Web Developers

This is the second report in our three-part The Mall Is Not Dead series that looks at the US mall landscape with a focus on the challenges malls face and their need for transformation. In this report, we examine the department stores and specialty stores that constitute the bulk of mall tenants to determine what is working for them and what is not.

The bottom line is that consumers are shopping less frequently at full-price retailers and have fundamentally shifted the way they shop. Therefore, the mall as we know it is in a state of transition. In this report, we take a deep dive into the composition of malls to see what retailers and formats are succeeding. We look closely at the department stores and specialty stores that constitute the bulk of mall tenants to gain clarity on the future of the mall. This report highlights what is working and what needs to change in order for malls to regain their prominence and popularity among American shoppers.

The bottom line is that consumers are shopping less frequently at full-price retailers and have fundamentally shifted the way they shop. Therefore, the mall as we know it is in a state of transition. In this report, we take a deep dive into the composition of malls to see what retailers and formats are succeeding. We look closely at the department stores and specialty stores that constitute the bulk of mall tenants to gain clarity on the future of the mall. This report highlights what is working and what needs to change in order for malls to regain their prominence and popularity among American shoppers.

Executive Summary

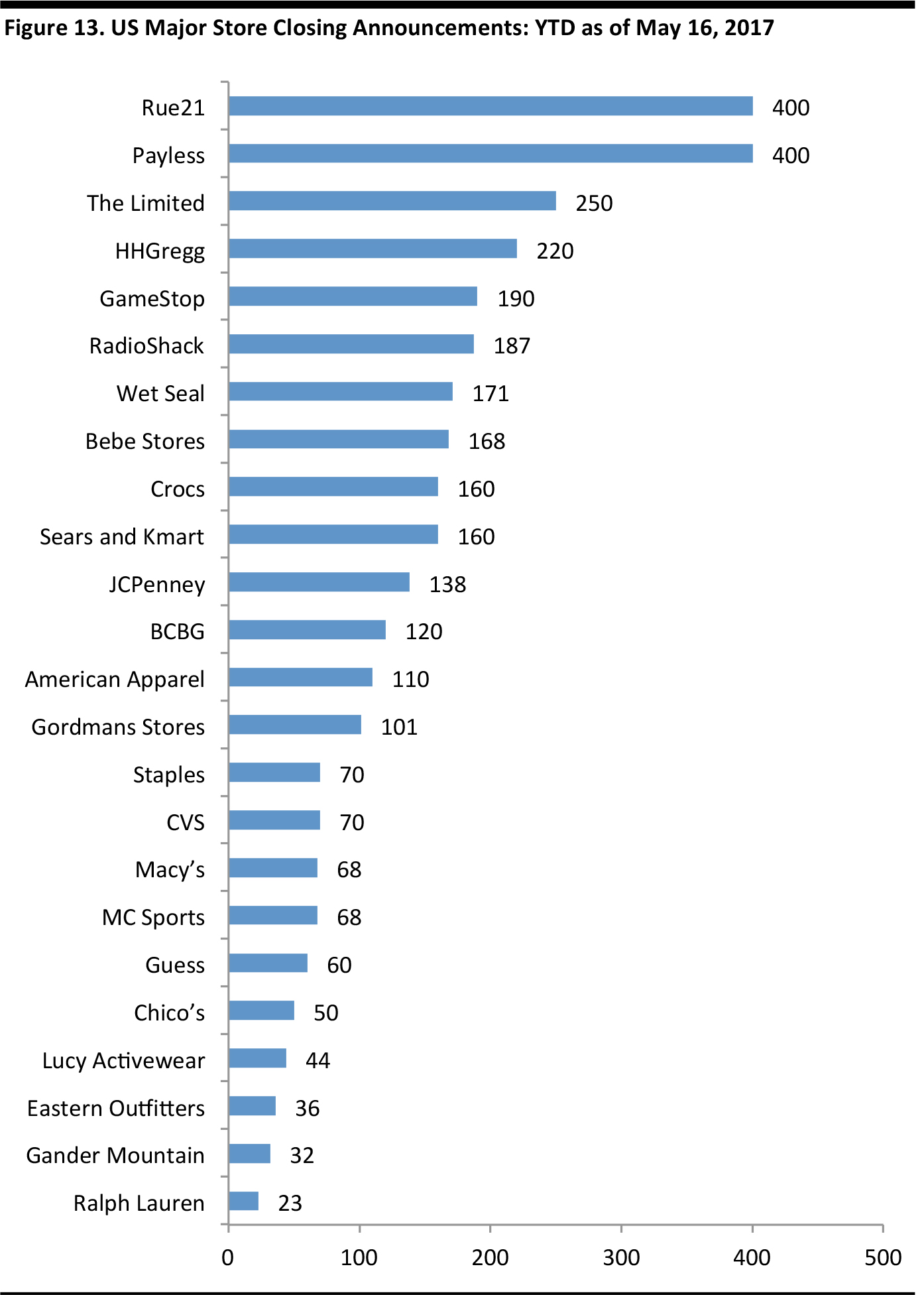

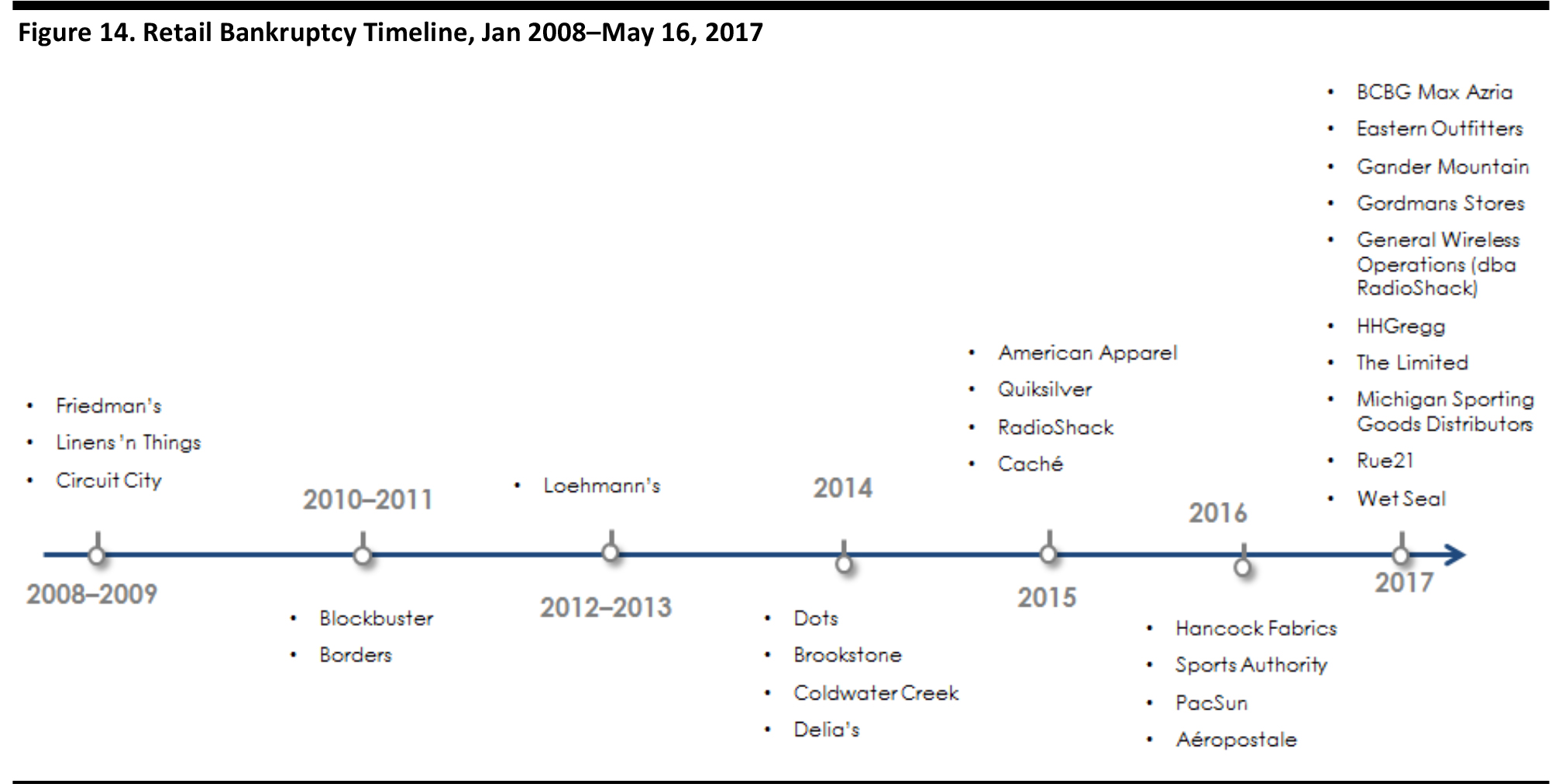

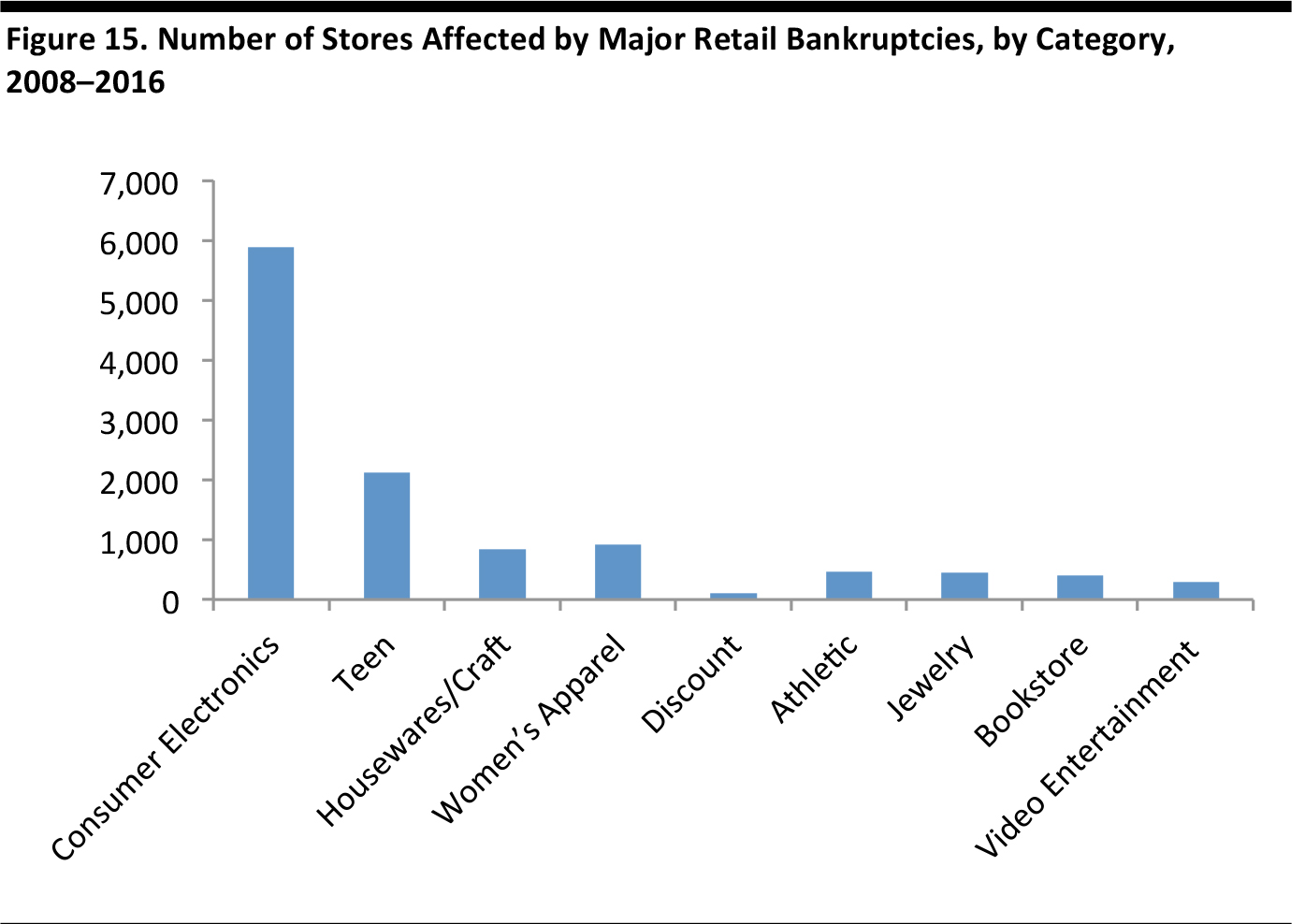

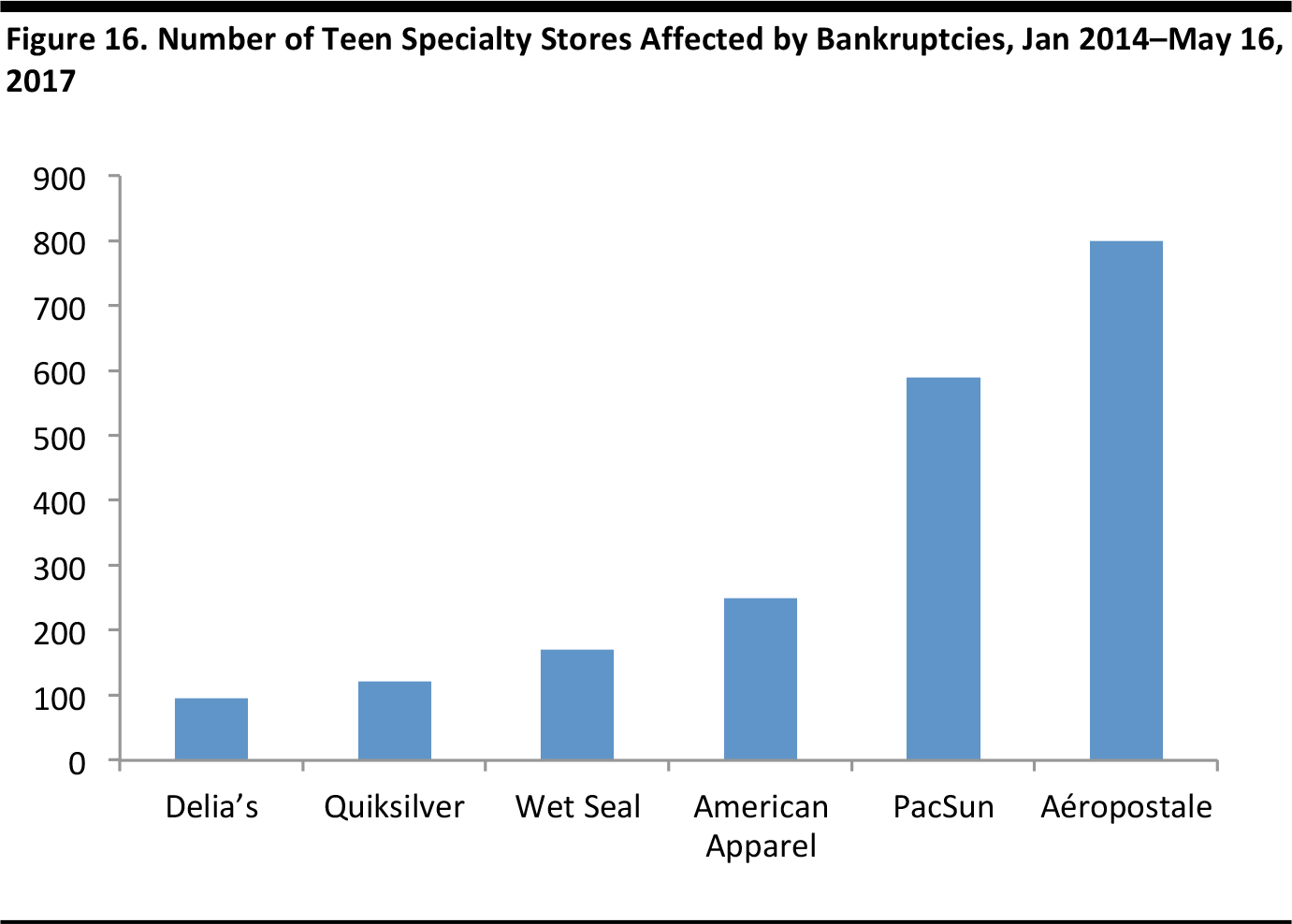

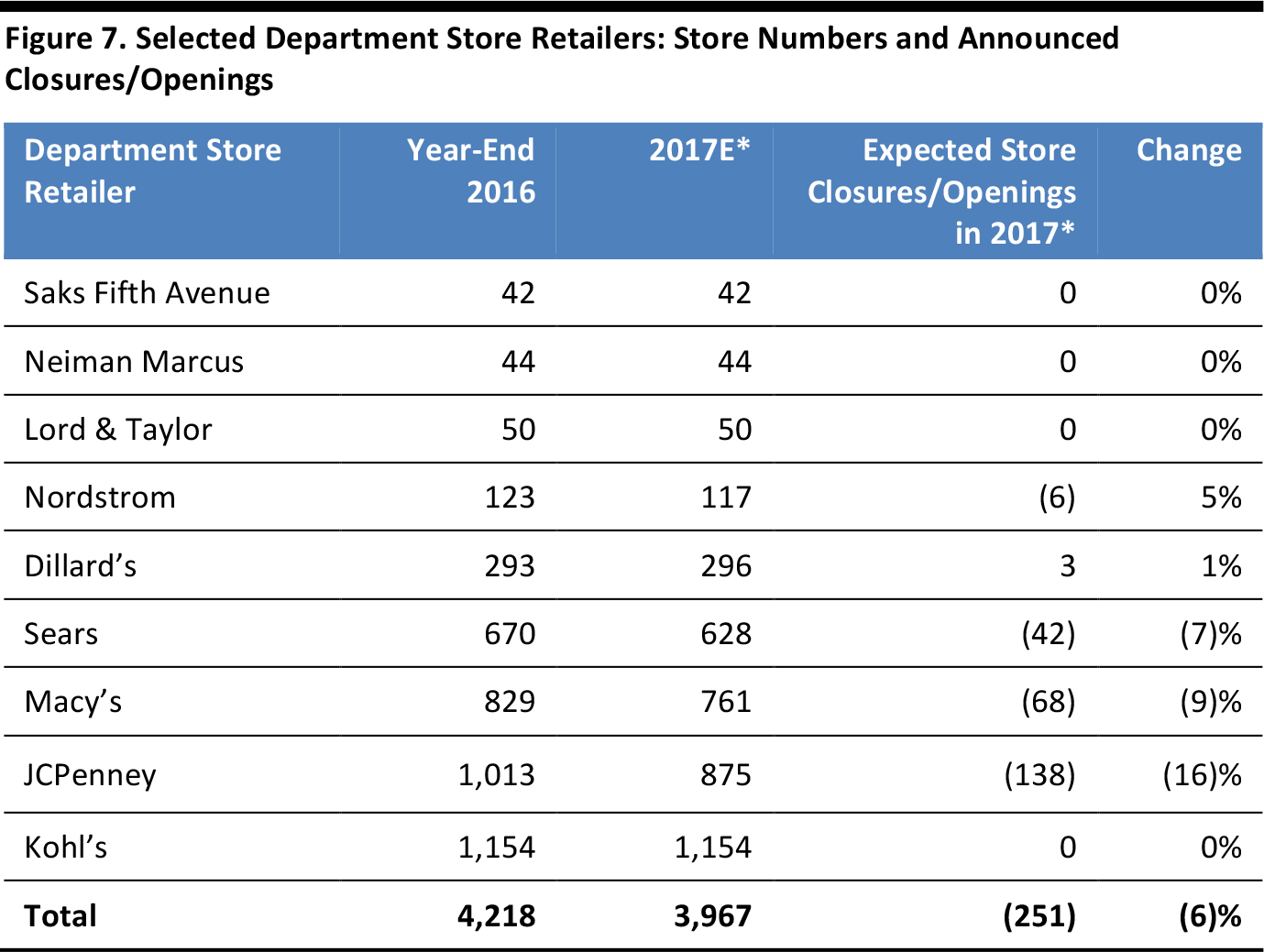

The mall is undergoing a metamorphosis, changing from its traditional form into “the mall of the future.” The mall format is still relevant, but what made it successful in the past is not working well today. In the first report in our Mall Is Not Dead series, published in November 2016, we asserted that the US is overmalled and that one-third of the 1,221 malls in the country should be closed. In this second report in our series, we look at the composition of malls—specifically at the department stores and specialty stores that constitute the bulk of mall tenants. We examine which retailers and formats are staying and which are leaving, and analyze what is working and what needs to change. Consumer behavior has already changed significantly, and retailers and mall owners need to catch up. Consumers today shop via multiple channels, and they look to social media influencers, mobile devices and computers to help inform their decisions and purchases. The conventional mall does not reflect the way consumers now live and shop. Department stores, which traditionally anchored and welcomed consumers to malls, are declining in prominence, and department store sales have fallen by 40% since 2000. Consumers used to shop for the entire family at department stores, but their one-stop-shop appeal has lessened as retail has gone omnichannel. Also, in the 1990s and early 2000s, consumer preferences began shifting toward specialty retailers. Now that lower-priced merchandise can be found at off-price and fast-fashion retailers, the specialty segment is thriving. In part due to the challenges and underperformance of the malls, store closures and retail bankruptcies have accelerated in 2017. Major department store retailers have already announced that they will close a total of 251 stores this year—and industry watchers expect that there will be more to come. At the time of writing, retail store closure announcements this year already totaled 3,296, which is nearly double the number of closures announced in the entirety of 2016. And as of mid-May, 10 major retailers had already filed for bankruptcy this year, affecting 1,585 stores. Retailers in the teen apparel segment have accounted for 36% of these bankruptcies, while consumer electronics retailers have accounted for 26% and women’s apparel retailers for 23%. The good news for mall owners and retailers is that although consumers are shopping differently, they are still shopping. US retail sales were up 4.5% year over year in April. In addition, just over 90% of purchases are still made in stores, according to the US Census Bureau, and we think that the majority of retail sales will continue to be made in physical stores.Introduction

Forces Affecting the Mall Landscape It seems that we see a new report every week saying that the mall is dead and that traditional retail is dying. Despite the doomsayers, we believe that the mall format is still relevant and that it can continue to thrive. What has worked in the past, though, will not work in the future. The mall is in a transition period due to a number of forces that are impacting the retail sector, including:

The bottom line is that consumers are shopping less frequently at full-price retailers and have fundamentally shifted the way they shop. Therefore, the mall as we know it is in a state of transition. In this report, we take a deep dive into the composition of malls to see what retailers and formats are succeeding. We look closely at the department stores and specialty stores that constitute the bulk of mall tenants to gain clarity on the future of the mall. This report highlights what is working and what needs to change in order for malls to regain their prominence and popularity among American shoppers.

The bottom line is that consumers are shopping less frequently at full-price retailers and have fundamentally shifted the way they shop. Therefore, the mall as we know it is in a state of transition. In this report, we take a deep dive into the composition of malls to see what retailers and formats are succeeding. We look closely at the department stores and specialty stores that constitute the bulk of mall tenants to gain clarity on the future of the mall. This report highlights what is working and what needs to change in order for malls to regain their prominence and popularity among American shoppers.

The Mall Is Focused on Apparel

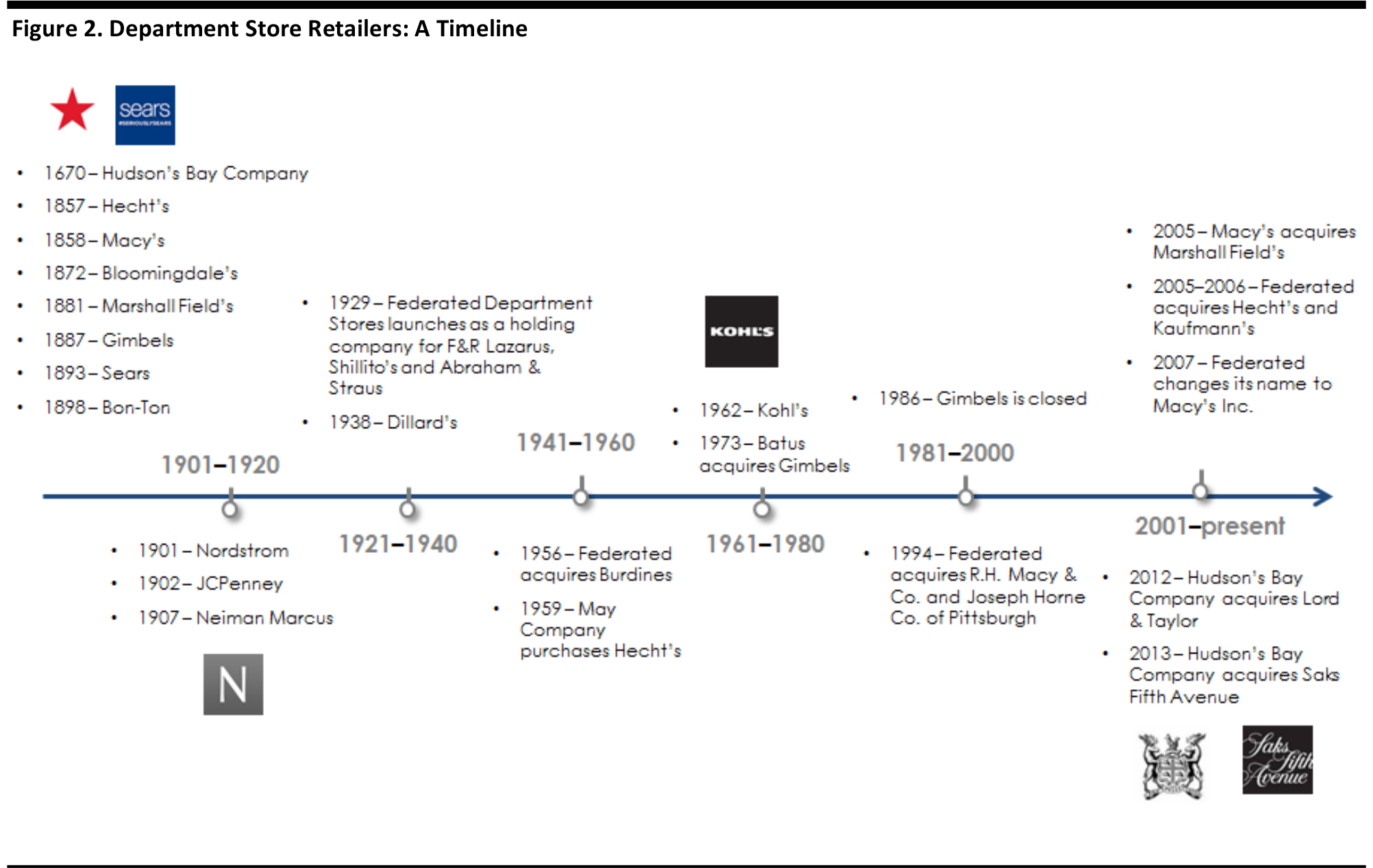

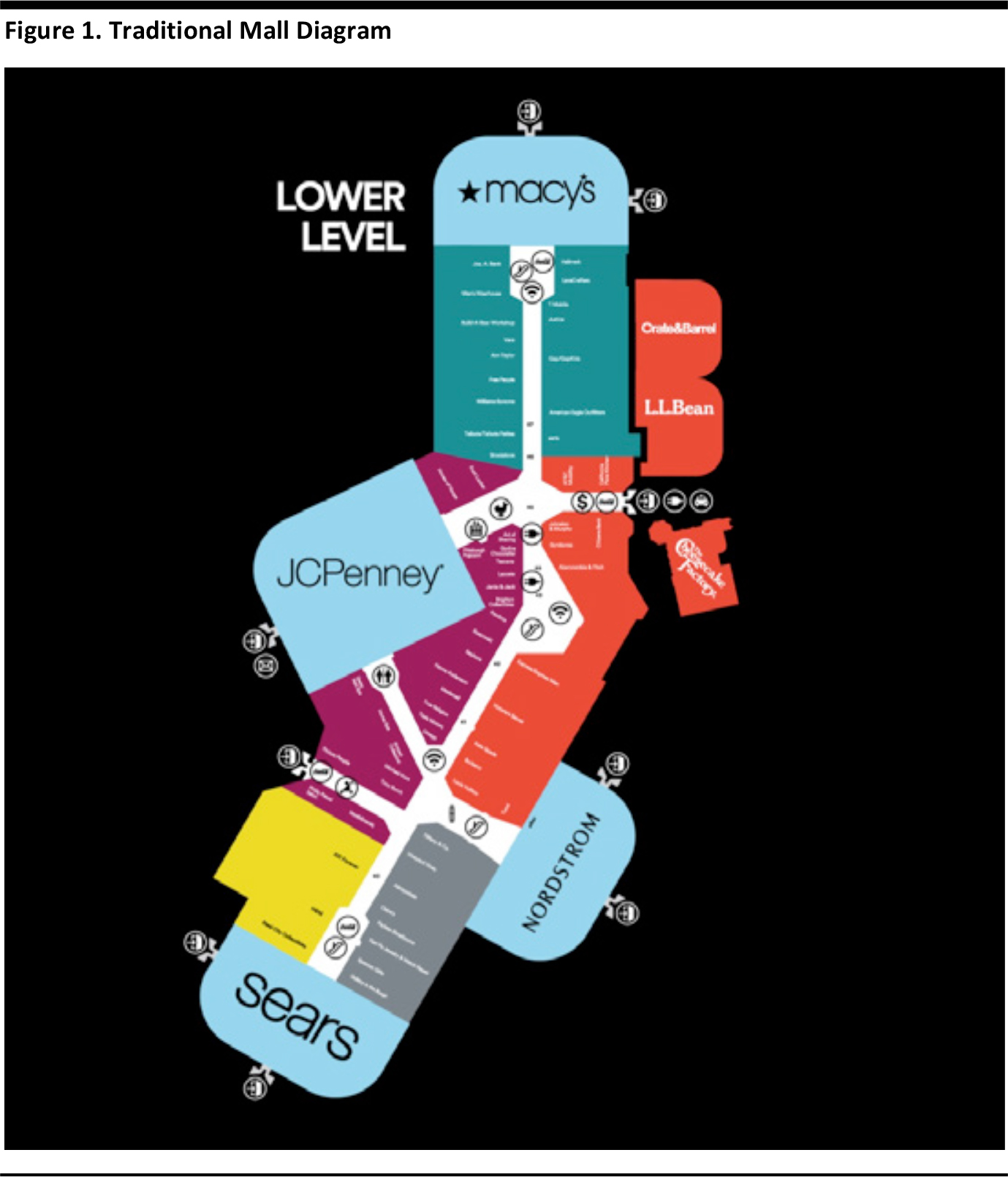

Traditional enclosed malls are focused on apparel, with 80%–90% of square footage devoted to department stores and specialty stores. According to the International Council of Shopping Centers (ICSC), nonretail/nonrestaurant tenants occupy 13.3% of space in regional malls as of early 2017, up from 10.5% in 2012. In super regional malls (those of 800,000 square feet or more), that figure rose from 10.5% to 10.8% over the same period. The diagram below depicts a traditional mall, with department stores as the mall anchors.

Ross Park Mall, Pittsburgh, PA. Source: www.simon.com/mall/ross-park-mall

Changes in the Department Store Sector

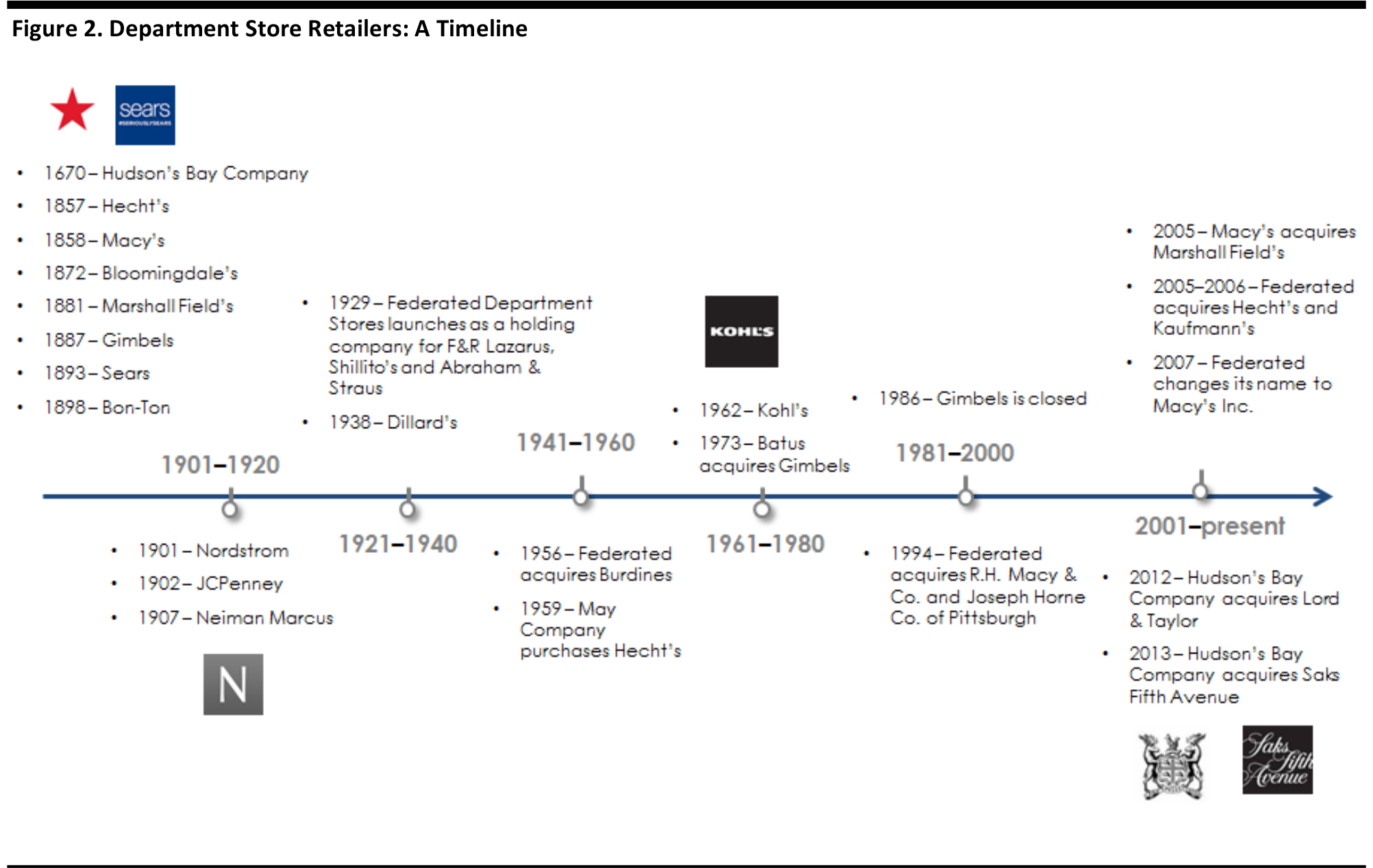

The department store is an icon of American shopping and American malls. Many of America’s department stores were launched before the turn of the 19th century, and Canada’s Hudson’s Bay Company, which now owns Saks Fifth Avenue and Lord & Taylor, among other chains, was founded as a fur trading business more than 300 years ago. The department store was traditionally the one-stop shop where consumers could buy everything they needed for their entire family. At one time, there were more than a dozen major department store retailers in the US, each with its own specialty or geographic coverage. As the retail landscape evolved, the department store sector consolidated and now there are just a handful of key players. The most recent acquisition in the sector was Hudson’s Bay Company’s purchase of Saks Fifth Avenue in 2013. By our calculations, there were approximately 4,439 department stores in operation in the US in 2016. As the sector has consolidated, department stores have become less specialized, offering mainstream products with the goal of appealing to a broader audience. Meanwhile, consumers have shown an increasing preference for shopping at specialty stores that offer particular brands and targeted concepts. The timeline below shows that a significant amount of merger and acquisition activity occurred in the department store sector after the 1980s, creating companies with larger portfolios of department store banners.

Source: Company reports/Fung Global Retail & Technology

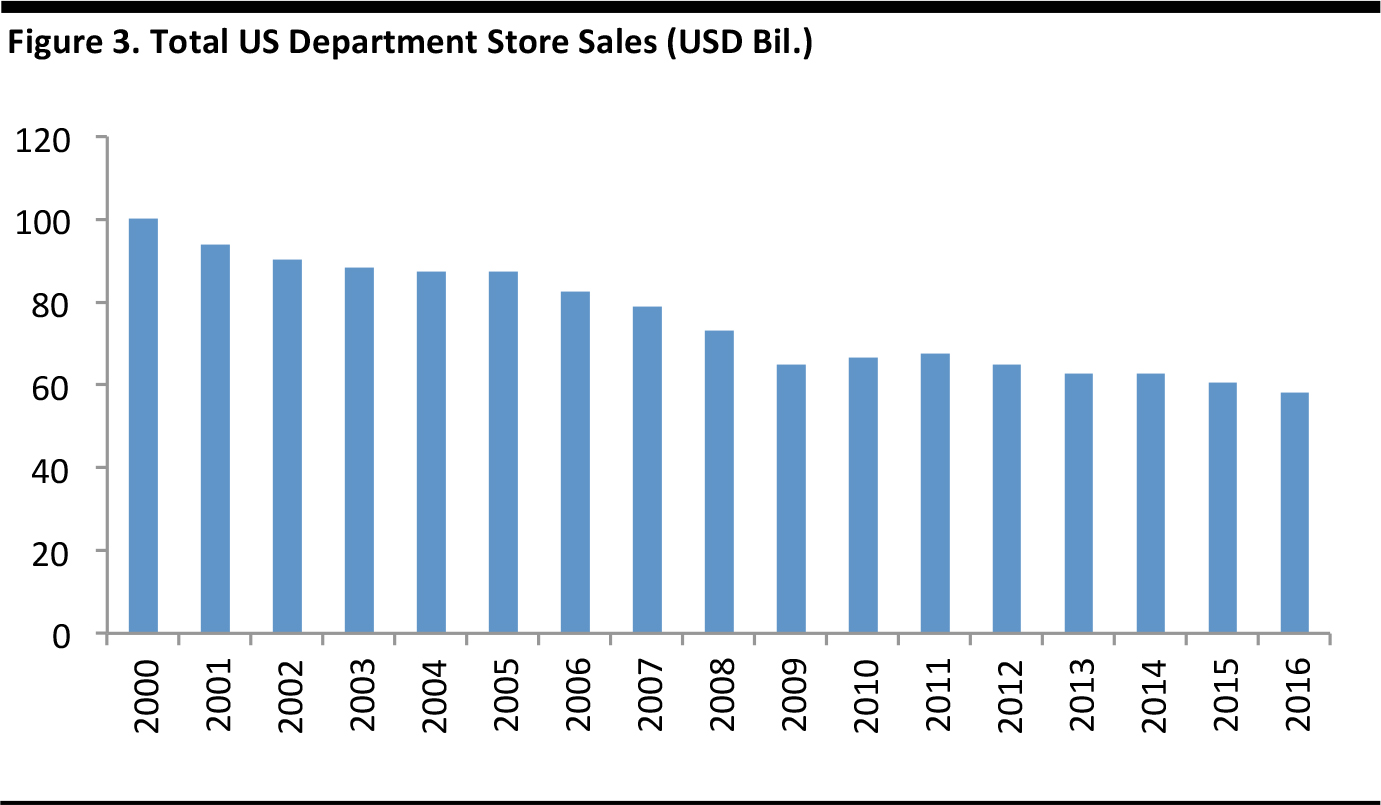

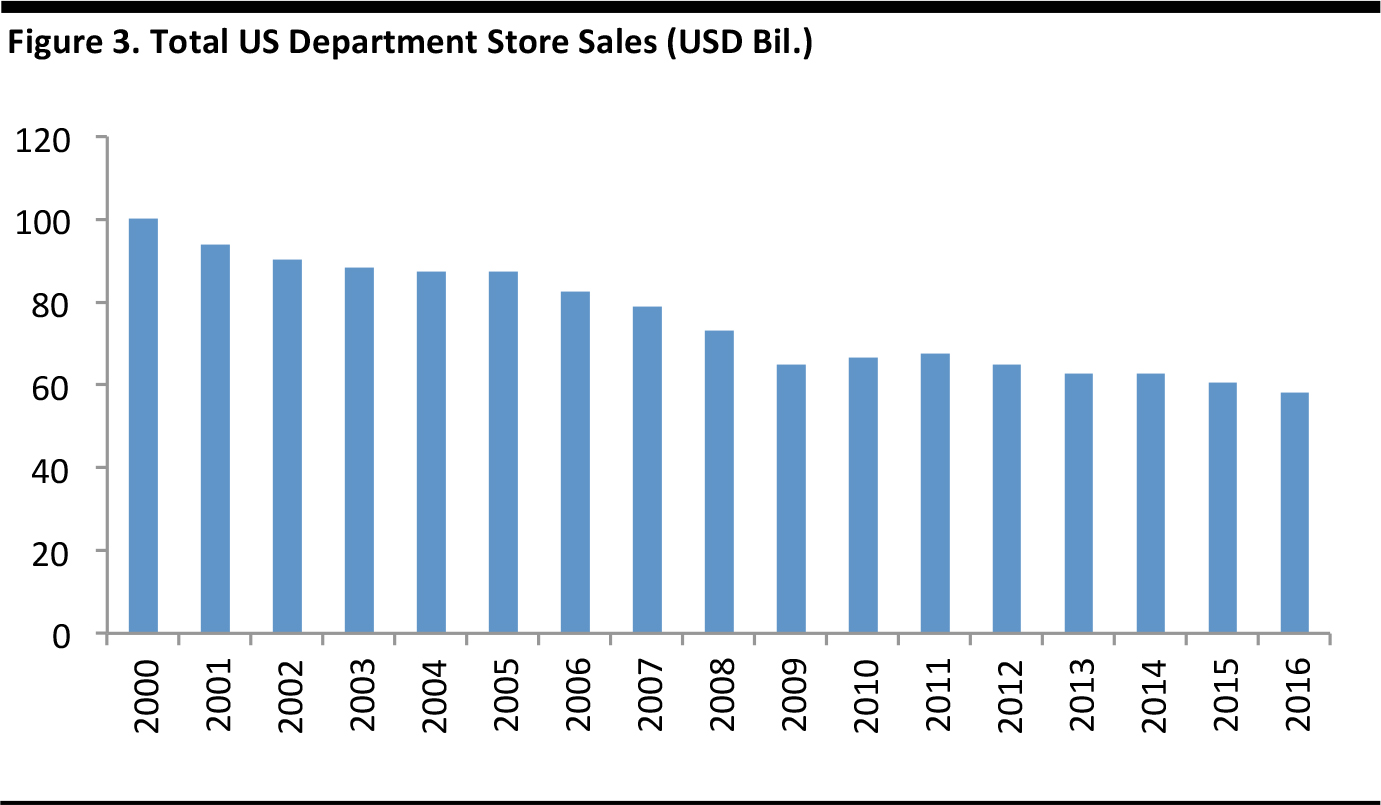

Department Store Sales Have Declined by 40% Since 2000

Following decades of success, department stores have been in transition in recent years. Many have carried too many products that seem to be offered everywhere, often at uncompetitive prices. Additionally, many department stores began to look the same over time. The sector has been struggling to stay relevant in a changing world. In the last 10 years, department store sales have declined by 30%, and since 2000, they have declined by 40%. Although these stores still constitute a multibillion-dollar industry, industry insiders are questioning whether the department store format is still viable. The products featured in these stores are considered neither inexpensive nor luxury by consumers and, without a point of view, the department stores are getting lost in today’s world of specialization, customization, personalization, fast fashion and off-price.

Source: US Department of Commerce

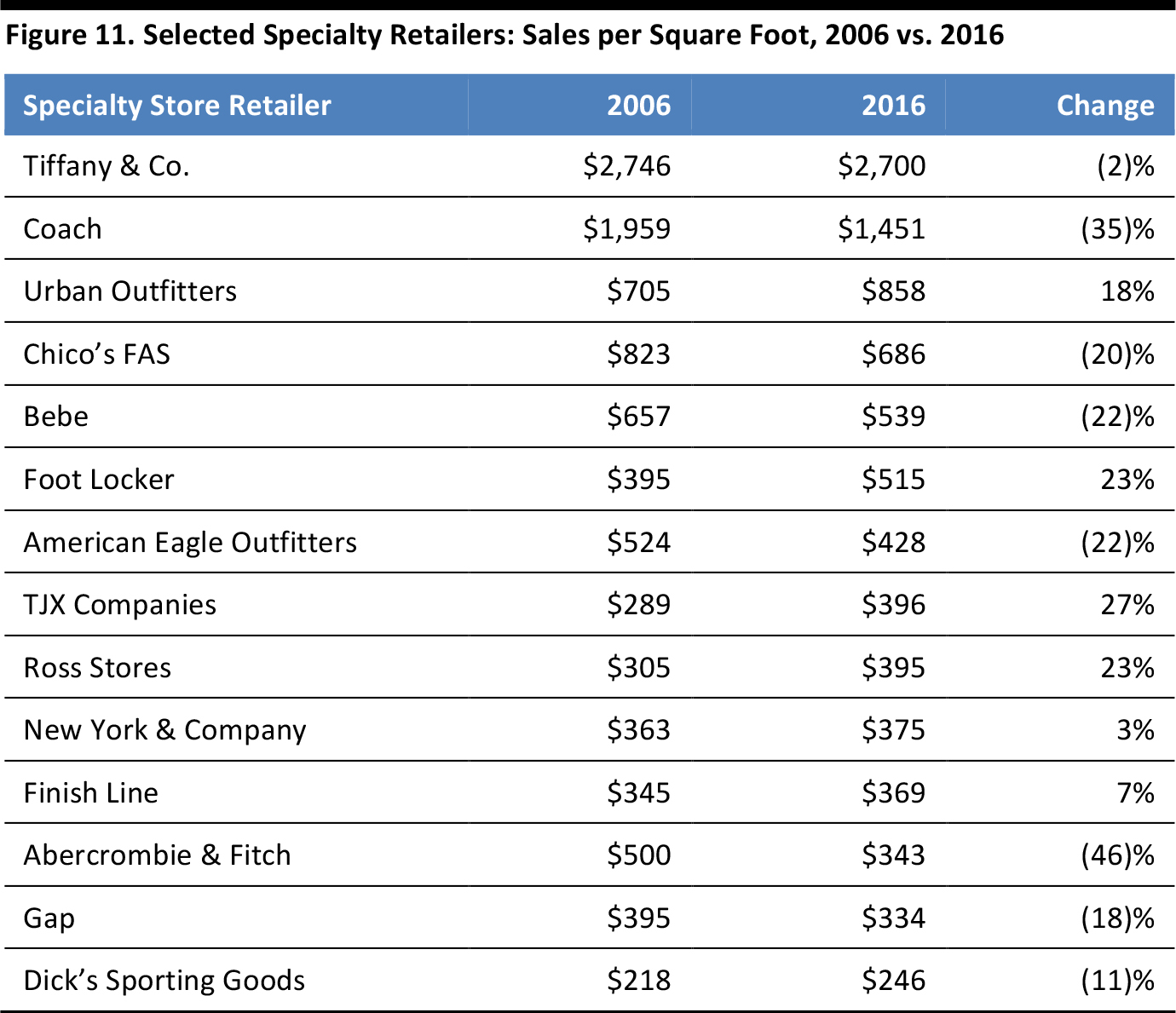

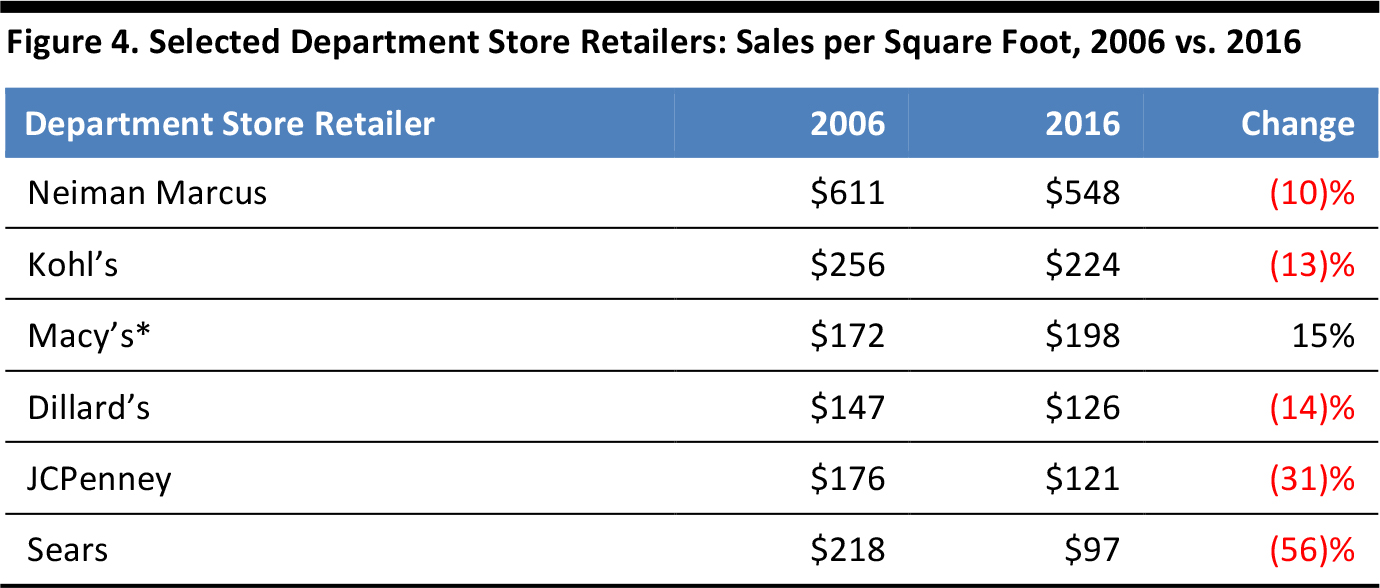

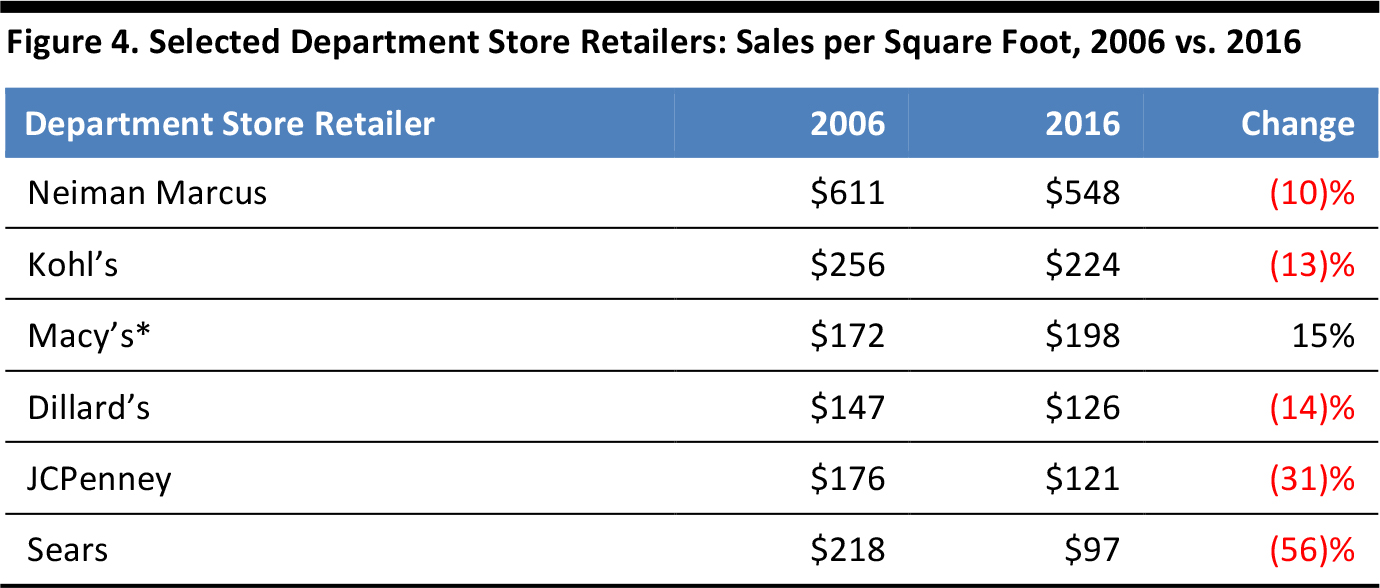

Sales per Square Foot at Department Stores Have Declined

Sales per square foot is one industry metric that is used to quantify how stores are performing. The table below compares sales per square foot in 2006 versus 2016 at selected department stores, and shows that such sales were lower in 2016 at five out of the six major department store chains listed.

Relevant data are not available for Lord & Taylor, Nordstrom and Saks Fifth Avenue. *Calculated based on revenue and square footage data. Source: Company reports

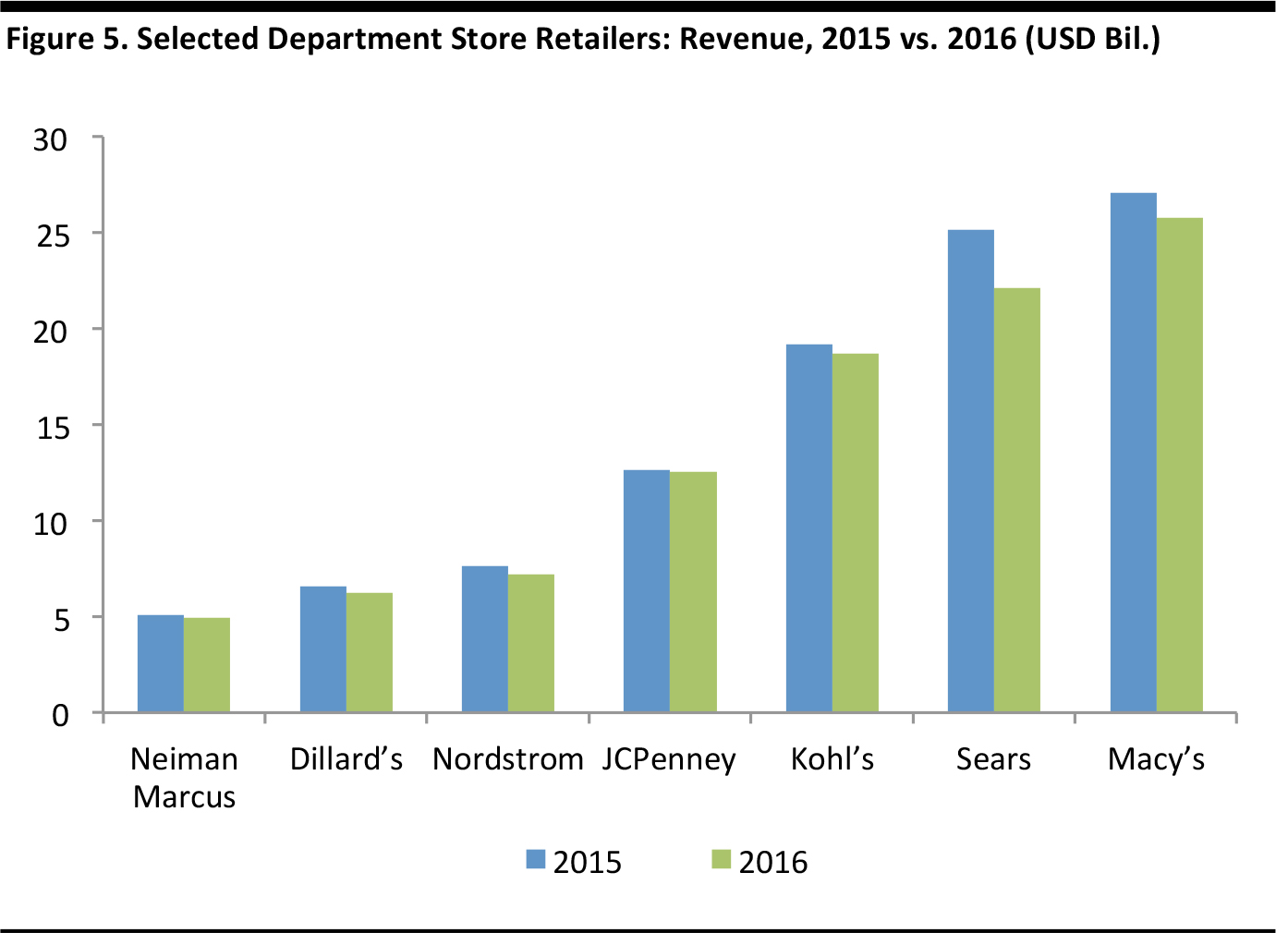

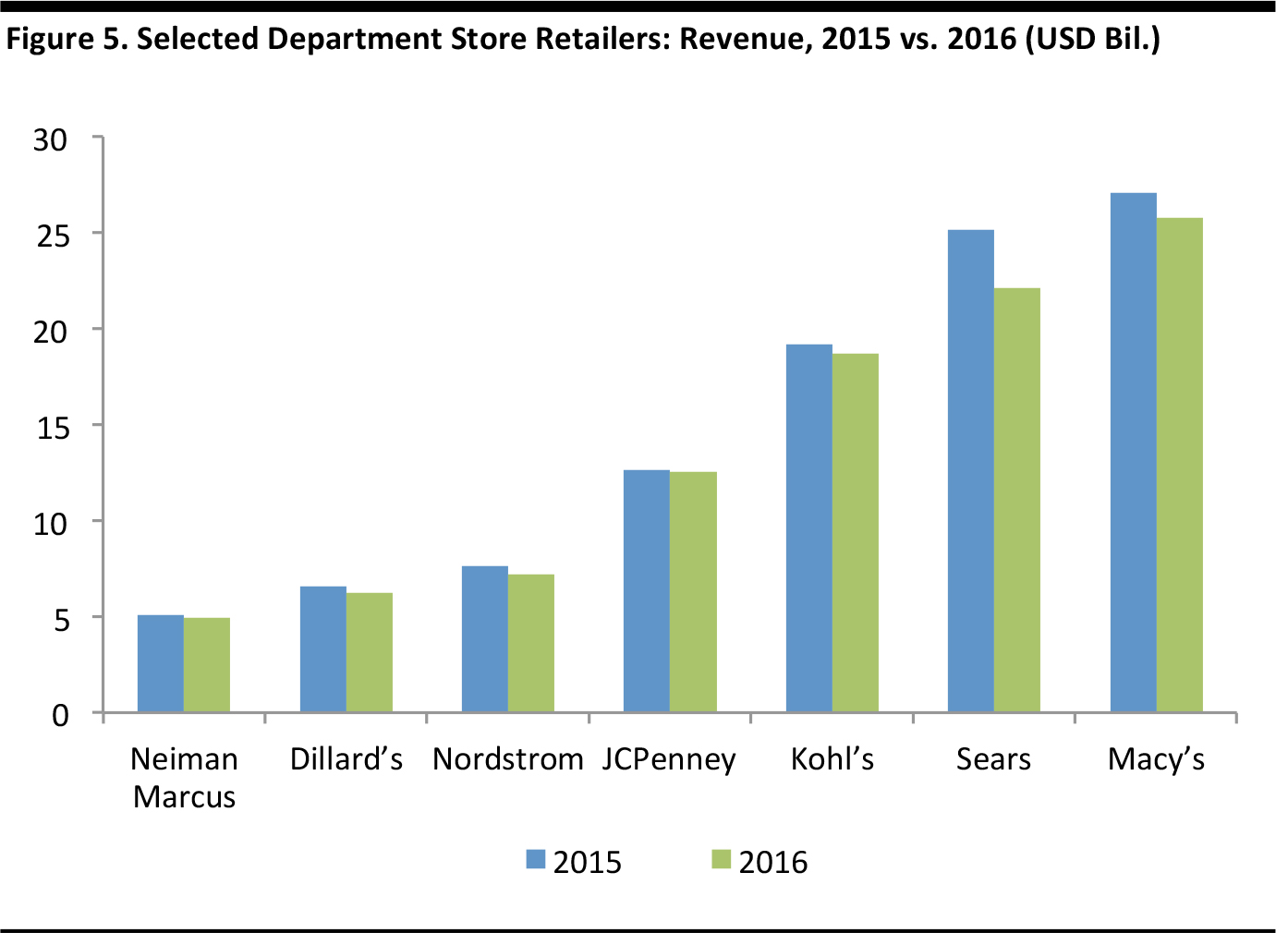

Of the department store retailers shown in the table above, Neiman Marcus had the highest sales per square foot in 2016, at $548. The company also had the fewest US stores among the group, with 44 total. Sears had the lowest sales per square foot of the group in 2016, at $97, and the company saw the metric drop by 56% over the 10-year period.A Group of Just Seven Department Store Retailers Saw a Combined Revenue Decline of $5.8 Billion from 2015 to 2016

Combined revenues for the seven companies shown in the graph below fell by more than $5.8 billion from 2015 to 2016. Sears saw the biggest decline, of $3 billion, over the period, while Macy’s saw revenues decline by $1.3 billion year over year.

Relevant financial data are not available for Lord & Taylor and Saks Fifth Avenue. Source: Company reports

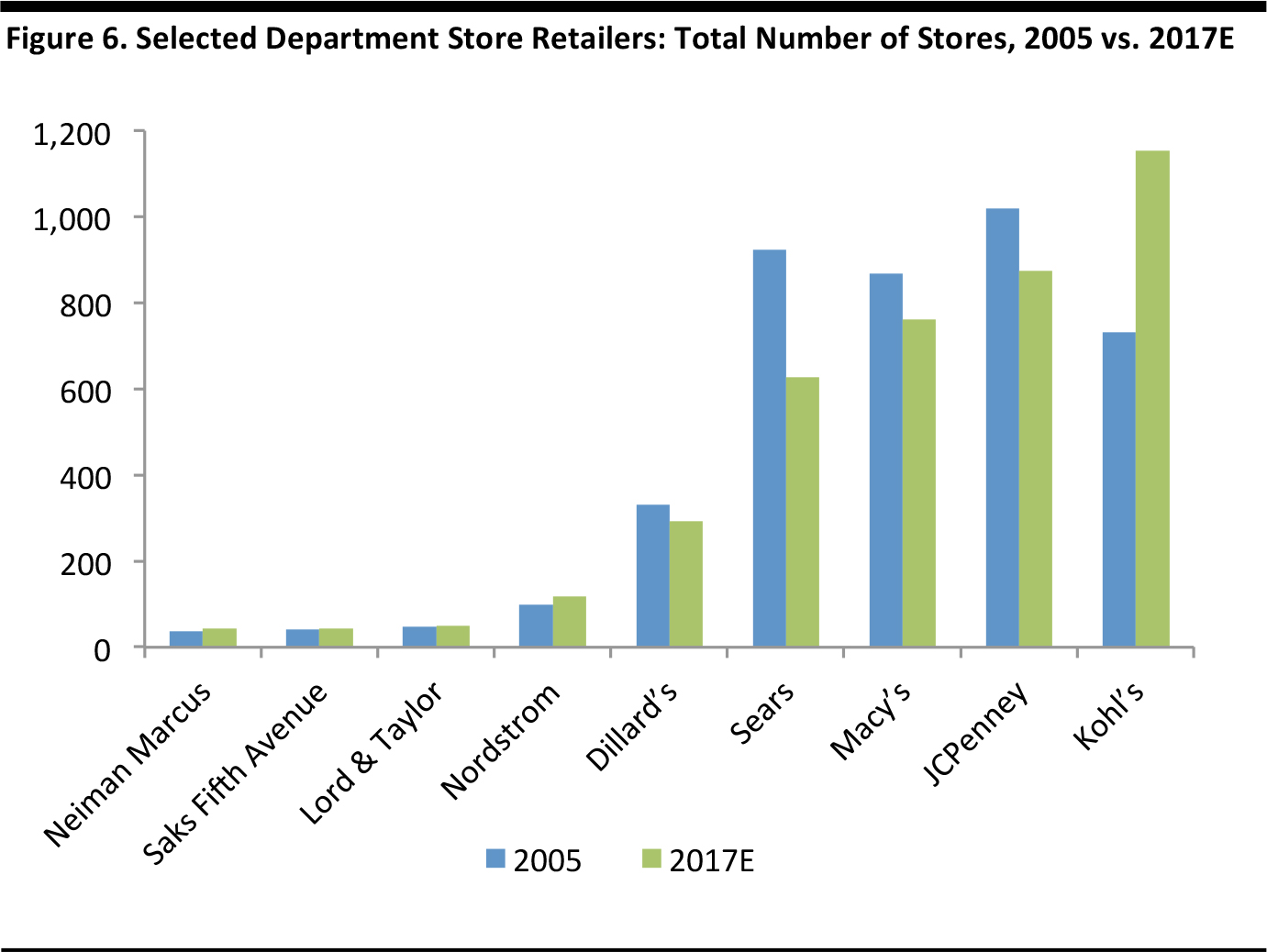

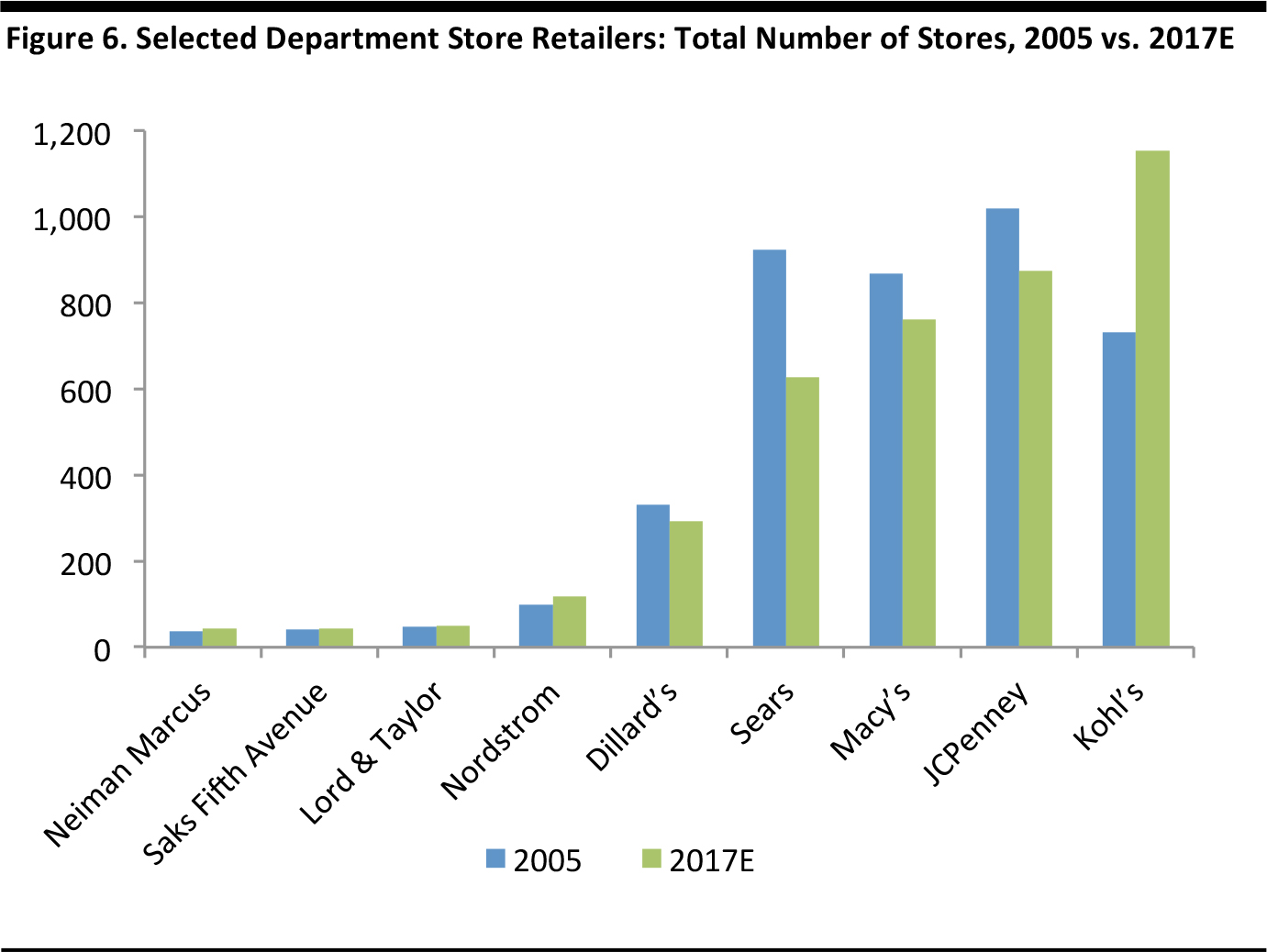

Number of US Department Store Closures Is Up

For this report, we looked at nine major US department store retailers that range from value-conscious to luxury in terms of positioning. In 2005, these nine companies operated a total of 4,098 stores, we calculate, based on company reports. That number had decreased by 3%, to 3,967 stores, as of May 16, 2017, we calculate.The graph below compares the total number of stores operated by each of the nine retailers in 2005 with their number of stores in 2017, including announced closures. Sears had the largest decrease in number of stores over the period, dropping from 924 in 2005 to 628 in 2017 (as of May 16), while Kohl’s had the largest increase, growing its fleet from 732 stores in 2005 to 1,154 in 2017.

2017 figures reflect announced store closures as of May 16, 2017. Source: Company reports

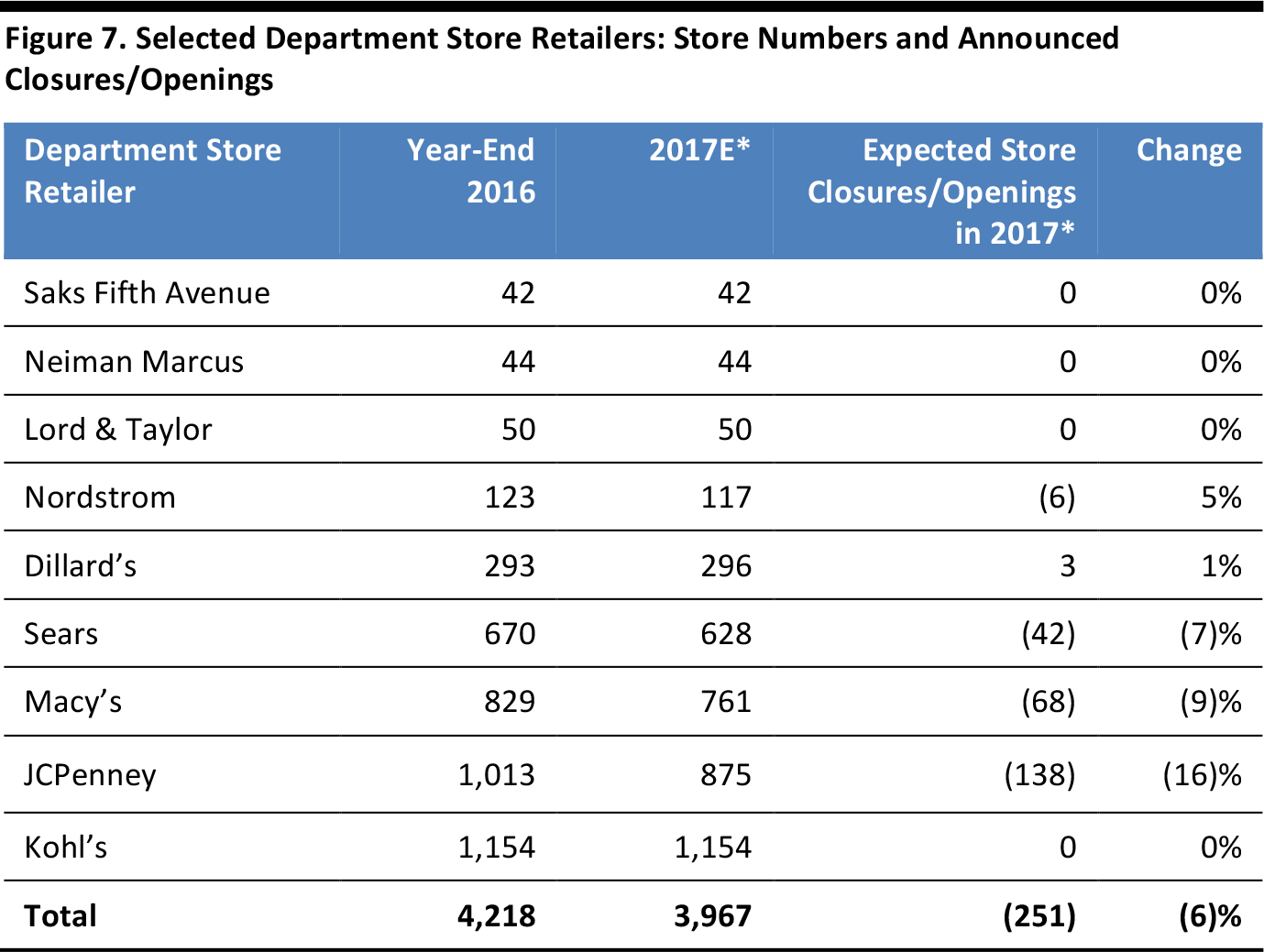

The table below compares store counts at the end of 2016 and as of mid-May 2017 for the selected group of nine department store retailers we examined. As of May 16, announced store closures by this group of companies would result in 6% fewer stores in operation than at the end of 2016.

*Based on store closure/opening announcements as of May 16, 2017 Source: Company reports

Specialty Stores

Consumers Are Shopping More at Specialty Stores and Less at Department Stores

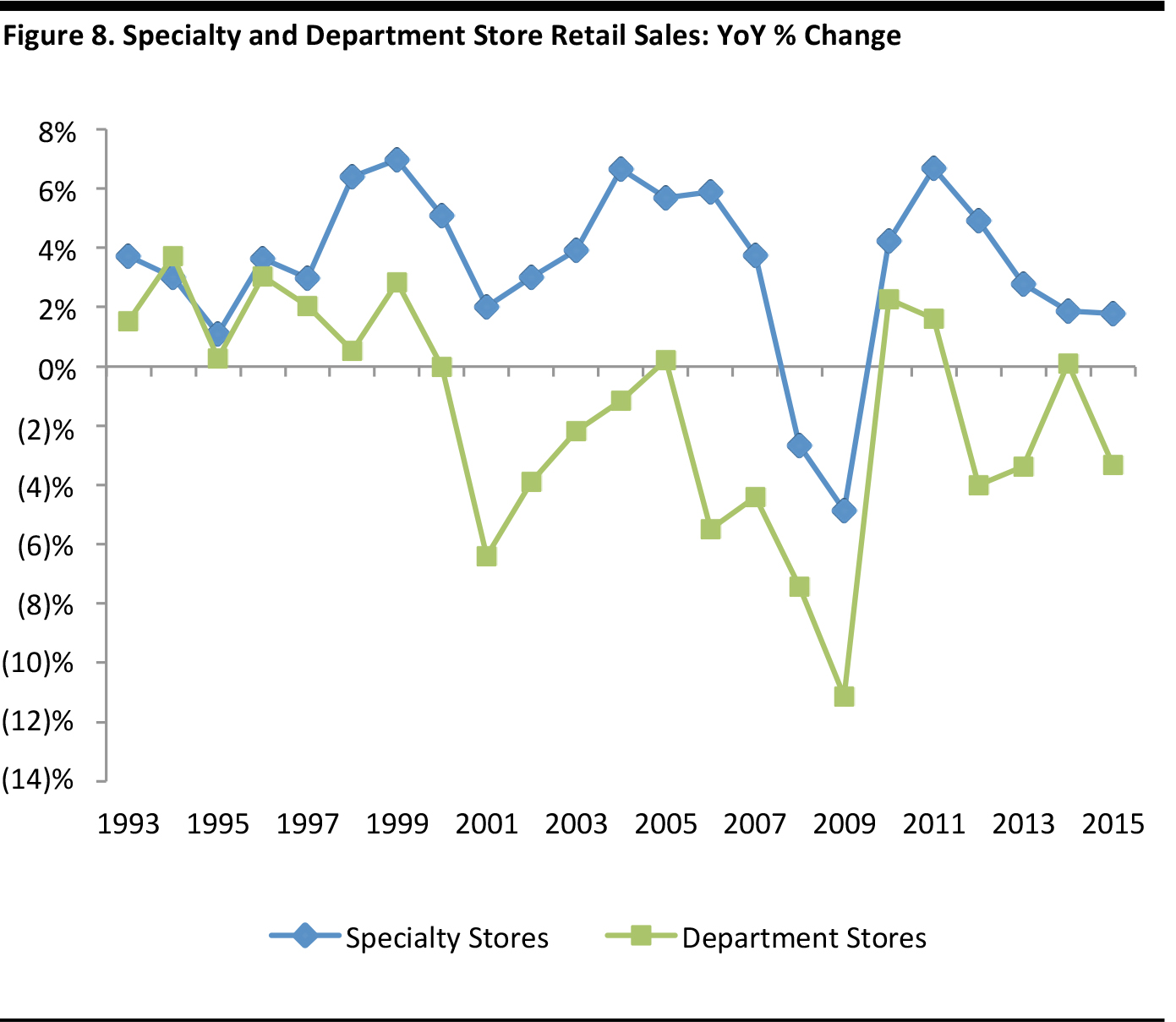

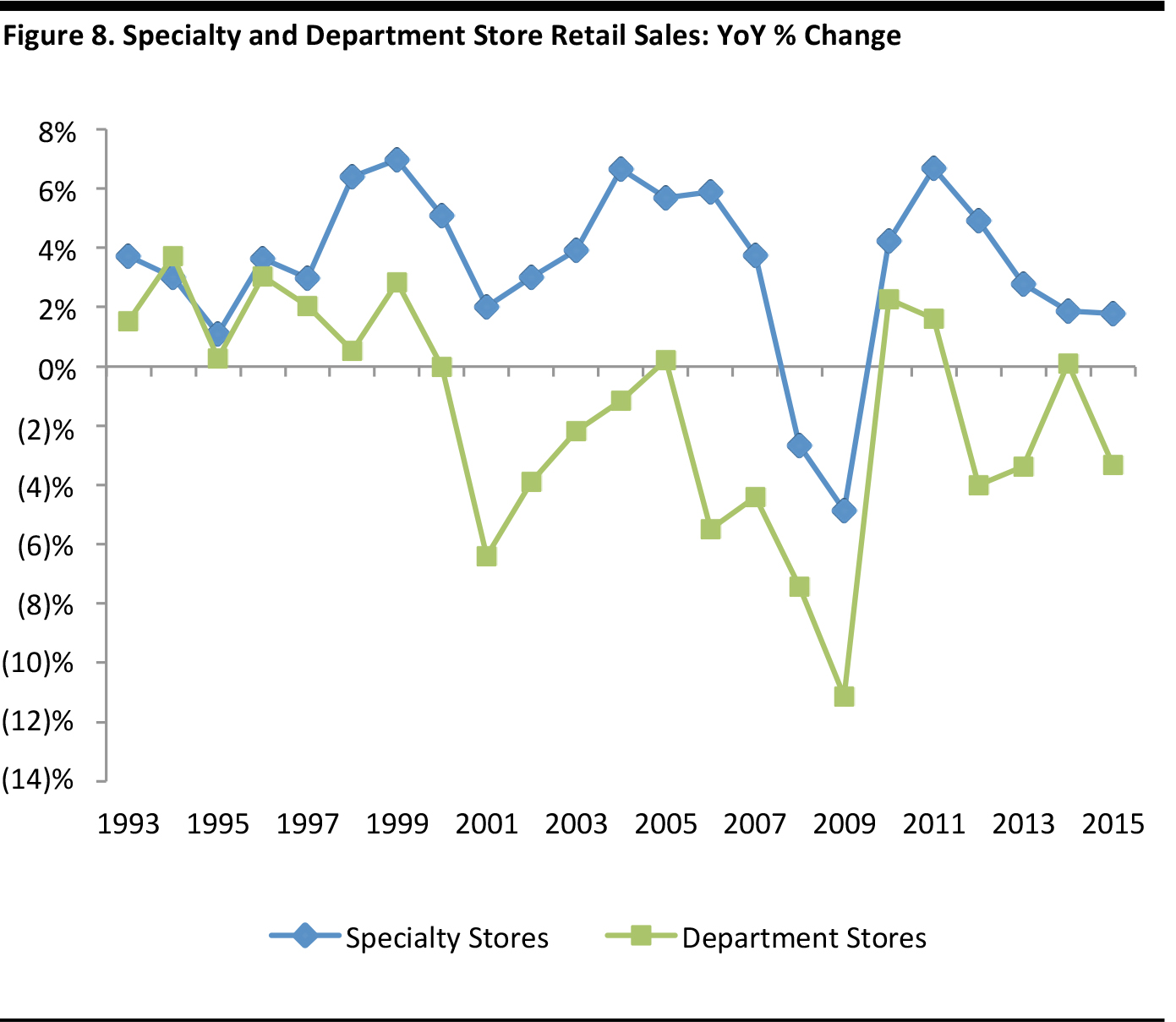

Beginning in the 1990s, consumers started to become very interested in brands with specific identities and niches. Retail stores built up around these specialized brand concepts. In women’s apparel, The Limited, Caché and Express appeared in the 1990s. In teen apparel, Express, Scoop and Abercrombie & Fitch gained popularity, while The Gap maintained its status as the original denim shop for the whole family. Other names, including Nike, Ralph Lauren, Izod Lacoste and Coach, also offered customers more reasons to shop at specialty stores instead of at department stores. The graph below illustrates consumers’ gradual move away from “everything under one roof” concepts toward specialized, differentiated selections. Specialty retailers saw positive year-over-year sales growth every year from 1993 through 2015 except during the 2008–2009 recession, according to data from the US Commerce Department. During the same period, department store sales saw positive year-over-year growth in the late 1990s, but then again only in 2010 and 2011.