Executive Summary

Direct selling refers to products or services which are sold directly to consumers by independent sales representatives, eliminating middlemen such as wholesalers and retailers. It is a major global retail channel worth US$134.2 billion in 2016, a 2.8% increase from the previous year.

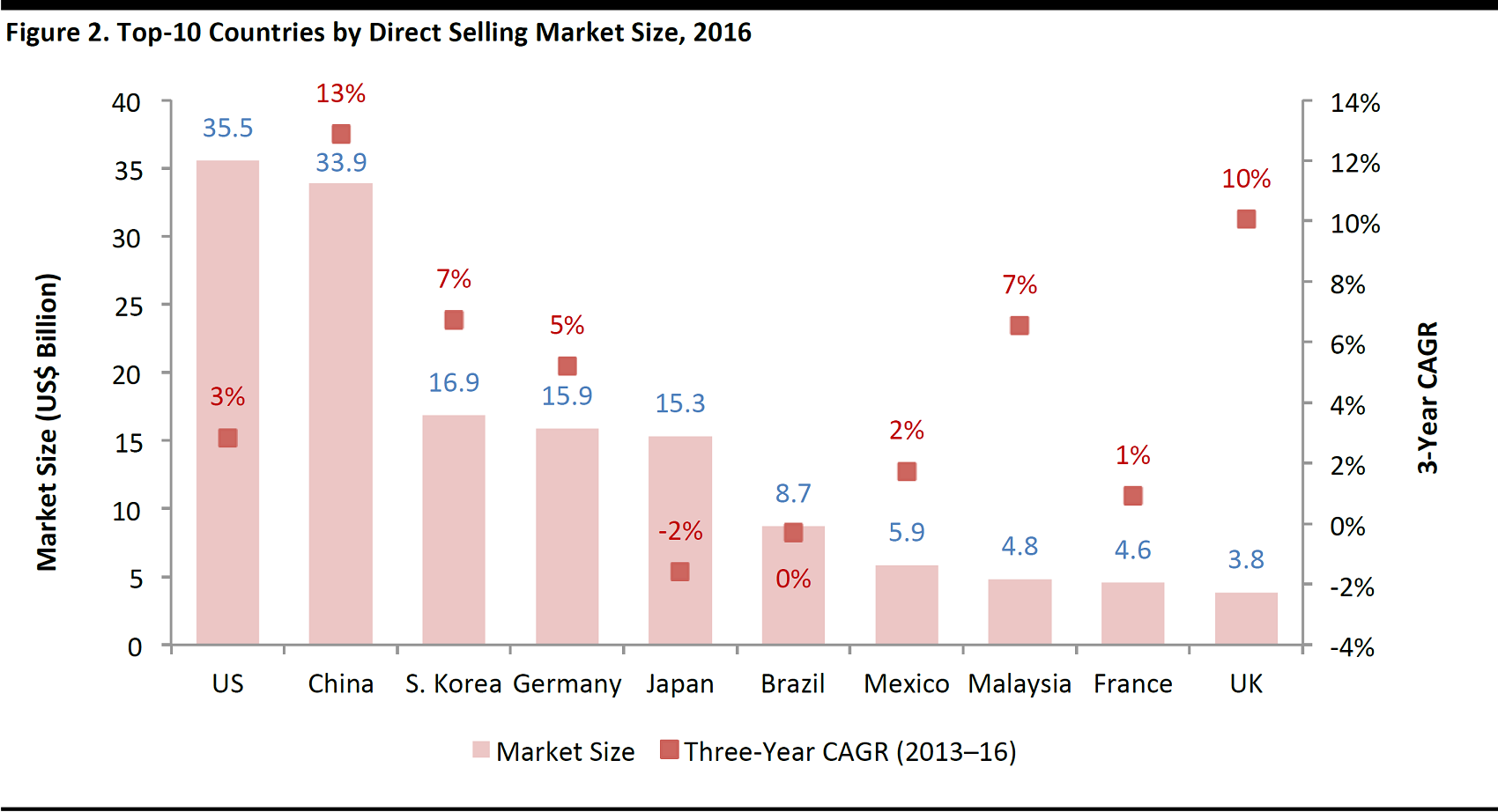

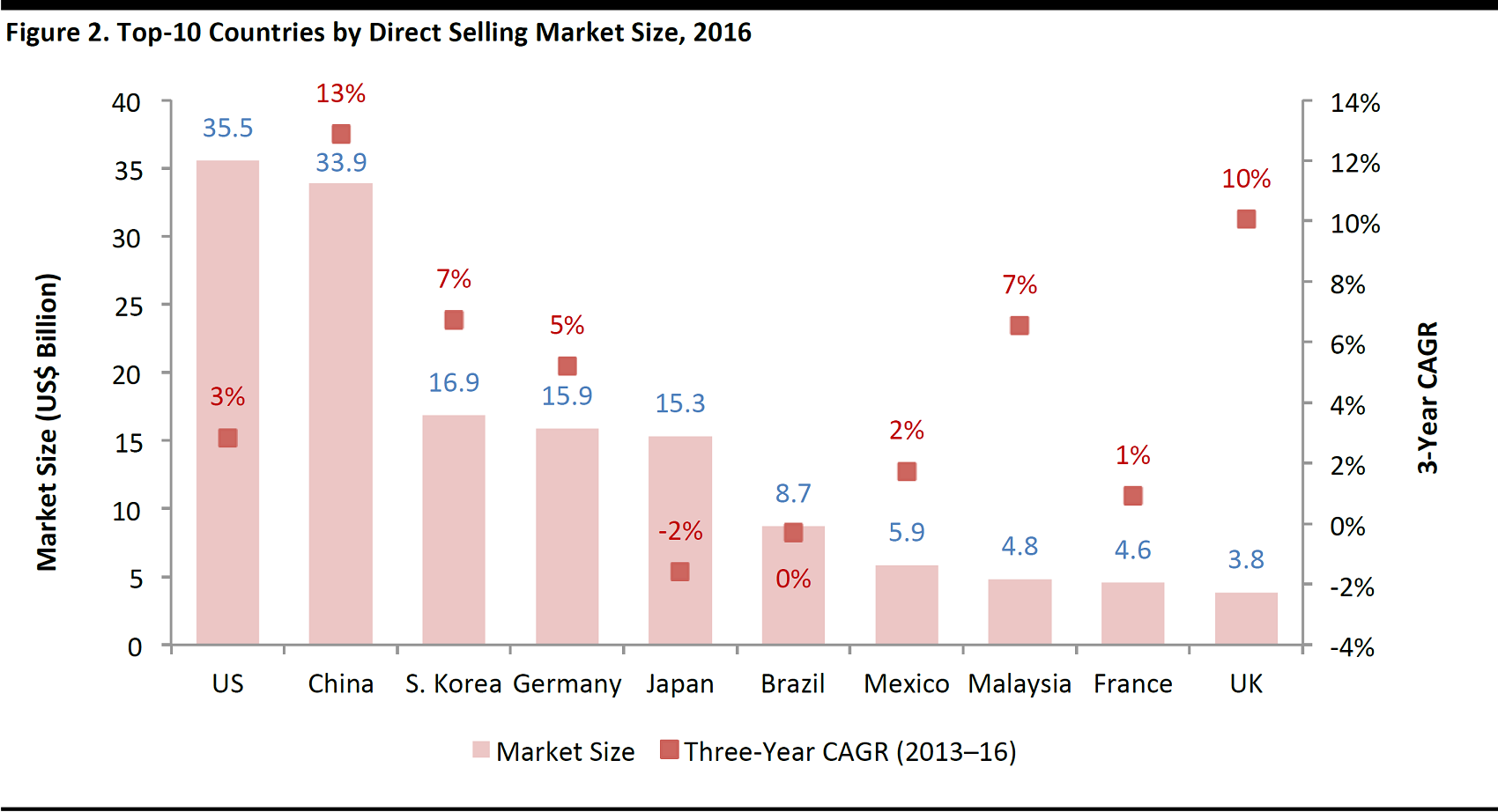

The US is the largest direct selling market, valued at US$35.5 billion in 2016, with China trailing close behind, at US$33.9 billion, according to the World Federation of Direct Selling Associations (WFDSA). Growing at an estimated three-year compound annual growth rate (CAGR) of 13%, China is expected to overtake the US as the largest direct selling market in the next few years, according to Direct Selling News.

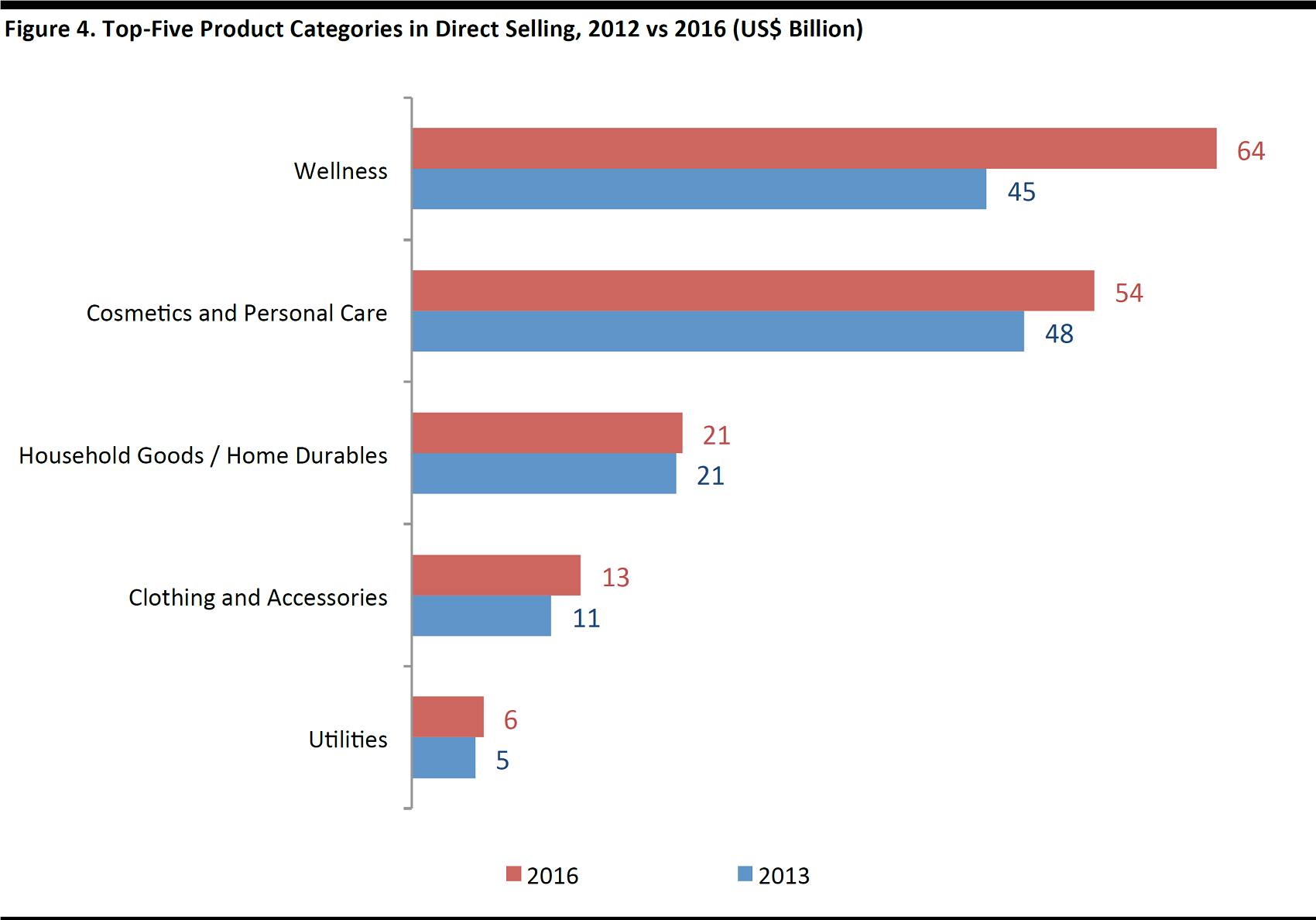

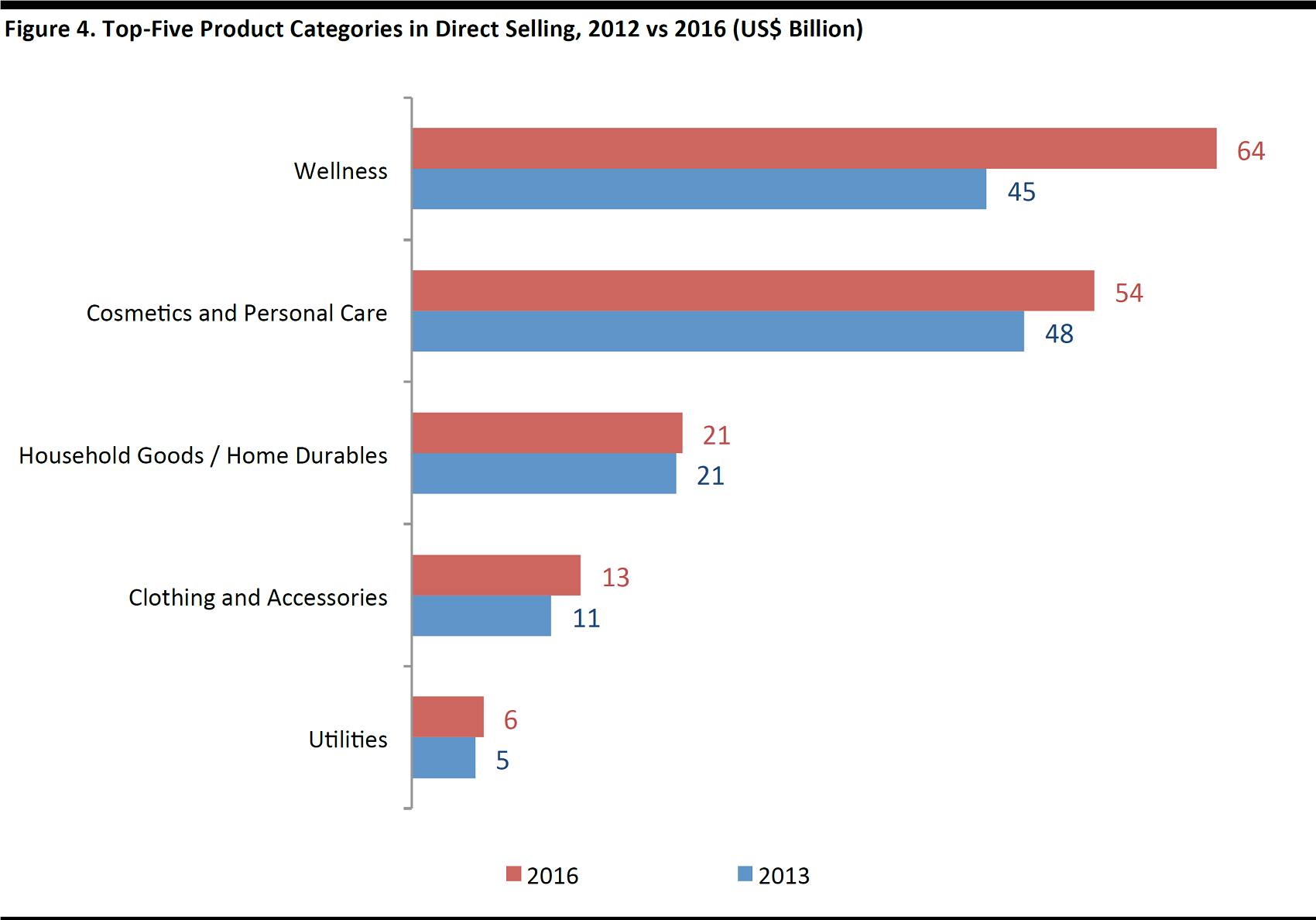

Wellness is the largest product category in direct selling, generating US$63.5 billion in revenues in 2016, up 40.1% from 2013. Cosmetics and personal care follows as the second-largest product category, valued at US$48.3 billion in 2016. The success of direct selling in these two categories can largely be attributed to the personalized service provided by sales representatives.

Even though direct selling is growing globally in absolute terms, direct selling companies are facing digital-age challenges similar to those faced by traditional store-based retailers: consumers are shifting more of their purchases online and technological innovations have enabled brands and retailers to provide more personalized services over the Internet. Furthermore, direct selling companies are also facing the challenge of recruiting sales representatives, as technology and the sharing economy have brought about alternative ways to earn supplemental income.

Despite these challenges, some direct selling companies have enjoyed unparalleled growth in recent years, as they have leveraged digital tools to increase operational efficiency and to broaden their reach to potential customers.

Source: iStockphoto

Market Overview

Direct selling refers to products or services which are sold directly to consumers by independent sales representatives, eliminating middlemen such as wholesalers and retailers. This business model originated in the US in the 18th century and has become a major retail channel.

Source: iStockphoto

The global direct selling market peaked at US$140.1 billion in 2013, then experienced a drop for two consecutive years in 2014–2015, shrinking to US$130.6 billion in 2015, down 6.8% from 2013.

The market then rebounded to US$134.2 billion in 2016, and is expected to experience a resurgence over the next few years to reach US$163.1 billion by 2020 with a CAGR of 4.9%, according to Euromonitor.

Source: Euromonitor International

China on Track to Become the Largest Direct Selling Market

US: The US is the largest direct selling market in the world, valued at US$35.5 billion in 2016, according to the WFDSA. The top-three direct selling companies globally—Amway, Avon and Herbalife—were all founded there. The US also has the largest number of sellers—20.5 million in 2016.

China: Close behind in second place is China, valued at US$33.9 billion. According to a report by Direct Selling News, the explosive growth in China’s direct selling market can be attributed to the Chinese government’s approval of more licenses for direct selling companies. Growing at an estimated three-year CAGR of 13%, the country is expected to overtake the US as the largest direct selling market within the next few years.

South Korea: Valued at US$16.9 billion in 2016 and with a three-year CAGR of 6.7%, South Korea is the third-largest direct selling market. Direct selling is one of the major distribution channels for consumer health products in South Korea, accounting for 34.4% of the retail value share in 2015, according to Euromonitor International.

Source: iStockphoto

Source: World Federation of Direct Selling Associations

Top Direct Selling Companies Face Declining Revenues

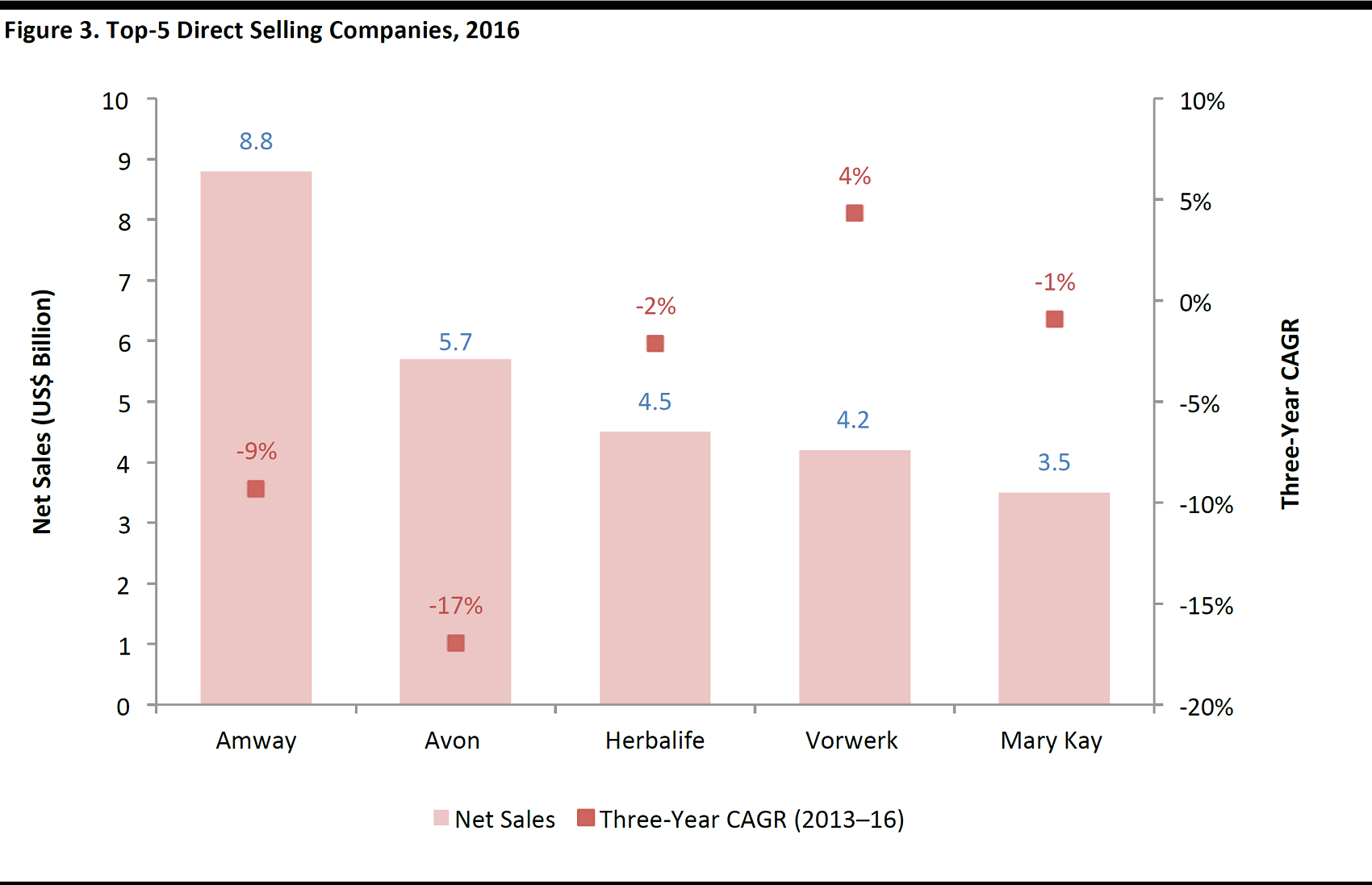

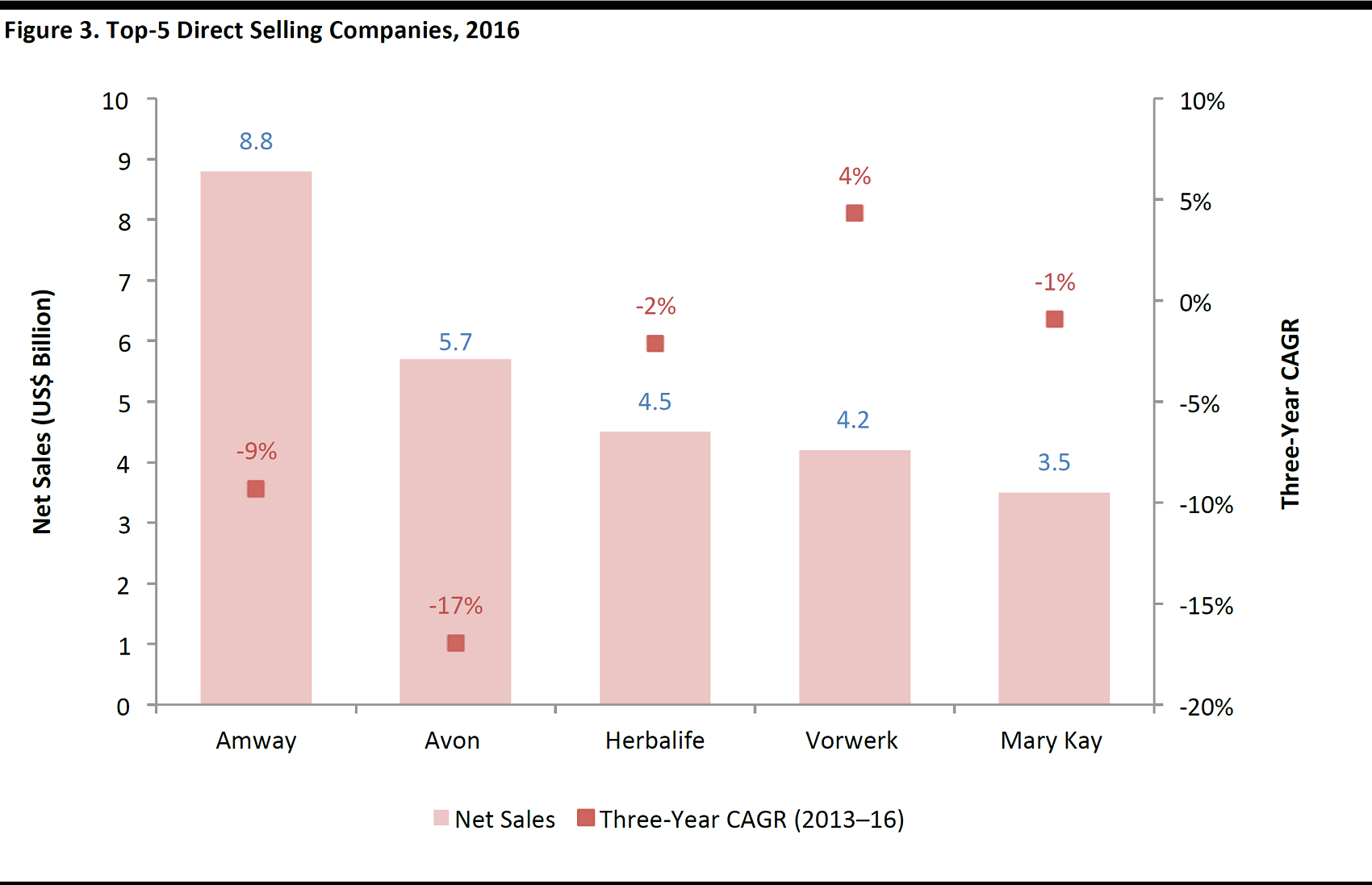

Amway: Founded in 1959 by Jay Van Andel and Richard DeVos, Amway is the world’s largest direct selling company by revenues, recording US$8.8 billion in 2016. The company sells a wide range of products including wellness, beauty and home care products.

Source: amway.com

Avon: Founded in 1886, and one of the oldest companies in the industry, Avon is the second-largest direct selling company in the world. It reported net sales of US$5.7 billion in 2016. In 2016, Avon sold its US business to Cerberus, and has since moved its headquarters to the UK. The company offers products in the beauty, household and personal care categories.

Source: avon.com

Herbalife: Herbalife focuses on the wellness category, selling nutrition supplements, weight-management, sports-nutrition and personal-care products. The company was founded in 1980, with a relatively shorter history among the top-five direct selling companies.

Source: herbalife.com

The ranking of the top-five direct selling companies has remained unchanged in the past three years. However, four of these companies have suffered a drop in revenues, registering a negative CAGR between 2013 and 2016.

Source: Direct Selling News

Wellness Overtakes Cosmetics and Personal Care as the Largest Category

Wellness: Wellness is the largest direct selling category, generating US$63.5 billion in 2016, up 40.1% from 2013. Fundamental drivers such as the aging of the population in major developed markets and increasing awareness of health and wellness among consumers have underpinned the explosive growth in this category.

As noted by Paul Pilzer, an American economist, the direct selling channel is well suited to wellness products, due to the person-to-person nature of the channel. Unlike a car or clothing salesperson, the wellness sales representative is an experienced user of the product, serving as a wellness advisor to the consumer. In addition, satisfied consumers also have the incentive to introduce the products to others, as they can easily enroll as sales representatives, themselves.

Cosmetics and personal care: Valued at US$48.3 billion in 2016, and up 11.4% from 2013, cosmetics and personal care is the second-largest direct selling category globally. Despite the double-digit growth, it has fallen from the top spot and been overtaken by wellness, when compared with 2013.

Household goods and home durables: The third-largest category, valued at US$21.4 billion in 2016, is household goods and home durables. Home products have the lowest growth among the top-five product categories, up only 2.3% from 2013.

Source: World Federation of Direct Selling Associations

Challenges Faced by Direct Sellers in the Digital Age

Competition for Consumers

Although direct selling and traditional store-based retailing operate different business models, they are both facing the challenges posed by Internet retailing in the past decade, as consumers increasingly shift their purchases online.

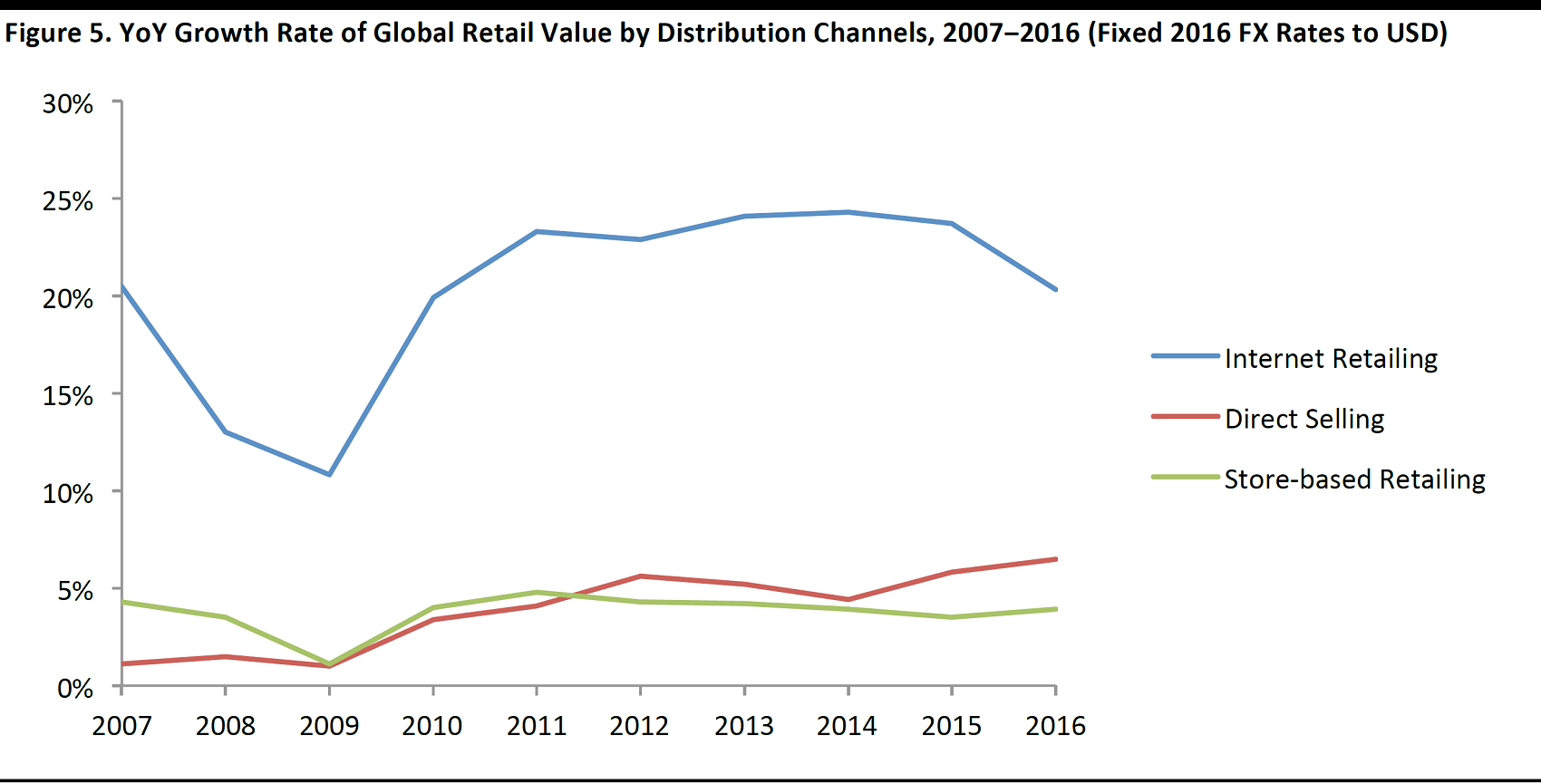

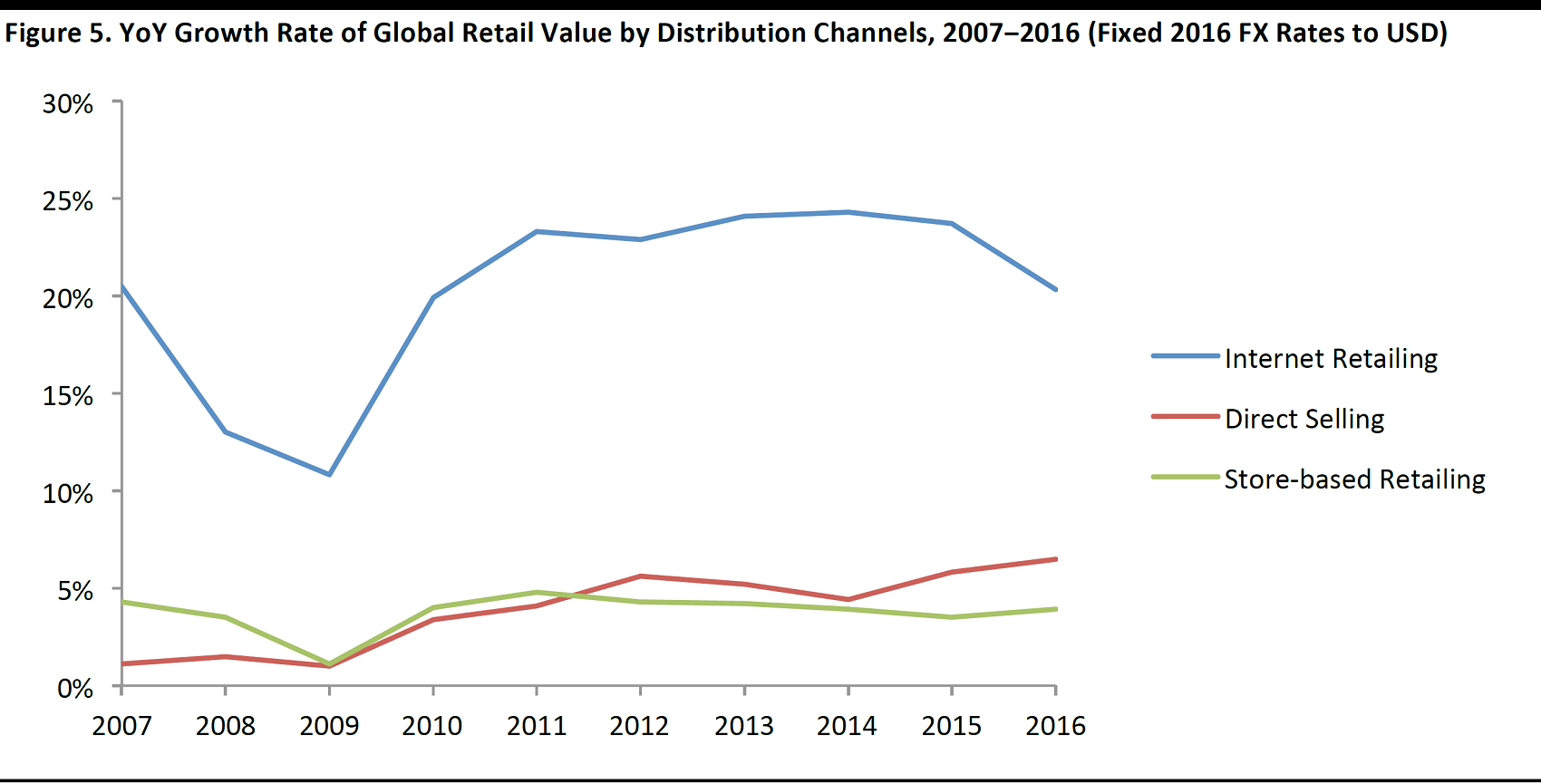

According to Euromonitor, year-over-year growth of Internet retailing has outpaced that of both direct selling and store-based retailing for 10 consecutive years. In 2016, direct selling and store-based retailing registered year-over-year growth of 6.5% and 3.9%, respectively, while Internet retailing grew at 15.1% year over year.

Source: Euromonitor International

Competition for Workforce

Apart from customers, direct selling companies also face the challenge of recruiting sales representatives in the digital age, as technology has brought about alternative ways for people to earn a supplemental income.

Direct selling companies offer the opportunity to start a business without heavy initial investment, such as renting a store and hiring staff, with a curated range of products. However, it is now possible to do so on an e-commerce platform such as eBay, or even social media networks such as Instagram. Apart from the greater flexibility in choice of products to sell, selling online also provides a wider reach to potential customers, without the geographical boundaries.

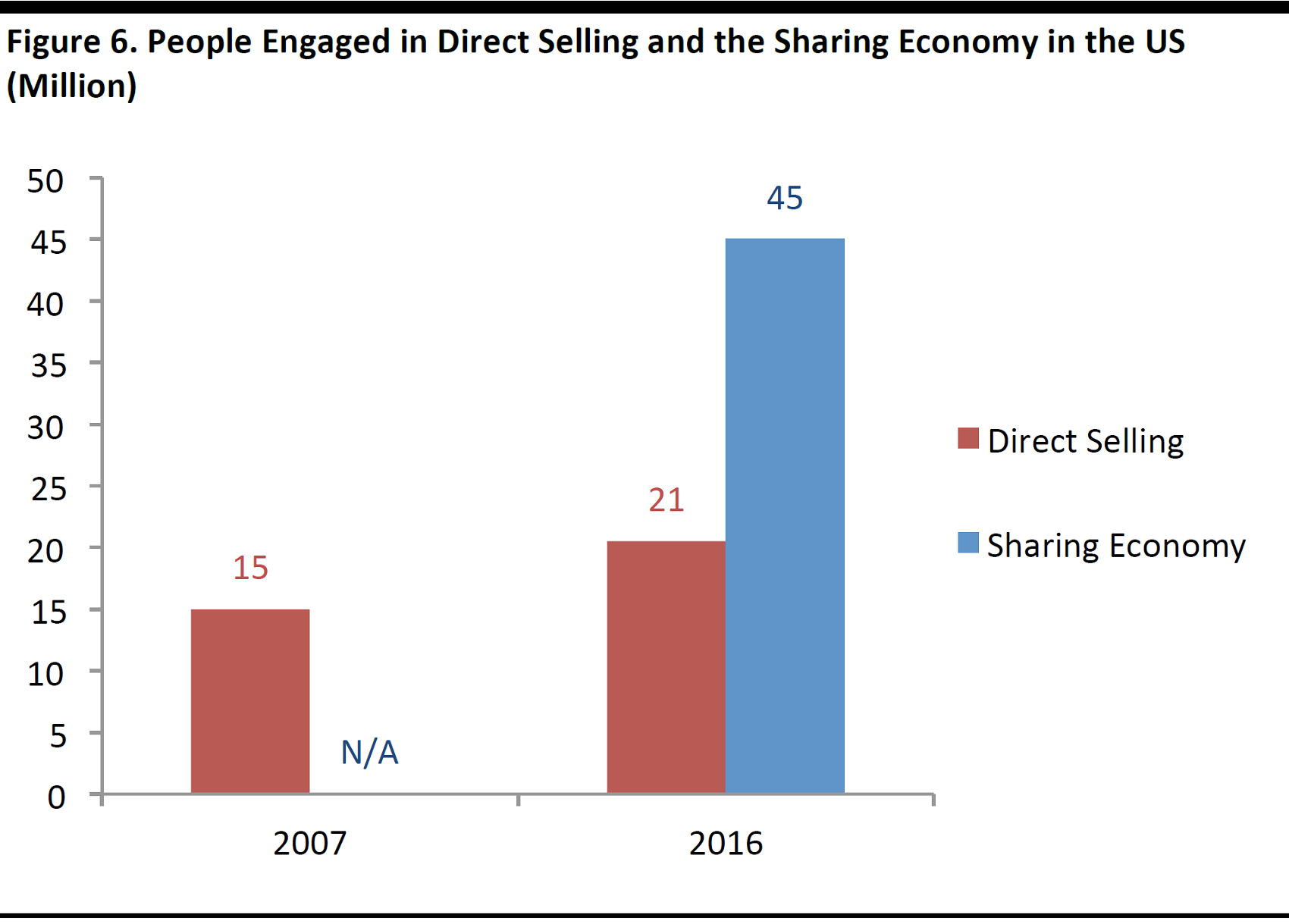

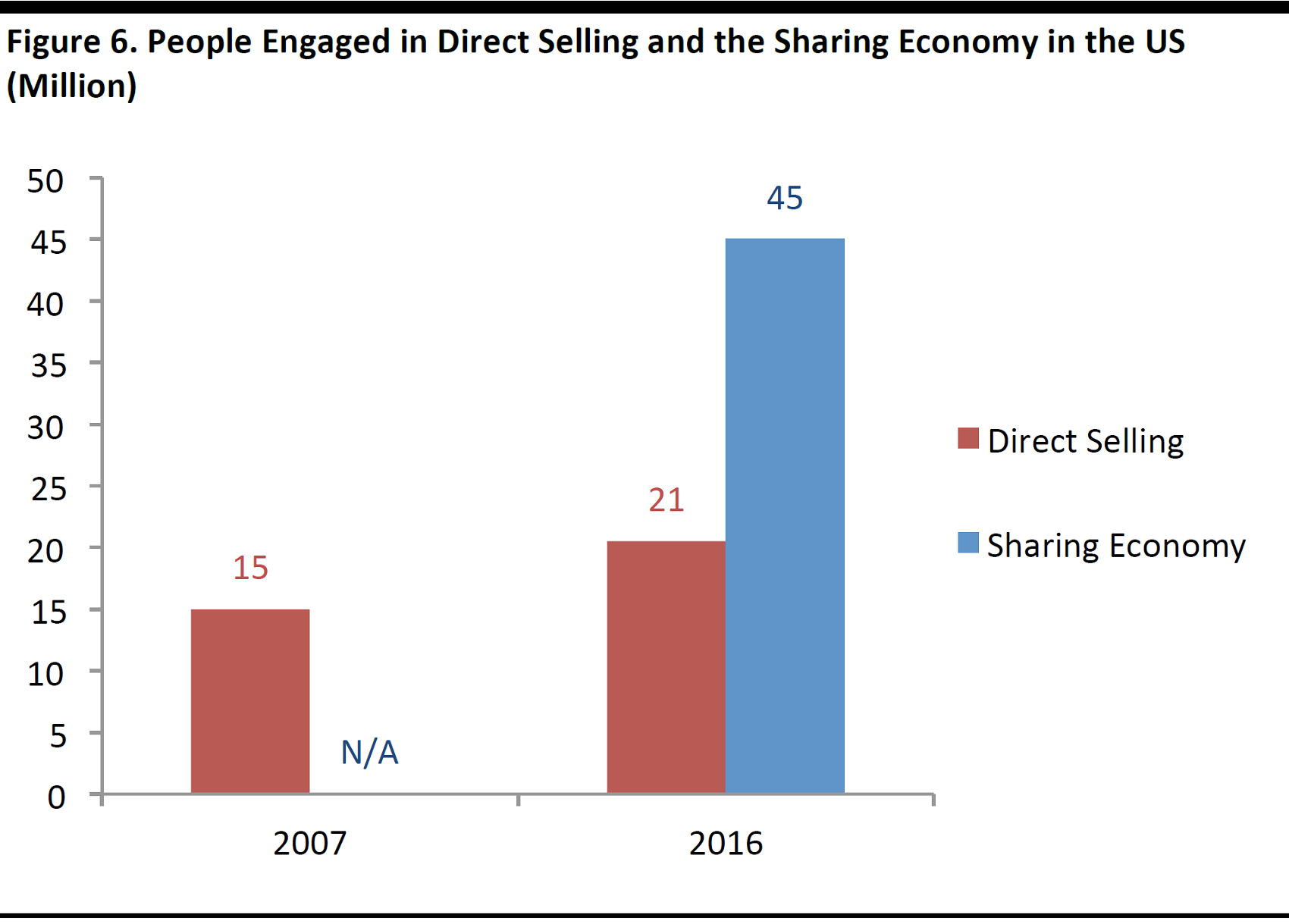

In addition, the sharing economy has brought about more ways to earn a part-time income. According to a poll conducted by Penn Schoen Berland in 2016, it is estimated that 45 million people in the US are participating in the sharing economy by offering goods or services. This figure has surpassed the number of direct sellers in the US, which stood at 21 million in 2016, according to the WFDSA.

Source: Direct Selling News

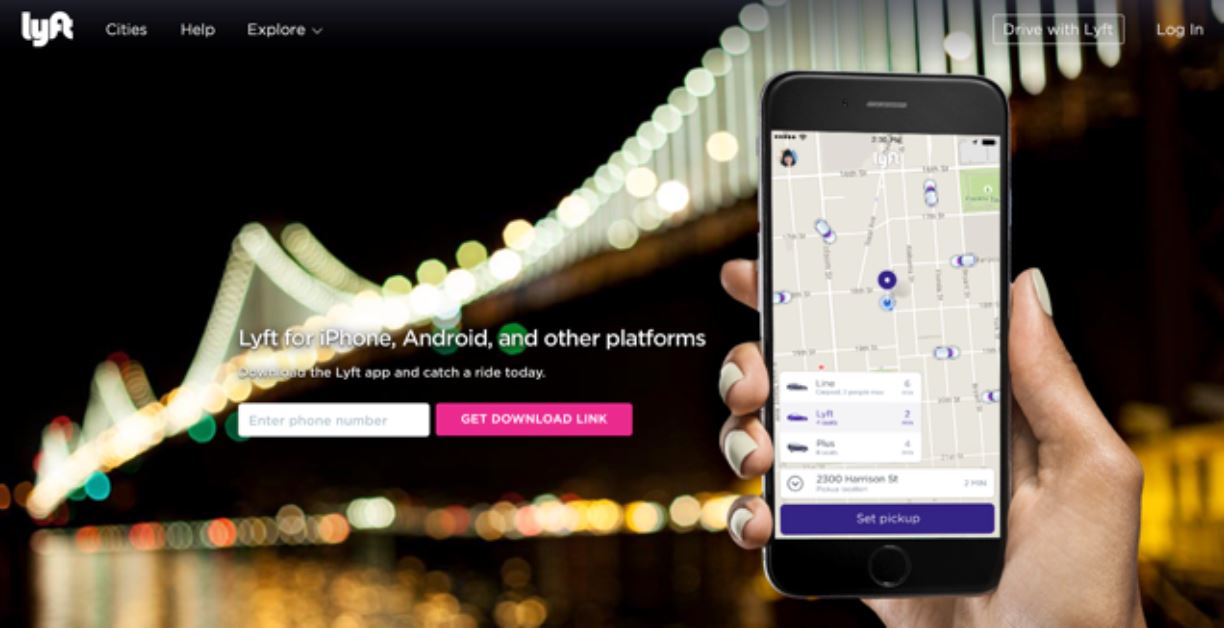

For example, apps such as Uber and Lyft have enabled private car drivers to use their private car to earn extra income, and companies such as Instacart employ thousands of personal grocery shoppers. Compared with direct selling, which requires business skills and a commitment to develop a customer base, the sharing economy appeals to those who do not wish to make such a commitment.

Source: lyft.com/app-sms

The Rise of Influencers and Key Opinion Leaders

In the digital age, the rise of influencers, or key opinion leaders (KOL) as they are called in China, has been dramatic. Influencers gain popularity on social media, which they monetize by advertising and selling products.

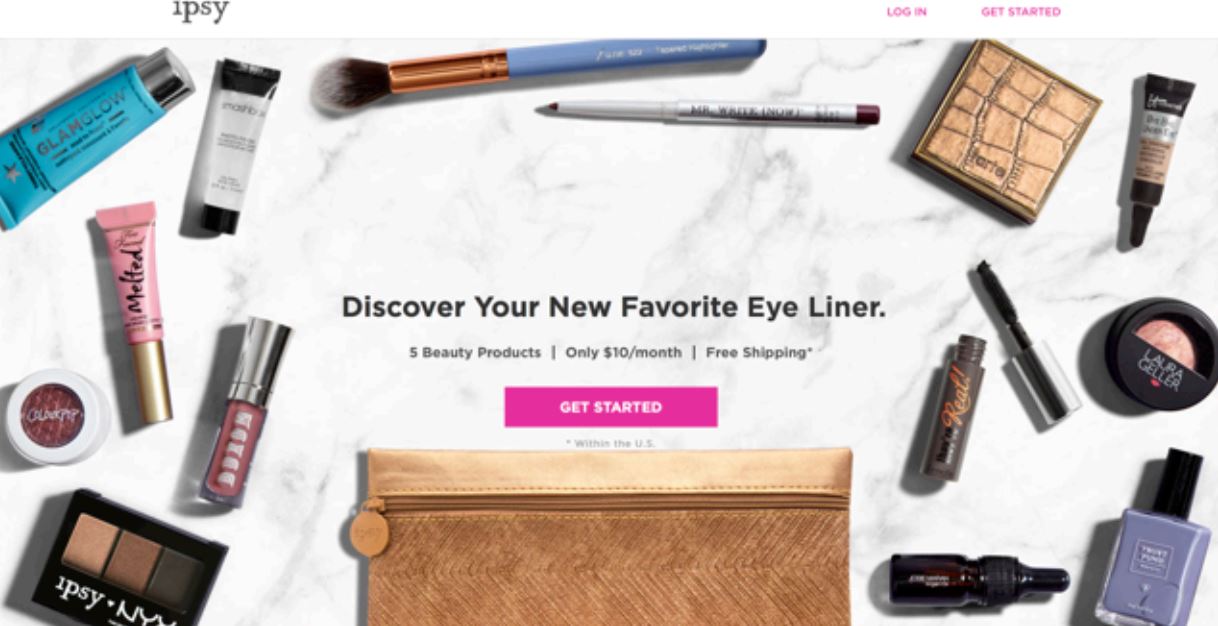

Some KOLs have even launched their own brands. For instance, in the US, Michelle Phan, a video blogger with over 8 million subscribers on YouTube, launched her own beauty subscription box company Ipsy in 2011. Ipsy charges a monthly subscription fee to deliver a bag of five cosmetic samples to subscribers, which helps consumers to discover new products at a reasonable cost. The company gained popularity among social media as video bloggers posted videos and shared their experience of unboxing the

beauty products.

Source: ipsy.com

In China, we are seeing wanghong (online celebrities or cewebrities) setting up their own stores on e-commerce platforms. For example, among the top 10 womenswear Taobao stores launched in 2016, half of them were launched by fashion cewebrities. According to CBN Data, the e-commerce market size of online celebrities reached $8.6 billion in 2016.

In the long term, the rise of KOLs may disrupt the traditional person-to person distribution approach used by direct sellers, as more consumers are relying on social media to shop. Indeed, a study by igCommerce in 2017 shows that 23% of US shoppers are influenced by social media recommendations or reviews. In addition, the study shows that 51% of millennials are likely to make a purchase over social media, higher than baby boomers at 14%.

Erosion of Competitive Advantages

Direct selling companies leverage their network of sales representatives to engage with their customers directly, providing personalized services and product recommendations according to each individual’s needs. This is a key advantage when it comes to health, wellness and beauty products, which helps explain why these are the most-popular categories sold through this sales channel.

However, the digital age has brought with it technology that enables brands and retailers to provide personalized services and product recommendations. More sophisticated loyalty programs that help track customer behavior, including usage of products and services, are one way retailers are offering a higher degree of personalization. For example, beauty retailer Ulta’s Ultamate Rewards program aims to deliver more targeted and personalized offers across all channels. Customers who join the loyalty program receive exclusive offers via e-mail or by post.

Another beauty retailer, Sephora, also utilizes its loyalty program to provide relevant recommendations to members. For instance, Sephora records the skin type of customers and its promotional e-mails make relevant recommendations accordingly.

Source: sephora.com

With the application of big data analysis, brands and retailers now provide personalized services and product recommendation, which was only previously possible through sales representatives of direct selling companies.

Amazon uses the shopping patterns of customers to make contextual recommendations of products. Its homepage shows the top sellers in different categories, depending on the user, and personalizes every user’s homepage based on their browsing behavior. When users click on a specific product, Amazon will show what complementary or related products other customers have purchased. These help consumers discover relevant items that are potentially desirable to them.

Source: amazon.com

Direct Sellers Embracing the Digital Age

Facing the challenges of the digital age, a number of new direct selling companies have enjoyed unparalleled growth, while some established players have recognized the challenges and are transforming their business to embrace the digital age. To understand both scenarios, we examine two companies in this section: Jeunesse and Amway.

Jeunesse

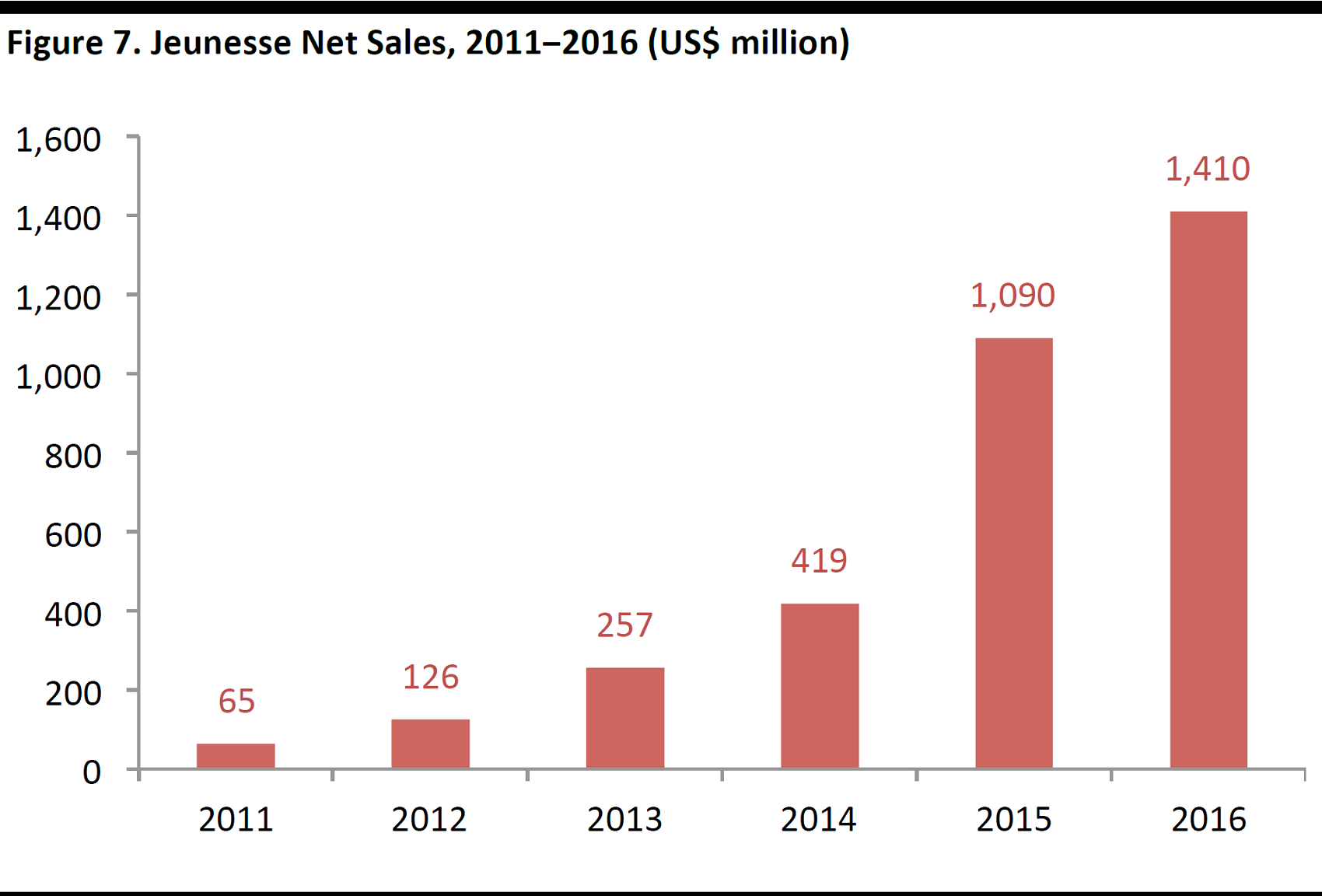

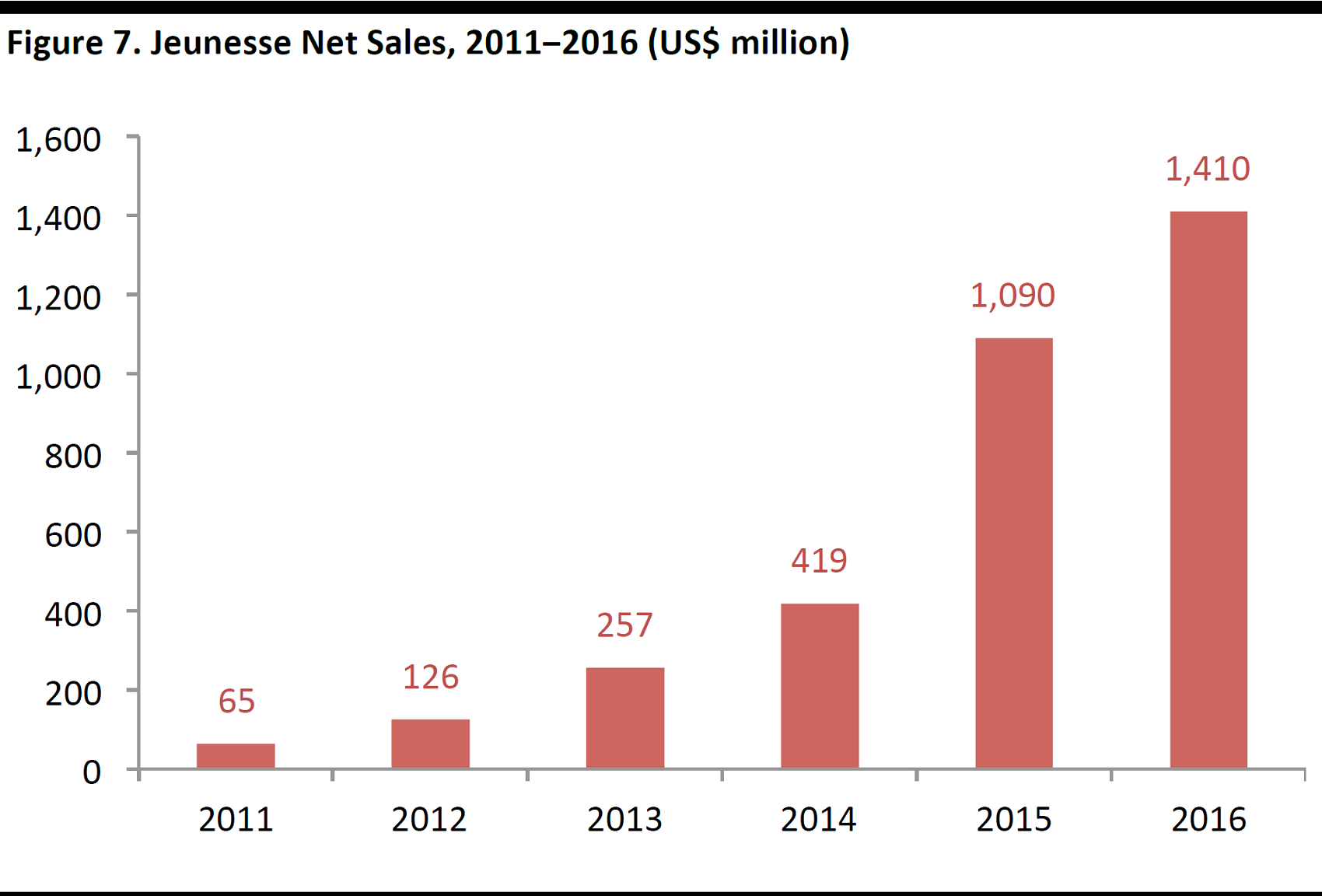

Founded in 2009, Jeunesse is one of the fastest-growing direct selling companies in recent years. It focuses on wellness and skincare products. Despite the tough challenges faced by direct sellers, its revenues grew from US$65 million in 2011 to US$1,41 billion in 2016, registering a CAGR of 85%.

Source: jeunesseglobal.com/en-HK

Source: Direct Selling News

The rapid expansion of the company can be attributed to its adoption of digital tools for distribution, promotion and training.

As of 2015, Jeunesse has established 30 offices and 44 distribution centers around the world, but with a much wider presence in over 125 markets.

Randy Ray, CEO of Jeunesse, pointed out that the company’s early investment in technological infrastructure has helped its global expansion.

The company makes use of an online platform to allow sales representatives to manage their business, including placing orders, reviewing earnings, as well as to receive the latest promotional materials. The platform is available on both desktop and mobile app, the latter of which has already surpassed 100,000 downloads on the Google Play Store.

In this sense, the technological backbone of the company allows it to scale across geographies quickly, as sales representatives may join the company even if there are no physical offices in their country or region.

In addition, the company also trains its sales representatives via webinars or0 YouTube videos, making it easier for new joiners to learn and share their skills in direct selling.

Amway

Amway is the largest direct selling company in the world in terms of revenue. However, revenues dropped to US$8.8 billion in 2016, down 28% from 2013. Facing the challenges of the digital age, the company is implementing strategies to improve both its online and offline selling channels.

Amway rolled out its mobile e-commerce system in China, which includes 10 WeChat public accounts and 11 apps as their online sales initiative. Sales representatives can promote products and communicate with customers on WeChat, China’s most popular instant-messaging platform. Using Amway’s mobile e-commerce system, customers can place orders and make payments online, and sales representatives can provide customer service on mobile devices as well.

In addition to its online strategy, Amway has developed experience-driven brick-and-mortar stores, which, in the past, had served merely as product distribution points. The brick-and-mortar stores now serve as a place for potential customers to experience new products and for sales representatives to communicate with their customers.

In the Amway digital experience store, customers are given a NFC-enabled Smart Experience Card once they have spent a designated amount on purchases in-store that can be connected to the customers’ social media accounts and can record every action the customers make. Customers can take part in digital experiences with a series of interactive installations instore, and take snaps in the photo booth, which they can then share on social media to create a higher awareness. In the first two weeks of the opening of the experience store in Hong Kong, it received over 1,500 NFC activations, over 1,000 shares on social media and over 5,500 booth checkins.

Source: Amway

Sales representatives can also organize events or form communities to strength their relationship with customers. For example, in China, Amway formed a mothers’ club for women to share their experiences with child nurturing or their skin-care techniques. The community improves bonding between sales representatives and customers, as well as loyalty for Amway’s products.

Conclusion

Similar to traditional store-based retailers, direct selling companies also face challenges from the rise of e-commerce, as consumers continue to shift more of their purchases online. While some store-based retailers have successfully transformed their business by adapting omnichannel strategies, several direct selling companies have also embraced the digital age and remained competitive, registering strong growth in recent years.

Omnichannel retailers have taken advantage of both the online and offline world, such as allowing consumers to experience the product(s) in a physical store and being able to purchase it online at any time. In the case of these direct sellers, they have leveraged the personal touch and interaction with consumers, as well as utilizing digital tools to improve operational efficiency and allowing end consumers to place orders online.

Similar to the case for brick-and-mortar retailers, direct sellers that are able to adapt to and embrace the digital age will remain relevant to consumers in the digital age. Jeunesse, which we discussed in this report, has enjoyed unparalleled growth in recent years, while Amway has seen growth in several top markets, as well as double-digit percentage growth in a further nine markets.