Executive Summary

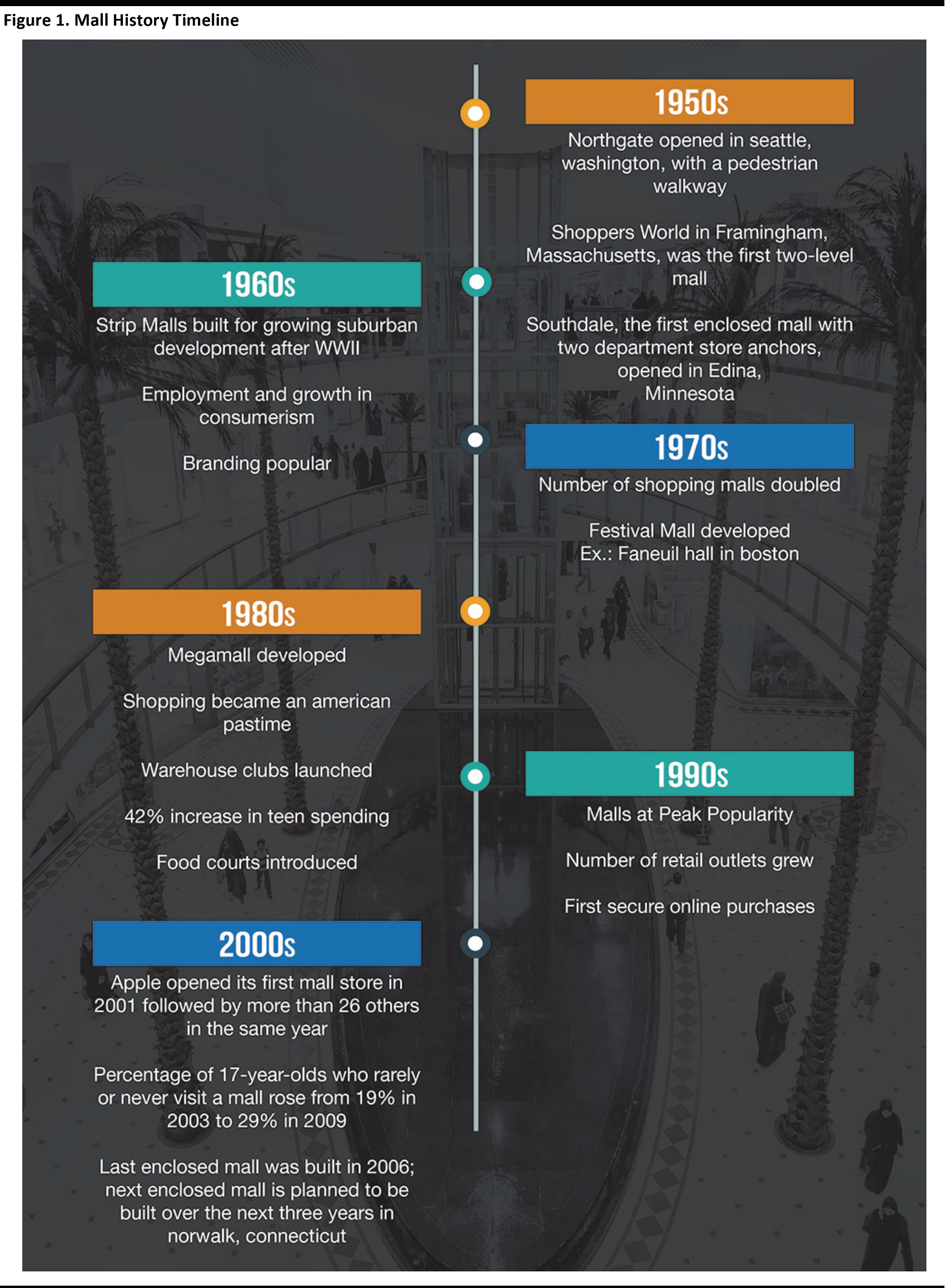

The mall is not dead. It is, however, evolving at a pivotal time in the context of a changing retail landscape and shifting consumer demand. The new mall is an exciting, hybrid format encompassing retail, entertainment, food, outlets, housing, education, and even medical facilities, in some cases.

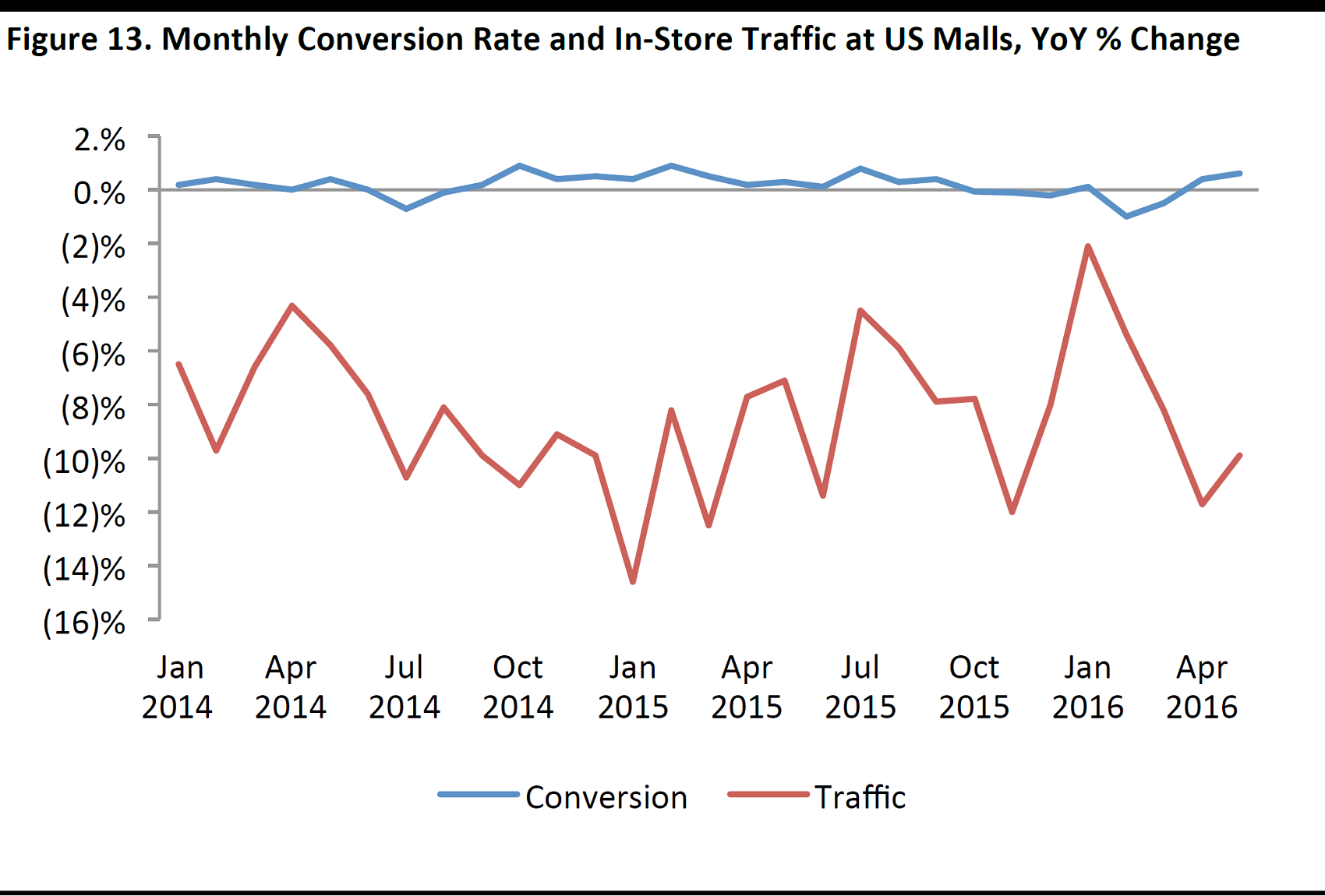

Traditional mall tenants such as movie theaters and restaurants are returning to malls and newer tenants, including the likes of Tesla Motors and Apple, are choosing malls to expose their brands to meaningful traffic. Although traffic at malls has declined by 9.1% since January 2015, it is still significant—and conversion rates are increasing despite the drop in traffic. Furthermore, even though some stores have closed, many new ones are opening and creating hybrid formats that we have not seen in malls before.

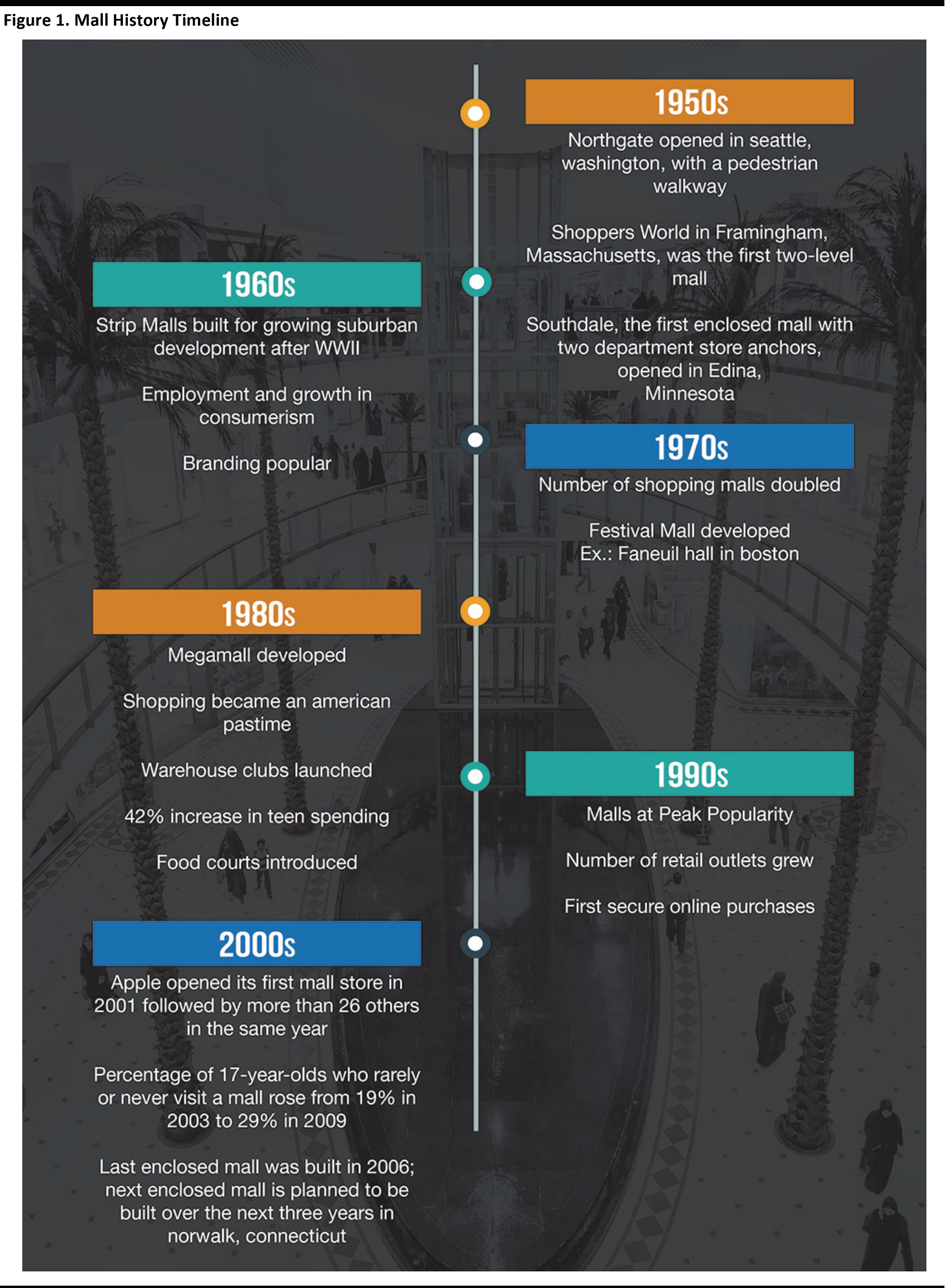

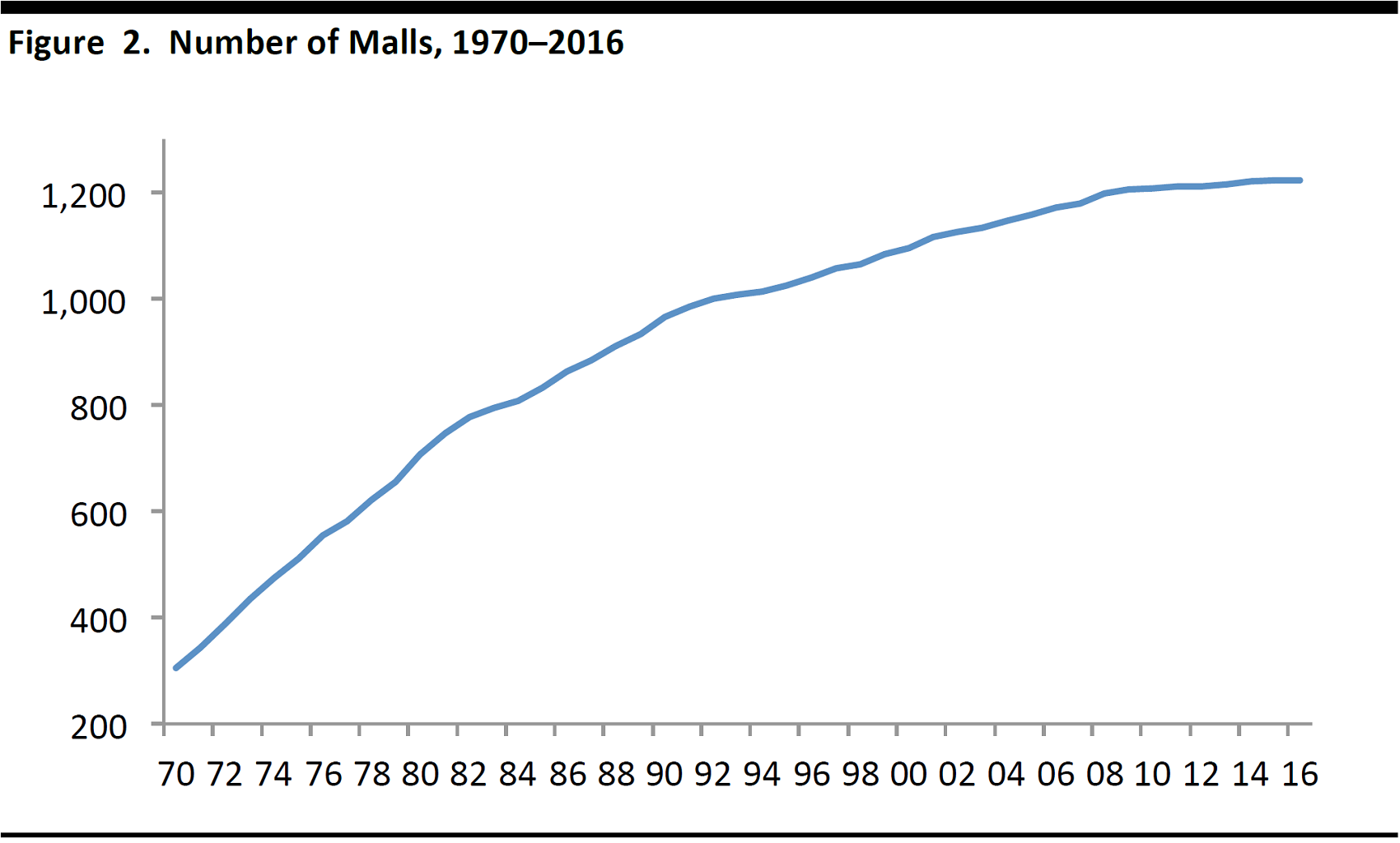

The number of malls in the US has grown by more than 300% over the last 45 years. The 1970s was the biggest period of growth, and the number of malls doubled during the decade. In the 1980s, shopping became an American pastime and malls became ingrained in our culture; they were featured in movies, songs, and television shows. The megamall concept was developed in the 1980s and, in 1992, The Mall of America opened, featuring over 500 shops and three roller coasters. By the 1990s, mall growth had peaked and begun to slow; an average of 15 new malls were built every year in the 1990s compared with 25 in the 1980s. E-commerce also came onto the scene in the 1990s, and retail outlet stores started to gain momentum.

The number of new mall openings has continued to decline since 2000, averaging just eight per year.

Given the current oversaturation of malls in the US, we believe that at least 30% of them—mostly within the C and D classifications—need to be closed. Malls classified as A properties are the most productive; they account for only 20% of all malls, yet represent 72% of total mall sales. The top 10 malls in the US see average sales per square foot of over $1,000, which is more than twice the mall average. Sales at A malls have grown by double digits in the past five years, and most A malls are in urban or tourist areas.

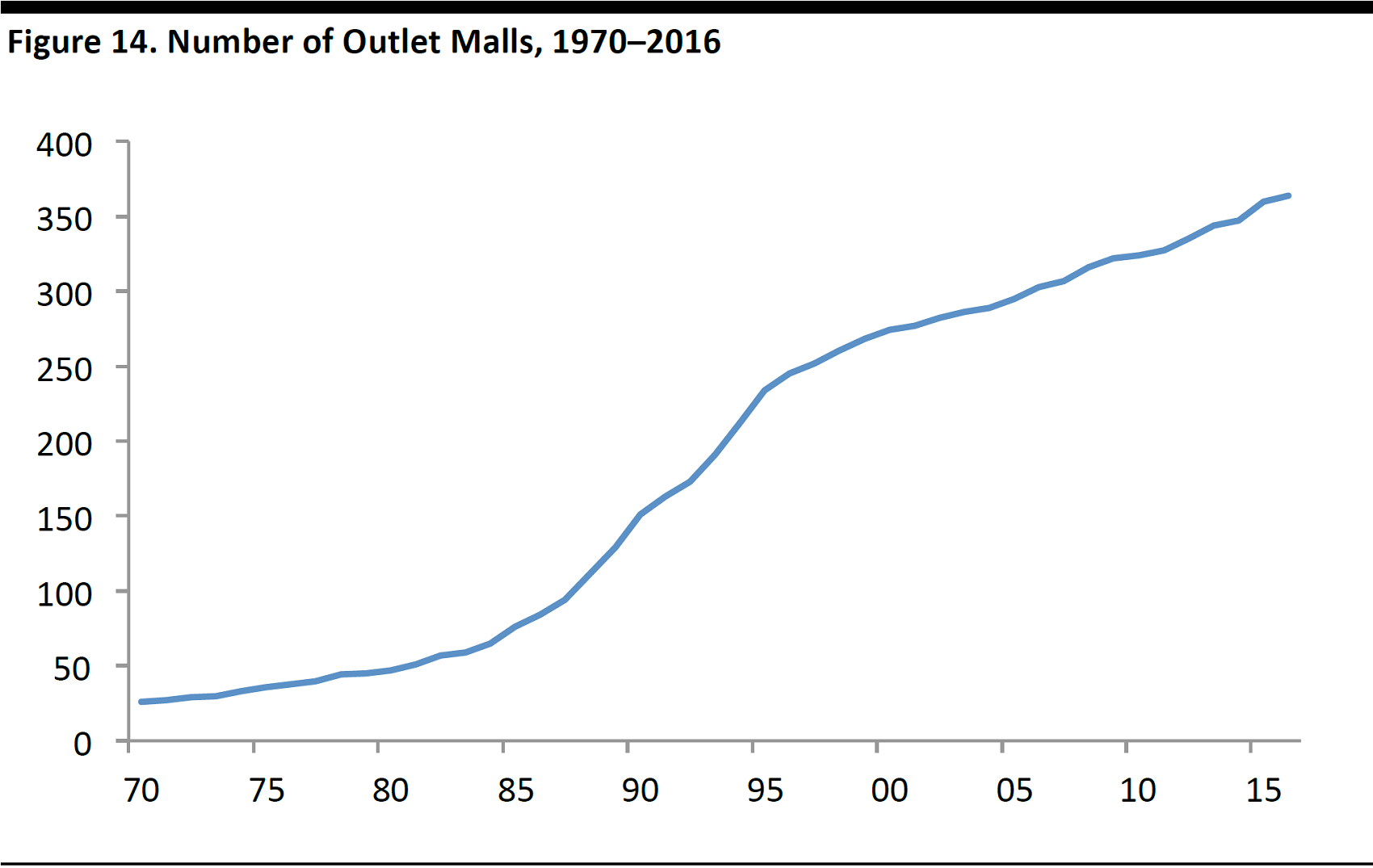

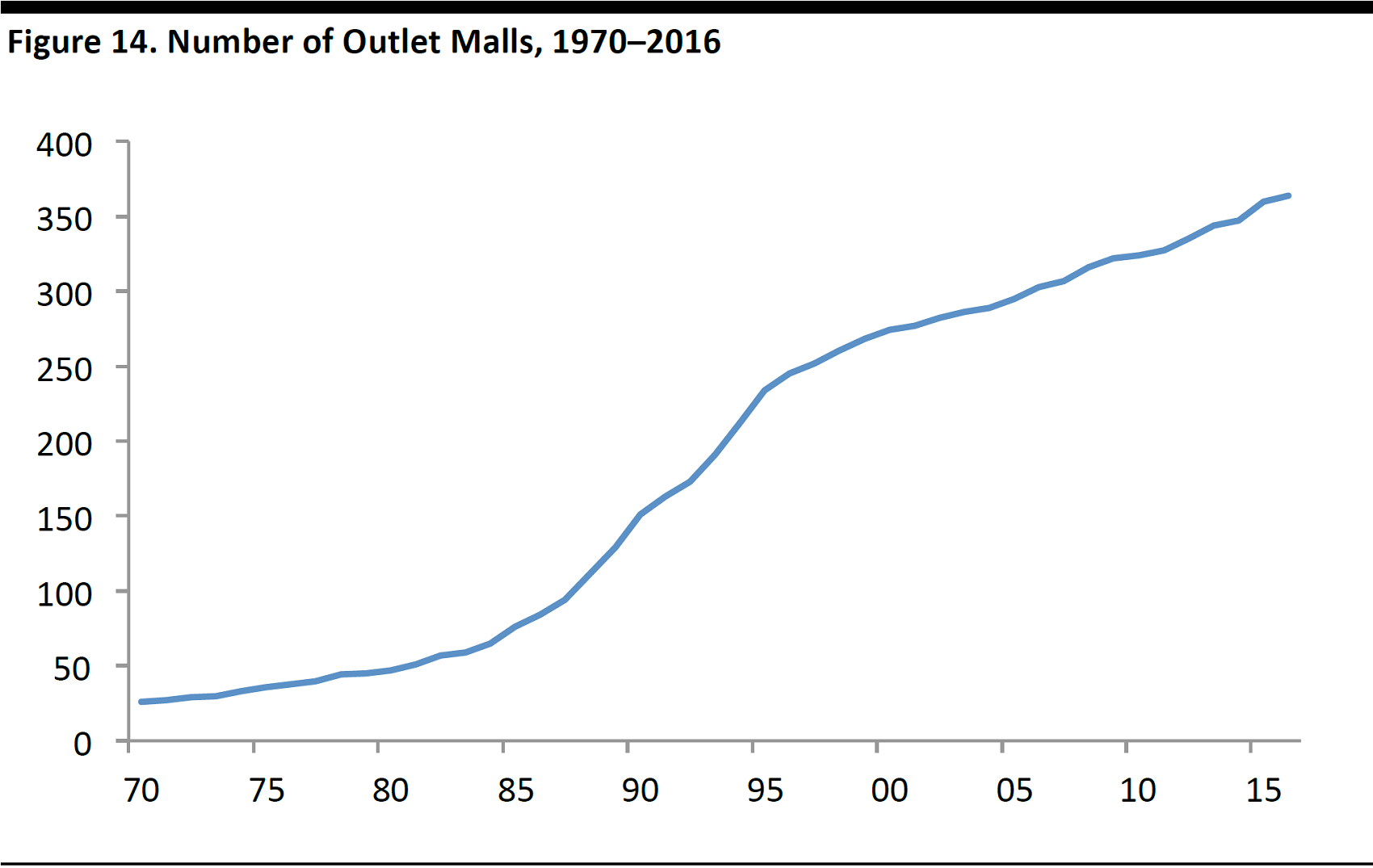

The retail outlet format has grown in popularity, and the number of outlet stores has risen by 47% over the past 20 years. Since 2012,41 outlet centers have opened in North America and another 57 new outlets or expansions are set to open by 2018. Six outlets are planned to open in 2016.

In this report, the first in our three-part

The Mall Is Not Dead series, we analyze the US mall landscape. We review the history of malls in the US, as well as mall types, sales growth, retail occupancy rates, traffic and outlet malls. Other reports in this series will analyze department and specialty stores in malls, trends impacting malls, the evolution of malls, and store concepts that are expanding.

Our research shows that the mall is not dead, but that it is transforming in order to accommodate shifts in consumer demand. In many cases, malls will need to repurpose their space to become hybrids or A malls in order to become relevant in today’s economy.

Malls Have Not Evolved Much Since the 1960s

Victor Gruen, an architect and émigré from Vienna, Austria, is credited with inventing and opening the first US mall in 1956. He created the mall, in Edina, Minnesota, southwest of Minneapolis, to be a civic center as much as a commercial center, with a daycare, library, post office, community hall and art. Gruen’s vision of the first mall was never fully realized: it was supposed to be the centerpiece of a 500-acre area that would include houses, apartments, office buildings, a medical center and schools. Author Malcolm Gladwell suggested that, as creator of the mall, Gruen was the most influential architect of the 20th century.

In the 1960s, the economy was doing well, and strip malls became popular before larger malls became commonplace. The American consumer was introduced to branding, particularly in the grocery store, via ready-made meals, yogurts and desserts. Kellogg’s Pop-Tarts and Apple Jacks, General Mills Lucky Charms, Yoplait Yogurt, Campell’s Chunky soups, and Pringles potato chips were all introduced in the 1960s.

The 1970s were a period of growth that saw the development of the festival mall format, which utilizes historical architecture and real estate and features local artists as tenants. Designed to revitalize an area, festival malls include Faneuil Hall in Boston, Station Square in Pittsburgh, Navy Pier in Chicago and Harborplace in Baltimore. The traditional American mall also started to gain popularity during the 1970sas Americans began to enjoy the convenience and pleasure of shopping at them. The number of regional malls grew by 130% over the 1970s.

Source: Shutterstock

The 1980s represented a great time for the American mall, and saw the development of the megamall format. A Gallup poll found that Americans averaged approximately four trips per month to the mall during the 1980s. Hit pop songs such as “Valley Girl” specifically referenced malls, and teenagers spent their free time hanging out at malls. There was a 42% increase in teen spending during the 1980s. The word “shopaholic” was coined, and shopping became an American pastime. Food courts were introduced and brands such as Orange Julius, Panda Express and Chick-fil-A became mall staples. Several warehouse clubs, including Costco, Sam’s Club and BJ’s, were also founded during the early 1980s.

During the 1990s, malls reached peak popularity. The largest mall in the US, The Mall of America, in Bloomington, Minnesota, opened in 1992. It is home to three roller coasters and 500 shops and retail outlets. The 1990salso saw the introduction of the first secure online purchases, with the launch of Amazon in 1994 and eBay in 1995.

In 2001, Apple opened its first mall store, and then opened more than 26 other stores in malls and urban shopping districts that same year. But malls seem to have started slipping in the mid-2000s. According to a 2009 Gallup poll, 29% of 17-year-olds reported that they rarely or never visited a mall, a sharp increase from 19% in 2003.

As we celebrate the 60-year anniversary of the mall, the format of these shopping centers in the US is moving back toward Gruen’s original vision, and many malls are now becoming mixed-use, retailtainment centers.

Source: Shutterstock

Source: Fung Global Retail & Technology

The Number of Malls Doubled from 1970 to 1980

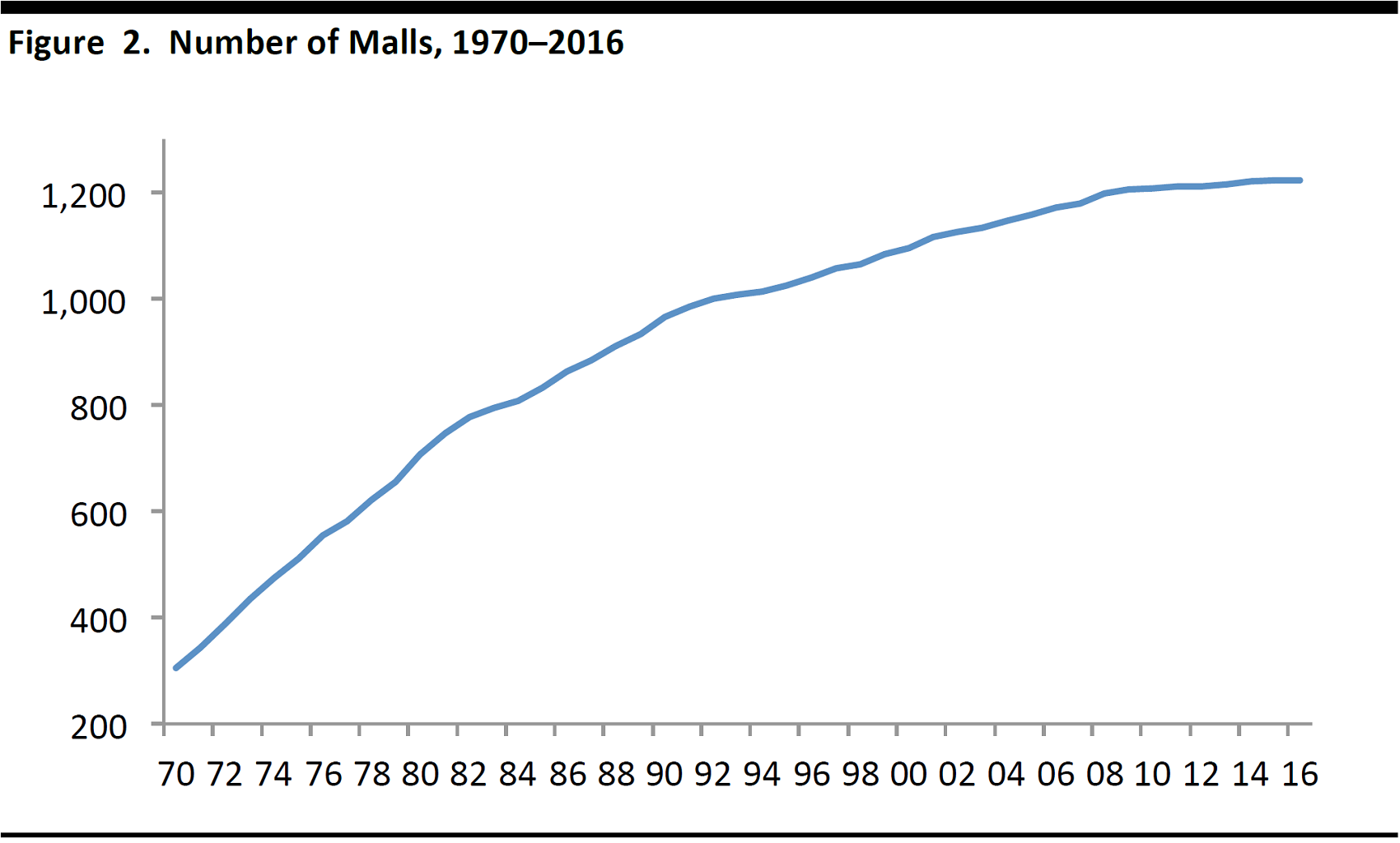

Over the past 45 years, the number of malls in the US has grown by 300%. According to the ICSC, there are currently 1,221 malls in the US versus just 305 in 1970. Malls gained popularity and more than doubled in number between1970 and1980, from 305 to 707. From 1980 to 1990, mall growth continued at a rate of 36%, and there were 965 malls in the US in 1990. Growth slowed to 13%from 1990 to 2000 and fell to 10% from 2000 to 2010. Although the pace of mall development has slowed, the continued and consistent growth overall has created an abundance of malls in the US.

Source: ICSC

Source: Shutterstock

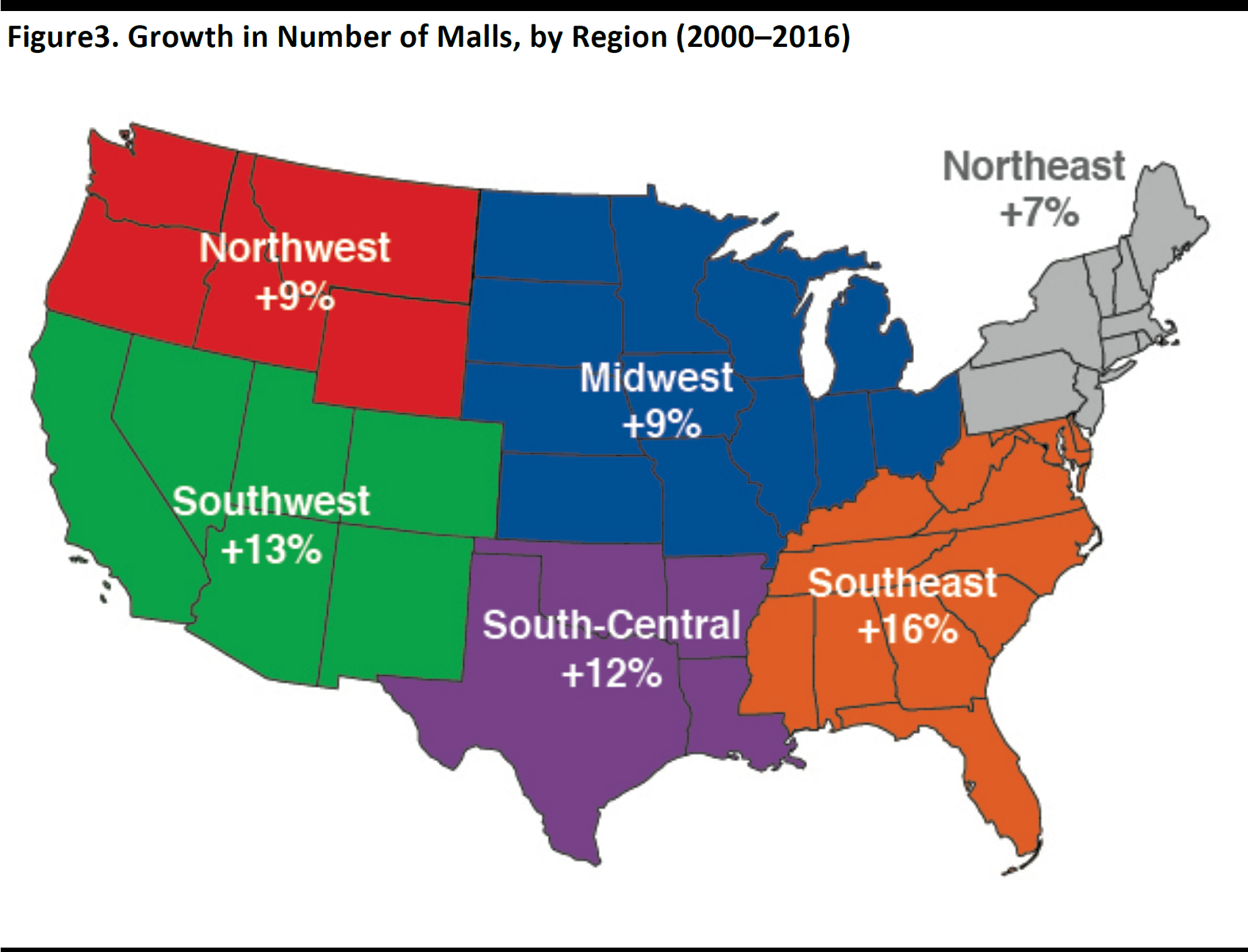

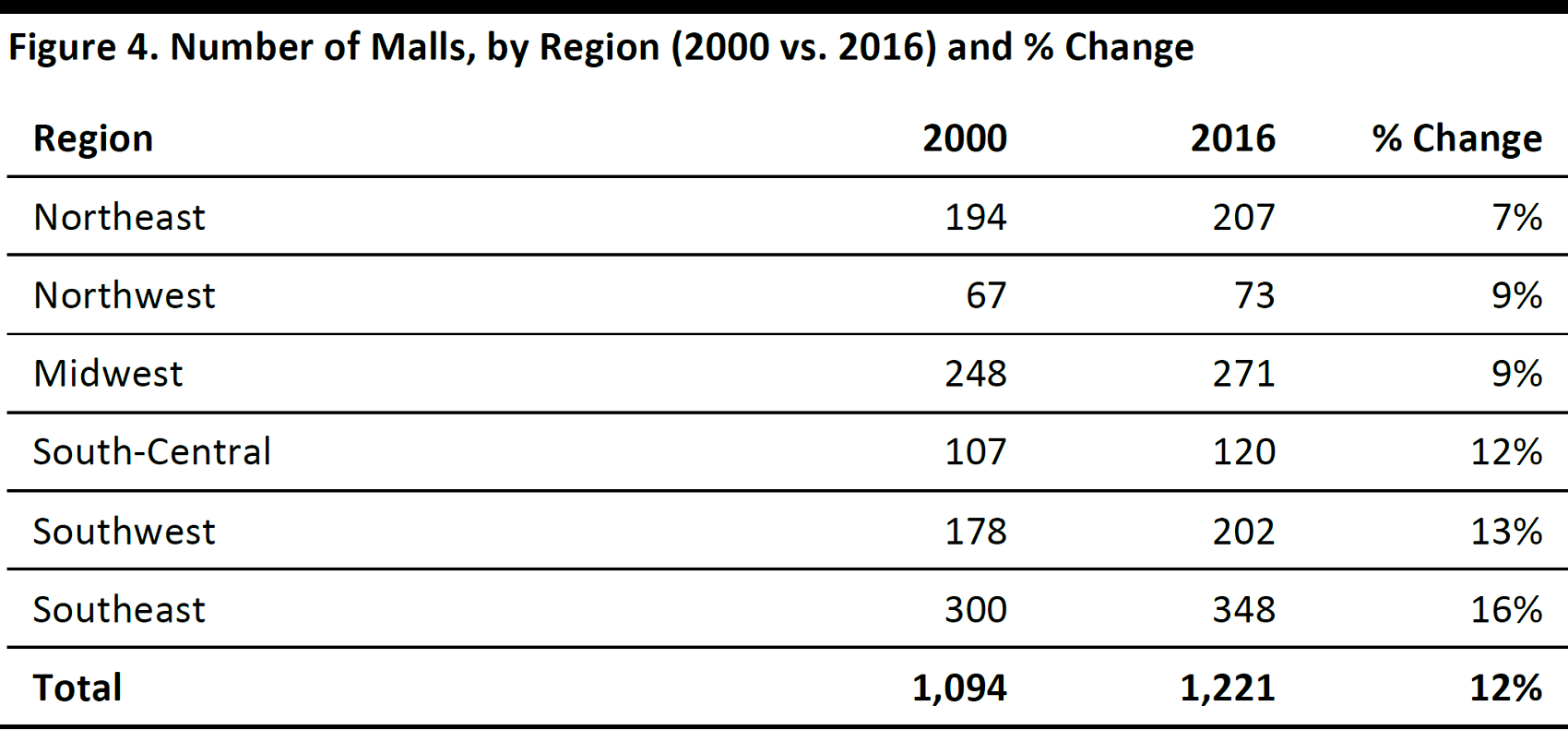

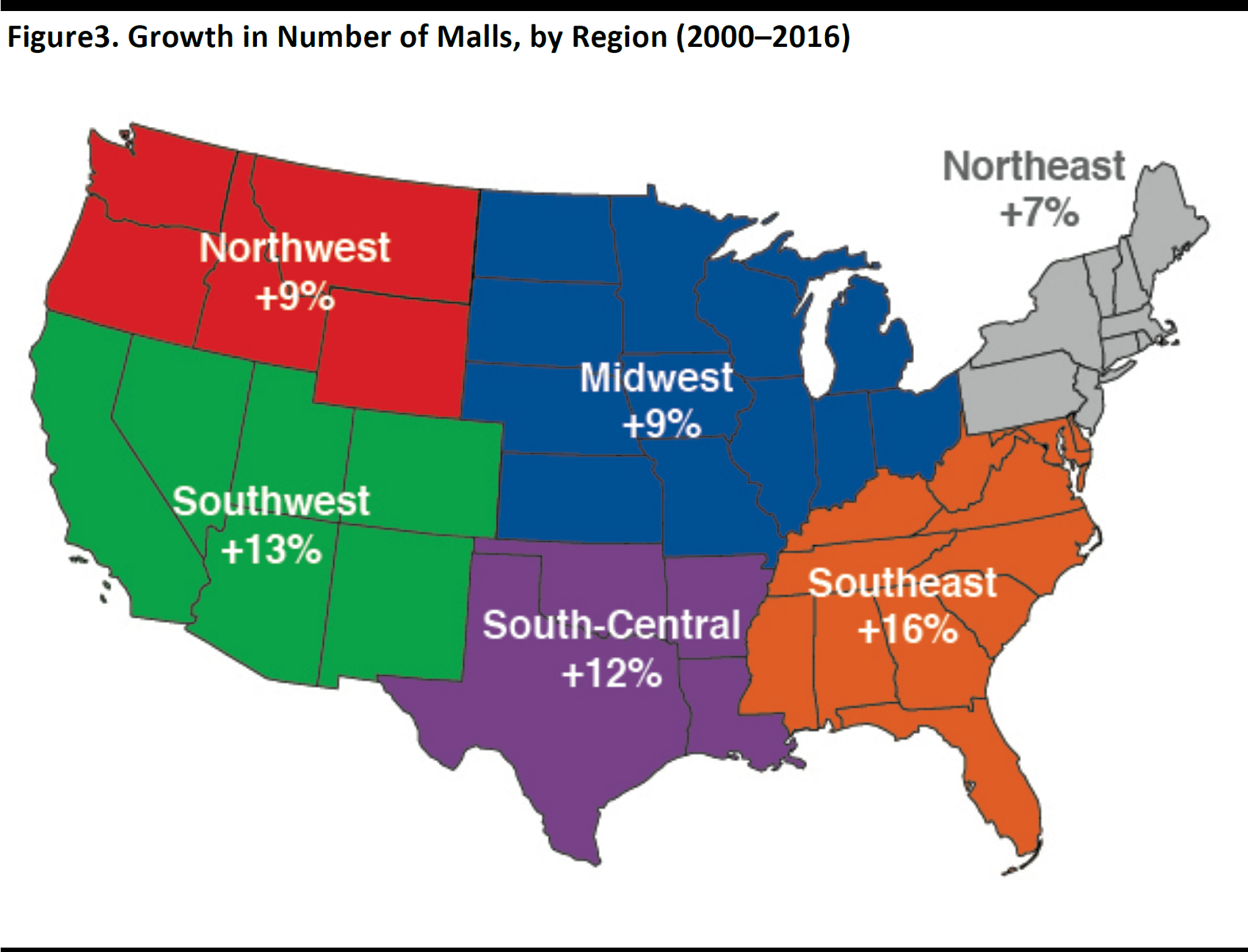

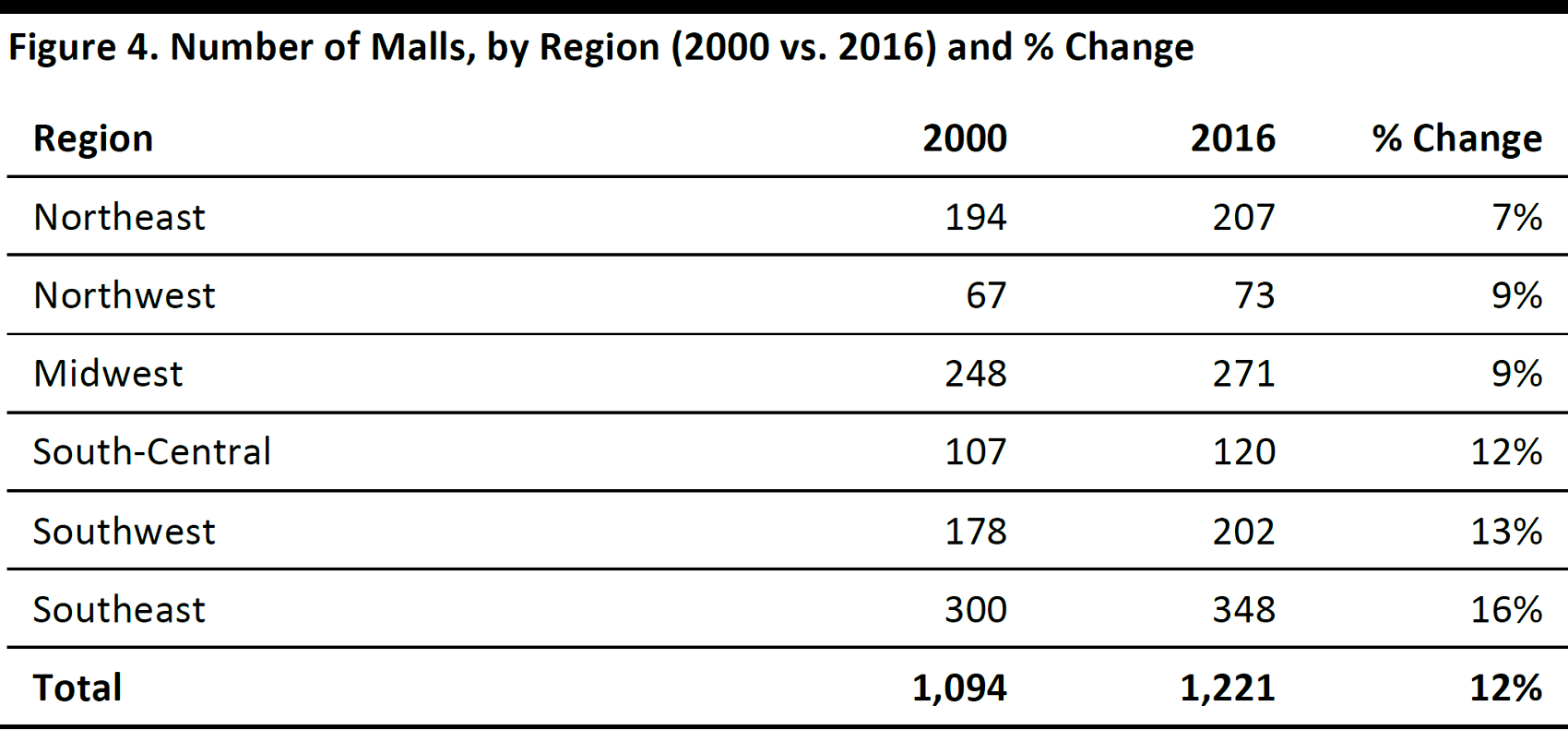

The number of US malls has grown by 12% since 2000, according to the ICSC. The map below highlights mall growth over the past 16 years, by region. The Southeast region experienced the strongest growth, at 16%, followed by the Southwest region, at 13%.

Source: ICSC

Source: ICSC

Some of Today’s Retailers Were Founded in the 1800s

Below, we present a historical timeline of top retailers and industry influencers over the past 150-plus years. Five of today’s major US department stores were launched before 1910. Dillard’s and Dollar General were launched during the 1930s and the value store trend continued with H&M and Ross Stores entering the market during the 1940s and 1950s, respectively. The 1960s paved the way for a new type of shopping as Walmart and Target entered the market and changed how we shop for brands.

Home Depot launched in the 1970s along with discounter T.J. Maxx. Specialty retailers Gap and Sephora launched in 1969 and 1970, respectively, altering how we shop for denim and cosmetics.

Most warehouse stores launched in the early 1980s. Two other major retail influences—the J.Crew catalog and QVC—also launched in the 1980s, and both affected patterns of shopping at home.

In 1994, Amazon.com was founded, and eBay launched the following year, forever changing the world of online shopping. Lululemon Athletica and Under Armour launched in the 1990s, too, introducing us to a new world of sportswear and athleisure. Factory retail outlets also became very popular during the1990s.

The 2000s saw the continued evolution of online shopping, with retail-hosting websites such as Rue La La, Groupon, and Gilt entering the market.

The retail landscape has continued to evolve, and new modes of shopping, including consignment services, the sharing economy, and subscription packages, emerged in 2010 and 2011 with the launch of The RealReal, Stitch Fix and Birchbox.

Source: Shutterstock

Source: Company reports/National Retail Federation/Fung Global Retail & Technology

Just 20% of Malls, the A Malls, Generate 72% of All Mall Sales

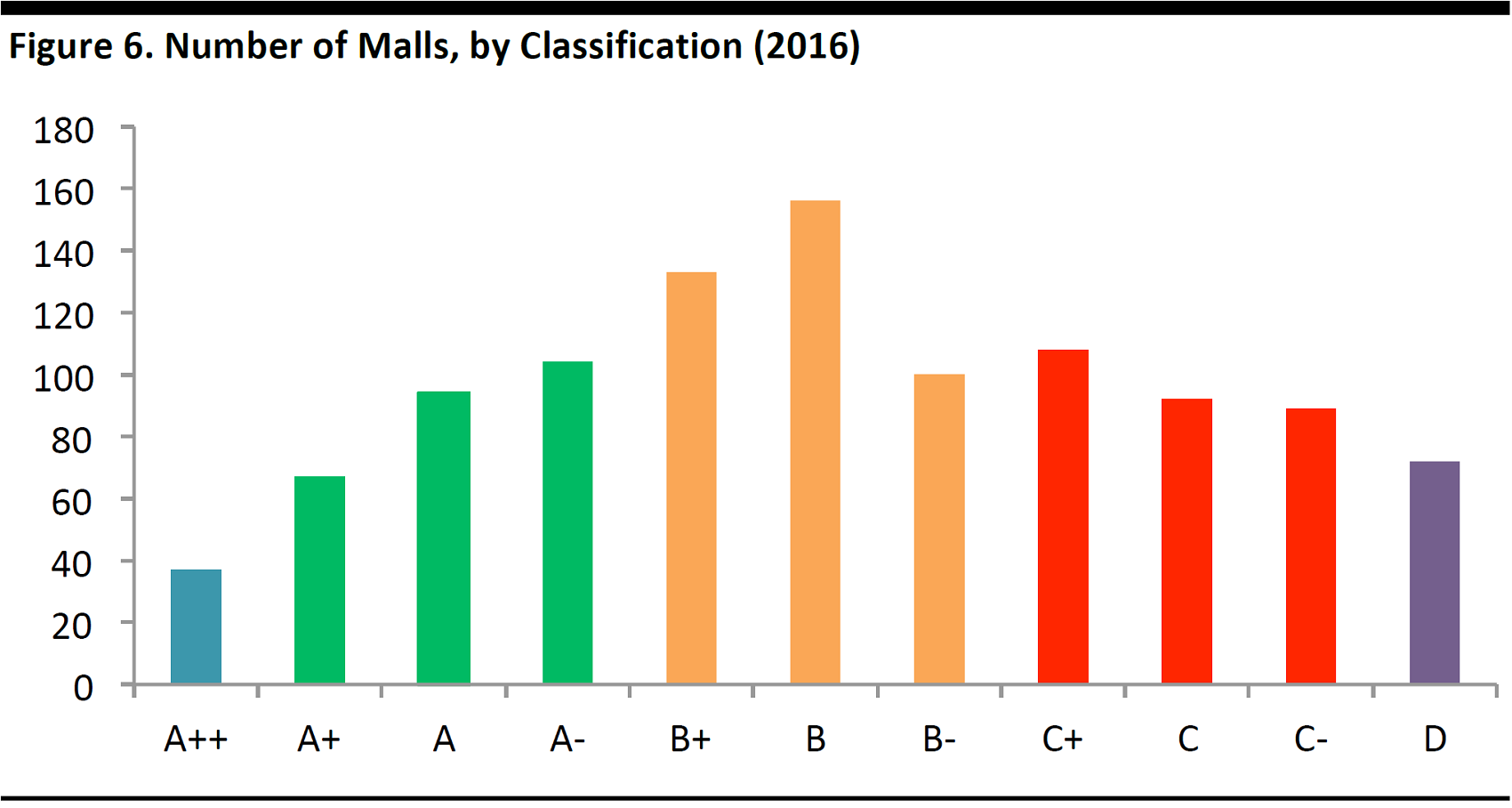

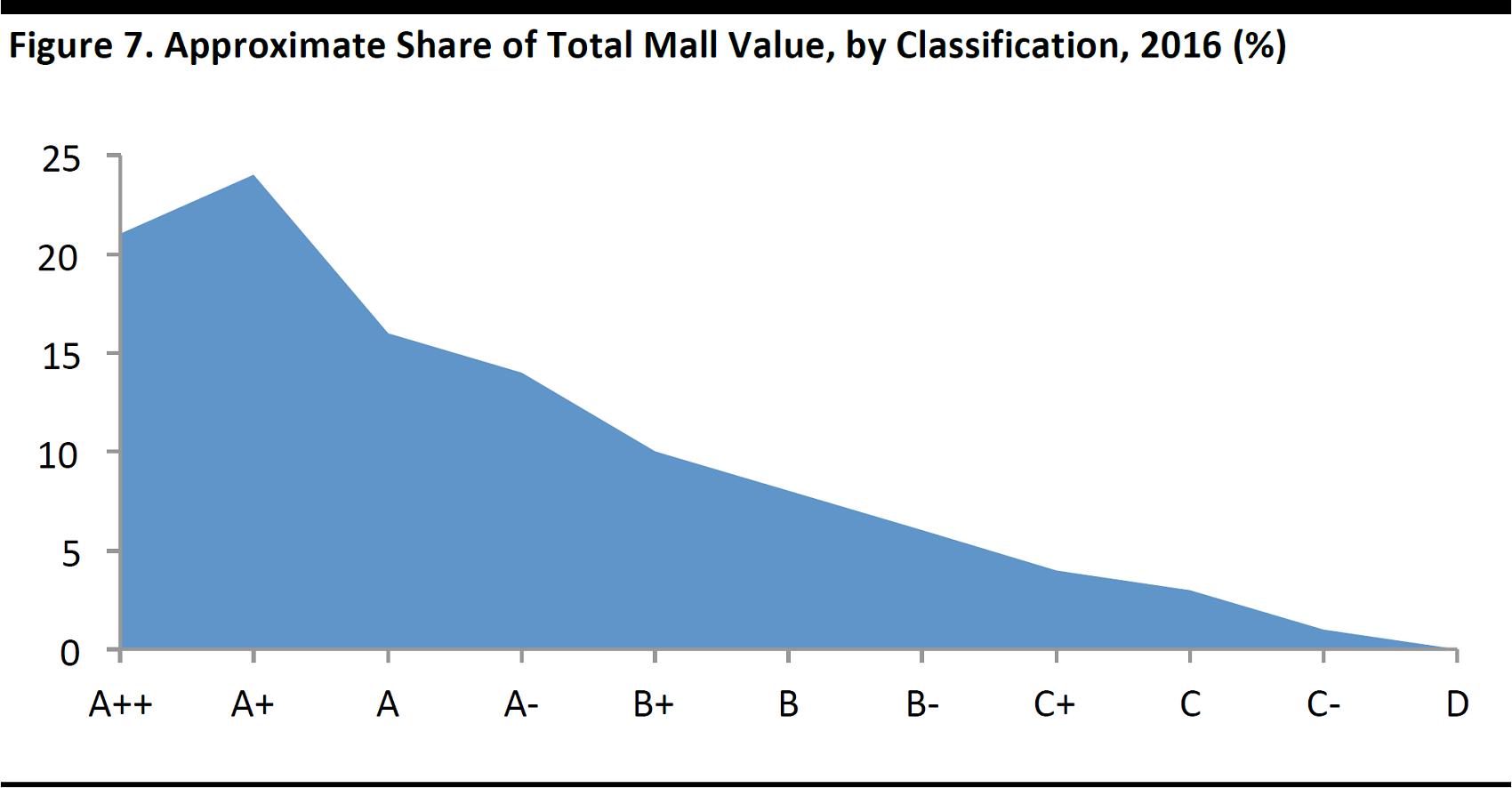

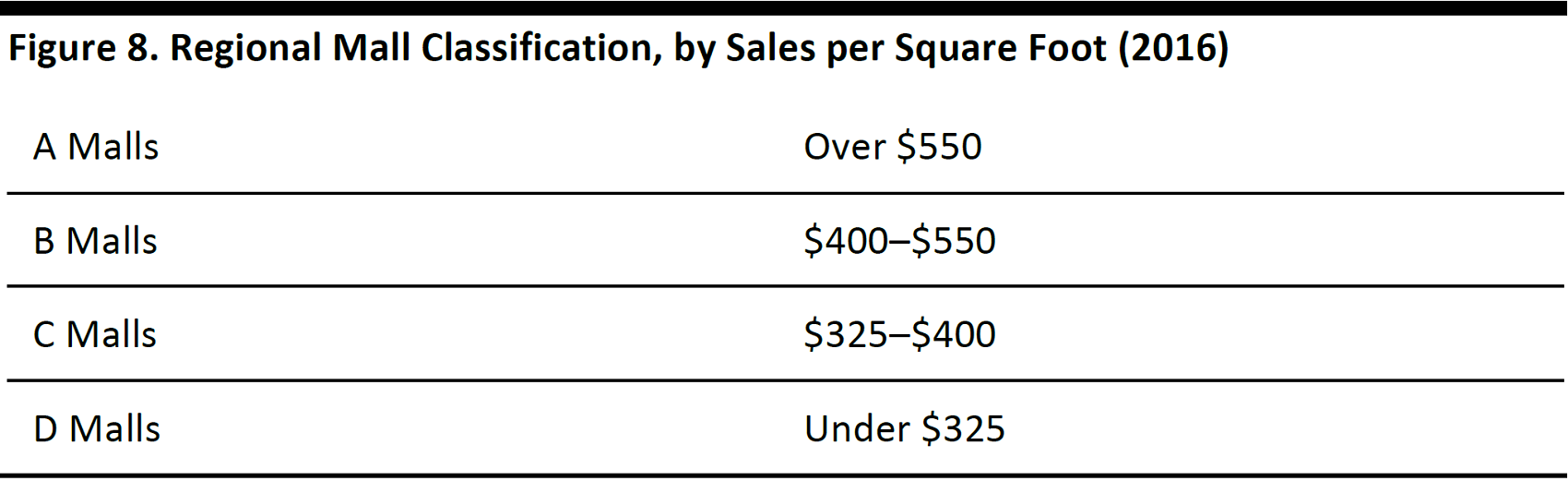

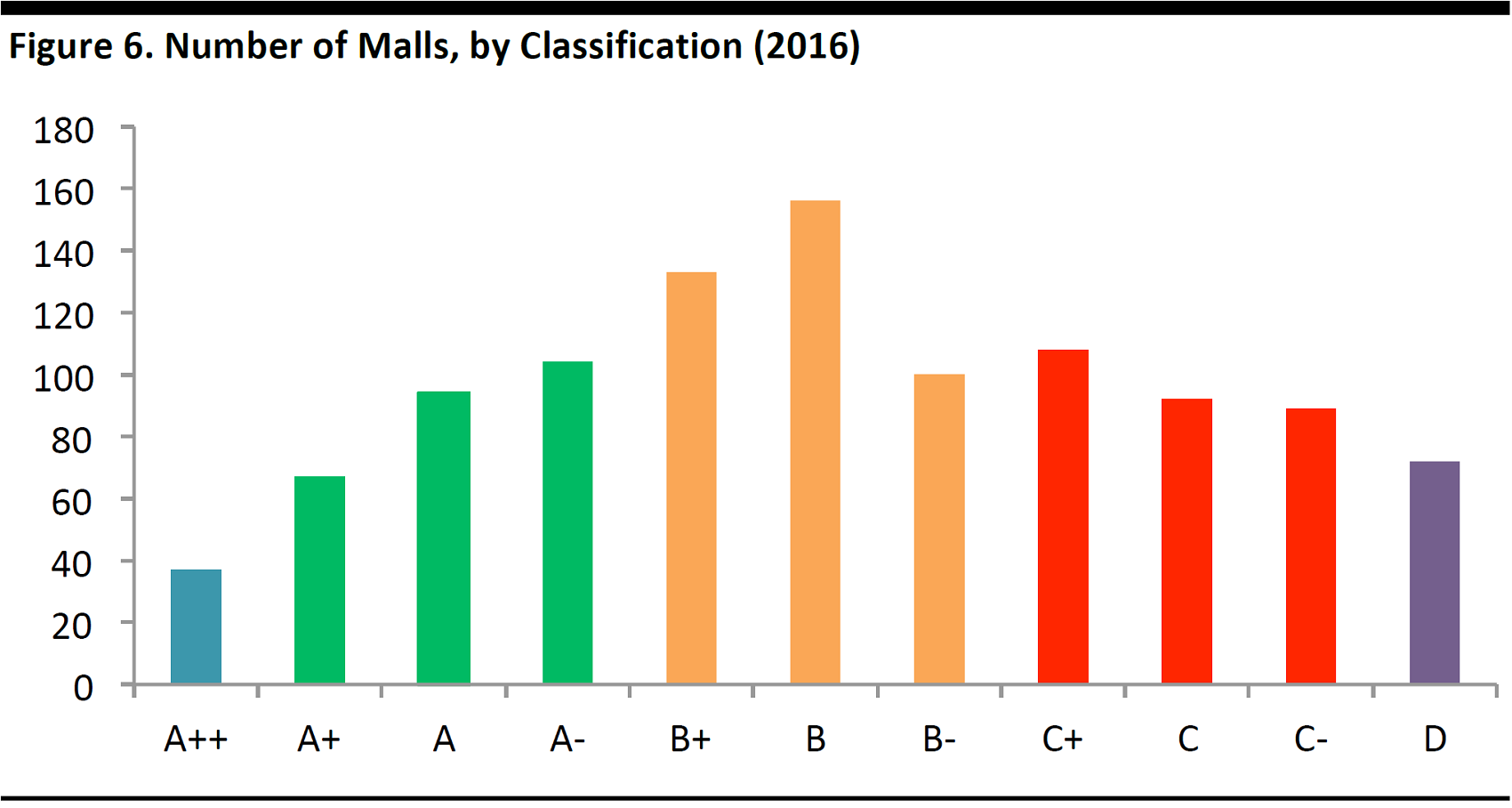

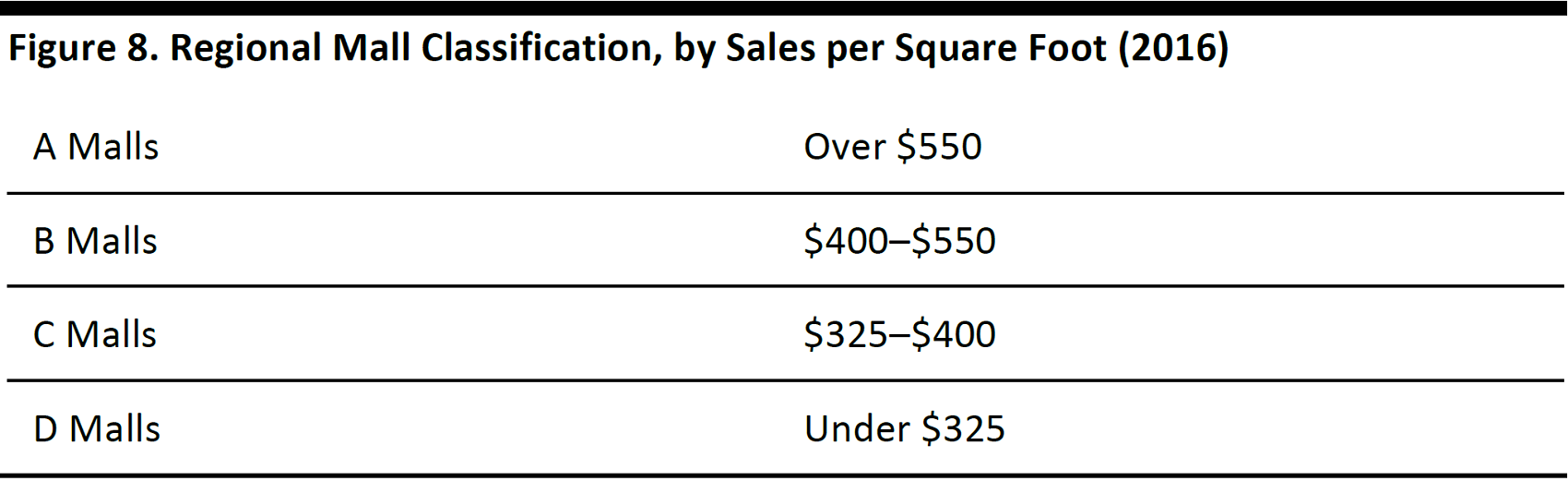

Malls are classified from A–D in the retail real estate industry, based on sales per square foot. The ICSC does not further classify its super-regional and regional malls by type, and there is no universally accepted method for calculating sales per square foot in the industry. Therefore, there may be some variation among REITs on how each classifies A–D malls.

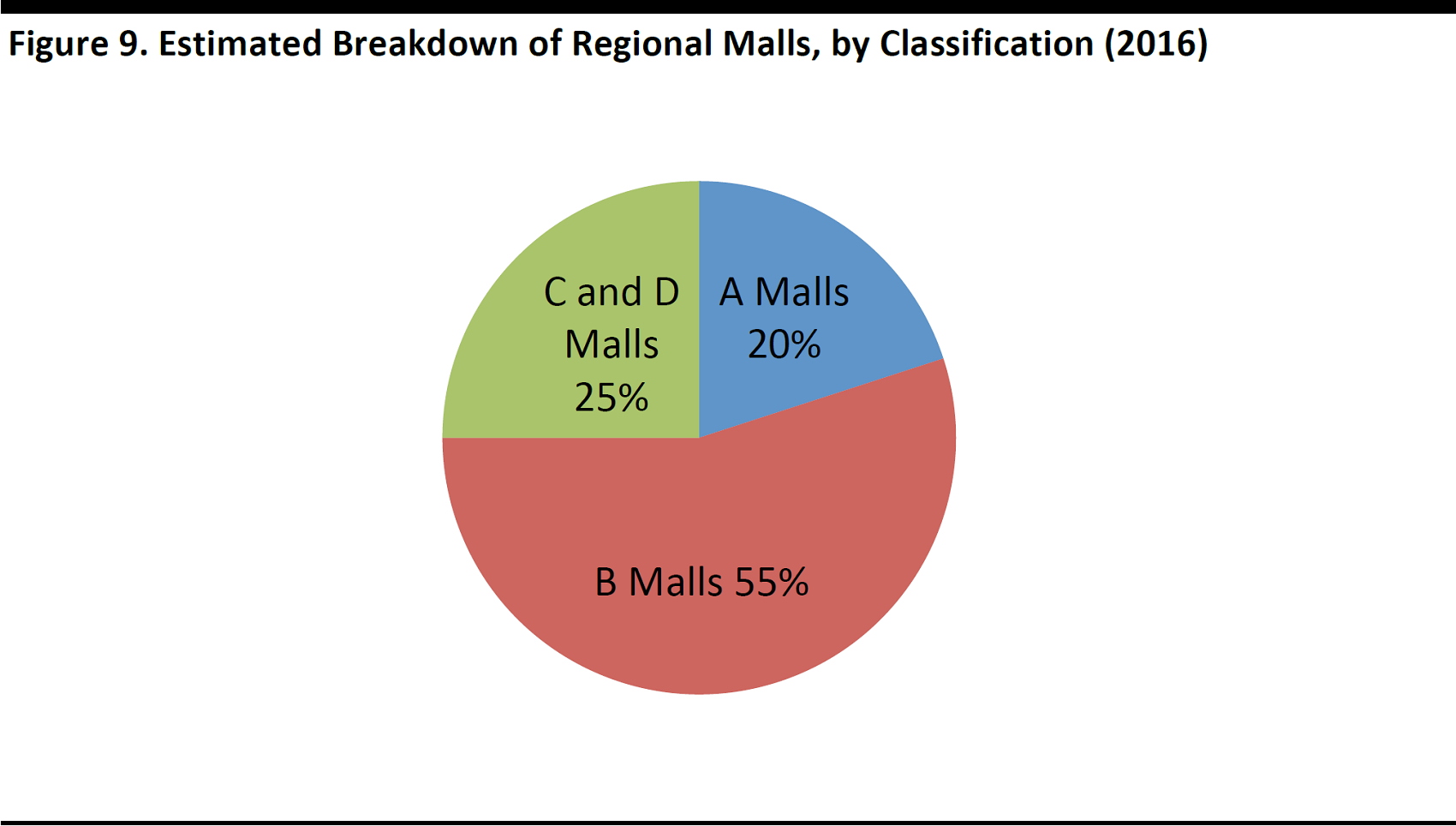

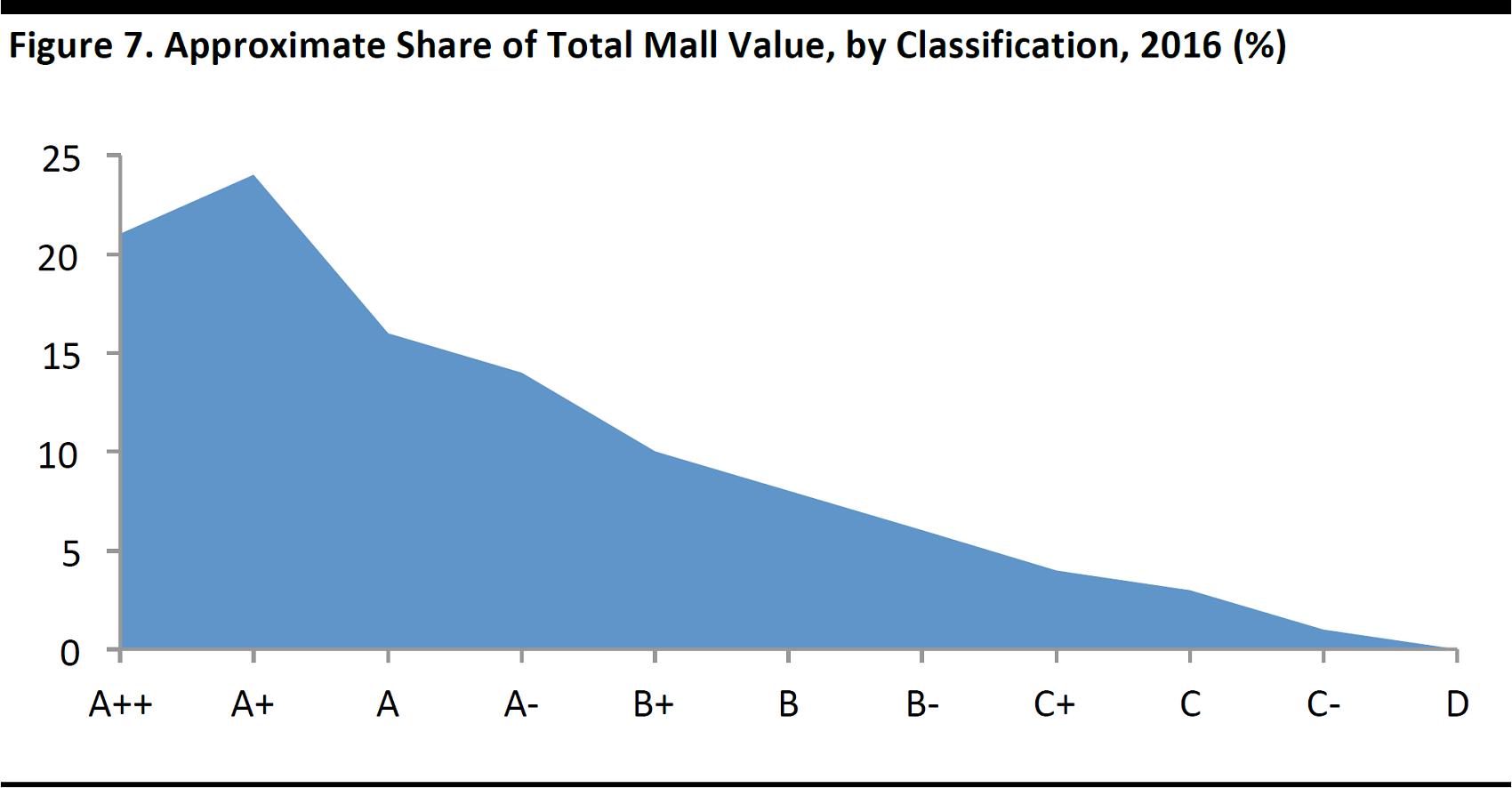

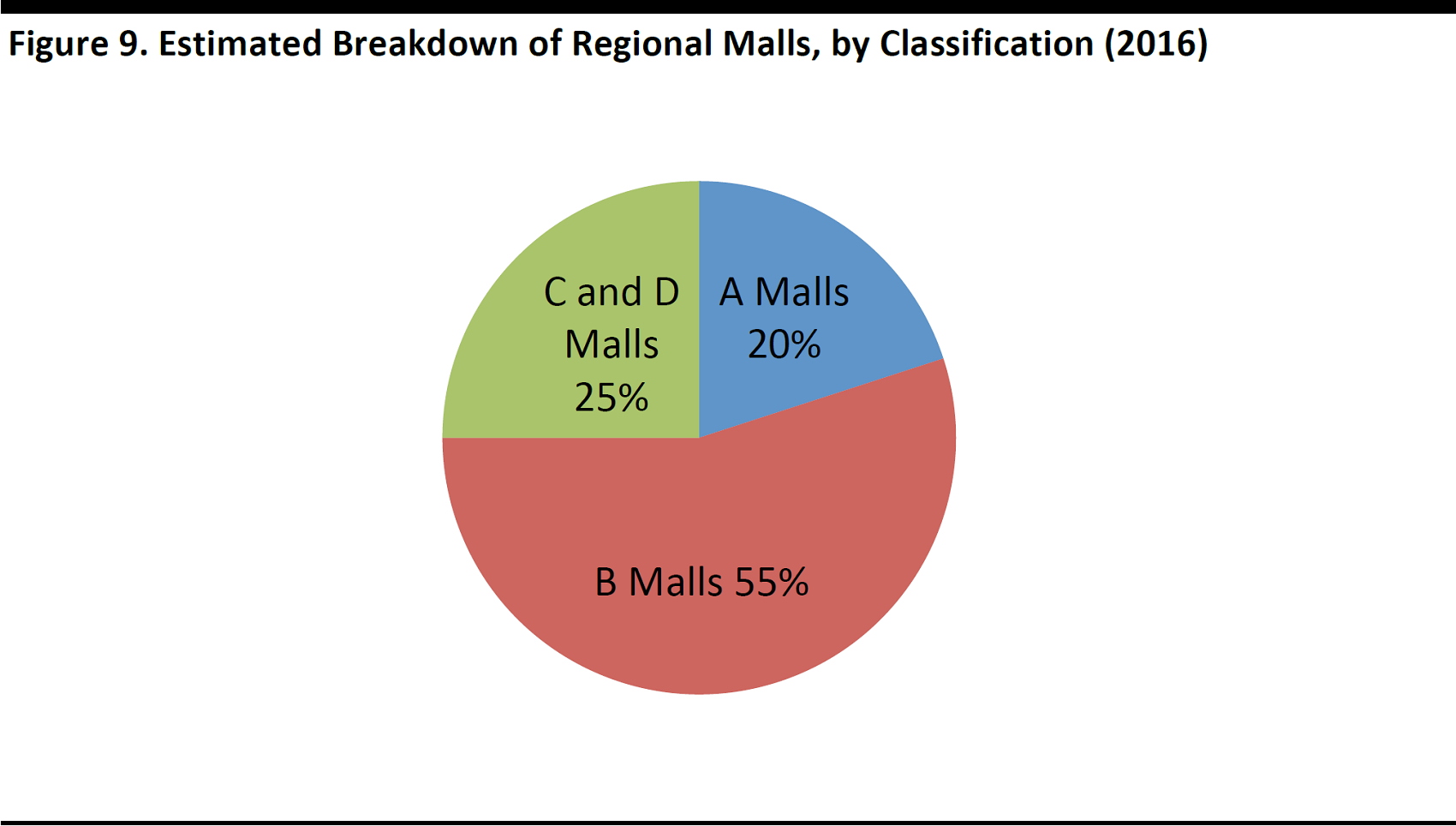

As shown in the graphs below, 270 A malls constitute only 20% of the market, but they account for nearly 72% of all mall sales. By contrast, B and C malls combined number approximately 550, but they represent only 28% of mall sales. Less than 80 D malls account for 0.2% of all mall sales.

Source: Green Street Advisors/Bloomberg

Over the past 10 years, A malls have seen sales productivity increases of over 10%, whereas B and C malls have seen increases in only the low-to-mid single digits. According to commercial real estate group CoStar, sales per square foot at A+ malls have grown by more than 50% during the period.

Source: Green Street Advisors/Bloomberg

The table below shows Podell Real Estate Advisors’ regional mall classifications based on sales per square foot.

Source: Podell Real Estate Advisors

Approximately 20% of the malls in the US are classified as A malls, 55% are B malls, and 25% are C and D malls. Fluctuations may exist among REIT portfolios depending upon individual REIT classifications of A–D malls.

Source: Podell Real Estate Advisors

To Increase Retail Sales at A Malls, 30% of Malls Should Be Closed

Sandeep Mathrani, CEO of General Growth Properties, stated at a recent industry conference that 30% of the retail real estate in the US should be eliminated in order to enhance a smaller-format experience and increase profitability.

Ken Bernstein, President and CEO of Acadia Realty Trust, and Bill Lenehan, President and CEO of Four Corners Property Trust, agreed with Mathrani, and all three noted that the selection of offerings within malls is shifting toward a more well-rounded, lifestyle offering. Whereas malls formerly featured only retailers, they now encompass gyms, salons, restaurants and other forms of entertainment; even theaters that previously left the malls are starting to return. Mathrani stated that the retail and shopping center industry has been overbuilt and that the ratio of retail square feet per capita has doubled in the US in the past 20 years. He said that only the fittest retailers will survive, and that those survivors will come out stronger and smarter.

Sales at A Malls Have Grown by Double Digits Since 2012

According to General Growth Properties, A malls have experienced double-digit sales growth since 2012. These malls’ sales have grown by 20% since 2012in the most populated markets across the US: Atlanta, Boston, Chicago, Dallas, Houston, Los Angeles, Miami, New York, Philadelphia and Washington, DC.

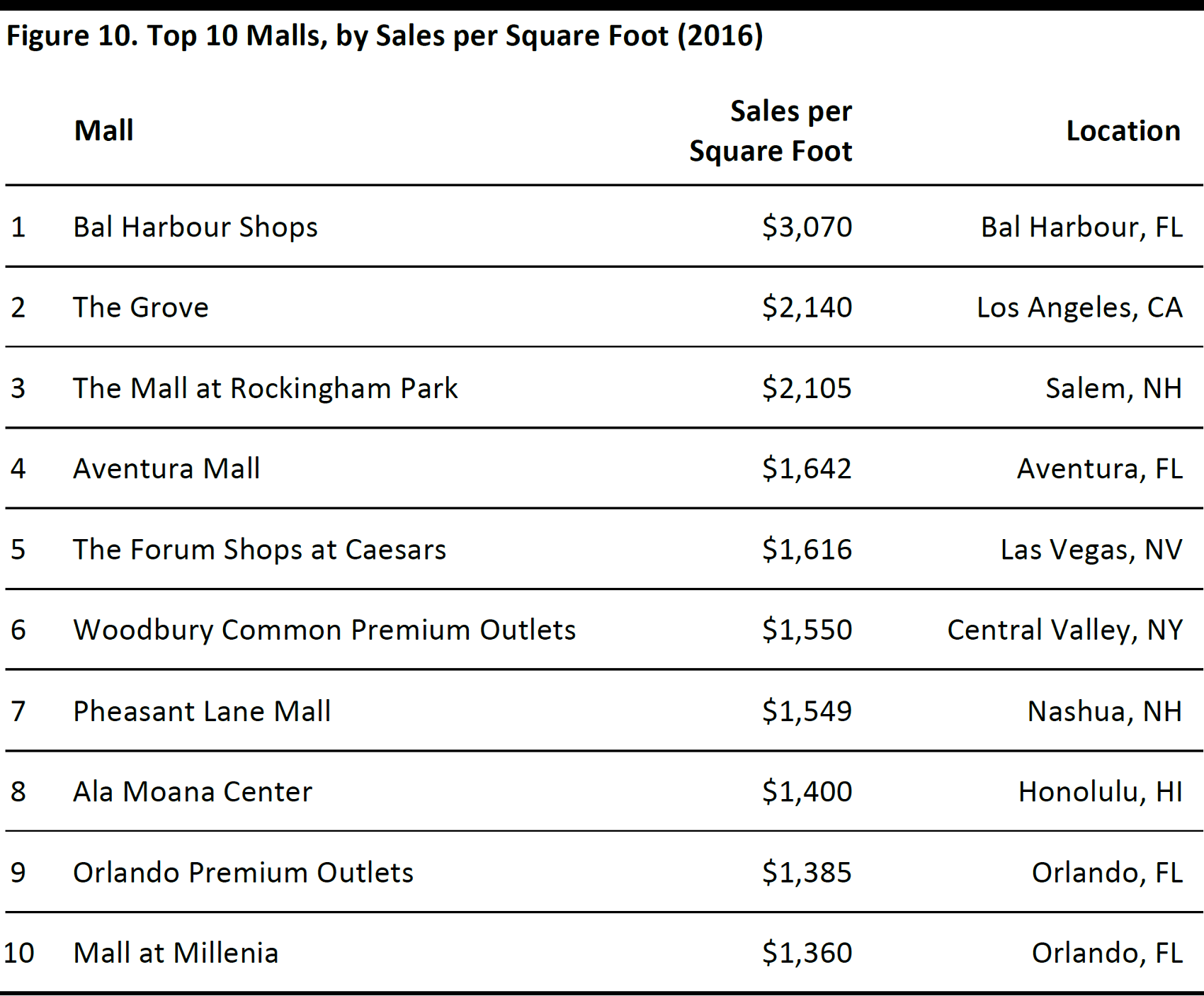

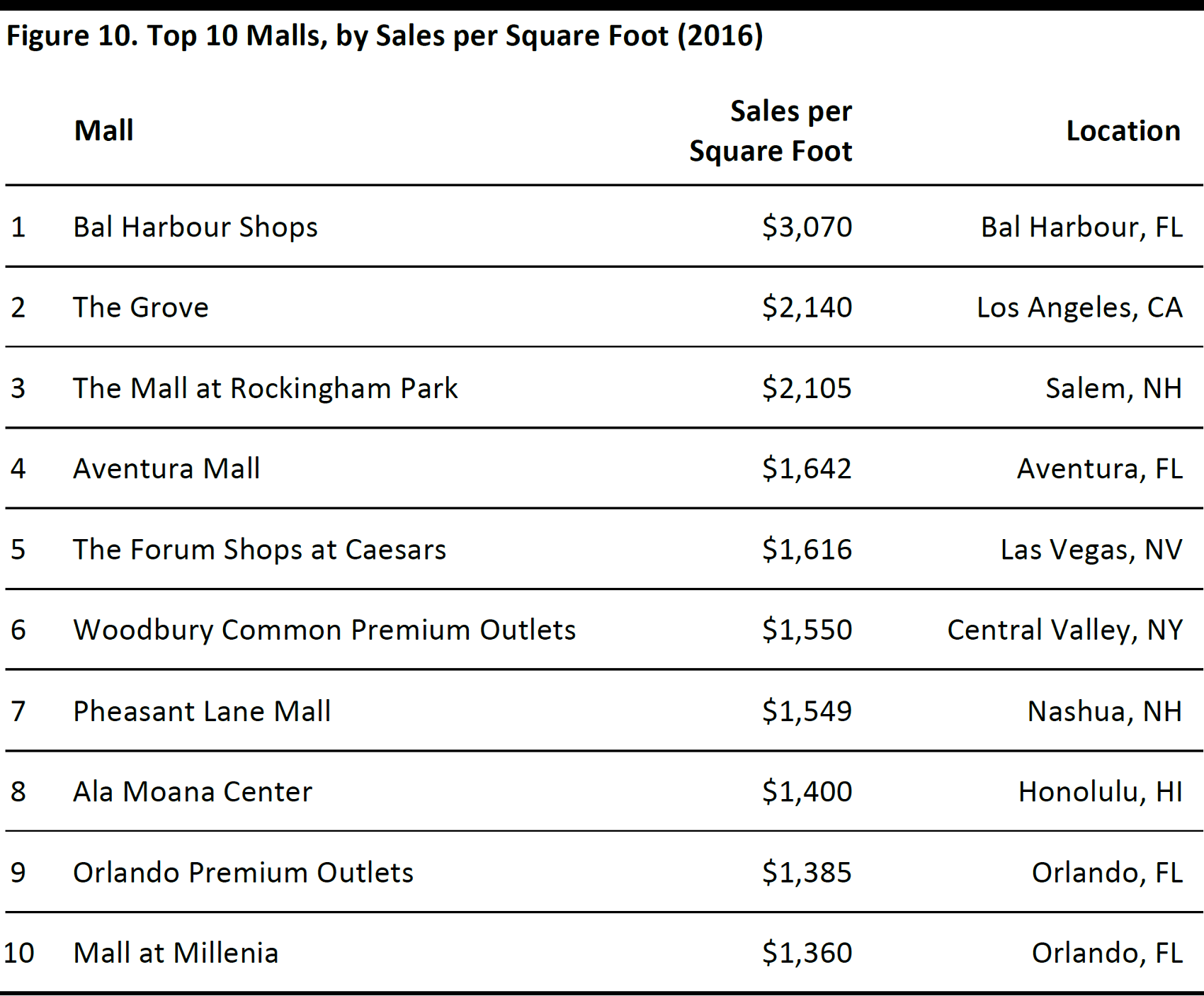

The top-performing malls usually are located in or near major urban or tourist areas. The table below shows the top 10 malls in the US by sales per square foot. Of these, four are located in Florida, two are located in tax-free New Hampshire, two are retail outlet malls and two are located in resort destinations (Las Vegas and Honolulu). Sales per square foot at Orlando's Mall at Millenia—the mall ranked at the bottom of the list of 10—average $1,360, which is more than 2.5 times higher than theUS mall average of $487.

What differentiates top-performing malls from the average mall? It varies by mall. At some A malls, the addition of Apple and TeslaMotors as tenants has helped boost the malls’ success, given that these brands’ sales productivity is significantly higher than that of typical apparel and accessories retailers.

Top-ranked Bal Harbour Shops in Florida is 50 years old, but the mall continually updates its stores and features the latest in luxury retail and high-end dining. Bal Harbour is anchored by Neiman Marcus and Saks Fifth Avenue, and its website highlights its “social scene,” which includes designer benefits, fashion shows and its fashion magazine.

Fifth-ranked The Forum Shops at Caesars, Las Vegas has a spiral escalator, a 50,000-gallon aquarium for exotic fish and talking statues as part of its Atlantis fountain show. The mall also offers a full range of shopping options, from Versace and Salvatore Ferragamo to Gap and H&M.

Mall operators and owners must reinvest, even in properties in good locations, in order to ensure their malls remain productive; otherwise, those properties will become obsolete.

Source: Shutterstock

Source: Fortune/CNBC

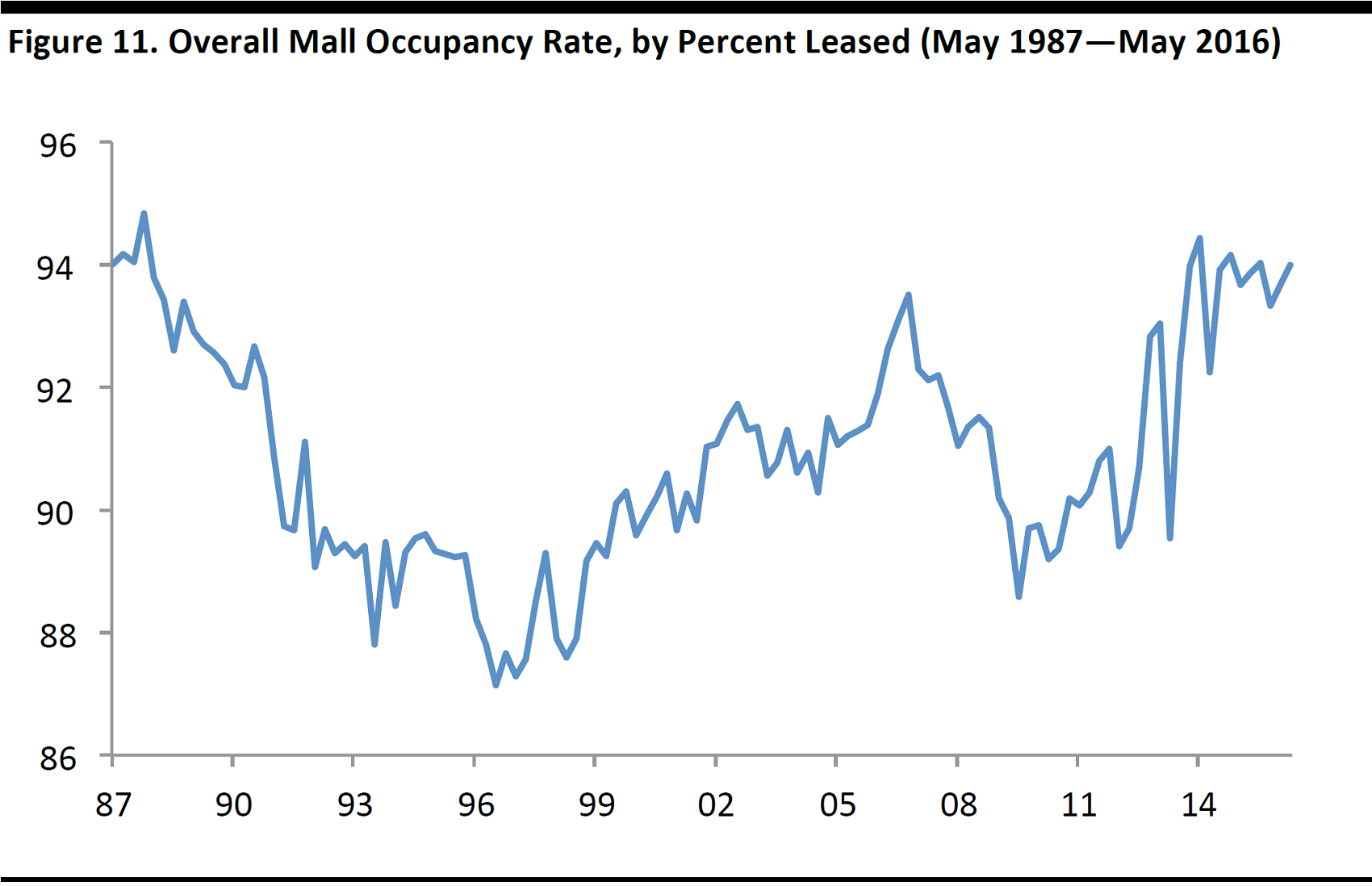

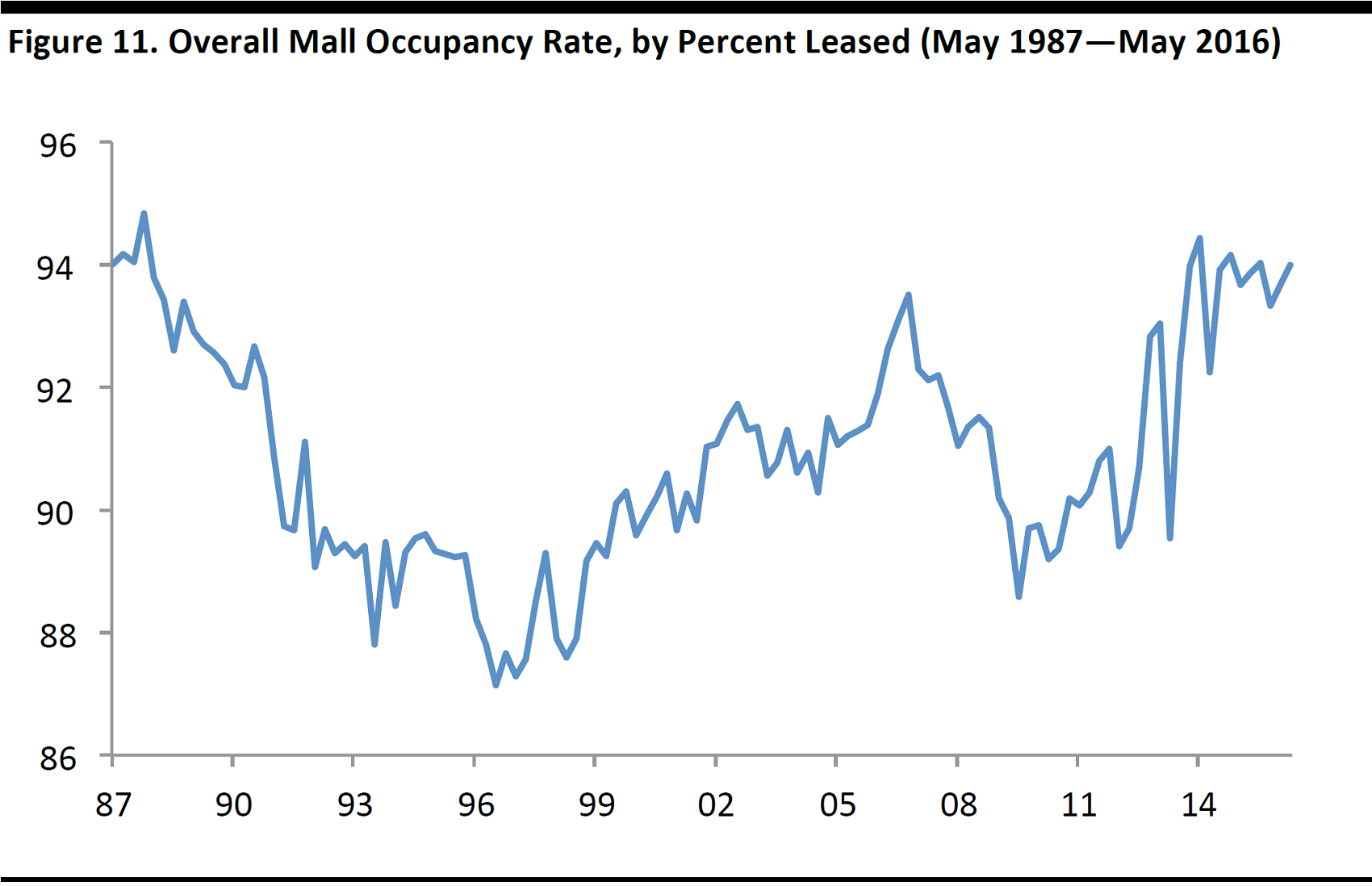

Mall Occupancy Rate Stabilizes at 94%

The mall occupancy rate has been on an upward trend over the past five years, after hitting a low of 89% in 2009. The overall mall occupancy rate has been stabilized at 94% since September 2014.

Source: ICSC

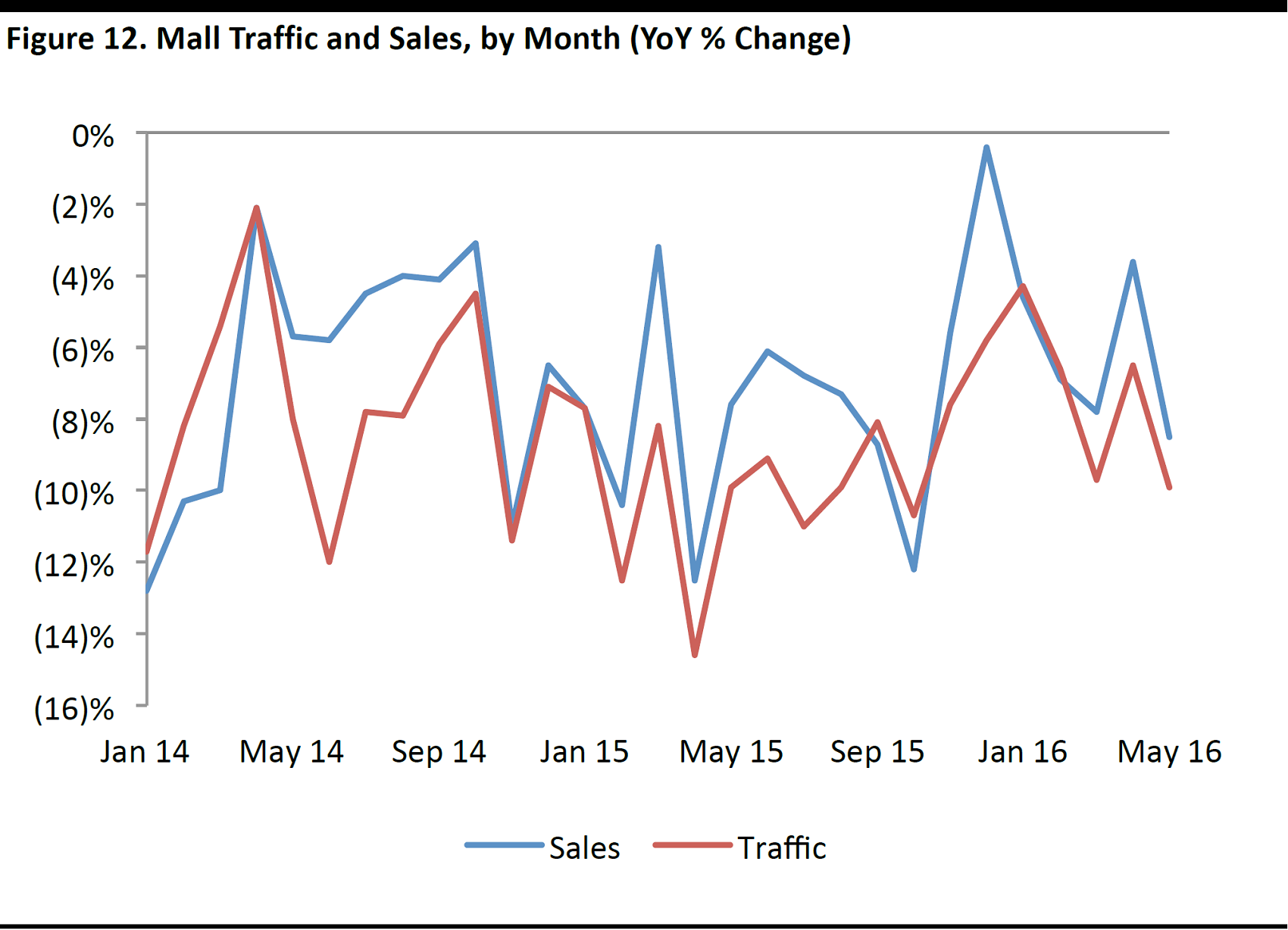

Mall Traffic Still Meaningful Despite Declines

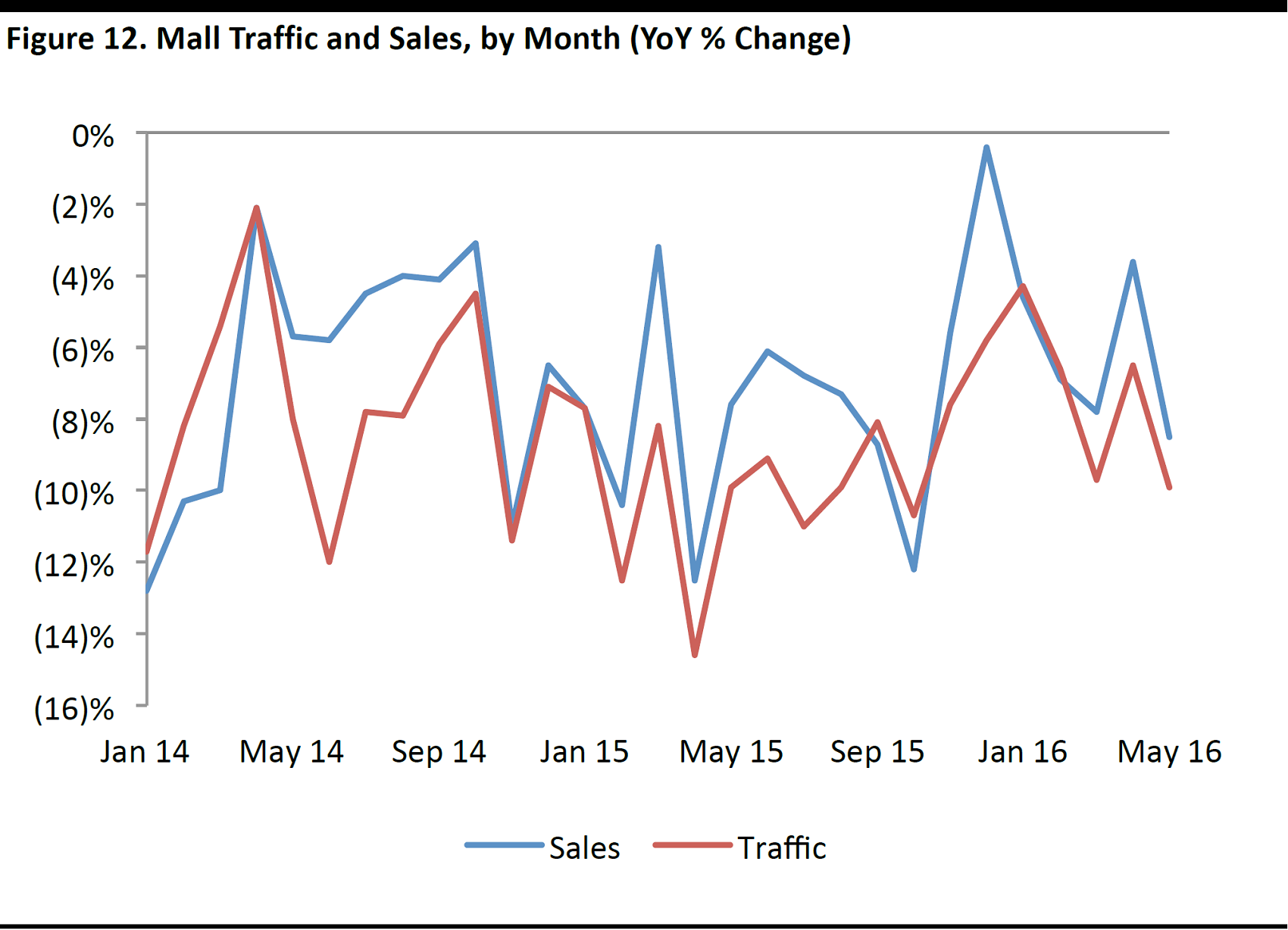

Malls have seen an average traffic decrease of 9.1% since January 2015. According to RetailNext, mall traffic in the US has decreased for 42 consecutive months and continues to be challenging.

Higher-end malls have been less affected by the traffic decreases and, according to mall owners, productivity is up at these malls. Specifically, General Growth Properties reported that traffic at its malls was up 2% in 2015. Taubman Centers also reported elevated traffic in 2015. Traffic was flat at Simon Property Group’s malls in 2015, but same-store sales climbed by 5.7%, according to David Simon, Chairman and CEO. Simon Property Group holds 108 malls in its portfolio, totaling 122 million square feet.

Source: ICSC

Although mall traffic may be lower than in prior years, it is still significant, and some companies are acting accordingly. Tesla Motors, for example, has been moving its showrooms into malls rather than to locations on the outskirts of towns, because malls are where the traffic is. Restaurants located in mall parking lots are moving inside the malls to be closer to foot traffic, whereas they had previously moved out of the malls. The theory that these restaurants are more convenient because they are located in parking lots has not proven to be the case.

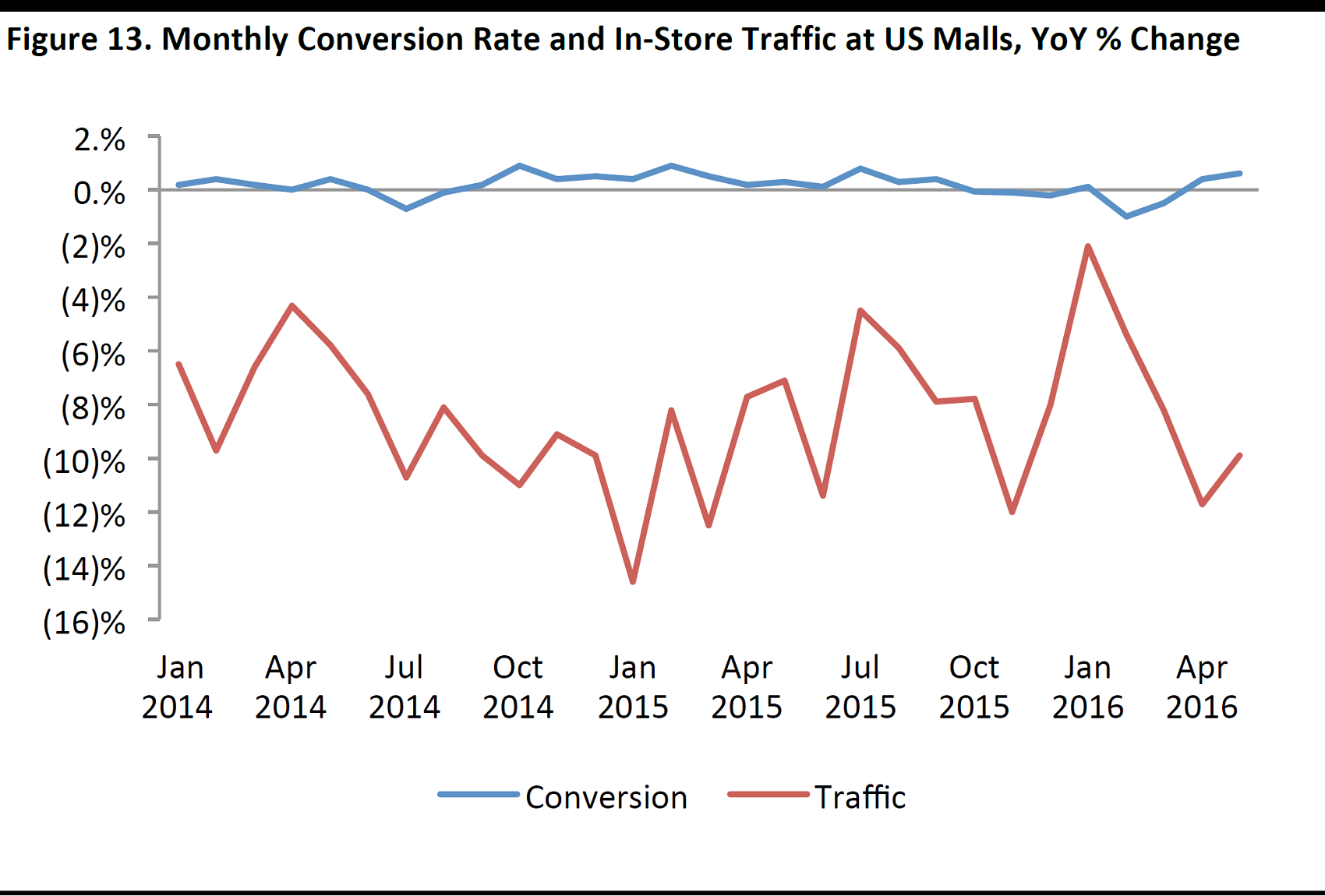

Conversion Rates Are Higher Despite Drops in Traffic

Customers are converting more of their visits into purchases and, year over year, conversion rates have continued to increase despite the continuous drop in retail traffic. That means a greater proportion of store traffic is being converted into sales.

Macerich, a mall REIT, performed research on a cross section of its shopping centers and found that lower average expenditures and shorter trip durations were more than offset by increased frequency of visits and higher conversion rates.

Source: ICSC

Number of Outlet Malls Has Increased by 47% over the Past 20 Years

In 2015, there were 360 outlet malls in the US, compared with 245 in 1996, a 47% increase over the 20 years. The format continues to grow, and six outlet malls are proposed to open in 2016.

Source: ICSC

In 2015, US outlet center sales averaged $546 per square foot, up from $532 in 2013, according to

Value Retail News, the ICSC’s trade publication. Since 2012, 41 outlet centers have opened in North America and another 57 new outlets or expansions are set to open by 2018. Factory outlet gross leasable space has increased by 32.8% since 2005, from 67 million square feet to 87 million square feet.

Conclusion

Malls in the US grew in popularity and number over the second half of the last century, but they have seen declines in various metrics since the mid-2000s. There are now 1,221 malls in the US, and approximately one-third need to be closed due to oversaturation. Others will need to repurpose their space or work to become A malls, which are classified as the most productive. A malls have performed strongly, seeing double-digit sales growth in recent years. And many malls are already responding to changing consumer habits by offering new, hybrid retail formats and services designed to boost traffic and conversion.

Although mall traffic is declining, it is still considerable. Retailers such as Tesla Motors and Apple are moving into malls to take advantage of the shopping centers’ footfall, and even theaters and restaurants that previously left the malls are starting to return. In addition, the popular outlet mall format continues to grow and six new outlet malls are set to open in the US by the end of this year. So, although malls are facing necessary transformation given the current retail landscape and shifting consumer demand, the mall is definitely not dead.