Executive Summary

Fung Global Retail & Technology attended Intime Retail Group’s analyst briefing in Hong Kong, where the senior management team discussed how they would implement Alibaba’s New Retail initiatives after the company’s privatization. Alibaba announced on January 10, 2017, that it had offered to privatize Intime for HK$19.8 billion (US$2.6 billion) and use Intime’s department stores and malls as a key pilot for its New Retail initiatives. The deal is pending shareholders’ approval, which is expected later this year.

New Retail has been touted as a game changer for China’s retail landscape since Alibaba Chairman Jack Ma first talked about the concept in October 2016. Subsequent discussions pertaining to New Retail have been in abstract terms and this is one of the first meetings where Alibaba’s CEO Daniel Zhang and Intime’s CEO Xiaodong Chen went into details about how New Retail would be implemented—reflecting that the idea has moved from the conceptual phase to the implementation phase.

Source: Fung Global Retail & Technology

Core Message: Retailers Need to Embrace New Retail to Keep Pace with Consumers’ Changing Preferences

- Retailers will need to change their mindsets and operating model to integrate both the online and offline experience. The mobile internet has drastically changed consumers’ preferences and the way they shop.

- To redefine a new operating model under the New Retail, Alibaba’s CEO Zhang stated that holistic changes to the current retail model are necessary, and that retailers will need to redefine the relationship between consumers, merchandise and stores.

- In the era of New Retail, retailers such as Intime will be establishing themselves as consumption solutions providers, driven by big data to enhance consumers’ shopping experiences, rather than the traditional retail real estate model.

Intime’s Approach to New Retail: Digitalization, Omnichannelization, Platformization and Entertainmentization

- Digitalization: Intime will overhaul its operating model—with a particular focus on redefining the brand and digitalizing the supply chain—to improve efficiency.

- Omnichannelization: Intime will continue to leverage Alibaba’s big data capabilities and Internet mindset to emphasize customers’ needs and enhance the omnichannel experience

- Platformization: Intime plans to further integrate Alibaba’s data platform by unifying the online and offline information of customers, products and services.

- Entertainmentization: Intime will continue to integrate leading fashion, art and lifestyle icons into its malls, in line with consumers’ growing preference for experiential retail.

The Outlook for China’s Retail Landscape Will Remain Challenging

Zhang believes China’s domestic consumption story is intact. However, the growth of the department store industry in both China and globally will continue to be limited by the current operating model as well as geographical constraints. He believes the approach to retail is converging globally, and draws a parallel between Alibaba’s push into physical retail and US e-tailer Amazon’s foray into physical retailing with bookstores and Amazon GO, its checkout-less physical grocery store.

New Retail will Likely be a Game Changer for China’s Retail Landscape

The analyst briefing was significant in that it provided more color concerning the implementation of Alibaba’s New Retail initiatives. The future of retail in China is a combination of the online and offline experience. The mobile internet has drastically changed consumers’ preferences and the way they shop. In the past, malls have used anchors such as supermarkets to attract traffic. However, 93% of consumers directly leave the mall after visiting a supermarket, according to Intime CEO Chen. Both online and physical retailers will need to change their mindsets and operating model.

Zhang, the Chairman of Intime, stated that the approach to retail is converging globally. In addition to Alibaba’s push into physical retail, US-etailer Amazon has also announced Amazon GO, its checkout-less physical grocery store. Both Alibaba and Amazon started out as e-tailers, and have since extended their presence to offline retail and are redefining retail with technologies such as cloud computing, big data and artificial intelligence (AI).

Below, we summarize the key takeaways from the analyst briefing.

Privatization of Intime is Conducive to Wholesale Changes To Enhance its Operating Model

Intime Chairman and Alibaba CEO, Zhang, stated that the company’s privatization will give Intime more room to redefine a new operating model under the New Retail, as the group will no longer be required to comply with financial reporting requirements for listed companies. He expects holistic changes to its retail model, rather than the piecemeal changes that have been implemented since Alibaba’s initial investment in 2014. He felt the previous innovation initiatives have not been thorough enough.

Zhang also stated that Alibaba looks highly on Intime’s innovation initiatives, and will provide full support for the implementation of New Retail initiatives. Together with Intime, Alibaba seeks to redefine the relationship between consumers, merchandise and stores.

How will Intime Evolve with Alibaba After Privatization?

In an effort to drive future growth, Intime will cooperate closely with Alibaba on the integration and development of the online-to-offline (O2O) business model.

Intime seeks to establish itself as a consumption solutions provider, driven by big data to enhance consumers’ shopping experiences. The group operates under the key tenets of “customer orientation, staff wellbeing, innovation and reform” through “digitalization, omnichannelization, platformization and entertainmentization.”

Intime’s existing senior management team will remain with the company after privatization. CEO, Chen, will participate in Alibaba’s core decision making as a member of senior management.

Intime's Key Initiatives: Digitalization, Omnichannelization, Platformization and Entertainmentization

Below, we summarize the four key O2O initiatives that will continue under the Alibaba-Intime partnership.

1. Digitalization of the Supply Chain Operations and Channels

Intime will overhaul its operating model, with a particular focus on redefining the brand and supply chain. By digitalizing its supply chain, the company seeks to reduce the layers of suppliers and improve efficiency. The group will also step up its efforts to integrate its CRM system and monitor store activities, sales and shopping preferences, and improve the merchandise mix to increase its competitiveness.

2. Omnichannelization with Big Data and Personalization

Intime will continue to leverage Alibaba’s big data capabilities and internet mindset to emphasize customers’ needs and enhance the omnichannel experience. Intime will further enhance its O2O initiatives, including Miaojie, Miaohuo, Choice, I Choice and Miaoke, which have been performing well. Intime has also introduced new O2O integration platforms, namely Jihood and InJunior.

Personalized in-store promotions with mobile technology: Intime has leveraged Alibaba’s mobile technology to provide consumers with more targeted promotions and membership benefits in-store. The in-store technology has enabled consumers to use virtual prepaid cards and pay

with Alipay at mobile points of sale (POS).

3. Platformization to Expand Product Selection and Improve Fulfilment

Intime plans to further integrate Alibaba’s data platform by unifying the online and offline information of customers, products and services. Alibaba’s Tmall has access to Intime’s offline inventory database, which will lead to a broader product selection and drive fulfillment of online orders at Intime’s physical stores. Intime’s physical stores display and sell online brands supported by Alibaba, and Alibaba’s platforms have onboarded Intime’s offline brands.

4. Entertainmentization

Intime has integrated leading fashion, art and lifestyle icons into its malls, as consumers increasingly prefer experiential retail. Intime has been promoting entertainment activities to create a relaxing shopping environment and increase brand awareness.

Source: Company reports

LINE: In summer 2016, Intime partnered with LINE Friends, the Korean company, to launch a cartoon-themed café and theme park in its Beijing mall.

SkyTechSport: Intime also introduced its “in SPORTS” brand, jointly developed by Intime and German

company SkyTechSport, to appeal to consumers with active lifestyles. “in SPORTS” experience stores use virtual reality (VR) technology to simulate sporting experiences. It opened its first “in SPORTS” experience store in its Beijing mall and plans to introduce more branches in other cities in China.

Intime’s Key Strategies: Customer Orientation, Staff Wellbeing, Innovation and Reform

Intime seeks to strengthen the relationship with customers and staff—its key stakeholders.

1. Customer Orientation

Intime has launched several innovative initiatives to alleviate consumers’ perception that pricing and customer service at physical stores are inferior to that offered online, which we outline below.

- Lower price points: Intime has lowered the price points of products by as much as 20-30% in some cases. During the week following Singles’ Day 2016, Intime announced that it would match prices at its physical stores with those on Tmall, pledging to compensate consumers who had bought products at its stores that were priced higher than products on Tmall.

- Provide a flexible returns service: Intime has implemented a liberal returns policy for handling product returns, with the aim of increasing consumer satisfaction. Consumers can return merchandise within one month of purchase without any specific reason. This has led to a high returns rate and increased operating expenses.

- Provide an online membership platform: Online membership is one of Intime’s key O2O strategies to increase customer loyalty. It will further integrate online and offline customer information on its CRM system.

- Enhance efficiency of the backend infrastructure: Intime seeks to improve the efficiency of the supply chain, and integrate inventory and orders both at physical stores and online.

2. Staff Wellbeing

- Align the interests of employees with that of the company: Intime is one of the pioneers in China’s department store space in terms of employee welfare. It offers competitive compensation and bonus packages to incentivize its staff with clearly defined KPI. Intime offers tutorial groups for the children of employees and gives employees two extra days leave on average as a bonus. Its employee welfare initiative was launched to deal with the labor shortage.

3. Innovation and Reform

- Promote a culture of innovation: Intime has implemented incentive programs for employees in order to align their interests with that of the company. To incentivize innovation within the firm, Intime plans to distribute a 20% stake in Innovation Partnership programs to participating employees.

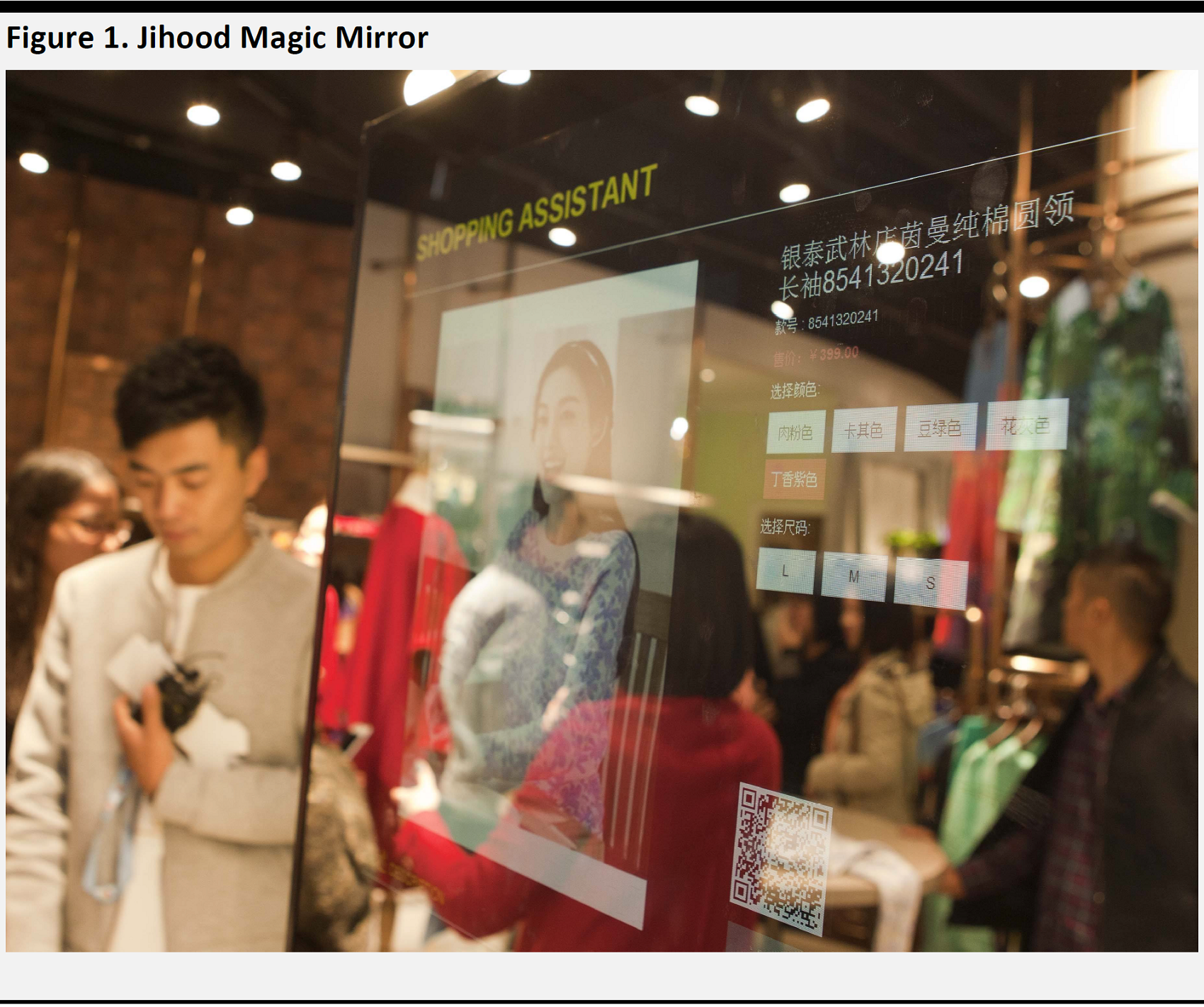

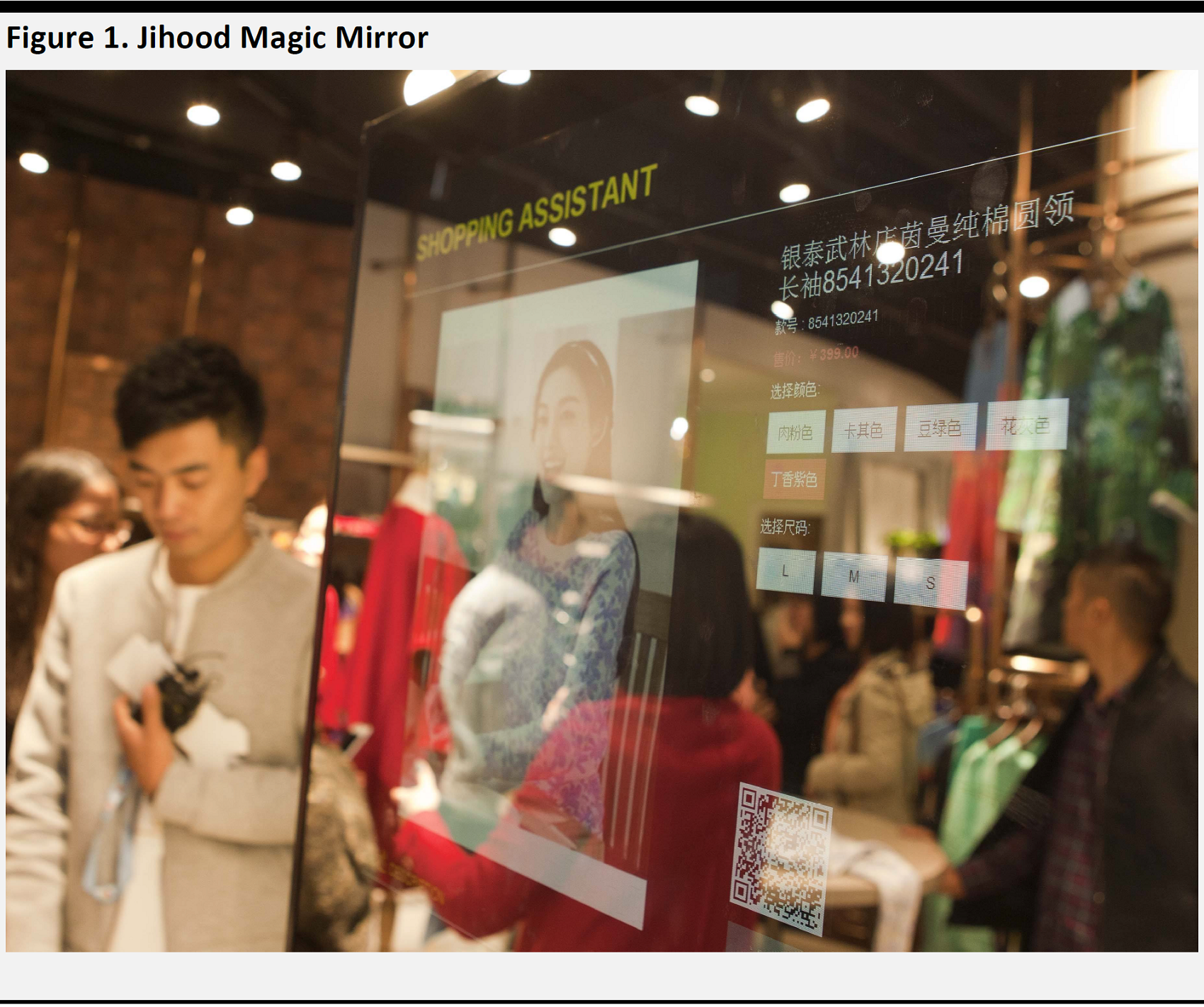

Example: Intime Jihood stores

Jihood is a series of O2O stores launched by Intime in 2015, which embody experiential social retail. Jihood stores curate high-quality products through the use of online sales data. Products on display at various stores can differ by 30%, as products are curated according to analytics on consumer preferences in each location. This essentially guarantees that prices at Jihood stores will be consistent with online marketplaces.

In-Store Magic Mirror

Jihood provides a “magic mirror” based on radio-frequency identification (RFID) and augmented reality (AR) technology. The magic mirror automatically displays different types of information, including product information, inventory, available sizes and suggestions for similar products. Each product in the store has a RFID tag. Online payment is also supported through the magic mirror.

Source: Sohu

Jihood Resonates with Intime’s O2O Vision

With the Jihood stores, Intime strives to implement its vision of O2O. The aim of the big-data application is to improve the quality and efficiency of the interaction between customers and products. Customers can enjoy low prices, high quality and convenience at the Jihood stores. Intime expects this to be the new norm going forward.

Source: Winshang

The Vision of New Retail—a Symbiotic Relationship Between Online and Offline Retail

The dual vision of New Retail is to enhance consumers’ shopping experience by integrating online and physical retailing, powered by big data technology. New Retail can define both changes in consumers’ purchasing patterns and preferences.

According to Zhang, companies operating in the New Retail will be transformed into internet and data companies. It is necessary for online companies to learn from physical retailers, and vice versa.

The Outlook for China’s Retail Landscape

Both Zhang and Chen were of the view that China’s retail environment and the future of traditional retailers will remain challenging. The primary factors underpinning their cautious outlook are: China’s decelerating economic growth rate, the growing sophistication of Chinese consumers and the growth of e-commerce, which has largely supported the growth of retail sales in China. In 2016, total retail sales growth of consumer goods decelerated to 10.4% year over year, below the 10.7% in 2015, while total online retail sales increased 26.2% year over year in 2016.

Challenges Facing China’s Physical Retailers

Although Zhang believes China’s domestic consumption story is intact, the growth of the department store industry is limited by its operating model as well as geographical constraints. Mall traffic has been declining, not because the products for sale at the physical retailers are any less attractive, but because of the mobile internet and its impact on consumer behavior. Consumers no longer feel the need to go to malls to shop, because they can search for products online more efficiently.

He expects more retailers to transform their operations to the New Retail by setting up e-commerce platforms. Currently, the revenue contribution from e-commerce for some fashion brands is only 10%–20%.

Chen believes the Chinese retail market has yet to reach an inflection point.

Intime Retail: FY16 Earnings Review

Total retail revenue increased 2.7% to ¥17.2 billion in fiscal year 2016, primarily driven by expansion of Intime’s retail network. Same-store sales growth was flattish at 0.3%, dragged down by the challenges facing China’s department store industry. Marketing expenses jumped 25.3% to ¥0.3 billion and comprised 11% of operating expenses. Attributable profit increased by 0.2% to ¥1.32 billion.

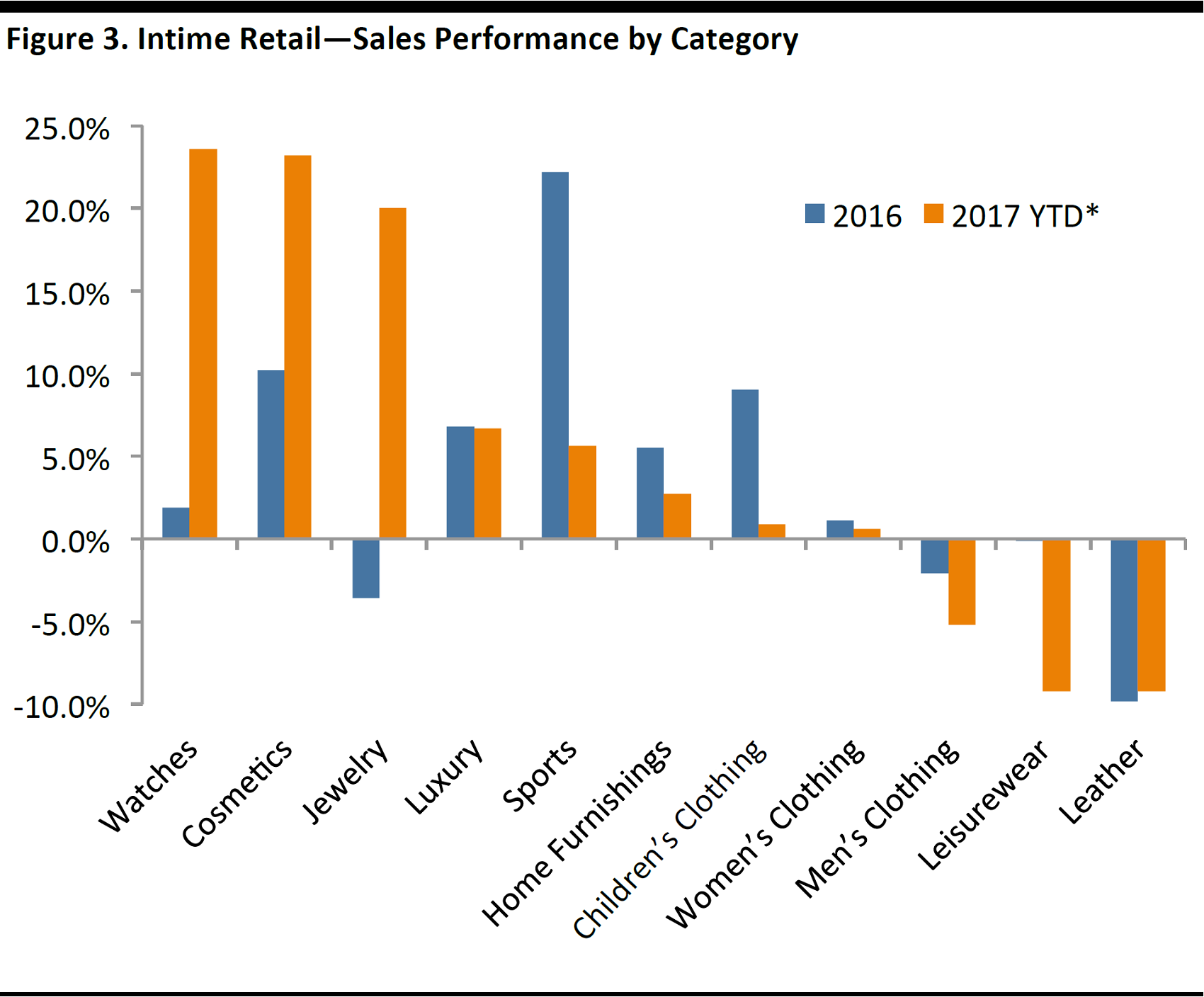

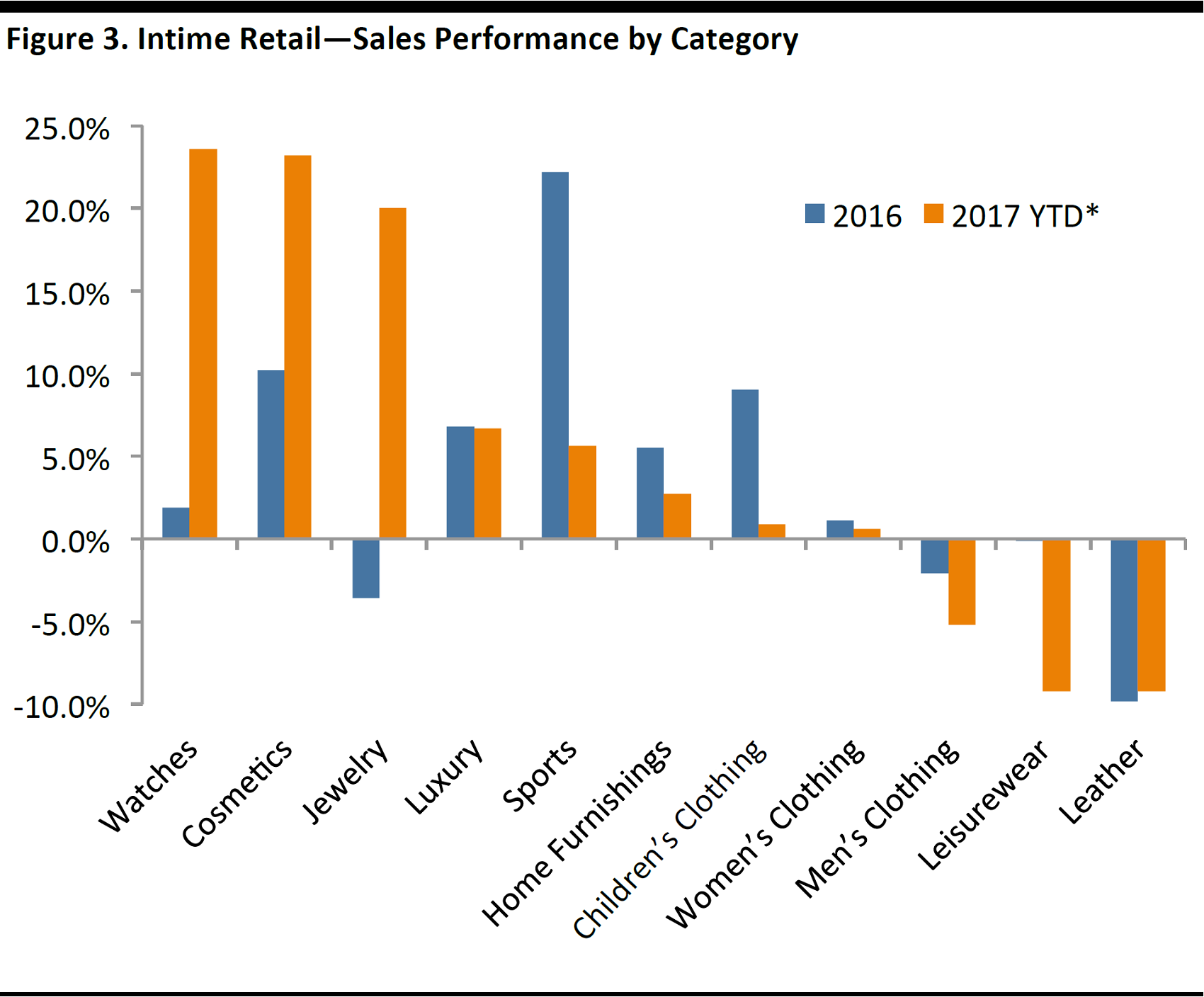

- Best-performing product category: In 2016, the best-performing product category by sales was sports (up 22% year over year) and cosmetics (up 10% year over year).

- Year-to-date March 2017, watches (up 24% year over year) and cosmetics (up 23% year over year) registered the highest sales growth.

Note: 2017 YTD covers the period between January 1 and March 15, 2017.

Source: Company reports

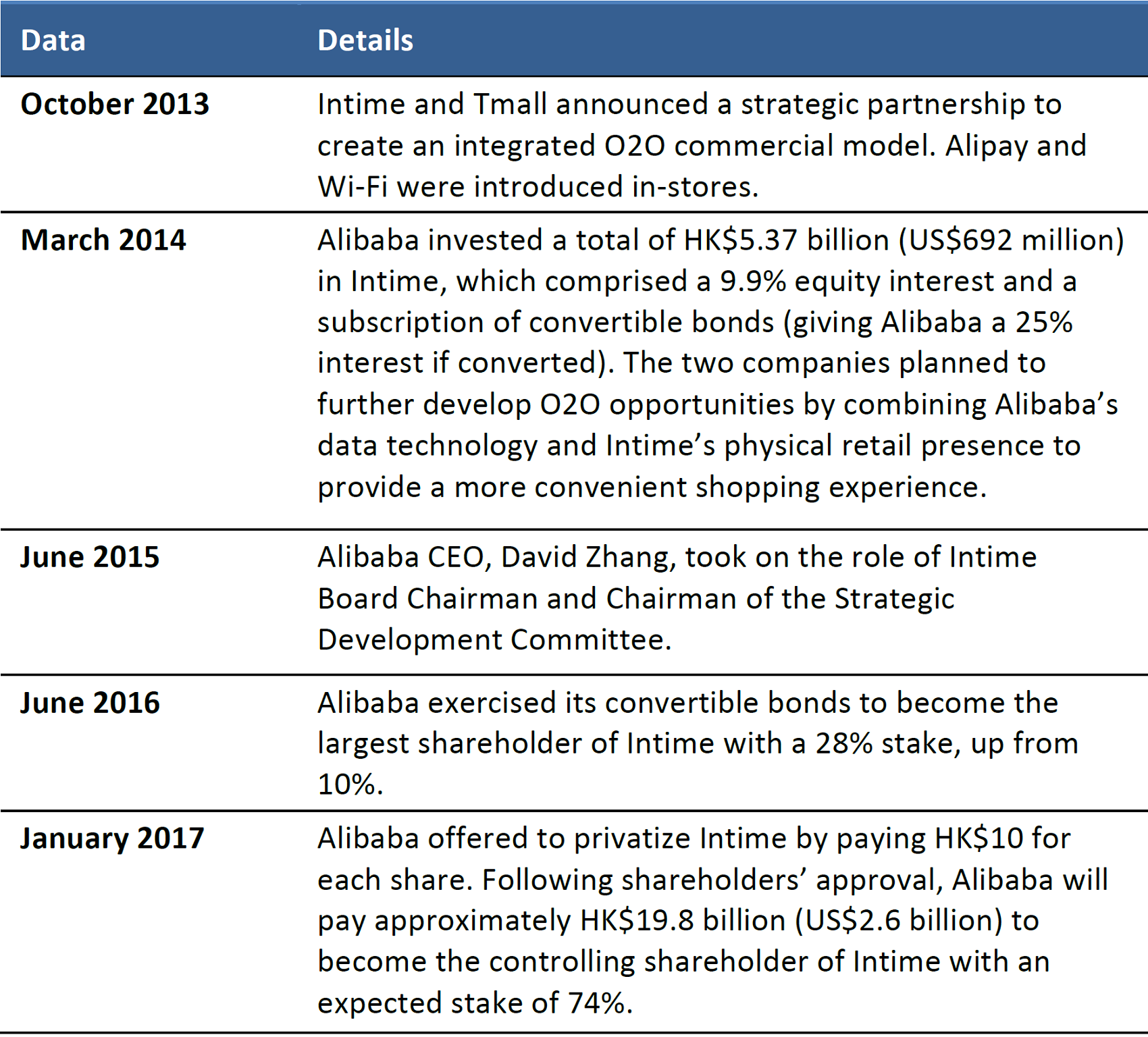

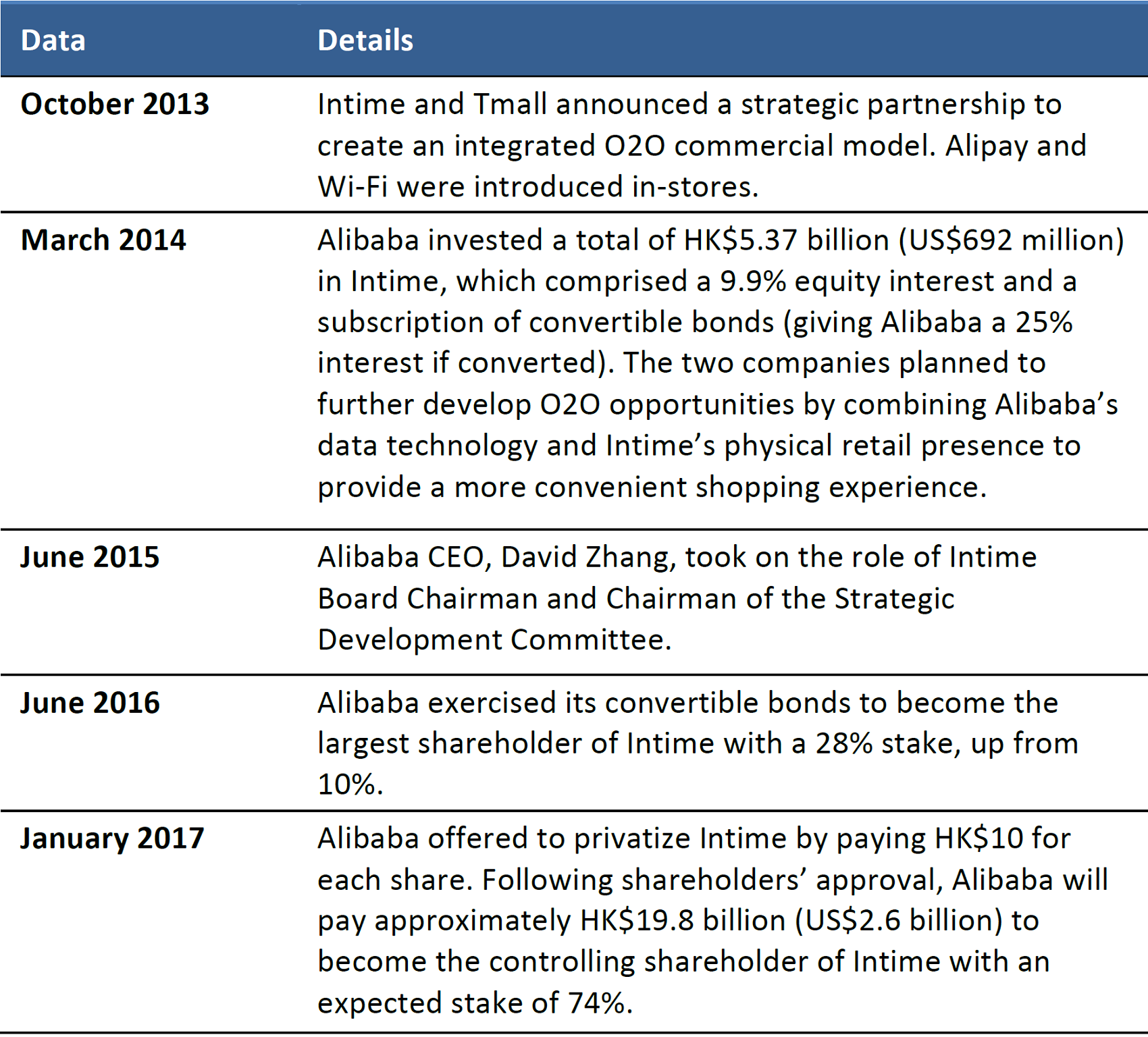

Alibaba’s Privatization of Intime

On January 10, 2017, Intime announced that Alibaba had offered to privatize the company for HK$19.8 billion. The move is intended to give Intime greater control over long-term strategic decisions. The offer is for HK$10 per share, representing a 54% premium over the stock’s average closing price of the previous 60 days.

The privatization is pending shareholders’ approval.

Privatization Timeline

Source: Company reports

Source: Bloomberg

About Intime

Intime Retail (Group) Company Limited operates a department store chain in China. The company retails a wide range of consumer products, including apparel, cosmetics, jewelry, footwear, luggage, athletic apparel, home furnishings, electronics and appliances. As of the end of 2016, Intime operated 49 stores (29 department stores and 20 shopping malls) and has a strong presence in Zhejiang Province where Alibaba is headquartered.

What is New Retail

New Retail refers to the integration of online and offline retail, and logistics across a single value chain, powered by data technology. It is expected to hold the solution for physical retailers and pure-play e-tailers and propel the industry’s transformation.

New Retail addresses the bottleneck of China's stagnating physical retail industry, which is defined by low operational efficiency, mall supply that is below most developed markets and a supply-demand imbalance between the top-tier and lower-tier cities.

Three Key Characteristics of New Retail

- Demand-orientation: Facilitated by data technology, retailers will be able to define the evolving needs of consumers and create products and services with the best experience for them. Retailers will redesign touch points with consumers according to their needs.

- Combination of physical and digital retail (omnichannel): Physical and digital retail will be perfectly integrated and the retail value chain will be reshaped.

- Highly diversified retail formats: Multiple retail touch points will emerge in terms of logistics, culture and recreation, restaurants, etc. More retail formats will emerge, supported by data technology.

For more details, see our recent reports on the topic:

- Deep Dive: New Retail―The Key To Unlocking Pent-Up Chinese Consumer Demand (link), published March 16, 2017

- Alibaba’s Big Bet: Physical Retail And E-Commerce Are A Winning Combination (link), published January 12, 2017

company SkyTechSport, to appeal to consumers with active lifestyles. “in SPORTS” experience stores use virtual reality (VR) technology to simulate sporting experiences. It opened its first “in SPORTS” experience store in its Beijing mall and plans to introduce more branches in other cities in China.

company SkyTechSport, to appeal to consumers with active lifestyles. “in SPORTS” experience stores use virtual reality (VR) technology to simulate sporting experiences. It opened its first “in SPORTS” experience store in its Beijing mall and plans to introduce more branches in other cities in China.