Web Developers

Executive Summary

In this report, we examine India’s apparel retail market and the characteristics that define it. We look at the opportunities and threats that lay ahead as international retailers increasingly push into the Indian market, and we share details of our on-the-ground store checks of global players and their major domestic rivals in India.Pursuing Growth

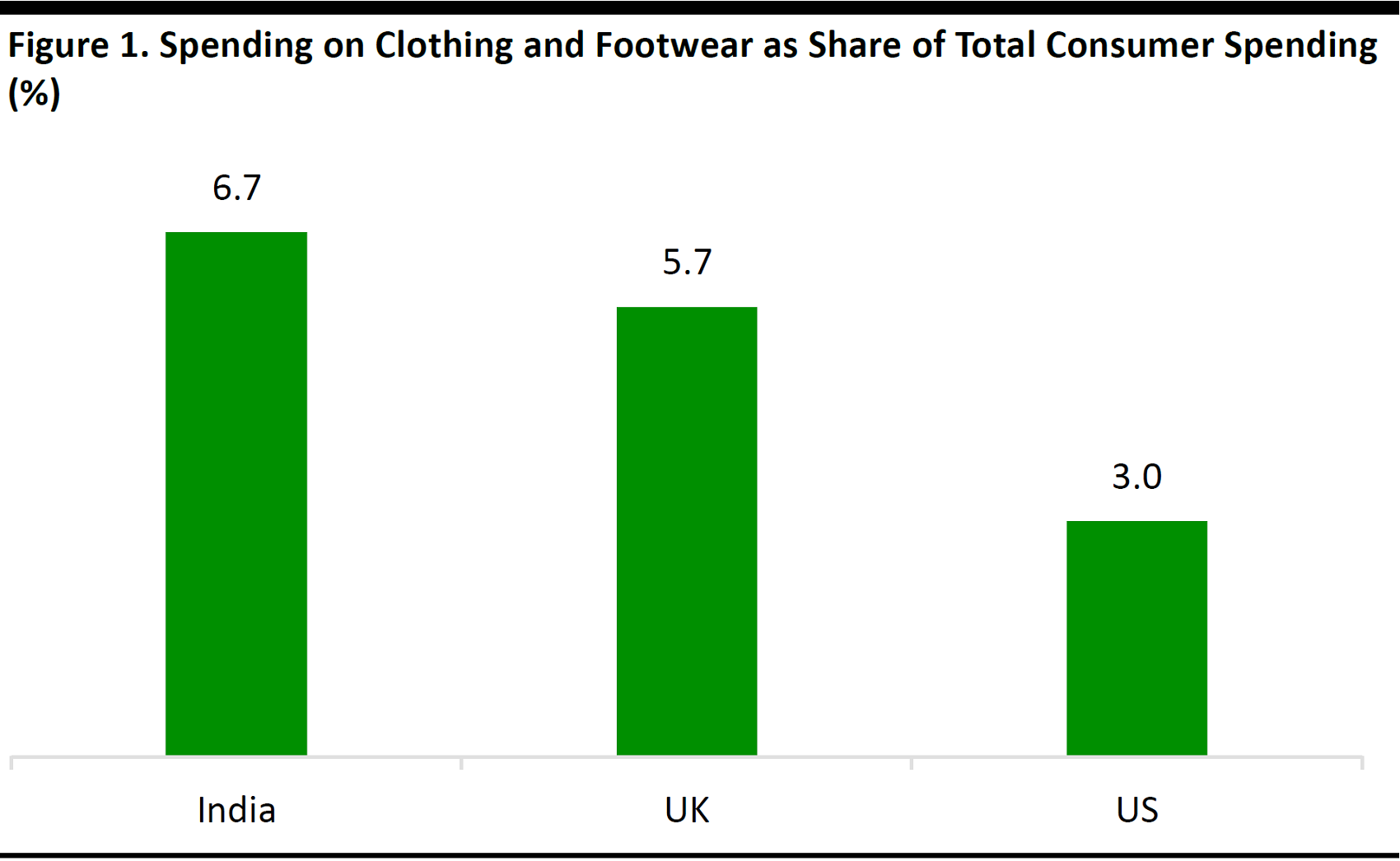

Indian consumer spending on clothing and footwear is growing fast: category spend rose 11% in the fiscal year ended March 2014 (latest confirmed), to reach $68 billion. We estimate category spending reached $85 billion in the fiscal year ended March 2017 (all figures are at fixed 2016 exchange rates). High inflation has underpinned spending growth and real-terms growth has been considerably lower. Indians allocated 6.7% of their total consumer spend to clothing and footwear in fiscal 2014, down from 7.0% in the previous year. Apparel is a semidiscretionary category and, as incomes rise, semidiscretionary purchases tend to capture a smaller share of consumers’ total spending.Jumping the Hurdles

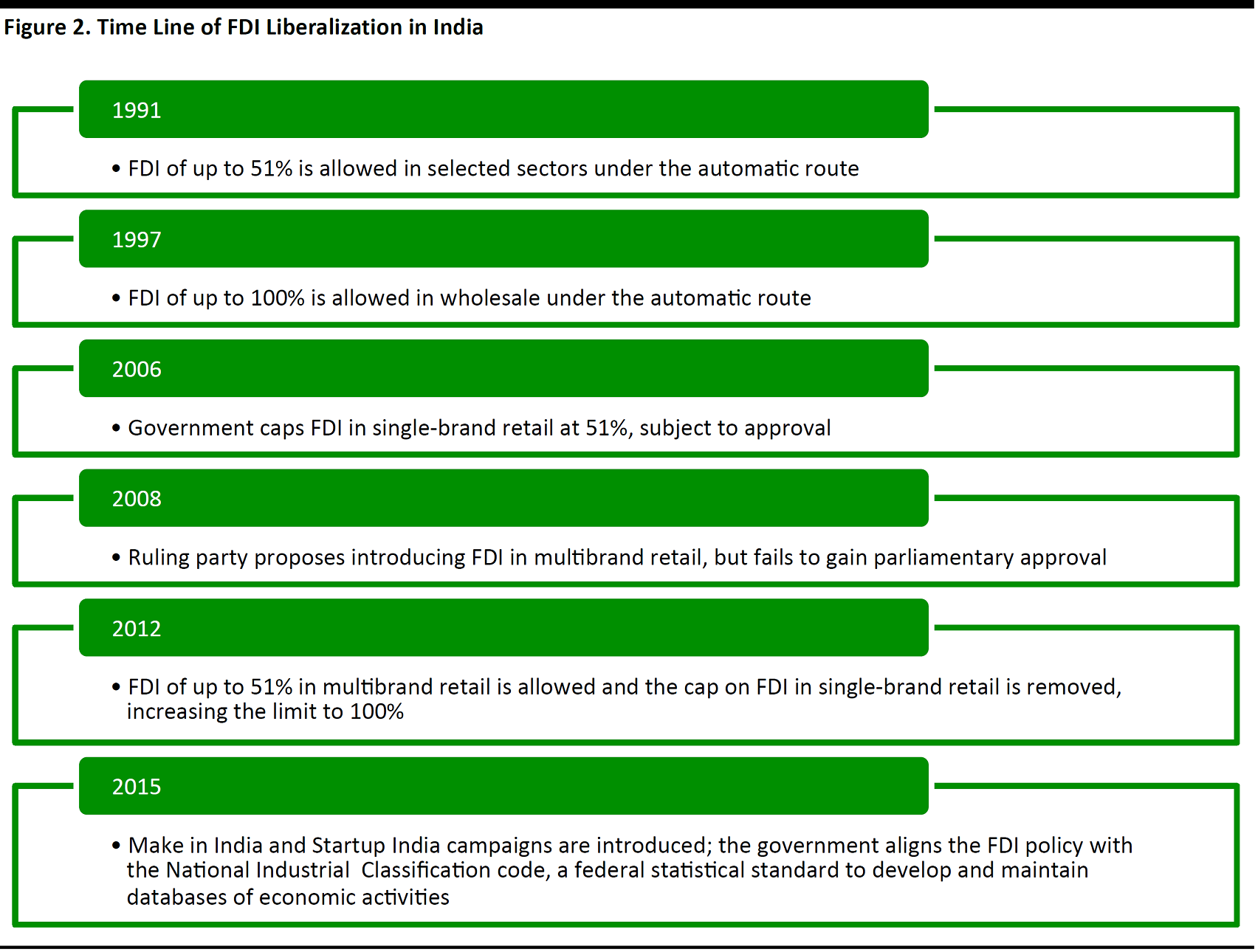

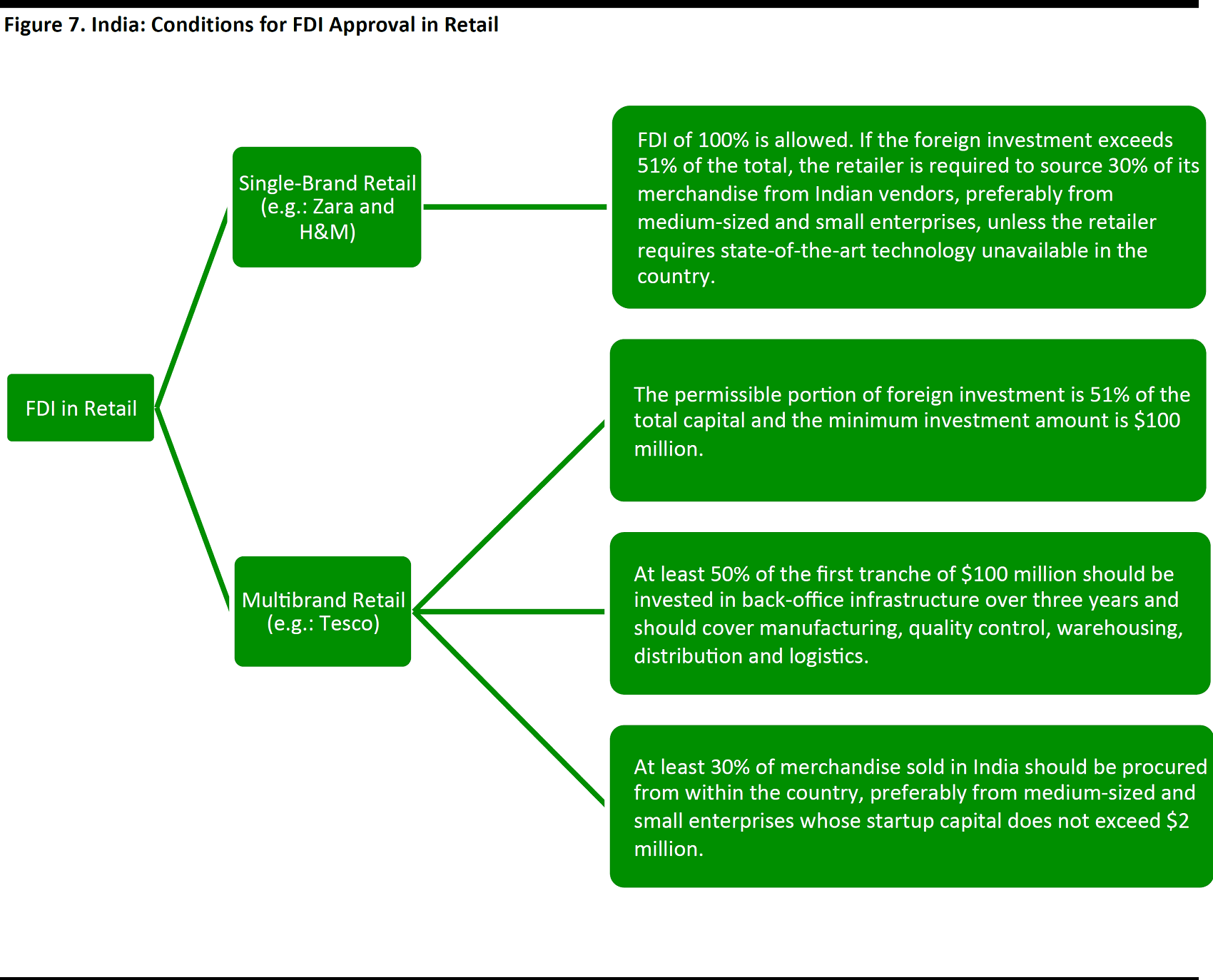

Protectionist measures have historically limited the strategies through which foreign retailers can enter India, although the government has instituted various liberalization reforms. Since 2012, single-brand retailers have been allowed to own their Indian operations completely. Multibrand retailers’ investment in Indian businesses is capped at 51%, subject to government approval. The government provides five methods of entry into the Indian market for international apparel retailers: licensing, franchising, wholly owned subsidiary, JV and limited liability partnership. Licensing was the preferred route until the government allowed entry through JVs beginning in 2006, after which JVs became the preferred route. They remained so until 2012, when the government removed the cap on single-brand retailers. Considering the formalities involved and the growth in e-commerce, many brands are looking at licensing and franchising as feasible options through which to enter the Indian market. Despite India’s attractiveness, there are several factors that need to be addressed in order for the country to become a preferred retail destination. Entry regulations need to be eased or simplified to facilitate further investment across sectors and infrastructure needs to drastically improve to provide high-quality retail spaces.Introduction: The Indian Apparel Retail Story

“For the apparel oft proclaims the man,” writes Shakespeare in Hamlet. Though the play was written in a distant era for an audience in continental Europe, the message behind this quote resonates rather soundly among present-day Indian consumers. Until recently, most Indians, particularly women, were passionately loyal to traditional clothing styles. But increased access to affordable Western clothing, increased disposable incomes, and social and cultural transformations have fueled change in Indians’ sartorial preferences. And the entry of international retailers such as Marks& Spencer (M&S), Gap, Zara and H&M into India, powered by the opening up of the Indian economy, is increasingly capturing global attention. This is the first of a brief series of reports that examine international retailers in India. Here, we examine India’s apparel retail market and the characteristics that define it. We also look at the opportunities and threats that lay ahead as international retailers increasingly push into the market, and share insights from our on-the-ground store checks in various cities in India. A subsequent report in this series will look at the food retail and wholesale sector.

Source: iStockphoto

Sizing the Indian Clothing Market

We begin by looking at some key details of the Indian retail sector, apparel’s share of the sector and some of the characteristics that are unique to the Indian apparel market. It is not surprising that India is an appealing target for investment by international retailers: the country has the world’s second-largest population, at 1.3 billion people, and the world’s fourth-fastest-growing economy, which increased by 7.6% in 2015 (latest).The Prize: An $85 Billion Apparel Market

Indian consumers spent a total of $645 billion at retail in 2016, according to the India Brand Equity Foundation (IBEF). The foundation further estimates that the retail sector will grow at a CAGR of about 12% to 2020, when it will reach almost $1 trillion. The average Indian consumer spends more on food than on discretionary items such as clothing and entertainment. The following spending estimates are based on data from the Ministry of Statistics and Programme Implementation (MOSPI) and are at fixed 2016 exchange rates to strip out the effects of currency fluctuations:- In current prices, Indian consumer spending on clothing and footwear grew by 15% in the fiscal year ended March 2013 and by 11% in the year ended March 2014 (latest), to reach $68 billion.

- We estimate category spending reached approximately $85 billion in fiscal 2017.

- Much of the historical growth in the category has been inflation driven: in real terms, spending on clothing and footwear grew by 4.2% in fiscal 2013 and by 1.1% in fiscal 2014, according to MOSPI.

Data are for fiscal 2014 for India and calendar 2016 for the UK and the US. Source: MOSPI/UK Office for National Statistics/US Bureau of Economic Analysis/Fung Global Retail & Technology

Four Characteristics of the Indian Apparel Market

There are four characteristics unique to India that have shaped the country’s clothing market and its consumers’ fashion preferences: the apparel market is fragmented, Indian consumers are loyal to traditional clothing styles, the apparel market focuses on women’s styles and many of the larger apparel brands are owned by conglomerates.1. India’s apparel market is fragmented, with few large, prominent names and numerous smaller, independent retailers: Organized, modern retail accounts for only6%–8% of India’s total retail market, according to industry estimates. However, organized retail’s share in the clothing sector is higher, at approximately 30%, we estimate, based on company data from S&P Capital IQ.

According to brokerage firm Edelweiss Securities, branded apparel constituted some 35% of the total ready-made garments segment in India in 2014. Branded clothing sales totaled about $45 billion that year, the firm estimates, and it expects branded apparel to account for 46%–48% of the total ready-made garments segment by 2019.

2. Indian consumers are loyal to traditional dress: India comprises 29 states and seven union territories, almost all of which have a distinct identity exhibited through language, spiritual beliefs, and traditional dress. Some 42% of the Indian clothing market consists of ethnicwear, with the remaining distributed among tops, bottoms, apparel sets, and dresses, according to market research firm Intelligence Node.

3. The Indian clothing market focuses on women’s apparel: Also according to Intelligence Node, womenswear accounts for some 69% of the total apparel offering in India, while menswear represents 21% and childrenswear represents 9%. The remaining 1% comprises a unisex mix. In Western markets such as the US and the UK, roughly half of all clothing sales are in the womenswear segment.

4. Many of the larger players are owned by conglomerates: Most of the large homegrown retailers in India belong to conglomerates. One exception is Future Lifestyle Fashions, which began as a retail pureplay.

Despite Indians’ diverse cultures and loyalty to traditional dress, international brands have found an audience in the country’s youthful and evolving consumers. A relaxation in economic policy has significantly helped international brands enter and sell in India more easily.

Source: Global.marksandspencer.com

Economic Reforms Enable International Firms to Enter India

Between 1990 and 2004, the Indian economy was somewhat liberal and the government considered foreign investments on a case-by-case basis. But after 2004, the government slowly moved toward a highly protectionist stance, making it challenging for foreign firms to establish businesses in India and sell directly to the domestic market. As one of its first moves to open up the economy, the Indian government implemented a policy in 2006 that allowed FDI of up to 51% in single-brand retail, subject to government approval. So, retailers such as Gap and Zara, which sold only their own-brand products, were allowed to open stores in India in partnership with a local company, with a maximum ownership stake of 51%.

Source: iStockphoto

In 2012, the government removed this threshold and increased the permissible investment by a foreign entity in single-brand retail to 100%. Swedish fast-fashion retailer H&M became the first foreign apparel retailer to enter India independently through this route. In addition to removing the cap on single-brand retail investment in 2012, the government allowed FDI of up to 51% in multibrand retail (which includes department stores and supermarkets that stock and sell products of various brands), subject to government approval. In the figure below, we outline some of the major milestones marking the liberalization of India’s economy.

Source: TechSci Research/IBEF/Fung Global Retail & Technology

As a result of these liberalization measures, many international brands have now entered the Indian market through various routes.Entry Routes for Foreign Brands and Retailers in India

Due to restrictions on incorporating foreign companies in India, the government has established several routes through which international firms can trade in the country. Under the non-FDI route, there are two methods through which international retailers can sell goods in India, licensing and franchising. Licensing: Under this method, the owner of the brand (the licensor) leases the rights to use the brand name to the retailer (the licensee), allowing the retailer to stock and sell the branded merchandise. For example, the Lee Cooper brand, which belongs to the Iconix Brand Group (the licensor), is licensed to Future Lifestyle Fashions (the licensee) in India. PVH Corp. licenses the Calvin Klein and Tommy Hilfiger brands to Arvind Brands in India. Franchising: Similar to licensing, franchising allows a retailer (the franchisee) to use a brand’s (franchisor’s) intellectual property, as well as its business model, marketing strategy and distribution model, in order to sell the brand’s goods. In India, Arvind Brands owns the rights to sell merchandise belonging to American fast-fashion brand Forever 21online and offline through a franchise agreement. Under the FDI route, there are four methods through which international retailers can sell goods in India: JV, wholly owned subsidiary, limited liability partnership, and extension of the foreign entity via a liaison office, branch office or project office. JV: A JV is an enterprise in which two or more firms have pooled their capital and other resources. One of the most famous examples of an international retailer entering India through this route is British retailer M&S’s JV with Reliance Retail, part of Reliance Industries. M&S owns 51% of the JV, incorporated as Marks & Spencer Reliance India, while Reliance Retail owns the remainder. Wholly owned subsidiary: With this method, an organization (the parent or holding company) sets up a new company that is incorporated as a domestic business in India. The entire equity stake of the subsidiary is owned by the parent company. H&M was one of the first international retailers to enter India after the cap on FDI in single-brand retail was removed. The company created a wholly owned subsidiary called H&M Hennes & Mauritz Retail. Limited liability partnership: In this model, the partners of the firm have limited liabilities, i.e., one partner cannot be held responsible for another partner’s mismanagement of the company.

Source: iStockphoto

Extension of the foreign entity via a liaison office, branch office or project office: International companies can also set up an office in India that represents their interests under one of the above categories. The establishment of a liaison office, branch office or project office is subject to further rules laid out by the Indian government and central bank.Key International Brands in Indian Apparel Retail and Their Local Partners

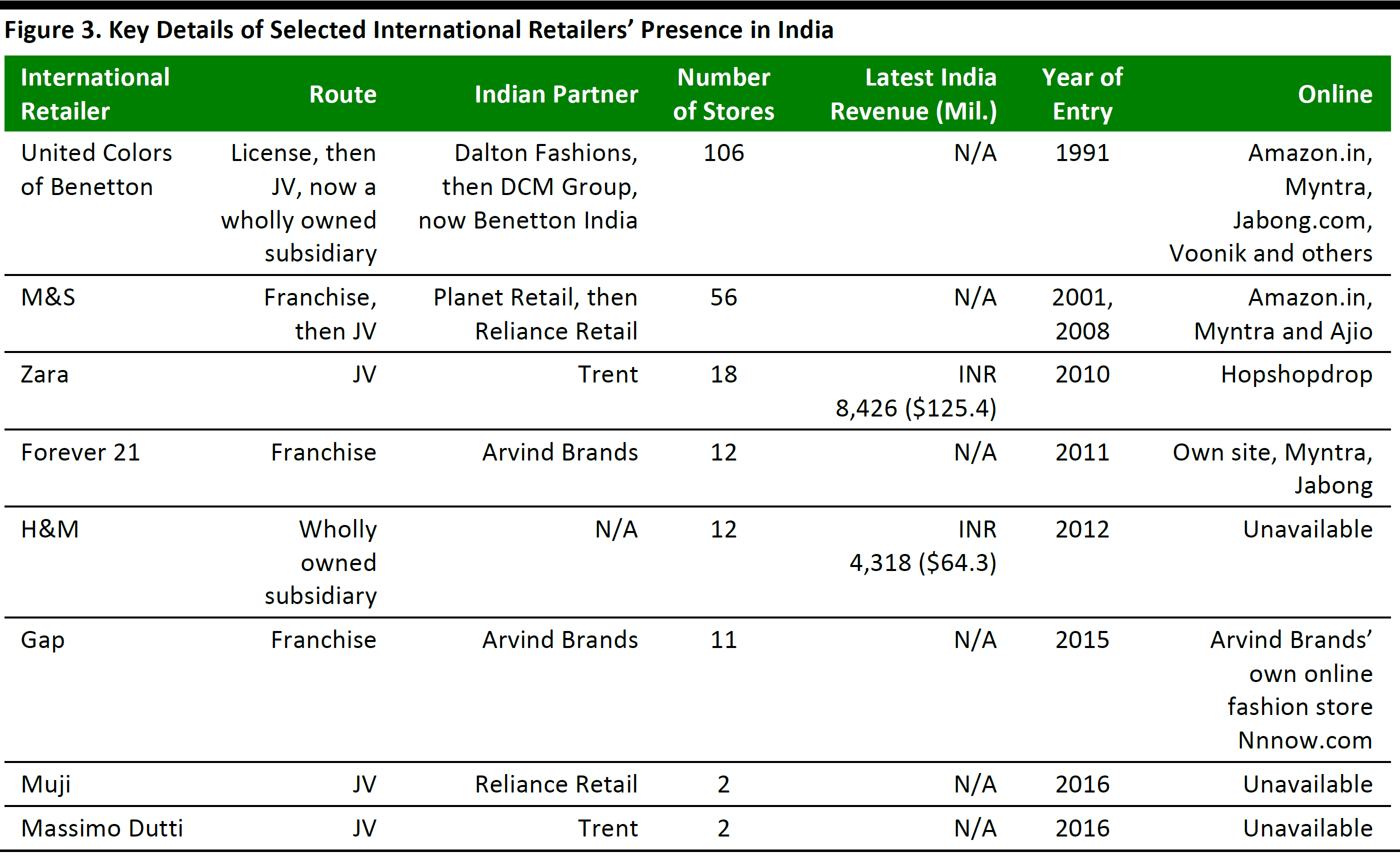

In this section, we discuss some of the major international apparel brands operating in India and the retailers that they have partnered with in order to sell in the country. Though fast fashion is a fairly new concept in India, it is quickly gaining traction, as brands such as Zara and H&M have been welcomed with much fanfare. In fact, when H&M opened its first store in India, at the Select Citywalk mall in New Delhi, the mall remained open all night before the opening to accommodate the enthusiastic shoppers and fans of the Swedish retailer who lined up to be the first to buy its clothes. Below, we list some of the key international apparel retailers in India and provide details about the route they have used to enter the country.

Source: Company reports/The Economic Times/Livemint.com

M&S first stepped into the country through a franchise in 2001; it later established a JV with Reliance Retail in 2008. The British retailer initially planned to open 50 stores over its first five years in India, and now has 56 stores in the country, the highest number outside the UK.M&S also sells online in India through its own site and through other e-commerce sites.

M&S first stepped into the country through a franchise in 2001; it later established a JV with Reliance Retail in 2008. The British retailer initially planned to open 50 stores over its first five years in India, and now has 56 stores in the country, the highest number outside the UK.M&S also sells online in India through its own site and through other e-commerce sites.

The JV route was the preferred option for international retailers that wanted to enter the Indian market from the time the Indian government instituted liberalization reforms until 2012, when the government removed the cap on single-brand retail investment. This allowed H&M to set up a wholly owned subsidiary in India. Despite entering India two years after Zara did, H&M has generated Indian revenues that have been about half those of Zara(H&M’s FY16 Indian revenues were $64.3 million versus Zara’s $125.4 million) and it has about a third the number of stores as Zara has in the country.

The JV route was the preferred option for international retailers that wanted to enter the Indian market from the time the Indian government instituted liberalization reforms until 2012, when the government removed the cap on single-brand retail investment. This allowed H&M to set up a wholly owned subsidiary in India. Despite entering India two years after Zara did, H&M has generated Indian revenues that have been about half those of Zara(H&M’s FY16 Indian revenues were $64.3 million versus Zara’s $125.4 million) and it has about a third the number of stores as Zara has in the country.

Gap, on the other hand, struggled in 2015, its first year of trading in India, as its sizes were slightly unsuitable for Indian body types and its price points were much higher than those of Zara due to its sourcing policy. It imported its products into India, transferring transport and tariff costs to the customer, unlike Zara, H&M and M&S, all of which source the majority of their products locally.Newspapers reported in January 2017 that, in order to boost its growth in India, Gap intends to slash its prices by some 10%–15% as it works to alter its sourcing policy. Gap and its Indian franchise partner, Arvind Brands, did not confirm the reports.

Gap, on the other hand, struggled in 2015, its first year of trading in India, as its sizes were slightly unsuitable for Indian body types and its price points were much higher than those of Zara due to its sourcing policy. It imported its products into India, transferring transport and tariff costs to the customer, unlike Zara, H&M and M&S, all of which source the majority of their products locally.Newspapers reported in January 2017 that, in order to boost its growth in India, Gap intends to slash its prices by some 10%–15% as it works to alter its sourcing policy. Gap and its Indian franchise partner, Arvind Brands, did not confirm the reports.

Others

Rising real estate prices and complicated entry regulations have led many brands to resort to the licensing and franchising routes, and we may see more brands choosing to enter the Indian market with these models instead of through the more tedious JV model. These routes have also been facilitated by the rise in e-commerce in India, and banners such as Dorothy Perkins and Miss Selfridges are serving customers in the country through fashion websites Jabong.com and Myntra.International Apparel Retailers Versus Homegrown Retailers: Our On-the-Ground Observations

Members of our UK team visited the stores of international retailers H&M, Zara, Forever 21, Muji and M&S, and domestic retailers Pantaloons and Reliance Trends in India. In this section, we share our observations and selected images. Layout and ambience: The international retailers’ stores in India are definitely smaller than their stores in the UK,but the décor, themes and ambience are similar. Common features among the international retailers’ stores,which set them apart from the domestic retailers’ locations,include an easy-to-navigate layout and the presence of clear, open spaces, such as in H&M, pictured below. Parts of the Pantaloons and Reliance Trends stores we visited felt very spacious, but the peripheral areas with merchandise displays felt somewhat crowded:display stands were squeezed close to the wall displays, and there was little space to navigate around them.

H&M store in Bangalore (left) and Reliance Trends store in Mangalore (right) Source: Fung Global Retail & Technology

Assortment: Both the Indian and international apparel stores we visited had wide assortments. The Indian retailers had a good mix of ethnic clothing displayed alongside nontraditional wear, and the merchandise was definitely more colorful than what we saw at Zara, H&M and M&S. While there was a wide variety of clothing on offer at the Indian retailers, the items tended to be stacked up according to type for most brands. For example, we saw branded shirts stacked up or displayed together, while pants and other coordinates were displayed elsewhere. At Zara, H&M and M&S, however, the main pieces were interspersed with the appropriate coordinates, such as shoes and hats, and pants were paired with shirts or tops, thus increasing cross-selling opportunities.

H&M store in Bangalore (left), Zara store in Bangalore (right) Source: Fung Global Retail & Technology

Pantaloons store in Mangalore Source: Fung Global Retail & Technology

Price points: Prices at the international retailers’ stores we visited were slightly higher than those at the domestic retailers’ stores. For example, Pantaloons was selling three women’s T-shirts with prints on them for INR 799 ($12) and women’s printed tops for INR 599–INR 699 ($9–$11). Men’s jeans at Pantaloons started at around INR 900 ($14). At H&M, women’s plain and basic T-shirts were selling at INR 699($11) and men’s jeans were priced at INR 1,799–INR 3,999 ($28–$61).

Shirts at Pantaloons in Mangalore Source: Fung Global Retail & Technology

Staff and customer service: We noticed many more staff at the Pantaloons and Reliance Trends stores we visited than at the international retailers’ stores. Staff at H&M, Forever 21 and Zara politely acknowledged our presence, but let us navigate through the stores on our own unless we requested help. Staff at the domestic retailers acknowledged us as we entered the stores and then tended to be either disinterested or highly enthusiastic as we browsed.

Shirts and jeans at H&M in Bangalore Source: Fung Global Retail & Technology

Store traffic: Traffic at Pantaloons and Reliance Trends stores was certainly higher than at the international retailers’ stores we visited. This was in part due to the timing of our visits, as we visited the international retailers’ stores on a late Friday afternoon and evening, and the domestic retailers’ stores on a late Monday afternoon and evening. But, generally,the domestic retailers’ stores were busier, as the international brands cater to a slightly more affluent group of shoppers in larger cities.

Entrances to the Forever 21 store in Bangalore (left) and the Reliance Trends store in Mangalore (right) Source: Fung Global Retail & Technology

Lack of in-store technology: Many retail stores in the US and the UK have elements of technology spread around the space that are designed to help customers along their shopping journey. One is likely to find“endless aisle” kiosks or store staff with tablets, for example. In India, however, there was a noticeable absence of technology in nearly all the stores we visited, except for Muji, which used limited technology to provide customers with product information. We saw no technology that enabled in-store online shopping at the stores we visited.

Monitor displaying product information for socks at the Muji store in Bangalore Source: Fung Global Retail & Technology

We have uploaded more photos from our store visits in India to the Fung Global Retail & Technology Facebook gallery, which can be found here.Socioeconomic Factors that Make India an Attractive Destination for International Retailers

There are many factors that make India a sought-after market for foreign retailers. Western apparel retailers have seen declining demand on their home turf in recent years, due to the highly competitive, low-growth nature of many developed markets. So, they have been looking eastward for opportunities in emerging markets that are poised for growth. In this section, we outline some of India’s unique socioeconomic factors that make it the next high-growth target destination for many international retailers.A Large, Youthful Population in Tune with Global Trends

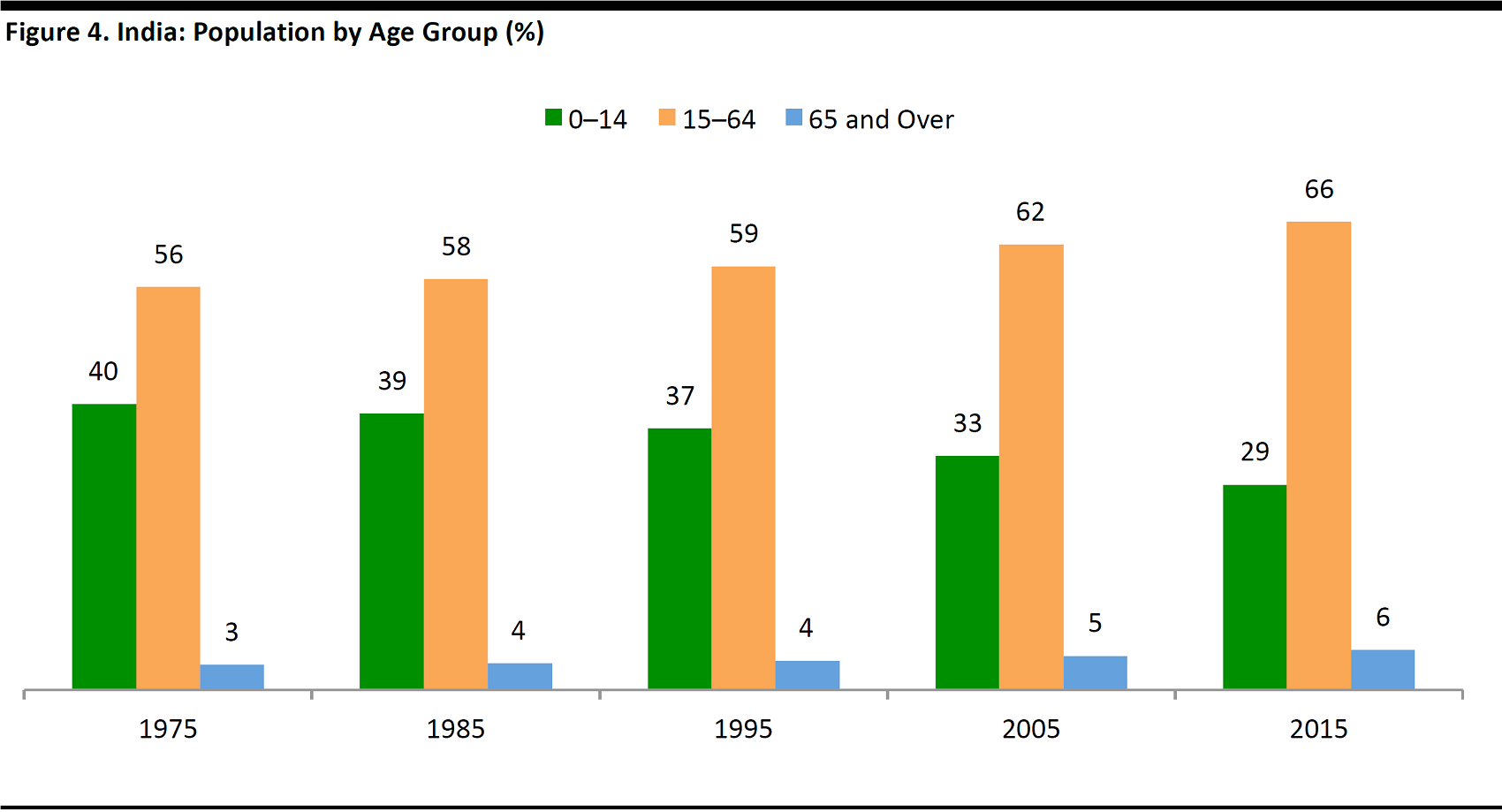

India’s population is young. According to the World Bank, 66% of Indians were ages 15–64 in 2015, and the majority of that group was below the age of 35. The 15–64 age group has grown faster in the last decade than it has in any other decade since 1975. And there is a growing preference for international brands and Western apparel among this age group, which is becoming increasingly globally connected through social media platforms.

Source: World Bank

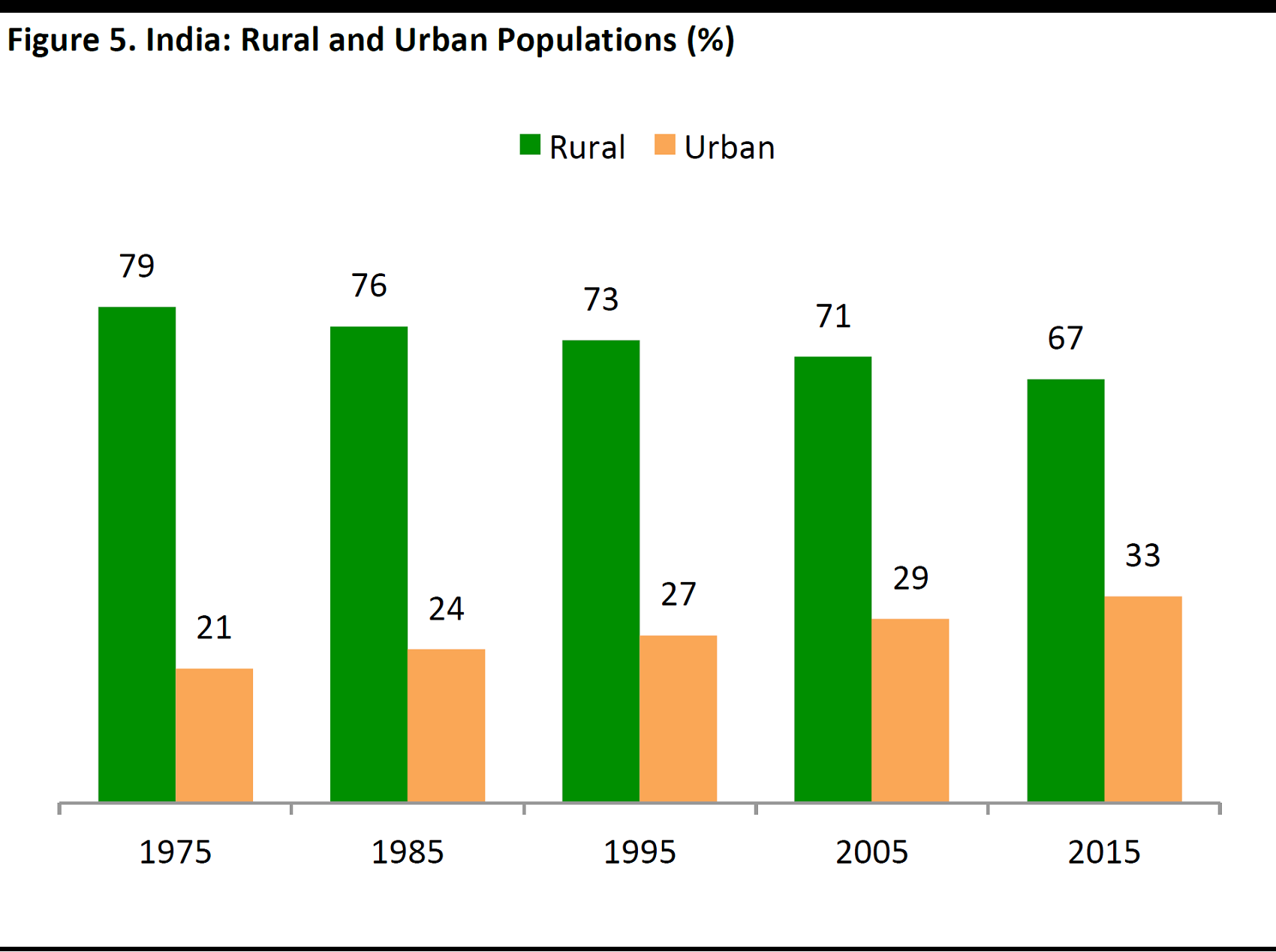

Population Migration from Rural to Urban Areas

Some 67% of people in India lived in rural parts of the country in 2015, according to the World Bank, but the urban population has been expanding faster in the last decade than it did in previous decades. This has led to broader knowledge and acceptance of other cultures, both within the country and outside the country, a less conservative social mindset and more consumers aspiring to modern lifestyles.

Source: World Bank

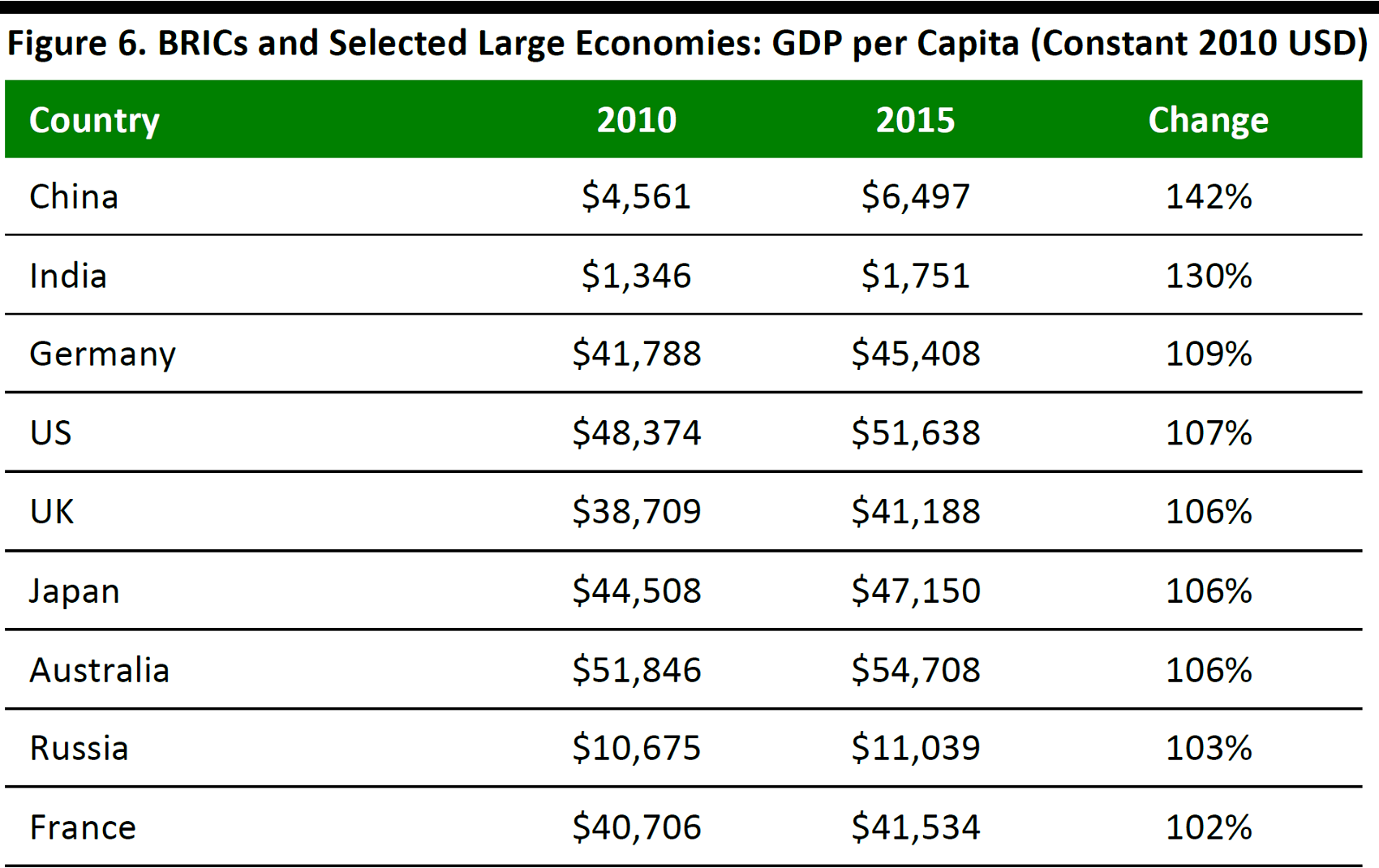

Extreme Growth in GDP per Capita

In absolute value terms, GDP per capita in India is one of the lowest among both the BRIC countries and the largest global economies, which is indicative of a lower standard of living. However, India showed the second-strongest growth in GDP per capita among selected countries between 2010 and 2015, after China.

Source: World Bank

Proximity to Source, as India Is a Textile Manufacturing Hub

India is also appealing to international retailers because it is a textile and apparel-manufacturing hub that provides a faster and more economical route to the source of production. India is the largest cotton and jute producer in the world, and the second-largest textile fiber producer. It also has the second-largest textile-manufacturing capacity globally, and accounts for 5% of world trade in textiles and apparel, according to Make in India, an initiative launched in 2014 to transform India into a global design and manufacturing hub.

Source: iStockphoto

Many of the international brands operating in India already source products from the country to sell in their stores across the globe. Shipping and distribution account for a significant proportion of the cost of goods, but retailers that source locally in India save on those costs while selling to the domestic market. Under the Make in India campaign, the government provides several incentives for textile and apparel manufacturers in India. The government has also established Special Economic Zones and National Investment and Manufacturing Zones, where manufacturers can set up production facilities at subsidized rates.Five Remaining Challenges International Retailers Face

While India is on a strong growth trajectory, and has many socioeconomic features and policies that are favorable to foreign retailers that enter the country, a number of challenges still exist. International retailers that wish to operate in India must still meet FDI requirements and deal with low apparel consumption rates, a lack of infrastructure, a potential loss of autonomy over business decision making and cultural factors that are unique to the country.1. FDI Regime Comes with Conditions

Despite the relaxation in regulations regarding investment in and ownership of international brands’ operations, the Indian government has levied many conditions that make entry into India a difficult process for retailers. We outline the conditions in the figure below.

Source: Department of Industrial Policy & Promotion/Wazir Advisors

2. PerCapita Apparel Consumption Is Still Low in India

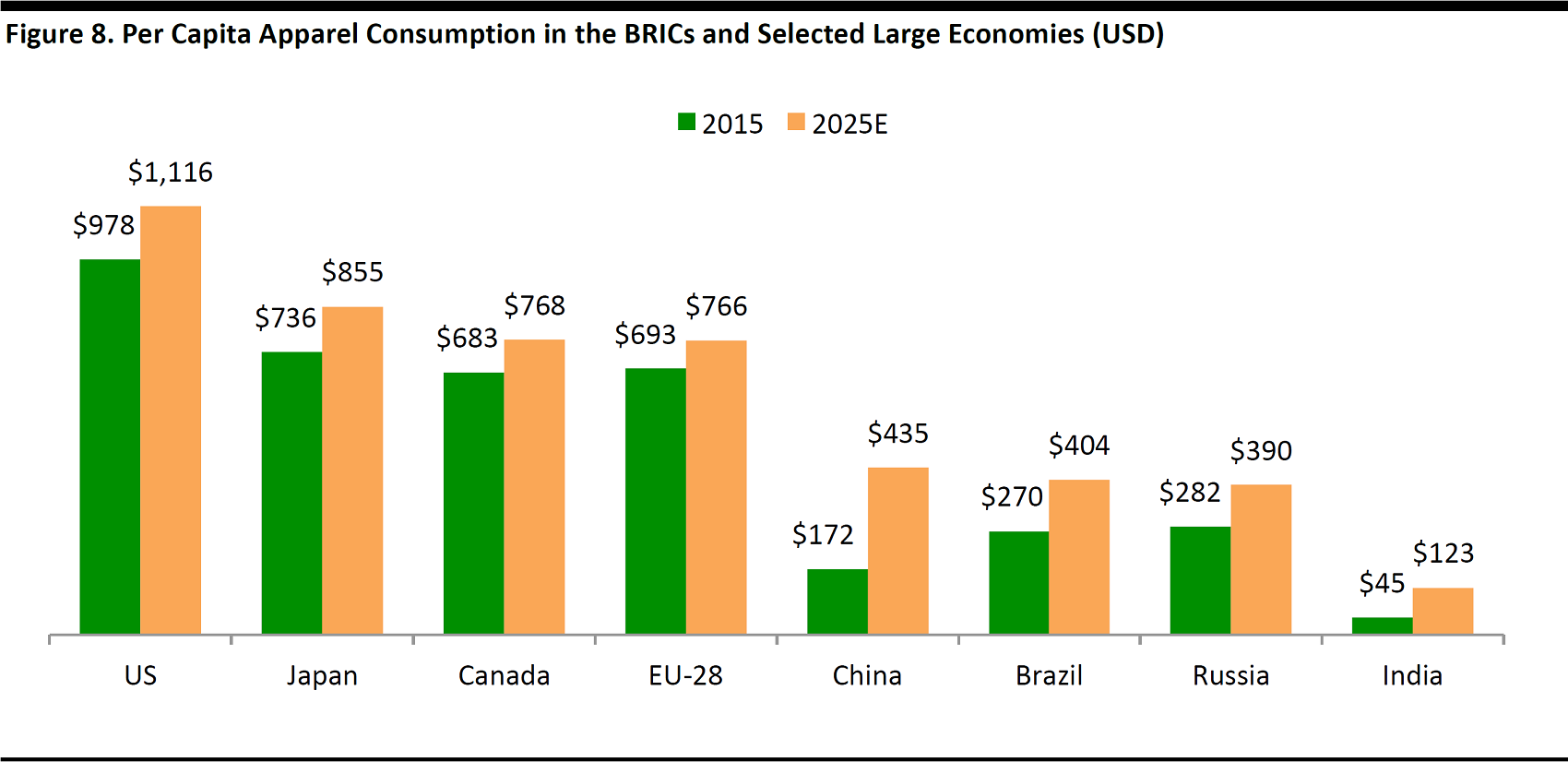

Compared with the other BRIC nations and some of the largest global economies, percapita apparel consumption is still very low in India. Indian retail consultancy Wazir Advisors estimates that apparel consumption percapita in India will increase from $45 in 2015to $123 in 2025. That means it will still be lower in 2025 than it was in 2015in the other BRIC nations and many of the world’s large developed economies, as illustrated below.

Source: Wazir Advisors

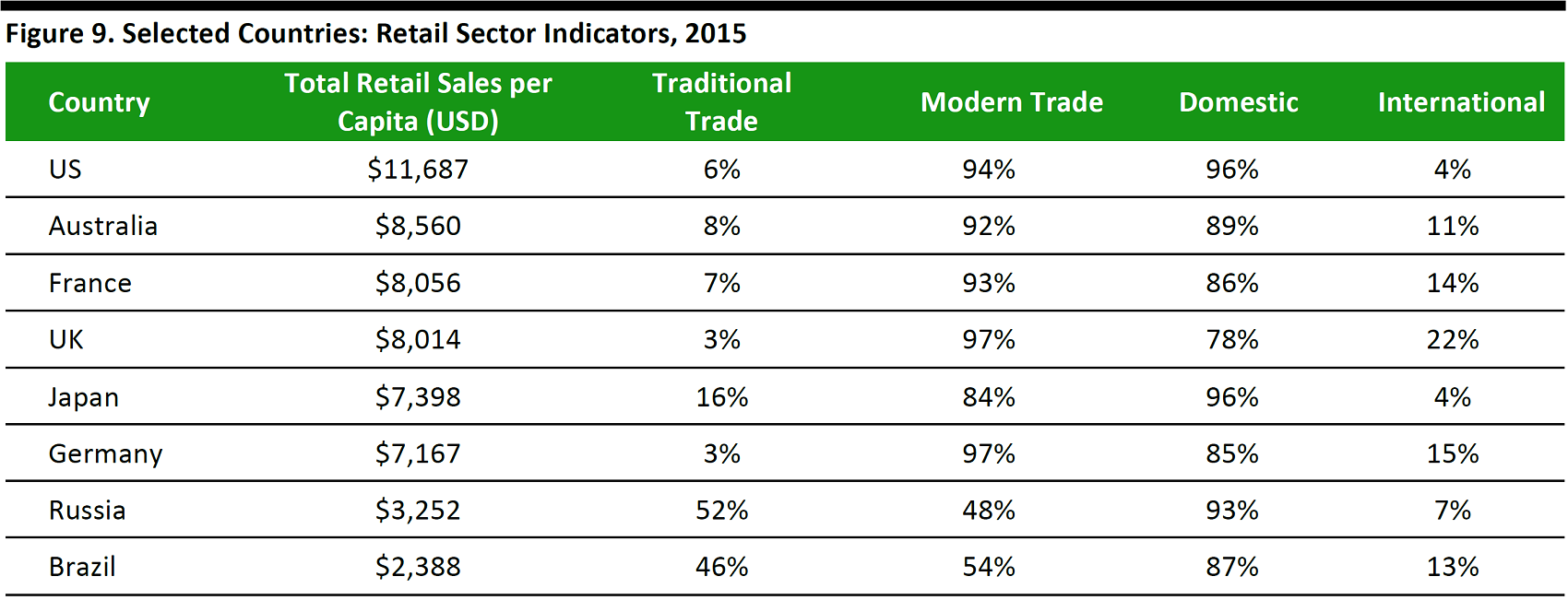

3. Lack of Infrastructure

Despite the size and economic growth of India, mall and modern store penetration is still low in the country. Various estimates suggest that organized retail (modern trade) constitutes only 6%–8% of total retail in India. Sales per capita made through modern retail formats totaled just $793 in India in 2015, while those same sales in each of the other BRIC nations totaled at least a few thousand dollars. Among the countries listed in the table below, India ranks the lowest in terms of modernization of the retail industry (as represented by e-commerce), shop units and shopping malls (compared with bazaars and markets in traditional trade), and international trade.