Executive Summary

This is the third report in our X Factor series in which we identify themes that we believe will be critical for the US retail landscape in 2H17 and beyond.

In this report, we focus on the supply chain. We summarize the challenges that retailers face in their supply chains and analyze the initiatives they have embarked upon over the past few quarters. Based on our findings, we see the need for retailers to digitalize the supply chain in order to better position themselves to compete in the increasingly challenging retail industry.

X Factor―Competitive Advantages that Could Revolutionize an Industry

The Supply Chain as an X Factor of Retail

The rapidly changing retail environment and disruption from e-tailers have caused traditional retailers to suffer from decelerating top-line growth. Cost-cutting and enhancing operational efficiency have become the focal points of discussion during earnings calls these past few quarters. By investing in their supply chains, retailers are looking at solutions that will eventually transform how they source and deliver goods to the consumer.

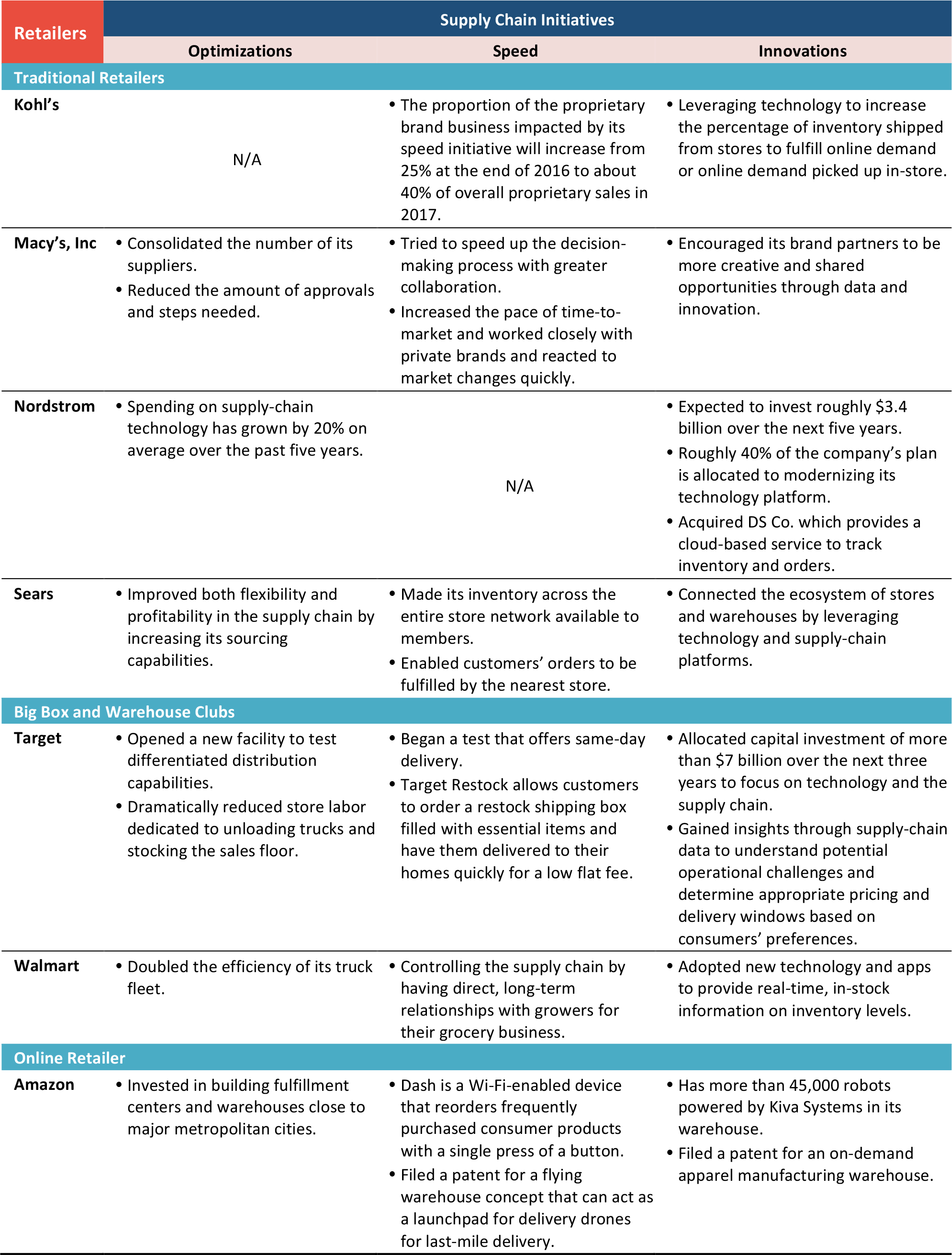

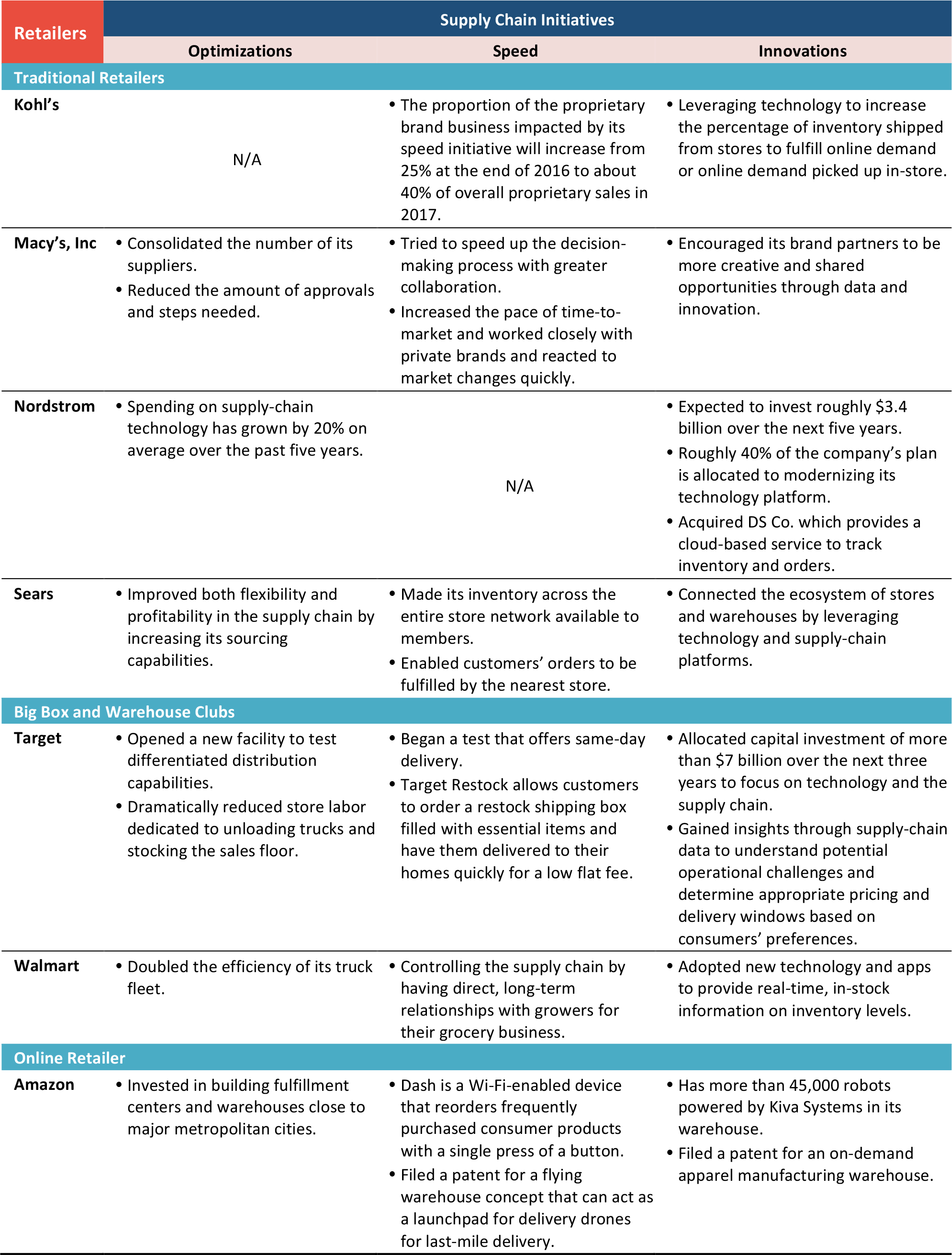

By analyzing conversation between top management and analysts during recent retailers’ earnings calls, we have summarized three key initiatives that are transforming supply-chain operations:

- Optimization: Increasing the efficiency of the supply chain, which leads to shorter lead times as well as cost savings.

- Speed: Enhancing speed-to-market so retailers can manage their inventory and product offerings with more flexibility.

- Innovation: Investing in new supply-chain technology.

In order to adapt to the fast-changing retailing environment, retailers need to look at digitalization to transform the way they operate their brick-and-mortar stores. The transformation needs to involve every stakeholder along the value chain, and all the processes and information flows―such as data accessibility, data sharing, collaboration and data analytics―need to be fluid and transparent.

Source: Company earnings calls

Inventory Levels are Picking Up Again

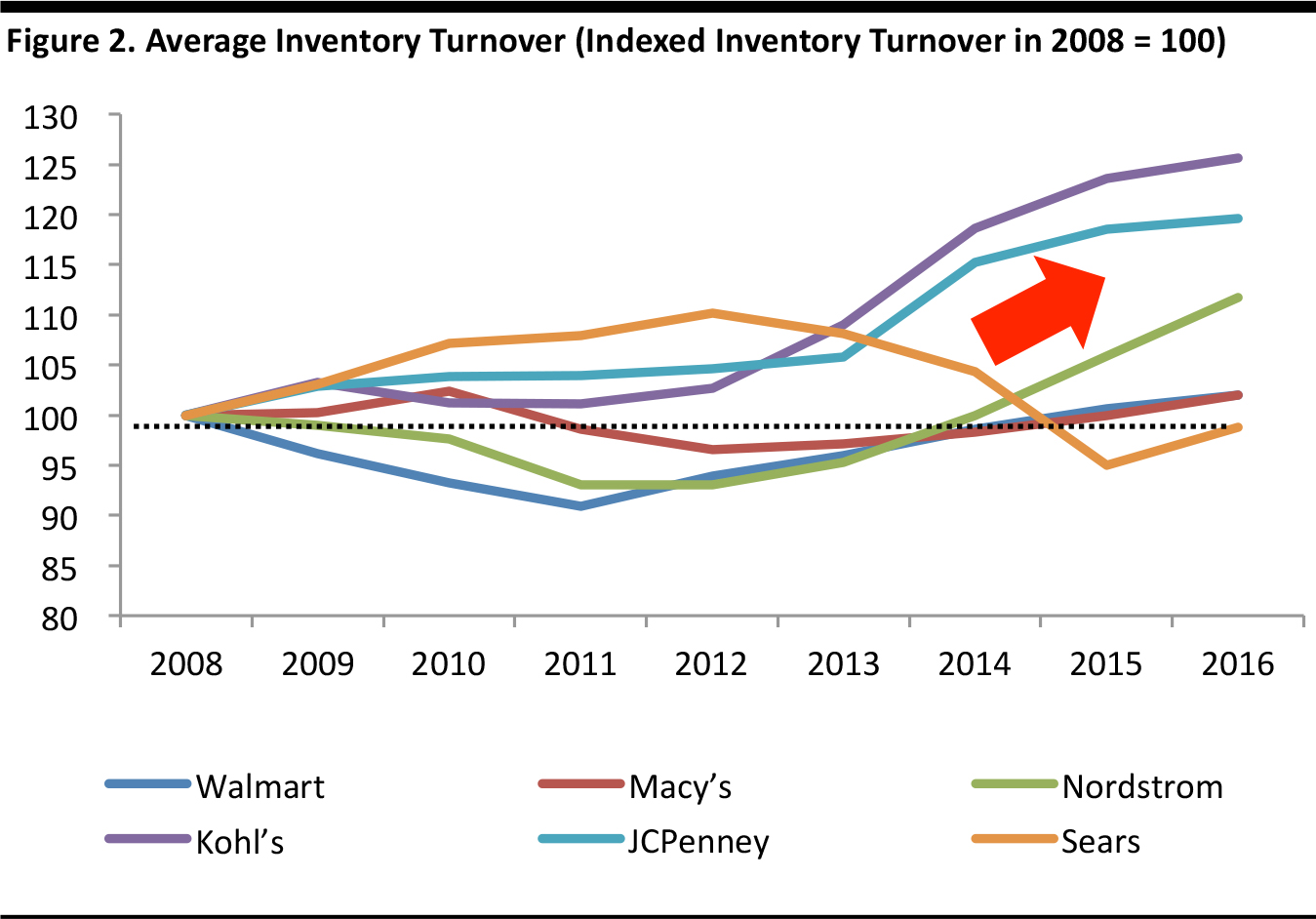

Many US retailers have been suffering from weakening top-line growth in the past few quarters. Declining mall traffic, an overstored industry and the structural shift in consumers’ preferences toward online shopping have contributed to the stagnant demand at physical stores.

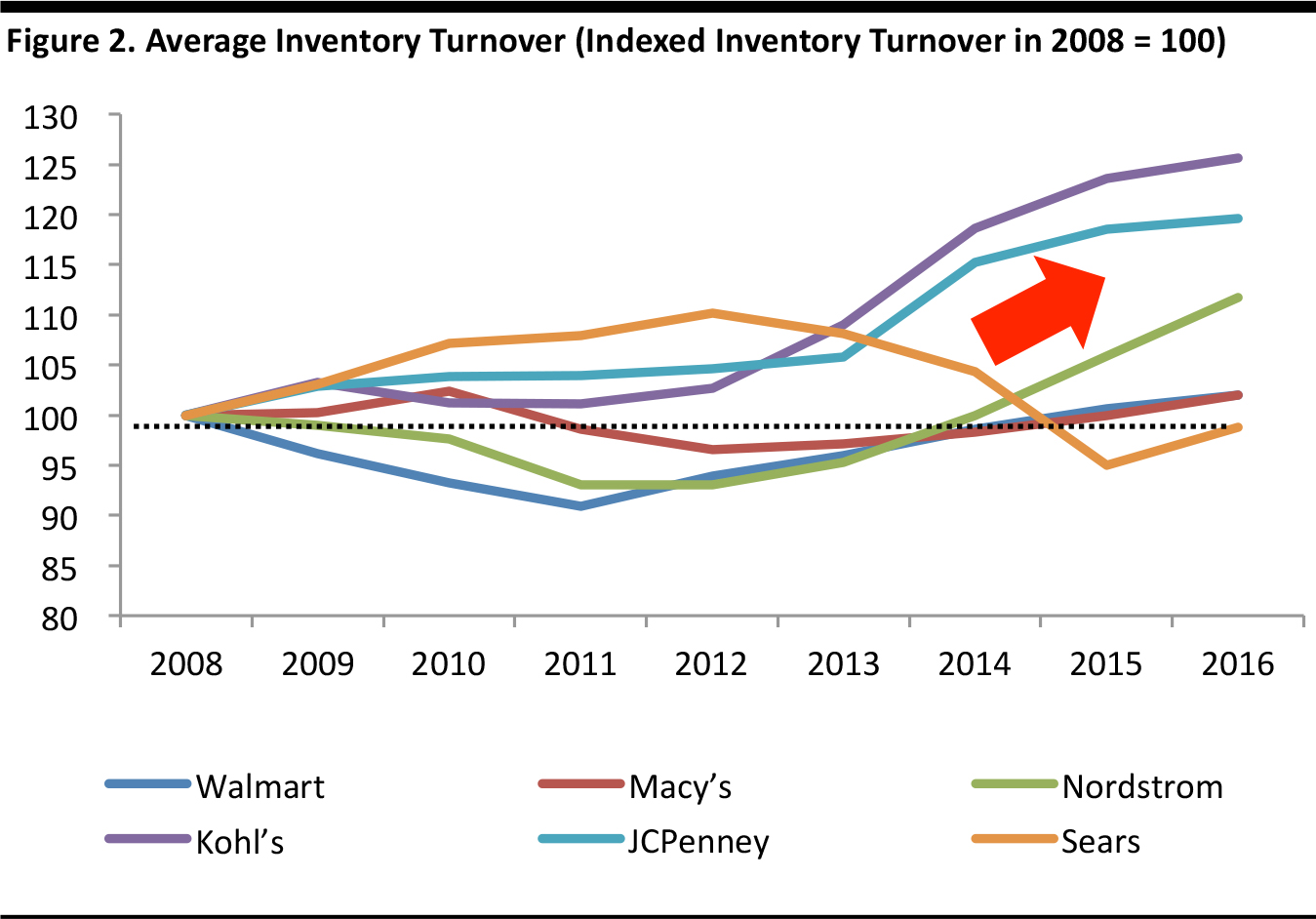

Most retailers strived to adopt an inventory-light model after the financial crisis in 2008; for example, Walmart, increased investment in its supply chain. However, emerging e-tailers have become a disruptive force that is driving rapid change in the retail industry, and retailers must once again adapt to survive.

Looking at inventory turnover at a select group of retailers and department stores since 2008, we notice that the inventory levels of major retailers are rising. Even at Walmart, known for its world-class supply-chain management, its inventory turnover in 2016 was close to levels seen in 2008―which were unusually high because of the aftereffects of the financial crisis.

And if we look at Amazon, even though its inventory turnover has also increased over the years, this is largely due to its strategy of offering as many different products as possible. According to ExportX, which is an e-commerce company, Amazon offered 488 million different products in 2015, introducing an average of 485,000 new products per day (by comparison, Walmart offers approximately 150,000 products at its Supercenter store format). The massive selection means inventory turnover rises significantly.

Source: Bloomberg, Fung Global Retail & Technology

As such, increasing supply-chain efficiency has become a key area for retailers to sharpen their competitiveness. In the strategy updates during retailers’ conference calls these past few quarters, senior management have reiterated their focus on cost cutting and opening up new revenue opportunities by investing in supply chains.

In the second part of our report, we summarize the key points that top management at Macy’s, Walmart, Kohl’s, Nordstrom, JCPenney, Sears, Target and Amazon has mentioned during their recent earnings calls.

Physical Retailers’ Supply-Chain Initiatives

We break out the top retailers’ supply-chain initiatives into three key categories:

- Optimization: Increasing supply-chain efficiency

- Speed: Enhancing speed-to-market

- Innovation: Investing in supply-chain technology

Challenges and Priorities

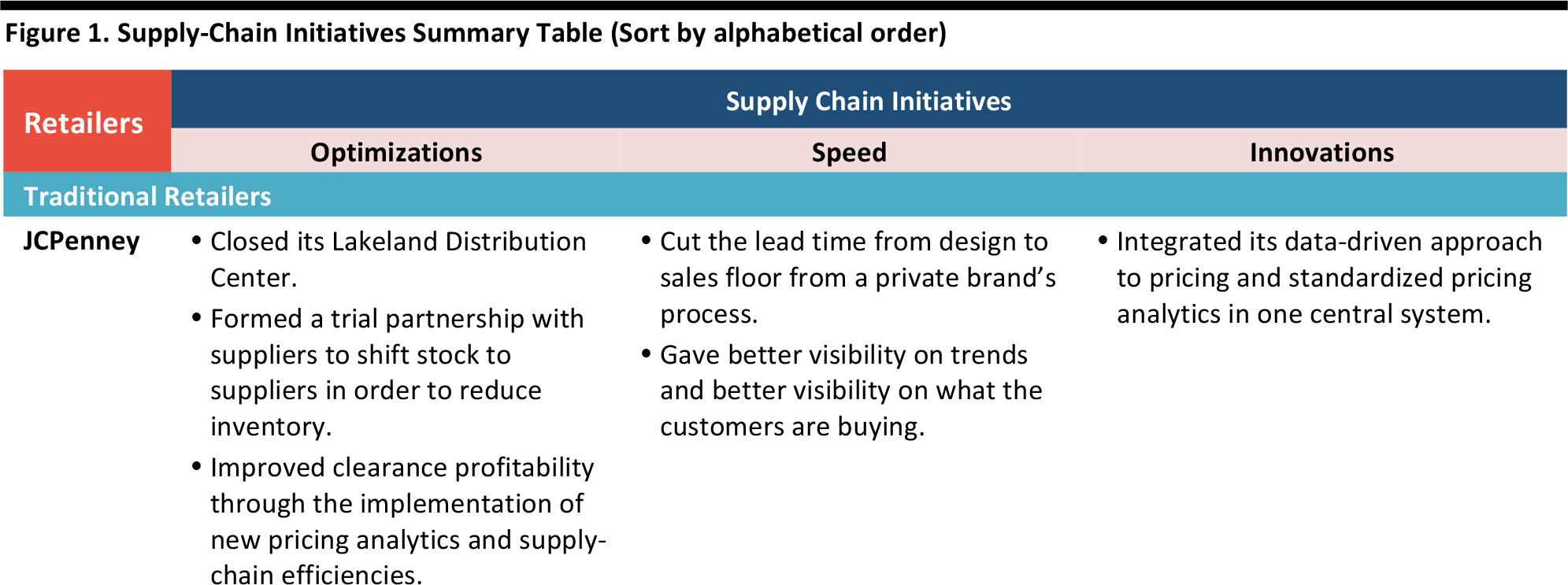

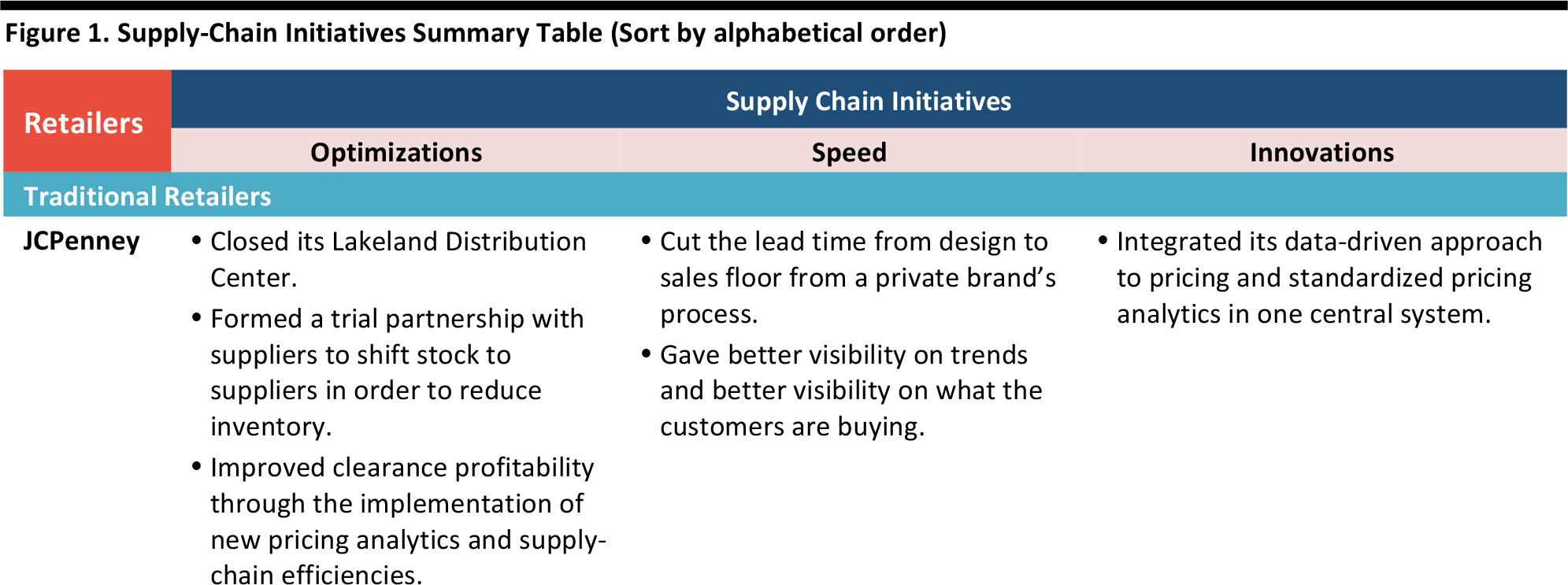

Marvin Ellison, President and CEO of JCPenney, said the key benefit of e-commerce is convenience. JCPenney had been learning how to simplify the in-store environment so it can offer a better shopping experience. Optimizing the network from an omnichannel standpoint, JCPenney decided to close some stores to ensure it could service its omnichannel customers more effectively.

Supply-Chain Initiatives

- Optimization: JCPenney has closed its Lakeland Distribution Center and formed a trial partnership with supplier Ashley Furniture, shifting stock to the supplier in order to reduce held inventory. It is working on improving its replenishment process domestically and to be less dependent on a very long supply chain. In addition, the retailer has made efforts to improve inventory clearance profitability, implement new pricing analytics tools and enhance supply-chain efficiencies.

- Speed: JCPenney has reduced the lead time from design to sales floor in the private brands’ manufacturing process, allowing better visibility on trends and on what the customers are buying.

- Innovation: JCPenney has taken a data-driven approach to pricing and standardized pricing analytics into one central system.

Challenges and Priorities

According to Kevin Mansell, CEO of Kohl’s, the weak apparel environment has hurt topline growth. Kohl’s strives to make the product offering in underperforming stores more relevant and more effective. It intends to continue to lower inventory per store by about 3% per year over the next three years, with larger inventory reductions at its retail stores and at its warehouses.

Supply-Chain Initiatives

- Speed: Kohl’s focuses on speed and localization initiatives to improve its supply chain. This spring it expanded its speed initiative to other private and exclusive brands across the apparel and soft home categories. The percentage of the proprietary brand business of overall proprietary sales impacted by this speed initiative will increase from 25% at the end of 2016 to about 40% in 2017.

- Innovation: Kohl’s is leveraging technology to increase the percentage of inventory shipped from stores to fulfill online demand or online demand picked up in-store.

Supply-Chain Initiatives

- Speed: Kohl’s focuses on speed and localization initiatives to improve its supply chain. This spring it expanded its speed initiative to other private and exclusive brands across the apparel and soft home categories. The percentage of the proprietary brand business of overall proprietary sales impacted by this speed initiative will increase from 25% at the end of 2016 to about 40% in 2017.

- Innovation: Kohl’s is leveraging technology to increase the percentage of inventory shipped from stores to fulfill online demand or online demand picked up in-store.

Challenges and Priorities

During recent earnings calls, Macy’s management has commented on the huge challenge it has been to find the right size fit for its customers. It is difficult to standardize sizes and patterns for each of their brands when they have different manufacturing and sourcing partners. To ensure the stores have the size and color that the customer wants in stock, Macy’s need to build the assortments and hold sufficient stock for the best-selling styles.

Supply-Chain Initiatives

- Optimization: In 1Q17, Jeffrey Gennette, President and CEO of Macy’s, said the company has consolidated the number of suppliers it works with in the Far East and now has embedded teams in place to reduce the amount of approvals and steps in the buying process.

- Speed: Macy’s has also tried to speed up the decision-making process through greater collaboration. This has meant increasing the pace of the decision-making process and working closely with private brands and reacting with market changes more quickly―being more agile and thus able to make decisions more quickly.

- Innovation: Macy’s encourages its brand partners to be more creative and share opportunities through data and innovation.

Supply-Chain Initiatives

- Optimization: Spending on supply-chain technology has grown by 20% on average over the past five years.

- Innovation: Nordstrom expects to invest roughly $3.4 billion over the next five years. Roughly 40% of the company’s planned expenditure has been allocated to modernizing its tech platform, making digital and mobile enhancements and expanding the fulfillment network. Nordstrom acquired DS Co., a provider of cloud-based services, to track inventory and orders, and hence lower retailers’ costs by requiring them to hold less inventory.

Challenges and Priorities

According to Michael Koppel, Executive VP and CFO at Nordstrom, the retailer has been working through the operational challenges of operating an integrated in-store and online business, as it did not have all the systems fully aligned. Processing returns made online in-store and finding the right way to balance inventory are also key challenges the company faces. During recent earnings calls, management has also mentioned changing customer expectations―what customers expect nowadays is very different from what they had expected in the past.

Supply-Chain Initiatives

- Optimization: Spending on supply-chain technology has grown by 20% on average over the past five years.

- Innovation: Nordstrom expects to invest roughly $3.4 billion over the next five years. Roughly 40% of the company’s planned expenditure has been allocated to modernizing its tech platform, making digital and mobile enhancements and expanding the fulfillment network. Nordstrom acquired DS Co., a provider of cloud-based services, to track inventory and orders, and hence lower retailers’ costs by requiring them to hold less inventory.

Challenges and Priorities

A weak demand environment, warm weather, increased promotional activities and intense competition are the key challenges that Sears has mentioned on its recent earnings calls. The company intends to improve the performance of the apparel business through changes in sourcing, product assortment, space allocation, pricing, expense management and inventory-management practices.

Supply-Chain Initiatives

- Optimization: Sears is working on improving both flexibility and profitability in the supply chain by improving its sourcing capabilities.

- Speed: The company is making inventory across the entire store network available to members of its loyalty club so customers can search, find and purchase items regardless of physical location. The system enables the store closest to the customer to fulfill the order so it can be delivered faster and at a lower cost.

- Innovation: Sears is taking steps to connect the ecosystem of its stores and warehouses by leveraging technology and supply-chain platforms. This has allowed the company to deliver to 99% of US households within two days or less.

Challenges and Priorities

John J. Mulligan, COO of Target, reiterated that the challenge facing the company is to make retail shopping more experiential―in other words, delivering more of the inspiration that consumers can only find in the physical stores. He expects consumers to continue to be drawn to e-commerce to save time on shopping and emphasized that retailers need to understand how consumers’ preferences and expectations are evolving. By being able to anticipate the direction consumers are heading, retailers can find new ways to engage them at every stage.

Supply-Chain Initiatives

- Optimization: Target opened a new facility in the Northeast that will allow the retailer to test differentiated distribution capabilities, including store replenishment based on the appropriate unit of measure on every item. Target has also dramatically reduced hours of store labor that is dedicated to unloading trucks and stocking the sales floor, so that the store labor can focus on serving customers.

- Speed: At its Tribeca store in New York City, Target is ready to begin beta-testing of same-day delivery to customers at that store. Target Restock, which will begin rolling out to the Twin Cities, allows customers to place a restock order―a box filled with essential items, such as toothpaste, diapers, coffee and cereal―and have it delivered to their homes quickly for a low flat fee (constrained by a weight limit).

- Innovation: Target has allocated capital expenditure of more than $7 billion over the next three years to focus on technology and its supply chain. It plans to build a smart network that leverages all its stores and distribution assets to serve consumers more quickly and more flexibly in every channel. By digitalizing the supply chain, Target can gain insight into the potential operational challenges and determine appropriate pricing and delivery windows based on consumers’ preferences. These innovations are designed to provide more convenience, inspiration and faster fulfillment.

Challenges and Priorities

On recent earnings calls, Douglas McMillon, CEO of Walmart, has reiterated four priorities for the company:

- Make every day easier for busy families.

- Operate with discipline.

- Change how Walmart works by becoming a more digital enterprise.

- Deliver results and position the company to win.

Walmart focuses on sustainability and enhancing the shopping experience for its customers.

Supply-Chain Initiatives

- Optimization: It has doubled the efficiency of its truck fleet.

- Speed: Walmart controls the supply chain for its grocery business by having direct, long-term relationships with food growers.

- Innovation: Walmart has adopted new technology and apps to provide real-time information to improve in-stock levels and better manage inventory.

Amazon’s Supply-Chain Initiatives

Next, we look at how Amazon differentiates itself through supply-chain management.

Based on the three factors discussed above, we highlight a few examples to demonstrate what Amazon is doing compared to traditional retailers:

- Optimization: For its Prime Members, Amazon offers free two-hour shipping in eligible areas or free two-day shipping. To enable such an efficient logistics process, Amazon built fulfillment centers and warehouses close to major metropolitan cities a few years ago. During its first quarter 2017 earnings call, Brian Olsavsky, SVP and CFO, mentioned that most of the 51% year-over-year growth in capex was spent on expanding the fulfillment network. This echoed last year’s “Dragon Boat” initiative, which Bloomberg has said is a corporate strategy to take control of Amazon’s end-to-end supply chain globally. Amazon also formed a team to focus on the development of driverless technology, and also aims to achieve logistics automation, according to the Wall Street Journal.

- Speed: Amazon is continuously investing in technologies and products that automate the shopping process and speed up fulfillment. It’s Dash Button is a device that makes reordering certain products, such as detergent, as easy as the push of a button. Last year, Amazon also filed a patent for a flying warehouse concept that acts as a launchpad dispatching delivery drones for last-mile delivery. The concept calls for a blimp or airship that would act as a flying fulfillment center hovering in the air where demand for certain products is ramping.

- Innovation: According to The Seattle Times, Amazon now has over 45,000 robots in its warehouses. Powered by Kiva Systems, these robots can sort, pick and pack orders without any human intervention. In addition, Amazon launched a home virtual assistant Alexa―an AI-powered device that it hopes will become the central nervous system of the connected home―which enables shopping through voice commands. In late 2015, another patent filing from Amazon shows an on-demand apparel manufacturing warehouse that can quickly produce the product after an order is placed. The system would include an assembly line, cutters and textile printers.

Source: Amazon

Digitalization of the Supply Chain

In order to enhance optimization, speed and innovation of the supply chain, retailers will need to rely on digitalization to transform their sourcing and distribution processes as well as how they operate brick-and-mortar stores. The transformation would require every partner along the retail value chain to be involved.

Some examples of digitalization along the value chain include:

- Product design: Digital design software, cloud computing, virtual sampling, predictive analytics and 3D printing.

- Manufacturing: Internet of Thing (IoT) technology, sensors and digital printing.

- Distribution: Robots, autonomous vehicles, blockchain technology, radio-frequency identification (RFID) and near-field communication (NFC).

- Sales: Technology that tracks inventory and/or consumer behavior, which includes devices with radio-frequency identification (RFID) sensors that can track the location and movement of items in-store, as well as track consumer behavior in-store.

On the supply-chain side, end-to-end inventory tracking through IoT enables closer integration with all stages of the supply chain, i.e., distribution, supporting more efficient operations and limiting the occurrences of misplaced or out-of-stock items.

Connected supply chains also increase the opportunities for customers to connect and interact with products, and retailers to capture new revenue opportunities. In-store connected technology increases merchandise engagement—for example by using smart mirrors that enable customers to virtually try on items or through NFC tags that send information about an item to the customer’s smartphone.

For more detailed analysis of digitization of the supply chain, please refer to our reports:

IoT in Retail—Digitalizing Brick-and-Mortar Stores and

An Overview of the Digitalization of the Apparel Supply Chain.

Conclusion: Innovate or Die

The brick-and-mortar channel is currently losing the growth fight to e-commerce. As a result, major retailers are undertaking new supply-chain initiatives focusing on optimization, speed and innovation in order to survive in the new digital commerce era. The premise is to make physical retailing as convenient as online shopping for the consumer, and to achieve operational efficiency based on an omnichannel business model. Given the speed of technological innovation, traditional retail businesses are faced with an “innovate or die” proposition and one major area that requires innovating is their supply chains. By digitalizing the way goods are designed, produced, sold and delivered, retailers stand to benefit from operational efficiency as well as new revenue opportunities, competing more effectively in a digital world.