Executive Summary

In recent years, retailers and brands have shown growing interest in partnering with startups and creating dedicated innovation teams, rather than relying on traditional, closed, in-house R&D teams. In this report, we provide an overview of corporate innovation centers, and analyze what is driving the rise of these new centers as well as their main areas of focus and the major companies that are establishing such centers.

Source: iStockphoto

Partnering with startups and other players in the retail ecosystem can offer a range of benefits to retailers, including accelerating the speed of innovation, providing fresh sources of ideas and helping companies build a culture of innovation. We have identified four main types of corporate innovation centers: corporate accelerators, in-house innovation labs, university residences and innovation outposts.

Three key factors are fueling the rise of new corporate innovation centers: technology-driven trends across the online, mobile and in-store channels are reshaping retailing and shopping behaviors; government initiatives are encouraging entrepreneurship and the development of new businesses; and retailers are increasing their IT budgets due to the pressure to innovate.

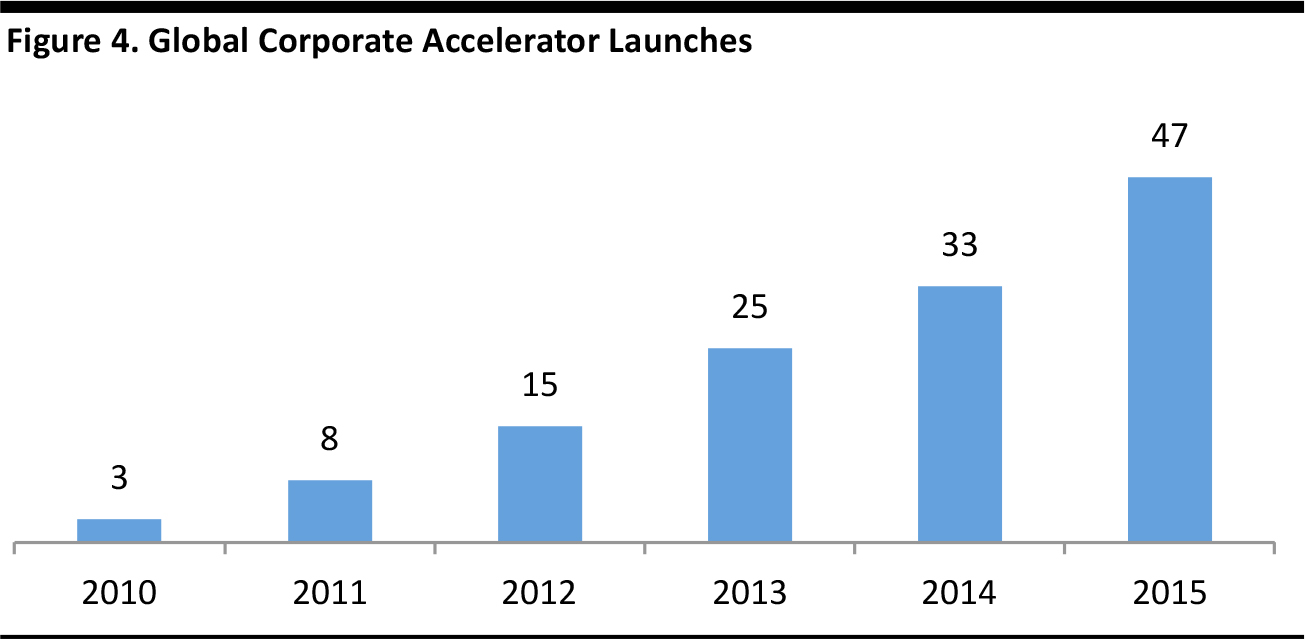

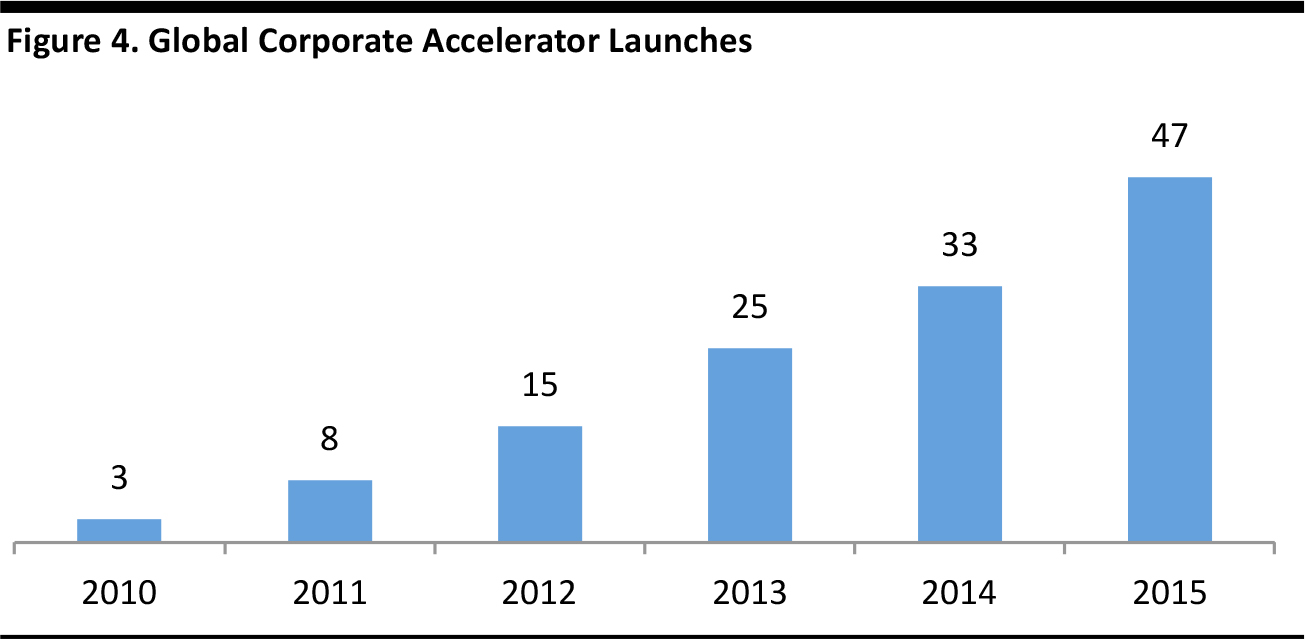

Between 2013 and 2015, 105 corporate accelerators were launched globally. Of these, 47 were launched in 2015, according to the Massachusetts Institute of Technology’s Database of Corporate Accelerator Programs and our own additional research.

As the pace of change within the retail industry accelerates, corporate culture at many companies is shifting toward expanding in-house solutions beyond traditional corporate R&D departments, so that innovation efforts are part of a more open and collaborative environment.

Corporate Innovation is the New R&D

Disruptive new technologies and shifting consumer behaviors are challenging retailers to reinvent their innovation models. The rapid development of new retail technologies across the online, mobile and instore channels, along with disruption from startups, is dramatically shifting consumers’ expectations and behaviors—and their expectations regarding price, convenience and experience continue to climb.

Source: iStockphoto

In recent years, retailers and brands have shown growing interest in partnering with startups and creating dedicated innovation teams, rather than relying on traditional, closed, in-house R&D teams. Many companies have adopted an open innovation strategy that emphasizes the importance of joint R&D efforts with external partners.

Partnering with startups and other players in the retail ecosystem can offer a range of benefits to retailers, including accelerating the speed of innovation, providing fresh sources of ideas and helping companies build a culture of innovation. In addition, an open innovation model represents a relatively low-cost and low-risk commitment. Compared with the in-house R&D model, the open innovation model does not require much in terms of capital commitment and corporate resources for managing staff. Retailers that partner with accelerators, for example, can benefit from the fact that the accelerators tend to do the work of qualifying, recruiting and supporting companies themselves.

Defining Corporate Innovation Centers

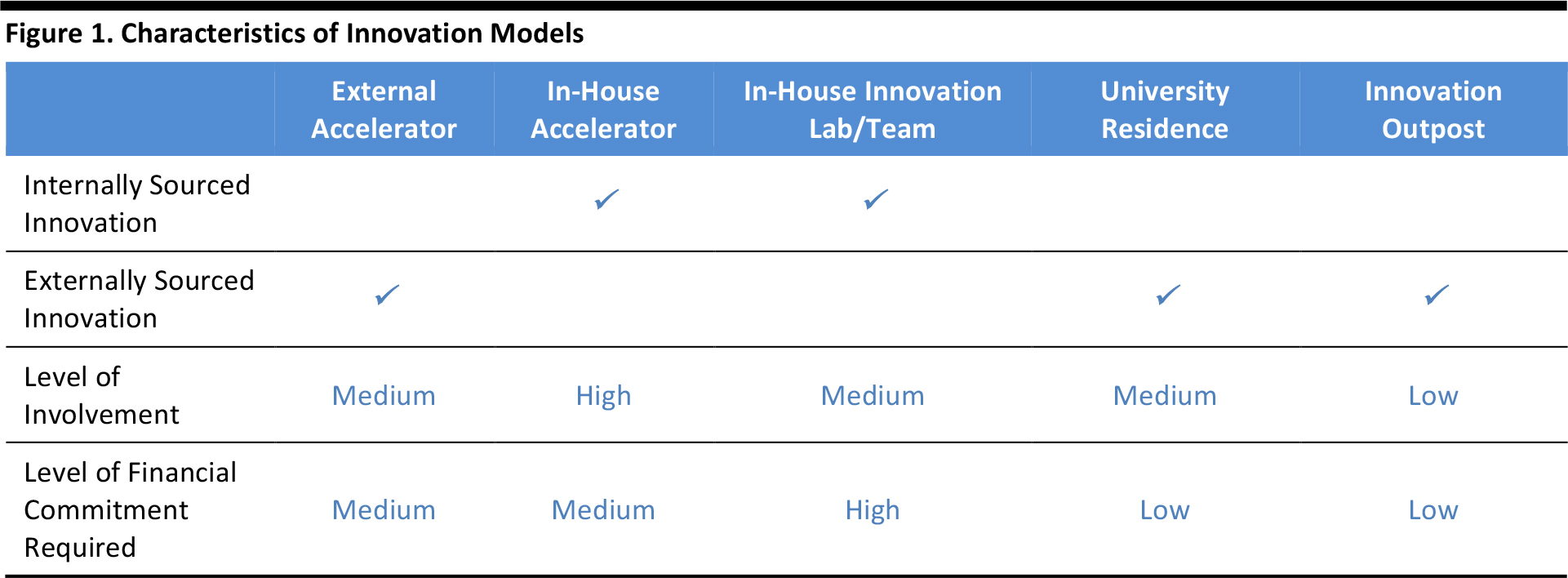

Corporate innovation centers are designed to help companies understand new market dynamics, obtain new resources, and align with startups, investors and other related entities. Traditionally, they function outside a company’s operational landscape, and aim to accelerate digital innovation, rethink the customer experience and experiment with new business models. Innovation centers fall broadly into four categories: corporate accelerators, in-house innovation labs, university residences and innovation outposts.

Corporate accelerators are programs that typically provide pre-seed-stage equity funding. These accelerators admit a small batch of startups to programs that normally range from three to six months. The participating startups are provided with mentoring and resources and, at the end of the program, the startups present their businesses to potential investors and industry partners. Corporate accelerators can take two forms:

- Externally sourced: Some companies team up with innovation specialists (accelerators, consultants and entrepreneurs) to develop an externally sourced accelerator program. The specialists recruit startups based on a specific technology focus and provide day-to-day support.

- In-house: Other companies operate an in-house accelerator,sourcing their own companies without relying on an outside partner.This model requires more corporate resources.In both cases, the startups receive mentorship from the company, allowing them to cultivate relationships and providing them with opportunities to develop targeted technologies.

In-house innovation labs rely on a team of programmers and developers that a company hires specifically to develop and test new products and services. These centers typically perform all innovation activities in-house, from inception to prototyping.

University residences are centers that are set up on a university campus to drive innovation through university researchers.

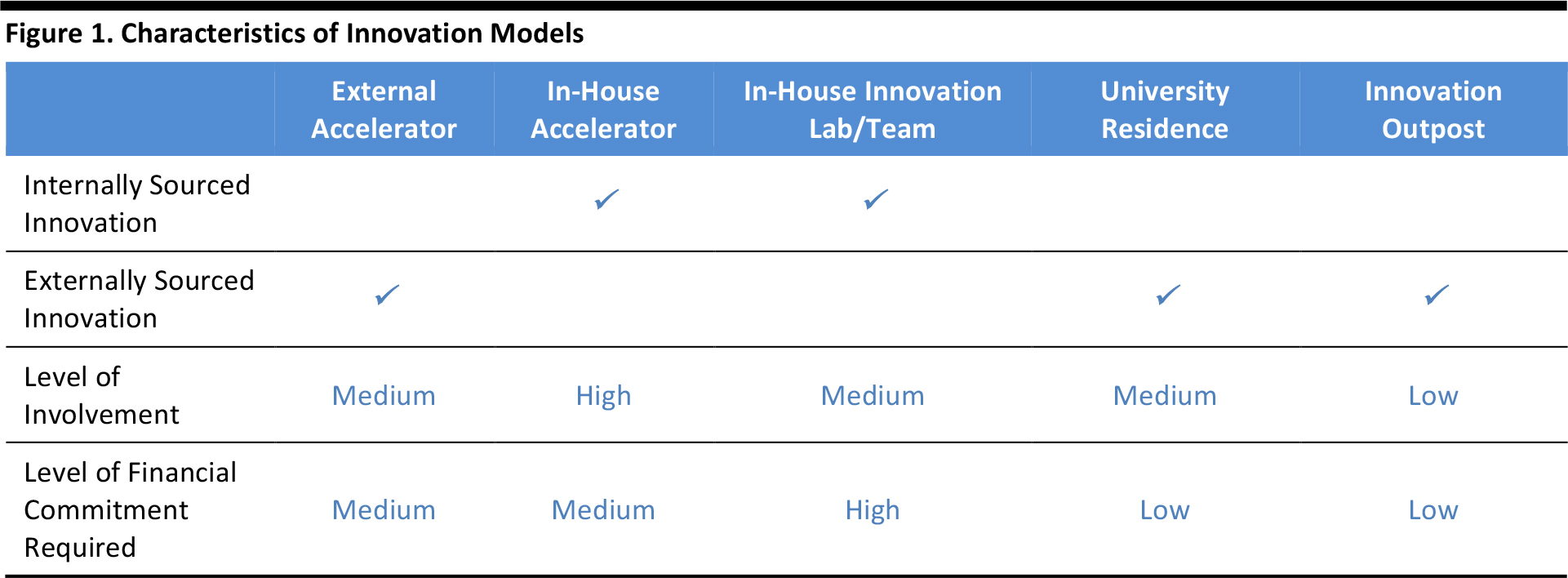

Innovation outposts employ small teams that are based in technology hubs such as Silicon Valley. Companies benefit from the teams’ immersion in the tech community, but do not need to commit significant investment in establishing a large innovation center in the tech hub.The table below compares the characteristics of the various innovation models, which differ in terms of goals and required investment.

Source: Fung Global Retail & Technology

Consumer Products and Retail Innovation Centers on the Rise

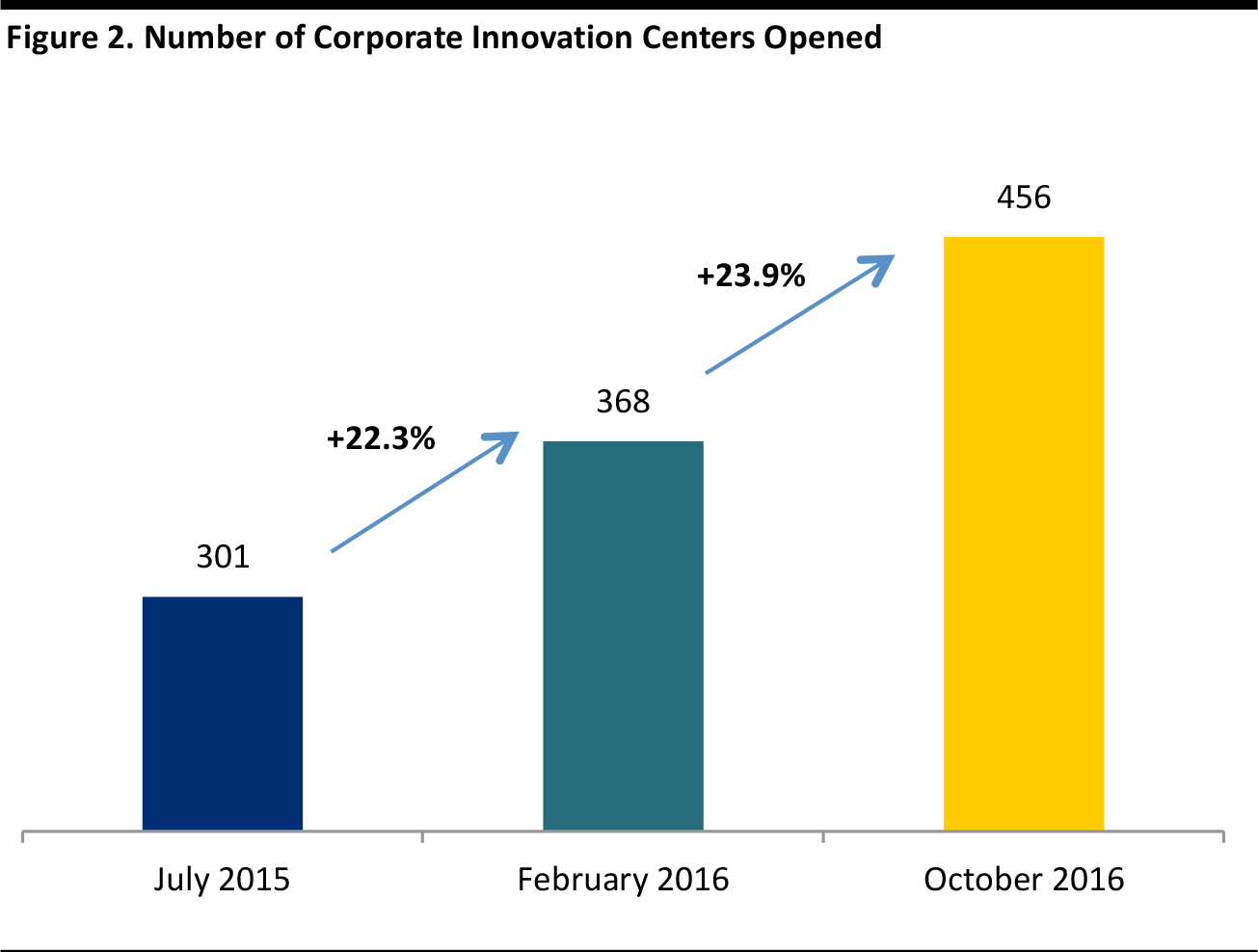

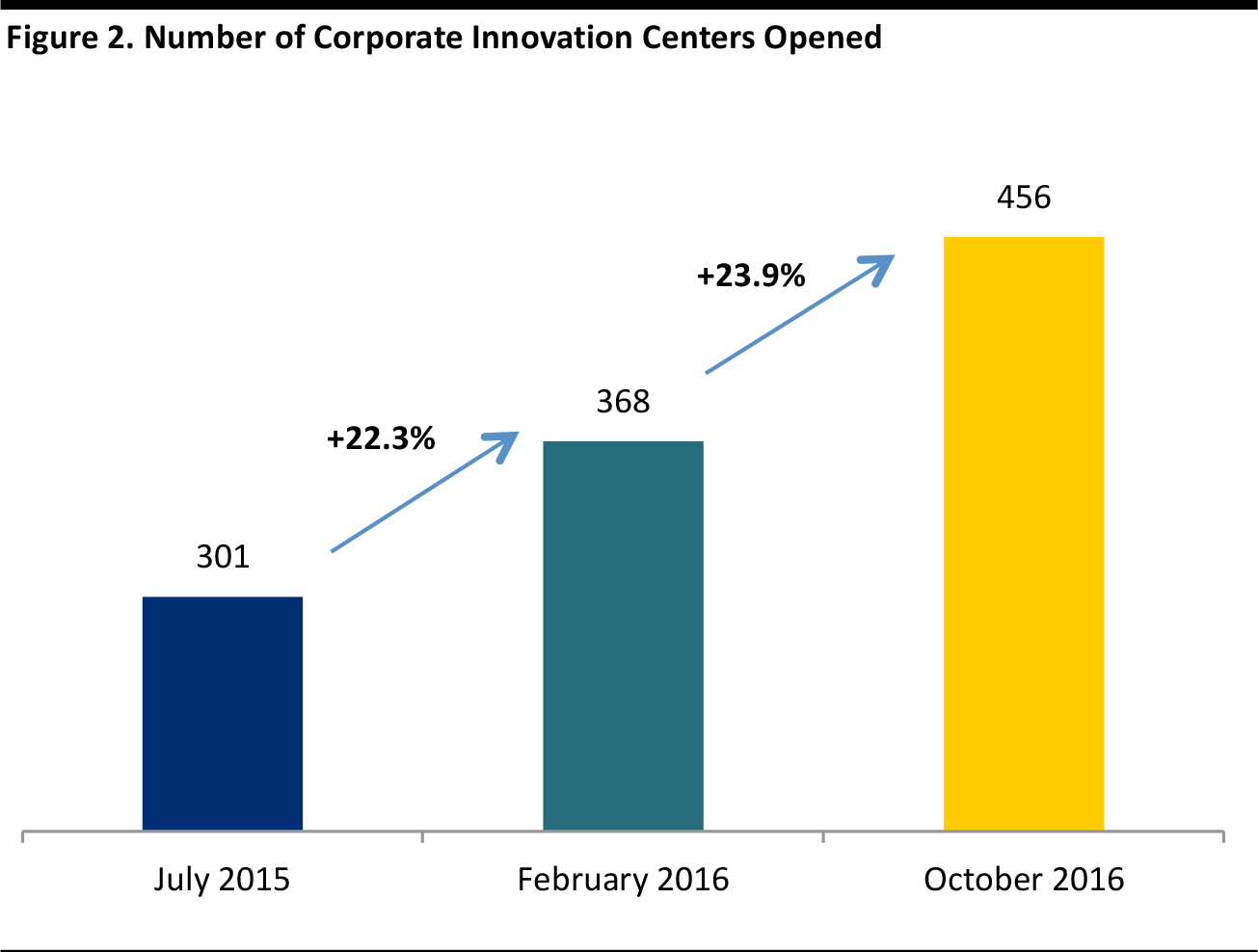

A July 2015 study conducted by research firm Altimeter looked at the 200 largest companies, by revenue, in five industries: automotive, financial services, consumer products and retail, manufacturing and telecom. The study found that 38% of the companies in the group had established a corporate innovation model (these companies had opened a total of 301 innovation centers as of the date of the study). Of the 40 consumer products and retail companies studied, 30% had established innovation centers.

A follow-up study found that 67 new innovation centers had been opened across 20 countries between July 2015 and February 2016. The number of consumer products and retail innovation centers increased by 20% over the period, second only to the number of new financial services innovation centers opened. The graph below illustrates the rapid acceleration in innovation center openings by large, established companies between July 2015 and October 2016.

Source: Fahrenheit 212/Altimeter

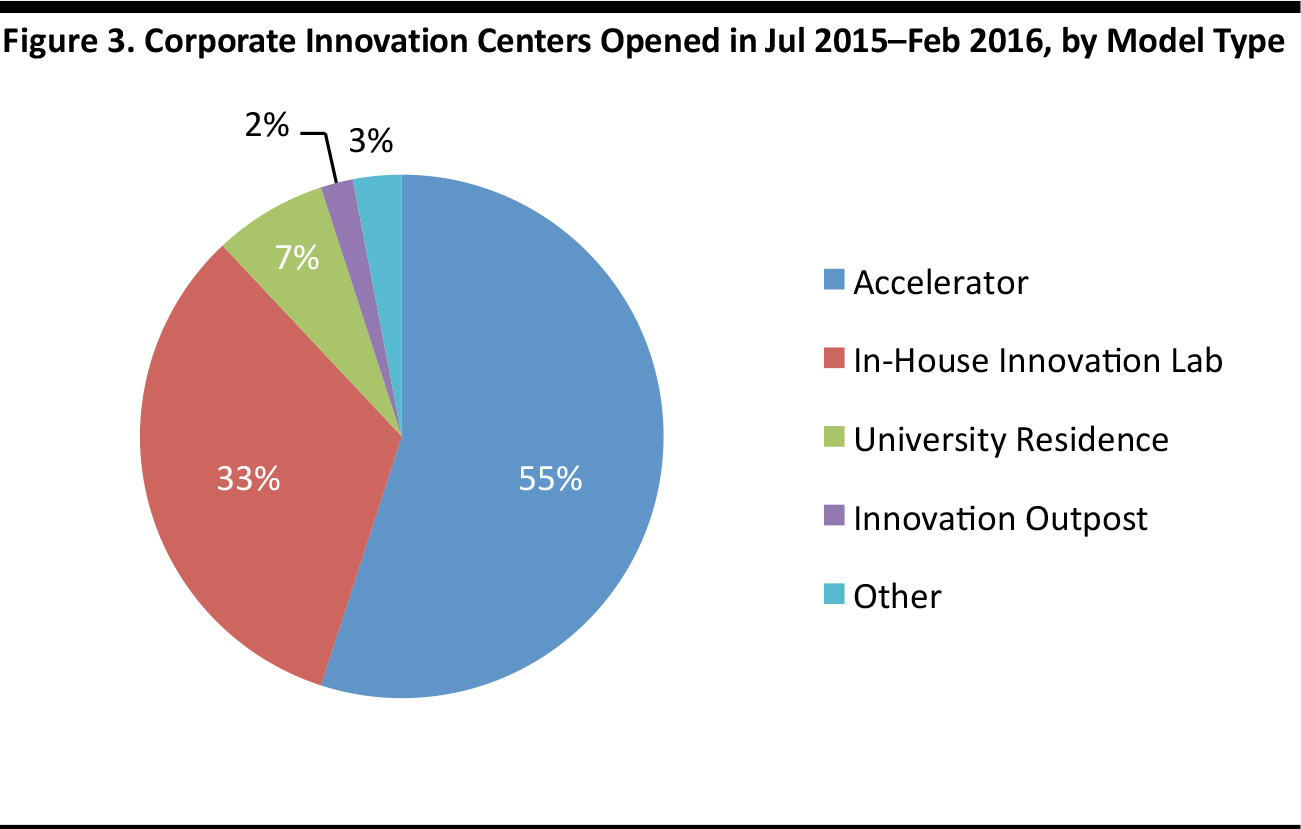

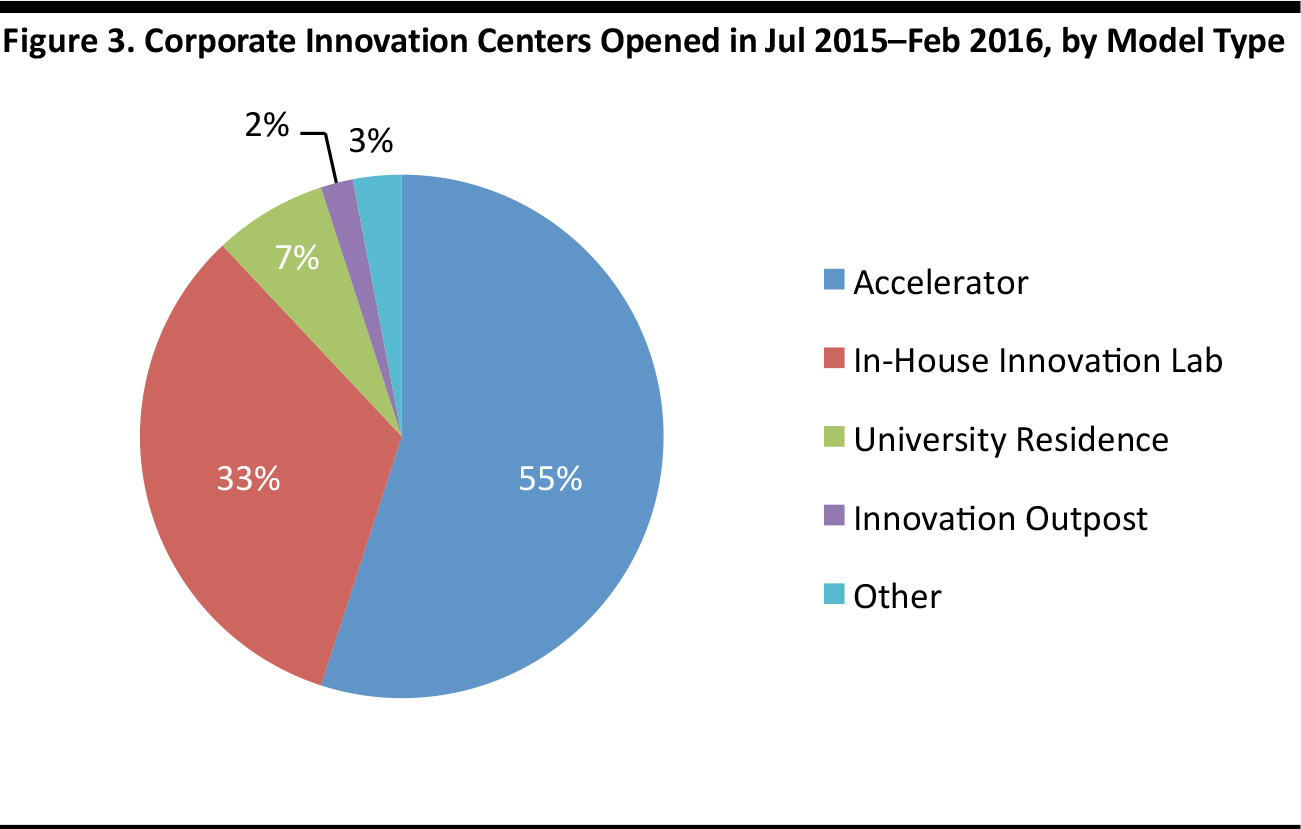

Of the 67 global innovation centers that were opened between July 2015 and February 2016, 55% were designed to operate on the corporate accelerator model. The second-most-common model was the in-house innovation lab model, which represented 33% of the centers opened over the period.

Source: Altimeter

Retailers such as Target, Qualcomm, John Lewis, L Brands and Unilever have launched corporate accelerators in the past three years. These accelerators offer a number of benefits to the companies that run them:

- Insights into emerging technologies and trends

- Rapid, cost-efficient R&D

- Economic returns from investment

- Talent discovery, with a potential for acquisition/partnership

Source: qualcomm.com

Startups that participate in accelerators benefit from the sponsoring corporations’ resources and from mentorship within the industry. They also might find that the company running the accelerator turns into a future customer.

Between 2013 and 2015, 105 corporate accelerators were launched globally. Of these, 47 were launched in 2015, according to the Massachusetts Institute of Technology’s Database of Corporate Accelerator Programs and our own additional research.

Source: Corporate-accelerators.net/Fung Global Retail & Technology

Focus Areas for Retail Corporate Innovation

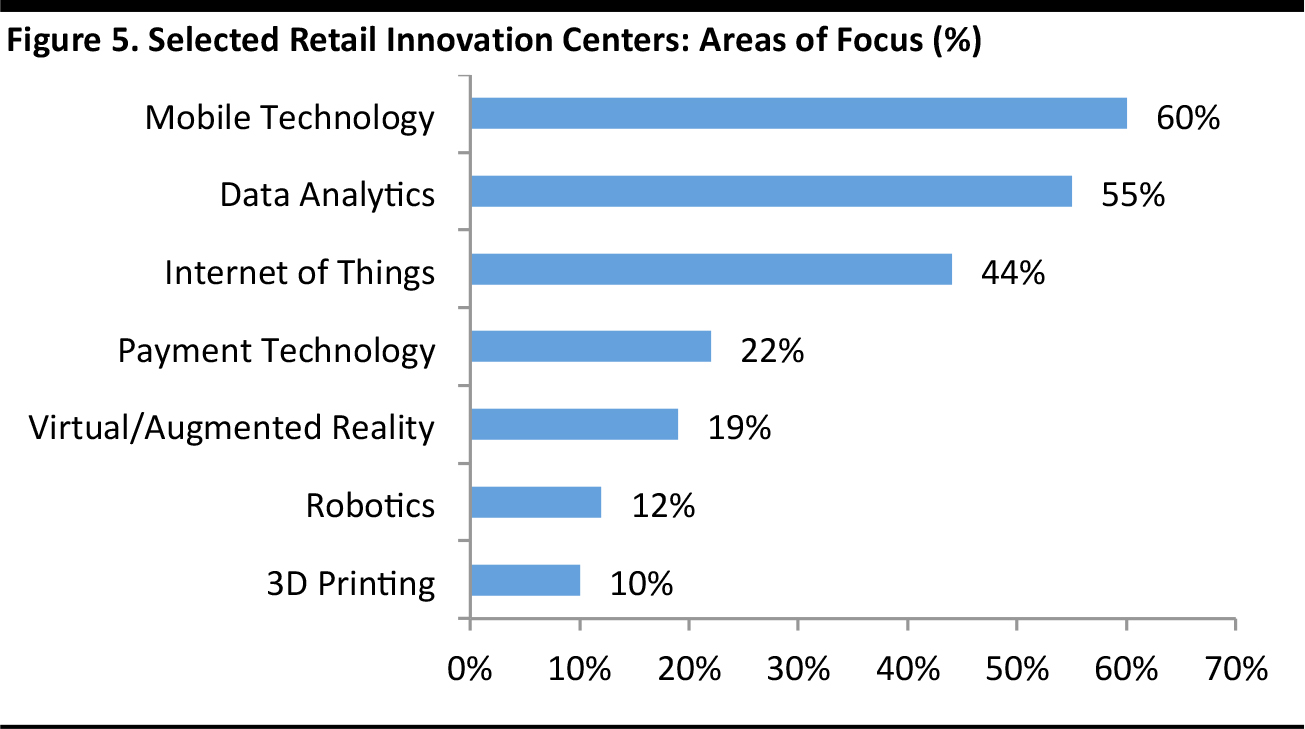

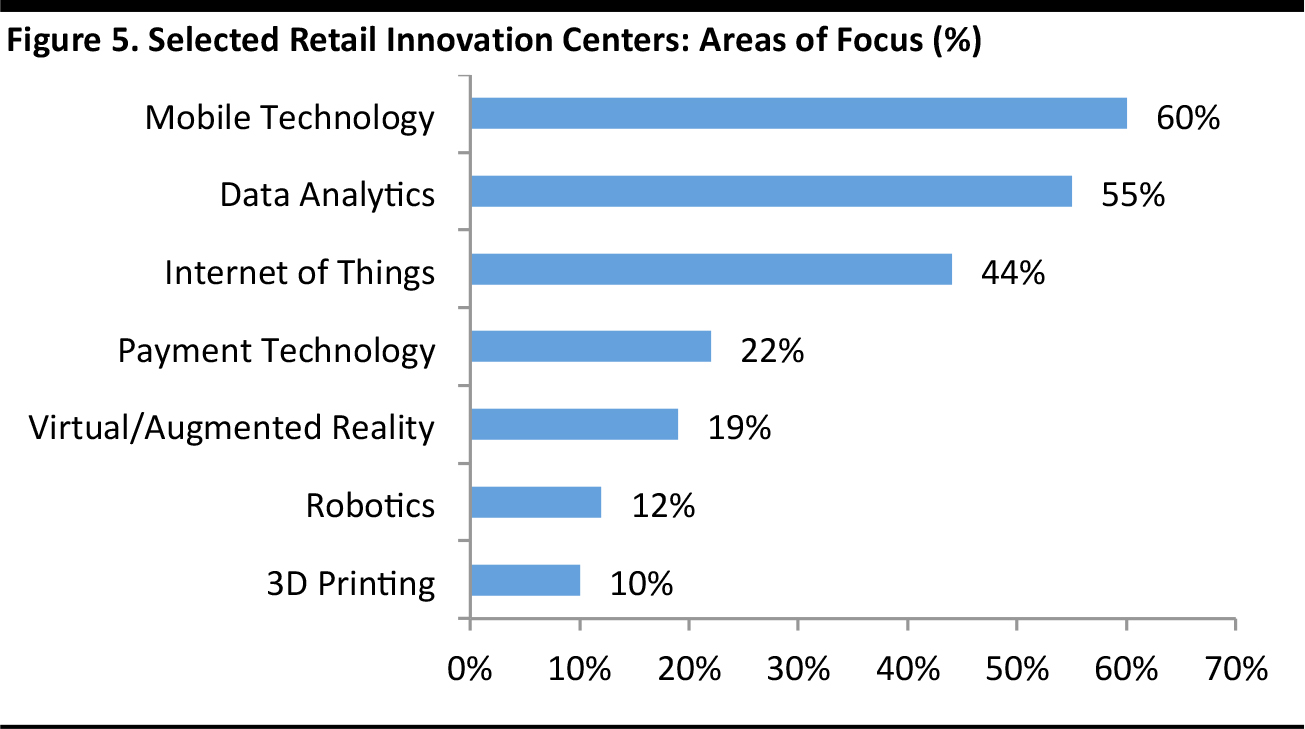

We selected 20 retailers1 from the Fung Global Retail & Technology coverage list that have opened innovation centers to see what their common areas of focus are. According to our findings, the focus areas mentioned most often by these companies were mobile technology (60%), data analytics (55%), the IoT (44%), payment technology (22%), virtual and augmented reality (19%), robotics (12%) and 3D printing (10%).

The percentages may not sum to 100%, as some innovation centers have multiple focus areas.

Source: Fung Global Retail & Technology

Case Studies: Inside Retail Innovation Centers

We looked at several retailers to analyze their approaches to corporate innovation as well as the results they have seen. Innovation centers provide a number of benefits, such as enabling companies to develop new products or proofs of concept, bring initiatives from idea to business impact, accelerate the speed of innovation, attract top talent and take advantage of existing innovation hubs, and incubate and invest in startups.

1. Develop New Products or Proofs of Concept

The Sephora Innovation Lab debuted in 2015 in San Francisco’s Mission Bay district. The facility’s first project was to build and test in-store displays, but it expanded its focus to include creating web, mobile and brick-and-mortar solutions. Several of those experiments have now been implemented by the company:

- Sephora launched the Pocket Contour mobile app, which helps women determine their face shape and shows them how to use makeup to contour.

- The lab also enabled Sephora to test emerging technology in new applications, including a monthly subscription service called Sephora Play, which debuted in summer 2016.

Panasonic has utilized an in-house innovation approach to develop and test products. In 2016, the company opened an innovation center named Cloud9 to provide collaborative product testing. Rather than being a place to brainstorm new products or operating like a traditional R&D lab, Cloud9 partners with more than 30 technology suppliers and brings them together to test and develop products in an interactive and collaborative way.

Source: news.panasonic.com

2. Bring Initiatives from Idea to Business Impact

Sears launched its Integrated Retail Labs (iRLabs) in 2012 with the aim of analyzing data from members of its Shop Your Way loyalty rewards program and developing technology-driven solutions to suit their needs. iRLabs is an in-house innovation team that operates like a startup, with open workspaces and casually dressed employees. Since the launch, Sears has implemented the following innovations:

- In-Vehicle Pickup, which enables customers to pick up their online purchases at any Sears store within five minutes of arrival, without leaving their car.

- Meet With an Expert, which connects shoppers who are eyeing major appliance purchases with a Sears product expert.

3. Accelerate the Speed of Innovation

Compared with large R&D teams, startups and dedicated innovation teams provide a faster pace of innovation. These teams can operate as separate entities from the parent company, allowing for faster prototyping with fewer constraints. For example:

- Zappos Labs enabled Zappos to launch its “Ask Zappos” digital personal assistance service in just 12 weeks.

- Walmart’s search engine was developed at Walmart Labs in nine months with just a handful of employees.

- Staples’ Velocity Lab helped launch a digital wallet service in nine weeks. The project was Staples’ fastest deployment ever, according to company reports.

4. Attract Top Talent and Take Advantage of Existing Innovation Hubs

Companies can use their innovation centers to showcase their brand strength and tech savviness, and thereby attract new talent. They can also locate their centers in existing innovation hubs in order to benefit from partnerships with other innovation experts in the area. Kohl’s opened its Digital Center in Milpitas, CA, in 2015, and the hub provides increased proximity to numerous technology partners. The center works with Oracle to customize the Oracle Commerce solution, which plays a key role in the retailer’s mobile strategy. The center houses 250 employees and is an extension of the Kohl’s IT team. According to management, the hub location was critical to advancing the company’s omnichannel initiatives:

- The Digital Center redesigned the Kohl’s mobile app, which now allows customers to browse and shop by category and easily manage and redeem their loyalty rewards points.

- Since its relaunch in fall 2014, the Kohl’s mobile app has been downloaded more than 9 million times.

Source: westfieldretailsolutions.com

Westfield Labs was established in 2012 by Westfield Corporation, but it operates virtually as its own entity. The center is one of the most publicly visible innovation efforts among large companies. It has a dedicated website and blog, and its own Twitter account and LinkedIn page. According to the company, Westfield Labs’ transparency has enabled it to attract top digital and design talent.

5. Incubate and Invest in Startups

Some innovation centers are tasked with identifying disruptive startups that the parent company can invest in, partner with or acquire. Walmart Labs, which is responsible for building and testing online and mobile technology for Walmart, has acquired 14 startups in the past three years.

In 2016, Target partnered with Techstars to create a retail-focused startup accelerator in Minneapolis. Ten companies were selected for a three-month program through which they were mentored by Target executives and other local entrepreneurs and business leaders. According to Target management, the accelerator program provided new ideas and the opportunity to work with startups internally. Target saw significant results from the 2016

program:

- The company invested in Inspectorio, which is dedicated to quality inspections for textiles and consumer goods. Target and Inspectorio are currently in the midst of two pilot programs focused on footwear and apparel.

- Target also invested in data analytics startup Nexosis, which is now integrated with e-commerce platforms such as Lightspeed, Magento and Shopify.

Source: corporate.target.com

In January 2017, Target announced the second round of its Techstars corporate accelerator program. In addition to continuing the program,Target plans to develop and run several new accelerators, including one that will be housed within its IoT team.

Additional Factors Driving New Corporate Innovation Models

and Investment

Companies Face Pressure from Consumers’ Rising Expectations

Amazon has single-handedly raised the bar in terms of consumer expectations, a phenomenon often referred to as “the Amazon effect.” The digital transformation is leading to:

- More information for consumers, which provides them with more choices and greater opportunity to influence organizations.

- Decreasing brand loyalty, as consumers have less patience and are more willing to switch among brands.

- Higher expectations regarding customer service, personalization and experiences.

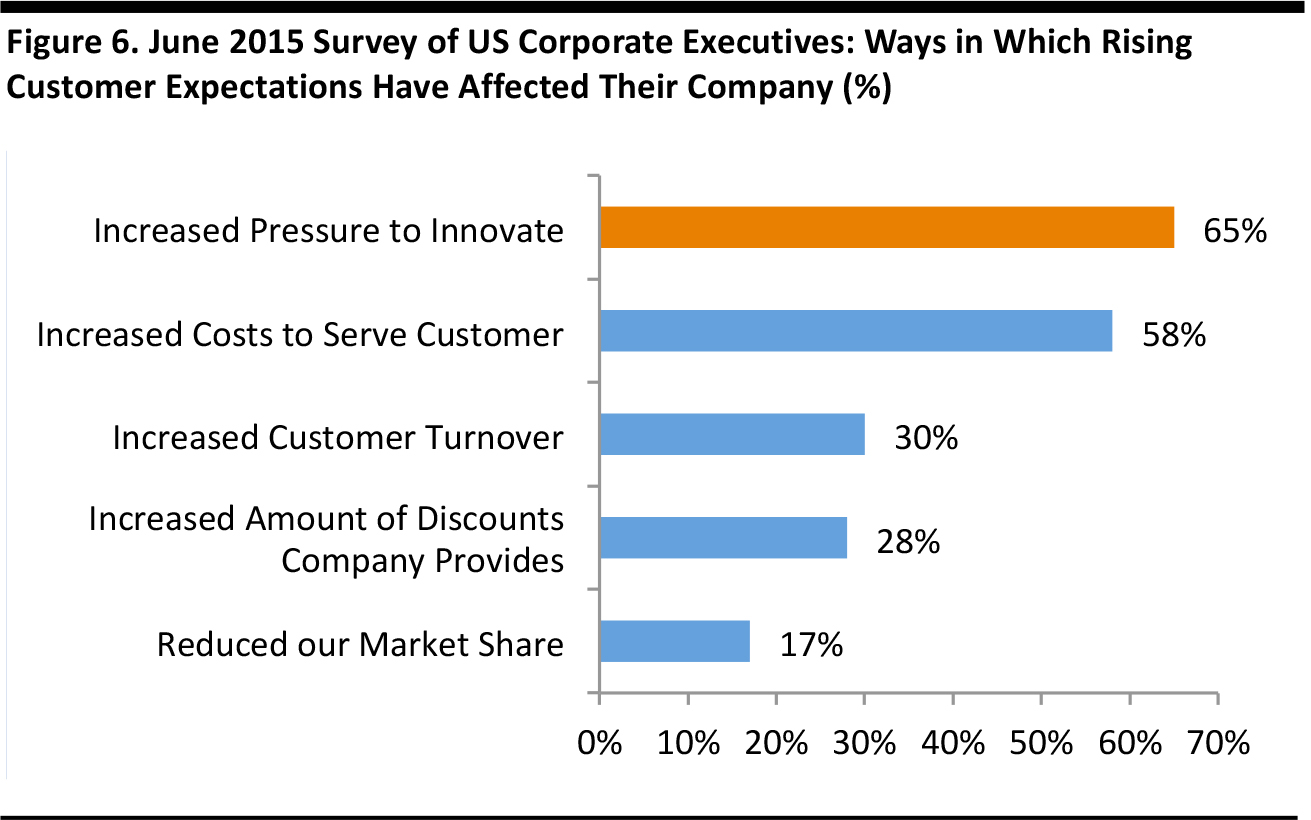

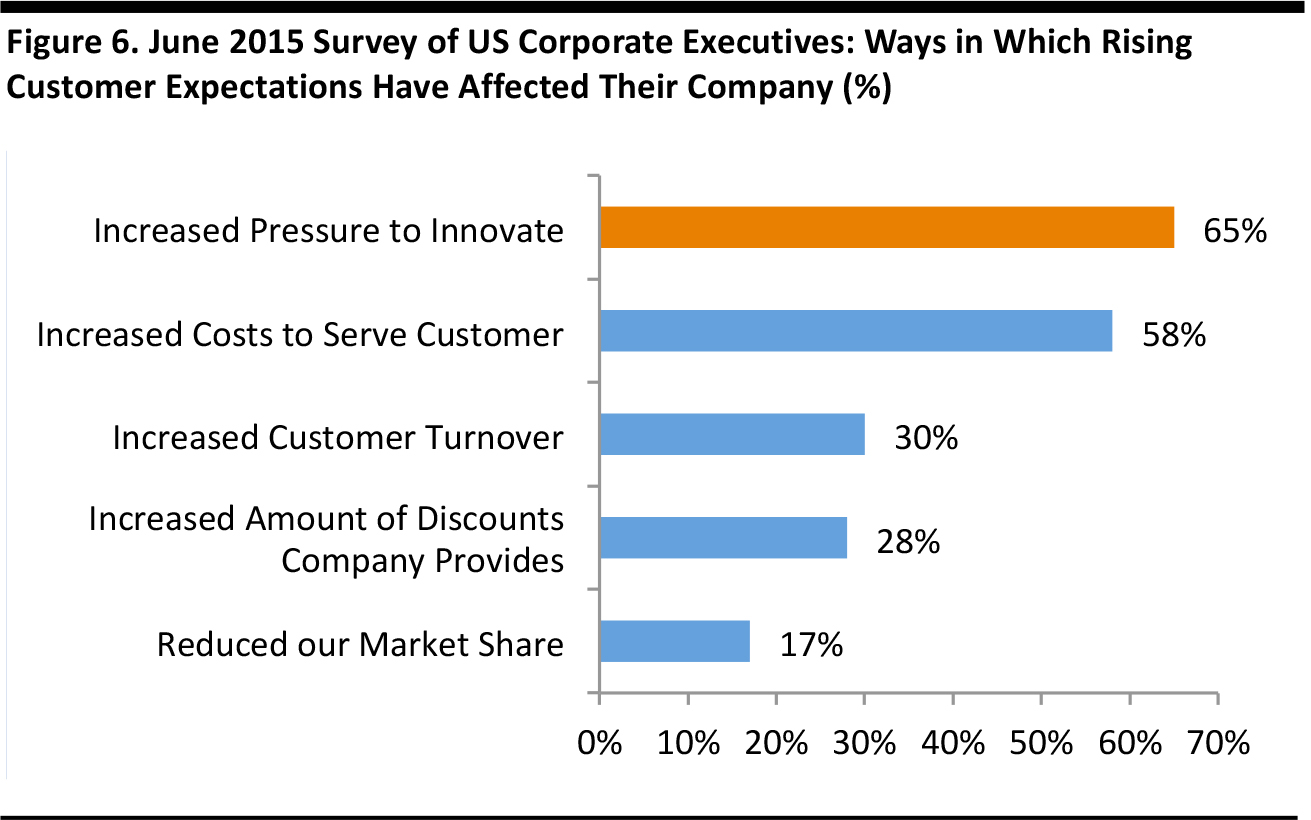

In 2015, Harris Poll conducted an online survey of 300 US corporate executives (at the VP level or higher) at companies with revenue of $1 billion or more, and found that businesses are feeling the effects of rising consumer expectations. Of the business leaders surveyed, 82% said that their customers have higher expectations than they did three years ago. When asked about the ways “rising expectations have put pressure on[their] company,” the top answer, cited by 65% of respondents, was that they felt increased pressure to innovate.

Source: Harris Poll

Innovation Around the World: Government Initiatives Are Spurring Opportunities in Asia and Israel’s Innovation Ecosystem Is Growing

Asia has started to overtake Europe as the second-most-popular region (behind the US) in which to establish an innovation hub. According to the latest data released by the World Intellectual Property Organization, Asia accounted for 56% of the world’s total patent grants in 2015. The percentage was the highest among all geographies and up from 45% in 2005. In comparison, Europe’s share of global patent grants fell from 24% to 13% during the same period.

Source: iStockphoto

The rise of Asia as an innovation hub has been led by four key cities: Singapore, Bangalore, Shanghai and Tokyo. Government initiatives and talent availability have encouraged companies to choose Asia when setting up innovation centers.

China

In 2016, the Chinese government announced a three-year program to boost the growth of its artificial intelligence sector. The Chinese government will provide “supportive fiscal policies” for the sector to encourage international cooperation. The program’s key areas of focus will include intelligent home appliances, smart automobiles, intelligent wearable devices and robotics.

India

In India, the government has introduced campaigns such as “Startup India” and “Make in India” to encourage investment and to support businesses and entrepreneurs in the country.

The Startup India initiative, launched in January 2016, is facilitating bank financing for ventures in order to boost entrepreneurship and encourage startups in the country.

The Make in India initiative was launched in September 2014. The government introduced several reforms to alleviate outdated policies and regulations and encourage foreign investment and foster business partnerships. The initiative also facilitates innovation and research activities, supported by an easier registration system and an improved infrastructure for protecting intellectual property rights.

The number of tech startups in India was estimated to have reached 4,750 by the end of 2016, up 12% year over year, according to the National Association of Software and Services Companies (Nasscom), an Indian trade association.

- Nasscom estimates that the number of active incubators and accelerators in India increased by 35%–40% in 2016, to more than 140. In 2015, India saw its highest-ever level of startup funding, with some $9.0 billion invested in the country’s firms, up from approximately $5.0 billion in 2014, according to YourStory, a media platform for entrepreneurs.

In the last decade or so, foreign investors have shown increasing interest in India. This has been particularly notable in the past three years, as the aforementioned government campaigns have encouraged investment. Below, we identify some of the main foreign companies investing in the retail and tech space in India.

- JCPenney opened a global in-house innovation center in Bangalore in August 2016.

- Apple announced plans to open a startup accelerator in Bangalore in May 2017.

- Cisco launched a startup accelerator program called Cisco LaunchPad in India in 2016. Cisco plans to invest $100 million over two years to fund early-stage and growth-stage companies in the country.

- The Microsoft Accelerator was set up in Bangalore in 2012 to identify and support early-stage tech entrepreneurs. It runs two four-month programs to mentor startups working on cloud, Internet and mobile technologies that use Microsoft.

- In 2016, Target India announced that it had chosen the fifth set of companies for its startup accelerator program, through which it mentors startups that develop retail solutions that are relevant to Target’s business.

Israel

Israel, long known as a hub of cybersecurity talent, has developed into one of the world’s top retail tech ecosystems in recent years. Due to disruption from Amazon and the increasingly digitalized consumer, retail technology has become one of the greatest areas of focus for the country. Companies are looking to Israel for innovation across multiple segments of ecommerce, including marketing, payments, supply-chain management and analytics. In 2015 alone, Israel’s e-commerce sector saw $230 million in investment, yielding $484 million in exits, according to angel-investing community iAngels. Other top trends driving investment in Israeli innovation are the mainstreaming of artificial intelligence (AI) and machine learning, VR/AR and the development of voice- and image-recognition technology

Source: iStockphoto

The growing Israeli startup ecosystem has been driven by investments from Alibaba, Walmart, eBay and others, and by tax breaks from the government. Several retailers, including Kimberly-Clark, Sears and Coca-Cola, operate in house innovations labs or accelerator programs in the country.

- Launched in 2014, The Bridge by Coca-Cola is a seven-month accelerator program in Tel Aviv. The five core themes are consumer engagement, consumer retail, supply chain, marketing innovation, and health and wellness. Out of the three graduating classes have come 68 pilot programs, 15 license agreements and four global license agreements.

- In 2017, Adidas launched the LeAD Sports Technology Accelerator in partnership with equity crowdfunding platform OurCrowd. The accelerator is designed to support early-stage Israeli startups in the discovery of high-potential innovation in sports-related products and services.

- Kimberly-Clark’s Digital Innovation Lab (D’Lab), which has an office in Tel Aviv, relies on an open-source innovation model. D’Lab engages with startups, technology companies, government and the academic community in order to bring new ideas to the consumer goods category.

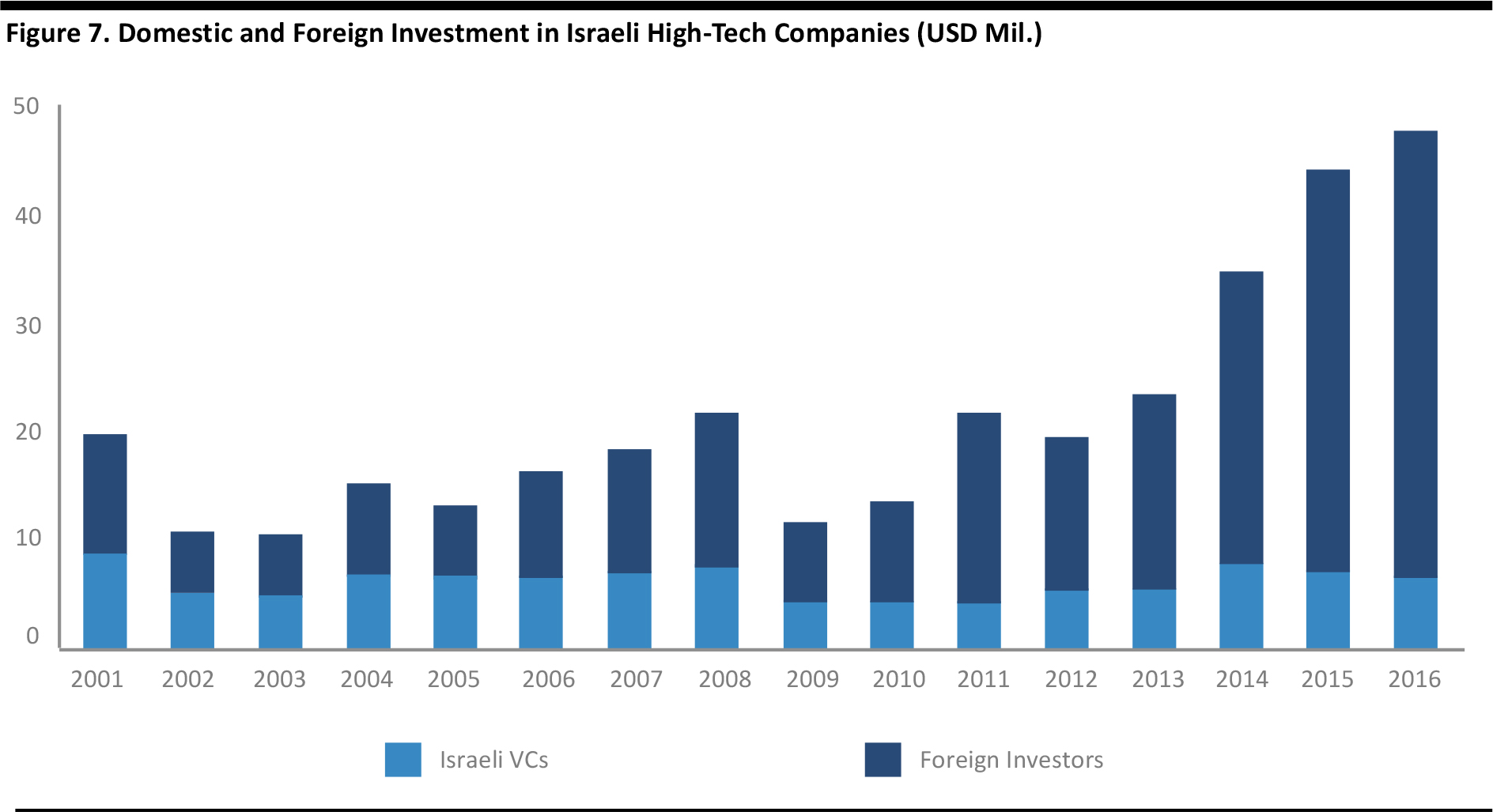

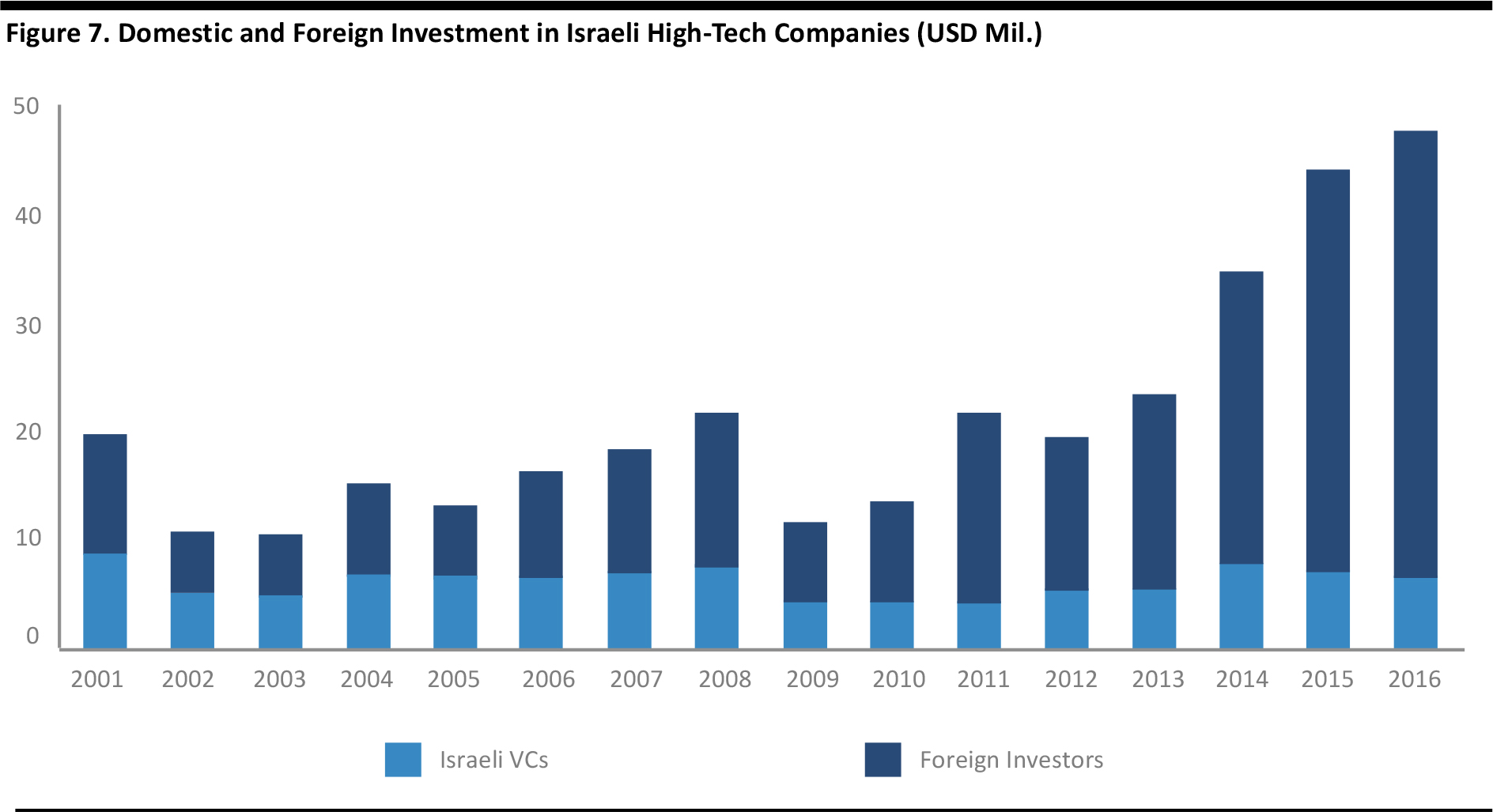

According to OurCrowd, more than $4.8 billion was invested in Israel-based high-tech startups in 2016—more than was invested in Silicon Valley companies that year and up 120% from 2013.

Source: OurCrowd

Retailers are Increasing Technology Investment Spending

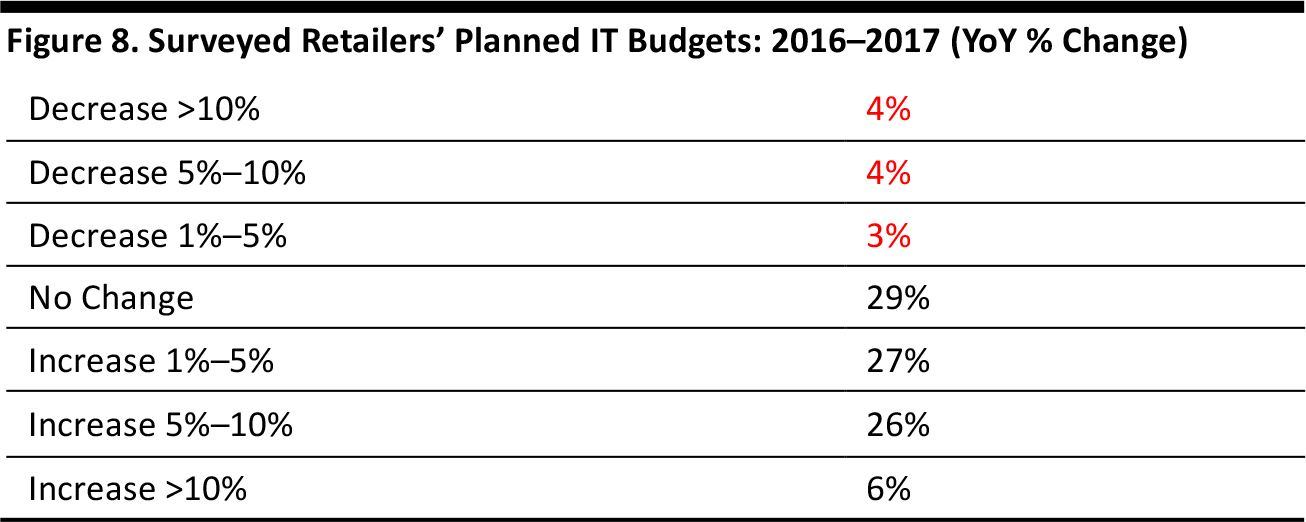

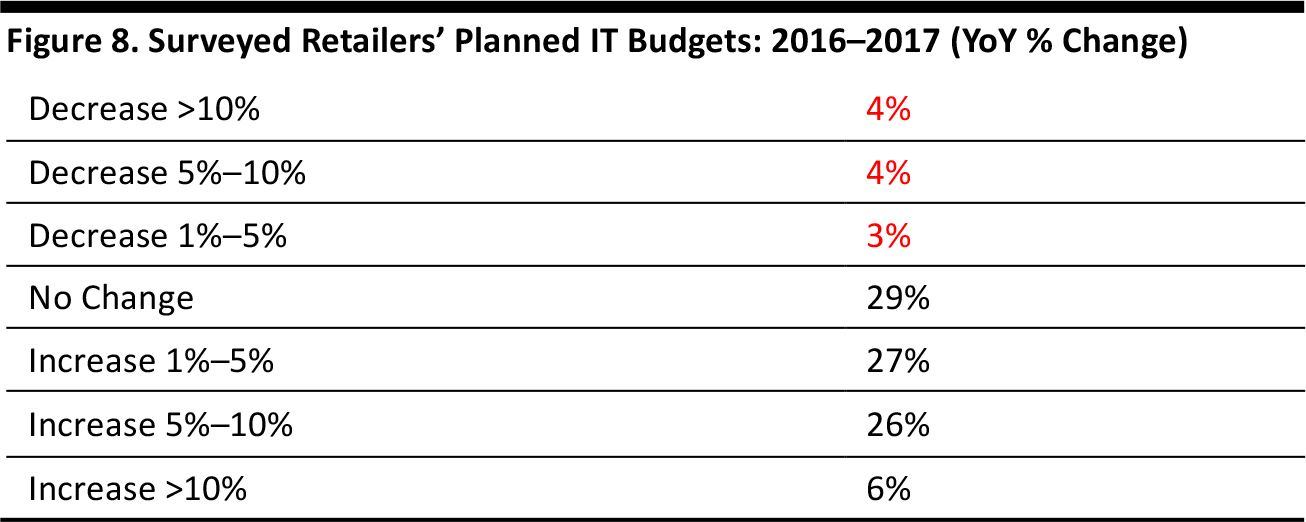

According to the RIS/Gartner Retail Technology Study 2016, in calendar year 2017, nearly six out of 10 retailers surveyed (59%) plan to raise their IT budgets, and 31% plan to increase their budgets by more than 5%. The study2 was based on a survey of 100 senior retail executives, nearly 41% of whom were VP level or higher. The respondents represented three major retail segments—specialty (29%), food/drug/convenience (25%) and apparel/footwear/accessories (20%)—as well as department store/mass merchandise/discounter (12%), other (8%) and e-commerce (6%).

On average, the retailers surveyed planned to increase their IT budgets by 3.5% year over year in 2017, the same rate as indicated by the study the prior year. Increased IT budgets signal retailers’ commitment to developing and deploying new solutions, and could signal greater investment in corporate innovation programs.

Source: RIS/Gartner

Recent Announcements: Walmart Launches New Investment Arm

In March 2017, Walmart announced a new internal venture arm dubbed Store No. 8. The goal of the organization is to form strategic partnerships with promising young e-commerce companies, particularly those working on artificial intelligence and autonomous vehicles, and to identify other emerging technologies that could prove useful to Walmart. Along with incubating new ventures, Store No. 8 is intended to help create and develop new startups.

Source: walmart.com

The corporate venture capital model is becoming a more popular channel for corporate-startup engagement. Unlike conventional venture capital, there are no overarching strategic or financial objectives. Corporate venture capital tends to require more resources and specialized corporate structures, but it allows corporations to build closer and longer-term relationships with startups.

Conclusion

Consumers have changed how, when and where they shop, and retailers must rethink the overall shopping experience in order to meet consumer expectations and demands. As the pace of change within the retail industry accelerates, the corporate culture at many firms is shifting toward expanding in-house solutions beyond traditional corporate R&D departments, so that innovation efforts are part of a more open and collaborative environment. We believe that corporate-startup collaboration will be an essential part of every successful company’s innovation strategy going forward.