Web Developers

Singles’ Day has grown to become the single-most significant online shopping day in China and the biggest shopping event globally. Following our Singles’ Day Shopping Festival 2017 preview survey in October, which detailed consumer sentiment and buying preferences ahead of the 11.11 event, we conducted a post-Singles’ Day survey to gauge shoppers’ satisfaction with key retailers in China. We detail our key findings in this report.

EXECUTIVE SUMMARY

Following FGRT’s Singles’ Day 2017 preview survey in October, which detailed consumer sentiment and buying preferences ahead of the 11.11 event, we conducted a post-Singles’ Day survey to gauge shoppers’ satisfaction with key retailers in China. We detail our key findings in this report.Key Findings

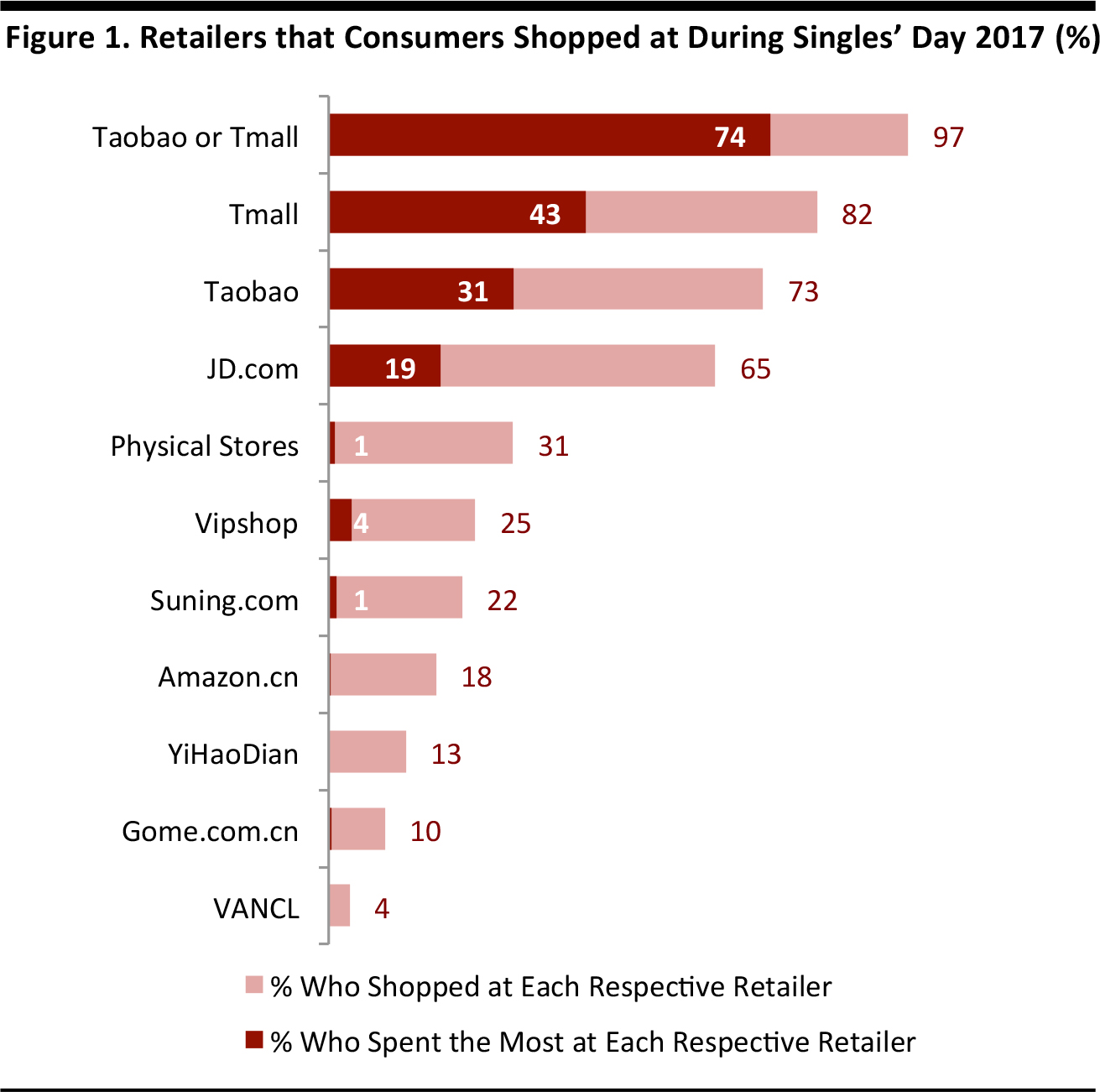

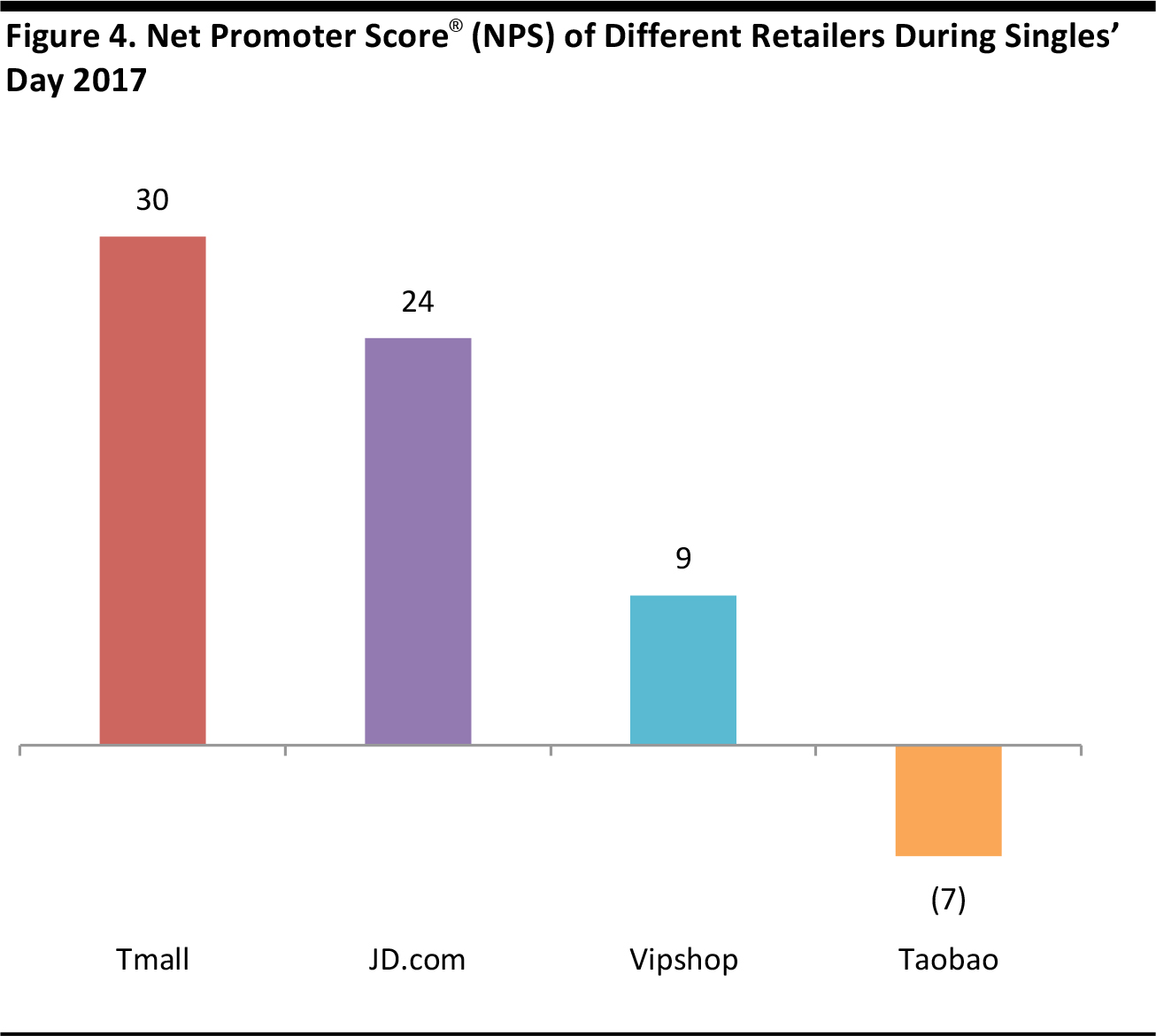

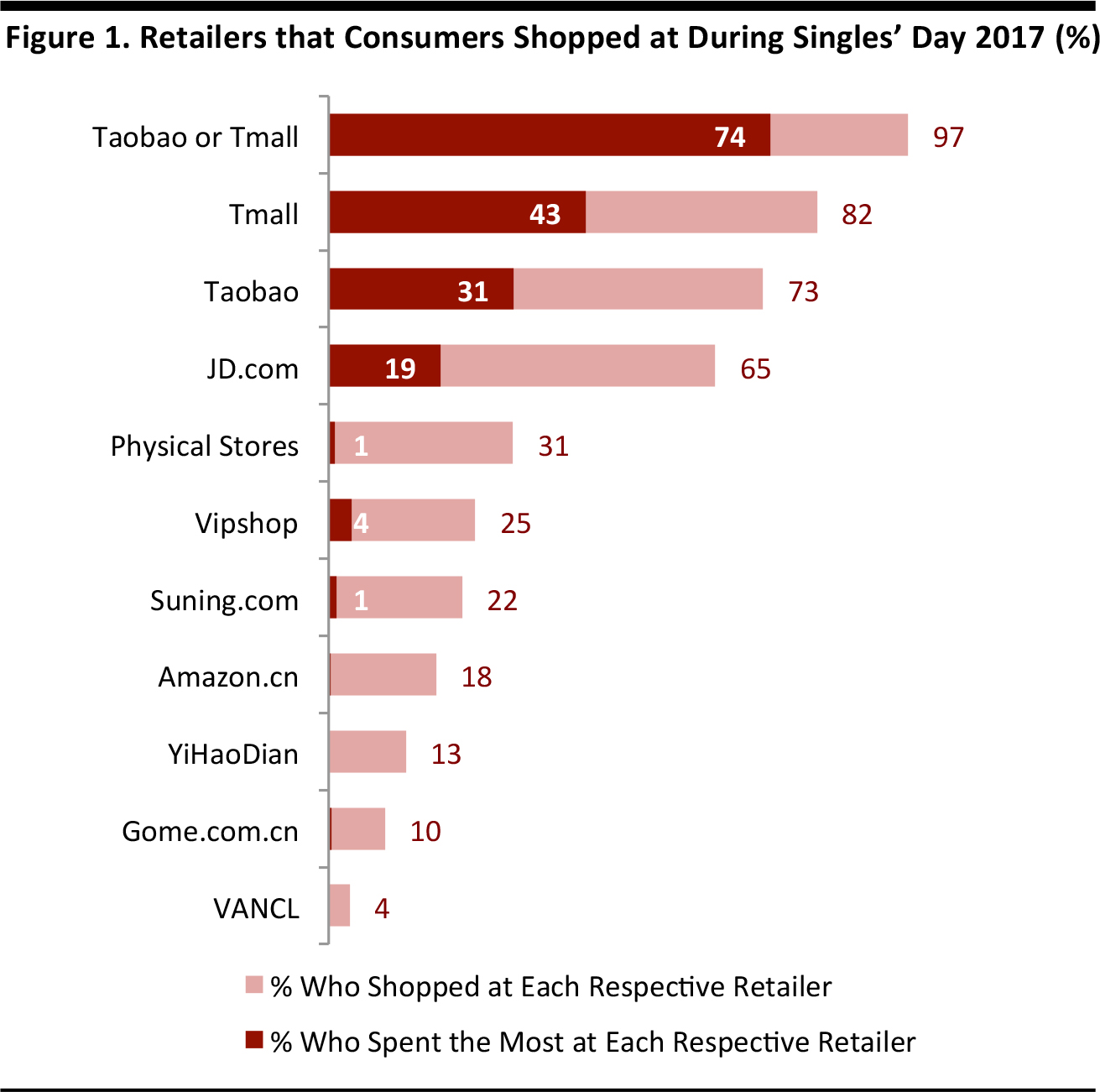

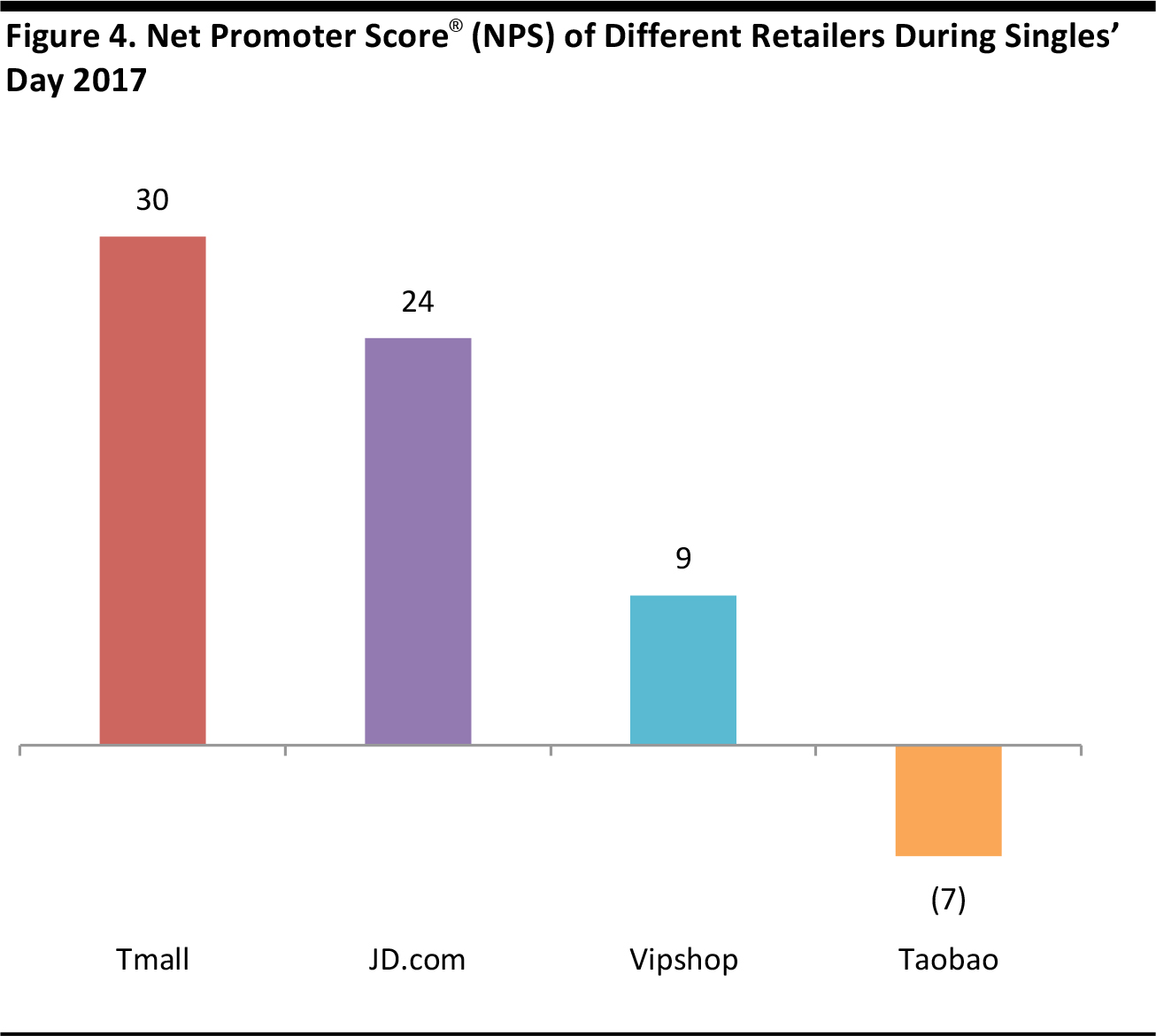

1. Taobao and Tmall Still Dominate, but JD.com Is Gaining Traction Alibaba’s two main marketplaces Taobao and Tmall continue to dominate Singles’ Day sales, but JD.com is gaining traction as a shopping destination and a competitor to Tmall and Taobao. While nearly every Singles’ Day shopper we surveyed said they purchased on Tmall or Taobao—with an impressive 74% saying most of their money was spent at either one of these marketplaces—it is interesting to note how quickly JD.com is making its mark. Some 65% of survey participants said they shopped on JD.com, with 19% saying they spent the most there. 2. Both Tmall and JD.com Scored Well on Overall Satisfaction, but Taobao Is Lagging In terms of overall customer satisfaction, Tmall and JD.com both scored well, while Taobao lags behind. To gauge shoppers’ satisfaction during the Singles’ Day shopping festival, we used Net Promoter Score (NPS), which also measures consumers’ willingness to recommend respective retailers to other consumers. Tmall topped the league with an NPS of 30, higher than competitors JD.com at 24 and Vipshop at 9. Alibaba’s other marketplace Taobao, however, fared poorly, with an NPS in negative territory, at (7). 3. Tmall and JD.com Scored Well on Product Quality, the Most Impactful Factor Driving Customer Satisfaction Tmall and JD.com both scored well in terms of satisfaction with product quality. Attributes related to product quality such as guarantee of authenticity and the quality of the item itself were found to have a moderately positive relationship with NPS. In terms of delivery speed, JD.com outperformed both Tmall and Taobao. However, according to our analysis, this factor has less impact as a driver of customer satisfaction. While the results of our survey show that JD.com outperformed both of Alibaba’s marketplaces in terms of overall satisfaction, we do not expect the company to overtake them any time soon, given the degree of brand awareness and the share of wallet that Tmall and Taobao command.Research Methodology

Our survey was carried out among 492 mainland Chinese Internet users between the ages of 18 and 59 who made purchases over a three-day period (November 15–17) during the Singles’ Day Shopping Festival. The survey data was weighted according to the age and gender distribution in China’s urban areas, based on the latest available census by the National Bureau of Statistics of China. We assume our online survey represents the opinions of the majority of the urban mainland Chinese population, as the Internet penetration rate had already reached 69% as of June 2017, according to the China Internet Network Information Center (CNNIC).

Source: istockphoto

Exchange Rate

We used an average foreign exchange rate from S&P Capital IQ for October 2017 when converting renminbi (CNY, yuan) to the US dollar (USD), resulting in a rate of ¥6.626 to $1.00 (¥1:$0.1509).SINGLES’ DAY 2017 REVIEW

Taobao and Tmall Continue to Dominate, but JD.Com Is Gaining Traction

Nearly every Singles’ Day shopper who participated in our survey spent money on Alibaba’s two main marketplaces Taobao and Tmall. An impressive 74% of survey participants said they spent the most at either one of these marketplaces. However, what was surprising to learn is how quickly JD.com is emerging as a force to be reckoned with. Some 65% of survey participants said they shopped on JD.com this year, with 19% saying they spent the most on this platform. Another surprising piece of information we learned is that Singles’ Day is no longer limited only to e-commerce—31% of surveyed shoppers said they purchased goods at physical stores during the 11.11 event this year. Indeed, under Alibaba’s New Retail strategy to promote the seamless integration of online and offline, the company set up 60 physical stores across 12 cities and converted 100,000 stores into “smart stores.”

Base: Singles’ Day shoppers (N=492). Source: FGRT

Apparel Still the Most Popular Product Category; Shoppers Not Yet Making all Their Purchases During Singles’ Day

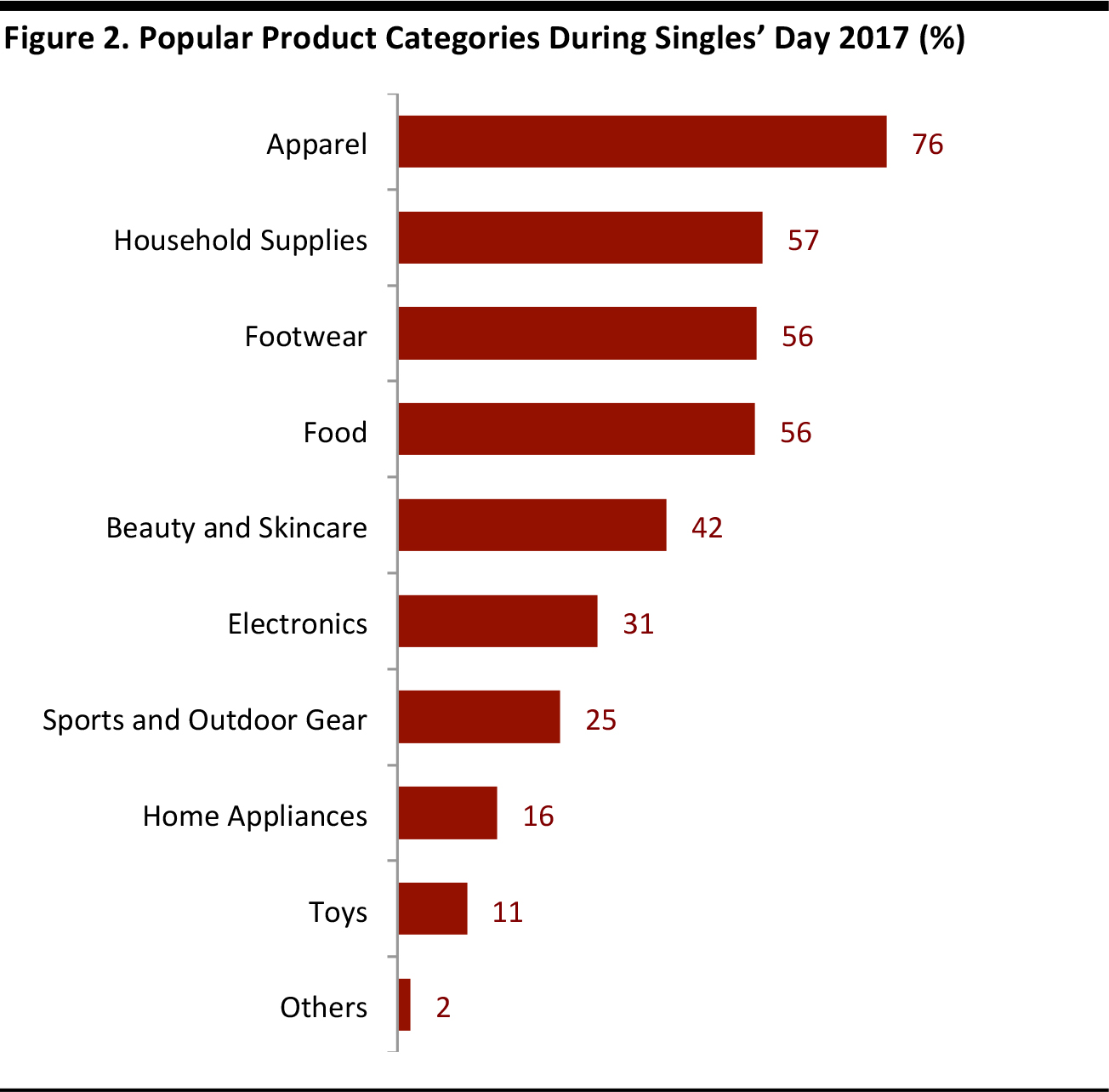

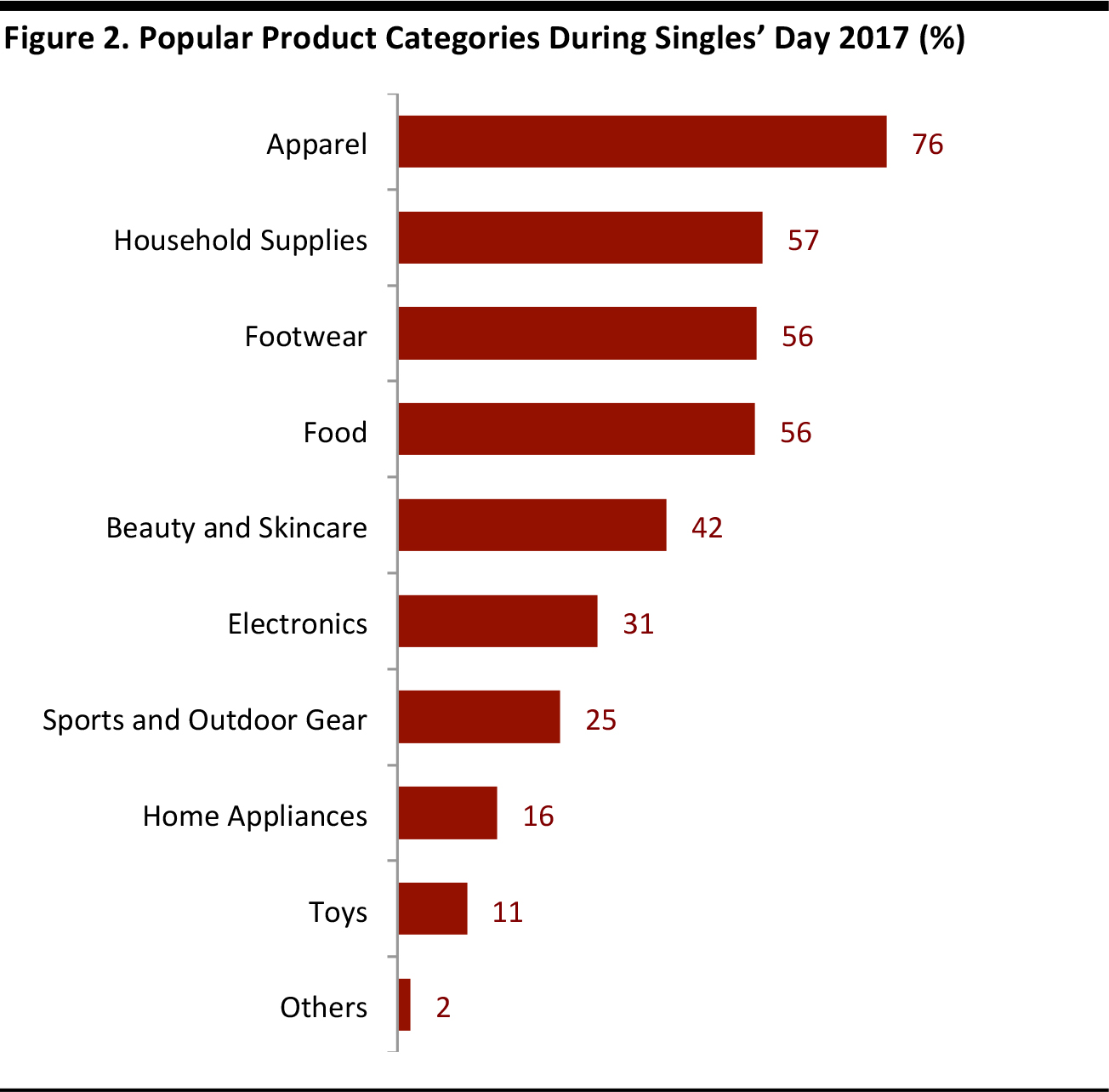

Despite the deep discounts offered by retailers during Singles’ Day, shoppers are not yet making all their purchases during the 11.11 shopping event. Of the 10 product categories we have listed, survey participants purchased items from 3.7 categories on average.

Source: iStockphoto

Apparel is the most popular product category, with 76% of surveyed shoppers saying they purchased apparel this year. This is followed by household supplies at 57% and footwear at 56%.

Base: Singles’ Day shoppers (N=492). Source: FGRT

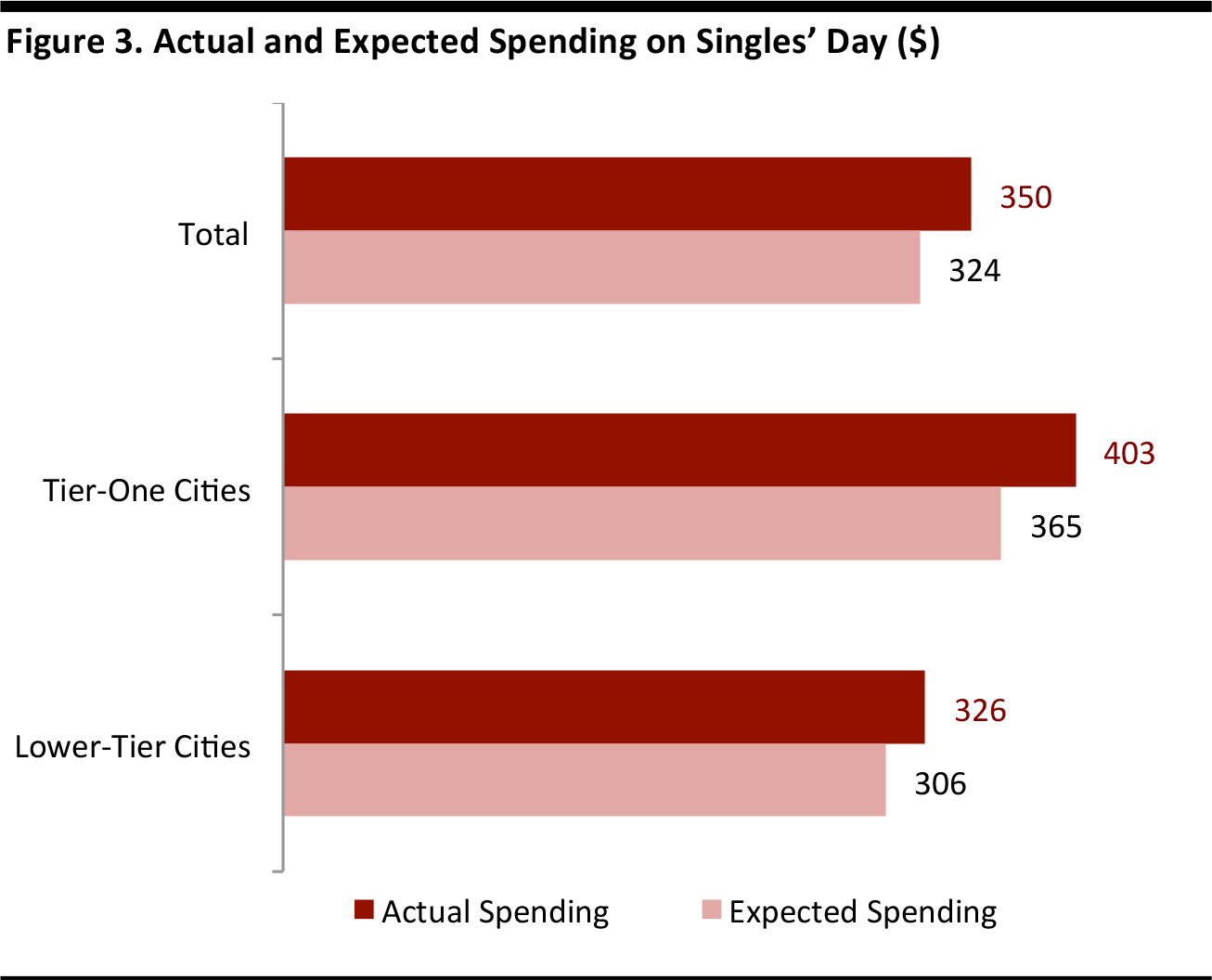

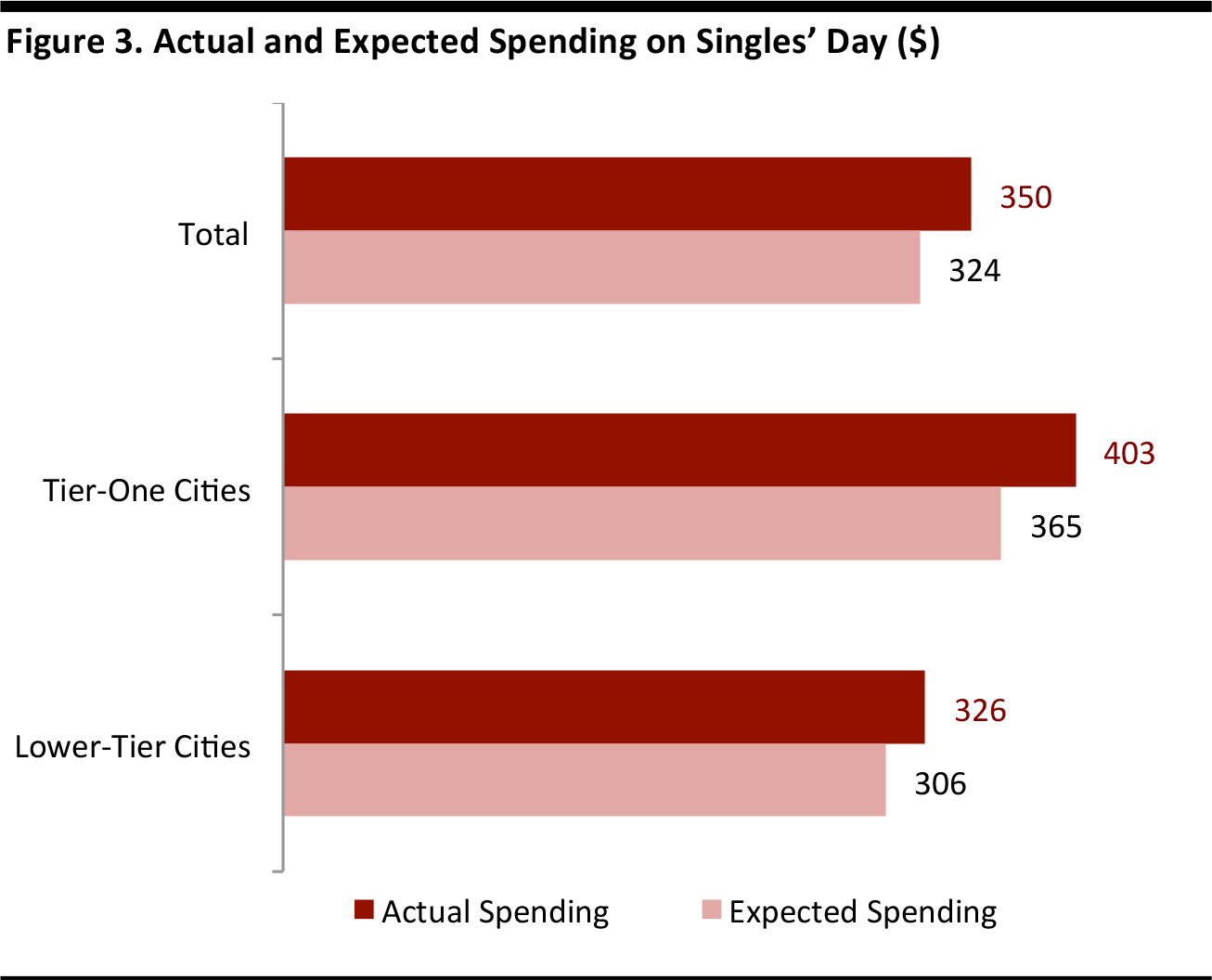

Singles’ Day Shoppers Spent More than They Expected

On average, shoppers spent $350 (¥2,316) during this year’s 11.11 shopping event, 8.0% higher than the expected amount given in our Singles’ Day preview survey conducted in October. Shoppers from tier-one cities on average spent $403 (¥2,672), 24% higher than their counterparts in lower-tier cities. This result was also higher than the expected amount given in our preview report of $365 (¥2,396), and 24% higher than consumers in lower-tier cities.

Base: Review survey (N=492); Preview survey (N=954). Source: FGRT

OVERALL SATISFACTION WITH SINGLES’ DAY RETAILERS

Both Tmall and JD.com Scored Well on Overall Satisfaction, but Taobao Lags Behind

To gauge shoppers’ satisfaction with key Chinese retailers during the 11.11 shopping event, we used Net Promoter Score (NPS), which also measures consumers’ willingness to recommend retailers to other consumers. Tmall topped the league with a score of 30, higher than competitors JD.com at 24 and Vipshop at 9. Alibaba’s other marketplace Taobao, however, did not fare so well, with an NPS of (7). In the following charts, we look at Singles’ Day shoppers’ overall satisfaction with different Chinese retailers according to different criteria, and identify which factors drive loyalty and customer satisfaction.

Base: Taobao shoppers (N=362); Tmall shoppers (N=407); JD.com shoppers (N=323); Vipshop shoppers (N=144). Note: Net Promoter, Net Promoter Score and NPS are registered trademarks of Bain & Company, Fred Reichheld and Satmetrix Systems. Source: FGRT

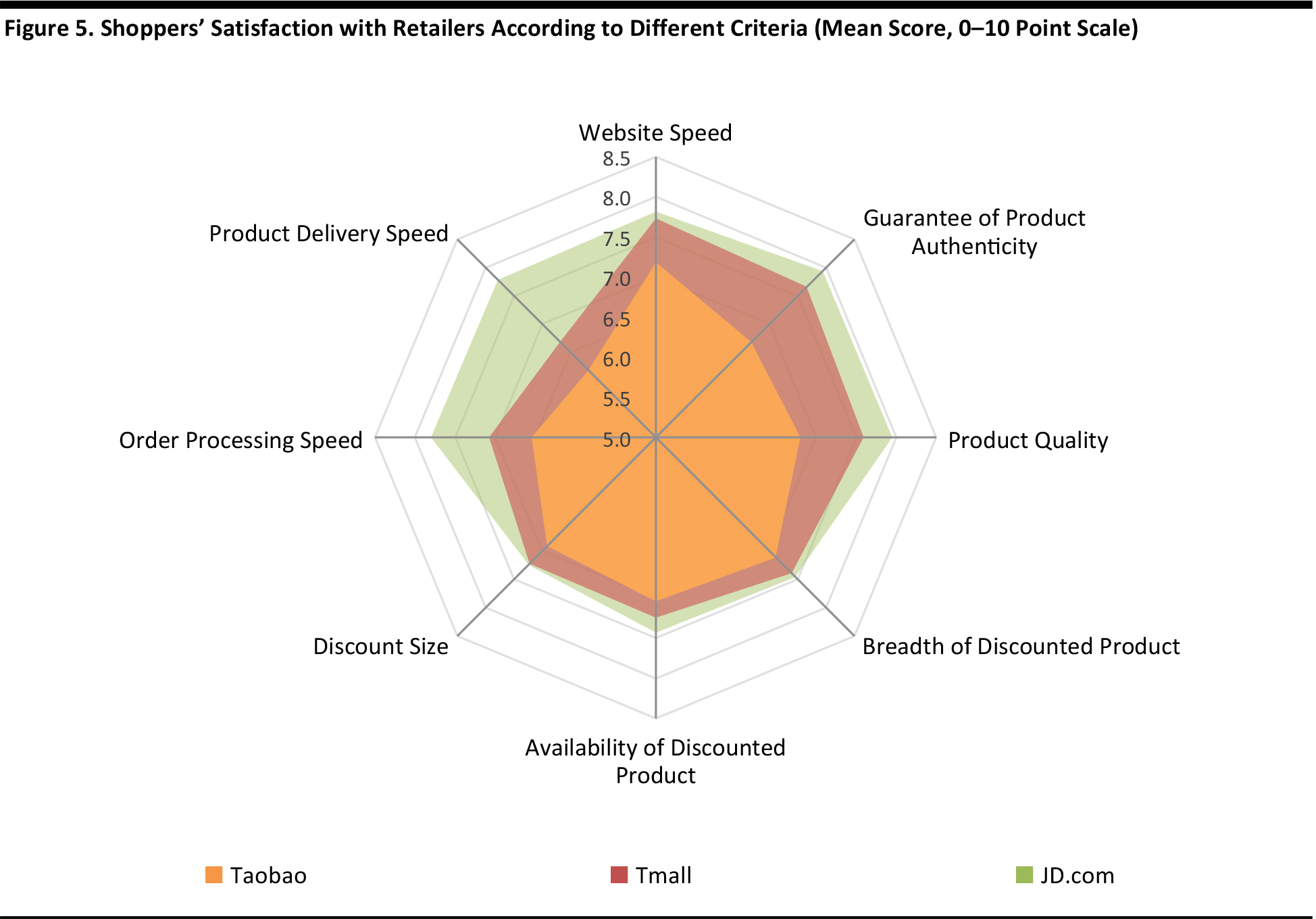

Tmall and JD.com Score Well on Product Quality, the Most Impactful Driver of Customer Satisfaction; JD.com Scored Well on Delivery Speed

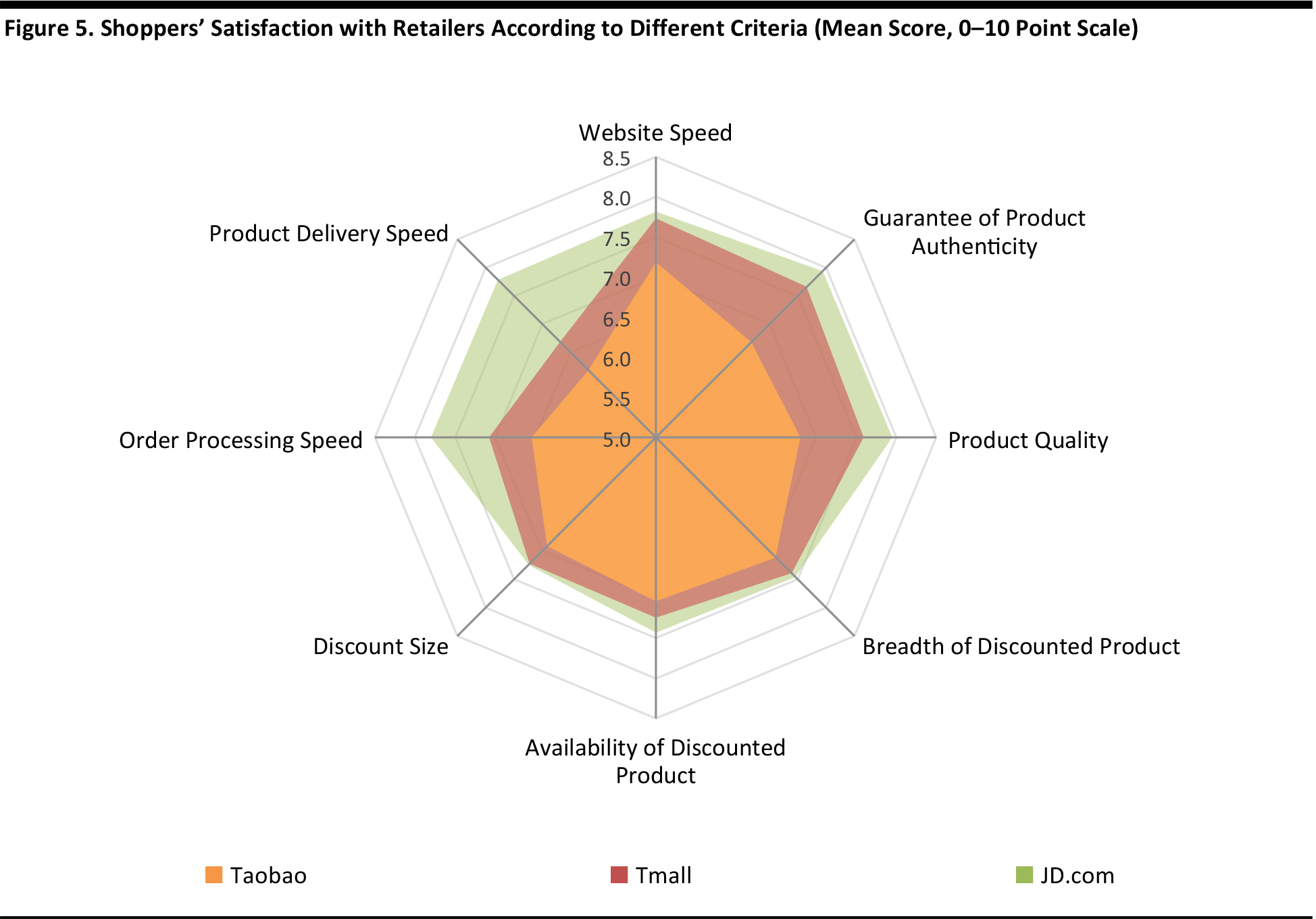

The results of our survey show that JD.com outperformed Tmall and Taobao in terms of overall customer satisfaction. When questioned about criteria related to this year’s discounts— such as the amount of the discount, the availability of discounted products and the breadth of the choice of discounted products—shoppers scored all three marketplaces pretty much the same. Surveyed shoppers were more satisfied with Tmall and JD.com in terms of product quality, which, according to our analysis, is the most impactful factor driving customer satisfaction during Singles’ Day. This could be attributed to these platforms’ better consumer protection such as a seven day returns policy, as well as the company registration requirement for sellers on both Tmall and JD.com. In terms of delivery speed, JD.com outperformed both Tmall and Taobao.Since JD.com operates its own logistics network, it can offer a more consistent experience for shoppers compared to Taobao and Tmall, which use third-party couriers. However, according to our analysis, as a driver of customer satisfaction, delivery speed has less impact.

Base: Taobao shoppers (N=362); Tmall shoppers (N=407); JD.com shoppers (N=323). Source: FGRT

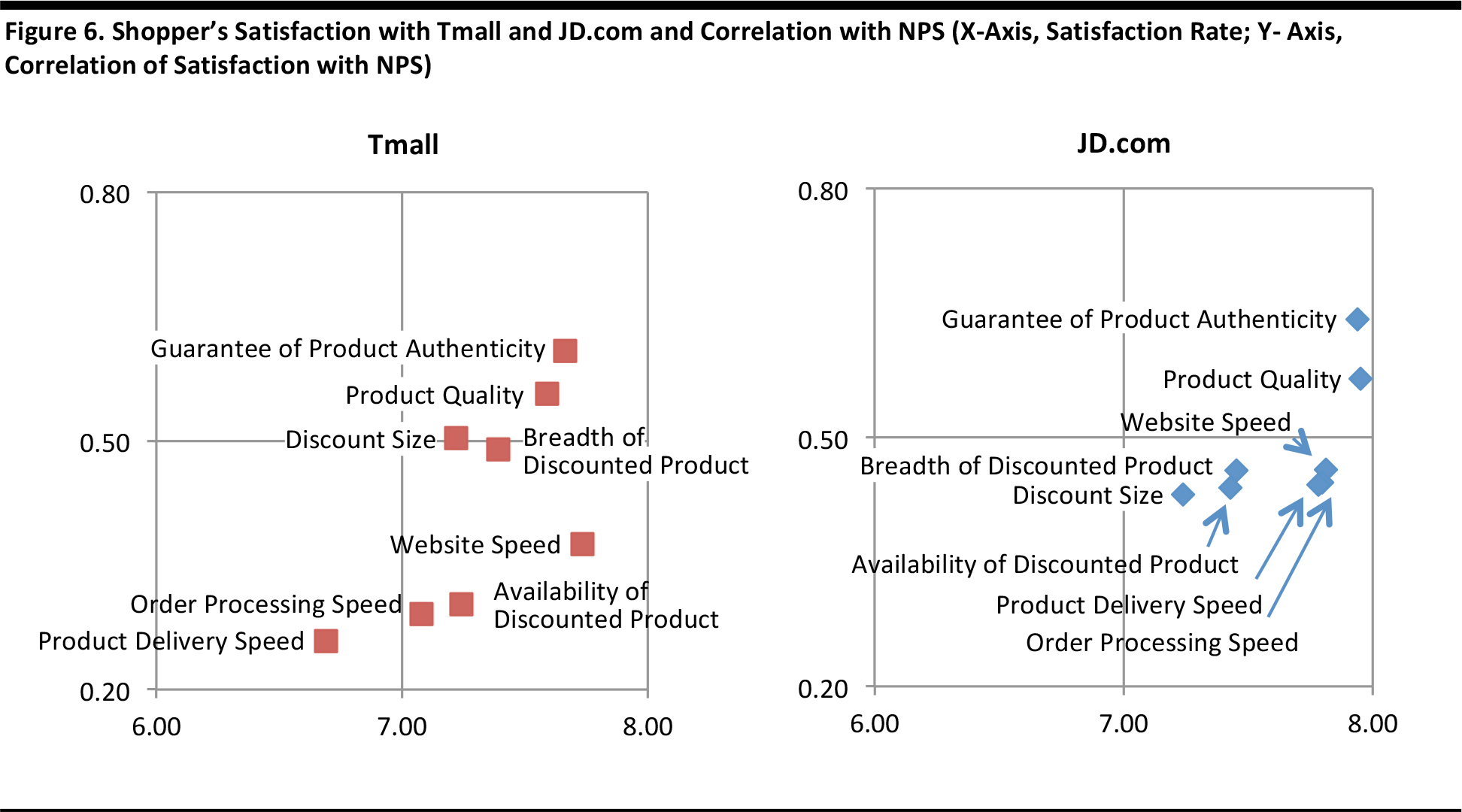

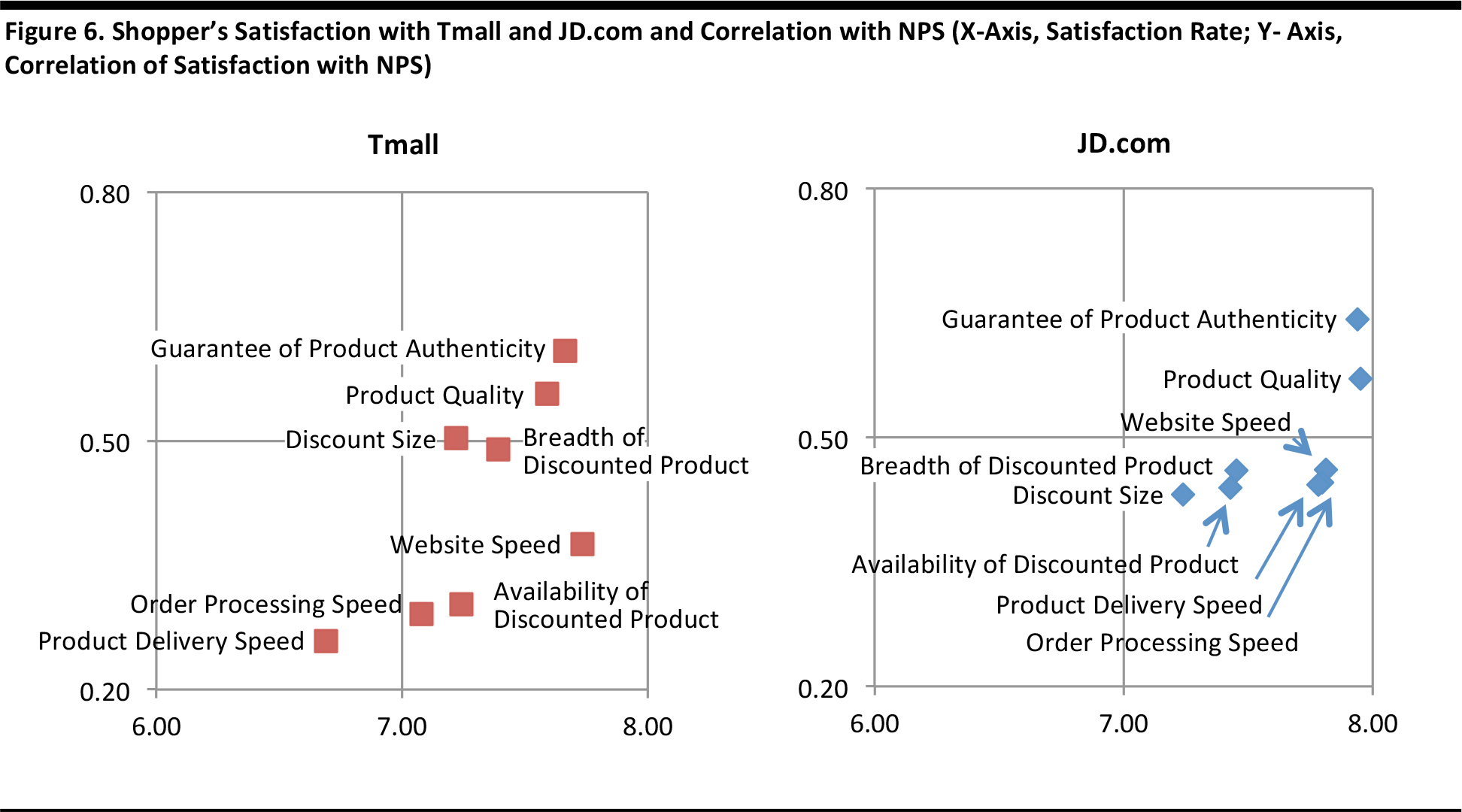

Product Quality Is the Most Impactful Factor Driving Customer Satisfaction

Tmall and JD.com both score well in terms of product quality, which is also a factor that helps drive customer satisfaction and loyalty. Attributes related to product quality such as guarantee of authenticity and the quality of the item itself have a correlation coefficient of between 0.56 and 0.64, meaning that they have a moderately positive relationship with NPS. This is also consistent with our findings in our Singles’ Day preview survey,where the majority of surveyed shoppers were focused more on quality over price. As mentioned earlier, JD.com scored well in terms of delivery speed. However, according to our analysis, as a driver of customer satisfaction, this factor is not as impactful as product quality is during Singles’ Day.

Base: Tmall shoppers (N=407); JD.com shoppers (N=323). Source: FGRT

KEY TAKEAWAYS

Initially the brainchild of Alibaba Chairman Jack Ma, Singles’ Day has grown to become the single-most significant online shopping day in China and the biggest shopping event globally. In this year’s post-Singles’ Day review survey, we found that nearly every Singles’ Day shopper spent money on Taobao or Tmall, with the vast majority saying they spent the most on either one of these marketplaces. However, it is interesting to note how quickly JD.com is gaining traction, emerging as a shopping destination and a key competitor to Alibaba’s marketplaces Tmall and Taobao during the Singles’ Day shopping event