Executive Summary

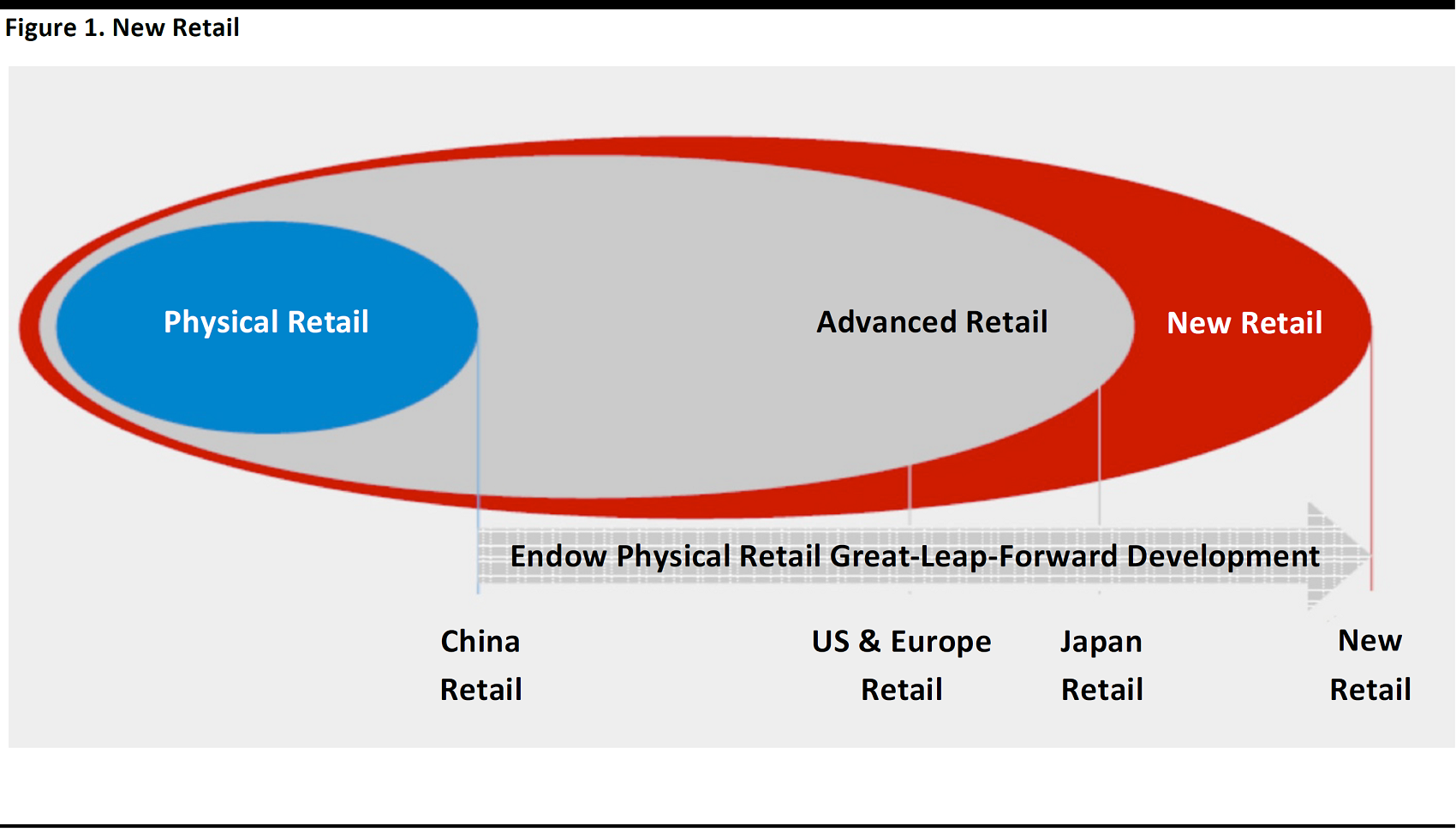

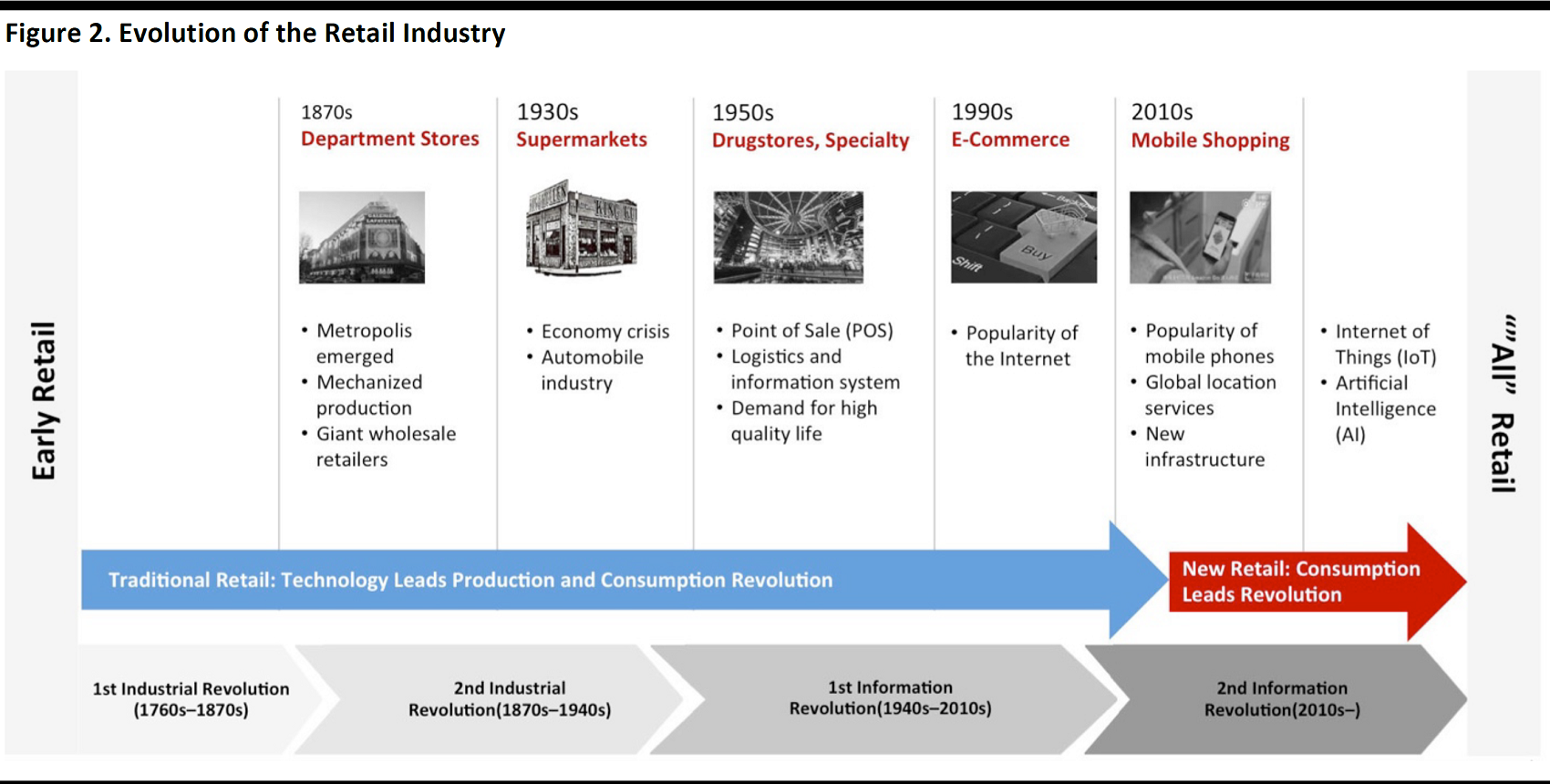

China’s retail industry will likely reach an inflection point with the advent of New Retail, which is the core message coming out of the 5th China E-commerce and Retail Innovation Summit. New Retail refers to the integration of online, offline, logistics and data across a single value chain. New Retail was one of the pillars of the “Five New Trends” first introduced by Alibaba Chairman Jack Ma in October 2016.

What the Future of Retail Looks Like

- New Retail emphasizes a C2B (consumer-to-business) model, whereby consumers proactively shape the demand signals to retailers. The characteristics of New Retail include demand-orientation, omnichannel and diversified retail formats.

- The platform economy will redefine the future of retailing. With digital marketplaces, commerce will be driven by both individuals and multinational companies. Manufacturers can effectively bypass distributors/agents, by having their own online shops and taking orders directly from consumers.

- Personalized content powered by data technology is at the heart of the transformation. Retail will have a social dimension, with diversified retail formats and multiple touch points.

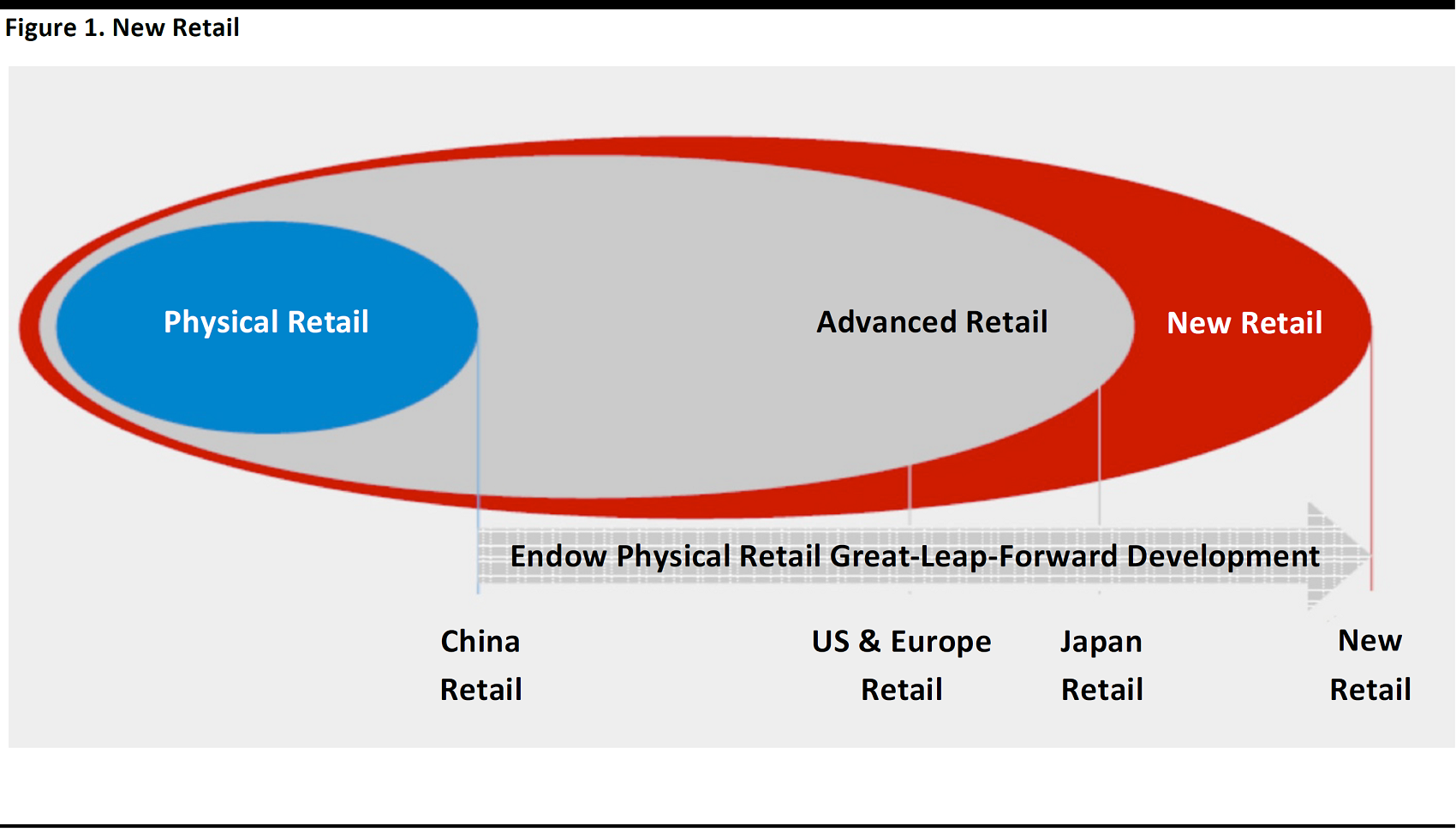

The potential to catapult Chinese retail ahead of its global peers: New Retail is expected to hold the solution for physical retailers and pure-play e-tailers and propel the industry’s transformation. McKinsey estimates that by 2030, China will contribute 30% of the global retail growth.

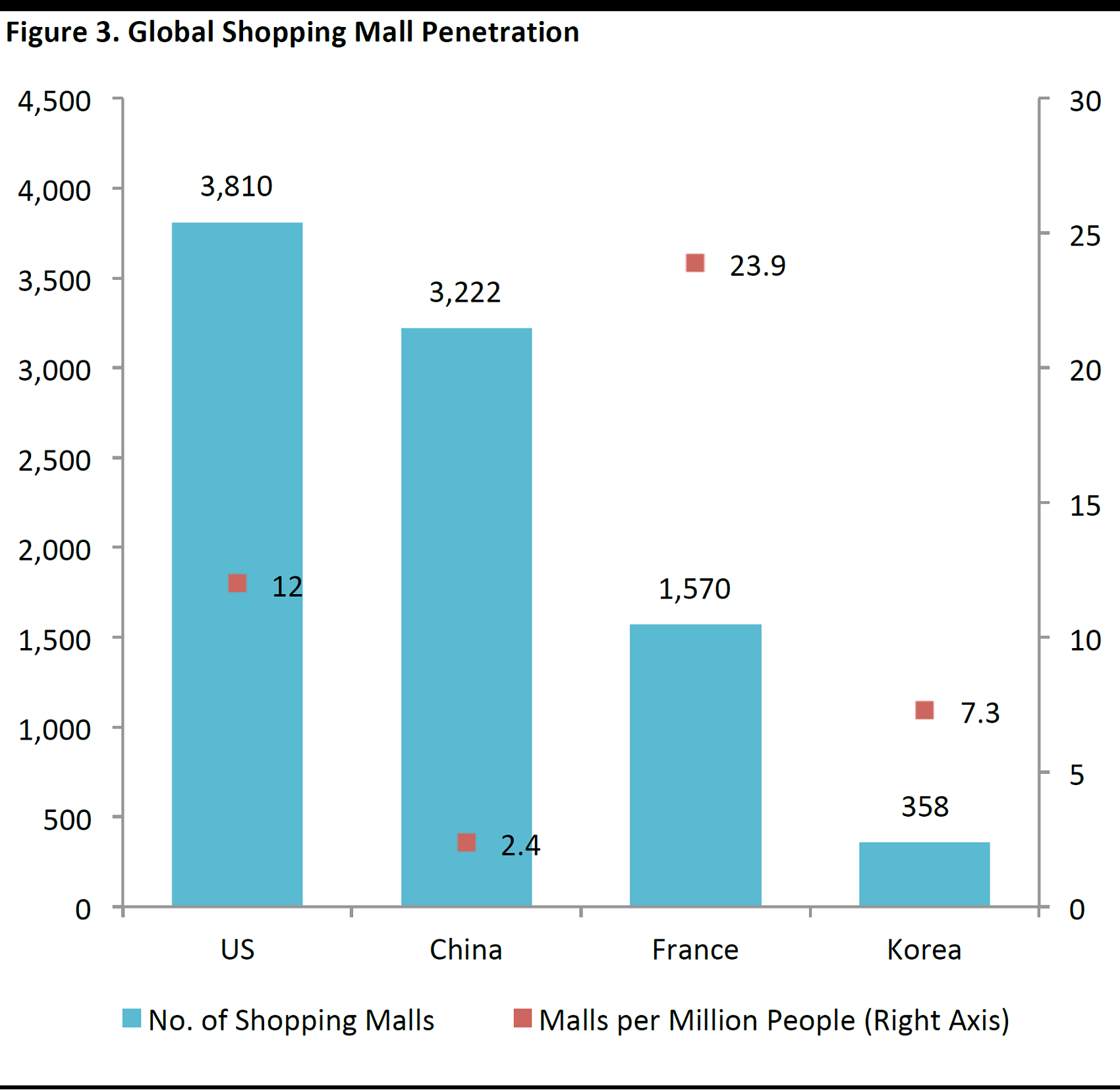

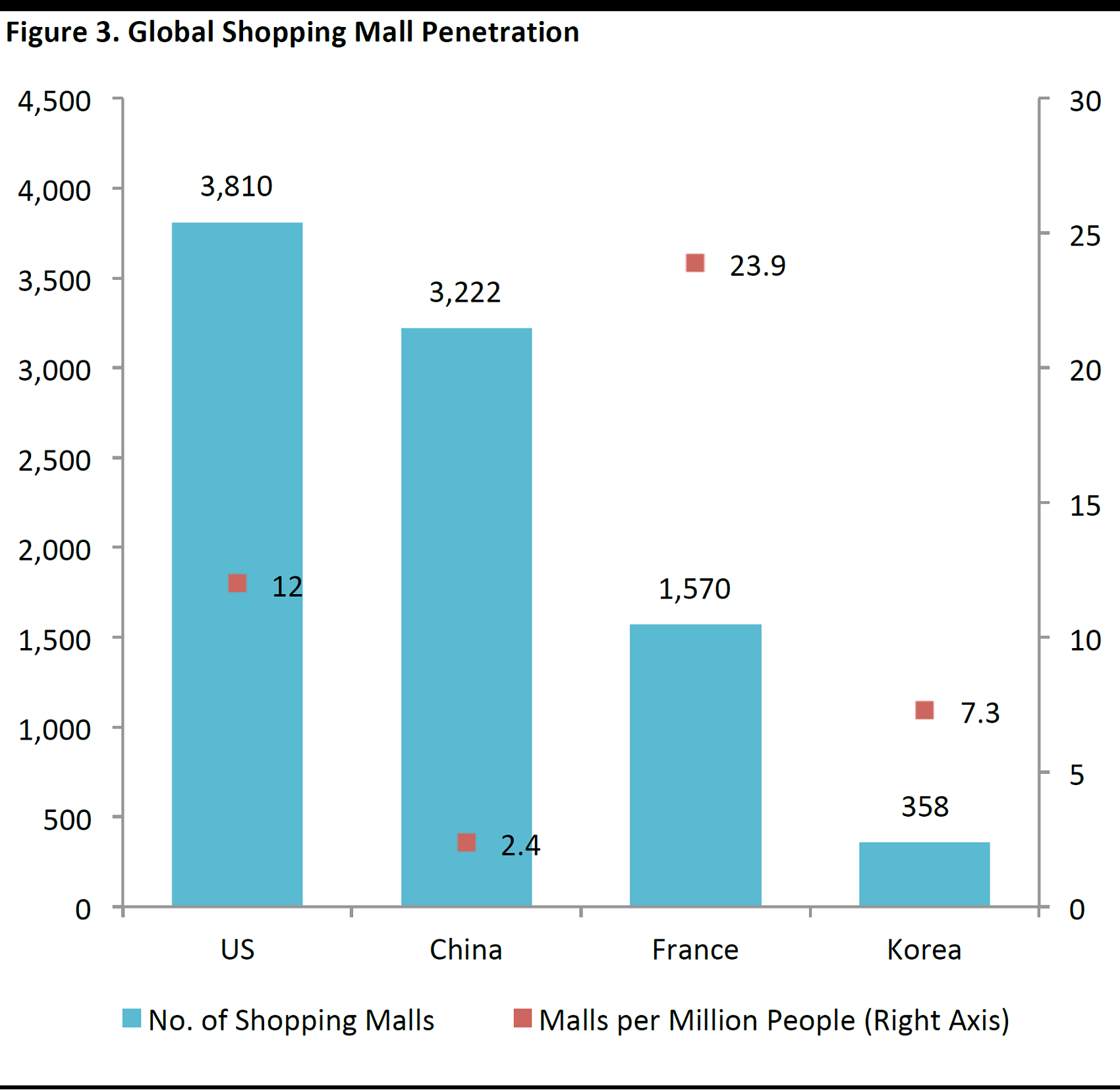

New Retail addresses the bottleneck of Chinese retail growth: China’s physical retail industry is defined by low operational efficiency, mall supply that is below most developed markets and a supply-demand imbalance between the top-tier and the lower-tier cities. A large proportion of Chinese rural consumers are underserved: China has 2.4 malls per 1 million people compared to the US, which has 12 malls for every 1 million people, according to AliResearch. Digital platforms have wider reach than physical stores, and will enable excess inventory to reach rural consumers.

China is “New Retail”-ready: China appears ready for New Retail, with: 1) a solid digital infrastructure―including big data, mobile internet, cloud computing and marketplaces―powered by data technology; 2) a digitally literate consumer base, with e-commerce penetration of some categories exceeding 50%, according to PWC; and 3) a retail industry that is stagnating and is in need of new growth drivers.

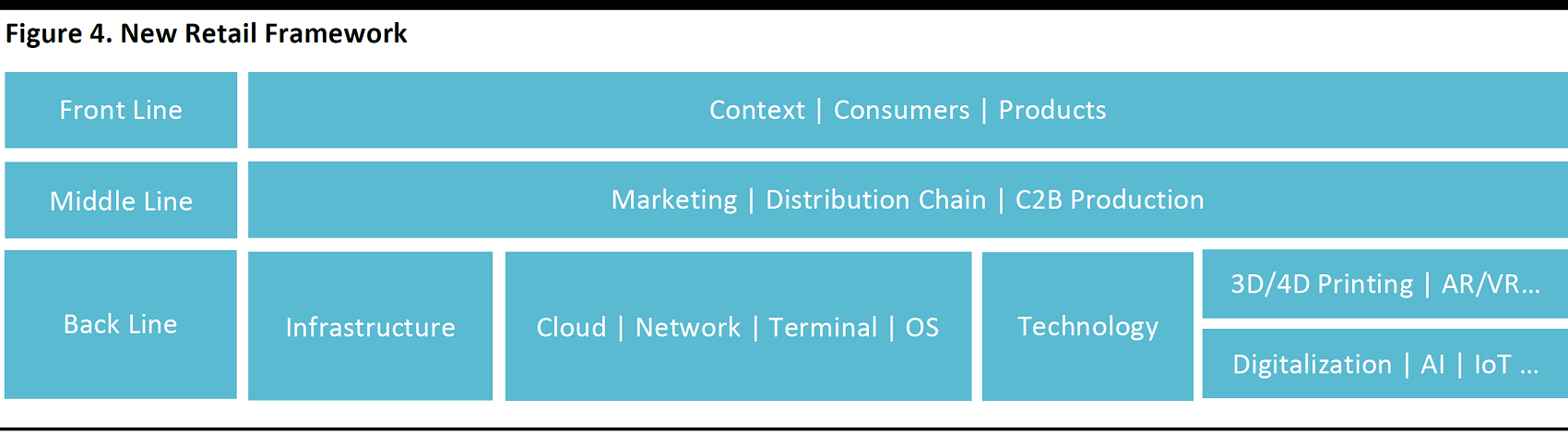

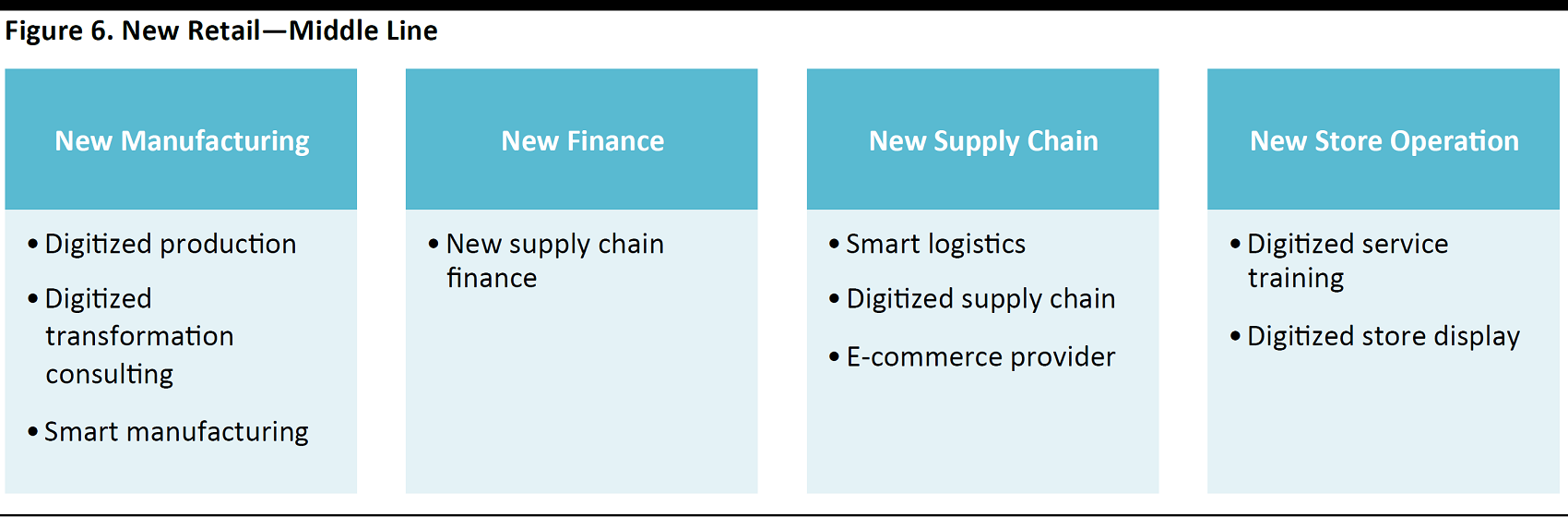

The best way for retailers to position themselves: Those retailers that are able to most effectively adapt to the changing environment by leveraging disruptive technologies and big data will succeed. To satisfy consumers’ demands, retailers’ value chain will need to extend upstream to product design and innovation. A consumer-centric, data-driven offering focused on content is at the heart of the transformation. Retailers can utilize new touch points and content on the front end; smart manufacturing, supply chain and store operations in the middle; and 3D/4D printing, AR/VR, IoT and AI in the back end, according to Aliresearch.

Slow adopters beware: Enterprises that are slow to embrace the online and offline integration, and remain anchored in a standardized rather than a personalized product/service offering, will likely be negatively impacted. Those reduced to a traditional business are: 1) traditional retail; 2) traditional manufacturing; and 3) pure-play e-commerce.

Aligns well with Alibaba’s vision and national policy: Alibaba’s strategy for a digital economy ties in with the structural trend of China’s consumption upgrade. Chinese consumers and their consumption demand become an engine to drive the country’s economic growth. Alibaba expects gross merchandise volume (GMV) to double to ¥6 trillion in 2020 (from ¥3 trillion in fiscal year 2016) and further increase to ¥10 trillion in 2024.

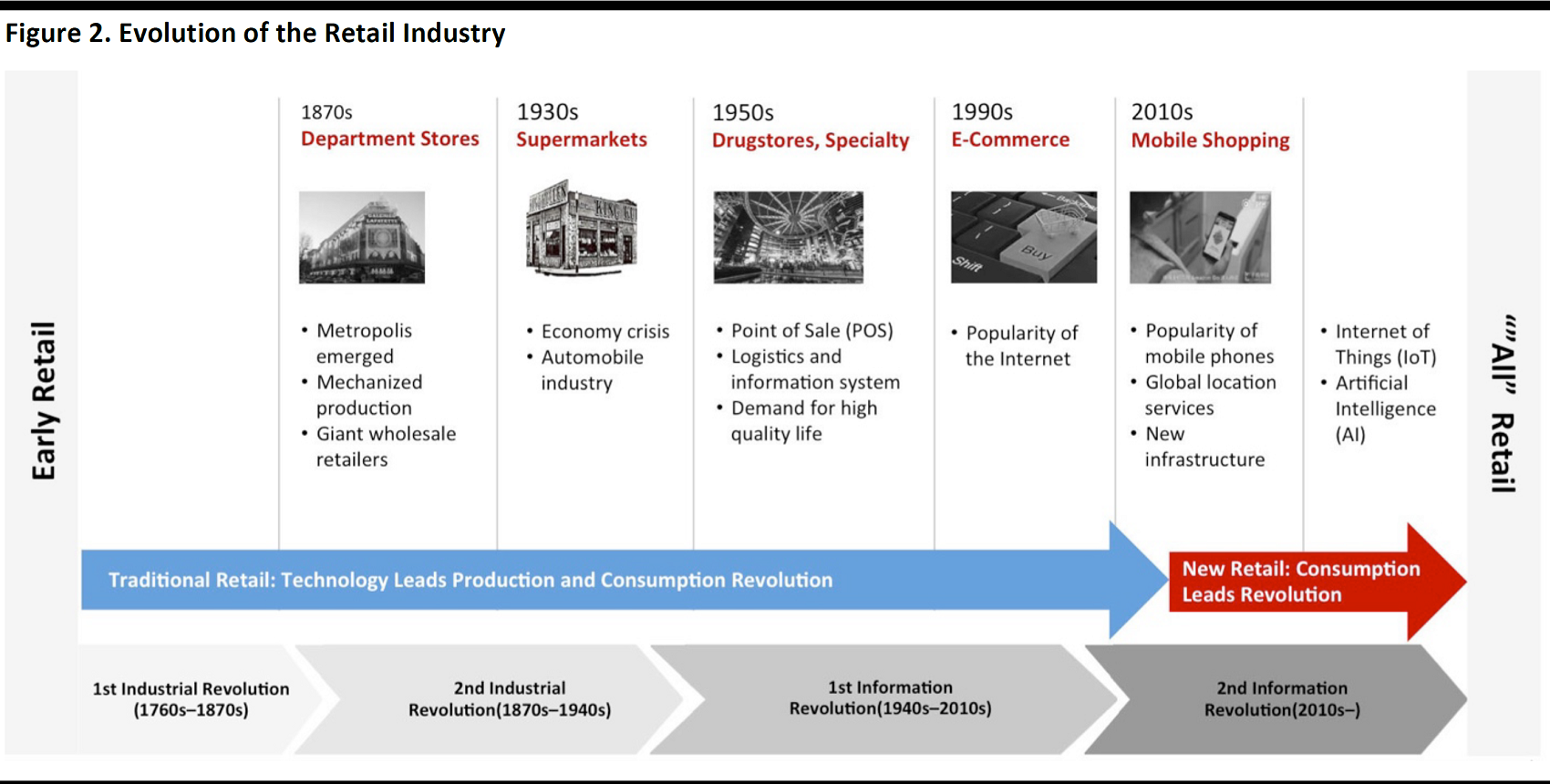

Execution is the key downside risk: In our view, the positive impact of New Retail may not meet expectations should physical retailers in China be slow to embrace digital technology and omnichannel initiatives. The development of China’s physical retail industry has lagged that of its global peers and have been slower in adopting retail technology. Department stores in developed markets were built in the 1870s and have reached saturation. China, on the other hand, only began to develop its department

stores in the past 30 years.

Source: Aliresearch/Fung Global Retail & Technology

New Retail, The ‘C’ Era

Jian Yang, Deputy President of Alibaba Research Institute (ARI), or AliResearch, discussed the retail landscape in the future and elaborated on the framework of the “New Retail.”

New Retail = Consumer-Demand Oriented + Data-Driven Retail

New Retail emphasizes a C2B (consumer-to-business) model, rather than B2C, whereby consumers proactively shape the demand signals to retailers. Alibaba believes its network and data technology assets will facilitate the transformation.

Retail has taken functions beyond selling and will include manufacturing and design. With e-commerce platforms such as Taobao and Tmall, manufacturers can effectively bypass distributors/agents, by having their own online shops and taking orders directly from consumers.

Characteristics of “New Retail”

There are three key characteristics of “New Retail”: 1) demand-orientation; 2) omnichannel; and 3) highly diversified retail formats.

- Demand-orientation: Facilitated by data technology, retailers will be able to define the evolving needs of consumers and create products and services with the best experience for them. Retailers will redesign touch points with consumers according to their needs.

- Combination of physical and digital retail (omnichannel): Physical and digital retail will be perfectly integrated and the retail value chain will be reshaped.

- Highly diversified retail formats: Multiple retail touch points will emerge in logistics, culture and recreation, restaurants, etc. More retail formats will emerge, supported by data technology.

China is ready for new retail

Yang believes the Chinese retail environment is ready for New Retail, primarily due to three factors: 1) a new business infrastructure has been established; 2) a shift in consumer preferences to online shopping; and 3) the global retail industry is stagnating.

- New business infrastructure has been established: The accelerating pace of globalization 3.0 is driven by high internet penetration and technologies including big data, cloud computing, mobile internet, smart logistics, internet finance and a national marketplace. In the new era, the world will be connected by a uniform digital platform, and international trade will be driven by individuals rather than multinational companies.

- A shift in consumer preferences, as digitally-literate consumers prefer online shopping: In China, the online consumer base is growing at a faster pace than the global average, according to PWC. The e-commerce penetration rates for some categories are over 50%. Quality, instead of prices, will become the key consideration for consumers. They prefer high quality and personalized products. This new generation of consumers will lead global consumption growth. China will be playing an important role in the transformation of the global retail industry. McKinsey estimates that by 2030, China will contribute 30% of the global retail growth.

- The global retail industry is stagnating and will need to seek new growth drivers: Traditional brick-and-mortar retailers are experiencing little or even negative growth, while e-tailers are increasingly taking a bigger share. China’s physical retail industry is at an early stage with low operational efficiency. Diversified retail formats are expected to emerge.

Source: Aliresearch/Fung Global Retail & Technology

New retail is particularly relevant to China

Yang also raised the issue of the supply-demand imbalance in Chinese retail, and how New Retail will address it.

Chinese Physical Retail Development Lags Global Peers

The development of China’s physical retail industry lags that of its global peers, with manifestations in the following areas:

- Department stores in developed markets were built in the 1870s and have reached saturation. China, on the other hand, only began to develop its department stores in the past 30 years.

- China’s mall supply per capita is below that of most developed markets. There is a significant regional supply-demand imbalance in China, as tier-1 cities have an oversupply of mall space, while the lower-tier cities are undersupplied. In other words, a large proportion of Chinese consumers are underserved.

Source: Aliresearch/INSEE/Statistics Korea/US Census Bureau/Fung Global Retail & Technology

New Retail will potentially catapult China’s retail industry ahead of its peers

The New Retail model of Alibaba will be more flexible and should be better able to address the supply-demand imbalance within China.

The speaker gave an example of how retailers can use Alibaba’s digital economy to overcome oversupply. For example, the Global Financial Crisis in 2008 prompted an oversupply and sharp decline in global trade. Through Taobao, excess inventory can be sold to consumers in lower-tier cities and young consumers in higher-tier cities.

Taobao enabled retailers to reach new groups of consumers that traditional retail was not previously able to cover. For example, the catchment area of a physical store is typically 10 km. A typical Taobao shop has exposure to 0.5 billion registered Taobao users a day.

New Retail uncovered

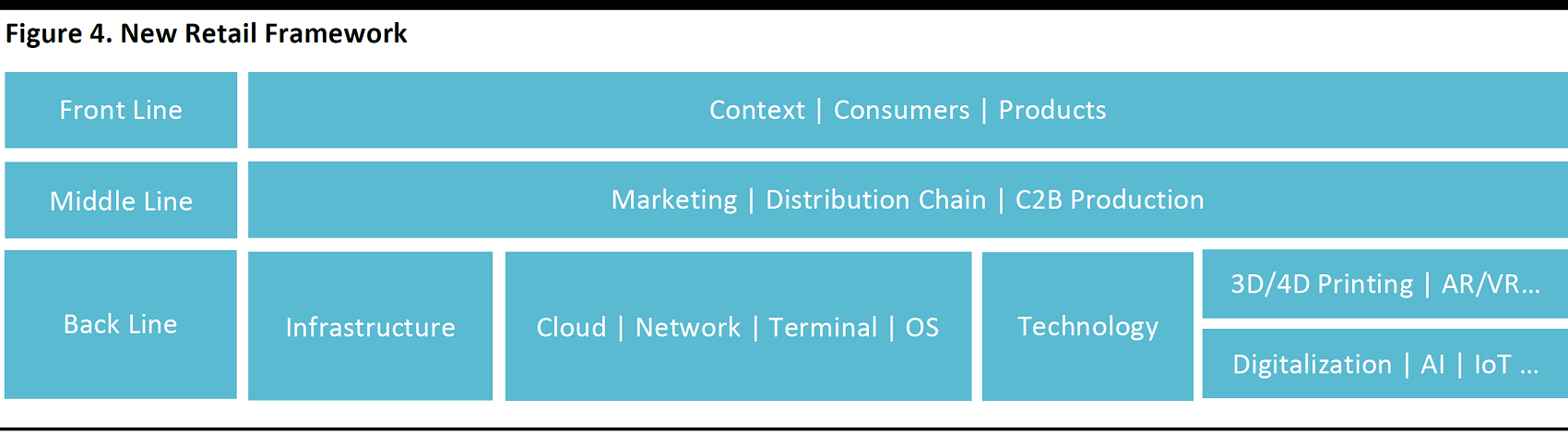

The framework of New Retail will consist of the following:

- Front end: Context, consumers and products

- Middle line: Marketing, distribution and C2B channel

- Back end: Infrastructure, 3D/4D printing, AR/VR, IoT, AI and other technology

Source: Aliresearch/Fung Global Retail & Technology

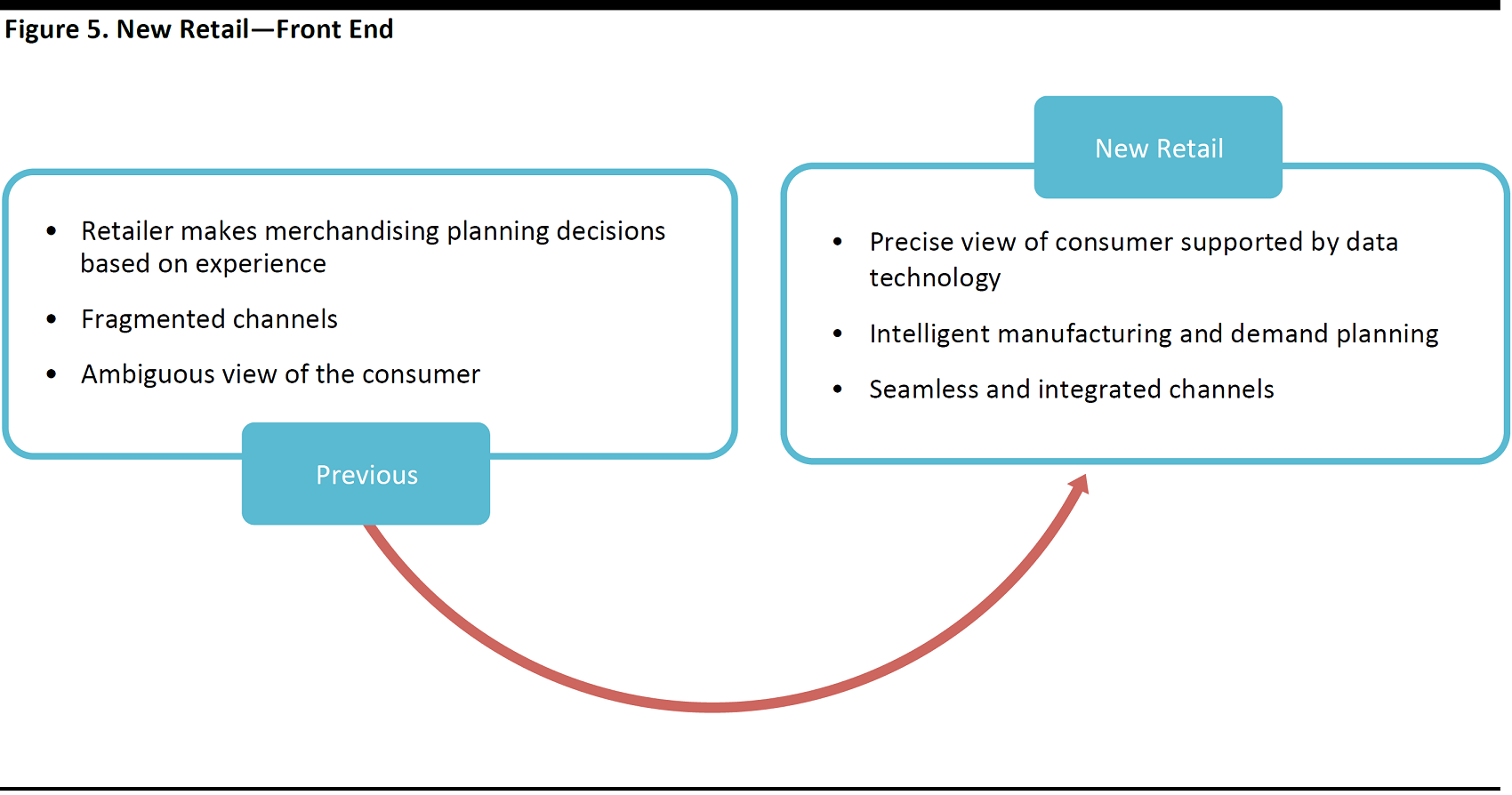

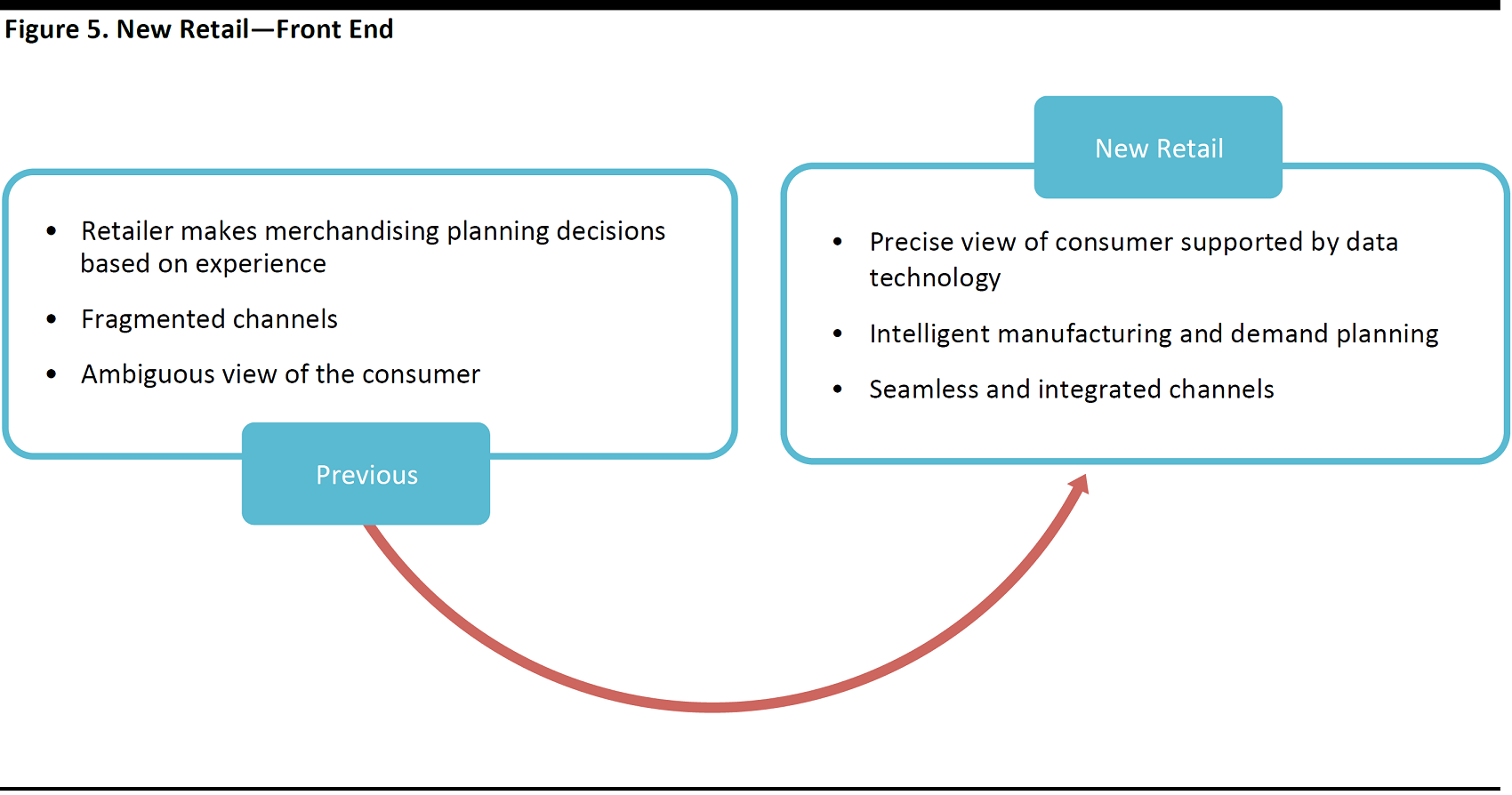

New Retail―Front End

On the front end, new retail emphasizes the introduction of: 1) new touch points; and 2) new demand for content.

- New touch points: New Retail will emphasize multiple touch points for retailers to interact with consumers. In addition to the traditional retail touch points (such as department stores, outlets, convenience stores, shopping malls), there will also be new ones (live broadcasting, smart devices, mobile devices, VR).

- New demand for content: Retailers will need to fulfill consumers’ demand for content, as shopping will also include a social dimension for consumers to interact with each other and retailers. In the past, it was adequate for retailers to satisfy consumers’ demand for functions

and experience. In the future, the new breed of consumers will expect high quality, personalized product and service offering and a seamless payment experience.

Source: Aliresearch/Fung Global Retail & Technology

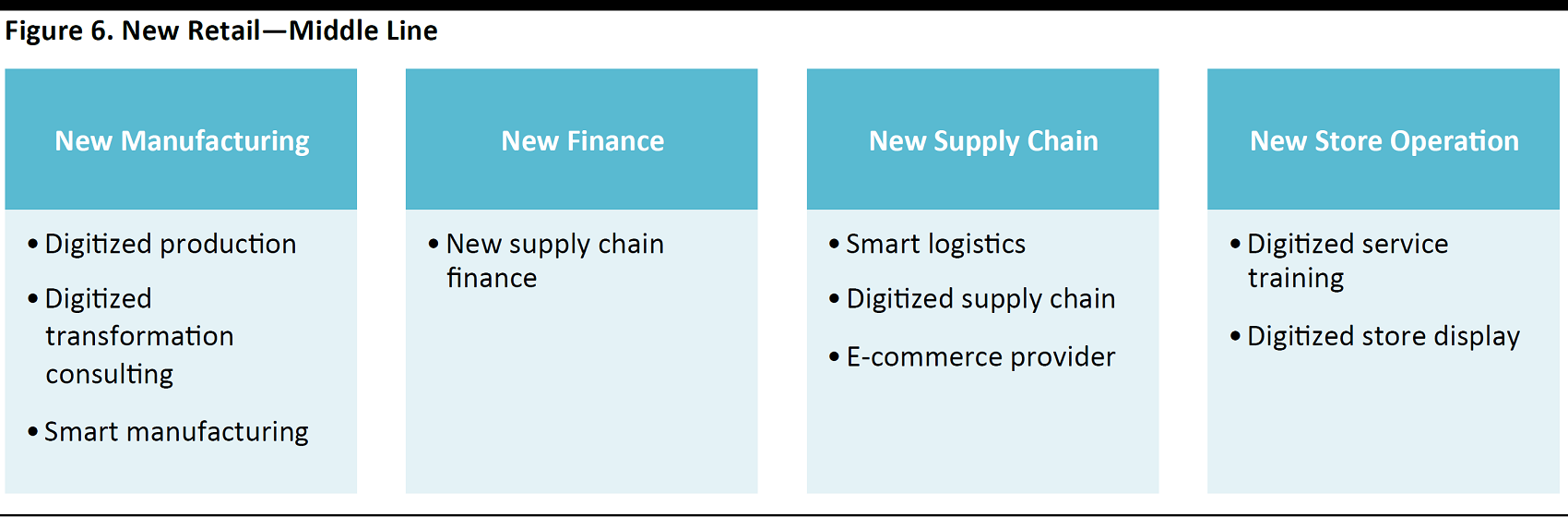

New Retail―Middle Line

The middle line of New Retail emphasizes consumer-centric analysis that is powered by data technology. Retailers can leverage data technology to understand consumers’ preferences, loyalty and feedback by integrating data collected from all channels.

Source: Aliresearch/Fung Global Retail & Technology

New Retail―Back End

The back end of New Retail is primarily responsible for driving the transformation of the infrastructure from one premised in the industrial economy to one that is founded on the digitized economy.

The technological components of the back end of New Retail include:

- 3D/4D printing: This can create highly customizable products. It is predicted that 3D printing will be widely used in fashion in the future.

- AR/VR/mixed realty: This can provide a virtual retail experience. VR has applications in Alibaba Buy + VR store, test driving, tourism, etc. AR was used by Pepsi, Converse, IKEA, Shiseido, Topshop and AR games.

- Sensors and IoT: This can enhance customers’ experience through automated checkout, layout optimization, customer tracking, personalized promotions and inventory optimization.

- AI: This will integrate the entire retailing process with machine learning technology, smart robotics and personalized recommendations.

Source: Mckinsey Global Institute

How Retailers can Win in the New Environment

Retailers that can most effectively adapt to the changing environment by leveraging disruptive technologies and big data will succeed.

In the future, the retail ecosystem will change significantly. The platform economy will redefine the future of retailing. New Retail is expected to hold the solution for physical retailers and pure-play e-tailers.

Retailers’ value chain will need to extend upstream, to product design and innovation, in order to satisfy consumers’ demands.

Slow Adopters Beware

Pure play e-commerce: The e-commerce market in China is almost saturated. Currently, GMV at major online marketplaces is approaching a ceiling, as indicated by the slowing growth rate. Without the support from innovative technologies and physical stores, pure e-commerce players will find it hard to survive in the new business environment.

Traditional retail: At present, the prevalent model of traditional retail in China is based on real estate. This is expected to be negatively impacted, with the advent of New Retail. The problem with traditional retail real estate is the unsustainability of the business model, according to AliResearch. Depending on revenue generated mainly from local customers will pose as a ceiling to a retailers’ growth potential. Online presence is among the most effective solutions for traditional retailers and provides the optionality for further revenue growth.

Traditional manufacturing: Manufacturing has been focused on standardizing output. With the increasing demand for personalized and customized products, the traditional manufacturing process will be changed. The old production-marketing-selling process (B2C) will be replaced by a new one, starting with a consumer’s order; the manufacturers will then need to realize the order so as to complete the deal (C2B).

Execution the Key Risk

In our view, the impact of New Retail could be less positive as expected should physical retailers in China be slow to embrace digital technology and omnichannel initiatives. The development of China’s physical retail industry has lagged that of its global peers, as the country leapfrogged to online retailing without laying a very solid foundation for offline retail.

Applications of New Retail

The conference also covered many ways that retailers can incorporate new retail initiatives into their businesses.

Transformation and Innovation in China’s E-Commerce and Retail Strategy

Speaker: Jessie Qian, National Head of Consumer Markets, KPMG China

Source: Fung Global Retail & Technology

Jessie Qian discussed the prevalence of mobile commerce, and suggested retailers to find a balance between online and offline, and design KPIs to optimize performance.

China’s mobile evolution: Chinese consumers have entered the mobile era and are leading the global transition towards m-commerce. Some 90.4% of consumers in China have used smartphones for online shopping, according to KPMG.

New purchasing patterns: Consumers are influenced by both online and offline factors when making purchasing decisions. A survey shows that nearly two-thirds of consumers will read online reviews and recommendations and compare prices online. Consumers also prefer to touch and feel the products in physical stores.

Omnichannel retailing: It is crucial for retailers to manage their online presence and closely monitor their customers’ feedback. Integrated omnichannel retailing will be the primary trend in the future.

Analysis of Luxury Consumer Behavior in the Pursuit of Quality of Life

Speaker: Vishal Bali, Managing Director, Nielsen China

Vishal Bali discussed the theme of channel fragmentation and the tactics necessary for retailers to win.

A growing consumer base: Rising income is driving a willingness to spend on luxury. Chinese consumers are among the most confident consumers globally, according to Nielsen’s research. The number of households in China with earnings of over $50,000 has been increasing at a 29% CAGR for the past eight years. Chinese consumers are becoming more sophisticated in their pursuit of beauty, enjoyment and quality.

The Extension of Luxury

- In China, the concept of luxury has extended beyond the traditional product range of apparel, jewelry and watches. With new technological developments, luxury products now exist in fields such as household products, travel, personal services, sports equipment, etc.

- The geographic and demographic coverage of luxury has also expanded in China. On average, 12.3% of the population in tier-two cities purchases luxury goods, only slightly lower than 14.3% in tier-one cities. Young consumers born after the 1990s make up 17% of people buying luxury items.

Strategies for luxury retailers

- Physical stores will remain the dominant channel in luxury retail. The online channel for luxury is emerging, but only serves as a supplement to the physical channel.

- Luxury retailers should cater to their consumers’ preferences. Luxury consumers focus on quality, uniqueness, heritage and style.

- According to a survey, 80% of luxury consumers are open to new brands.

Billions of Storefronts―Bridging the Gap between Brand Exposure and Transaction

Speaker: Mark Heap, Asia Pacific CEO, MediaCom

Source: Fung Global Retail & Technology

Mark Heap discussed the technologies that will power the future of retail.

Media is an opportunity to connect with consumers: Brands can use media as a channel to connect with their customers and drive revenue growth. Dior let consumers customize their limited edition bags through WeChat for 2016 Valentine’s Day. The bags were sold out within two days.

Media as an experience: New technologies such as VR and AR allow retailers to provide vivid shopping experiences for their customers.

Compared to physical stores, media technologies are more convenient and efficient, and can effectively reduce the cost for retailers and drive bottomline growth.

The Unique Marketing Strategy of Uber

Speaker: Santiago Wang, Senior Marketing Manager, Uber

As a global service provider, Uber has set several excellent examples of how businesses can apply unique marketing strategies in an innovative and effective way.

UberBoat: During Miami Art Week in November 2015 in Miami, Florida, Uber provided a transport service that combined boat and car service. UberBOAT allows riders to travel between Miami Beach and the Art Districts by jetting across Biscayne Bay on luxury yachts. The service solved the traffic congestion problem during Miami Art Week and increased the number of local Uber users.

Uber Ice Cream: For the past two years, Uber has held this ice cream delivery event in over 400 cities. During the week-long Uber Ice Cream event, Uber users can get ice cream delivered to their specified location within minutes. The activity became a hot topic on social media platforms.

Uber Lion Dance: To celebrate Chinese New Year, for the past few years, Uber has been offering lion dance activity on-demand in Singapore. Users can request a lion dance show from one of the troupes.

Source: Uber Newsroom

The 5th China E-Commerce and Retail Innovation Summit 2017

The conference was attended by multinational and domestic retailers, brands, e-commerce platforms and service providers. Speakers included KPMG, Nielsen, AliResearch, North Face, Starbucks, Nestlé, JD Worldwide, Lenovo, Gap, Uber, and Tencent. The theme of the conference was “using big data and internet technology to explore the future of New Retail.”

Alibaba’s Vision For New Retail

Alibaba’s strategy ties in with the structural trend of China’s consumption upgrade. Chinese consumers and their consumption demand has become an engine to drive the country’s economic growth.

Alibaba’s GMV Forecast to Double by 2020

Alibaba’s gross merchandise volume (GMV) reached ¥3 trillion ($463 billion) in fiscal year 2016. Alibaba expects GMV to double to ¥6 trillion in 2020 and further increase to ¥10 trillion in 2024.

Alibaba: Five New Trends of the Business World

Alibaba Founder and Chairman Jack Ma predicted a radical change in the global retail industry in the future. In his opening keynote at the 7th Alibaba Computing Conference in October 2016 and in a letter to Alibaba’s shareholders, he said, “Pure e-commerce will be reduced to a traditional business and replaced by the concept of New Retail―the integration of online, offline, logistics and data across a single value chain.”

Source: Company reports/Fung Global Retail & Technology

The “five new trends” framework was proposed by Jack Ma as a prediction of the landscape of the future business world. The five emerging trends that he highlighted were:

- New retail

- New production

- New finance

- New technology

- New resources

1. New Retail

New retail refers to the integration of online, offline retail and logistics. The role of logistics is to optimize inventory management and minimize inventory.

2. New manufacturing

New manufacturing refers to the transformation to a C2B from the current B2C model. Customization and personalization to the individual consumer will be the emphasis of new manufacturing.

Future manufacturing processes will be more intelligent, customized for individual consumers and make use of IOT, AI, smart machinery and data technology.

The sequence of the manufacturing process will be reversed. Manufacturers have to constantly evolve to cater to consumers’ demand, instead of driving decisions by themselves.

3. New Finance

New finance points out the variety of investment projects and the importance of small- and mid-sized companies in the future.

The future finance industry will support 80% of enterprises (including small to mid-sized companies, as they will be driving economic growth and innovation). In the past, the development of the finance industry was premised on the 80:20 rule, whereby banks support 20% of enterprises (the larger companies), which are expected to drive 80% of overall economic growth. In the future, the core focus of finance industry will be to promote development of 80 percent of small and mid-sized companies.

The last two elements –

4. new technology and

5. new resources – both emphasize the important role of data. AI, cloud computing, new energy and big data will be the core of future advances.

Conclusion

The gist of New Retail is to catapult China to data-powered, consumer-centric omnichannel retail from traditional retail.

Data technology is required to bring China’s retail industry into the era of New Retail. Alibaba’s role will be to bring data technology to empower physical retailers to be truly consumer-oriented.

We will continue to monitor the progress of New Retail and the transformation of China’s retail industry.