Executive Summary

Outdoor apparel, footwear and gear constitute a growing sector that benefits from consumers’ increasing participation in outdoor activities, particularly in large markets such as the US, Europe and China:

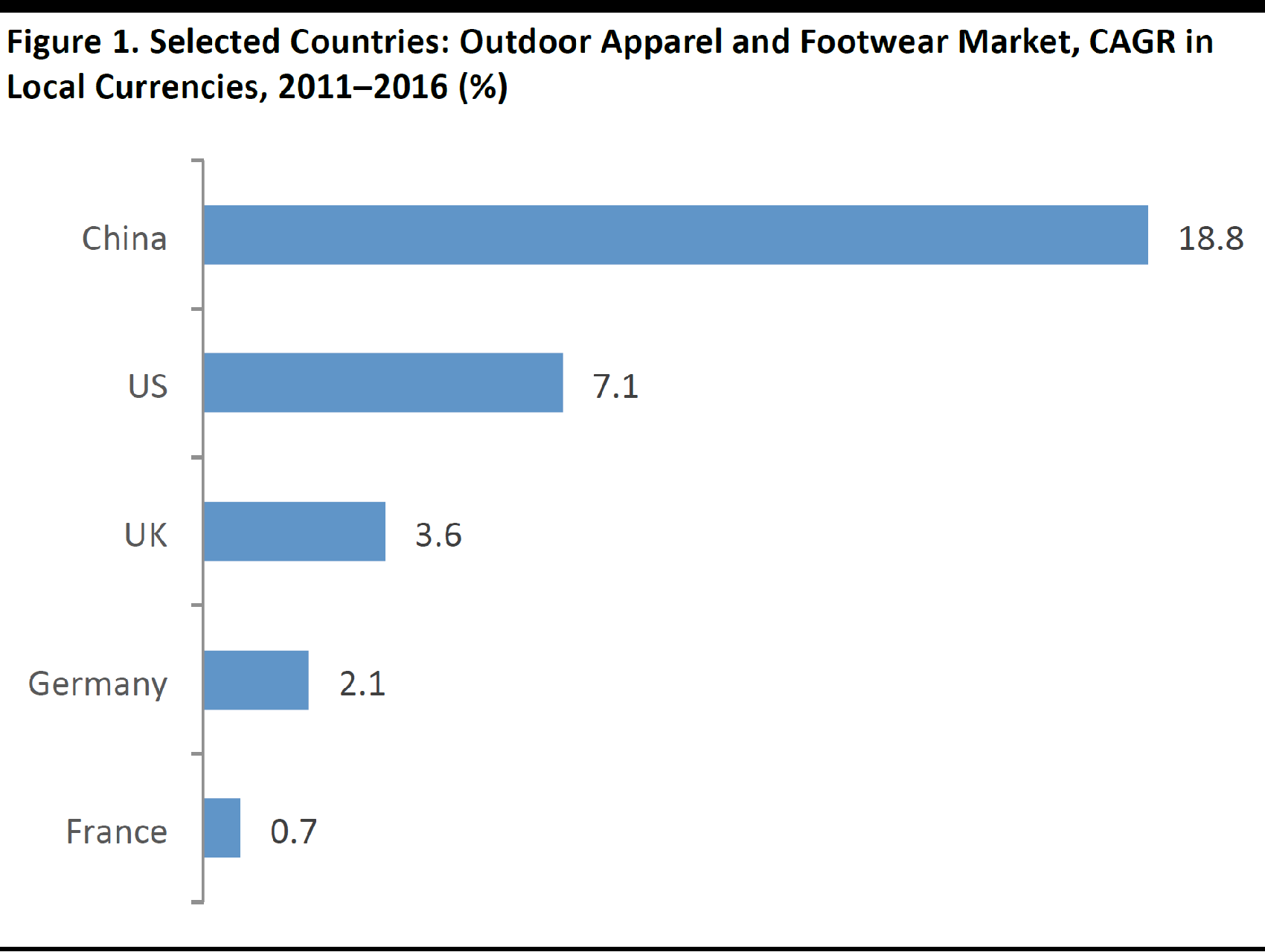

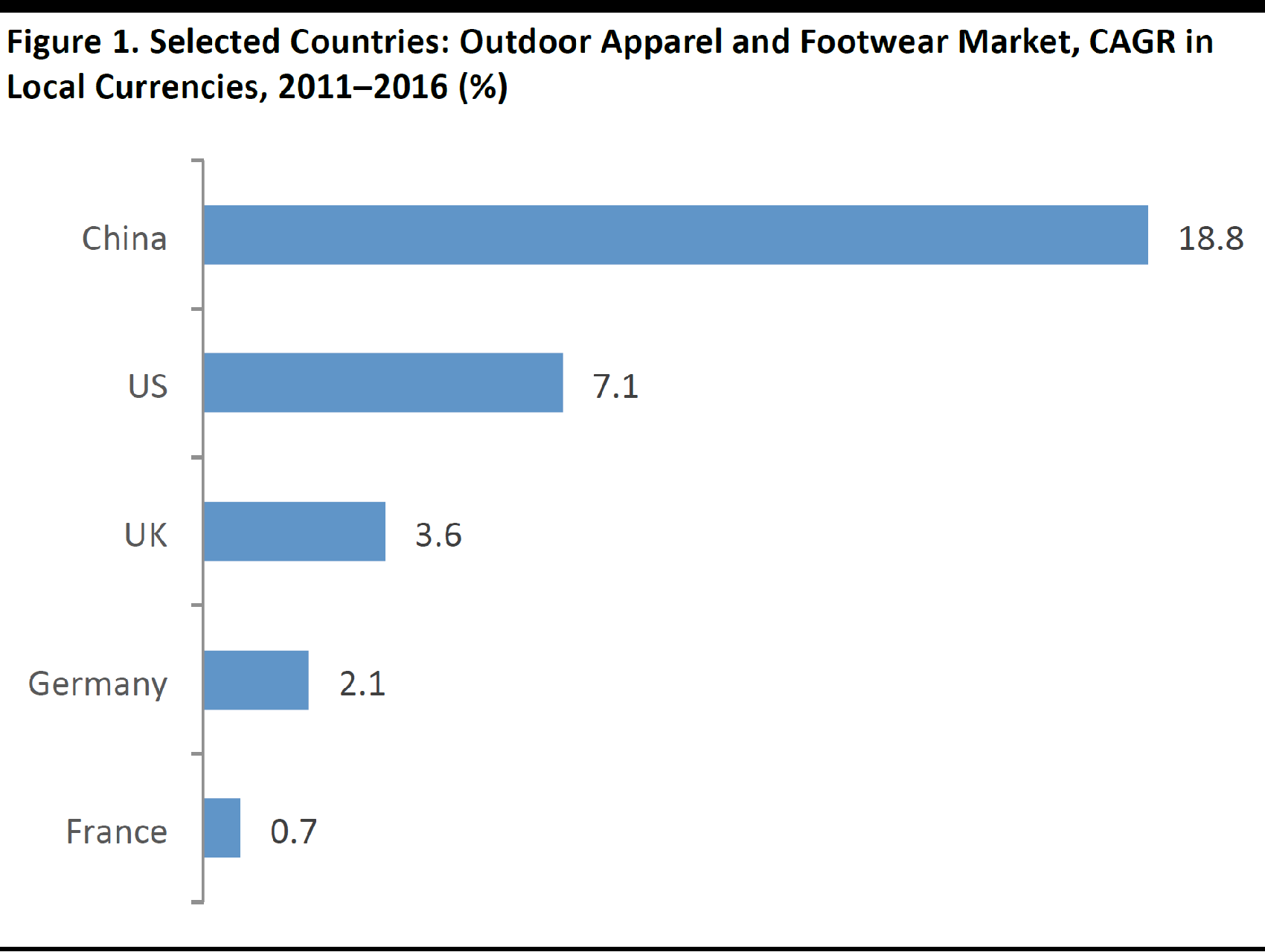

- The US outdoor clothing and footwear market grew by a CAGR of 7.1% between 2011 and 2016, which included growth of 6.0% in 2016, according to our analysis of Euromonitor International’s data. The US market was supported by 2 million more Americans taking part in outdoor activities in 2016 than in 2015, according to the Outdoor Industry Association, a US-based trade association.

- The European outdoor goods market (including apparel and nonapparel products such as tents, sleeping bags and accessories) was worth €11.5 billion (US$12.7 billion) in 2016, according to a survey by the European Outdoor Group trade association. Sales of outdoor clothing in Europe have grown particularly fast (at 4.2% in 2016), helped by the athleisure trend, according to the. Among large European markets, the UK saw the fastest growth in outdoor goods over the 2011–2016 period, with the market growing at a CAGR of 3.6%.

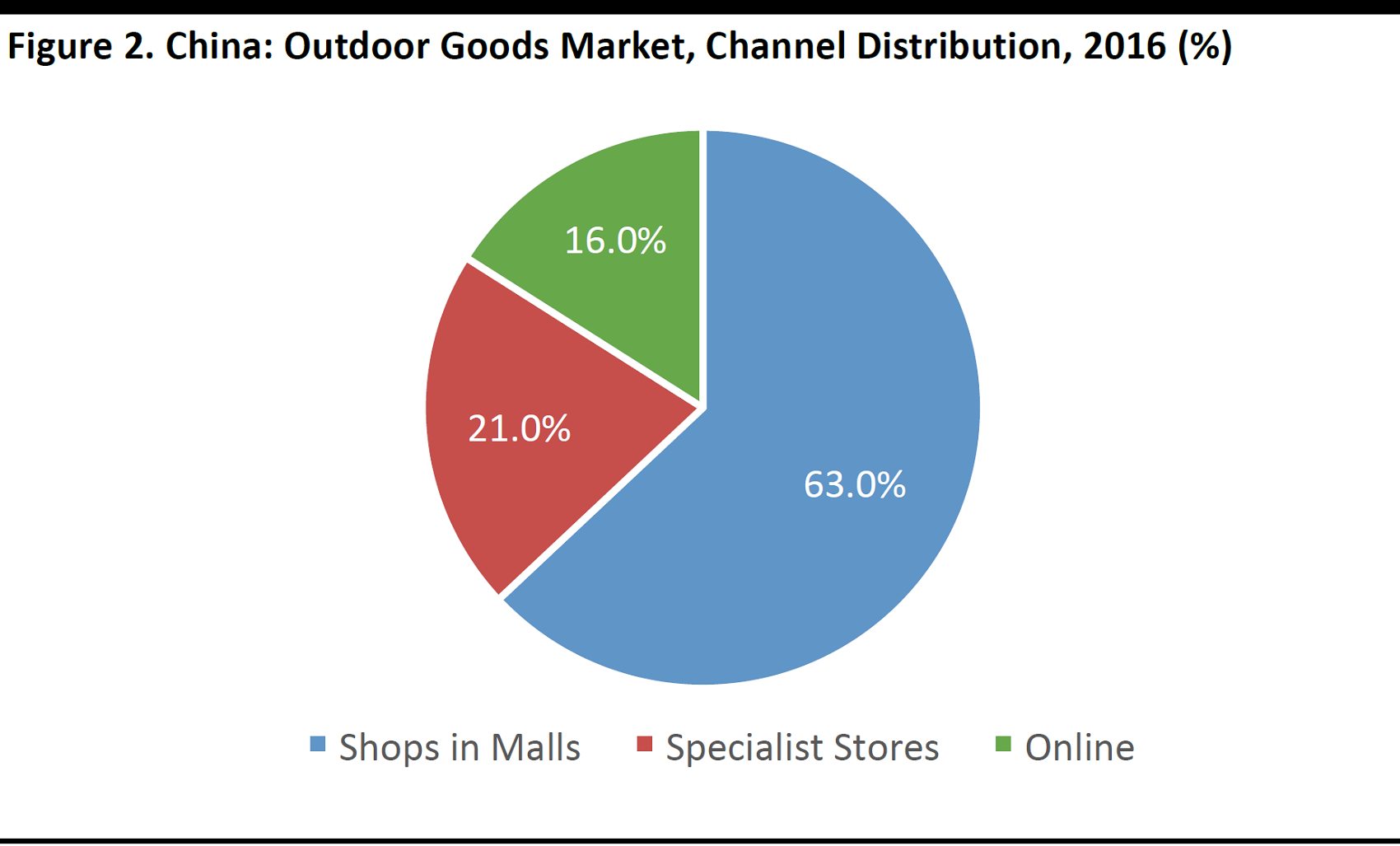

- In China, the outdoor clothing and footwear market grew at a CAGR of 18.8% from 2011 through 2016, according to our analysis of Euromonitor International data. Chinese consumers still buy outdoor gear mainly in malls, but e-commerce is growing fast and is expected to account for 31.5% of such sales in China by 2020. Among the factors supporting growth in the outdoor sector are increasing domestic tourism and government-sponsored initiatives to promote winter sports in preparation for the 2022 Winter Olympics in Beijing.

Source: iStockphoto

Brick-and-mortar outdoor retail specialists face a number of challenges, especially in the US. These include competition from e-tailers and brands that sell directly to consumers and downward pressure on prices.

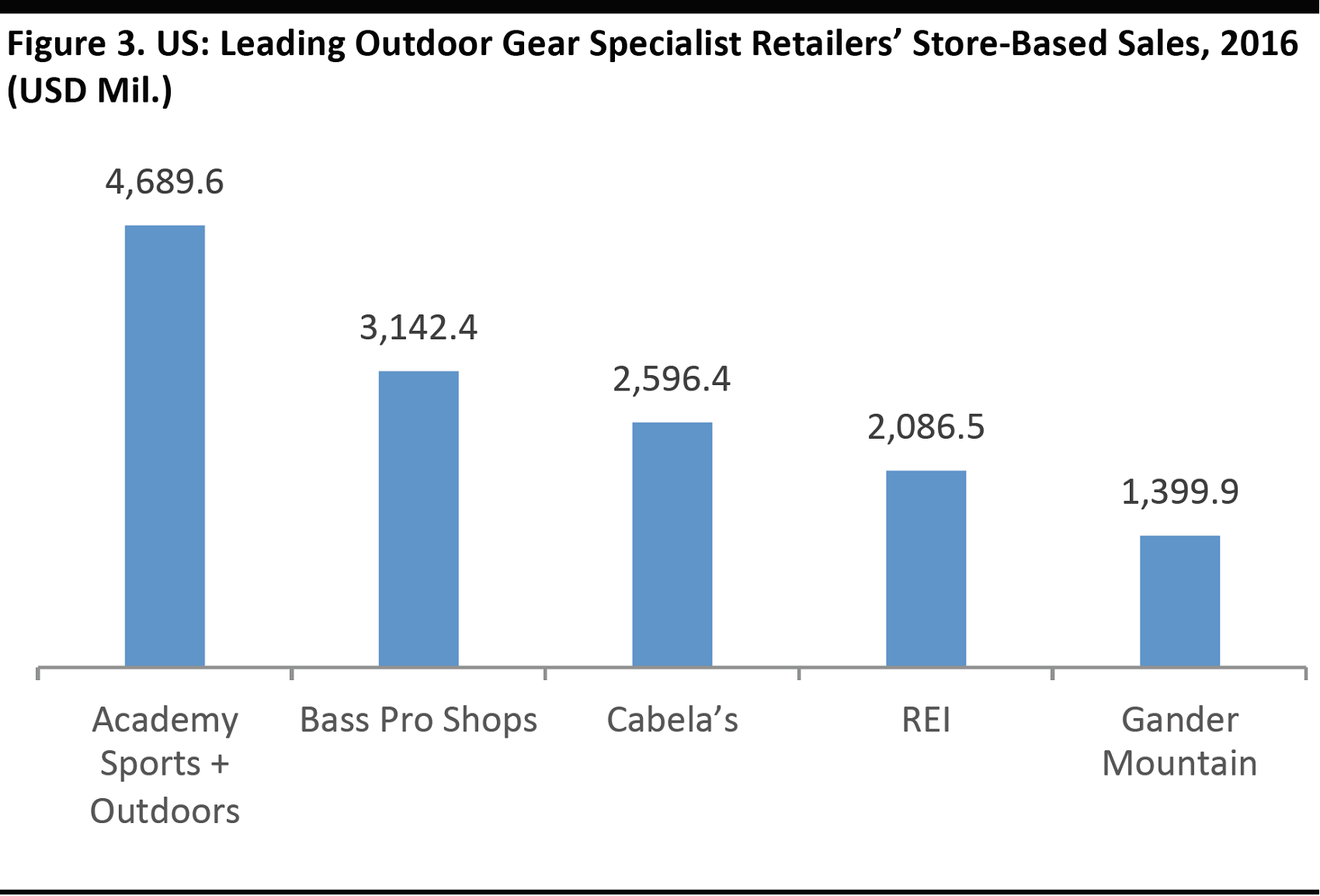

- US specialist retailers that have faced difficulties include Academy Sports + Outdoors and Cabela’s, which have seen comparable sales declines. In addition, outdoor retailer Gander Mountain filed for bankruptcy in 2017.

- Major UK outdoor specialist retailers have tended to perform more strongly than their US counterparts, following a round of consolidation in the UK sector.

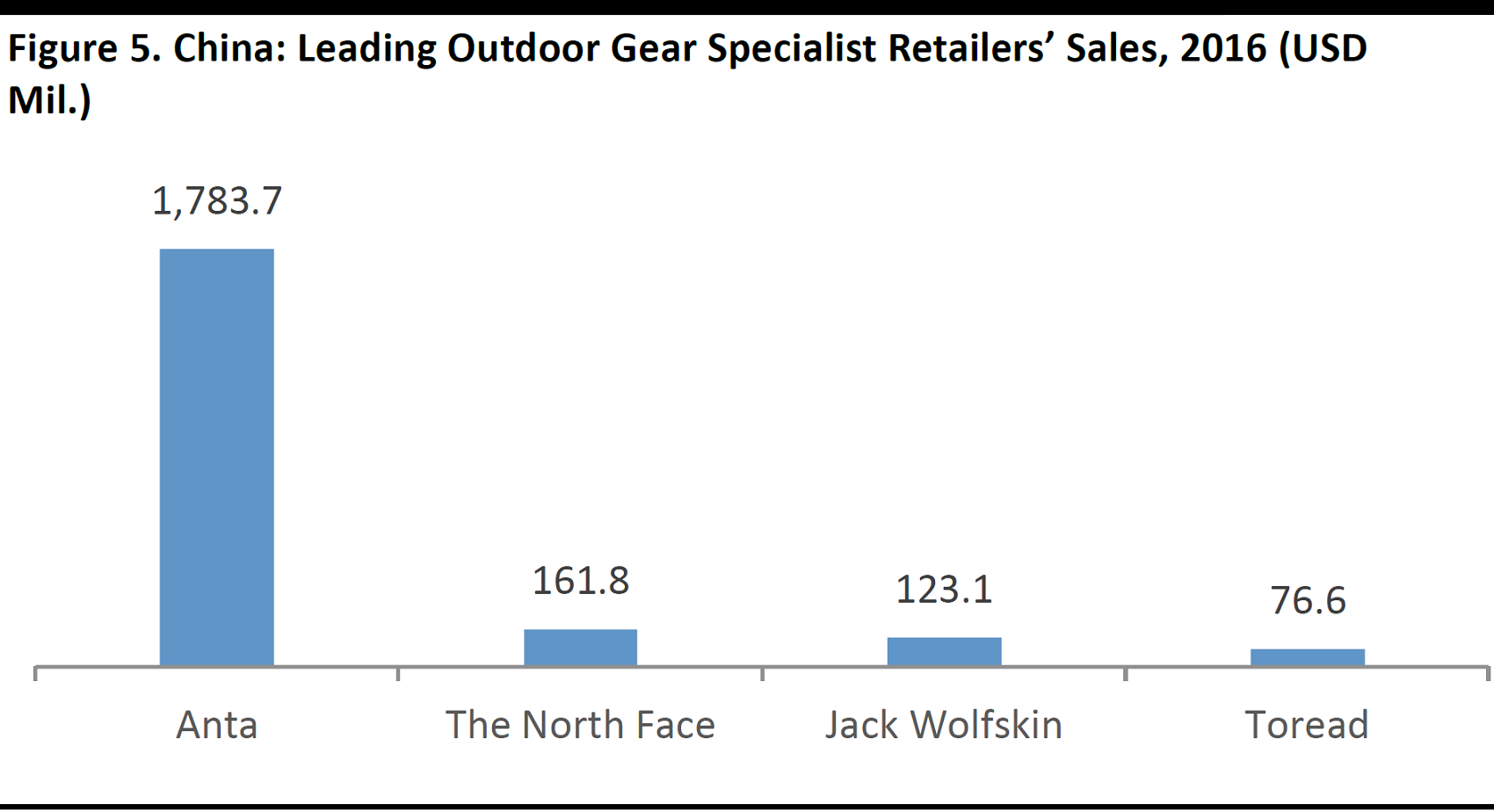

- The Chinese outdoor retail specialist segment is led by monobrand stores, with leading domestic brands such as Anta and Toread gaining share of the market.

Athleisure, sustainability and technical innovation are the three key trends influencing the main international outdoor brands. VF Corporation’s The North Face brand, for example, is collaborating with lifestyle brand Supreme and designer Junya Watanabe to launch trendy outdoor apparel collections. And the company’s flagship Denali Jacket, which was originally produced from oil when it debuted in the 1980s, has been manufactured from recycled plastic bottles since 2014. Several other major brands, including Columbia Sportswear and Anta, use high tech fabric to produce performance outdoor apparel that protects the wearer from harsh weather while ensuring comfort at the same time.

Source: TheNorthFace.com

Introduction

The outdoor goods market has registered dynamic growth in countries such as China and the US, where it has benefited from increasing consumer participation in outdoor leisure activities and winter sports. Nevertheless, the market remains challenging for some brick-and-mortar specialist retailers, which face competition from the online channel as well as other challenges.

We consider the outdoor apparel and footwear category to include all clothing and footwear items—such as jackets, coats, trousers, tops, gloves, scarves, shoes and boots—that are specifically designed for outdoor sports and recreational activities, including trekking, hiking, and skiing. Outdoor goods specialist retailers typically also sell nonapparel items for outdoor activities—such as tents, sleeping bags, backpacks and, in some cases, guns. While this report focuses on outdoor clothing and footwear, we include nonapparel products in some market data.

This report gives an overview of the outdoor goods market in the US, Europe and China and the competitive environment in which the main brick-and-mortar outdoor retailers in these regions operate. The report also outlines three main trends—athleisure, sustainability and technical innovation—that the major international outdoor brands are pursuing in order to gain a competitive edge in the market.

The Growing Outdoor Clothing and Footwear Market

The global outdoor apparel and footwear market was worth $43.6 billion in 2016, according to Euromonitor International. Among the largest regional markets, China and the US saw the fastest growth in the outdoor goods category last year. In Europe, the UK’s outdoor goods market outperformed those of Germany and France in recent years, growing a CAGR of 3.6% from 2011 through 2016.

Source: Euromonitor International/FGRT

Below, we briefly profile the US, European and Chinese outdoor apparel markets, noting the main industry drivers and developments in these geographies.

The US: Total retail sales of outdoor apparel and footwear stood at $9.5 billion in 2016, an increase of 6% year over year, according to our analysis of Euromonitor International data.

Outdoor activities are very popular in the US. The Outdoor Industry Association estimates that about half (48.8%) of the US population undertook an outdoor activity at least once in 2016. And participation in outdoor activities is on the rise, as 2 million more Americans took part in such activities in 2016 than in 2015.

Nevertheless, brick-and-mortar outdoor gear specialist retailers in the US are struggling, as we will explore later in this report. This is mainly due to competition from the online channel and brands that sell directly to consumers, as well as a highly promotional environment.

Europe: The European outdoor goods market (apparel and nonapparel products, including tents, sleeping bags and accessories) reached €11.5 billion (US$12.7 billion) in 2016 and wholesale turnover grew by 3% year over year, according to a survey of 115 outdoor brands from 22 countries undertaken by the European Outdoor Group. The survey also found that outdoor clothing sales grew particularly quickly in 2016, at 4.2% year over year, helped by the popularity of athleisurewear—casual, comfortable clothing designed to be suitable for both exercise and everyday wear. In addition, the survey found that 80% of respondents expect 2017 to be a better year for the outdoor goods market than 2016 was.

Source: iStockphoto

In the medium term, the outdoor clothing and footwear markets in the US and Europe could benefit from an aging population, as outdoor activities tend to be more popular among mature consumers. For example, in 2016, 37% of outdoor activity participants in the US were aged 45 or older, making these consumers the most significant age group for the market, according to a survey by The Outdoor Foundation. Moreover, in the UK, domestic holidays—or “staycations”—could prove more popular in the near future, as the current weakness of the pound could encourage British holidaymakers to swap vacations abroad for excursions to national parks in the UK.

China: The Chinese outdoor goods market (apparel and nonapparel products, including tents, sleeping bags and accessories) reached a total retail turnover of ¥48 billion (US$7.2 billion at current exchange rates) in 2016, according to the China Outdoor Association (COA). The “core” outdoor gear market, defined by the COA as sales of both domestic and international branded outdoor apparel and nonapparel products, was worth ¥18.91 billion (US$2.7 billion) in 2016.

The total Chinese outdoor clothing and footwear market grew at a CAGR of 18.8% from 2011 through 2016, according to our analysis of Euromonitor International figures. However, the pace of growth is slowing. Year-over-year market growth decelerated from 40.1% in 2012 to 7.3% in 2016, according to our analysis of Euromonitor data. The deceleration was partially due to the market reaching a more mature stage, but a slowdown in the Chinese economy also affected category sales.

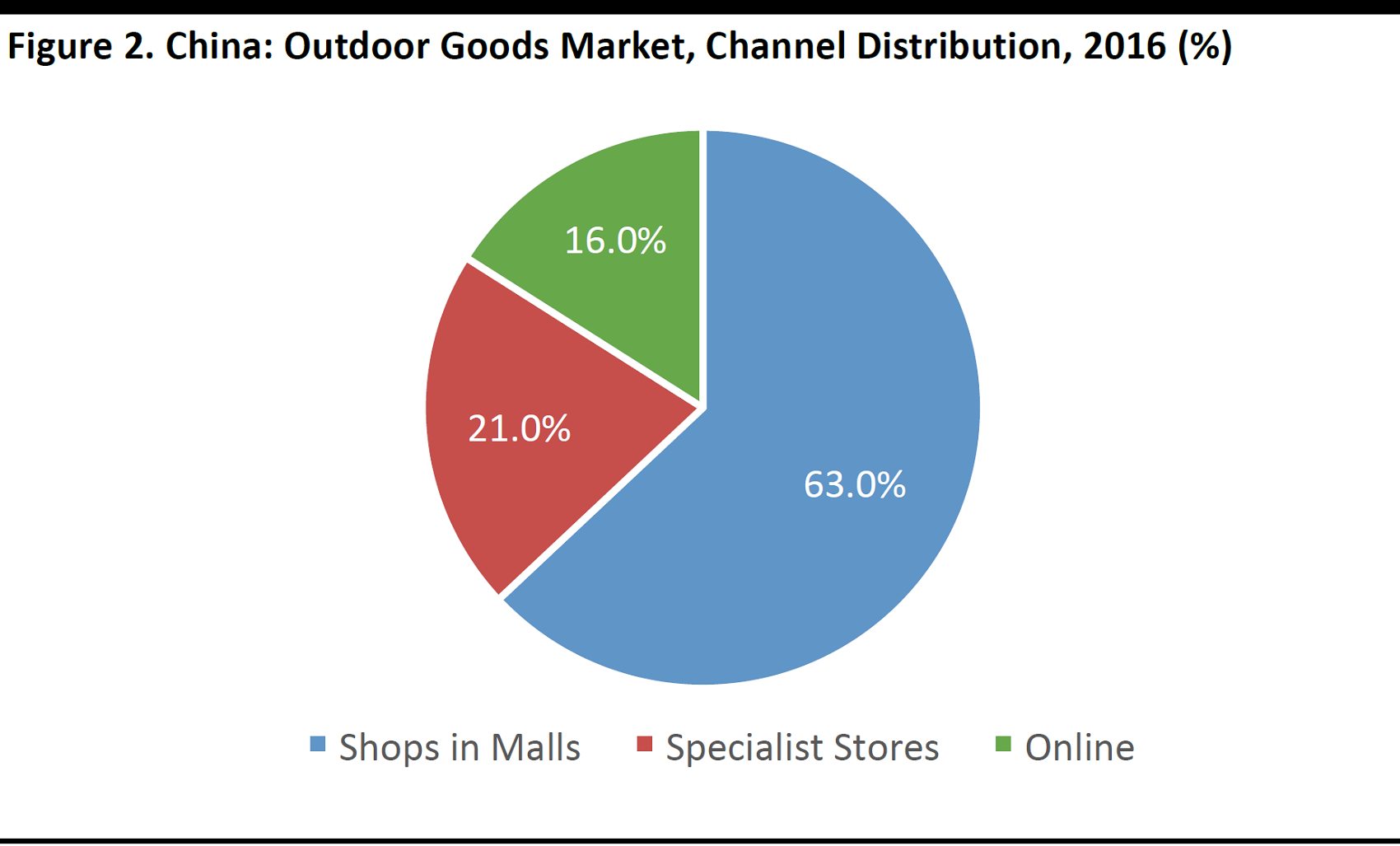

Stores in shopping malls make up the leading outdoor goods distribution channel in China, as shown in the figure below, but e-commerce is the fastest-growing channel. Internet sales of outdoor products grew by 61.7% year over year in China in 2014 (latest confirmed year-over-year growth), according to the COA.

Source: COA

The COA expects the Chinese core outdoor market to grow by 73.5%, to ¥32 billion (US$4.6 billion) by 2020. The online channel should be the main driver of the growth, and the COA predicts that it will account for 31.5% of category sales by 2020.

The Chinese outdoor goods market has been driven by growth in domestic tourism, which has made outdoor activities such as visiting national parks more popular. In 2016, domestic tourists made 4.4 billion trips, an increase of 11.0% year over year, according to the China National Tourism Administration.

Another factor contributing to the growth of the outdoor goods market in China is that the 2022 Winter Olympics will be held in Beijing. In preparation for the event, the Chinese government has been promoting winter sports. It is looking to increase the number of ski resorts from 500 currently to 1,000 by 2030 and to boost the number of skiers from about 5 million currently to 300 million over the same period, according to the Financial Times.

The Challenging Environment for Brick-and-Mortar Outdoor Gear Specialist Retailers

In this section, we discuss the main trends shaping the brick-and-mortar outdoor gear retail sector in three key markets—the US, the UK and China—and highlight the development of the leading brick-and-mortar specialists that operate in these markets.

The distinction between sporting goods retailers and outdoor gear retailers is not always straightforward, as many specialist sporting goods retailers also sell outdoor gear. For the purposes of this report, we analyze sporting goods retailers for which outdoor apparel and footwear is a significant focus (for example, Academy Sports + Outdoors in the US), but we exclude from our discussion others that are much more oriented toward the sporting goods segment (such as Dick’s Sporting Goods in the

US).

In the US, many sporting goods retailers are struggling to adapt to changing market conditions. More shoppers are now buying sports and outdoor apparel and equipment online, sportswear brands are selling directly to consumers and price competition is reater than ever:

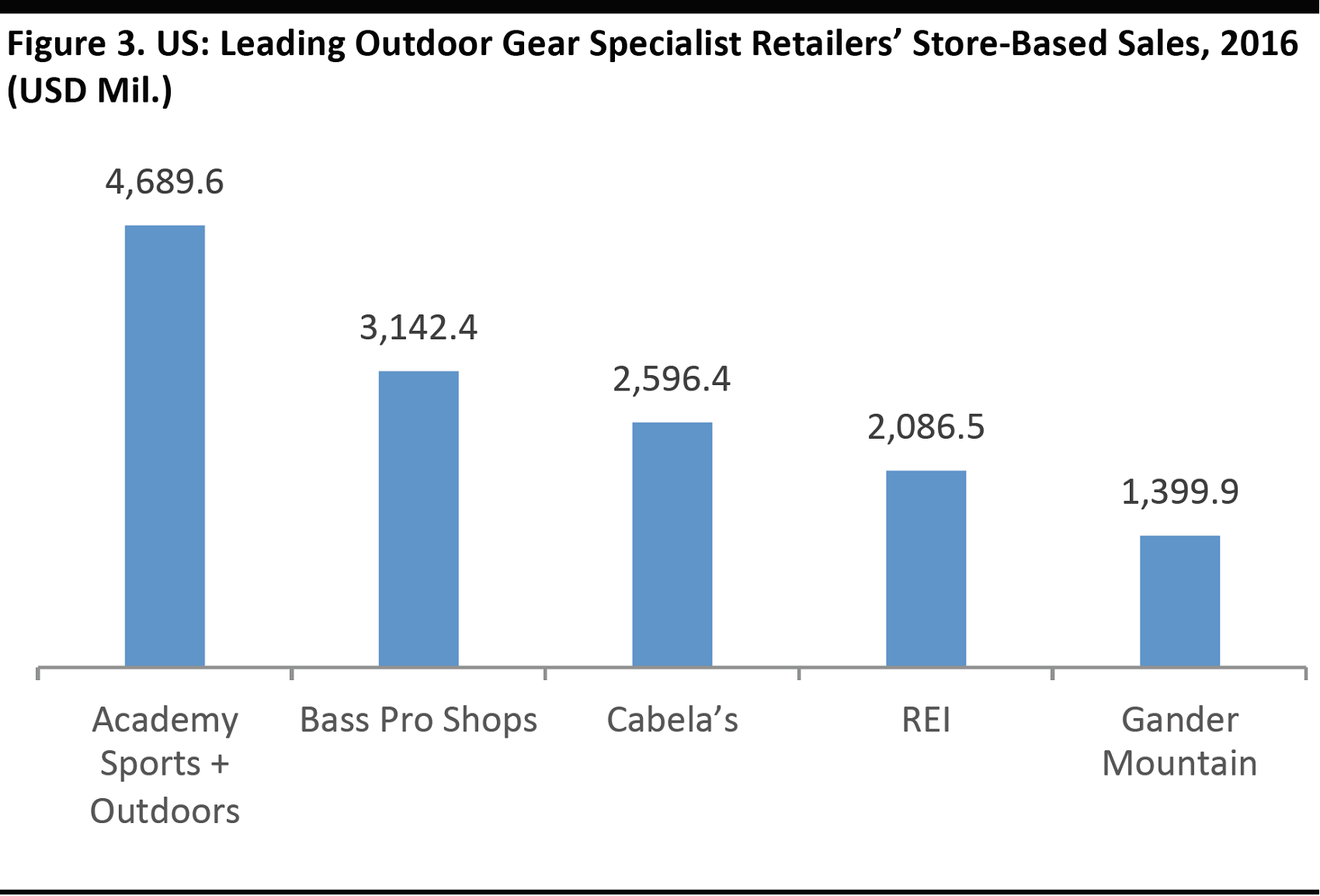

- Privately owned Academy Sports + Outdoors is struggling to adjust to consumers’ shift to online shopping and a highly promotional environment, according to Reuters. The retailer’s same-store sales decreased by low single digits and its adjusted EBITDA fell by 23% in 2016, according to credit and rating agency Moody’s.

- Privately owned Gander Mountain filed for bankruptcy and announced 32 store closures in March 2017, according to USA Today. Some of the retailer’s assets were later acquired by recreational vehicle firm Camping World Holdings.

- In its most recent earnings report, for the second quarter of 2017, Cabela’s reported a 4.2% decline in revenue, a 7% decline in retail store sales and a 9.3% slump in comparable-store sales. The company stated that the revenue decline was partly caused by a slowdown in firearms and shooting-related categories, and was worsened by the fact that a major competitor had held liquidation sales following its bankruptcy filing (the Cabela’s report did not state it explicitly, but that competitor was Gander Mountain). Cabela’s reported total revenue of $4.1 billion in 2016; the figures in the chart below are Euromonitor’s estimates for store-based retail sales only.

Figures are for store-based sales only and do not include online sales.

Source: Euromonitor International/FGRT

Major specialist retailers are performing much more strongly in the UK. This follows a wave of consolidation in the sector that has seen some specialists, such as Blacks and Millets, return to robust growth.

- JD Sports acquired Go Outdoors for £122 million (US$157.9 million) at the end of 2016. The acquisition was approved by the UK Competition and Markets Authority in May 2017. In the year ended January 31, 2016, Go Outdoors generated £202.2 million (US$309.1 million) in revenue, an increase of 11.5% year over year.

- JD Sports had previously acquired Blacks Outdoor and Millets from Blacks Leisure, which entered administration (bankruptcy) in 2012. By 2014, Blacks and Millets had returned to profitability, following a restructuring of retail operations that included simplifying operational leadership, improving the camping goods offering and reducing markdowns. Blacks Outdoor Retail, which includes the Blacks and Millets banners, reported 12.5% revenue growth and a gross margin increase of 130 basis points in the year ended January 30, 2016 (latest).

- In June 2015, Cotswold Outdoor owner AS Adventure Group purchased Snow & Rock from LGV Capital for an undisclosed sum. The two retail brands were merged into a single legal identity called Outdoor and Cycle Concepts, which reported 17.1% turnover growth in the year ended December 31, 2015 (latest).

Sales include international and online sales. Figures reported in pounds were converted into US dollars using an average exchange rate for 2015, the closest calendar year to most of the fiscal years’ results shown.

Source: Company reports

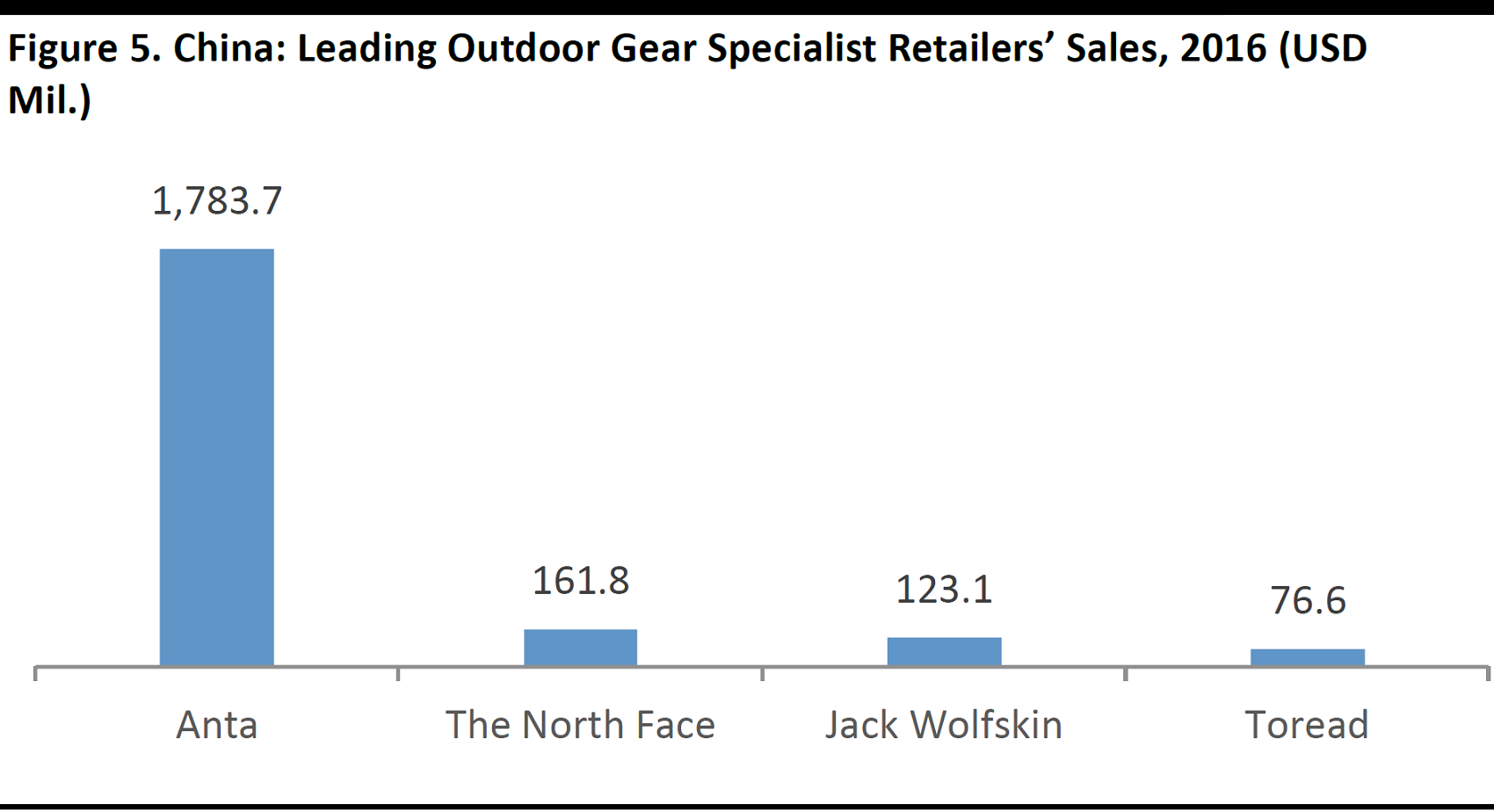

In China, monobrand outdoor gear stores account for the majority (69%) of physical outlets, according to the COA. Foreign outdoor brands still lead the market, but Chinese brands are catching up. In 2014 (latest available data), Chinese brands comprised 45.7% of all outdoor gear brands sold in China, up from 37% in 2010, according to our analysis of COA data. Chinese brands grew by 24.7% in 2014, while international brands grew by just 2.9%, according to the COA.

Due to the slowdown of the Chinese market and increasing e-commerce competition, it is likely that there will be some consolidation among Chinese brick-and-mortar retailers. This, combined with the growth of Chinese brands, should lead to stronger and larger domestic monobrand retailers. The number of outdoor goods stores in China has already been falling: according to the COA, the number of brick-and-mortar stores that sell outdoor goods fell by 1% in 2014, to 12,302, due to the cost of store rental and the growth of the online channel.

Anta and Toread are the two leading domestic sporting goods specialists in China, according to our analysis of Euromonitor International data. While Toread is a monobrand retailer, Anta offers its own brand alongside international brands such as Japanese ski gear brand Descente.

Source: Descente.co.jp

Figures do not include online revenues. Totals in US dollars were calculated using August 31, 2017, exchange rate.

Source: Euromonitor International/FGRT

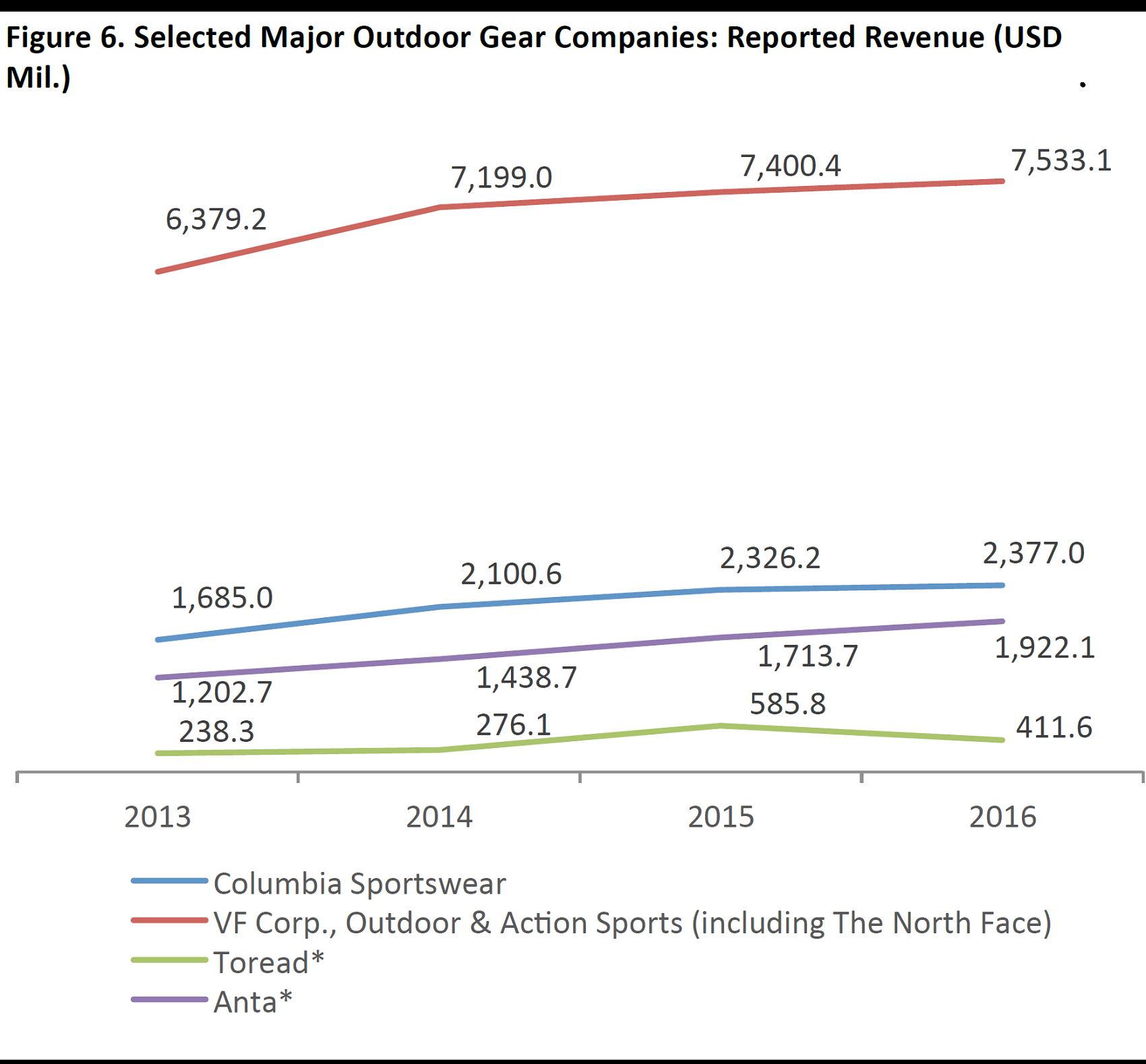

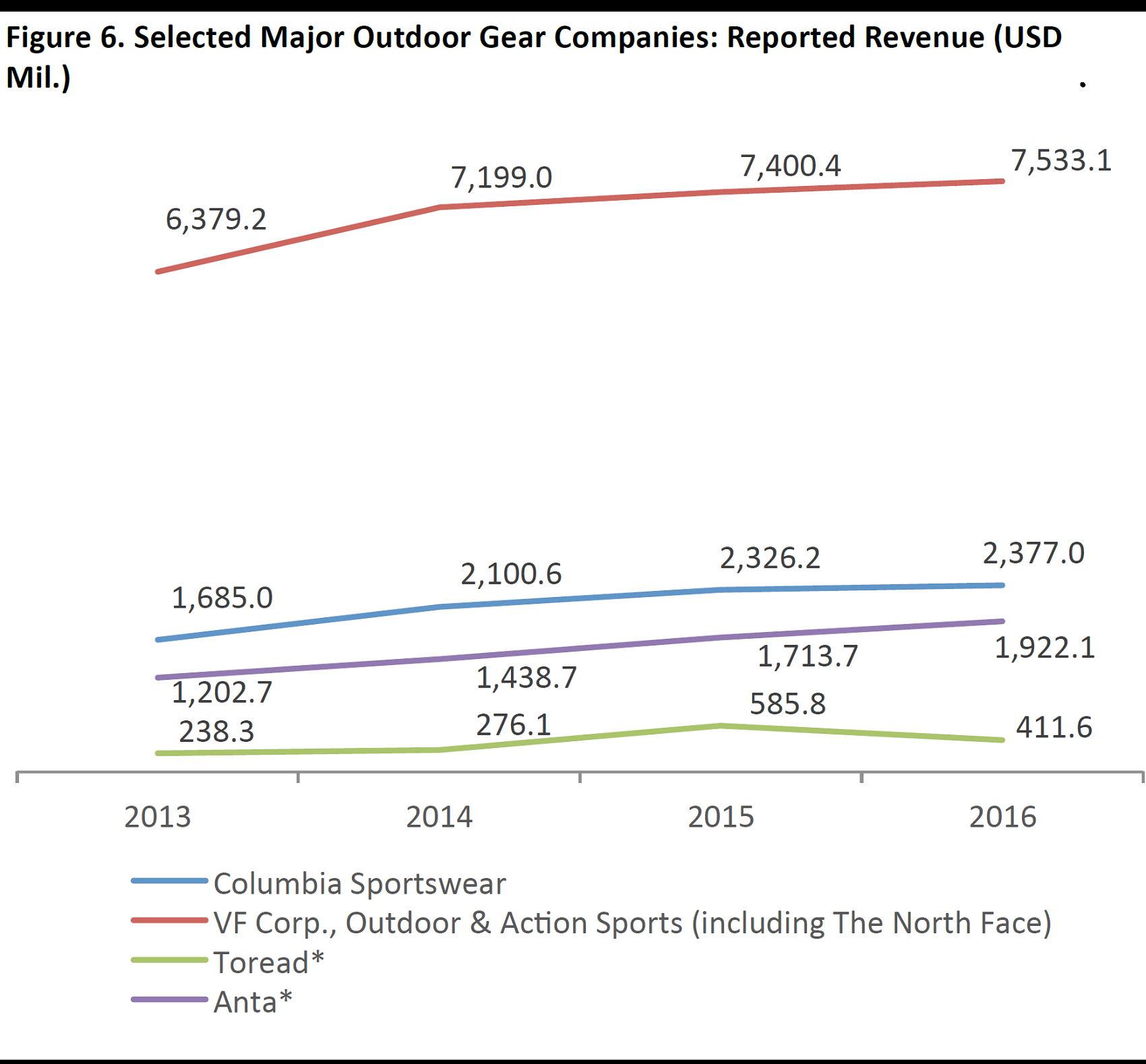

Main Trends Shaping International Outdoor Brands

In this section, we briefly describe the top three trends— athleisure, sustainability and technical innovation—that are shaping the outdoor gear industry, and offer specific examples of how some major brands are incorporating these trends. The companies shown in the figure below are among the main publicly listed outdoor and apparel companies, by revenue. Two are American companies (Columbia Sportswear and VF Corp., owner of The North Face) and two are Chinese (Toread and Anta).

All four companies’ fiscal years end December 31.

*Reports financial results in renminbi.

Source: S&P Capital IQ

1. Athleisure

Outdoor brands have become more fashion-conscious to meet consumer demand for versatile outerwear that is stylish but has the technical characteristics of traditional outdoor gear. This trend, defined as athleisure, consists of casual, comfortable clothing designed to be suitable for both exercise and everyday wear, as we noted earlier. The North Face is one example of an outdoor apparel brand that has launched fashionable lines. The brand is collaborating with fashion designer Junya Watanabe and streetwear brand Supreme to produce trendy outdoor apparel collections.

A raincoat from The North Face is an example of an athleisure item (display at Selfridges in London)

Source: FGRT

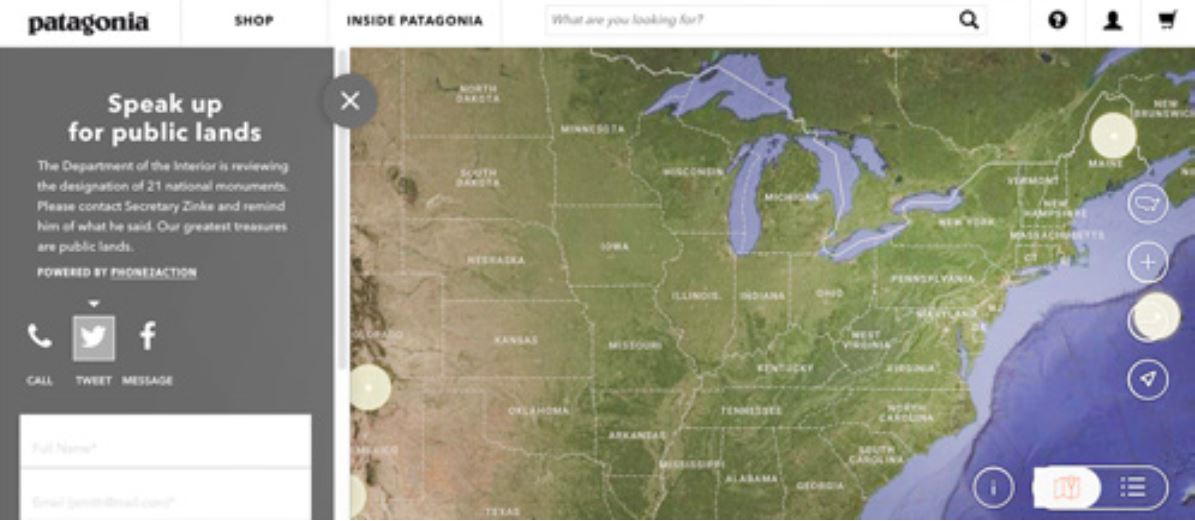

2. Sustainability

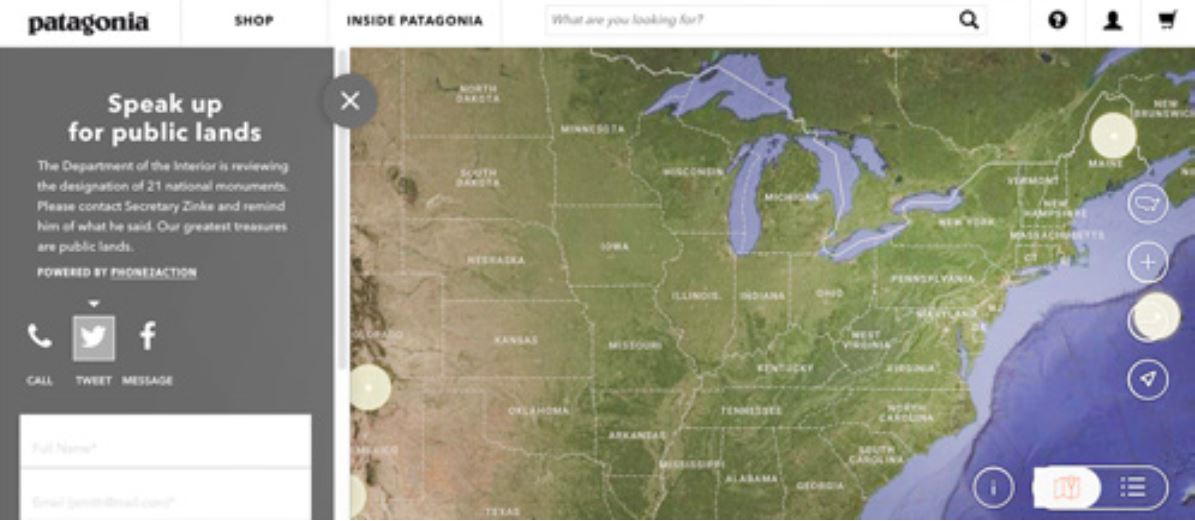

Customers who love outdoor activities tend to have a significant interest in the impact their apparel has on environmental sustainability, and a quick browse of major outdoor gear brands’ websites shows that sustainability is an important marketing message for the companies in the industry. For example, outdoor clothing and footwear company Patagonia embraces sustainability as part of its company mission. Patagonia defines itself as an “activist company” and organizes many initiatives to support the environment. When we checked the company’s website, founder Yvon Chouinard was using it to encourage site visitors to contact the US Secretary of the Interior regarding the need to protect public lands amid a planned review of the designation of 21 national monuments in the US.

Source: Patagonia.com

The website of VF Corp.’s The North Face describes how the brand has become more sustainable over time by showing the evolution of its flagship product, the Denali Jacket. When the jacket was originally launched in 1988, it was produced using oil, but the company started manufacturing it from recycled plastic bottles in 2014, and it is now made using a dyeing process that employs up to 50% less water and chemicals and 25% less energy than traditional processes.

Source: TheNorthFace.com

3. Technical Innovation

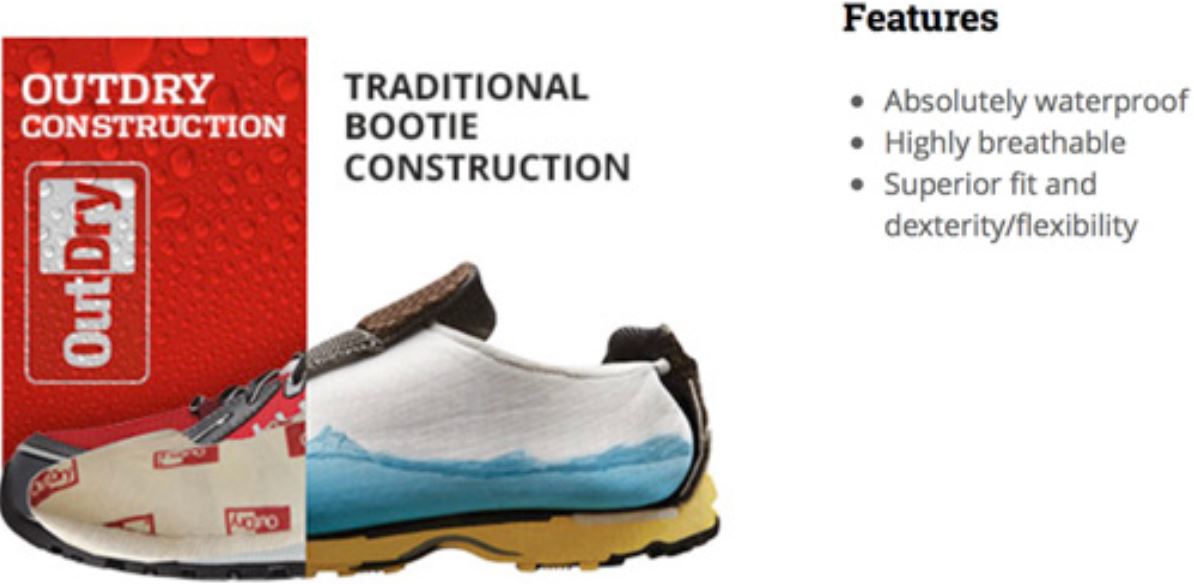

Outerwear brands are constantly looking for innovative materials that deliver better technical performance and increase comfort and wearability. Some recent examples of brands incorporating such technical innovations include:

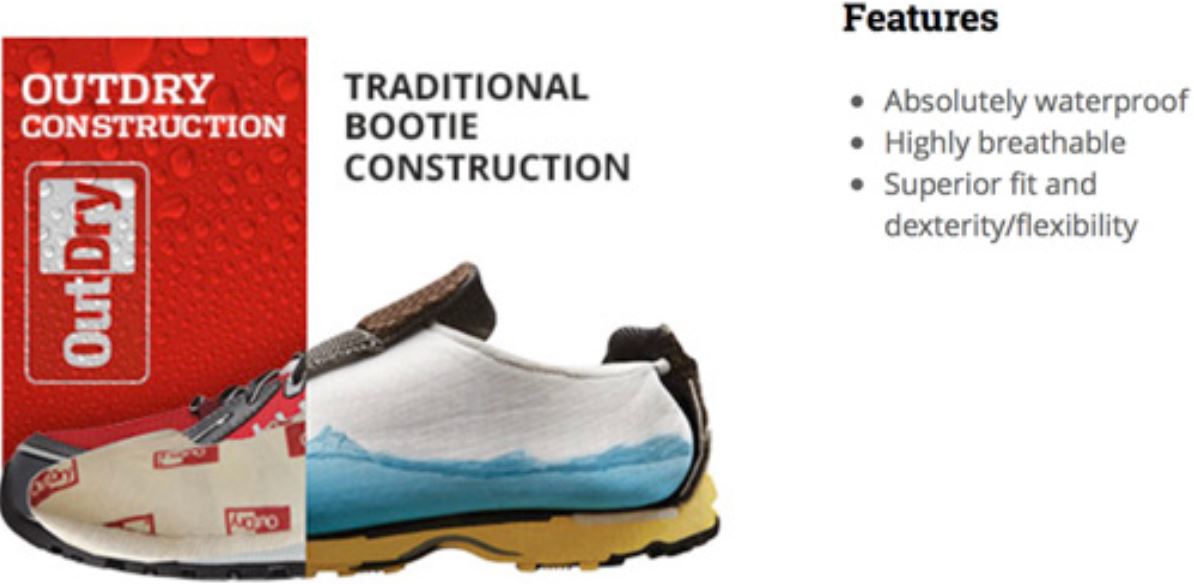

- In 2016, Columbia launched OutDry, a fabric technology that consists of a double-layer, waterproof, breathable membrane that is assembled so that the seam is fully sealed, which keeps water from being able to penetrate the garment. The fabric is used in the brand’s raincoats, footwear and gloves.

Source: Columbia.com

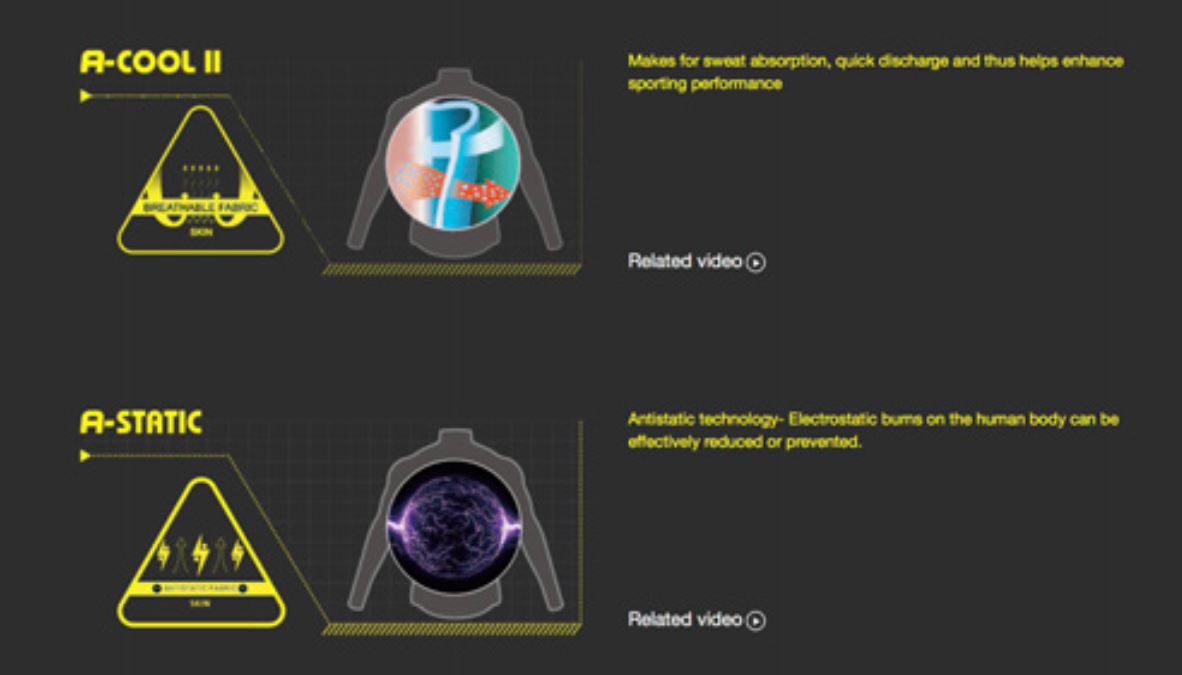

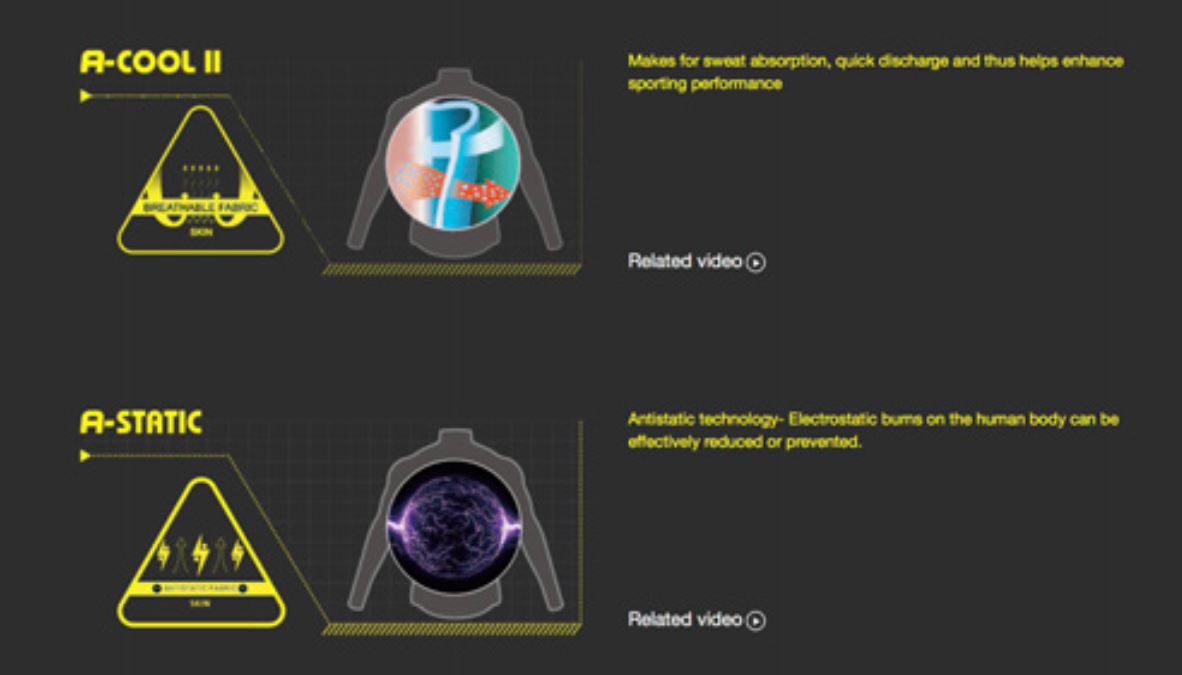

- Chinese outerwear brand Anta features different technologies in its outdoor apparel products that enhance the comfort of the wearer, thus favoring better performance. These include A-Cool, a breathable fabric technology, and A-Fresh, a fabric that releases fragrance when the wearer plays sports.

Source: en.Anta.com/technology.php

There are also examples of technology applications in outdoor apparel that are designed to engage with the wearer rather than improve the performance of the garment. US skiwear company Spyder, in collaboration with Li & Fung and Amsterdam-based tech firm Smartrac, launched a US Ski Team collection of gear enabled with near-field communication (NFC). The line, unveiled in October 2016, consists of items that can connect with consumer devices thanks to embedded NFC tags. The technology enables users to access location-based information, such as weather and snow conditions, and to interact in real time on social media.

Source: Spyder.com

Key Takeaways

The global outdoor apparel and footwear market is benefiting from consumers’ demand for athleisurewear, their sensitivity to environmental issues and their growing participation in outdoor activities and winter sports in countries such as China and the US.

Among the largest markets, China is the fastest-growing market for outdoor apparel and footwear. The branded outdoor gear market grew by a CAGR of 10% in China from 2012 through 2016, according to the COA.

The US outdoor goods market grew by 6% in 2016, according to Euromonitor International, helped by rising participation in outdoor leisure activities. However, a number of US brick-and-mortar outdoor specialist retailers are struggling with the challenges of online competition and a highly promotional environment.

The outdoor market in Europe has also seen dynamic growth, with outdoor clothing sales increasing by 4.2% in 2016, helped by the athleisure trend, according to the European Outdoor Group. In the UK, a number of outdoor specialist retailers continue to grow apace, following a wave of consolidation in the sector.

Athleisure, sustainability and technical innovation are the top three trends that are influencing major international outdoor apparel brands.