Executive Summary

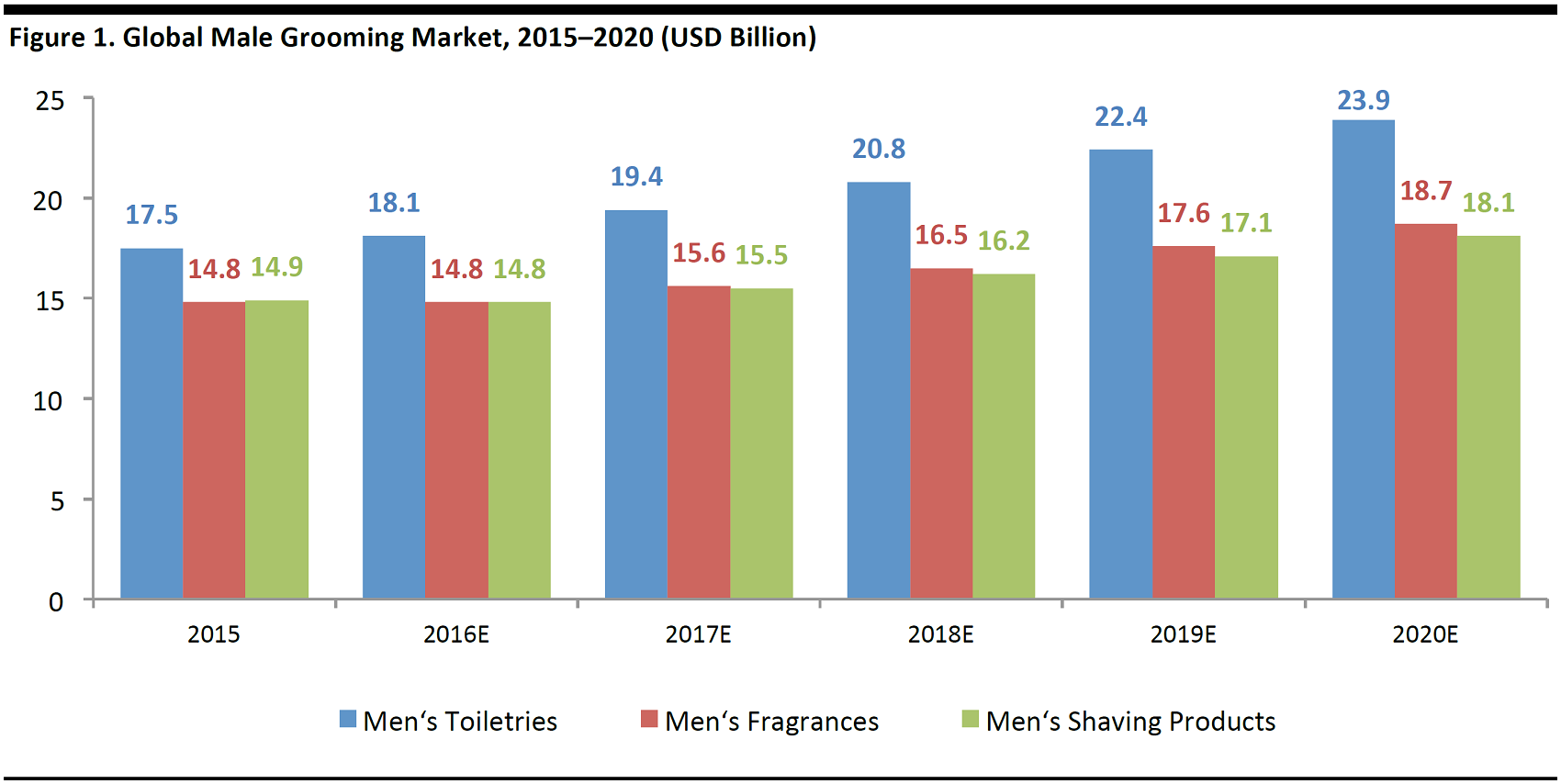

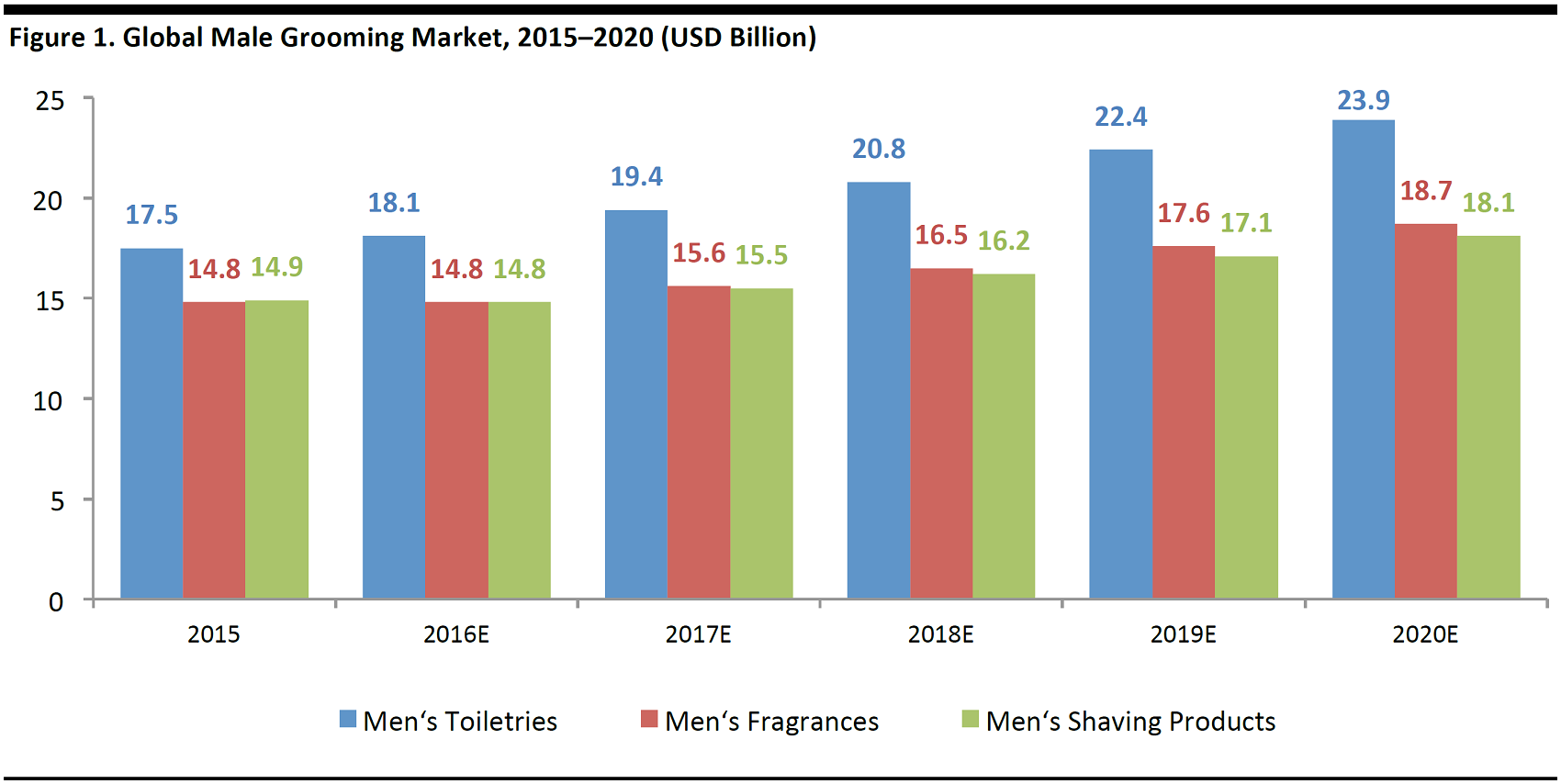

The global market for male grooming products is booming and is projected to reach US$60.7 billion by 2020, according to Euromonitor. While some may attribute this to the growth in shaving products and fragrances, the strongest growth is actually in the largest category, male toiletries. Valued at US$17.5 billion and comprising 37% of total sales in 2015, this category includes men’s bath and shower, deodorant, skin and hair care products.

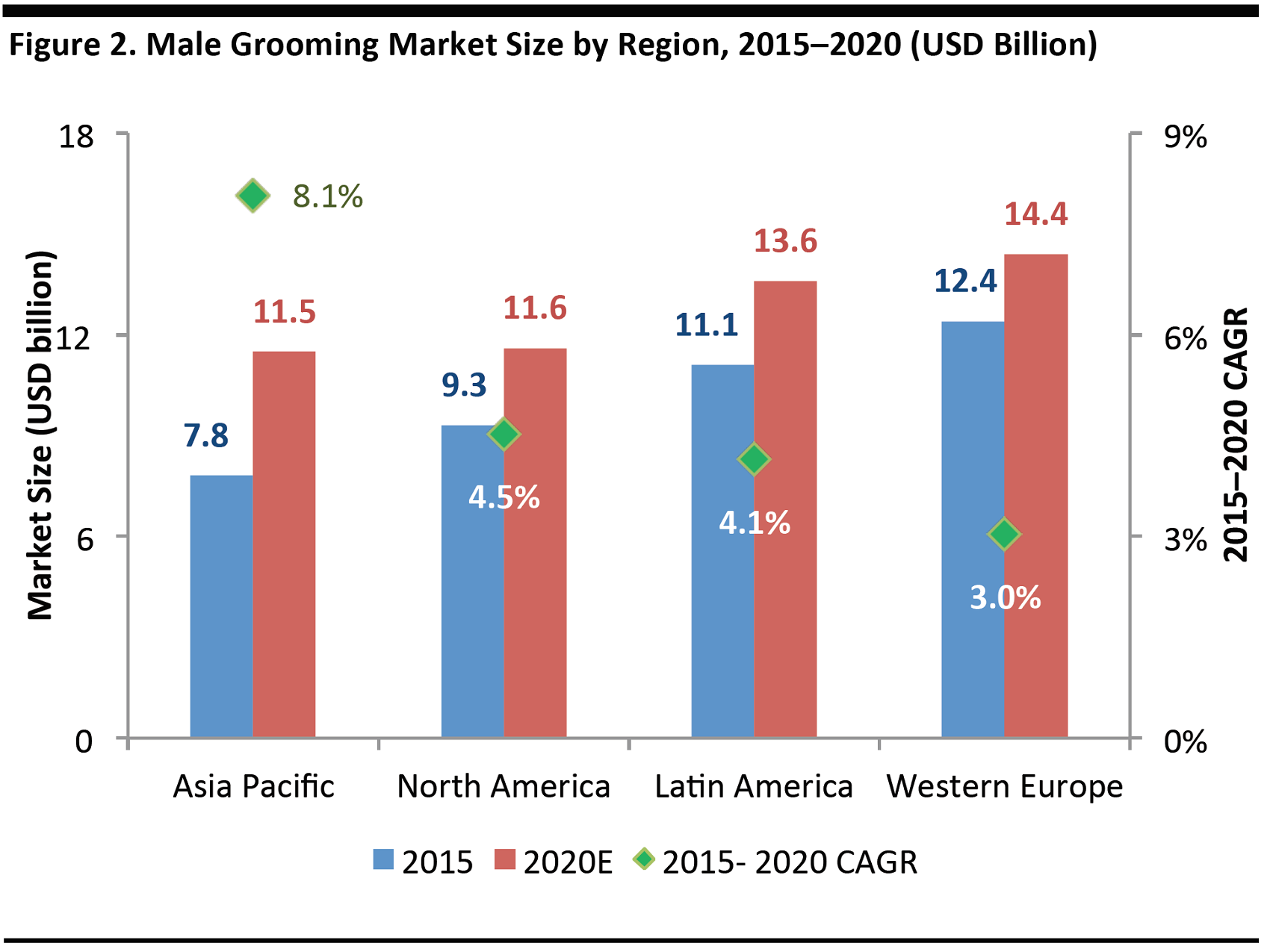

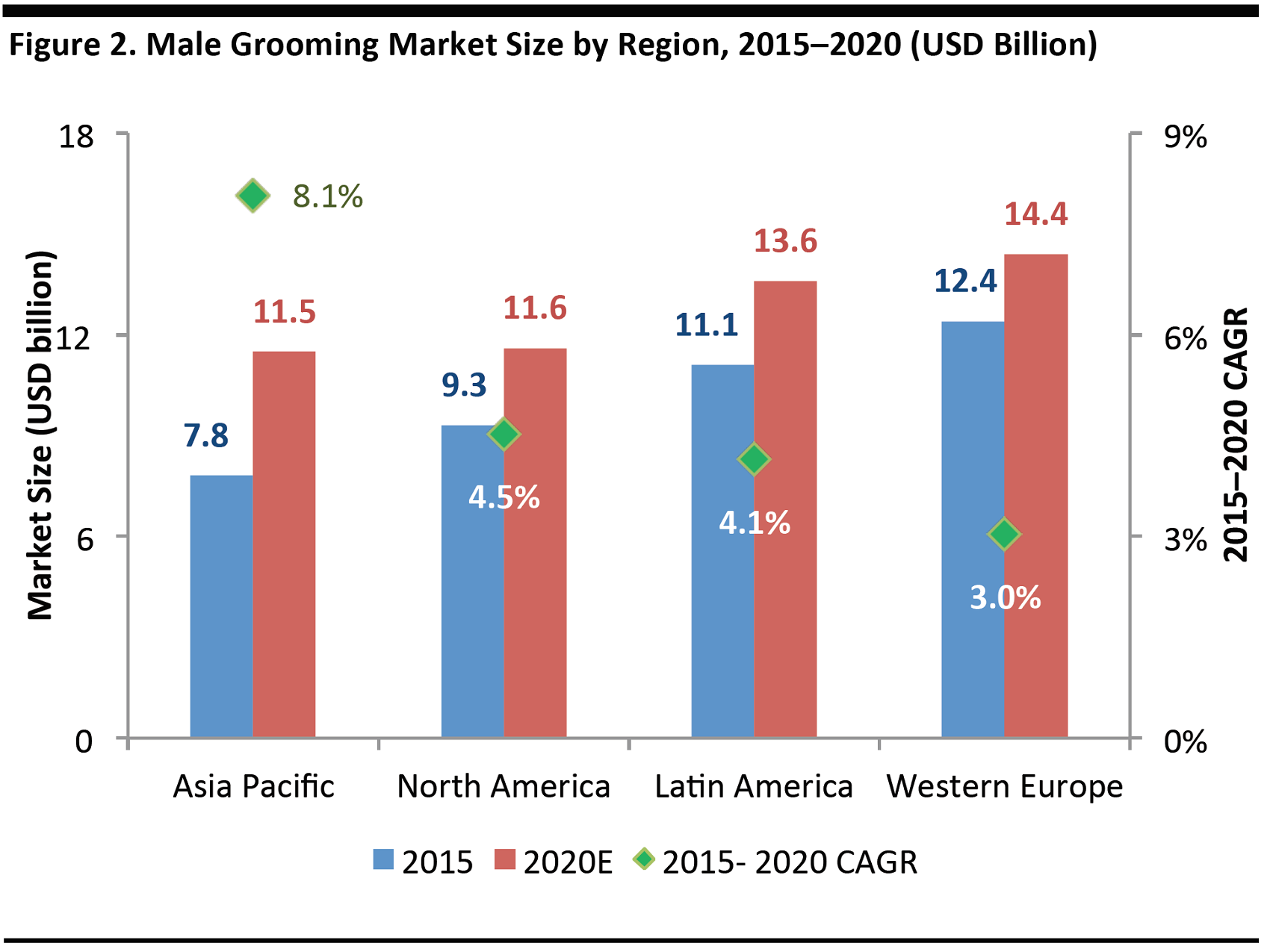

The largest male grooming market is Western Europe, valued at US$12.4 billion in 2015. Asia Pacific is the highest growth market, forecast to grow at a compound annual growth rate (CAGR) of 8.1% to $11.5 billion by 2020 from US$7.8 billion in 2015, according to Euromonitor.

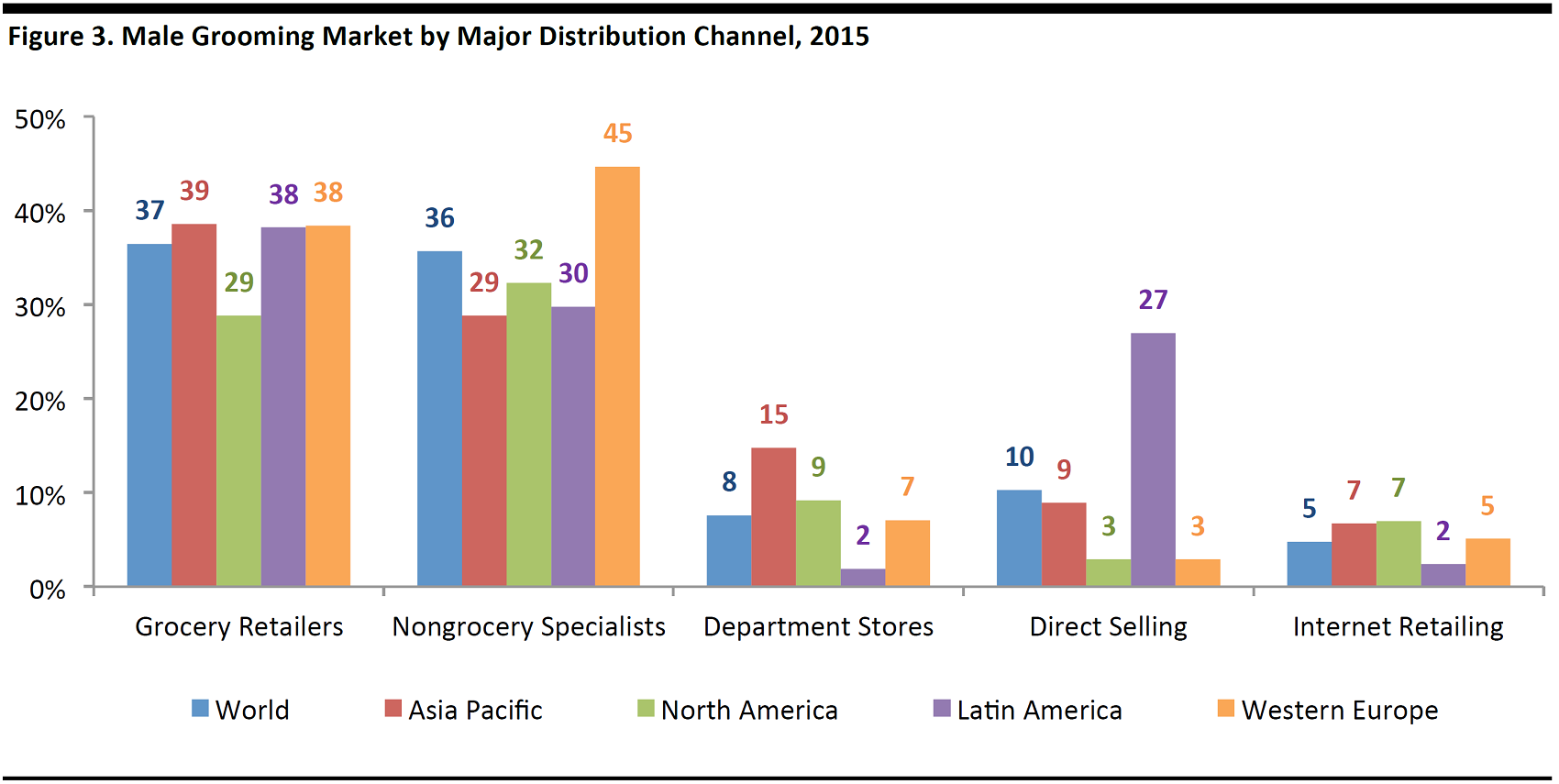

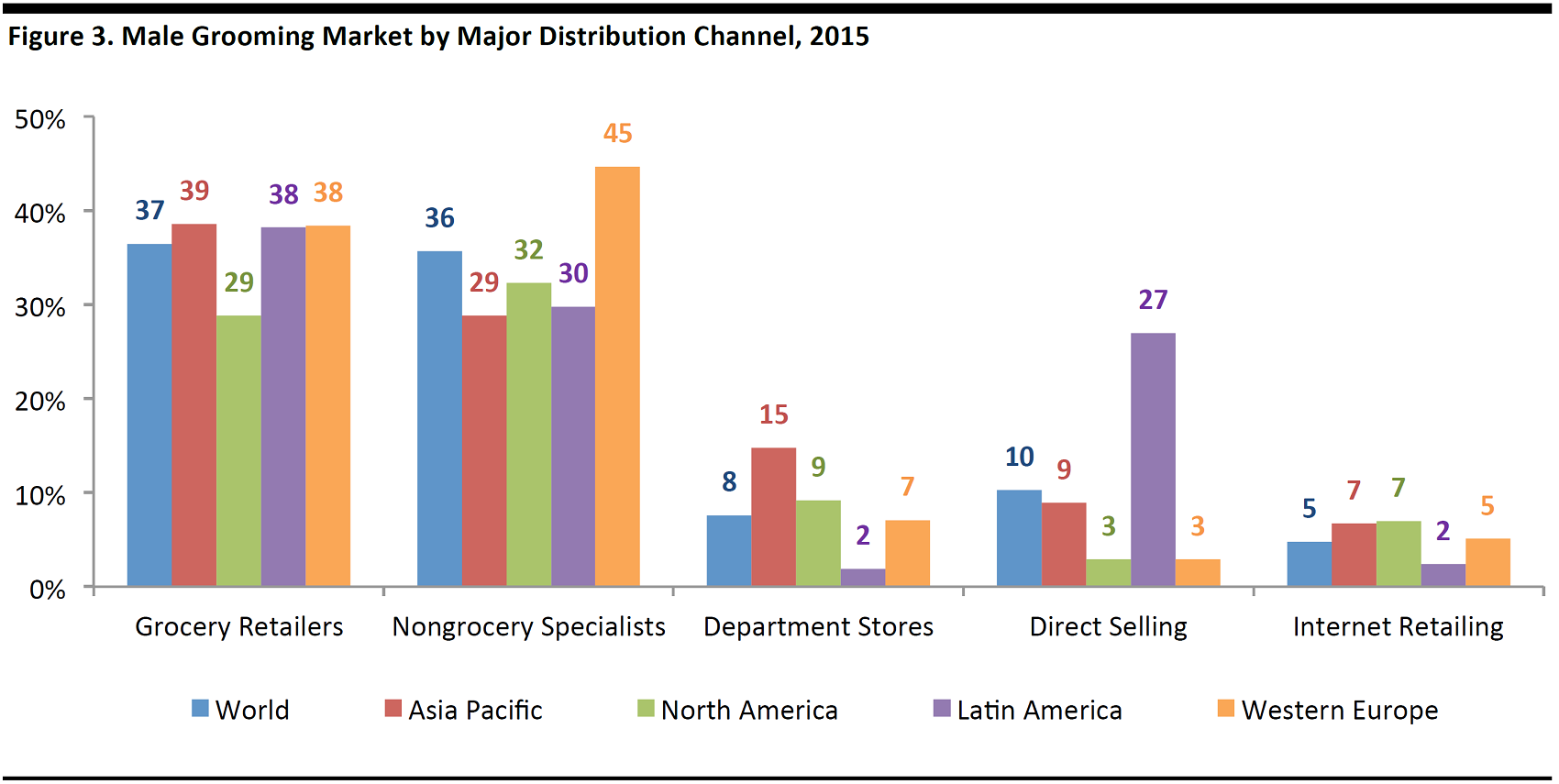

Brick-and-mortar is the main distribution channel for male grooming products, accounting for 81% of total sales in 2015. Grocery retailers and nongrocery specialists—mostly health and beauty specialist retailers—are the two major distribution channels, accounting for 37% and 36% share globally in 2015, according to Euromonitor.

Some retailers have designed store layouts to match men’s shopping needs in this category, including specialty beauty retailer Kiehl’s, as well as department stores such as Macy’s and Nordstrom. The Art of Shaving, a premium grooming omnichannel chain store, is offering barber shops in selected outlets, delivering grooming experiences to its customers. L’Oréal and Philips collaborated in December 2016 and launched a popup barber shop at Singapore Changi Airport, showcasing their products in a bid to widen their customer base.

While most of the major beauty and personal care product companies have already created dedicated brands or sub-brands for their male grooming products, a number of male grooming startups have emerged in recent years, successfully tapping into the unmet needs and growing trends in this field.

Source: Shutterstock

Male Grooming is a $47 Billion Market

The global male grooming market was valued at US$47.2 billion in 2015, and, according to Euromonitor, is projected to grow at a CAGR of 5.2% to reach US$60.7 billion by 2020.

Men’s toiletries, which include men’s bath and shower, deodorant, skin and hair care products, was the largest category, valued at US$17.5 billion, and comprised 37% of total sales in 2015. It is expected to see the largest absolute growth of US$6.4 billion to reach US$23.9 billion by 2020, and rising to 39% of total sales.

The next-largest categories, shaving products, and fragrances, were valued at US$14.9 billion and US$14.8 billion, respectively, in 2015. Fragrances are expected to reach US$18.7 billion and 31% of total sales by 2020 to become the second-largest category within male grooming products, while shaving products are expected to reach US$18.1 billion by 2020, and account for 30% of total sales.

Male Grooming Has Gone Beyond Shaving and Fragrances

The growth of men’s toiletries outpacing that of fragrances and shaving products indicates that the trend of male grooming has gone beyond the basics of shaving and fragrance. In recent years, more men are paying attention to their appearance, boosting the growth of male-specific skin care and hair care products.

Source: Euromonitor

Asia Pacific to be the Growth Engine

Among the top-four male grooming markets, Asia Pacific is expected to see the largest absolute growth, expanding at a forecast CAGR of 8.1% to $11.5 billion by 2020 from US$7.8 billion in 2015, according to Euromonitor.

The strong growth in the Asia Pacific region can be attributed to the increase in disposable household income, which increased to US$13,415 in 2015 from US$11,025 in 2010, a CAGR of 4.0%, higher than the global average of 0.6% in the same period.

Korea, the leading male grooming market in the Asia Pacific region, is expected to reach US$825 million in 2016, according to the

Korea Times. Korean men are as obsessed with beauty as their female counterparts, as illustrated in our report

Korean Innovation In Beauty; a cosmetic U&A survey conducted by the Korea Ministry of Food and Drugs Safety in 2015 reveals that Korean men use an average of 13.3 beauty items per month, and 35.5% of Korean men in their 20s use moisturizer. China is another fast-growing market, as we outline in

Male Beauty Market Growing in China.

The largest male grooming market is Western Europe, valued at US$12.4 billion in 2015. Even with the lowest projected growth CAGR for 2015–2020 of 3.0%, it is expected to remain the largest market, reaching US$14.4 billion by 2020.

Source: Euromonitor

Brick-and-Mortar Accounts for 80% of Sales

Brick-and-mortar accounts for over 80% of male grooming product distribution, and in Western Europe, the share is 91%, the highest among all the regions.

Grocery retailers and nongrocery specialists—mostly health and beauty specialist retailers—are the two major distribution channels for male grooming products, with 37% and 36% share globally in 2015, according to Euromonitor. Grocery retailers are the top channel in Asia Pacific and Latin America, with a share of 39% and 38%, respectively. Nongrocery specialists have the highest share in North America and Western Europe, accounting for 32% and 45%, respectively.

Direct selling is a major distribution channel for male grooming products in Latin America with a 27% share, much higher than other regions. It is common to purchase beauty and personal care products via direct selling, as over 50% of color cosmetics and 40% of skin care products were sold via direct selling in Latin America. Further coverage regarding direct selling of beauty products is covered in our report “

The Beauty Market in Brazil.”

Internet retailing accounts for 5% of male grooming product distribution. Although still a niche channel, some online stores have reported rapid growth. For instance, mrporter.com recorded 300% growth in sales in male beauty and grooming products in 2015, according to a report by

The Independent.

Source: Euromonitor

Redesigning Stores to Meet Male Grooming Needs

Retailers have responded to the growing demand for male grooming products with store designs matching men’s needs. For example, as early as 2012, some department stores had created dedicated sections for male grooming products. According to a report by

The Wall Street Journal, Macy’s opened a “men’s grooming zone” at its downtown Philadelphia store, featuring face wash, moisturizer, and other male skin care products. Nordstrom made a similar move by relocating the men’s grooming counter inside the men’s furnishings area.

Kiehl’s, an upmarket skincare brand owned by L’Oréal, has a significant male customer base. Company president Chris Salgardo estimated that one-third of its customers are men. The brand has over 300 stand-alone shops in over 40 countries, and the store designs are made to make both men and women comfortable when they shop, according to Salgardo.

Source: Kiehl’s Facebook Page

Grooming Experience at a Retail Outlet

The Art of Shaving is a high-end male grooming brand, with products ranging from shaving and skincare to fragrances. Apart from its e-commerce platform, it has over 100 retail locations across the US, of which, 56 feature a “Barber Spa,” which provides shaving, haircutting express facial services using the brand’s products. According to the company’s website, it “offers men an indulgent grooming experience in a masculine and luxurious environment.” This corresponds well with the growing experience economy, where consumers are showing a willingness to increase their spending on leisure services more than on retail categories.

The Art of Shaving was acquired by Procter & Gamble in 2009, after the conglomerate had already acquired Gillette in 2005. This has extended the FMCG giant’s coverage in the male grooming market from the mass to the premium segment.

Source: The Art of Shaving

Pop-Up Store at Changi Airport to Capture Male Customers

L’Oréal and Philips partnered in December 2016 to launch a Male Grooming Club at Singapore Changi Airport. At the shop, professional barbers provided a range of shaving and grooming services using Philips’ shavers, as well as skincare products by the L’Oréal Paris Men Expert range. Grooming advisors at the store had one-on-one consultations with male travelers on the skincare and shaving products that best suit their needs.

The aim of the pop-up store was to help the two brands to better capture male customers. As mentioned in our

travel retail report, beauty products have the largest share in this retail channel. According to L’Oréal Travel Retail Managing Director Vincent Boinay, customers are also more likely to try out new brands when they travel and become loyal customers of these brands later. This pop-up store thus provided the two brands an opportunity to widen their customer base as they showcased their products to male travelers.

Source: Royal Philips and L’Oréal Groupe

Major Players in the Male Grooming Market

Most of the major beauty and personal care product companies have created dedicated brands for their male grooming products, such as Unilever’s Axe and P&G’s Gillette; or sub-brands such as Clinique for Men, L’Oréal Men Expert, and Biotherm Homme.

Source: Company Websites

Although among the three male grooming product categories, shaving is projected to see the slowest growth over the next five years, it is the anchor point for male grooming routines. Most of the male grooming brands offer shaving products, and they very often position toiletries as a pre- or post-shaving procedure in order to help cross-sell to existing male customers.

For instance, Nivea has introduced a face grooming guide known as “Get Your PhD in Shaving,” which includes three simple steps—cleansing, shaving, and aftercare. This regime introduces male customers to products such as cleansers, after-shave lotions, and moisturizers.

Source: Nivea

As with other product categories, celebrities play an important role in influencing consumers. An online survey conducted in 2014 revealed that 13% of men in the UK claimed that they were inspired by celebrities such as David Beckham, Joey Essex and David Gandy. For instance, Biotherm Homme and Seven Global, David Beckham and Simon Fuller’s joint venture with Global Brands, have signed a long-term partnership to develop a male grooming line, which will be launched in 2017.

Source: Biotherm Homme

Emerging Male Grooming Brands and Retailers

A number of male grooming brands and retailers have emerged in recent years, successfully tapping into the unmet needs and growing trends in this field. They have grown rapidly despite fierce competition from the established beauty giants. Further, we believe the

Men's Grooming Category is Ready for Disruption as millennials embrace grooming products. We're also finding that increasingly,

Global Companies are Innovating with Independent Brands to Expand Portfolios.

Anthony has a series of multi-functional, multi-benefit male grooming products ranging from skin care and shaving to bath and body. The products feature natural ingredients and utilize the latest technology. Originally known as Anthony Logistics For Men, the company renamed its brand in 2014 to reflect its growing popularity and reach to female customers, adopting a new slogan “Developed for men. Borrowed by Women”.

Source: Beauty Bridge

Anthony Sosnick, the founder of the company, was a real estate developer frustrated by the lack of quality grooming products for men. Recognizing this as an opportunity, he founded Anthony in 2000.

Bevel is a Silicon Valley startup that sells shaving products primarily targeted at people with coarser hair who often face the frustration of irritated skin and razor bumps.

Source: Bevel

Tristan Walker, the founder of Bevel who himself faces this problem, has turned its solution into a business by launching a shaving product line for this skin type, the Bevel Shave System. It was designed specifically to help reduce razor bumps and irritation. The startup currently sells its products on its website, and has expanded its brick-and-mortar presence to Target.

As of 2016, the startup has raised $33 million in funding from ventures including Insight Venture Partners, Andreessen Horowitz and Google Ventures.

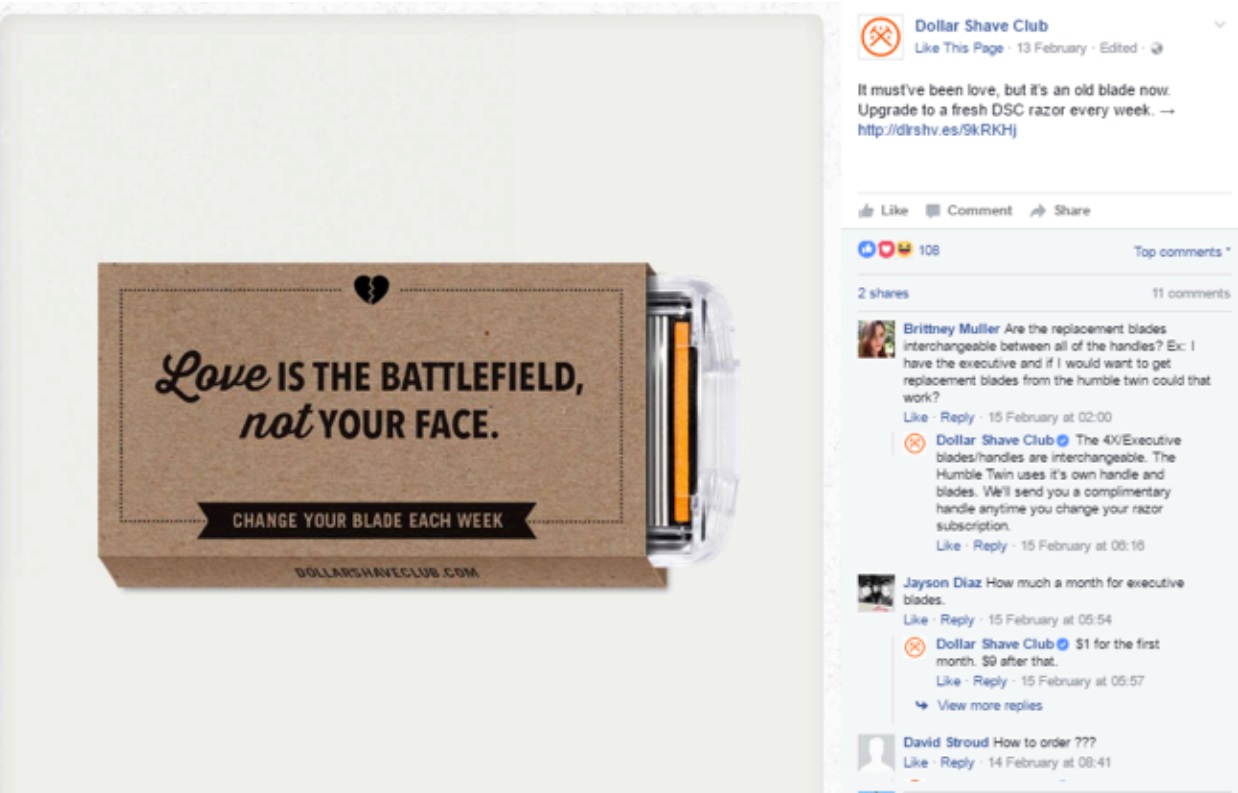

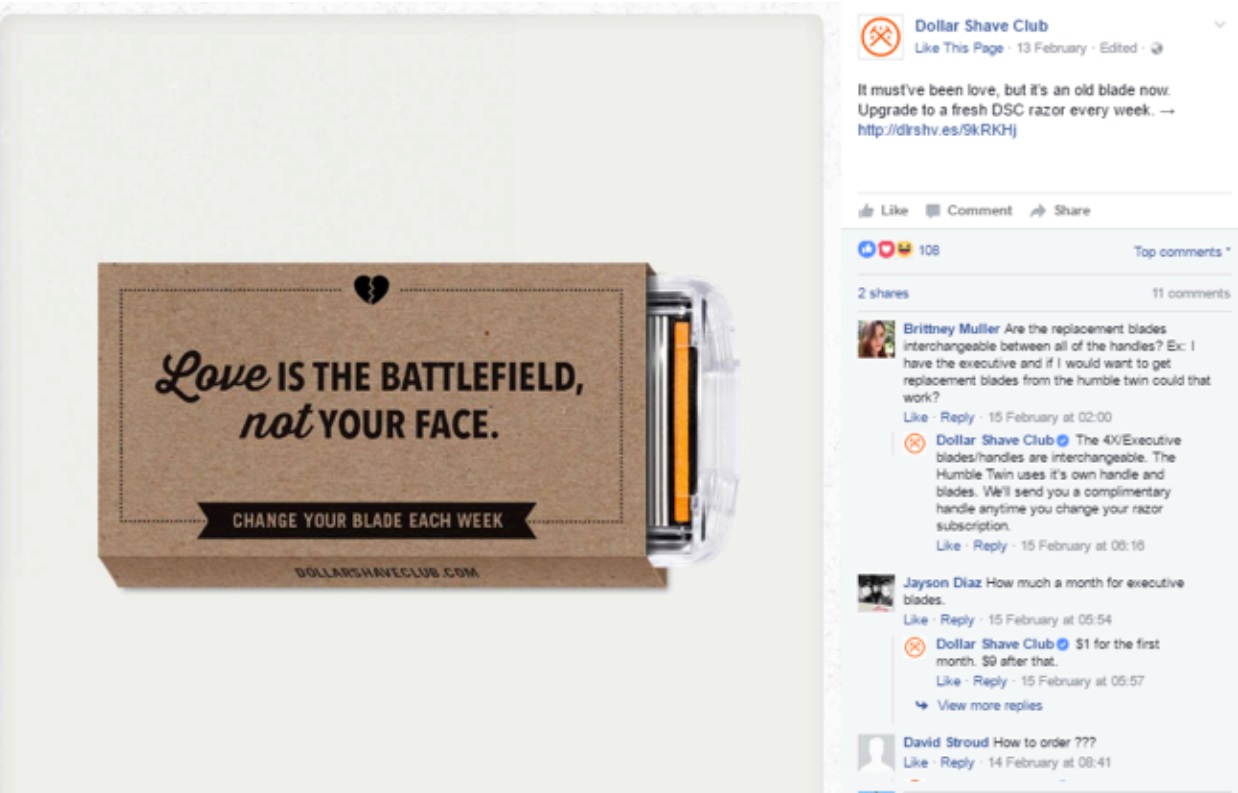

Dollar Shave Club was founded in 2011. The US startup offers a monthly membership service for razor blades home delivery for a fee as little as $3 a month. In 2014, it expanded to other grooming categories such as post-shave moisturizer and hair styling products in response to growing demand for these products, and surpassed US$150 million in sales in 2015.

As the startup sells solely online, its marketing efforts are targeted at the internet-savvy millennials. The startup creates content on social media that clicks with millennials—the message is authentic, direct and with a touch of humor. In 2015, Dollar Shave Club had a 0.9% market share in men’s shaving products globally, far from Gillette’s share at 55%, according to Euromonitor. However, Dollar Shave Club is the leader on social media, where it has over 3 million “Likes” on Facebook, 1 million more than Gillette’s page.

Dollar Shave Club was acquired by Unilever in 2016 for US$1 billion, according to a Bloomberg report, the FMCG giant had an eye on its customer relation skills, especially with the millennials, as well as access to the data and analysis of its customers.

Dollar Shave Club’s Facebook post prior to 2016 Valentine’s Day

Source: Dollar Shave Club

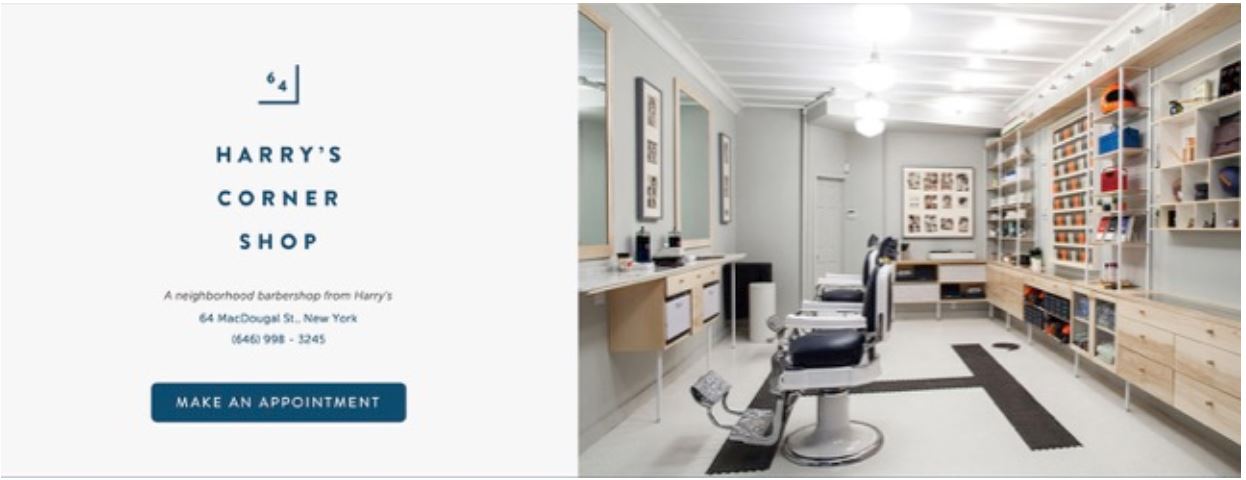

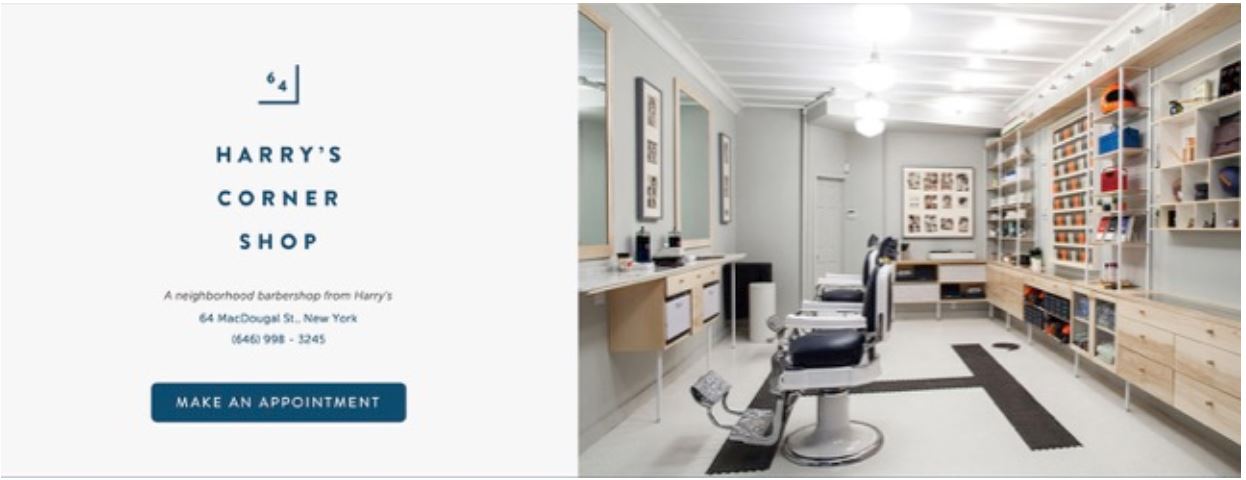

Harry’s is a shaving startup founded in 2011. It offers customized subscription plans based on the frequency that one shaves, as well as the shaving products needed. Customers can also purchase their products on a one-off basis.

In 2013, Harry’s opened a corner shop in New York. It serves as both a barbershop and a retail location, with a collection of Harry’s shaving products and lifestyle items. The shop helps to extend the Harry’s brand experience from online to offline, providing the opportunity to cross-sell products as barbers give advice or recommendations to customers. It also helps to build rapport with customers, who all need to visit a barber regularly.

According to a Business Insider report in July 2016, the company has more than 2 million customers. As of July 2015, Harry’s has raised US$287 million in six rounds of funding from 16 investors, according to Crunchbase.

Source: Harry’s

The Man Company is a subscription e-commerce platform for male grooming products based in India that launched in 2015. The startup offers products with an average price of US$9–10, a mid-market price point that urban dwellers can afford. Customers can freely choose a basket of products and have the products delivered to them on a regular basis.

The startup caters to men who need a wide range of quality grooming products at their convenience, according to company founder Mohit Saxena. As reported by Inc24, The Man Company is one of the first entrants to offer male grooming products by subscription, which has not been attempted by any other company yet.

Source: The Man Company

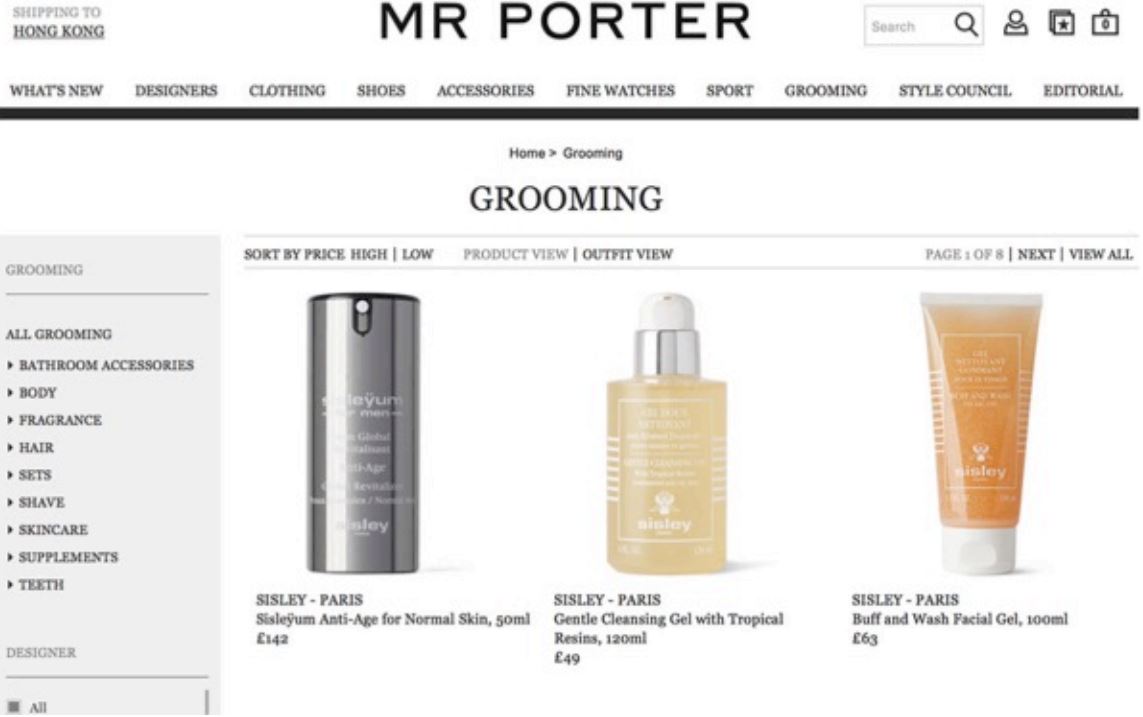

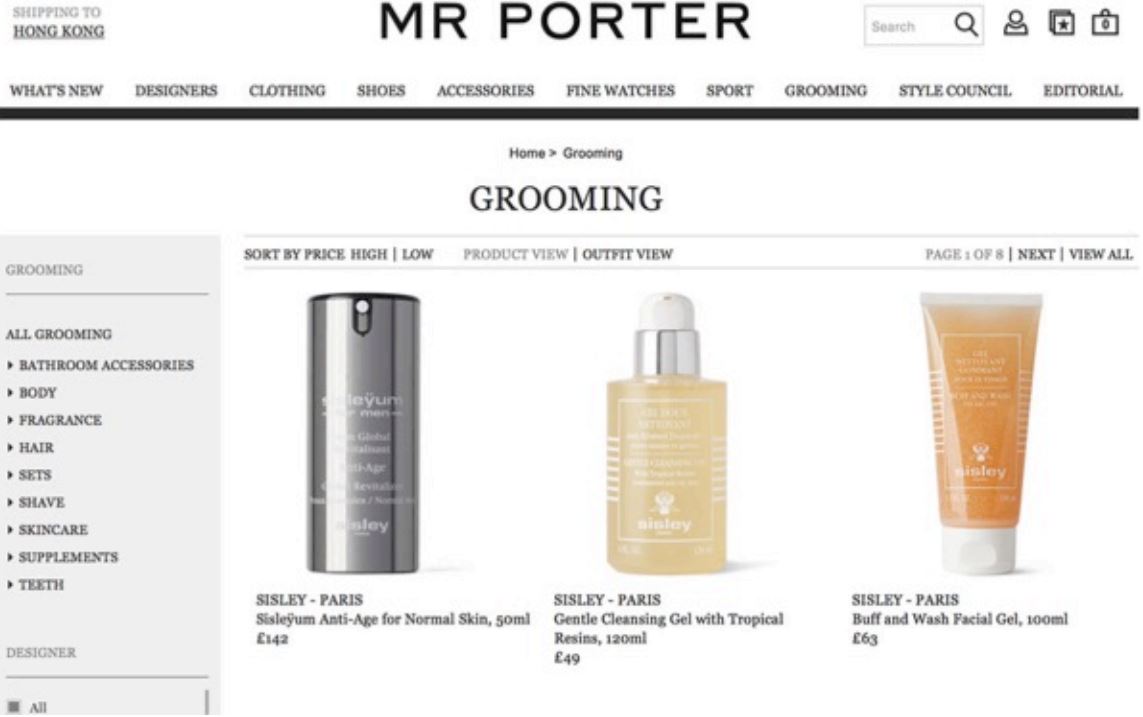

Mr Porter is a subsidiary of the Italian online fashion retailer

YOOX Net-a-Porter Group. It was launched in 2010, positioned as a global high-end menswear e-tailer. It currently has a total of 2.5 million unique visitors each month, and ships to over 170 countries. In 2015, it recorded 300% growth in sales of male beauty and grooming products.

Source: Mr Porter

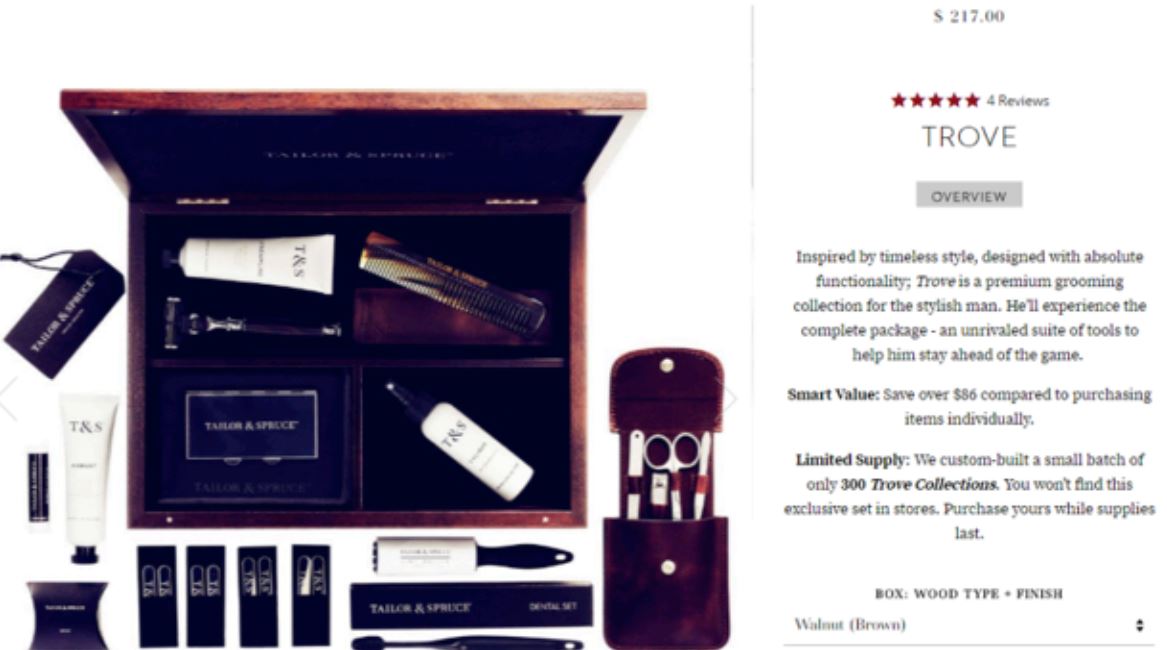

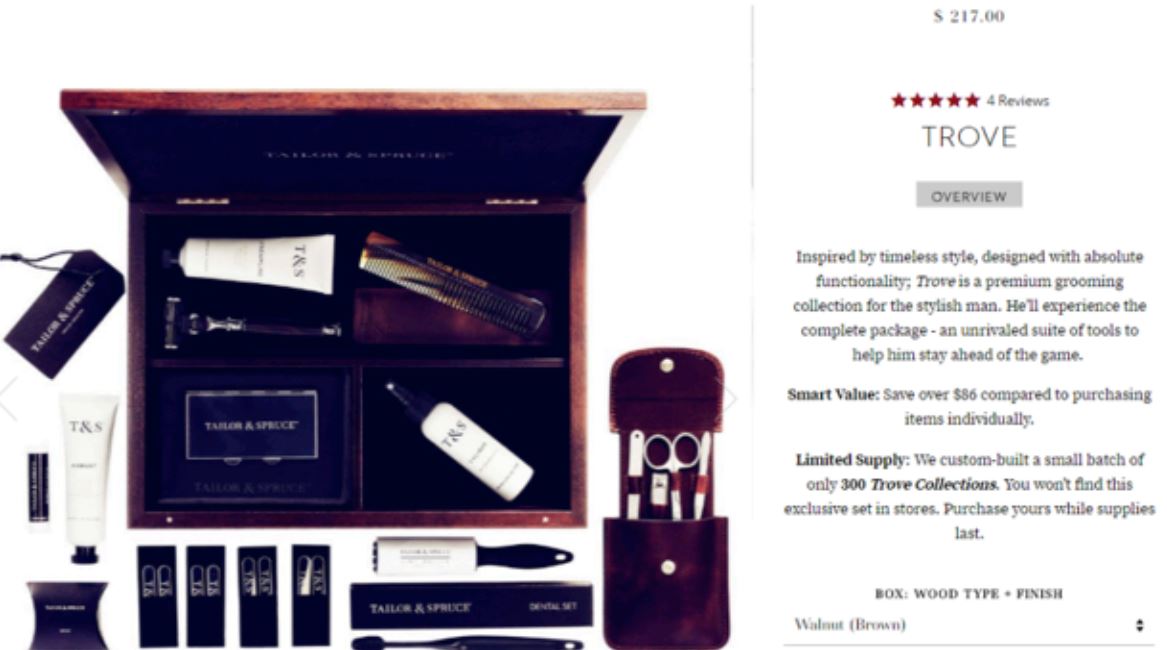

Tailor & Spruce is a premium grooming brand launched in 2015, targeted mainly at male professionals. It has released a luxury kit that helps men to keep looking sharp, with 15 essential grooming products, including razor, deodorant, comb, toothbrush, pocket mirror and more. The company currently sells direct-to-consumer on its official website.

Source: Tailor & Spruce

Turo Skin is an emerging male skincare brand that produces multi-beneficial and simplified skin care products for men. Understanding that most men are reluctant to use a lot of products, Turo Skin has created a 3-in-1 shower gel that combines shampoo, cleanser, and moisturizer into one single formula that one can use on the face, hair and body.

Source: Turo Skin

Key Takeaways

The global male grooming market is booming, as more men are paying attention to their appearance and skin. Growth of the men’s toiletries category, which includes male-specific skin care and hair care products, is expected to outpace that of shaving products and fragrances. However, we believe that shaving products will remain an important category, as it is the anchor point for male grooming routines, where toiletries products are marketed as post- or pre-shaving products.

Brick-and-mortar will remain the main distribution channel for male grooming products in the near future. Some retailers have redesigned or setup stores that specifically cater to the needs of male customers, while others are delivering grooming experiences at their outlets. We believe this trend will continue with the growing importance of the male grooming market. We also see

Three Shifts in the US Beauty Market that could impact the male grooming space.

A number of successful startups targeting these male customers have emerged in recent years. While most international beauty brands have already established male-specific grooming brands or sub-brands, the success of these startups may inspire them in developing or enhancing their brands and products, such as identifying the unique and unmet needs of male customers—i.e., developing simple and multifunctional products, or finding ways to engage them actively.