Web Developers

As part of our Retail Revolution series, this report brings together significant data points that chart the changing nature of the US apparel market and allow us to dig deeper into some established narratives and preconceptions. Top takeaways include:

The revolution in US retail is perhaps more evident in apparel than in any other category. E-commerce players, international “invaders” and off-price retailers are creating a whirlwind of disruption for middle-ground incumbents.

In this report, we bring together data from company filings, market-research firms and consumer surveys to illustrate in 20 charts the shifts in the US apparel market. We also use data to explore some established narratives, including those about Amazon’s scale in apparel and the growth of fast-fashion retailers.

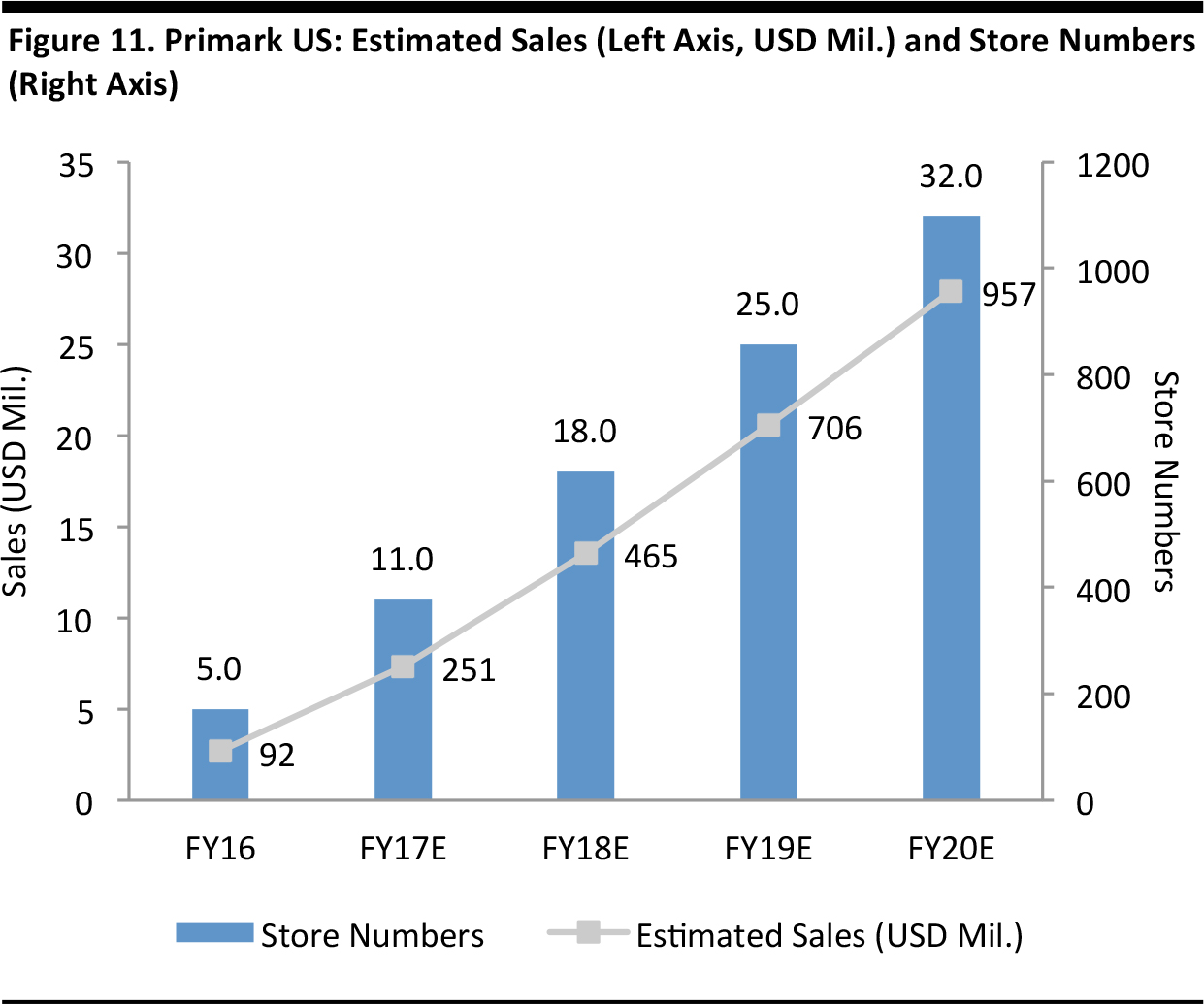

Among the subjects we cover are consensus expectations for growth at the biggest apparel retailers in fiscal year 2018, H&M’s sharp downturn in US trading, estimates for store numbers and revenues at Primark, and data on where US consumers shop for womenswear, menswear and footwear.

The following sections cover:

The revolution in US retail is perhaps more evident in apparel than in any other category. E-commerce players, international “invaders” and off-price retailers are creating a whirlwind of disruption for middle-ground incumbents.

In this report, we bring together data from company filings, market-research firms and consumer surveys to illustrate in 20 charts the shifts in the US apparel market. We also use data to explore some established narratives, including those about Amazon’s scale in apparel and the growth of fast-fashion retailers.

Among the subjects we cover are consensus expectations for growth at the biggest apparel retailers in fiscal year 2018, H&M’s sharp downturn in US trading, estimates for store numbers and revenues at Primark, and data on where US consumers shop for womenswear, menswear and footwear.

The following sections cover:

Introduction

The revolution in US retail is perhaps more evident in apparel than in any other category. E-commerce players, international “invaders” and off-price retailers are creating a whirlwind of disruption for middle-ground incumbents.

In this report, we bring together data from company filings, market-research firms and consumer surveys to illustrate in 20 charts the shifts in the US apparel market. We also use data to explore some established narratives, including those about Amazon’s scale in apparel and the growth of fast-fashion retailers.

Among the subjects we cover are consensus expectations for growth at the biggest apparel retailers in fiscal year 2018, H&M’s sharp downturn in US trading, estimates for store numbers and revenues at Primark, and data on where US consumers shop for womenswear, menswear and footwear.

The following sections cover:

The revolution in US retail is perhaps more evident in apparel than in any other category. E-commerce players, international “invaders” and off-price retailers are creating a whirlwind of disruption for middle-ground incumbents.

In this report, we bring together data from company filings, market-research firms and consumer surveys to illustrate in 20 charts the shifts in the US apparel market. We also use data to explore some established narratives, including those about Amazon’s scale in apparel and the growth of fast-fashion retailers.

Among the subjects we cover are consensus expectations for growth at the biggest apparel retailers in fiscal year 2018, H&M’s sharp downturn in US trading, estimates for store numbers and revenues at Primark, and data on where US consumers shop for womenswear, menswear and footwear.

The following sections cover:

- The Top Retailers

- Amazon and E-Commerce

- Off-Price

- Fast Fashion

- Athleisure

- Store Closures

- Where Consumers Shop

The Top Retailers

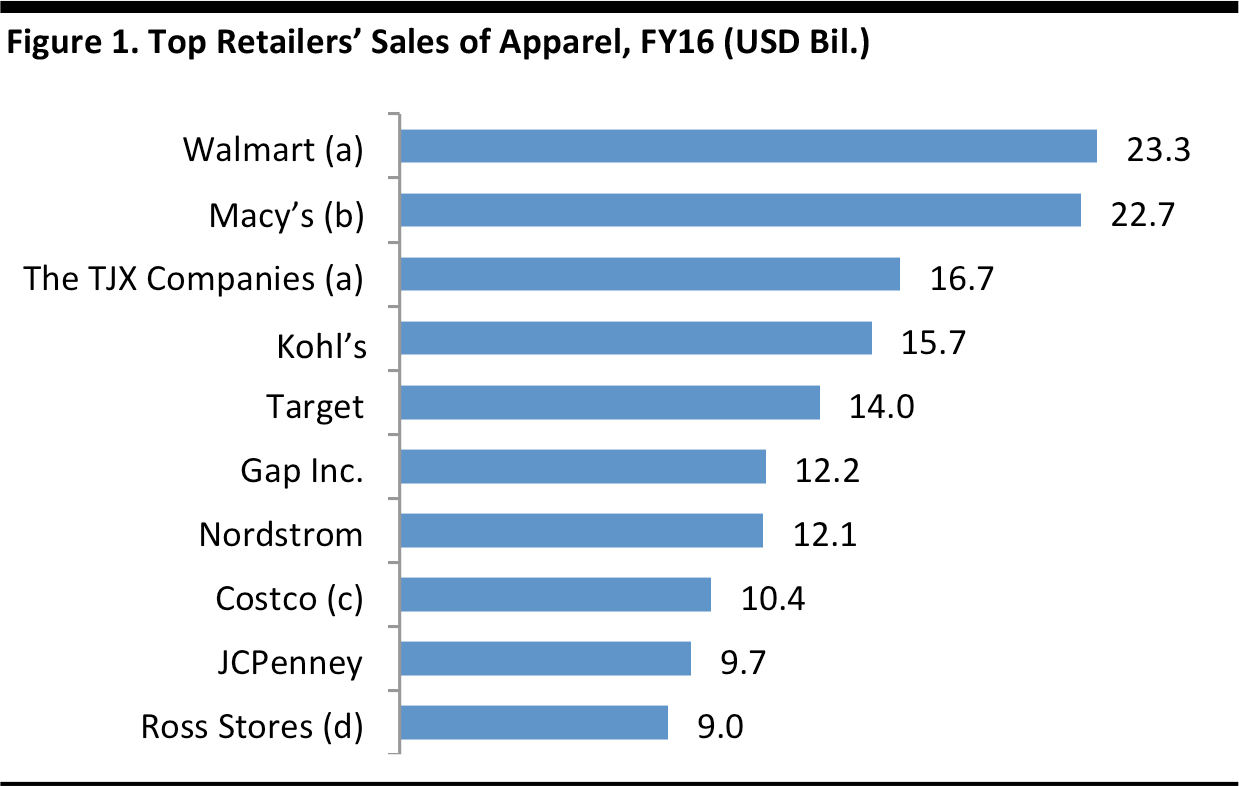

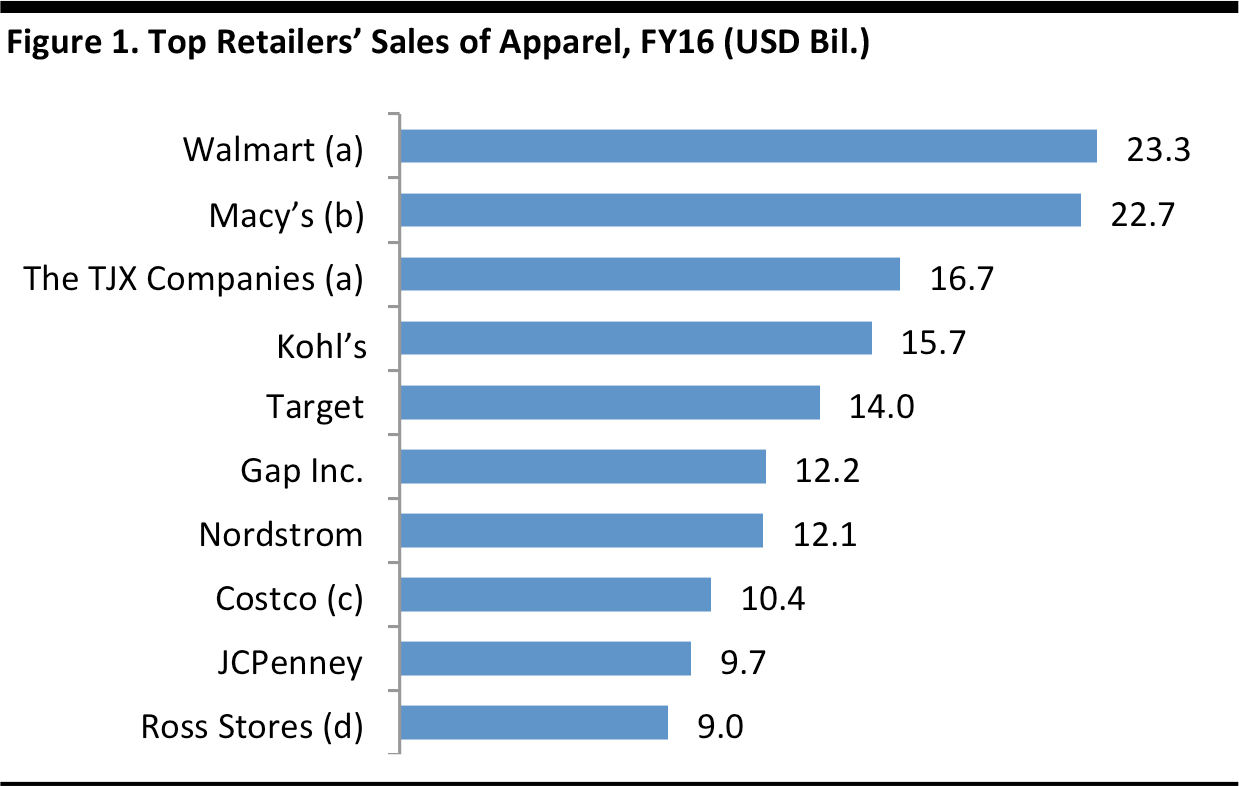

All data are for fiscal year ended January 2016, except for Costco, which is for fiscal year ended August 2016. All data are for US revenues only. (a) Including jewelry; TJX total is $13.1 billion excluding apparel accessories and jewelry. (b) Including cosmetics (c) Softlines, which include apparel and small appliances (d) Including jewelry and fragrances Source: Company reports/Fung Global Retail & Technology

We begin with a ranking of America’s 10 biggest clothing, footwear and accessories retailers. Walmart overtook Macy’s to become the top apparel retailer in the year ended January 2016, we estimate. Two of the top 10 apparel companies are off-price retailers: TJX Companies, which includes the T.J.Maxx and Marshalls chains, and Ross Stores. Value retail is further represented by Walmart, Target and Costco, and four of the top 10 are department store retailers: Macy’s, Kohl’s, Nordstrom and JCPenney. Only one, Gap (including Old Navy and Banana Republic), is a specialized nondiscount retailer. Amazon, with an estimated $5.5 billion in apparel retail sales in 2016 (excluding third-party sales on its site), fails to make the top 10. But if Amazon can grow its first-party sales by around 20% a year, it will be retailing an estimated $9 billion of apparel by 2019.

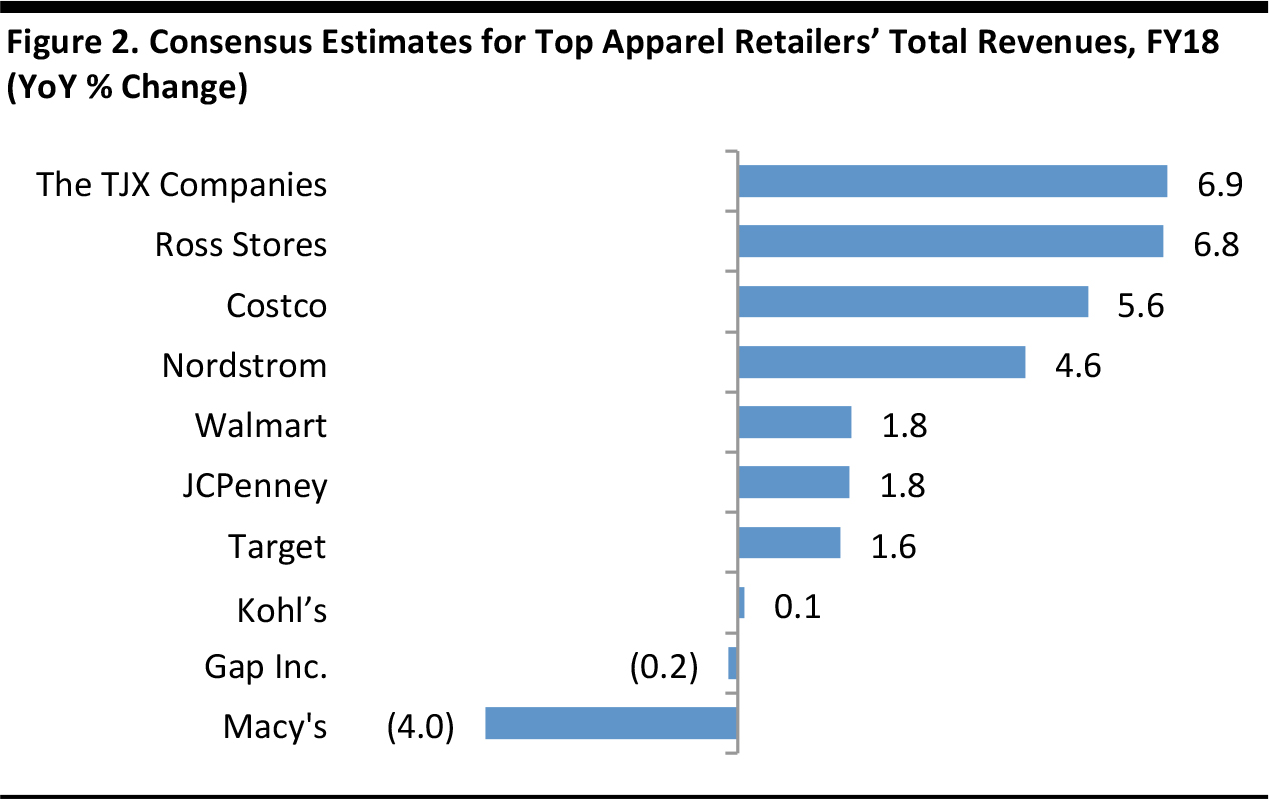

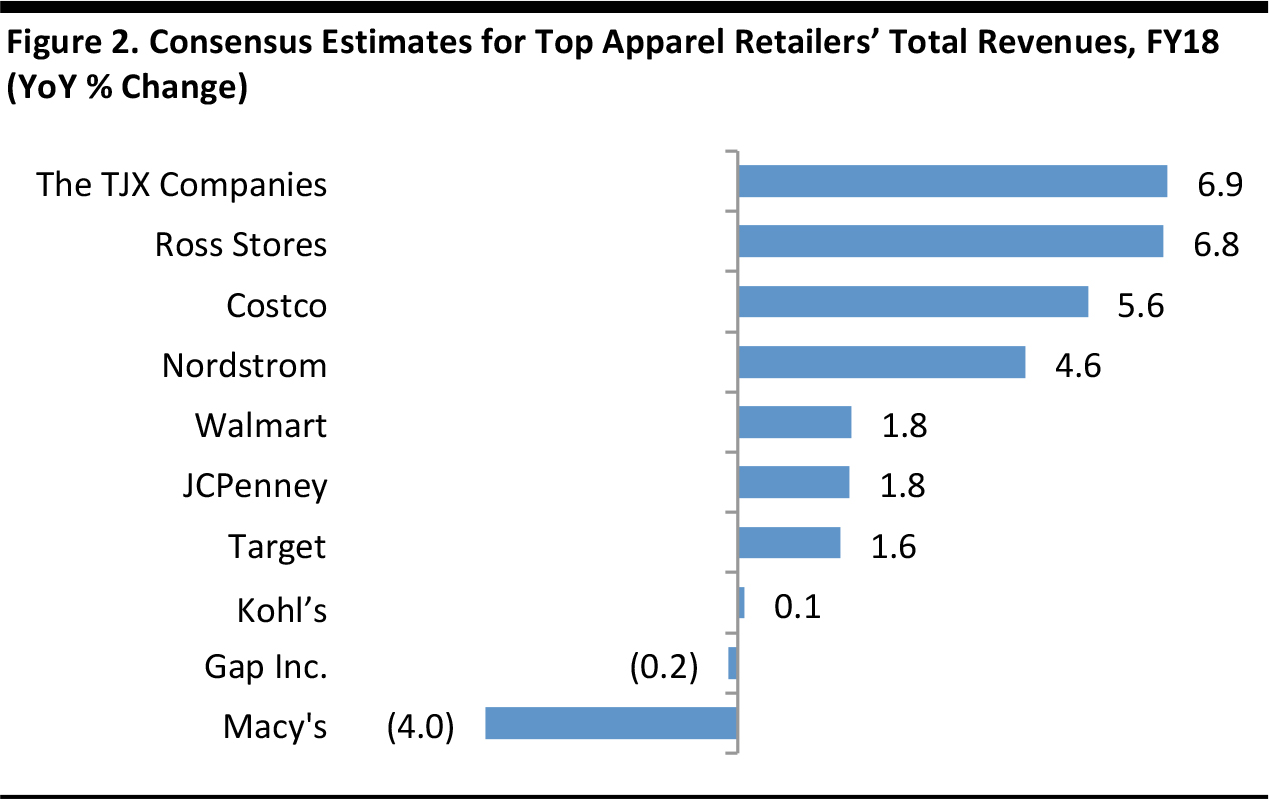

As of February 7, 2017. Data are for total company revenues, including any nonapparel revenues and non-US revenues. Source: S&P Capital IQ/Fung Global Retail & Technology

Above, we chart analysts’ consensus expectations for total revenue growth among these retailers in fiscal year 2018. We look ahead to 2018 because fiscal 2017 has finished for all but one of the top 10 retailers (Costco is the outlier; its fiscal 2017 year ends in August). It will surprise few readers that the off-price and discount channels are set to be the strongest performers among the biggest retailers. The anticipated revenue decline for Macy’s is in the context of store closures (an issue we cover later in this report).Amazon and E-Commerce

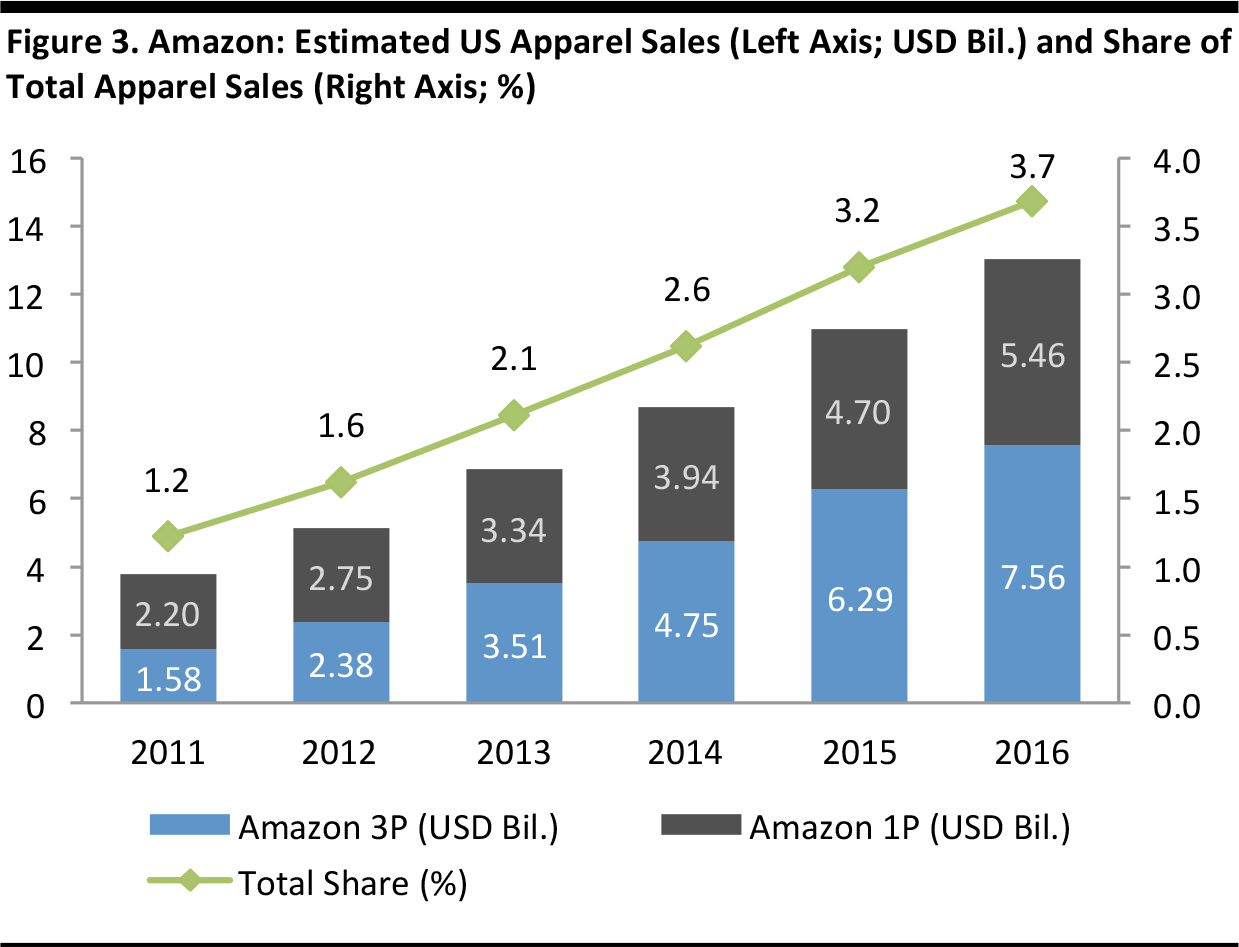

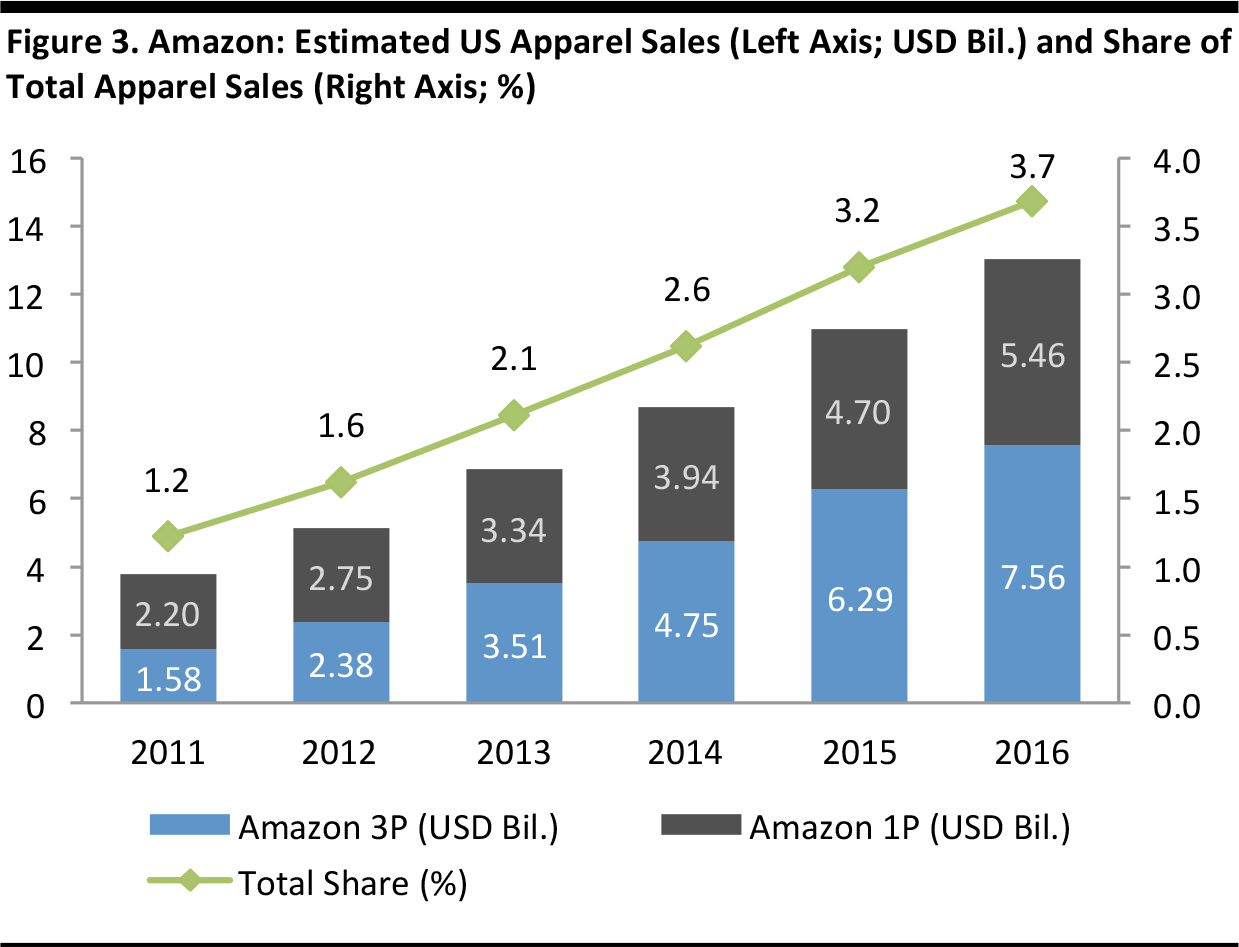

3P = third-party sellers; 1P = Amazon’s own retail sales (first party). Source: Euromonitor International/Fung Global Retail & Technology

Many analysts have attempted to estimate Amazon’s sales in the apparel category, but these estimates are typically based on little hard data. The picture is complicated by third-party (3P) sales, which now make up half of Amazon’s total sales. According to Euromonitor International estimates, clothing and footwear sales made through Amazon US totaled $13 billion in 2016. This was a $9 billion increase from five years earlier. However, $7.56 billion of the 2016 sales were Amazon Marketplace sales. Amazon fails to make our ranking of the top 10 retailers because it functioned as simply a portal, not a retailer, for more than half its sales. As estimated by Euromonitor, apparel accounted for about 13% of Amazon’s 2016 US gross merchandise volume (GMV), which seems a sensible ballpark figure to us.

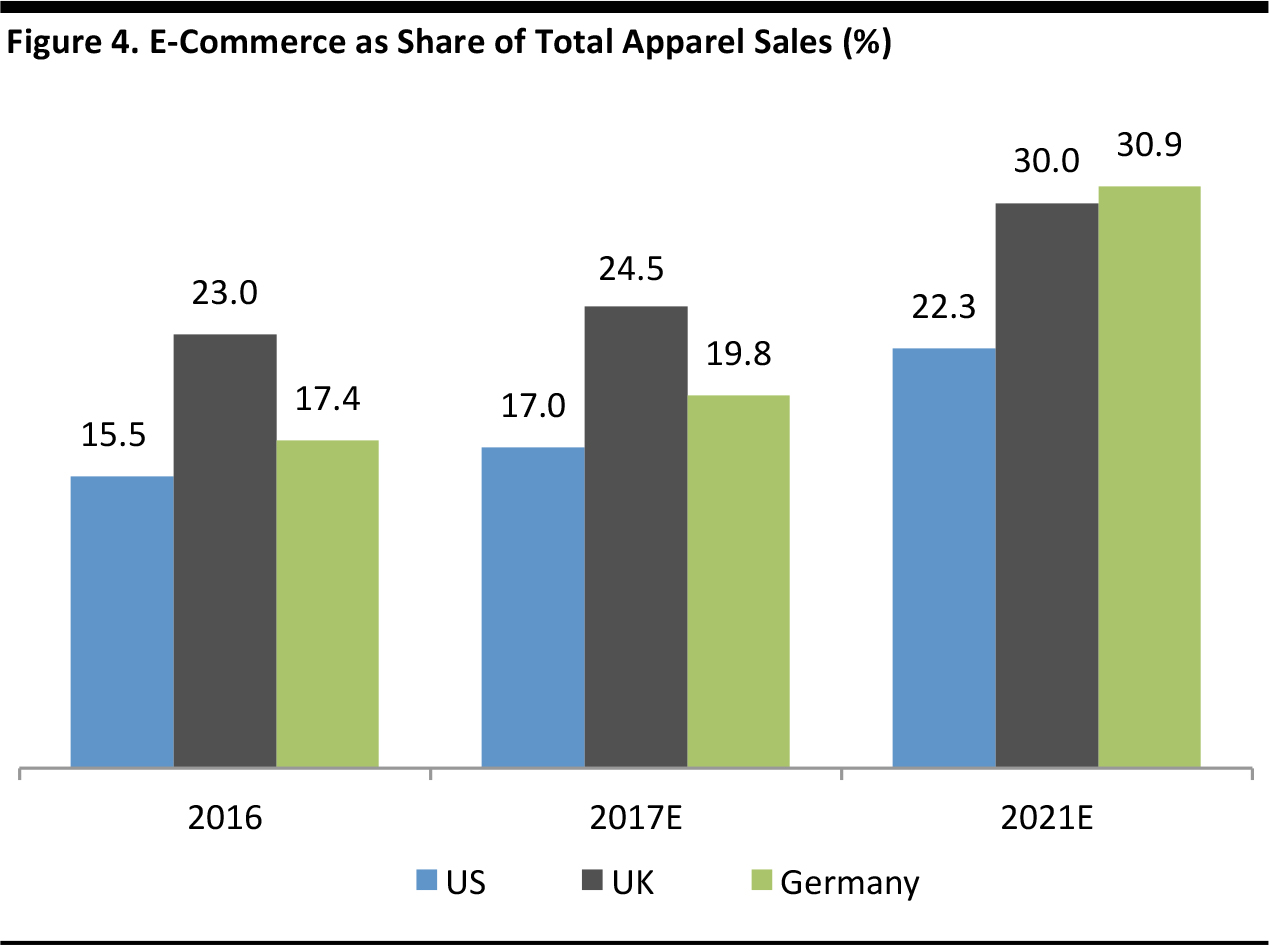

Source: Euromonitor International/Kantar Worldpanel/Fung Global Retail & Technology

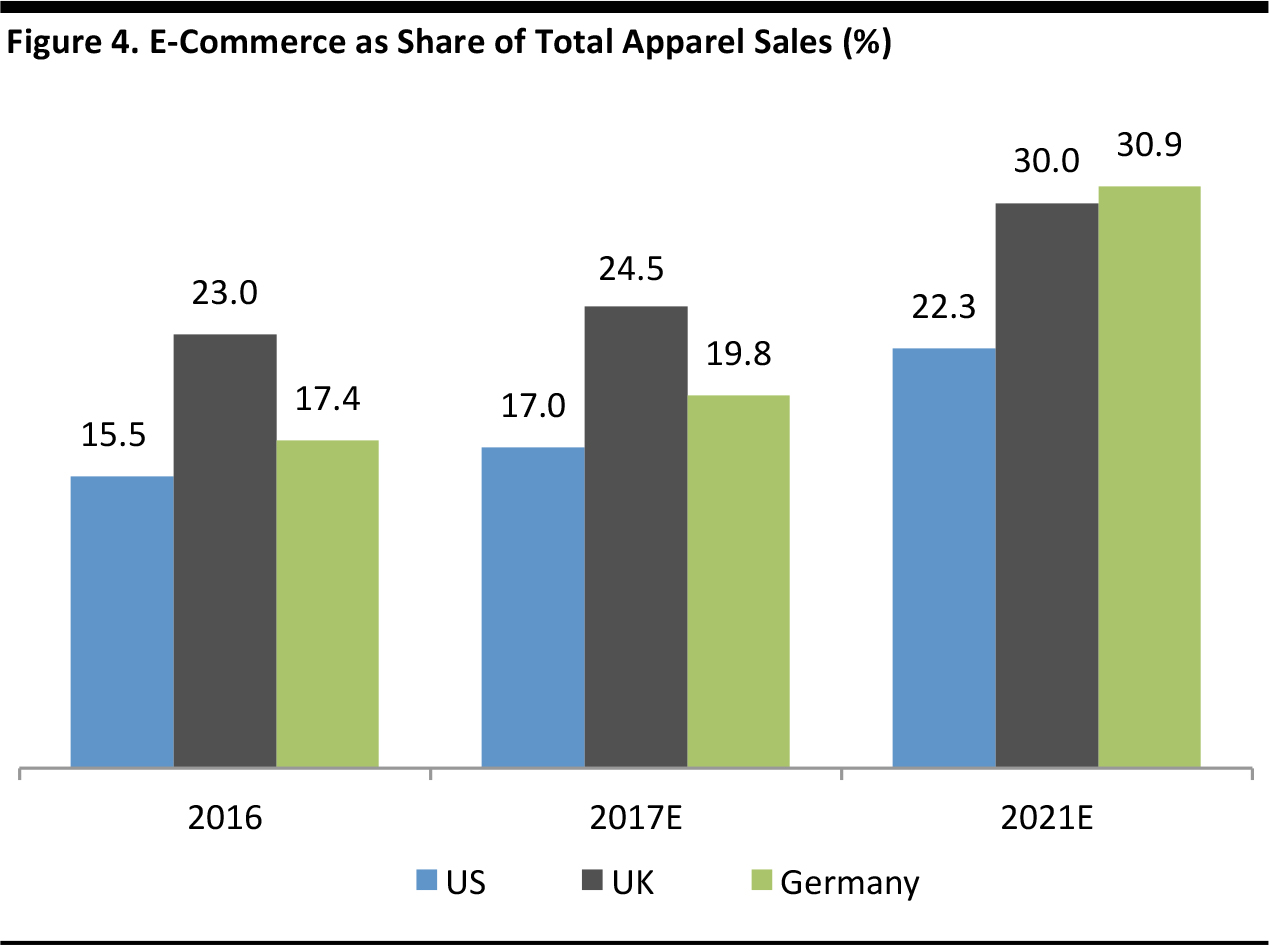

Euromonitor estimates that around 17% of US apparel sales will be made online this year, which equates to around $62 billion in sales. E-commerce’s share of apparel category sales in the US lags its share in peer countries such as the UK and Germany, and this effect is expected to persist over the coming five years.- Later in this report, we include consumer survey trend data that show how many US consumers buy apparel from Amazon.

Off-Price

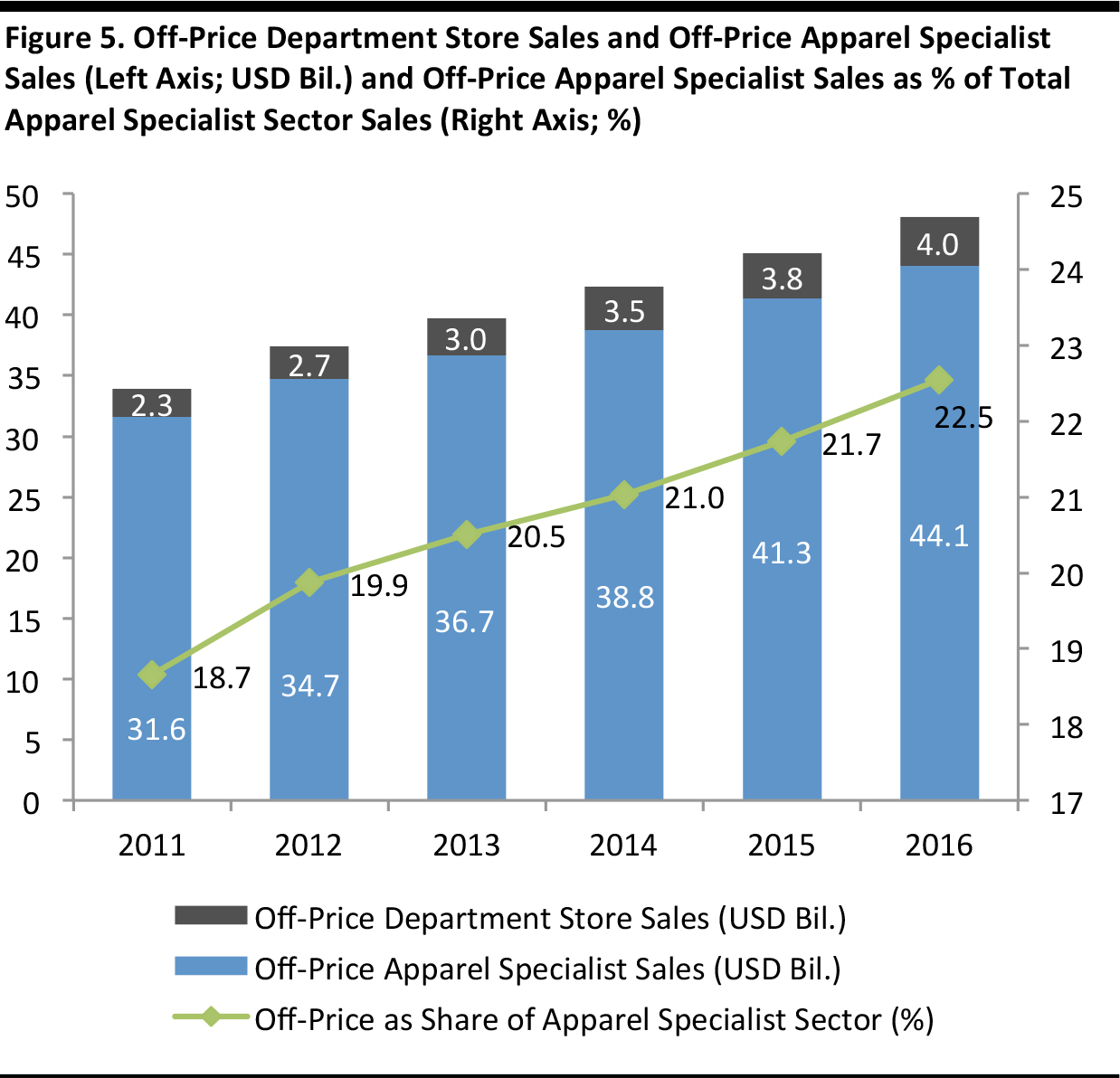

Source: Euromonitor International/Fung Global Retail & Technology

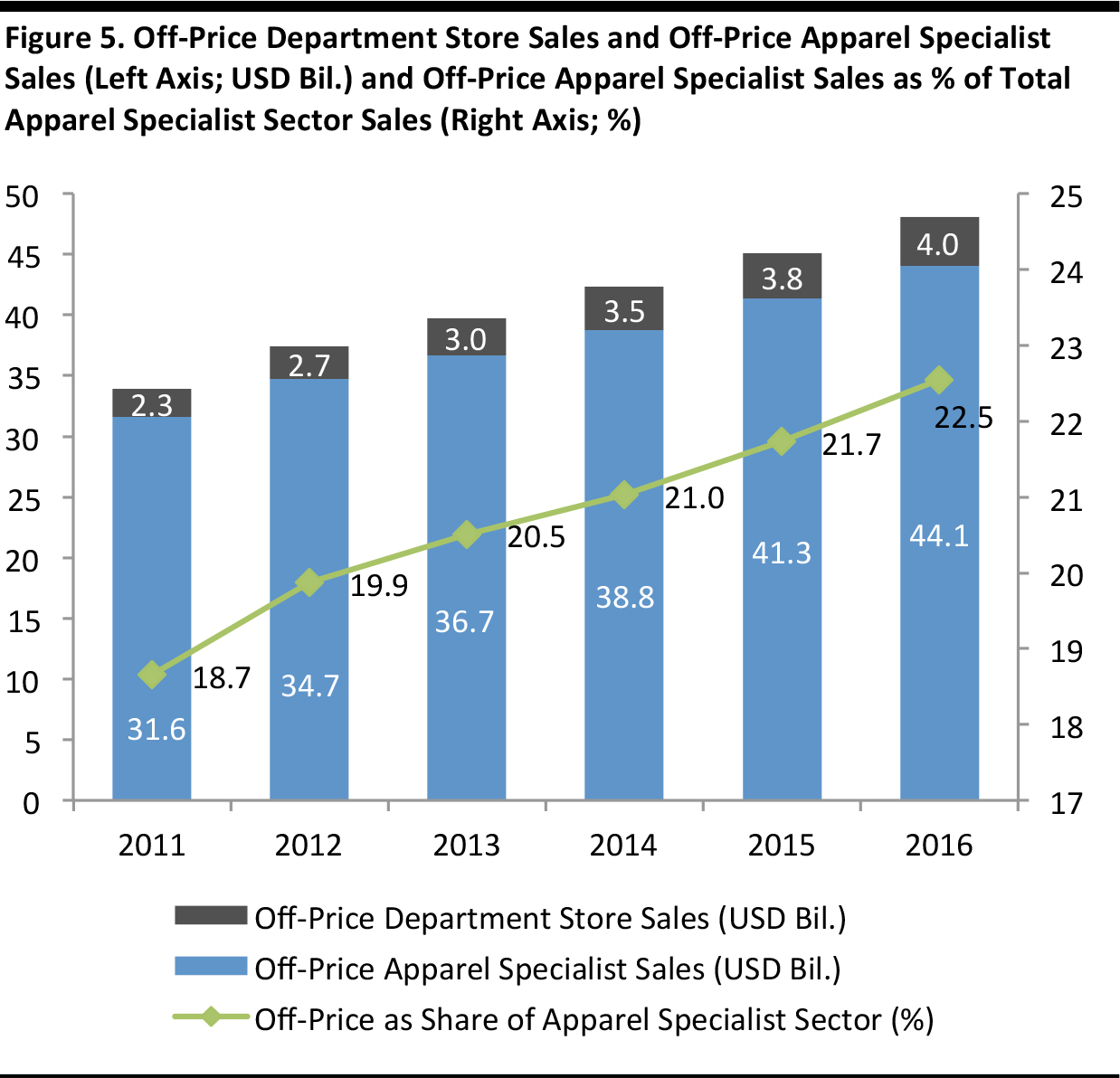

The off-price apparel specialist segment grew revenues by 39% between 2011 and 2016. Its $44 billion of sales in 2016 accounted for nearly one-quarter of total apparel specialist sector sales. Between the years ended January 2012 and January 2016, segment leader TJX Companies grew sales at its US T.J.Maxx and Marshalls chains by 30%, to $19.9 billion.

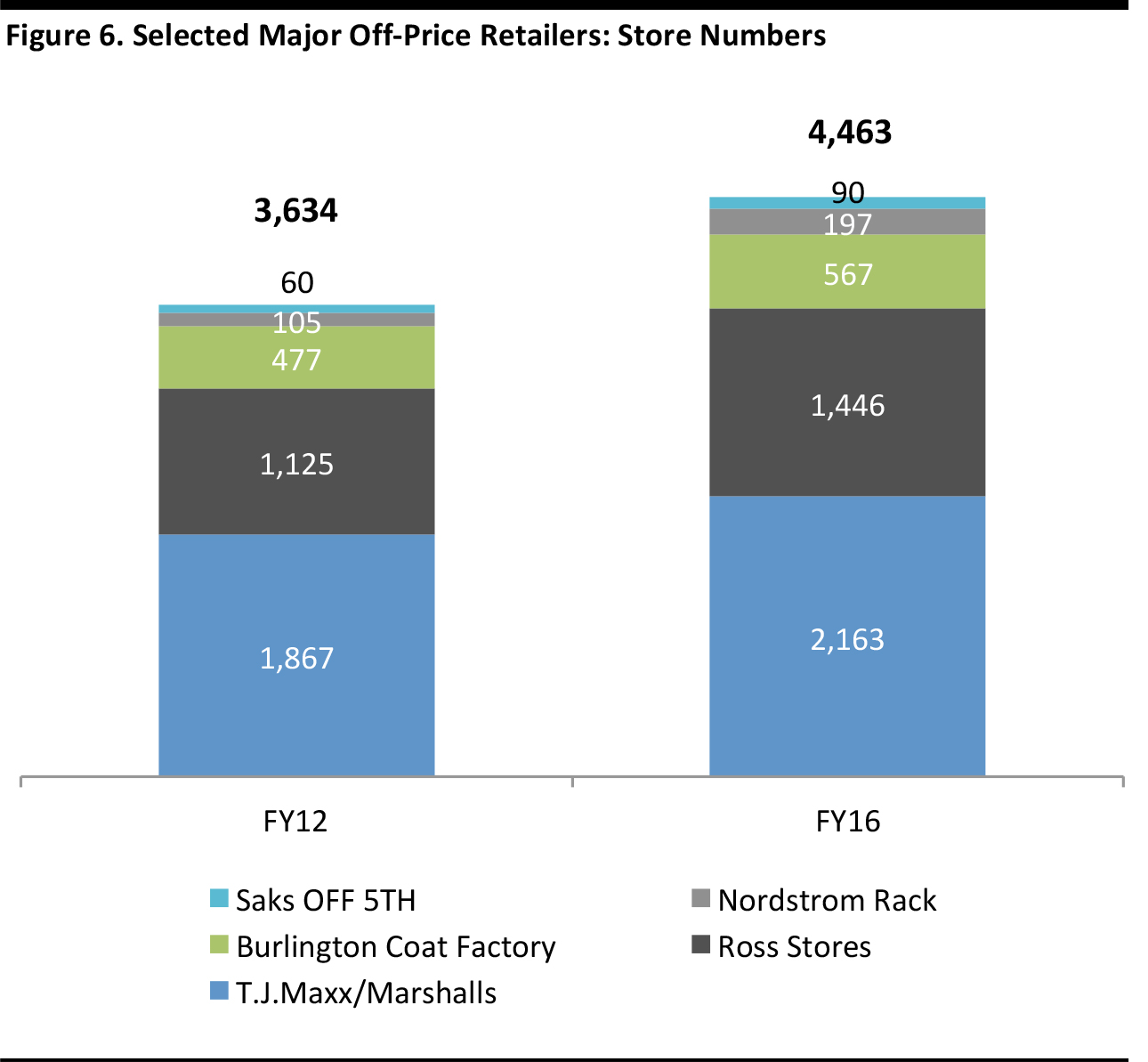

Fiscal years ended January Source: Company reports

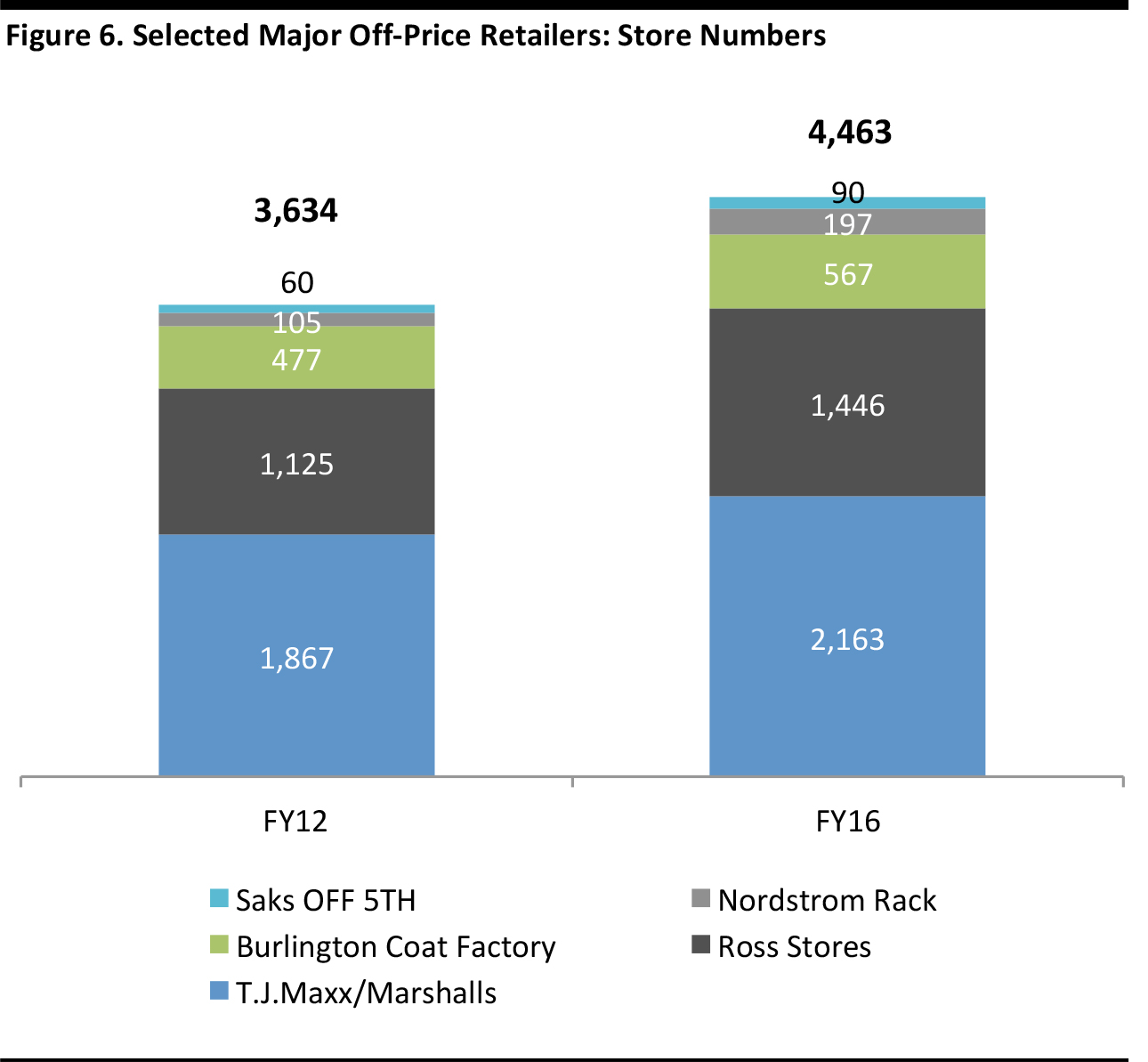

The major off-price retailers grew their store numbers by 23%, to 4,463, between the years ended January 2012 and January 2016. This compares with 2.2% growth in store numbers across the total clothing and footwear specialist sector, bringing that total to 118,561 in calendar 2015, according to Euromonitor. New entrants such as Macy’s Backstage and Find @ Lord & Taylor are not included due to lack of trend data.Fast Fashion

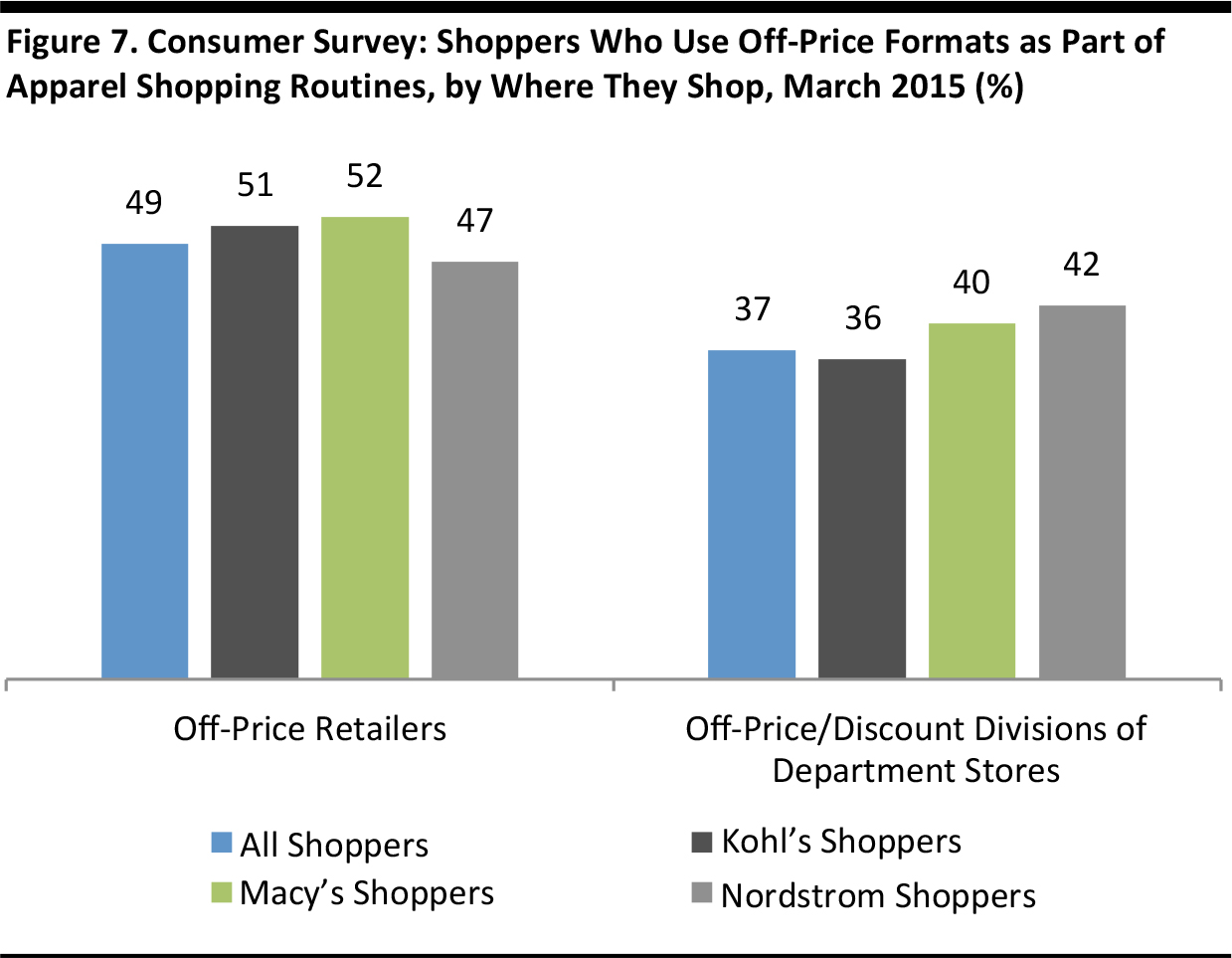

Source: Kantar Retail

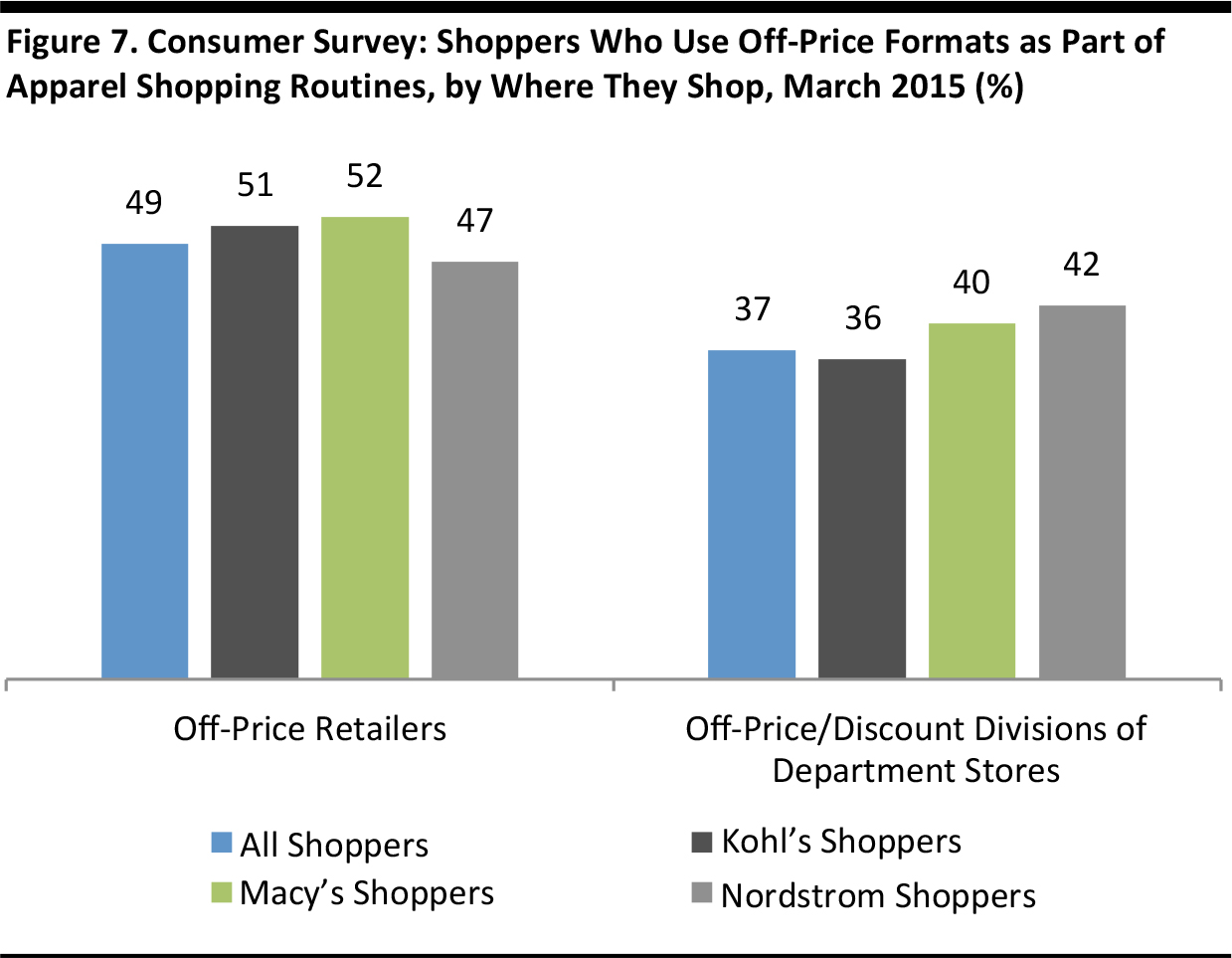

Around half of US consumers buy from off-price retailers; the proportion is slightly higher among the subgroup that also shops at Kohl’s and Macy’s. Off-price specialist retailers, such as T.J.Maxx, continue to be shopped more heavily than off-price or discount divisions of department stores, such as Nordstrom Rack and Saks OFF 5TH.

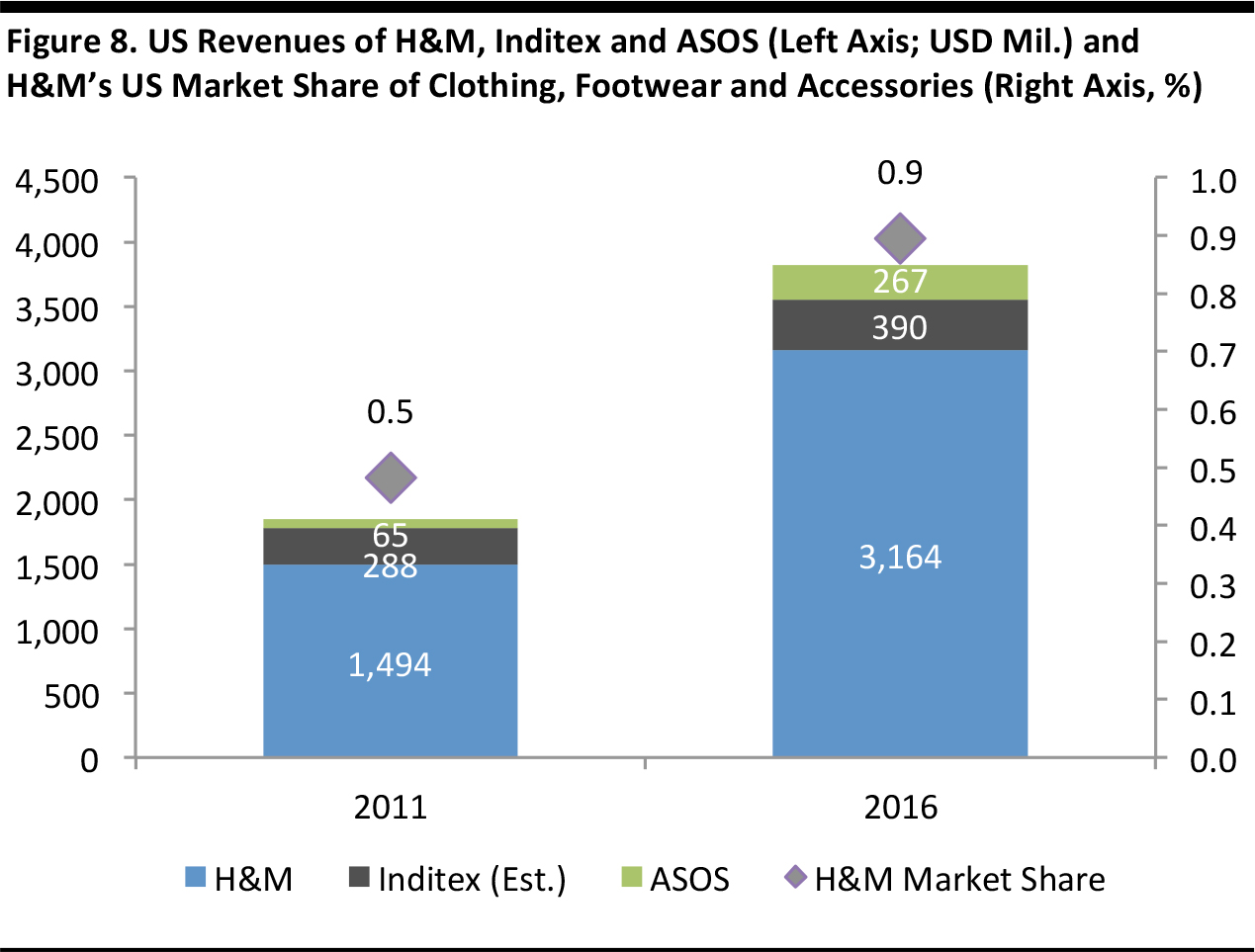

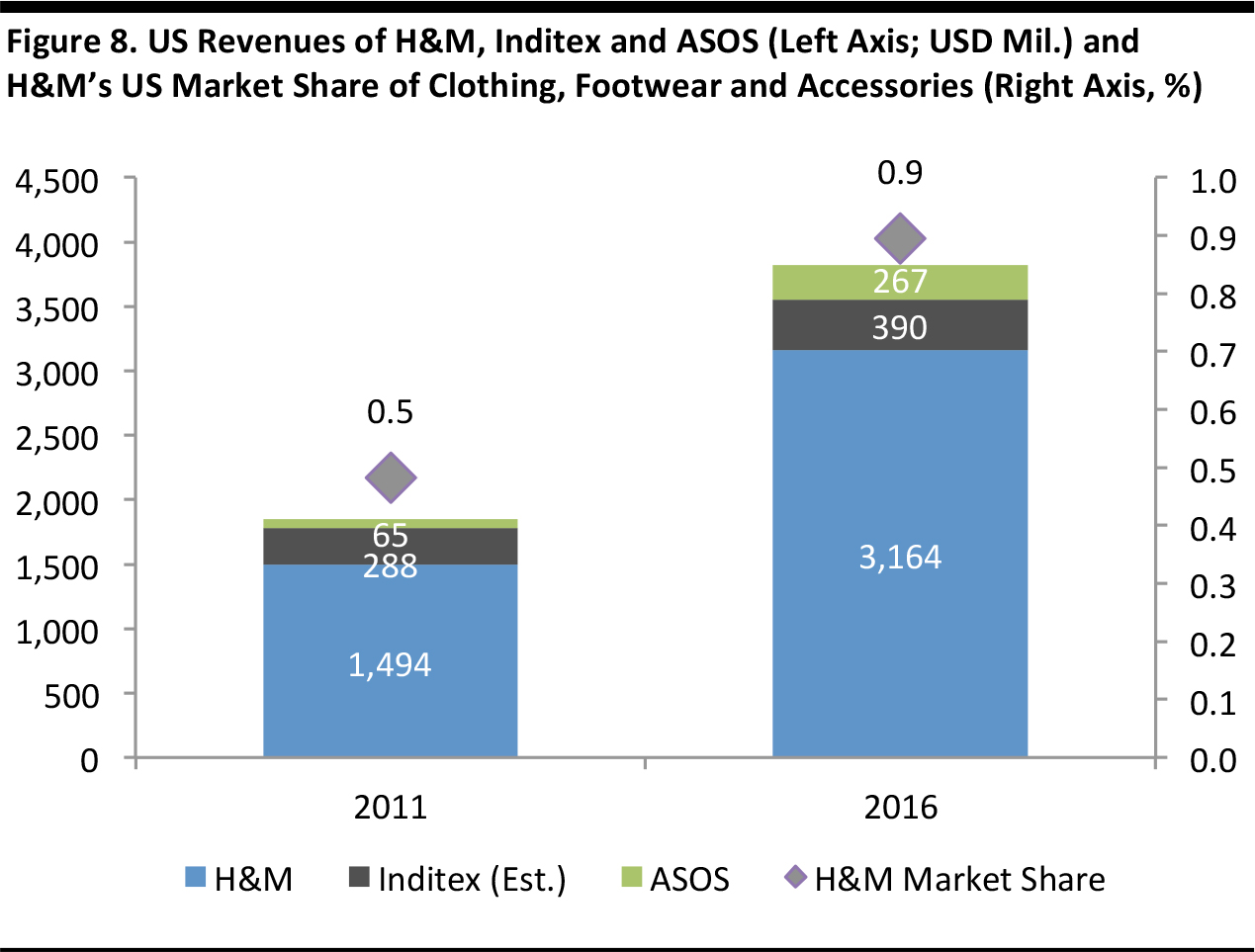

Data for H&M and ASOS are for the nearest fiscal years to calendar years. H&M includes sales tax. Source: S&P Capital IQ/Euromonitor International/company reports/Fung Global Retail & Technology

In recent years, European fast-fashion specialists have been perceived as a significant threat to incumbent apparel retailers. H&M has led the charge of international fast-fashion invaders. Its $3.2 billion in revenue in 2016 gave it an apparel market share of just under 1%. Among apparel specialists, H&M ranks between privately owned Forever 21, which generated $4.4 billion in sales in 2015, according to press reports, and American Eagle Outfitters, which turned over $3.1 billion in the year ended January 2016 (latest). Inditex (Zara) remains much smaller and, in terms of revenue, is in the same ballpark as British online-only retailer ASOS.

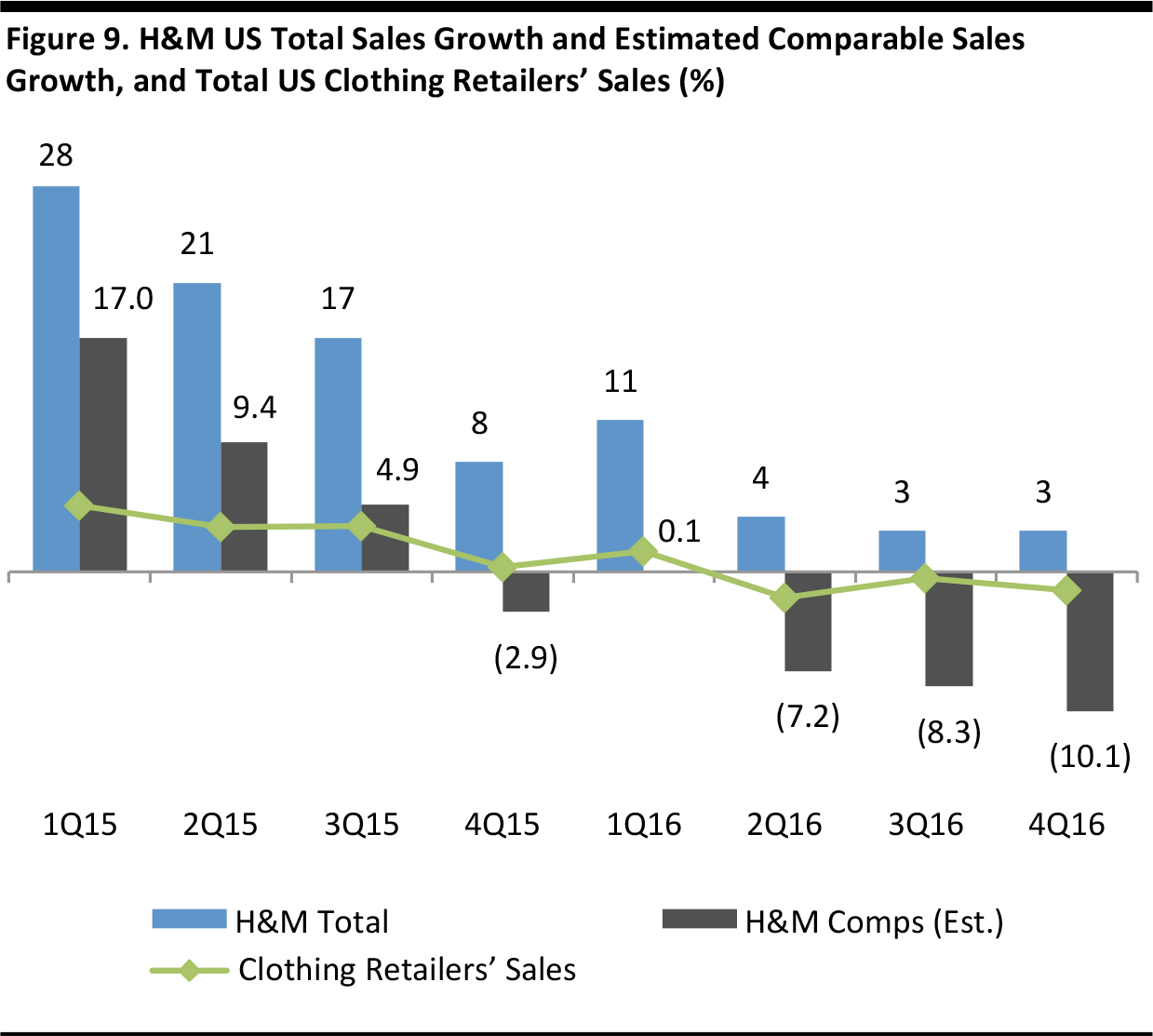

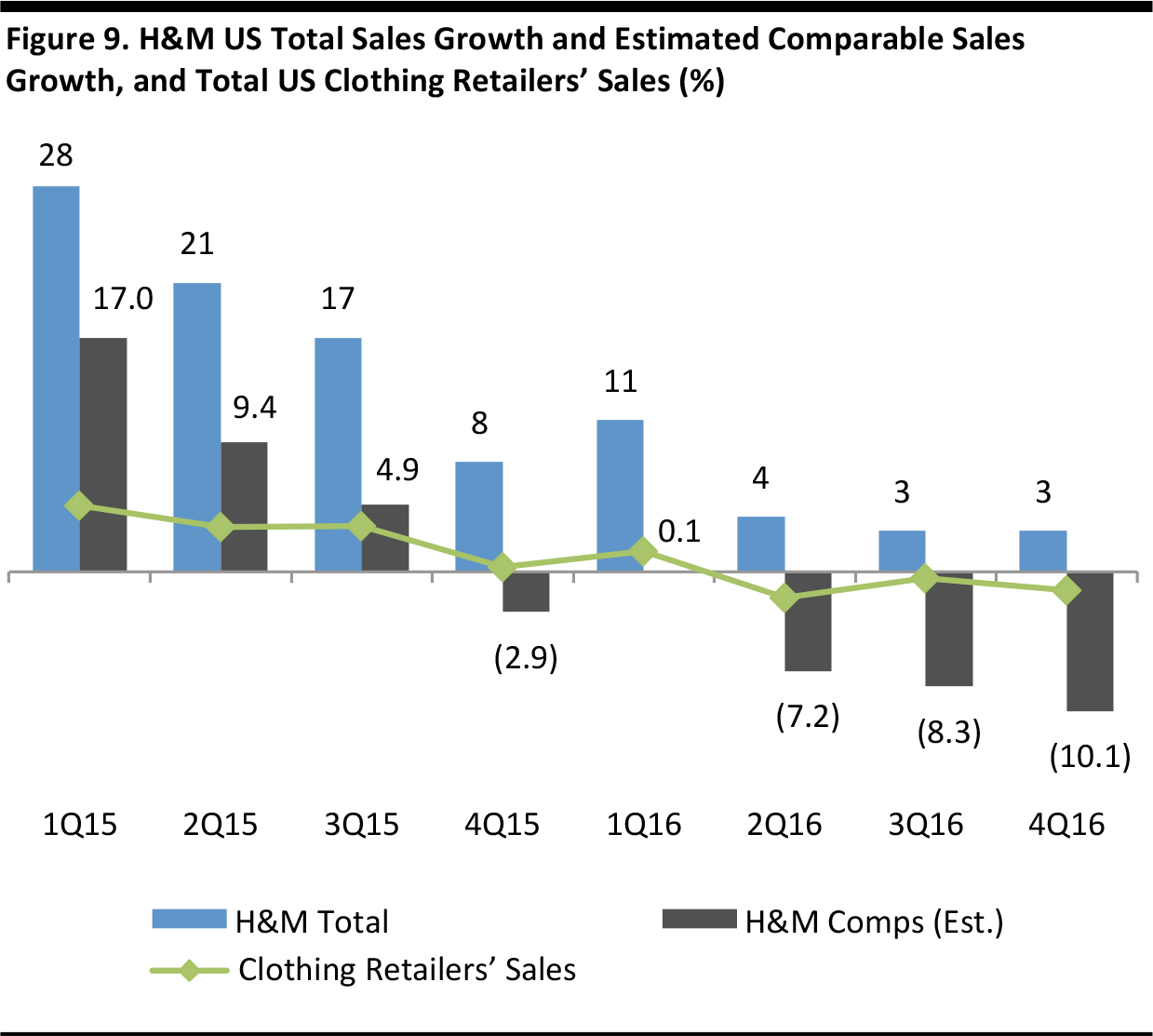

Clothing retailers’ sales for 4Q16 are for November and December (latest). Source: Company reports/Goldman Sachs/US Census Bureau/Fung Global Retail & Technology

Despite its substantial medium-term growth, H&M’s US performance has recently nosedived, with total sales growth supported by continued store openings. A number of brokers estimate that comparable sales were negative in 2016, and were deeply negative in the three most recent quarters. For comparison, the chart above shows H&M’s total US sales growth versus total sales growth in the clothing specialist sector, as recorded by the US Census Bureau.

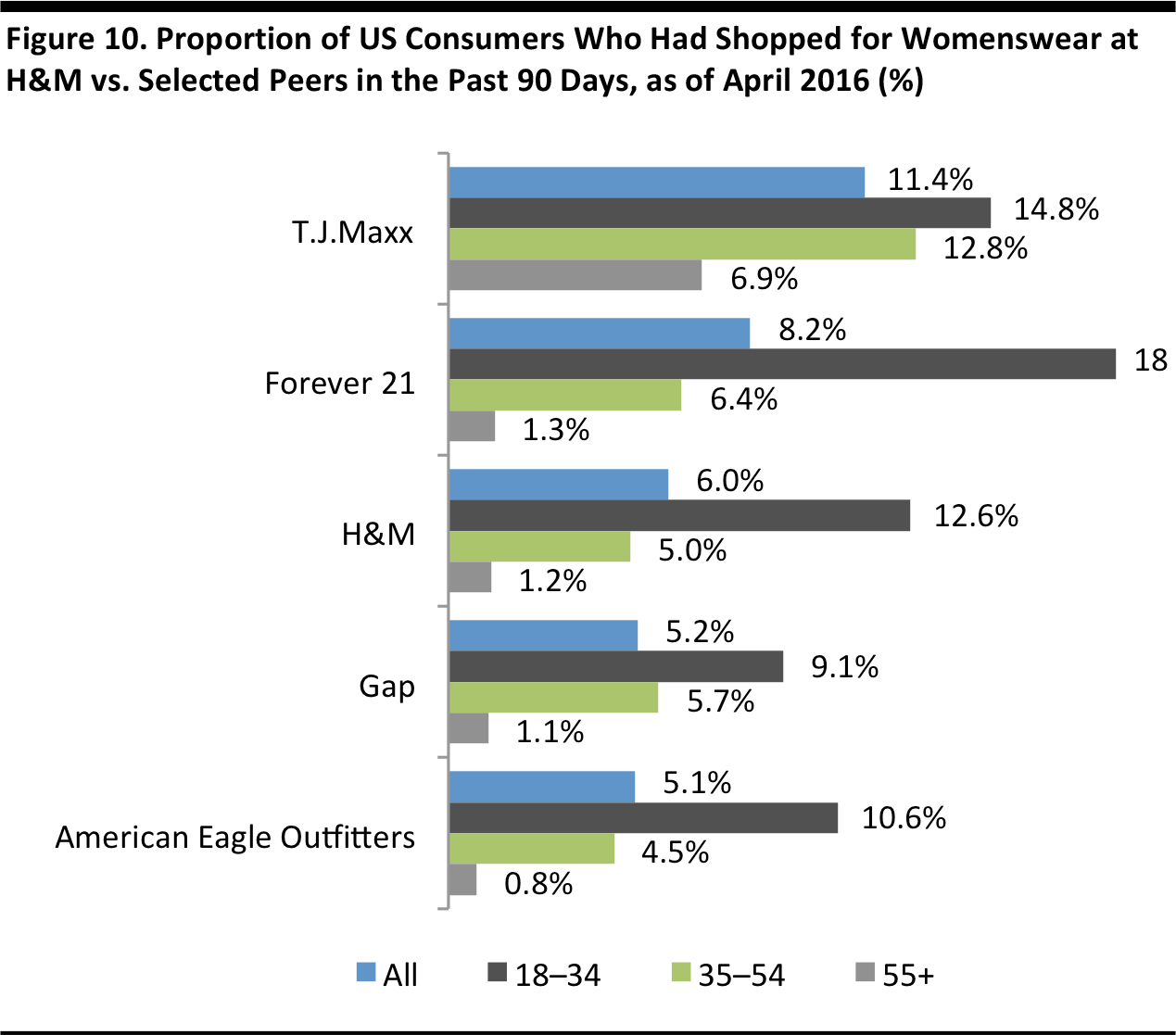

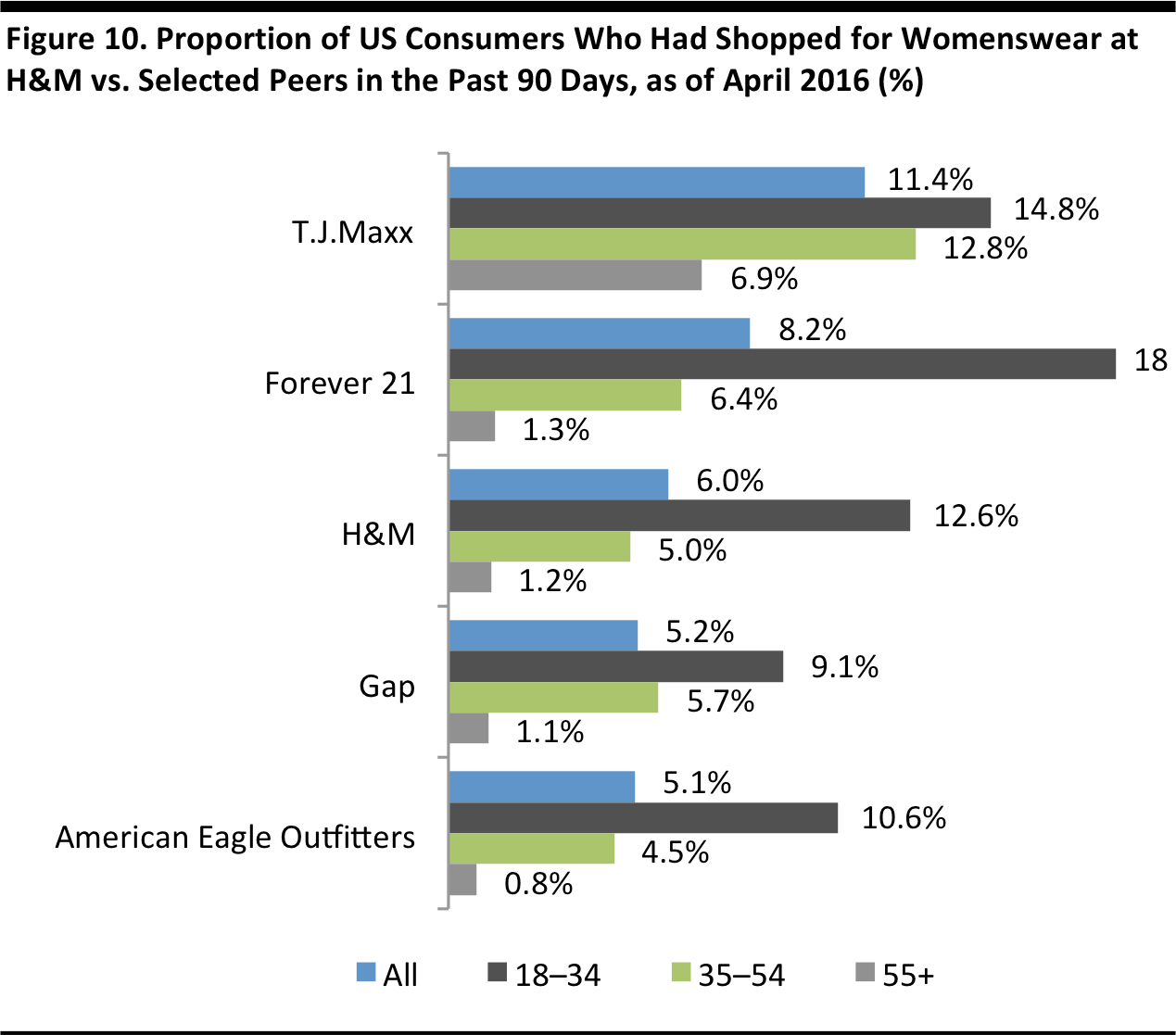

Base: 7,008 adults aged 18+ Source: Prosper Insights & Analytics

H&M’s relatively small overall market share belies its strength in its core consumer segment: it ranks much more highly among younger shoppers than among the overall population of shoppers. According to data from our research partner, Prosper Insights & Analytics, some 6% of Americans surveyed said they had shopped for womenswear at H&M in the past 90 days in 2016. That figure, however, was 12.6% among 18–34-year-olds (and 13.5% among 18–24-year-olds, a range not charted above).- Later in this report, we include more survey data on where consumers shop for womenswear, menswear and footwear.

Athleisure

Source: Company reports/Fung Global Retail & Technology

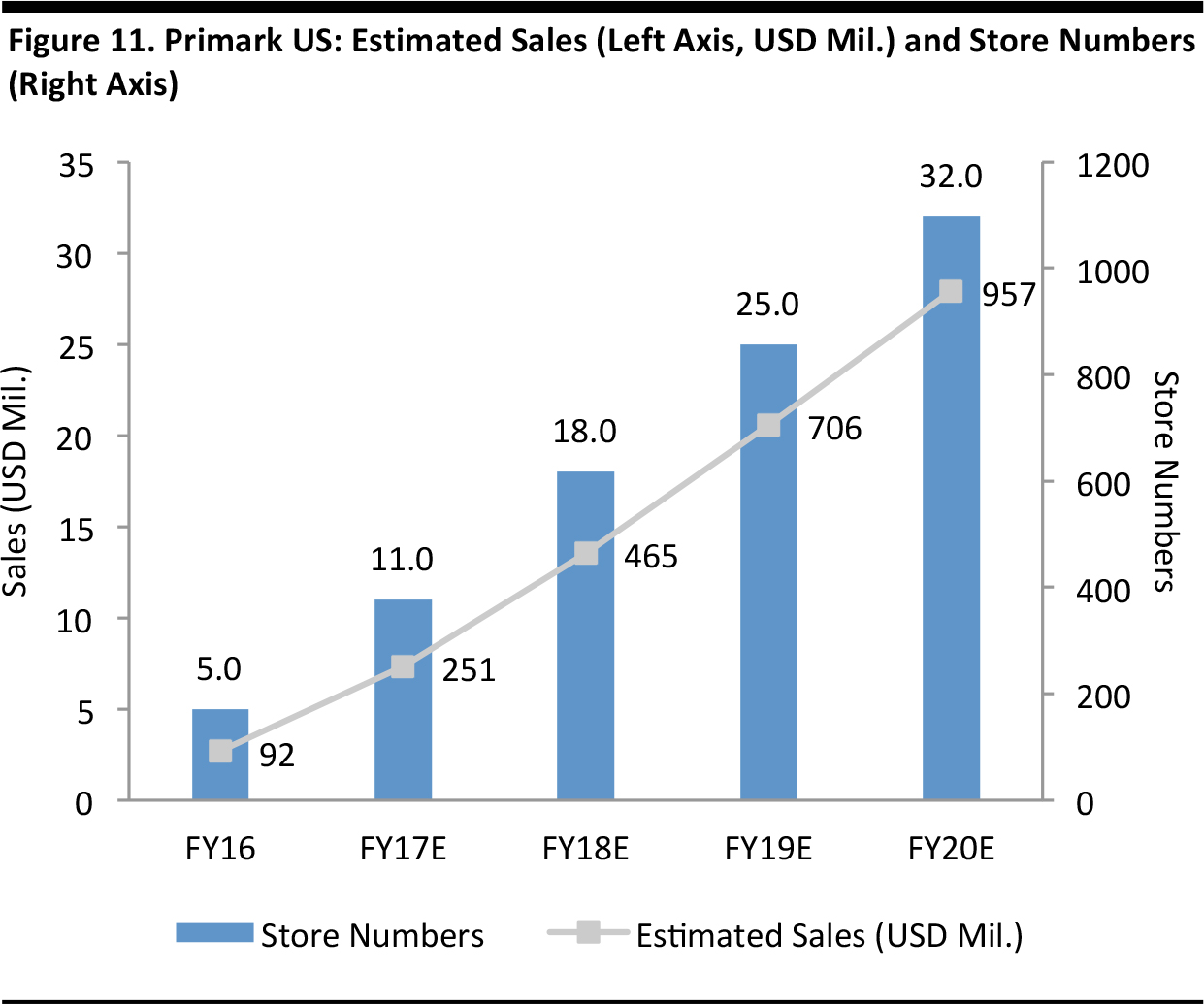

Primark looks to be the next big challenger to incumbents. It opened its first US store, in Boston, in September 2015, and had opened five stores by its latest year-end, September 2016. Based on Primark’s expansion in significant continental European markets, we estimate it will open approximately seven US stores per year. Based on average sales per store in non-UK markets, that would take its US sales to just under $1 billion by the fiscal year ending September 2020. The company does not break out revenues by geographic market.

Source: Euromonitor International/Fung Global Retail & Technology

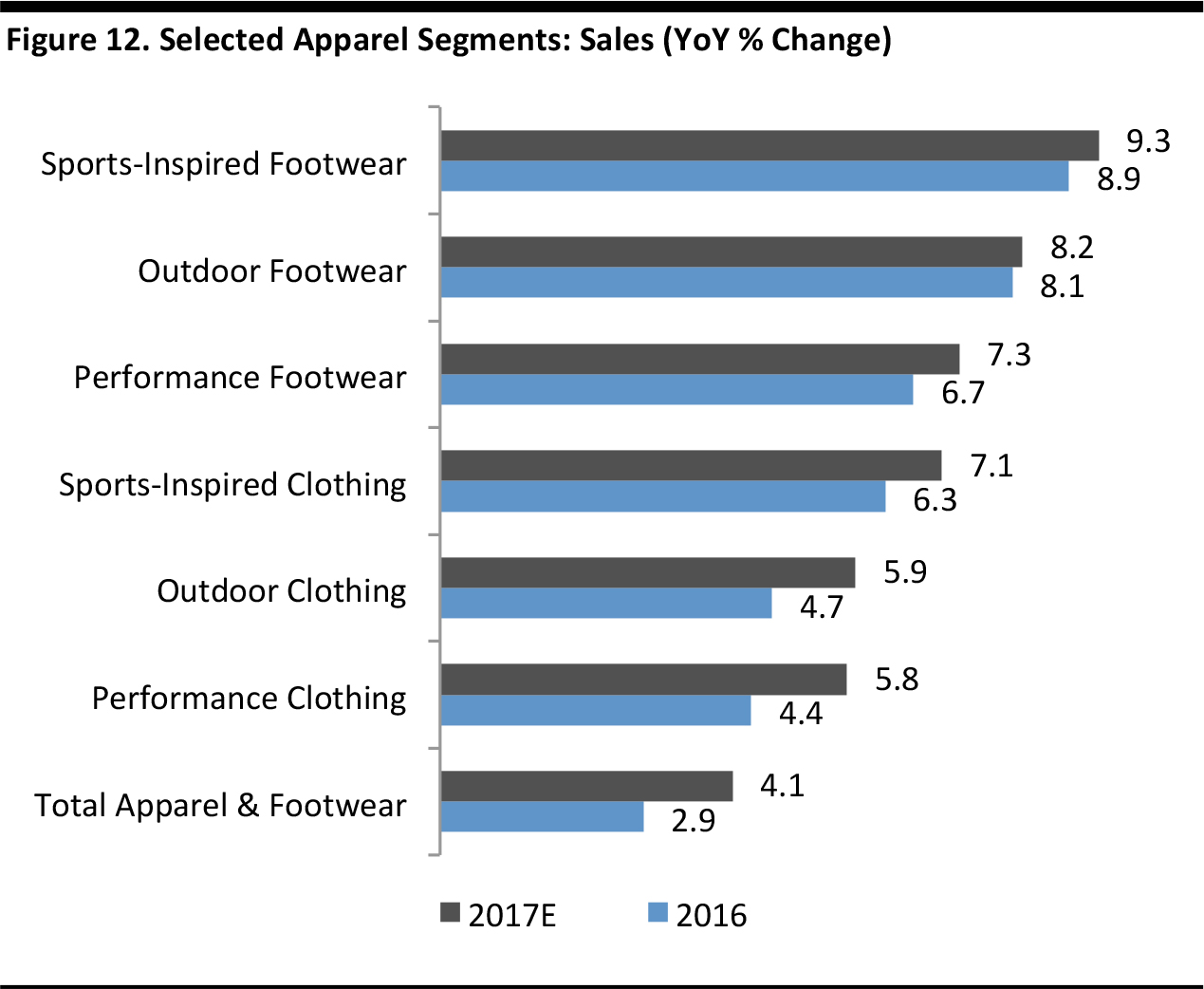

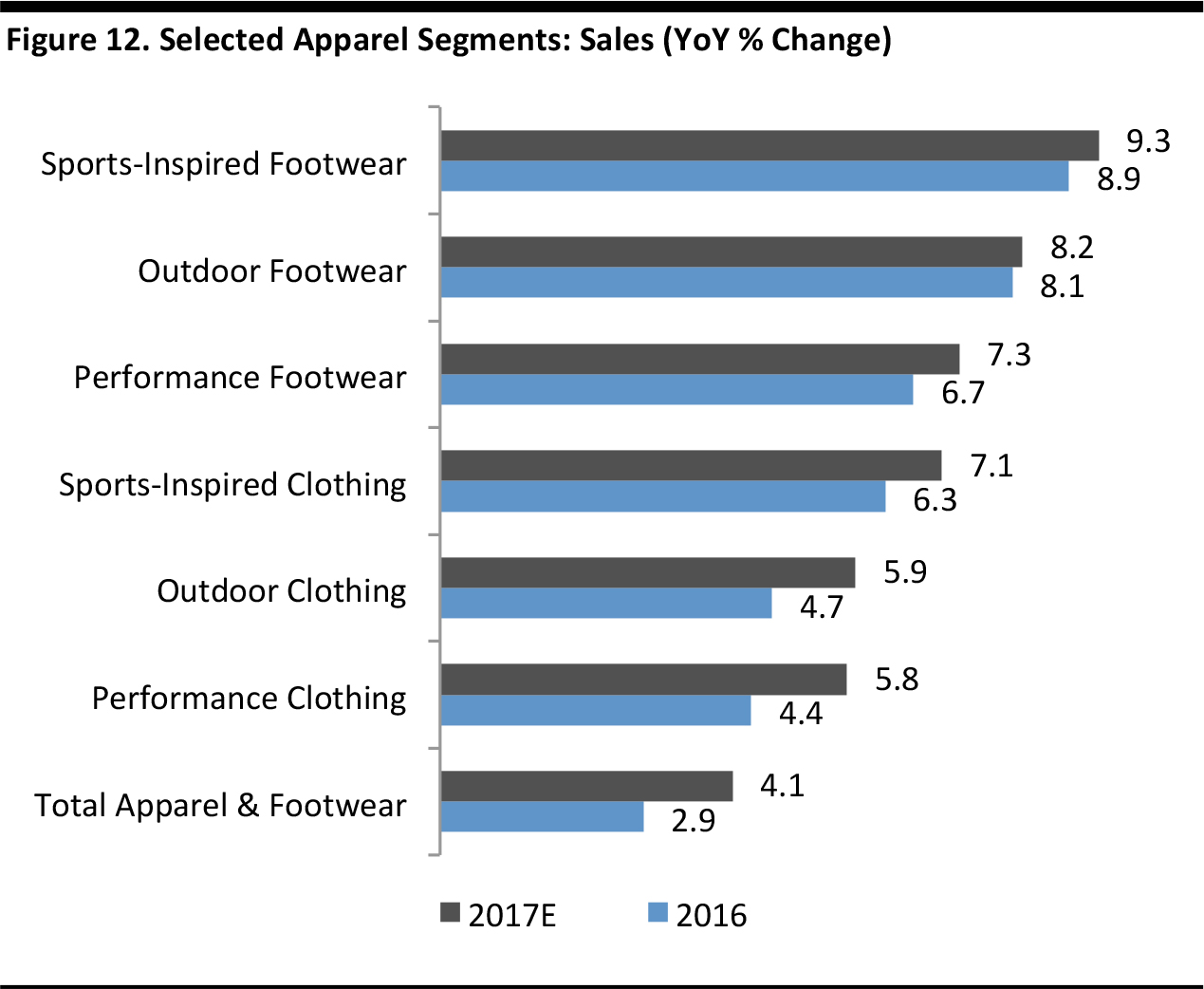

Athleisure remains an important driver of total apparel sales growth. Euromonitor recorded very strong performances across sports clothing and footwear in 2016, and it forecasts that this growth will strengthen this year. Data from Euromonitor and The NPD Group suggest that the strongest growth has been seen in sports-inspired products rather than in performance products (see also Figure 13).

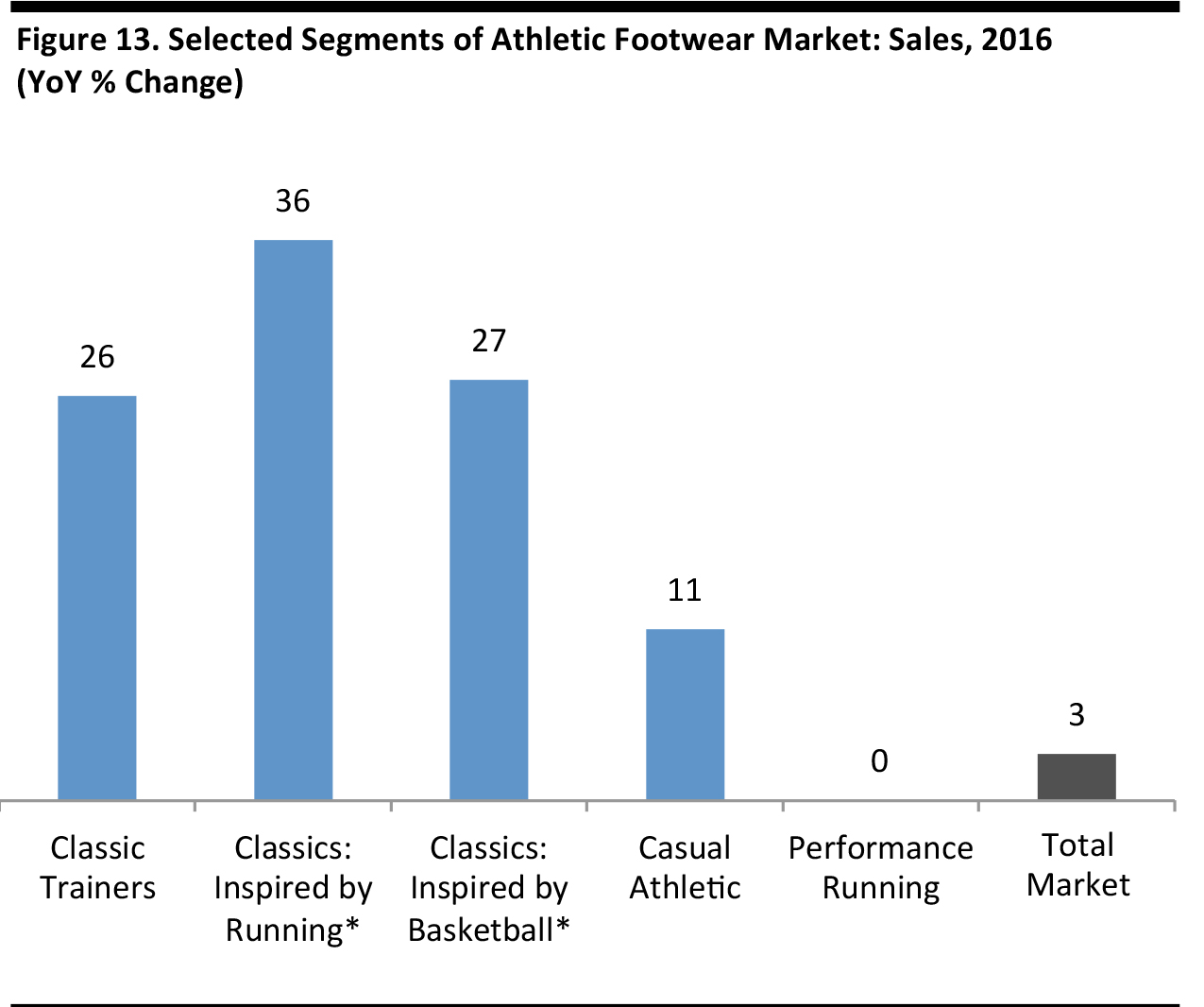

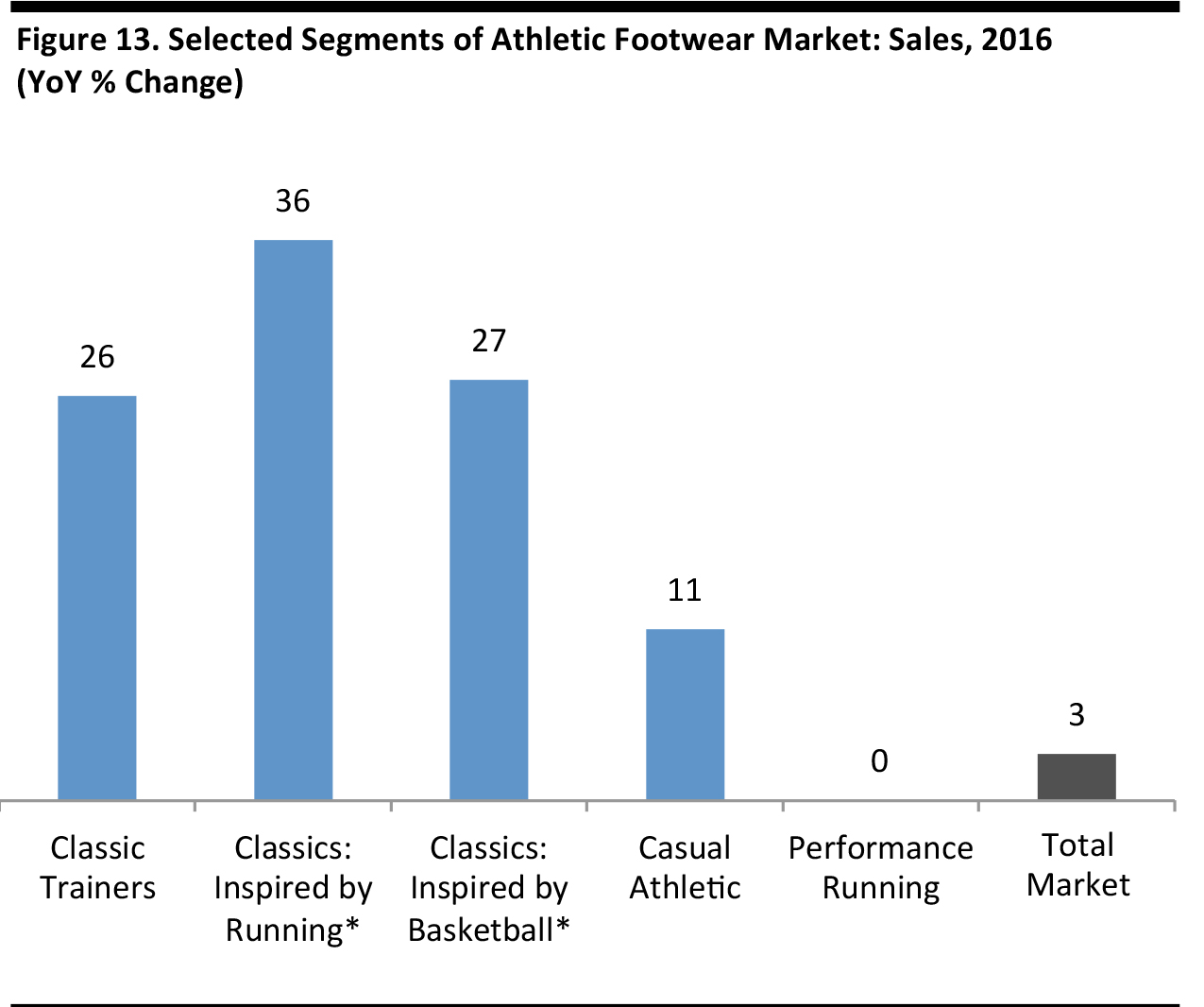

*Segment within Classic Trainers Source: The NPD Group

In 2016, The NPD Group found that growth in the athletic footwear market was driven by the “classics” segment (the fashion segment) rather than by the “performance” segment. The classics segment includes retro and sports-inspired lines. Performance running shoes recorded zero growth and performance basketball footwear sales declined by an unspecified amount in 2016. According to The NPD Group, total market growth was impacted in the fourth quarter due to the bankruptcies of Sports Authority and Sports Chalet.

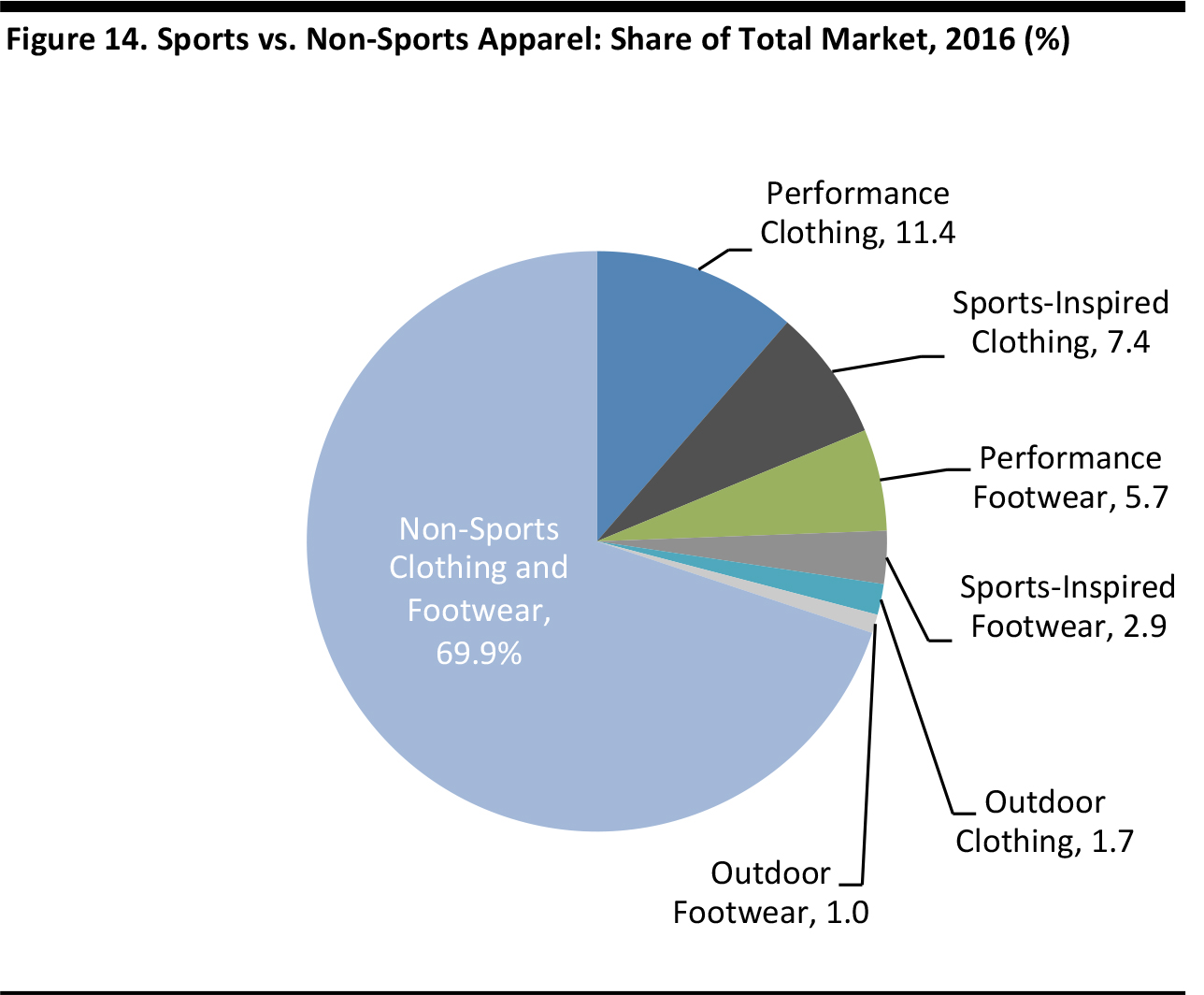

Source: Euromonitor International/Fung Global Retail & Technology

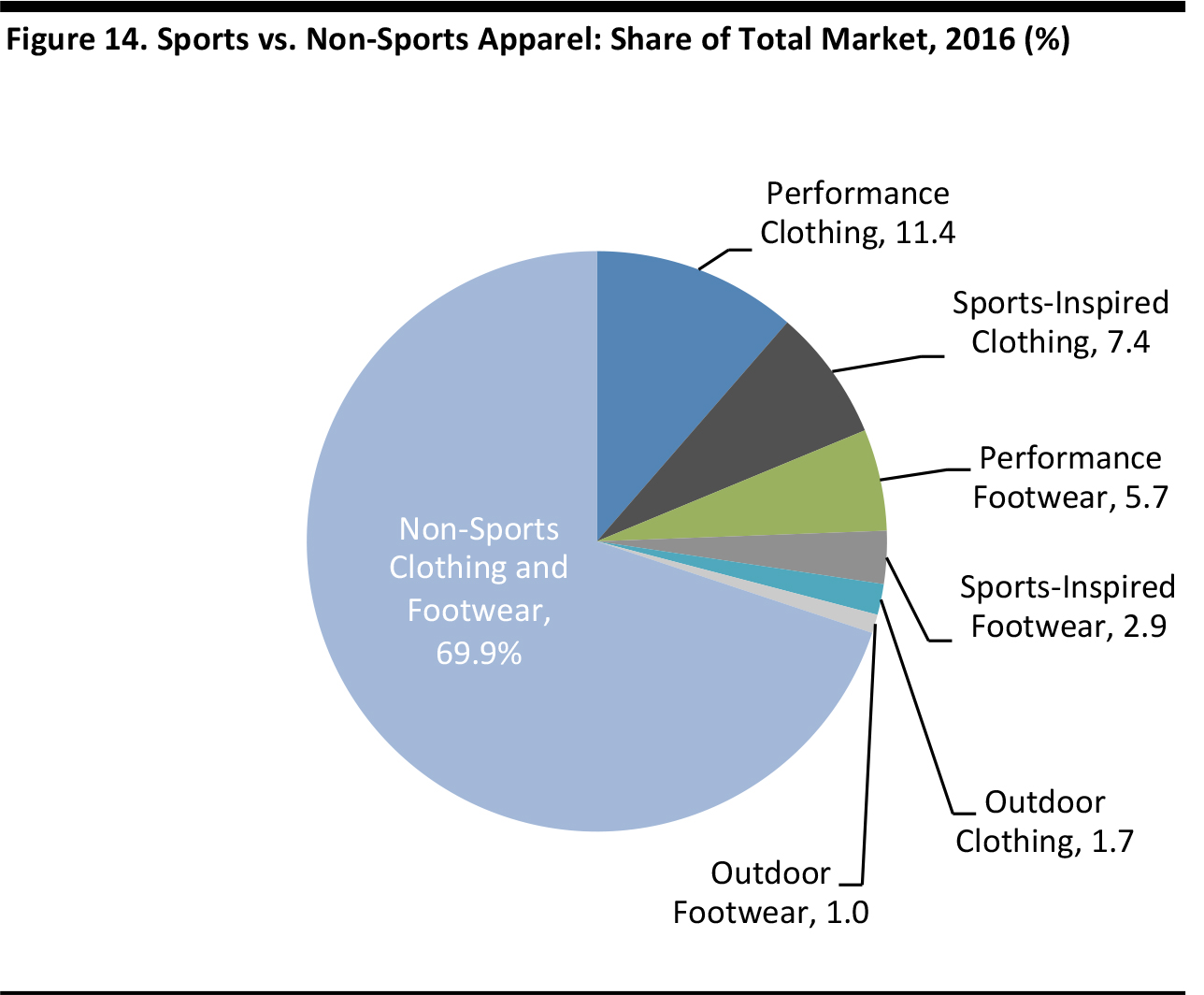

Sports apparel accounts for 30% of the total US clothing and footwear market. This share has risen by approximately one percentage point per year over the past five years.Store Closures

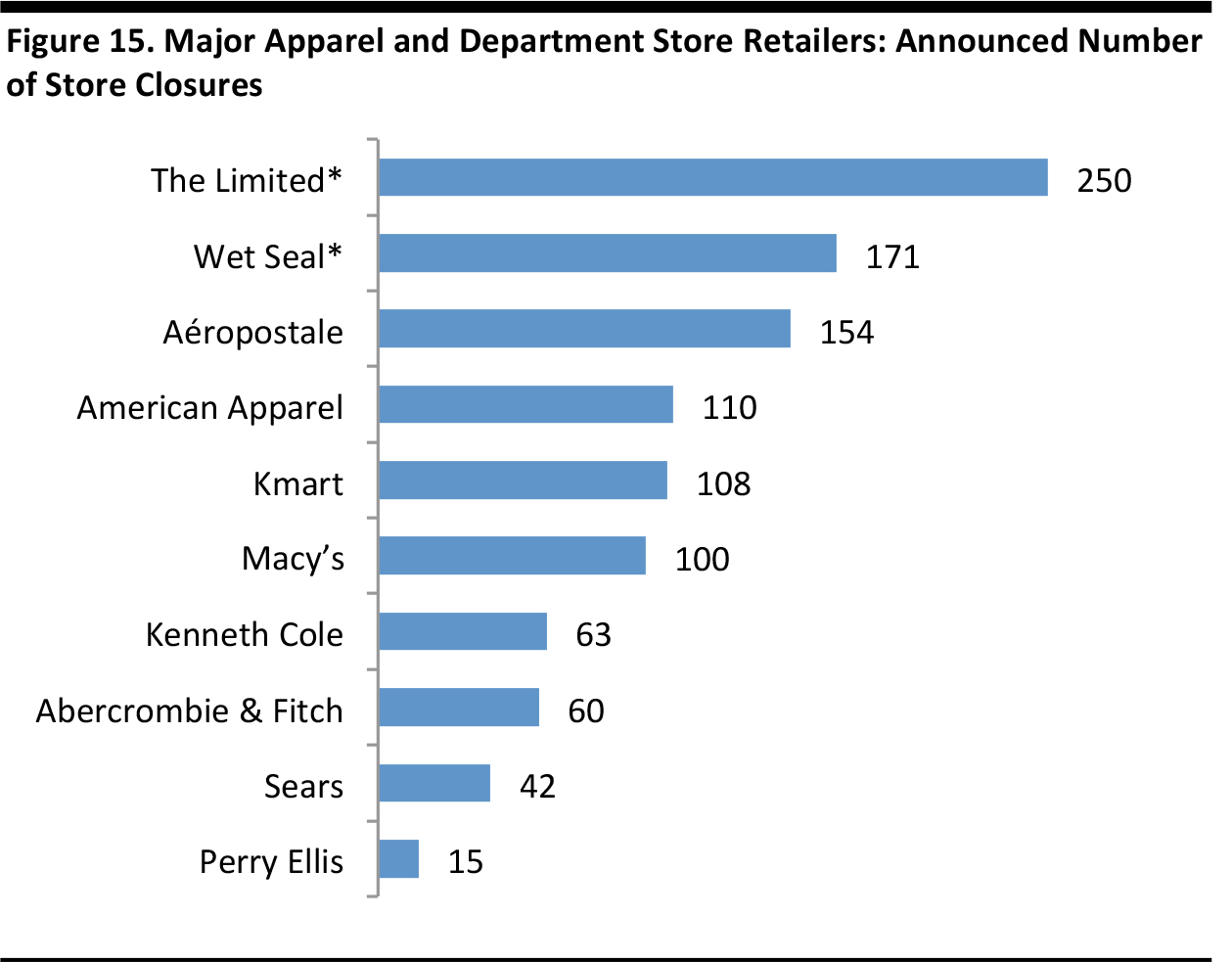

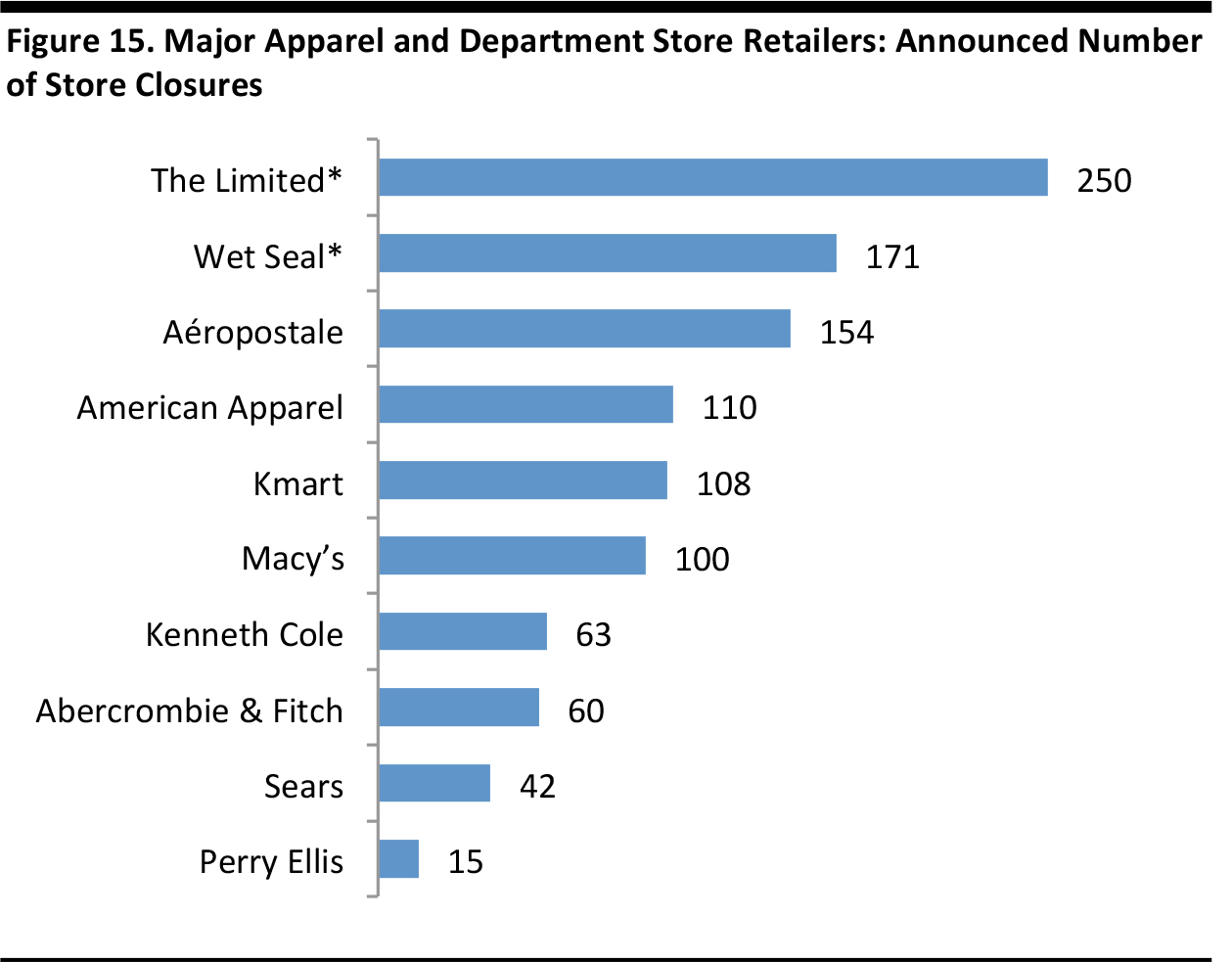

Store closures announced in the third quarter of 2016 or later *Represents all of the company’s stores Source: Company reports

Major names such as Macy’s have joined a raft of retailers that are closing stores. The closures charted above are those announced since the third quarter of 2016, so, for companies such as Sears, this is not the grand total. Macy’s announced 100 store closures in August 2016, and the company recently said that 68 of these will close by mid-2017. Sears has been one of the most aggressive retailers in terms of closing stores: it reduced its store count by 926 between the year ended January 2014 and its fiscal third quarter of 2017 (latest), according to company filings. Its latest closures, announced in January 2017, total 150 stores across the Sears and Kmart chains.

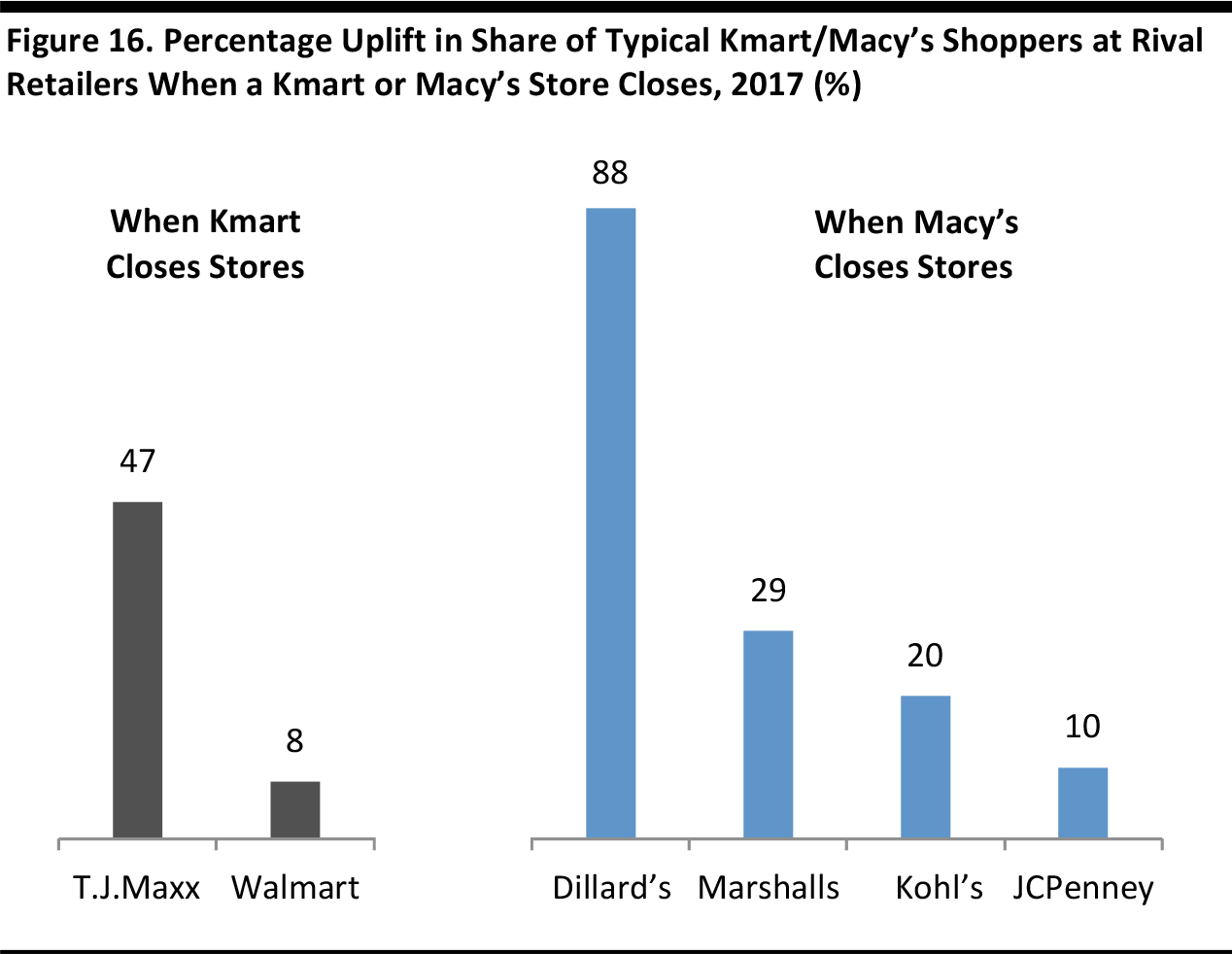

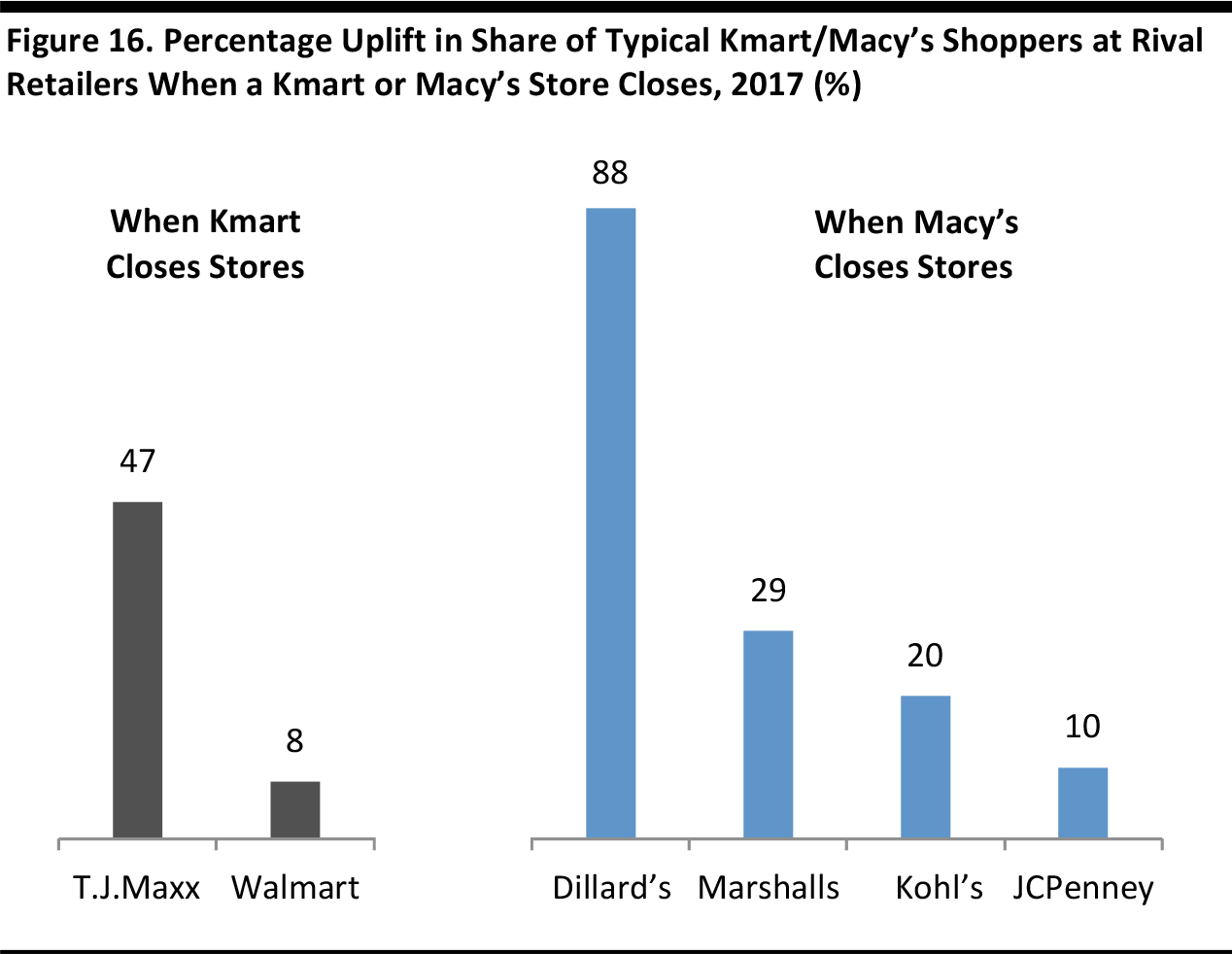

Data refer to the percentage increase in named retailers’ share of “typical shoppers” at Kmart or Macy’s in the nine months following store closures. Source: Foursquare

Where do shoppers go once their favorite department store closes? The data above show that T.J.Maxx gains the most when Kmart closes stores and that Dillard’s mops up the most shoppers proportionately when Macy’s shutters stores.

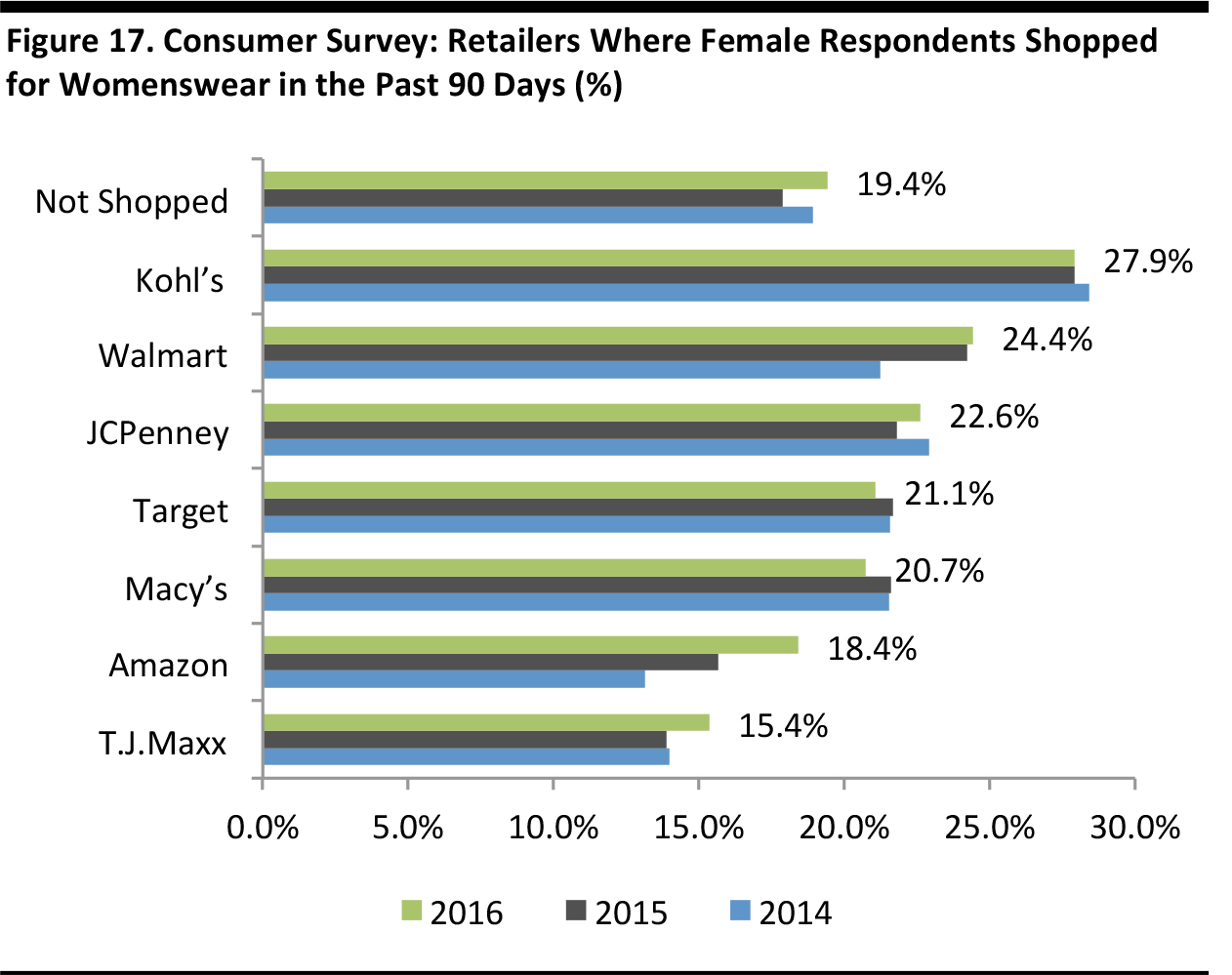

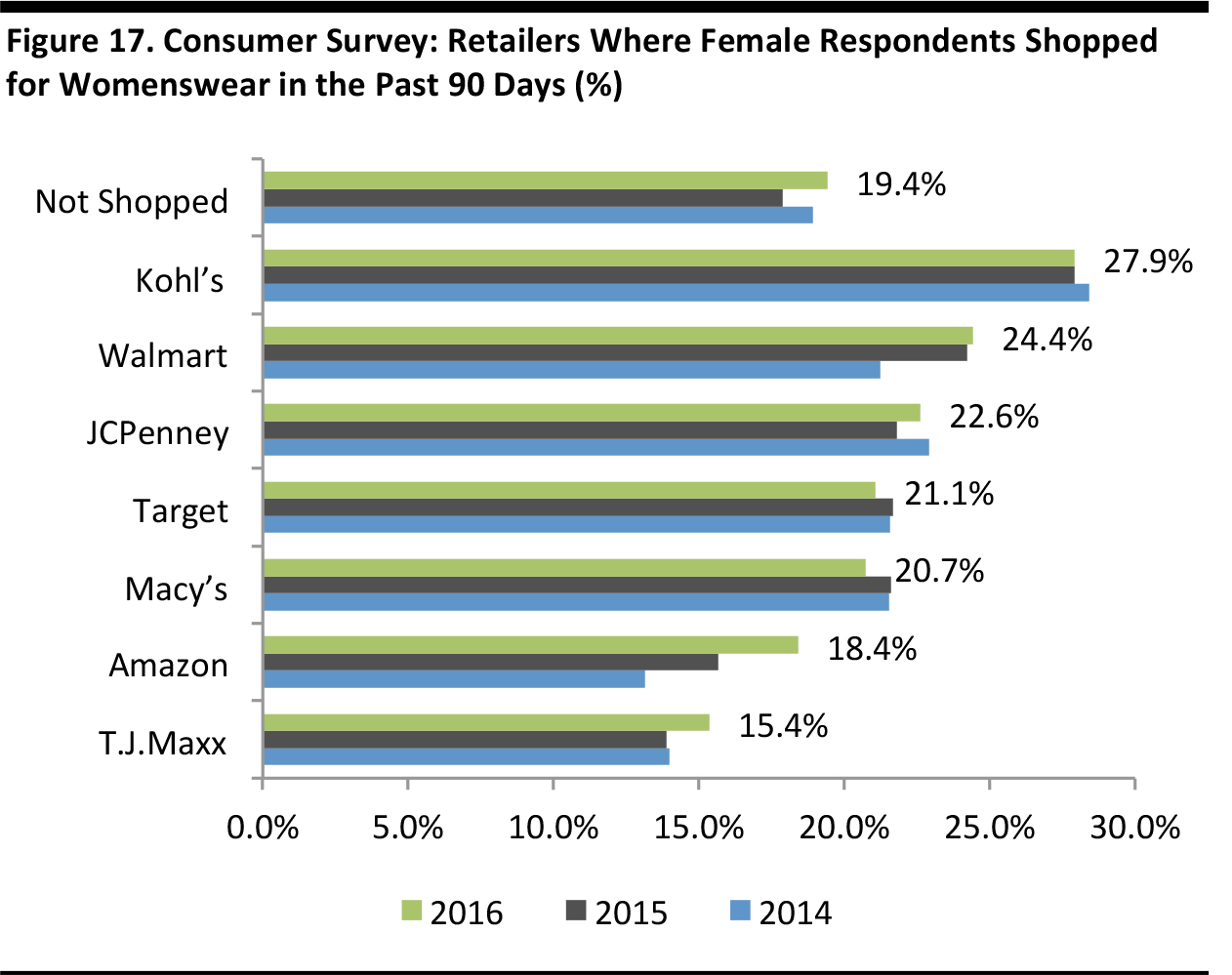

Base: 2,541–3,651 females aged 18+ in each survey period; surveys were conducted in April of each year. Source: Prosper Insights & Analytics/Fung Global Retail & Technology

Womenswear accounts for around half of the clothing market, making it much the most valuable segment for retailers. Department stores continue to take leading positions for womenswear, by female shopper numbers. Amazon is comfortably inside the top 10 by number of shoppers.

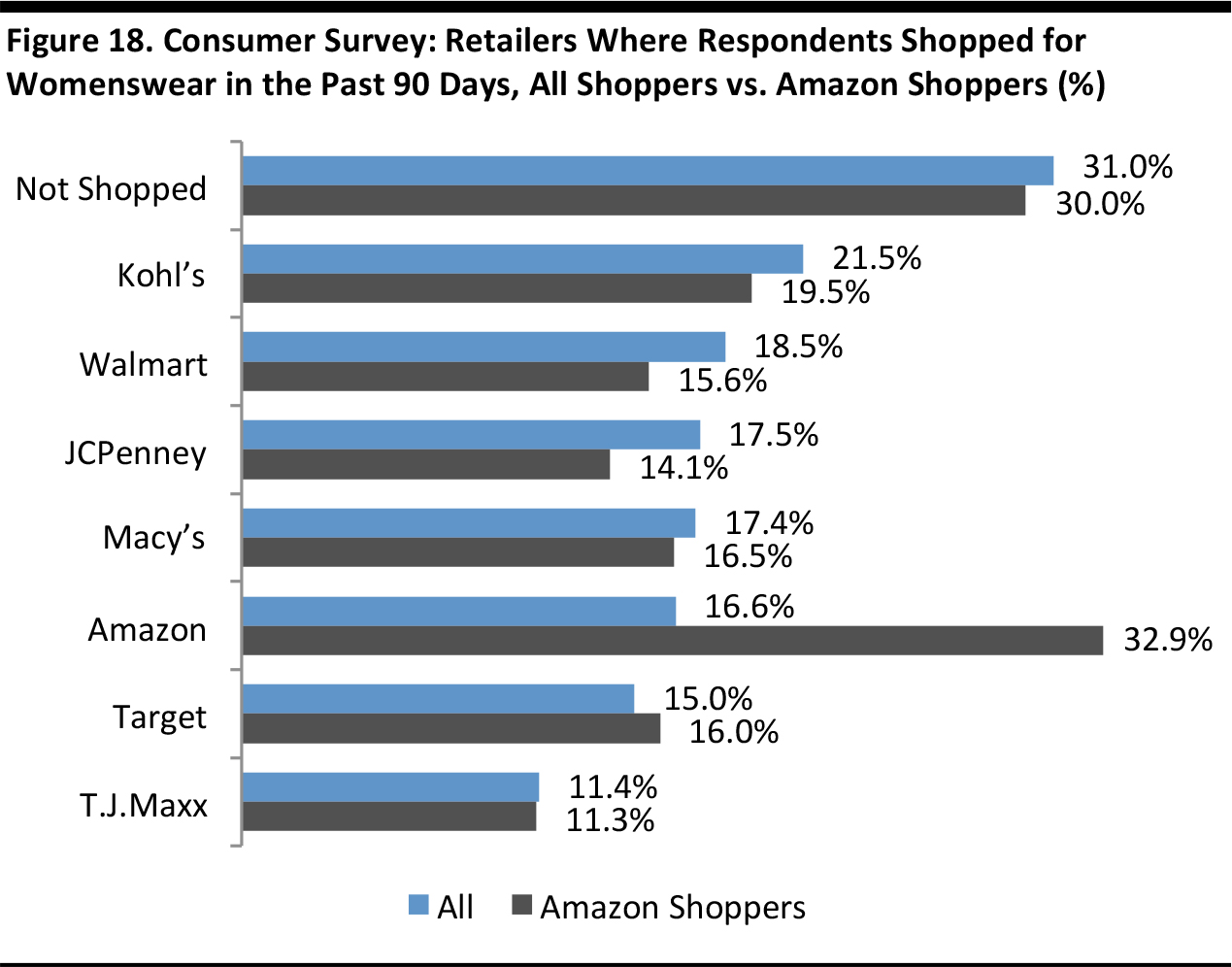

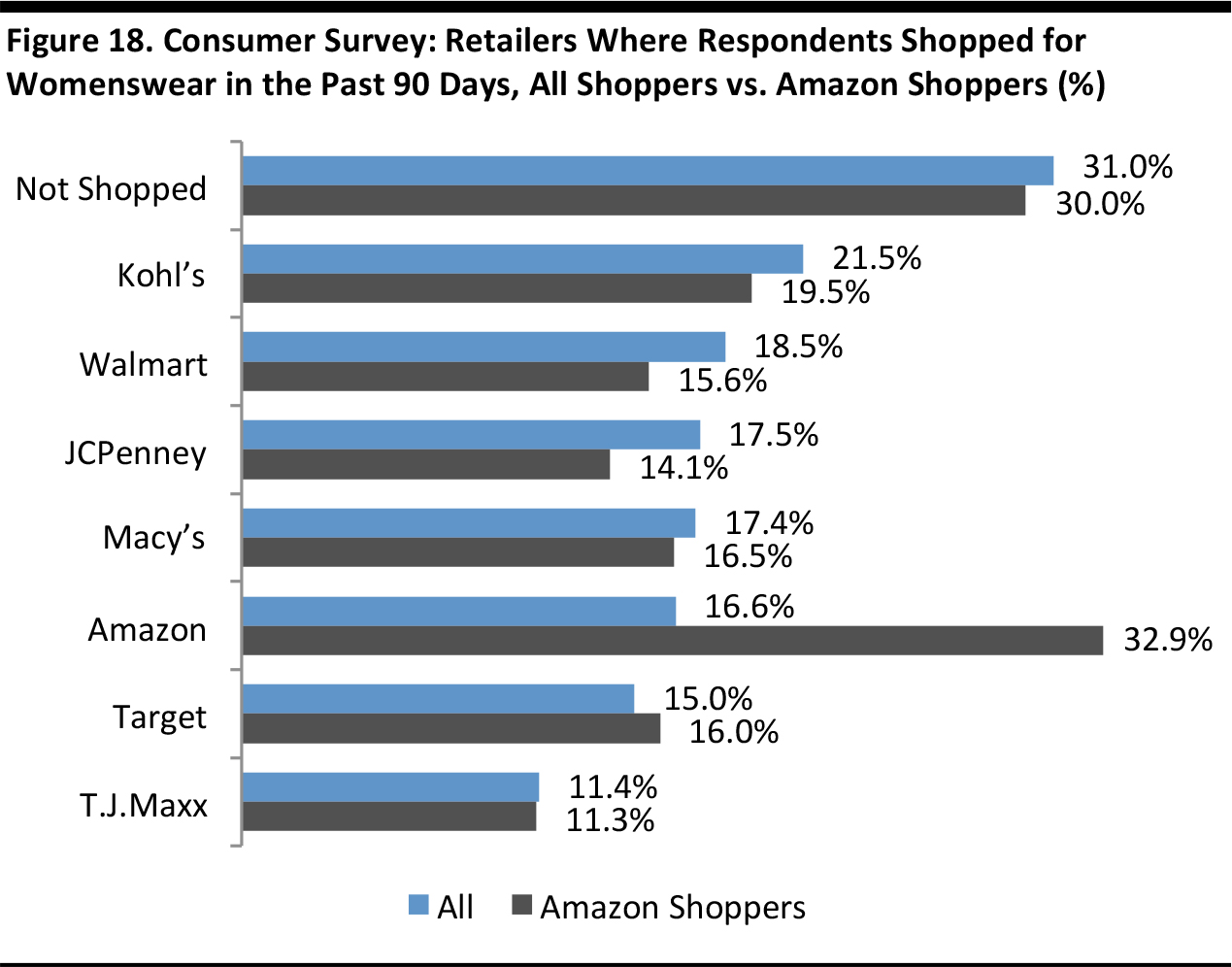

“Amazon shoppers” defined as respondents that rank Amazon as the store they shop at the most often for any category within the survey. Base: 4,912–7,008 adults aged 18+ in each survey period; surveys were conducted in April of each year. Source: Prosper Insights & Analytics/Fung Global Retail & Technology

When we drill down to where Amazon shoppers (male or female) buy womenswear, Amazon itself ranks much more highly, with around one-third buying womenswear from the retailer. “Amazon shoppers” are defined as respondents who stated they shop at Amazon the most often for any category about which Prosper surveys consumers (from groceries to toys to electronics to apparel).Menswear

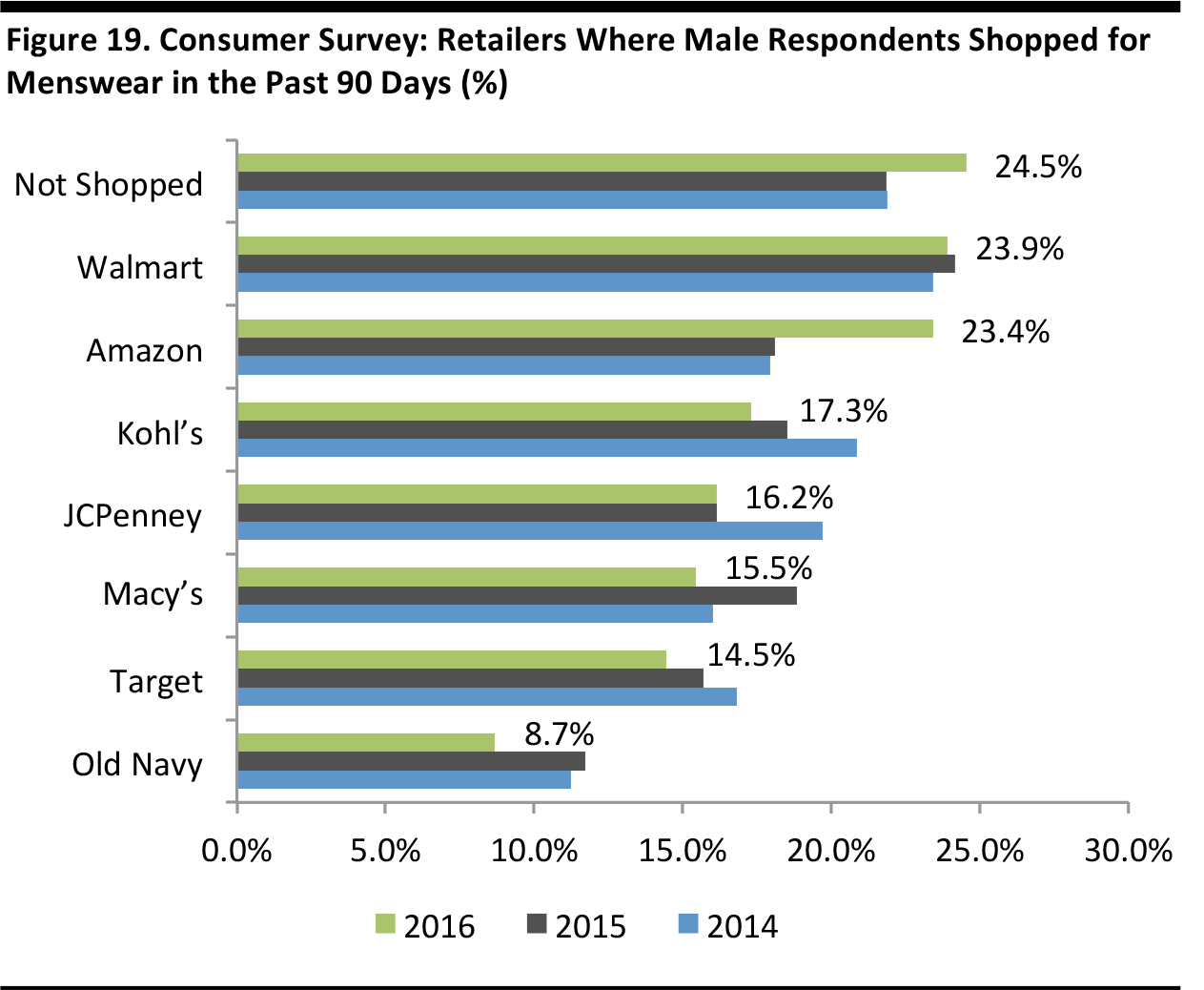

Base: 2,763–3,373 males aged 18+ in each survey period; surveys were conducted in June of each year. Source: Prosper Insights & Analytics/Fung Global Retail & Technology

Menswear accounts for around one-third of the total clothing market. Here, Walmart leapfrogs Kohl’s to take first position and Amazon seizes second place, having registered a leap in shopper numbers between 2015 and 2016. The differences in ranking and the presence of Old Navy for menswear suggest a greater focus on low prices among male shoppers than among female shoppers.

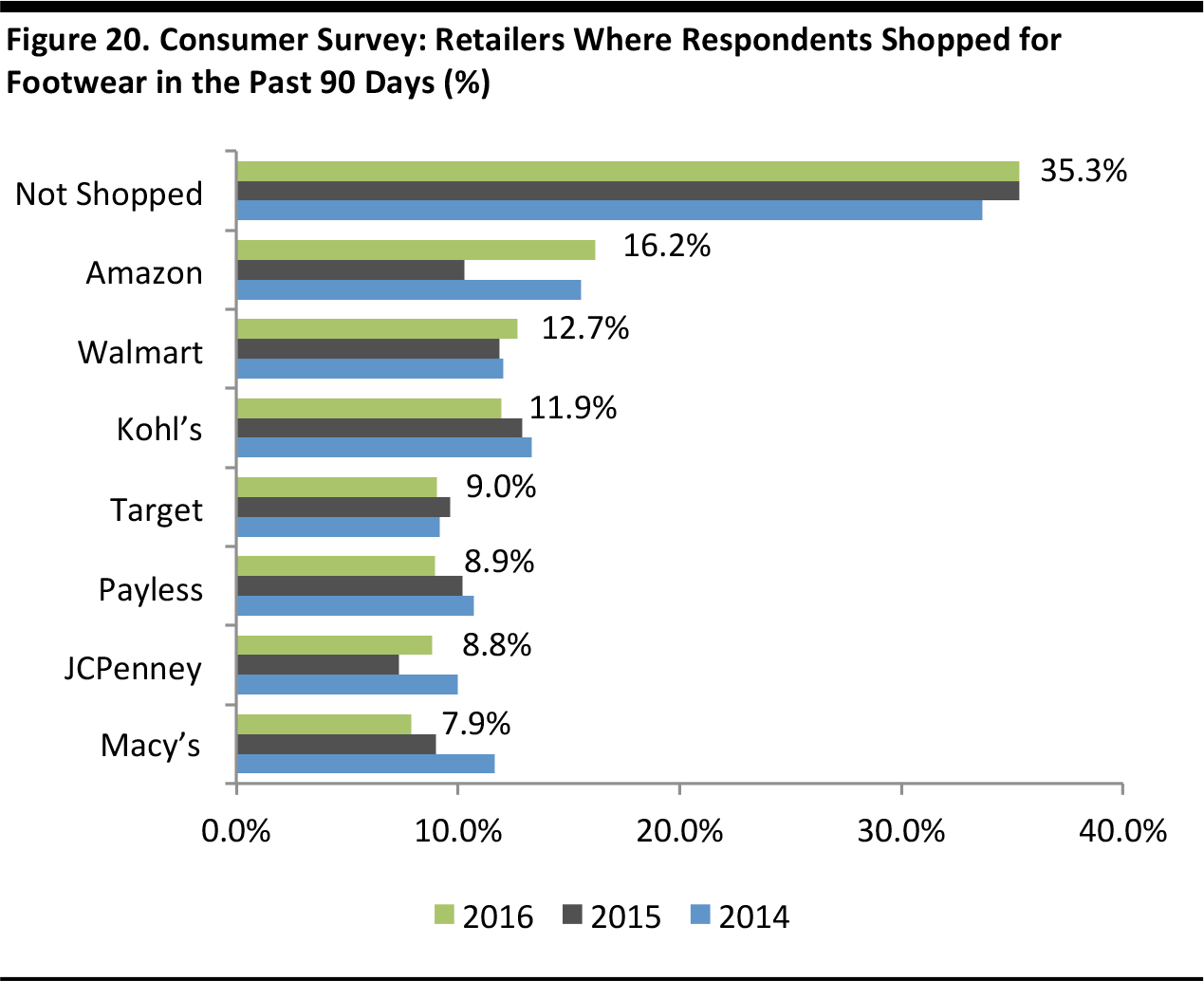

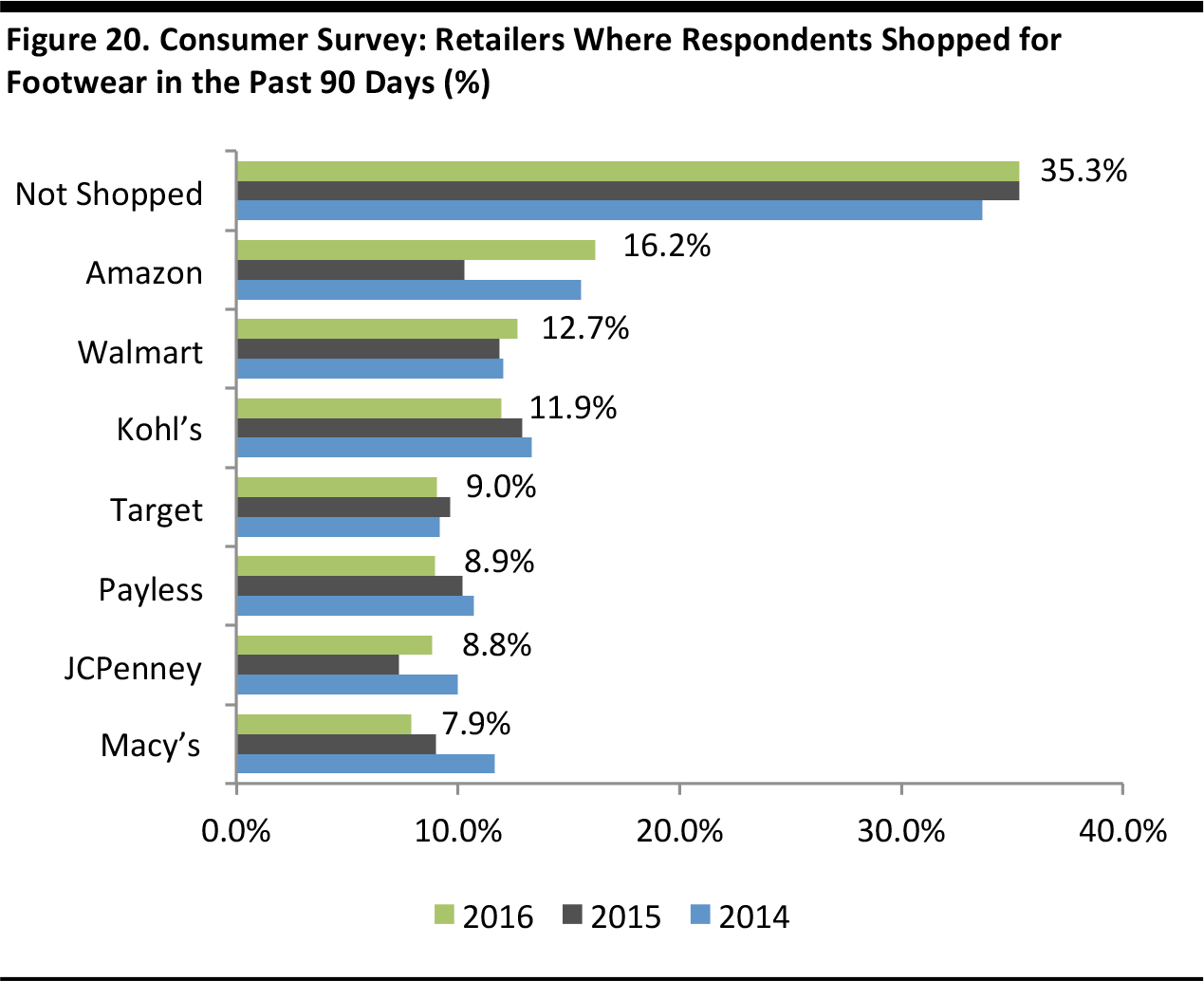

Base: 6,178–6,809 adults aged 18+ in each survey period; surveys were conducted in July of each year. Source: Prosper Insights & Analytics/Fung Global Retail & Technology

Amazon rates more highly for footwear than for clothing. In Prosper’s 2016 survey, respondents indicated that Amazon was the most-shopped retailer for shoes.- Readers can find further analysis of Prosper data in our recent report US Consumer Analysis: Apparel and Footwear.