Web Developers

Executive Summary

We define the members of Generation Z as those born after 2000, which means the group is both the next generation of consumers and one whose members have not all been born yet. We have identified three main themes within the Gen Z beauty market: Image pressures from social media are fueling beauty demand. Gen Zers are the first generation to both document their years growing up on social media websites and be exposed online to aspirational images of celebrities and self-made social media stars. Consequently, nearly one-third of US teen girls feel bad when comparing themselves with others they see on social media, according to a survey by the American Psychological Association. And academic research studies have found links between social media usage and low self-esteem. We think these pressures are likely to fuel teen spending on beauty products. Beauty spending is a growing priority for US teen girls. According to a Piper Jaffray survey, upper-income female teens’ share of spending on the beauty category grew to its highest level ever in the fall of 2016. Reflecting this trend, usage of facial cosmetics is high among girls ages 12–14: according to Mintel data, roughly half of this age group uses mascara, foundation or concealer. Reflecting the impact of social media, last year, brand owners Estée Lauder and L’Oréal attributed strong demand for cosmetics to the selfie culture. Gen Z turns to social media for beauty advice. Not only does social media heighten pressures on young people regarding personal appearance, but also serves as a source of beauty information and expertise for them. Many young consumers turn to social media, and especially video content, when shopping for beauty products. Mintel found that three-quarters of US female teens had looked to YouTube for tutorials on new styles or new products. Moreover, the amount of beauty content on YouTube surged by 200% between 2015 and 2016, according to analytics firm Pixability, and the firm found that female consumers ages 13–24 make up fully 47% of the audience for these videos. Brands seeking to engage with Gen Z must offer engaging, authentic content on visual-driven social media sites.

Source: Fung Global Retail & Technology

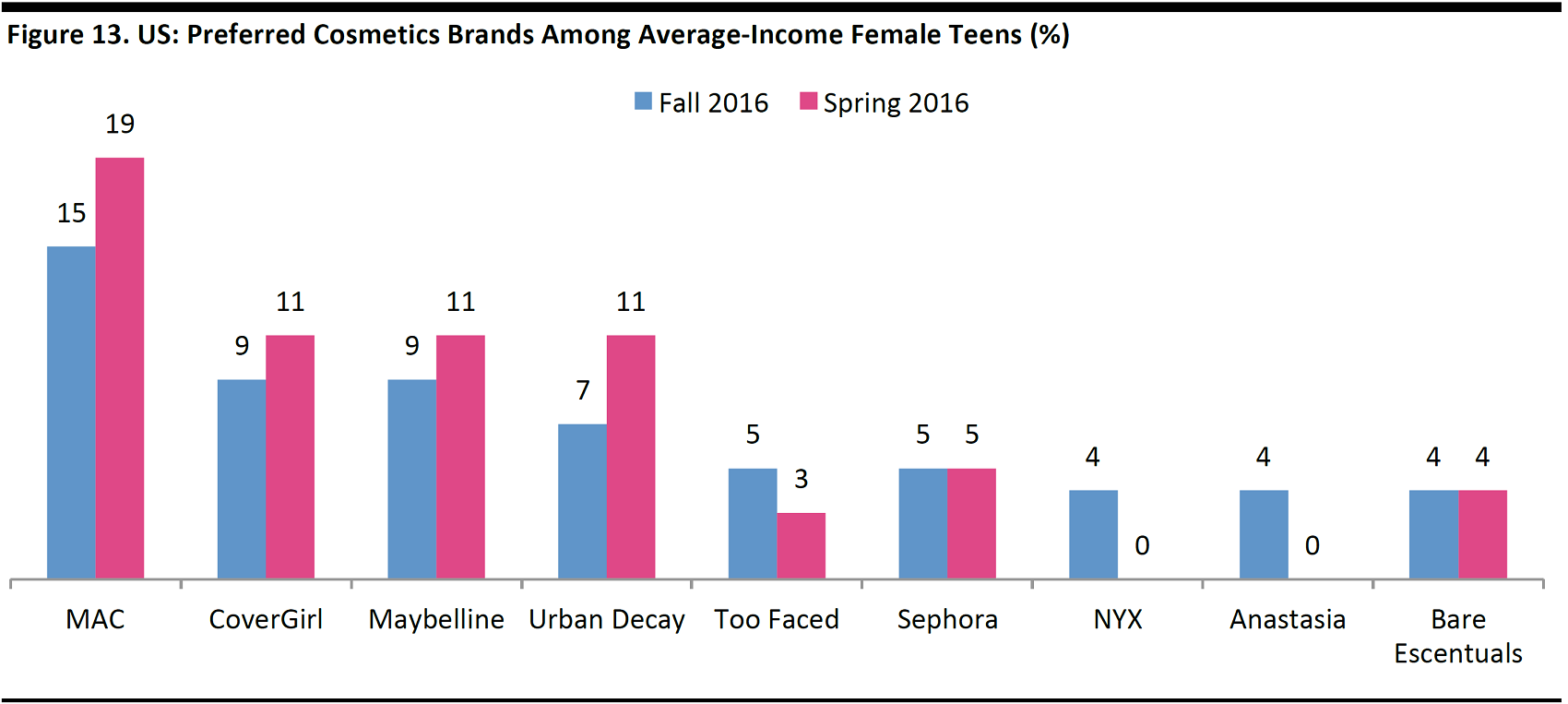

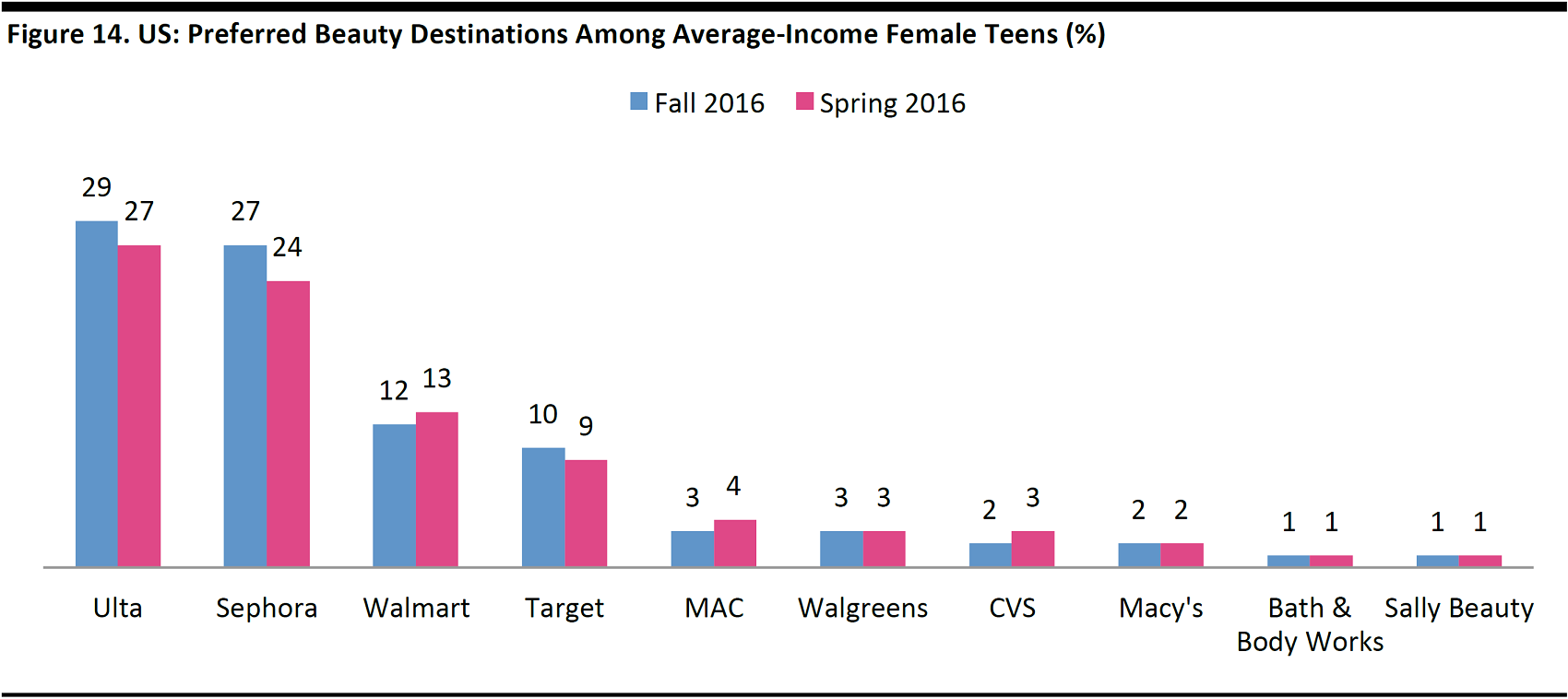

We estimate that US female teens ages 12–17 spent approximately $2.3 billion on the core beauty categories of skincare, cosmetics, and fragrances in 2016. In the US, MAC, CoverGirl, Maybelline, and Urban Decay are the favored brands of female teens, according to Piper Jaffray, while Ulta, Sephora, Walmart and Target are their favored retailers.

Source: Shutterstock

In the coming years, we expect the demands of Gen Z consumers to be a driver of beauty industry M&A. Legacy multibrand giants are likely to seek to strengthen their position with Gen Z as the demographic’s spending power accelerates. We believe Gen Zers place heightened importance on the following when shopping for beauty products, and that these preferences will impact beauty M&A in future years:- Formulated with pure and natural ingredients.

- Celebrity-branded and/or formulated by “star” skincare and haircare experts.

- Made by companies that recognize and demonstrate social consciousness, which may include a focus on diversity and equality and cruelty-free processes and goods.

Introduction

Born after 2000, Gen Z will form the next generation of consumers. Its oldest members are on the cusp of adulthood, and so are beginning to draw the attention of mass-market retailers. In August 2016, we published a 20-page overview of Gen Z and its preferences and behaviors as a consumer group: readers can find that report at bit.ly/FungGenZ In this report, we turn to the beauty category in more detail and discuss how social media in particular fuels beauty demand among teens. We also look at how, in turn, these consumers look to social media for advice and recommendations when shopping for beauty products. The following sections also explore which brands and retailers are preferred by US teens and the likelihood that Gen Z demands will impact future M&A in the beauty industry. This report is part of our new series, The New Beauty Consumer, which looks at various aspects of beauty retailing and consumption. Some of the data cited in this report are global or not specific to the US, but our focus is on the American market.Defining Gen Z

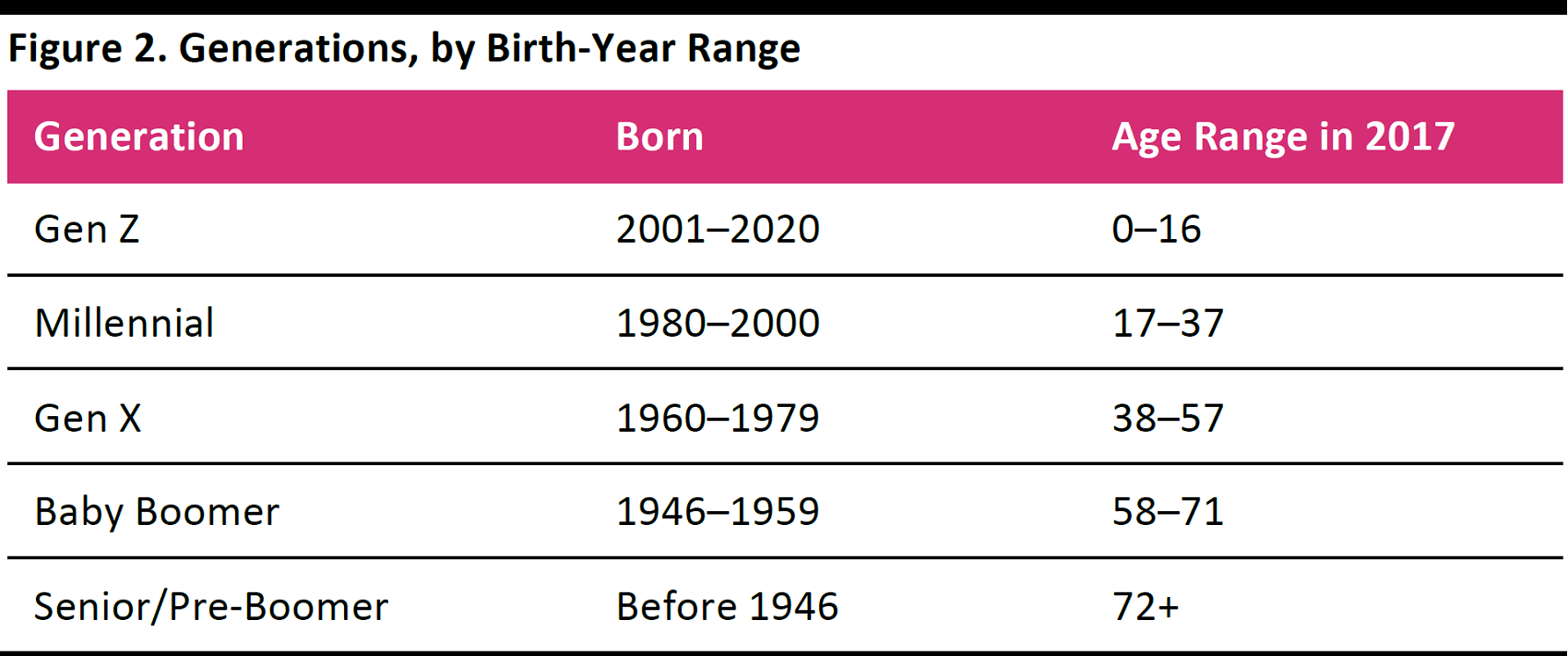

Gen Z is the fastest-growing segment of the population. We define Gen Z as those born after 2000, and maintain that not all of its members have been born yet. But there is no consensus on the definition of Gen Z: some commentators suggest that this generation includes only those born between the late 1990s and the mid-2000s. We think categorizing this generation as including those born in a span of approximately 20 years makes it more comparable to previous generations and that defining it as including only those born within a 10-year range, as some imply, is not useful. The table below illustrates how we define the generations.

Source: Fung Global Retail & Technology

In 2015, Gen Z made up 19% of the US population, we estimate, based on US Census Bureau data. By 2020, its share will be around 25%. Some of the data cited in this report are based on surveys of consumer groups that included some respondents who were older than Gen Zers, according to our definition, at the time the surveys were conducted. For instance, some surveyed groups included younger millennials. We cite these data anyway because we think having definitive cutoff points between generations is by definition arbitrary, and that such data often have value in pointing to more general trends and differences between broad age groups.Not Just Social...Visual

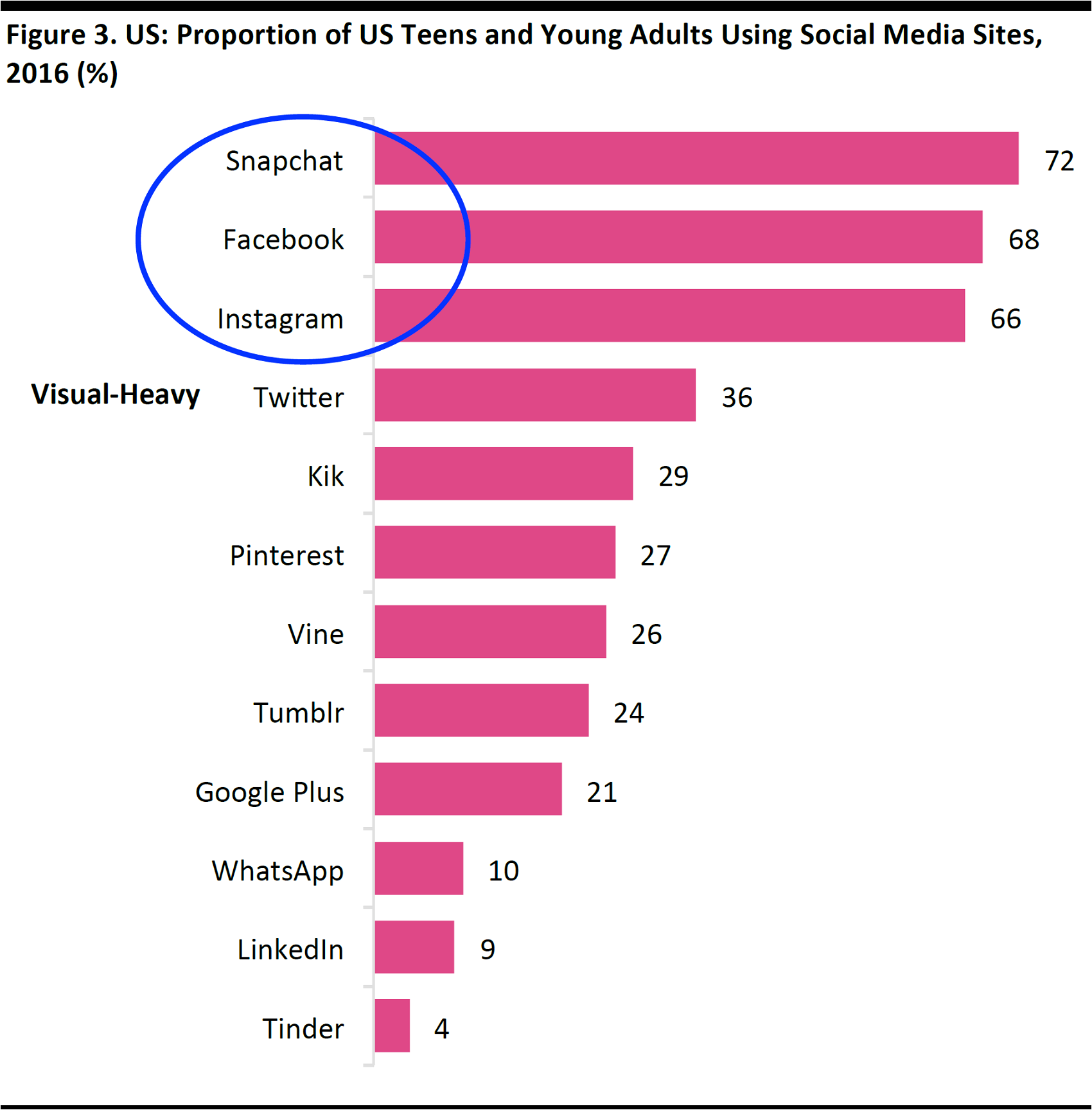

It is worth remembering that Gen Z is the first generation to grow up alongside—and so be shaped by—fast-changing consumer devices and services. From Skype to smartphones to Instagram to Amazon Prime, major everyday tech products and tech-enabled services have all emerged during Gen Zers’ lifetime. In addition, these consumers are enthusiastically documenting their lives online, from their social and political views to their photographs. The massive adoption of smartphones has coincided with the emergence of social media, and one result of this is that teens can now expect to be photographed anytime, anywhere—and to have those images shared online. Reflecting this emphasis on visual content, young consumers not only avidly use social media, but also flock to visual-dominated social media channels such as Snapchat and Instagram. In response, other major social media sites such as Facebook are racing to keep up with these image-heavy rivals by attempting to increase the amount of video content available on their platforms.

Base: 2,002 US respondents ages 12–24 surveyed in January–February 2016 Source: Edison Research/Triton Digital

We perceive social media as causing teens to focus more attention on their personal appearance, and we think that is likely to boost demand in the beauty product market, as well as adjacent markets that are focused on personal appearance, such beauty services, and the fitness industry.Social Media Fuels Image Concerns

“Every time [teens] switch on their phones, they’re getting messages about parties they haven’t been invited to, or they’re seeing photos of their friends doing things... .It absolutely permeates their sense of self-worth.”– Emily Cherry, Head of Participation at UK children’s charity NSPCC

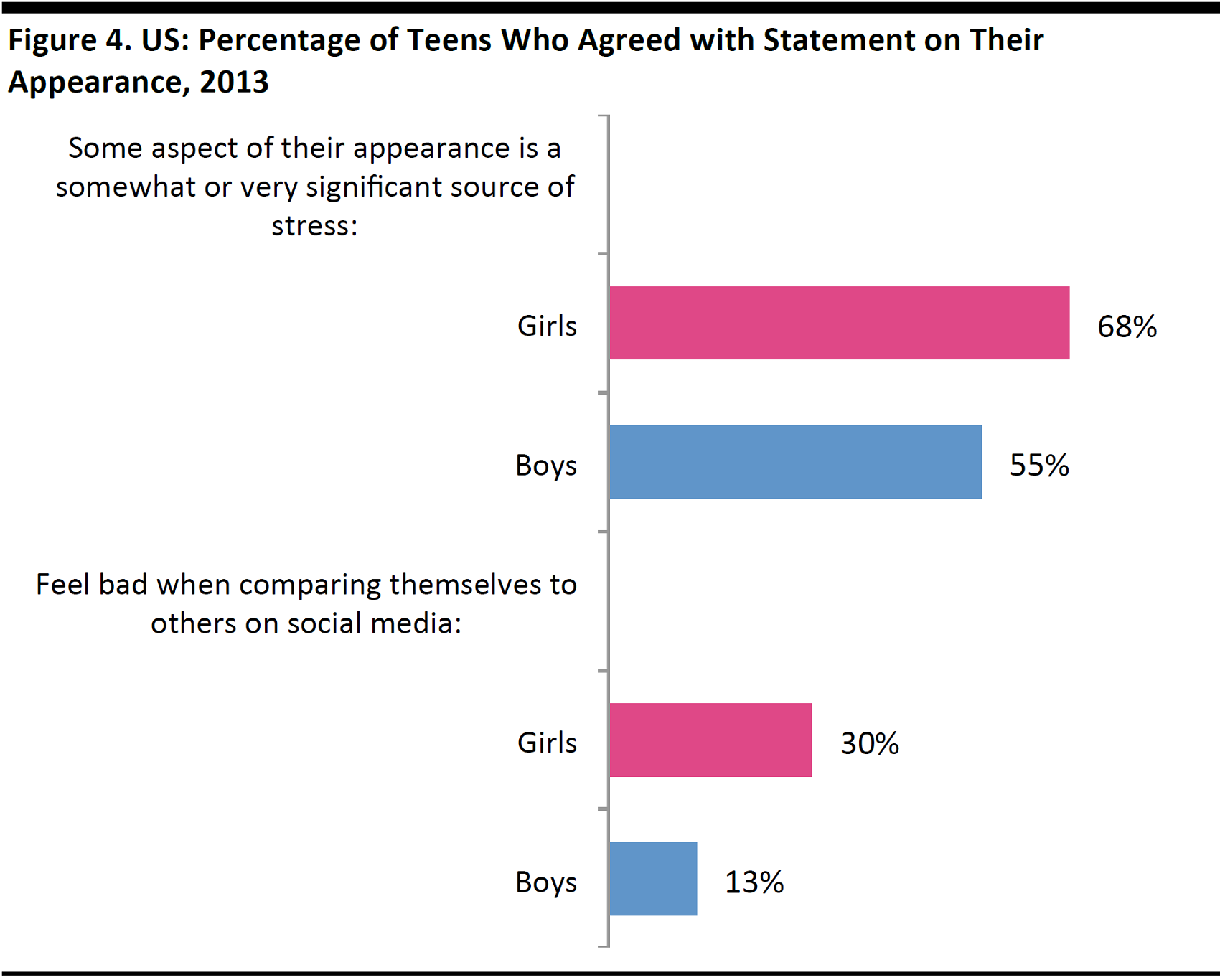

Social media use is “significantly associated” with increased incidence of depression, according to a 2016 study of young adults by the University of Pittsburgh School of Medicine. A 2015 report from Canada’s Centre for Addiction and Mental Health similarly found meaningful associations between time spent on social media and negative mental health indicators: heavy social media users were more likely to report low self-esteem, for instance. So, it is perhaps not surprising that negative sentiments associated with personal image and body-consciousness appear to be widespread among Gen Zers. According to a survey by the American Psychological Association, nearly one-third of US teen girls feel bad when comparing themselves with others they see on social media, as illustrated in the graph below. It is worth noting that this survey was conducted in 2013, when image-focused social media channels such as Instagram and Snapchat were still in their infancy.

Base: 1,018 US teens, ages 13–17 Source: American Psychological Association

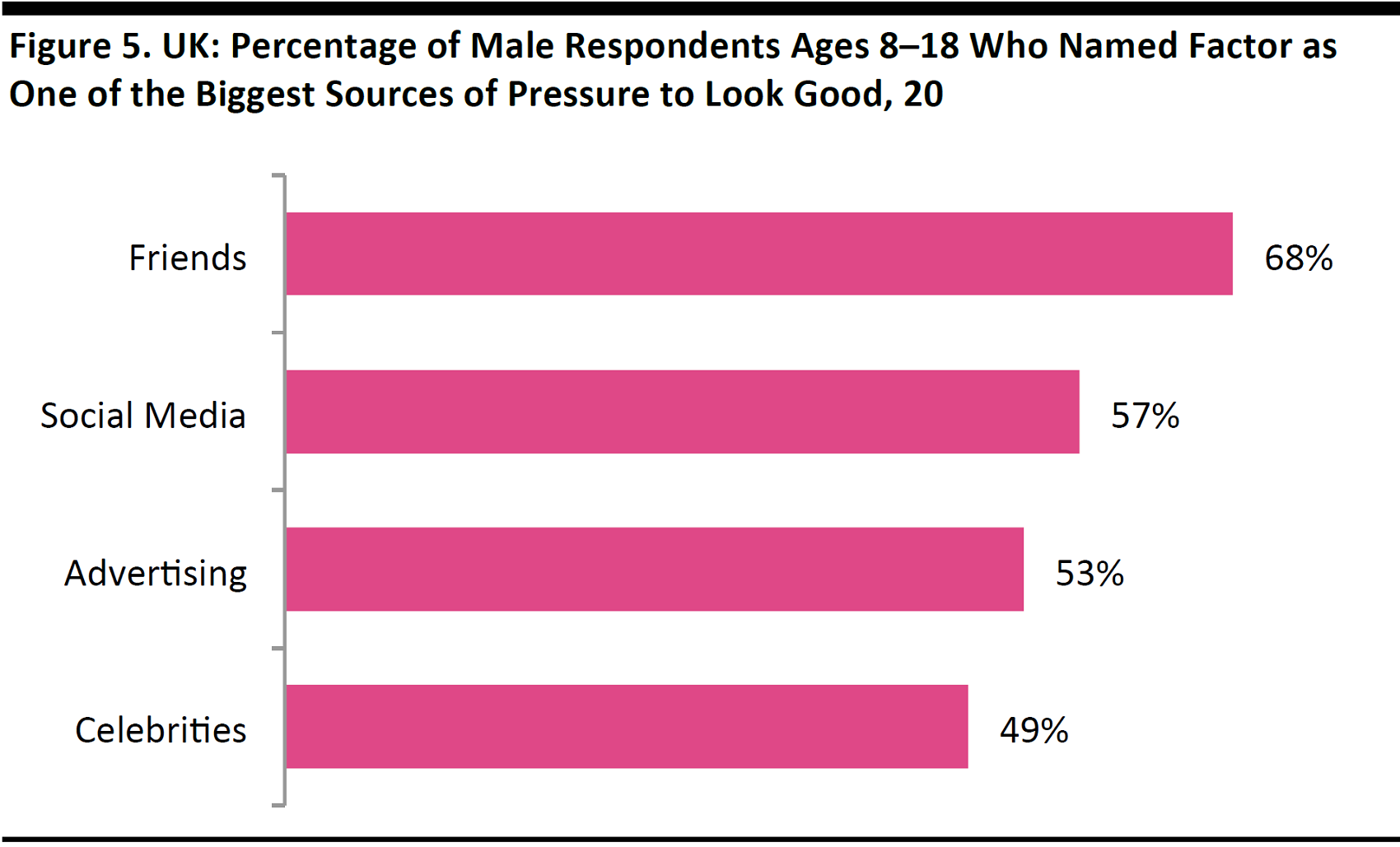

As the data above suggest, this is not an issue confined to girls. A 2016 survey sponsored by advertising think tank Credos in the UK found that more than half of young male respondents ranked social media as a source of pressure to look good. Social media ranked higher in importance overall than either advertising or celebrities did as a perceived source of pressure among respondents.

Base: 1,005 UK males, ages 8–18 Source: Credos

US Teens Are Growing Their Beauty Spending

So, young people appear to feel greater pressure than ever before to spend on their personal appearance. We note that the impact this pressure has on Gen Zers’ consumer behavior may change as the generation grows older, but, for now, beauty spending is a growing priority, particularly for US teen girls.

Source: Shutterstock

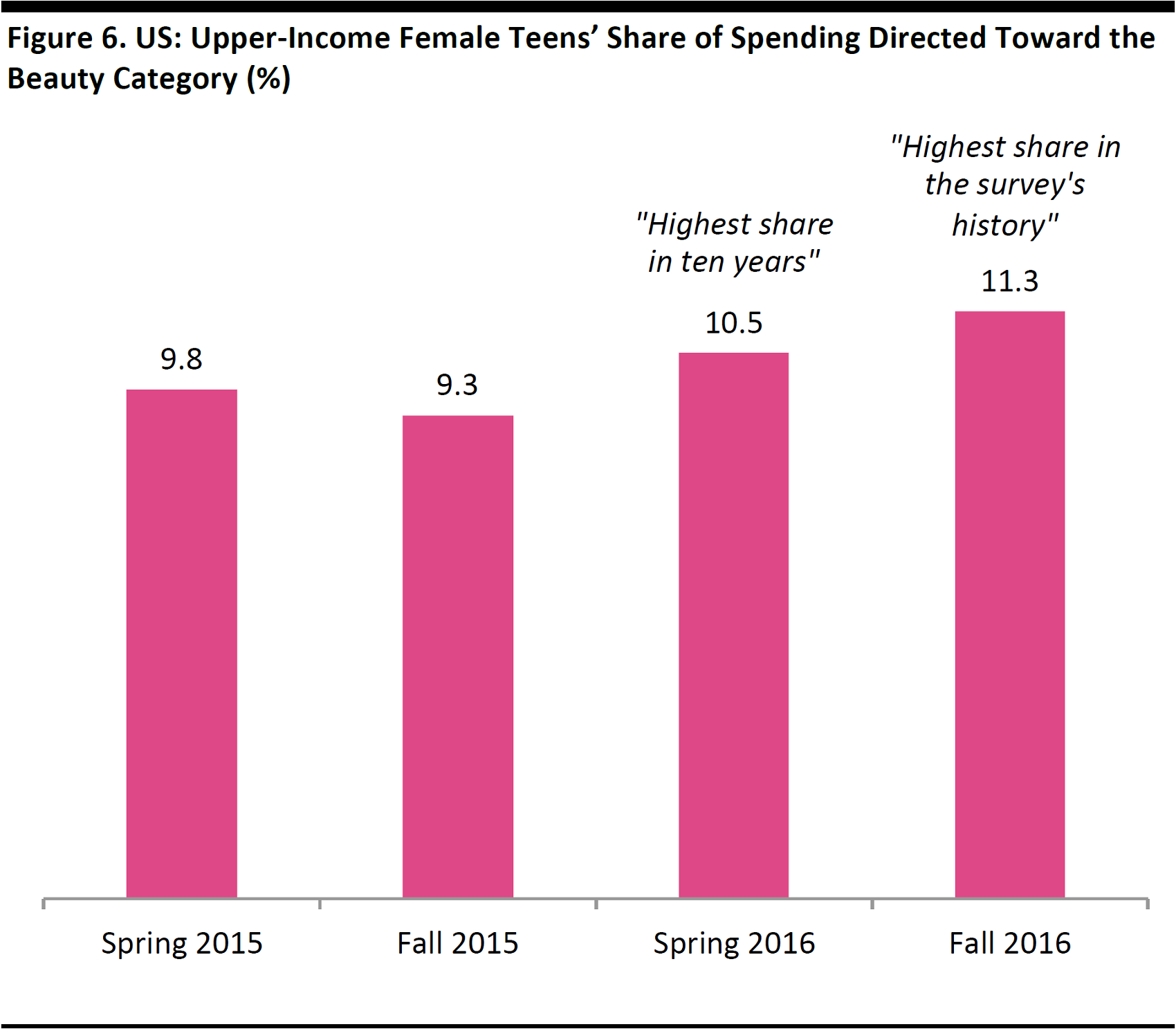

Upper-income female teens—a demographic seen as a leading indicator—grew their share of spending on the beauty category to its highest level ever in the fall of 2016, according to a survey by Piper Jaffray, an investment bank. Some 11% of this group’s total spending was on the beauty category.

Source: Piper Jaffray

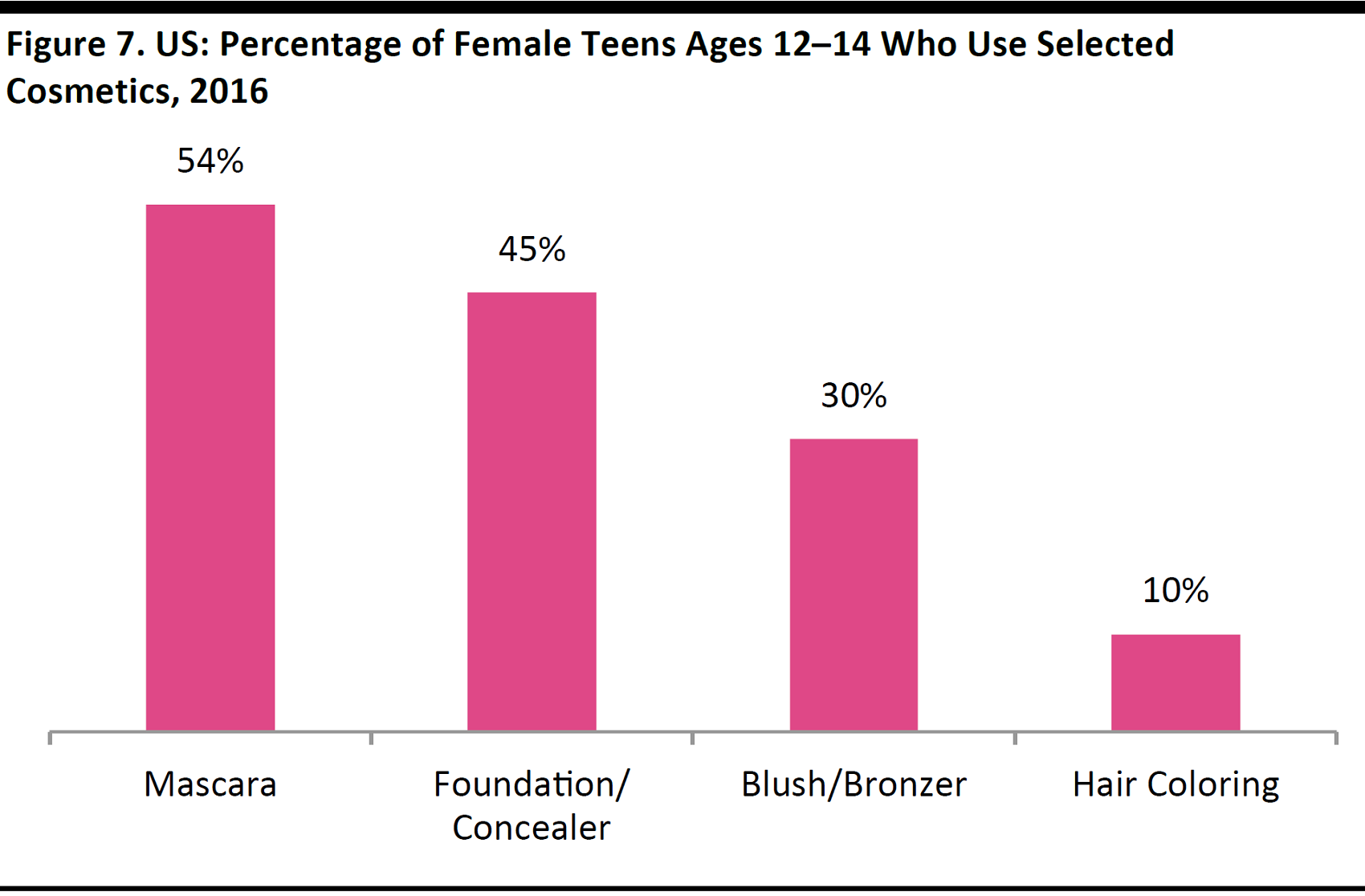

Reflecting this spending, usage of facial cosmetics is high among girls ages 12–14; according to Mintel, roughly half of this age group uses mascara, foundation or concealer.

Source: Mintel

According to Mintel, beauty and grooming product usage by male teens is also high, with four in 10male teens ages 12–17 using fragrance or lip-care products.

Source: Mintel

Beauty brands are reporting strengthened demand as a result of social media. In 2016, both Estée Lauder and L’Oréal said the selfie culture had contributed to strong growth in their cosmetics sales. And the particular trend for gym selfies is fueling young consumers’ demand for gym-friendly makeup from brands such as Tarte Cosmetics, Birchbox and Cult Beauty, according to The Times.Social Media Drives Beauty and Beauty Drives Social Media

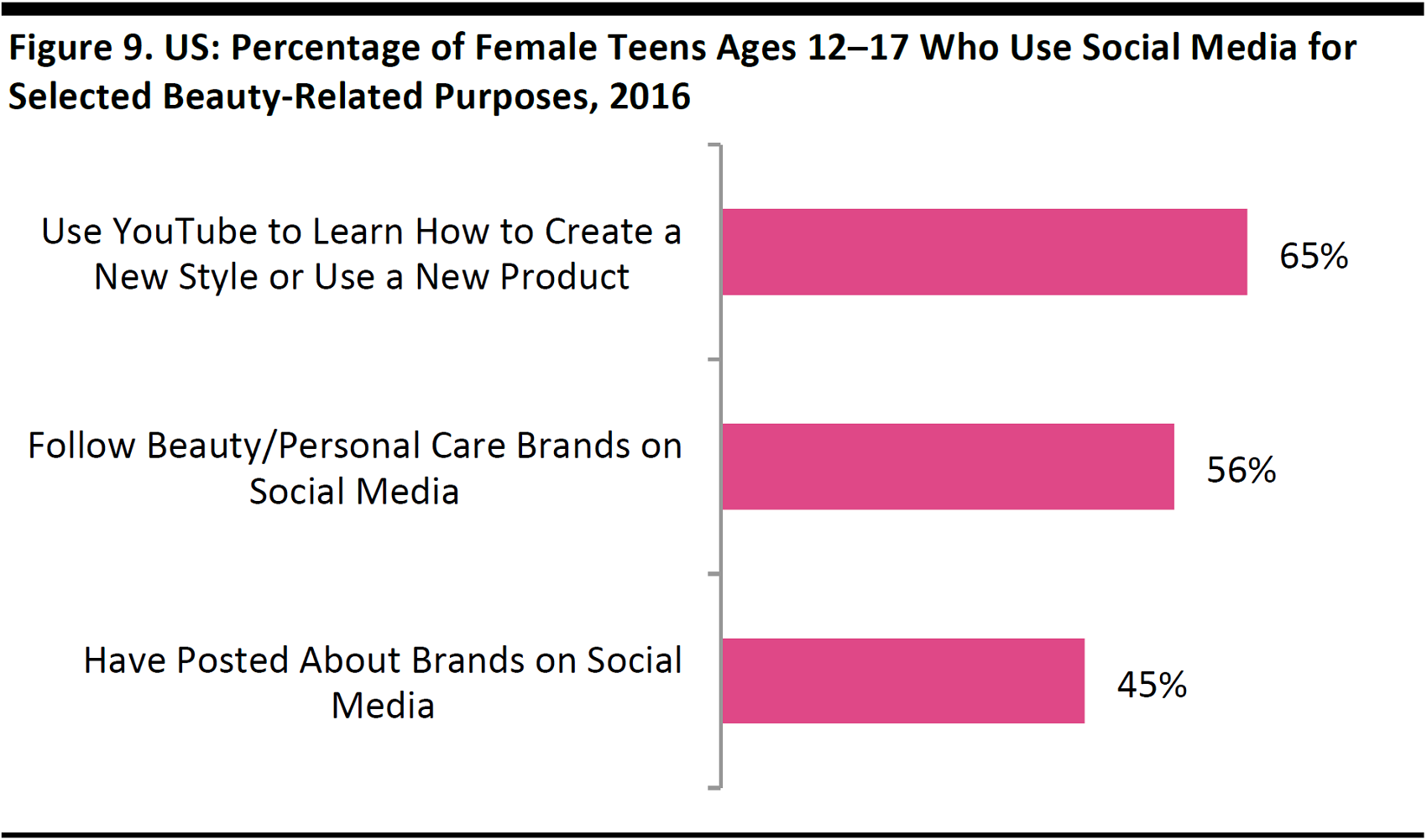

Visual-focused social media and the beauty market exist in a kind of symbiosis: not only does social media heighten pressures on young consumers regarding their personal appearance, but also serves as a source of information and expertise for them when they are shopping for beauty products. Many young consumers turn to social media, and especially video content, for information when deciding what beauty items to buy.

Source: Mintel

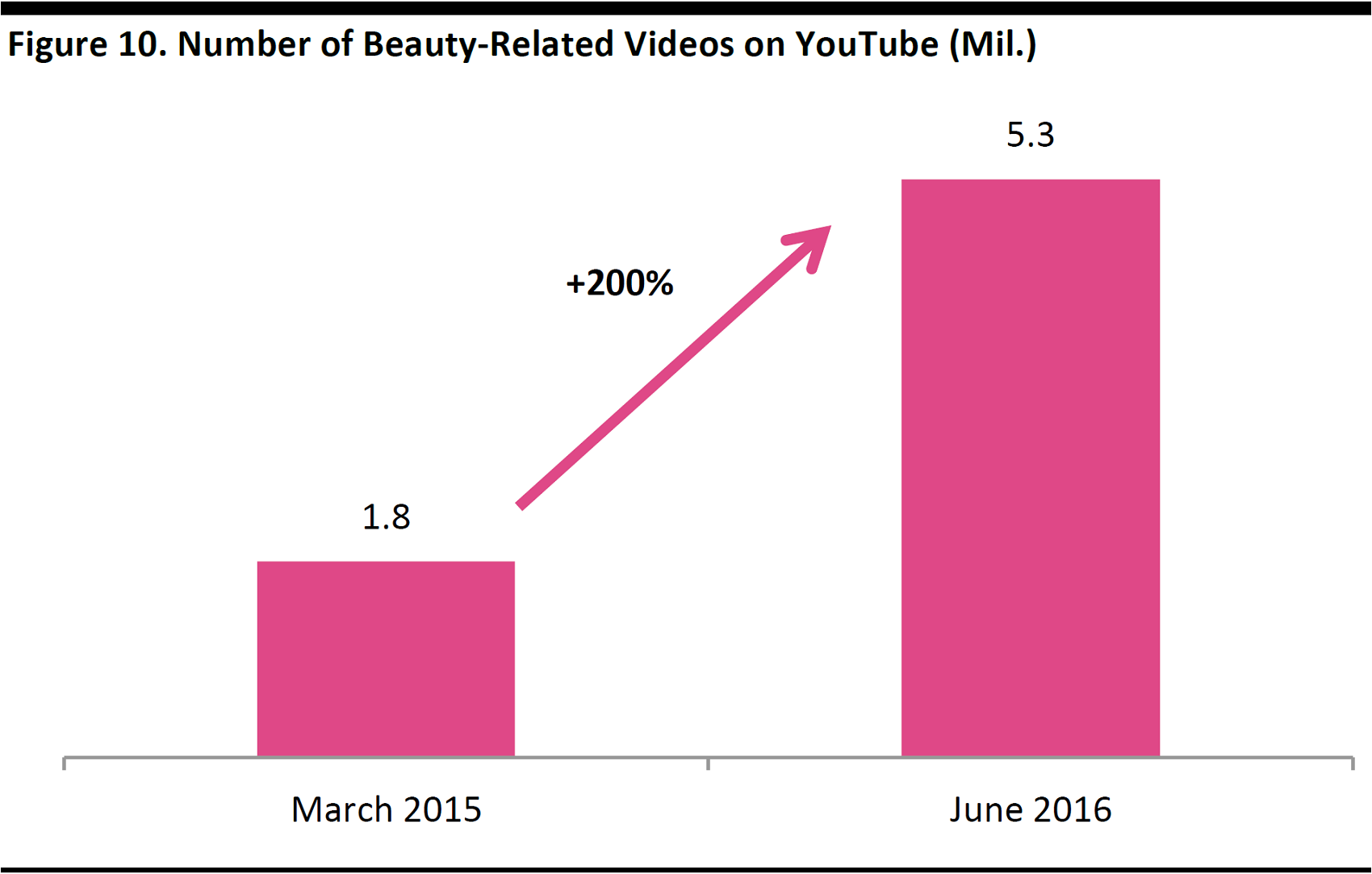

Beauty content has ballooned on YouTube and continues to grow apace. According to Pixability, the number of beauty-related videos hosted on YouTube more than tripled, to 5.3 million, in the 16 months ended June 2016.

Source: Pixability

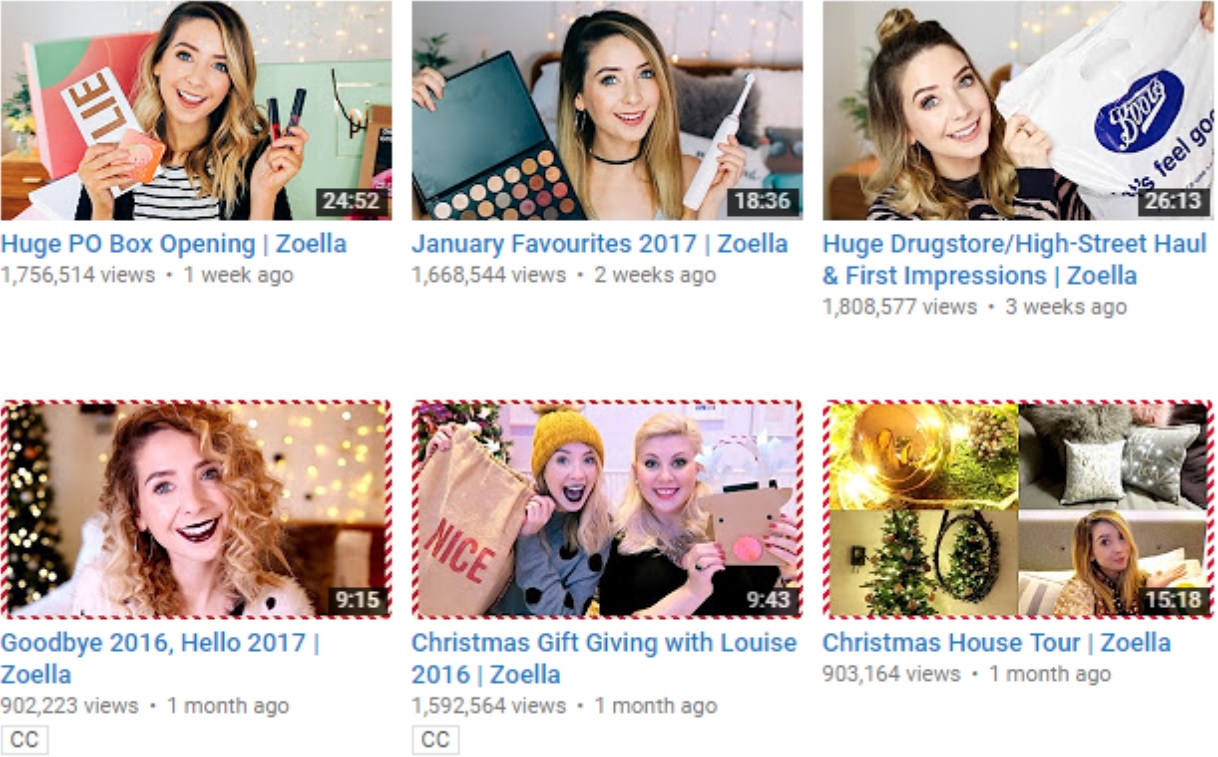

Gen Zers are the leading consumers of this content. According to Pixability, female viewers ages 13–24 make up fully 47% of the YouTube beauty audience. This kind of demand has made stars of vloggers such as Zoella, whose target audience is young female teens. Pixability says that Zoella leads by number of beauty subscribers, with 10.9 million signed up to follow her on YouTube.

Source: YouTube

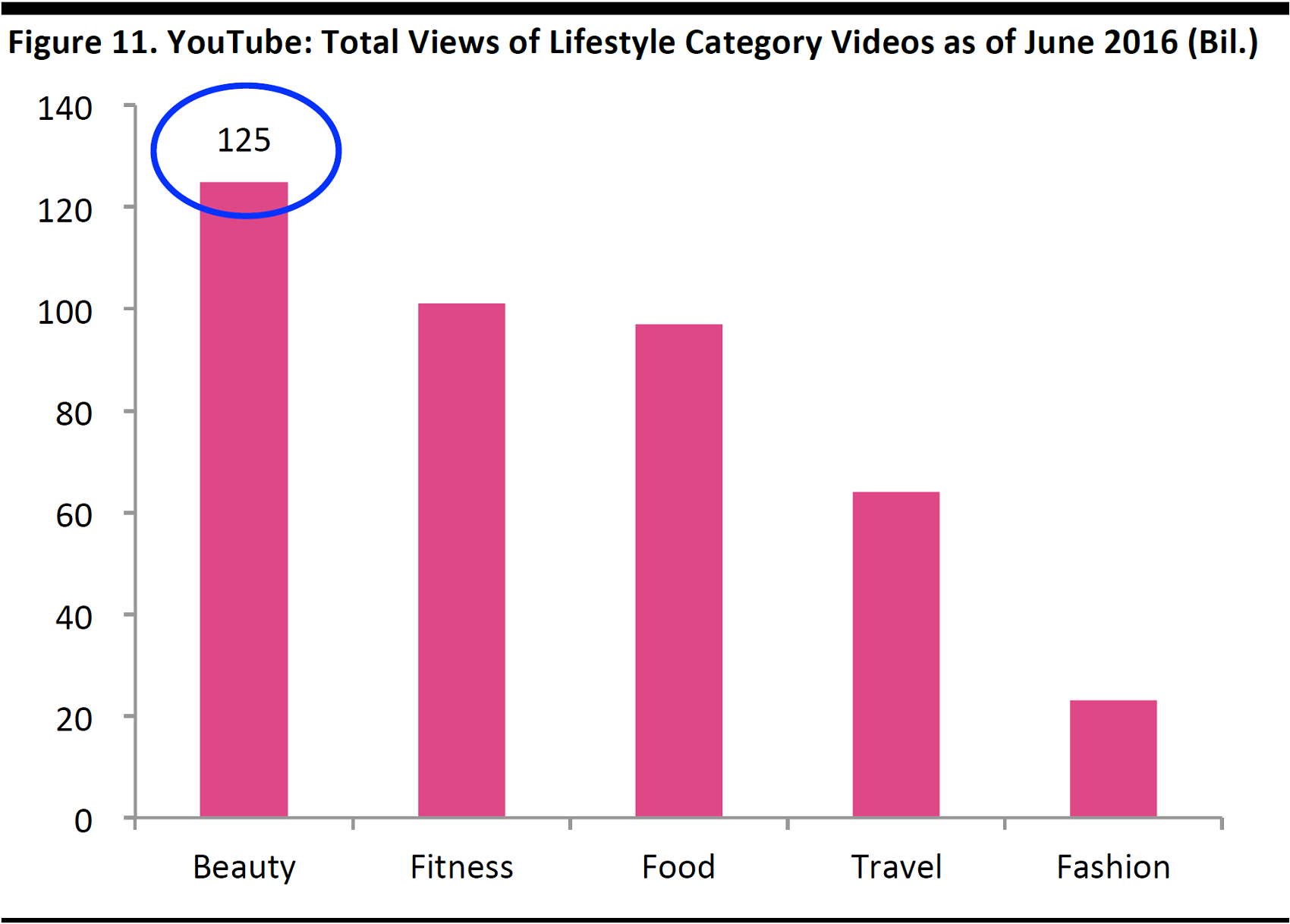

On YouTube, beauty videos garner far more views than do videos in rival lifestyle categories, Pixability says. As of June 2016, beauty videos on the site had been viewed125 billion times. Meanwhile, on Facebook, the top 200 beauty brands had notched some 850 million video views by June 2016.

Source: Pixability

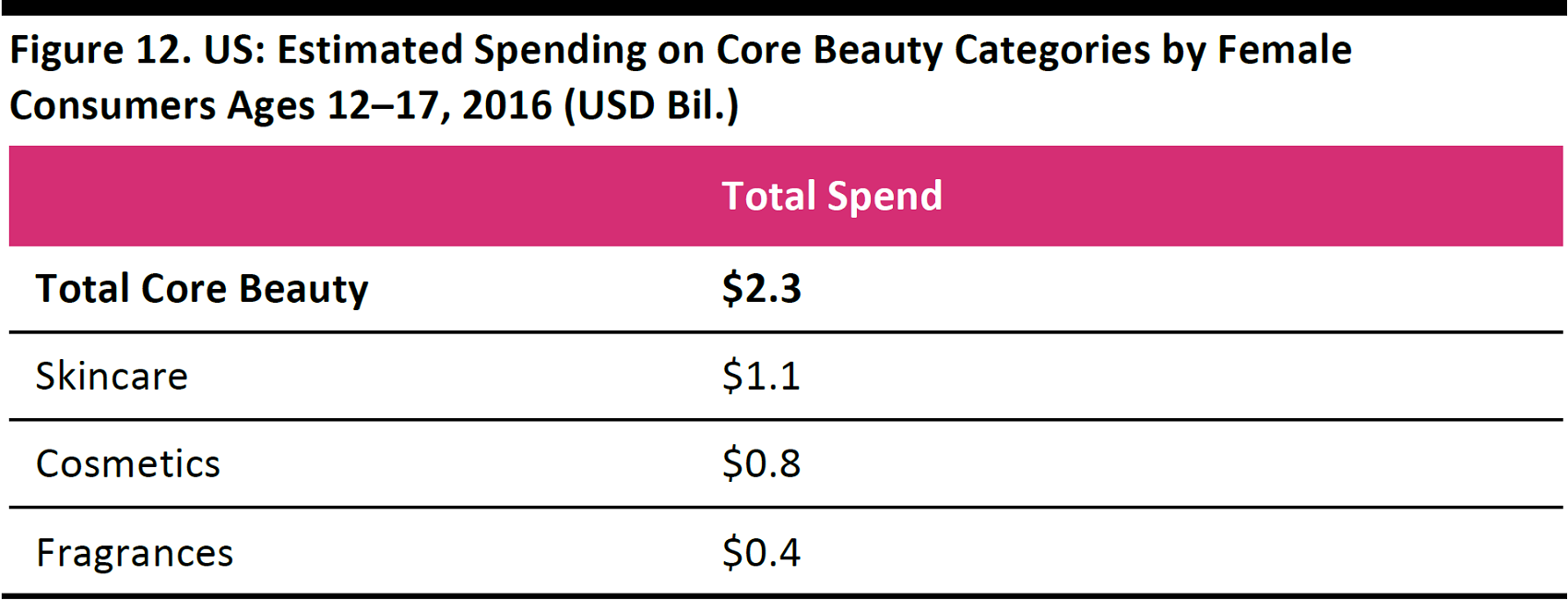

US Female Teens Spent an Estimated $2.3 Billion on Beauty Categories Last Year

We estimate that American females ages 12–17 spent approximately $2.3 billion on the core beauty categories of skincare, cosmetics and fragrances in 2016. This estimate is for spending by teens themselves and excludes spending by younger Gen Zers. The table below shows how our estimate breaks down by subcategory.

Source: Piper Jaffray/US Census Bureau/Fung Global Retail & Technology

The following data points informed and contextualized our estimates:- Piper Jaffray’s fall 2016US teen survey found that upper-income female teens spent an average of $395 across skincare, cosmetics and fragrances per year. Based on the ratio of upper-income household income to average-income household income in the Piper Jaffray survey, we estimate that average-income female teens’ annual spending was about $192 across skincare, cosmetics and fragrances in 2016.

- Population estimates of around 12 million female teens ages12–17 in the US lead to a ballpark spending figure of $2.3 billion across these three beauty categories.

- Our estimate equates to 3% of the total US beauty and personal care market size as recorded by Euromonitor International for 2016 (and we note that Euromonitor’s total includes toiletries and personal care categories that extend beyond skincare, cosmetics and fragrances). Our estimate suggests that female teens accounted for around 7% of the US skincare market recorded by Euromonitor and 6% of the cosmetics market.

- US families spent $24 billion on “miscellaneous” categories—which include beauty products and services—for those ages 12–17 in 2015, we estimate, based on US Department of Agriculture survey data. Our estimated figure of $2.3 billion for core beauty categories equates to just under 10% of this miscellaneous spending total.

Source: Shutterstock

Gen Z’s Favorite Brands

Beauty brands that are affordable, aspirational or, ideally, both resonate with teens. The aspirational MAC brand topped the most recent Piper Jaffray survey of teens’ preferred brands. However, budget-priced CoverGirl and mass-market Maybelline were the next two most popular brands, the survey found.

Base: 10,000 respondents with an average age of 16 Excludes one “name withheld” brand in each period Source: Piper Jaffray

Turning to retailers, the same Piper Jaffray survey found that Ulta and Sephora enjoy strong positions among female teens. The prominence of value retailers such as Target and Walmart remind us that young consumers tend to have strictly limited budgets.

Base: 10,000 respondents with an average age of 16 Source: Piper Jaffray

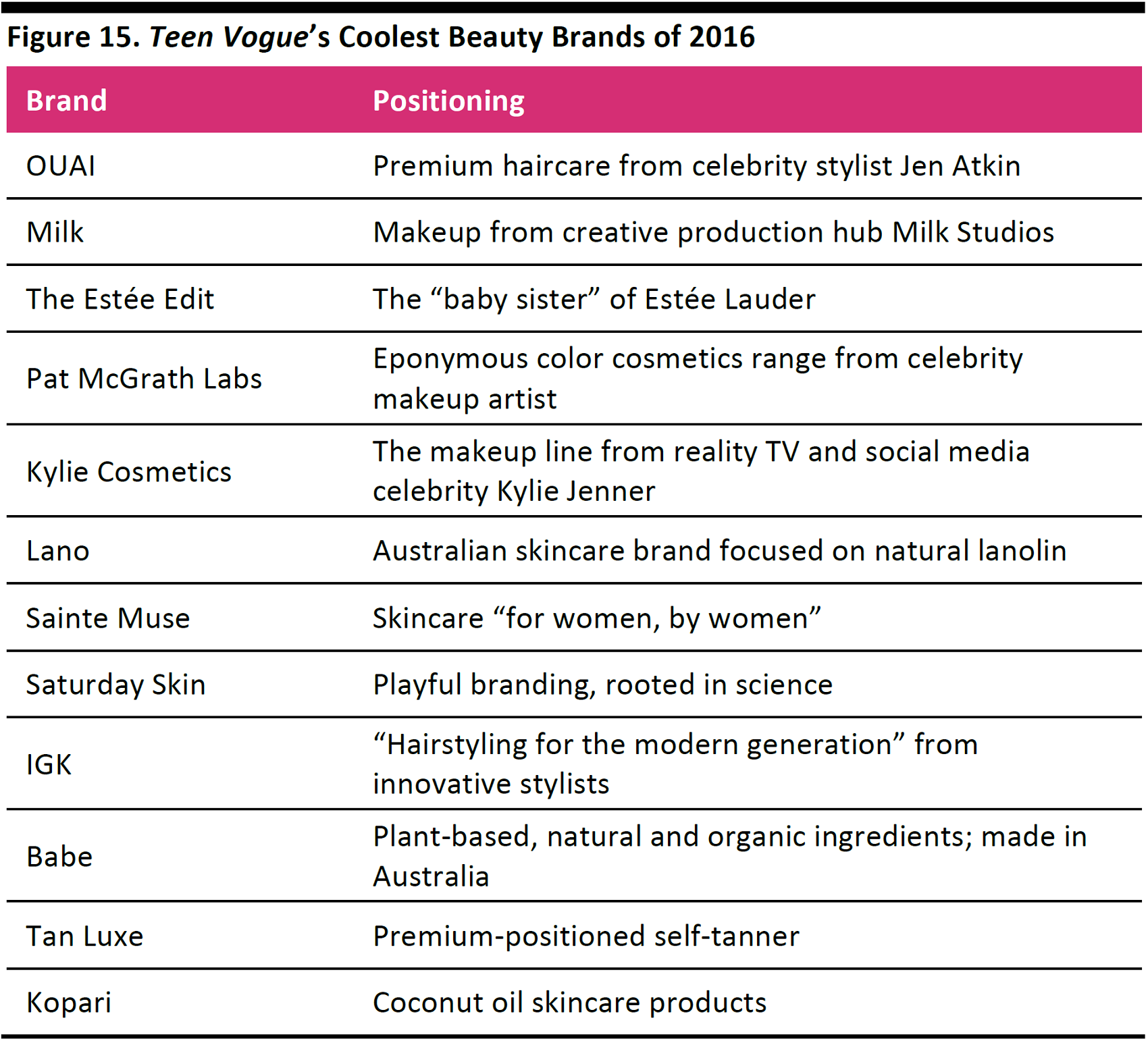

In Europe, we perceive mass-market retailers such as KIKO Milano, Sephora and Lush as well positioned to resonate with Gen Zers. Like MAC, each of these retailers is vertically integrated, being a retailer as well as a brand, and each combines a quality brand experience with some aspirational qualities and relative affordability. The beauty brands listed below are more niche or nascent brands that were ranked as the coolest by Teen Vogue for 2016. We note the following brand-positioning themes within this list, which we think give some indication of the preferences of younger consumers:- Skincare based on natural ingredients.

- Haircare designed by celebrity or cutting-edge stylists.

- Positive messaging, such as “for women, by women.”

- Celebrity names, such as Kylie Jenner.

Source: Teen Vogue/company reports

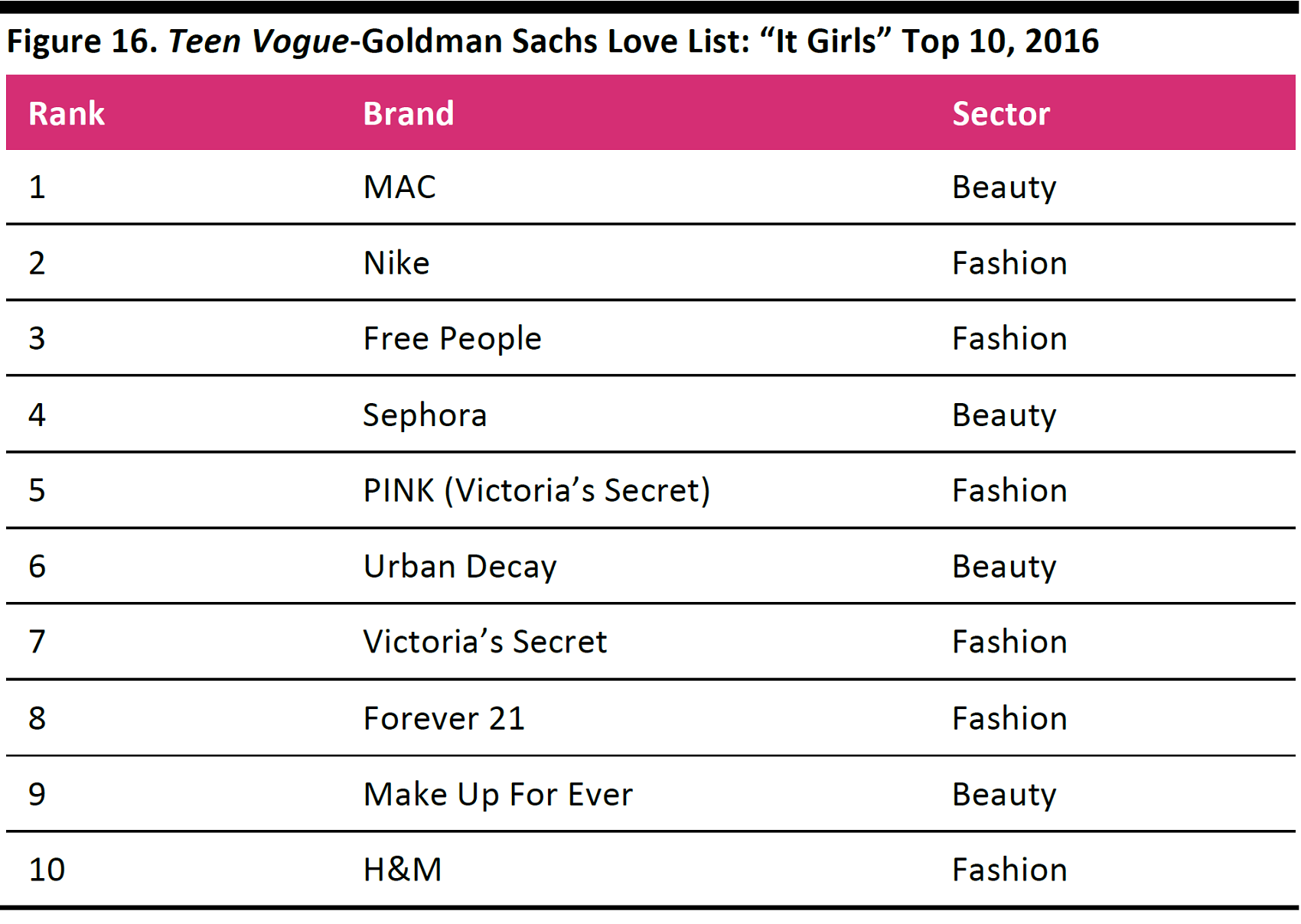

Also in 2016, Goldman Sachs and Teen Vogue ranked what teens and young women ages 13–29 said were their favorite brands. While the age range of this survey extends significantly beyond our Gen Z definition to include part of the millennial demographic, we think the listing shown below further suggests the strength of MAC, Sephora and Urban Decay among young consumers.

Based on a survey of trend-focused, fashion-conscious “it girls” Source: Goldman Sachs/Teen Vogue/Business Insider

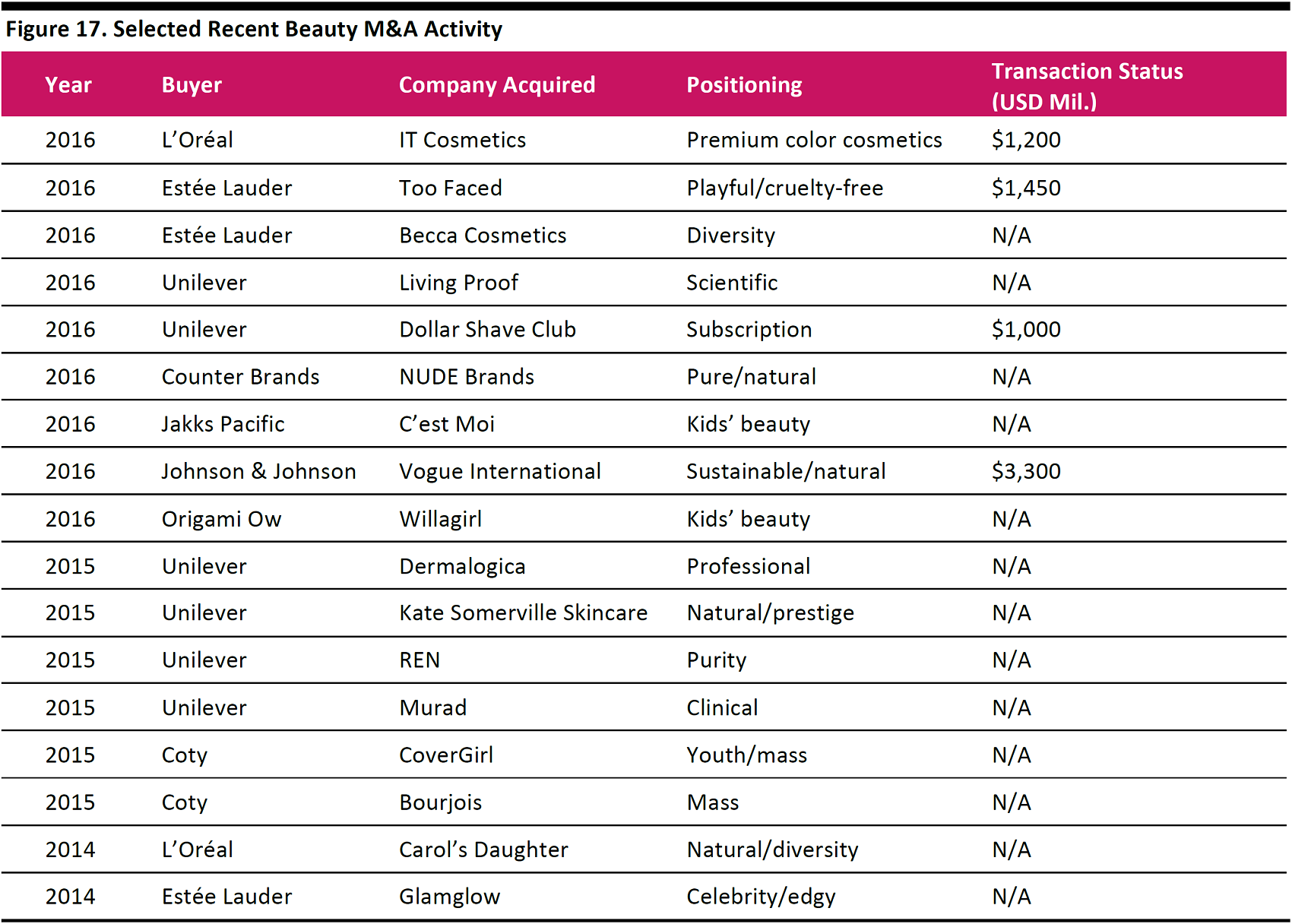

Gen Z Likely to Impact Beauty M&A

In the coming years, we expect the demands of Gen Z consumers to influence beauty industry M&A activity. Legacy multibrand giants such as L’Oréal, P&G, and Unilever are likely to seek to strengthen their position with Gen Z consumers as the demographic’s spending power accelerates. Based on attitudinal survey data and other indicators such as the brand rankings shown above, we believe the following product themes are of heightened importance to Gen Z, and so will drive beauty M&A in the future:- Products formulated with pure and natural ingredients.

- Celebrity-branded products and products formulated by “star” skincare and haircare experts.

- Products made by companies recognize and demonstrate social consciousness, which may include a focus on diversity and equality and cruelty-free processes and goods.

Source: Bloomberg/company reports

Key Takeaways

- Some retailers and brands already count Gen Zers as customers—but the group comprises the customers of tomorrow for all retailers and brands. The oldest people in this demographic will turn 16 this year, and so are on the cusp of becoming fully fledged adult shoppers.

- Social media impacts Gen Zers’ spending, particularly in the beauty category. In turn, Gen Zers often turn to social media for information and expertise when shopping for beauty items. There appears to be greater pressure than ever before on young people to spend on their personal appearance—although it is possible that these pressures will lessen as this generation gets older.

- In the near term, brands seeking to engage with Gen Z must be present in the spaces that these consumers frequent—visual-driven social media sites—and they must offer engaging, authentic content.

- Looking further ahead, we expect the demands of this generation to be a factor in future beauty industry M&A activity as legacy players seek to appeal to Gen Z by buying up beauty brands that align with the generation’s preferences.