EXECUTIVE SUMMARY

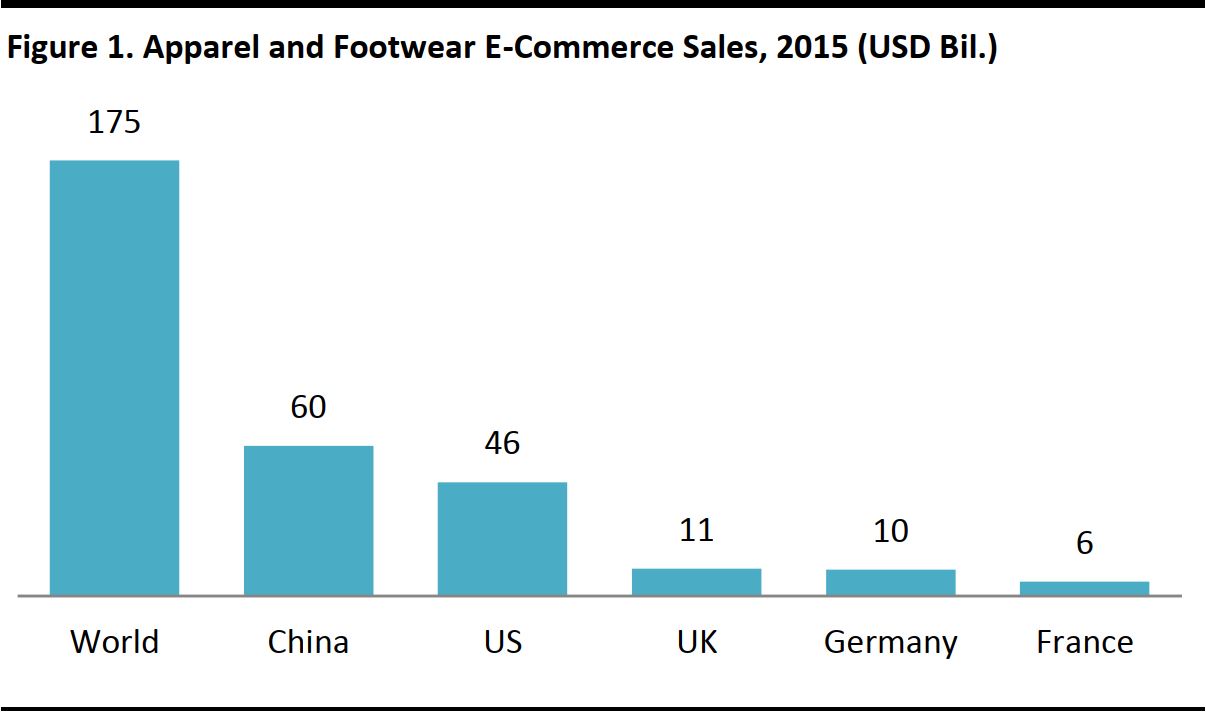

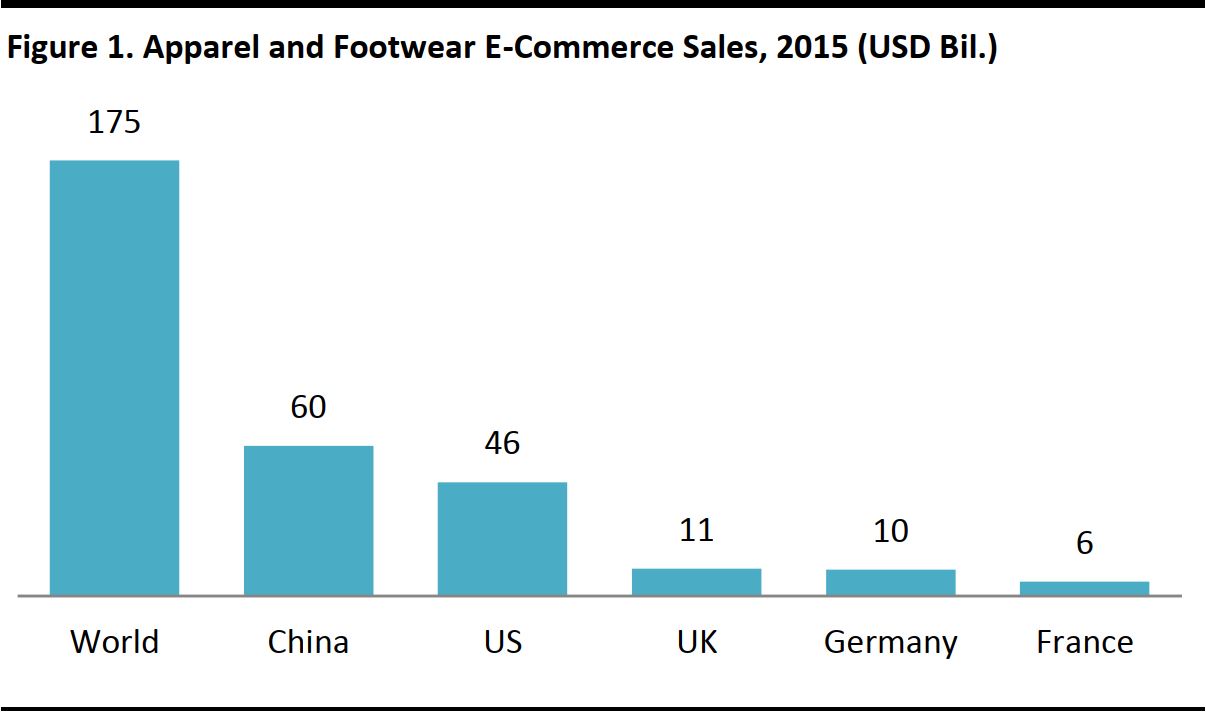

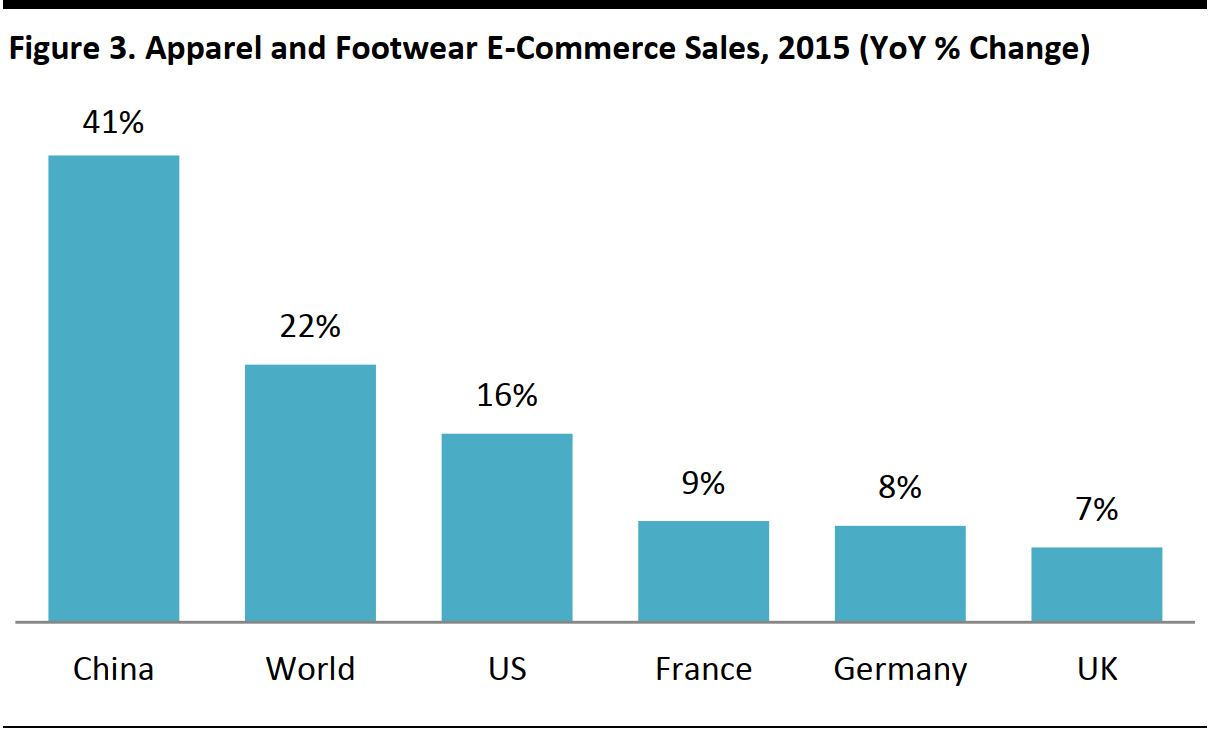

Global footwear e-commerce sales have a spring in their step. Worldwide online footwear and apparel sales increased by 22% in 2015, and e-commerce accounted for 12% of total global footwear sales of US$340 billion last year, equivalent to US$41 billion. By comparison, the total footwear market grew by 6% last year.

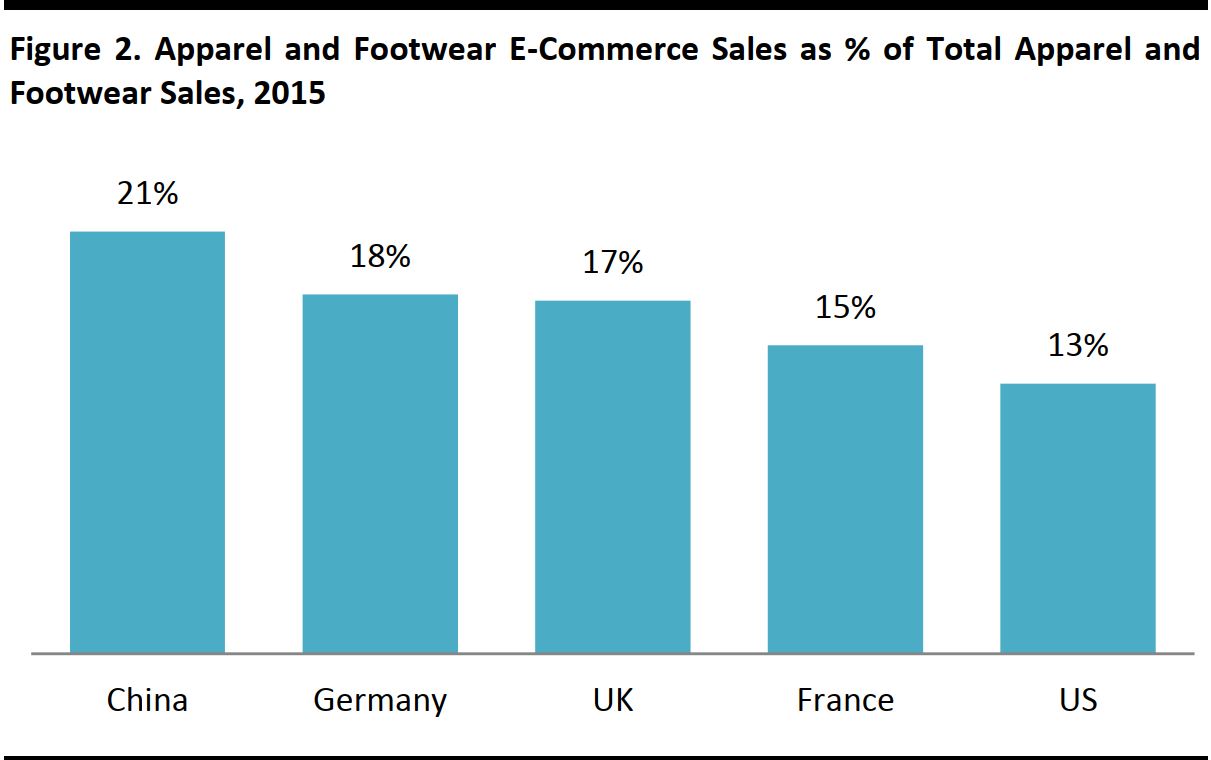

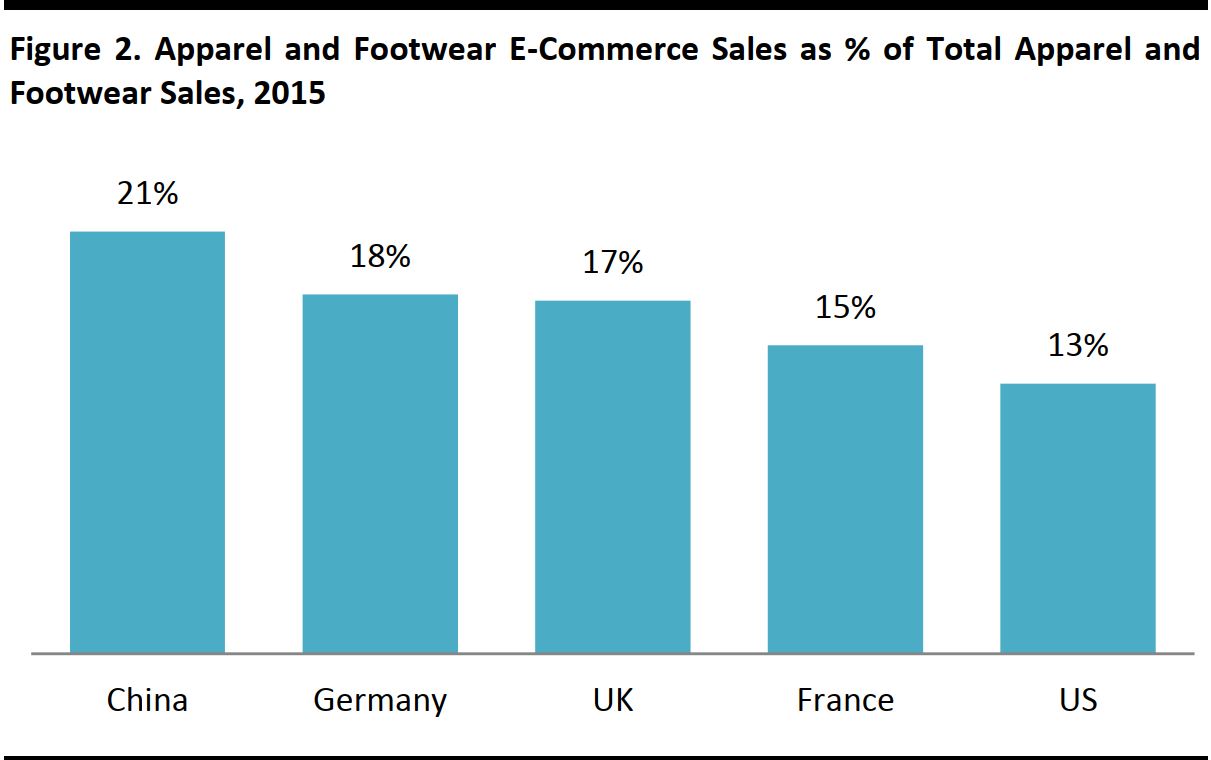

China has the largest online apparel and footwear market worldwide and is also the country with the highest proportion of apparel and footwear sold online: some 21% of total category sales were online last year. Moreover, China reported by far the most robust growth rate in online apparel and footwear sales in 2015 among major e-commerce markets.

Germany and the UK are also very developed e-commerce markets; online apparel and footwear sales in the two countries accounted for 18% and 17%, respectively, of total apparel and footwear sales in 2015. There are several factors driving the robust growth in footwear e-commerce, including customization, personalization and millennials’ preference for online shopping. Meanwhile, the athleisure trend is strengthening underlying demand for footwear.

Athletic footwear is a major category within the global footwear e-commerce market. Global sports footwear sales increased by 14% in 2015, according to Euromonitor. The US athletic footwear market increased by 8% in 2015 and the sneaker market in China is growing at 7% annually, according to HKTDC Research. The athleisure apparel trend and broader global lifestyle shifts toward health and fitness will power sales growth in the sports and sneaker footwear category, and will consequently boost online footwear sales.

Online customization of footwear is a growing trend, primarily driven by millennials, that provides consumers with greater product variety and differentiation options than are available in stores. Product customization is often for aesthetic purposes, but it can also help consumers obtain a better shoe fit, as shoes can be custom fit in terms of size and foot shape.

The rise of

3D printing has significant implications for footwear customization. Nike, Adidas and other brands are already using 3D printing to enable shoppers to customize the way their shoes fit, printing soles that are perfectly molded to an individual’s foot. As the technology evolves and the cost of 3D printers and materials continues to fall, it is possible that consumers will eventually use the technology to design and print their own shoes at home.

Fitting issues are a barrier for consumers and result in costly returns for retailers. According to the founder of Fitcode, a fitting technology service for retailers, companies lose US$260 billion annually in e-commerce returns, with fit issues being the number one reason for returns.

New technologies are helping shoppers find their perfect fit online and, so, helping retailers save money. Several fitting and sizing technology services, such as True Fit and Fitcode, have been launched to help retailers increase customers’ fit confidence and drive down return rates.

In the last few years, numerous innovative pure-play online footwear and apparel retailers have entered the market. These include names such as Zalando, Sarenza and Spartoo.

THE GLOBAL FOOTWEAR E-COMMERCE MARKET

Global Online Footwear Sales Step Up

In this report, we explore global online footwear retailing, the size of the market, forecast growth rates and the proportion of footwear sales generated online compared with total sector sales. We also examine online footwear retailing in leading e-commerce markets, including China, the US, the UK and continental Europe. Our analysis focuses on leading apparel and footwear retailers that have built large e-commerce businesses, as well as pure-play and innovative startup online retailers.

Source: Shutterstock

The online footwear market will continue to experience robust growth globally, driven by customization opportunities, the evolution of technologies to address shoe fit issues, and the continuation of the athleisure and healthy lifestyle trends.

E-COMMERCE IS SETTING THE PACE IN FOOTWEAR

Footwear e-commerce sales made great strides in 2015: online sales of footwear and apparel in aggregate grew by 22% worldwide, and e-commerce accounted for 12% of total global footwear sales, according to Euromonitor. Footwear and accessory retailers generally report a smaller proportion of sales via e-commerce than apparel retailers do, according to eMarketer.

As depicted in the graphs below, China has the largest online apparel and footwear market worldwide and is the country with the highest proportion of apparel and footwear sold online. According to PwC, as of February 2016, 83% of Chinese purchasers of clothing or footwear had made at least one apparel or footwear product purchase online in the past 12 months.

Source: Euromonitor International

Germany and the UK are also very developed e-commerce markets; online apparel and footwear sales in the two countries account for 18% and 17%, respectively, of total apparel and footwear sales.

Source: Euromonitor International

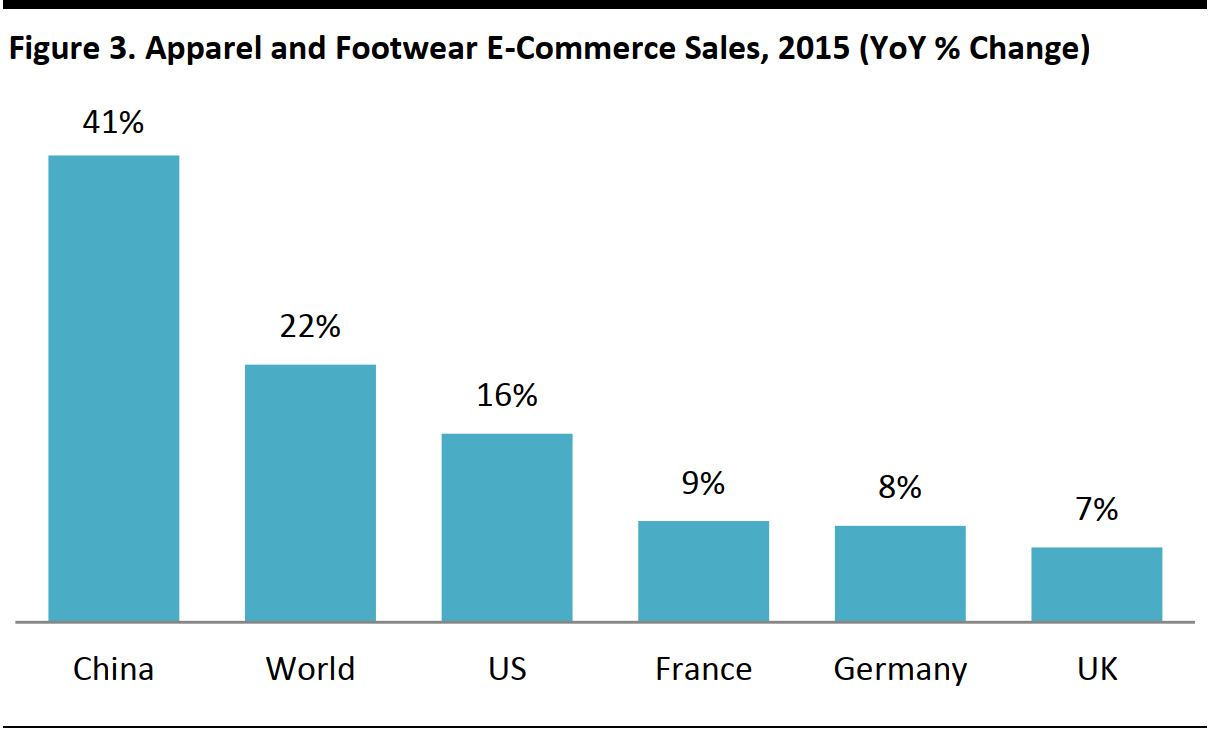

China also reported by far the most robust growth rate in online apparel and footwear sales in 2015 among major e-commerce markets.

Data are at constant currency, to remove currency effects.

Source: Euromonitor International

Athletic footwear is a major category within the global footwear e-commerce market. Global sports footwear sales increased by 14% in 2015, according to Euromonitor. The US and China are the largest global sneaker markets. The US athletic footwear market increased by 8% in 2015 and the sneaker market in China is growing at 7% annually, according to HKTDC Research.

Source: Shutterstock

The athleisure apparel trend and broader global lifestyle shifts toward health and fitness will power sales growth in the sports and sneaker footwear category. Furthermore, the growing work-related trends of less formal business attire in the workplace and an increasing number of people working from home are contributing to the demand for casual and athletic footwear. We think that the incremental demand for athletic footwear will consequently boost online footwear sales going forward.

What Is the Appeal of Buying Footwear Online?

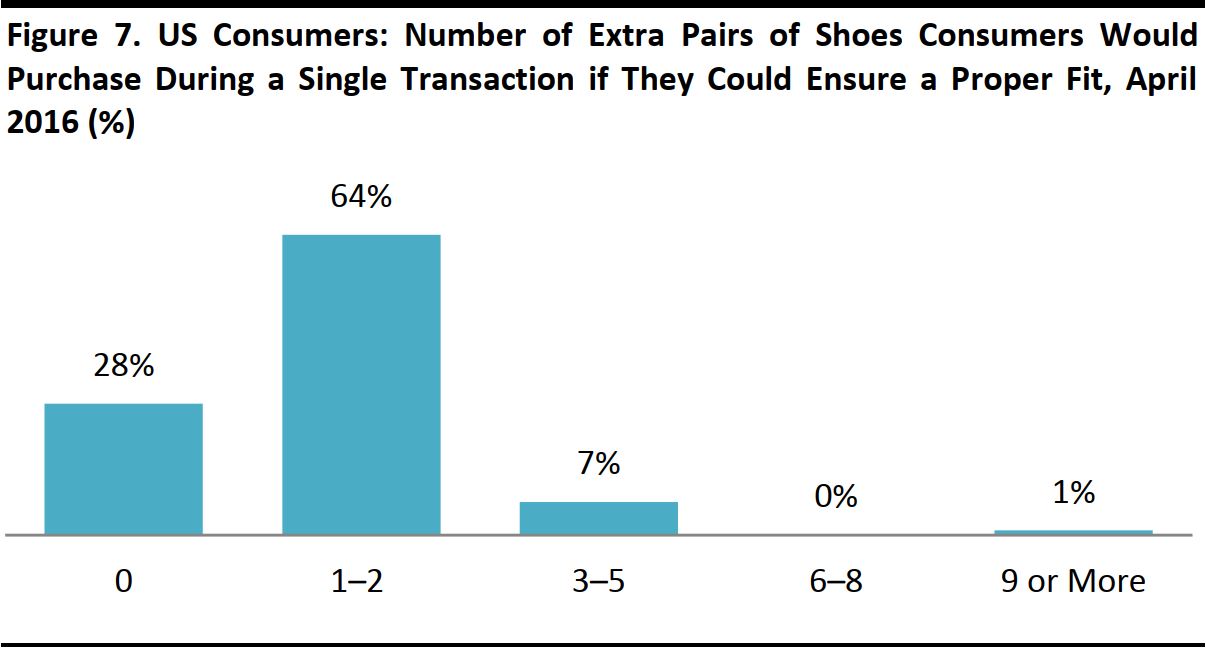

The online channel makes it easy for consumers to research hundreds of varying footwear designs, without needing to visit an endless round of stores. Many customization options that are available online allow for a level of differentiation that stores cannot provide. Web resources such as Pinterest and fashion blogs provide inspiration and curation, and several new resale sites have gained footholds, providing consumers with new design and product ideas. Multiple companies have even launched size-fitting technologies that help online shoppers find the right fit, and customer reviews on some sites allow consumers to find further information regarding footwear fit and comfort.

Online customization of footwear is a growing trend that provides shoppers with greater product variety and differentiation options than are available in stores. Product customization is used not only for aesthetic purposes, but also to obtain a better shoe fit.

Millennials appear to be driving the customized footwear trend. According to The NPD Group, millennials crave products that make them stand out from the crowd, and online customization allows for the expression of uniqueness.

The global footwear e-commerce market will likely make further strides as tech-savvy millennials age and start families, and as baby boomers become more comfortable purchasing online. As the online channel has matured, customers of all ages have become more comfortable making more, and more varied, purchases online.

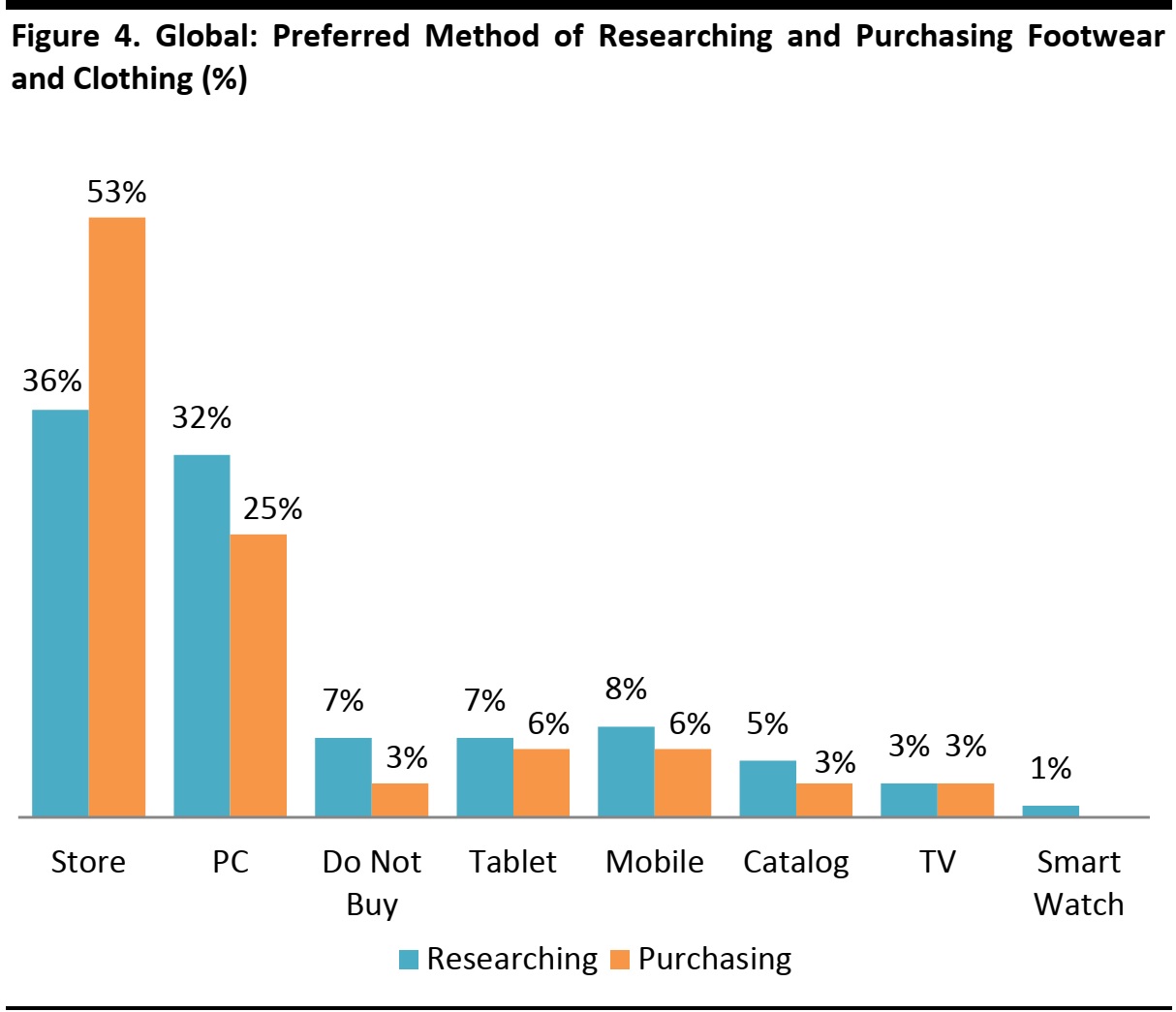

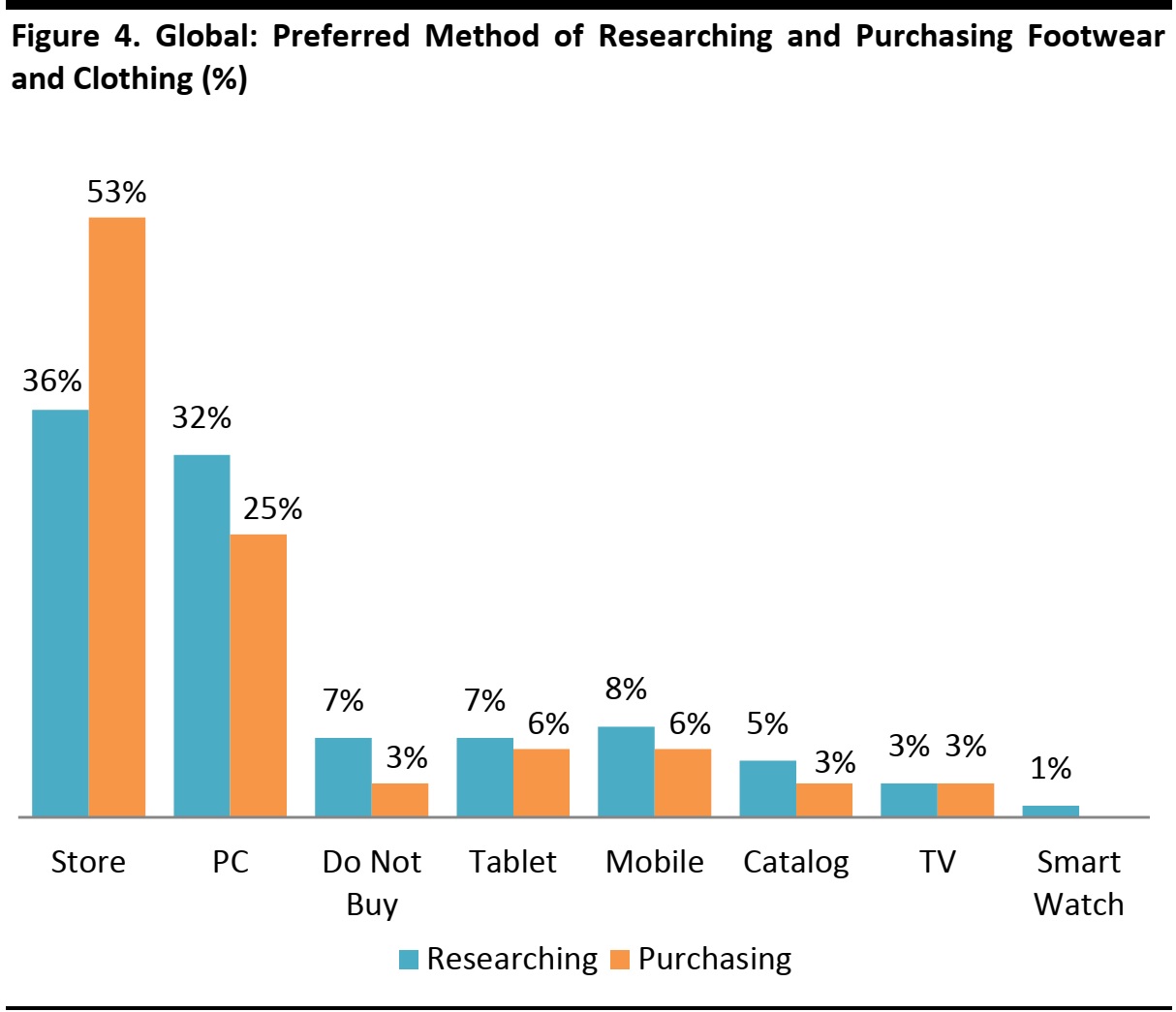

According to PwC surveys, websites overindex on research versus purchases, while stores overindex on purchases versus research: the Internet is disproportionately a channel for research and browsing.

Base: Approximately 23,000 consumers in 25 countries

Source: PwC, Total Retail Survey 2016

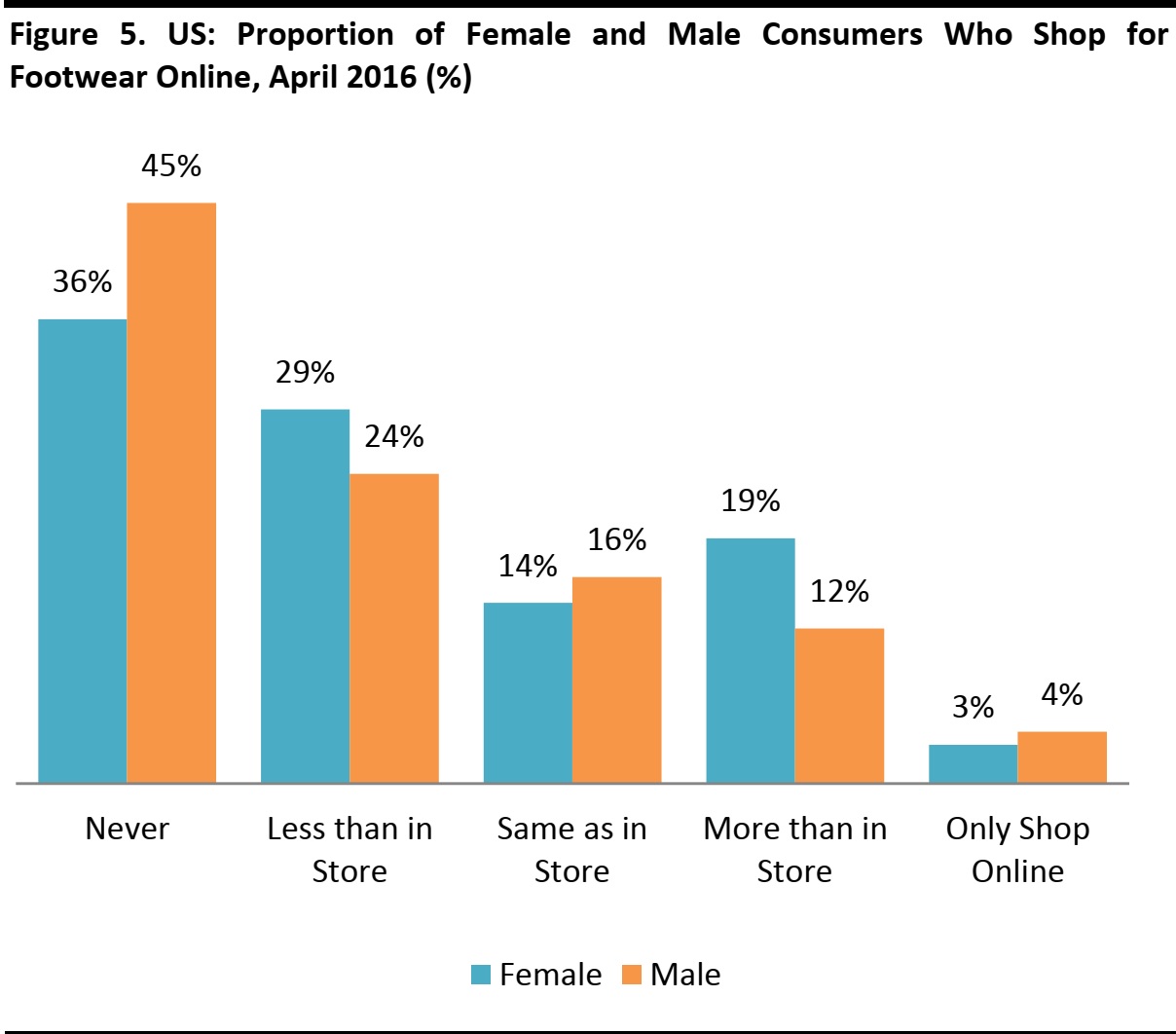

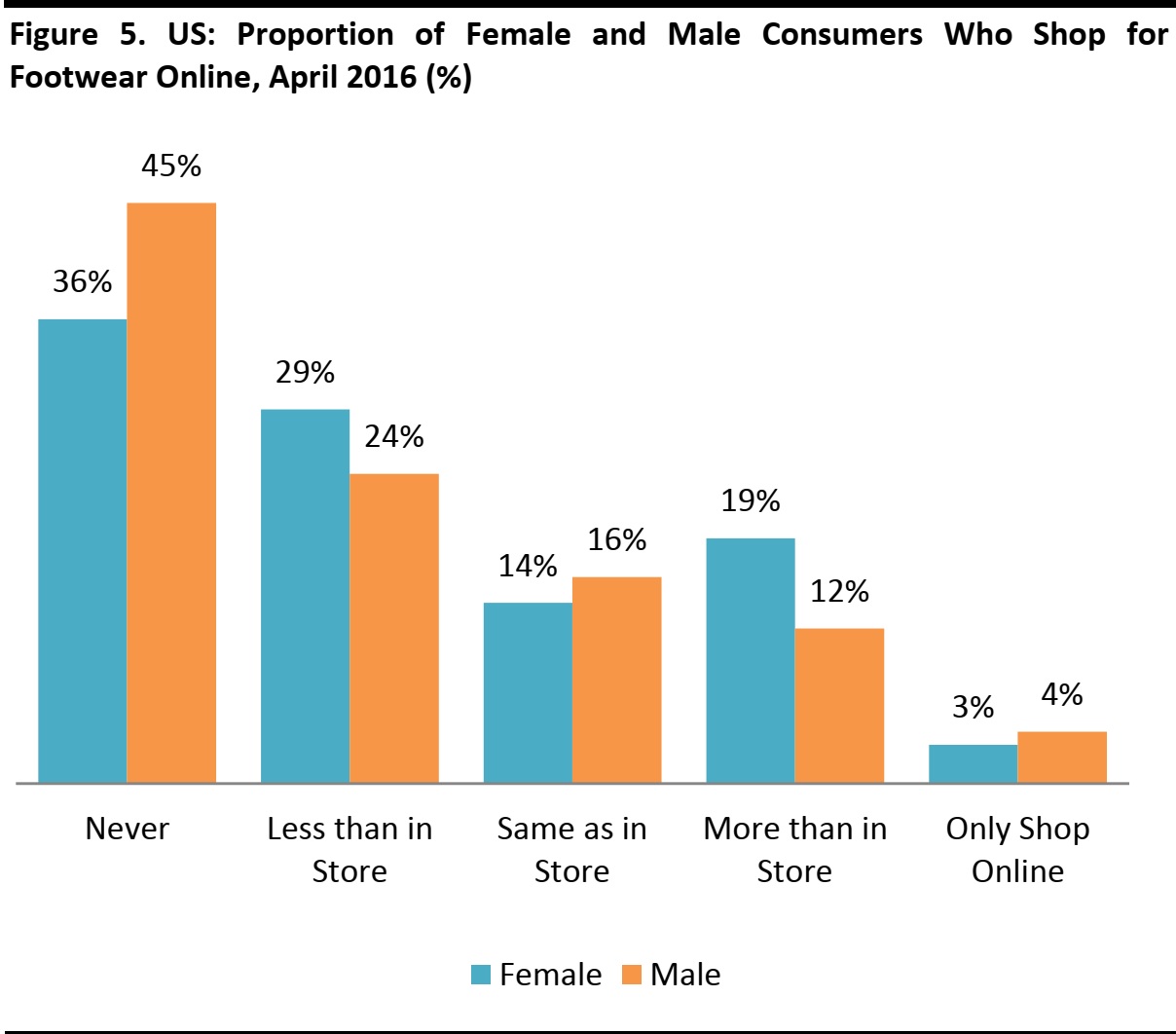

An April 2016 survey by Body Labs, a US-based fit-sizing technology company, found that women shop more frequently for apparel and footwear than men do, and that women are more open to shopping for these categories online.

Base: 1,130 US consumers

Source: Body Labs

CUSTOMIZATION AND FIT AND SIZING TECHNOLOGIES WILL DRIVE GROWTH IN FOOTWEAR E-COMMERCE

Customization and Personalization

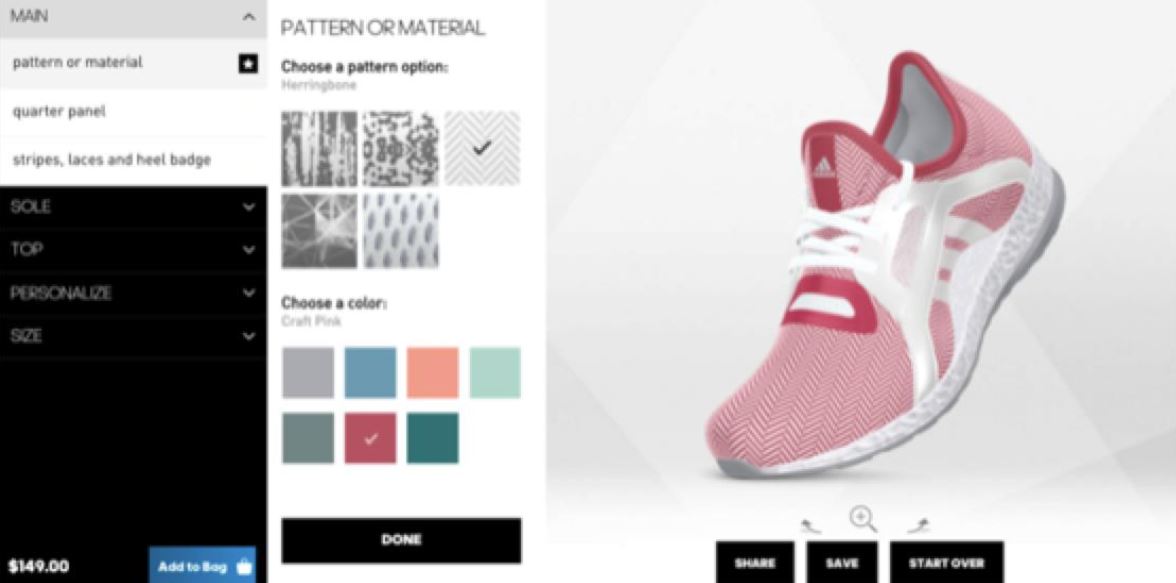

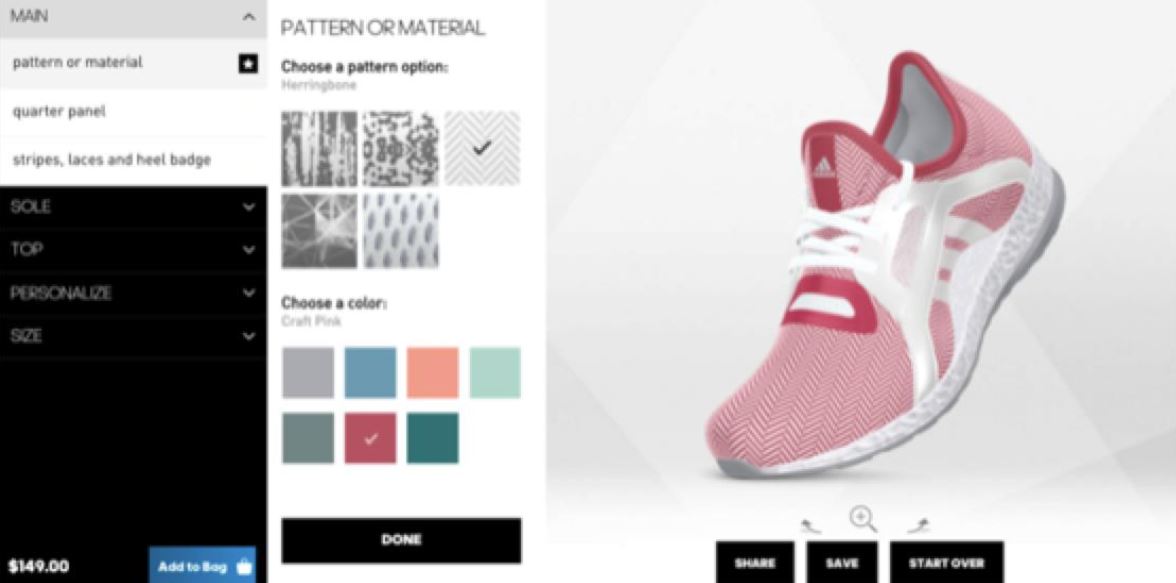

Online customization of footwear is a growing trend, primarily driven by millennials, that provides consumers with greater product variety and differentiation options than are available in stores. Product customization is often used for aesthetic purposes, but it can also help consumers obtain a better shoe fit, as shoes can be custom fit in terms of size and foot shape, including the arch and toe bed.

Design customization options include laser printing and airbrushing. The rise of 3D printing has also had significant implications for footwear customization. As the technology evolves and the cost of 3D printers and materials continues to fall, it is possible that consumers will eventually use the technology to design and print their own shoes at home.

Nike and other sports footwear manufacturers already offer some customized design options online that are rarely available in brick-and-mortar stores; for example, when ordering online, customers can choose between main patterns, swoosh colors and custom name/number stitching for some models. In 2015, Nike reintroduced the NikeLab Bespoke iD program, which allows customers to meet with a Nike design consultant in person and customize selected footwear for up to $1,000. The company operates customization studios in London and New York.

Source: Nike

Nike, Adidas and other brands are already using 3D printing to enable shoppers to customize the way their shoes fit, printing soles that are perfectly molded to an individual’s foot. Adidas has stated that its future stores will be linked to production facilities where robots will be able to produce a customized pair of sneakers in about 15 minutes.

Source: Adidas

Hot on their heels, New Balance and Under Armour are also exploring footwear performance-customization opportunities through 3D printing. And US-based department store chain Nordstrom has partnered with specialty running retailer Road Runner Sports to offer 3D proprietary athletic shoe fit analysis.

It will likely be about 10 years before 3D printing becomes fully mainstream and is incorporated into factories’ mass-production processes. But, in the future, consumers will be able to scan the shape of their feet via smartphone app, and send the scans to manufacturers, which will use them to create sneakers with customized midsoles that are sent directly to shoppers’ homes.

According to Bain & Company, less than 10% of consumers own customized merchandise today, but 25%–30% would be interested in influencing the product design process. Some customers have already been willing to pay anywhere from US$200 for a customized Nike check pattern to US$350 for custom soles to US$10,000 for a unique, fully customized pair of sneakers. Customization will likely give companies the opportunity to increase footwear prices, while reducing the need for excess inventory and discounting.

Sizing and Fitting Technologies

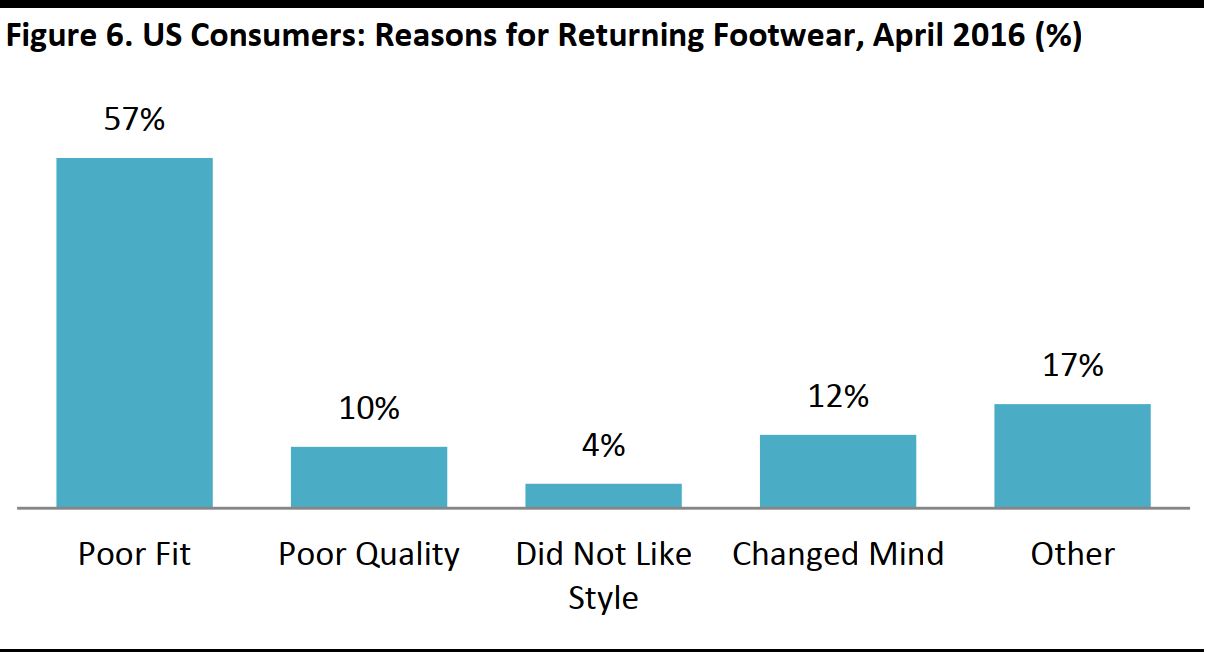

Issues with poor fit, and the consequent returns they necessitate, are the Achilles’ heel of online footwear retailing. Clearly, customers’ uncertainty about finding the right fit while shopping online for apparel and footwear increases product returns and drives up costs for retailers. Our previous research established a “window” of return rates in online apparel and footwear retail: multichannel fashion retailers typically see 15%–20% of online purchases returned, but for pure plays, the proportion can be higher. For instance, online apparel and footwear pure play Zalando has reported return rates as high as 50% and ASOS has reported return rates of around 30% in recent years.

Additionally, many companies offer free product returns, which digs into profitability. The costs are further compounded with cross-border retail transactions, for which shipping and return charges are substantially higher.

Several fitting and sizing technology services, such as True Fit and Fitcode, have been launched to help retailers increase customers’ fit confidence and drive down return rates.

According to Jessica Murphy, Cofounder of True Fit, return rates are highest in dresses and shoes, where a close fit is essential. On average, just 2% of website visits convert into a purchase, but True Fit can help retailers boost conversion rates up to 8%. True Fit has recently raised a US$25 million round of funding, and the company has partnered with ALDO, DSW, Sperry, Clarks, Saucony, Cole Haan, Jet, Brooks, Stuart Weitzman, UGG, Adidas, Dune, Reebok and Skechers.

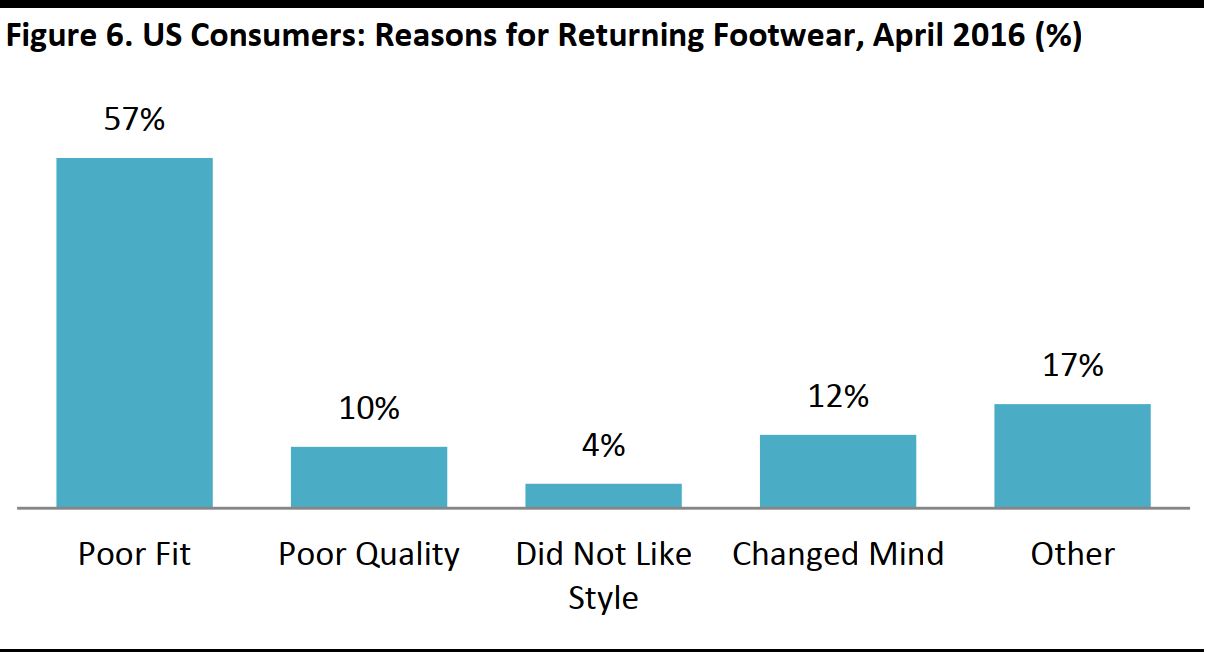

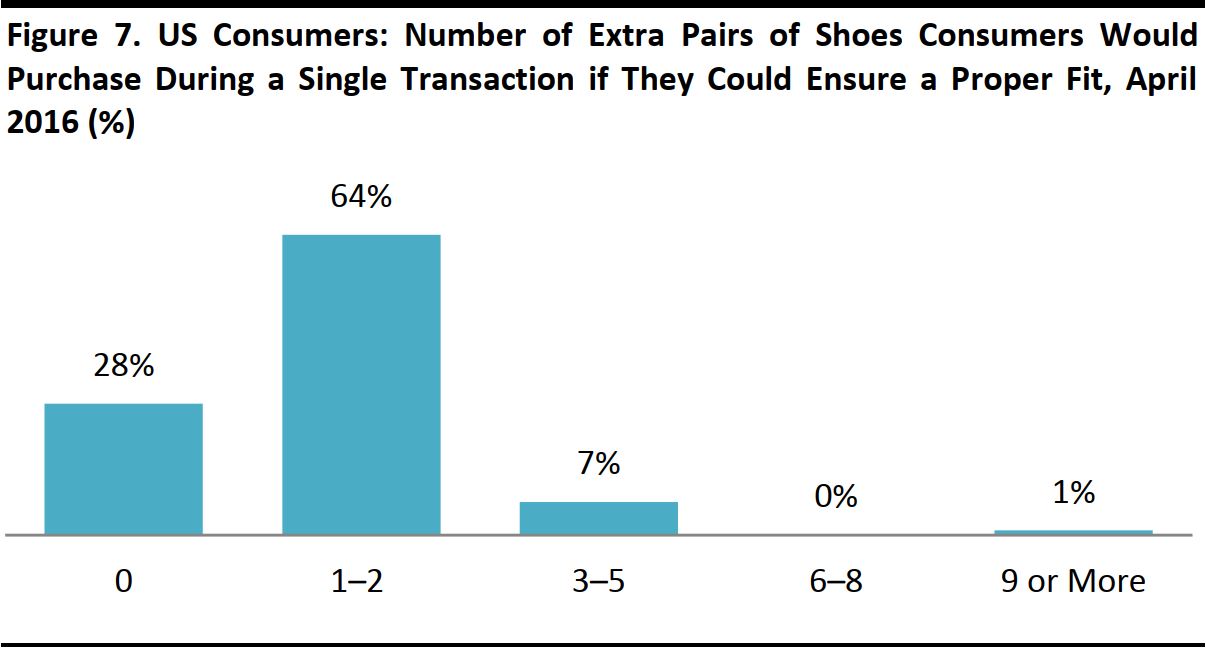

According to the founder of Fitcode, another fitting technology service for retailers, companies lose US$260 billion annually in e-commerce returns, with fit issues being the number one reason for returns. According to a Body Labs survey in April 2016, US consumers on average say they returned 20% of online footwear purchases, compared with 13% of in-store purchases and 23% of online clothing purchases.

Base: 1,130 US consumers

Source: Body Labs

Fast and free shipping and returns give customers confidence to purchase online. According to Accenture, 76% of shoppers examine a retailer’s return policy before completing an online purchase, and Body Labs says that 57% of shoppers will purchase clothing or footwear online only from brands or in styles they know will fit.

Base: 1,130 US consumers

Source: Body Labs

Amazon is also dipping its toes in the water, working on a technology that will be able to provide customers with size recommendations based on reference items. The company plans to use a device to take internal measurements of products, which will then be used to create 3D models that will be stored in a database. Amazon’s goal is to be able to recommend products with similar fits based on the stored reference item specifications. Last year, Amazon acquired sizing technology company Shoefitr, which also serviced companies such as Nordstrom and Cole Haan.

Source: Shoefitr

MAJOR ONLINE FOOTWEAR PLAYERS

Footwear is sold at a variety of retail formats, including footwear specialist stores, clothing specialist stores, department stores, off-price retailers and sporting goods chains. Retailers across these formats have stepped up to the online channel with omni-channel propositions. Online stalwarts such as Amazon and eBay are also major players in global footwear e-commerce. In the past few years, numerous innovative online pure plays have also gained a toehold in the footwear market. We highlight some of the world’s major footwear e-commerce retailers below.

Pure-Play Footwear Retailers

Zappos is a US-based online footwear retailer that was founded in 1999. The company was purchased by Amazon in 2009.

Amazon sold 196,000 pairs of shoes in the US on its second annual Prime Day in July 2016, according to

Women’s Wear Daily. Birkenstock recently decided to discontinue distributing its shoes through Amazon and to prevent third-party merchants from selling its merchandise on Amazon due to counterfeiting issues.

Shoes.com is a Canadian online shoe retailer that sells a wide variety of US and international brands. The company’s revenues totaled US$234 million in 2015 and grew at 300% year over year. The company’s goal is to reach annual sales of US$1 billion by 2020. Shoes.com has opened one brick-and-mortar location, in Toronto, and is planning to open several more in Canada and the US. The stores will feature one rotating brand a month in each store, and brand representatives will be available to educate customers about their footwear, which customers can then easily purchase online.

German retailer Zalando was founded in 2008, initially as a dedicated online footwear retailer. Over time, the retailer branched out into other product categories, including apparel and accessories. Zalando distributes in 15 European countries and says it holds 5% market share in footwear in Germany. It offers more than 150,000 products and more than 1,500 brands. Zalando is currently Europe’s largest online-only fashion group by revenues. The company’s 2015 sales increased by 34% year over year to US$3.0 billion. At the end of the second quarter of 2016, the company had 18.8 million active customers and the average number of orders per active customer reached an all-time high of 3.3 per year. The return rate at Zalando is 50%.

French online footwear retailer Sarenza carries more than 750 brands and 55,000 SKUs. Established in 2005, the company saw 2015 sales increase by 21% year over year, to approximately US$226 million. More than half of Sarenza’s sales are generated outside France, in Western and Eastern Europe.

France-based online shoe retailer Spartoo was established in 2006. The retailer sells more than 1,500 brands and 100,000 SKUs to more than 20 countries, including France, Germany, England, Italy and Spain. The company sees more than 14 million unique website visitors per month. Spartoo has received up to US$51 million in funding from French, European and US private equity firms and investment banks.

Omni-Channel Footwear Retailers and Brands

US-based discount footwear retailer DSW purchased off-price online shoe e-tailer Ebuys for US$65.2 million in February 2016. Apart from Ebuys, DSW also maintains its own namesake e-commerce business. DSW directly operates 469 US stores and distributes to 400 wholesale partner stores in the US. Ebuys contributed US$15.1 million of DSW’s total sales of US$681 million in the company’s fiscal third quarter of 2016.

Nike footwear revenues amounted to US$8.5 billion in 2015, representing approximately 28% of total company revenues. Nike footwear accounted for almost half of the US athletic footwear industry’s US$17.2 billion in sales in 2015, according to The NPD Group. Nike has stated that it plans to grow its e-commerce business from US$1 billion in 2015 to US$7 billion by 2017.

Adidas currently produces approximately 300 million pairs of shoes per year. E-commerce is the company’s fastest-growing channel and online revenues are expected to increase to US$2 billion by 2020. The company’s s e-commerce revenue grew by 42% year over year on a constant-currency basis in 2015.

Innovative Online Footwear Startups

In the last few years, numerous innovative online footwear and apparel retailers have also entered the market.

Sydney-based Shoes of Prey is an online customizable-shoe retailer that has sold more than 6 million customized pairs of shoes since launching in 2009. Customizable shoes are made from the ground up: the customer selects the pattern, fabric, decorations and even heel height. Finished products are delivered within two weeks. Over the past year, Shoes of Prey has reported an 18% return rate and has said that the majority of customers who make returns choose to remake their purchased shoes rather than obtain refunds. Last year, Shoes of Prey established a partnership with Nordstrom and raised US$15 million in investment capital, partially from Nordstrom.

New York–based Stadium Goods is an online reseller of rare sneakers, and offers more than 15,000 pairs through its website. Nike sneakers represent 96% of total consignment sneaker sales, but other brands include Adidas, Puma, Vans and New Balance. The company is expanding into China through a partnership with Alibaba’s Tmall e-commerce platform. In 2015, Alibaba’s two online platforms, Tmall and Taobao, accounted for 80% of China’s US$300 billion e-commerce retail market. Stadium Goods has opened one brick-and-mortar store, in New York. The company has also established a partnership with eBay.

Farfetch is a London-based online luxury retailer that retails apparel, footwear and accessories. The company derives the majority of its revenue from the US, followed by the UK, Australia and Brazil. Since its founding in 2008, Farfetch has sold enough shoes to circle the equator six times.

Paris-based online apparel and footwear retailer Sézane has grown from a simple eBay store in 2004 to a dedicated online retailer with 10,000–20,000 monthly orders. Shoes are Sézane’s top-selling category and the average footwear price point is around US$165. The company plans to open a second brick-and-mortar store in London and a New York store in 2017. Since 2014, Sézane has launched three collection collaborations with Madewell, and a fourth is to be unveiled in October 2016. The company generates approximately 80% of its total revenues in France, followed by the UK, the US and Belgium, according to

The Business of Fashion. About 1,000 monthly orders are derived from New York. Further collaborations with department store Le Bon Marché will follow. Sézane has no external investors and has generated profits since inception.

San Francisco–based Everlane is an online apparel and footwear retailer. Everlane is expected to reach US$100 million in revenues this year.

KEY TAKEAWAYS

- Footwear spending is growing rapidly: worldwide footwear sales grew by 6% year over year in 2015, to US$340 billion. Global footwear e-commerce sales accounted for 12% of this total, according to Euromonitor.

- Customization and personalization, evolving sizing and fitting technologies, and millennials’ shopping patterns are driving the robust e-commerce growth in footwear.

- Challenges with footwear e-commerce include sizing and fit issues, as well as high costs for retailers from providing free product returns. Innovations such as fitting technologies, are helping to drive down return rates and, so, limit costs for online retailers.

Nike and other sports footwear manufacturers already offer some customized design options online that are rarely available in brick-and-mortar stores; for example, when ordering online, customers can choose between main patterns, swoosh colors and custom name/number stitching for some models. In 2015, Nike reintroduced the NikeLab Bespoke iD program, which allows customers to meet with a Nike design consultant in person and customize selected footwear for up to $1,000. The company operates customization studios in London and New York.

Nike and other sports footwear manufacturers already offer some customized design options online that are rarely available in brick-and-mortar stores; for example, when ordering online, customers can choose between main patterns, swoosh colors and custom name/number stitching for some models. In 2015, Nike reintroduced the NikeLab Bespoke iD program, which allows customers to meet with a Nike design consultant in person and customize selected footwear for up to $1,000. The company operates customization studios in London and New York.

Nike, Adidas and other brands are already using 3D printing to enable shoppers to customize the way their shoes fit, printing soles that are perfectly molded to an individual’s foot. Adidas has stated that its future stores will be linked to production facilities where robots will be able to produce a customized pair of sneakers in about 15 minutes.

Nike, Adidas and other brands are already using 3D printing to enable shoppers to customize the way their shoes fit, printing soles that are perfectly molded to an individual’s foot. Adidas has stated that its future stores will be linked to production facilities where robots will be able to produce a customized pair of sneakers in about 15 minutes.