Introduction

German discount hypermarket chain Kaufland is set to be the next international retailer to launch in Australia, according to a number of media reports. The company told us that it is only scoping the market, saying:

We are currently reviewing the Australian market in terms of potential market entry. We [will] examine the competitive situation, … the real estate market, as well as the situation in the labor market. Only after completion of [these] studies are we in a position to decide a possible market entry.

If Kaufland launches in Australia, it will be joining international value retail names such as Aldi, Costco, H&M and TK Maxx that have already moved into the country. In April, Amazon announced that it, too, will launch in Australia, and Decathlon looks set to open its first stores in the country soon.

Kaufland’s launch was reported in March, and it is currently advertising on its website for locations. The company is owned by Schwarz Group, the biggest retailer in Europe. Schwarz Group is a privately owned German company that also operates Lidl discount supermarkets.

In this report, we discuss the tailwinds that could drive Kaufland’s expansion in Australia and the headwinds the company could face there. We also offer some key facts to introduce readers who are unfamiliar with Kaufland to the company’s operations.

In 2016, media reports speculated that Kaufland sister chain Lidl could enter the Australian market, too.

The Sydney Morning Herald, for instance, reported in September 2016 that Lidl had contacted Australian suppliers and applied to register trademarks in the country. However, in November 2016, RealCommercial.com.au reported that a representative of real estate firm Colliers International had claimed that Lidl had scouted the Australian market and decided against launching there. Whether Lidl decides to move into Australia or not, much of the content in this report is as applicable to Lidl as it is to Kaufland.

Meanwhile, Schwarz Group is expanding elsewhere: Lidl will open its first US stores in mid-June.

Readers may also be interested in the following May 2017 reports:

Kaufland: Key Facts

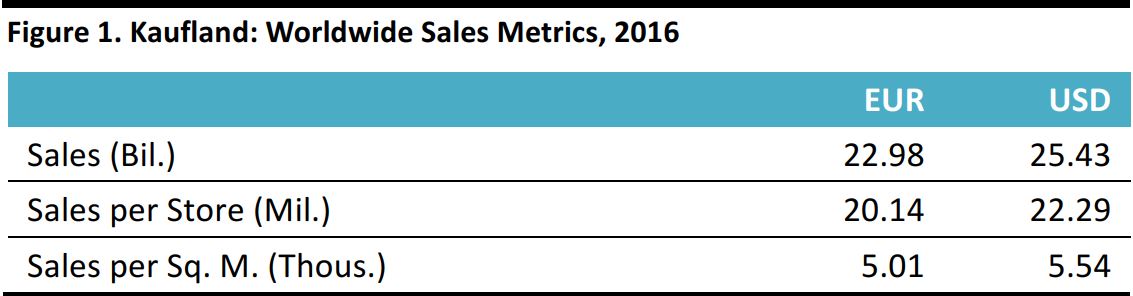

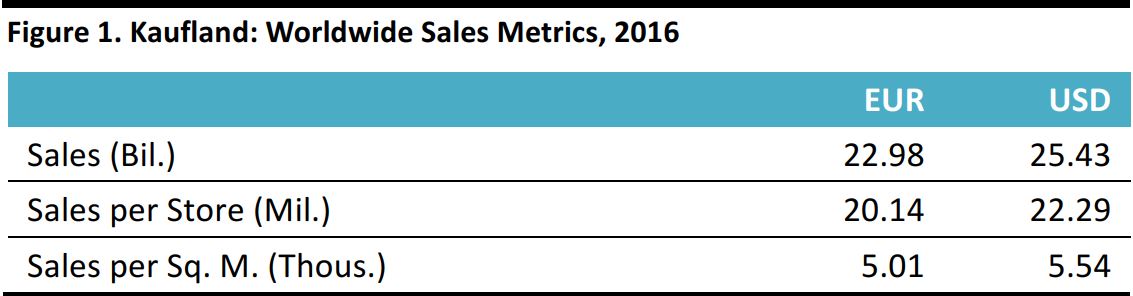

Kaufland generated revenues of US$25.4 billion in 2016, according to Euromonitor International. It is the smaller part of the Schwarz Group, which reported US$99.8 billion in group sales in the year ended February 2016. Lidl contributed the remainder of Schwarz Group revenues.

Sales per store and sales per square meter are calculated using average annual store numbers and average annual sales area, respectively.

Source: Euromonitor International/Fung Global Retail & Technology

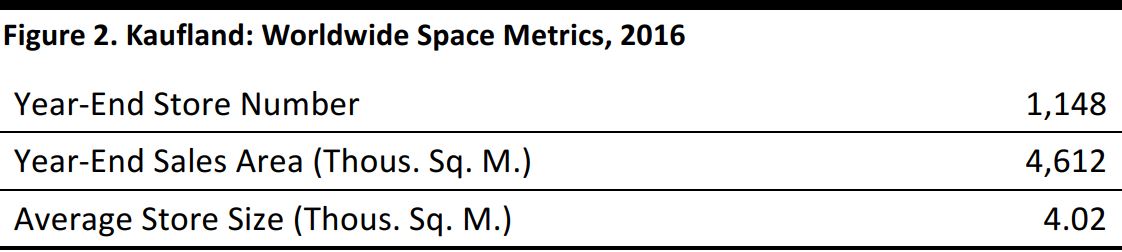

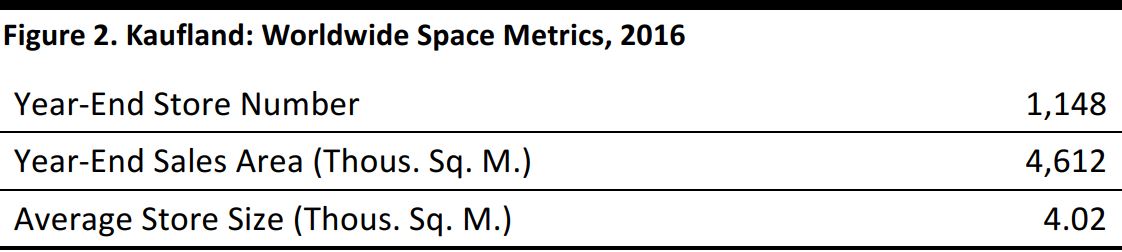

Kaufland’s 1,148 stores averaged 4,017 square meters (43,223 square feet) of selling space in 2016. Recently opened stores in Germany have included around 3,300 square meters (35,508 square feet) of selling space. Kaufland’s new Australian website says that it currently operates 1,230 stores worldwide.

Source: Euromonitor International/Fung Global Retail & Technology

According to Euromonitor, the grocery category accounts for around 80% of Kaufland’s German sales, with the remaining 20% made up of nongrocery sales such as apparel and general merchandise. Unlike Lidl, which focuses very strongly on private labels, Kaufland stocks a range of major third-party brands in grocery categories. Kaufland stores offer up to 60,000 stock keeping units (SKUs), per the company’s Australian website. Recently opened stores in Germany have offered around 20,000 SKUs, according to company press releases.

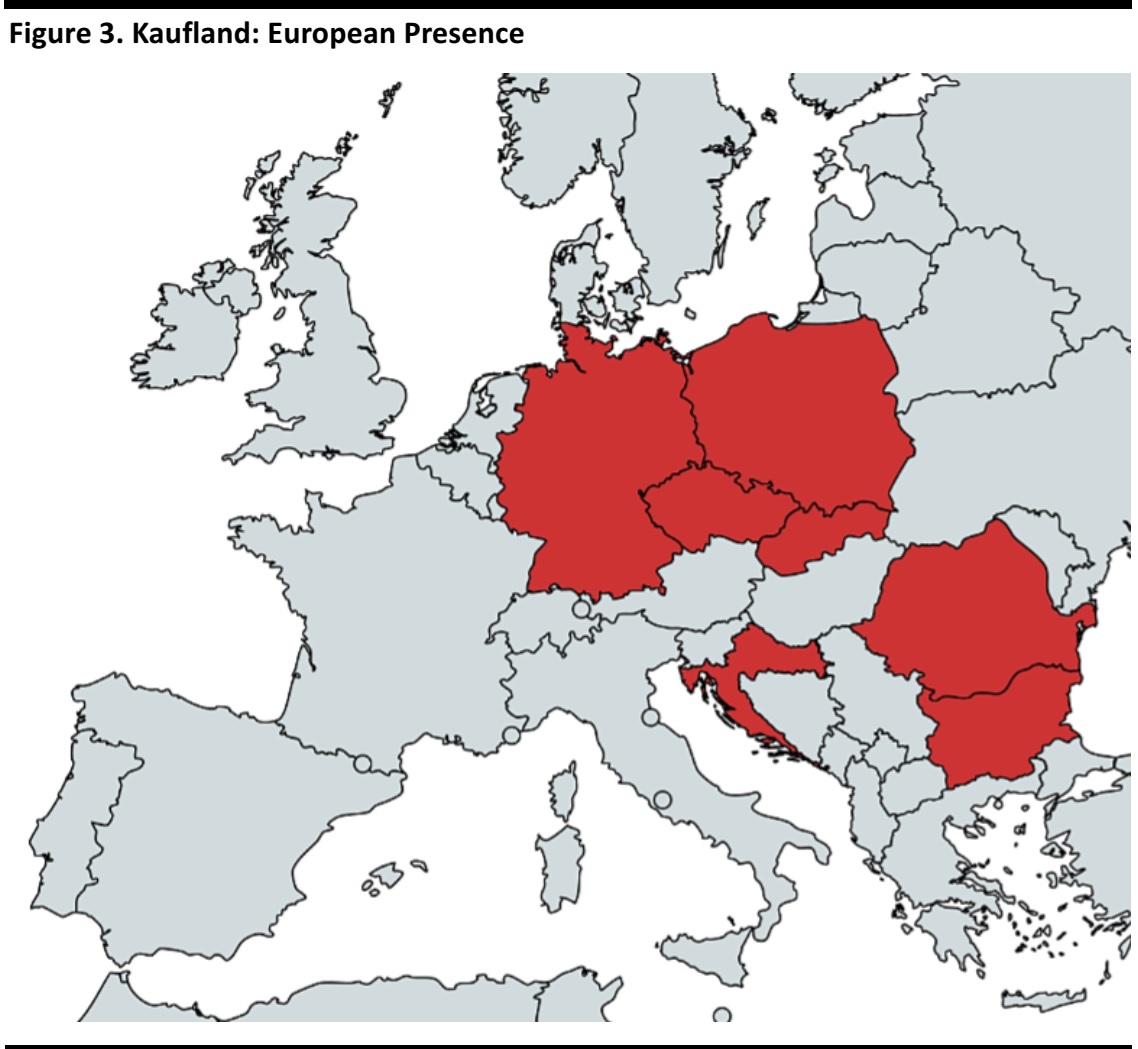

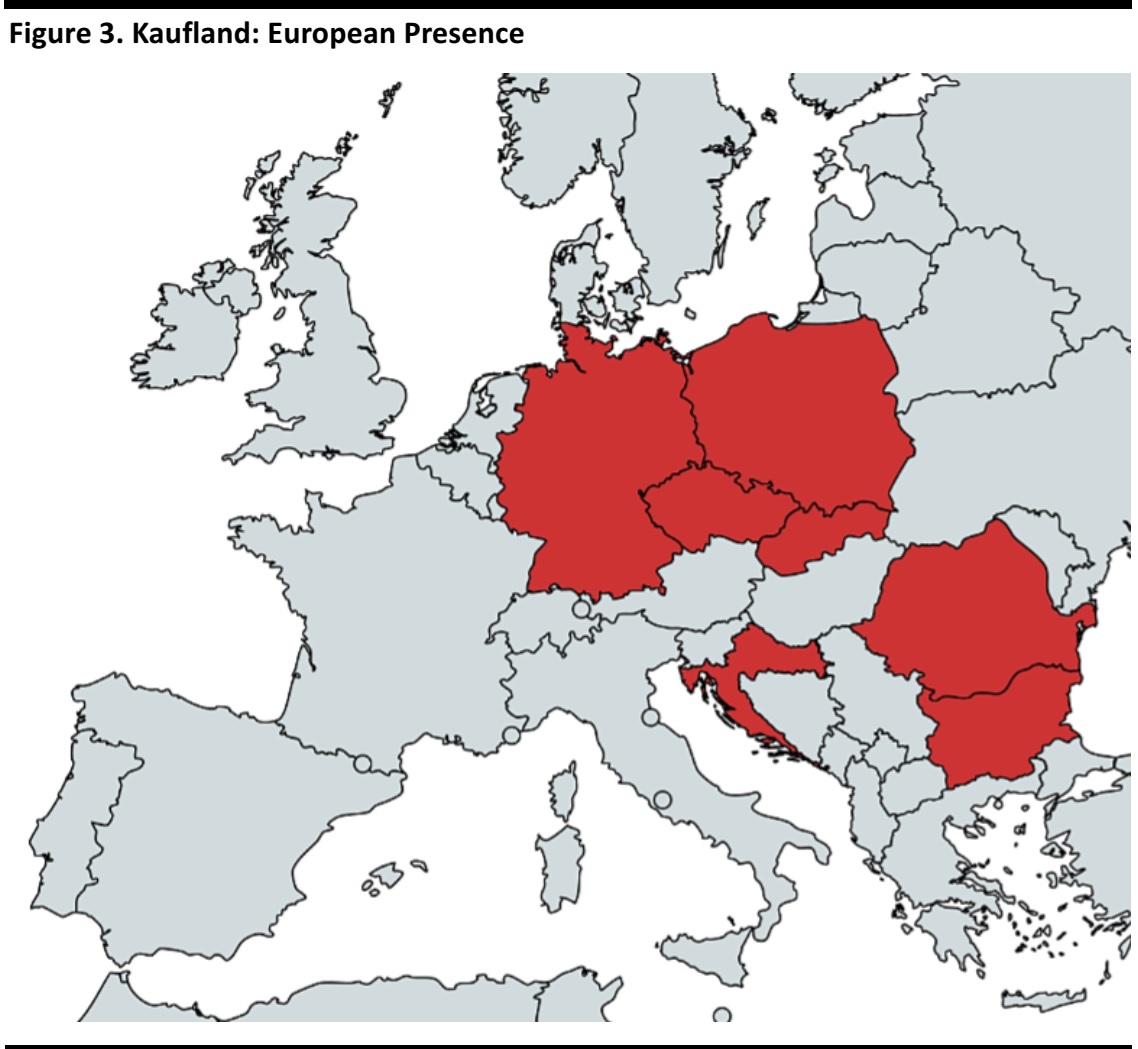

In 2016, 640 of Kaufland’s stores were located in Germany. The remaining 508 stores were located across Poland, the Czech Republic, Slovakia, Bulgaria, Romania and Croatia.

Source: Company reports/Fung Global Retail & Technology

Kaufland has built scale by serving customers in less affluent regions. Prior to its East European expansion, Kaufland piled into the eastern states of Germany following reunification in 1990. Australia would be the first new market for Kaufland outside Eastern Europe—and, so, its first entry into a developed retail market.

- Kaufland is advertising for plots of land of at least 10,000 square meters, and preferably of 15,000–20,000 square meters.

- The Sydney Morning Herald reported in March 2017 that Kaufland’s Australian headquarters will be in Melbourne.

- Given the company says it is still reviewing the market, there are no details of where it would open stores, or how many stores it would open. As of June 1, 2017, the company’s Australian website was advertising no job vacancies.

Kaufland in Australia: Prospects

The Major Tailwinds Are in Grocery: A Sector Duopoly and Consumer Appetite for Discounters

A Paucity of Competition

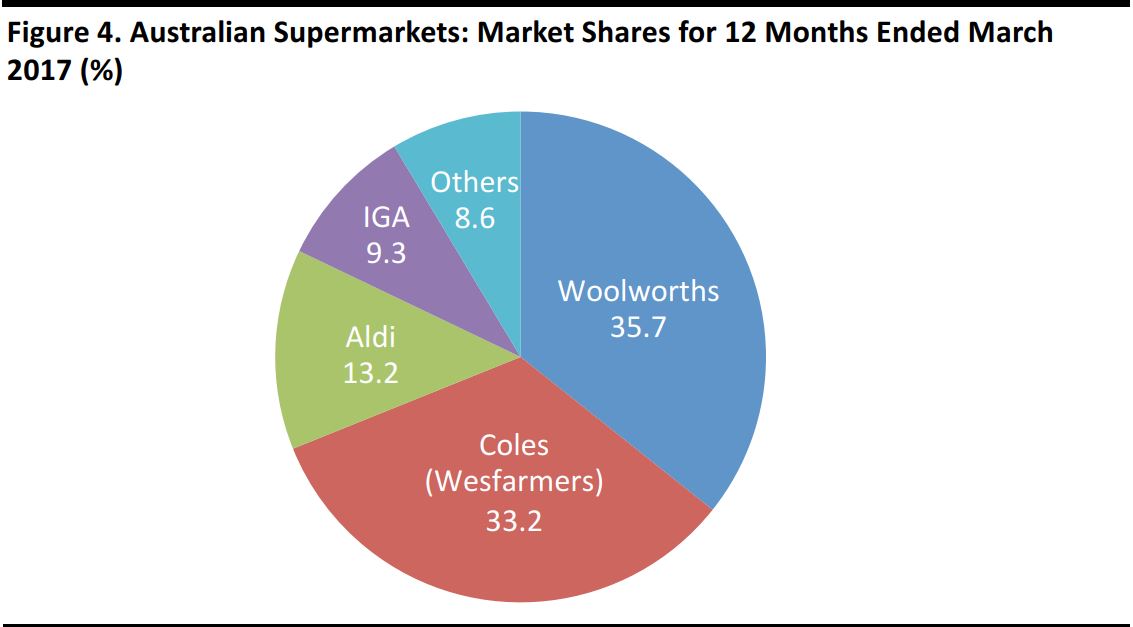

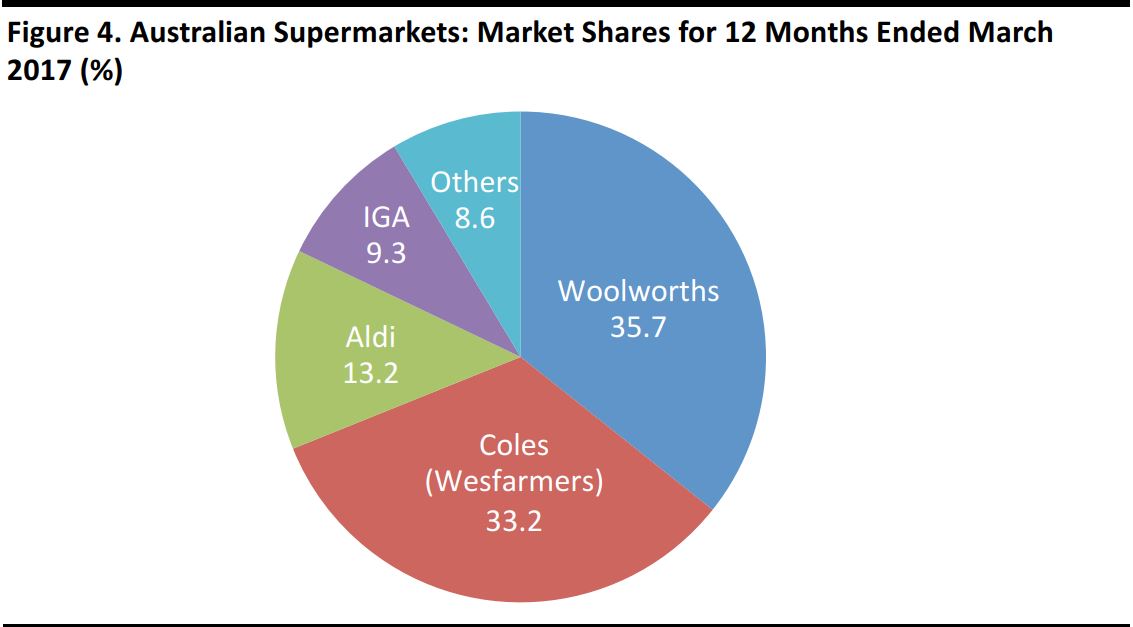

We see opportunities for Kaufland to capture grocery market share from incumbents in a supermarket sector that is characterized by an unusually low level of competition. Two retailers, Woolworths and Coles, account for almost 70% of Australian supermarket sector sales, making the sector among the most concentrated in developed retail markets.

Based on an A$90.3 billion supermarket sector size

Source: Roy Morgan Single Source Australia

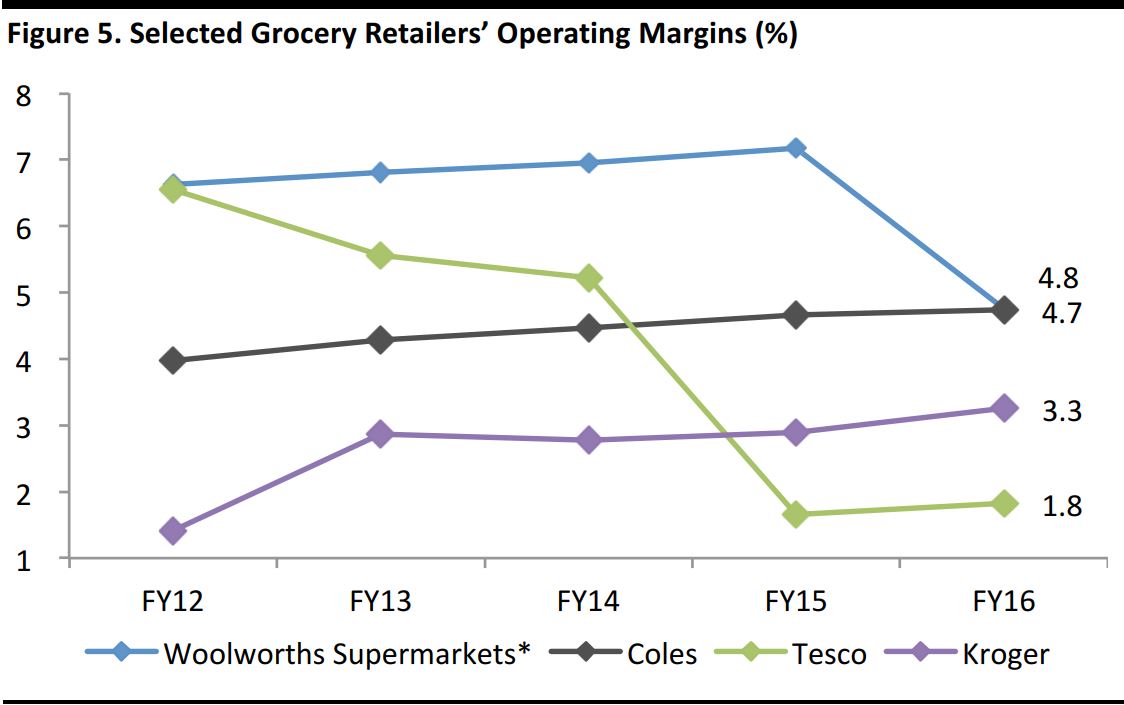

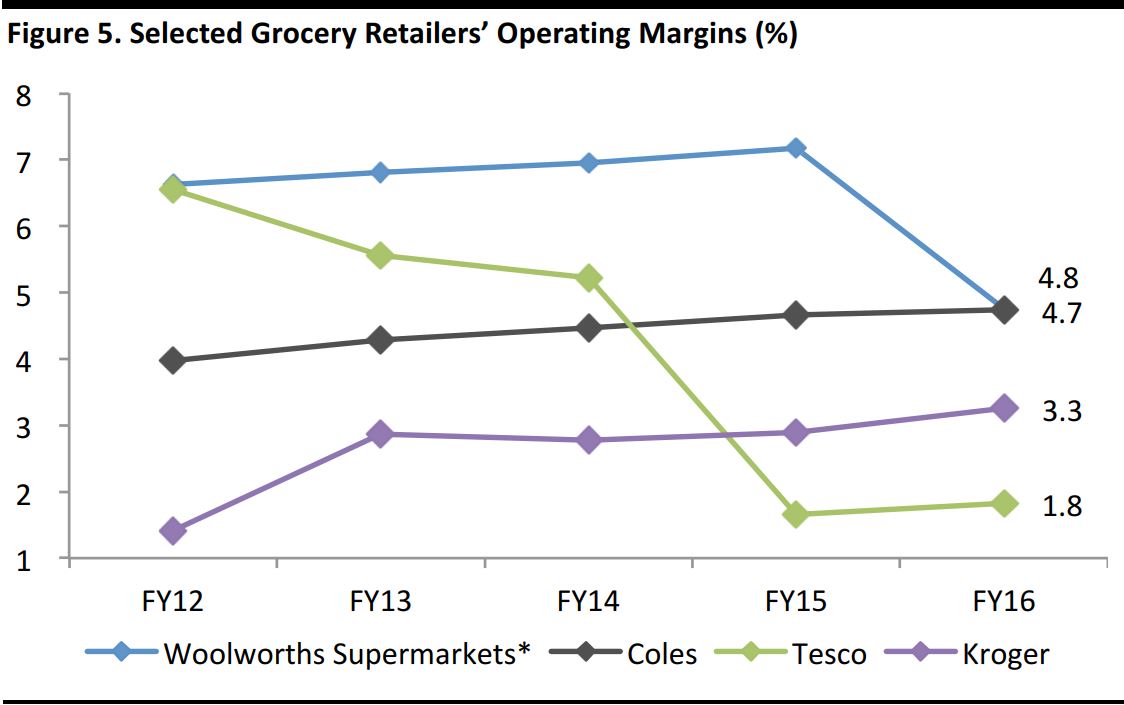

Moreover, Woolworths and Coles enjoy margins of nearly 5%—higher than the margins of major grocery peers such as Kroger in the US and Tesco in the UK. These margins suggest that the leading Australian grocery retailers may not be feeling the same level of competitive pressures as their peers elsewhere do.

*Margins for Woolworths’ Australian food, liquor and petrol segment

Source: S&P Capital IQ/Fung Global Retail & Technology

Higher Food Prices Create an Appetite for Discounters

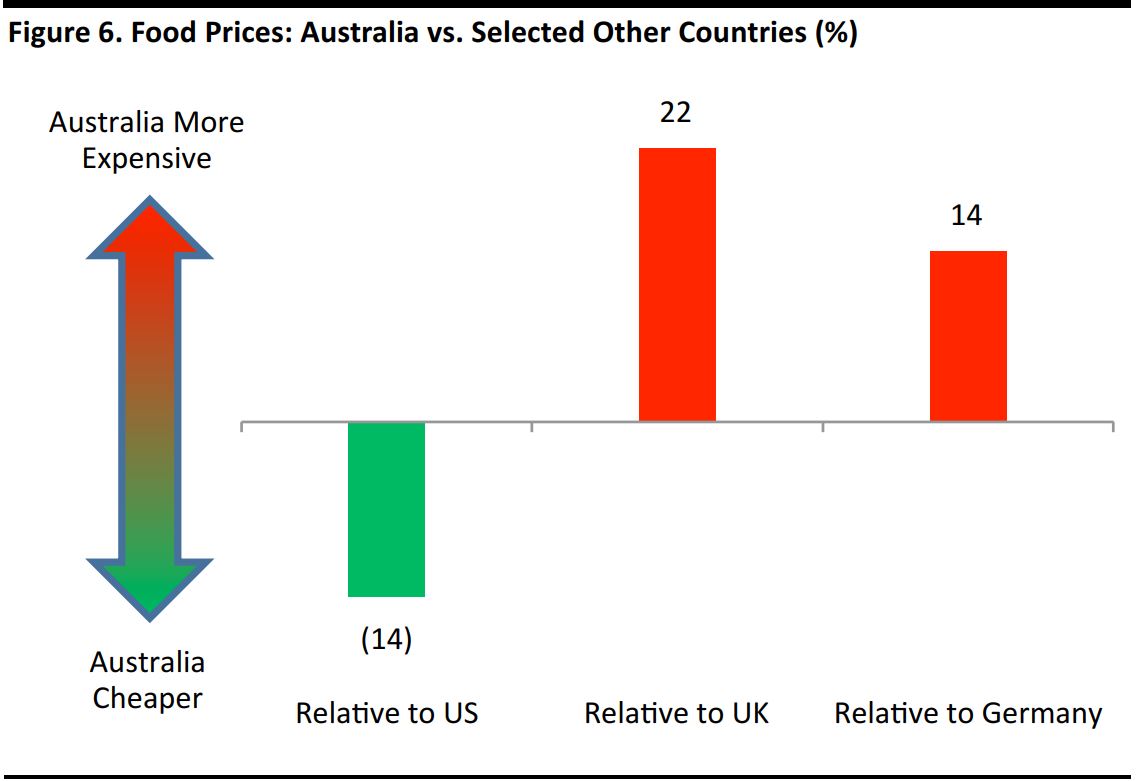

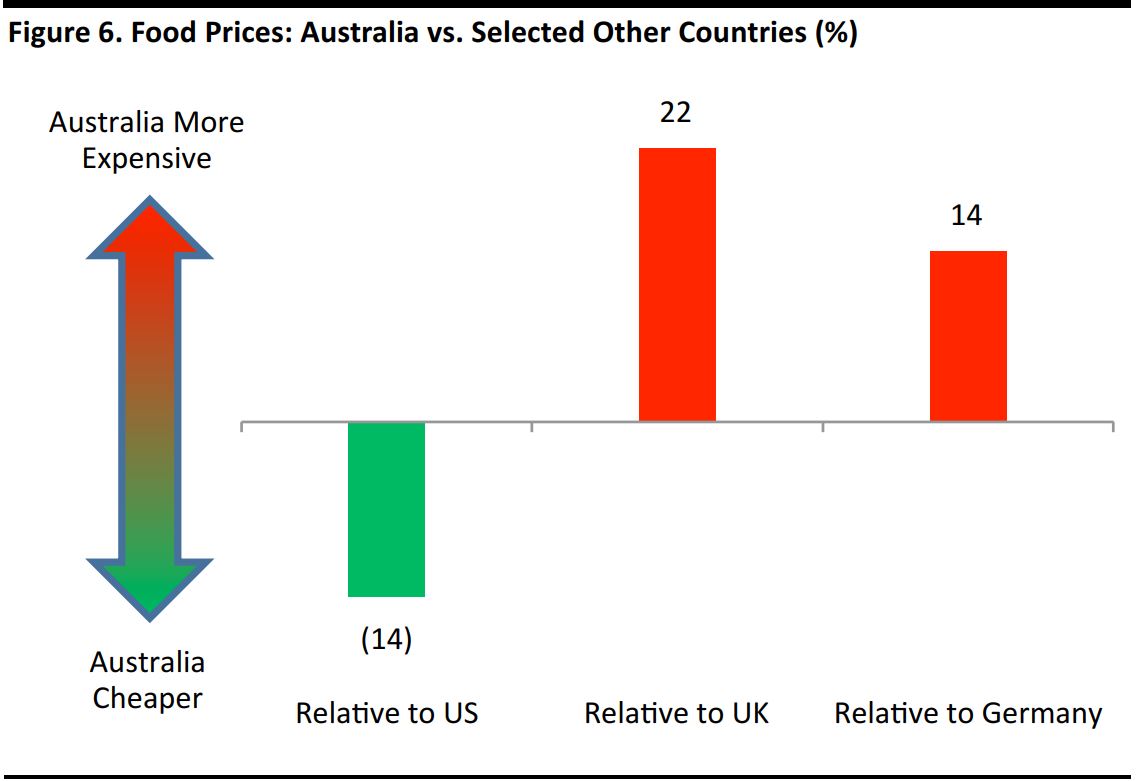

Media reports indicate that Australian consumers perceive that they pay high prices for groceries. Based on crowdsourced food-price data from the Numbeo database, we calculate that Australians pay significantly more for their groceries than do consumers in the UK and Germany, but less than consumers in the US do.

Based on average prices for a basket of 14 staples, including items such as fresh milk, eggs and apples

Source: Numbeo/Fung Global Retail & Technology

Those higher prices could make Australia fertile ground for strongly value-led grocery retailers such as Kaufland. Aldi and Costco have already tapped this market, suggesting that Kaufland could succeed with a discount food and nonfood offering.

- Aldi launched in Australia in 2001 and has grown substantially there, overtaking IGA to capture third position in the supermarket sector in 2013, according to Roy Morgan Research. Aldi grew its supermarket market share to more than 13% on sales of A$11.9 billion in the 12 months ended March 2017, per the same source. That was up from a 12.5% share in the six months ended September 2016.

- Costco launched in Australia in 2009 and at the end of 2016 it had eight warehouses in the country. The Australian newspaper reported that Costco Australia posted revenue of A$1.52 billion in the year ended August 2016. That was up 15% from A$1.32 billion in the prior year.

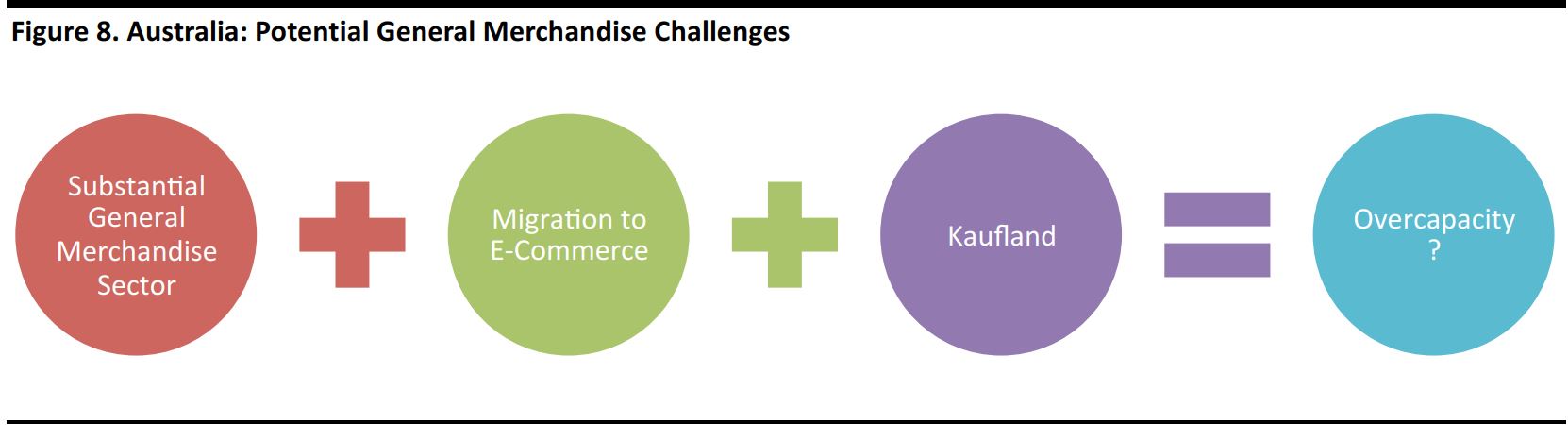

The Major Headwinds Are in Nongrocery: A Crowded Mixed-Goods Sector and Consumers’ Move to Online Shopping

Established Competition in Nongrocery

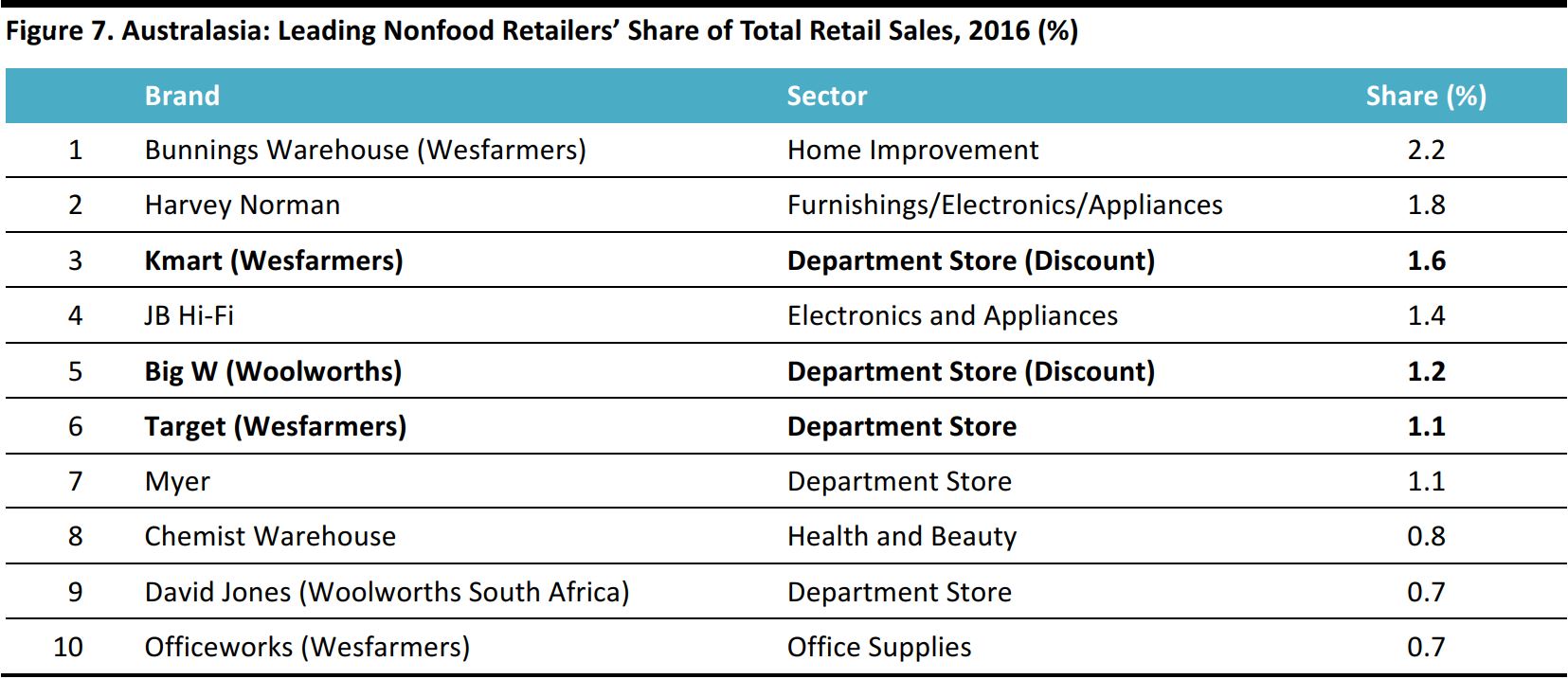

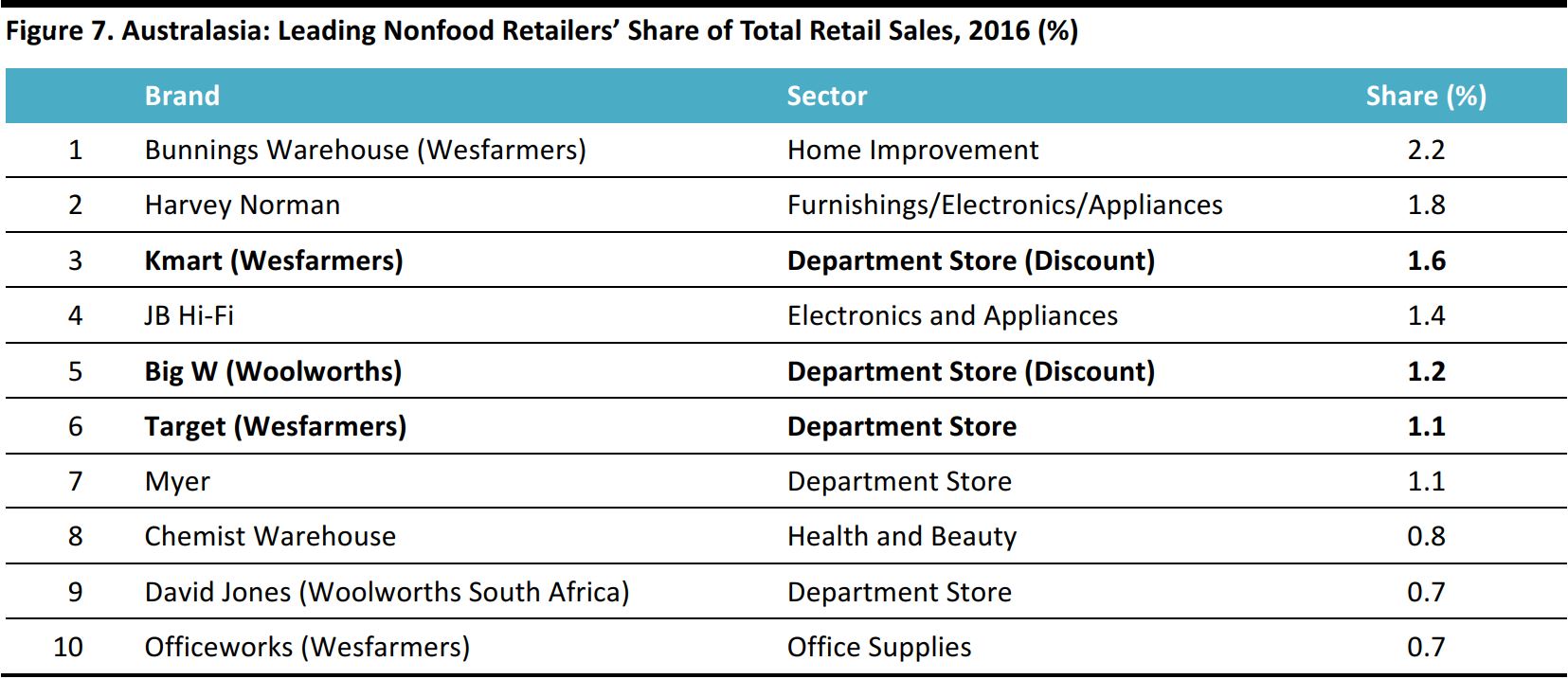

The other side of the coin to opportunities in grocery is the relatively crowded nongrocery space: Australia is home to a significant number of value-focused general merchandise retailers. Like most hypermarket retailers, Kaufland has a substantial nongrocery offering.

Kmart (owned by Wesfarmers), Big W (owned by Woolworths) and Target (also owned by Wesfarmers) hold strong leading positions in Australia, although Big W has posted declining sales in recent years. Costco is another major player in terms of nongrocery, and the leading grocery retailers also have substantial general merchandise offerings.

Australasia is the sum of Australia and New Zealand.

Source: Euromonitor International

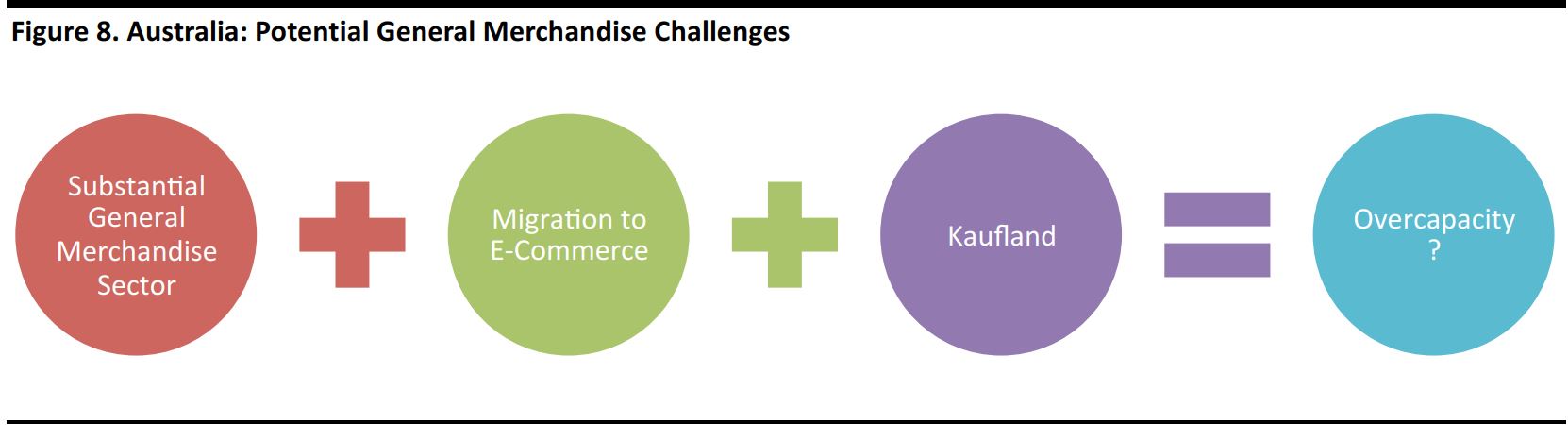

Furthermore, e-commerce is capturing an ever-greater share of nongrocery sales in categories that range from electronics to apparel to home goods. And we expect Amazon’s market entry to boost the migration of sales online (see our

separate report on Amazon’s entry into Australia).

Kaufland would therefore be adding space to a nongrocery market that could already be facing overcapacity in the coming years: i.e., too many stores fighting for share in a dwindling or low-growth market.

In other markets where rival channels have eaten into hypermarket sales (notably, the UK), the result has been lower store productivity and consequent downsizing of space in the sector.

Source: Fung Global Retail & Technology

In addition, we note that Kaufland could face challenges in terms of operating in Australia’s well-developed retail market, finding store locations that are large enough and tapping a food retail sector that is smaller than in many other countries.

Making Kaufland Work in a Developed Retail Market

As we noted earlier, Kaufland has so far expanded only into Eastern Europe, where it has played a part in modernizing and consolidating faster-growing sectors. Its ability to build share in a developed, consolidated retail market (other than its home market of Germany) is so far untested. Aldi and Lidl have enjoyed great success in a number of markets by flexing their formats and softening their hard-discount proposition. We wonder if Kaufland would need to similarly adjust to the demands of consumers in Australia—for instance, by providing more appealing store environments and using more innovative marketing.

Availability of Space

Kaufland’s requirements for large plots of up to 20,000 square meters could make finding locations difficult. According to a representative of Colliers International who was quoted in

The Sydney Morning Herald in March 2017, Kaufland could struggle to find prime locations, and zoning restrictions in New South Wales and Victoria present challenges for companies seeking to open very large grocery stores.

Tapping a Smaller Retail Sector

Including sales tax, the total Australian food retail sector was worth A$122.3 billion (US$135.3 billion) in 2016, according to the Australian Bureau of Statistics, and sector sales were up 3% year over year. While sizable, this is equivalent to just under half the value of the German food retail sector and it is around two-thirds the size of the UK food retail sector, we calculate, based on national statistics data. Kaufland would therefore be aiming to claim share in a market with less total potential.

Key Takeaways

- For Australian shoppers, Kaufland would represent a near-unique mix of grocery discounter and general merchandiser.

- The growth of Aldi and Costco in Australia attest to strong consumer demand for international entrants offering low grocery prices. This demand should support a market entry by Kaufland.

- The company’s value offering would heap further pressures on the two dominant Australian grocery retailers, Woolworths and Coles (owned by Wesfarmers). At the same time, the nongrocery chains operated by Woolworths and Wesfarmers are set to face competition from Amazon—as we note in our separate report.

- However, Kaufland’s ability to build share in a developed, consolidated retail market is so far untested. And it would be entering a market that not only has several incumbent value general merchandisers, but also is set to see more and more nonfood sales migrate online.

In short, we see opportunities for a discount grocery offering, but think that any launch by Kaufland may help nudge the general merchandise sector in Australia toward overcapacity.