Executive Summary

In this report, we examine the rise of luxury goods retailers such as Yoox Net-A-Porter, Matchesfashion.com and Farfetch that operate as multibrand online pure plays. Milan-based Yoox Net-A-Porter, in particular, has been a trailblazer in the space. The company operates multibrand in-season and off-price outlet stores through four websites as well as monobrand store websites for 41 luxury goods brands.

Sales and other key performance indicators for online pure-play luxury goods retailers have been growing robustly.Yoox Net-A-Porter reported that its fiscal year 2016 organic sales increased by 18% year over year, to €1.9 billion. The company expects its fiscal 2017 revenues to increase by 17%–20% year over year. London-based Matchesfashion.com reported that its sales increased by 61% year over year in its latest fiscal year.

We have identified10key factors behind the rise and continued robust growth of luxury goods retailers that operate as multibrand online pure plays:

- Endless Product Choice

- Ever-Improving Logistics and Delivery Services

- Luxury Sector Was Slow to Expand into E-Commerce

- Luxury Goods Democracy

- Immune to Amazon…So Far

- Digital Service and Marketing

- Luxury Consumers Are Embracing Digital

- Brick-and-Mortar Luxury Sector Is Struggling

- Brands Turn to Multibrand E-Commerce to Tap Online Growth

- US Department Store Woes

We believe that online luxury retailers will continue to see strong growth. McKinsey & Company forecasts that online sales will constitute 18% of total luxury sales in 2025, up from 8% in 2016. However, future competition and consolidation activity in the online luxury sector will only increase. Scale will be important, so there will be room for only several major players in the market. Economies of scale in customer acquisition and retention, as well as brand relationships and logistics and marketing efficiency, will become increasingly important. Sales growth in the overall luxury goods sector will mainly be achieved through market share gains and online sales. Past revenue drivers—such as store expansion, price increases and new developing-market penetration—will present only limited opportunities.

The luxury sector was slow to expand into e-commerce, but now players are vying for a share of the fast-growing online market. Global luxury goods company LVMH recently announced that it will launch its own multibrand e-commerce portal, which will feature all 70 of its brands on one site, in May. The portal will also offer labels that are not owned by LVMH. If more luxury retailers follow this path, and focus on their own platforms, it will come at the expense of long-standing multibrand pure plays.

Introduction

In this report, we examine the rise of multibrand, online pure-play luxury goods retailers. We identify key players in the space and discuss their performance and business models. We also identify 10factors that support the growth of these retailers and analyze the impact of growing competition in the online luxury goods space. Finally, we analyze LVMH’s move to launch its own multibrand e-commerce portal.

Source: lvmh.com

The Rise of Luxury Multibrand Online Pure Plays

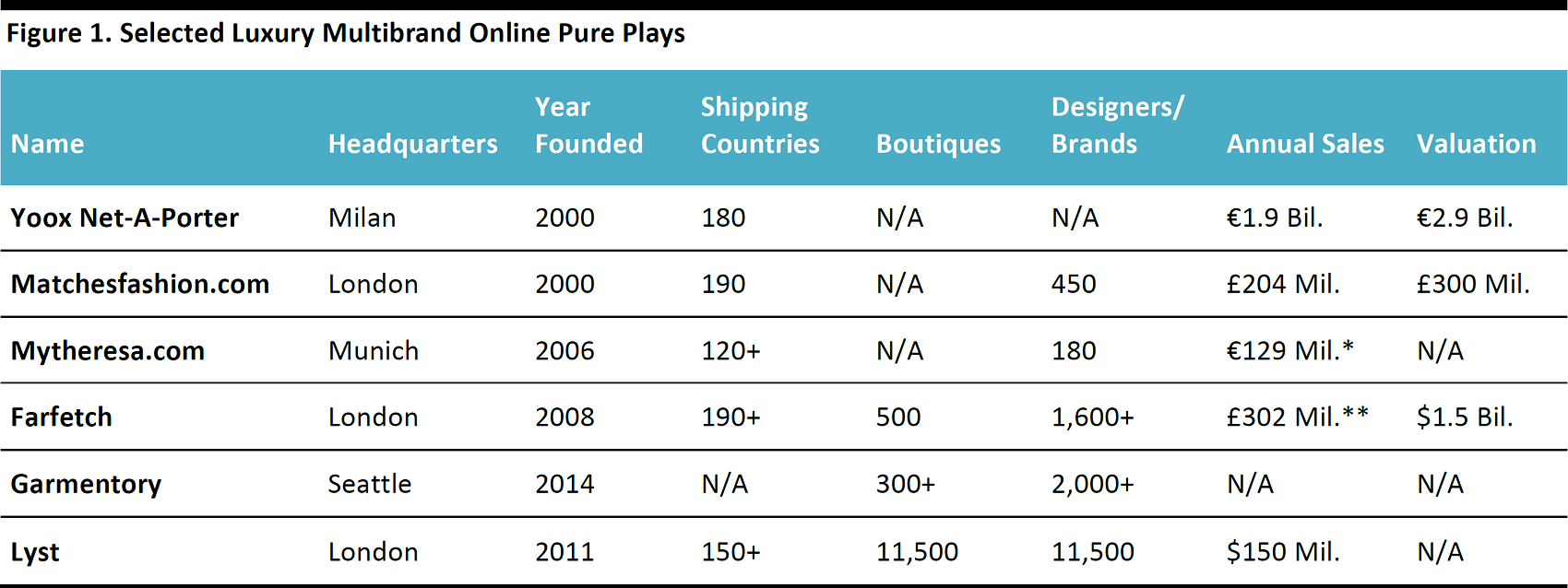

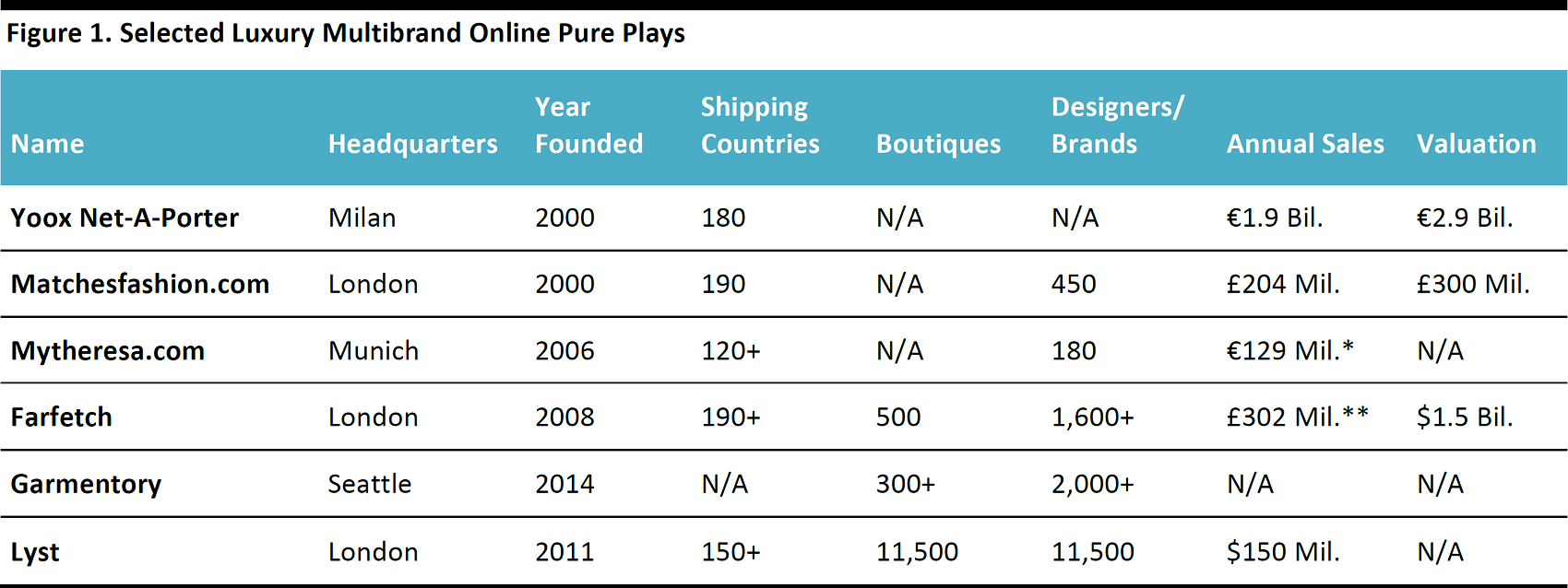

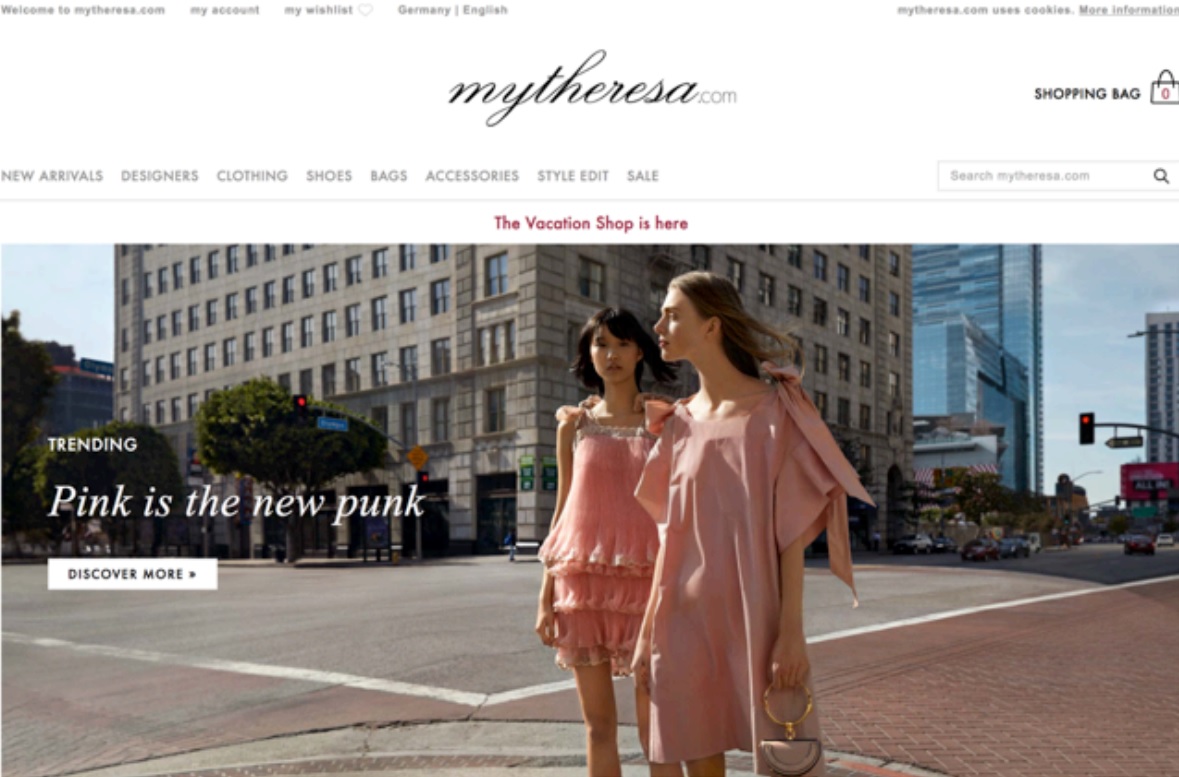

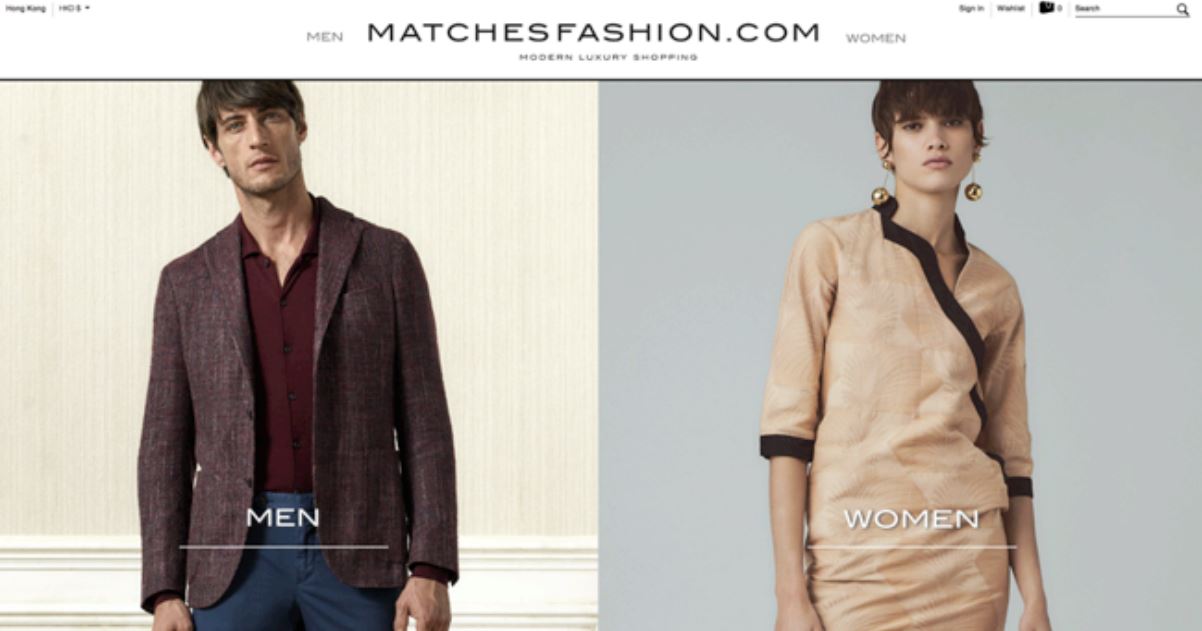

We have witnessed tremendous growth among online multibrand retailers and fashion platforms such as Yoox Net-A-Porter, Mytheresa.com, Matchesfashion.com, Farfetch, Garmentory, and Lyst. These companies ship goods to most countries around the globe. We introduce these retailers in the table below.

*At time of acquisition by Neiman Marcus in September 2014

**Gross merchandise value for fiscal year 2015, ended December 31,2015

Source: S&P Capital IQ/company reports/Companies House/Financial Times/TechCrunch.com

Multibrand Online Retailer Model

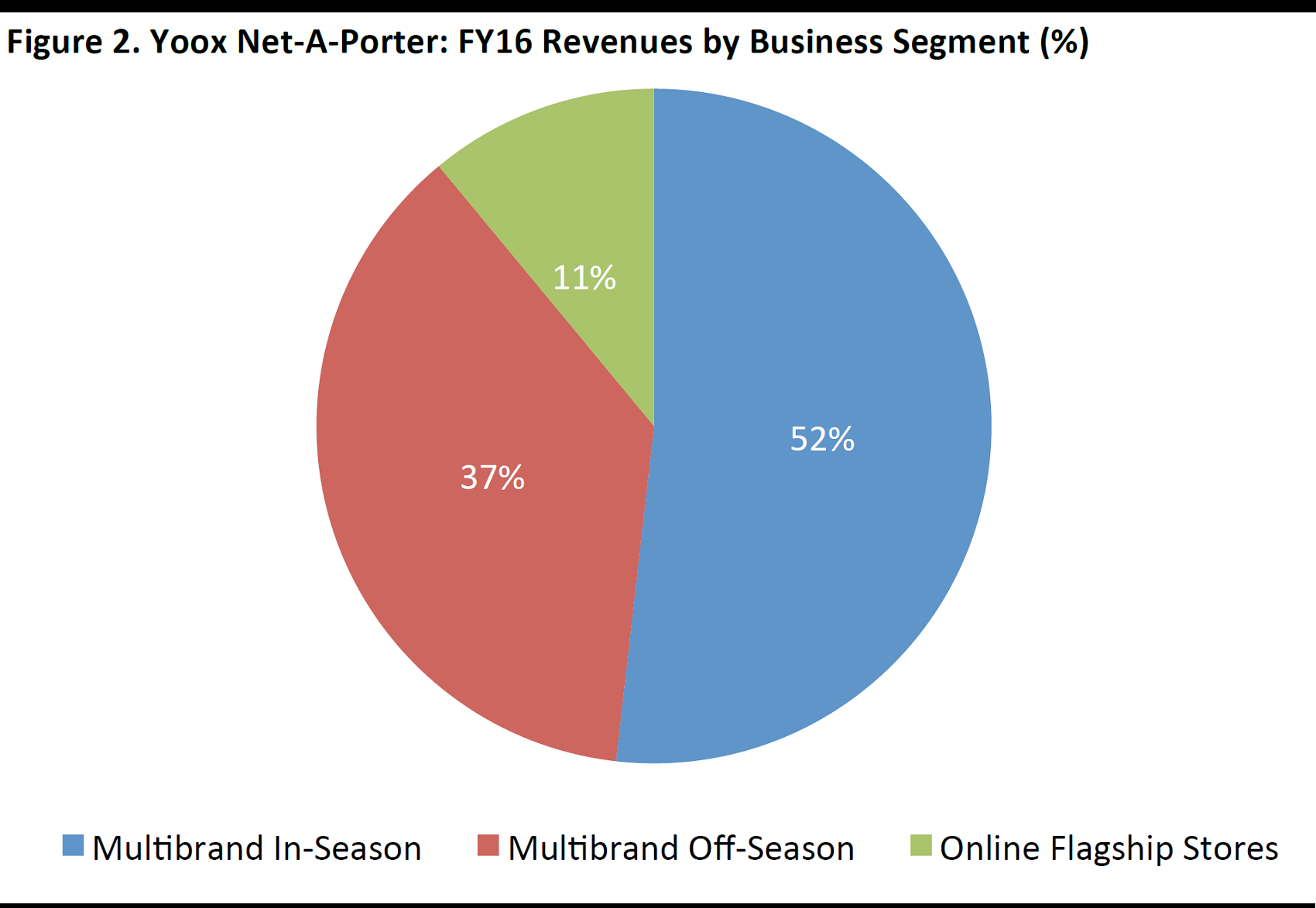

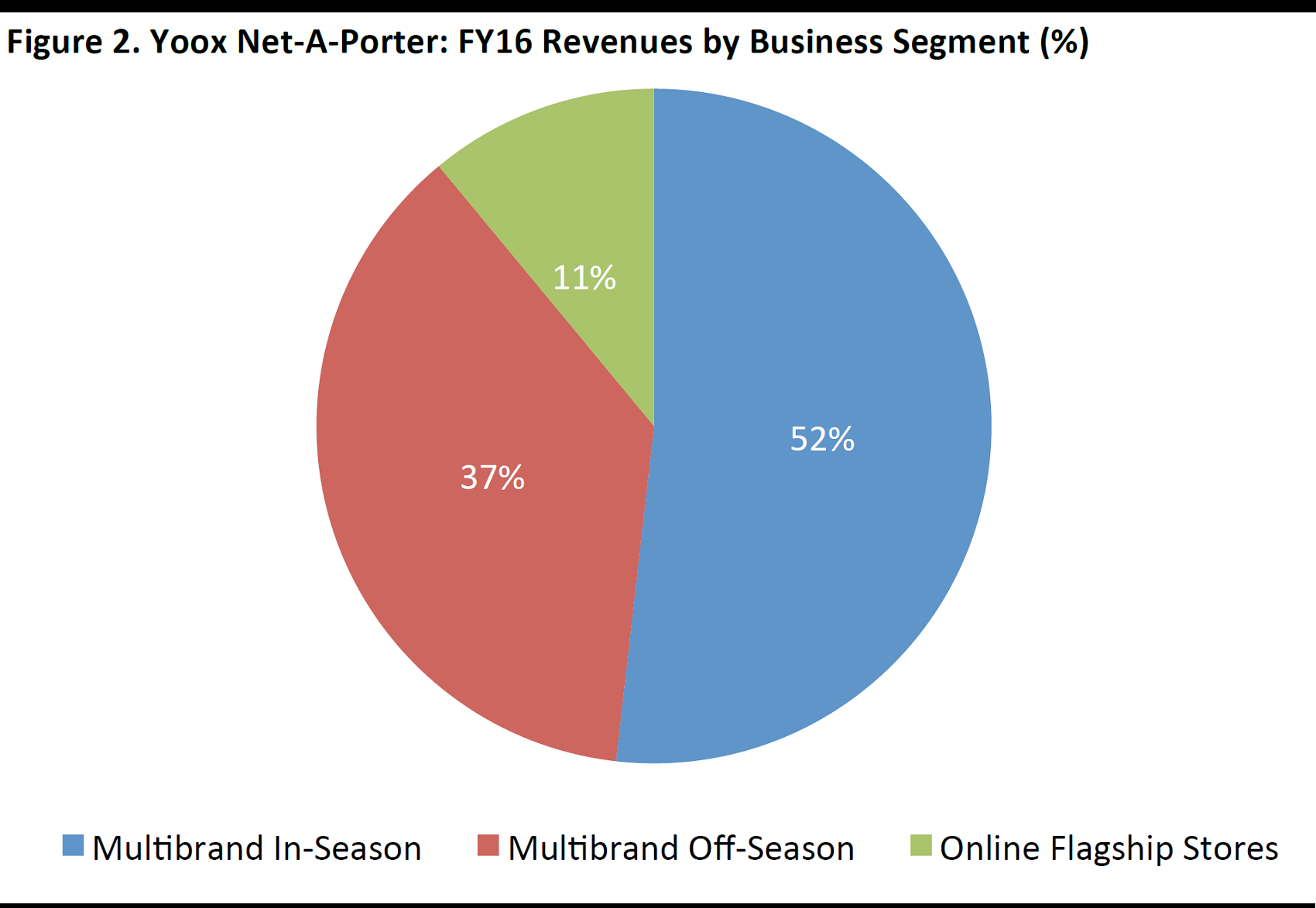

Multibrand online retailers operate as traditional retailers in the sense that they purchase selected pieces from brands and designer collections and resell them on their websites. Although Yoox Net-A-Porter operates virtual monobrand stores for 41 luxury brands, the company generates 90% of its revenues via its multibrand online stores, which, in essence, are virtual department stores. Yoox Net-A-Porter operates four proprietary regular price and off-price multibrand sites: Net-A-Porter, Mr Porter, Yoox, and The Outnet.

Source: Company reports

Matchesfashion.com and Mytheresa.com operate business platform models that are similar to Yoox Net-A-Porter’s.

Source: mytheresa.com

Online Boutique/Marketplace Model

Online boutiques and marketplaces act as aggregating platforms, which allow shoppers to browse hundreds of styles from third-party stores and designers. The platform operator does not purchase inventory and, so, incurs no inventory risk. The model allows smaller boutiques and designers to scale, thereby reaching a much wider customer base and increasing sales.

- The Farfetch platform enables independently owned boutiques that have small teams and limited technology resources to leverage e-commerce and distribute their products globally.

- Seattle-based Garmentory works with boutiques and small designers to help them clear excess inventory without taking big markdowns by selling that inventory online to a global audience.

- Even media content providers are moving into merchandise e-commerce, in order to offset dwindling subscriber numbers and advertising revenues. For example, Vogue publisher Condé Nast has relaunched its former runway review site in the form of a curated luxury marketplace called Style.com.

Luxury Online Pure Plays’ Sales Are On Fire

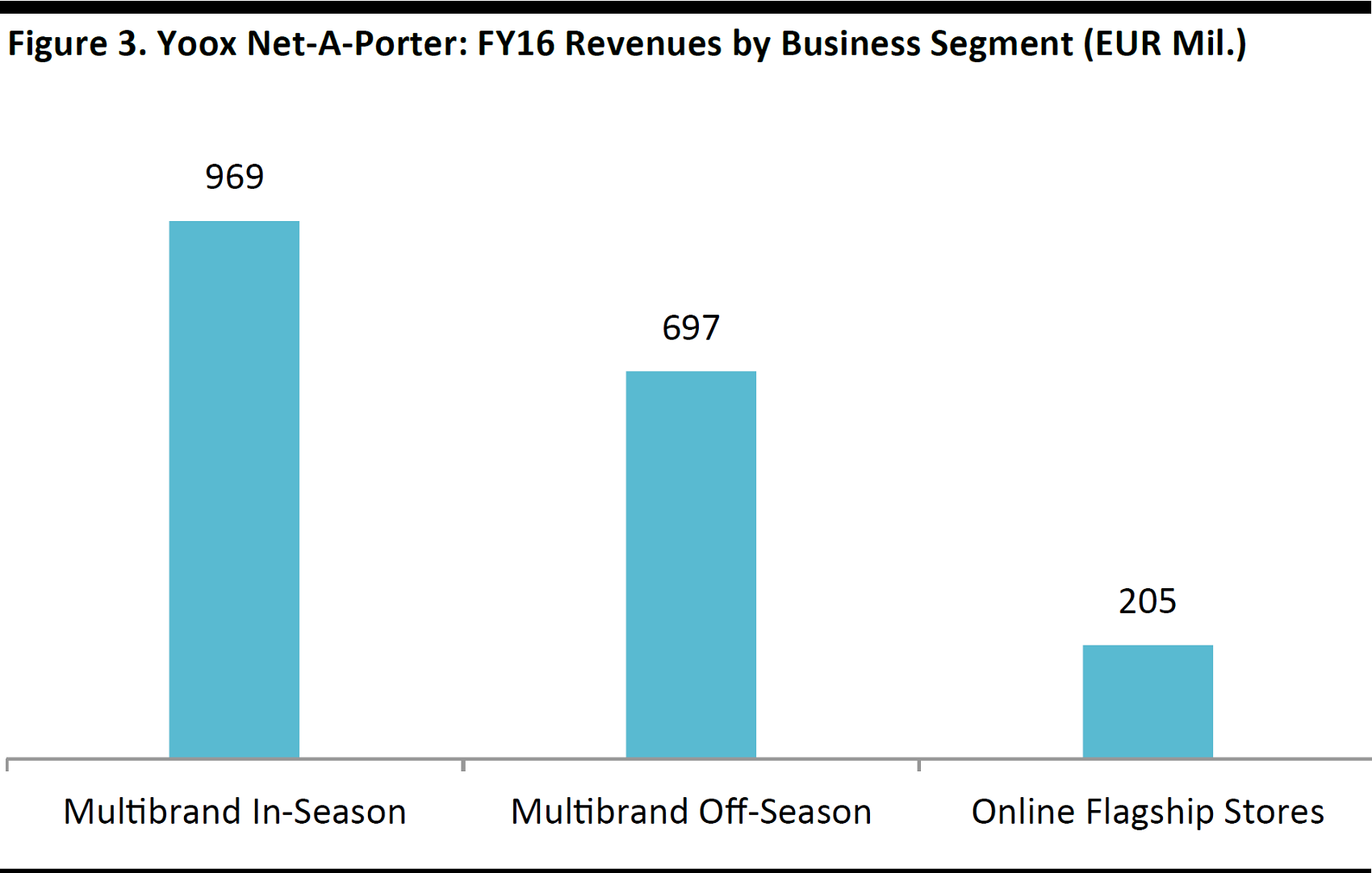

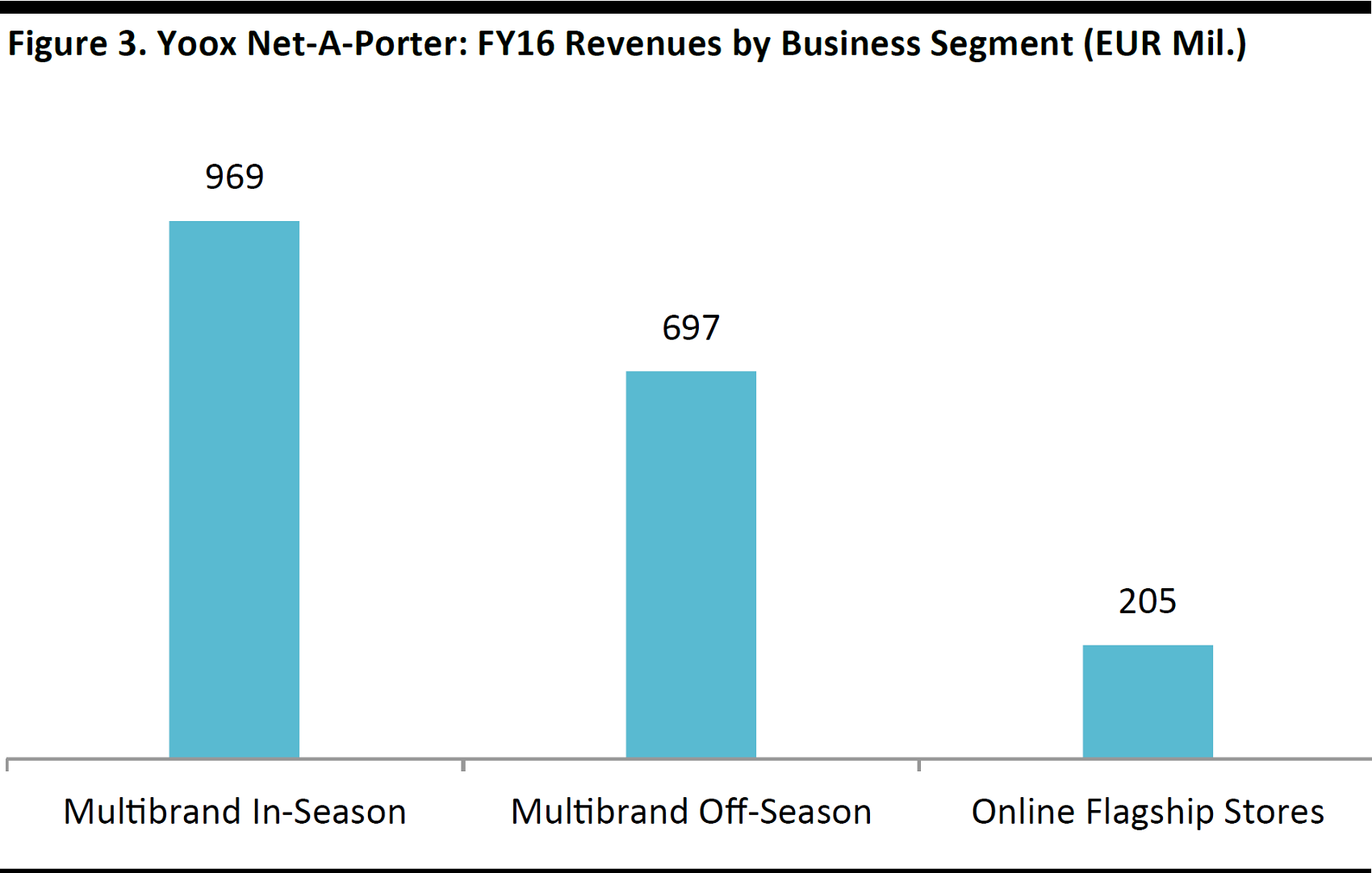

- Yoox Net-A-Porter is a trailblazer in online luxury. The company operates three e-commerce business segments: multibrand in-season stores (Net-A-Porter and Mr Porter), multibrand off-season stores that sell outlet items (Yoox and The Outnet) and flagship stores. The latter division designs and manages 41 monobrand websites for partner luxury goods brands; these include Moncler.com, Armani.com, Valentino.comand Chloe.com. The division is also in a joint venture to power Kering sites, including BottegaVeneta.com and StellaMcCartney.com. Yoox Net-A-Porter continues to add brands to its full-price on- and off-season offering. The company is also planning to launch a private-label business in the fourth quarter of 2017.

Source: Company reports

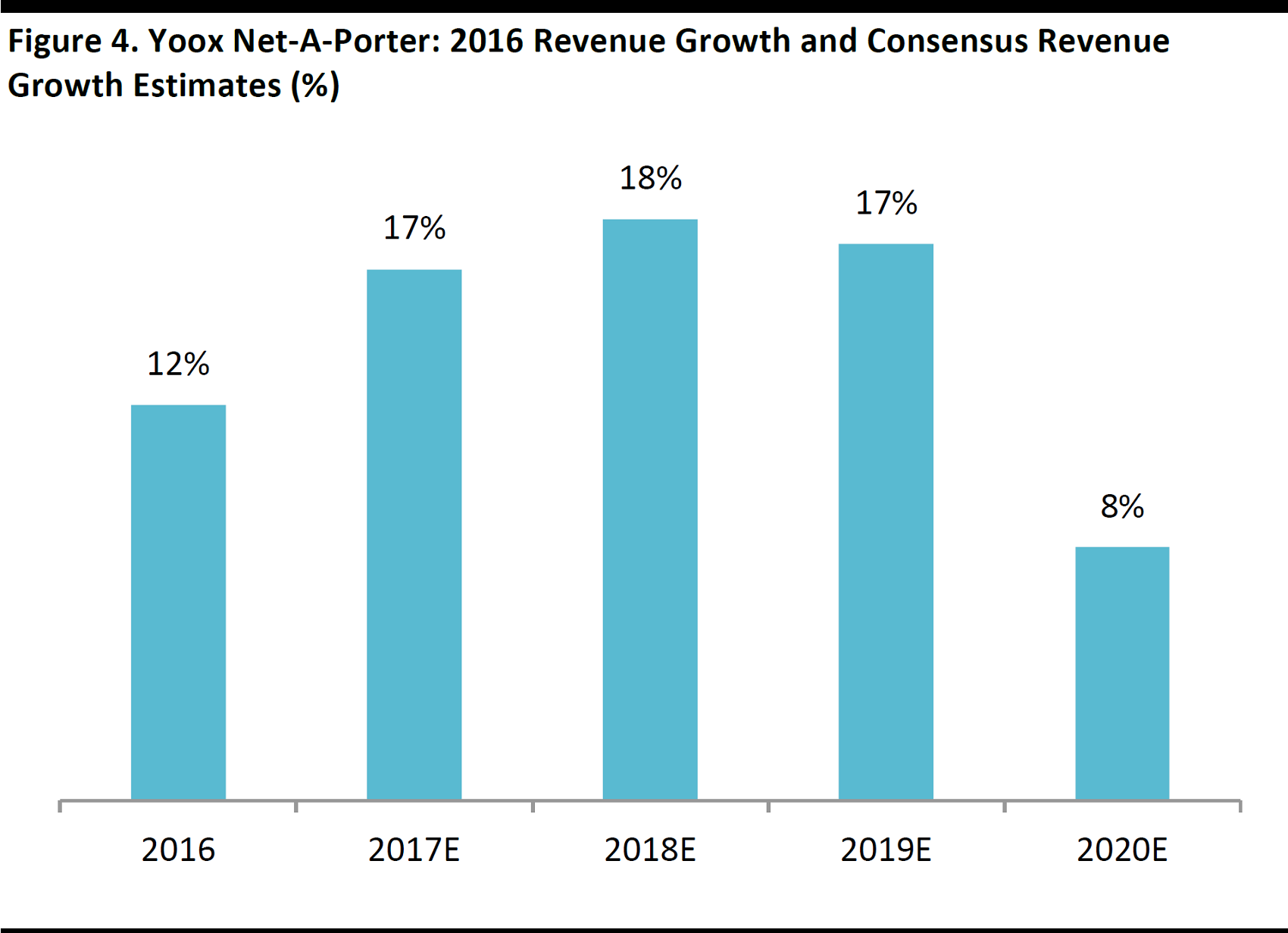

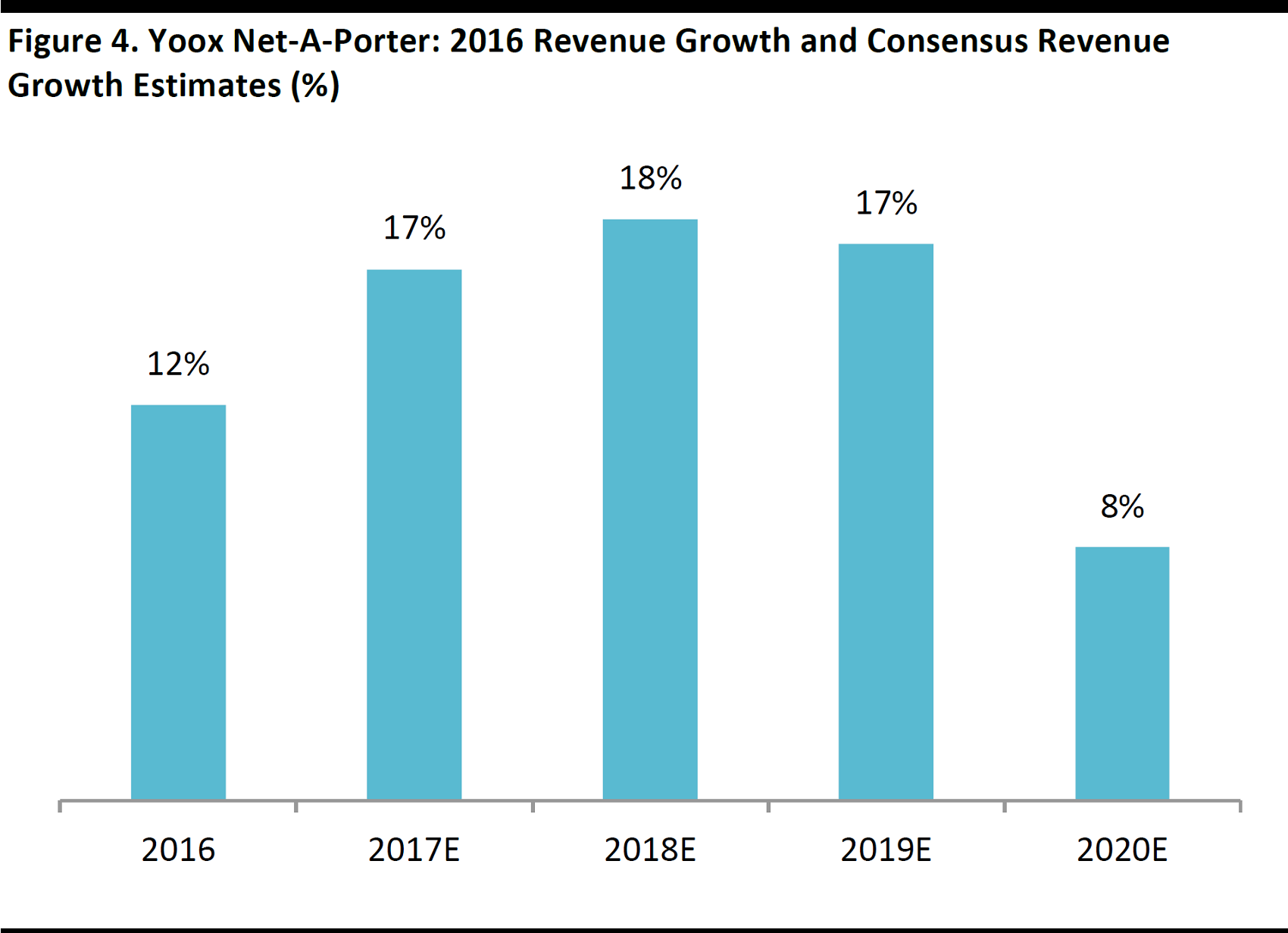

Yoox Net-A-Porter reported an 18% year-over-year organic sales increase, to €1.9 billion, for its fiscal year 2016, ended December 31. The company increased its monthly client base by 8%, to 28.8 million, and orders increased by 18% year over year, to 8.4 million. The company guided for 17%–20% year-over-year revenue growth in fiscal 2017. Analysts have a similarly bullish sales outlook for the company for the next few years.

Source: S&P Capital IQ/company reports

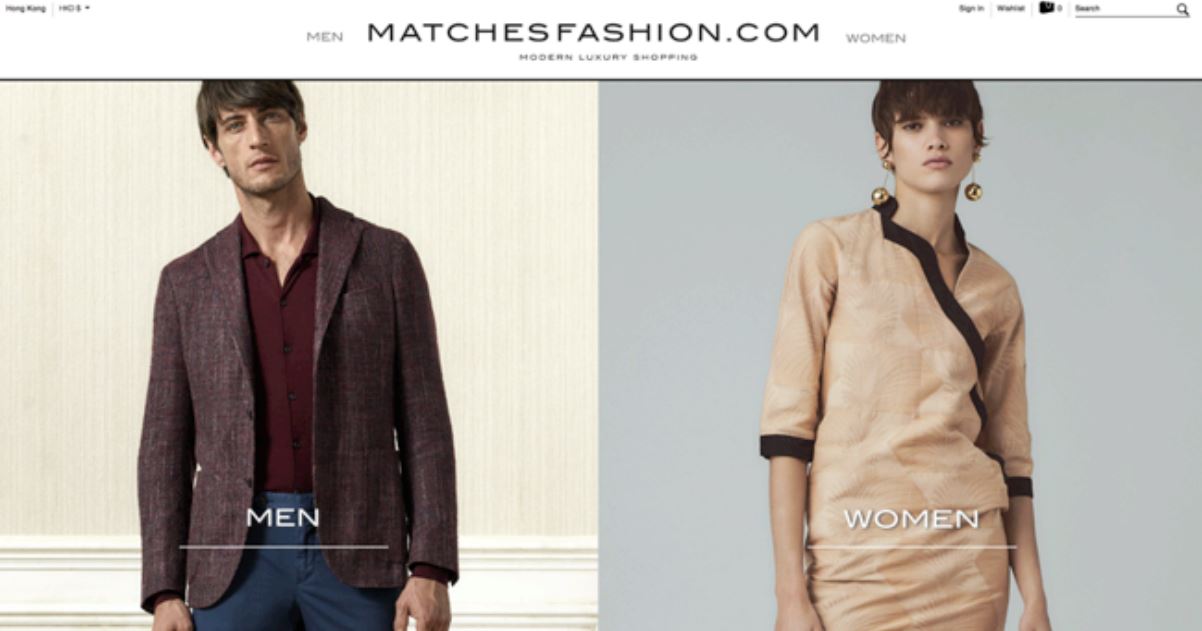

- Privately owned Matchesfashion.com, which is based in London, reported that its online sales increased by 61% year over year, to £204 million, in the fiscal year ended January 31, 2017. Matches fashion generates 95% of its sales online and 80% of sales are made outside of the UK market. Client average transaction spend increased 14% to £511 in FY16.

- The Farfetch website receives more than 10 million visitors each month, and the company grew gross merchandise value by 70% year over year in the fiscal year ended December 31, 2015.

We believe that these and other online luxury retailers will continue to see strong growth.

Why Are Multibrand Online Luxury Retailers Growing So Fast?

We have identified10key factors that are supporting the rise and continued growth of luxury multibrand pure plays:

1. Endless Product Choice

E-commerce offers unparalleled product choice from established designer names, emerging brands and independent boutiques. Some designers and boutiques distribute exclusively through particular platforms or create exclusive capsule collections for certain sites. E-commerce retail and marketplace sites offer:

- Curated and edited product content, with the best pieces from brand collections.

- Handpicked selections of the best brands and looks in the world, regardless of place of origin.

- Newness and choice. For instance, Matchesfashion.com features 1,400 new items on its site each week as well as limited-run capsule collections.

Source: matchesfashion.com

2. Ever-Improving Logistics and Delivery Services

Global shipping and delivery options are continuously improving and multiple players now provide same-day delivery in large cities. Luxury online pure plays provide fast, simple and free returns and exchanges for the most part. Luxury customers have high expectations with regard to e-commerce delivery; fast shipping, packaging and tracking are considered paramount.

- com delivers within 72 hours to more than 120 countries worldwide.

- com delivers within 90 minutes in London.

- Farfetch offers same-day delivery in10major cities across the globe.

- Yoox Net-A-Porter has rolled out pickup and drop-off points in several European cities and continues to roll out omnichannel functionalities to its clients’ online flagship stores. These services include click-from-store, in-store pickup and return, and the ability to check in-store availability online.

3. Luxury Sector Was Slow to Expand into E-Commerce

Luxury brands traditionally have been wary of e-commerce due to the lack of control brands have over the selling environment, pricing and quality on third-party platforms. Consequently, a number of luxury brands were slow to embrace e-commerce, initially dipping their toe in the waters by partnering with Yoox Net-A-Porter. This means the current, rapid growth we are seeing is from a small base, as luxury retail is playing catch-up with mass-market retail in e-commerce.

Source: ynap.com

4. Luxury Goods Democracy

Multibrand pure plays are a great distribution channel for emerging brands and designers.E-commerce levels the competitive playing field between industry players of different sizes, as it enables smaller luxury goods brands to reach a wide audience and enjoy the economies of scale that larger brands enjoy.

5. Immune to Amazon…So Far

Unlike the majority of discount and midprice retailers and brands around the world, luxury multibrand online pure plays have so far been largely insulated from Amazon’s threat in fashion retailing, which has allowed them to flourish.

- Luxury goods retailers have been quick to dismiss Amazon as a wholesale partner due to discounting and counterfeiting concerns, instead preferring to distribute products through dedicated luxury multibrand pure plays such as Yoox Net-A-Porter.

- Luxury goods companies also claim that Amazon is not the appropriate distribution channel for expensive and aspirational goods, as luxury companies must preserve their products’ scarcity and exclusivity in order to maintain a price premium; inappropriate presentation and uncontrolled discounting would kill the allure of luxury items.

- Luxury powerhouse LVMH has stated that it does not believe the business of Amazon fits with luxury or with LVMH brands. The company very recently unveiled plans to launch its own multibrand e-commerce platform.

- In time, however, Amazon may figure out how to make its offering work with the luxury business.

6. Digital Service and Marketing

E-commerce is benefiting from stronger precision marketing and personalization capabilities. Examples of increased online personalization include the following:

- com offers 24/7 advice through MyStylist, the company’s dedicated fashion concierge team.

- Mr Porter is launching an Apple TV app devoted to its video content. The first-of-its-kind shoppable app enables users to shop the looks they see on-screen as they watch on their mobile device.

- Yoox Net-A-Porter is developing a messaging technology to allow certain high-spending customers to purchase products directly through WhatsApp. Yoox Net-A-Porter’s personal shoppers already communicate with top clients via the text-messaging service, and the company will become one of the first Western retailers to use WhatsApp to sell directly to customers. Net-A-Porter’s mobile customers place more than double the number of orders as its desktop customers, and those mobile purchases, on average, are about twice as valuable.

- Lyst uses algorithms to personalize visitor experiences, suggesting new items for customers based on their prior purchases and showing inventory availability.

Source: lyst.com

7. Luxury Consumers are Embracing Digital

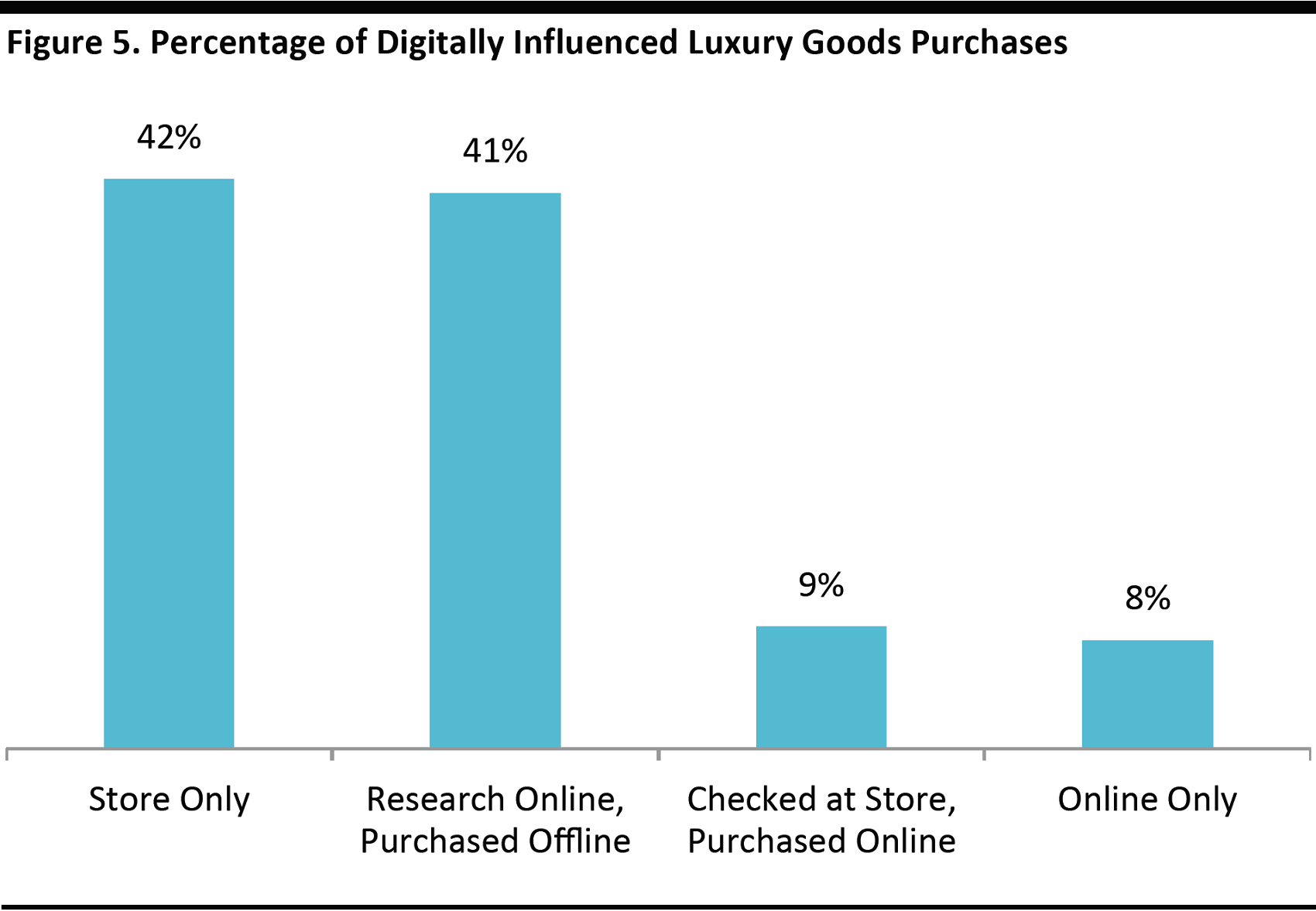

Initially, luxury retailers harbored concerns that their typical customer would not be willing to purchase high-value goods online. However, anecdotal evidence, surveys, nd research have repeatedly demonstrated that luxury goods shoppers, especially millennials, are digitally influenced and that they embrace e-commerce, including mobile purchasing. The multibrand online luxury retailers have capitalized on this shift in purchasing behavior, as evidenced by their stellar sales growth.

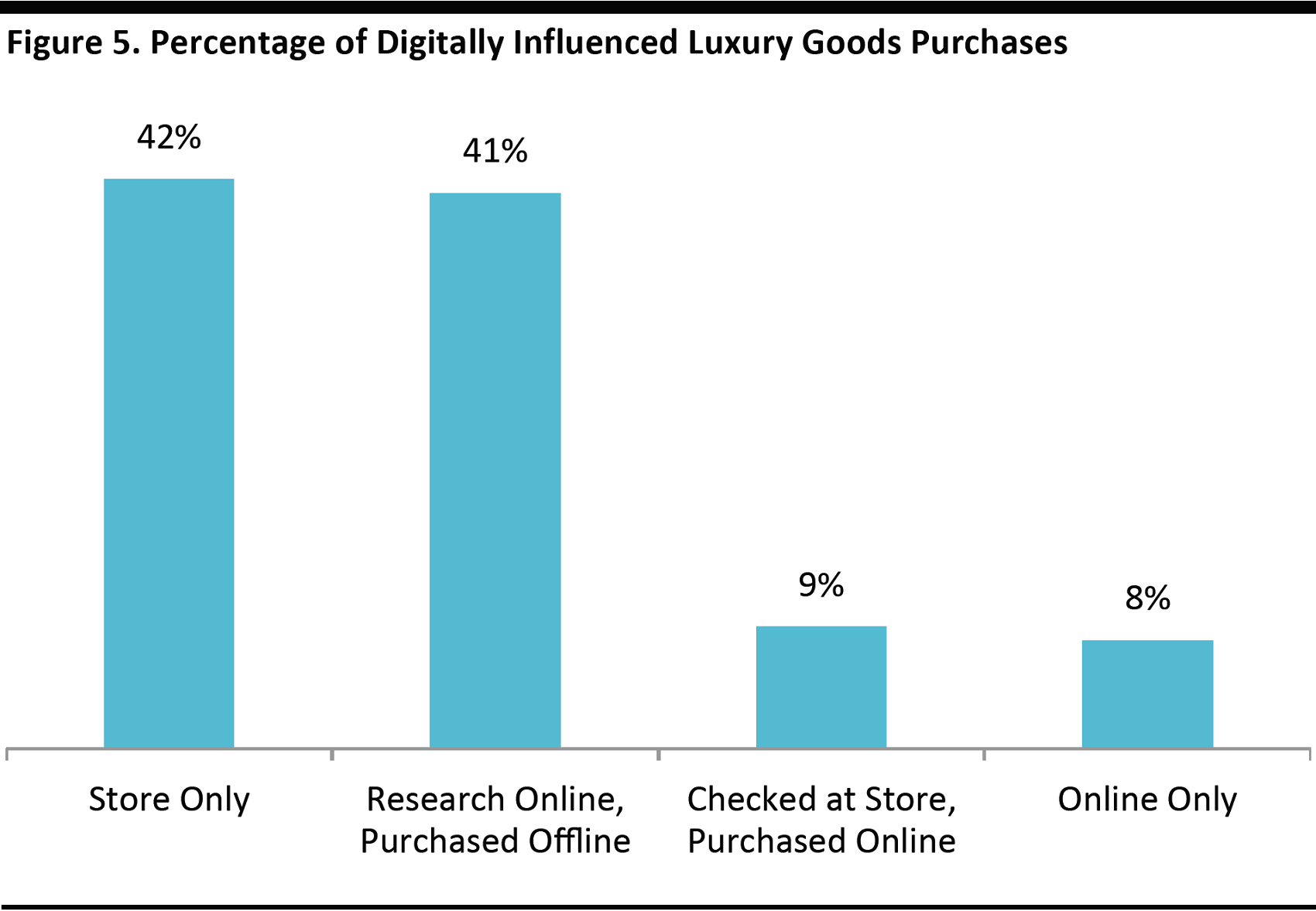

- According to the Boston Consulting Group (BCG), 60% of luxury sales are digitally influenced, and in-store purchases often follow online research. Approximately 41% of luxury customers research products and services online and buy in brick-and-mortar stores, while 9% research products in-store and purchase online, according to the consultancy.

Base: 10,000 respondents in 10 countries

Source: BCG

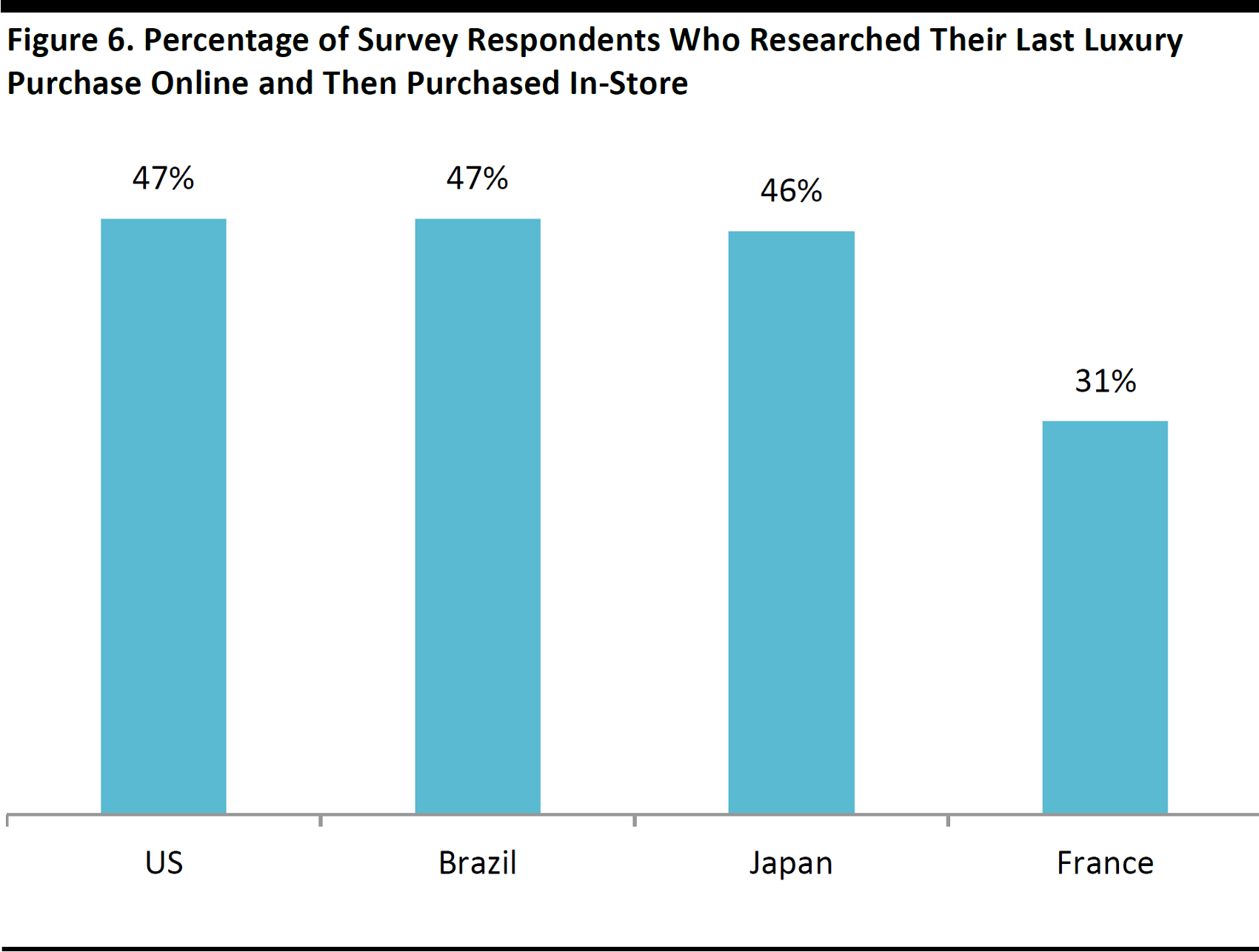

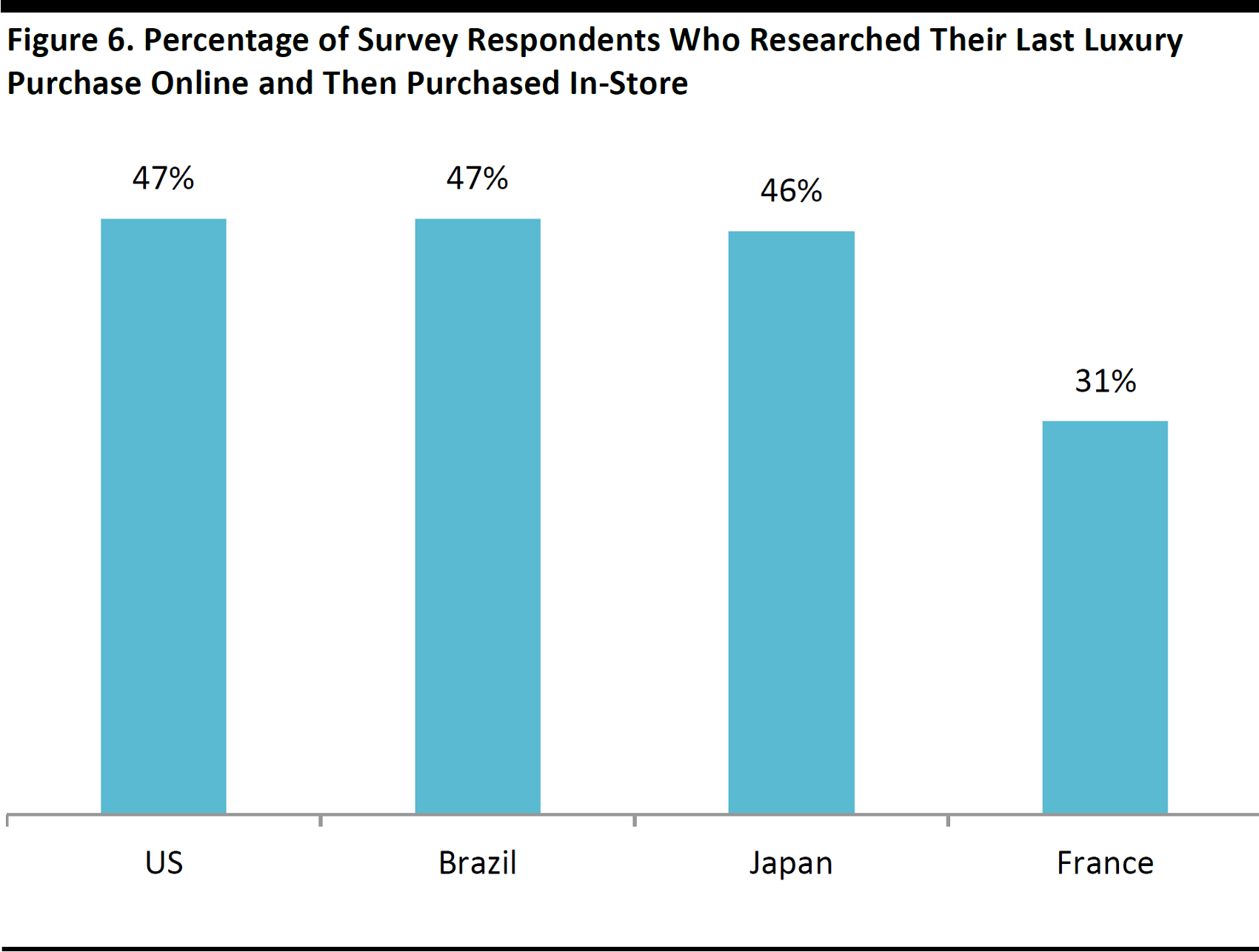

The US and the UK are the most digitally mature luxury markets: more than two-thirds of luxury customers in the two countries either purchased their last product online or researched it online first before purchasing it in-store, according to BCG. Italy and France are the least digitally mature of the established luxury markets.

Source: bcg.com

Base: 10,000 respondents in 10 countries

Source: BCG

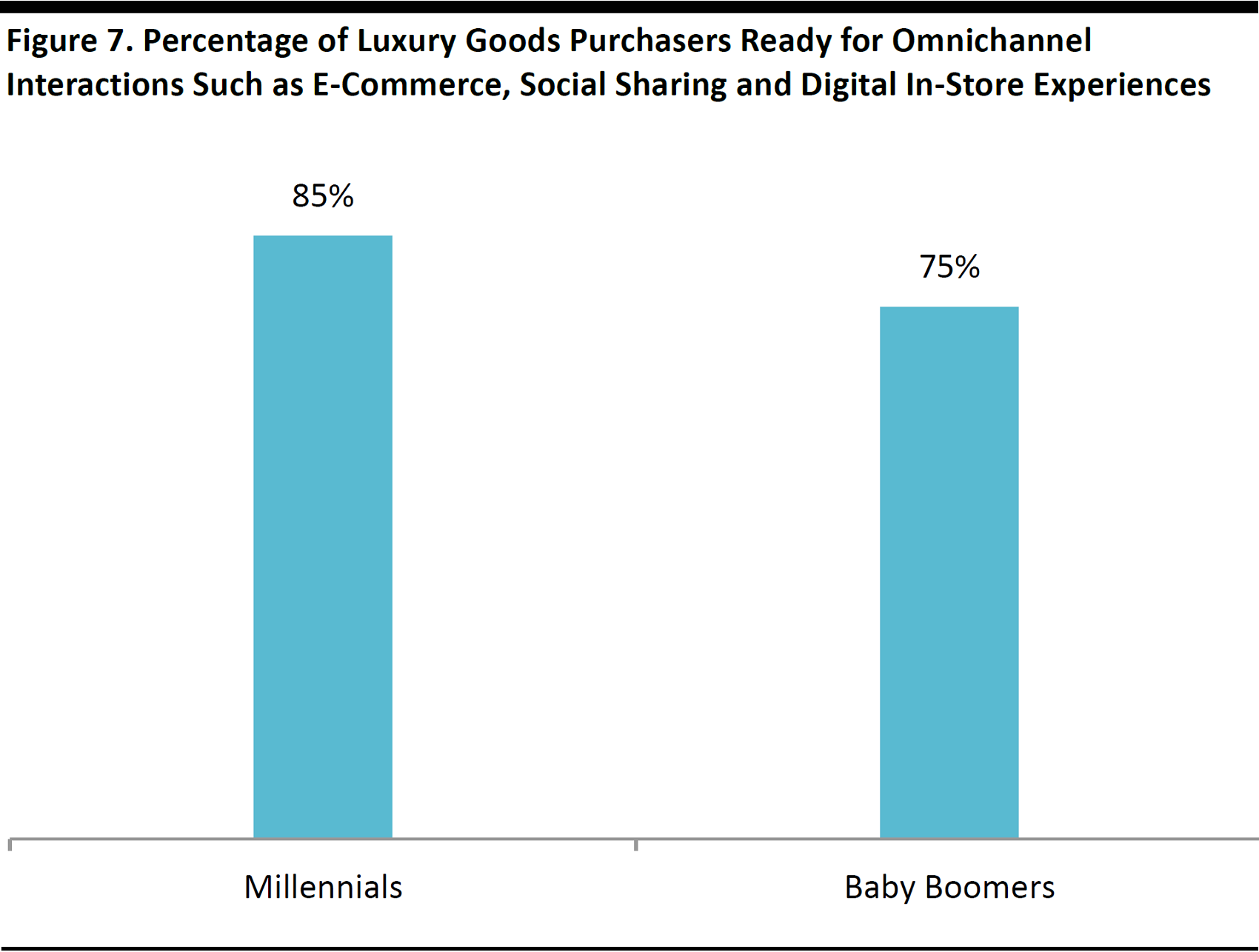

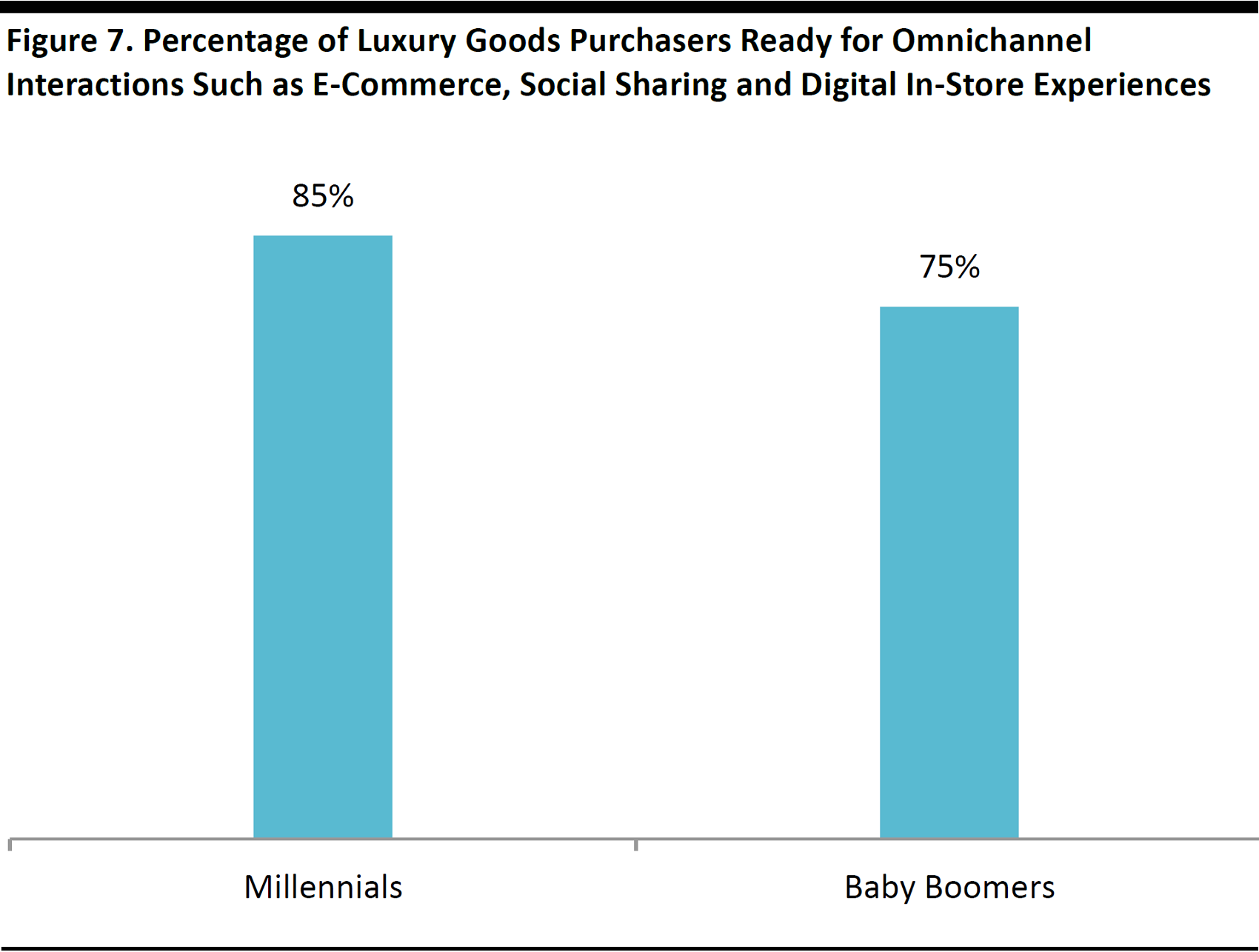

It is not just digitally-savvy millennials who are attracted to e-commerce, though. Baby boomers are also interested in omnichannel interactions with luxury brands.

Base: 10,000 respondents in 10 countries

Source: BCG

8. Brick-and-Mortar Luxury Sector Is Struggling

Brick-and-mortar luxury goods sales have been challenged for several years, and 2016 marked the worst year for the sector since 2009, with market growth essentially flat, according to the Altagamma Foundation, an organization committed to increasing the competitiveness of Italian luxury goods companies. Several factors have contributed to sluggish sales in luxury brands’ directly operated brick-and-mortar stores and, consequently, have made online luxury shopping a more attractive option:

Source: altagamma.it

- Tourism spending in Europe has fallen following terrorist attacks and the strong US dollar has impacted tourist sales in the US. Approximately 40% of luxury goods sales are derived from tourism. Online platforms have benefited versus tourist sales.

- Persistently low commodity prices have affected currencies and demand from Brazilian and Russian tourists.

- Over expansion and store opening saturation, especially in Asian cities, and rising fixed costs due to escalating real estate costs have affected the sector. Companies have been closing some stores and opening smaller ones.

Several prominent bellwether luxury goods companies returned to growth in the fourth quarter of 2016. Sector sales growth in the future will likely be much more subdued than the double-digit annual increases seen in the 2000s. BCG forecasts that global luxury goods sales will grow at just 2%–3% annually through 2020.

9. Brands Turn to Multibrand E-Commerce to Tap Online Growth

E-commerce still represents only a small share of total luxury goods sales, but the channel is a key growth opportunity. Furthermore, luxury goods companies have recognized that market-share gains and online sales will be their main growth drivers going forward, as past strategies of emerging-market penetration, opening directly operated stores and hiking prices are no longer viable. Due to their lack of experience with digital strategies, many luxury goods retailers turned to multibrand online retailers such as Yoox Net-A-Porter to gain an e-commerce foothold.

- E-commerce is the fastest-growing distribution channel globally for luxury goods. McKinsey & Company forecasts that online luxury sales will total €70 billion (£60.7 billion) by 2025, constituting 18% of total luxury sales, up from 8% in 2016.

- The online off-price luxury goods segment is also outperforming.I n 2016, approximately 8% of luxury goods sales were made at outlet stores, according to global marketing agency PMX Agency.

- Luxury goods sold online are more profitable than those sold through any traditional sales channel, according to BCG.

- Even the luxury watch industry is moving online. Swiss watchmakers have historically been reluctant to sell online, but are now targeting younger consumers through e-commerce. According to a Deloitte report, Swiss watch makers are pessimistic about the industry’s prospects, and this has prompted them to shift online in order to find buyers. Half of the watch executives surveyed by Deloitte consider specialty e-commerce resellers as the most important sales channel in 2017.

- French luxury goods company Kering saw its online sales grow by more than 20% year over year in the first half of its fiscal year 2017. Kering’s largest brand, Gucci, saw online sales jump 19% year over year during the period.

Source: gucci.com

10. US Department Store Woes

High-end brick-and-mortar department stores in the US continue to struggle, partly because online pure plays such as Yoox Net-A-Porter are taking share. Also, in the off-price segment, online platforms that sell off-price luxury goods are taking share from off-price department store concepts such as Saks Off 5th.

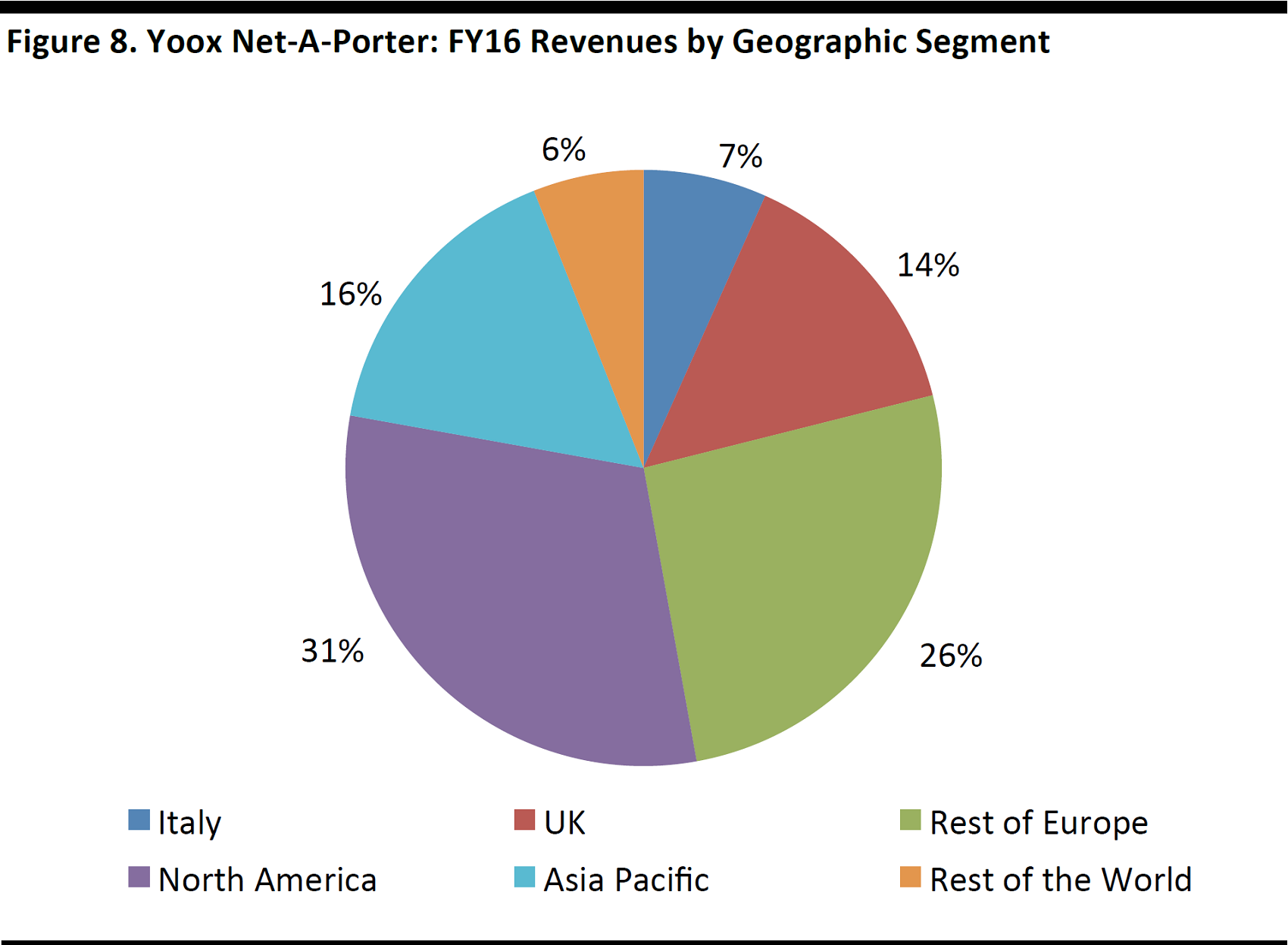

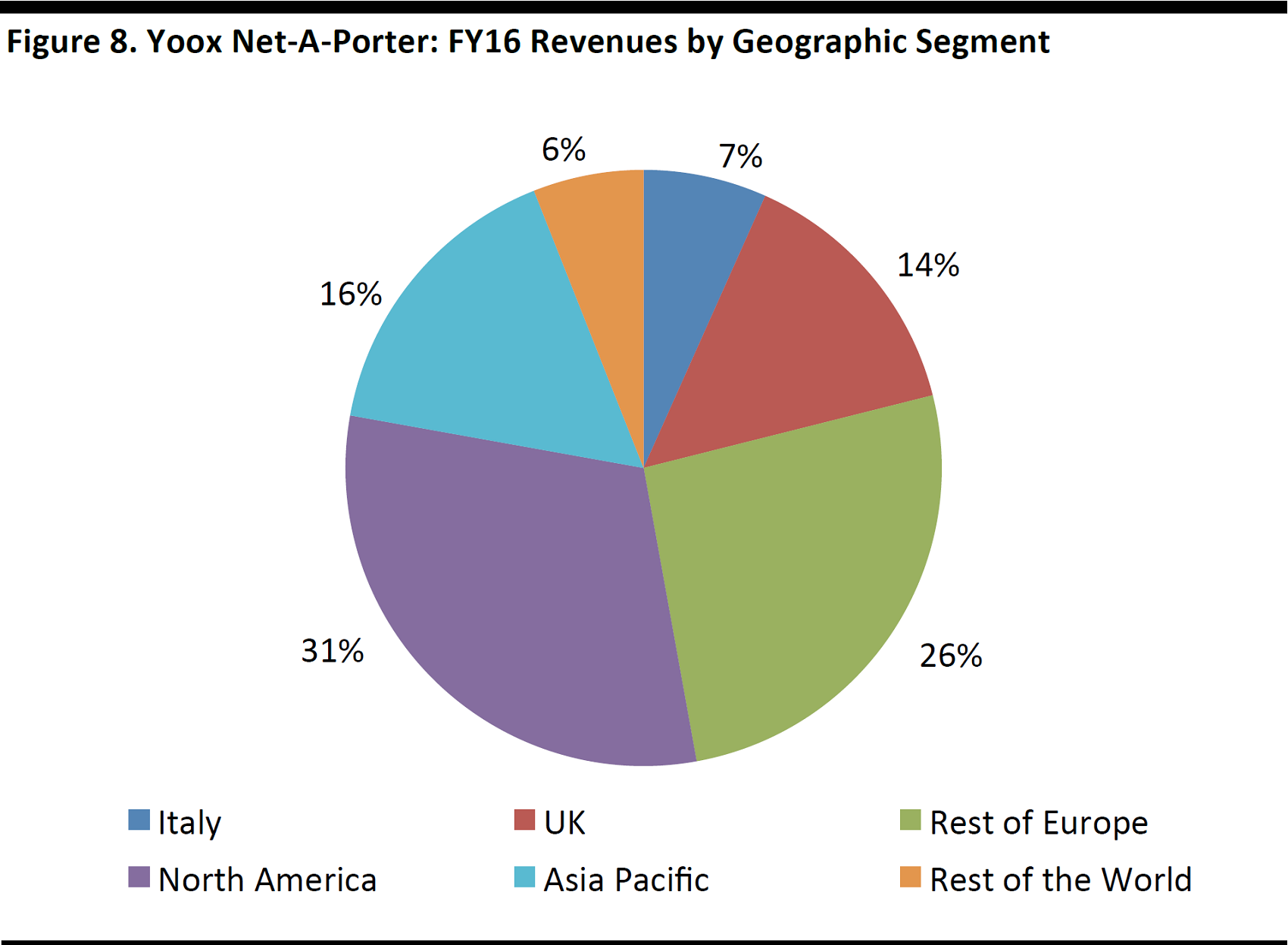

The US is the largest global luxury market, accounting for32% of luxury goods revenues in 2016. Approximately 31% of Yoox Net-A-Porter’s revenues are derived from the North American market, making it the company’s largest geographic market in terms of revenue.

Source: Company reports

Likewise, the US is expected to emerge as Matchesfashion’s largest market in 2017.

- US-based high-end department store chain Neiman Marcus, which is the parent company of Mytheresa.com, has suffered from declining sales and losses. Neiman Marcus’s comparable store sales declined by 7% year over year in the first half of its fiscal year 2017, ended January 28, 2017. In March, the company announced that it had put itself up for sale.

- Saks Fifth Avenue’s sales increased by just 0.1% in the fourth quarter of its fiscal year2016, ended January 28, 2017. Comparable sales at off-price segments Saks Off 5th and Gilt decreased by 6% over the period.

What Does the Future Hold?

Competition for a Slice of the Digital Pie

Scale will be important in online luxury retail, so there will only be room for several major players in the market. Economies of scale in customer acquisition and retention, as well as brand relationships and logistics and marketing efficiency, will become increasingly important. Sales growth in the luxury goods sector will mainly be achieved through market share gains, as past revenue drivers—such as store expansion, price increases and new developing-market penetration—now present only limited opportunity.

- Consolidation activity has increased following rising competition. US chain Neiman Marcus acquired Munich-based Mytheresa.com in September 2014, and Milan-based Yoox merged with London-based Net-A-Porter in March 2015. It would not be surprising to see further consolidation in the sector going forward.

- Competition from traditional department stores, and especially competition from luxury goods brands’ own online stores, is also increasing.

Luxury retailers were slow to expand into e-commerce, but now players are vying for a share of the fast-growing online market. The luxury sector lags other consumer sectors in terms of implementing digital technologies and strategies, according to BCG, but it is sprinting to catch up. We are likely to see some luxury brands internalizing their e-commerce platforms at the expense of multibrand online pure plays.

Competition Heating Up with LVMH Portal Launch

In May, LVMH will launch its own multibrand e-commerce portal, which will feature all 70 of its brands on one site. The portal will also offer labels that are not owned by LVMH. The company is the world’s largest luxury goods firm by revenue; in fiscal 2016, ended December 31, LVMH’s group sales increased by 5%, to €38 billion.

- The online platform will compete directly with Net-A-Porter, Matchesfashion.com, and Farfetch, which already wholesale several LVMH brands. The move follows LVMH’s hiring of an Apple executive in 2015 to fill the newly created role of Chief Digital Officer and lead the company’s online retail expansion.

- Currently, LVMH’s 70 brands each choose their own digital strategies, which include distributing through Yoox Net-A-Porter or their own monobrand websites.

- This marks LVMH’s second foray into multibrand online fashion retail; the company operated the eLuxury platform between 2000 and2009. When LVMH shuttered the site, its brands introduced stand-alone e-commerce operations.

- Some LVMH brands are working on one-day delivery, and store assistants are encouraging customers to order online while in-store.

Key Takeaways

- We are witnessing the proliferation of online multibrand retailers and aspirational fashion platforms—such as Yoox Net-A-porter, Matchesfashion.com, Farfetch, and Mytheresa.com—that provide global infrastructure and distribution for luxury brands.

- Online luxury penetration is poised to grow from 8% in 2016 to 18% in 2025, according to McKinsey & Company.

- Luxury brands traditionally have been wary of e-commerce due to the lack of control brands have over the selling environment, pricing and quality on third-party platforms. However, luxury brands are now fully embracing digital sales. As a consequence, we expect some brands to focus on their own e-commerce platforms at the expense of multibrand online pure plays.