.

- Product rental services: We see urbanization underpinning demand for product rentals, as the generally younger, digitally connected populations in urban areas face limited space in their homes but enjoy greater access to rapid delivery options and local collection points. These characteristics are likely to fuel growth in apparel rental as urban consumers try to match their small closets with their high expectations, and in furniture rental as urban renters choose temporary home furnishings over investment pieces. Rentals of other household goods, such as maintenance tools and outdoor living products—which may be needed less frequently or require too much storage space to keep year-round—are also likely to grow.

- On-demand delivery: Rapid delivery services will continue to boom as denser populations make those business models more feasible. More consumers will enjoy near-immediate access to everything from online product purchases to meals from local restaurants. In the food category, the immediacy and convenience provided by services such as UberEATS may result in consumers moving some of their spending from retail (grocery stores) to the food-services sector (restaurants). Within retail, this trend is likely to drive a shift in spending toward those retailers that can offer same-day delivery; in practice, these are typically Internet pure-play retailers such as Amazon and Zalando.

Additionally, We see growing urbanization as benefiting other, more traditional service sectors, too:

- Professional maintenance services: Apartment living typically means leaving any building or external maintenance to trade professionals, rather than undertaking DIY projects. In apartment buildings, chores such as painting, replacing fences, repairing paths, and fixing gutters, roofs and plumbing are normally overseen by the building’s managing agent. Therefore, we are likely to see a shift in home-maintenance spending from consumers to professionals as more people move to urban areas.

- Leisure services: Spending on cultural and leisure services is likely to grow along with greater urbanization, as city dwellers are in closer proximity to an abundance of such services. From food and film festivals to concerts and sporting events, urban living provides greater temptations for consumers to spend on leisure activities. In countries such as the US and the UK, we are already seeing many consumers, especially younger ones, shifting more of their spending to leisure services, and we expect greater urbanization to sustain this trend. Consumers are likely to cut back their discretionary spending on products in order to fund their leisure spending, and this will impact retailers.

In general, the retail sector faces threats from the urban-living trend, as city dwellers are likely to spend more on services. Everyday categories such as grocery are likely to lose spending share to more easily accessible food-service providers, while bigger-ticket categories such as cars are likely to be hit by urbanites choosing to rent such items only when they need to instead of buying them. Within retail, the operators that are best equipped to cater to urban consumers are those that can offer rapid fulfilment or tap markets such as food-service or product rental.

2. Spending to Combat Pollution

As more people move to cities, they will face the effects of breathing polluted air—and the forecasts make for grim reading. In 2016, the OECD estimated that, by 2030, some 4.1 million deaths will be caused by outdoor air pollution, which includes emissions from vehicles, industry and energy generation. That figure is up from an estimated 2.9 million related deaths in 2010. In the US, some 99,000 people are forecast to die from outdoor air pollution in 2030, up from an estimated 93,000 in 2010.

Source: iStockphoto

The OECD also forecasts a surge in the number of people diagnosed with bronchitis and asthma due to outdoor air pollution, which will bring associated costs in terms of healthcare and lost working days. The Institute for Health Metrics and Evaluation at the University of Washington says that ischemic heart disease, stroke, lung cancer and lower respiratory infections are the most common causes of death from outdoor air pollution.

Growing awareness of the risks associated with air pollution is pressuring governments to take action to limit it, but it is also driving the expansion of categories such as air purifiers, antipollution masks and skincare products that claim to combat the effects of pollution.

Air Purifiers and Antipollution Masks

More and more urban consumers are turning to technology to purify the air they breathe. Euromonitor International says that demand for air purifiers is growing most rapidly in the Asia-Pacific and Middle East and Africa regions.

- According to a 2016 report from market researcher TechSci Research, growth in the global air purifier market is being underpinned by increasing vehicular and industrial pollution, growing incidence of airborne diseases, heightened health consciousness among consumers and the introduction of advanced air-purification technologies.

- Zion Market Research estimated that the US residential air purifier market saw $2.0 billion in revenue from 6 million unit sales in 2015. The firm forecast that the market would grow at a CAGR of 5.2% to 2021, to reach $2.7 billion.

- According to Grand View Research, the global indoor air purification market will reach $21.8 billion by 2024. This total includes industrial and commercial users, which account for a large proportion of the market. The Asia-Pacific region accounted for the largest demand share in 2015, at an estimated at 35.7%.

- Grand View Research also forecasts that the residential air purifier market will be the fastest-growing segment from 2016 through 2024.

- Research and Markets forecasts that the global residential air purifier market will grow at a CAGR of around 6% between 2016 and 2020.

Major names in electronics and consumer goods are attempting to cultivate and capture growth in the air purifier market:

- Dyson launched its Pure Cool Link air-purifying device in March 2016.

- Unilever completed its acquisition of air purifier brand Blueair in December 2016. Unilever reported that Blueair, founded in 1996, had a turnover of $106 million in 2015.

- In India, Panasonic launched a range of new air purifier products in late 2016, and in 2017 the company announced that it would incorporate air purifiers into all the new air-conditioning units it sells in the country.

China, along with India, is seeing sustained demand for air-purifying products. According to a March 2017 report from Chinese firm ZDC published on Xinfengxitong.net, the number of air purifier brands available to Chinese consumers rose from 78 in 2013 to 688 in 2015. The same source stated that Chinese spending on air purifiers grew by 23.6% in 2016, and that Xiaomi’s Mi is the top-selling air purifier brand in China, followed by Philips, Blueair and Sharp.

Antipollution face masks, such as those made by 3M and Honeywell, are also reported to be a growing market. Masks tend to fall into two categories: replaceable particulate respirators and disposable particulate respirators. Use of face masks is more common in China than in Western countries, although cyclists appear to be leading adoption of replaceable respirator masks in the West.

Data on the scale of the antipollution mask market is scarce, but according to Daxue Consulting, Chinese state media estimated that the market was worth nearly ¥4 billion ($643 million) in China in 2015. And according to Reuters, online retailer Taobao sold ¥870 million ($141 million) worth of antipollution goods such as face masks and air purifiers in 2013.

The efficacy of antipollution masks is contested, however. They need to be able to filter out particles as small as PM2.5 (i.e., particles with a diameter of 2.5 micrometers or less), and many disposable masks are said to fail on this measure. Also, the masks must seal tightly against the face to prevent any pollution from circumventing the filters, and few consumers are able to ensure that their masks seal properly. Greater awareness of the limitations of antipollution face masks could stymie growth, particularly in the disposable, value segment, as informed consumers tend to seek products that offer real benefits.

Skincare

Combating pollution is not just a matter of health, but of appearance, too. Products that fight the effects of air pollution are one of the hottest trends in skincare, and Clarins, Clinique, Kiehl’s, Ren and The Body Shop are among the brands that have launched antipollution product lines. The trend originated in Asia with brands such as Boroplus in India, Hua Niang in China, Etude House in South Korea, and Shiseido and Fumakilla in Japan, according to Euromonitor International.

- A 2015 study by L’Oréal that was published in the International Journal of Cosmetic Science found that polluted air can impact skin quality in terms of increased sebum, lower vitamin E and an increase in lactic acid.

- A spokesperson for Clarins told Glamour magazine in 2017 that “an accumulation of pollutant particles on the skin surface can diminish skin’s radiance, making it look dull.”

- The Body Shop says that pollution can clog pores and accelerate cell oxidation, ultimately leading to dry and prematurely aged skin.

Solutions for combating the effects of pollution on skin vary. Some products incorporate active ingredients such as plant extracts and antioxidants to counteract the effects of pollution, while others are designed to simply act as a barrier to keep pollutants out.

Mintel, which tracks new product launches, has noted the Asia-Pacific region’s importance in this market segment. The firm said that, in the first 10 months of 2016, 38% of new beauty products that carried an antipollution claim were launched in the Asia-Pacific market, up from 28% in 2015. Worldwide, only 1% of all beauty product launches in the first 10 months of 2016 carried an antipollution claim, according to Mintel. However, that share was 8% in Australia, 3% in Thailand, 2% in Japan and 2% in China. Note that these figures are for all beauty products, not just skincare products. Drilling down to skincare, in the first quarter of 2016, 79% of products launched globally carried an antipollution claim, according to Mintel data cited by CosmeticsDesign-Asia.com.

Survey data reveal that consumer concern is fueling growth in this market. According to Mintel, 61% of consumers surveyed in China said they are very concerned about PM2.5 particles. In France, 41% of women surveyed said that they agree that environmental factors such as pollution affect the skin. In the US, 14% of those surveyed said that pollution is one of the most important factors impacting their skin.

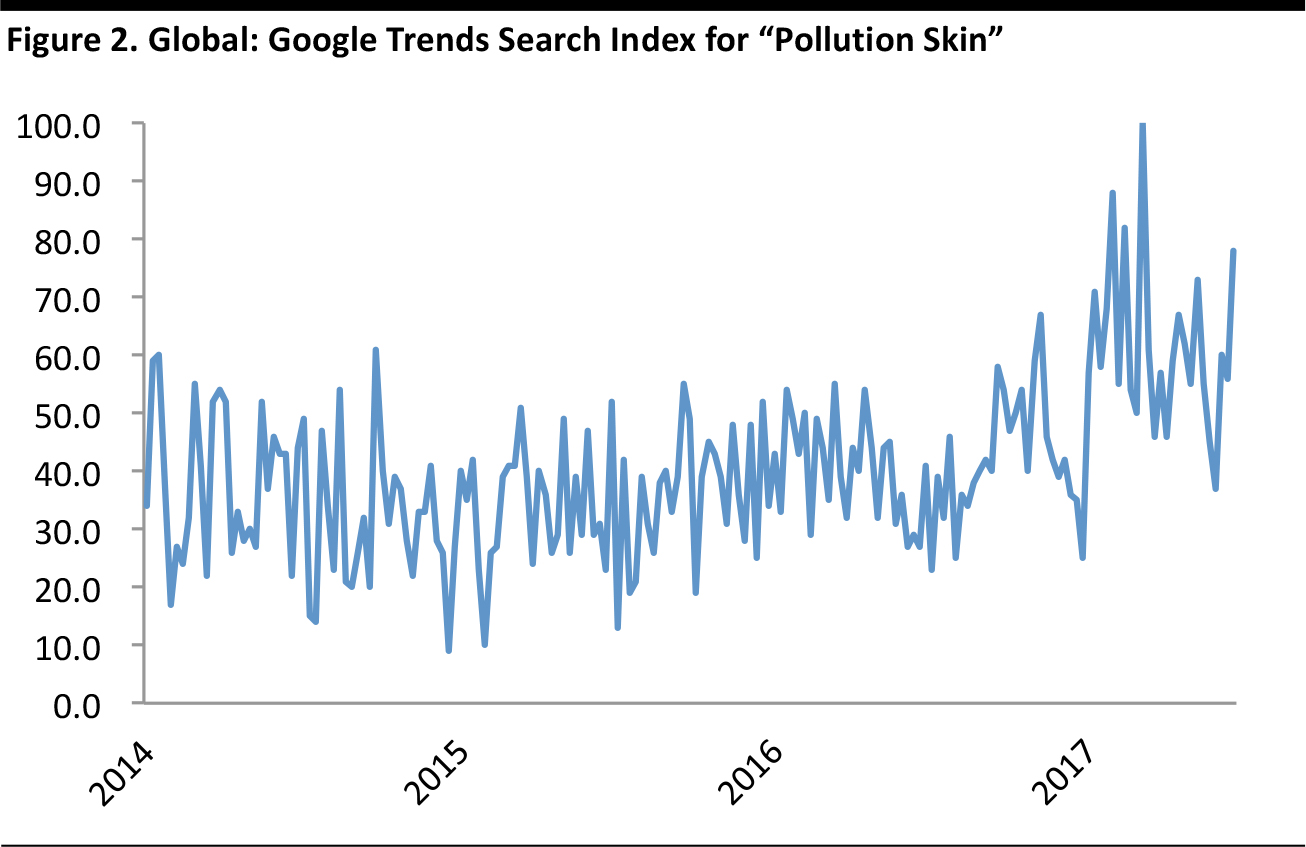

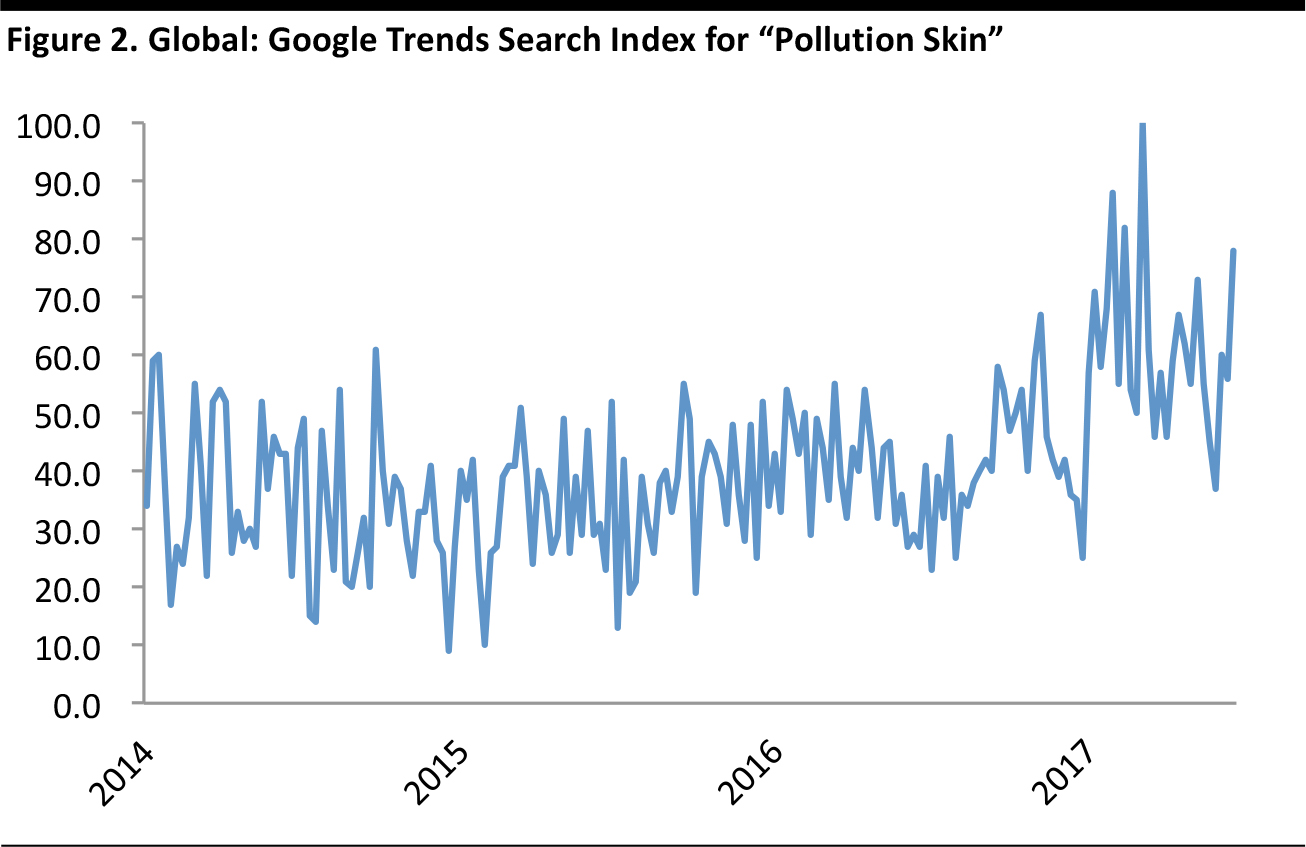

Google Trends showed a peak in the number of worldwide searches for “pollution skin” in March 2017, following an acceleration in related searches during 2016.

100 represents the peak number of searches for each search term.

Source: Google Trends

Source: TheBodyShop.com

3. Coping with Less Space

Fewer Rooms, Smaller Spaces, Fewer Gardens

People living in cities tend to enjoy less space than their peers in smaller towns or rural areas. Data from Eurostat, the European Commission’s statistics office, bear this out: in the UK, for example, the average number of rooms per person in 2015 was 1.8 for city dwellers versus 2.1 for those living in towns and suburbs and 2.2 for those living in rural areas. Eurostat records similar trends for major countries such as France and Germany, as well as for the EU in aggregate.

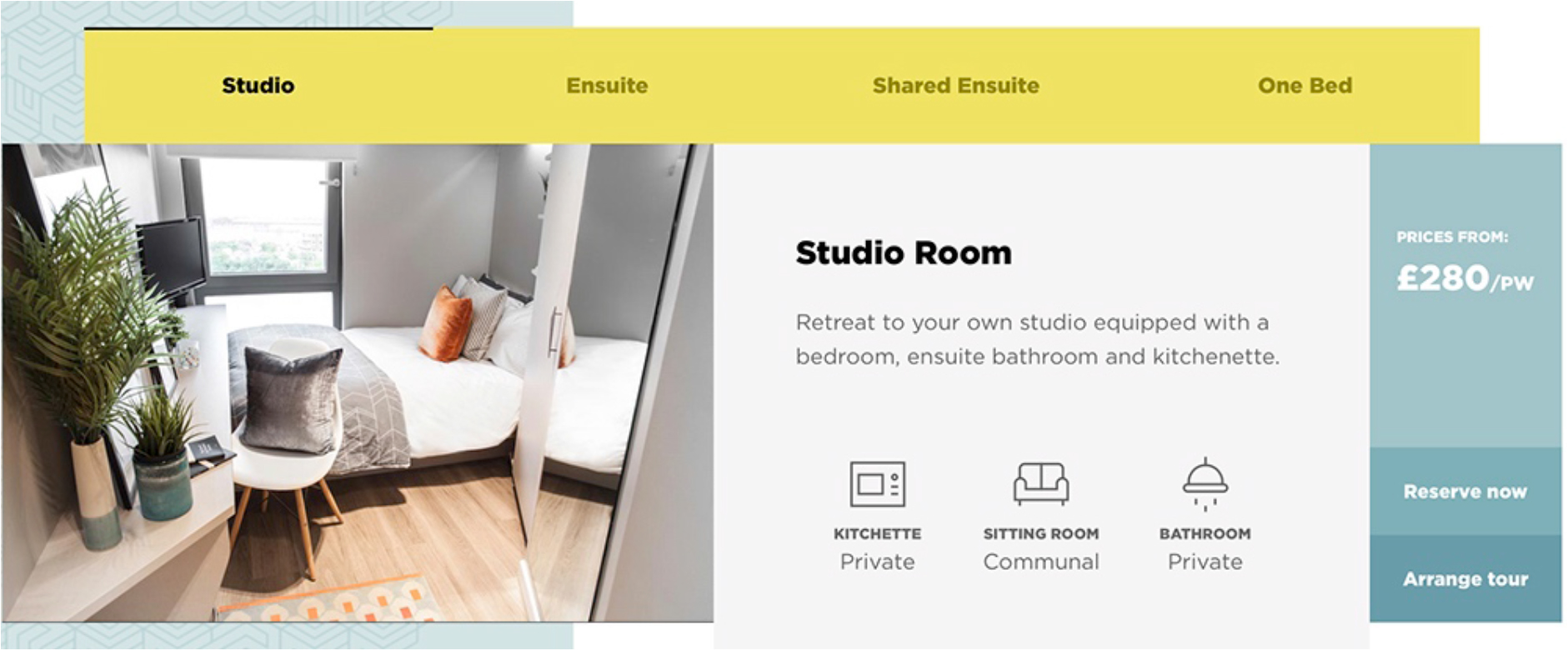

For some city dwellers, space is even more scarce. Microapartments and premium “co-living” developments are among the housing trends that provide residents with even less space.

- In cities across the world, microapartment condominiums are springing up. In New York, the Morgans Hotel was sold in June 2017 for conversion into tiny apartments, some of which are expected to total only 300 square feet.

- Premium co-living developments such as The Collective in London offer rooms, studios or flats supplemented with shared living spaces such as kitchens, game rooms, libraries, laundry rooms, gyms and dining rooms.

Source: www.thecollective.co.uk

We see the space limitations many urban dwellers face as fueling several trends:

- With less space to fill, urban consumers are likely to divert some spending from products to services. As noted above, city living has a pull effect on leisure spending, as it puts more leisure activities in front of consumers. But living in smaller spaces has a push effect, too: buying more physical products is less appealing less to consumers living in smaller homes, and less outdoor space means less spending on at-home leisure categories such as outdoor living products.

- The decluttering lifestyle trend, which advocates living more simply and with fewer possessions, dovetails with this scarcity of space.

- Urban consumers looking to buy household goods are likely to turn to smaller and multipurpose items that make the best use of their space. In its How We Shop, Live & Look 2016 report, UK department store John Lewis noted strong demand for small sofas, compact beds and slimline desks. IKEA recognized this trend back in 2014 and launched a 51-piece “On the Move” collection inspired by its own research finding that one in five urban dwellers live in a space smaller than 30 square meters. IKEA has continued to address this market, such as with its Square Metre/Foot Challenge videos.

- Open-plan living creates new consumer demands, too, particularly as kitchens get combined with living rooms in new-build apartments. John Lewis noted a 10% year-over-year jump in sales of Quiet Mark appliances, which promise noise reduction versus regular appliances.

More people living in city-center apartments also implies fewer consumers with gardens. Data on participation in and spending on gardening from the US National Gardening Survey and national statistics offices in the US and the UK do not yet bear out a decline in gardening: these sources suggest participation in and spending on gardening has, in aggregate, continued to grow. However, we think that any sustained, long-term shift toward city-center living will negatively impact spending on gardening and outdoor-living categories such as patio furniture and barbecue grills.

4. Cocooning to Insulate Oneself from City Life

Urban living typically means more noise—whether from traffic, neighbors or revelers. So, we see city-center living as fueling a cocooning trend, whereby consumers insulate themselves from their surroundings. Visitors to any metropolis can see this in effect on any busy urban subway system, as commuters don earphones to create their own “bubble.” We see the emergence of similar trends inside the home, with the sleep economy in particular set to gain from consumers seeking quiet, peaceful rest in noisy city environments.

Sleep Technology

A wave of new technologies promises to help consumers fall asleep more easily, wake up more gently and monitor how well they rest. Consumers can choose from an abundance of smartphone features and apps that monitor or guide their sleep, including:

- The Bedtime function on the iPhone, which measures periods of uninterrupted sleep and reminds users when to go to bed.

- Sleep Cycle, an app that tracks the users’ sleep phases and wakes them during the phase of light sleep.

- Sleep Genius, an app claimed to be “the most scientifically designed sound program for sleep in the world today.” The app has four programs, each of which play sounds to guide the user to fall asleep. It also features a power nap function that allows the user to nap for 30 minutes, alarm tunes with gentle sounds to wake the user after a sleep program and a relaxation program to help de-stress and relax the user.

Sleep-enabling hardware allows users to place devices close to their bed, to measure the bedroom environment for air and sound quality, movement and other factors that may affect sleep, or to use gentle sounds and lights to simulate sunrise when it is time to wake up. Examples of such hardware include:

- S+ by ResMed, which measures movement, breathing, noise, temperature and light. It integrates with a smartphone and allows users to view data and adjust their bedroom accordingly in order to facilitate better sleep.

- Beddit, which consists of a sensor strip that is placed under the bed sheet to record the user’s movement, heart rate, snoring and breathing. It senses when the user goes to bed and tries to sleep and sounds an alarm to wake the user up at the ideal point in his or her sleep cycle.

Health wearables that have been created specifically to track sleep include:

- The Dreem device, which is a headband worn while sleeping. It uses neurotechnology to understand what stage of sleep the user is in to trigger the apt sound stimulation and help the user sleep better.

- Oura, which is a finger ring marketed as a sleep and activity tracker. It works like a wristband tracker and uses tiny sensors to detect movement, heart rate and sleep. It integrates with a smartphone app via Bluetooth, so the user can track his or her progress.

- Thim, which is also a ring. The wearable detects when the user has fallen asleep and wakes him or her up after three minutes. It repeats this until the wearer is conditioned to fall asleep sooner. Professor Leon Lack, who co-developed this device, claims that if the body is made to repeatedly experience the sensation of falling asleep, the person will fall asleep sooner and will stay asleep longer.

An emerging trend in relaxation and sleep is the use of videos and audio clips to elicit autonomous sensory meridian response (ASMR). ASMR refers to a tingling sensation that begins on the scalp and moves down the spine and neck, making the person experiencing it relaxed and calm. Videos and audio clips in which a person narrates soothing phrases in soft tones, perhaps with background music, or guides the listener through a meditation fall under this category. In September 2016, YouTube said that there were 5.2 million videos related to ASMR on its site.

Other online media companies, such as music-streaming service Spotify, have also noticed a rise in the popularity of sleep-related searches. According to Spotify, consumers have downloaded more than 5 million recordings of sleep noise to help them fall asleep.

Investing in Furnishings to Sleep Better

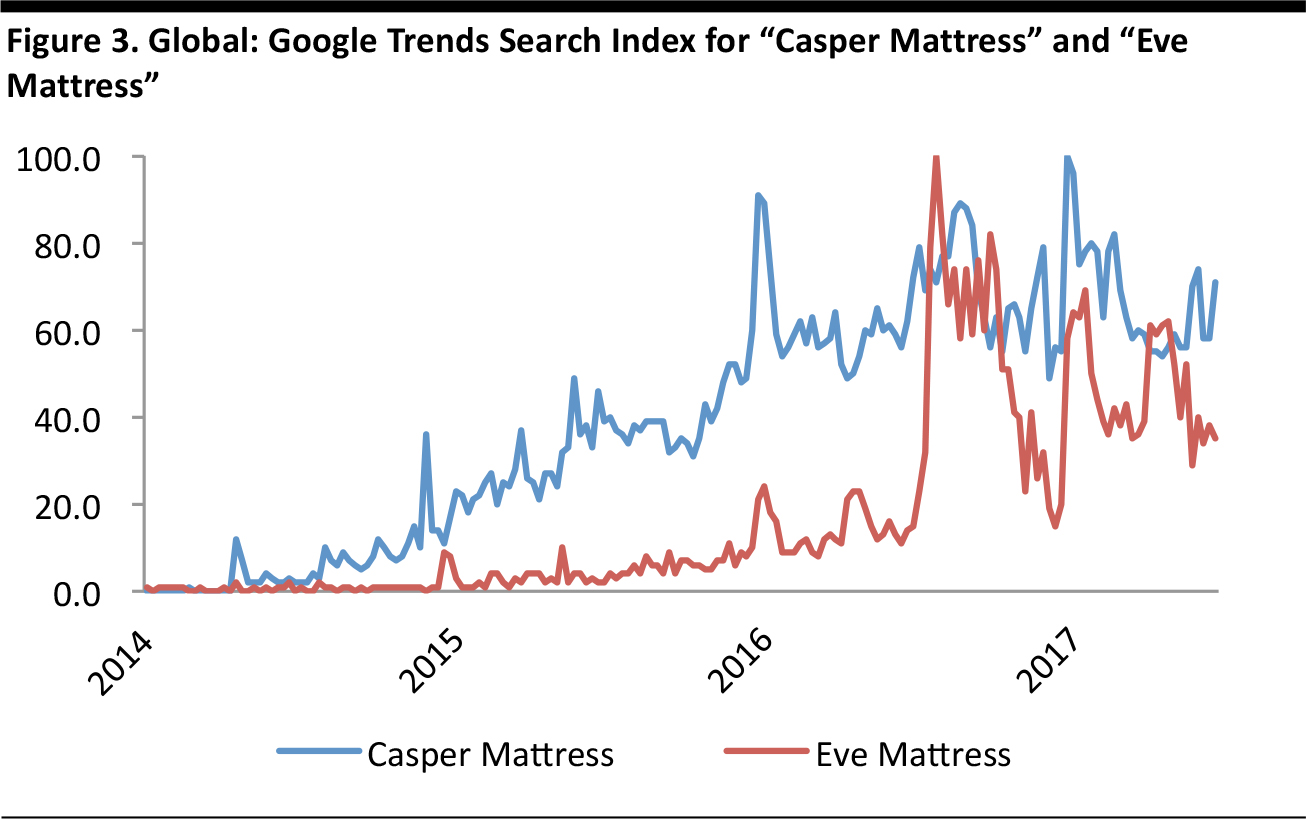

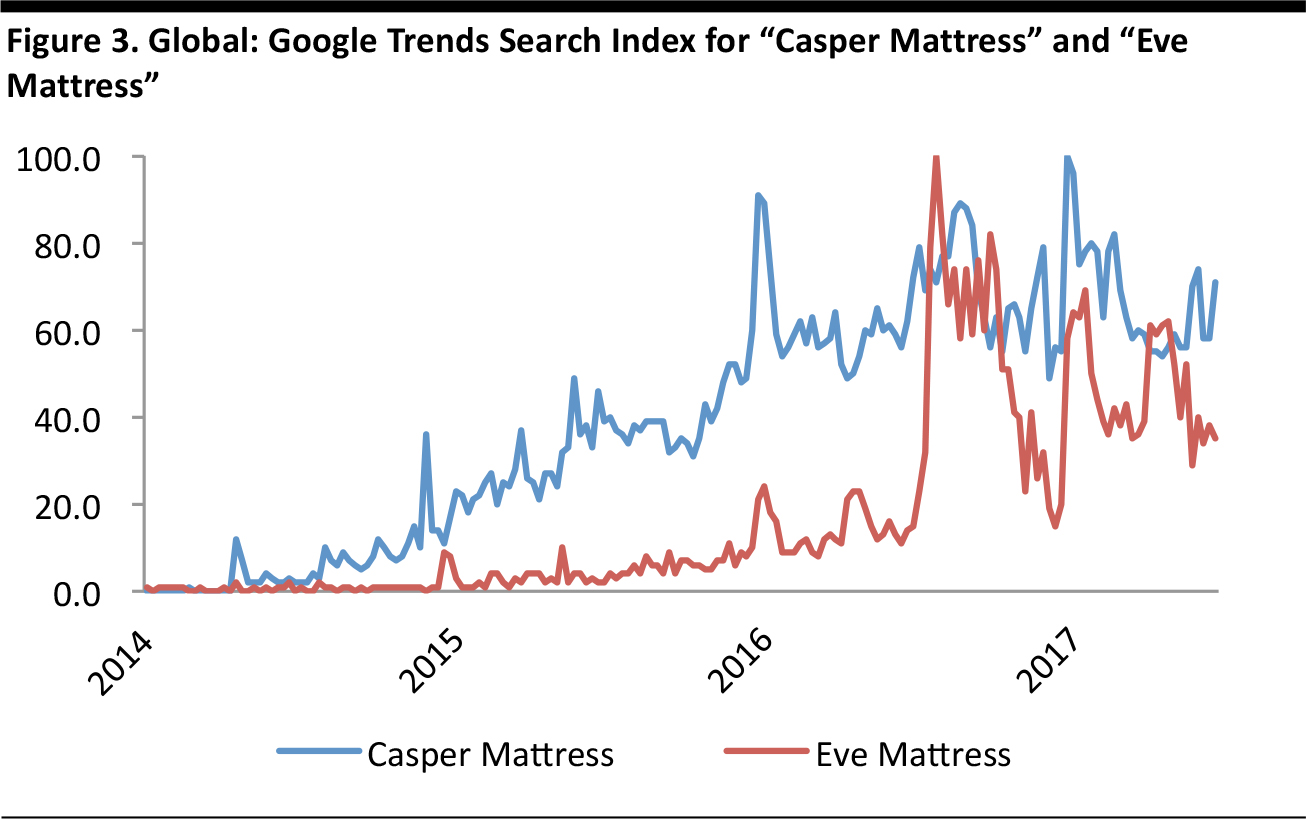

New e-commerce-focused mattress brands are riding the cocooning trend to encourage consumers to invest in desirable, fashionable sleep furnishings. Casper has led this segment, building an aspirational and contemporary image for its mattresses. Casper inspires devotees to share their love for the brand on social media such as Twitter. The company has also ridden the “unboxing” trend, whereby shoppers talk through the process of opening their purchase in online videos. In short, it has built a brand that appeals to younger, style-conscious consumers.

In June 2017, Casper revealed that it had raised $170 million from investors that include Target, which made an unconfirmed $75 million investment, according to Recode. The funding round valued Casper at $750 million, according to

The New York Times.

In the UK, Eve has similarly established itself as a contemporary, aspirational brand through its own direct-to-consumer website. In May 2017, Eve raised £35 million ($44 million) in an IPO on the UK’s AIM stock exchange; the IPO valued the business at £140 million ($178 million).

Both brands have diversified to adjacent categories, and both are pitched at a premium level: a double mattress from Casper costs $800, while a double mattress from Eve costs £549 ($696). As we chart below, these brands have seen a boom in the number of people searching for them on Google.

100 represents the peak number of searches for each search term.

Source: Google Trends

5. Expecting Retailers to Do the Work

Finally, we turn away from product categories to look at how retail formats may be impacted by the urban-living trend. We see these lifestyle shifts as accelerating the move away from a big-box store model where consumers put in much of the effort—including driving to the store, browsing the aisles in a large-format shop, and picking and packing their own purchases—to one where consumers expect retailers to put in the legwork, including bringing products to them quickly.

We expect to see the following kinds of shifts in retailing:

- In grocery, perhaps the most obvious shift will be toward small, city-center convenience stores. This presents opportunities for major retailers to move in and drive consolidation in the convenience sector, which tends to be more fragmented than the supermarket sector. The UK offers an example of major retailers tapping these opportunities in recent years: major supermarket retailers Tesco and Sainsbury’s have built very substantial, higher-growth, convenience store chains. The US has yet to see this kind of consolidation. In fact, Walmart closed its Express convenience format in 2016.

Source: iStockphoto

- Online grocery shopping services will cater to urban households that may find access to large superstores more difficult. Urbanites are likely to make more use of home delivery or local collection services than the kind of drive-through collection services that large-store retailers Walmart and Kroger are rolling out in the US. In the UK, “city sophisticates” are the top consumer segment for buying groceries online, according to analysis by consulting firm CACI.

- Large superstores located on the edge of town are likely to be hit by these trends, but they could support store traffic by providing shuttle buses for urban residents who do not own cars, as hypermarket retailers Auchan and Carrefour have done in China.

- In nonfood categories—especially more functional categories such as home maintenance—further urbanization will similarly push retailers to pursue shoppers by opening smaller, more centrally located stores. These could offer a curated selection of products and serve as collection points for online orders. Many retailers that traditionally operated stand-alone big-box stores are already moving into city centers. In the US, Target is launching smaller, city-center formats. In the UK, furniture retailer DFS and DIY chain B&Q are among those trialing small, high-street stores. We expect less functional, more leisure-driven categories such as fashion and beauty to continue to drive shopper traffic to destination malls and shopping streets.

- As urbanization continues, more consumers will enjoy access to rapid delivery services such as Amazon Prime Now, which offers delivery within one hour. Legacy brick-and-mortar retailers will likely be forced to compete on this front, and we are already seeing this in the UK, with Sainsbury’s and Tesco offering one-hour delivery options. However, it is important to note that the rapid delivery model requires high population densities in order to achieve efficiencies. Accordingly, Sainsbury’s and Tesco are offering these services only to customers in London.

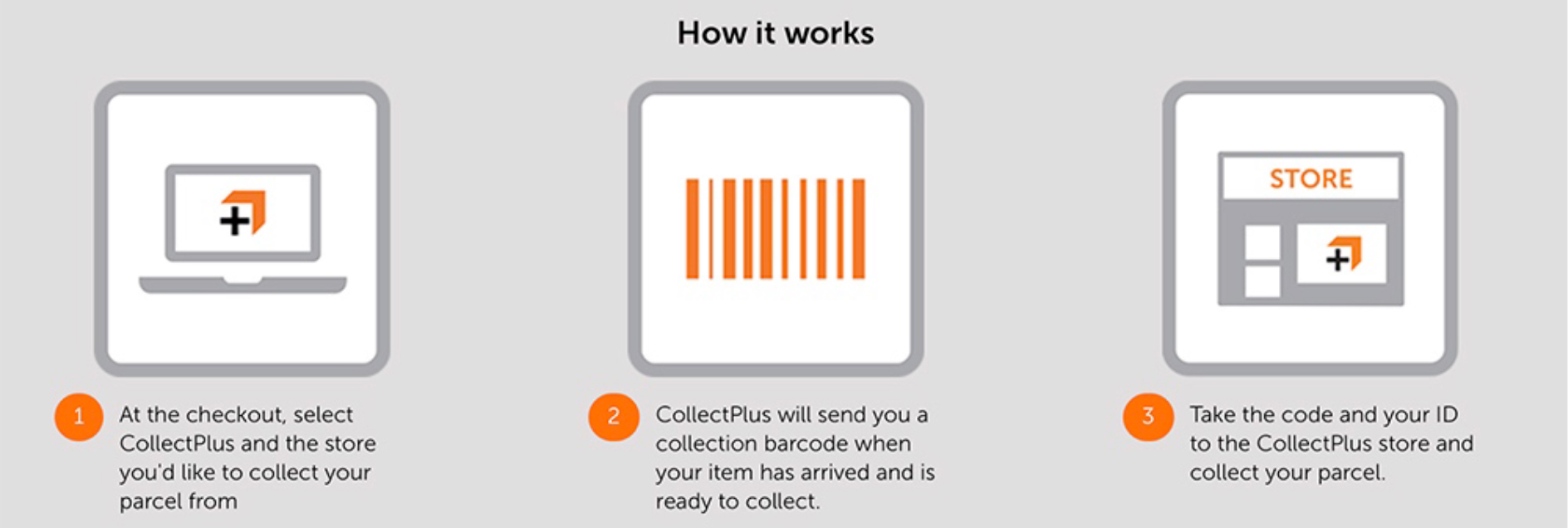

- More third-party collection points will spring up in urban areas. The UK has already seen this trend, with CollectPlus offering collection from existing local stores and Doddle providing dedicated collection points at locations such as railway stations. We see opportunities for similar services in other countries, as the critical mass of population makes collection services more feasible in urban areas.

Source: www.collectplus.co.uk

In short, urban living will drive demand for proximity, convenience and immediacy. The challenge for retailers is making new, urban-friendly business models as profitable as traditional ones.

- It costs retailers more to service smaller basket sizes in higher-rent convenience stores. However, in most markets, convenience stores are able to pass these costs on to customers via higher prices.

- Online grocery delivery services are notoriously less profitable. For example, it costs £10–£12 ($13–$16) for UK grocery retailers to pick and deliver an online order, according to Shore Capital stockbrokers cited on Bloomberg.com in June 2016. However, those UK retailers typically charge their customers just a few pounds for delivery.

- By contrast, brick-and-mortar retailers offering one-hour delivery are so far attempting to recoup costs through premium pricing for the service. For instance, Tesco’s new one-hour service costs shoppers a hefty £7.99 ($10). Longer term, we see competition eroding these charges. Amazon already offers free two-hour delivery in certain cities with Prime Now, although it currently charges £6.99 ($9) for one-hour delivery. As Amazon widens its catchment and recruits more shoppers into Prime membership, the pressures on rivals to compete will grow.

- Any shift away from superstores leaves retailers with the challenge of being left with space that is less productive. Superstore retailers in the UK, such as Tesco, have been grappling with this in recent years, and some have sought to lease space in their large stores to other companies.

Overall, retailers catering to city dwellers’ increased expectations for convenience and immediacy are likely to see costs rise significantly.

Key Takeaways

Retailers face two primary risks associated with a sustained trend toward city living:

- Consumers will continue to shift more of their spending to services, including renting various products only when they need them instead of buying them at retail.

- When shoppers do spend at retail, they will increasingly expect retailers to offer greater convenience at minimal additional cost. We are moving from a retail model where consumers put in much of the hard work—such as getting to the store, browsing a large-format shop, and picking and packing their own products—to one where consumers expect retailers to put in greater effort, at greater cost to the retailers.

�Appendix: Charting Urbanization

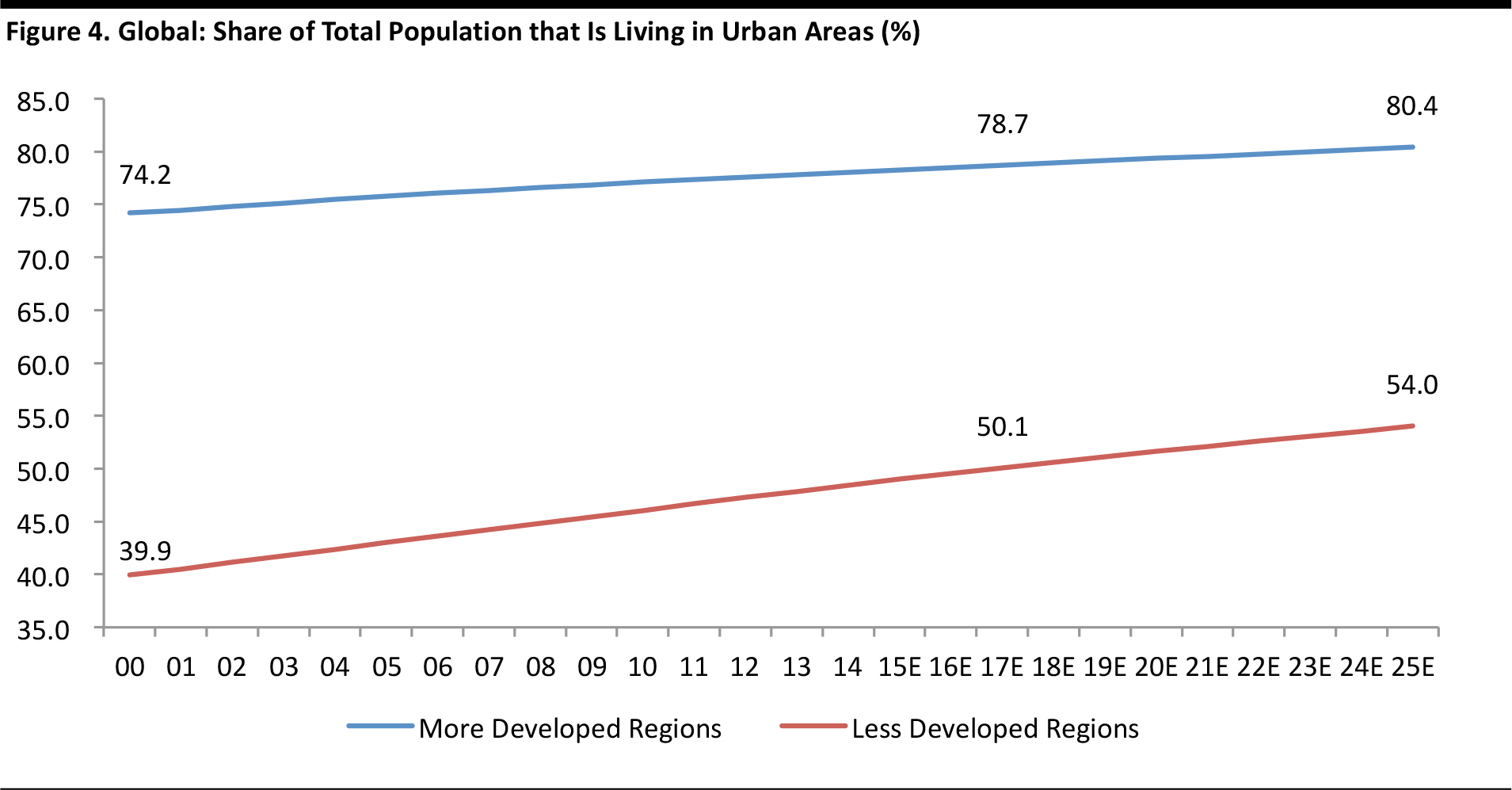

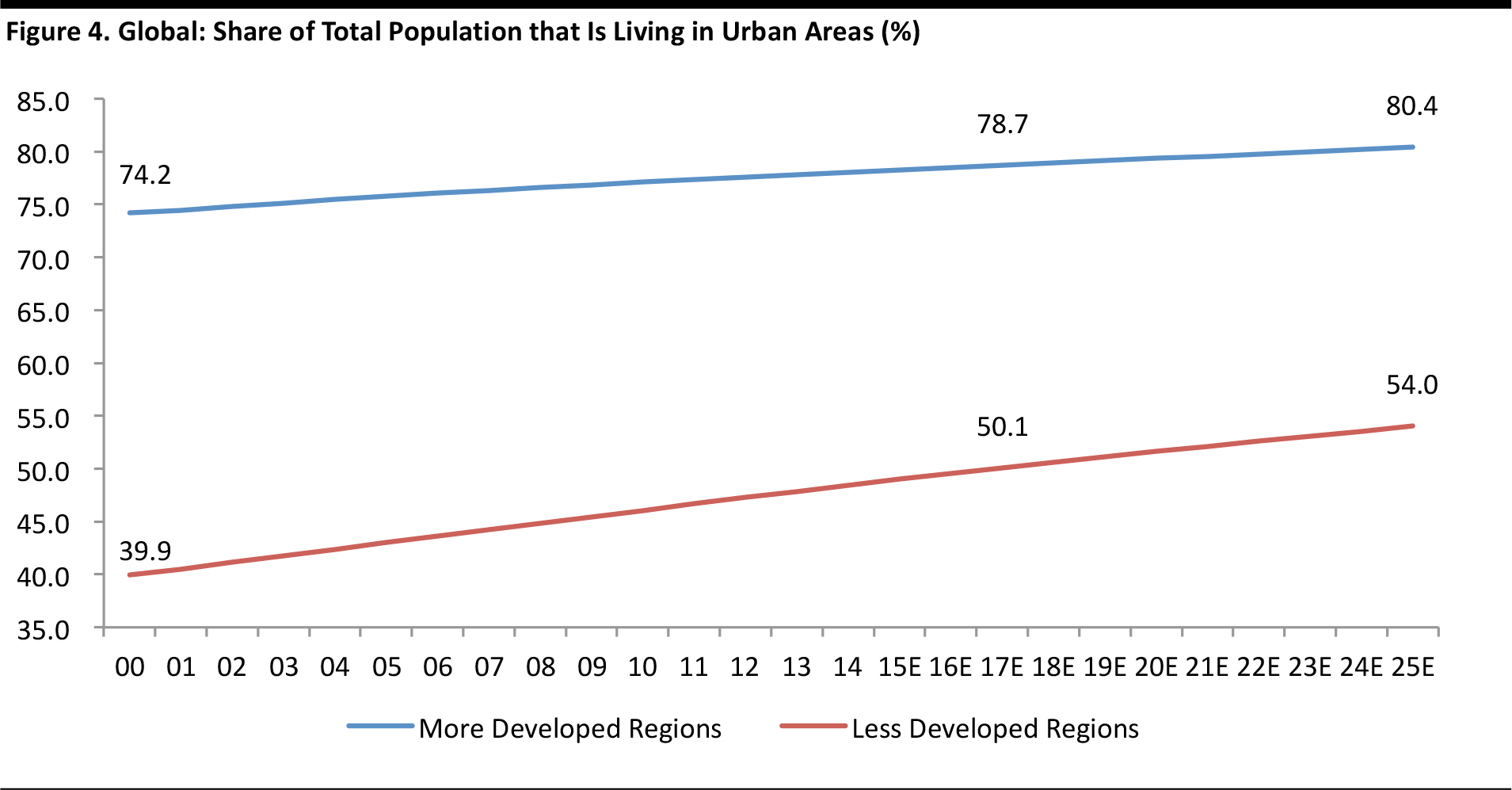

In this section, we provide supporting data that show the increasing urbanization of populations worldwide.

More developed regions comprise Europe, North America, Australia/New Zealand and Japan. Less developed regions comprise Africa, Asia

(excluding Japan), Latin America and the Caribbean, plus Melanesia, Micronesia and Polynesia.

Source: UN, World Urbanization Prospects: The 2014 Revision

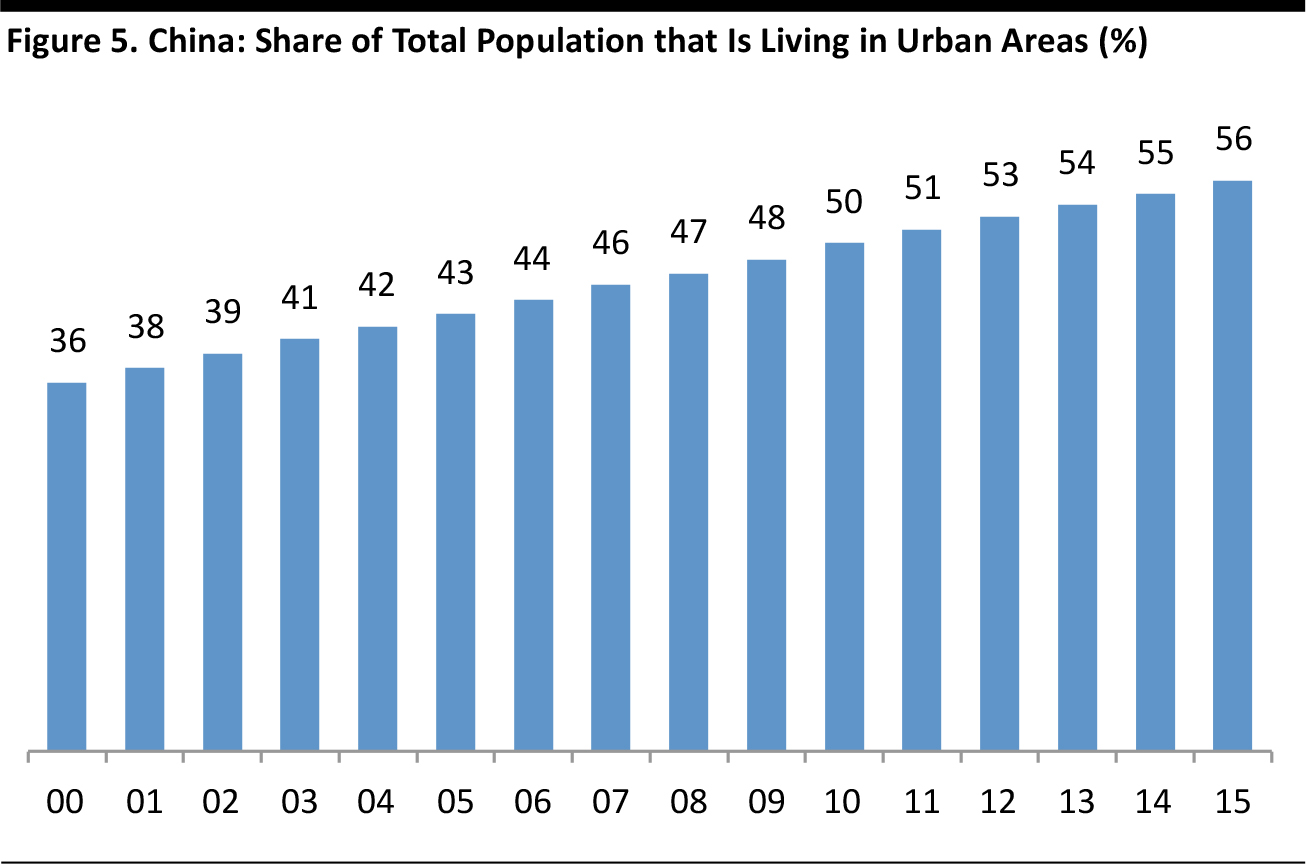

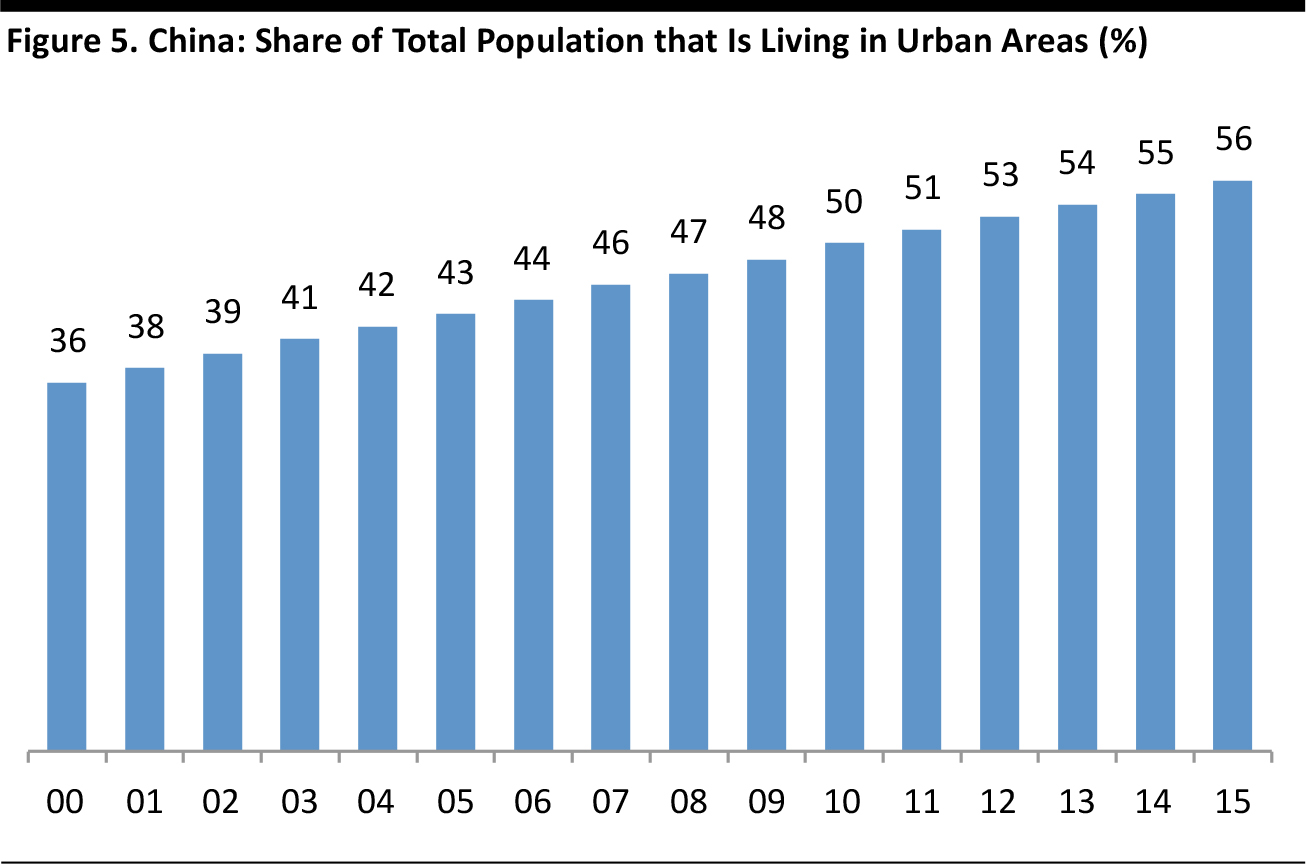

In China, the proportion of the population that is living in urban areas has been growing by about one percentage point per year. Some 56% of the Chinese population lived in urban areas in 2015 (latest). However, this migration from the countryside to towns does not necessarily translate to the kind of city living that is the subject of this report.

Source: China Statistical Yearbook 2016

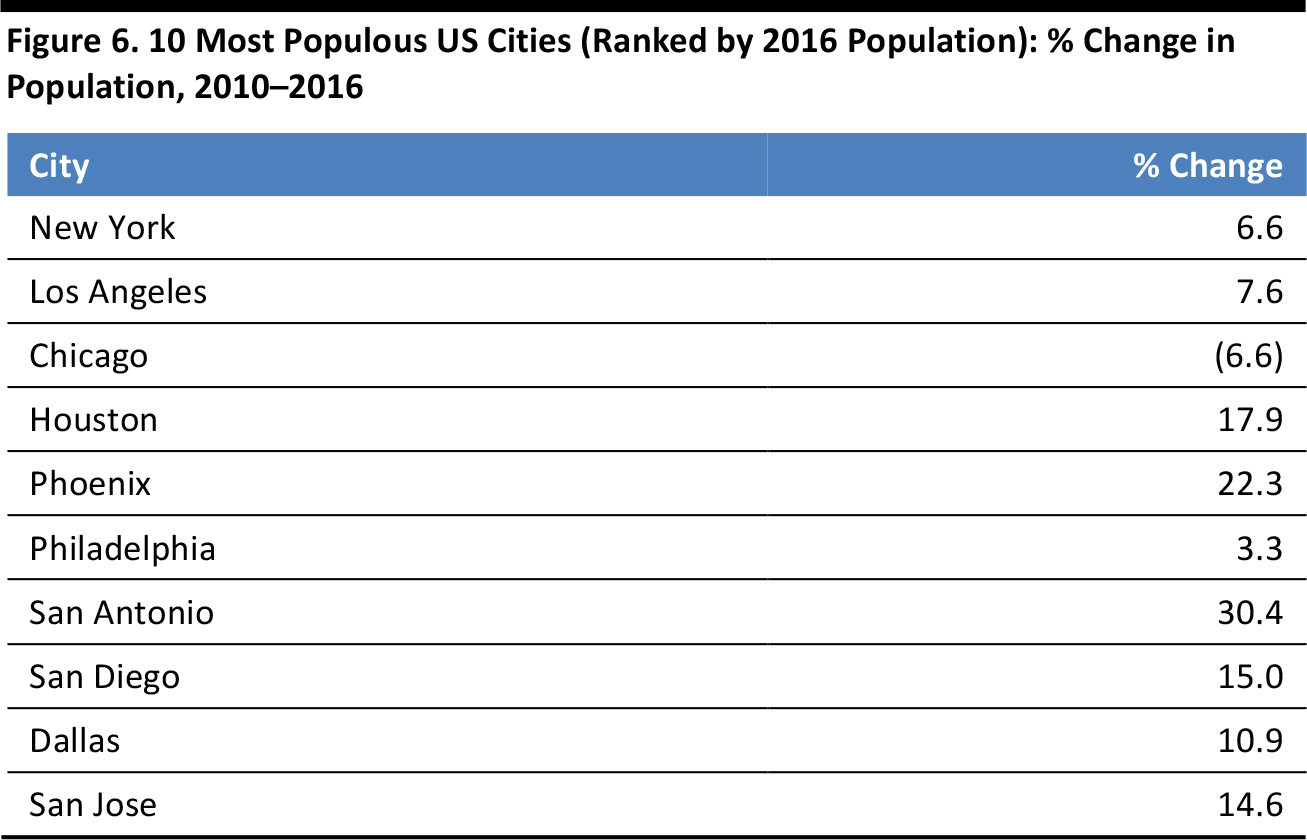

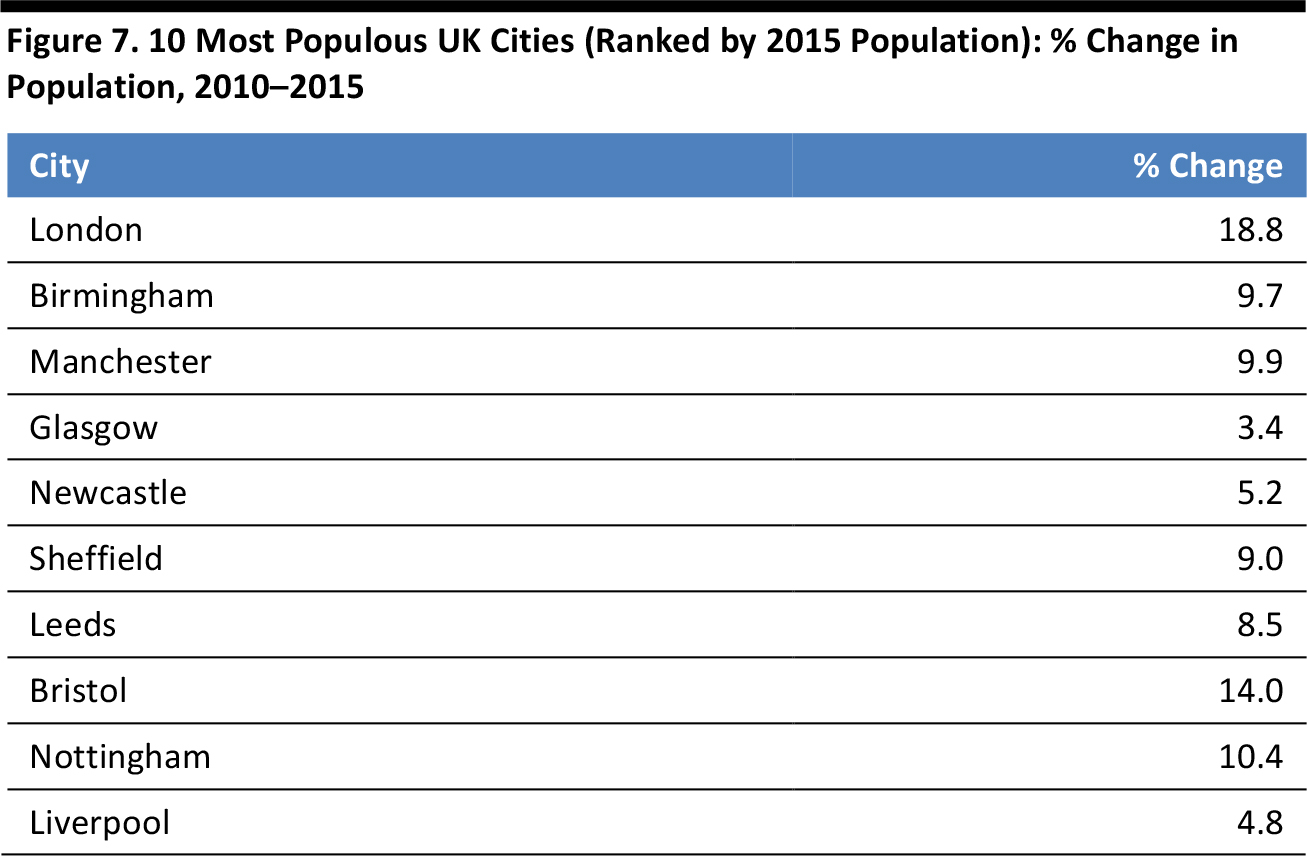

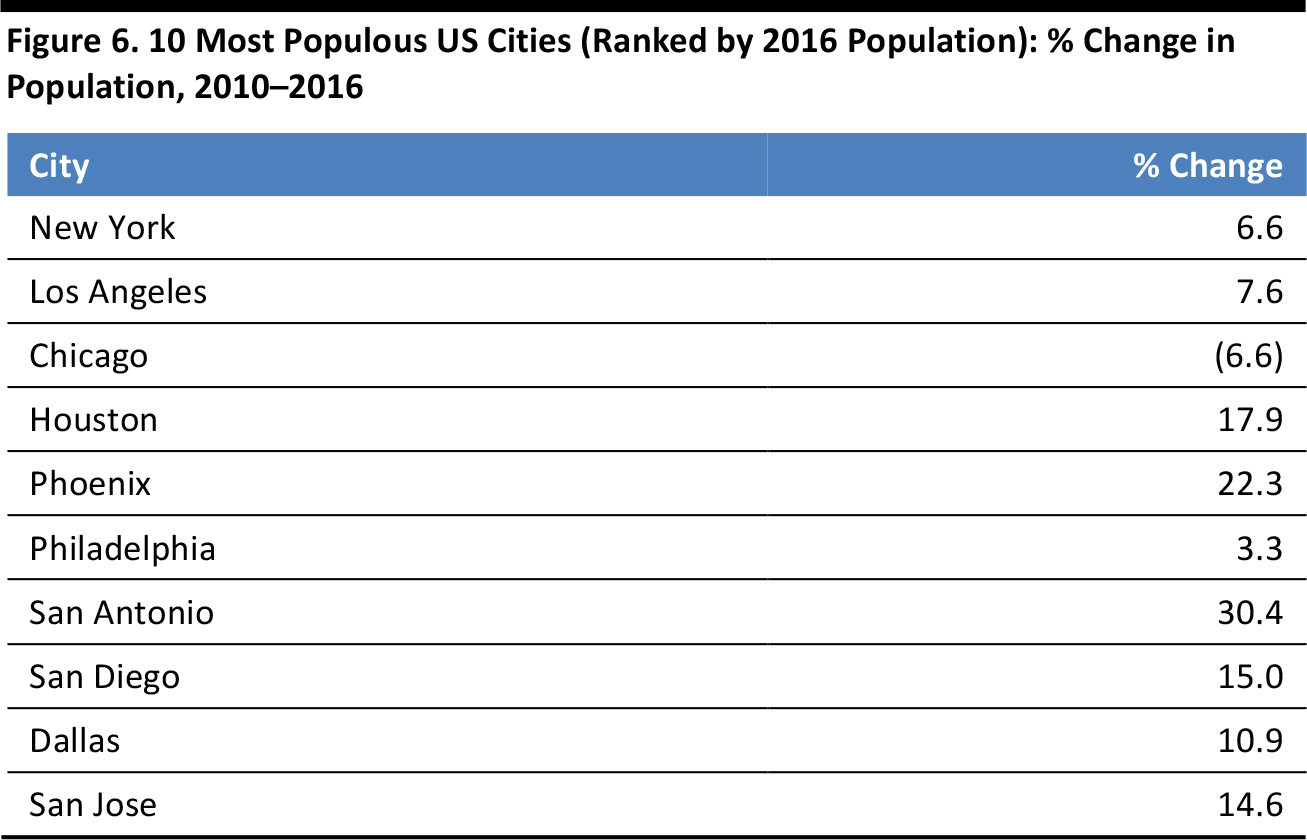

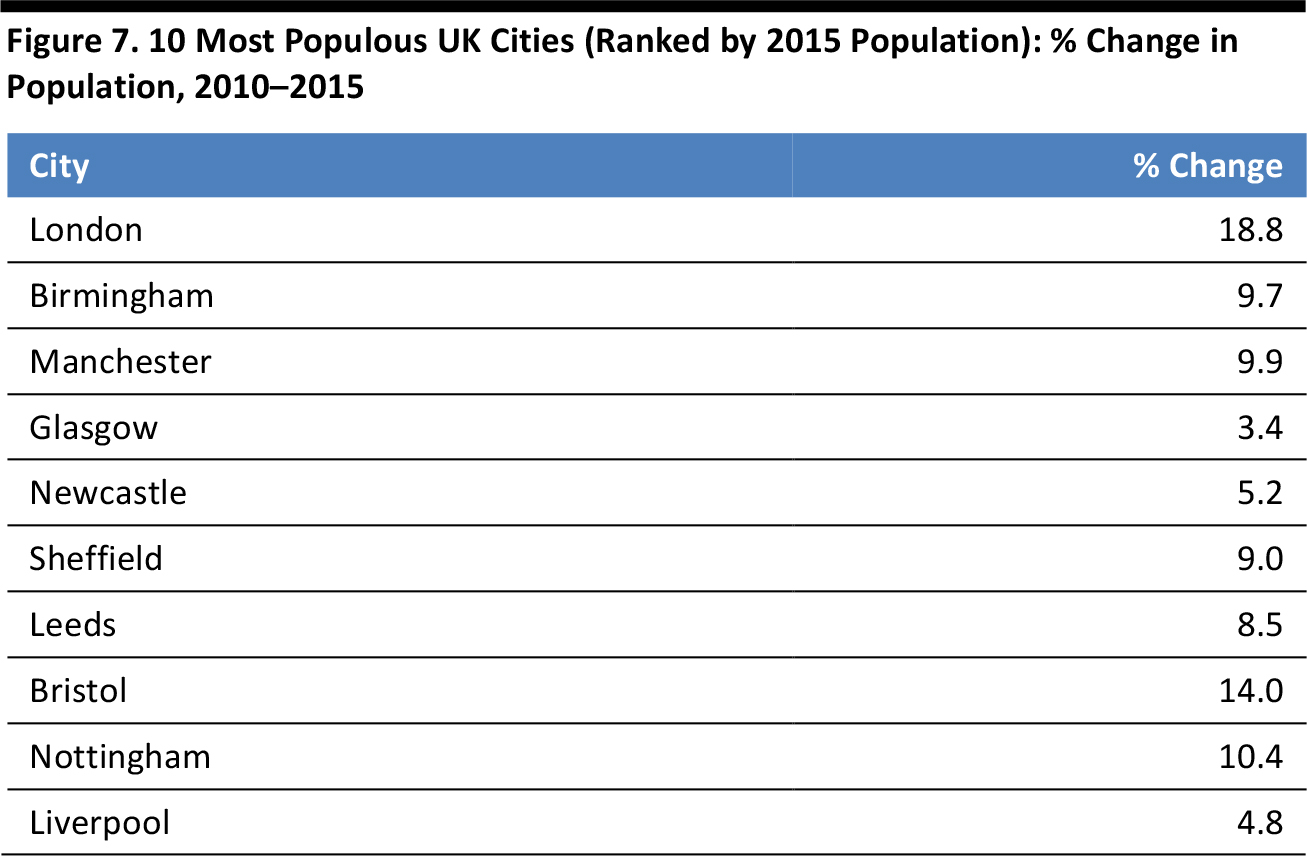

Below, we provide more granular data on the growth of the 10 biggest cities in the US and the UK.

Source: US Census Bureau/FGRT

Source: Centreforcities.org/FGRT

Perhaps urban living’s greatest impact on consumer goods industries will be that it drives an incremental shift from spending on retail purchases in favor of spending on product rentals, subscription services, on-demand fulfillment and leisure services. Factors supporting this shift in spending include the space limitations urban dwellers face; the critical mass of population that urbanization brings, which makes many of these services feasible; and the connected nature of urban populations.

Urbanization looks set to benefit a number of emerging service categories that are based on paying for something only when it is needed and on consumer demand for immediacy and convenience, including:

Perhaps urban living’s greatest impact on consumer goods industries will be that it drives an incremental shift from spending on retail purchases in favor of spending on product rentals, subscription services, on-demand fulfillment and leisure services. Factors supporting this shift in spending include the space limitations urban dwellers face; the critical mass of population that urbanization brings, which makes many of these services feasible; and the connected nature of urban populations.

Urbanization looks set to benefit a number of emerging service categories that are based on paying for something only when it is needed and on consumer demand for immediacy and convenience, including:

Data on the scale of the antipollution mask market is scarce, but according to Daxue Consulting, Chinese state media estimated that the market was worth nearly ¥4 billion ($643 million) in China in 2015. And according to Reuters, online retailer Taobao sold ¥870 million ($141 million) worth of antipollution goods such as face masks and air purifiers in 2013.

The efficacy of antipollution masks is contested, however. They need to be able to filter out particles as small as PM2.5 (i.e., particles with a diameter of 2.5 micrometers or less), and many disposable masks are said to fail on this measure. Also, the masks must seal tightly against the face to prevent any pollution from circumventing the filters, and few consumers are able to ensure that their masks seal properly. Greater awareness of the limitations of antipollution face masks could stymie growth, particularly in the disposable, value segment, as informed consumers tend to seek products that offer real benefits.

Data on the scale of the antipollution mask market is scarce, but according to Daxue Consulting, Chinese state media estimated that the market was worth nearly ¥4 billion ($643 million) in China in 2015. And according to Reuters, online retailer Taobao sold ¥870 million ($141 million) worth of antipollution goods such as face masks and air purifiers in 2013.

The efficacy of antipollution masks is contested, however. They need to be able to filter out particles as small as PM2.5 (i.e., particles with a diameter of 2.5 micrometers or less), and many disposable masks are said to fail on this measure. Also, the masks must seal tightly against the face to prevent any pollution from circumventing the filters, and few consumers are able to ensure that their masks seal properly. Greater awareness of the limitations of antipollution face masks could stymie growth, particularly in the disposable, value segment, as informed consumers tend to seek products that offer real benefits.

Urban living typically means more noise—whether from traffic, neighbors or revelers. So, we see city-center living as fueling a cocooning trend, whereby consumers insulate themselves from their surroundings. Visitors to any metropolis can see this in effect on any busy urban subway system, as commuters don earphones to create their own “bubble.” We see the emergence of similar trends inside the home, with the sleep economy in particular set to gain from consumers seeking quiet, peaceful rest in noisy city environments.

Urban living typically means more noise—whether from traffic, neighbors or revelers. So, we see city-center living as fueling a cocooning trend, whereby consumers insulate themselves from their surroundings. Visitors to any metropolis can see this in effect on any busy urban subway system, as commuters don earphones to create their own “bubble.” We see the emergence of similar trends inside the home, with the sleep economy in particular set to gain from consumers seeking quiet, peaceful rest in noisy city environments.

An emerging trend in relaxation and sleep is the use of videos and audio clips to elicit autonomous sensory meridian response (ASMR). ASMR refers to a tingling sensation that begins on the scalp and moves down the spine and neck, making the person experiencing it relaxed and calm. Videos and audio clips in which a person narrates soothing phrases in soft tones, perhaps with background music, or guides the listener through a meditation fall under this category. In September 2016, YouTube said that there were 5.2 million videos related to ASMR on its site.

Other online media companies, such as music-streaming service Spotify, have also noticed a rise in the popularity of sleep-related searches. According to Spotify, consumers have downloaded more than 5 million recordings of sleep noise to help them fall asleep.

An emerging trend in relaxation and sleep is the use of videos and audio clips to elicit autonomous sensory meridian response (ASMR). ASMR refers to a tingling sensation that begins on the scalp and moves down the spine and neck, making the person experiencing it relaxed and calm. Videos and audio clips in which a person narrates soothing phrases in soft tones, perhaps with background music, or guides the listener through a meditation fall under this category. In September 2016, YouTube said that there were 5.2 million videos related to ASMR on its site.

Other online media companies, such as music-streaming service Spotify, have also noticed a rise in the popularity of sleep-related searches. According to Spotify, consumers have downloaded more than 5 million recordings of sleep noise to help them fall asleep.