Web Developers

Augmented reality (AR), virtual reality (VR) and mixed reality (MR) can be grouped together and referred to as “reality technology,” a category that has the potential to disrupt retail. In this report, we:

Executive Summary

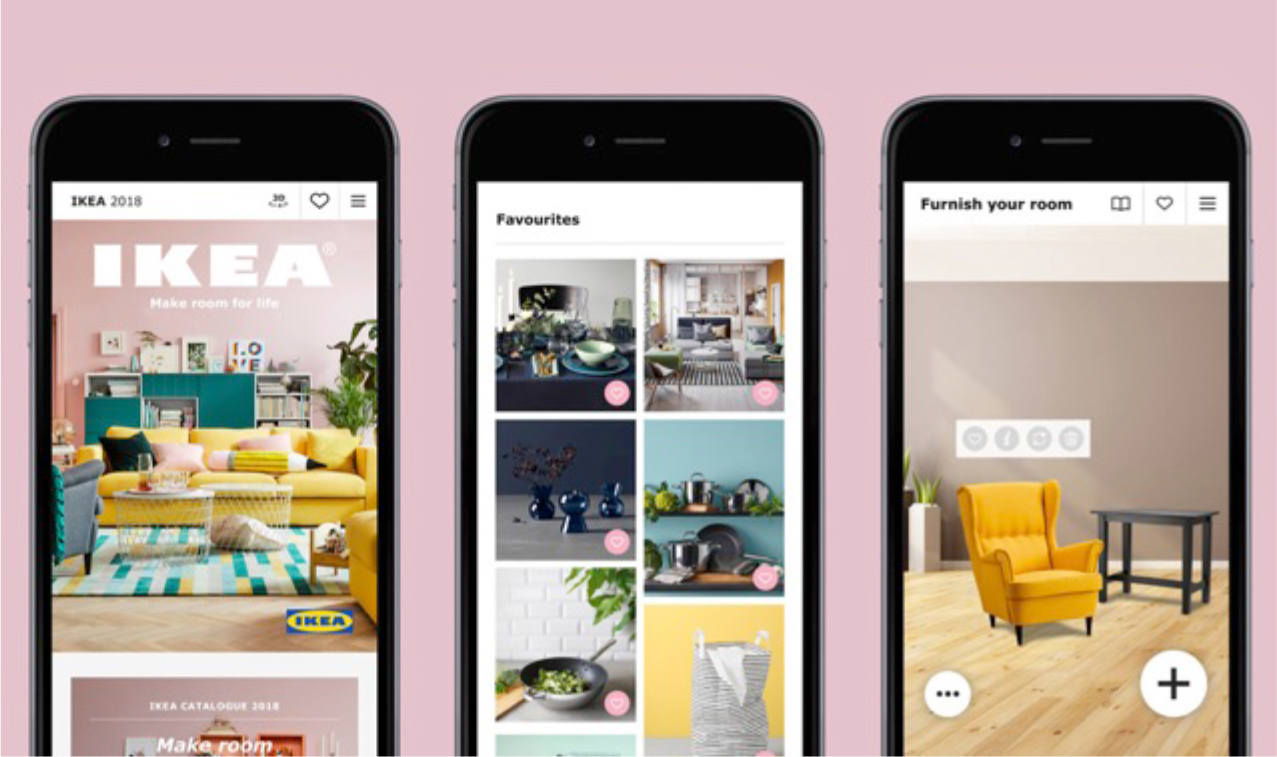

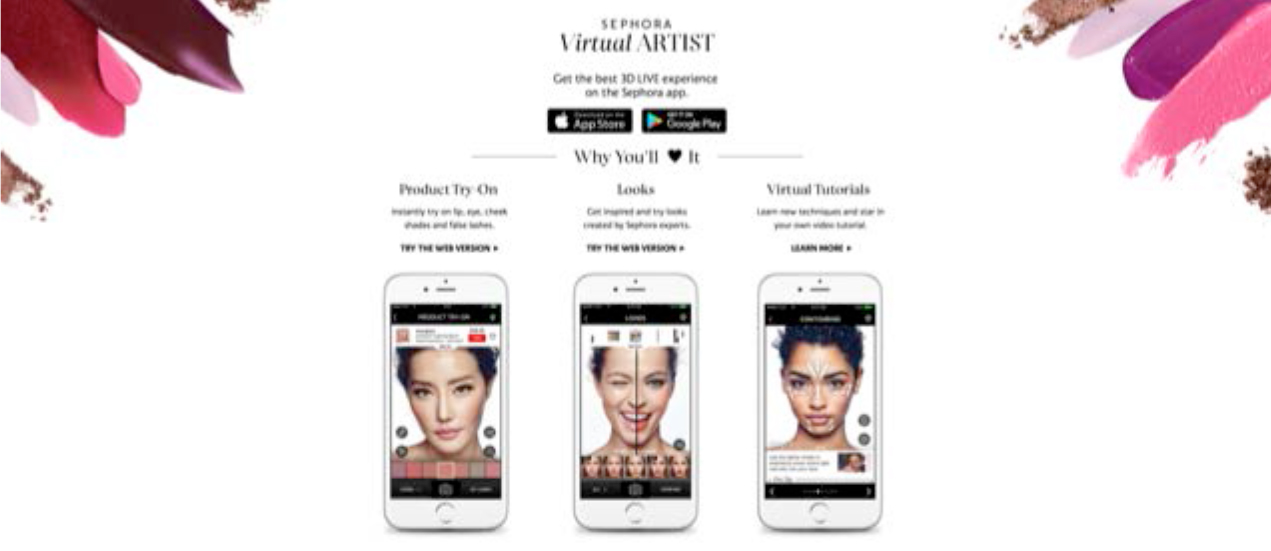

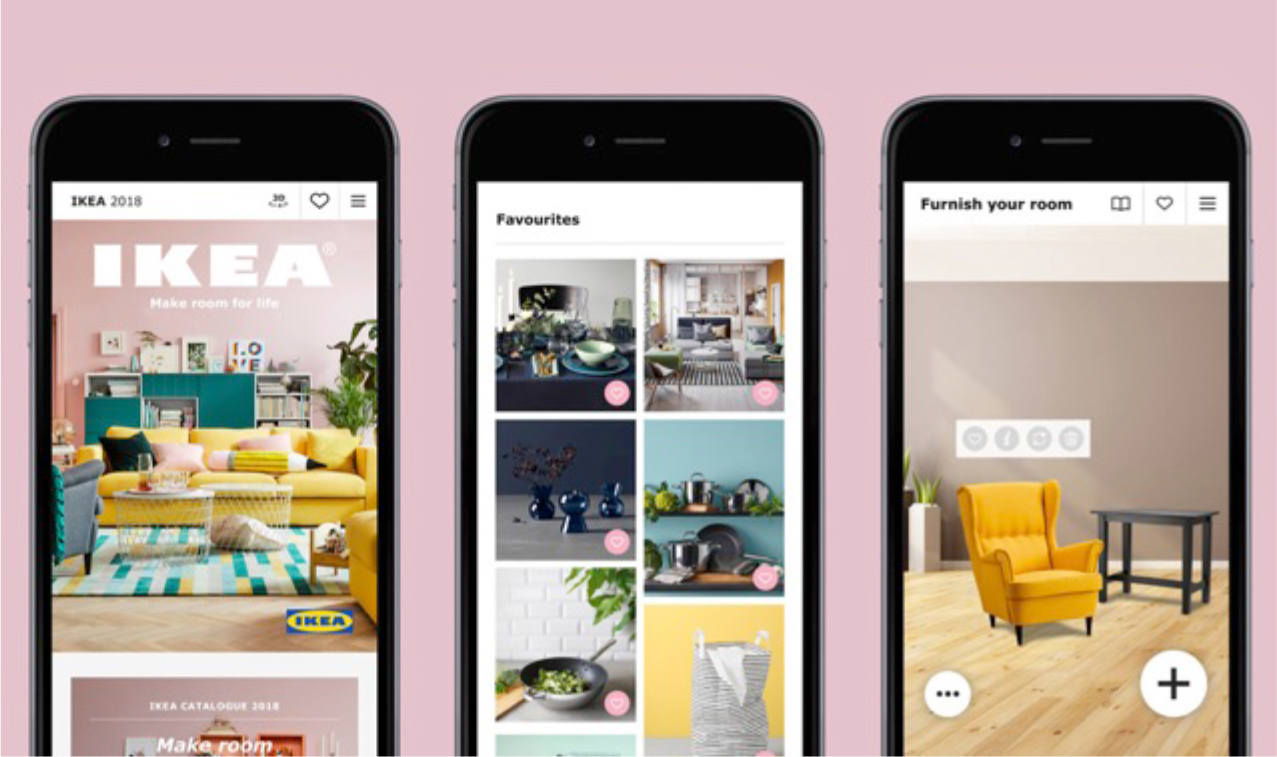

“Reality technology,” a term we use to group together AR, VR and MR, has the potential to disrupt retail by introducing new ways to guide shoppers through their journey. The three types of reality technology are used to digitally simulate or expand the user’s environment. AR enhances physical objects with digital content, VR simulates a completely virtual 3D environment, while MR combines the two by creating a VR environment in which physical objects are a part. Companies are testing the use of reality technology, in particular, to provide customers with virtual “try before you buy” services. IKEA: In 2014, IKEA launched an AR app, which, in conjunction with the company’s printed catalog, could show how a piece of furniture would look in a physical environment such as the customer’s lounge.

Source: IKEA Catalog App in iTunes Preview

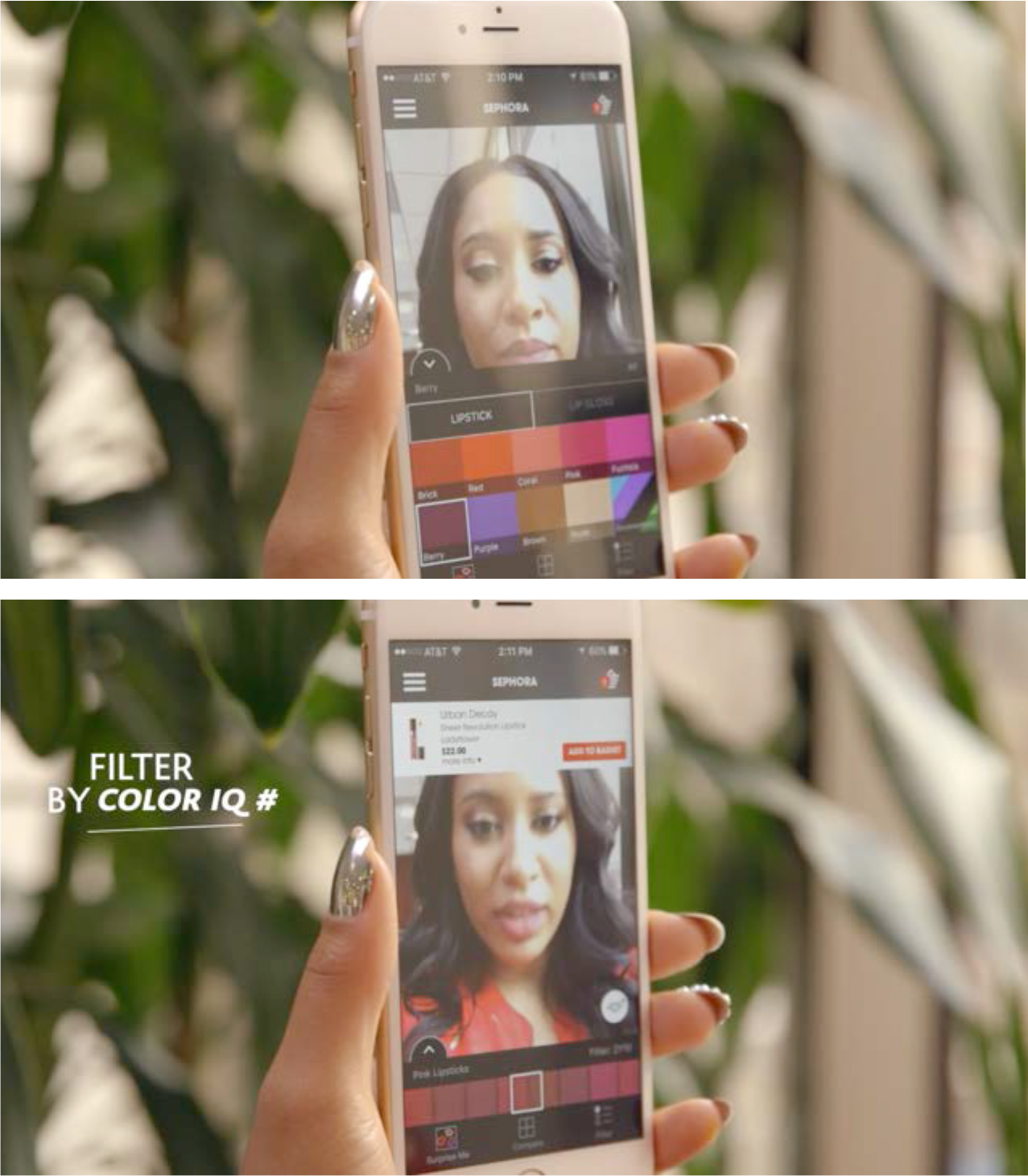

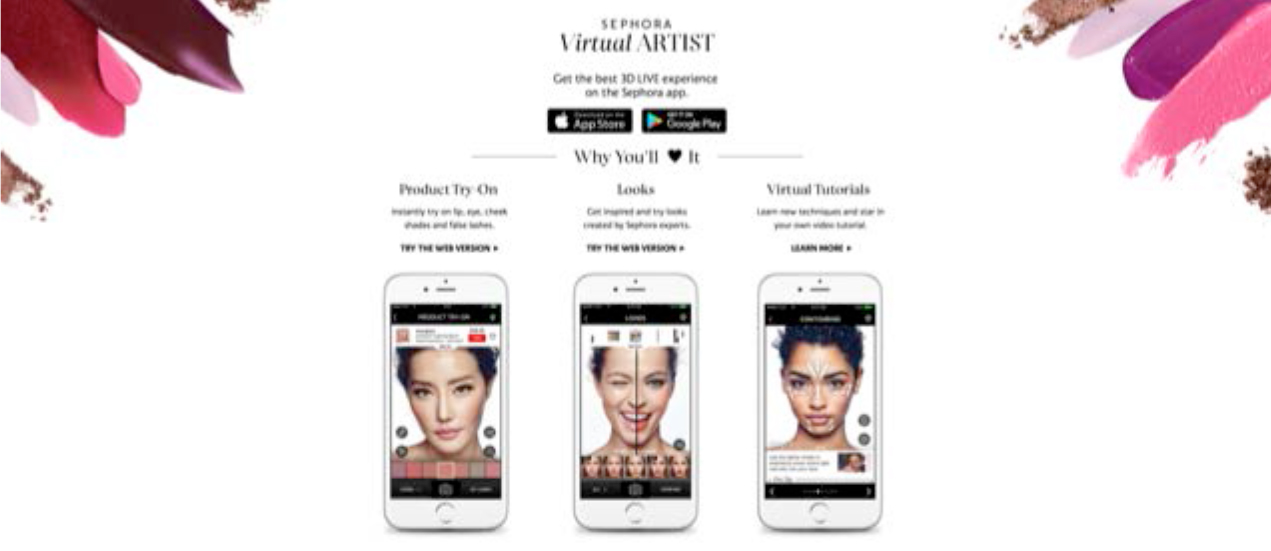

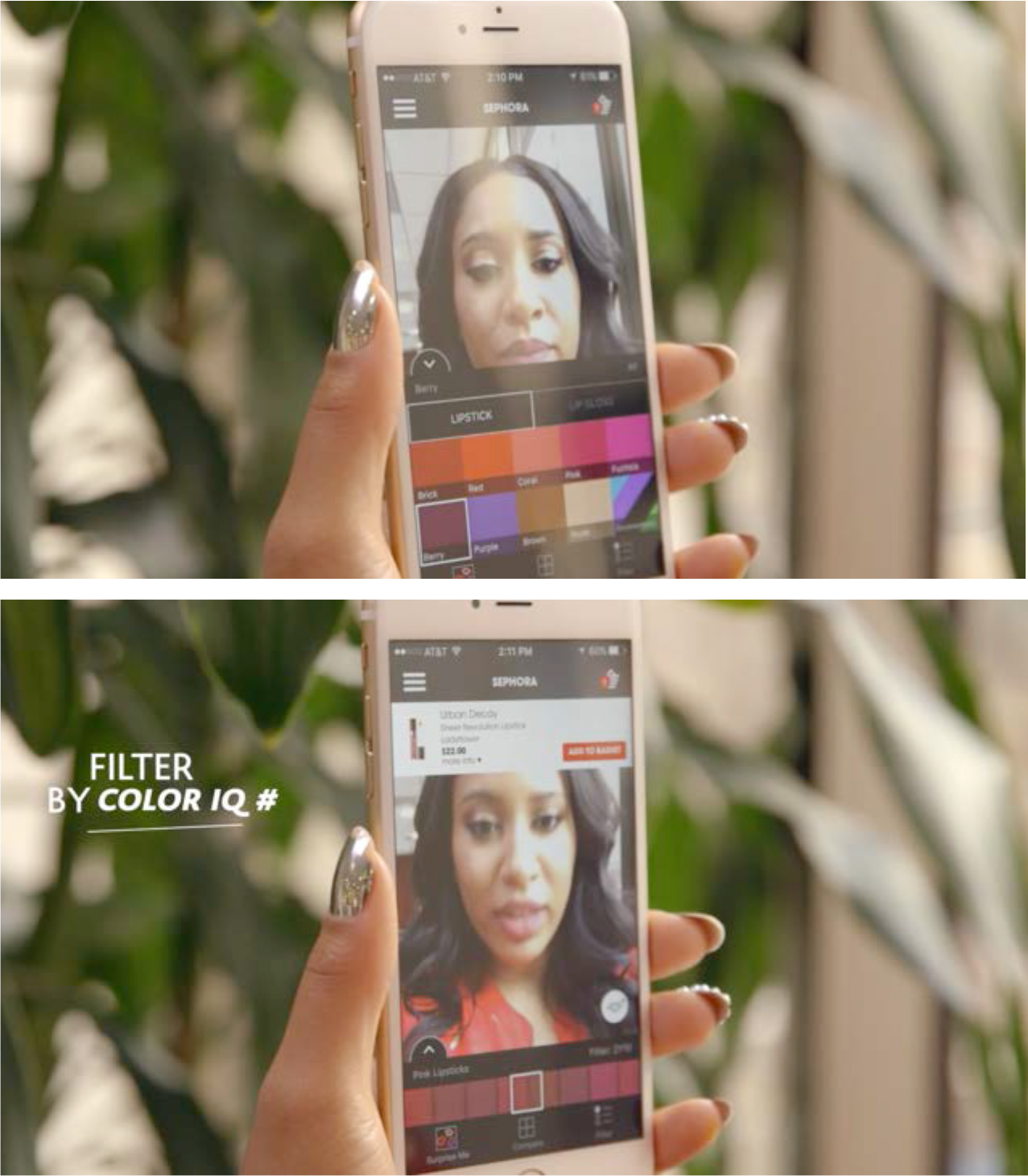

Sephora: In 2017, beauty retailer Sephora launched an AR app that enables users to see how they would look with different makeup on.

Source: Sephoravirtualartist.com

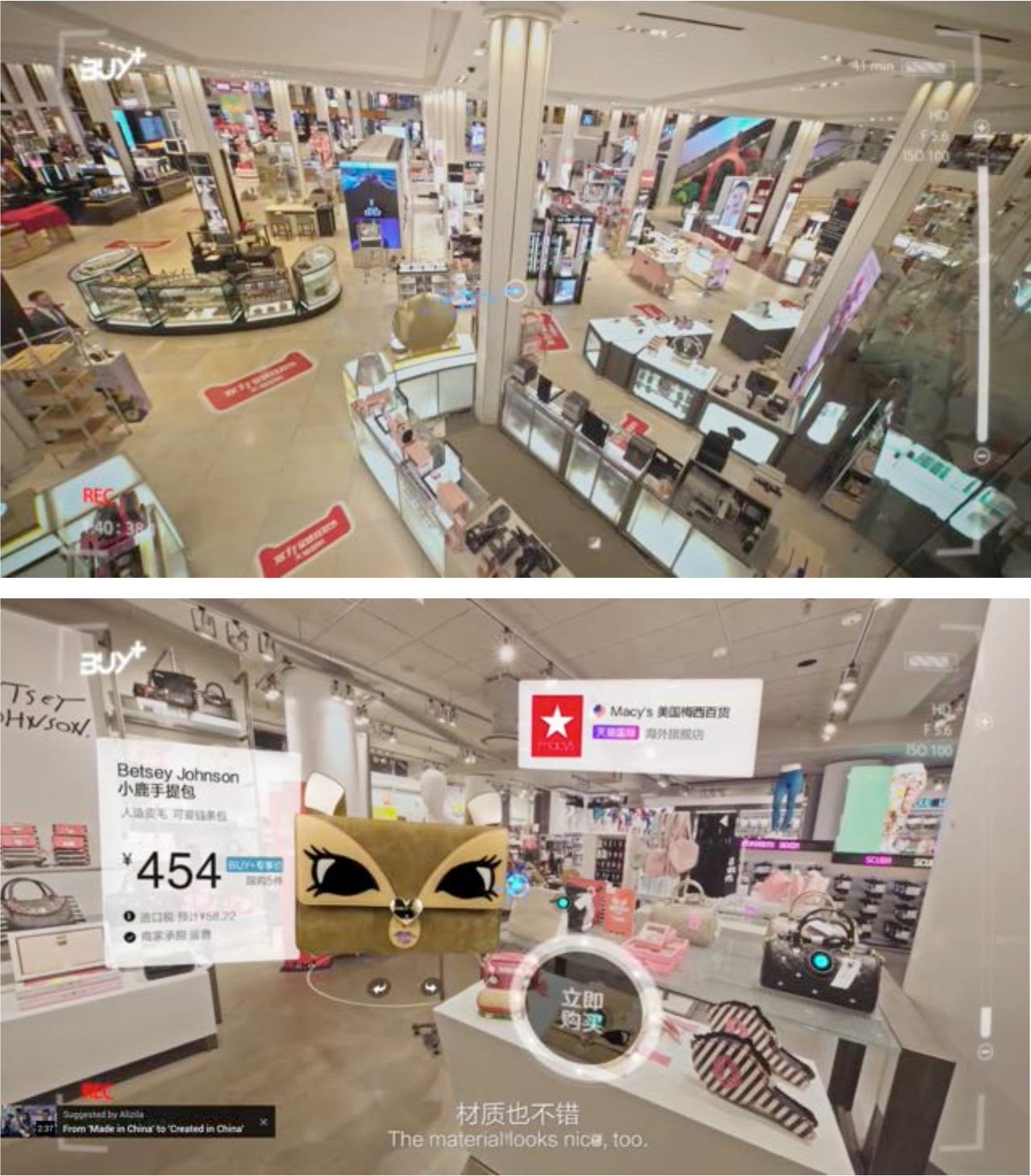

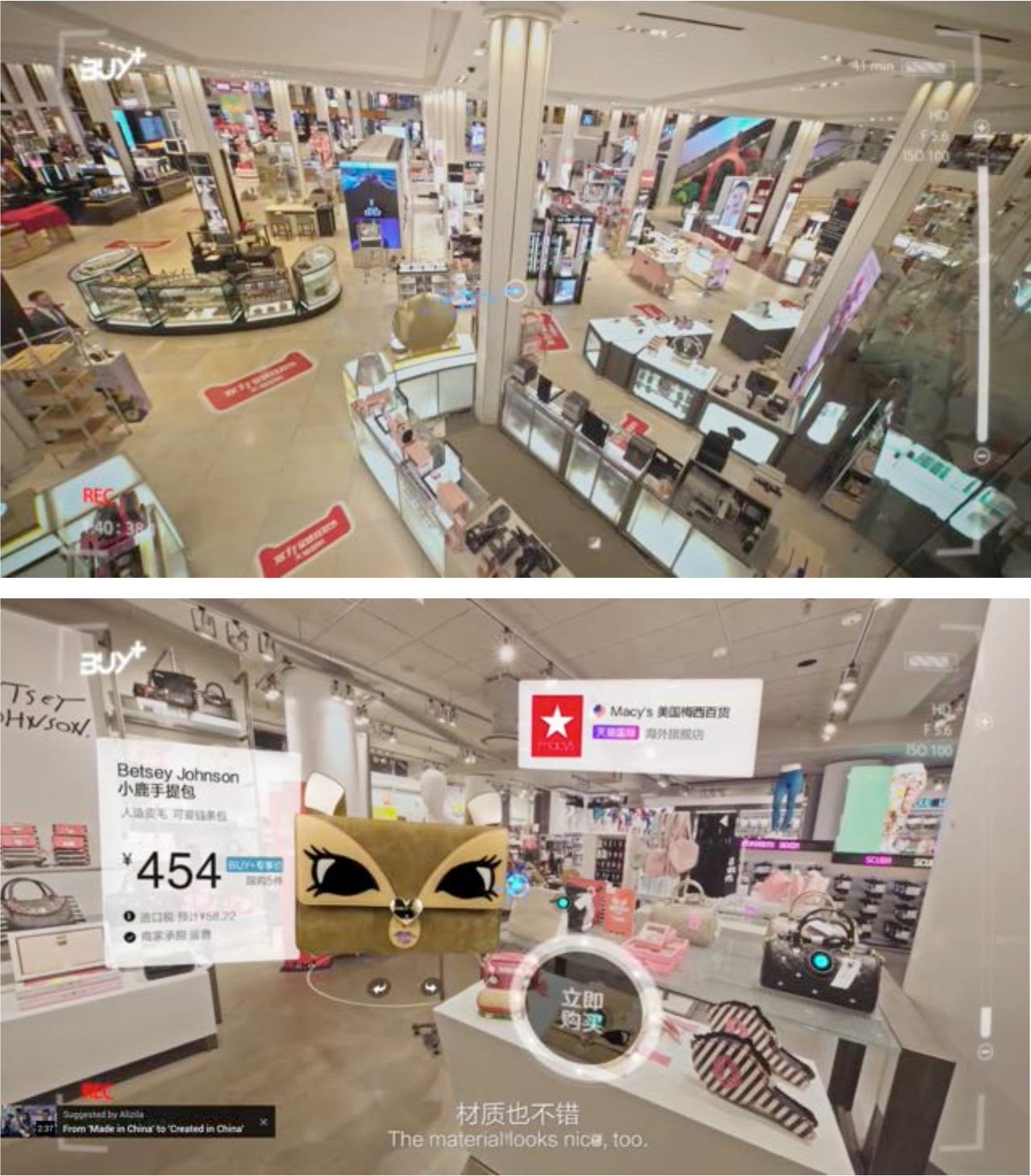

Alibaba: In 2016, Alibaba introduced the concept of shoppable VR with Buy+, a VR set that can simulate a shopping journey at iconic destinations such as Macy’s store on 34th Street in New York.

Source: YouTube

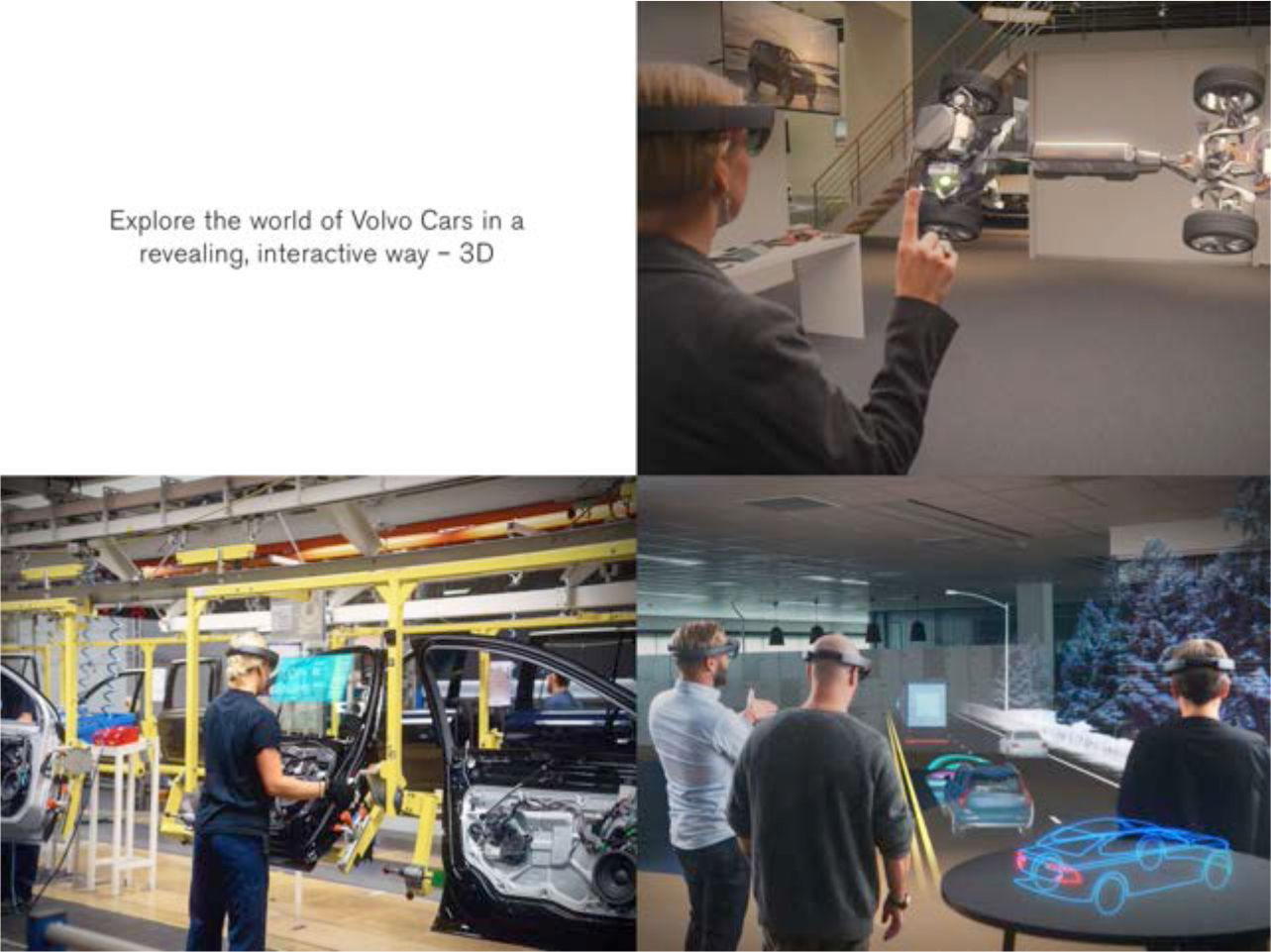

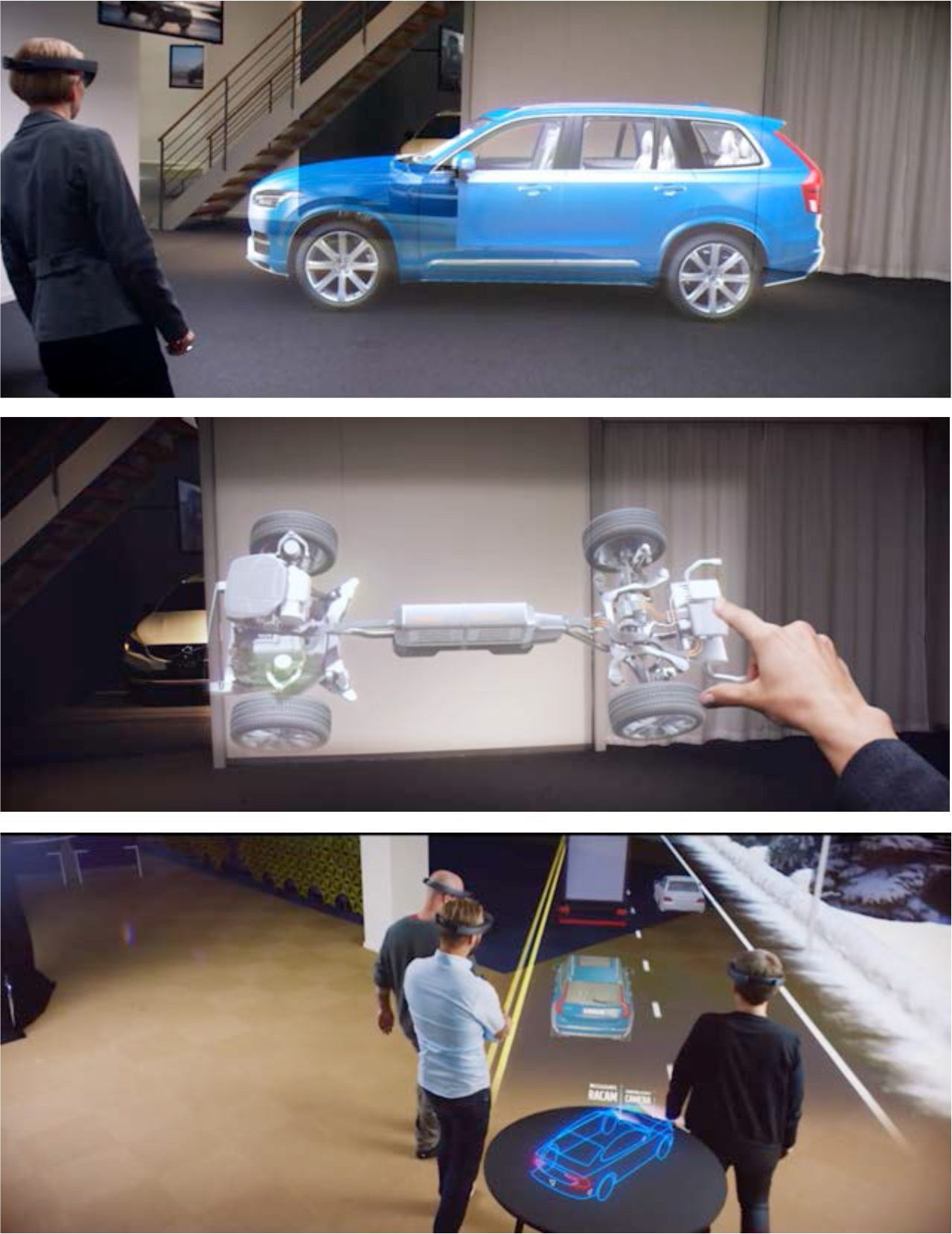

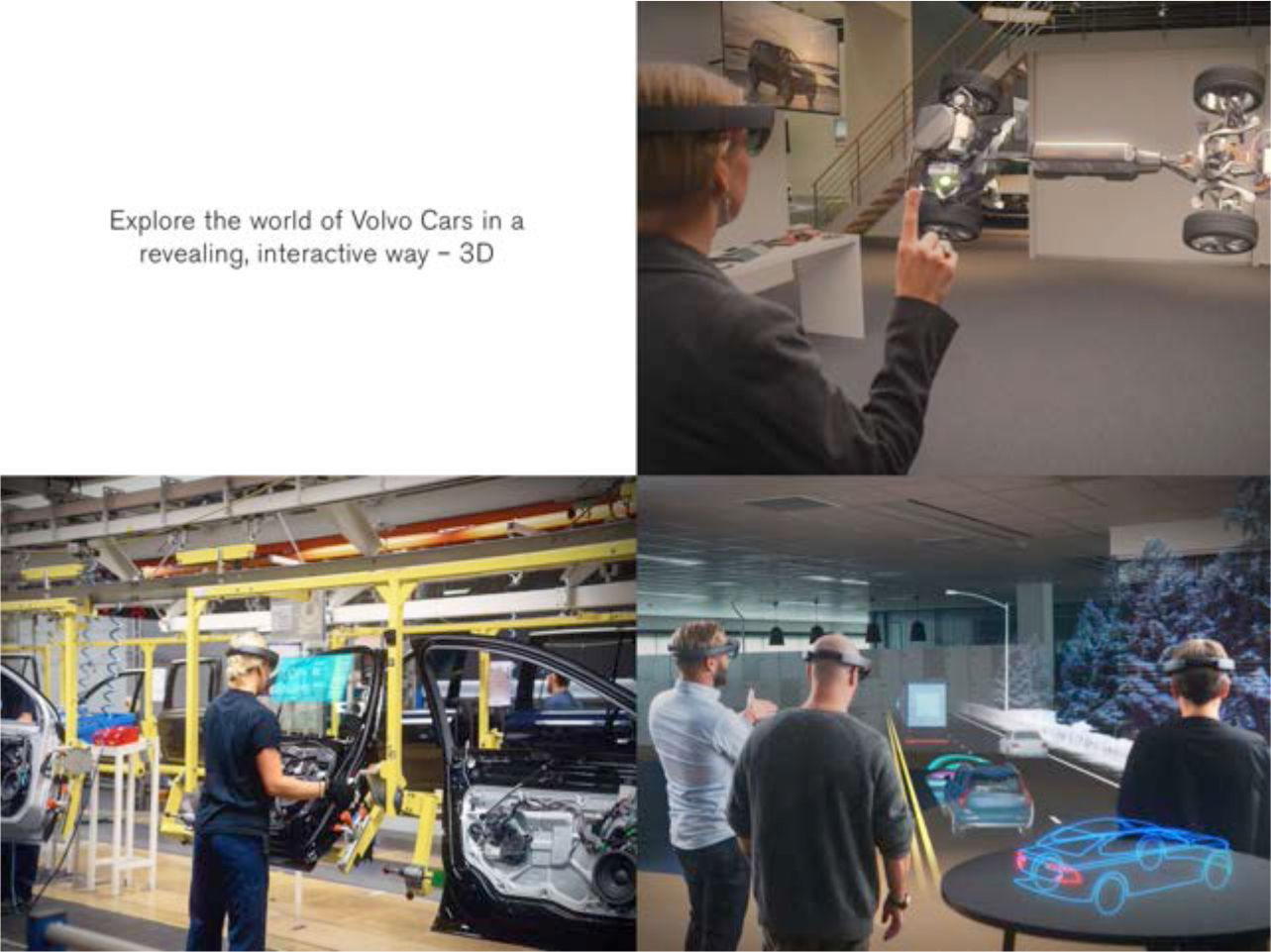

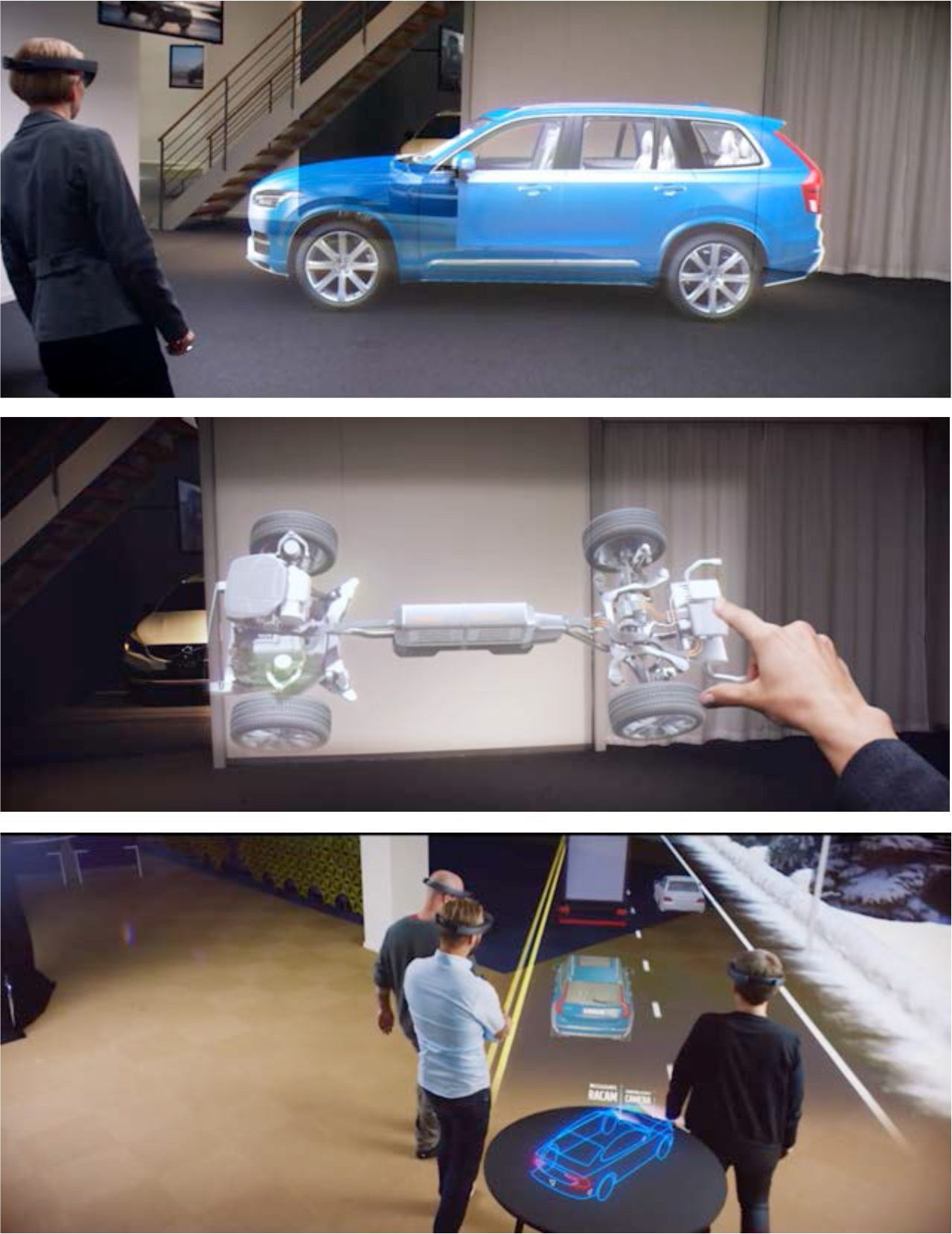

Volvo: Since 2015, Volvo has been using the advanced MR features of Microsoft HoloLens to enable customers to virtually experience how the technology embedded in Volvo’s cars works.

Source: Volvocars.com

Despite the interest that the use of reality technology has raised among retailers, adoption rates are still quite low—for VR technology it is just 4% among companies across industries, according to a survey conducted in 2016 by Information Technology (IT) professional network Spiceworks. Hardware challenges, lack of content and consumers’ reluctance to invest in the technology are preventing wider adoption. Nevertheless, the reality technology market presents a significant opportunity for retailers. Companies embracing the technology are expected to see a positive impact on profitability, as they will be able to capitalize on the strong growth of the VR market, which is forecast to grow by 531% in the three years to 2020, according to research company SuperData Research. Figures of Goldman Sachs Global Investment Research give us an idea of the future scale of reality technology in the retail industry: the investment bank estimates that the value of the VR retail software market globally will reach US$500 million in 2020 and US$1.6 billion in 2025. In this report, we propose three recommendations for retailers looking to adopt reality technology:- Develop reality technology apps for smartphones: We believe smartphones are likely to become the device of choice for users of reality technology.

- Combine functions: Consumers would be encouraged to use reality technology apps if they could also perform additional functions such as social media sharing.

- Focus content on the provision of product and service demonstrations: Reality technology can inform the customer’s purchasing process and encourage conversions to increase profitability.

Introduction

While the retail industry is still at a very early stage in the adoption of reality technology, companies have started to introduce the technology to enrich the shopping journey with a tool that can inform shoppers’ decision-making process—for example, by virtually replicating what it is like to use the product or service once purchased. Going forward, reality technology could disrupt retail by changing the way consumers shop. In this report, we provide an overview of the application of reality technology in retail. We illustrate notable examples of how retailers have introduced reality technology as a tool to provide better customer service. Next, we outline the main factors that still prevent the widespread adoption of the technology among consumers and companies. Finally, we illustrate the opportunities that the adoption of reality technology can bring to companies that embrace it, and formulate recommendations on what areas companies should focus on to maximize the impact on consumer reach and profitability.Defining Reality Technology: AR, VR and MR

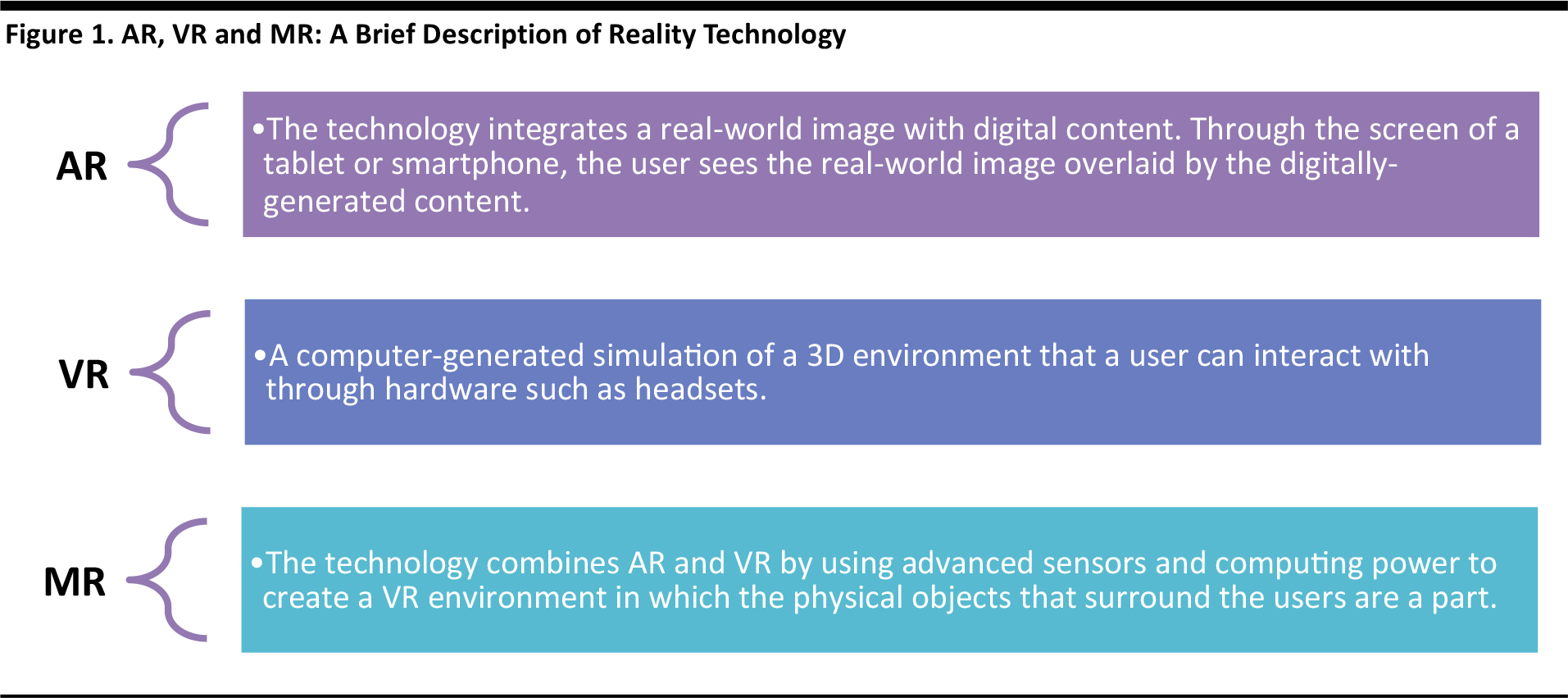

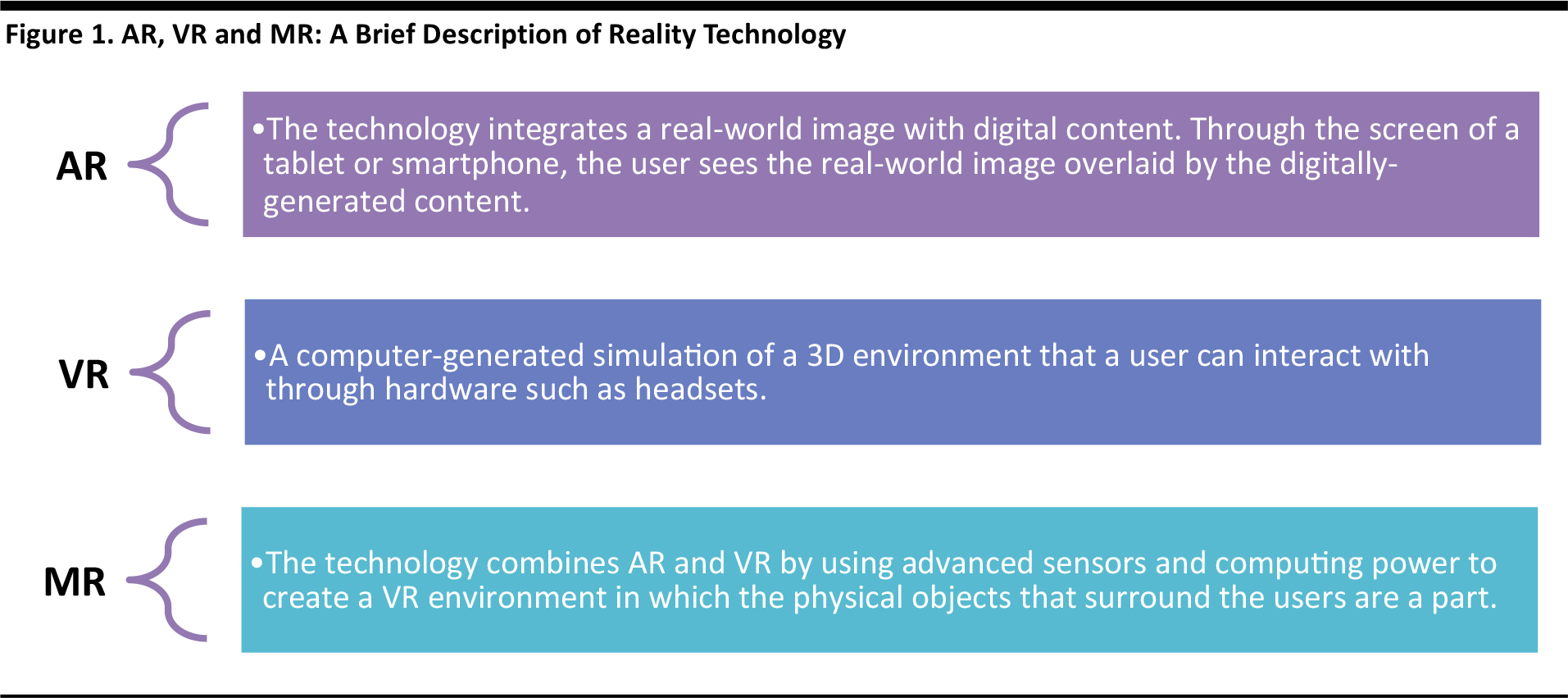

Reality technology is used to simulate or expand the user’s environment and includes AR, VR and MR. Figure 1 briefly describes the three types of reality technology.

Source: FGRT

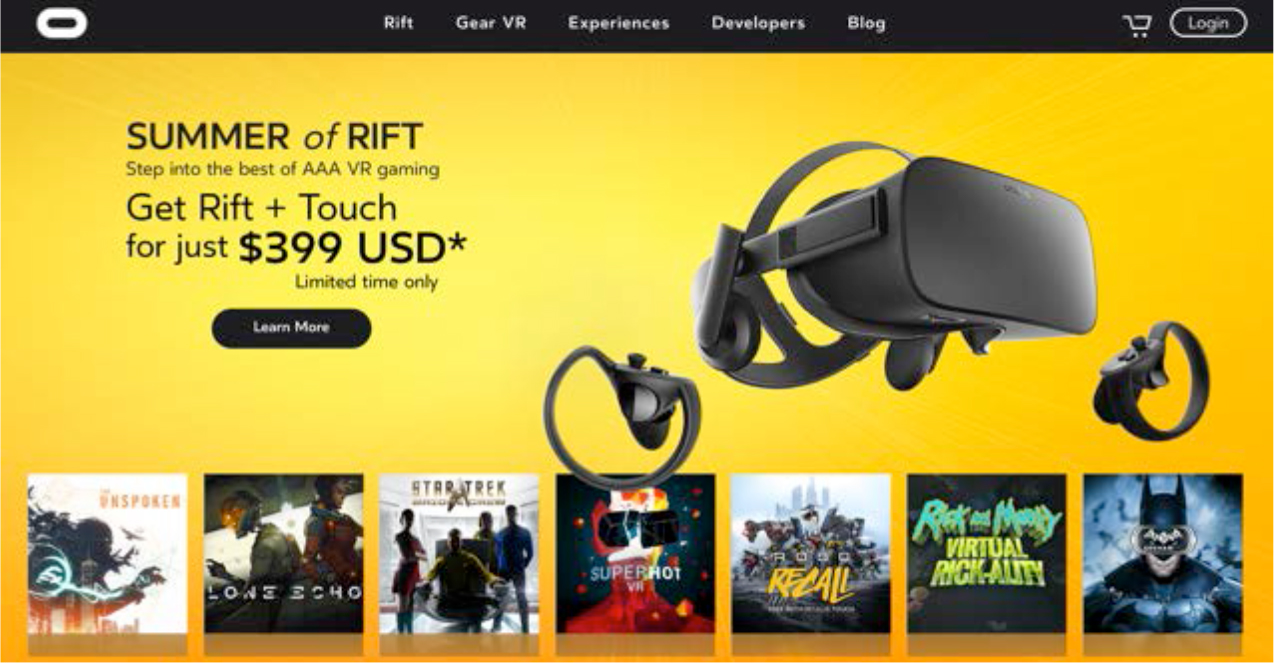

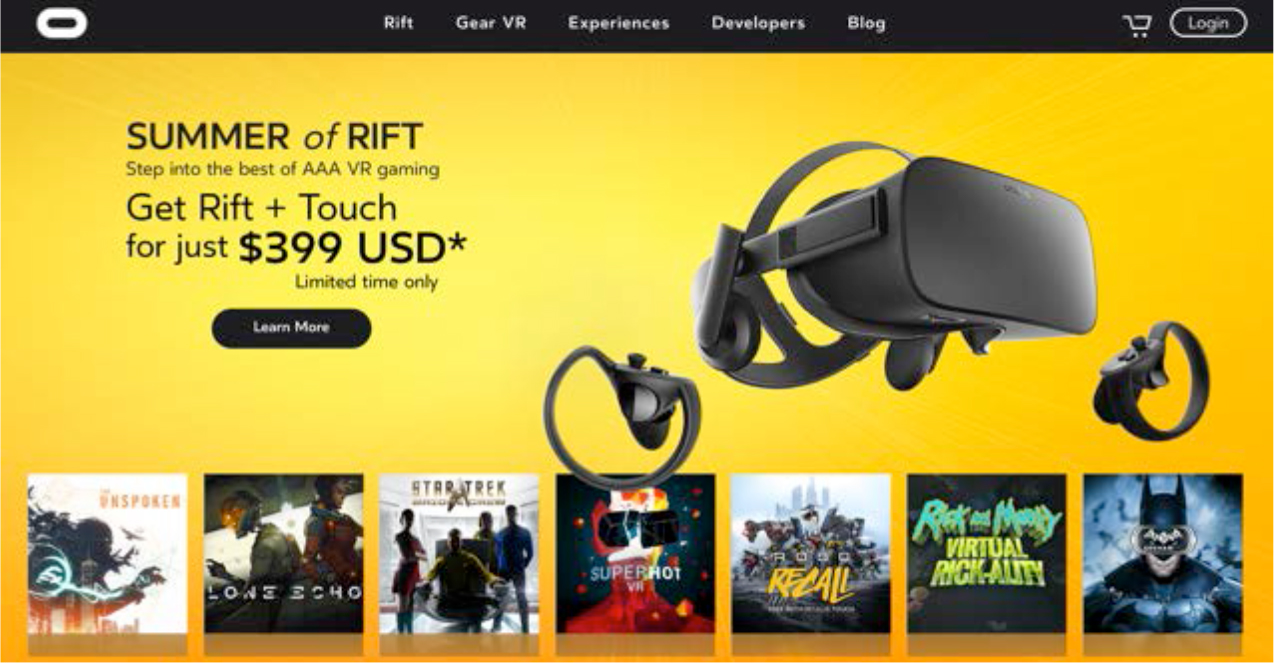

Attempts at developing reality technology date back at least to the 1960s, but it was only from the late 1980s and early 1990s that the technology—VR in particular—started to take its first steps into commercial applications, first applied to video games, according to the Virtual Reality Society. In recent years, we have seen rapid advancements that have made the technology cheaper and more convenient to use. This evolution has unleashed further commercial applications.Facebook’s purchase of VR firm Oculus Rift in 2014 increased interest in the potential of the commercial applications of the technology, including in industries such as retail.

Source: Oculus.com

The Applications of Reality Technology in Retail

Retailers have recently started to experiment with applications of VR, AR and MR so that customers can simulate what it is like to use the product or service sold by the company, and to provide new ways to shop. Below, we highlight a few notable examples of how retailers have applied reality technology. From these, we can see that there are two main ways that retailers can offer customer experiences powered by reality technology:- Developing apps that run on shoppers’ own devices, such as AR apps for smartphones and tablets or VR apps for VR headsets.

- Making reality technology hardware available in-store for customers to use as part of a tech-enhanced brick-and-mortar shopping experience, such as the MR experience that car manufacturer Volvo offers in its showrooms.

AR Catalog: IKEA

In conjunction with its 2014 catalog, furniture retailer IKEA launched an app that, through AR, enables users to preview how the furniture shown in the catalog would look in the shopper’s own home.

Source: YouTube

To use the service, consumers download the IKEA catalog app, scan the product from the printed catalog that the user intends to preview, place the printed catalog on the spot where the users want to preview the piece of furniture and point the camera of the smartphone or tablet device at that spot to obtain a simulation of the furniture item with the physical space in the background.AR Beauty App: Sephora

In 2017, beauty products retailer Sephora introduced a new feature of its iOS app “Sephora Virtual Artist.” Through AR, the app enables users to virtually try on different types of makeup and create different makeup looks.

Source: YouTube

The user first scans their face using their smartphone or tablet, and through the app can visualize how they would look with different makeup. As the customer virtually tries on different solutions, they can get more information about the makeup products they have tried, which can then be added to their shopping basket for purchase. It is also possible to share the look with friends on social media. The app was developed in partnership with tech firm ModiFace.Shoppable VR: Alibaba

One week ahead of its 2016 Singles’ Day shopping festival, Alibaba launched the trial of Buy+, a VR set through which users can access a virtual shopping experience that simulates shopping trips to iconic locations such as Macy’s store on 34th Street in New York. This marked the introduction of shoppable VR, a new retail application for the technology.

Source: YouTube

To use Buy+, the shopper plugs their smartphone into the VR set to access the simulation. The session starts with a visual of a wall with posters of different shopping locations in the US, including Macy’s and Target stores. Once the user selects a location, they are transported inside the store, and using a pointer to display products, get information and can purchase the items. Payment is processed through payment app Alipay, which is integrated in Buy+. Within 10 days of the trial launch, 8 million shoppers had tried Buy+. It is not known what impact the technology, as revenues generated by this new shopping channel were not disclosed by Alibaba, according to news channel CNN. Buy+ is an unusual use of VR in retail, in that it is intended to complement e-commerce rather than to augment the in-store experience.VR-Powered Interior Design and Training Tool: Lowe’s Holoroom

Home improvement retailer Lowe’s adopted an in-store VR system, Lowe’s Holoroom, which uses VR to enable customers to visualize how different Lowe’s products would look in a real-world space—such as a kitchen or a bathroom. The technology has changed what was once done using CAD drawings on a store associate’s tablet, into an easy and fun experience that allows the user to play around in the Holoroom by repositioning pieces of furniture and changing materials such as countertops, paint colors or cabinet finishes. Meanwhile, the store associate can simultaneously see on their own tablet what the customer is seeing to help the shopper reach a decision.

Source: Lowesinnovationlabs.com

At the end of the session, customers can transfer the result of their interior design session on YouTube 360 for sharing and for viewing at home with a complimentary Google Cardboard VR set. Lowe’s Holoroom was tested in two stores in 2014 and rolled out to 19 stores across the US in November 2015. In addition to its in-store VR interior-design experience, in 2017, Lowe’s launched in selected stores in Boston and Canada Holoroom How To, a VR training tool that teaches people how to undertake home improvement projects such as painting a wall or tiling a bathroom.

Source: Lowesinnovationlabs.com

Holoroom How To consists of a booth in-store in which customers wear VR gear (a headset and controller), through which they are given step-by-step instructions on how to complete a task. At the same time, they can virtually implement the instructions and visualize the results. Holoroom How To is an example of how VR can be used for customer engagement and in-store entertainment.VR-Powered In-Store Entertainment: Topshop

To mark the start of the 2017 summer season, fashion retailer Topshop launched a VR waterslide at the company’s flagship store on Oxford Street, London.

Source: FGRT

To experience the attraction, visitors to the Topshop flagship store wore a VR headset and sat on an inflatable ring on top of a slide similar to those found at water parks. Once the user started to physically travel down the slide, the VR headset simulated a waterslide journey among the busy Central London streets surrounding the store. The users had the feeling that the waterslide they were traveling on was passing next to London’s iconic red, double-decker buses and other famous tourist landmarks of the city. The attraction, which represents a good example of in-store entertainment used to encourage footfall, was available for shoppers to try from May 25 to June 4.Mixed Reality Shopping with Microsoft HoloLens: Volvo

In 2015, carmaker Volvo partnered with tech giant Microsoft to test the application of Microsoft HoloLens, an MR technology. Volvo showrooms used the technology to improve the car-buying experience.

Source: Youtube

HoloLens mixes AR with VR and enables the user to see the hologram of a virtual object (the car) in a real space and to interact with it. The technology is embedded in a wireless headset that is worn by the user. Through Microsoft HoloLens, customers visiting Volvo’s showrooms can browse colors, features and options, but most importantly, they can experience virtually how the technology embedded in the car works. For example, the HoloLens gives the customer an idea of how safety features such as autobraking work in action. At the time of writing, Volvo was still testing the potential of HoloLens, according to the company’s website.Obstacles to Wider Adoption of Reality Technology

Despite the interest that reality technology is raising among companies, the business application of it is still in its infancy. A survey conducted in 2016 among IT professionals working in different industries in North America, Europe, the Middle East and Africa by US-based Spiceworks, a professional network for the IT industry, shows that the rate of adoption of VR technology among respondents was just 4%. We identify three main types of problems that prevent the widespread adoption of reality technology in industries such as retail:- Hardware challenges: These include the reliance on cables to operate the devices, as well as issues related to comfort, heat and battery life.

- User motivation: Consumers still need to be convinced that technologies such as VR are a “must have” rather than just a tech gimmick. So far, widespread adoption has not been achieved, even with the introduction of cheaper hardware, a sign that consumers are still struggling to see the point of using reality technology.

- Chicken-and-egg dilemma: The lack of content is probably one of the main factors that impacts a user’s motivation to buy reality technology, and it is the result of what Goldman Sachs Global Investment Research defines as a chicken-and-egg dilemma. Content makers (such as app developers) are reluctant to develop content if consumer adoption is low, and, conversely, consumer adoption remains low as long as there is little content available.

Source: YouTube

Opportunities for Retailers Embracing Reality Technology

The current period, characterized by a low adoption of reality technology, can be considered as the early stage of growth in the technology life-cycle in which innovators and early adopters (such as Alibaba and Volvo) pave the way for other companies to follow through. It is reasonable to expect that, as technology progresses, the problems highlighted above will be overcome and that AR, VR and MR will become more widespread. By then, innovators would have developed a competitive advantage over late adopters. Therefore, companies that aim to remain competitive should consider how AR, VR or MR could improve their hedge against competitors. Below, we summarize the main opportunities that the adoption of reality technology can bring to companies:The Reality Technology Market Is Expected to Continue to Expand

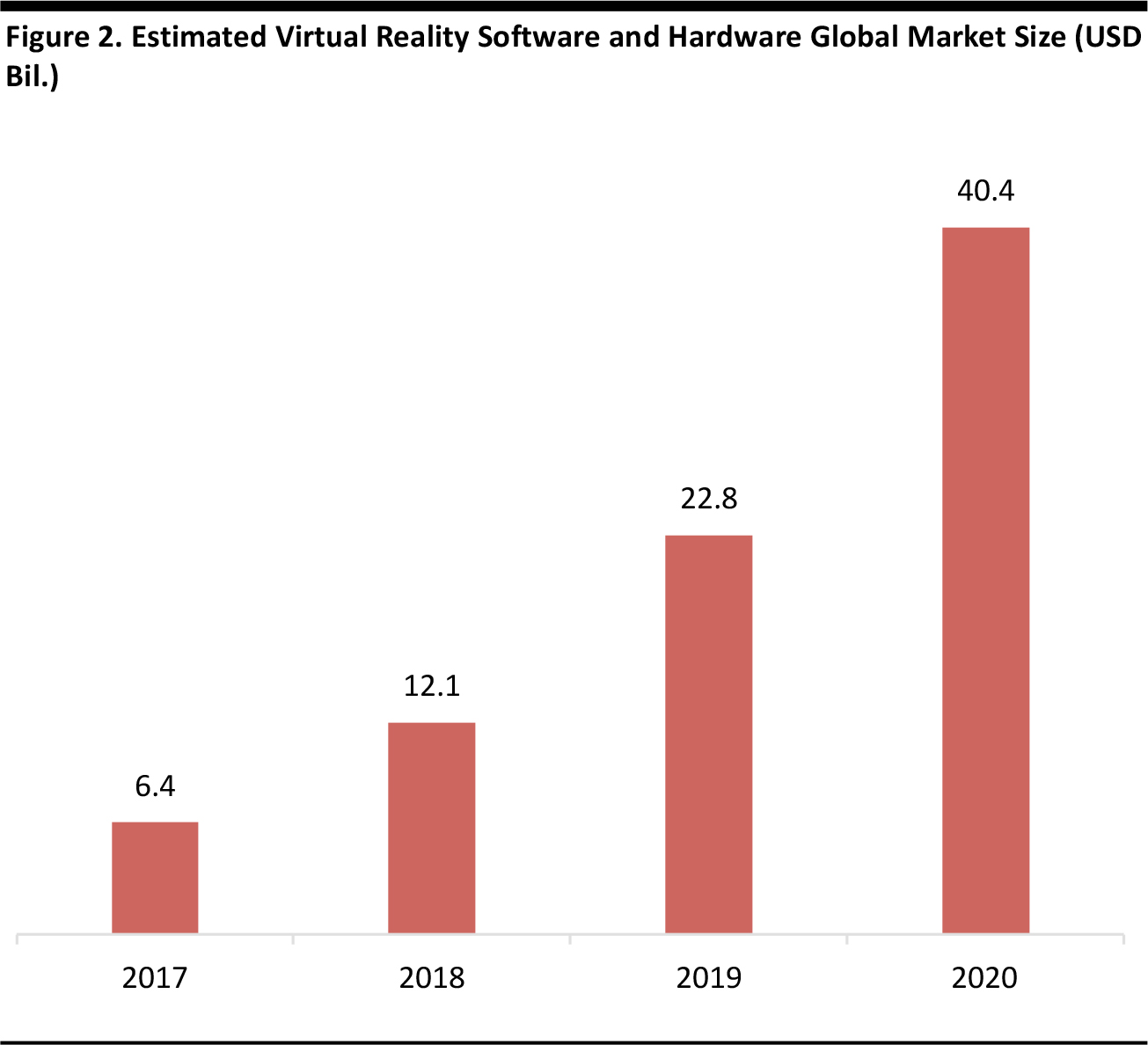

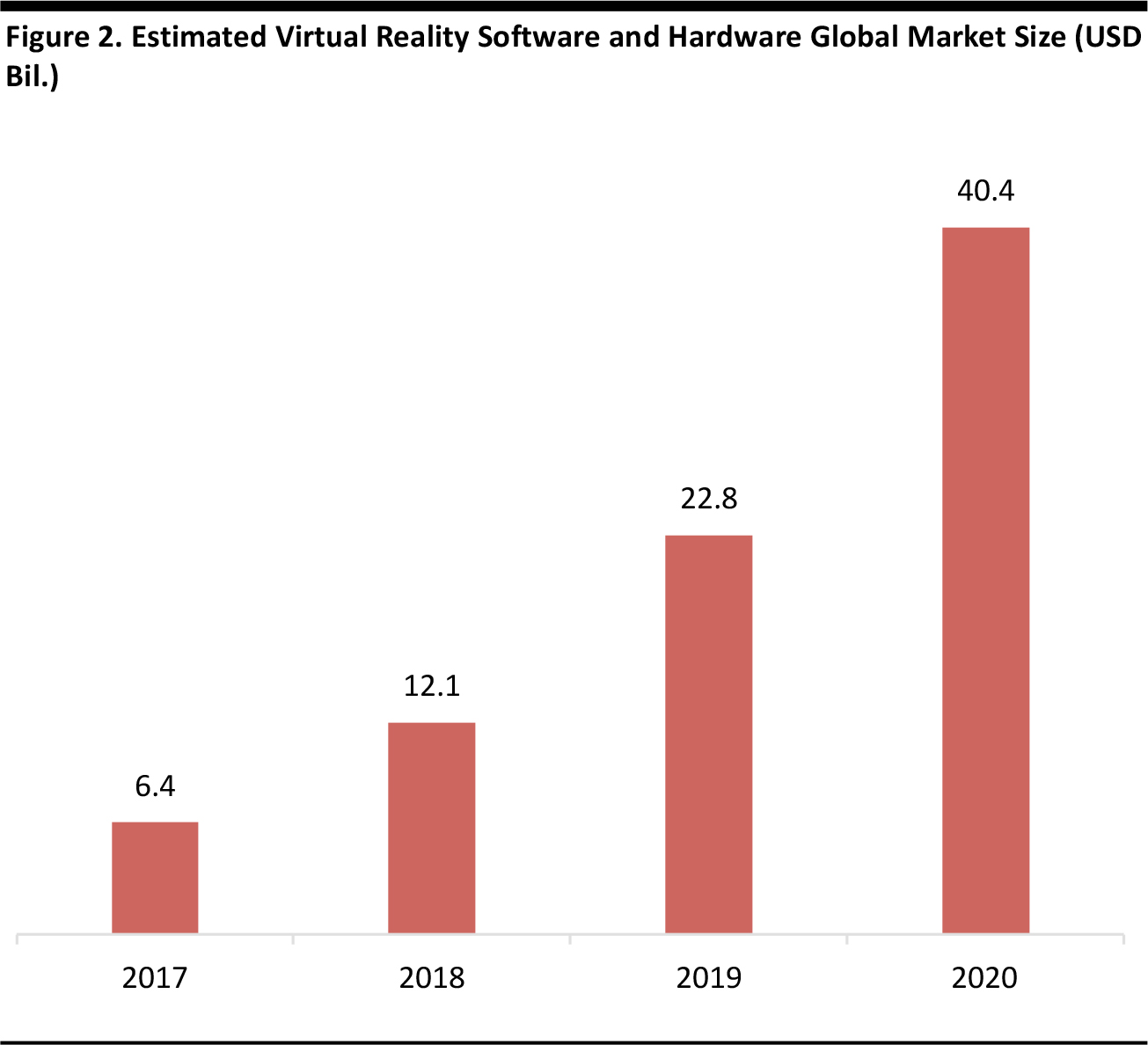

There will be an estimated half a billion VR headsets globally by 2020, according to research firm Strategy Analytics, and the global VR market is expected to record an impressive 531% growth in the three-year period to 2020 to reach US$40.4 billion, according to research company SuperData Research. Given these figures, it is easy to imagine that retailers that will develop content for reality technologies will greatly benefit from this fast-paced expansion.

Source: SuperData Research

Positive Impact of Reality Technology on Profitability

The application of reality technology to retail should reflect positively on profitability. As we have seen from the examples from IKEA, Sephora and Volvo, the application of reality technology in retail aims to improve the customer’s shopping experience, encourage brand engagement and assist the purchasing decision. This should increase conversion rates and reduce returns. Moreover, as for any digital technology used in retail, its implementation provides a wealth of data for customer analytics to inform strategiesSource: iStockphoto

While hard data is not yet there, given the embryonic stage of the technology in terms of retail applications, a study undertaken by virtual reality market research agency Greenlight Insight in 2016 confirms that brands using VR should enjoy a positive impact on their image, customer engagement and sales. The survey, with a sample of 1,300 adults in the US, shows that 71% of the respondents agree that brands using VR look more forward thinking and modern, 62% said that they would feel engaged with a brand that sponsors a VR experience and that 53% responded that they are more likely to buy from brands that use the technology.Meeting Shoppers Expectations

Once larger and more tech-savvy retailers adopt reality technology, customers will more likely expect AR, VR or MR as part of their shopping experience. This could imply that retailers that resist the adoption of reality technology will not be able to meet customer’s expectations and could lose a competitive edge. According to a 2017 survey undertaken among UK consumers by tech firm Vista Retail Support:- 56% of respondents who had not experienced AR in stores said that implementing AR should be a priority for retailers.

- 75% of respondents said that they see the value of the application of the technology in retail.

- 96% of respondents who had experienced AR in a brick-and-mortar store said that the technology improved their shopping experience.

Disrupting Retail

Retail is one of the industries that looks most likely to be disrupted by reality technology, and companies using the technology will increase their competitive advantage and the share of their existing market, according to Goldman Sachs Global Investment Research. The bank forecasts that the value of the VR retail software market globally will reach US$500 million in 2020 and US$1.6 billion in 2025.

Source: iStockphoto

The investment bank believe that reality technology will be adopted, in particular, by retailers selling big-ticket items, such as furniture, holidays or cars, but does not discount a use case for apparel shopping, where customers can use the technology to see how clothes look on them without physically trying them on. Goldman Sachs research forecasts that reality technology could also reduce the need for in-store display inventory and could accelerate the erosion in value of physical space in brick-and-mortar stores, as consumers will be able to virtually browse and try items on.Recommendations for Retailers Adopting Reality Technology

It follows from the opportunities highlighted above that the adoption of reality technology can bring significant advantages to retailers aiming to stay ahead of the competition. However, along with the adoption of new technologies comes the commitment in terms of organization resources and the need to be implemented correctly. Below, we list three recommendations that should help retailers to maximize their results when adopting reality technology:- Develop reality technology apps for smartphones: Smartphones are likely to become the device of choice for reality technology users. Low-cost hardware that uses smartphones as the screen of the VR set—such as Google Cardboard—are likely to become the most successful in encouraging adoption. So, to reach most consumers that will have access to reality technology, retailers should focus on the development of apps that work on smartphone devices.

- Combine functions: Devices and software that can be used in different contexts are likely to become more successful, as users would have more reasons to purchase the technology. For example, a retailer could consider developing VR apps that enable users to perform different functions including social media sharing and omnichannel features such as in-store entertainment.

- Product and service demonstration: The use of reality technology should be aimed at effectively informing the customer’s purchasing process and not simply be a “nice to have” technology to impress shoppers. The difference will come from the ability to use AR, VR and MR to provide customers with an effective simulation of what using the product or service would be like. As illustrated by the earlier examples from IKEA, Sephora and Volvo, this would be the strongest case for the adoption of the technology by retailers, as it is likely to encourage conversions and increase profitability.