Executive Summary

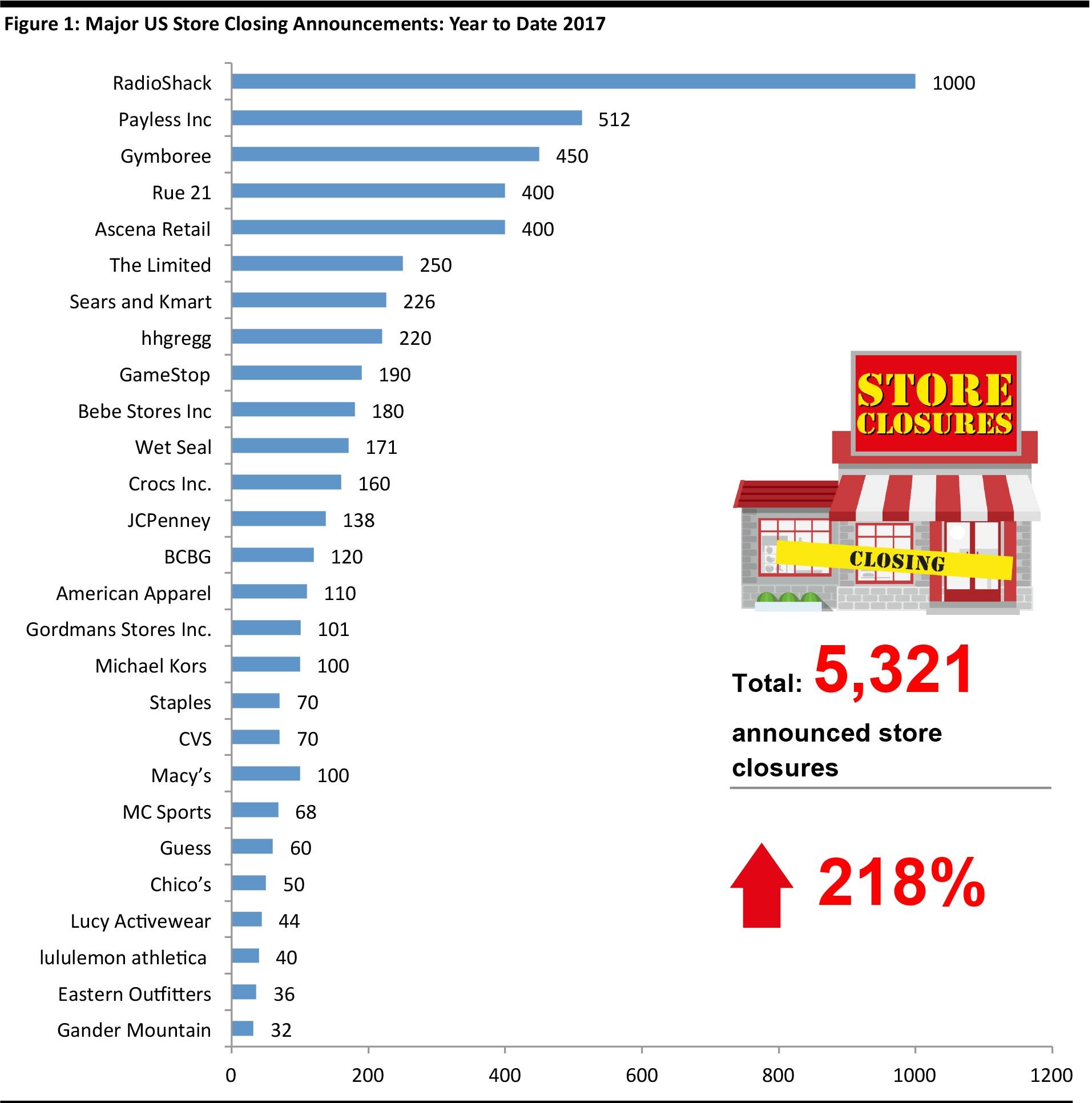

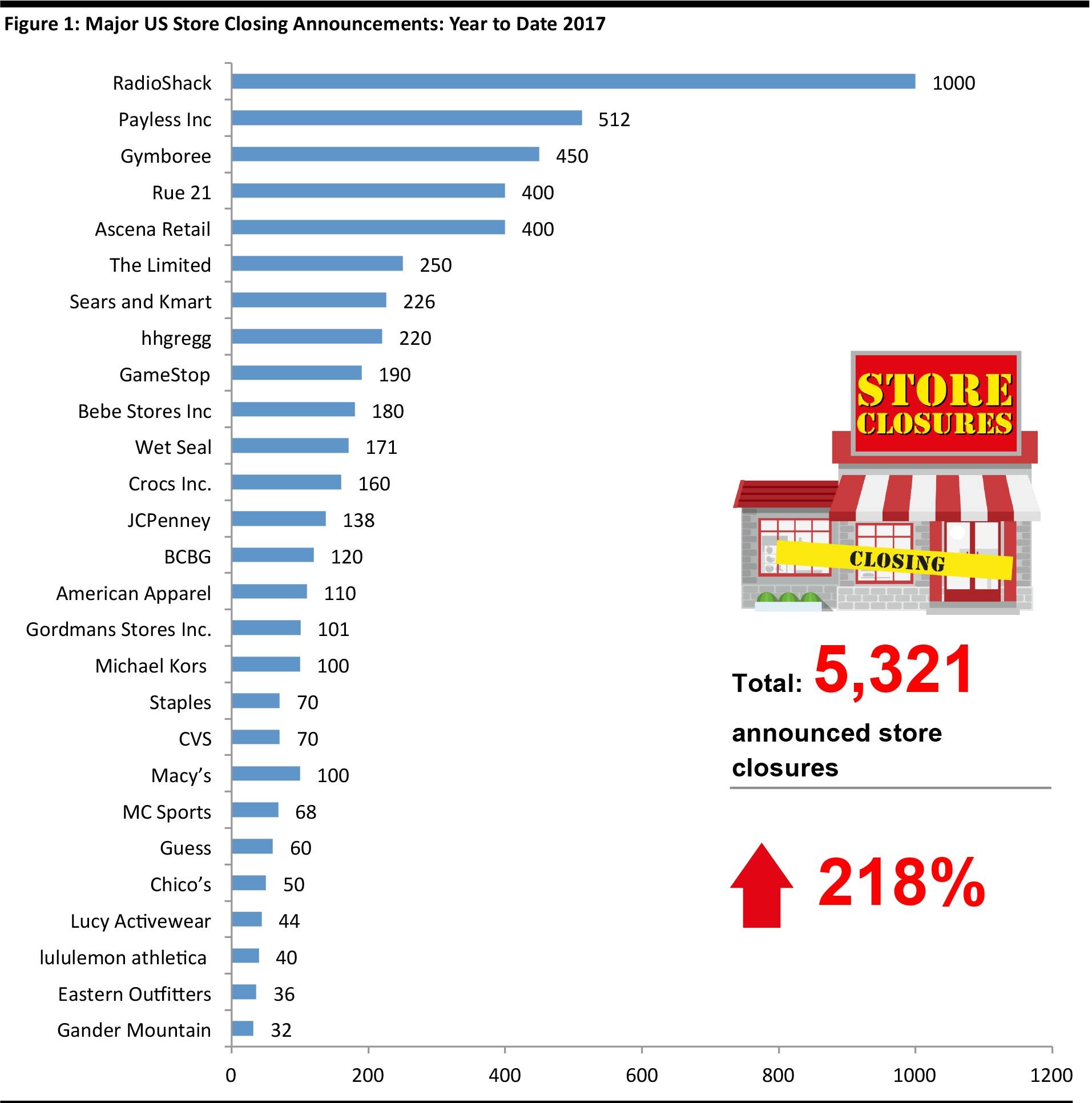

The US retail industry is experiencing a revolution. Traditional retailers such as department stores and specialty retailers are undergoing huge disruption, emerging players in different segments are intensifying competition and higher e-commerce penetration is challenging brick-and-mortar retailers. The rate of change seems to be accelerating. Retailers have already announced a total of 5,321 store closures so far this year, up 218% year over year, and 11 retailers have filed for bankruptcy.

In this report, we look beyond the current turmoil and share some potential solutions that retailers could implement to overcome the challenges they currently face. Store closures could help retailers optimize their fleets and many stores could benefit from a major transformation. Traditional retailers could also benefit by making further investments to expand their offerings and improve delivery speed, regardless of channel.

The US Retail Revolution Has Accelerated

The US retail industry is experiencing a period of revolution rather than evolution. Traditional retailers are being confronted by emerging competitors, fast-changing consumer behavior and the ever-increasing influence of technology in the industry. Therefore, the old guard is being forced to undergo drastic changes in order to remain relevant. Three things characterize the current retail revolution: traditional retailers such as department stores and specialty retailers are being disrupted, emerging players in different segments are increasing competition and higher e-commerce penetration is challenging brick-and-mortar retailers.

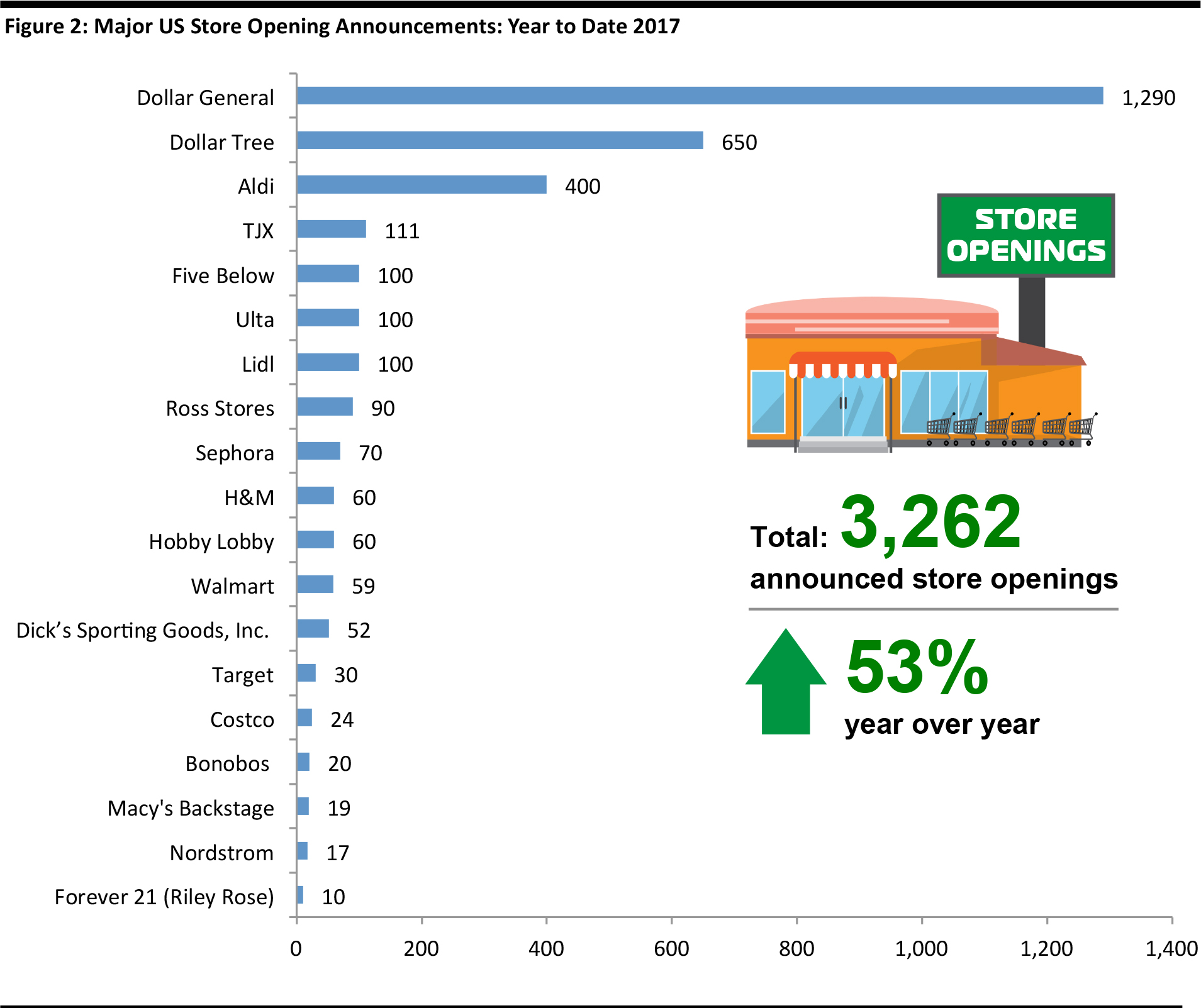

The pace of change also seems to be accelerating. Legacy retailers are closing stores at a faster rate, while value, fast-fashion and beauty retailers continue to expand their footprints. Meanwhile, increasing e-commerce penetration is pushing traditional retailers to adopt new measures in the face of fierce competition.

As of mid-June this year, we have already witnessed a significant numbers of store closure announcements and retail bankruptcies. We calculate that retailers have announced a total of 5,321 store closures so far this year, up 218% year over year. Also, 10 retailers have filed for bankruptcy this year; that number is already higher than the number of retail bankruptcies filed in all of 2016. Rue21 was the latest, filing for bankruptcy on May 15. BCBG Max Azria and The Limited both filed for bankruptcy earlier this year, and Eastern Outfitters is closing 48 stores, or 56% of its store fleet, as part of its bankruptcy proceedings. Sears and Kmart are closing 10 more stores than previously announced, and consumer electronics retailer HHGregg announced it would close all 220 of its stores after failing to secure a buyer.

Gymboree announced it would be closing 350-450 stores. Ralph Lauren’s store closing number was part of the 50-store closure plan announced in June 2016. Payless will close an additional 296 stores if negotiations with landlords are unsuccessful. Ascena will close between 268 and 667 stores by July 2019, depending on negotiation with landlords.

Source: Company reports/Fung Global Retail & Technology

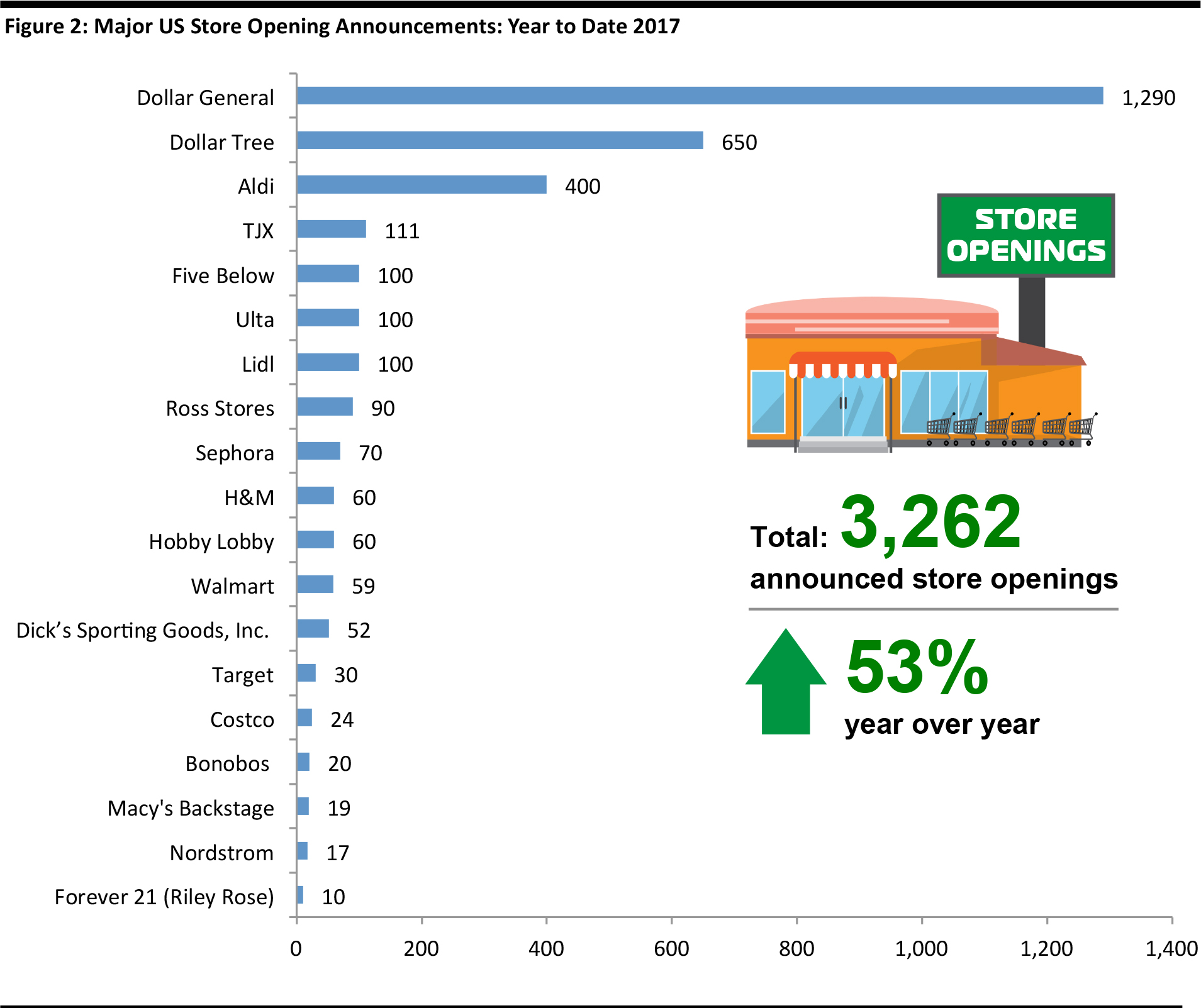

As traditional retailers are closing stores, value, fast-fashion and beauty retailers continue to expand their store fleets despite the challenging environment—and many of them continue to outperform. However, the number of announced store closures so far this year, 5,321 as of mid June, up 218% year over year) far exceeds the number of announced store openings (3,262, up 53% year over year). Among the notable store opening announcements this year was Sephora’s statement that it plans to open 70 stores-in-stores inside JCPenney locations this year.

Aldi will complete a 400-store expansion by the end of 2018. Walmart’s target of 59 stores includes new, expanded and relocated stores. Target is only opening stores in small format. Macy’s Backstage will be opened within existing full-line Macy’s stores.

Source: Company reports/Fung Global Retail & Technology

Strong e-commerce competition has propelled retailers to make a new wave of changes to their businesses. We are seeing more direct-to-consumer brands building their offline presence. Amazon is opening some physical grocery stores and bookstores in US cities. Traditional retailers are taking various measures, including acquiring online pure plays, to build up their e-commerce capabilities. Walmart, for example, has acquired ModCloth, ShoeBuy and Moosejaw this year in order to boost its e-commerce offerings.

We see a number of potential solutions that retailers can adopt to address the fundamental challenges of the ongoing retail revolution.

1) Store closures can help retailers optimize their fleets.

What are the challenges?

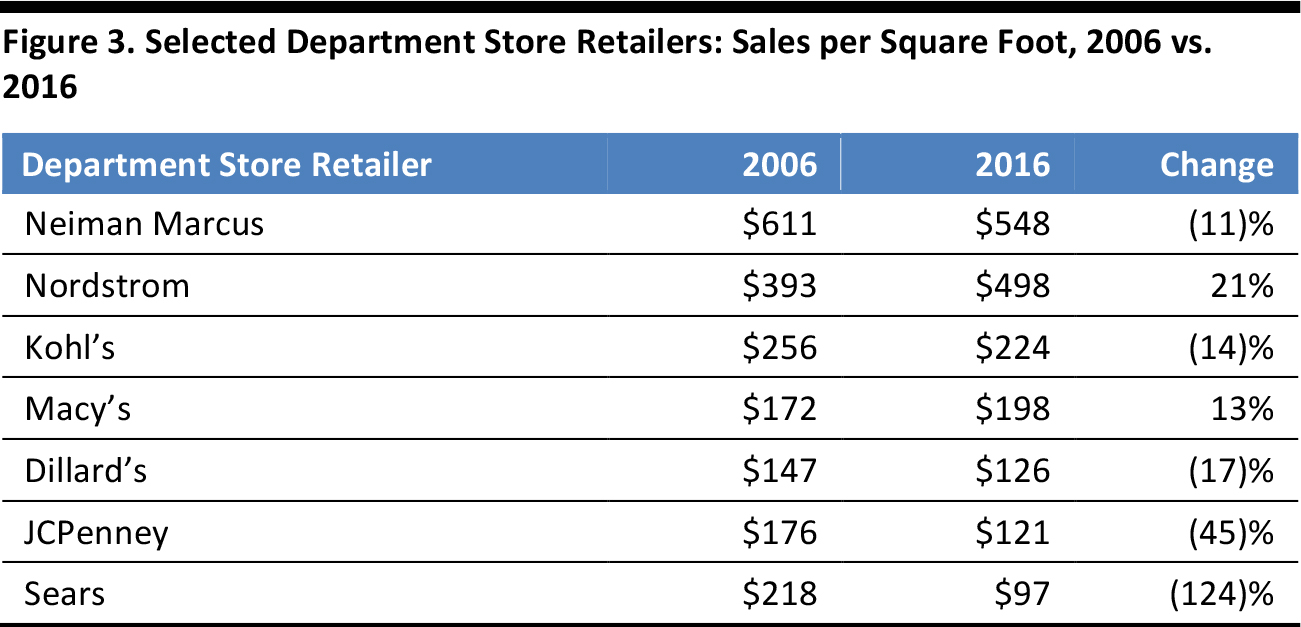

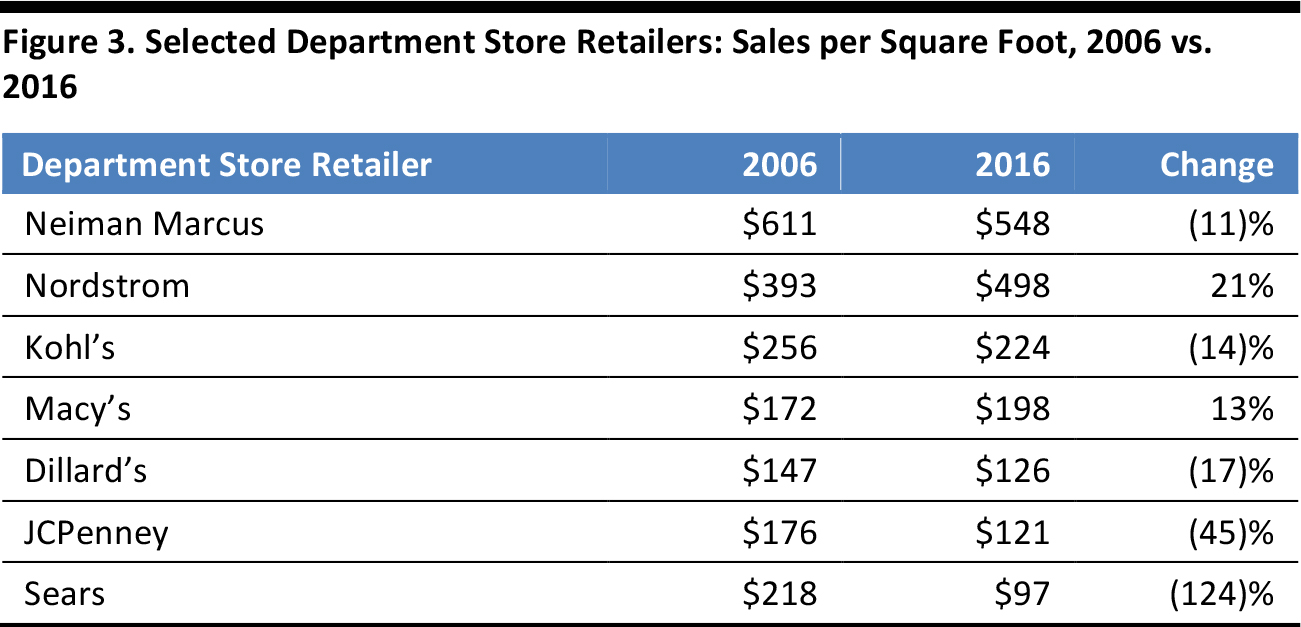

The retail industry is overstored, especially in the department store and specialty retailer space. Our own research shows that five out of the seven major department store chains listed in the table below experienced declines in sales per square foot over the past 10 years. Of the group, Sears saw its store productivity drop the most; it fell by 124% over the period.

Source: Company reports

The specialty retail sector experienced a bifurcation of store productivity performance over the 2006–2016 period. Various mid-tier specialty brands saw sales per square foot decline by 18%–46%, while off-price retailers enjoyed an improvement of roughly 30%. We continue to expect mid-tier retailers to announce more store closures.

*Fung Global Retail & Technology calculations, based on company reports

Source: Company reports

Potential Solutions

Closing poorly performing stores is part of many retailers’ initial steps toward improving their store portfolios and overall comp performance. The stores that retailers have decided close are largely underperformers in terms of sales and likely more so in terms of profitability and four-wall contribution. Beyond closing poorly performing stores, certain retailers need to address the fact that they simply have too many stores.

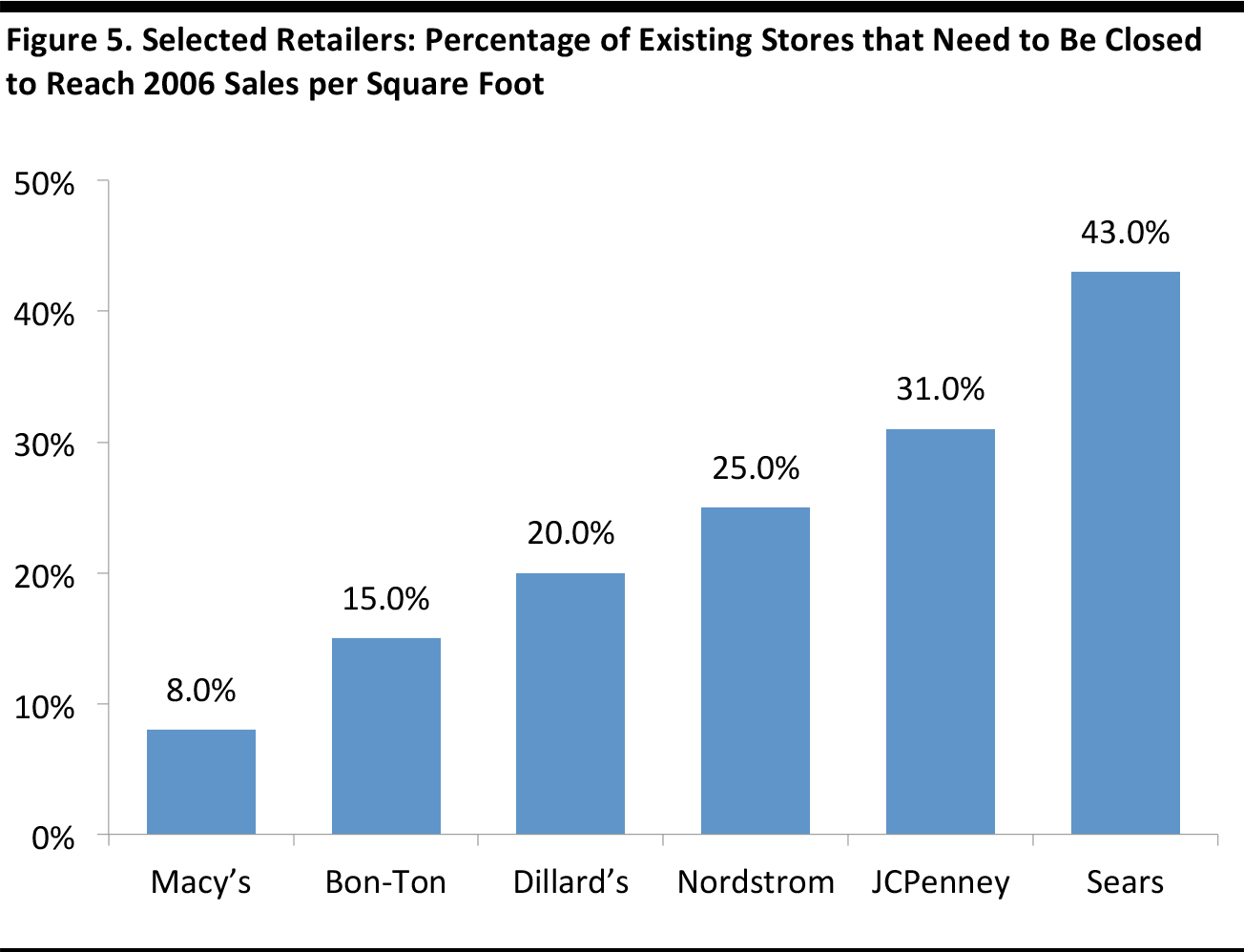

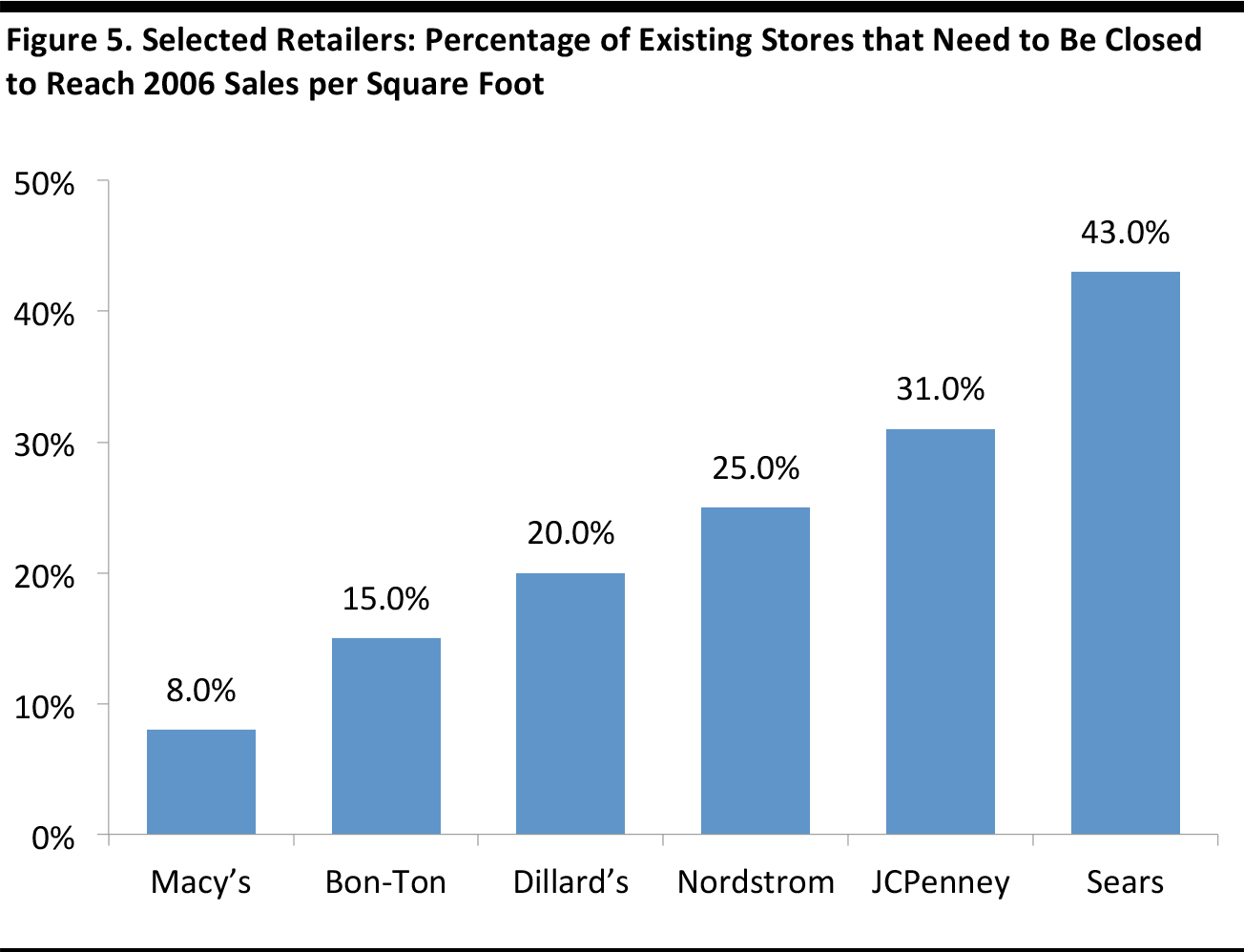

Real estate research firm Green Street Advisors estimates that the major department store retailers shown in the graph below will need to close between 8% and 43% of their stores to achieve the same level of store productivity that they saw in 2006.

As mall anchor stores continue to close, we expect to see more closures of other stores, more mall closures and additional bankruptcies. We maintain that 30% of the 1,221 malls in the US will need to be closed, and that most of these are lower-tier properties classified as C and D malls.

Source: Green Street Advisors

2) Stores are not dead, but they are in need of a major transformation.

What are the challenges?

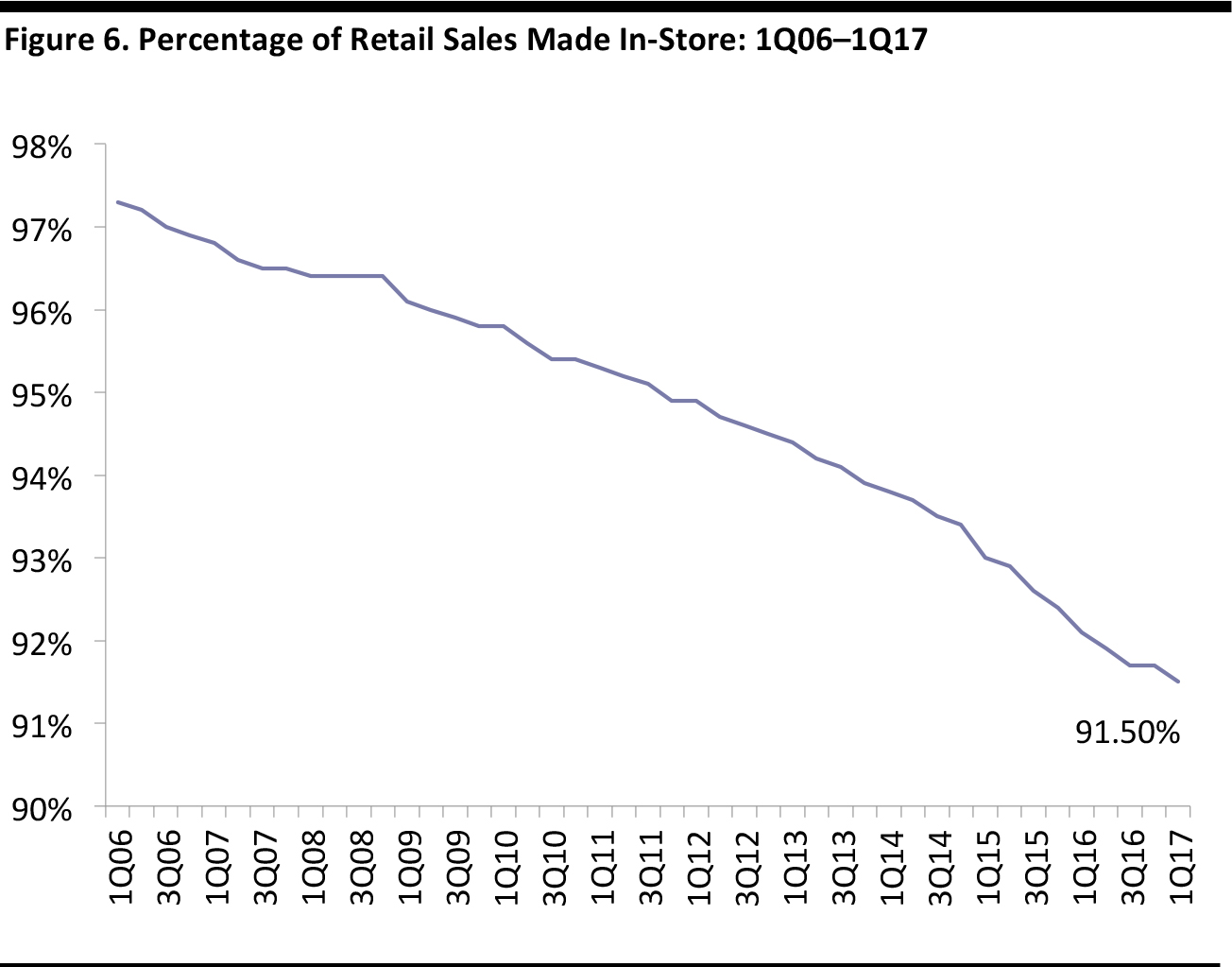

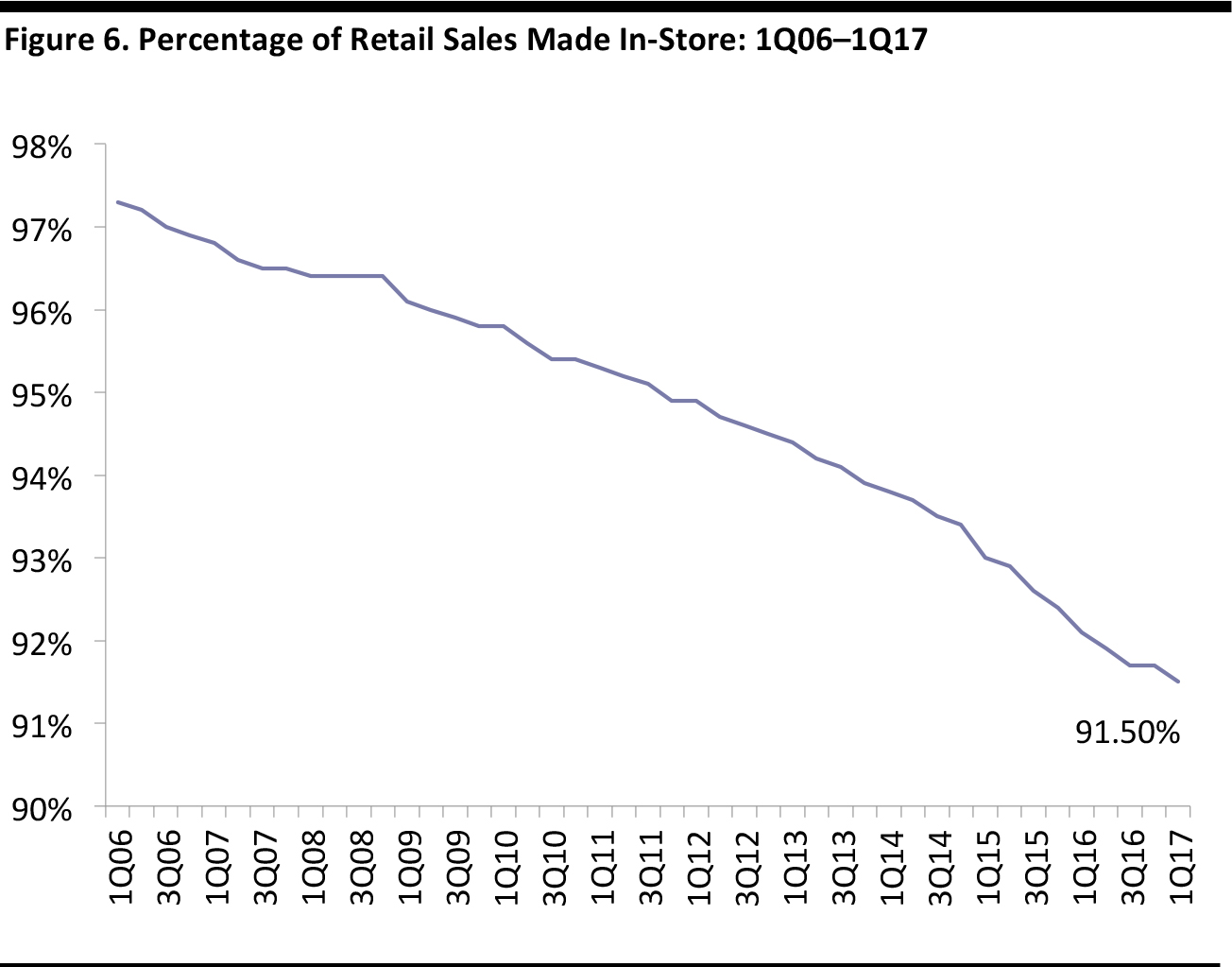

More than 90% of US retail sales are still generated from brick-and-mortar stores, according to the US Census Bureau. For some traditional retailers—such as Walmart, Target and Costco—sales made in physical stores still represent 95%–97% of total sales, according to company reports.

Source: US Census Bureau

Faced with oversized store fleets, outdated in-store technologies and a lack of engaging customer experiences, many retailers must implement changes. At many stores, customers find a lack of excellent customer service, a good deal of friction in the purchase process and no “wow factor.”

Potential Solutions

Retailers should consider making significant changes to their in-store experiences and be willing to take more risks in general.

Stores can become gathering places that foster a sense of community, rather than just being places to transact. People are social creatures and they need to engage with others. Making stores a gathering place and creating a sense of community provides an additional reason for consumers to visit stores, which can eventually generate additional sales.

Stores can also serve as a hub for services, offering travel booking, dry cleaning and hair salons. Retail stores have an opportunity that online stores do not have in terms of providing a memorable experience for customers that will translate into long-lasting customer loyalty. The best store experience is not solely about transacting, but about making customers’ time in the store the best part of their day, leading to them walking out of the store holding the brand in higher regard.

At updated Apple Stores, for example, consumers can play and learn in addition to making a purchase. Many consumers visit Apple Stores not just to buy a product, but because they enjoy a sense of gathering there. Athletic brands such as Lululemon Athletica regularly offer yoga classes and running clubs to customers in order to create a sense of community. Retailers as varied as PetSmart and Ulta are also providing additional services to their customers in-store. At PetSmart stores, customers can send their pets to day camps and access veterinarian care and grooming services for their pets, all of which drive store traffic. At Ulta, beauty services are an integral part of the store offering: customers can get their hair and nails done in-store in addition to booking skincare treatments and makeup sessions.

Source: iStockphoto

The Vitamin Shoppe is revamping existing stores as experiential “wellness locations,” offering in-store beverage bars, open spaces to gather, sampling counters and health enthusiasts on-site. Home appliances store Pirch offers complementary cooking and baking classes in stores so customers can experience the products in action. Customers can also reserve store spaces for private parties.

Shopping malls can upgrade their “retailtainment” offerings as part of the improved shopping experience. The Mall of America has added indoor roller coasters to its entertainment offerings. The Dubai Mall has the largest indoor aquarium in the world. Chinese mall developer Wanda Group built an entertainment space in the northern Chinese city of Jinan in 2016 that includes shopping malls, sports facilities and a theme park, all under one roof.

3) Increasing e-commerce competition is forcing retailers to further innovate to compete on convenience.

What are the challenges?

E-commerce competitors such as Amazon provide compelling offers that combine convenience and value, forcing traditional retailers to compete in creative ways to differentiate themselves from e-commerce pure plays. Amazon, the dominant force in online retail, accounted for 53% of online retail sales growth in 2016, according to Slice Intelligence. In 2016, Amazon recorded a 25.2% increase in sales, while the e-commerce industry overall averaged only low-double-digit growth. The e-commerce channel has seen the fastest growth in retail: online sales accounted for 4.2% of total retail sales in 2010, but that percentage had grown to 8.5% by the first quarter of 2017, according to the US Census Bureau.

Source: iStockphoto

Potential Solutions

To increase their profitability and market share in their overall businesses, traditional retailers need to make further investments to expand their offerings and improve delivery speed, regardless of channel.

Retailers can provide more convenient last-mile delivery options for customers. As the shopping journey becomes more complex for customers and more expensive for retailers, we continue to see companies adopting creative e-commerce fulfillment solutions. An increasing share of purchases are being fulfilled through click-and-collect services and third-party collection points such as neighborhood lockers.

Click-and-collect: Integrating physical stores and online shopping channels has proven an effective strategy for competing with e-commerce pure plays. Physical stores provide convenient pickup locations for customers. In a survey conducted by

Internet Retailer, more than 70% of respondents said they prefer in-store pickup to avoid shipping costs, while 32.2% cited convenience as a top motivating factor for taking advantage of in-store pickup. For retailers, in-store pickup often drives store traffic and incremental sales. Target’s management has said that one-third of shoppers purchase something else in the store when picking up their Target.com online order.

Neighborhood pickup: We have also seen innovative last-mile delivery options that utilize residential neighborhood facilities. DropSpot is a mobile app that turns neighborhood stores into package delivery locations. Customers receive packages through a network of neighborhood merchants and the merchants enjoy increased traffic to their stores in exchange. The company has enlisted more than 1,000 merchants across the US to become “drop spots” for packages, and that number is expected to double by the end of 2018.

In China, packages are often delivered to password-protected community lockers that are located close to residential buildings. Shoppers receive a text message with a password to unlock the community locker and they can pick up packages at their convenience.

Is the Online Marketplace the Answer to Competing with Amazon?

We are seeing more retailers deploy online marketplaces in an attempt to boost their offerings with minimum inventory risk. Amazon has led the trend: Fung Global Retail & Technology estimates that third-party sellers on Amazon sold around $69 billion worth of goods in 2015, and those sellers are expected to sell more units than Amazon itself this year.

Walmart has ramped up its own marketplace offering by acquiring Jet.com and investing in JD.com. Home furnishings retailer Crate and Barrel launched a curated e-commerce marketplace that offers unique products selected by its merchants. The company can offer customers much greater selection as well as products that complement its own brands through this marketplace.

While the marketplace model could be one solution for retailers looking to expand their e-commerce offerings, the option is more suitable for multicategory, big-box retailers and department stores than it is for monobrand retailers. Marketplaces and multicategory retail operate more similarly, so it seems a more logical step for these retailers.

Conclusion

The ongoing retail revolution is expected to intensify, and we are likely to see even more store closures and retail bankruptcies. For many retailers, however, store closures should eventually improve profitability and store productivity. After closing underperforming stores, retailers will still need to make significant changes to their existing store experience offerings. Beyond investments, retailers will also need to innovate to compete with the convenience and value offered by the e-commerce players.