Executive Summary

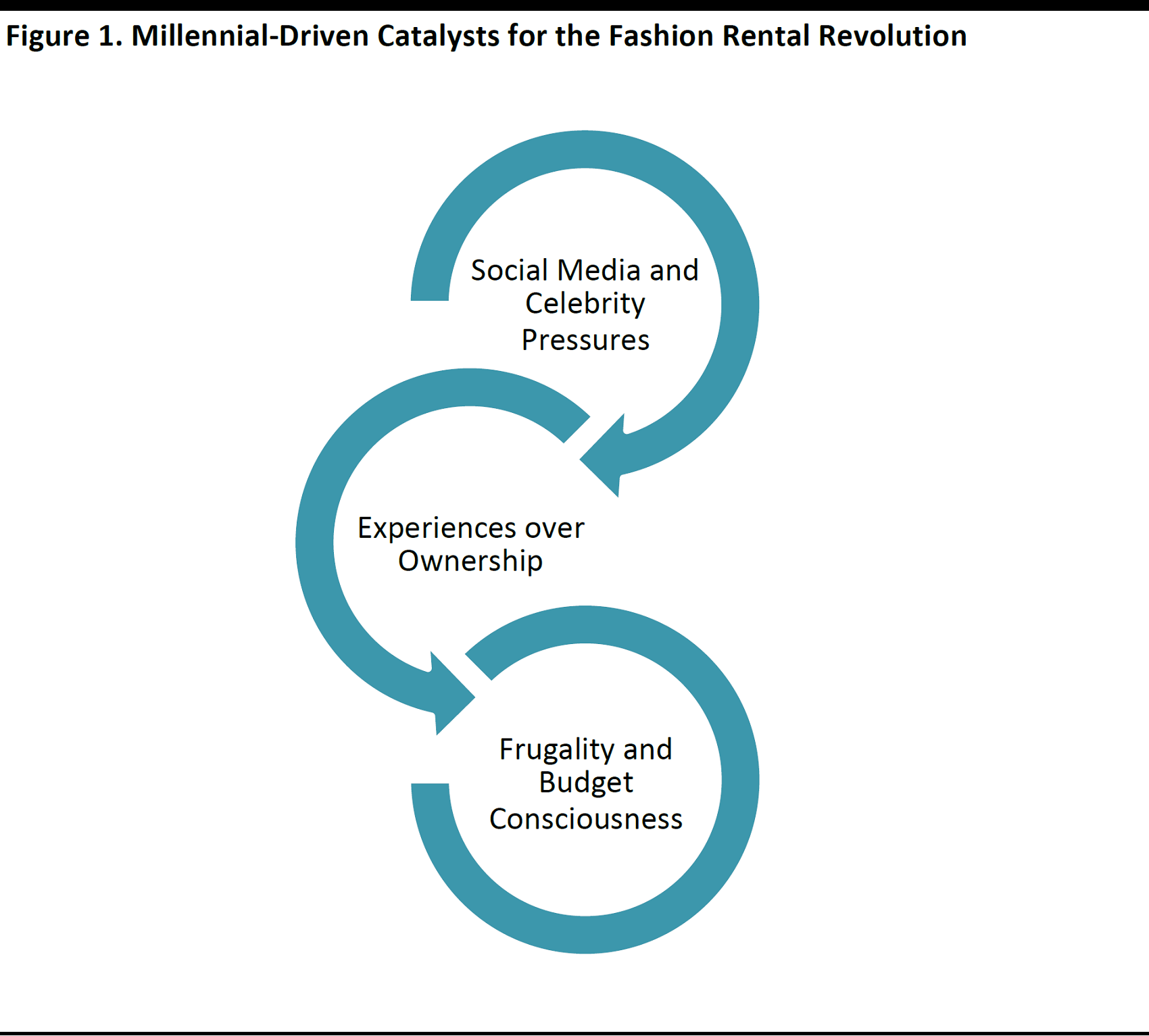

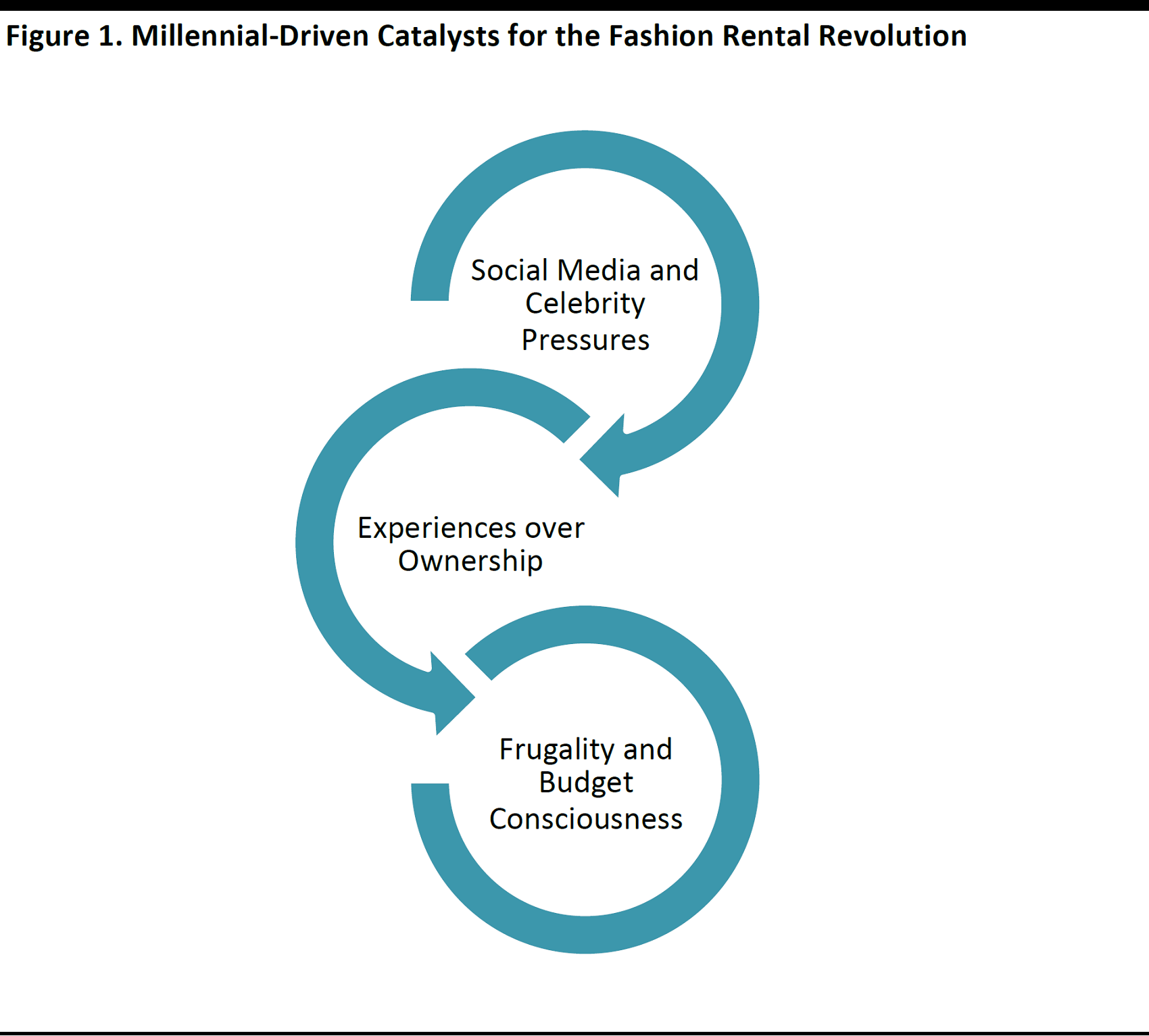

Online apparel and accessory rental startups are proliferating. Apparel rental models allow customers to borrow items for a set time period, typically at a much lower cost than buying the items outright. Millennials-those born between 1980 and 2000—appear to be driving the growth of the apparel rental segment. In particular, three millennial lifestyle trends are underpinning the development of the segment:

1) The Instagram effect, celebrity culture and the selfie phenomenon necessitate that millennials have an ever-changing, on-trend wardrobe. Apparel rental services allow consumers to wear a changing selection of major brands without having to spend as much as they would if they bought the items outright.

2) Millennials value experiences over acquiring products. Apparel rentals allow millennials to wear high-end brands at lower cost, and so funnel more of their spending toward services and leisure experiences. Meanwhile, the low priority that millennials attach to owning products makes renting apparel a more viable option.

3) Millennials are considered budget conscious, so renting items makes sense for them, especially high-worth and expensive items that are used only occasionally.

Further factors supporting the apparel rental segment include the decluttering trend, the prevalence of fast fashion and millennials’ concern for environmental sustainability.

Apparel rental services have expanded in line with the rapid growth of the sharing economy. In today’s increasingly digitalized world, more and more consumers are forgoing ownership of products and services and choosing to rent, borrow or barter for them instead. The Internet has facilitated new marketplaces that provide superior communication and logistics services that links owners with borrowers and renters.

Online apparel rental companies can siphon off sales that would otherwise go to retailers. On the flip side, renting can inspire consumers to make future purchases, as some may feel more confident about buying a particular item or brand after trying it on. Rental services introduce potential customers to new brands and designers, especially ones whose products the customers cannot afford to buy currently, but may be able to buy in the future. This is particularly relevant now, as luxury goods sales have been on a declining trend.

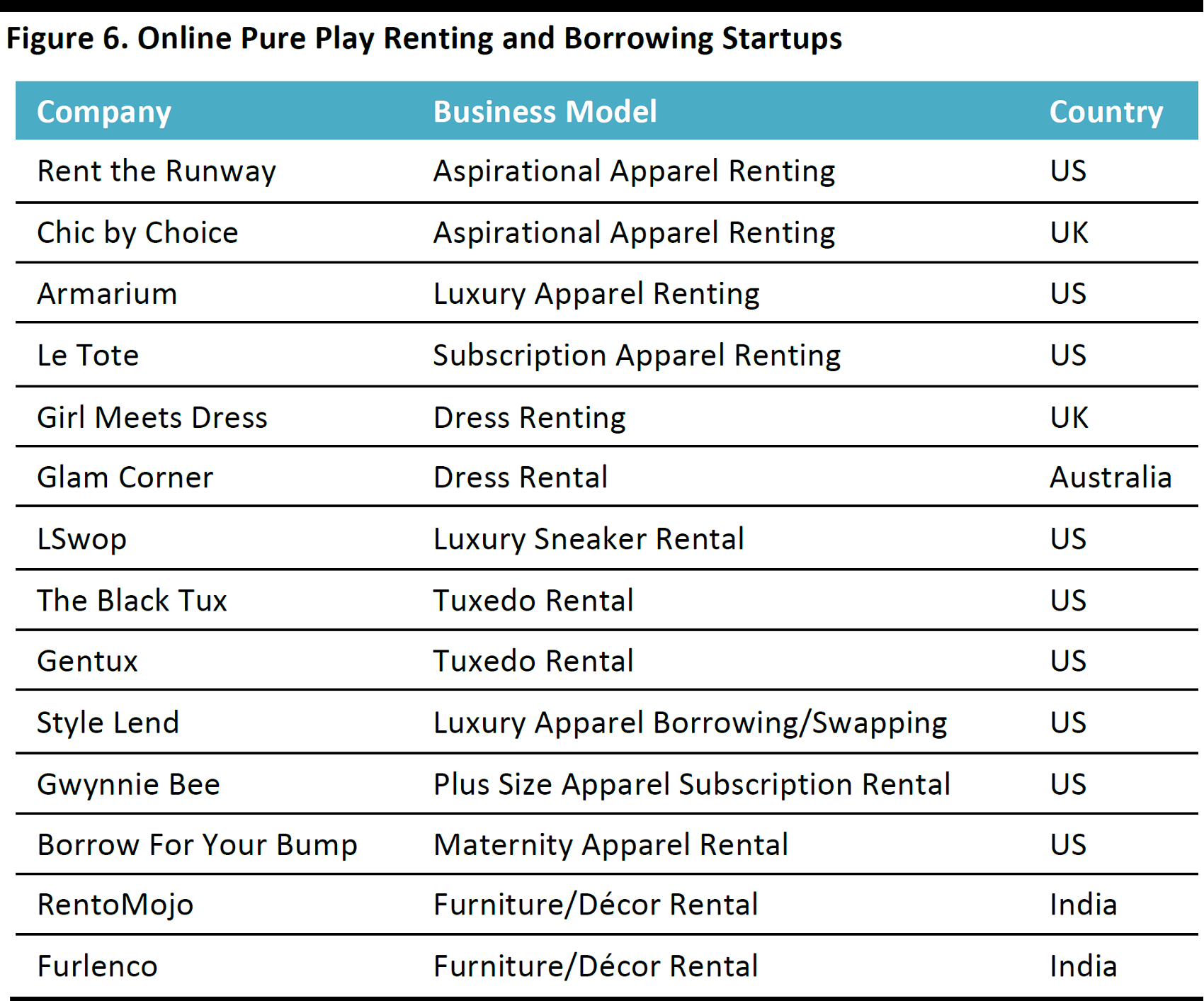

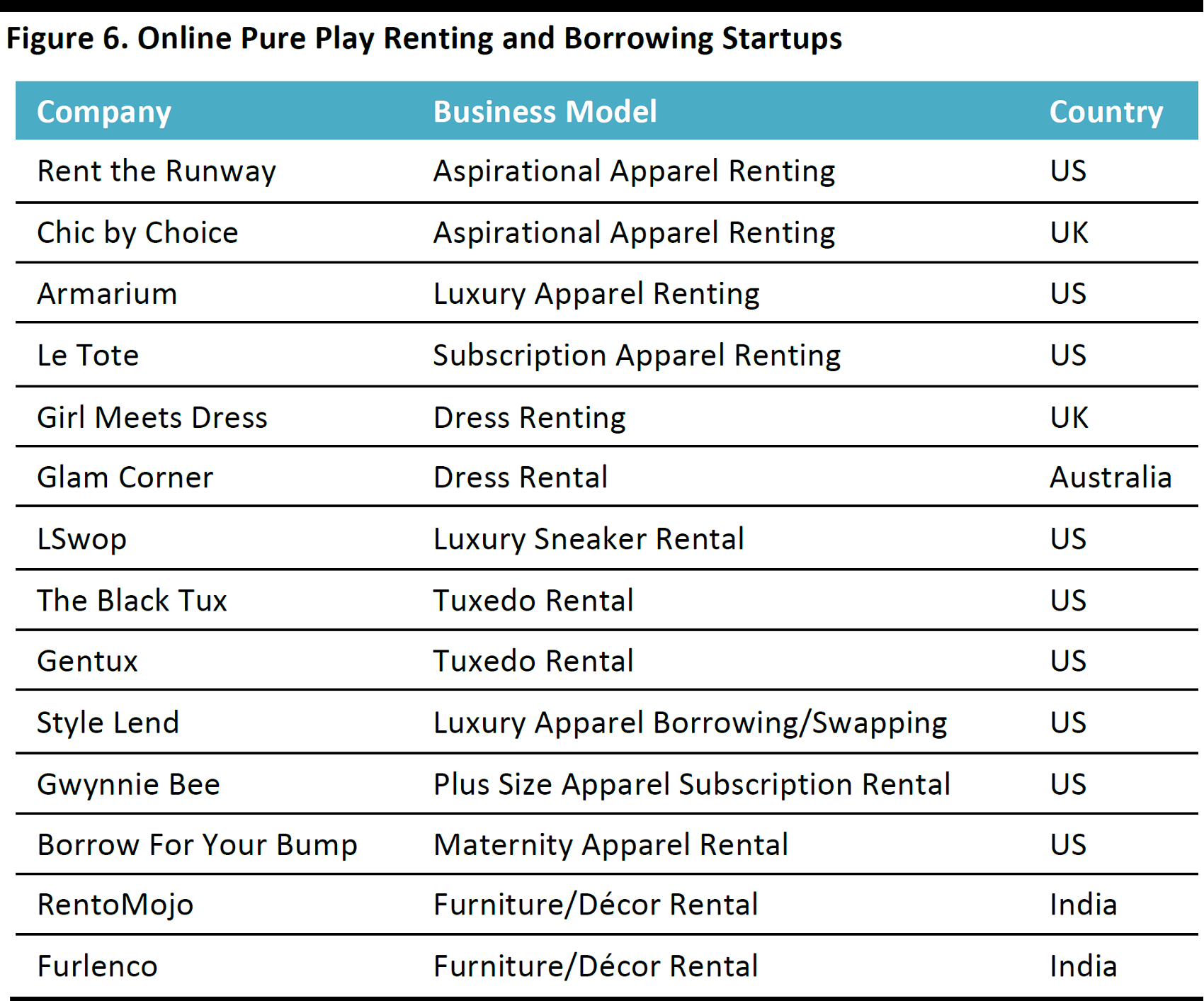

A number of fashion rental companies and peer-to-peer marketplaces have launched operations in the last few years in the US, the UK, Europe, and Australia. The majority offer higher-end designer merchandise, and some target niche markets.

Services such as virtual fitting rooms and augmented-reality apps will encourage more online purchases and rental transactions, as these new technologies resolve some of the challenges related to finding the right fit or size while shopping for apparel online. However, apparel rental and peer-to-peer sharing services still face some challenges and roadblocks that inhibit their adoption on a larger scale.

Introduction

In this report, we examine the trend of renting fashion, which consists of renting merchandise such as apparel, footwear and accessories for a specific, predetermined time period and fee. We identify three key millennial trends that are underpinning the market for apparel rentals. We also consider the potential implications of the rental trend for retailers, showcase various online startup companies that offer rental services for apparel and other items, and shed light on how the apparel sharing economy and rental movement are likely to evolve in the future.

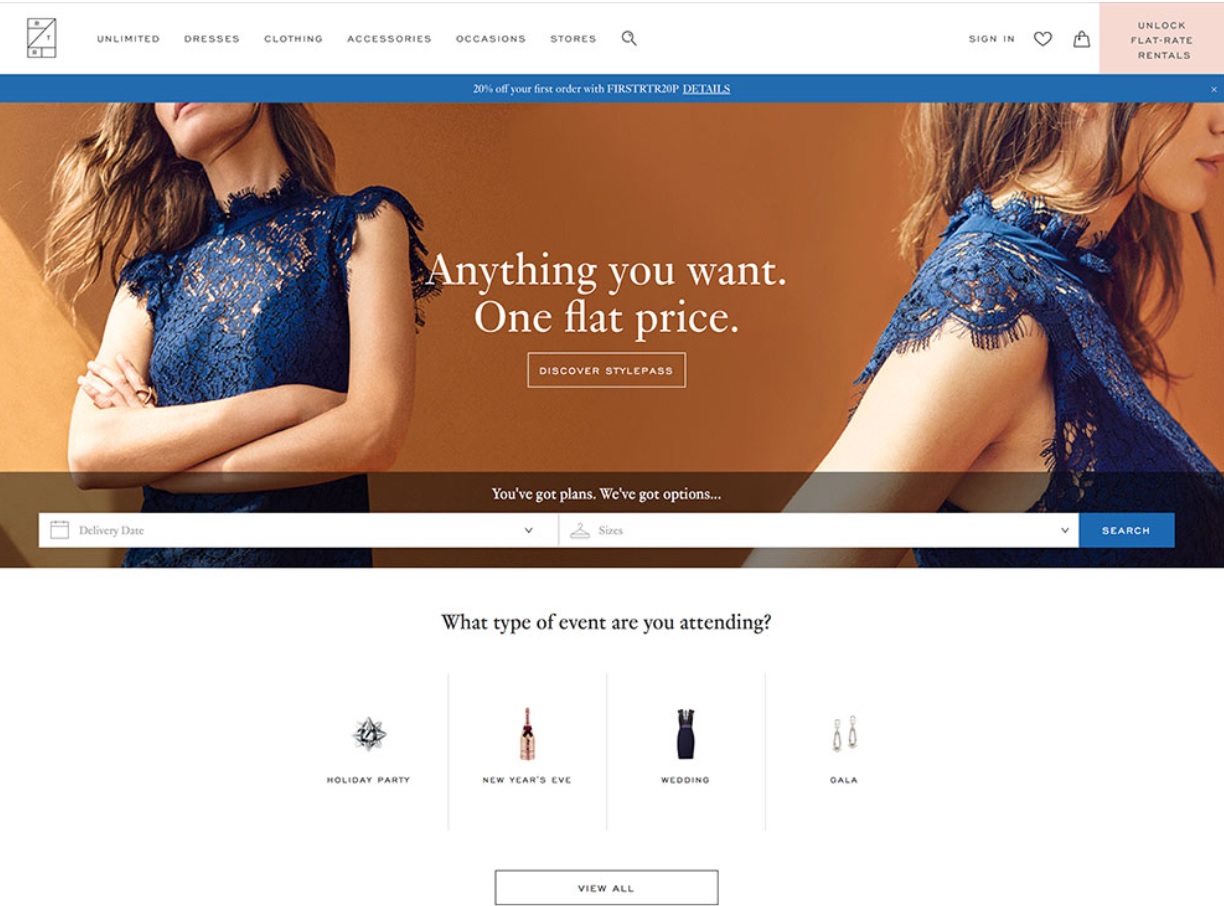

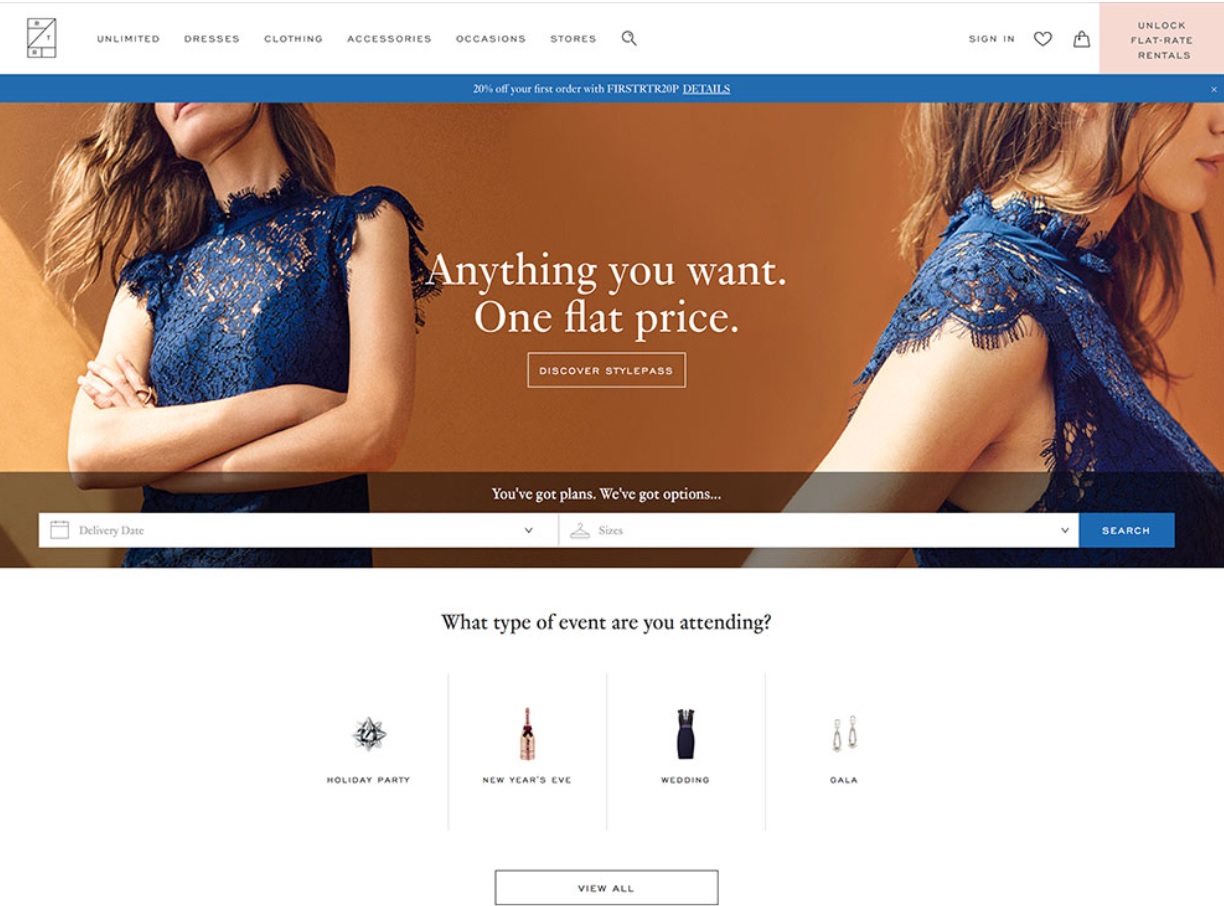

Source: Renttherunway

The Rent-the-Runway Revolution

Alongside the rapid expansion of the sharing economy for all kinds of goods and services, online apparel and furniture rental startups and peer-to-peer sharing platforms have proliferated. Rental models allow customers to borrow items for a set time period, typically at a meaningful discount to the products’ retail prices. Perhaps the best-known apparel rental company is US-based Rent the Runway, which launched in 2009 and currently has more than 6 million members.

Rental companies provide product accessibility by offering aspirational, discounted designer products to a broader audience; these consumers often would not be able to afford to buy the products, but are able to rent them for a period of time at a lower cost. The fashion rental model expands the fashion market by enlarging the customer base and making a wider array of fashions available to younger and less-wealthy consumers. The rental market is geared toward special occasion wear and formal wear, as such items are often rarely worn but of high value.

Millennial Lifestyle Trends Underpin Apparel Rental

Millennials-those born between 1980 and 2000—appear to be driving the growth of the apparel rental segment:

- According to a survey by shopping-center operator Westfield, about46% of millennials in the UK and 35% in the US would be willing to spend £200 (US$253) or more monthly to rent clothes.

- The survey found that almost half of 25–34-year-olds in the UK and the US would be interested in a monthly rental subscription plan for clothes. Consumers in urban areas are particularly interested in renting clothes from their favorite stores, the Westfield survey found.

- In addition, about 60% of millennials prefer renting goods to owning them, according to a survey conducted by the Organisation for Economic Co-Operation and Development in 2013.

We see three key millennial lifestyle trends underpinning the development of the rental segment: a desire to be seen wearing an ever-changing, on-trend wardrobe that is driven by social media and celebrity culture; a preference for spending on experiences rather than on goods; and frugal consumption habits.

Source: Fung Global Retail & Technology

1. Instagram, Celebrities and the Selfie Generation

The Instagram effect, celebrity culture and the selfie phenomenon lead many millennials to desire an ever-changing, on-trend wardrobe. Millennials are very much influenced by celebrities and social media, and we see platforms such as Facebook, Instagram, Twitter and Snapchat stimulating demand for fashion and apparel rentals. Millennials want to be seen in designer goods and the latest apparel styles, and rental services provide a more affordable means of procuring designer clothing. They also offer consumers continuous product newness and variety, allowing renters to wear a changing selection of major brands, but at a lower cost than buying them.

2. Experiences over Acquisitions

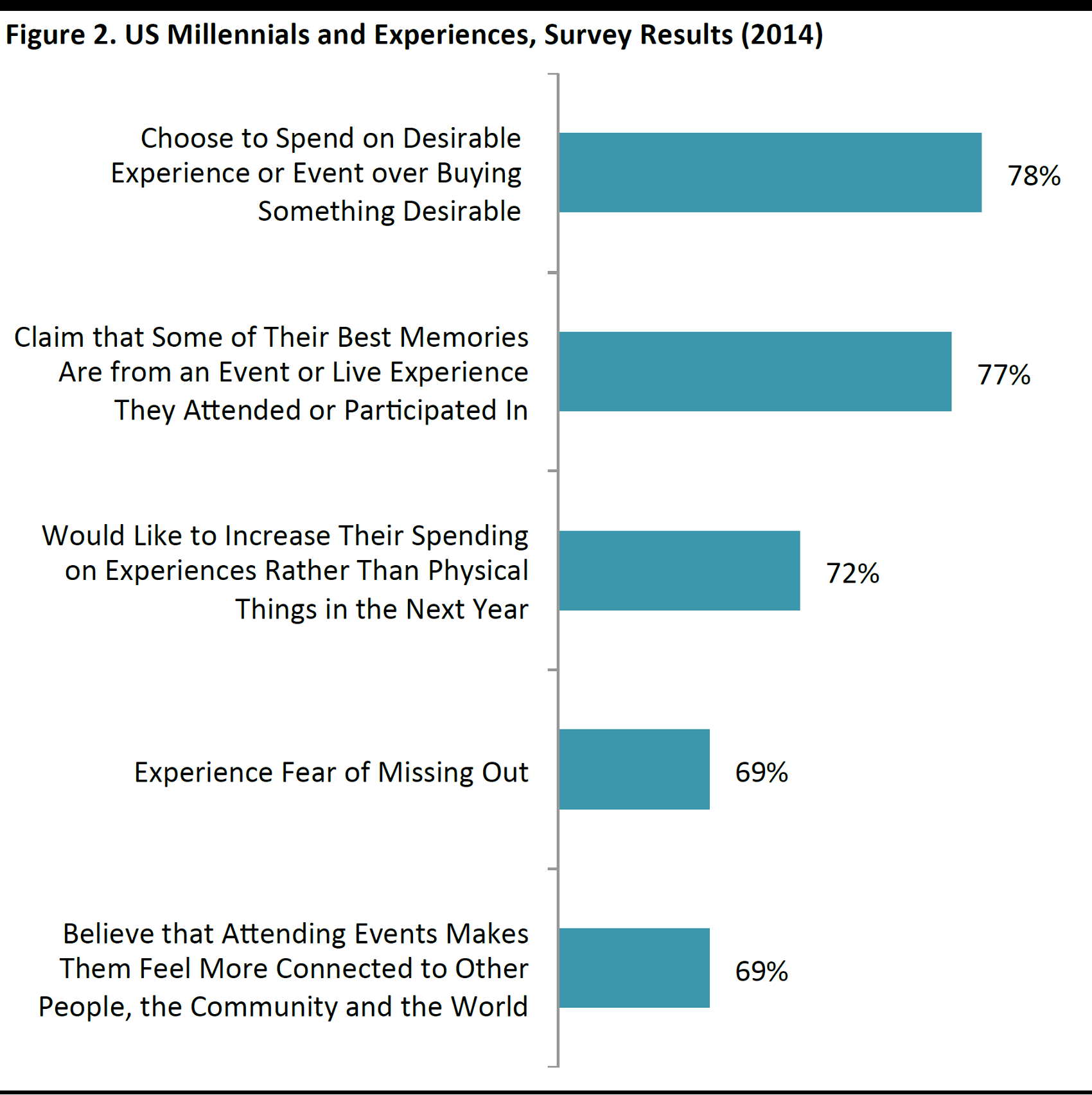

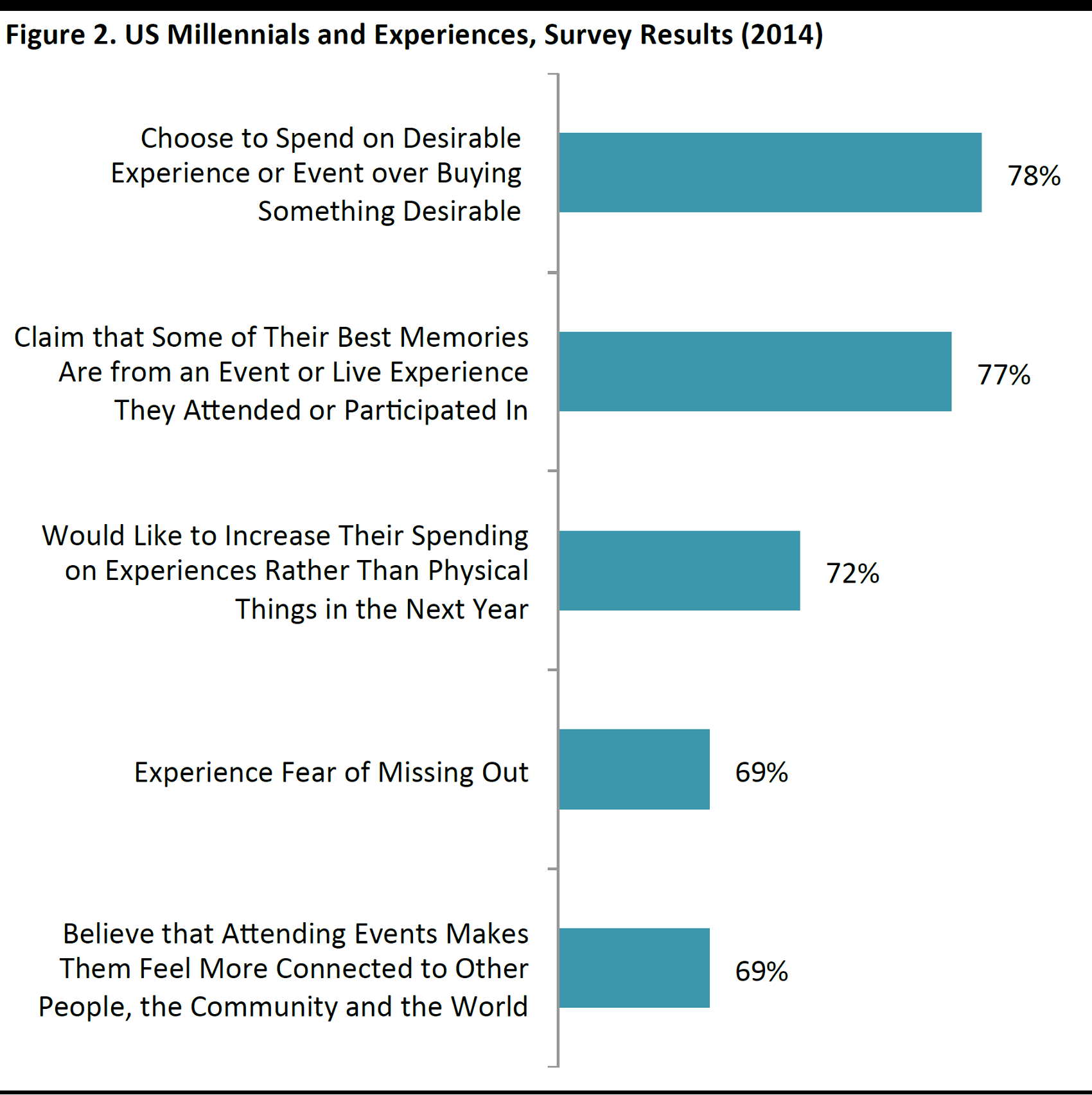

Millennials overwhelmingly value leisure experiences over material possessions, and they and many consumers in other demographics now prefer to rent or share certain items rather than own them outright. According to a survey by Eventbrite and Harris Poll, fully 78% of US millennials prefer to spend on a desirable experience than to buy a desirable product.

Source: Eventbrite/Harris Poll

Apparel rentals dovetail with this trend in two ways:

- First, the rental model allows millennials to wear high-end brands at lower cost, leaving them more to spend on the services and experiences that they value more highly.

- Second, the low priority that millennials attach to owning products makes rentals a more viable option: if these consumers had a strong preference for acquiring products, the model would not work.

3. Limited Financial Means and Budget Consciousness

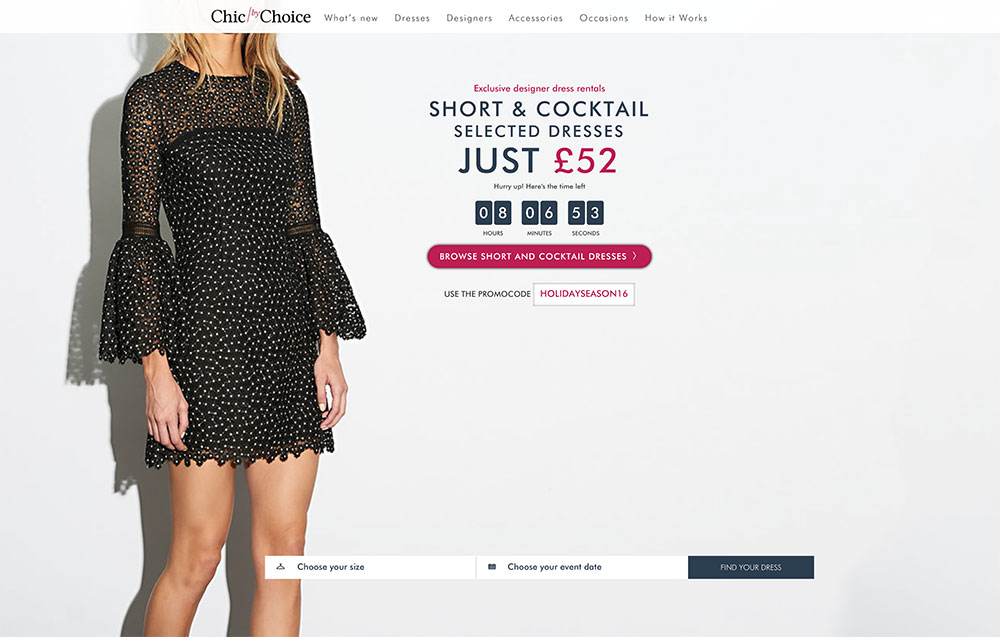

In the aftermath of the financial crisis, many millennials in the US, Canada and the UK are grappling with high student debt levels and soft employment prospects. In Continental European countries such as France, Italy and Spain, millennials are facing much higher levels of unemployment than other generations do. Unsurprisingly, this age group is considered budget conscious. Millennials seek value, so renting items makes sense for them, especially for high-worth and expensive items that are used only occasionally. According to UK-based apparel rental startup Chic by Choice, only one-third of millennials are willing to purchase apparel at full price.

Source: Chic-by-choice

Further Factors Supporting the Rental Segment

Decluttering

Peer-to-peer rental services help consumers declutter their homes and sustainably make use of unworn and unused items. According to online resale store ThredUp, more than US$8 billion worth of apparel is just sitting, unworn, in consumers’ closets in the US. The rental model allows consumers to clean out their closets and monetize the clothes they never wear themselves.

Fast Fashion

Renting and borrowing apparel builds on the fast-fashion business model, as apparel rental services provide customers with more choice and variety, along with continuously on-trend merchandise. Fast fashion, due to its low-value, expendable nature, is also an extension of consumers’ desire to experience products rather than own them forever. Fast-fashion online pure plays such as Boohoo.com and ASOS have reported very strong sales results in their affordable bridal and special occasion dress categories.

Sustainability

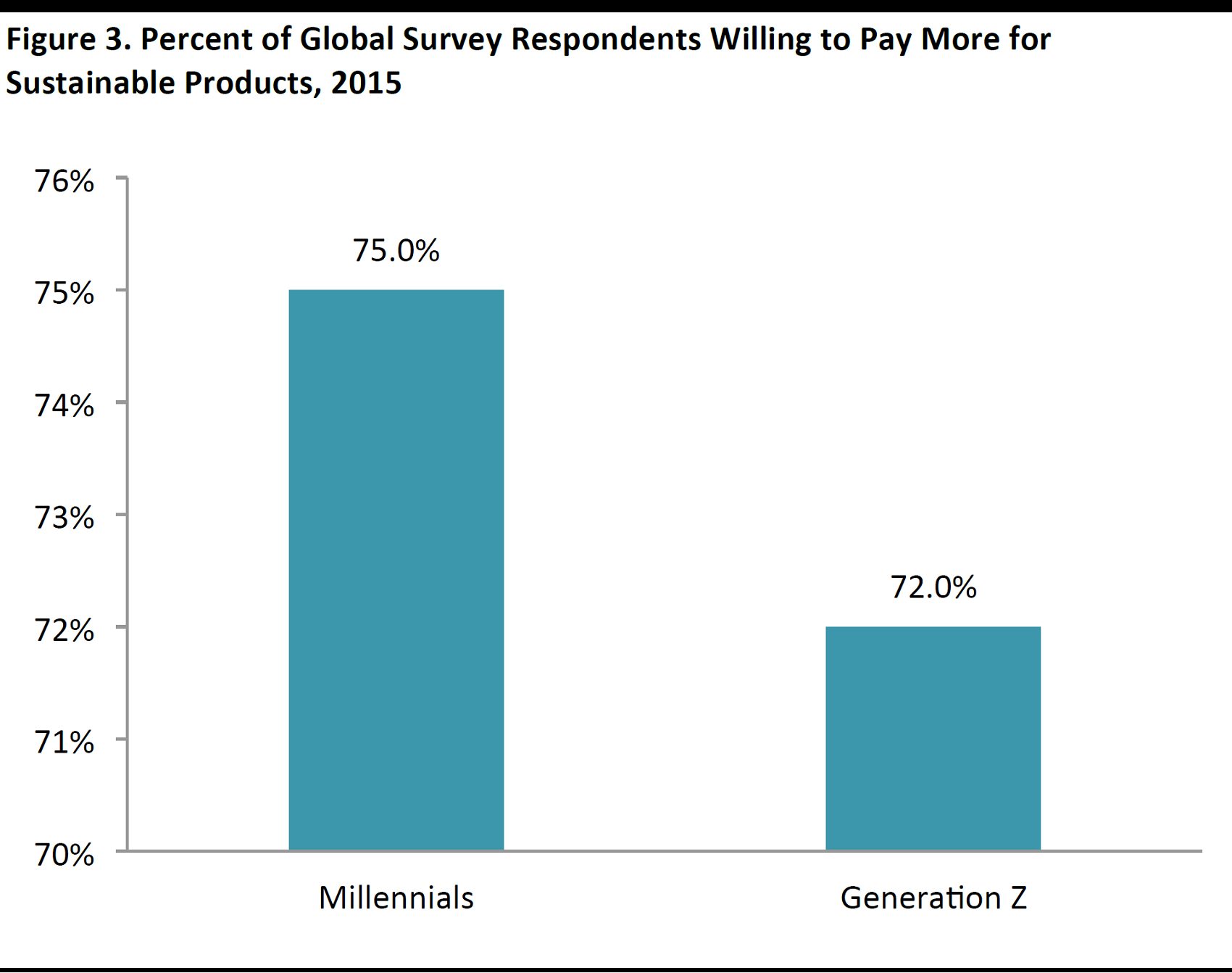

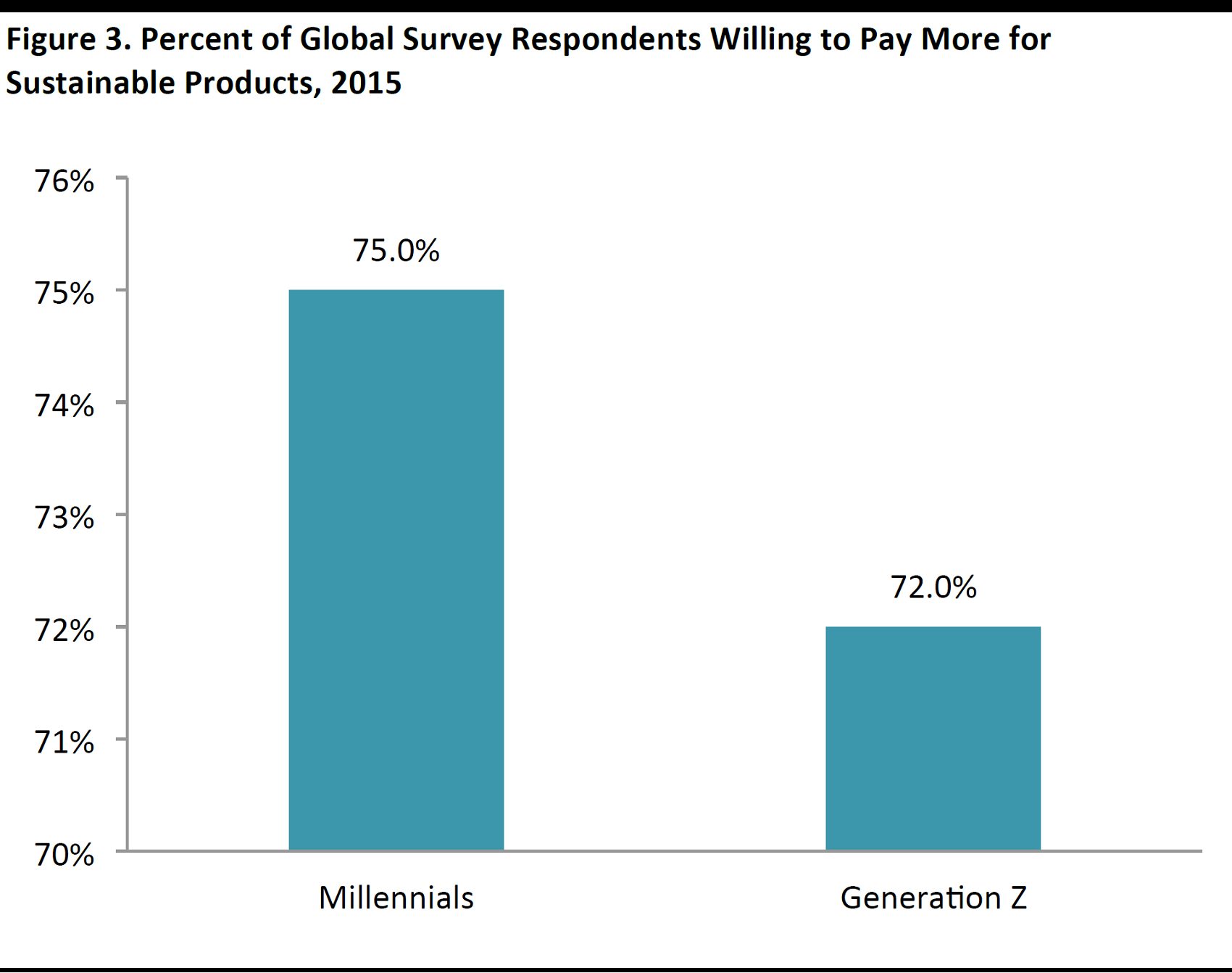

Finally, in some ways, it is more sustainable and environmentally friendly to rent clothes than it is to buy them, as the textile industry—especially fast fashion—is one of the biggest polluters globally. One counterargument could be that the transportation of rental garments creates additional pollution. According to Nielsen, millennials are more likely than Generation Zers (the generation that follows the millennials) to be willing to pay more for sustainable products.

Source: Nielsen

One Element of the Booming Sharing Economy

In today’s increasingly digitalized world, more and more consumers are forgoing ownership of products and services and choosing to rent, barter for or borrow them instead. The Internet has facilitated new marketplaces that provide superior communication and logistics that link owners with borrowers and renters.

For transportation, many consumers use rental/ride-sharing services such as Uber, Zipcar, and Getaround, as well as scooter rental services. Others are sharing vacation rentals that are booked through home-sharing platforms such as Airbnb. The sharing economy has also expanded to include peer-to-peer rentals of furniture, appliances, tools, art and, of course, apparel and footwear.

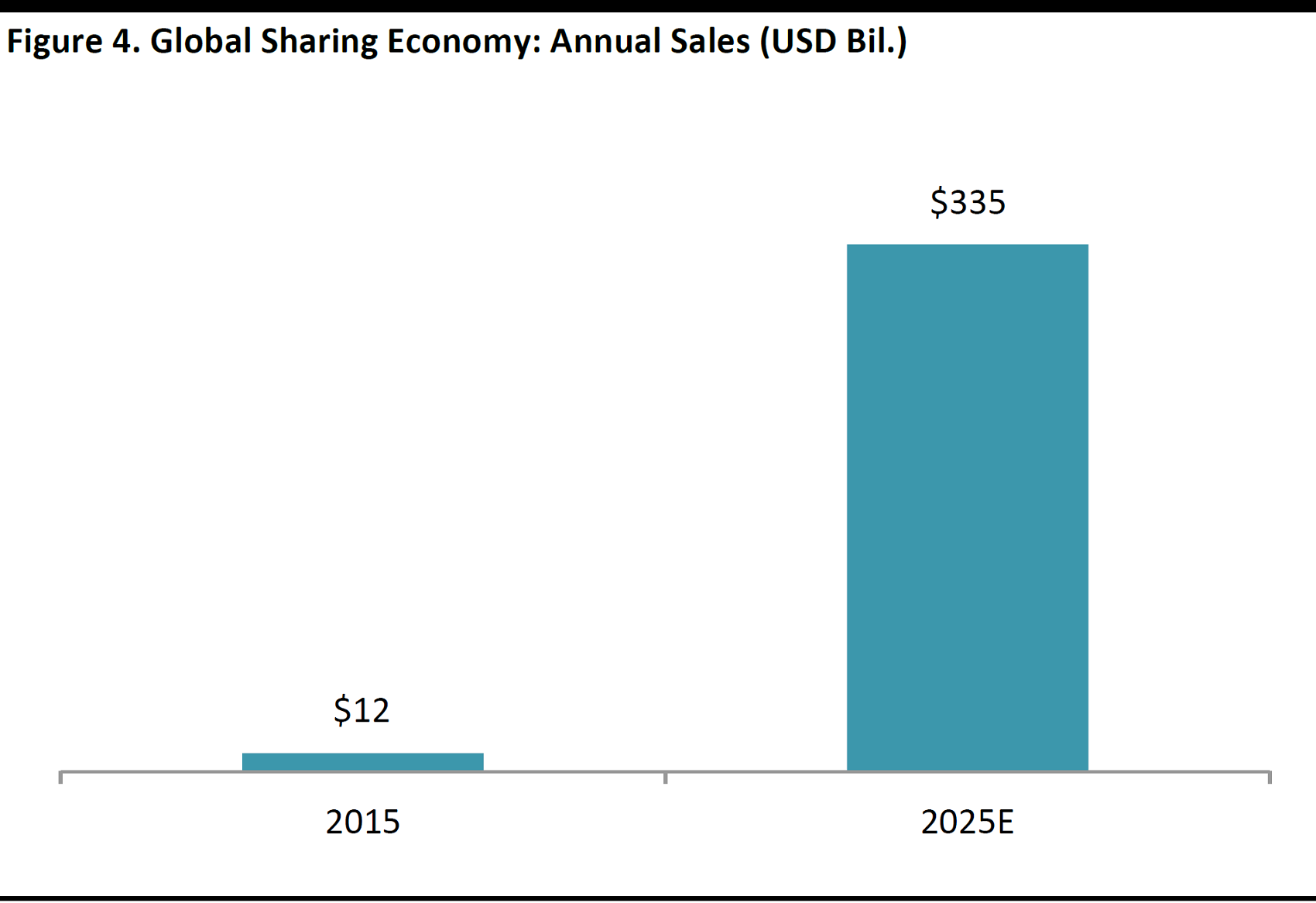

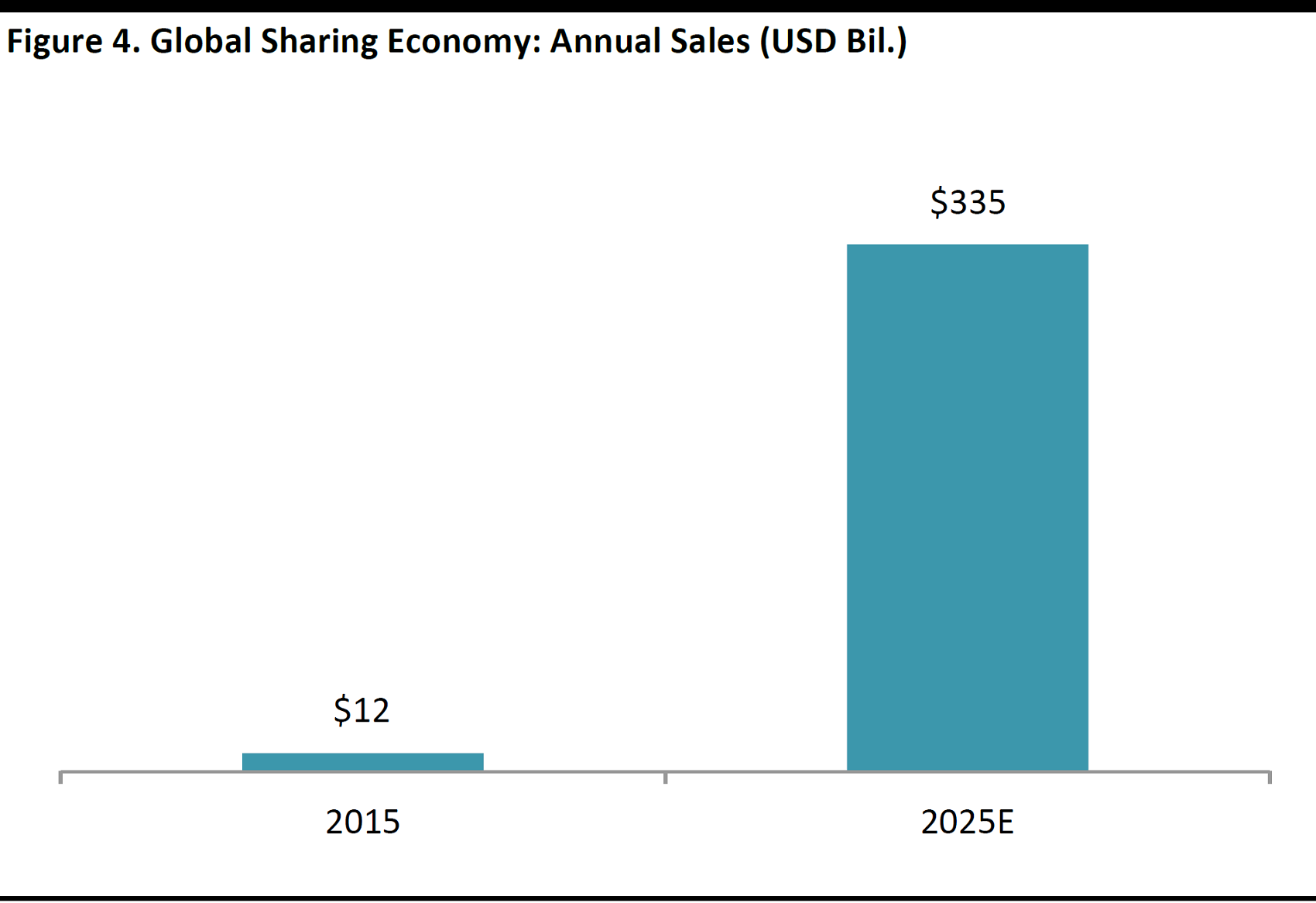

PwC forecasts that the global sharing economy could generate US$335 billion in annual revenue by 2025, up from about US$12 billion in 2015. However, it is unclear how much of that will be accounted for by retail or fashion apparel rentals.

Source: PwC

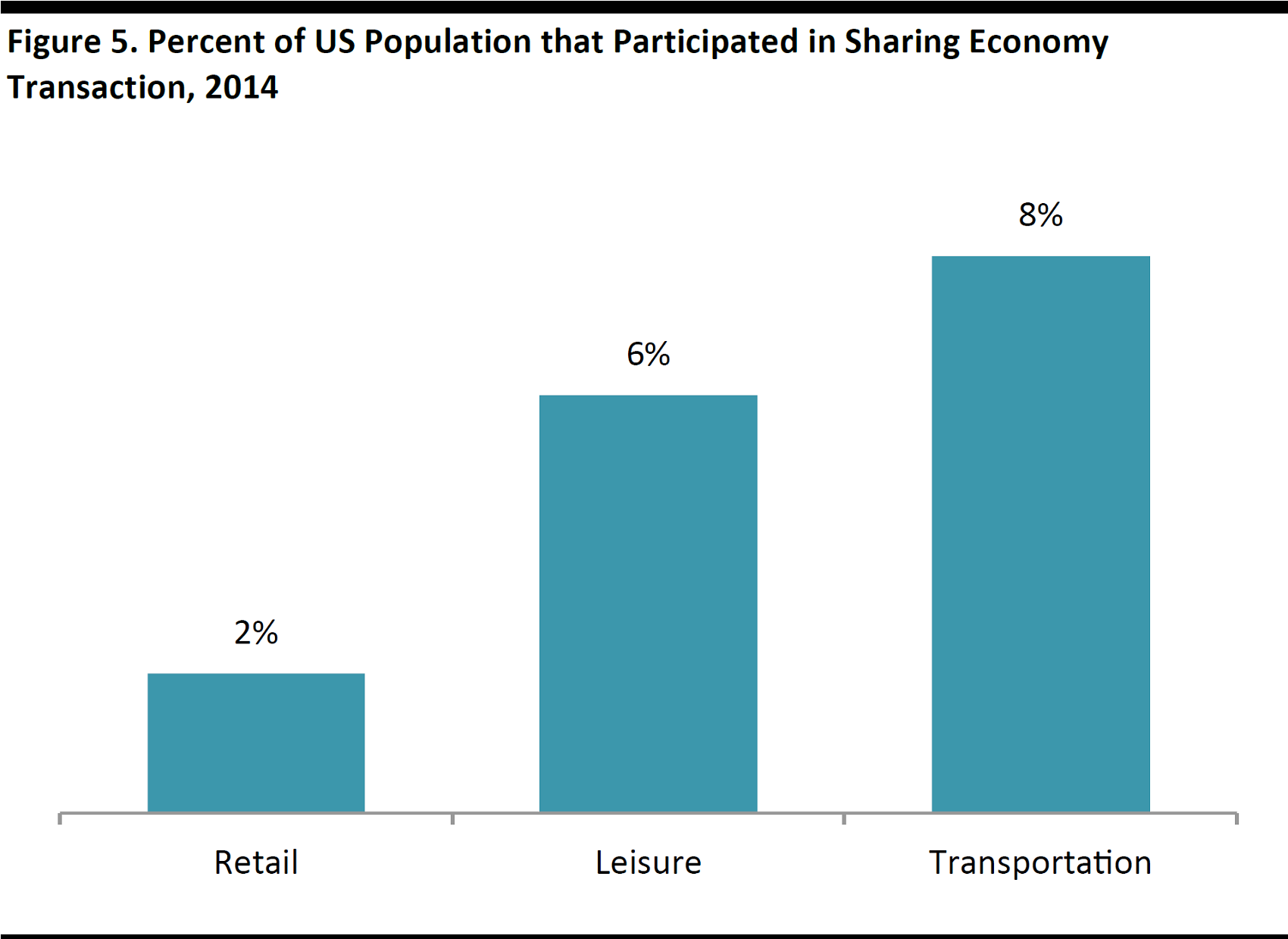

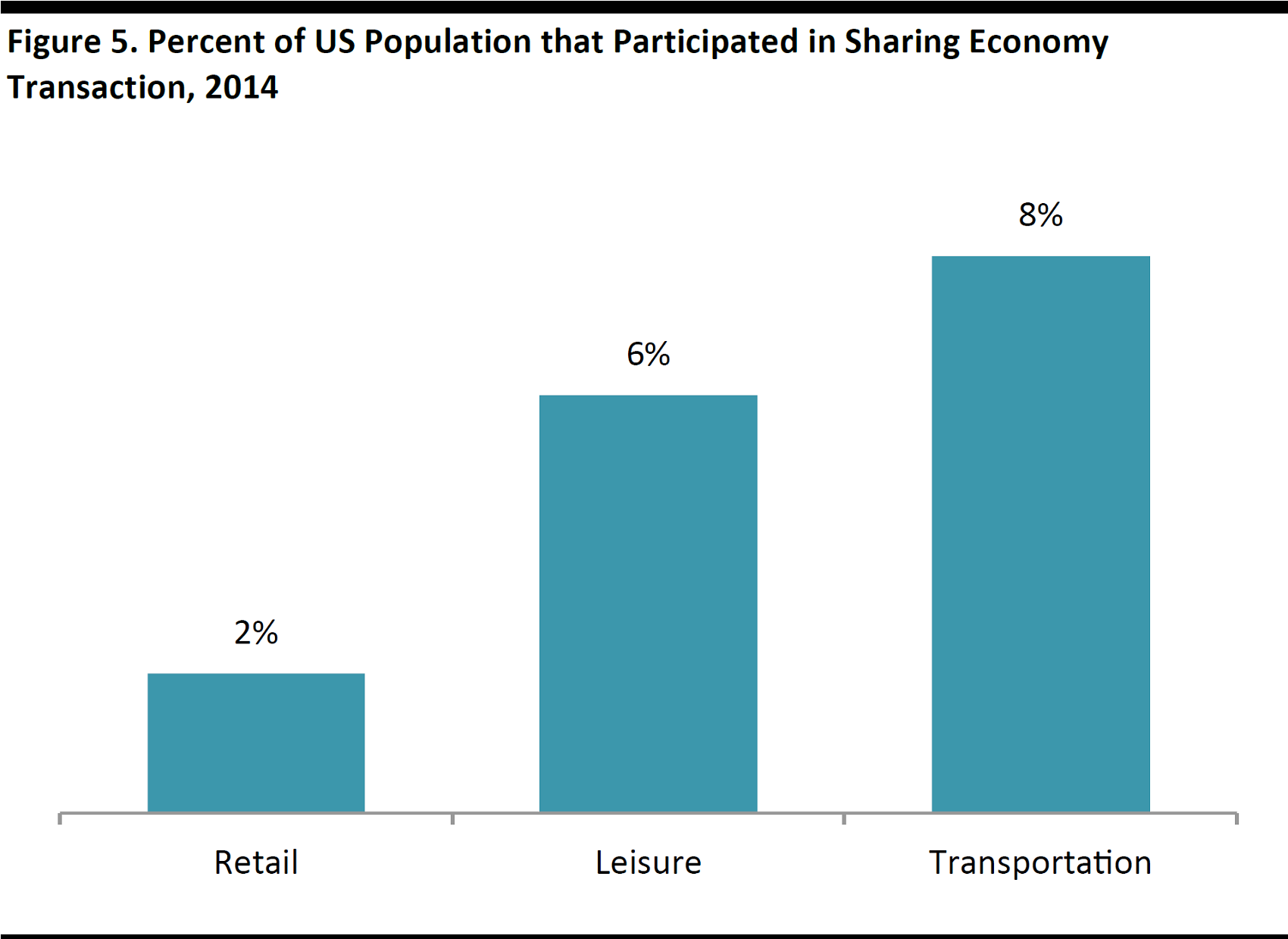

As of 2014, only 2% of the US population had participated in a sharing transaction in retail, compared with 6% for leisure and 8% for transportation, according to PwC.

Source: PwC

Implications for Retailers

Online apparel rental companies can siphon off sales that would otherwise go to retailers. If the apparel rental economy takes off on a larger scale, fast-fashion retailers will likely be most affected, since they sell on-trend and seasonal, but inexpensive, products. Traditional tuxedo and formalwear rental companies such as Moss Bros and Men’s Wearhouse may also see pressure, as the customary experience of renting formal attire for special occasions has often been characterized as unpleasant and outdated.

On the flip side, renting can inspire consumers to make future purchases once they have tried on a certain item or brand. Rental services are a means of introducing potential customers to new brands and designers, especially ones that the renters may not have been able to afford to buy outright. This is particularly relevant now, as luxury goods sales have been on a declining trend.

According to Rent the Runway, 95% of apparel renters are trying a new brand for the first time, so rental companies are facilitating customer access and introducing customers to brands. In some instances, customers would likely never have tried the brand if the apparel rental service had not been available.

Rent the Runway has opened a showroom in US luxury department store Neiman Marcus in San Francisco, and the two companies consider their partnership a way to introduce customers to new brands and to expand sales or rentals to new customers. Rent the Runway’s core customers are 20–30-year-olds and Neiman Marcus’s core customers are 40–50-year-olds. The department store is especially trying to attract millennial fashion customers and introduce them to new fashion categories.

Likewise, New York–based luxury rental startup Armarium has established a new partnership with European online luxury marketplace Yoox Net-A-Porter. When Armarium members select a rental piece, they are also offered a selection of footwear and/or accessories available on Net-A-Porter that have been selected by Armarium’s stylists. Net-A-Porter sells many of the items that are available on Armarium already.

Source: Armarium

What Does the Future Hold?

The CEOs of rental startups believe that renting apparel will become more common than purchasing it, and that rental companies will disrupt the apparel market. Services such as virtual fitting rooms and augmented-reality apps will encourage more online purchases and rental transactions, as these new technologies resolve some of the challenges related to finding the right fit or size while shopping for apparel online.

However, apparel rental and peer-to-peer sharing marketplaces still face some challenges and roadblocks that inhibit their adoption on a larger scale. First, not all consumers want to share apparel, footwear, and accessories or wear apparel that has been worn by others, although the consumer mindset may evolve favorably on this over time. Second, not all brands want to offer their products on loan.

The most likely scenario is that consumers will use apparel rental services most often for special occasion apparel and formalwear, as well as certain unique lifestyle pieces. Currently, fewer than 1million tuxedos are purchased in the US annually, while more than 10 million are rented out. Given the growth of the athleisure trend and the less-formal dressing habits that are defining the workplace, there could be a sizable opportunity in renting suits and tuxedos for specific occasions.

Rental startups that target niche markets such as maternity wear and plus sizes are also likely to succeed. Furthermore, it definitely makes sense to rent specialized but stylish, sporadic-usage apparel for certain outdoor activities or sports such as skiing, snowboarding, sailing and yachting, and clothing for winter vacations and jungleor desert trekking. Finally, we believe there is also demand for online rental of furniture, art and home décor, especially in large urban centers with relatively mobile populations.

Source: Shutterstock

Company Profiles

A number of fashion rental and peer-to-peer sharing companies have launched operations in the last few years in the US, the UK, Europe, and Australia. The majority offer higher-end designer merchandise, and some target niche markets. Almost all of these companies offer free shipping and returns, as well as assume the costs of repairs and dry cleaning. Most also offer free personalized stylist advice for fit and styling support. Some companies also offer item insurance and the option to purchase items after rental at a discount to the retail price. Startups in the sector likely have high operational costs and we would not be surprised if most of them are not currently profitable.

Revenue data are thin on the ground, given a preponderance of private ownership. Rent The Runway has been reported to be targeting US$100 million in revenue in 2016. Glam Corner reported approximate sales of AU$1 million in 2015 and Gentux revenues were projected to reach US$1.2 million in 2015 and over US$20 million in 2016.

Source: Company reports; press articles

Rent the Runway

US-based Rent the Runway offers designer-branded fashion rentals, including special occasion dresses and outfits. The company was launched in 2009, and currently has 800 employeesserving6 million customers. Apart from its online platform, the company has opened six brick-and-mortar showrooms, in New York City, Chicago, Las Vegas and Washington, DC. Rent the Runway has also launched a 2,500-square-foot showroom at Neiman Marcus in San Francisco, and is planning to open more stand-alone showroom locations.

The company expanded its rental offerings from evening gowns and for malwear to all-occasion wear and launched a service called Unlimited that allows members to rent up to three items for a monthly fee of US$139, or US$1,700 annually. Rent the Runway is projecting annual company revenues of US$100 million in 2016 and is valued at an estimated US$500 million. The company also has a dedicated team of 250 employees to help customers find outfits through Snapchat. According to the company, Rent the Runway operates the largest dry-cleaning operation in the US, cleaning 2,000dresses every hour.

Chic by Choice

Chic by Choice is a UK-based counterpart to Rent the Runway. Chic by Choice purchases premium brands from the wholesale channel, rents them multiple times and resells them on consignment websites such as Vestiaire Collective and The RealReal. Chic by Choice ships throughout the UK and to more than15 European markets, including France, Italy and Germany. The company offers items from more than 40 high-end designers.

Armarium

New York–based Armarium was established in April 2016. The company offers an app-based rental platform for women’s luxury apparel, footwear and accessories. Items can be rented at close to one-tenth their cost at retail. Armarium rents statement pieces and special occasion items at high price points, with most dress rentals costing around US$500 for four days, so the concept appeals to those who can afford designer brands but would like to increase the variety of their wardrobes. Armarium has established a new partnership with online luxury marketplace Yoox Net-A-Porter and also has a brick-and-mortar showroom in New York.

Le Tote

San Francisco–based Le Tote offers a member service option that allows customers to rent a broad selection of apparel and accessories for US$59 a month. Available brands include Nike, Lucky Brand, Vince Camuto, French Connection and Levi’s. Le Tote also offers maternity clothing and a specialized maternity subscription.

Girl Meets Dress

UK-based dress rental company Girl Meets Dress offers styles from more than 150 designers. Customers can rent dresses for two or seven nights and can choose up to three dresses to try on. The company has opened its first showroom, in Battersea, London. The company’s website states that Girl Meets Dress is seeking further investment funding.

GlamCorner

GlamCorner is an Australian online rental service for special occasion dresses. The company offers a collection of more than 1,500dresses from over 100 acclaimed international and local designers, as well as accessories and footwear. Renters can borrow dresses for four or eight days and accidental damage insurance is available. The startup currently has sales of over A$1 million annually and expects to increase its sales to A$3 million. GlamCorner has raised A$1.3 million in investment funding to date.

LSwop

LSwop (Luxury Swop) is an online pure play luxury sneaker rental service for men. The company operates on a monthly subscription business model and sneakers can be rented for one to four days. Customers can rent one pair a month for US$150, two pairs for US$250 and three pairs for US$350. LSwop offers luxury sneakers from Tom Ford, Christian Louboutin, Balmain, Givenchy and Rick Owens, among others, which are typically priced at $800–$1,000. According to the company’s founder, no sneakers are rented out more than two times and membership subscribers can purchase sneakers at a discounted price. This fall, the company set up a temporary pop-up store in New York’s Soho neighborhood.

The Black Tux

The Black Tux

The Black Tux is an online rental service for formal and special occasion menswear. The company’s business model is similar to Rent the Runway’s. The Black Tuxrents affordable suits, tuxedos and accessories, offering a simple selection of five classic styles—three tuxedos and two suits. The company rents each item an average of 15 times before removing it from service. The Black Tux claims that competitor tuxedo rental services such as Men’s Wearhouse rent the same item 40 to 80 times before retiring it. The company has raised US$10 million in investment funding to date.

Generation Tux

Founded in 2014 by the founder and former CEO of Men’s Wearhouse, Generation Tux is an online suit and tuxedo rental business. The company has 25,000 weekly visitors and has generated more thanUS$1 million in sales to date. The company believes that suit rental is the next big growth opportunity.

Moss Bros

Moss Bros is a UK-based men’s formalwear retailer that sells suits, tuxedos and associated formal and professional wear accessories. Although the company has a brick-and-mortar presence, with 125 stores in the UK, it recently announced that it will put greater focus and investment toward its suit rental service, with the aim of boosting growth in the category. The rebranding targets young consumers who will rent suits for job interviews and other everyday events, instead of just for weddings and black tie events.

Style Lend

NewYork–based Style Lend is an online peer-to-peer rental marketplace that provides apparel swapping/rental services. The company was founded in 2014. Consumers browse through renters’ digital closets to choose items from Chanel, Saint Laurent, Valentino, Givenchy, Balmain, BCBG and many other popular and emerging designers. Prices vary based on dress and designer. Items are delivered within hours in New York and in two to three hours outside the city. Renters can keep the pieces for seven to 14 days. In the US, StyleLend requires owners to send in items they want to rent out, and the company stores and handles delivery and dry cleaning, much like a traditional rental company.

Gwynnie Bee

US-based Gwynnie Bee offers online women’s plus-size fashion rentals by subscription, targeting professional women ages 28–45. Gwynnie Bee offers women’s clothing rentals in sizes 10–32from more than190 brands, including ASOS. Since 2012, the company has increased sales by 10%–15% annually, becoming one of the largest purchasers in plus-size fashion. By 2015, the company had shipped more than 3 million subscription boxes.

Borrow For Your Bump

US-based Borrow For Your Bump is an online maternity wear rental service. The company provides a onetime dress rental and/or a subscription box service for various maternity items. For US$99, renters can borrow four items for 30 days.

RentoMojo

Bangalore-based online furniture rental companyRentoMojo was founded in 2014. RentoMojo offers online rental services for furniture, appliances, trekking equipment and bikes. The company has been growing at 30% month over month and has a presence in Delhi, Mumbai, Pune and Bangalore.The startup has raised US$7 million in investment funding to date.

Furlenco

Furlenco is another Indian startup that rents furniture and home décor packages, which are delivered and set up within 72 hours. The company operates in Pune, Mumbai and Bangalore. Furlenco has raised US$6 million in investment funding.

Key Takeaways

As the sharing economy for all kinds of goods and services has rapidly expanded, we have witnessed a proliferation of online apparel and furniture rental startups and peer-sharing platforms for apparel.

Rental models allow customers to borrow items for a set time period, typically at a meaningful discount to retail. Rental companies provide product accessibility by offering aspirational, discounted designer products to a broad audience that might otherwise not be able to afford them.

Apparel rental is more geared toward special occasion apparel and for malwear due to the infrequent usage but high value of such clothing. Millennials in particular appear to like the option of renting a trendy but inexpensive dress or an expensive designer gown rather than buying one.

US-based Rent the Runway offers designer-branded fashion rentals, including special occasion dresses and outfits. The company was launched in 2009, and currently has 800 employeesserving6 million customers. Apart from its online platform, the company has opened six brick-and-mortar showrooms, in New York City, Chicago, Las Vegas and Washington, DC. Rent the Runway has also launched a 2,500-square-foot showroom at Neiman Marcus in San Francisco, and is planning to open more stand-alone showroom locations.

The company expanded its rental offerings from evening gowns and for malwear to all-occasion wear and launched a service called Unlimited that allows members to rent up to three items for a monthly fee of US$139, or US$1,700 annually. Rent the Runway is projecting annual company revenues of US$100 million in 2016 and is valued at an estimated US$500 million. The company also has a dedicated team of 250 employees to help customers find outfits through Snapchat. According to the company, Rent the Runway operates the largest dry-cleaning operation in the US, cleaning 2,000dresses every hour.

US-based Rent the Runway offers designer-branded fashion rentals, including special occasion dresses and outfits. The company was launched in 2009, and currently has 800 employeesserving6 million customers. Apart from its online platform, the company has opened six brick-and-mortar showrooms, in New York City, Chicago, Las Vegas and Washington, DC. Rent the Runway has also launched a 2,500-square-foot showroom at Neiman Marcus in San Francisco, and is planning to open more stand-alone showroom locations.

The company expanded its rental offerings from evening gowns and for malwear to all-occasion wear and launched a service called Unlimited that allows members to rent up to three items for a monthly fee of US$139, or US$1,700 annually. Rent the Runway is projecting annual company revenues of US$100 million in 2016 and is valued at an estimated US$500 million. The company also has a dedicated team of 250 employees to help customers find outfits through Snapchat. According to the company, Rent the Runway operates the largest dry-cleaning operation in the US, cleaning 2,000dresses every hour.

Chic by Choice is a UK-based counterpart to Rent the Runway. Chic by Choice purchases premium brands from the wholesale channel, rents them multiple times and resells them on consignment websites such as Vestiaire Collective and The RealReal. Chic by Choice ships throughout the UK and to more than15 European markets, including France, Italy and Germany. The company offers items from more than 40 high-end designers.

Chic by Choice is a UK-based counterpart to Rent the Runway. Chic by Choice purchases premium brands from the wholesale channel, rents them multiple times and resells them on consignment websites such as Vestiaire Collective and The RealReal. Chic by Choice ships throughout the UK and to more than15 European markets, including France, Italy and Germany. The company offers items from more than 40 high-end designers.

GlamCorner is an Australian online rental service for special occasion dresses. The company offers a collection of more than 1,500dresses from over 100 acclaimed international and local designers, as well as accessories and footwear. Renters can borrow dresses for four or eight days and accidental damage insurance is available. The startup currently has sales of over A$1 million annually and expects to increase its sales to A$3 million. GlamCorner has raised A$1.3 million in investment funding to date.

GlamCorner is an Australian online rental service for special occasion dresses. The company offers a collection of more than 1,500dresses from over 100 acclaimed international and local designers, as well as accessories and footwear. Renters can borrow dresses for four or eight days and accidental damage insurance is available. The startup currently has sales of over A$1 million annually and expects to increase its sales to A$3 million. GlamCorner has raised A$1.3 million in investment funding to date.

The Black Tux is an online rental service for formal and special occasion menswear. The company’s business model is similar to Rent the Runway’s. The Black Tuxrents affordable suits, tuxedos and accessories, offering a simple selection of five classic styles—three tuxedos and two suits. The company rents each item an average of 15 times before removing it from service. The Black Tux claims that competitor tuxedo rental services such as Men’s Wearhouse rent the same item 40 to 80 times before retiring it. The company has raised US$10 million in investment funding to date.

The Black Tux is an online rental service for formal and special occasion menswear. The company’s business model is similar to Rent the Runway’s. The Black Tuxrents affordable suits, tuxedos and accessories, offering a simple selection of five classic styles—three tuxedos and two suits. The company rents each item an average of 15 times before removing it from service. The Black Tux claims that competitor tuxedo rental services such as Men’s Wearhouse rent the same item 40 to 80 times before retiring it. The company has raised US$10 million in investment funding to date.

Founded in 2014 by the founder and former CEO of Men’s Wearhouse, Generation Tux is an online suit and tuxedo rental business. The company has 25,000 weekly visitors and has generated more thanUS$1 million in sales to date. The company believes that suit rental is the next big growth opportunity.

Founded in 2014 by the founder and former CEO of Men’s Wearhouse, Generation Tux is an online suit and tuxedo rental business. The company has 25,000 weekly visitors and has generated more thanUS$1 million in sales to date. The company believes that suit rental is the next big growth opportunity.

Moss Bros is a UK-based men’s formalwear retailer that sells suits, tuxedos and associated formal and professional wear accessories. Although the company has a brick-and-mortar presence, with 125 stores in the UK, it recently announced that it will put greater focus and investment toward its suit rental service, with the aim of boosting growth in the category. The rebranding targets young consumers who will rent suits for job interviews and other everyday events, instead of just for weddings and black tie events.

Moss Bros is a UK-based men’s formalwear retailer that sells suits, tuxedos and associated formal and professional wear accessories. Although the company has a brick-and-mortar presence, with 125 stores in the UK, it recently announced that it will put greater focus and investment toward its suit rental service, with the aim of boosting growth in the category. The rebranding targets young consumers who will rent suits for job interviews and other everyday events, instead of just for weddings and black tie events.

Furlenco is another Indian startup that rents furniture and home décor packages, which are delivered and set up within 72 hours. The company operates in Pune, Mumbai and Bangalore. Furlenco has raised US$6 million in investment funding.

Furlenco is another Indian startup that rents furniture and home décor packages, which are delivered and set up within 72 hours. The company operates in Pune, Mumbai and Bangalore. Furlenco has raised US$6 million in investment funding.