Executive Summary

This is the second report in our series X Factor series in which we identify themes that we believe will be critical for the US retail landscape in the second half of 2017 and beyond. In this report, we focus on the store. We look at US store activity, presenting recent store opening and closure activity in the US, analyze the challenges and opportunities for retailers against this backdrop and recommend solutions for retailers to best position themselves.

The Store as an X Factor of Retail

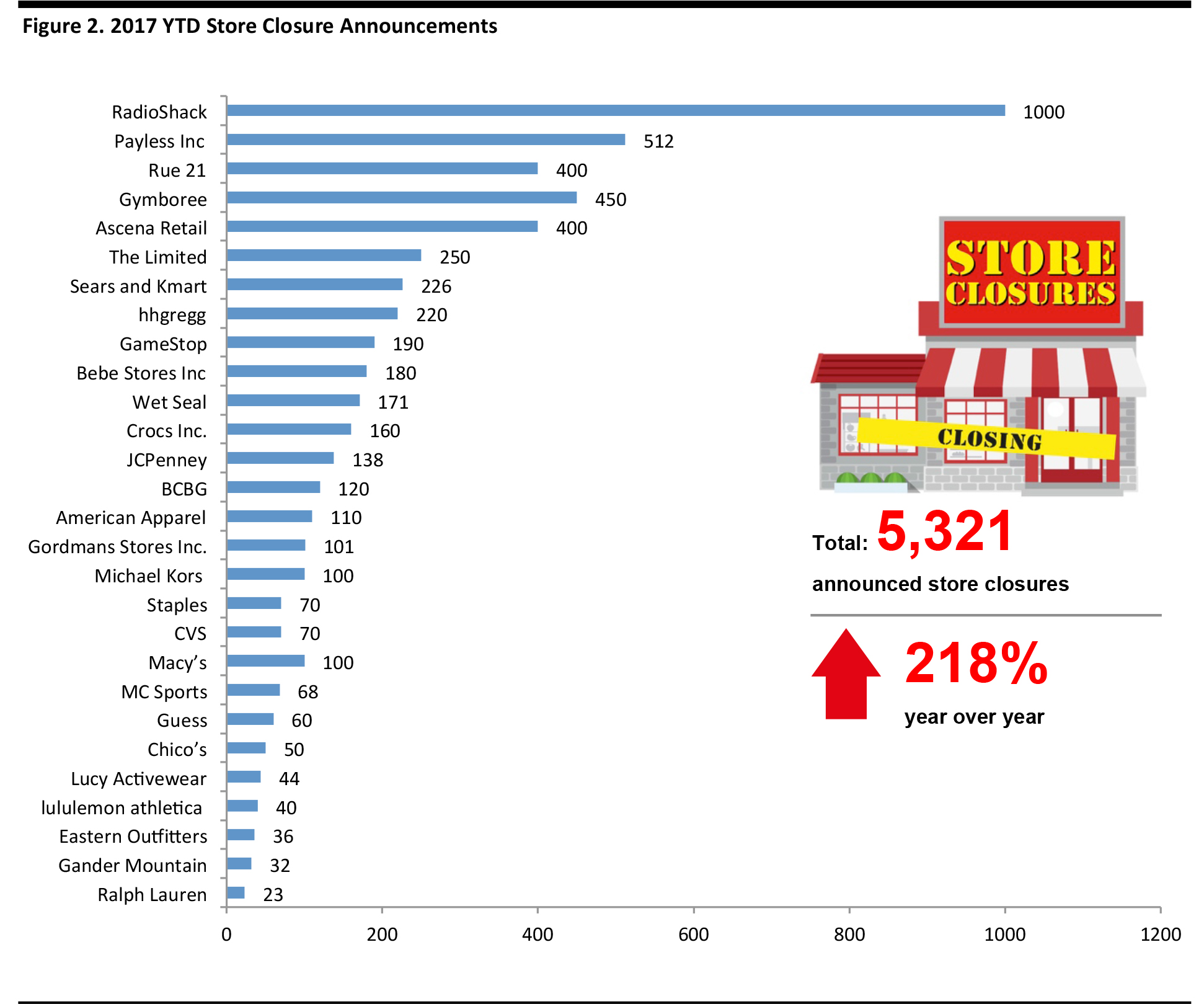

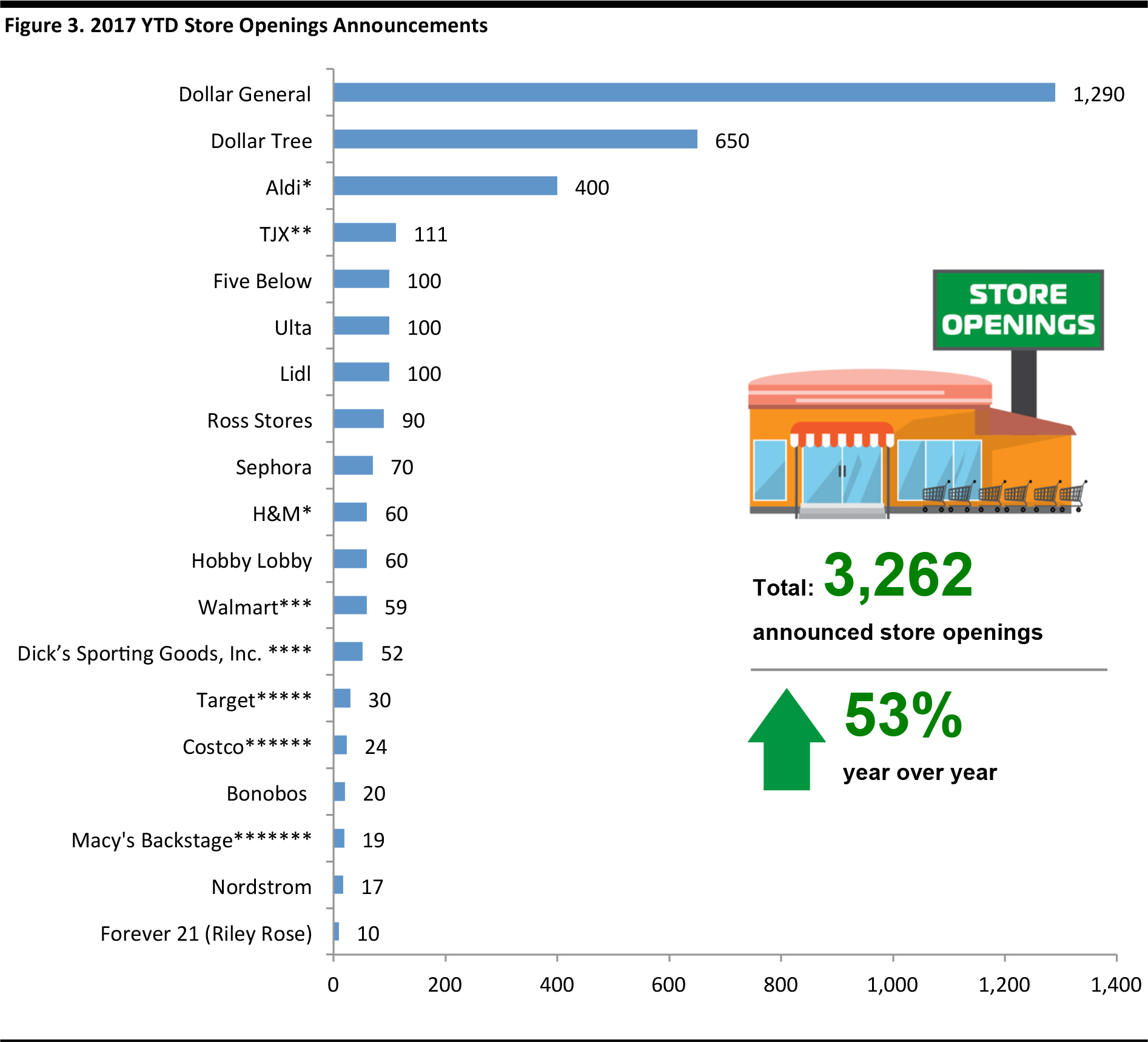

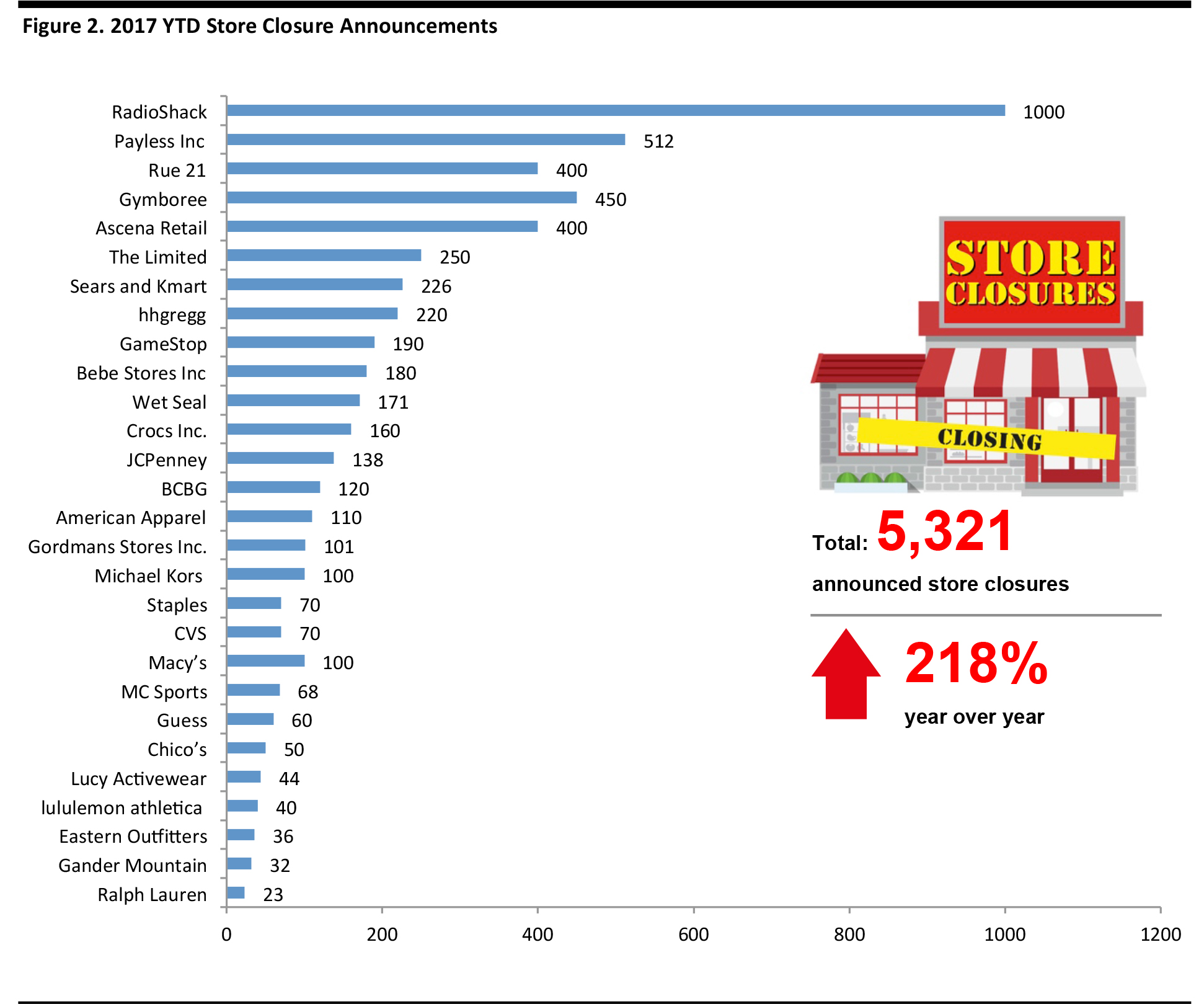

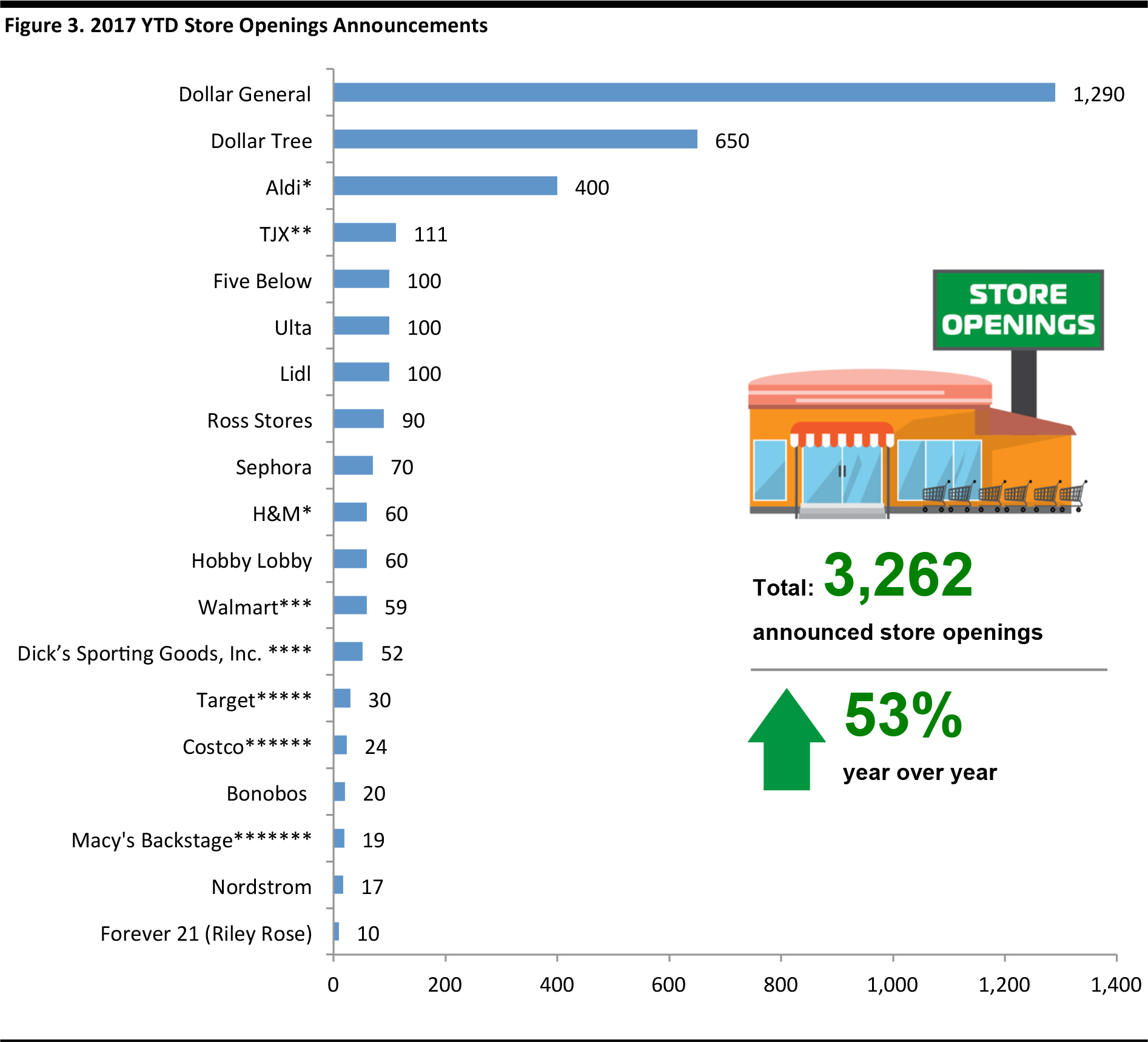

So far, 2017 has been a difficult year for the retail industry―the number of store closures since the start of the year has already outpaced the average in the past decade. Year to date, 28 major retailers have announced plans to close stores―the latest count is 5,321 stores, an increase of 218% year over year, far exceeding the number of store openings for the same period, at 3,262. We believe the store will remain a crucial touchpoint with customers, and, as such, will be one of the key “X factors” for the US retail industry that will either make or break a retailer. We expect more store closure announcements over the course of 2017, as retailers search to strike the right balance of online versus offline exposure.

Department Stores and Specialty Retailers Are the Primary Casualties

More than 5,300 store closures have been announced year to date in 2017, among which are over 5,000 stores shuttered by 23 department stores and specialty retailers. We see traditional retailers struggling to cope in a retail environment that favors a strong online presence, omnichannel initiatives and an optimal store presence.

Drivers of Store Closures

We believe the slew of store closures is symptomatic of several structural changes taking place in the retail industry.

- The US is overstored: Following an extended period of store expansion, the US topped the world with 23.5 square feet of retail space per person in 2016. This compares to 16.4 square feet in Canada and 11.1 square feet in Australia.

- Consumers are shifting to online shopping: The rise of online shopping has been driving consumers away from malls and to their PCs and mobile phones. This has led to declining mall traffic, as consumers embrace e-commerce.

- An over-levered capital structure is amplifying the situation: Among the major retailers that we track, 10 companies―unable to withstand the debt pressure―have filed for bankruptcy so far in 2017. Seven of the 10 bankrupt retailers had high levels of debt, mostly the result of previous leveraged buyouts orchestrated by their private equity owners.

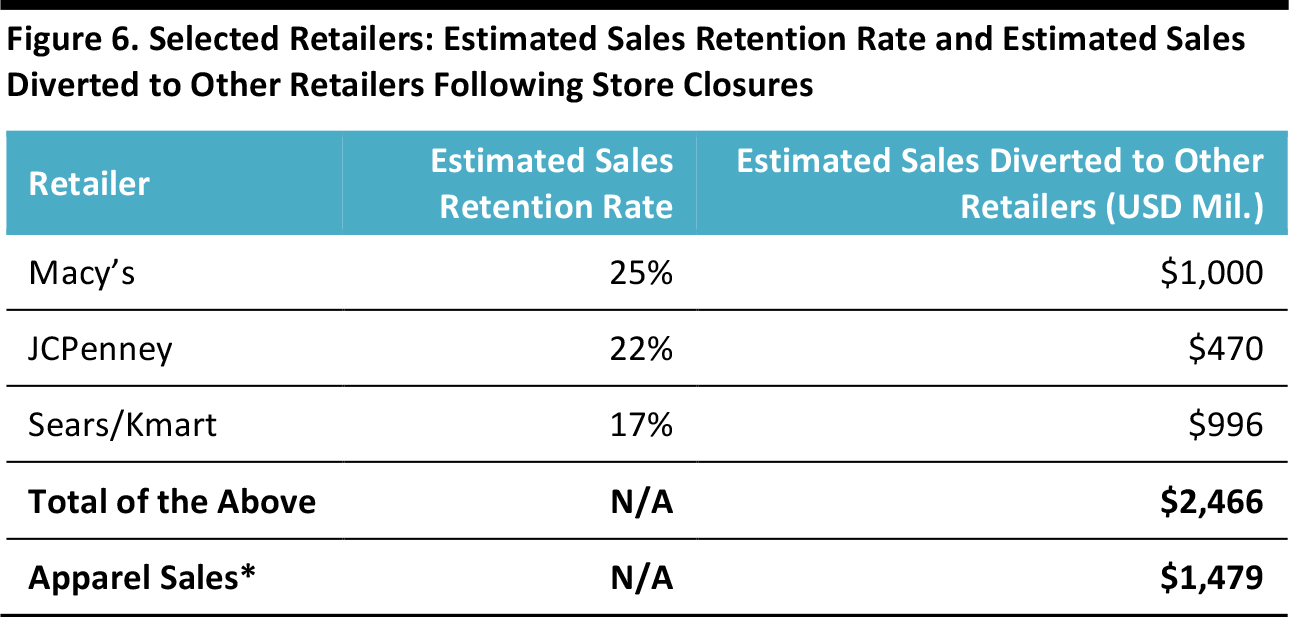

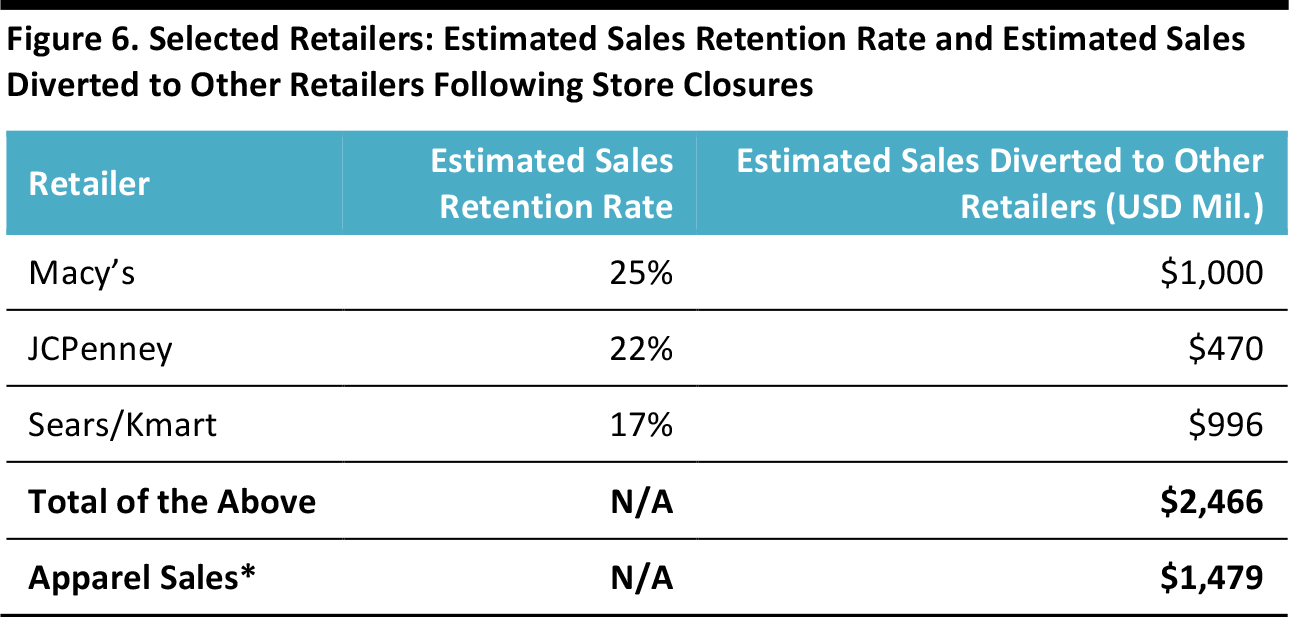

Outlook―Expect Capacity Rationalization

The physical retail market is currently imbalanced, and we forecast there will be more store closures throughout the year until equilibrium is reached. As retailers further consolidate their physical presence, they will begin to see higher operating leverage and greater productivity from remaining stores. Our analysis of potential opportunities in the event of store closures across the JCPenney, Macy’s, Sears and Kmart department-store chains indicate that approximately $2.5 billion in sales will flow to competing retailers. In our view, the beneficiaries are the stronger retailers who are well positioned to receive sales diverted from the closed stores of their competitors, such as Walmart and Macy’s (among others).

Growth Spurts―Which Formats Are More Defensive?

Some retailers are faring better than others; these include fast fashion, discounters and e-tailers, which are all opening stores.

Natural Selection―Who Will Remain Standing?

However, this gloomy outlook is not without its opportunities. In order to adapt to the new norm, retailers need to focus on innovation and value creation for consumers. Both traditional retailers and e-tailers have made attempts to boost sales, with varying degree of success.

The retailers we expect to benefit are those best positioned to adapt to the new norm―i.e., those launching new store formats, moving forward with effective omnichannel initiatives and successfully integrating technology into their retail operation.

- New store formats: New store formats such as pop ups and smaller formats better meet the needs of consumers’ changing preferences―Target has opened smaller store formats and Amazon is experimenting with physical grocery and book stores.

- Effective omnichannel retailing: Retailers can provide a seamless shopping experience across channels and collect data that can be introduced and used for better business planning.

- Integration of technology into retail: Retailers can invest in in-store technology to enhance the customers’ experience.

Slow adopters will likely be further marginalized, in our view.

Source: Fung Global Retail & Technology

About the X Factor Series

X Factor―Competitive Advantages that Could Revolutionize an Industry

Overall, the US retail industry continues to be challenged. We believe US retailers’ performance will continue to diverge:

- E-tailers such as Amazon will continue to benefit from increased wallet and market share.

- Traditional retailers will continue to suffer from sales lost to online rivals and be pressured by the increasing shift of consumption online.

We believe opportunities remain for those retailers that are quick to adapt. We use this X Factor series to identify themes that we believe will be critical for the US retail landscape in the second half of 2017 and beyond.

We start each report by introducing the recent developments in relation to that factor. In this report, we explore store opening and closure activity as one factor influencing the retail industry. In the second section, we analyze the challenges and opportunities, and finally, we conclude with strategies and solutions that retailers can adapt to address the challenges and give them a competitive advantage.

Overview

So far in 2017, the US retail industry has been overshadowed by an unprecedented level of store closurures and bankruptcies. Traditional retailers are facing competitive pressures from an overstored retail environment, declining mall traffic and consumers increasingly shifting to online shopping from offline. Department stores and specialty retailers are among the hardest hit, and we expect store closures to be an ongoing theme in retail until a new equilibrium is achieved.

Source: iStockphoto

Store Closures

Since the start of 2017, 28 major retailers, including household names such as JCPenney, Macy’s and Sears, have announced plans to close 5,321 physical stores in the US, 282% more than the total number of store closures for all of 2016.

Department stores and specialty retailers are undergoing the most rigorous consolidation seen in years, with over 5,000 of the shuttered stores belonging to 23 retailers in these categories.

Gymboree announced closing 350-450 stores. Ralph Lauren's store closing number was part of the 50-store closure plan announced in June 2016. Payless will close an additional 296 stores if negotiations with landlords are unsuccessful. Ascena will close between 268 and 667 stores by July 2019, depending on negotiation with landlords.

Source: Company reports/Fung Global Retail & Technology

Store Openings

Year to date, 19 major retailers have announced plans to open 3,262 stores in 2017, a 53% year-over-year increase and relatively modest compared to the store closure activity for the same period. Despite the challenging retail environment and the continuous wave of store closures, some retailers are still determined to expand their footprint. Store opening activity has been concentrated in the discounters, fast fashion and specialty beauty verticals. Retailers in these verticals are relatively unfazed by the current macro environment, although some have become less aggressive than their initial store opening plans.

Aldi will complete 400 stores expansion by the end of 2018. Walmart’s target of 59 stores includes new, expanded and relocated stores. Target is only opening stores in small format. Macy’s Backstage will be opened within existing full-line Macy stores.

Source: Company reports/Fung Global Retail & Technology

Discounters, Fast Fashion and Specialty Beauty Opening the Most Stores

In the following section, we identify the retailers (by verticals) that have been expanding.

Discounters

Discounters such as dollar stores are opening stores, as their value-for-money proposition is popular among consumers. German discount grocery chain

Aldi plans to open 400 stores in the US by the end of 2018.

Fast Fashion

Fast-fashion retailers such as H&M―which are popular among young consumers―are expanding their physical presence. Although H&M’s expansion plan was less aggressive than what had been initially announced, mainly due to difficulties in physical retail, we consider it a bright spot in an otherwise gloomy retail market.

Specialty Beauty

Specialty beauty retailers such as

Sephora and

Ulta are faring better than the average retailer. Both of these companies have invested to create a unique shopping experience for consumers:

Sephora has expert store associates who provide professional beauty advice to consumers, while

Ulta has equipped its stores with salons to provide customers with beauty treatments in-store.

Big-Box Retailers Trialing New Store Formats

Big-box retailers are opening new store formats to align with consumers’ shifting preferences in favor of convenience.

- Target has been experimenting with a smaller store format to appeal to millennials. These stores feature organic, natural and gluten-free options.

- Walmart opened Walmart Express and Kohl’s opened small format stores of 35,000 square feet to appeal to customers. Kohl’s CEO said that the aim is to achieve a rationalization of square footage, and not necessarily fewer stores.

Online Players Moving Offline

We are seeing increasingly more e-tailers opening physical stores to complement their online platforms.

- Amazon has opened physical book stores and is experimenting with its Amazon Go stores, fully automated grocery stores that do not require cashiers.

- Men’s fashion brand, Bonobos, moved offline to open GuideShops, which serve as showrooms for customers to try on product with one-on-one consultations.

�Bankruptcies

While some retailers are closing stores to mitigate the impact of decelerating sales, others have been pushed to the brink of bankruptcy. We expect more retailers to file for bankruptcy this year.

- Sporting goods companies including Eastern Outfitters and MC Sports have also filed for bankruptcy, citing difficulties in growing sales and too heavy a debt load.

- Apparel retailers including The Limited, American Apparel, BCBG and Wet Seal have gone bankrupt. The common thread to their poor financial performance was an inability to respond to the rapidly evolving fashion trends and consumer tastes.

Private Equity-Backed Retailers

Some highly levered retailers that filed for bankruptcy had been acquired in leveraged buyout deals by private equity funds. Leveraged buyouts, a preferred method of acquisition by private equity funds, refer to the financing of an acquisition with a small amount of equity and substantial debt. Leverage amplifies the risk during challenging times, forcing these highly leveraged retailers to close stores to generate liquidity, or even file for bankruptcy as a result.

- The Limited and Wet Seal are examples of retailers that have succumbed to the pressure of bankruptcy. Neiman Marcus is reported to be struggling from high indebtedness.

Acquired Retailers

Some brands that filed for bankruptcy have been acquired.

- Eastern Outfitters was acquired by UK sports retailer Sports Direct, which assumed both the intellectual property and the remaining stores. The brand continues to sell at its remaining stores.

- American Apparel has started selling its products again after being acquired by Canada-based Gildan Activewear at its bankruptcy auction. The brand built its reputation around quality and American manufacturing. After the change of ownership, American Apparel will keep some of its manufacturing in the US and charge a 25% premium on product made in the US.

Source: Company reports/Fung Global Retail & Technology

Analysis

Challenges

In our view, the key challenges facing retailers that could potentially lead to bankruptcies and store closures include:

- Direct competition from e-tailers such as “everything” store Amazon.

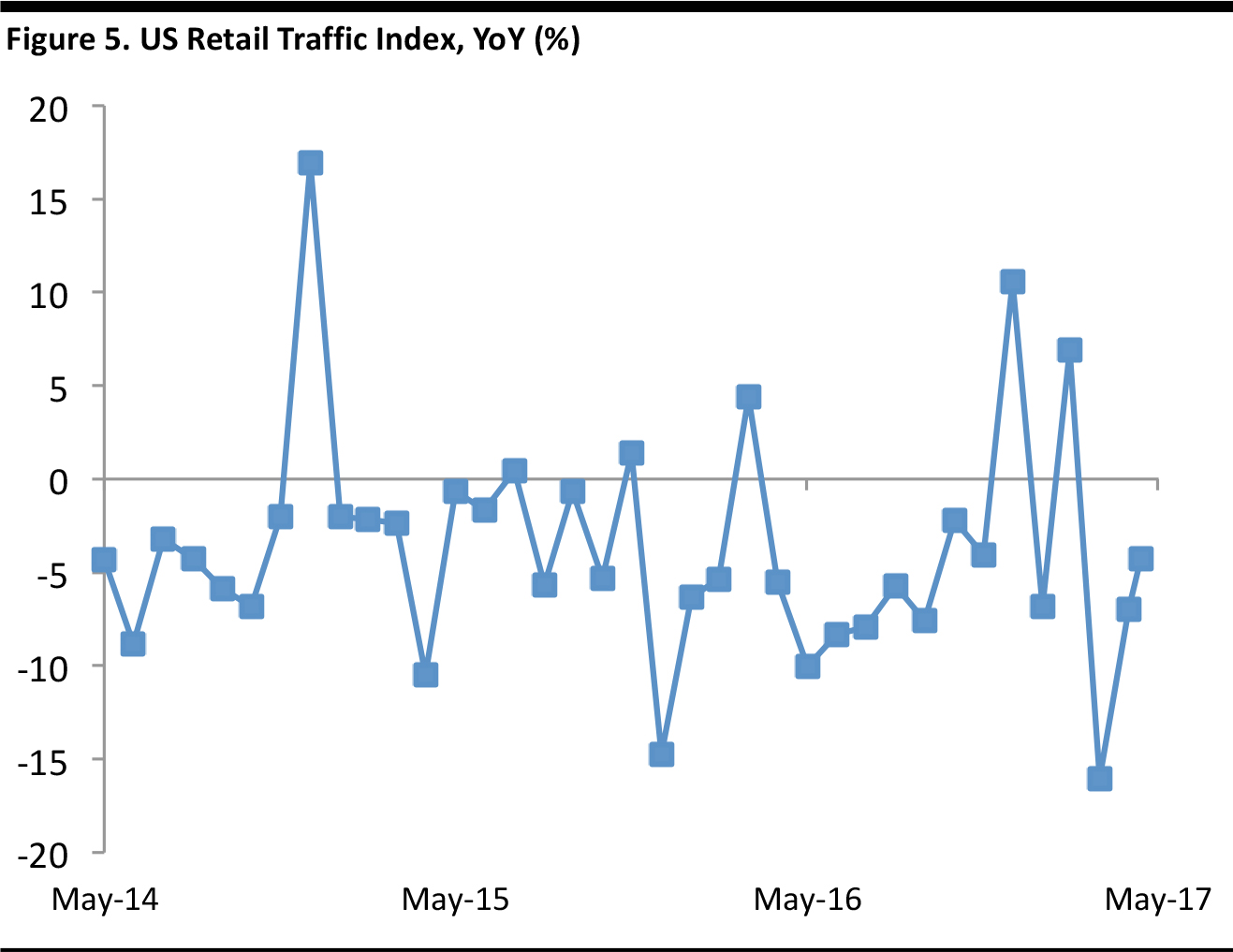

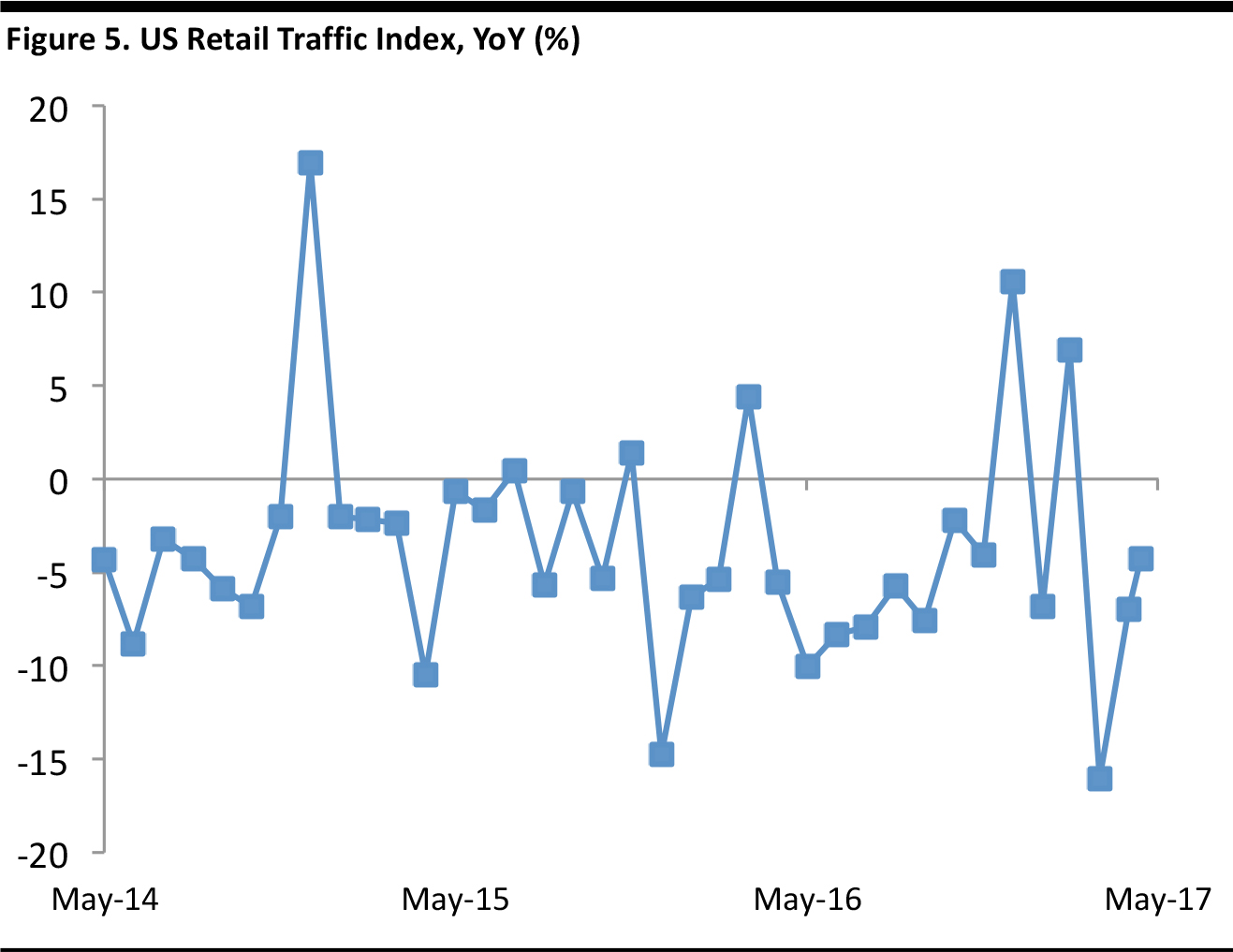

- An overstored industry: Many retailers are overstored, due to their aggressive physical expansion in prior years. These retailers are under pressure to cut back their physical store footprint, as a result of the structural shift to online shopping. According to Bloomberg, the US Retail Traffic Index was (4.2)% in May 2017, compared to the recent three-year average of 4.3%.

- The retail environment is heavily promotional: Discounting at stores has now become the norm in order to entice customers to buy at the stores, which has compressed retailers’ margins.

Source: Bloomberg

Opportunities

In our view, the recent spate of closures is not necessarily a bad thing―with it comes opportunities. Drawing insights from our report on the

Opportunities from US Department Stores’ Closures, we estimate that approximately $2.5 billion in sales will flow to competing retailers as a result of the 380–390 store closures across the JCPenney, Macy’s, Sears and Kmart chains, some $1.5 billion of which will be in the clothing, footwear and accessories categories.

When a retailer closes a store, it does not necessarily lose out on all of the sales associated with that store: other nearby stores of the retailer as well as its transactional website can pick up some of the lost sales, especially if the company has an established loyal customer following. The table below details our estimates of the proportion of sales retained by these retailers following store closures.

* Includes some elements of cosmetics (at Macy’s), Sephora (at JCPenney) and soft home goods (at Sears/Kmart).

Source: Company reports/Fung Global Retail & Technology

- The dollar value of the sales likely to be distributed to rival retailers as a result of closures at these chains.

- How much of the revenue JCPenney, Macy’s and Sears Holdings will be able to hold on to through other stores or e-commerce, in the aftermath of these closures.

- The incremental profit benefit of sales transference to remaining stores.

Effects of Operating Leverage

Retailers that optimize their store footprint will likely enjoy a boost to their earnings, as the majority of costs in brick-and-mortar retailing are fixed and the comps at store that remain open improve. Store rents, utility bills, taxes and depreciation, for example, remain much the same regardless of how much a retailer sells. Even in-store labor is largely a fixed cost, as a retailer will always need to employ a certain number of staff for the store to function.

Winners and Losers

Winners: The winners under the current retail environment are value plays such as fast fashion, discounters and e-tailers.

Losers: Slow adopters are likely to lose out. For the department stores and specialty retailers that are the hardest hit by store closures, their roles within the retail industry are increasingly at risk of being replaced by e-tailers. Should they fail to innovate, these retailers will likely continue to struggle.

How Retailers Can Cope

We outline three primary ways retailers can adapt to the new norm in retail: 1) overhauling their store portfolio; 2) enhancing their omnichannel strategies; and 3) creating a community for their customers.

1) Overhauling the Store Portfolio

Retailers can try to improve the performance of their brick-and-mortar stores by overhauling the design and layout, in addition to shuttering excess or non-profitable stores. Some retailers are moving to the following new store formats in order to raise store productivity:

- Store-in-store: This idea has been around for a long time, most notably employed by Sephora to build its successful stores inside JCPenney. This tactic is particularly relevant for brands that traditionally rely on department stores as a distribution channel. With store-in-store, these brands can now provide consumers with a full brand experience, without bearing the heavy financial and operational burden of a standalone store.

- Pop-up store: This is a similar concept to the store-in-store, with the difference being a store-in-store has a designated space within a retailer. Pop-ups usually appear for a short while inside a shopping mall, attracting consumers with time-limited offerings and eye-catching store design.

- Smaller stores: Retail stores in the US, especially those of big-box retailers and department stores, are known for their huge floor space. However, this has proven to be inefficient and increasingly costly under the current retail environment. US retailer Target has been experimenting with small format stores and finding success, and as a result, its expansion plans will likely continue to focus on smaller stores.

2) Enhancing Omnichannel Strategies

- Leverage technologies: The store experience can be better delivered to consumers through effective use of in-store technology. Beacon-based technology can allow store operators to better understand consumers’ shopping behavior and unlock the experience by adding gamification features that help with engagement. Technologies that empower store associates and provide seamless checkout can also be introduced to smooth out customer service and increase the efficiency of store operations.

- Physical retailers and reallocation of resources to digital: Traditional retailers are suffering the most under the current retail environment. It is, therefore, imperative for retailers to allocate more resources to technological improvements within the value chain. With store closures expected to continue, the proceeds eventually saved should be spent on developing technologies that can help level the playing field against e-tailers. Walmart has been investing heavily in its e-commerce arms with the aim of boosting online sales―it acquired Jet.com, ModCloth, ShoeBuy and Moosejaw for a total of $3.5 billion all within a year.

- Online retailers moving offline: Online retailers are also recognizing the value in having a certain physical presence. Amazon is actively expanding into the physical space, first with its book store and now with the cutting-edge Amazon Go grocery stores. And just very recently, Amazon announced its definitive agreement to purchase the grocery chain Whole Foods for $13.7 billion. The acquisition will add over 460 stores under Amazon, further proving the value of physical stores. A sound physical presence allows e-tailers to tap into a new market and open up a physical sales channel, which still accounts for the majority of US retail sales.

3) Creating a Community for Consumers In-Store

The concept of retail community has been gaining traction in recent years, as retailers actively look for means to engage consumers and increase traffic. With the threat of e-commerce looming, traditional retailers realized that brick-and-mortar stores have an advantage in fostering a sense of community, which e-tailers lack.

- Pirch, an appliance and furniture store, organizes events and classes at its interactive showroom to connect with customers.

- Vitamin Shoppe, a nutritional supplement retailer, is revamping existing stores as “wellness locations” with in-store beverage bars and open spaces for gatherings with health enthusiasts on site.

The key to creating a strong community is the ability to connect with one’s target customers and create a brand experience. Unique in-store experiences and services that customers can enjoy on the spot are effective ways to achieve that.

Conclusion

The outlook for the physical retail industry is challenging. The recent wave of store closures and bankruptcies announced so far in 2017 are symptoms of underlying structural trends:

- The US is overstored after an extended period of expansion.

- The rise of online shopping has been driving consumers away from malls and to online retailers.

- The excessive use of leverage by private equity owners of retailers has amplified the negative impact of weak operations, driving some retailers to bankruptcy.

The rest of 2017 will likely remain challenging for retailers, and we expect more store closure and bankruptcy announcements. However, we do not believe this currently bleak environment signals the demise of physical retail. Instead, we believe physical retail will undergo a round of consolidation until equilibrium is reached. With fewer stores, the productivity of each store will likely improve, thus allowing the retailer to enjoy the effects of operating leverage. In addition, sales will be directed to other retailers in the event of closures of competing stores, in our view. For example, we believe that Walmart and Target are set to benefit from the store closures of JCPenney, Macy’s and Sears.

Ample opportunities exist for retailers who are ready to change. To position themselves for the opportunity, it is imperative that retailers consider the following:

- New store formats: Open store formats such as pop-ups and smaller formats that meet the needs of consumers’ changing preferences.

- Effective omnichannel retailing: Provide a seamless shopping experience across channels by enhancing omnichannel retailing.

- Integration of technology into retail: Invest in in-store technology to enhance the customers’ experience.