Executive Summary

The UK retail real estate sector is facing ongoing headwinds, including the rapid rise of e-commerce, cutthroat competition and softening apparel sales.

However, the UK has seen few retail bankruptcies and store closures. Store footfall in the country is declining, but vacancy rates remain low and rent levels indicate that the retail real estate sector is still relatively healthy.

A structural change is taking place, as town centers, retail parks, and high streets continue to rebalance, offering more leisure outlets and experiences to attract shoppers. Retailers and retail landlords are trying to increase footfall and dwell time by providing shoppers with more and improved entertainment and leisure offerings.

The UK retail real estate market is also seeing increasing polarization between prime shopping centers located in large urban areas and weaker regional and local malls. There is continued strong demand for space in prime retail locations, as retailers are rushing to secure the best space. E-commerce will continue to have an effect on the widening gap in rental growth between prime and secondary locations.

The number of new stores opened in London by international retailers more than doubled year over year in 2016, according to CBRE. Foreign brands are especially keen to open stores in London, reflecting the demand for retail real estate in areas and streets that allow them to optimally showcase their brands.

Pop-up shops and temporary experiential retail spaces are also becoming more common in the UK. The sustained boom in e-commerce is boosting demand for warehouses that serve as distribution centers. Amazon accounted for over a quarter of all warehouse space rented in the UK in 2016 and the warehousing sector is set to have its best year on record in 2017.

More click-and-collect pickup locations and lockers are being set up in malls in partnership with online retailers such as Amazon and parcel locker provider Doddle. Mall lockers supplement major retailers’ in-store capabilities.

Retailers will restructure and prune their portfolios in order to adapt to consumers’ continuing shift toward online shopping. Many retailers will choose to have smaller store footprints and focus on larger flagship stores in the most desirable areas and spaces.

Rising UK property taxes in certain locations will act as a disincentive to operating physical stores versus online stores, especially in certain areas where rental property values have dramatically increased.

New retail space resulting from shopping-center store openings and revamps will reach a four-year high in 2017, posing a risk of excess supply in the face of waning demand.

Introduction

UK retail is caught in a whirlwind of rising payroll costs, higher rents and increasing business tax rates. Meanwhile, brick-and-mortar stores are attempting to fight off the threat from online-only retailers, whose double-digit sales growth has come at the expense of legacy players.

In this report, we examine UK retail real estate trends and analyze operating and performance metrics to determine how the sector is holding up in the face of increasing headwinds. The key metrics we look at include shopper footfall, tenant vacancy rates, and rental rates.

We discuss recent retail bankruptcies and store closures in the UK and examine the factors that led to them. We also shed light on growing trends and how the retail real estate sector is likely to evolve in the future.

Monthly Footfall Trends

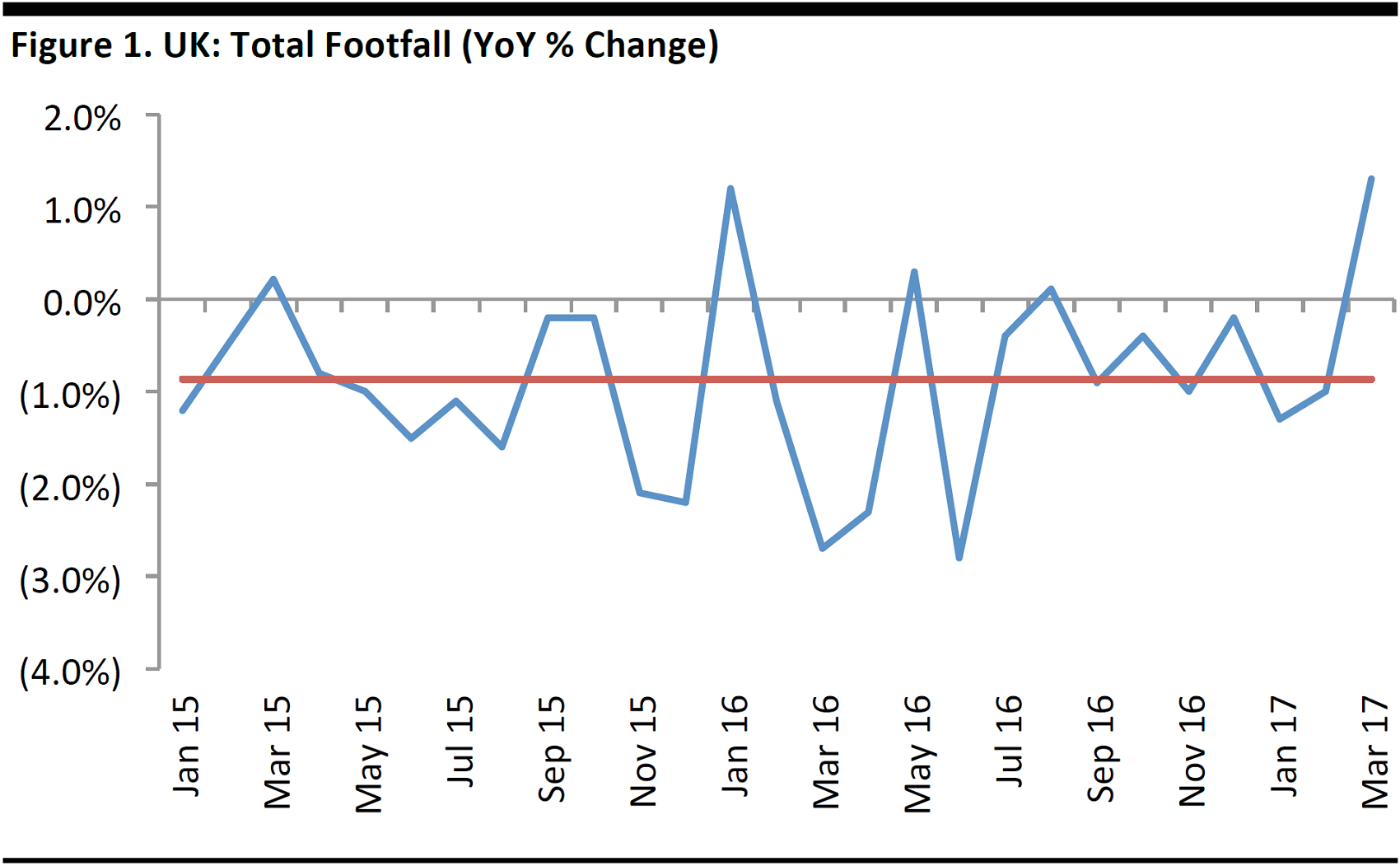

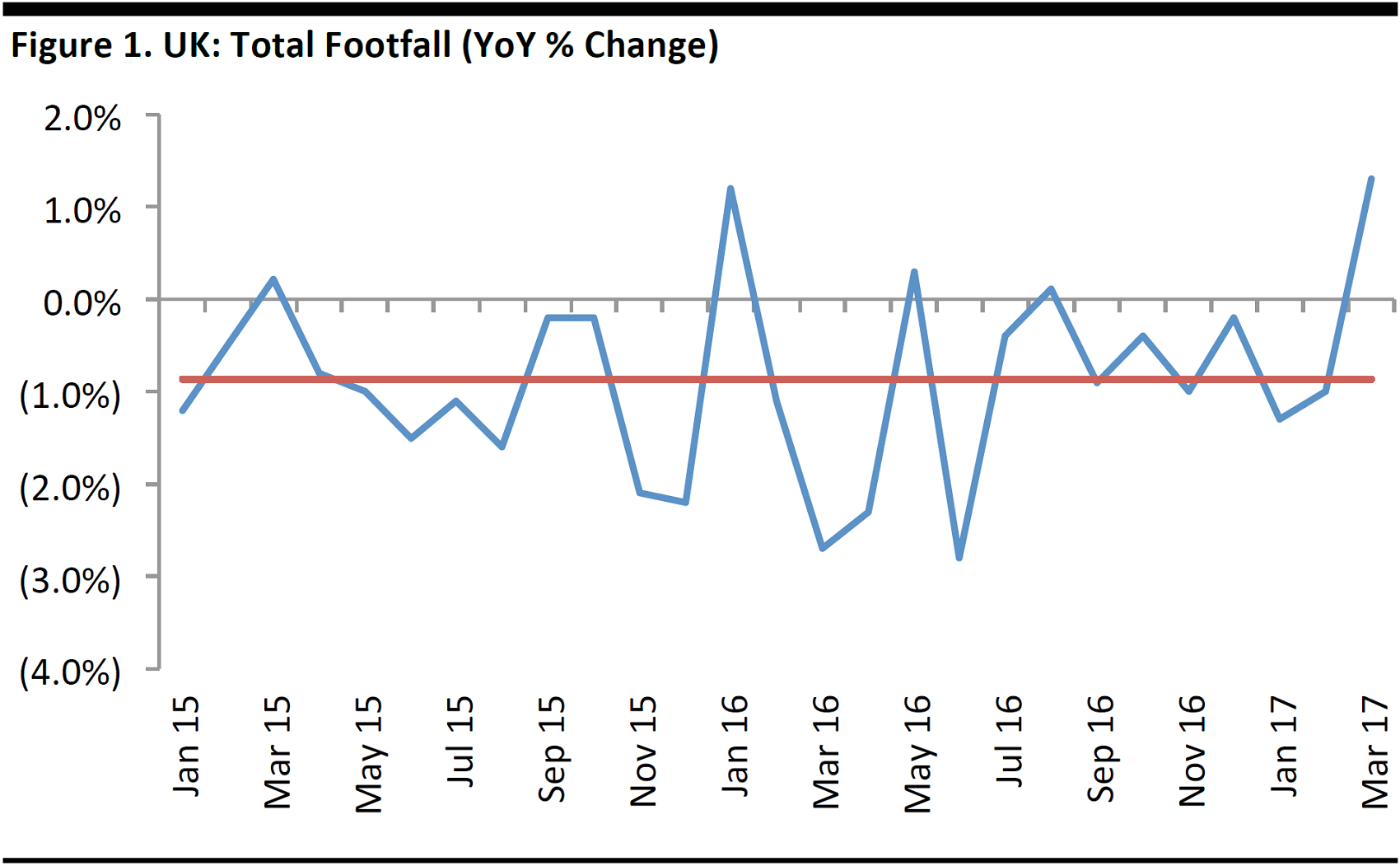

UK brick-and-mortar retailers are seeing footfall decline. According to the British Retail Consortium (BRC) and data-measurement firm Springboard, average monthly footfall has declined by 0.9% since January 2015, and footfall currently seems to be predominately driven by food and beverage spending. The graph below shows the trend in UK monthly footfall since January 2015.

Source: BRC/Springboard/Fung Global Retail & Technology

The jump in March 2017 footfall shown in the graph above was principally due to calendar effects:

- Retailers experienced the fastest growth in footfall in three years in March, when traffic increased by 1.3% year over year. This marked the strongest growth since March 2014 and a reversal of six months of declines. However, March 2017 included one extra shopping day versus the prior year due to the timing of Easter: retail stores in the UK close on Easter Sunday, and the holiday fell in March in 2016, but in April in 2017.

- Furthermore, there was a shift toward evening spending at food and beverage outlets in March, as consumers prioritized spending on experiences over goods. In fact, almost the entire increase in March footfall can be attributed to the evening period, as footfall during the 9 a.m.–5p.m. store hours declined by 0.5% on high streets and by 7.1% in shopping centers.

Vacancy Rates

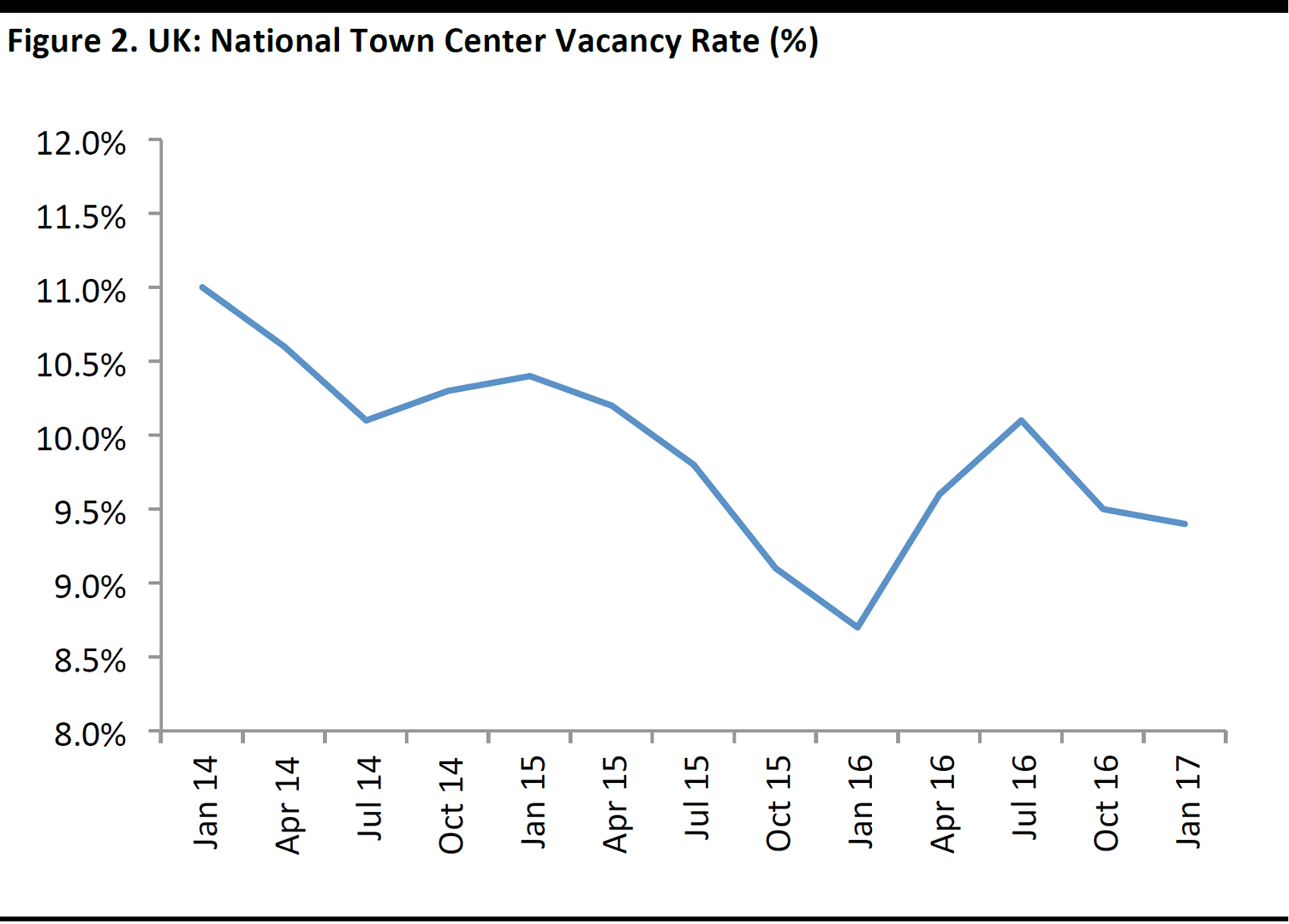

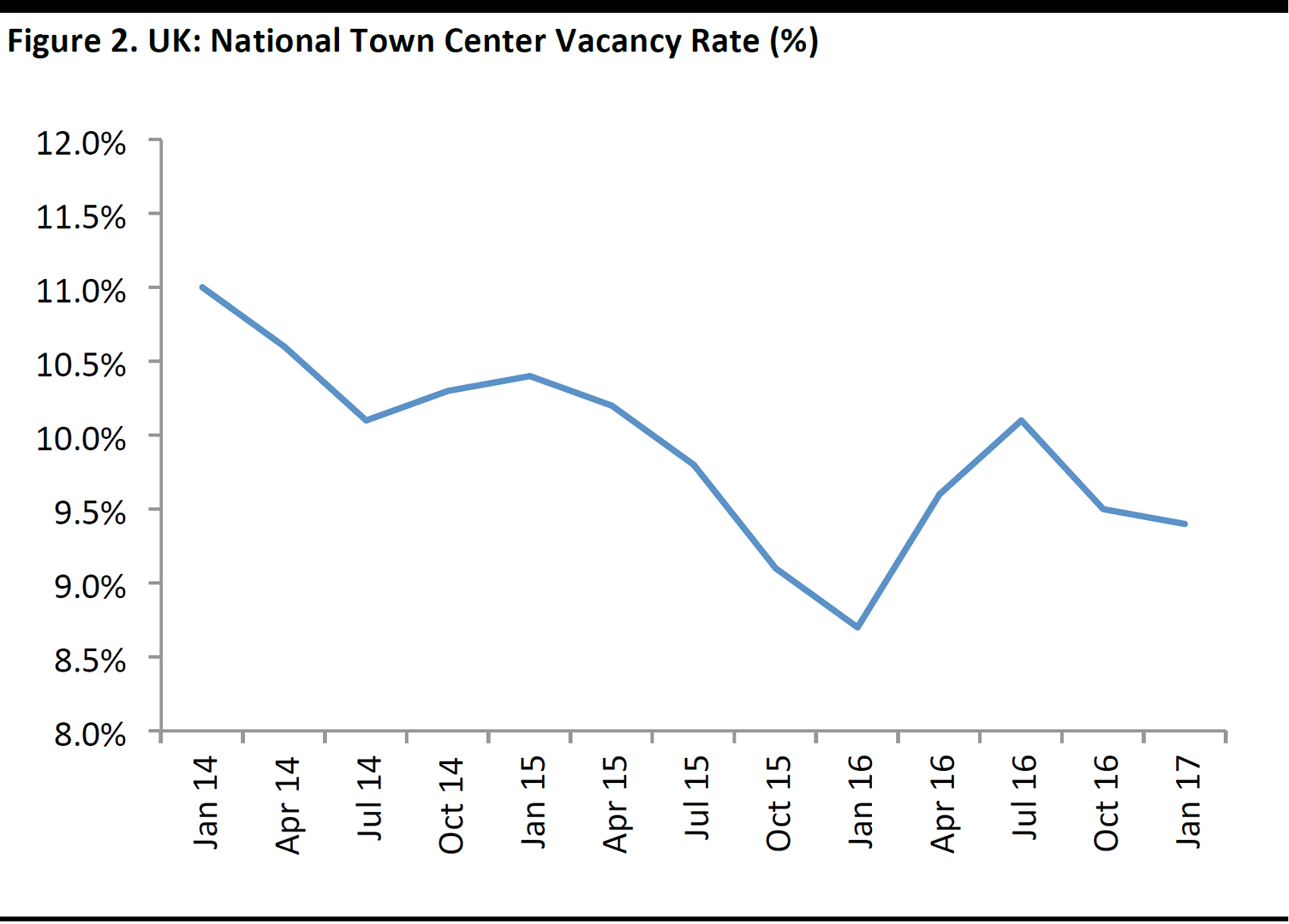

Retail real estate vacancy rates in the UK remain at healthy levels and have shown a broadly declining trend over the last three years. According to commercial real estate services provider Cushman & Wakefield, UK prime retail vacancy rates are low. The national town center UK vacancy rate improved from 9.5% in October 2016 to 9.4% in January 2017. The January figure marked the lowest vacancy rate since January 2016, when it was 8.7%. However, the rate was lower partly due to the movement of occupancy from retail to hospitality.

Source: BRC/Springboard/Fung Global Retail & Technology

- The vacancy rate in the UK has averaged about 9%–10% since July 2015. Some UK regions have much higher rates, and the variation between locations is growing wider, according to the BRC.

- UK retail parks had a low vacancy rate of 6.2%and shopping centers at 14.1% in 2016, according to the Local Data Company.

Retail Rents

Retail rent levels further indicate that the UK retail real estate sector is still in a healthy situation. In 2016, the majority of UK high-street rents remained similar to 2015 levels, according to property firm CBRE. Only 6% of the 400 locations that CBRE monitors experienced a decrease in rental values in 2016, while 9% saw rents rise.

Source: iStockphoto

London saw some of the strongest rental growth across the EMEA region last year,when retailers paid a premium to secure limited prime space. New Bond Street was ranked as the fourth-most-expensive street in the world in 2016, with rents rising 14.3%, according to Cushman & Wakefield. Likewise, rents for locations in London’s Covent Garden and on Sloane Street increased by 32% and 27%, respectively, in 2016.

The gap in rental growth between prime and secondary physical locations will continue to widen due to the growth of e-commerce, according to CBRE. Also, a lack of new supply in key locations will continue to create upward rent pressure, as prime locations see much higher footfall than do secondary locations. Key tourist towns and cities will continue to benefit from great tourist activity, due to the softness of the British pound.

Bankruptcy Filings and Store Closures

Despite the challenging retail market, the UK has seen low levels of retail company bankruptcy filings, restructurings, liquidations, and store closures. According to Deloitte, in 2016, 92 UK retailers filed for administration (bankruptcy), representing a decline of 4% year over year. However, the number of large retailers that collapsed grew from seven in 2015 to 11 in 2016.

UK retailer failures and store closures can be attributed to a mix of sector-specific and company-specific factors, including:

- A secular consumer shift from store-based to online shopping, and the consequent lower footfall in physical retail locations.

- Consumers moving away from spending on retail categories such as apparel to spending on leisure and experiences.

- The midmarket segment, especially department stores, facing structural challenges as it is squeezed between growth in the value segment and growth at the higher end.

- Foreign parent companies, especially US-based ones, filing for administration and following a global store closure program.

In UK apparel retail, a number of major names have filed for administration in 2016 and 2017 to date:

- Value department store chain BHS fell into administration in April 2016 and 164 BHS stores closed by August 2016.

- Upmarket women’s and men’s fashion clothing chain Jaeger filed for administration in April 2017 after failing to find a buyer. As a result, 20 UK store closings have been announced.

- UK footwear retailer Jones Bootmaker filed for administration and was bought by private equity firm Endless in April 2017. As a consequence, 31 UK stores are slated to close.

- Formalwear retailer Austin Reed entered administration in April 2016 and was purchased by Edinburgh Woollen Mill, which will relaunch the Austin Reed brand. The company plans to open 50 stores by early 2018.

- Discount fashion chain Store Twenty One closed 77 stores after defaulting on rent payments in July 2016.

The fact that the UK has seen relatively few retailer bankruptcies is rather impressive, considering the challenges retailers have been facing.

Store Closure Cases

The UK is also experiencing a trend of increasing store closures, although these remain at manageable levels:

- In 2016, a net 896 UK town center and high-street stores closed. This was nearly double the number in 2015 and was the highest net decline since 2012, according to the Local Data Company. Store closures in 2016 were amplified by the high-profile bankruptcy and closure of 164 BHS department stores.

- London witnessed the most significant increase in net store closures across all UK regions in 2016.

A number of prominent retailers have announced store closure programs since the beginning of 2016:

- Department store and grocery chain Marks & Spencer announced that it will close 30 stores and also cease selling apparel at 45 stores, replacing the full-line stores with food-only stores. The company has a total of 344 clothing-and-home stores in the UK.

- Department store chain Debenhams announced plans in April 2017 to close up to 10 stores, although it said that all of its 176 UK stores are profitable.

- US-based American Apparel closed all 13 of its UK stores following its bankruptcy filing. New owner Gildan Activewear did not want to purchase any of American Apparel’s stores, choosing instead to purchase only the brand’s intellectual property.

- Clinton Cards is considering closing about 120 shops, equivalent to approximately 25% of its UK estate. US owner American Greetings commented that 120 out of 393 UK shops need to be modernized and, as a result, are subject to an ongoing strategic review.

- Banana Republic closed all eight of its UK stores in late 2016.

Source: iStockphoto

The UK has seen a relatively low number of store closures overall, especially given that certain closures were made by struggling US parent companies.

Continuing Trends

Below, we outline a number of growing trends that we have identified in the UK retail real estate market. These include an increasing number of leisure and outlet openings, bifurcation of premium and secondary retail assets, pop-up stores, international retailers expanding in London, increasing demand for warehouse space, online pure-play retailers opening physical stores, and an increase in click-and-collect and locker pickup locations in retail formats.

Rise of Leisure

UK retailers continue to expand their leisure offerings in retail formats, as a strong leisure/hospitality offering drives footfall and dwell times in retail destinations. Many prime shopping-center and high-street landlords are replacing retailers with food and beverage offerings, gyms and fitness centers, cinemas and even ice rinks, art markets and amusement park rides. Developers are devoting more space to leisure tenants in new build developments, too. This is a trend that we are witnessing internationally, as landlords in the US, Canada, and Continental Europe adjust to the consumer shift toward greater leisure spending.

- Leisure outlets such as restaurants and bars account for close to 20% of leasable units in the UK’s top 30 shopping centers, according to Cushman & Wakefield.

- In 2016, the number of food and beverage chain branches in the UK increased by 6% and the number of casual-dining restaurants grew by 8%. In London alone, a record 200 new chain and independent restaurants opened last year, according to Harden’s Restaurant Guide 2017, and the guide’s publishers predict that the pace of growth in 2017 will continue at a similar rate.

Bifurcation Trend

The UK retail real estate market is also seeing increasing polarization between prime shopping centers located in large urban areas and weaker regional and local malls:

- There is continued strong demand for space in prime retail locations, as retailers are rushing to secure the best space, according to real estate agency Savills.

- Likewise, a lack of supply along major urban thoroughfares in the UK and Continental Europe is putting pressure on rents in those prime locations, where large, glossy flagship stores showcase retailers’ brands and attract tourist shoppers.

Pop-Up Stores

Pop-up shops and temporary experiential retail spaces are becoming more common in the UK:

- London has seen many retail pop-ups, particularly around holidays and coinciding with special occasions. Other pop-ups have been created as a collaboration between a specific retailer and designer.

- Appear Here is a temporary retail space marketplace that operates like an “Airbnb for commercial real estate” and partners with retailers and real estate developers. In the US, the startup has formed exclusive partnerships with mall owners The Blackstone Group, Simon Property Group, and Brookfield Asset Management. In the UK and France, Appear Here has worked with Google, LVMH, Net-A-Porter, Topshop, Supreme, and Spotify. In 2016, Appear Here facilitated the launch of 4,000 pop-up shops in London.

International Retailers Expanding in London

The number of new stores opened in London by international retailers more than doubled year over year in 2016, according to CBRE.Out of the 75 new London stores that CBRE tracked in 2016, 59 were opened by foreign retailers, up from 28 in 2015.

Foreign brands are especially keen to open stores in London, reflecting the demand for retail real estate in areas and streets that allow them to optimally showcase their brands, according to CBRE.

Source: iStockphoto

Warehousing Growing

The sustained boom in e-commerce is boosting demand for warehouses that can serve as distribution centers. According to Savills, the warehousing sector is set to have its best year on record in 2017.

- Amazon accounted for over a quarter of all warehouse space rented in the UK in 2016.

- Online retailers accounted for a third of the warehouse market in 2016, while supermarkets represented less than a quarter of warehouse space take-up.

- Increased demand has squeezed supply, and the amount of available warehouse space has declined by 71% since 2009.

Online Pure Plays Opening Brick-and-Mortar Stores

At the same time, a number of online pure-play retailers are seeking to open brick-and-mortar stores in selected locations:

Source: Fung Global Retail & Technology

- Online fashion pure play Missguided opened its first brick-and-mortar store, in London’s Westfield Stratford City shopping center, in 2016. The company plans to open three more stores in the UK in early 2017.

- Online furniture and housewares retailer Made.com has opened physical stores to complement its online offering.

- Amazon has reportedly been searching for high-street locations in prime central London areas for a potential launch of a checkout-free grocery store similar to the one that it is testing in Seattle, Washington, in the US.

Click-and-Collect in Malls

More click-and-collect pickup locations and lockers are being set up in malls in partnership with online retailers such as Amazon and parcel locker provider Doddle. Mall lockers supplement major retailers’ in-store capabilities. According to retail landlord British Land, approximately 30% of customers that visit local shopping centers use click-and-collect, whether they pick up from stores or from third-party points such as lockers.

The Future of the UK Retail Real Estate Sector

New Retail Space Additions Pose a Threat

New retail space from shopping-center store openings and revamps will reach a four-year high in 2017, according to Cushman & Wakefield. This brings the risk of retail space supply outpacing demand.

- More than 2.7 million square feet of additional shopping-center retail floor space is under construction and due to open in 2017, representing the largest amount of UK floor space additions in a single year since 2013. However, more than half of the new space consists of extensions and refurbishments of existing centers, highlighting the risk of developing and building new projects.

- According to CBRE, 1.2 million square feet of new retail park space is expected to open in 2017, an increase of a third over 2016. Retailer demand for units in retail parks will remain strong in 2017, as the parks offer a number of benefits, including ease of access, a varied tenant mix and free parking.

Threat from Business Tax Rates

Higher real estate tax rates will prove a headwind for UK retailers, particularly those with stores in London. New business tax rates are based on rental values, and the rates were updated in April 2017 for the first time in seven years. Retailers and industry watchers are concerned that levying higher taxes on brick-and-mortar shops will put them at a disadvantage versus online pure-play retailers.

Many retailers have been paying business rates that are based on real estate values that predate the financial crisis. Rental values have surged for spaces on streets with flagship retail stores in London and in the main shopping centers, while rental values for many assets in secondary locations have fallen.

- As of April 2017, some store locations will experience rateable value increases of more than 100%, and tax bills could increase by as much as 45% in 2017. Locations on some London streets in Mayfair, such as Bond Street, Regent Street, and Oxford Street, have doubled in value, according to real estate services firm JLL. A store on Regent Street can expect an average 87% surge in rates, according to Deloitte.

- However, the effect on retailers with a national footprint will be less severe, as the increases in London and the Southeast UK are expected to be offset by declines in values and rates payable in other regions of the UK.

- Furthermore, according to the BRC, UK property taxes are higher than anywhere else in the developed world. The onerous taxes have previously acted as a disincentive to operate physical space.

- Business rate revaluations could result in store closures, as they will prompt some retailers to consolidate their portfolio footprints. The BRC projects that the increase in UK business rates will result in 8,073 store closures by 2020, in the best-case scenario. Although the strongest retailers continue to selectively seek new stores, they are proceeding more cautiously.

- De Beers is leaving its De Beers Diamond Jewellers flagship store on Old Bond Street due to a significant increase in business rates.

Brick-and-Mortar Prospects

Retailers will restructure and prune their portfolios in order to adapt to consumers’ continuing shift toward online shopping. According to CBRE, retailers’ future strategies will focus on operating a smaller fleet of flagship stores in prime streets and shopping centers and in retail parks. However, a significant portion of UK consumers still prefer to shop in physical stores:

- A report by The Market Creative found that 75% of consumers surveyed said they would not abandon physical stores for online shopping. Close to half of respondents said that they prefer to get a feel for products and close to a quarter said that they enjoy the social side of shopping.

- Research by Savills and mall owner Intu found that 43% of consumers rate shopping centers as one of the top three places to purchase apparel and footwear.

Key Takeaways

- As retailers in the UK continue to struggle with declining footfall and underperforming sales, store and shopping-center operators are working to adapt to changing consumer dynamics.

- A structural change is taking place as town centers, retail parks and high streets continue to rebalance, offering more leisure outlets and experiences to attract shoppers. Retailers and retail landlords are trying to increase footfall and dwell time by providing shoppers with more and improved entertainment and leisure offerings.

- The incentive for retailers to invest in physical space in the UK will be dampened by higher tax rates in certain areas where rental property values have dramatically increased.