Introduction: The Mall Is Not Dead, but It Is Changing Fast

We published the first report in our

Mall Is Not Dead series in late 2016, prior to the wave of bankruptcies and closures that hit US retail in 2017. The reports in the series have been among our most widely read and, in the 18 months since we published the first installment, much has changed in US retail, ranging from major store closure programs by Macy’s and JCPenney to bankruptcy filings by Toys“R”Us, Rue21 and Bon-Ton. In this report, we offer a much-requested wrap-up to the series that looks ahead to the kinds of changes we expect to see in US shopping malls over the next five years.

In our previous reports in the series, we noted that the challenges malls face are not evenly distributed, as they tend to be concentrated among the weakest-performing shopping centers:

- In our first report, we noted that the US is “overmalled,” and said that we believe at least 30% of the country’s malls need to be closed. Malls are classified from A–D in the retail real estate industry, based on sales per square foot (with A malls ranking the highest). We expect closures to be concentrated among the weaker, regional C and D malls.

- Some 270 class A malls constitute only 20% of the market, but they account for nearly 72% of all mall sales.

- Mall occupancy rates remain high, especially in destination super regional malls, which are defined as those of 800,000 square feet or more. As of the fourth quarter of 2017, super regional malls saw an occupancy rate of 94.5%, while regional malls saw a lower, 91.3% rate, according to the International Council of Shopping Centers (ICSC).

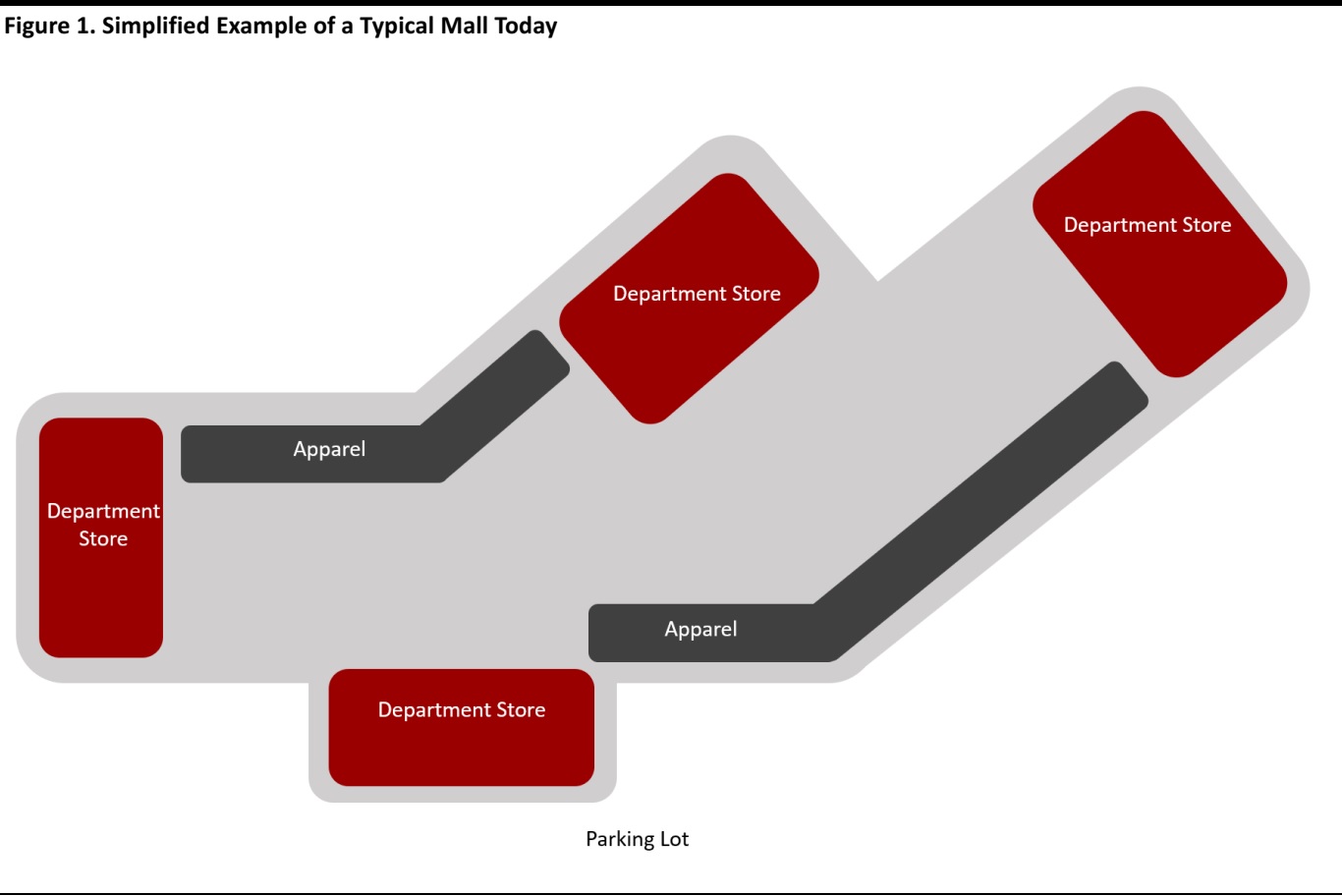

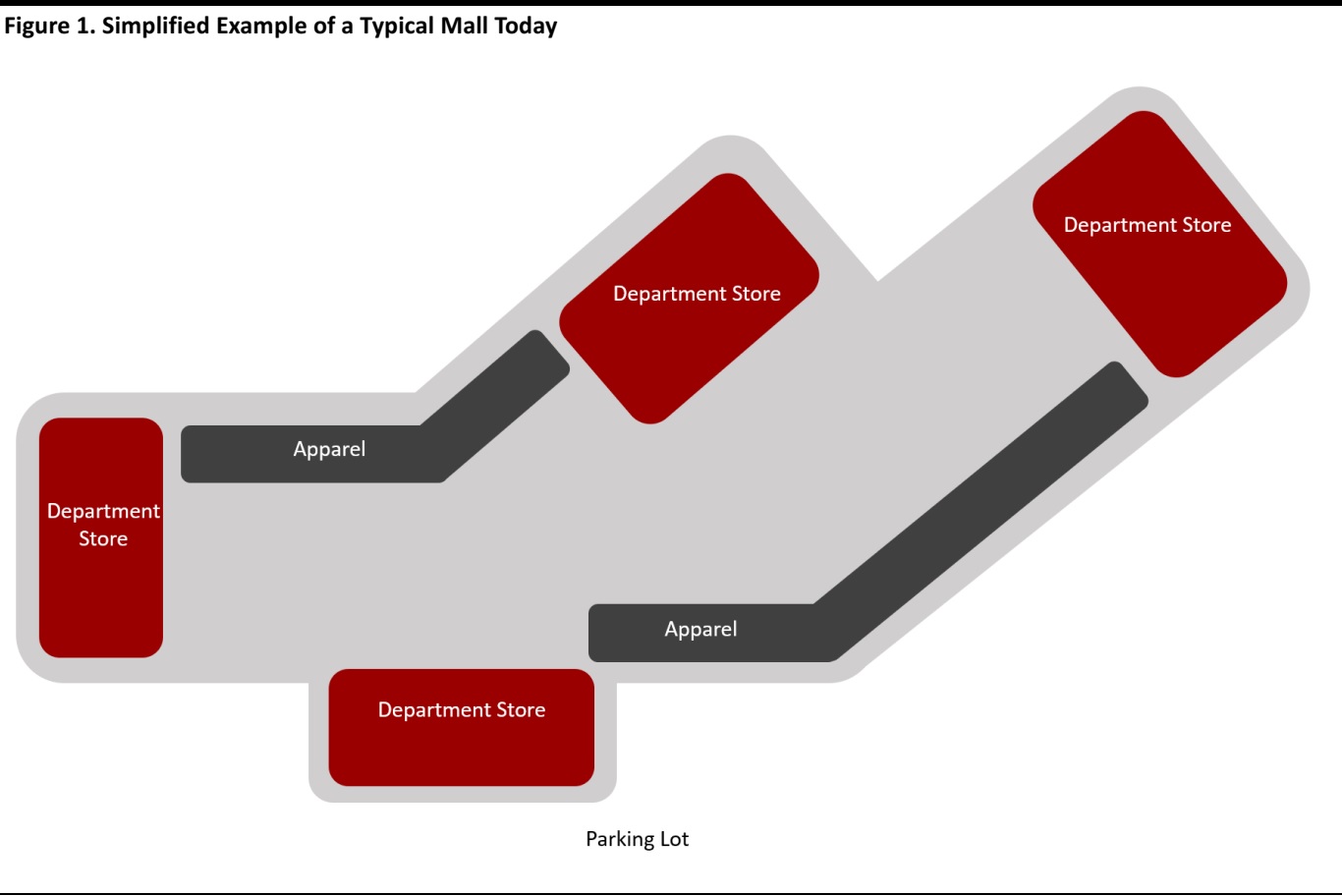

- In our second report in the series, we noted that traditional enclosed malls are focused on apparel, with 80%–90% of square footage devoted to department stores and specialty stores. According to the ICSC, nonretail/nonrestaurant tenants occupied 13.3% of space in regional malls as of early 2017, up from 10.5% in 2012. In super regional malls, that figure rose to 10.8% from 10.5% over the same period.

We also discussed the challenges and changes in US retail real estate in another report separate from this series:

What Retail Apocalypse? Reviewing Trends in US Brick-and-Mortar Retail. And readers may be interested in our

Weekly Store Openings and Closures Tracker, too, a weekly series that we have been publishing since April 2017.

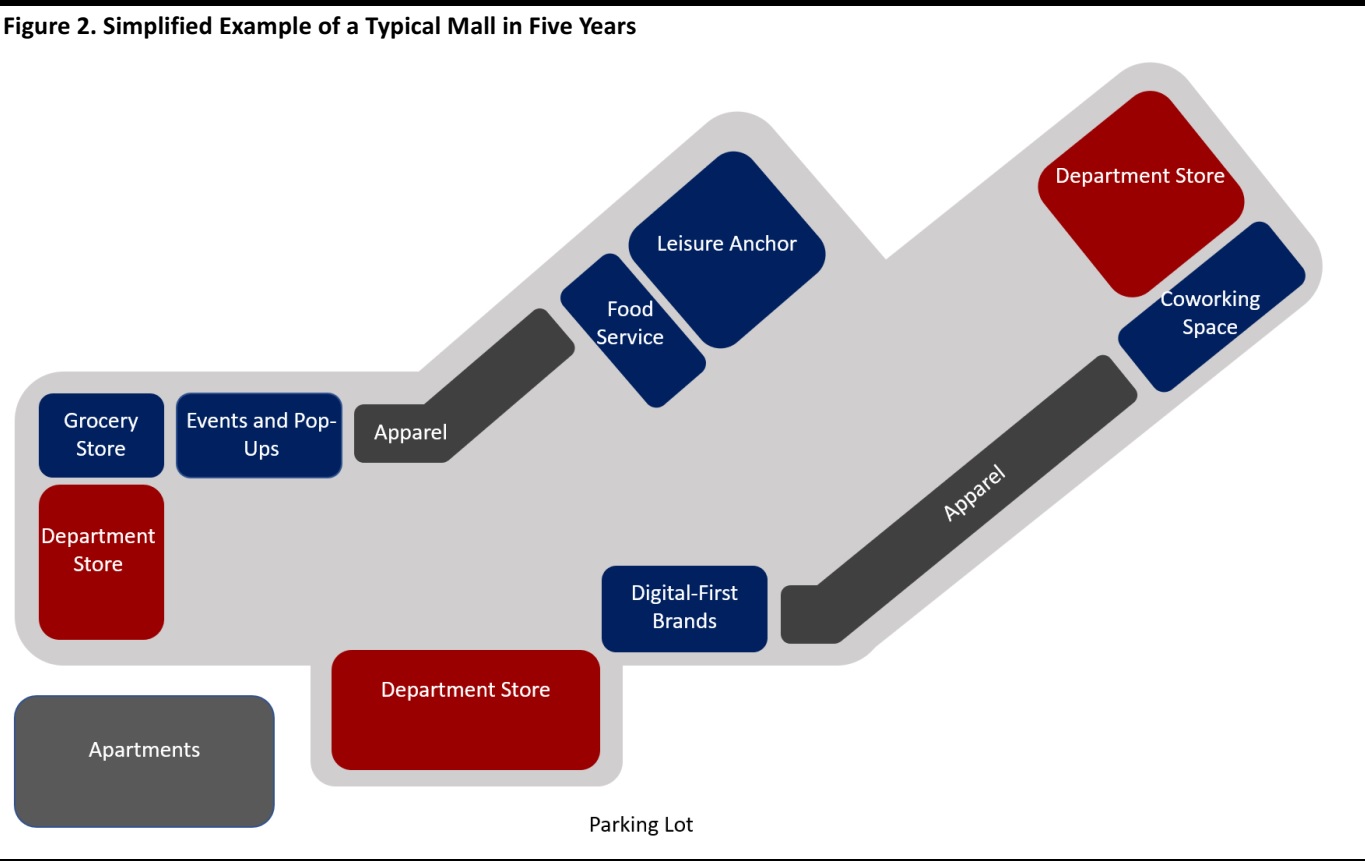

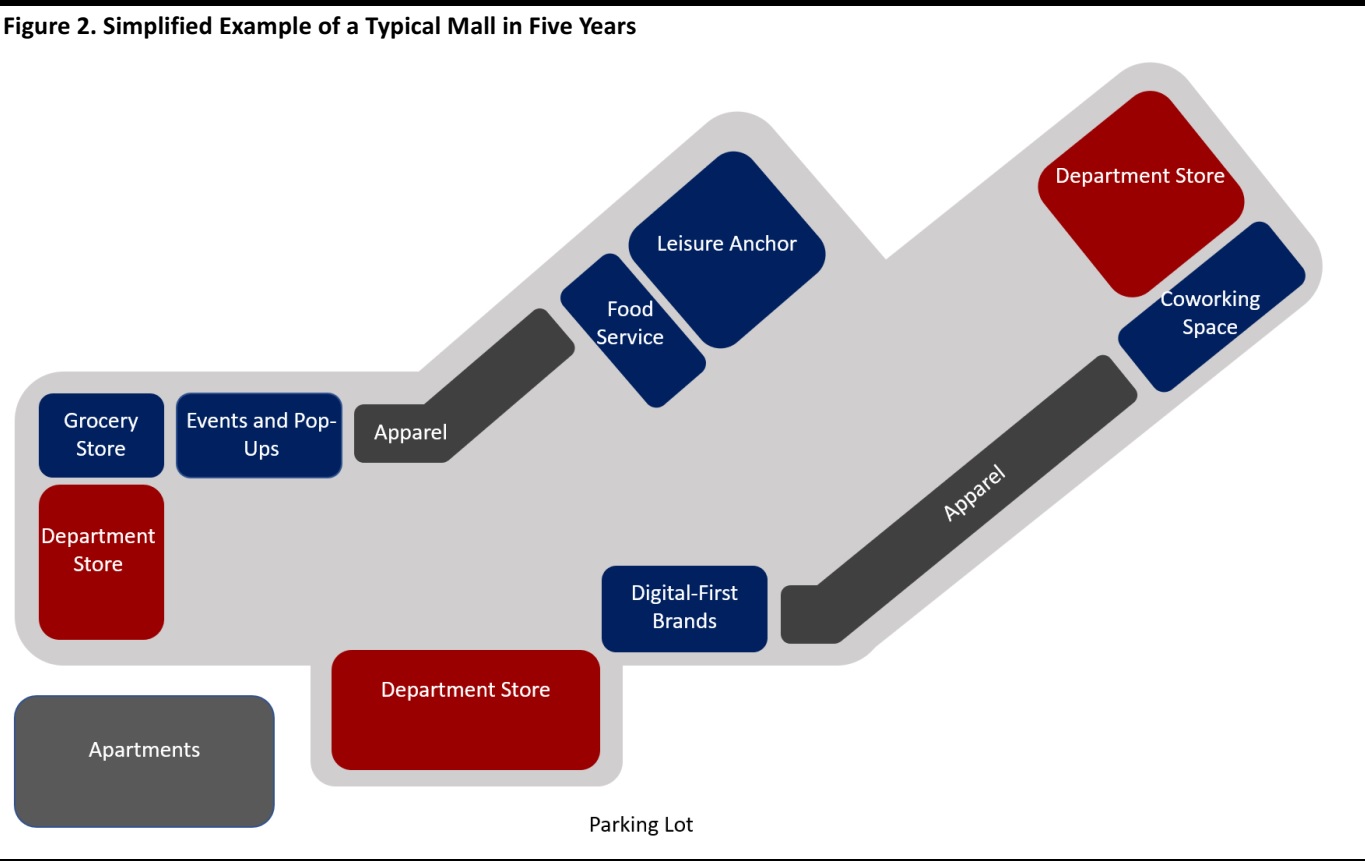

The Mall in the Next Five Years: Moving from a Focus on Apparel to a Retail-and-Services Ecosystem

Over the coming years, many malls will reshape their offerings, and move away from a focus on apparel stores clustered around department store anchors to more diverse networks that include nonapparel retailers, leisure and entertainment tenants, event and pop-up spaces, and business service providers. We expect to see:

- Multi category retail that includes brands moving from online to offline and a higher proportion of nonapparel tenants such as grocery stores.

- More leisure, entertainment and food-service offerings that cater to shoppers’ continuing preference for spending on leisure services at the expense of physical goods.

- More space allocated to time-limited events and pop-up stores designed to drive excitement among consumers, especially younger ones, who tend to prioritize quality of experiences.

- Space freed up by the migration to e-commerce repurposed for nonretail uses such as shared office spaces.

- Mall owners maximize the value of space outside their malls by converting some of it to nonretail purposes such as apartment buildings.

The graphics below illustrate the changes we expect to see.

Source: Coresight Research

Source: Coresight Research

Source: Coresight Research

Source: Coresight Research

How Demand Will Have Changed by 2023: Five Predictions

In the previous reports in this series, we noted the drivers behind the changes that have already impacted US malls. In the following sections, we look ahead five years and make five predictions of major shifts that will impact demand for the type and volume of space offered in malls.

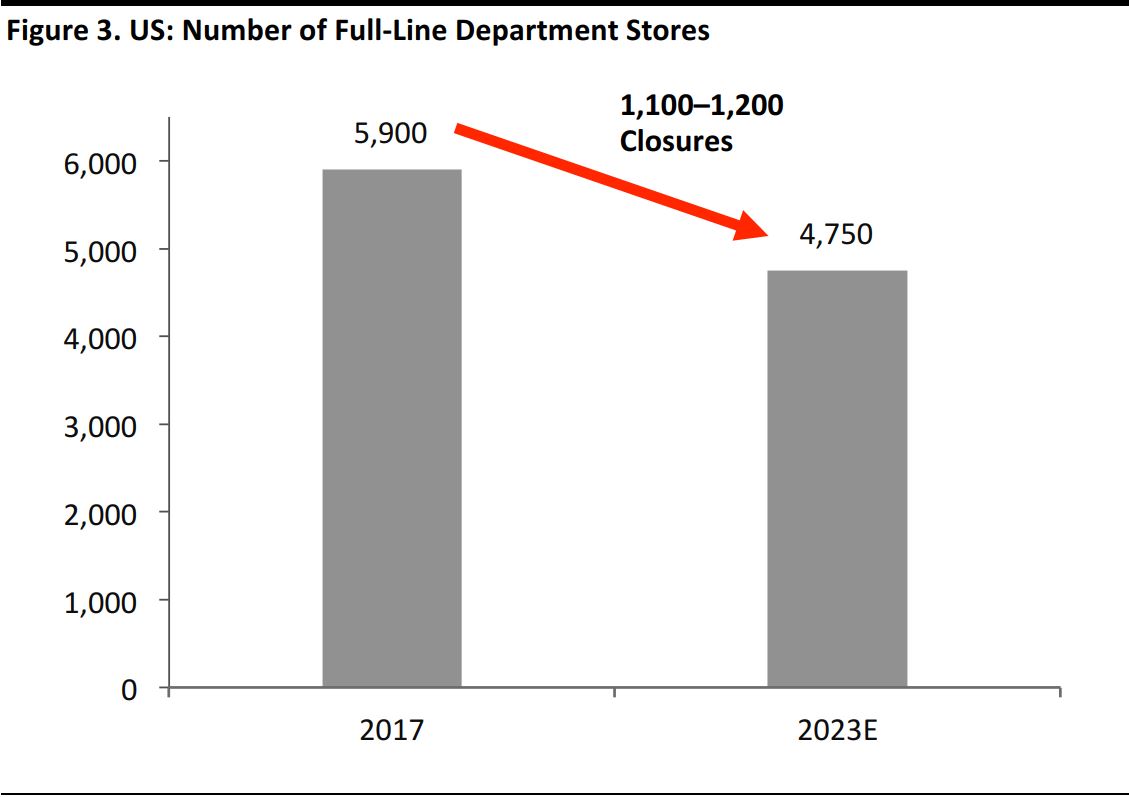

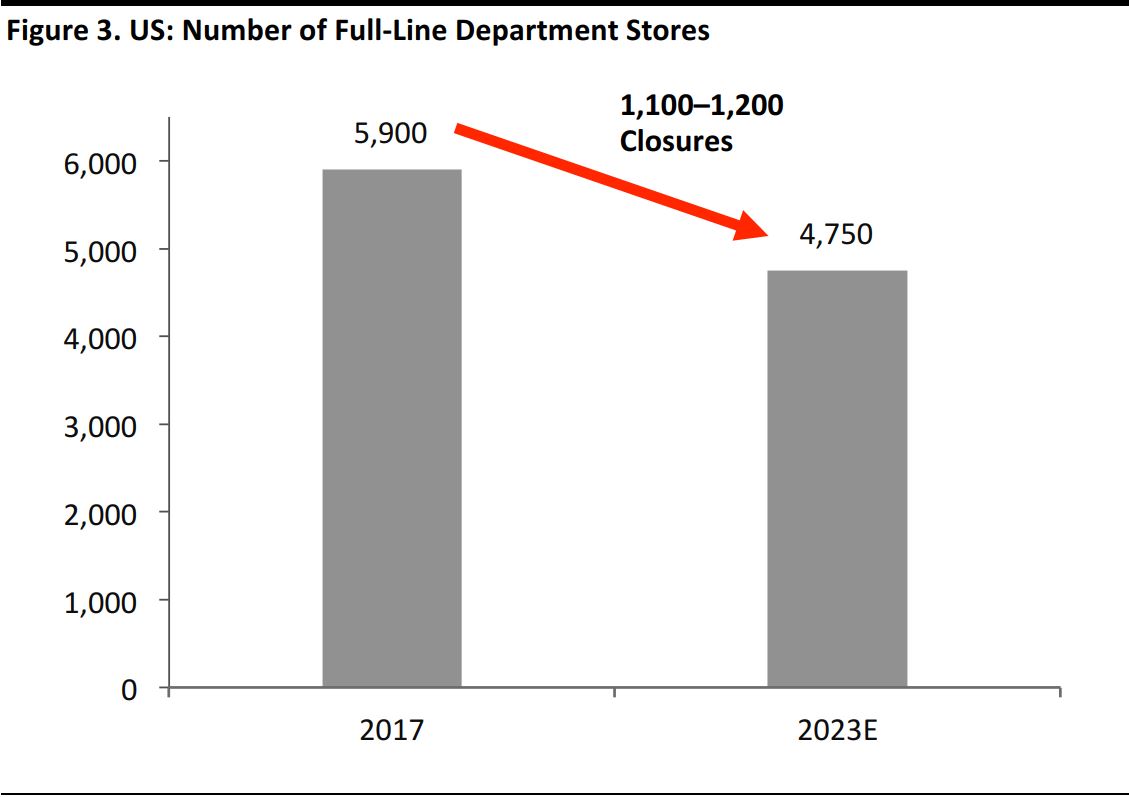

1. One in Five Department Stores Will Have Closed

US retail looks set to be rocked by a further decline in the department store sector. We predict that 1,100–1,200 department stores are likely to close between 2017 and 2023, reducing total sector store numbers by one-fifth.

Our estimates factor in the recent bankruptcy of Bon-Ton and assume that a long-struggling, major department store chain will close down within the next five years—meaning, we assume total closures will be driven by the very weakest retailers rather than reflecting across-the-board down sizings. However, we also estimate that midmarket chains that have already shuttered some stores will close some additional locations. We expect those closures will be partially offset by a very limited number of openings among higher-end retailers that have been growing their store estates modestly.

Figures exclude off-price department stores.

Source: Euromonitor International/Coresight Research

Figures exclude off-price department stores.

Source: Euromonitor International/Coresight Research

Implications

Closures on such a scale suggest that many malls will see an average of one anchor-store closure by 2023. However, that average assumes that store closings will be evenly distributed, which we do not expect them to be. Bankruptcies such as Bon-Ton’s will impact all types of locations indiscriminately, but surviving department stores will implement closure programs selectively. Those programs are likely to have a bigger impact on lower-traffic regional malls with lower sales densities than on premium malls—although retailers may opt to reduce the size of their expensive flagships, too.

We are already seeing department store retailers such as Macy’s place a greater emphasis on the

quality of the shopping experience to sustain traffic,and this implies that we could see the department store sector focus on better-invested, higher-quality and probably smaller stores in higher-traffic locations in the next few years.In turn, anchor-store closures will further dent shopper traffic and undermine the viability of some C and D malls, threatening to unleash a wave of closures of lower-tier regional centers. A cull of department stores is likely to intensify the polarization in mall performance.

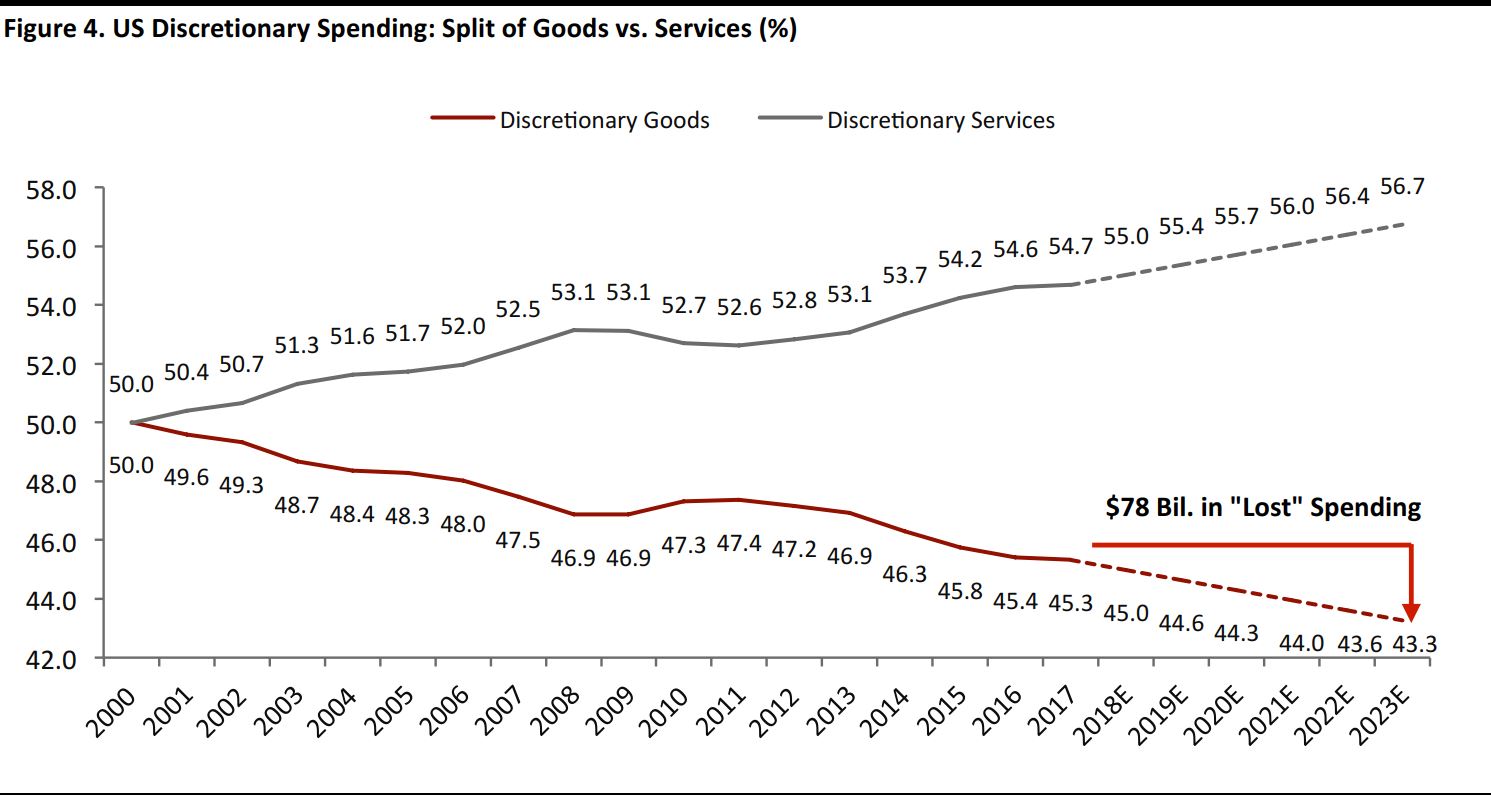

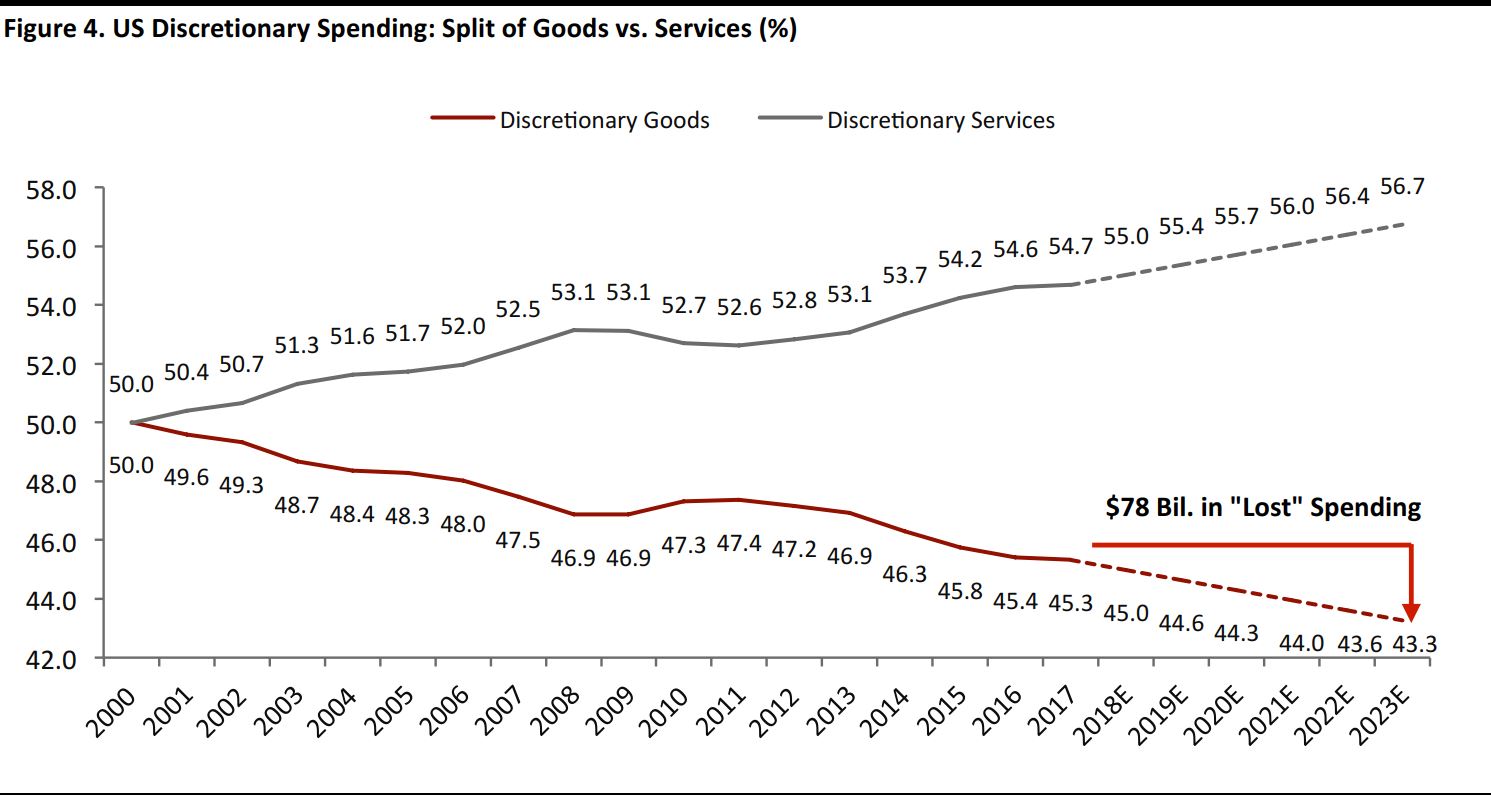

2. Shoppers Will Be Redirecting a Further $78 Billion in Spending from Retail to Services

Year after year, American consumers have dedicated a greater share of their total discretionary spending to services and a lower share to goods. We chart this bifurcation below, showing that spending on goods as a share of total discretionary spending fell from 50% to just over 45% between 2000 and 2017.

In absolute terms, this means that discretionary retailers have lost out on billions of dollars in sales that they would have made had the goods-versus-services balance remained consistent.

- We estimate that US consumers spent $139 billion less on discretionary goods in 2017 than they would have if the goods/services split had remained at the level seen in 2000.

- Looking ahead to 2023, we expect consumers will be redirecting an additional $78 billion in spending to discretionary services at the expense of discretionary goods. This is the difference between the forecast share of discretionary spending on goods in 2023 and the share seen in 2017, which was 45.3%—and it is over and above the $139 billion that consumers have already redirected away from discretionary goods.

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

Implications

Some of America’s biggest mall owners are already reacting to the structural shift toward spending on services. They are building more entertainment centers and leisure services into their malls, enhancing food-service offerings and repurposing retail space that has become redundant as consumers have reprioritized their spending.

At the best-invested malls, we expect to see further integration of consumer services, such as fitness centers and children’s entertainment formats, along with space carve-outs for business services such as coworking spaces.As stores face heightened competition for discretionary dollars, shopping for products will become just one of several reasons to visit a mall.

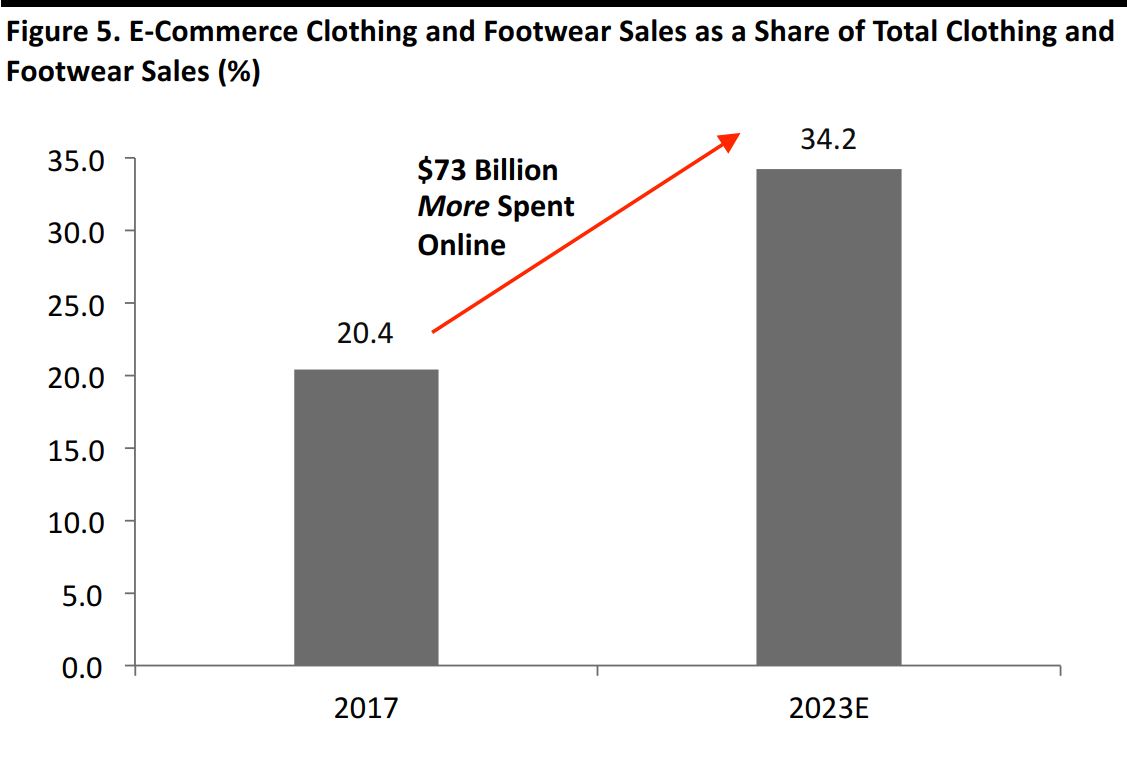

3. Consumers Will Buy $73 Billion More Worth of Apparel Online

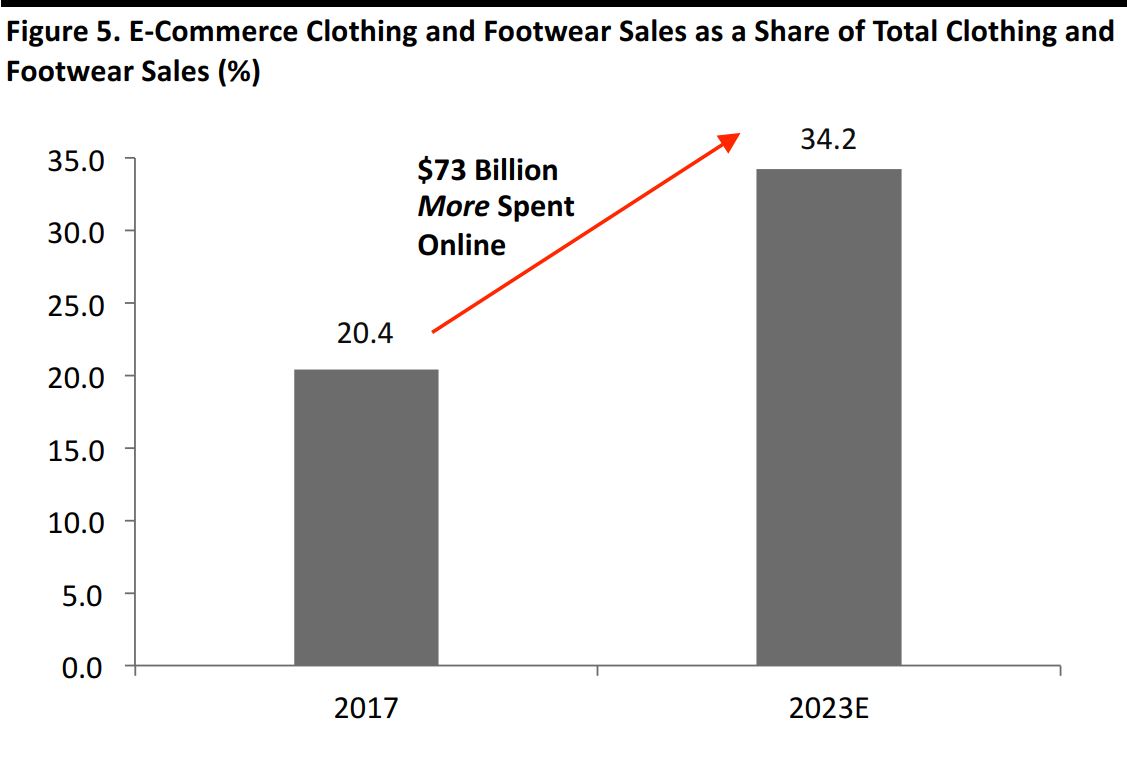

Apparel stores drove closures in 2017, partly because consumers continued to switch an ever-greater share of their spending from physical stores to e-commerce, a migration trend that is expected to remain strong in the coming years. E-commerce will capture more than one-third of all US clothing and footwear spending in 2023, we estimate from Euromonitor International data. That is up from one-fifth in 2017.

In absolute terms, online apparel sales are expected to more than double between 2017 and 2023, from $70 billion to $143 billion, meaning that shoppers will be buying an additional

$73 billion of apparel online by 2023. To illustrate the scale of shifting demand, we note that that $73 billion equates to the following in terms of store space:

- Fully 45,250 average clothing and footwear specialty stores, based on average sales per store of $1.6 million in 2017.

- Fully 5,635 department stores, based on average sales per department store of just under $13 million and the assumption that those stores sell only apparel.

Source: Euromonitor International/Coresight Research

Source: Euromonitor International/Coresight Research

That does not that mean store-based sales will

fall by $73 billion—they will not,because the total apparel market will continue to grow. In fact, in absolute terms, the total apparel market is forecast to grow by roughly the same amount as the online channel by 2023. But that means that in-store sales of clothing and footwear will tend to flatline over the coming years, though we may see intermittent negative growth through brick-and-mortar stores.

Implications

The mall is not dead, but malls focused on apparel are likely to continue to face challenges. The glut of closures we saw in apparel retail in 2017 was in the context of online sales rising by around 20% year over year. If online apparel sales double by 2023, as they are expected to, we will witness significant further downsizing of physical space in the category.

Accordingly, we expect to see a sustained pivot away from apparel by mall owners. We are already seeing greater leasing to nontraditional mall tenants such as grocery stores—for example, Lidl is set to open its first store in a covered US shopping center this year, at the Staten Island Mall in New York.

E-commerce retail brands that are moving into physical retail are adding to the tenant mix, too, although on a still-limited scale.

The migration of apparel sales online is dovetailing with the shift of spending toward services, and these two trends are driving the diversification of mall tenants beyond traditional retail categories. Both shifts demand that mall owners look for tenants that cater to the changed demands of in-store shoppers.

Many forward-thinking mall operators and real estate owners are already reshaping their tenant mixes. Those property firms that are proactively dealing with market shifts by broadening their range of tenants now—rather than simply reacting to apparel store closure programs and bankruptcies as they arise—look set to be the most resilient as the apparel market shifts further. A purely reactive strategy risks a negative spiral of higher-than-average vacancies, declining shopper appeal and lower mall traffic.

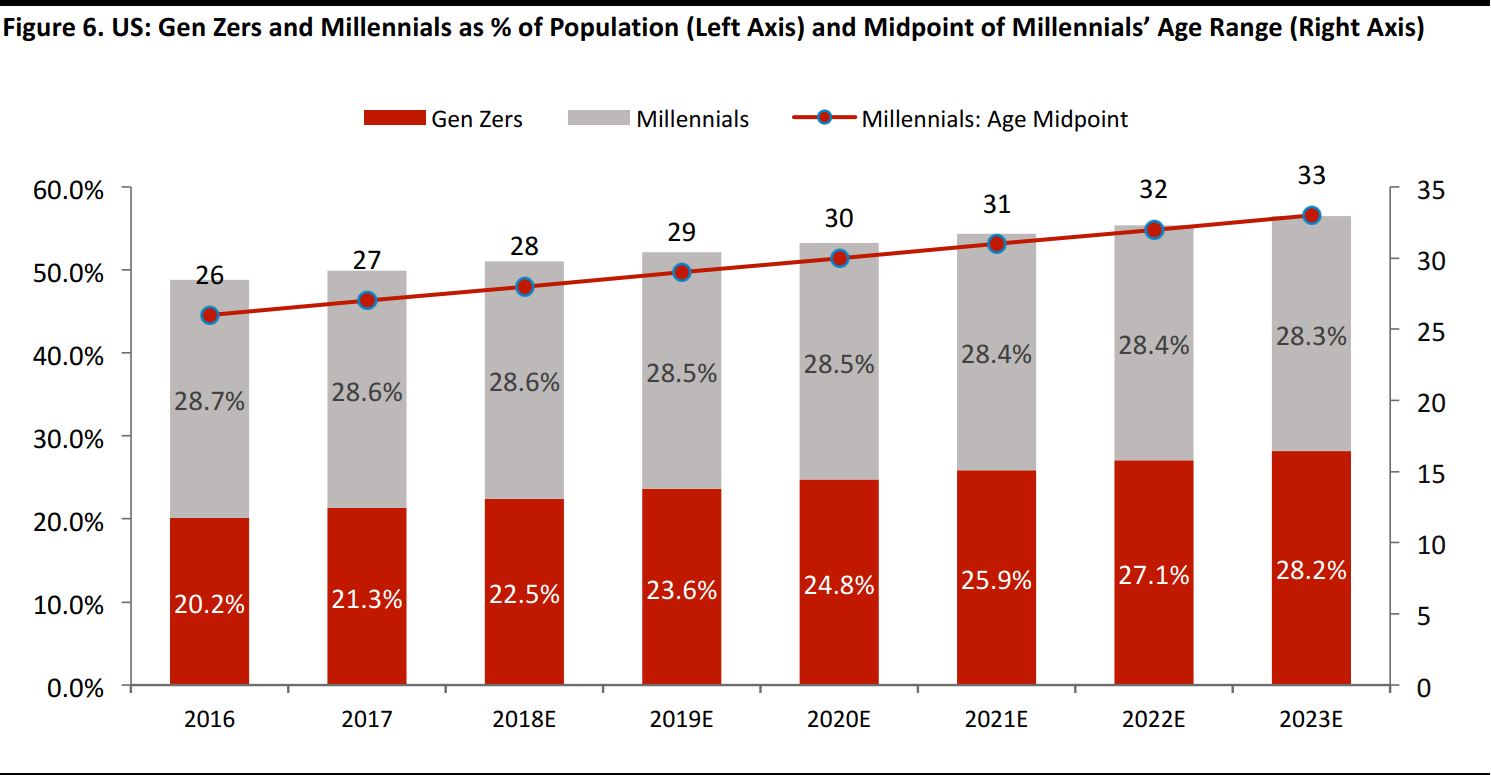

4. Millennials Will Control $5 Trillion of Consumer Spending

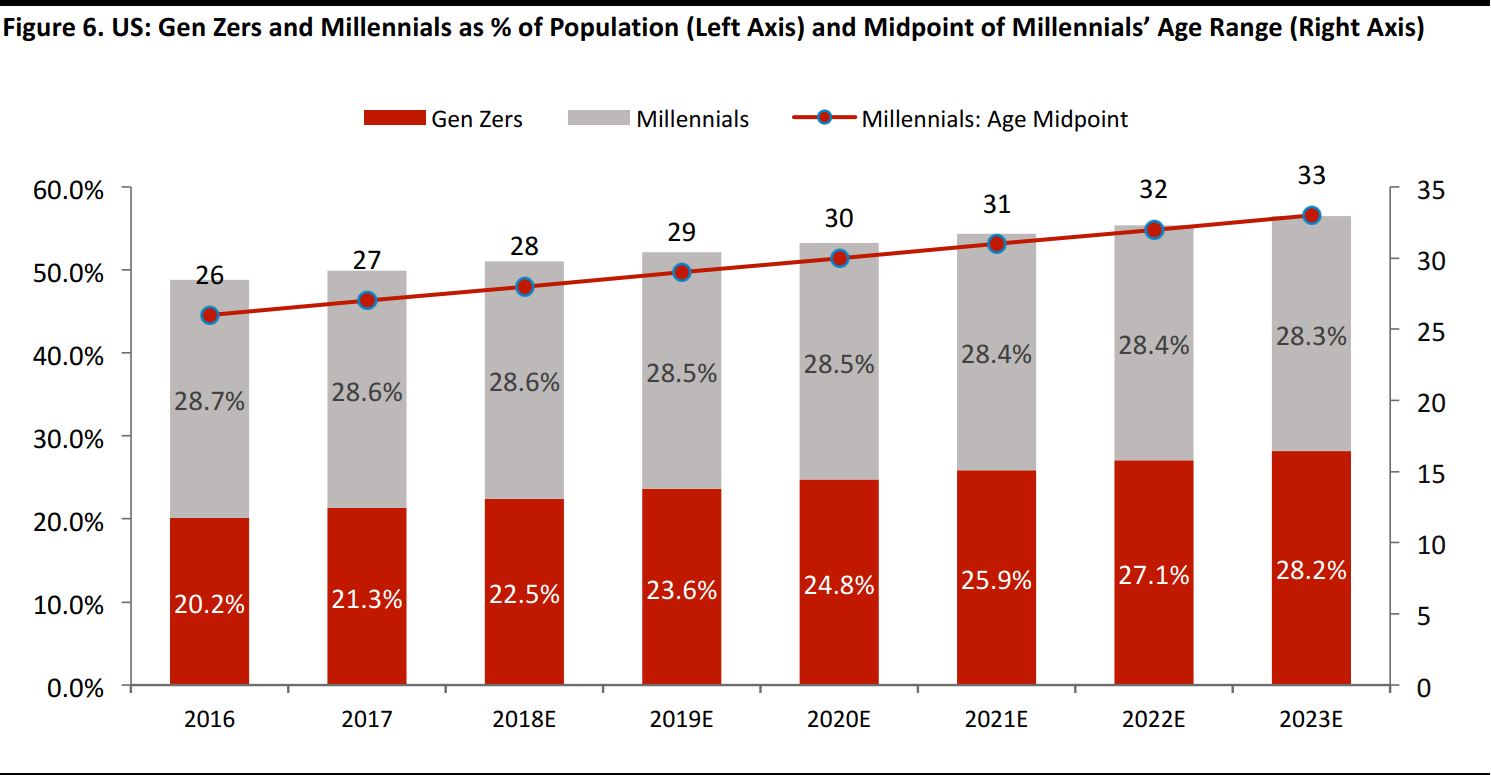

Millennials are getting old. The top end of this generation will turn 38 this year, and many of its members have already established families, bought homes and put down roots. By 2023, they will be headed toward middle age, and their spending power will have grown to reflect their maturity.

We estimate that millennial households will wield more than

$5 trillion of consumer spending in five years. This total spans all spending categories, from essentials such as housing to discretionary purchases such as vacations. By 2023, millennials’ demands will be impacting all retail and consumer goods industries, and their demands will continue to be numerous:compared with older generations, this age group shows a higher demand for convenience and immediacy when purchasing, a need for low prices at retail, an interest in quality experiences, and greater interest in healthy living. To learn more about these trends, see our reports on millennials’ impact on the

grocery sector,

beauty retailing and the

leisure industry.

We define millennials as those born between 1980 and 2000, meaning that the nonweighted average age of a millennial will be 33 in 2023. Gen Z follows on, being born after 2000, which means that, by 2023, the oldest Gen Zers will be in their early 20s and will be fully fledged consumers. Together, these younger consumer groups will make up more than half the US population in five years.

We define millennials as being born between 1980 and 2000 and Gen Zers as being born after 2000, so Gen Zers include children.

Source: US Census Bureau/Coresight Research

We define millennials as being born between 1980 and 2000 and Gen Zers as being born after 2000, so Gen Zers include children.

Source: US Census Bureau/Coresight Research

Implications

We see three major implications from these generations moving center stage.First, these consumers will fuel cyclical demand for value retailers, as younger consumers tend to have high expectations but skinny wallets. Younger adults are often weighed down with student debt, and they tend to enjoy less job security and less generous remuneration than previous generations did at their age. Therefore, they are often by necessity frugal when shopping for everyday goods such as groceries and beauty items. This frugality implies that we will see sustained in-store demand at value-driven retailers such as mass merchandisers and off-pricers that will, in turn,fuel demand for suitable shopping-center space.

Second, younger consumers’ familiarity with digital brands,coupled with millennials’

continued interest in shopping in physical stores, will support online retailers’ moves into brick-and-mortar formats. The resonance that brands such as Indochino menswear, Allbirds footwear, Fabletics athleisurewear and Glossier beauty products appear to enjoy with millennials is likely to support demand for the physical stores these brands are opening.

Third, consumers’ apparent prioritization of quality experiences over product ownership will underpin the shift from retail to services in mall space. Millennials and Gen Zers will drive the shift in spending from discretionary goods to discretionary services, supporting changes in tenant mix away from traditional retailers. That shift will also prompt malls to work harder to attract visitors by offering more experiential retail—for instance, time-limited events and pop-up stores.

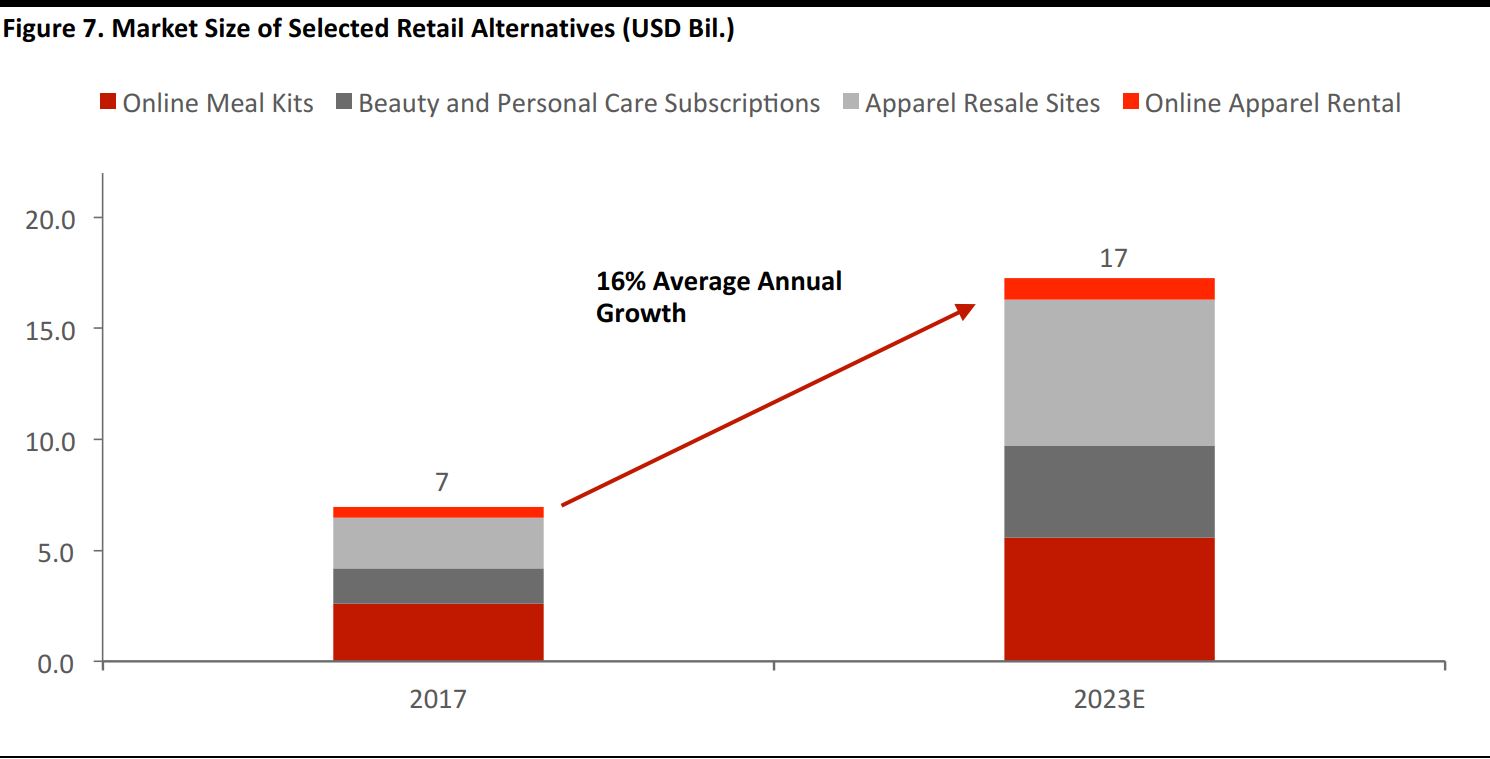

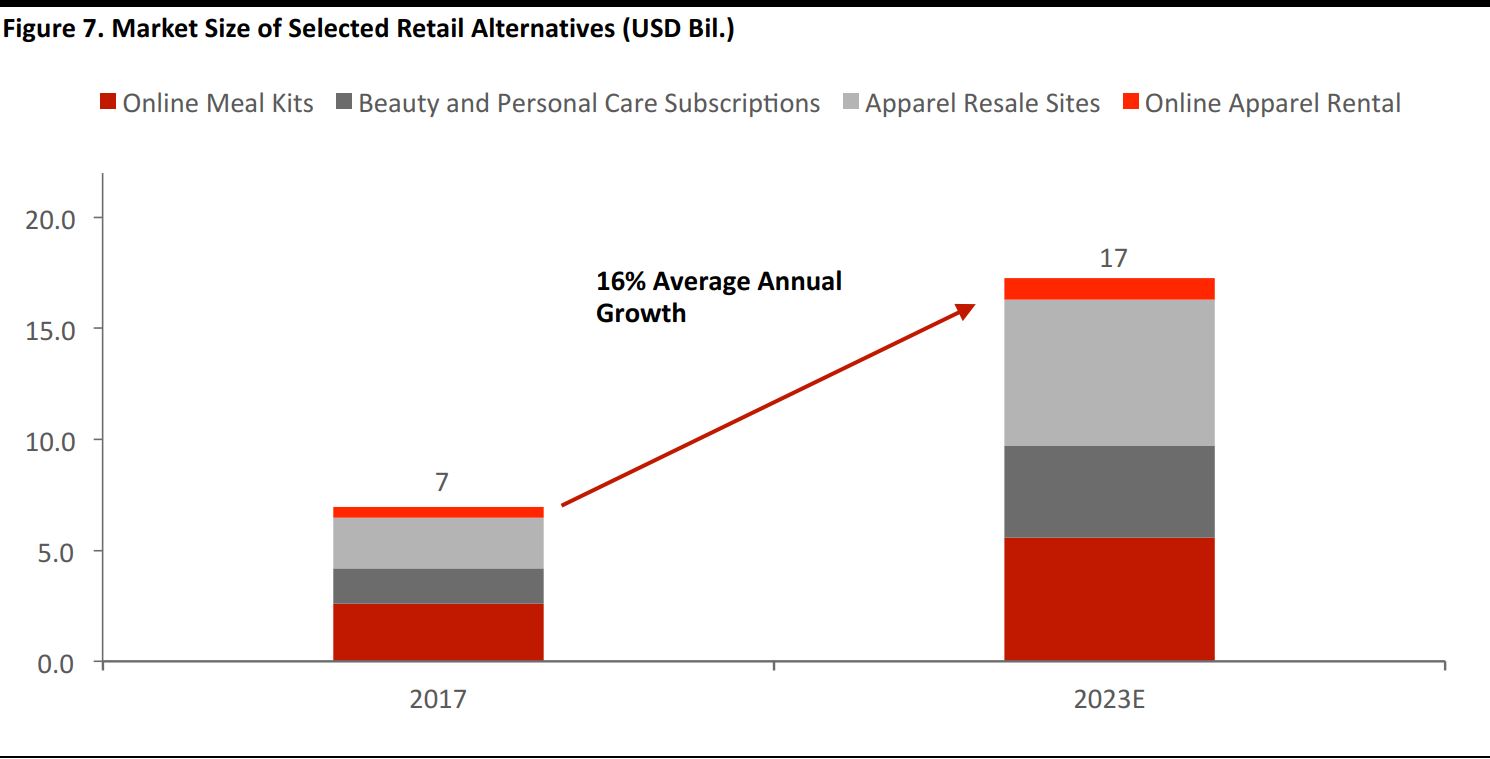

5. Retail-as-a-Service Will Peel Away $17 Billion from Traditional Retail Channels

The pressure traditional retailers are facing comes not just from e-commerce rivals and shoppers opting to spend more on experiences instead of products, but also from small, specialized rivals that are chipping away at their market share. In the hinterland between services and e-commerce is a new breed of “retail-as-a-service” firm that allows shoppers to acquire goods in a nontraditional way, such as through subscription, rental or resale.

Companies such as Blue Apron, Birchbox, Rent the Runway and ThredUp represent niche segments relative to retail in total. But, in aggregate, they erode the share of spending on products that is directed toward conventional retailers (whether offline or online). In fact, we estimate that by 2023, US shoppers will be spending around

$17 billion on online meal kit services, beauty and personal care subscriptions, and online apparel resale and rental sites, and that each of these segments will have enjoyed double-digit average annual growth over the previous five years.

Source: Coresight Research

Source: Coresight Research

Implications

These types of retail alternatives will still be minnows compared with the big fish of retail, even by 2023. However, they will account for a further erosion of spending on traditional retail. Combined with other forces such as Internet pure-play retailers and spending on experiences, these segments will continue to chip away at multichannel retailers’ share of spending.

Moreover, a number of these retail alternatives have emerged rapidly within the past five years. This means that sustained, long-term demand for services such as meal kit delivery has not yet been fully tested. But it also means that we are likely to see the emergence of further retail-as-a-service options in the coming five years. The segments noted here could well be joined by other models that heap yet more pressure on conventional channels.

Key Takeaways

Brick-and-mortar retail will face significant challenges in the next five years. If, as we expect, more than 1,000 department stores close and e-commerce captures more than one-third of apparel spending, the impacts on traditional shopping malls will be substantial. However, as we have underlined through this report series, the shifts in malls will not be uniformly felt, for two primary reasons.

First, there are variations between real estate firms. Some of the strongest mall operators, such as GGP and Simon Property Group, are already seeking to future-proof their centers by shifting new leases toward nonapparel categories, making space for pop-up shops and time-limited events, and bringing in entertainment and leisure concepts as new anchors.

Second, well-invested, destination A and B malls look likely to continue to thrive, as their mix of premium and flagship stores balanced with a range of services provides the experiential counterpoint to functional e-commerce. In sum, the mall is not dead—but continued challenges await the most unexceptional, apparel-dominated regional malls.

Source: Coresight Research

Source: Coresight Research Source: Coresight Research

Source: Coresight Research Figures exclude off-price department stores.

Source: Euromonitor International/Coresight Research

Figures exclude off-price department stores.

Source: Euromonitor International/Coresight Research Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research Source: Euromonitor International/Coresight Research

Source: Euromonitor International/Coresight Research We define millennials as being born between 1980 and 2000 and Gen Zers as being born after 2000, so Gen Zers include children.

Source: US Census Bureau/Coresight Research

We define millennials as being born between 1980 and 2000 and Gen Zers as being born after 2000, so Gen Zers include children.

Source: US Census Bureau/Coresight Research Source: Coresight Research

Source: Coresight Research