Executive Summary

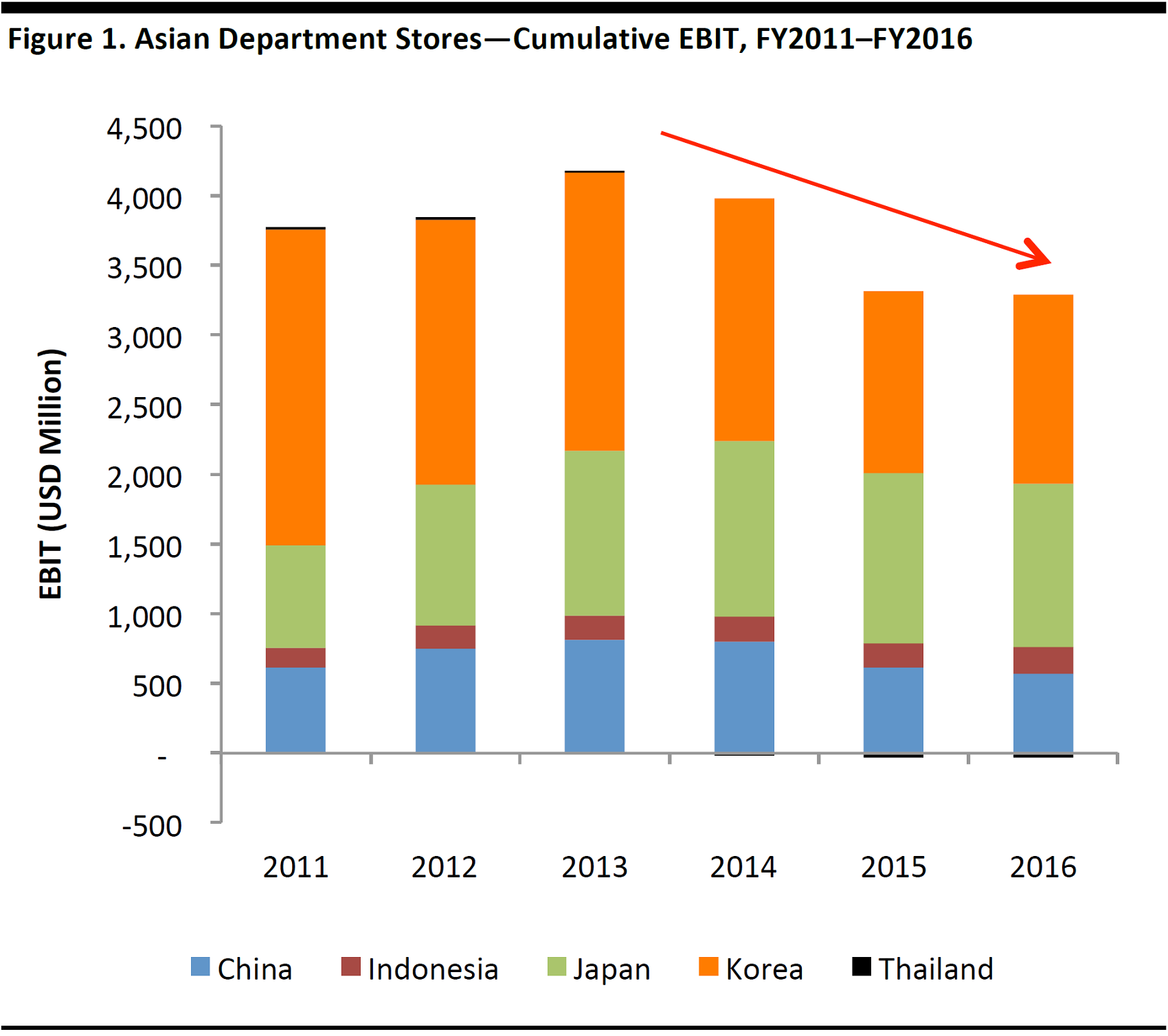

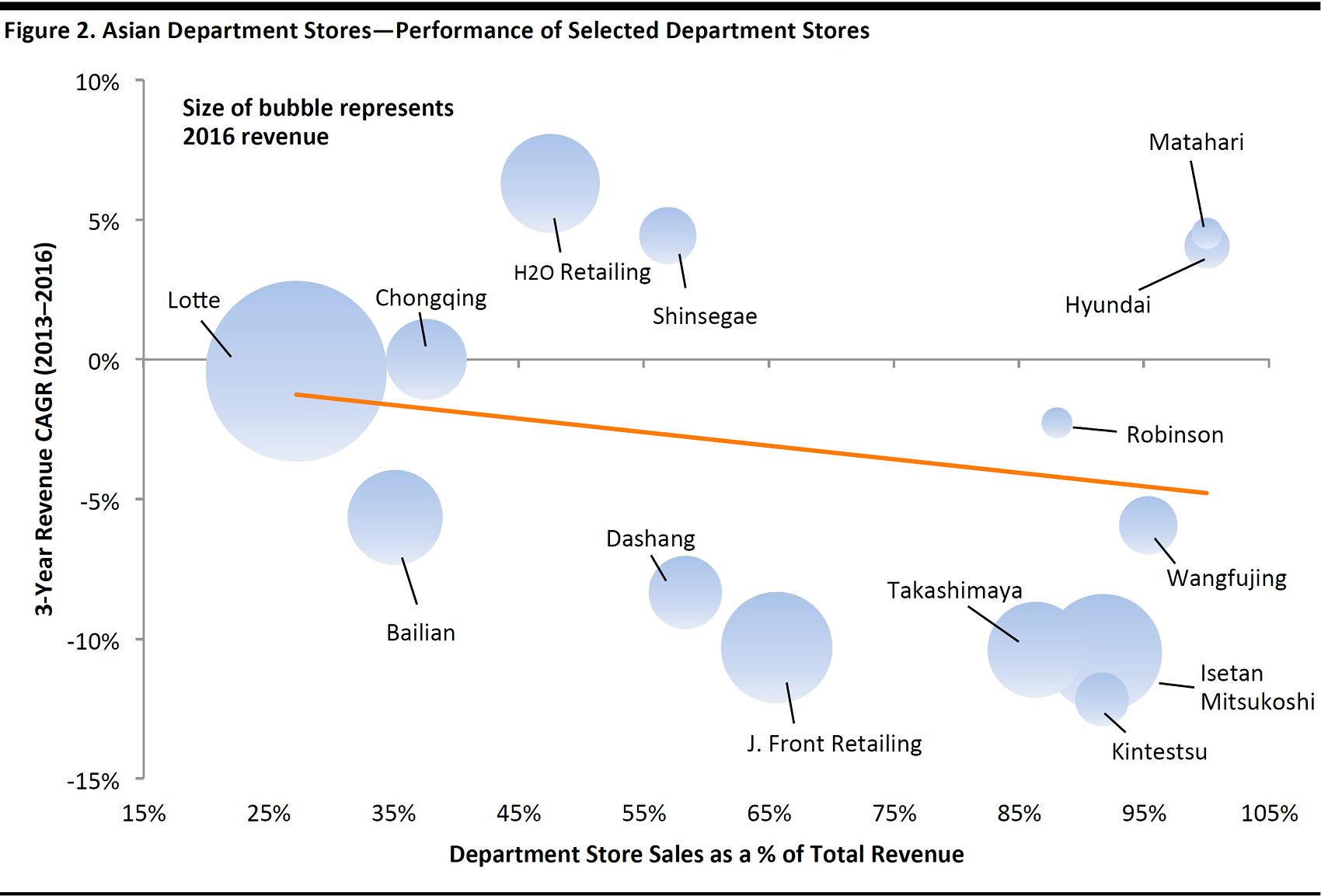

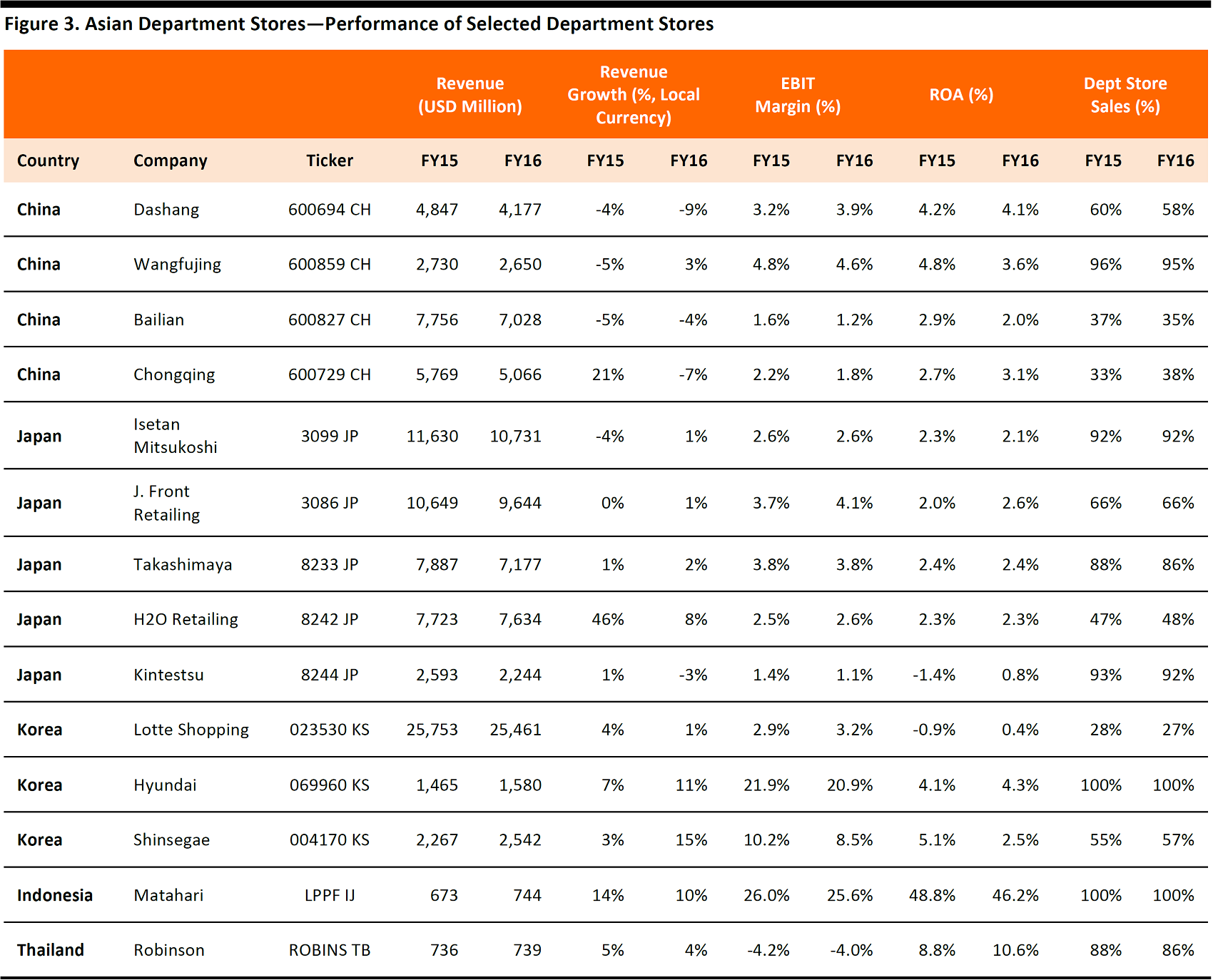

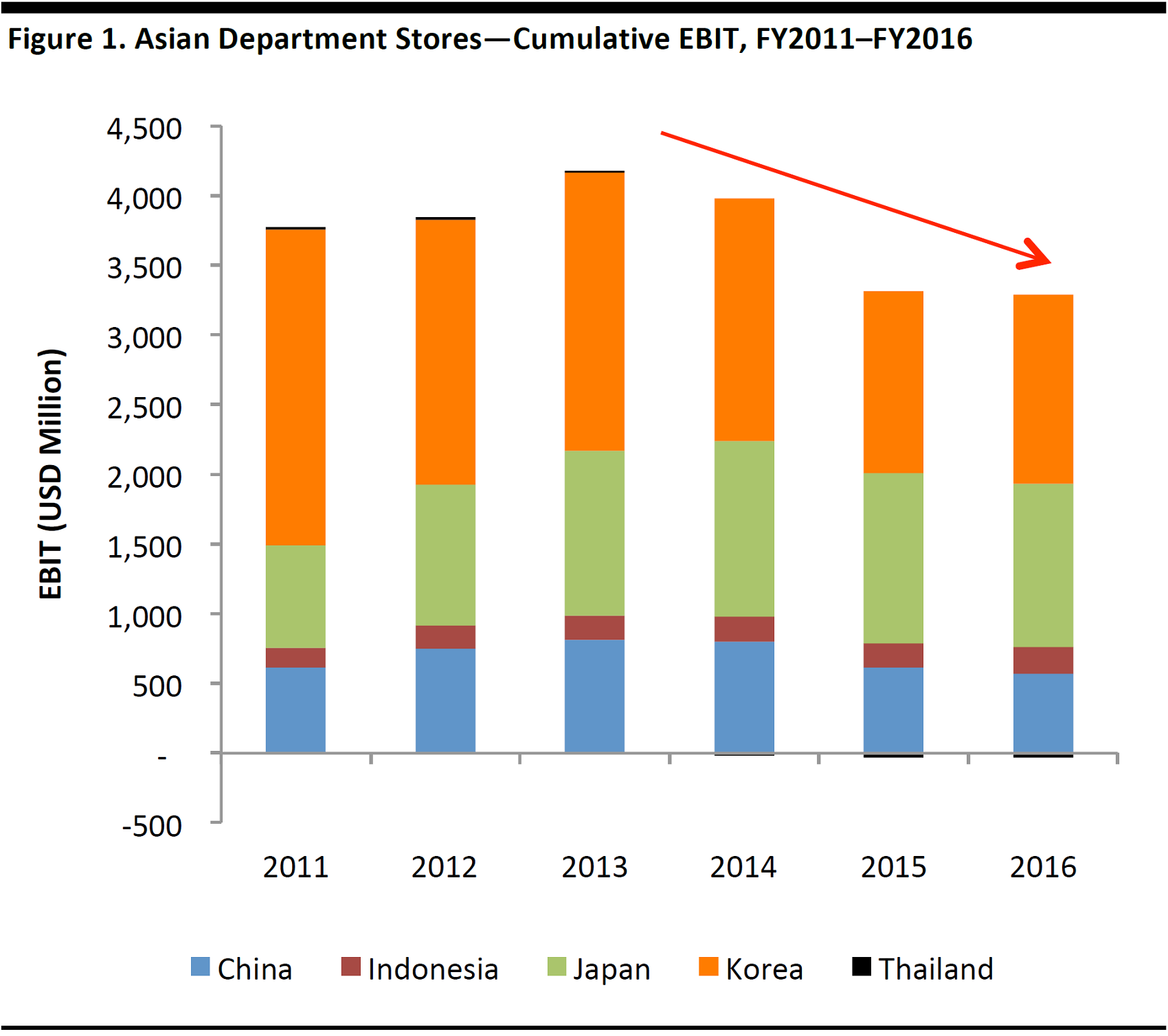

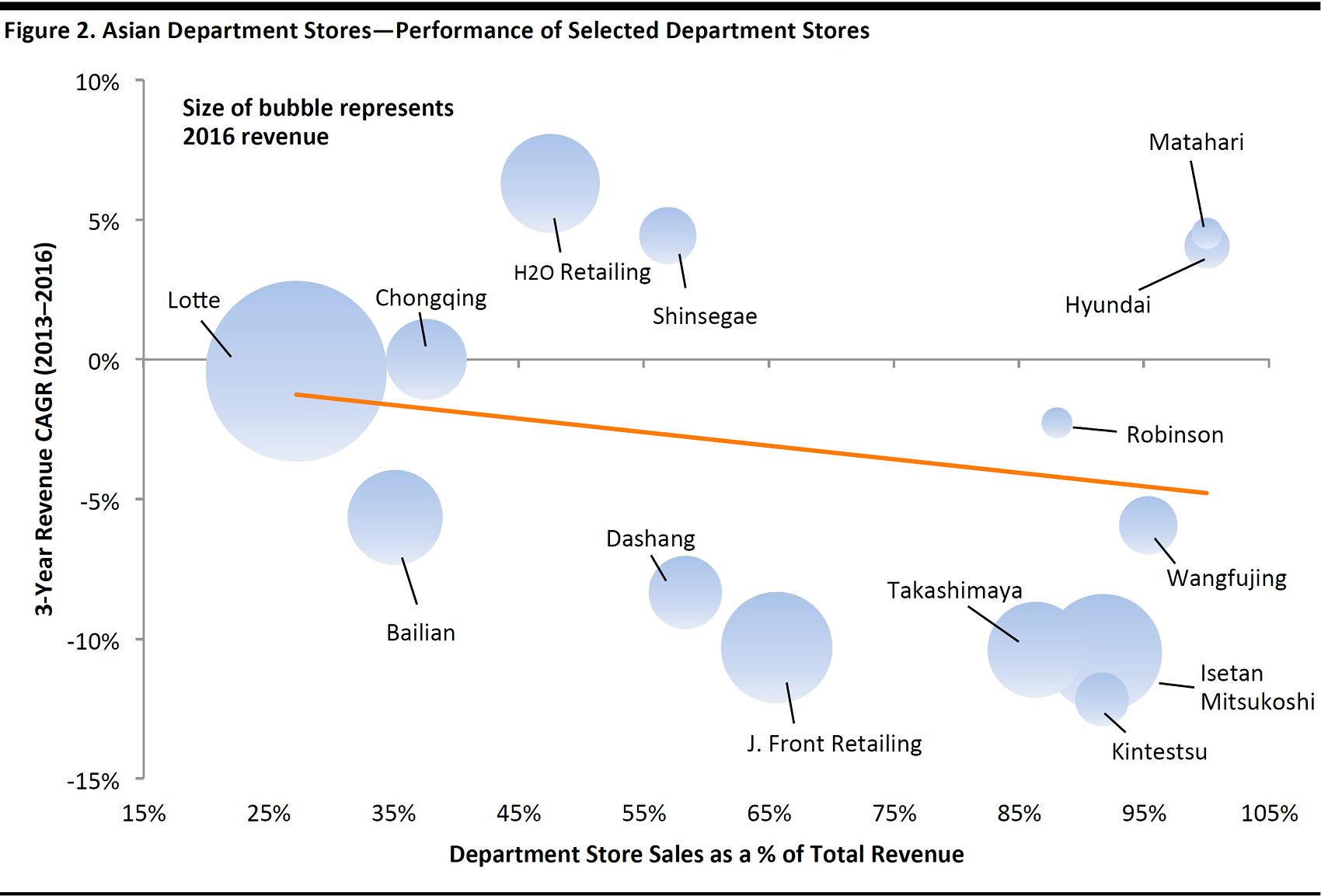

It is not an easy time in the department store industry. Secular changes in the retail environment—such as channel shifts to other formats (e-commerce, off-price, fast fashion), declining physical store traffic and a more promotional environment—have all been weighing on department store performance. The industry is also facing a changing consumer profile that is increasingly sophisticated and gravitates toward lifestyle experiences and convenience.

Here in Asia, department stores are in need of an overhaul—the result of brand homogenization, their lack of appeal to younger consumers and channel shifts to e-commerce and fast fashion. What actions managements take will have a significant impact on how department stores fare in the longer term. If nothing changes, sales will likely continue to decline and the stores’ future will be on the line.

In this report, we explore how the department store industry in Asia needs to evolve to navigate through the myriad of challenges currently facing it.

Consumer Trends in Asia

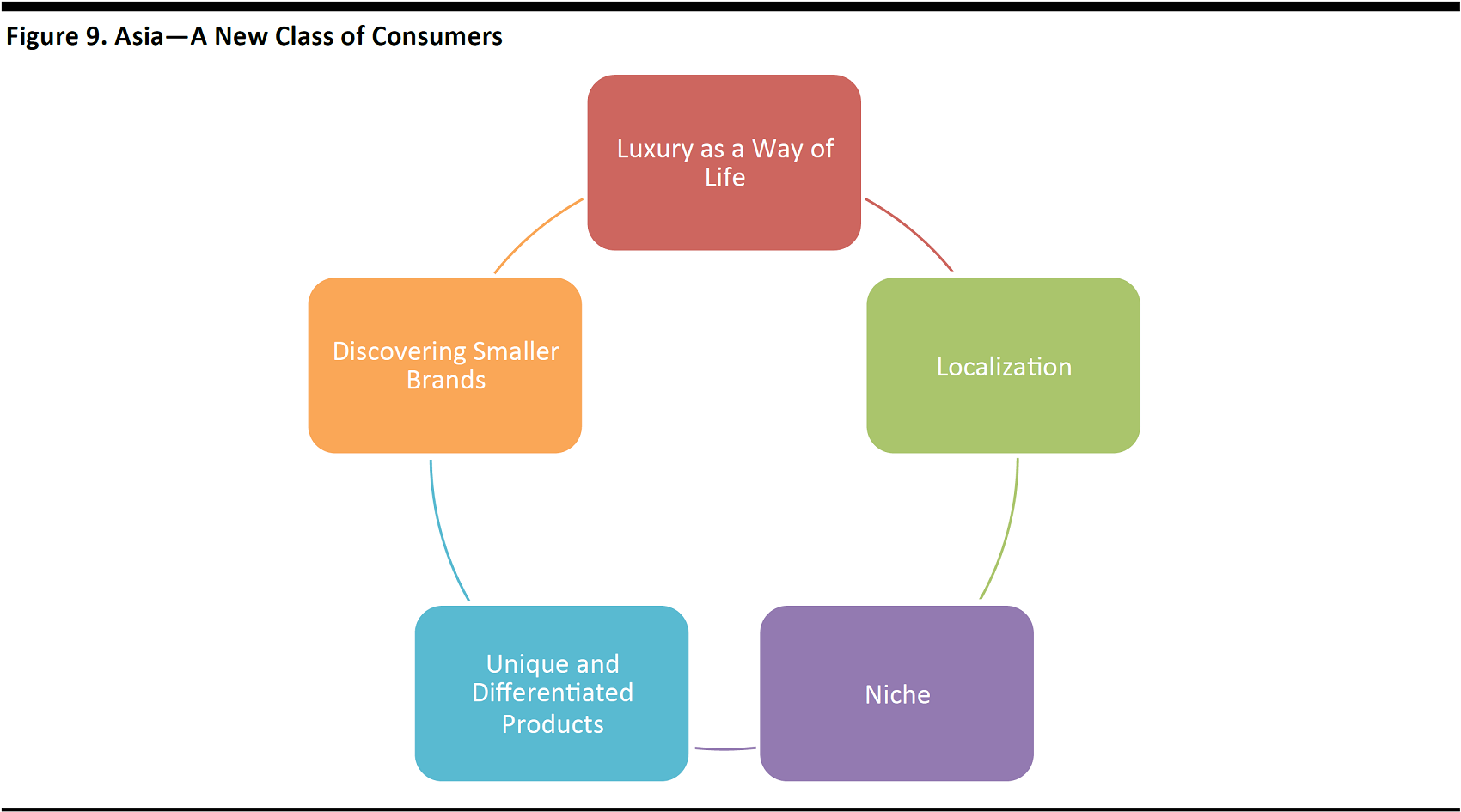

Department store operators in Asia need to understand the consumers they serve and to keep up with their changing preferences. While Asian consumers cannot be lumped into one group, there are some common traits that define them and the Asian department store environment in general: 1) they are increasingly urbanized; 2) there is a growing upper middle class; 3) they are digitally savvy; 4) they are searching for personalized experiences; and 5) they seek convenience.

Six Department Store Themes

Department stores are having to change their approach in order to attract shoppers back to their stores. We identify six themes in the department store industry: 1) new store formats and concepts as new growth drivers; 2)Southeast Asia as the next battleground and growth driver; 3) the experiential component remains a priority; 4)Chinese outbound tourism; 5)young consumer are increasingly driving stores’ business decisions; and 6)the omnichannel presence.

What Will the Future Department Store Look Like?

Department stores in Asia are constantly updating their merchandise offering and store layouts to maintain a differentiated consumer experience, and thus a sustainable competitive advantage for the future.

We outline the three primary characteristics of the department store of the future as it adapts to the new norm in retail:

- Retail technology will be extensively used as a means to increase store productivity.

- Department stores will come in all shapes and sizes.

- The store will provide an immersive shopping experience and a community for consumers.

Source: Company data

Note: Companies are those in the table for Figure 3

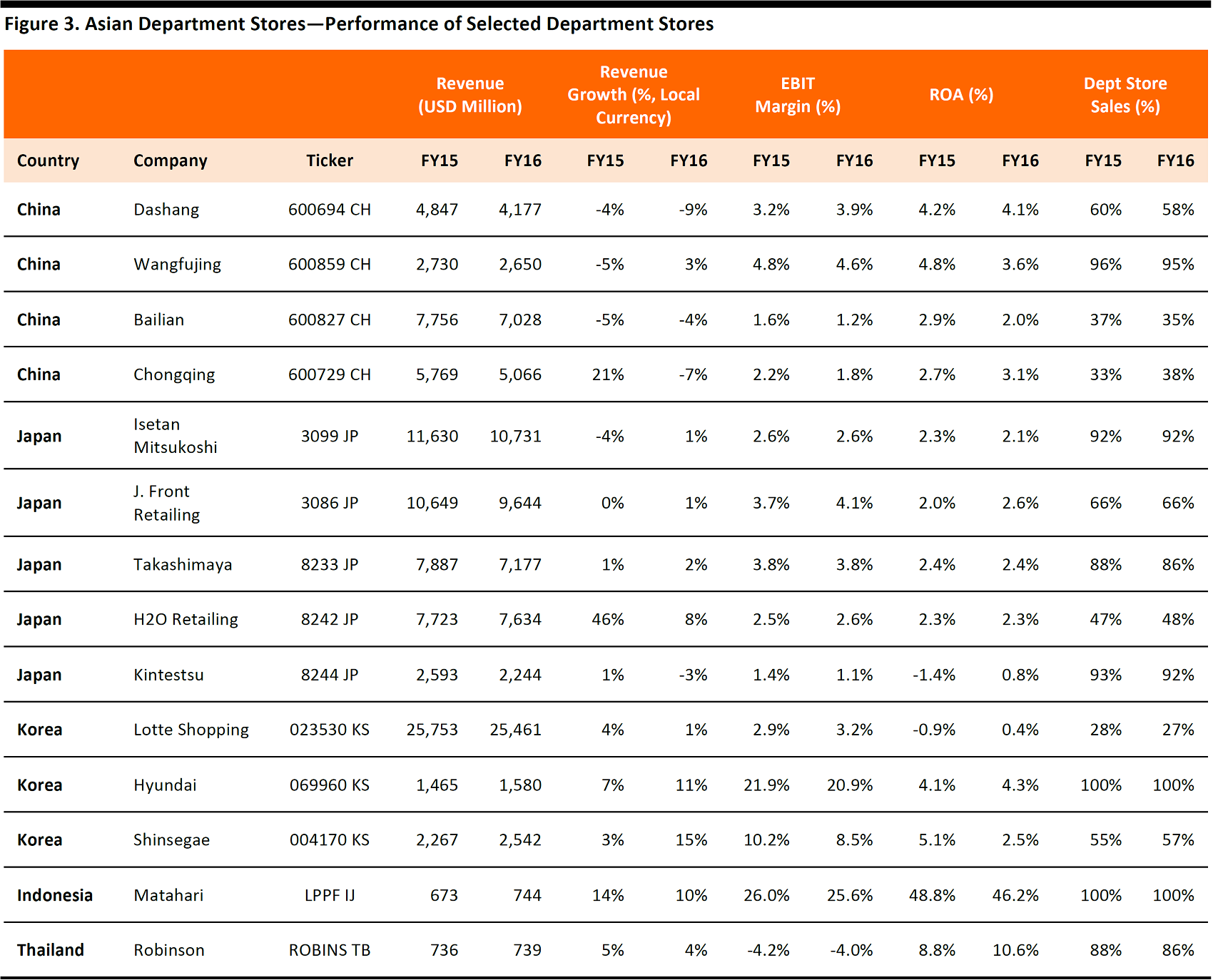

Source: Company data

Source: Company data

Department Store Industry Outlook

Department stores in Asia face similar challenges as those in the West. In the past, operating in prime locations was the primary determinant of success. However, the market has since moved on, and department stores worldwide have been impacted negatively by declining consumer traffic and revenues. We explore how the department store industry in Asia needs to evolve to navigate through the myriad of challenges currently facing the industry.

Consumer Trends in Asia

Department store operators in Asia need to understand the consumers they serve and to keep up with their changing preferences. In this section, we outline the trends that are shaping the preferences of consumers in Asia.

Asia—No Single Storyline

First of all, it is important to recognize that there is no single definition of a typical consumer in Asia. The consumers that department stores serve in the region represent a diverse range of shopping preferences, defined by various cultural backgrounds and habits. It would be wrong to treat them as one homogenous group.

Instead, we focus our discussion on some of the common traits that define consumers in Asia and the Asian department store industry in general:

- There is increased urbanization

- There is a growing upper middle class

- They are digitally savvy

- They are looking for personalized experiences

- They seek convenience

- There is an omnichannel presence.

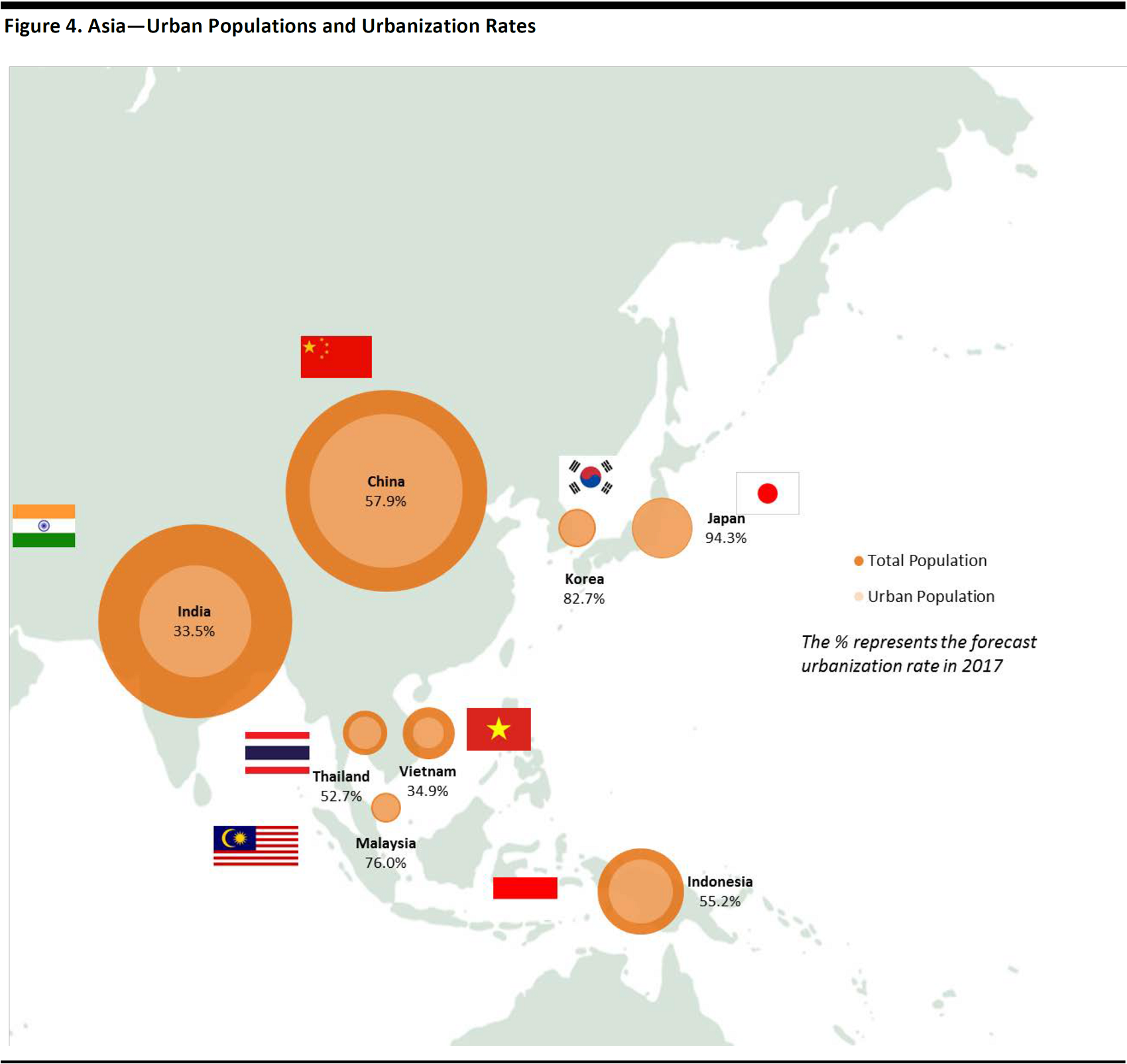

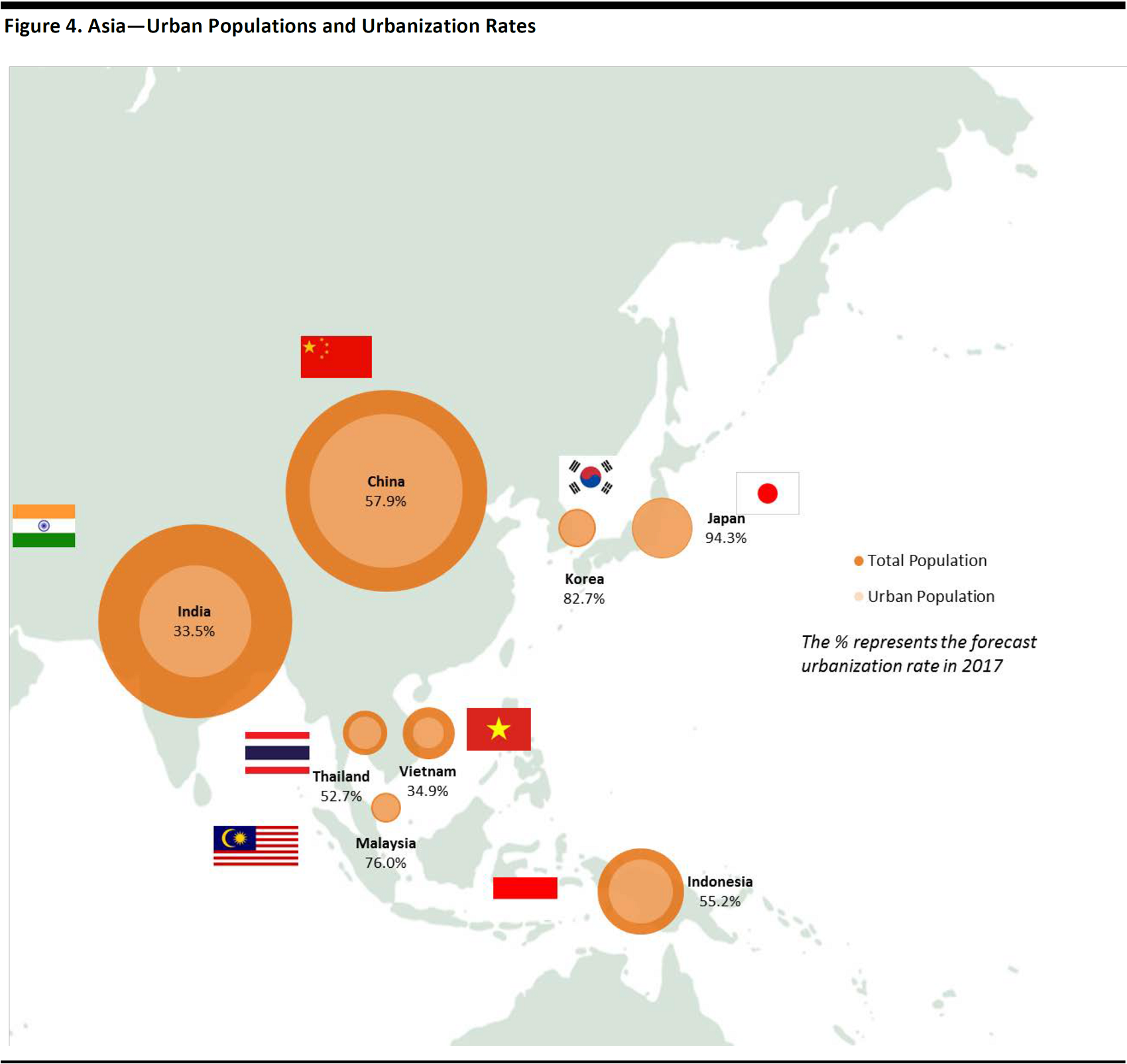

1. Increasing Urbanization

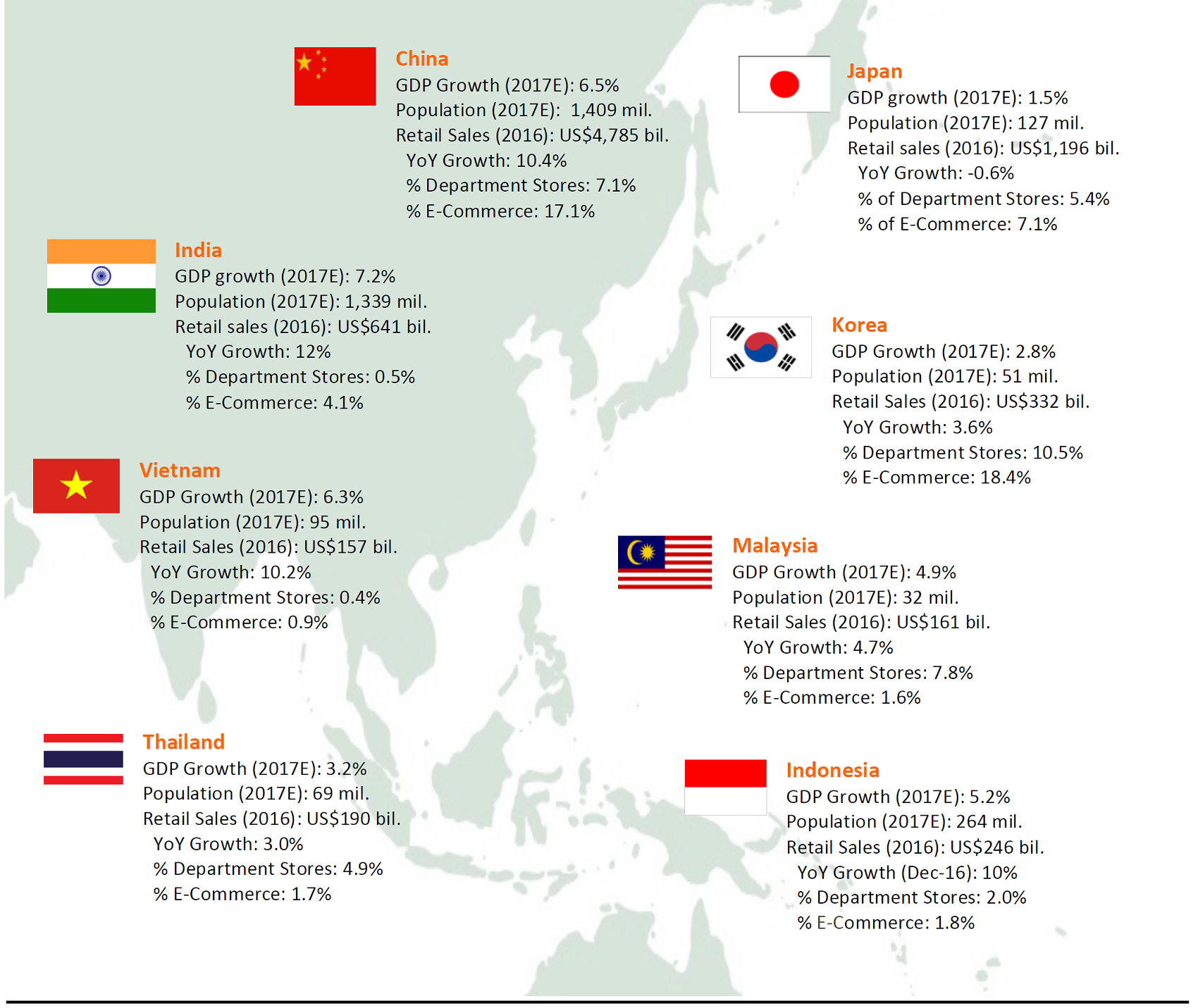

Asia has been undergoing rapid urbanization in recent years, and this has given a boost to urban department stores, bringing an influx of consumers into their catchment areas. Asia currently accounts for about 55% of the world’s urban population, according to the United Nations (UN). By 2018, the population of Asia is expected to be more than 50% urban, according to UN-Habitat’s Asian and Pacific Cities Report (2015).

- China: China has already experienced the largest boost from urbanization. Over half of the country’s 1.4 billion people currently reside in urban areas. China’s urbanization rate is expected to reach 57.9% in 2017.

- Southeast Asia: The Southeast Asian region as a whole is also undergoing rapid urbanization. By 2030, the proportion of its urban population is expected to grow to 55.8%, from 48.2% in 2016, according to the UN.

Source: United Nations/FGRT

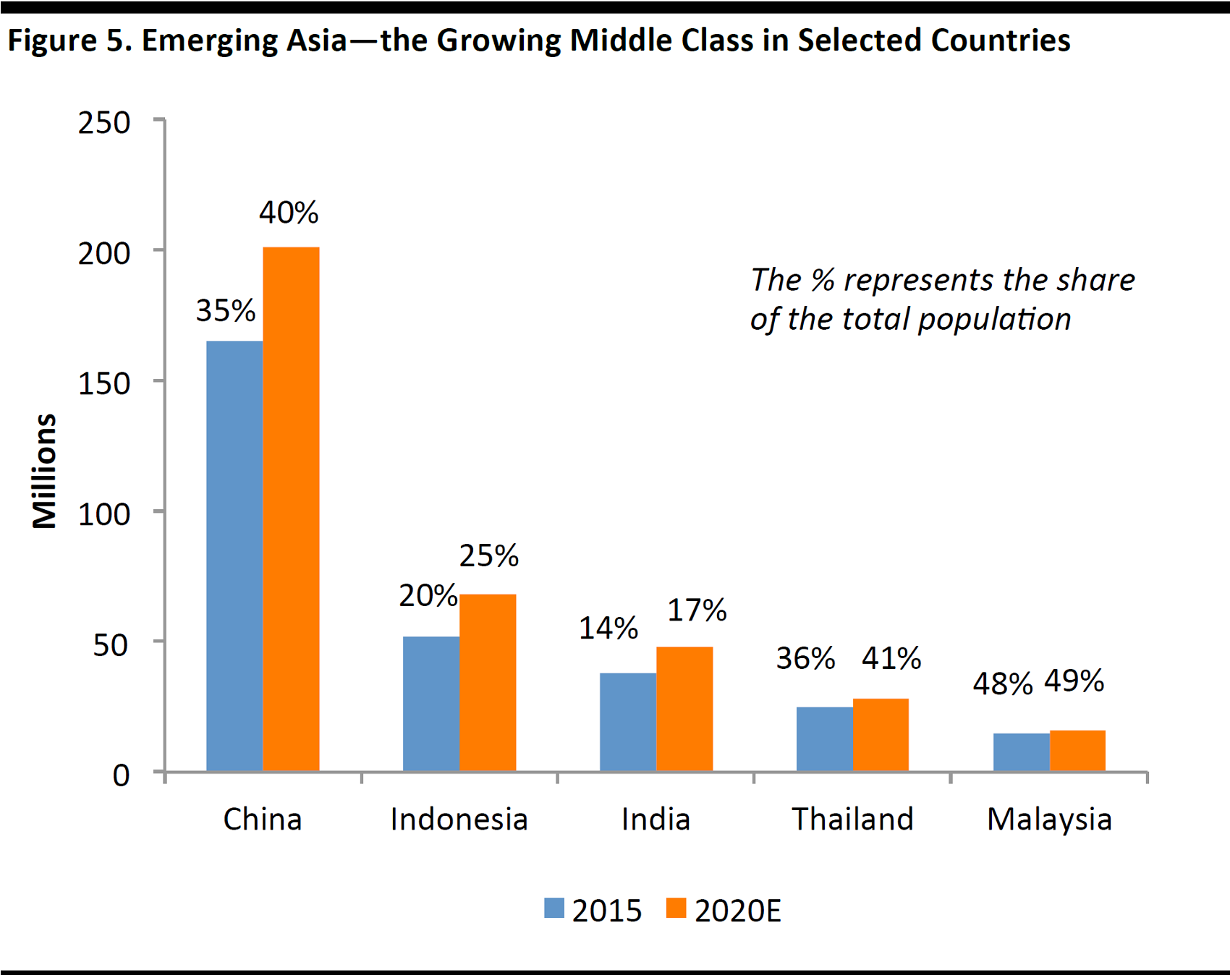

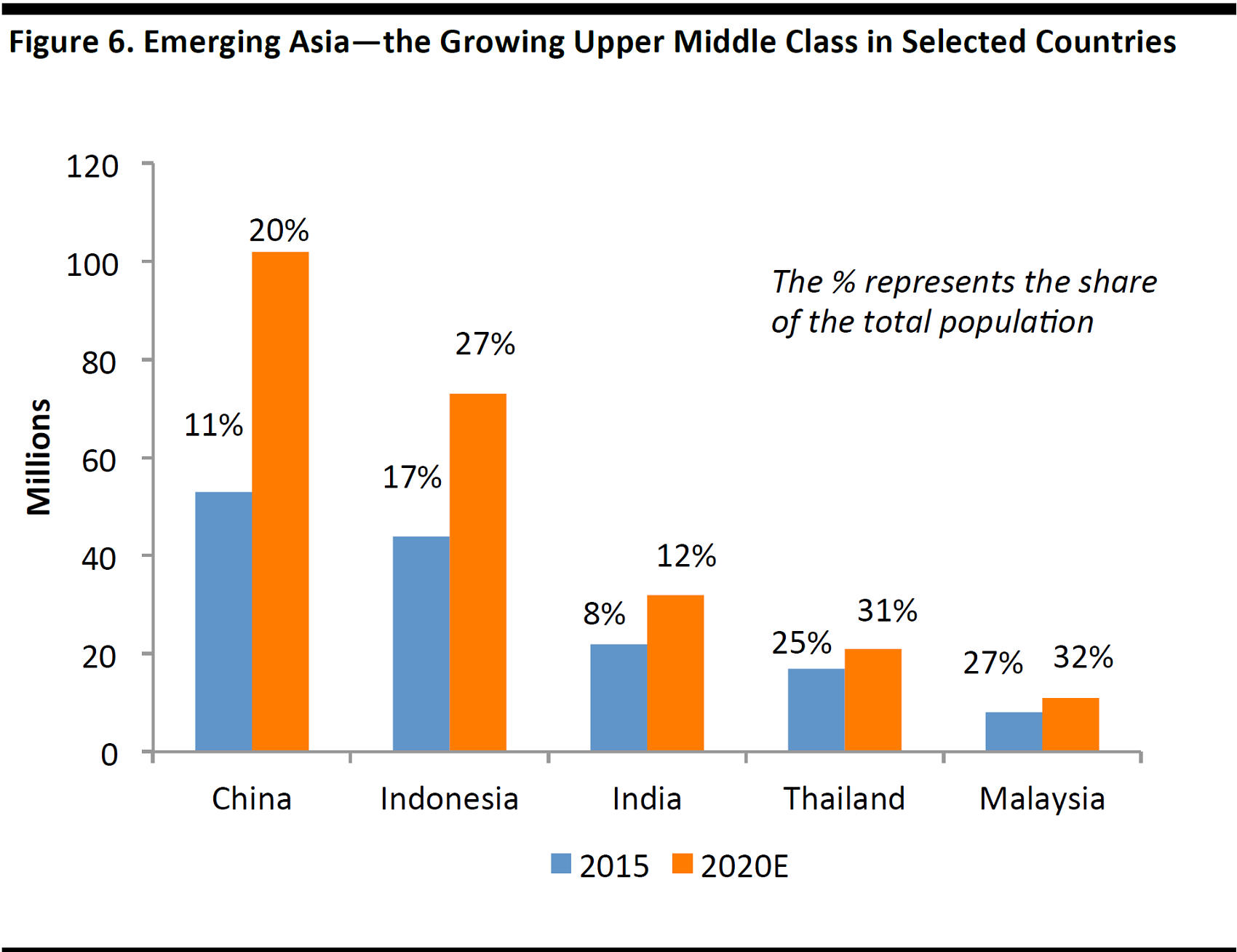

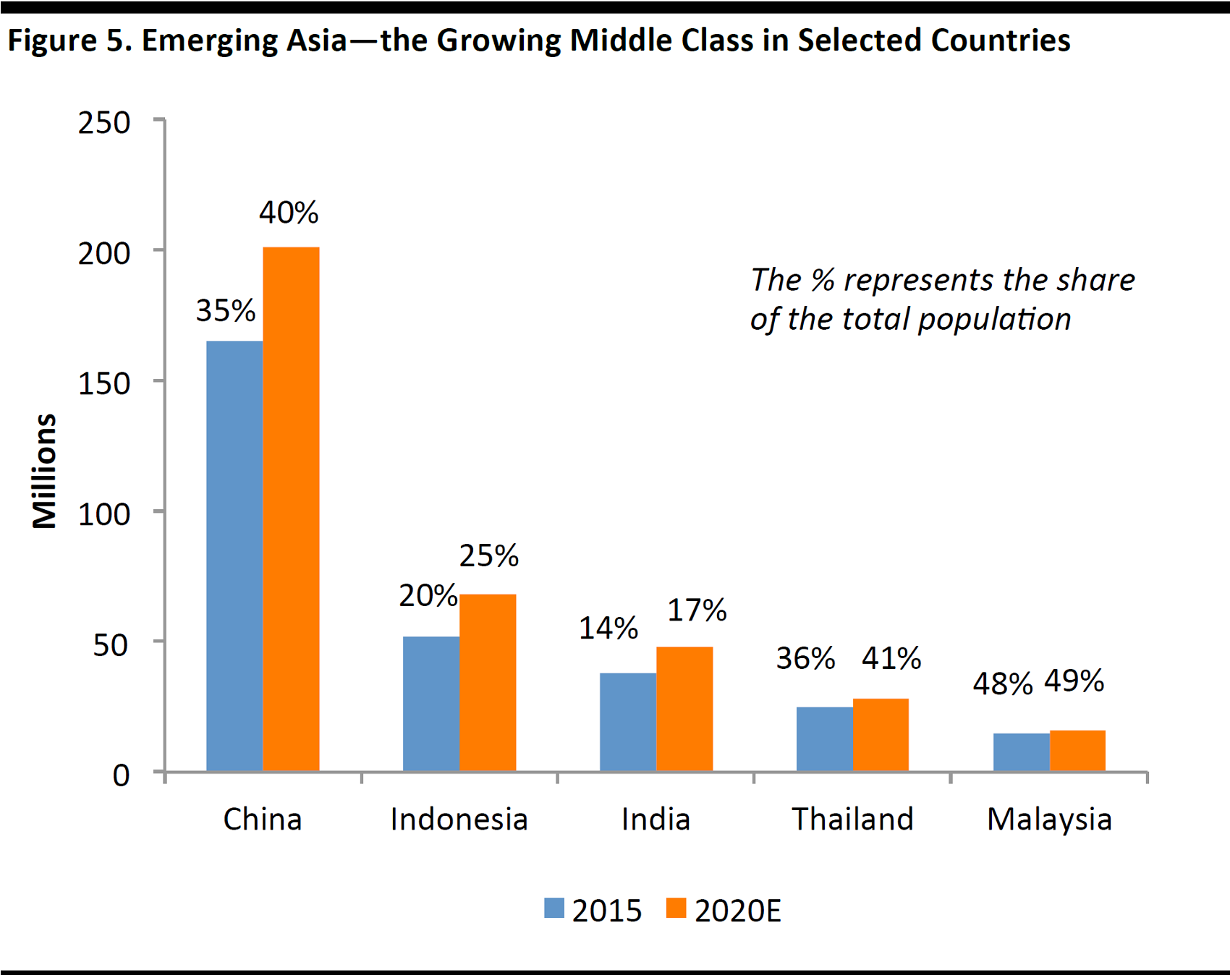

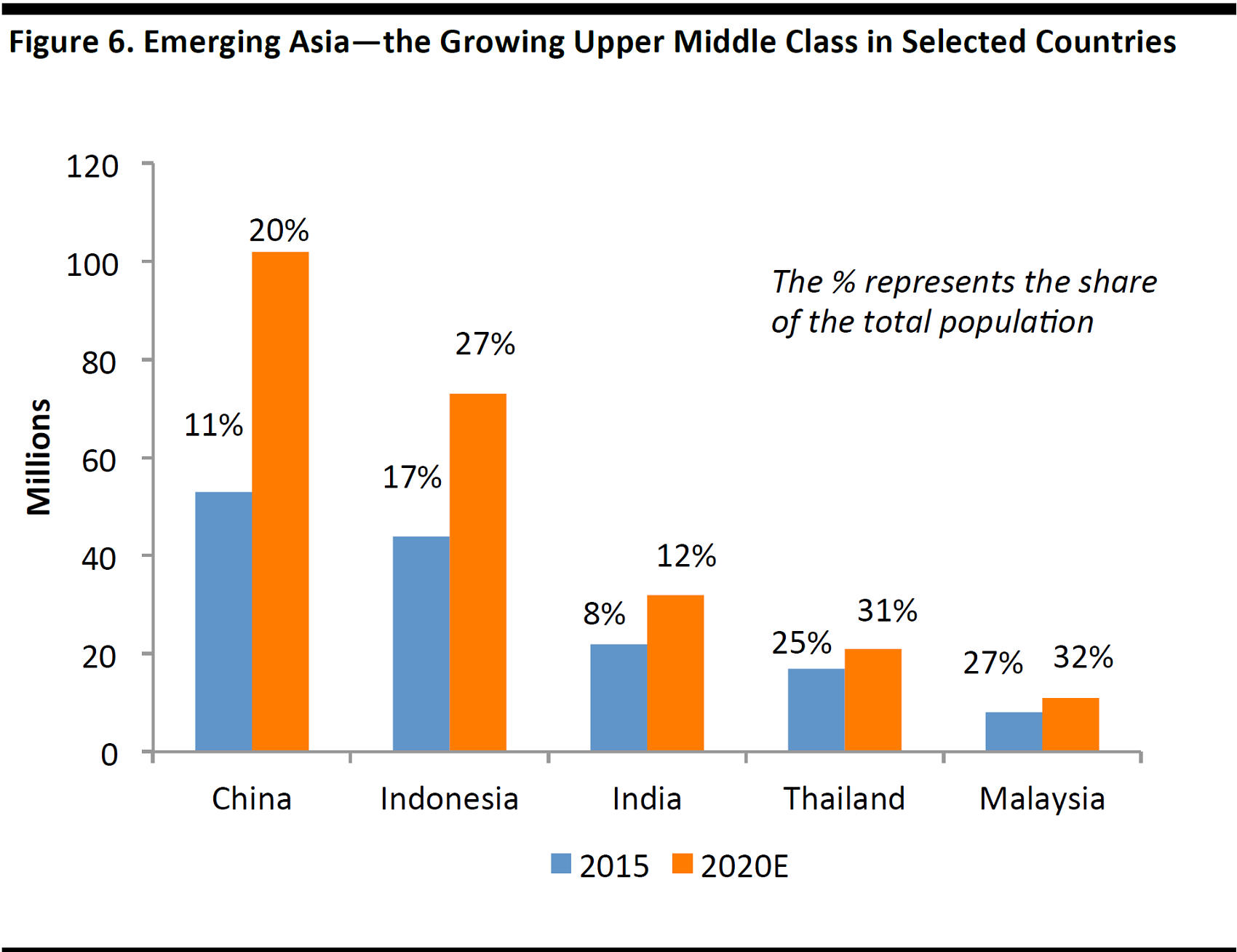

2. A Growing Upper Middle Class

As the region’s upper middle class continues to grow, so does consumer demand, and this represents huge potential. Consumers in the upper middle class are highly sophisticated, well informed about international trends and tend to spend more freely. In 2016, upper-middle-class consumers in China spent $1.60 for every $1.00 spent by middle-class consumers, according to BCG.

There are about 150 million upper-middle-class consumers in the developing countries in Asia, and this number is forecast to increase by 100 million in the next few years.

- In China, more than one in ten people qualify as upper middle class, and the proportion is expected to double by 2020.

- In Thailand, the upper middle class accounts for 25%, and in Malaysia 27%.

- The upper middle class in emerging Asia accounted for $3 trillion in annual spending in 2016, according to BCG.

Source: BCG/FGRT

Source: BCG/FGRT

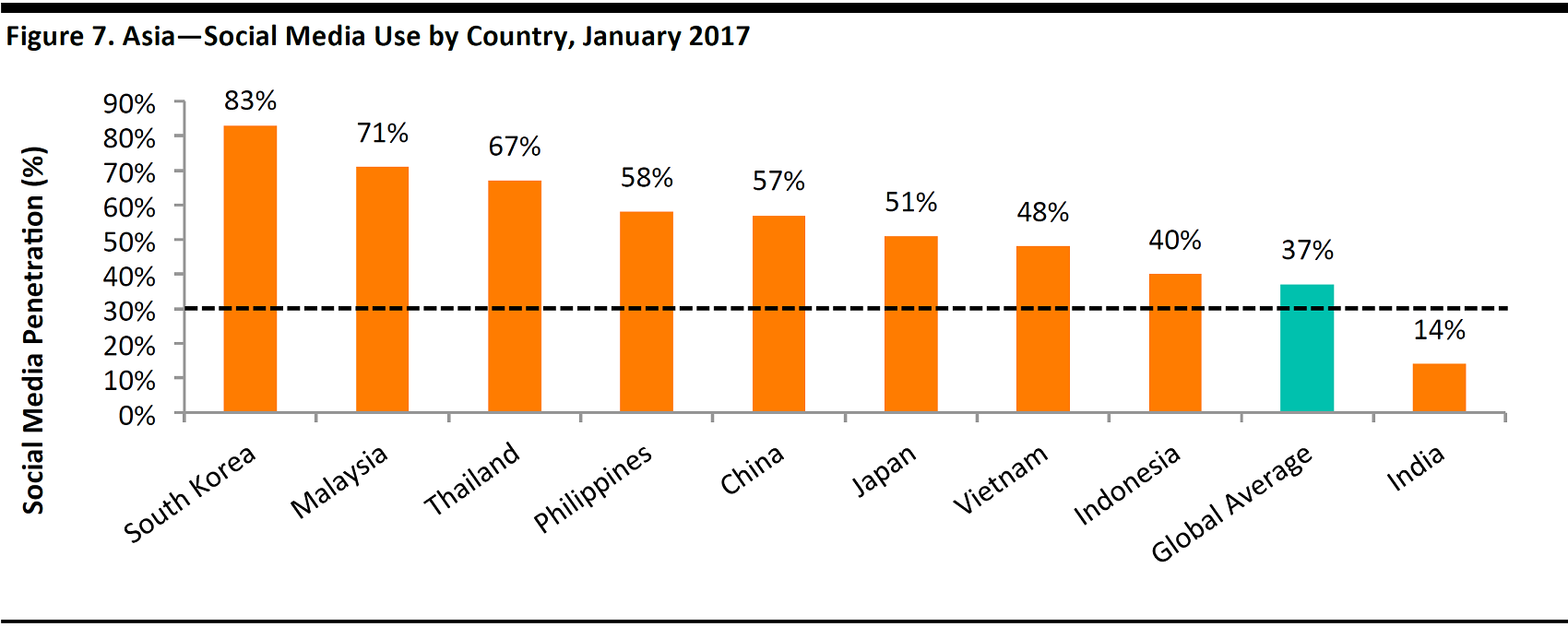

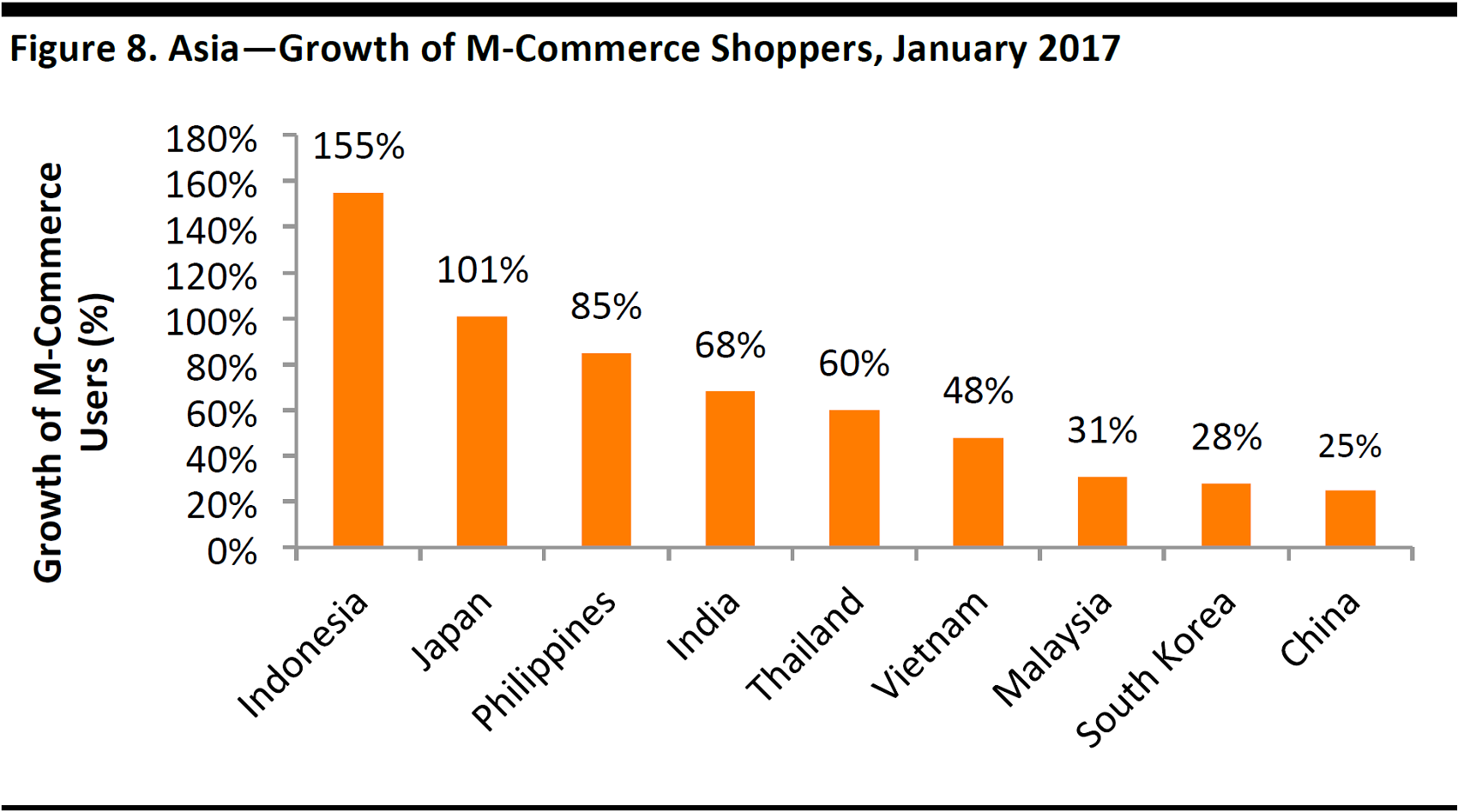

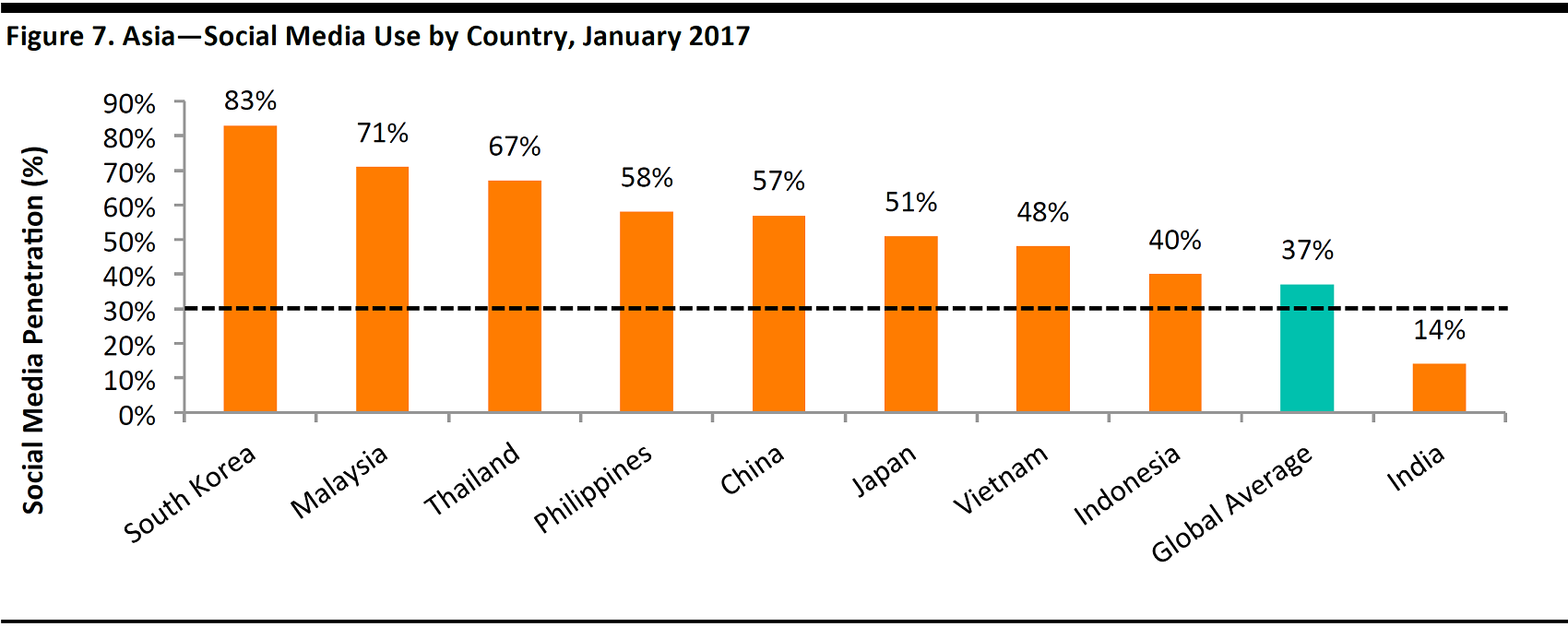

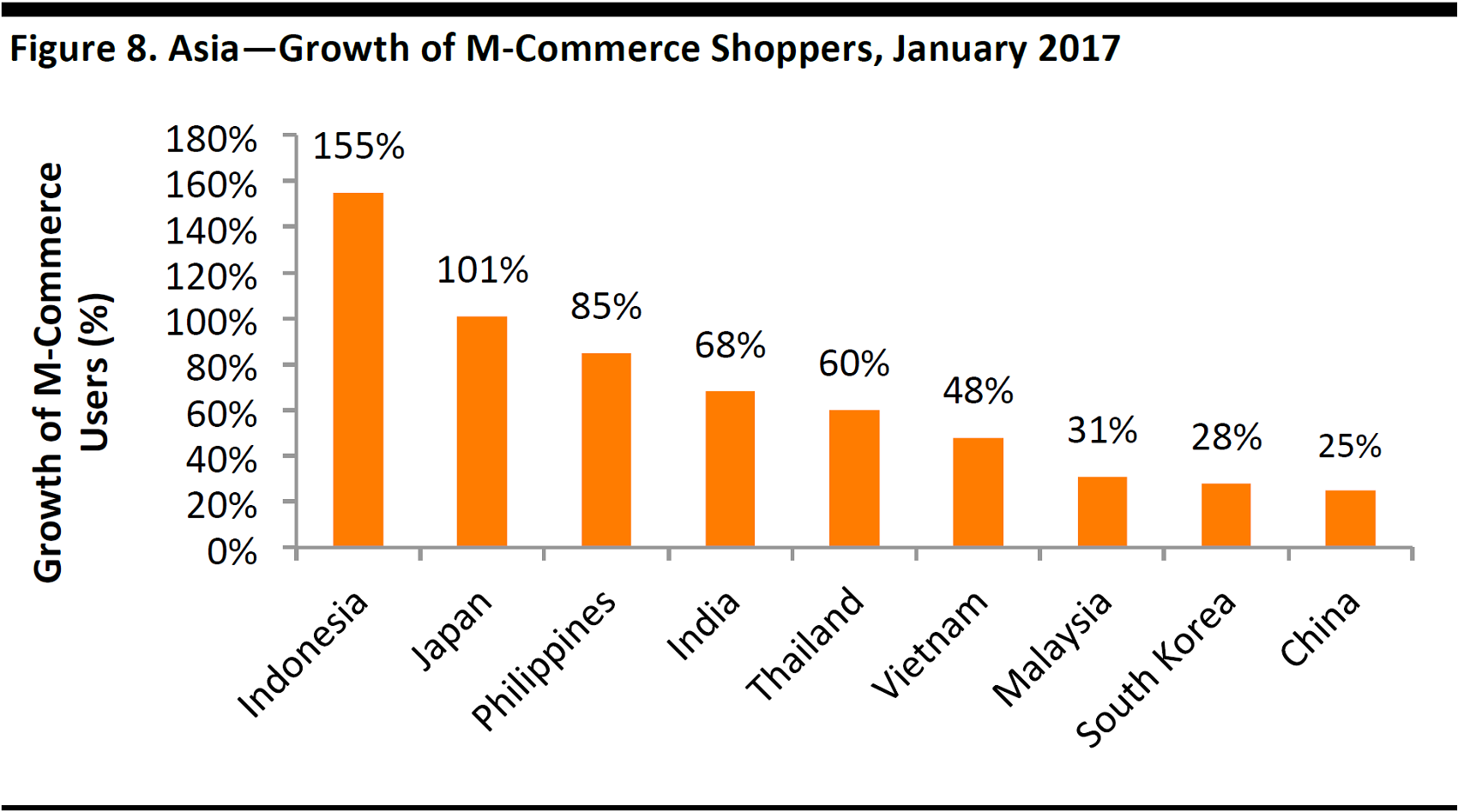

3. Digital Savviness

Asian consumers are digital natives, in other words, online platforms and social media are the easiest way to reach this group. In addition, their shopping preferences are increasingly shaped by social media marketing. The ubiquity of smartphones has also given rise to mobile commerce (m-commerce), as consumers increasingly browse for products, shop and pay, all using their mobile devices.

Source: Wearesocial.com/FGRT

M-Commerce and S-Commerce on the Rise in Southeast Asia

Mobile commerce(m-commerce) and social commerce (s-commerce) are entrenched in China, with virtually all retailers present on WeChat, China’s largest online messaging and e-commerce platform, and the rest of Southeast Asia is rapidly catching on. According to WARC, 30% of e-commerce sales across Southeast Asia come from consumer journeys, which originate on social media and end on messaging apps.

Fashion, beauty, infant nutrition and high-end skincare are some of the most popular categories for s-commerce. Retailers have set up their own profiles on social media platforms to interact with consumers and post advertising and promotional activity.

Source: Wearesocial.com/FGRT

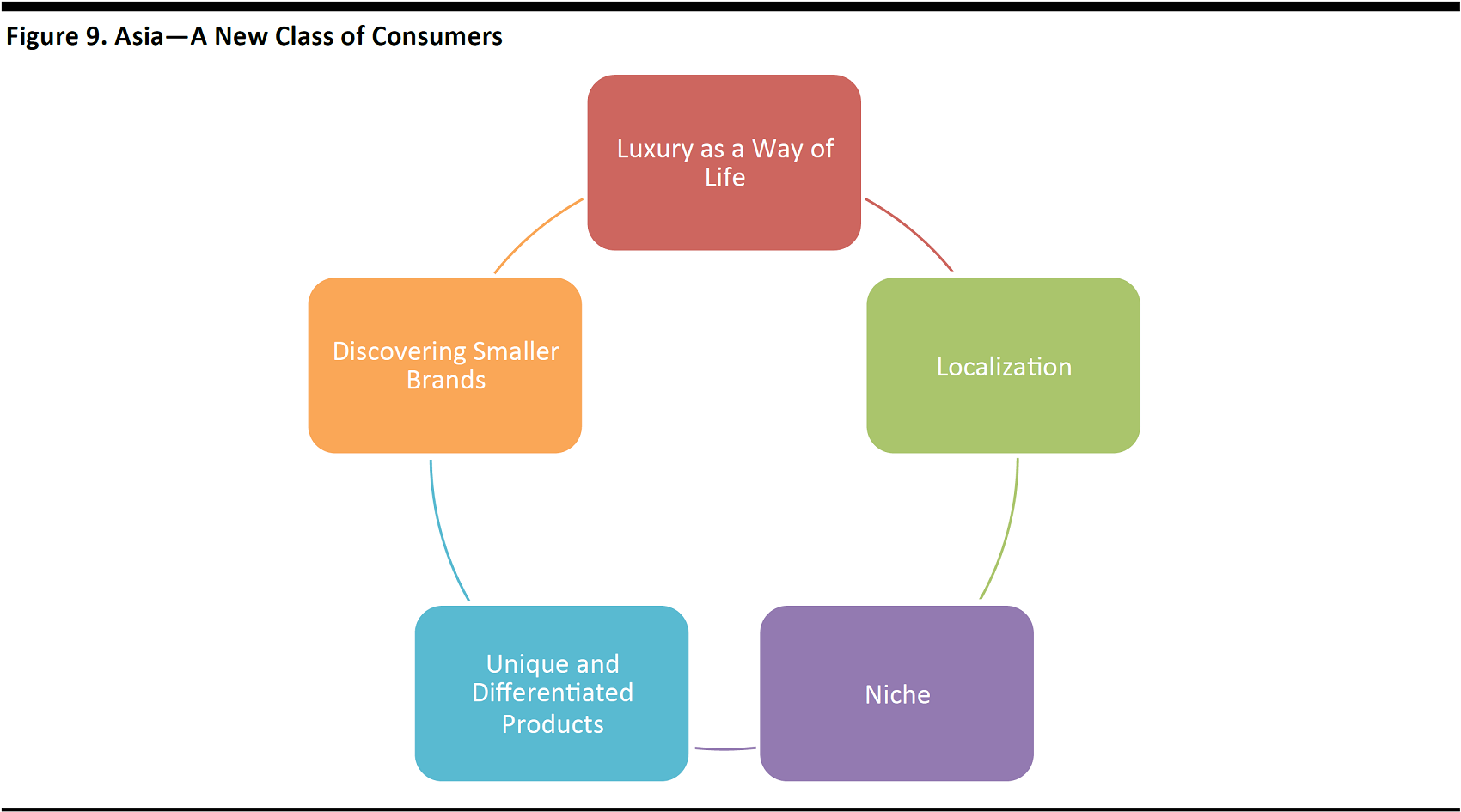

4. A Preference for Personalized Experiences

Asian consumers are relatively well-traveled and well-informed about brands’ offerings, making it important for department stores to cater to their sophisticated tastes. Department stores that do well are those that offer personalized products and services and lifestyle experiences.

Source: FGRT

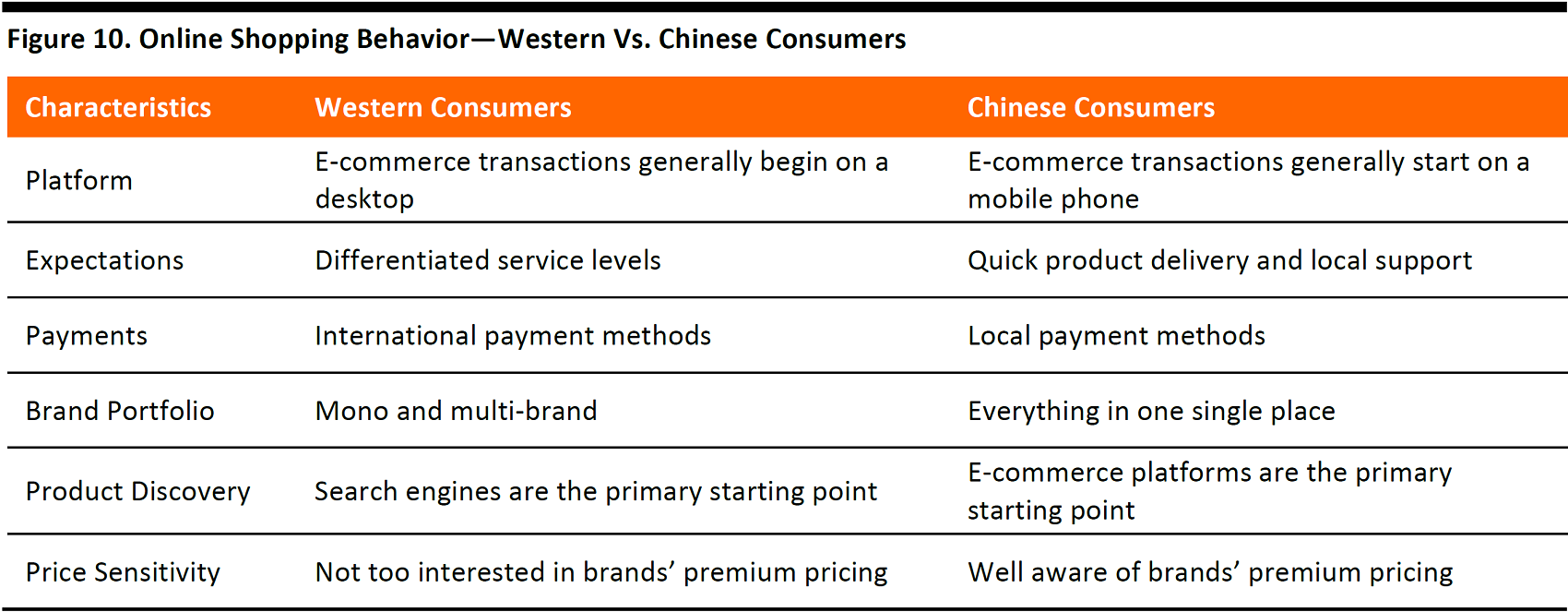

5. The Search for Convenience

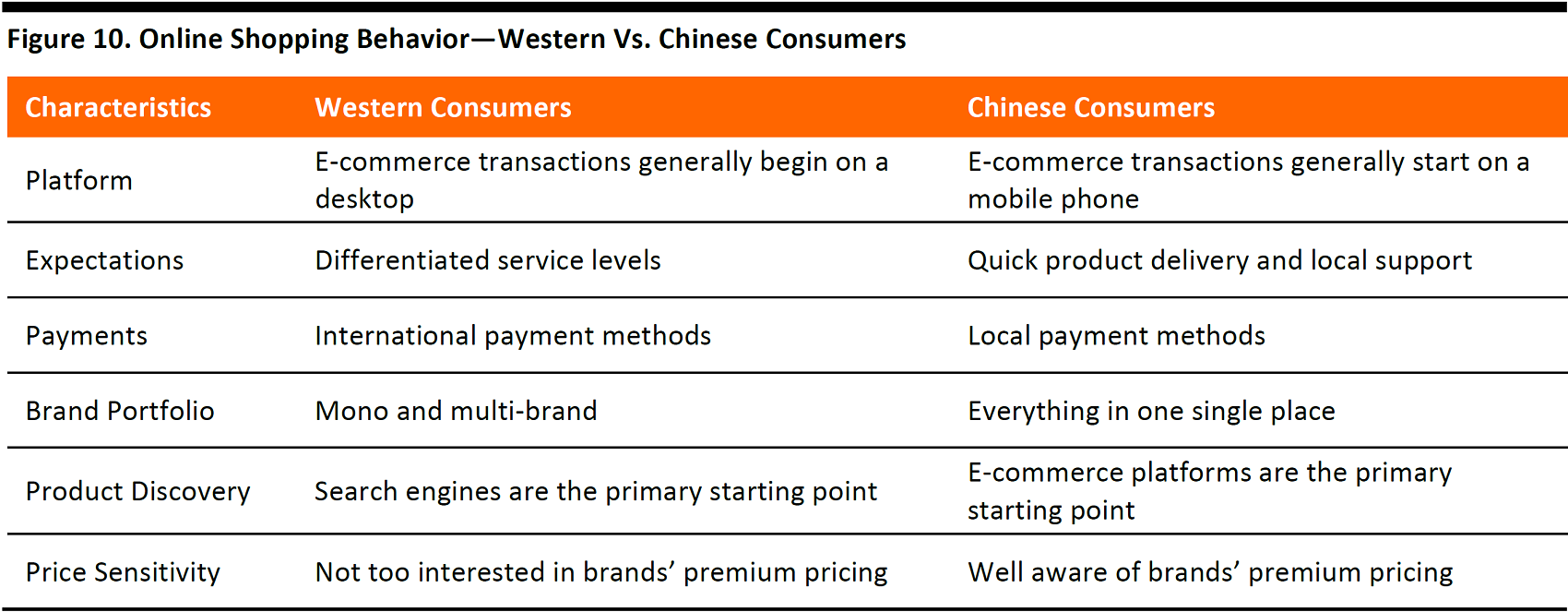

Similar to the West, Asian consumers prioritize convenience in their shopping experience. However, Asian consumers can sometimes be more demanding than their Western counterparts.

Take online shopping, for example. Chinese consumers generally expect next-day delivery compared to their Western counterparts who are more receptive to different service levels.

This expectation for on-demand services from retailers is not particular to China alone but shared across Asia. In July 2017, Amazon launched its Prime Now membership in Singapore, and one of the perks is two-hour delivery. Amazon’s move into Singapore, and eventually the rest of Southeast Asia, is expected to drastically raise customers’ expectations, putting pressure on Asian retailers to better service their customers.

Source: Vipshop/FGRT

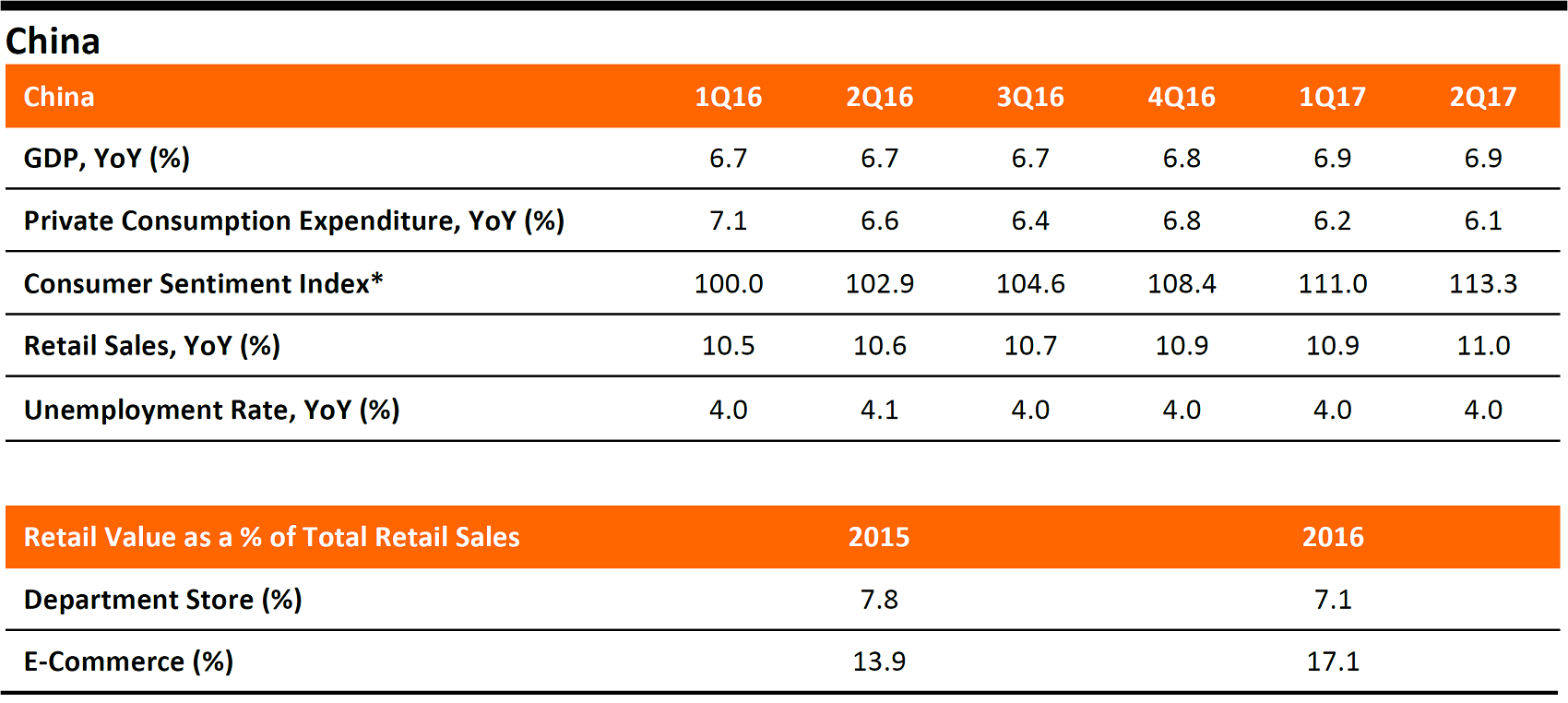

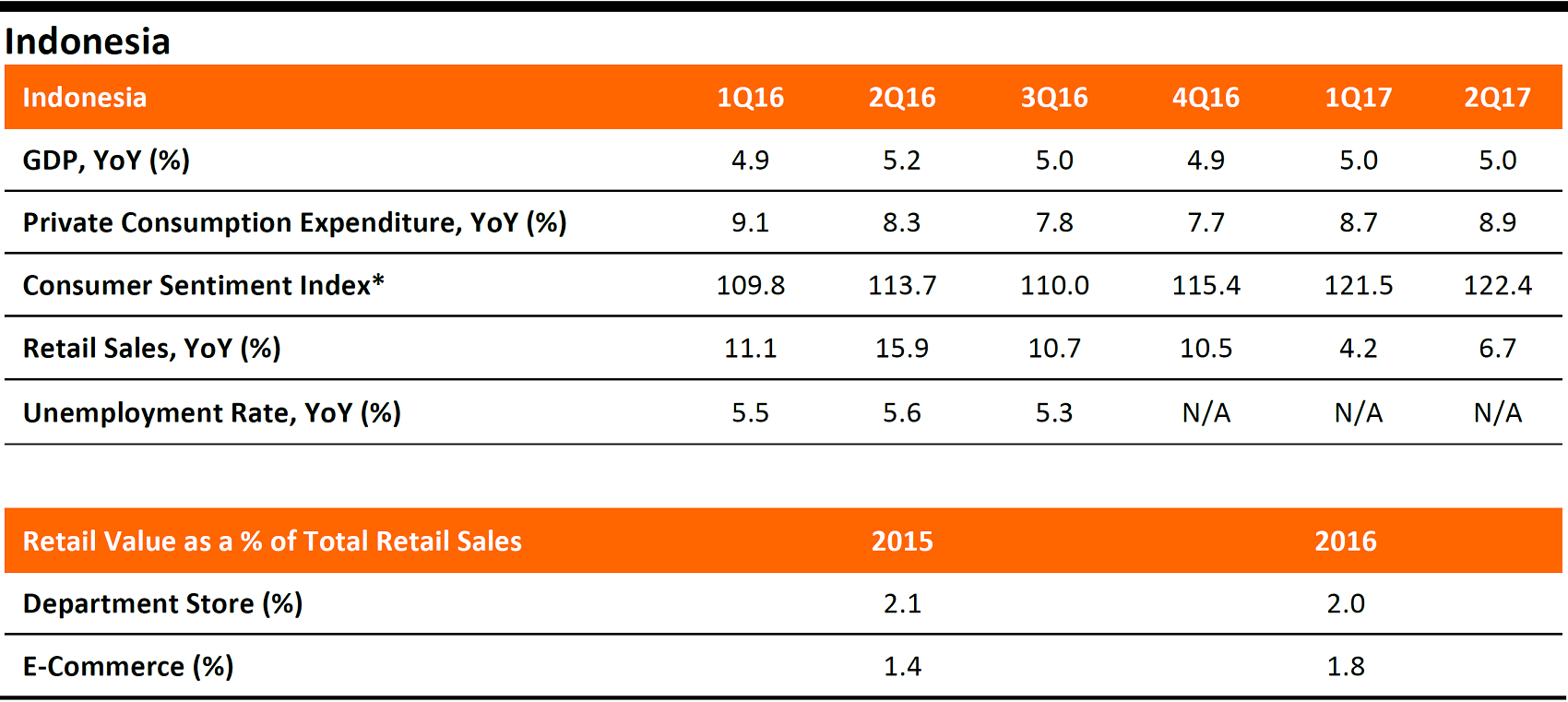

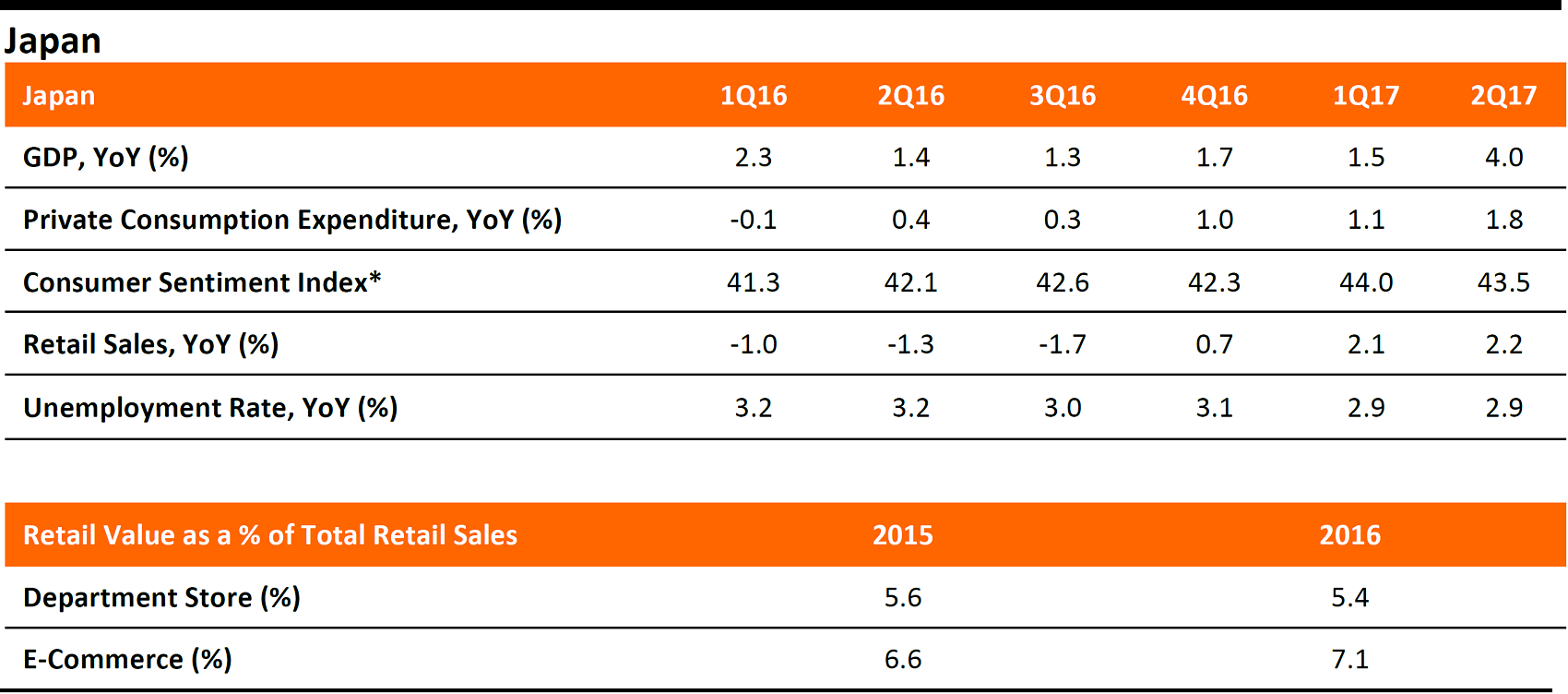

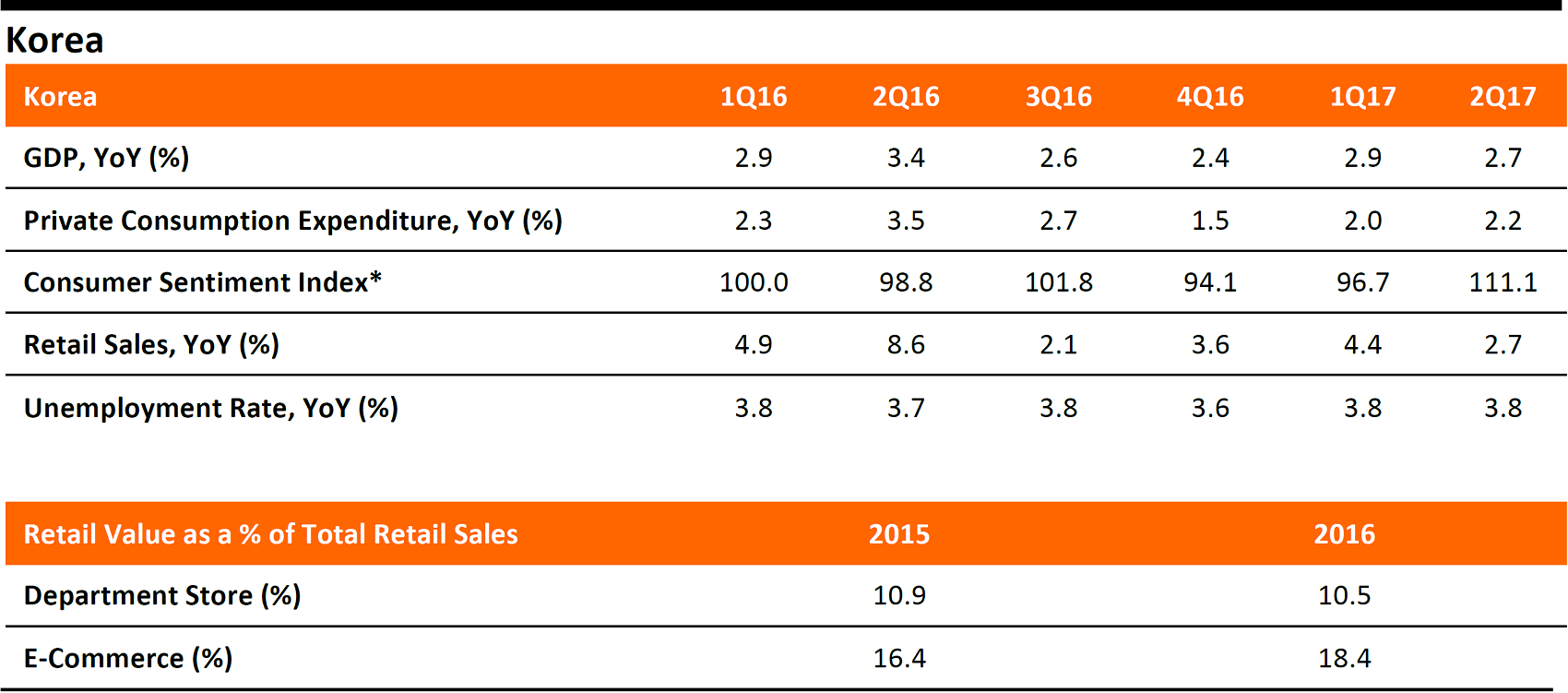

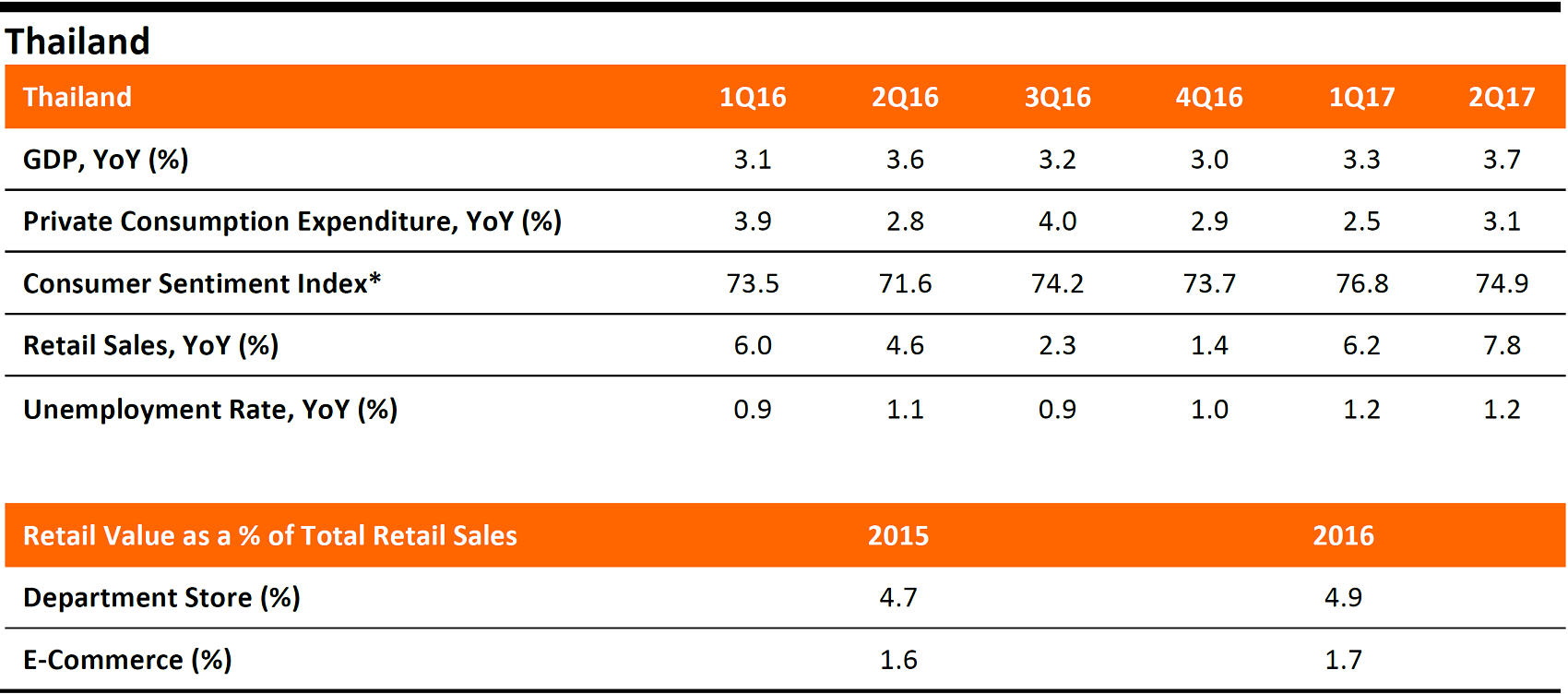

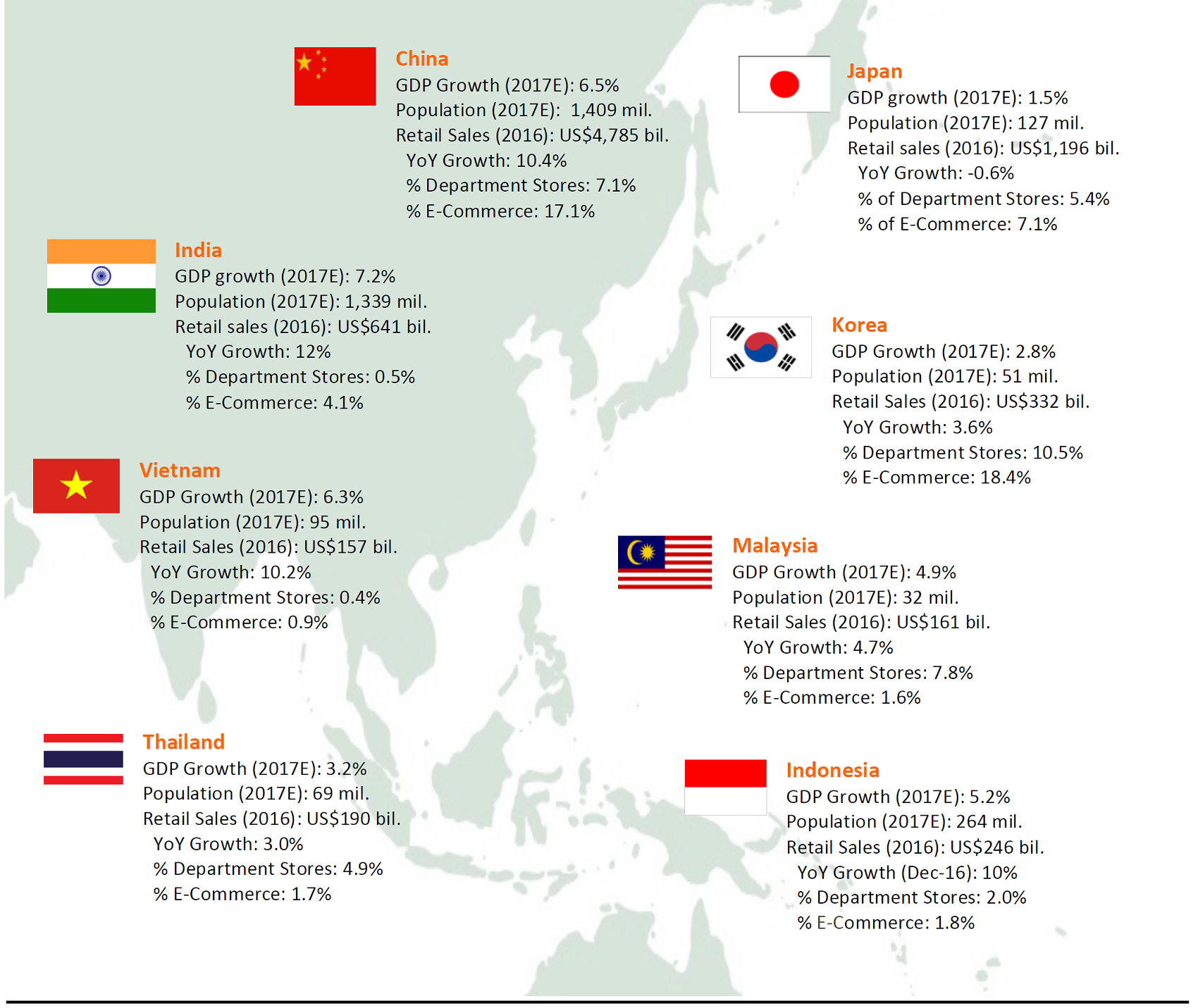

Dashboard: The Asian Retail Industry

Source: ICSC/United Nations/National Bureau of Statistic of China/Bank of Thailand/Bank of Indonesia/General Statistics Office of Vietnam/Ministry of Economy, Trade and Industry/India Brand Equity Foundation/eMarketer/Bloomberg estimates/FGRT

Six Department Store Themes

Department stores are changing their approach in order to attract shoppers back to their stores. We identify six themes in the department store industry: 1) new store formats and concepts as new growth drivers; 2) Southeast Asia as the next battleground and growth driver; 3) the experiential component remains a priority; 4) Chinese outbound tourism; 5) young consumers are increasingly driving stores’ business decisions; and 6) the omnichannel presence.

1. New Store Formats and Concepts as New Growth Drivers

Asian department stores are looking at overhauling their business models and store formats in order to cater to this new generation of customers. It has become clear that a homogenous product and service offering no longer appeals to these more demanding and discerning consumers. Hence, department stores have had to revisit their store formats to cater to the diversified needs of specific demographics.

Store formats that provide an upgraded and personalized shopping experience include:

- Department store complexes

- Large lifestyle centers

- Small-size store formats

- Multi-brand shops

- Duty-free shops

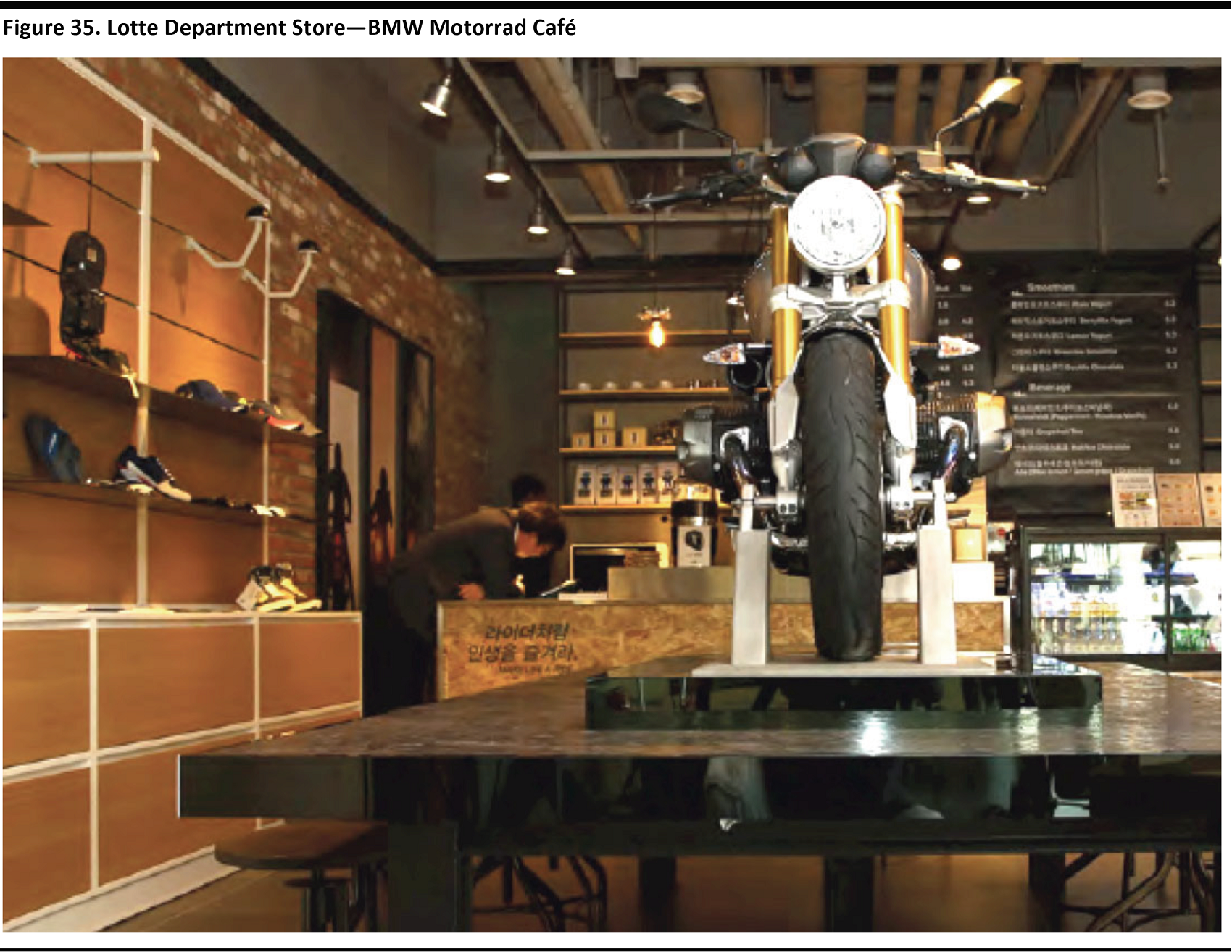

Department Store Complexes—the Korean Example

At one end of the spectrum, we are seeing department stores opening large complexes that resemble and offer a theme-park-like experience, making shopping more fun. The likes of Shinsegae’s Starfield Hanam and Lotte World Tower in Korea inspire the imagination with their all-encompassing shopping complexes.

- Starfield Hanam features Shinsegae’s flagship department store and sports and entertainment facilities, including an aquarium, an indoor water park, Korea’s first in-mall recreational sports park and cinemas. The mall recorded more than 2 million visitors per month in its first three months of operation.

- Lotte World Tower is one of Korea’s tallest skyscrapers with a duty-free shop, an aquarium, a concert hall and a theme park.

Source: InsideRetail

Large Lifestyle Centers—the Thai Example

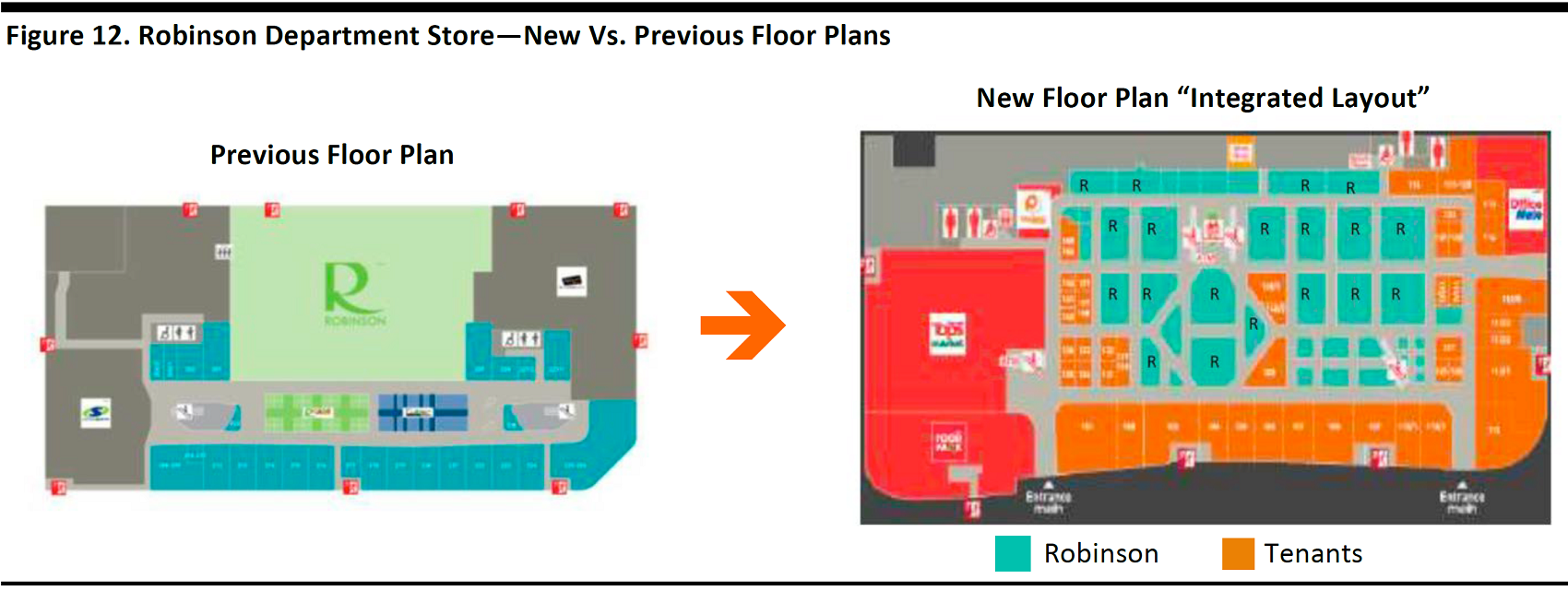

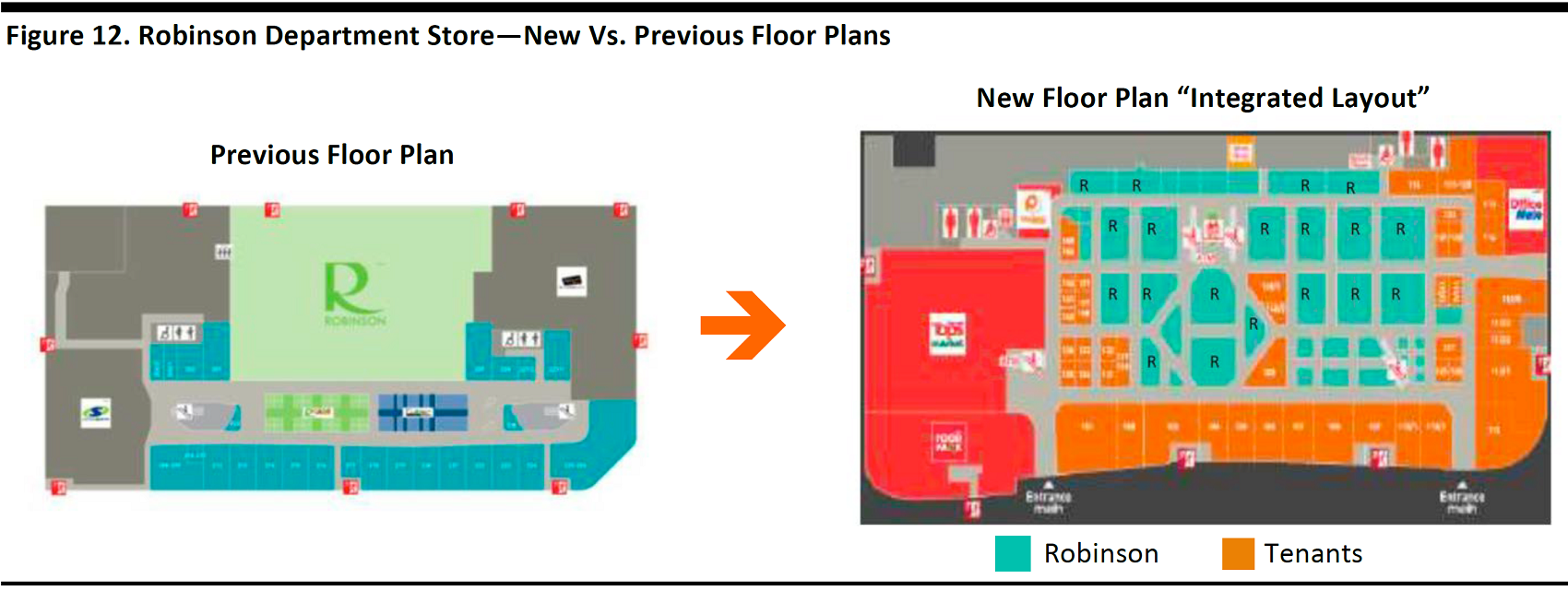

Instead of following the traditional model, department stores are moving toward a new integrated lifestyle center model, which generally consists of a shopping mall, a department store, a food park, and a cinema.

Robinson, one of Thailand’s leading department store operators, is pivoting to the strategy of a “Robinson Lifestyle Centre” format in order to increase its appeal among consumers. By 2020, Robinson plans to rejuvenate the store format of 20 major outlets into “lifestyle department stores,” with a budget of Bt25–Bt150 million (US$0.75–US$4.5million) per branch.

Under the new model, each Robinson Department Store will not only be smaller, but roughly 70% of the floor space of the lifestyle centers will be occupied by F&B, lifestyle services, fitness, and recreation.

Source: Company data

The Robinson Lifestyle Center at Petchaburi, which opened in May 2017, features an integrated layout with a shopping complex, cinema, and fitness center. The Robinson Lifestyle Center at Lop Buri, which opened in December 2016, has a water park.

Source: Company data

The strategies of other Thai department stores include:

- Central Group: The group will dedicate a minimum of 30% of its retail space at Central World department stores to services that cannot easily be replicated online.

- Others: Other luxury department stores are offering broader choices in dining, entertainment, wellness, and cosmetic surgery.

Small-Size Store Formats—the Japanese Example

We are also seeing department store operators opening smaller and more targeted outlets to capture those younger consumers who are not in the habit of visiting department stores.

Japan’s Isetan Mitsukoshi has been opening small- and mid-sized department stores in the Tokyo metropolitan area as well as other major cities. These smaller stores will operate in conjunction with the company’s larger stores, and provide better customer engagement.

In Korea, the increase in the number of one-person households and consumers’ preference for convenience has driven a rise in demand for convenience retailing. Lotte Shopping and Shinsegae Group both have a presence in convenience retailing.

Multi-Brand Shops—the Korean Example

Lotte: Lotte was among the first department stores in Korea to open a multi-brand shop when it opened el CUBE, which houses contemporary fashion labels targeting young consumers. Lotte opened several branches of its mini department store in Seoul, and plans to add 10 more specialized stores in 2017. With a store space of less than 900 square meters, el CUBE features merchandise and brands that are carefully curated for the demographic in each store’s catchment area.

AK Plaza: Korean department store AK Plaza also operates multi-brand stores, called “Official Holiday” with pop-ups and multi-brand fashion shops to broaden its consumer base and raise awareness among young consumers.

Source: Annual report

Duty-Free Shops—the Korean Example

At popular Asian destinations, duty-free shops and outlets have mushroomed, as department store operators have turned to store formats that appeal to tourists to cash in on the Chinese tourist boom.

Shinsegae began operating in the duty-free market five years ago, and Hyundai Department Store COEX Branch is scheduled to enter the market by the end of 2017. Lotte expanded its duty-free store to connect directly with the World Tower building in June 2017.

2. Southeast Asia—the Next Battleground and Growth Driver

Southeast Asia has seen an increase in investment activity, as international companies increasingly turn to the region as the next driver of growth. In the following section, we discuss investment activity trends in the retail industry, focusing our discussion on China, Korea and the US, whose retailers are pushing into the Southeast Asia region.

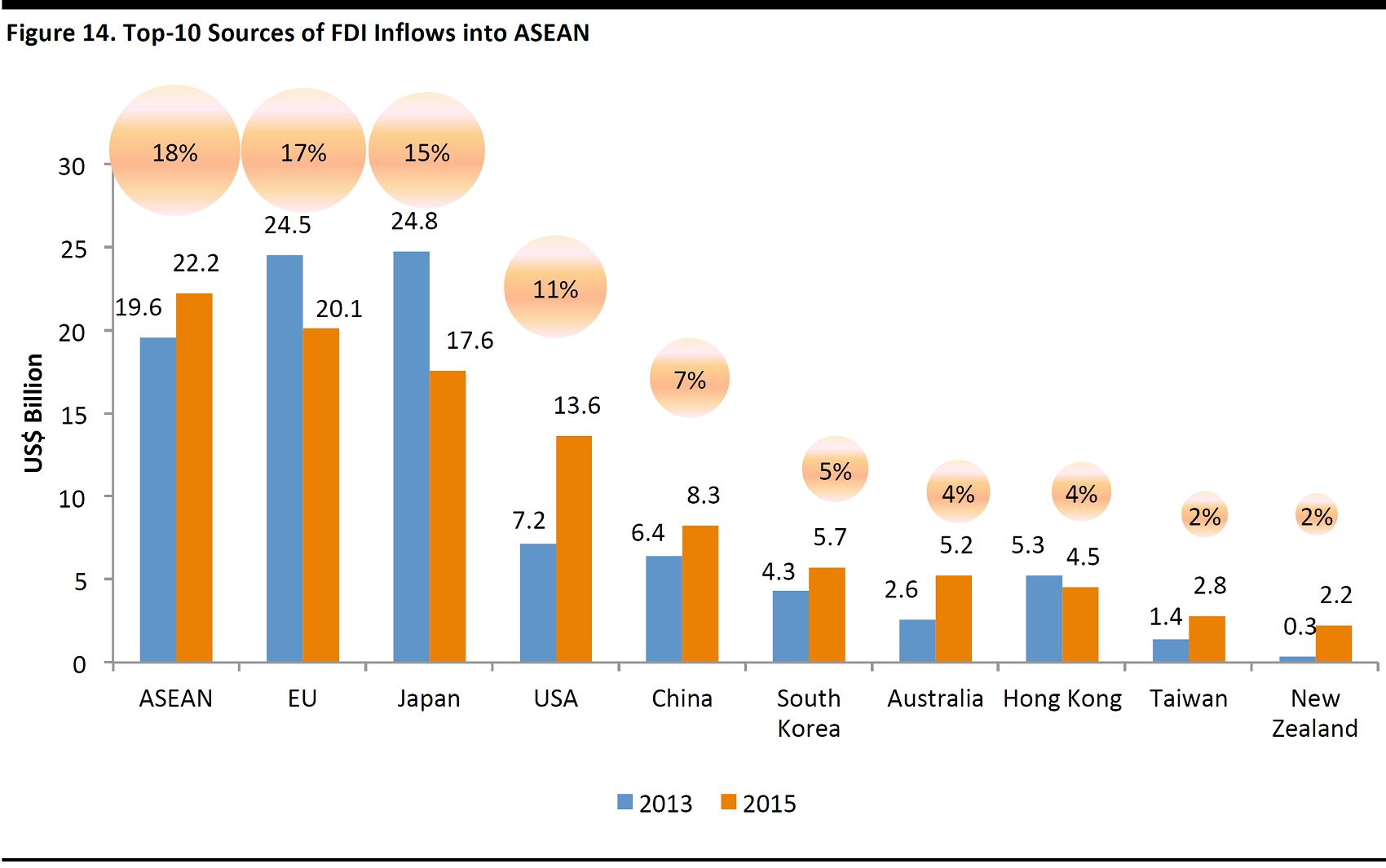

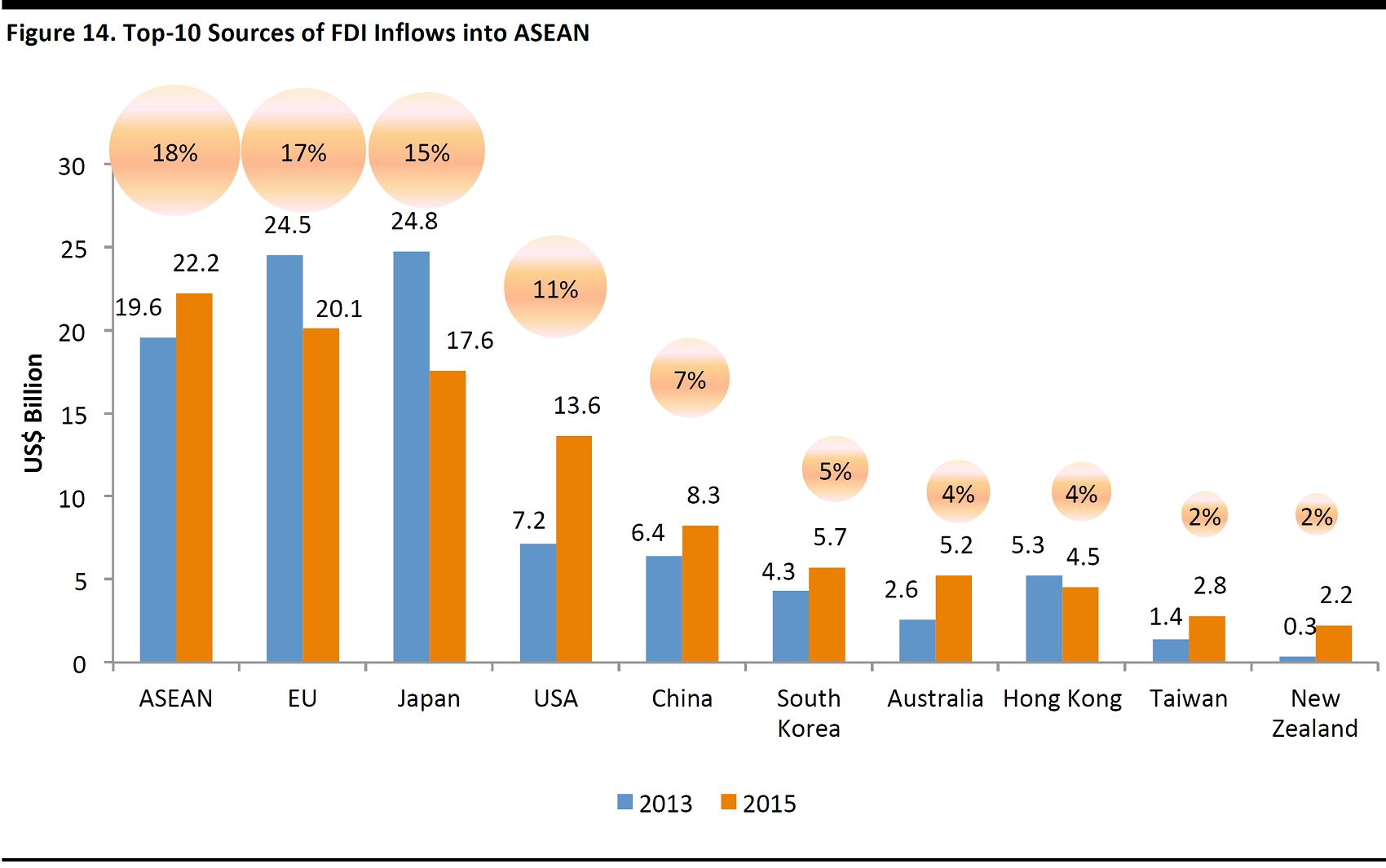

FDI Trends in Southeast Asia

Both physical and online retailers are investing in Southeast Asia in pursuit of growth, as is evident by the high level of inbound FDI into the ASEAN region. International retailers used to turn to the region mostly for cost considerations, but are now eying Southeast Asia’s growth prospects. In recent years, international retailers have been expanding in the region, with new store openings and investments to tap into the region’s rapid growth, young population, and rising middle class.

Source: ASEAN Foreign Direct Investment Statistics Database

Formation of the ASEAN Economic Community

The vision of the region’s ongoing agenda for ASEAN integration through to 2025 is to create a single market and economic region, and retailers operating across borders stand to benefit.

December 2015 marked the formal establishment of the ASEAN Economic Community, intended to draw the 10 member states toward closer economic integration and cooperation. The vast majority of import tariffs have been eliminated and cross-border movement of human and financial capital has been facilitated. However, we note that it will still take time before the benefits are realized.

In the following section, we focus our discussion on China, Korea, and the US, whose retailers are making a concerted push into Southeast Asia.

China

Internet companies go head-to-head in Southeast Asia: China’s Internet players have announced plans to move into Southeast Asia’s fragmented retail industry. Not so long ago, Chinese companies rarely had to look beyond the domestic market of 1.38 billion people for growth. However, as economic growth in the country has stabilized, China’s Internet players have been stepping up their overseas expansion activities.

- Alibaba announced in June 2017 that as part of its global expansion strategy it will increase its stake in leading Southeast Asia e-commerce platform Lazada to 83% from 51%. The company has also invested in Indonesia’s leading online retail platform Tokopedia.

- JD.com and Thailand’s Central Group are reportedly planning to launch an e-commerce joint venture in Thailand, according to Reuters in August 2017. This follows its announcement to enter the Thai e-commerce market by the end of 2017, in a move to expand its overseas business beyond Indonesia.

- Tencent is a backer of Sea Ltd, which operates online marketplace Shopee, e-wallet AirPay and digital entertainment platform Garena. Since its launch in 2015, Shopee, one of Southeast Asia’s e-commerce marketplaces, has achieved over $3 billion in annualized gross merchandise volume (GMV). The company also acquired full control of leading Thai online portal Sanook and rebranded it to Tencent Thailand at the end of2016.

Korea

Korea is an active investor in Southeast Asia. According to UNCTAD, Indonesia and Vietnam were the two largest recipients of Korean FDI in 2015. Lotte Group and E-Mart are two retailers that have been actively investing in the region.

Lotte Group

Korean conglomerate Lotte Group has turned to the Southeast Asian market for future growth, after encountering setbacks in China, following the THAAD missile incident earlier in2017. The group has made both greenfield investments and acquisitions in the retail sector throughout the region, in order to increase its overseas sales contribution. The group’s overseas department store segment remained loss-making in the second quarter of 2017.

Source: Lotte.co.kr

Lotte Group has made the following investments in Vietnam:

- Lotte is planning to build a shopping mall complex in Hanoi by 2020, and a department store complex in Ho Chi Minh by 2021.

- Lotte Shopping also plans to launch e-commerce site Lotte.vn to capture the growth potential of online retail in Vietnam. The company expects to become a dominant player in Vietnam’s e-commerce market with a 20% market share in the medium term.

- Lotte Mart first entered Vietnam in 2006. It plans to expand its chain to 60 supermarkets nationwide by 2020.

E-mart

Shinsegae Group subsidiary and Korean discount-store chain E-Mart has been developing Ho Chi Minh as a base for further expansion to the rest of ASEAN, such as Laos and Myanmar.

Source: English.shinsegae.com

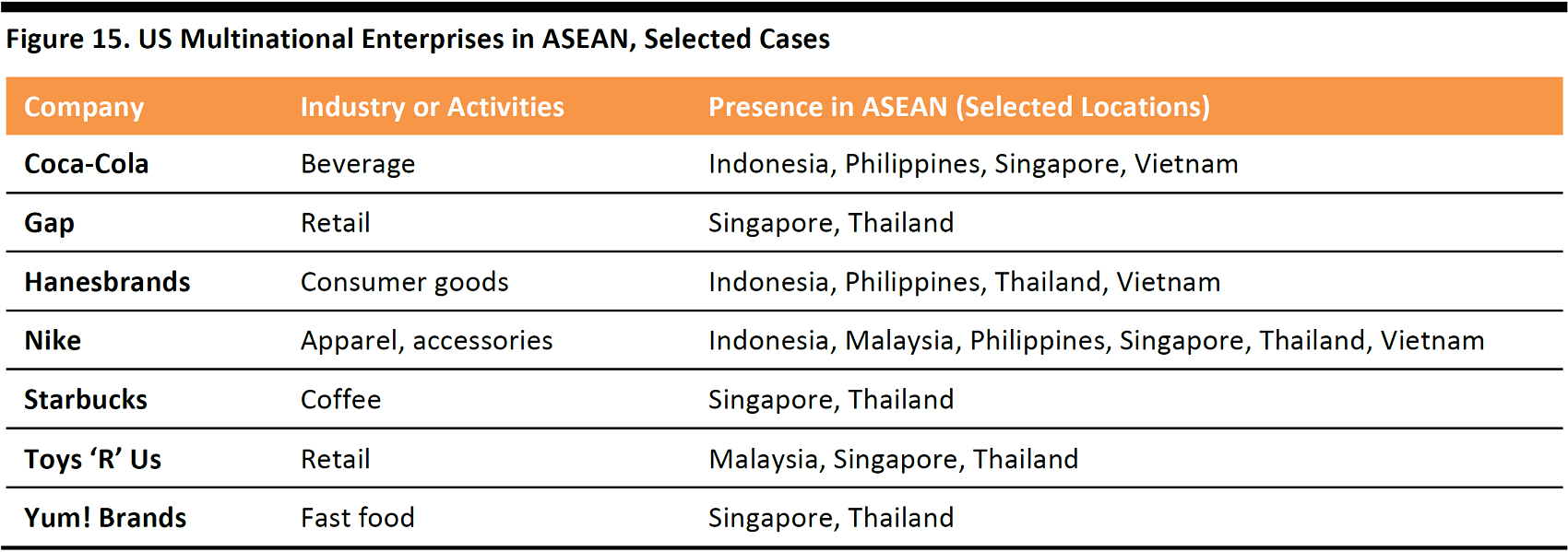

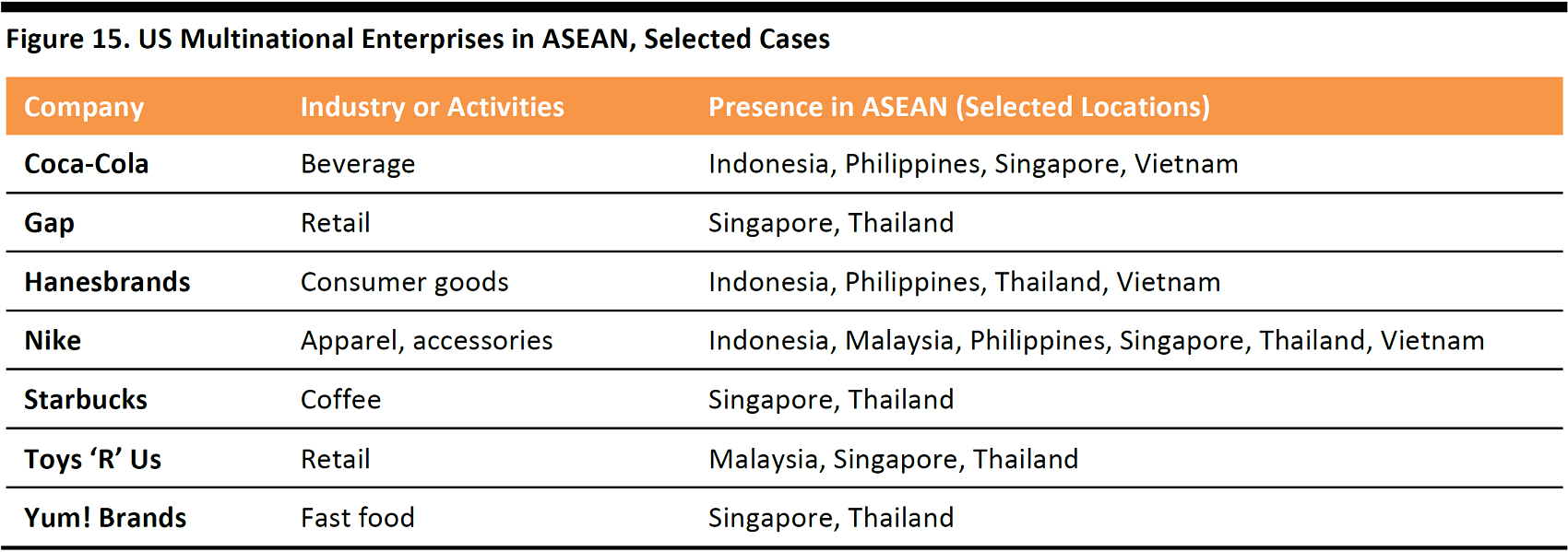

US

The majority of US overseas investments to date have been in the services industry. Most recently in July 2017, the country’s largest e-tailer Amazon entered the Southeast Asian region, with the launch in Singapore of Prime Now, which guarantees delivery within two hours. The effect of the US’s withdrawal from the Trans-Pacific Partnership (TPP) in January 2017will unlikely dent US companies’ investment activity in the region in the long term.

Source: UNCTAD ASEAN Investment Report 2016

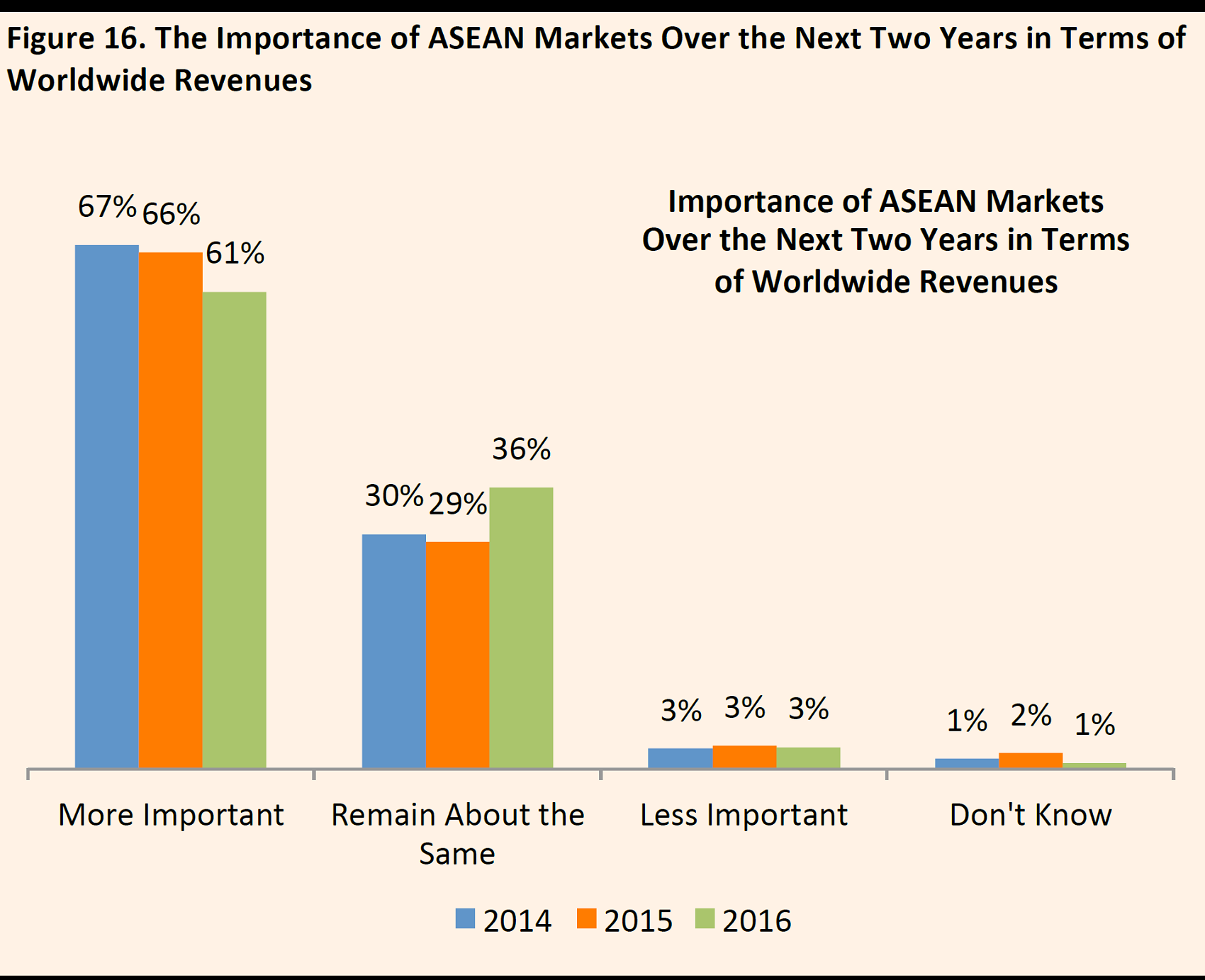

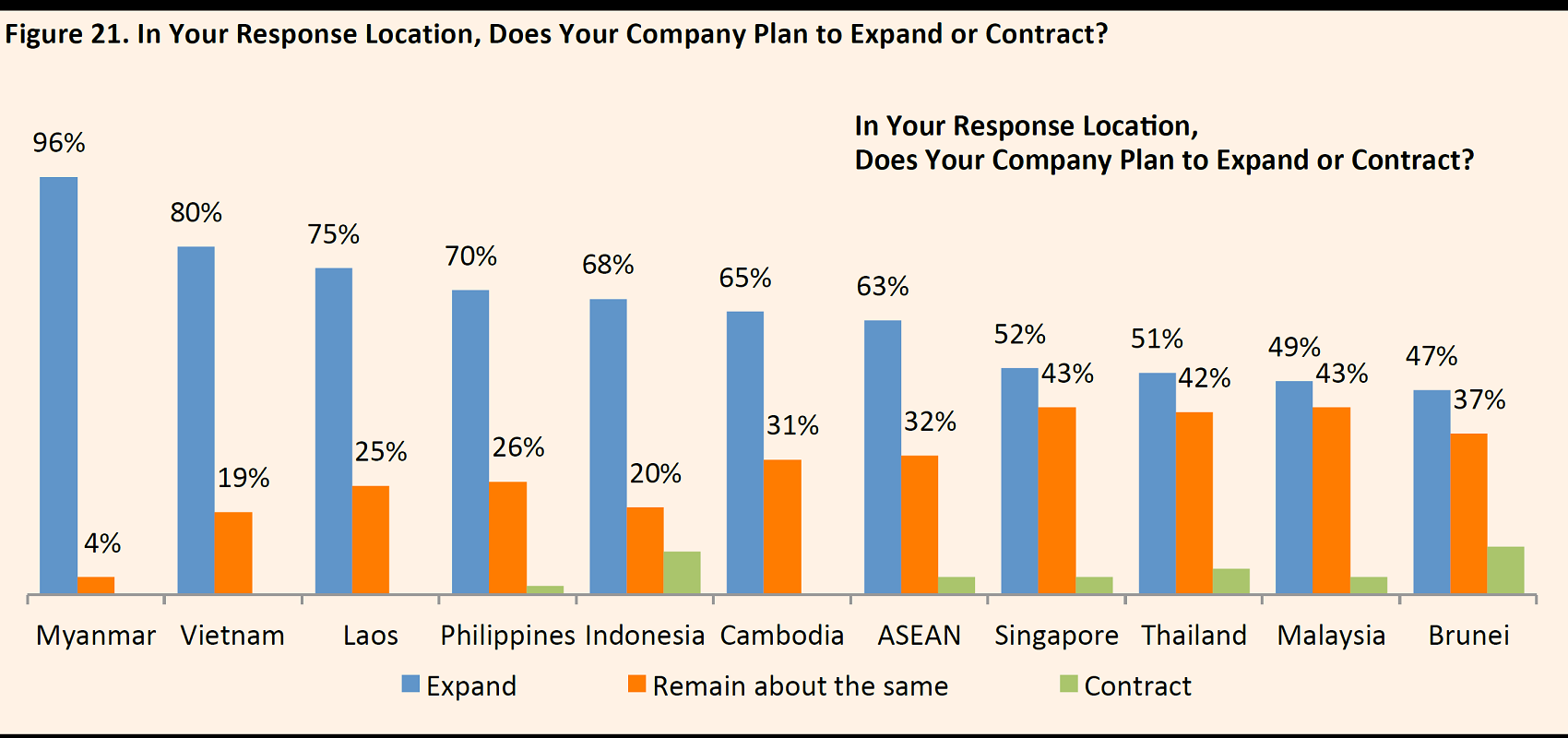

A 2017 Survey Shows a Positive Outlook for US Enterprises Operating in ASEAN

US companies operating in ASEAN generally feel optimistic about the region’s growth prospects. The ASEAN Business Outlook Survey 2017 by the American Chamber of Commerce serves as a barometer of US business sentiment in Southeast Asia. The primary takeaways of the most recent survey are:

- Some 97% of companies anticipate that ASEAN markets will grow in importance, or remain at a similar level, in the next two years.

- Some 87% of companies expect their activity in ASEAN to increase over the next five years.

- US companies’ investment decisions are primarily motivated by economic growth and the growing middle class in the region.

- Myanmar, Cambodia and Vietnam lead the region in terms of positive profit outlook.

- Vietnam tops the list as a priority market for future business expansion, followed by Indonesia and Myanmar.

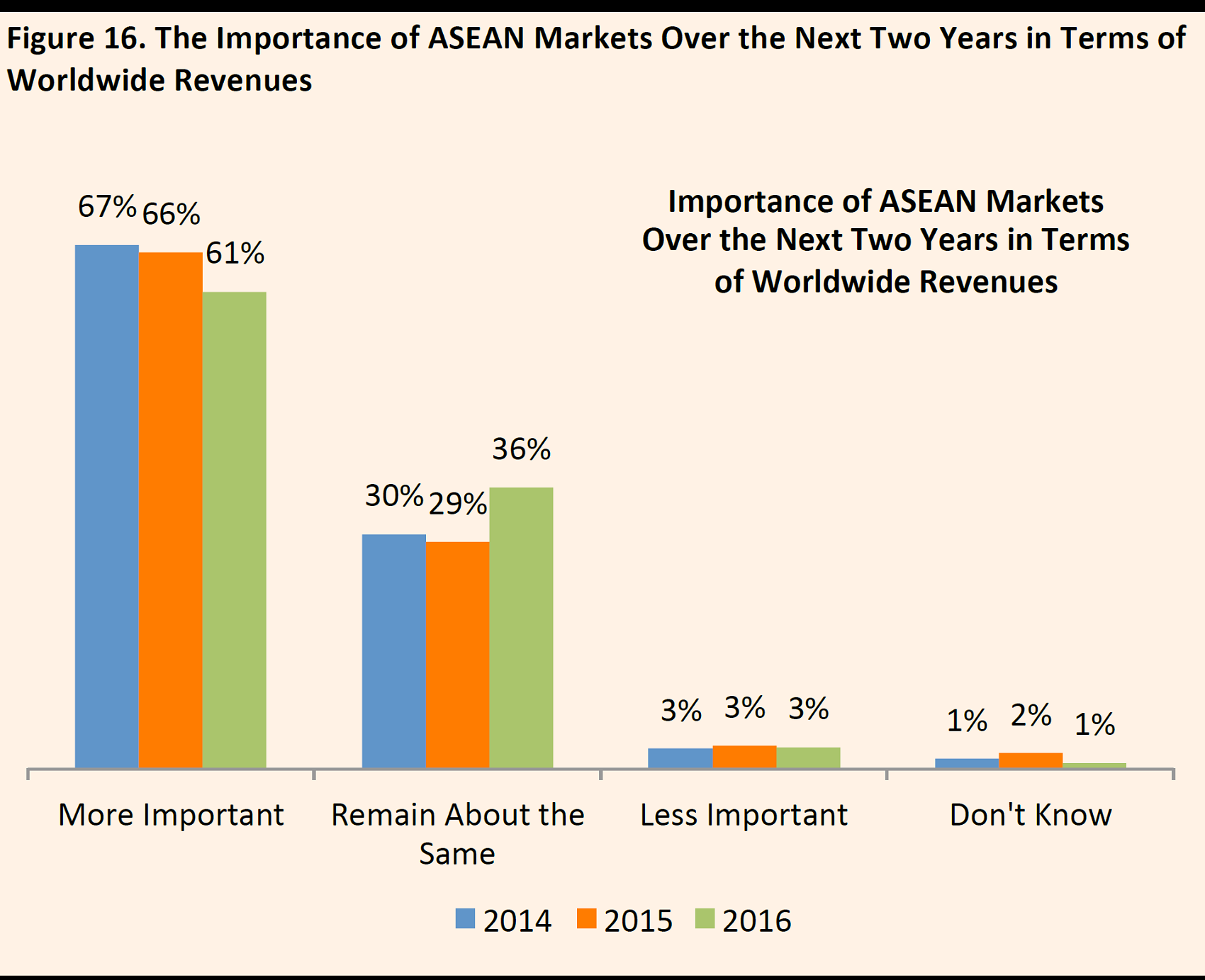

1) The Importance of ASEAN Markets Over the Next Two Years in Terms of Worldwide Revenues

An overwhelming majority of companies anticipate that ASEAN markets will grow in importance in the next two years (61%), while others anticipate they will remain about the same in importance (36%).

Source: ASEAN Business Outlook Survey 2017

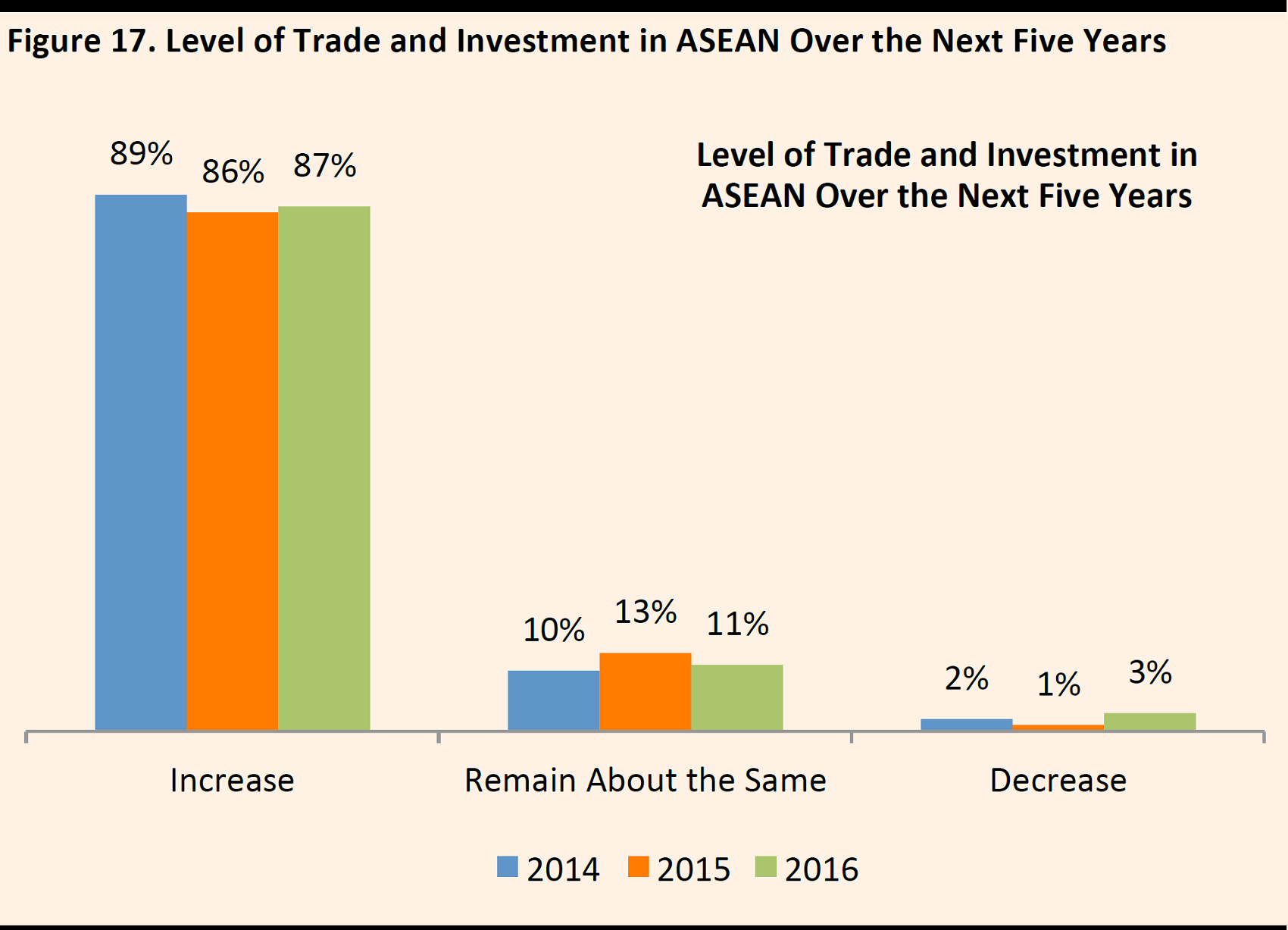

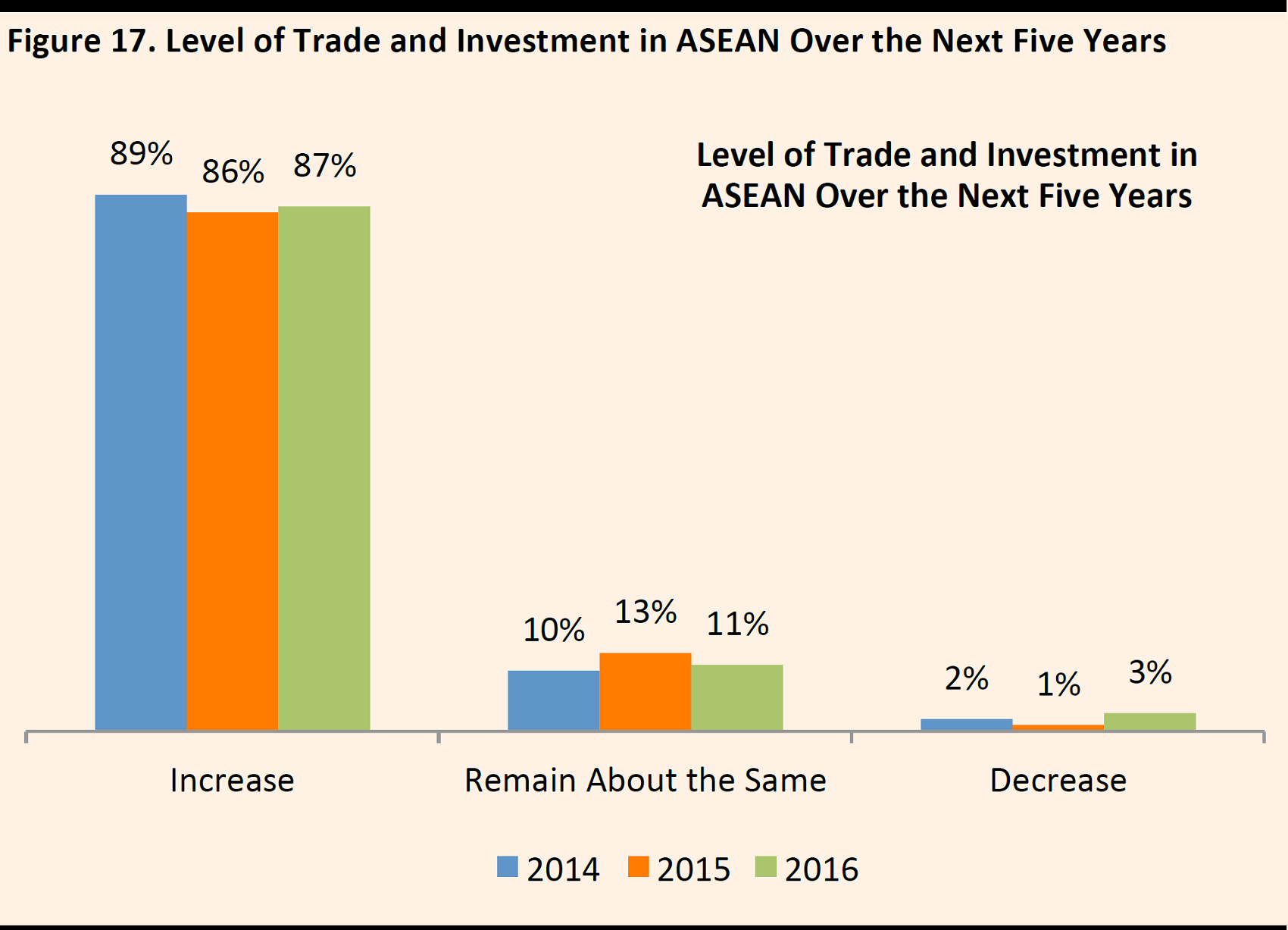

2) Expectations for the Level of Trade and Investment in ASEAN Over the Next Five Years

Some 87% of companies expect their level of trade and investment in ASEAN to increase over the next five years.

Source: ASEAN Business Outlook Survey 2017

3) Economic Growth and the Rising Middle Class Motivate Companies’ Investment Decisions in ASEAN

US companies cite economic growth (66%), a growing middle class (41%) and regional integration (25%) as the three primary reasons for their trade expansion and investment in Southeast Asia.

Source: ASEAN Business Outlook Survey 2017

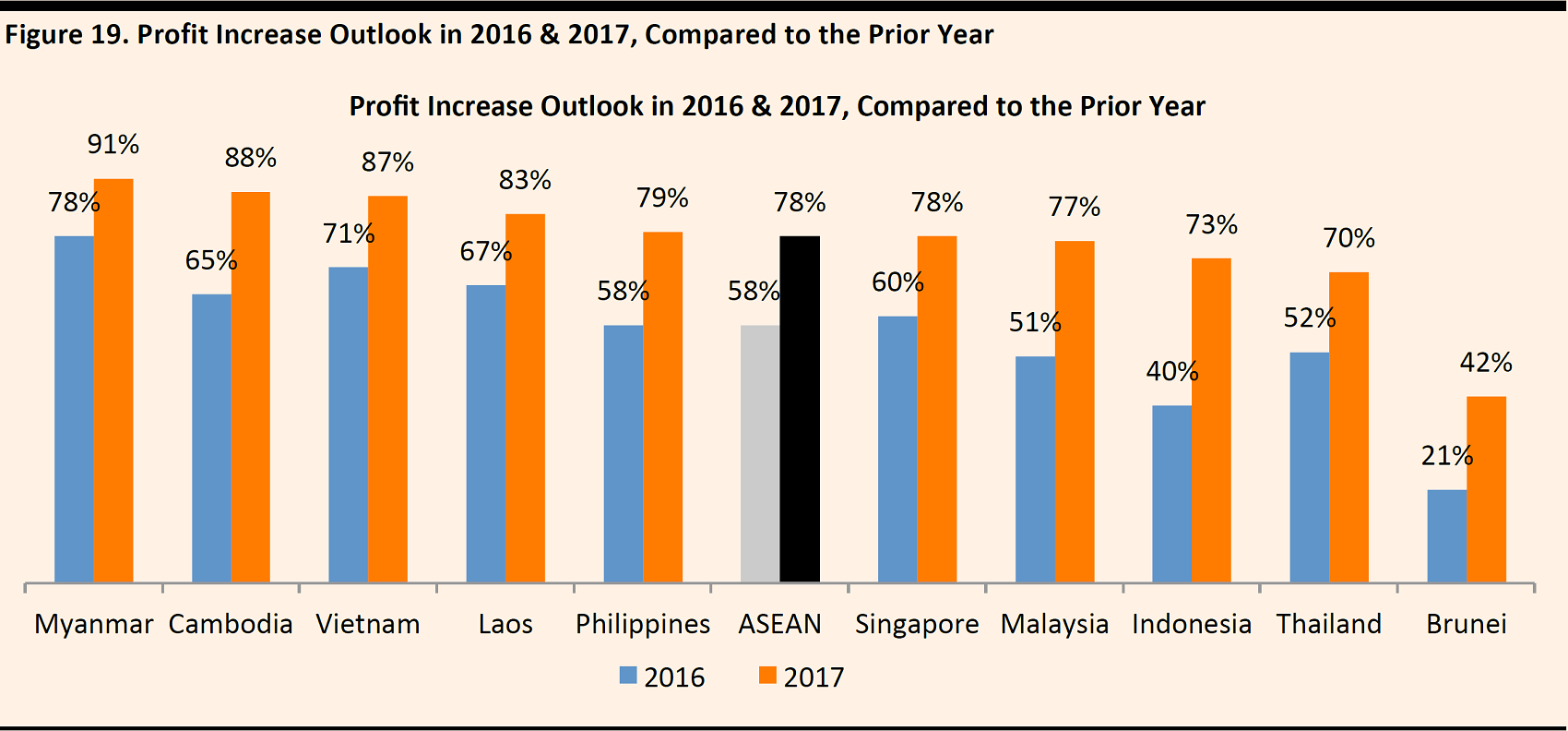

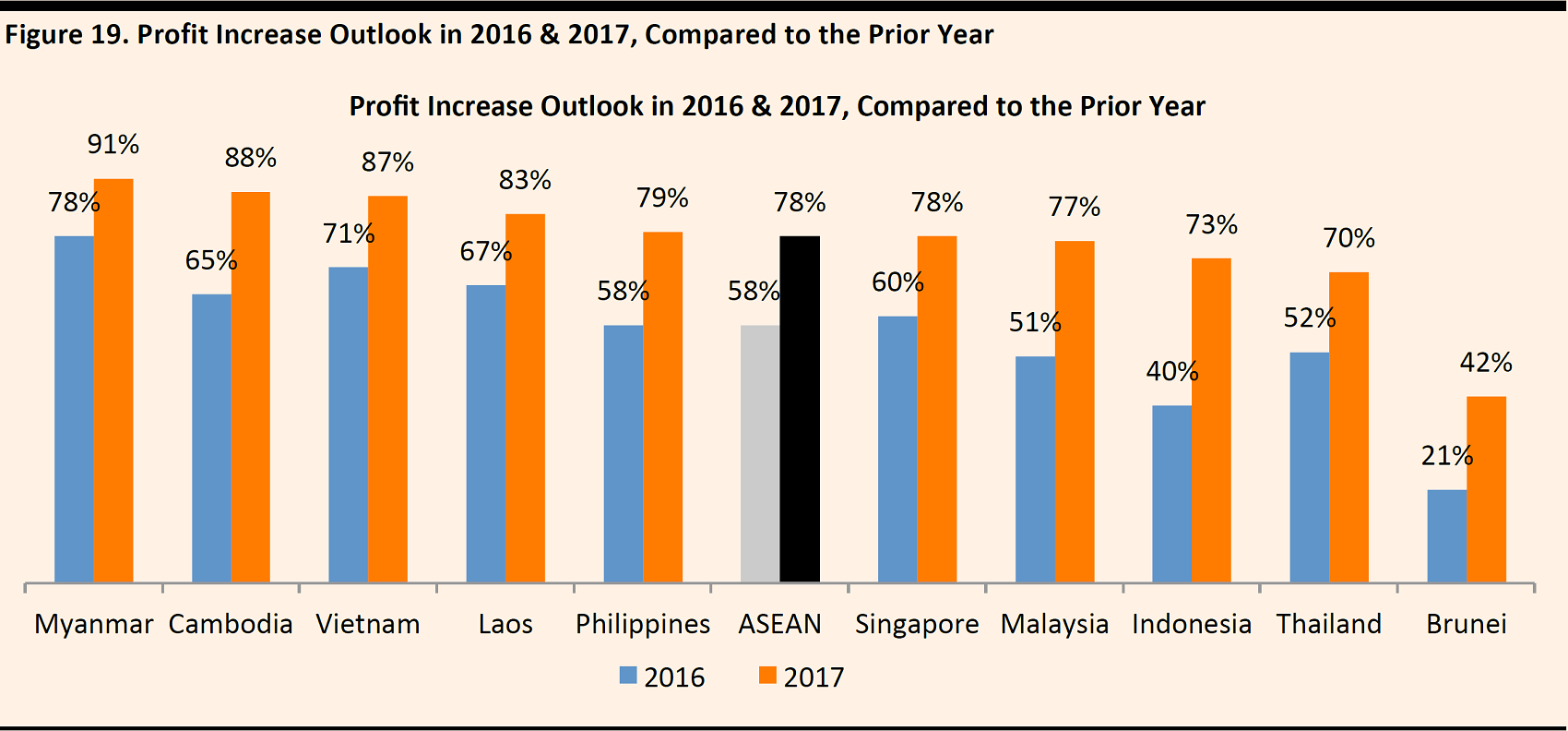

4) Future Profit Outlook

The majority of US companies surveyed (78%) expect an increase in profits in 2017, up from 58% the previous year. The US companies surveyed in Myanmar (91%), Cambodia (88%) and Vietnam (87%) are most positive about their profit outlook.

Source: ASEAN Business Outlook Survey 2017

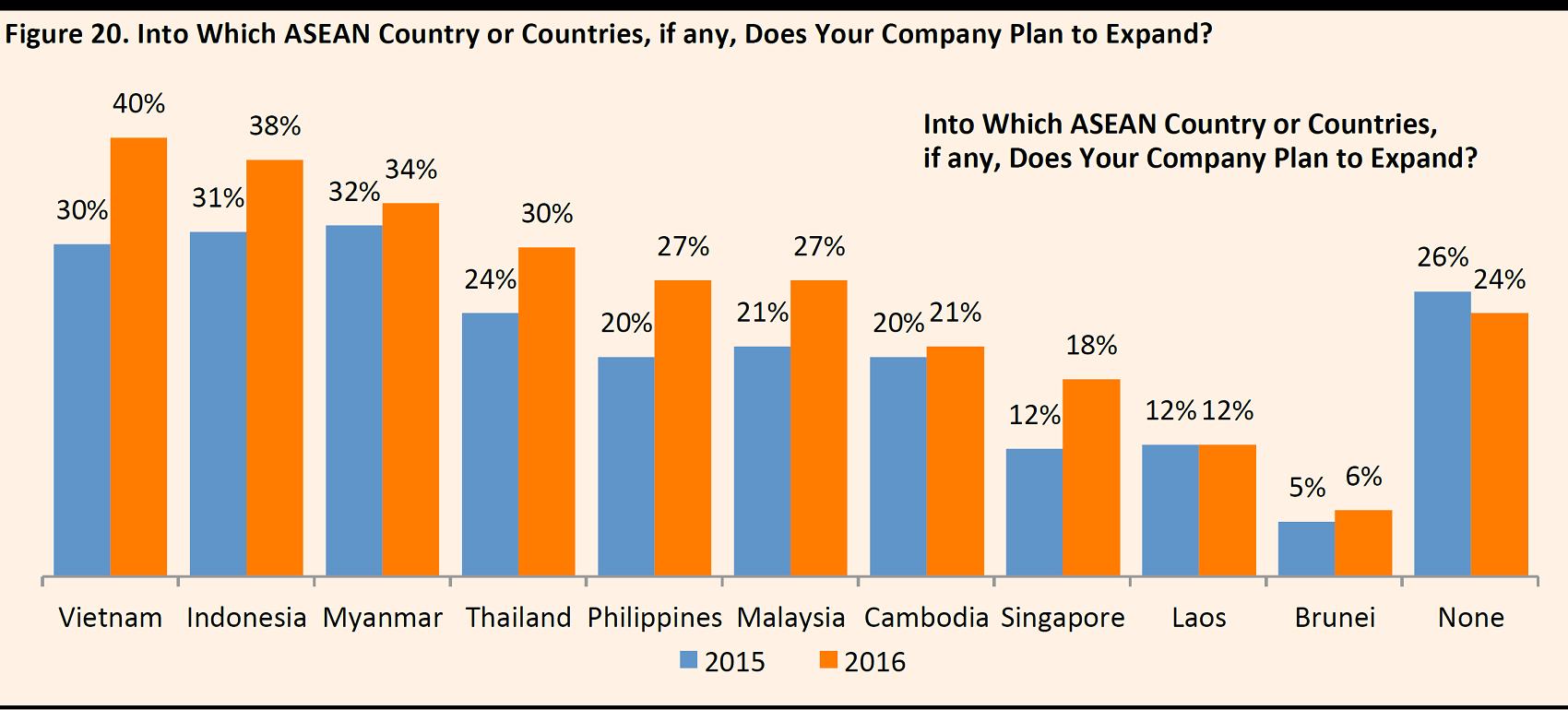

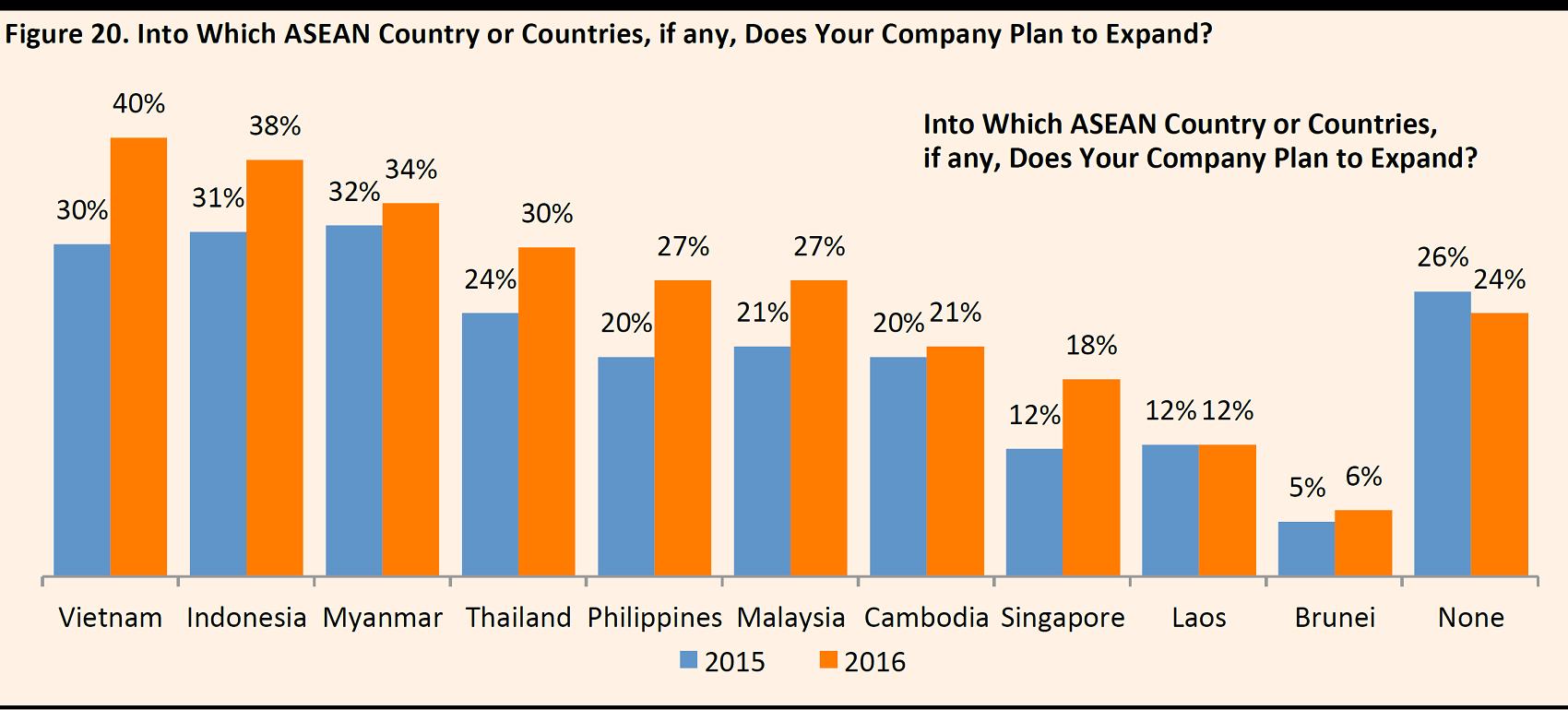

5) Business Expansion in ASEAN

The majority of surveyed US companies plan to expand their operations in the ASEAN region for reasons, such as to diversify their customer base. Vietnam (40%) tops the list of priority markets for future business expansion, followed by Indonesia (38%) and Myanmar (34%). Only 24% of companies indicated that they have no plans to expand into any ASEAN country.

Source: ASEAN Business Outlook Survey 2017

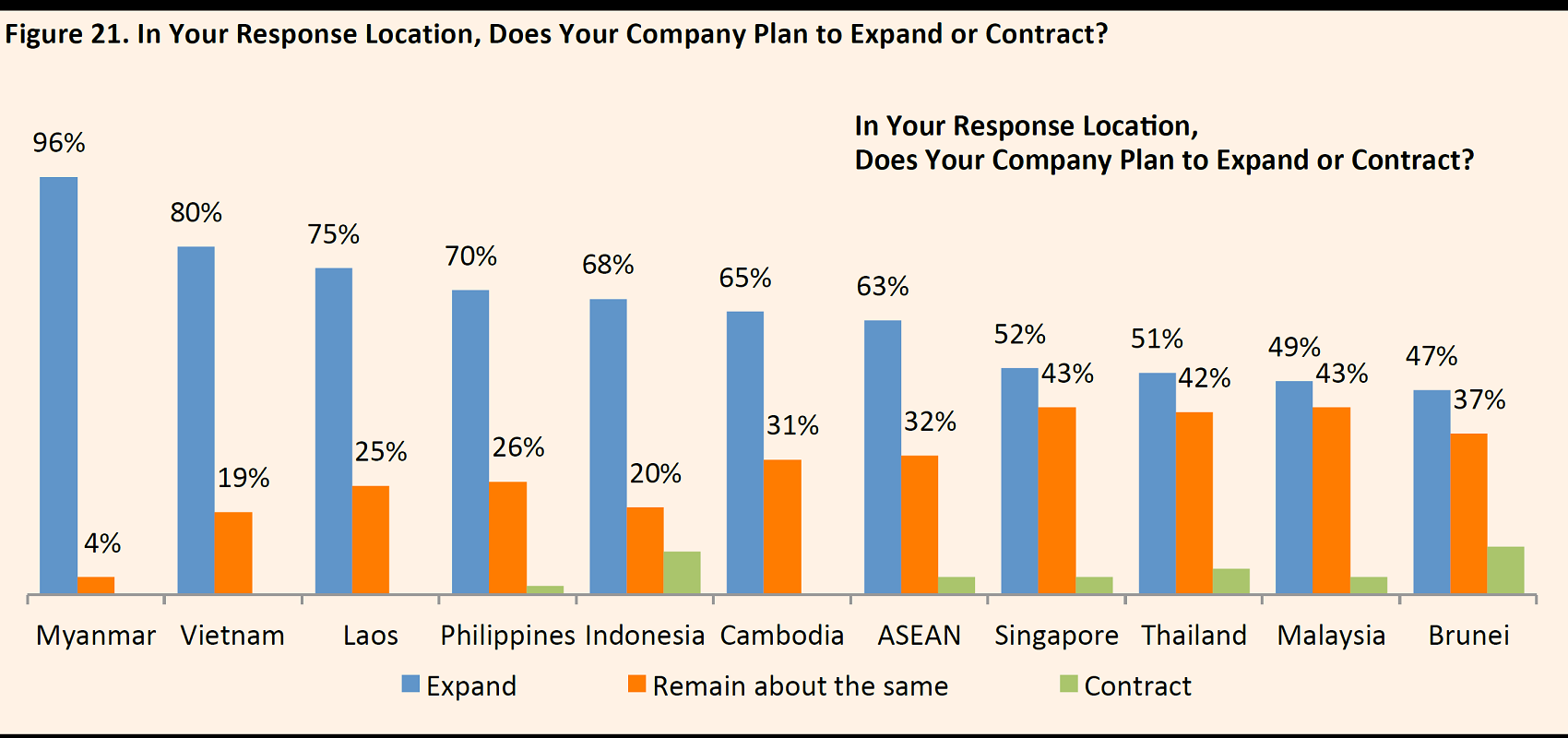

Among those countries in which US companies already have a presence, 96% of the companies in Myanmar said they would continue to expand their operations. Companies operating in Vietnam (80%) and Laos (75%) also expect to expand their operations.

Source: ASEAN Business Outlook Survey 2017

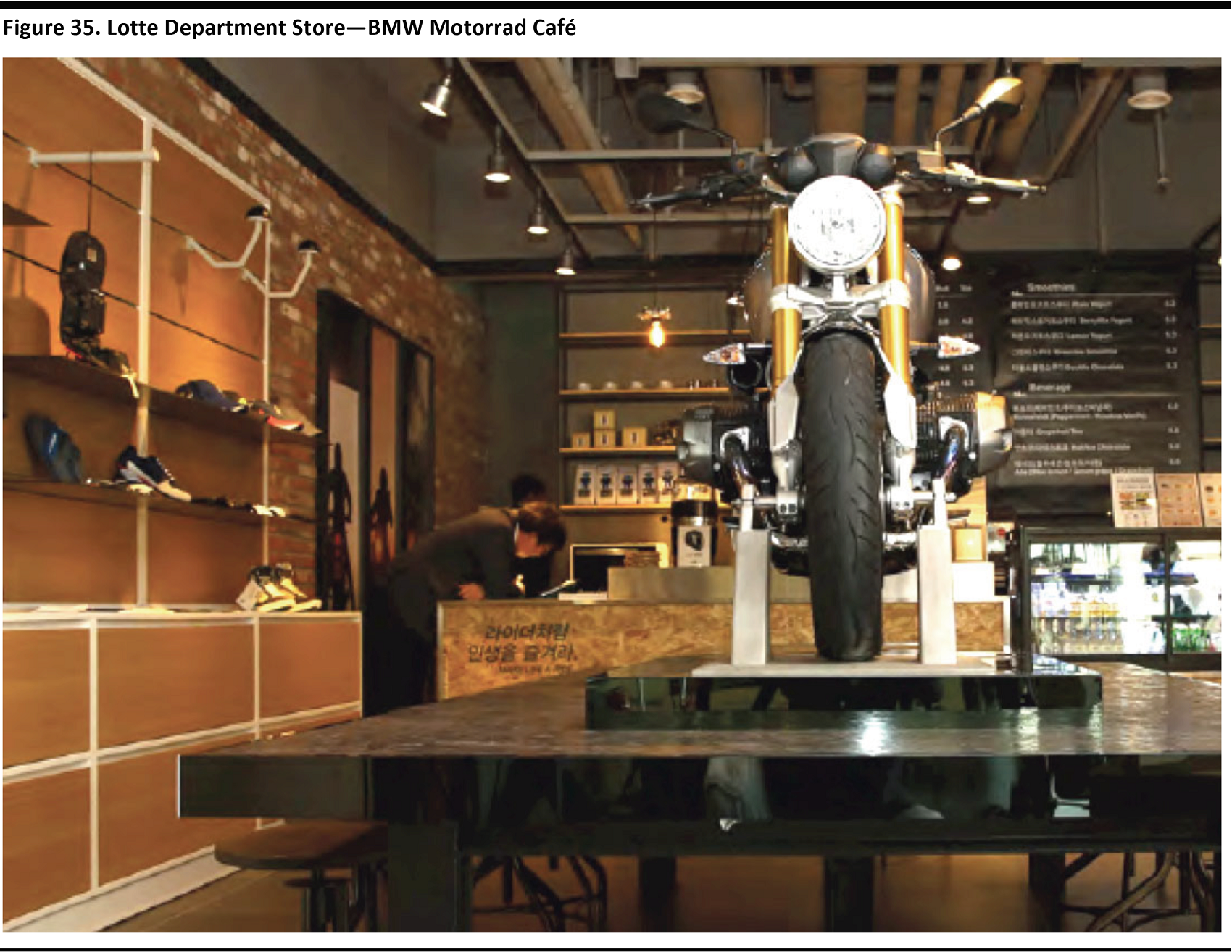

3. The Experiential Component Remains a Priority

The common strategy used by Asian department stores to counter the threat from online retailers is to enhance the customer experience at their stores, similar to what we are seeing happening in the West. This is predominantly done by increasing the range and quality of on-site tenants and adding more lifestyle components, namely F&B and entertainment.

Department Stores Have Added MoreF&Band Entertainment Options In-Store

Japan

In Japan, department stores are allocating more store space to F&B and lifestyle from apparel after worse-than-expected clothing sales in the recent fiscal year. As part of this initiative, some are converting their rooftops to beer gardens.

- Isetan’s Shinjuku department store has converted its rooftop to a beer garden, serving an Italian-themed selection of food.

Source: Isetan.mistore.jp

- Other examples of rooftop beer gardens include Mitsukoshi department store and Tokyu’s main Shibuya store.

Korea

In Korea, Shinsegae has added a children’s playground with built-in hologram technology to some of its stores.

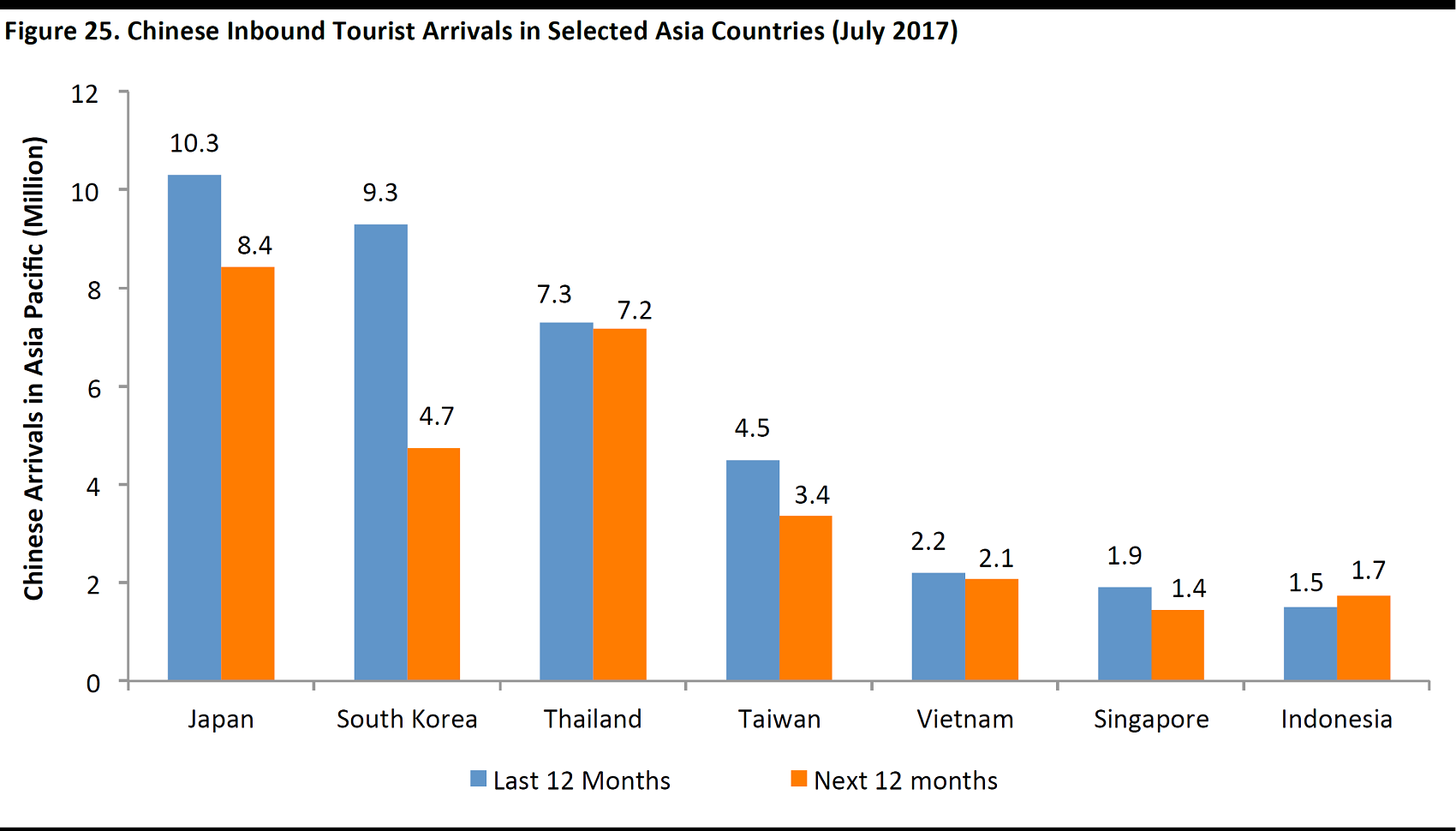

4. Chinese Outbound Tourism

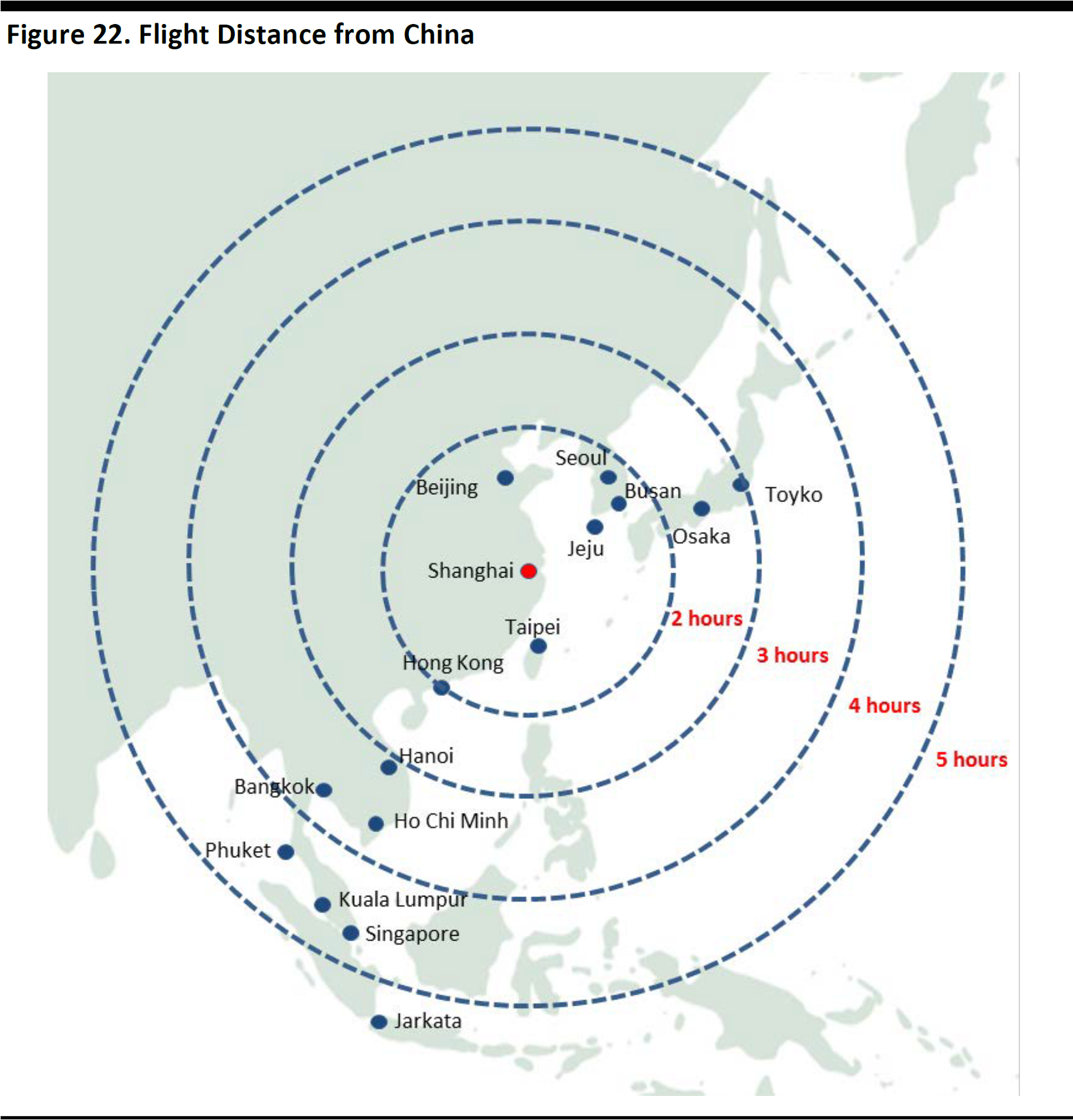

The continued rise in Chinese outbound tourism has been lifting the sales of department stores in Asia. Factors underpinning the growth in Chinese tourists have been driven by more relaxed visa policies and an increase indirect flights from China, which, in turn, has led to higher retail sales overseas.

- Chinese passport holders have visa-free or visa-on-arrival access to 57 countries, according to the Global Passport Power Rank 2017.

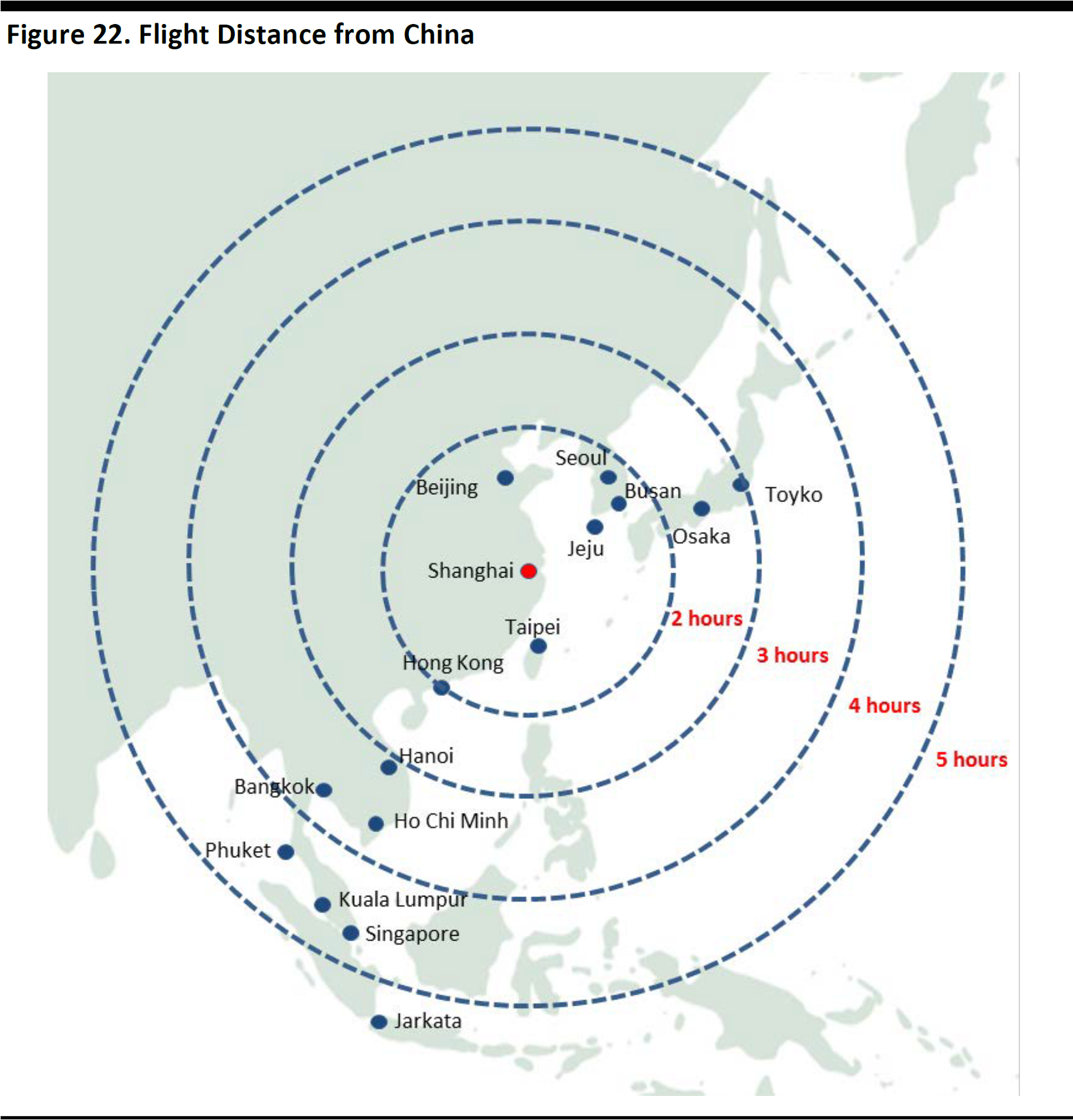

- Most Asian cities such as Bangkok, Seoul, Tokyo, Ho Chi Minh, and Taipei are within a five-hour flight from Shanghai, making them the preferred short- and medium-haul destinations.

Japan is moving toward 10-year visas for Chinese passport holders. Several countries (Taiwan, Malaysia, Vietnam, Bali) instituted a simplified visa process; whereas Thailand offers a visa-free process.

Source: FGRT

At popular Asian destinations, duty-free shops and outlets have mushroomed, as department store operators have turned to store formats that appeal to tourists to cash in on the Chinese tourist boom.

Source: National Tourism Organizations

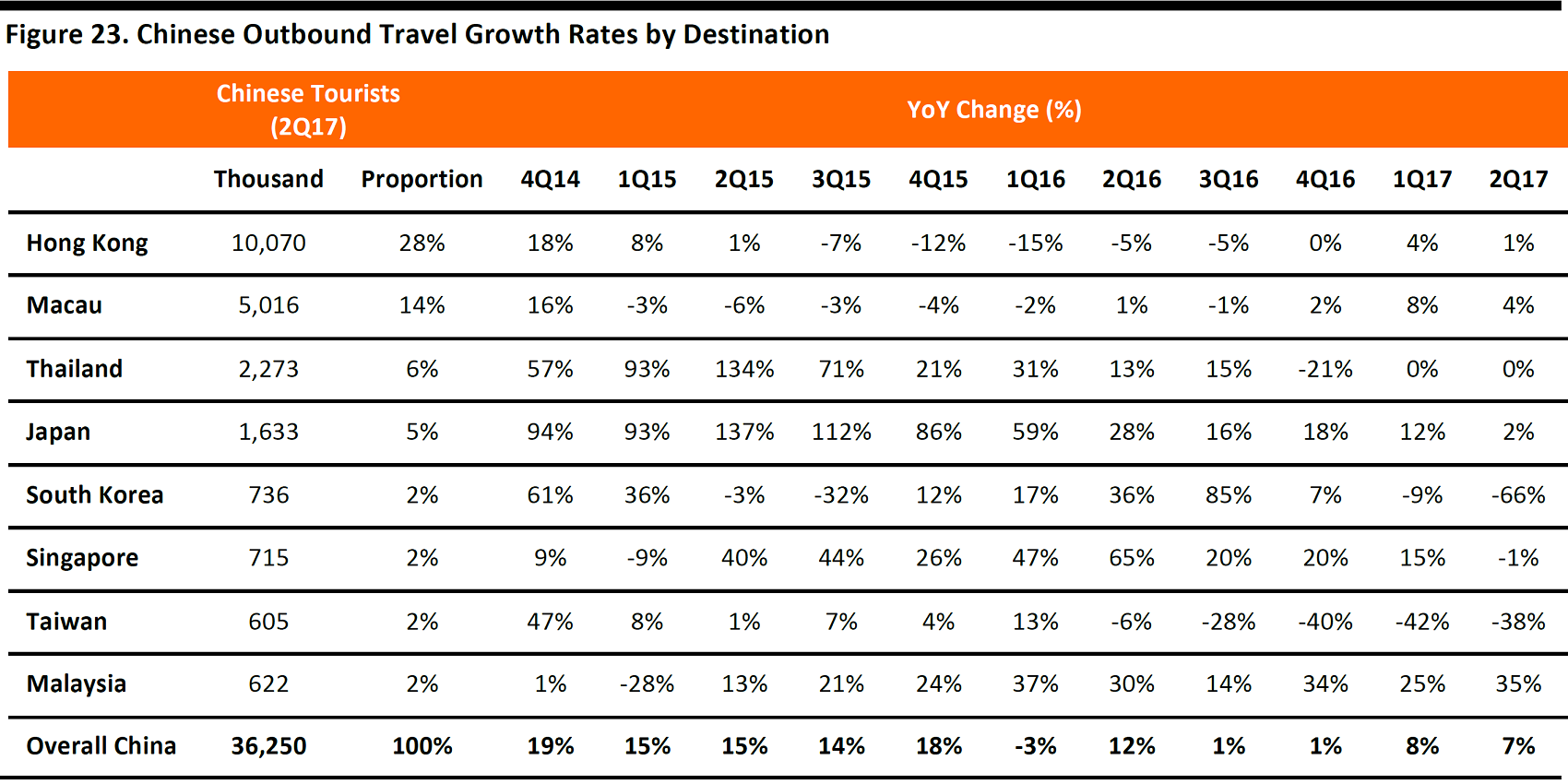

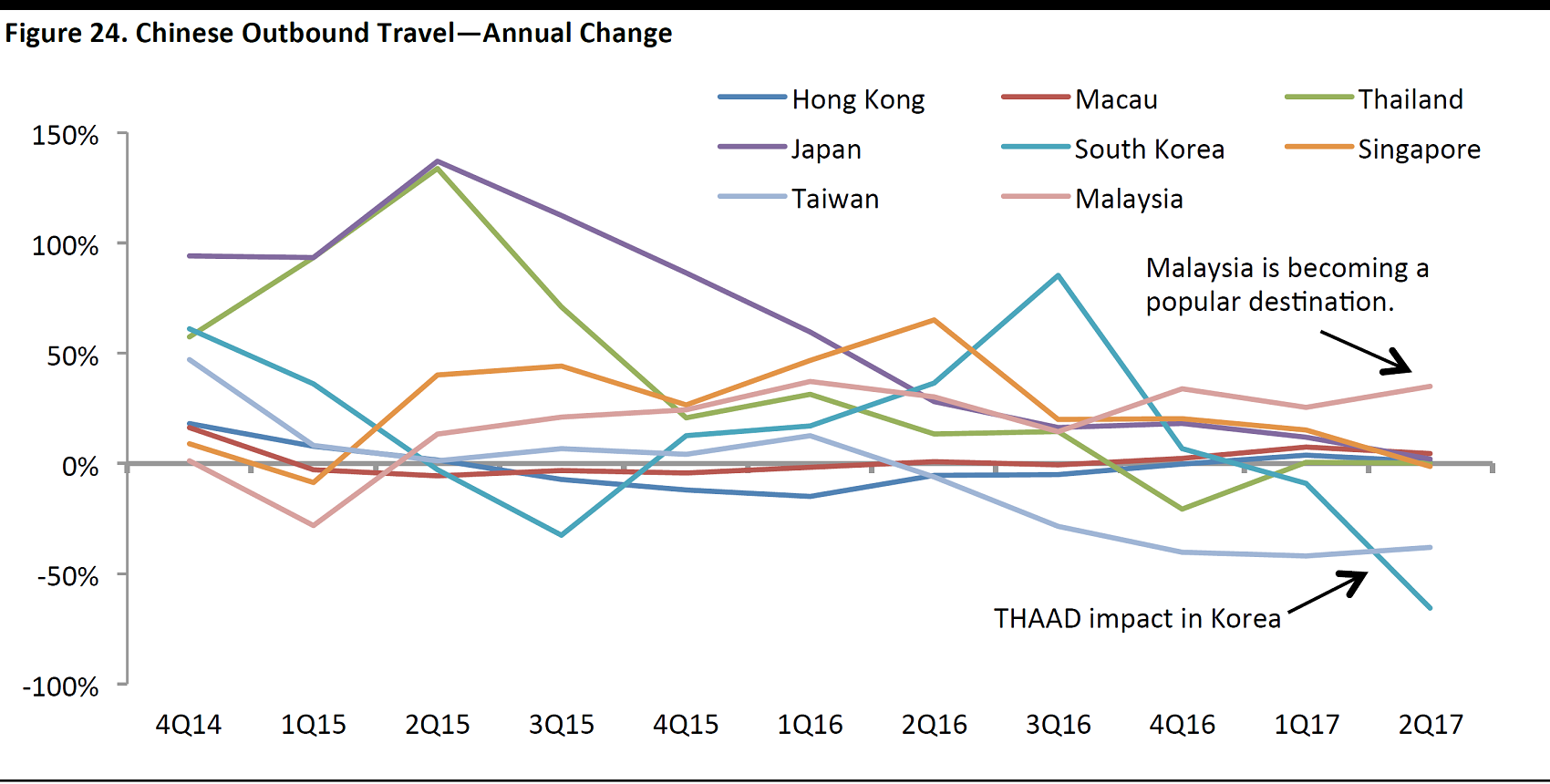

The Chinese Tourism Boom—Not Necessarily Sustainable

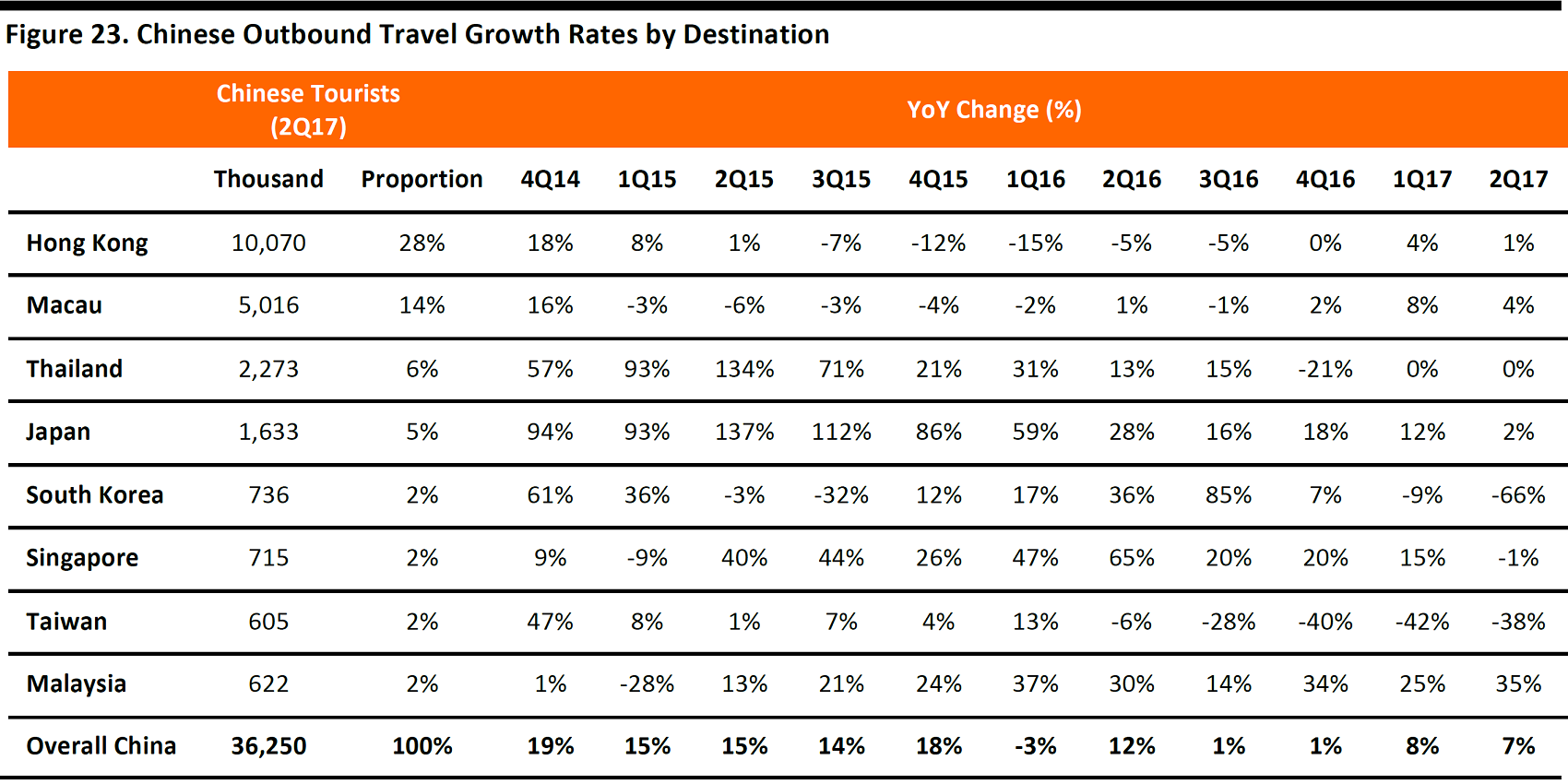

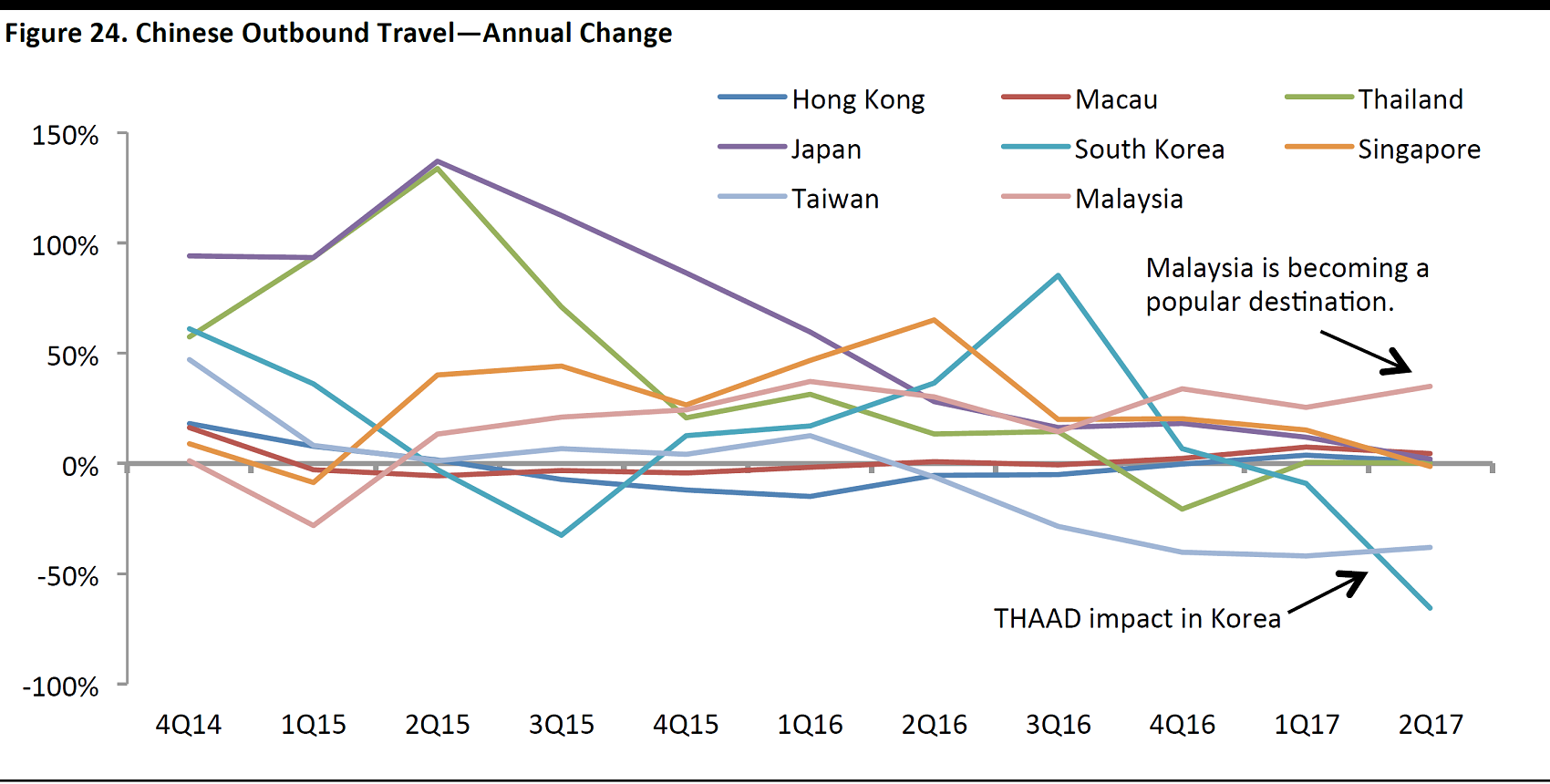

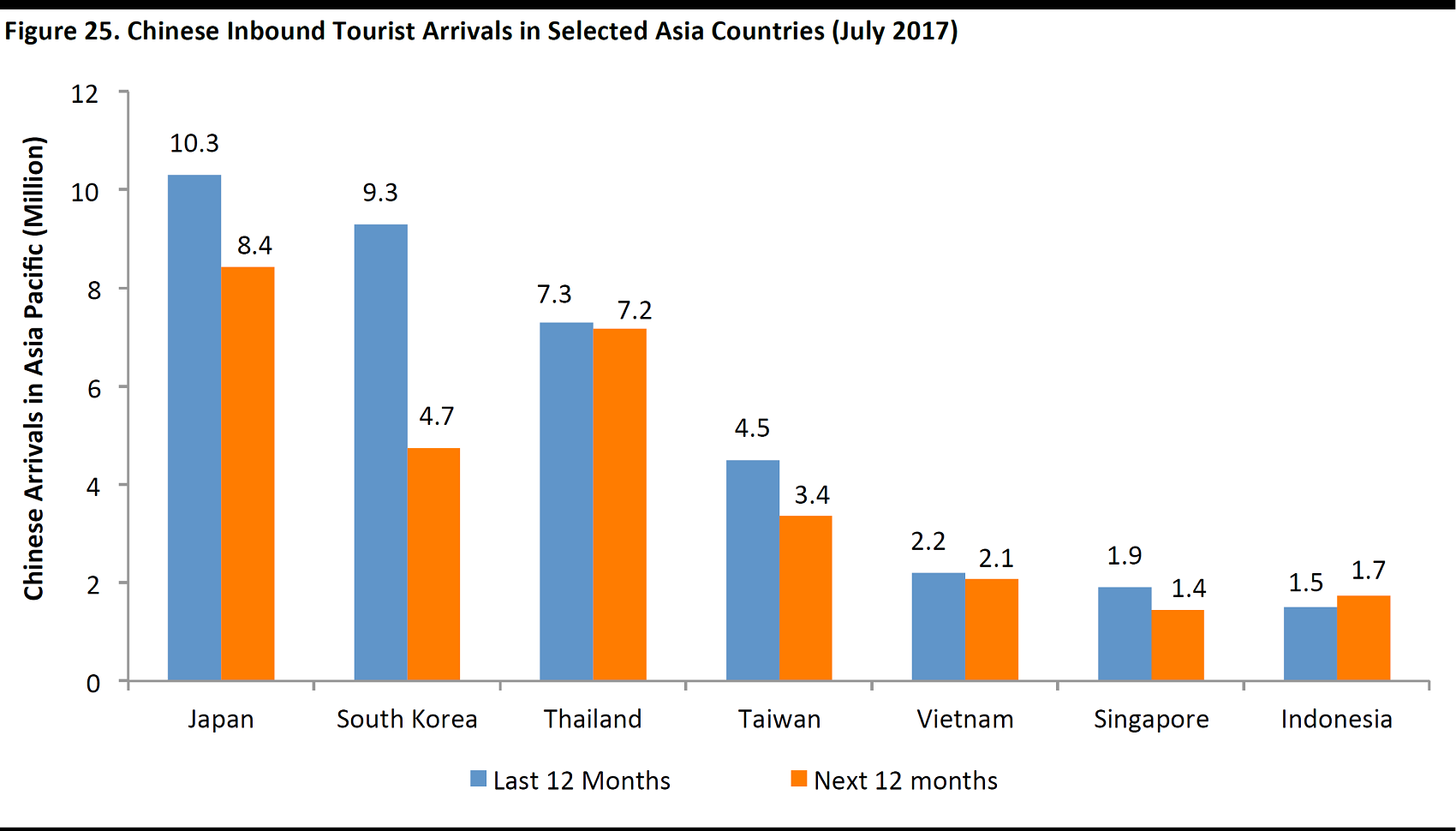

Despite the increase in outbound China travel, all destinations are not created equal, with a significant difference in tourist spending at the various Asian destinations.

Asian department store operators that are seeking to position themselves to benefit from the influx of Chinese tourists may find it hard to predict where their money will be spent.

Source: National Tourism Organizations

Source: The Moodie Davitt Report/FGRT

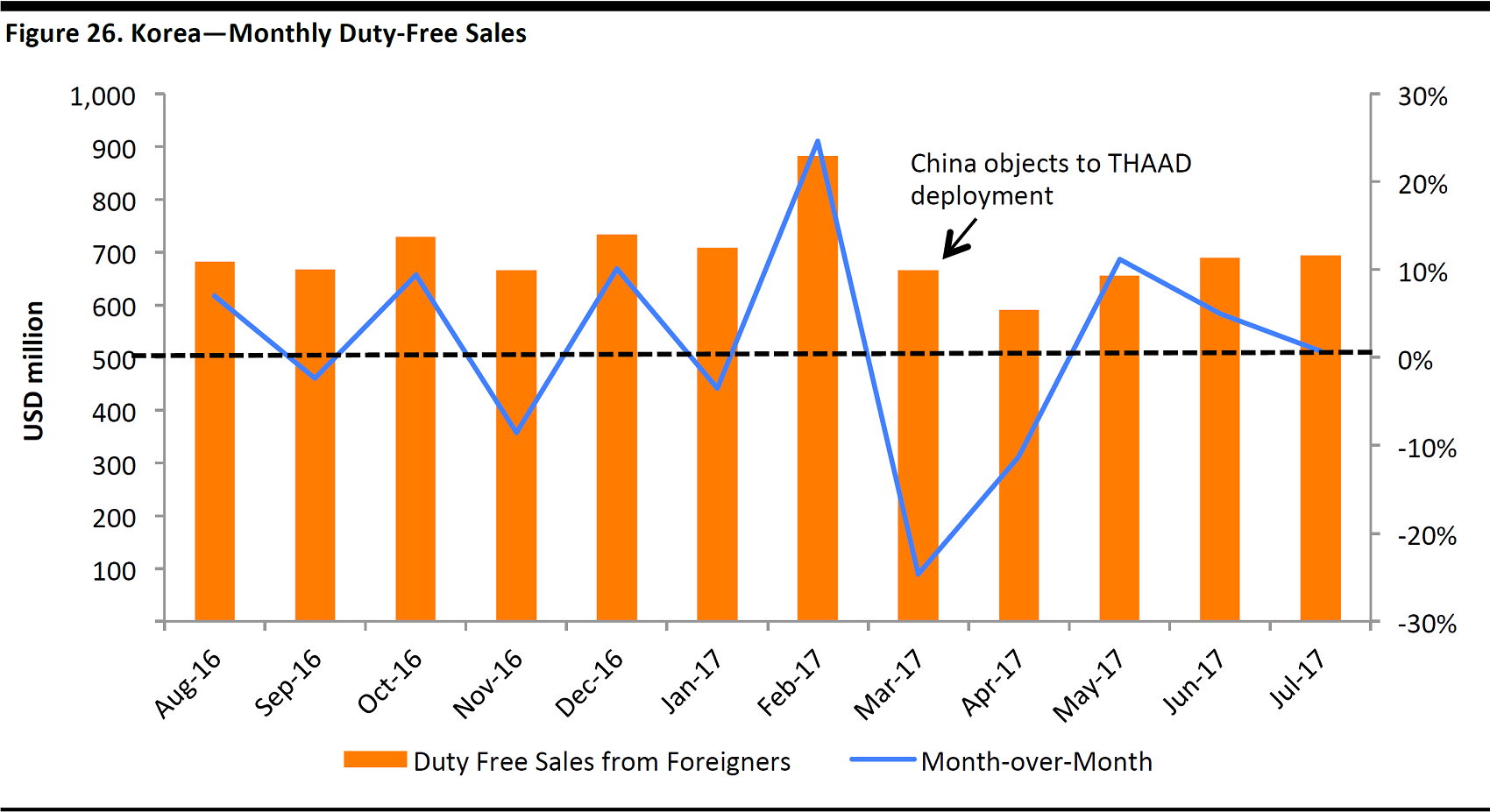

Korea

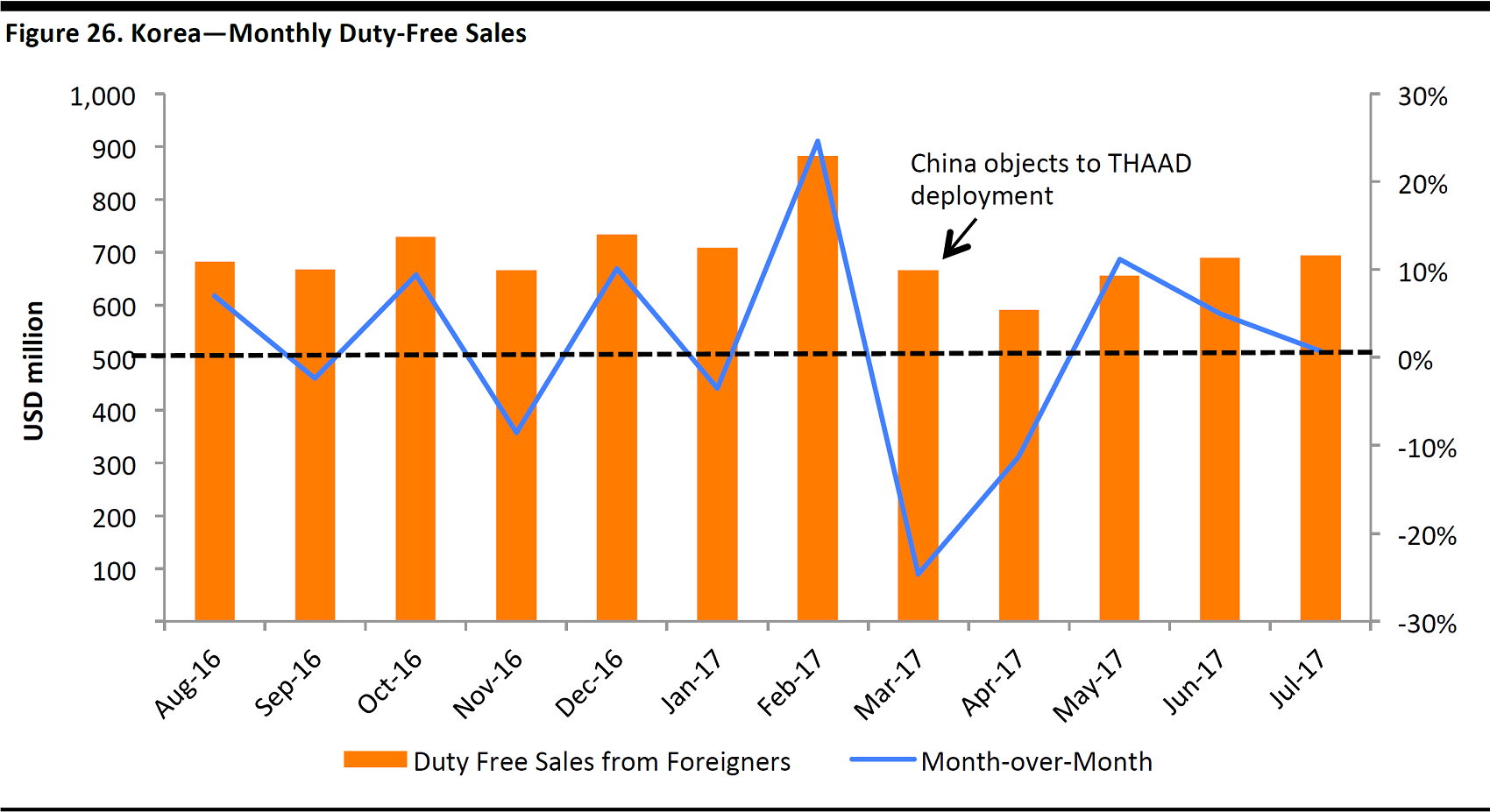

Korean department stores experienced a rollercoaster ride as the country turned from a magnet for Chinese tourists, to the victim of the THAAD missile incident in 2017. Since March 2017, the Chinese authorities have banned travel agencies from selling packaged tours to Korea, and this has had a significant impact on Korean retailers. For example, Lotte Duty Free reported its first quarterly loss since the SARS epidemic in 2003, due to a decline in sales, since the THAAD deployment.

The country’s department stores have had to broaden their base and expand their overseas operations as a result.

- Shinsegae: Korean retail conglomerate Shinsegae has been taking steps to gradually withdraw its business from China, with plans to complete the exit by the end of 2017. Instead, the company will be investing to expand in Southeast Asian markets, including Vietnam, Cambodia, and Laos.

Source: English.shinsegae.com

Source: Korea Duty Free Association

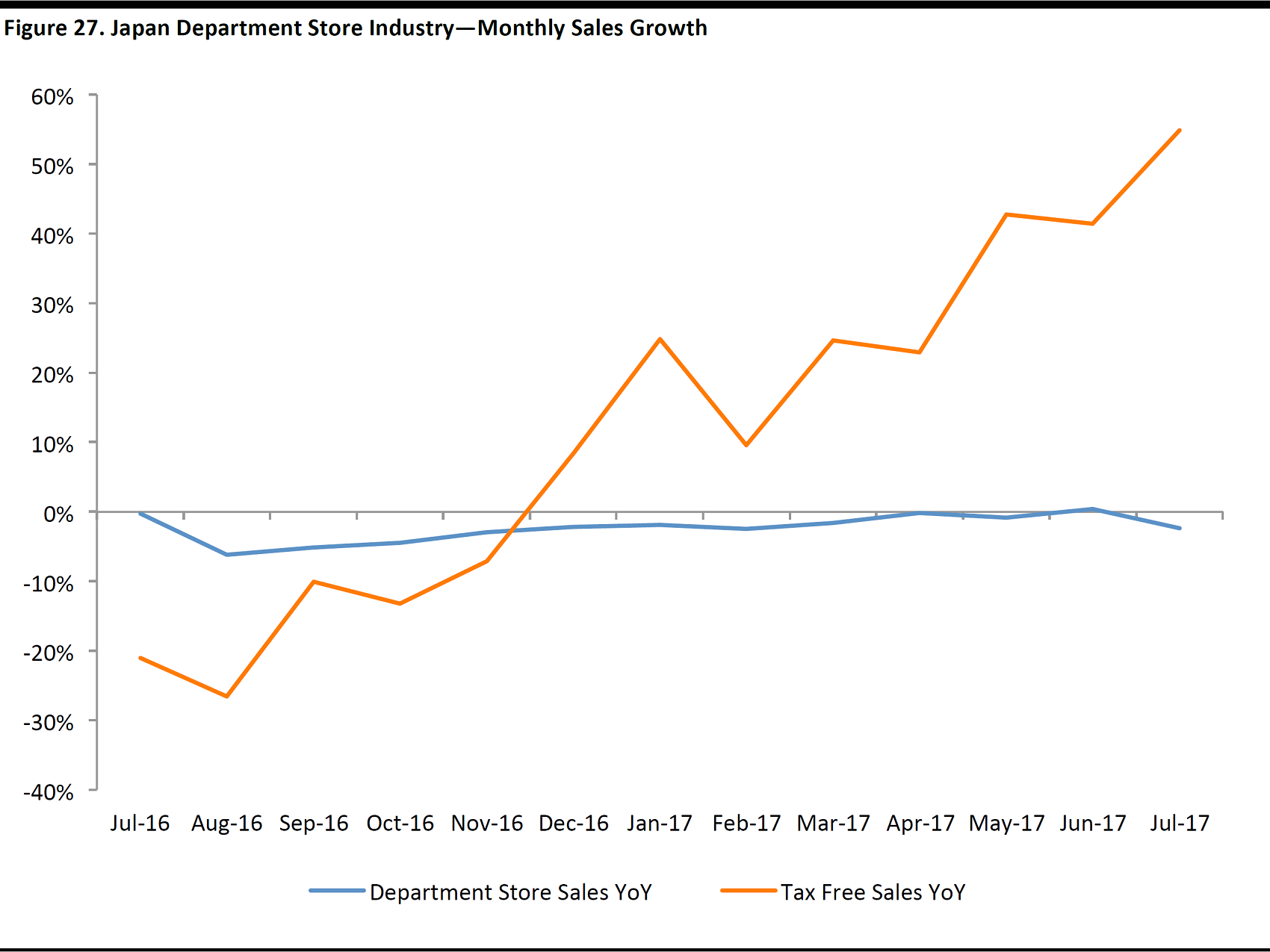

Japan

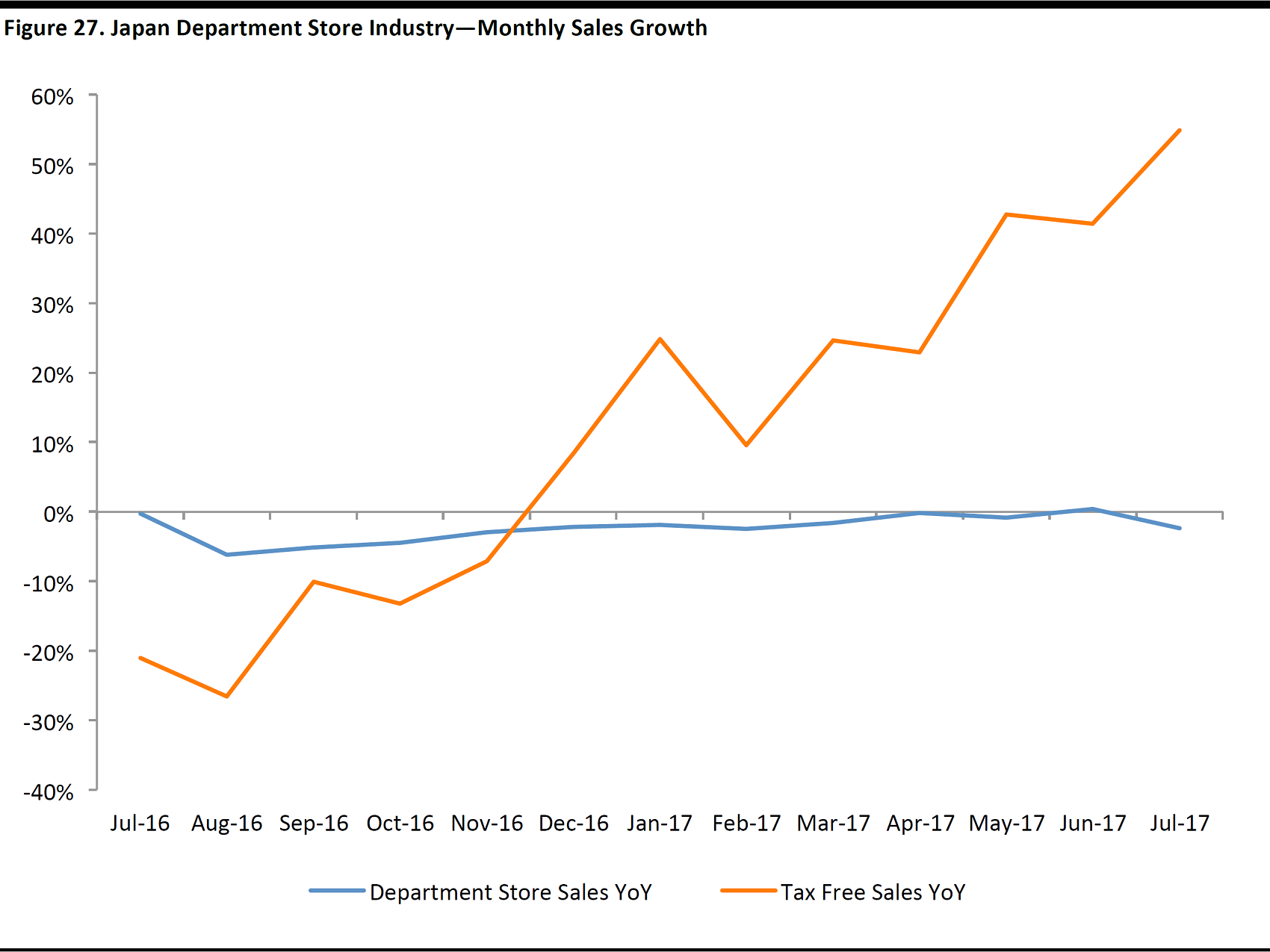

Japanese department stores have staged a sector-wide recovery in the first half of 2017, following a decline in tourist spending in the second half of 2016, buoyed by a revival in tourist spending. Nearly half (48%) of department stores expect tax-free sales to rise for full-year 2017, compared to the 4% that are expecting declines, according to a survey by

The Nikkei in August 2017.

- For July 2017, overall department store sales at 229 outlets operated by 80 companies totaled ¥546.9 billion (US$4.97 billion). On a same-store basis, sales were down 1.4%.

- Tax-free sales saw a year-over-year increase of30% year-to-date July 2017and by 55% in July alone, according to data from the Japan Department Store Association.

- The solid performance was driven mostly by a recovery in high-end consumption and spending by inbound tourists.

Source: Japan Department Store Association

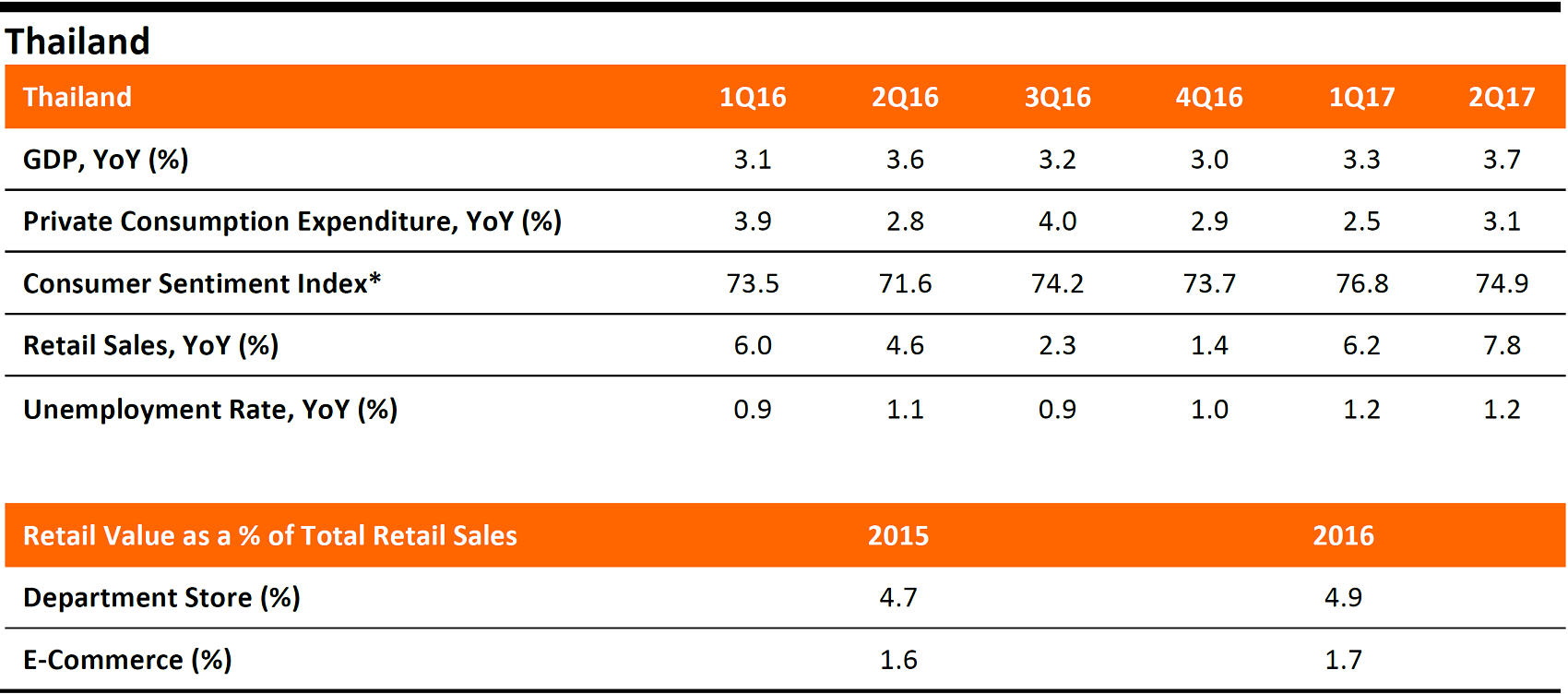

Thailand

Thai retailers have been adjusting their strategies to capture the growing wallet share of inbound Chinese tourists.

- Thai retailers are localizing their storefronts and merchandise offerings to coincide with major Chinese festivals. For Chinese New Year 2017, Robinson Department Store invested over Bt15 million (US$450,000) to launch the “Robinson Chinese New Year” campaign to attract Chinese tourists’ footfall and boost spending.

Source: Central Group

5. Young Consumers Are Increasingly Driving Stores’ Business Decisions

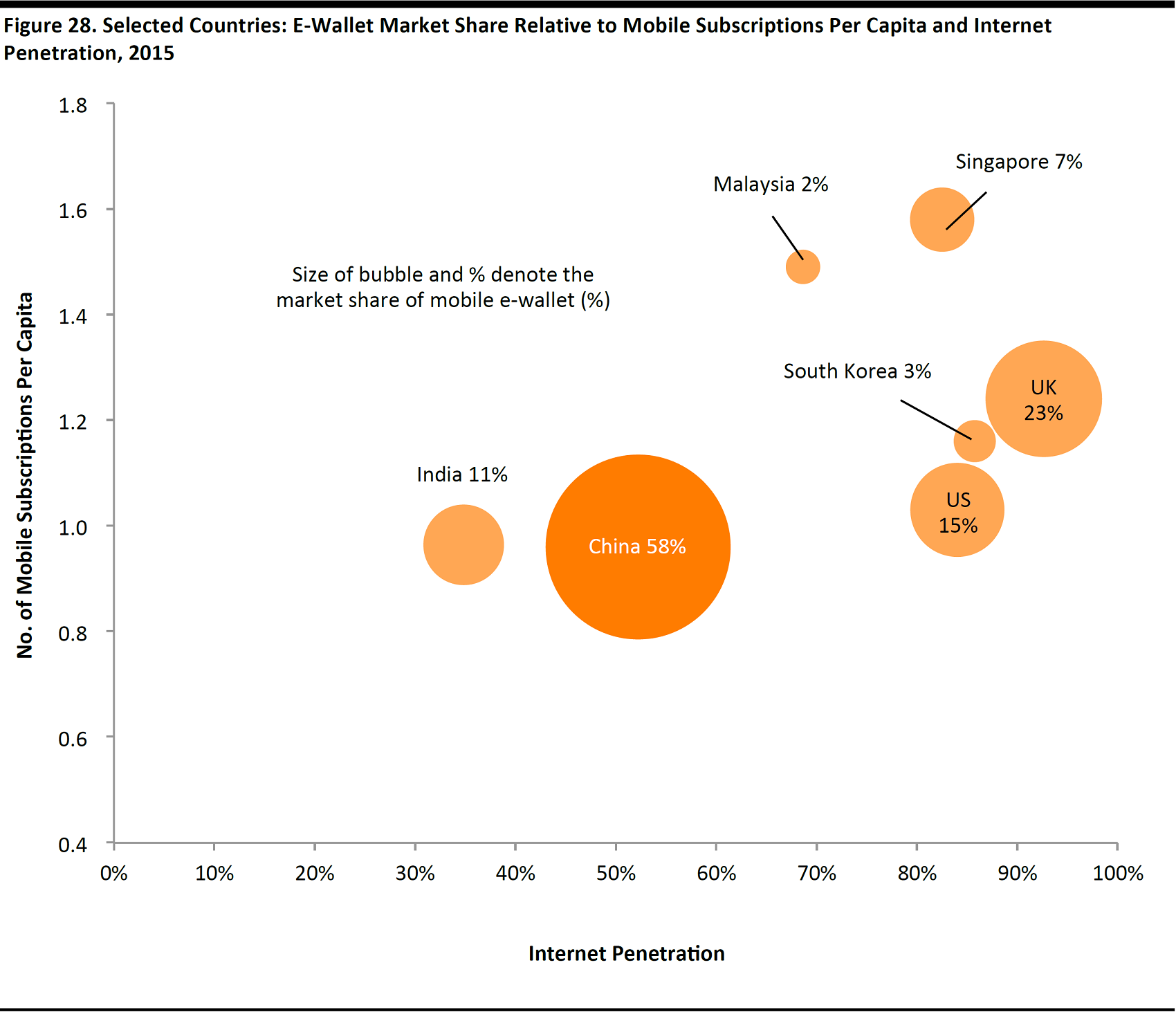

Department stores are increasingly aware of the need to listen to the preferences of consumers. Millennials and Generation Z consumers in Asia are digital savvy, and desire personalized products and services, lifestyle experiences and greater convenience.

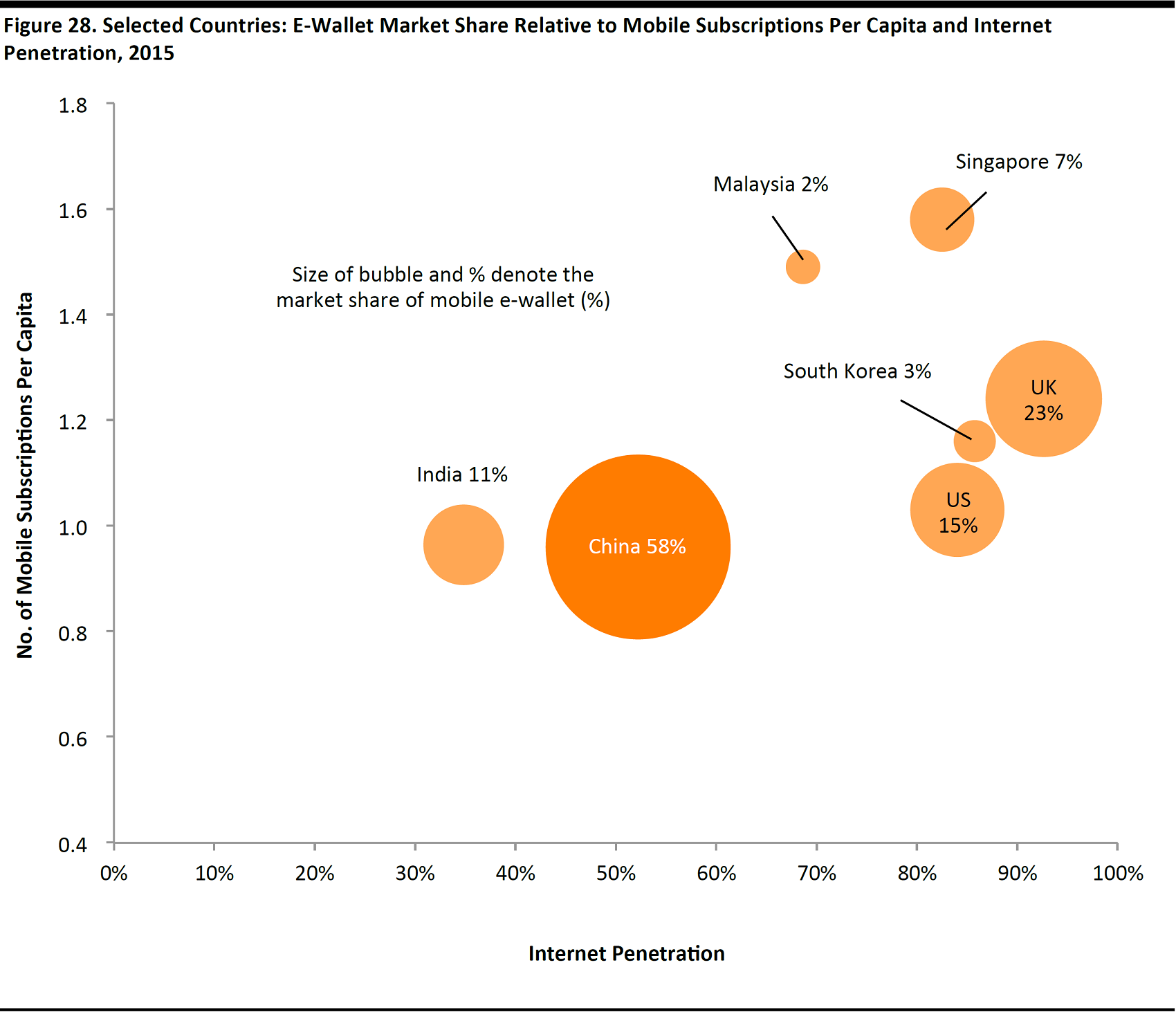

Note: E-wallet market share as of 2015; mobile and Internet penetration as of 2014.

Source: Worldpay Global Payment Report/World Bank/FGRT

Adapting Product Ranges to the Modern Asian Consumer

In order to attract the modern Asian consumer, increasingly more department stores are customizing their product offerings with brands to align themselves with consumers’ preferences, rather than competing on scale.

Case Study: Thai Department Stores Upgrading for the Consumer

The following section features several case studies of how Thai retailers are customizing their service offering to appeal to younger consumers.

Robinson Department Store—Five-Year Transformative Strategy

Thailand’s Robinson Department Store has a five-year transformative strategy through to 2020 to become a world-class retailer operating department stores, lifestyle malls and international brands with an international presence. To this end, the department store operator is executing on an aggressive store opening plan of one department store each year, expanding into Vietnam as well as into digital channels. We focus on its efforts to internationalize its brand offerings.

Robinson Adding International Brands to Expand its Portfolio

Robinson plans to significantly grow the distribution of its international brands in the Thai market. The retailer is placing an emphasis on international brands, as consumers increasingly prefer high-quality, imported products, as well as to differentiate itself from its peers.

- Robinson has a brand management division that is responsible for bringing in merchandise to sell at its stores.

- Since 2015, Robinson Department Store has been obtaining the distribution rights of well-known international brands in beauty, fashion, and accessories to add to its portfolio, including names such as Payless ShoeSource, Claire’s Accessories and Yves Rocher.

- By 2020, Robinson targets to have 50 new shop-in-shop and standalone stores for its imported brands in its approximately 56 branches nationwide.

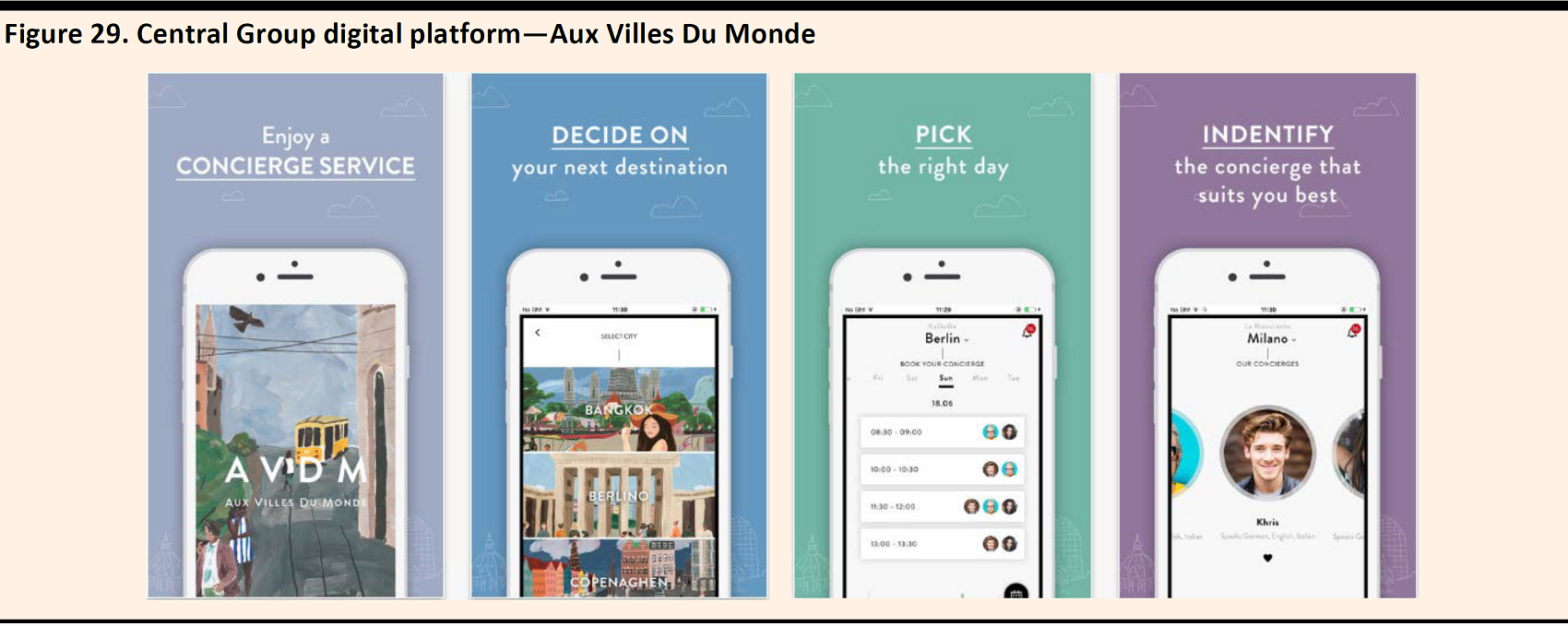

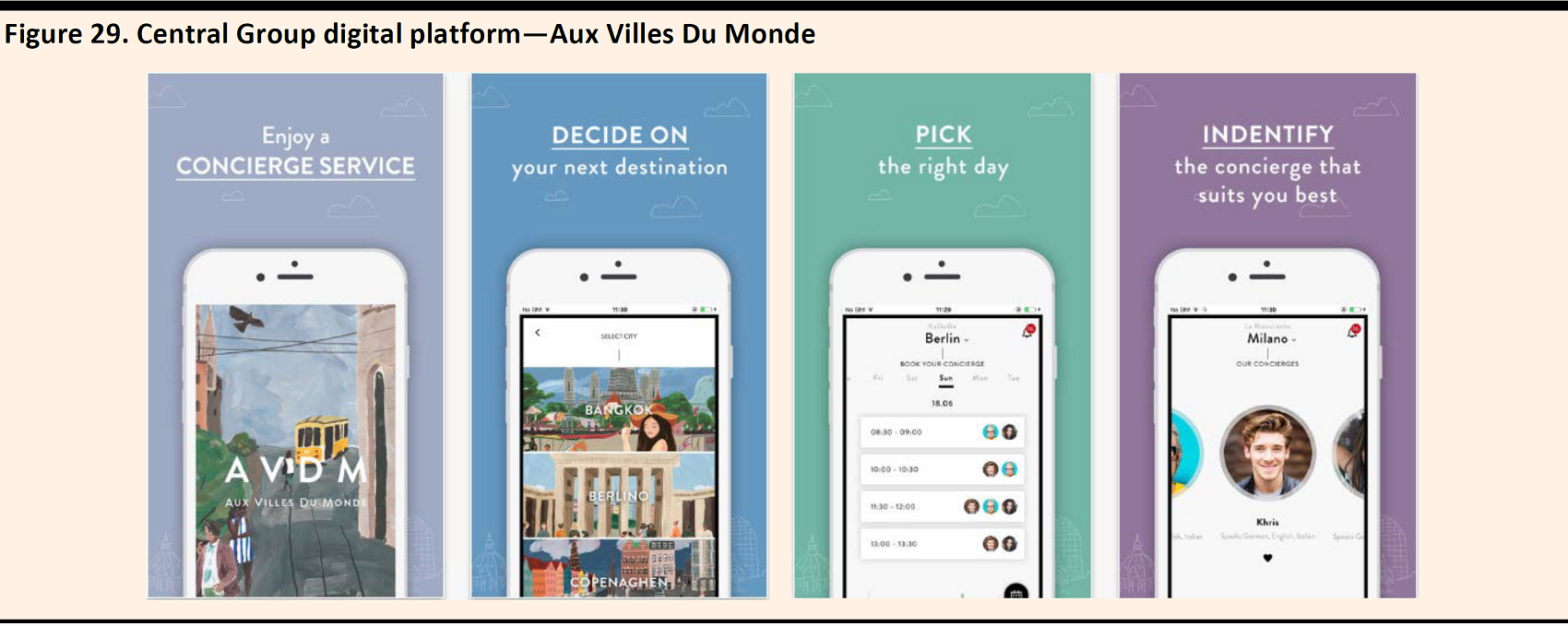

Central Group Introduces AuxVillesDuMonde.com

Central Group created AuxVillesDuMonde.com (and the partnering app), which allows customers to shop for special items at its department stores, and receive hotel and restaurant recommendations through a concierge network. The digital platform features the Central Group’s network of global department stores.

Source: iTunes

6. An Omnichannel Presence

Department stores in Asia have been stepping up their efforts to permeate various channels to make the omnichannel retail experience as seamless as possible. This entails payment and delivery options that are as smooth as buying online, and at the same time, lets consumers experience the products at physical stores.

Asia department stores operators appear to be taking a different approach, depending on their operating environment, but nonetheless, with the same goal in mind: to cement their omnichannel presence.

Southeast Asia

The negative impact of e-commerce on department stores has had less of an impact in Southeast Asia than in the US, although we expect the effect to be more profound as international players enter the region.

The retail industry in Southeast Asia is still in the nascent stage of the e-commerce game. Department stores in Southeast Asia are enjoying the positive effects of urbanization, which increases the population in the catchment areas of the average department store, and the knock-on effect of the hot climate, which drives consumers to the department stores.

Online retail remains in an early stage in Southeast Asia, accounting for less than 4% of total retail sales, according to Bain and Google. The region’s online retail market is expected to increase to US$200 billion by 2025, from US$31 billion in 2015, according to Google and Temasek.

Digital Initiatives

Nonetheless, department store operators in Southeast Asia have mainly been investing in their e-commerce platforms in order to gain share in what is a relatively fragmented market. Examples of retailers in Southeast Asia expanding their online platforms include:

- Central Group announced plans in 2017 to shift its future investment to digital technology from the previous focus on physical real estate. Under the “Digital Centrality” strategy, the group will focus on four key areas: 1) strengthening its core businesses; 2) launching best-in-class online platforms; 3) embracing the omnichannel experience; and 4) enhancing 1 Card loyalty engagement. Central Group CEO Tos Chirathivat expects the contribution from online shopping to expand to 15% of revenues in five years from 1% in FY16.

Source: Centralgroup.com

- Robison Department Store has been developing its online retail platform to increase the online sales contribution: the company has been partnering with Central Online for its online business and Zalora Thailand. It aims for its online channel to become Thailand’s No.1 store by 2020.

- Thailand’s Central Group and China’s JD.com are reportedly planning to launch an e-commerce joint venture in Thailand, with a planned investment of US$500 million, according to Reuters in August 2017. This news of a JV follows from Central Group’s purchase of the Thai arm of online fashion retailer Zalora.

- Matahari seeks to gain exposure to the rapidly growing e-commerce industry in Indonesia through its investment in mataharimall.com. This investment is consistent with its strategy to become an omnichannel retailer and to position itself to compete with e-tailers in the region. Customers ordering on mataharimall.com are able to collect purchases from the nearest store. Mataharimall.com completed 133,000 transactions in the second quarter of fiscal 2017, up 99% quarter over quarter, albeit off a low base.

- Korea’s Lotte entered Vietnam’s online retail market, unveiling its e-commerce platform lotte.vn in October 2016.

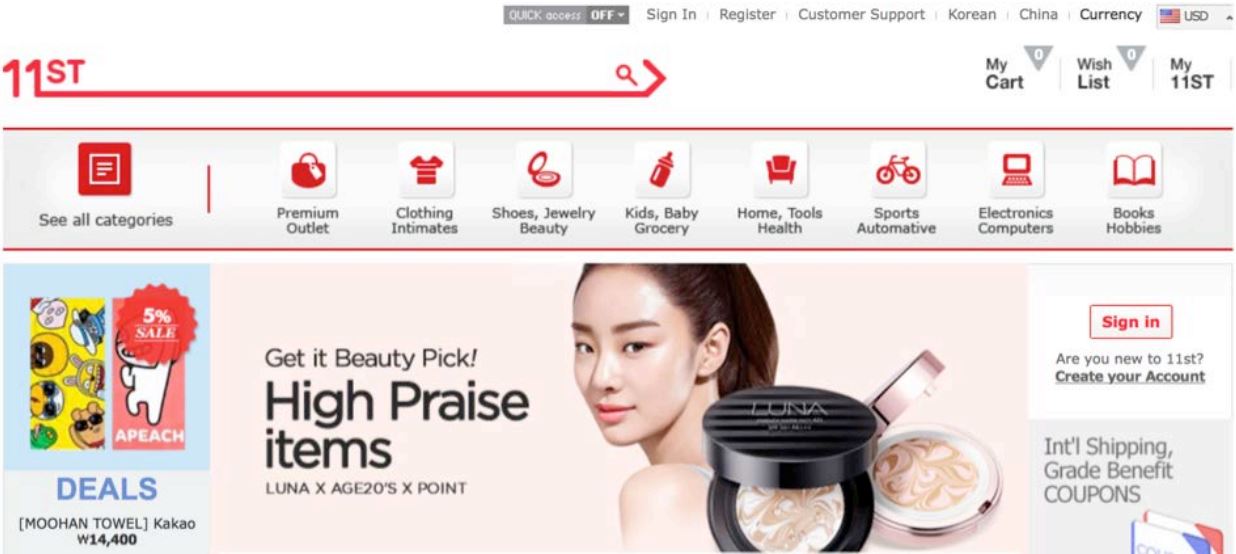

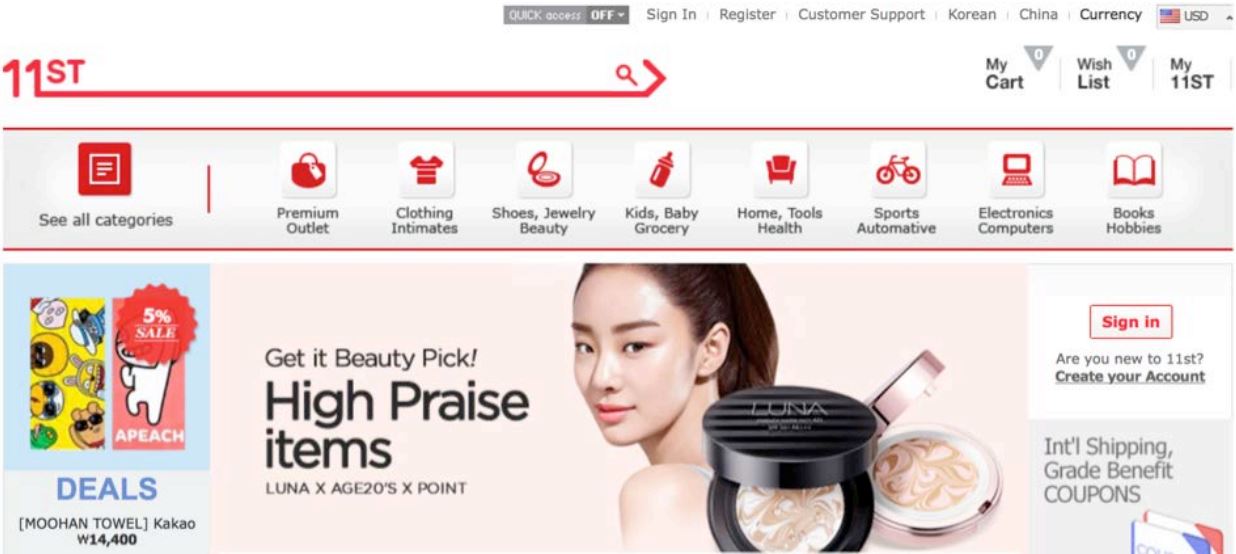

- Korean e-tailer 11st.com, also the target of Shinsegae, entered Thailand with a Thai platform at the end of 2016.

Source: Matahari.co.id

China

In China, where online retail is more mature and accounts for 17% of retail, strategic partnerships and mergers and acquisitions (M&A) between online and physical retailers are rife.

Department stores have been partnering with Internet companies to advance their omnichannel operations.

- Department stores Bailian and Intime have entered into strategic partnerships with Alibaba, which allows them to leverage big data technology and the business-to-consumer (B2C) marketplace Tmall.

Korea

Korean retailer Lotte Shopping has been accelerating its push into digital to make the offline retail experience as streamlined as buying online. Lotte Group has formed a task force dedicated to including elements of online shopping and payment to its retail outlets.

- Lotte is the first retailer in Korea to introduce a robot shopping assistant Elbot at its department store and to offer a virtual 3D fitting service.

- The company is partnering with IBM Watson to build a smart shopping advisor chatbot to provide customized shopping support to customers at its department stores.

- In May 2017, Lotte also launched the first system in the world that can process payments with the scan of one’s palm, which will be expanded to Lotte Department Store.

- Lotte Department Store is trialing a “Smart Shopper” service at some of its stores, which allows customers to browse, pay for items without carrying a cart, and have them delivered to their homes. The technology was initially deployed at the food stores of Lotte Department Store Bundang.

Source: Annual report

Source: Annual report

Case Study: New Retail in China

Retailers in China are implementing the New Retail initiative spearheaded by Alibaba. New Retail refers to the integration of online and offline retail, and logistics across a single value chain. New Retail has been touted as a game changer for China’s retail landscape since Alibaba Chairman Jack Ma first talked about the concept in October 2016.

Core Message: Retailers Need to Embrace New Retail to Keep Pace with Consumers’ Changing Preferences

- Retailers will need to change their mindsets and operating models to integrate both the online and offline experience. The mobile Internet has drastically changed consumers’ preferences and the way they shop.

- To redefine a new operating model under the New Retail, Alibaba’s CEO David Zhang stated that holistic changes to the current retail model are necessary, and that retailers will need to redefine the relationship between consumers, merchandise and stores.

- In the era of New Retail, retailers such as Intime will be establishing themselves as consumption-solutions providers, driven by big data to enhance consumers’ shopping experiences, rather than the traditional retail real estate model.

Challenges Facing China’s Physical Retailers

Although Alibaba CEO Zhang believes China’s domestic consumption story is intact, the growth of the department store industry is limited by its operating model as well as geographical constraints. Mall traffic has been

declining, not because the products for sale at the physical retailers are any less attractive, but because of the mobile Internet and its impact on consumer behavior. Consumers no longer feel the need to go to malls to shop, because they can search for products online more efficiently.

He expects more retailers to transform their operations to the New Retail by setting up e-commerce platforms. Currently, the revenue contribution from e-commerce for some fashion brands is only 10%–20%.

New Retail a Likely Game Changer for China’s Retail Landscape

The future of retail in China is a combination of the online and offline experience. The mobile Internet has drastically changed consumers’ preferences and the way they shop. In the past, malls have used anchors such as supermarkets to attract traffic. However, 93% of consumers directly leave the mall after visiting a supermarket, according to Intime CEO Xiaodong Chen. Both online and physical retailers will need to change their mindsets and operating model.

CEO of AlibabaDaniel Zhang stated at Intime’s fiscal year 2016 analyst briefing that the approach to retail is converging globally. In addition to Alibaba’s push into physical retail, US e-tailer Amazon has also announced Amazon GO, its checkout-less physical grocery store. Both Alibaba and Amazon started out as e-tailers, and have since extended their presence to offline retail, and are both redefining retail with technologies such as cloud computing, big data and artificial intelligence (AI).

Source: Amazon.com

Three Key Characteristics of New Retail

- Demand-oriented: Facilitated by data technology, retailers will be able to define the evolving needs of consumers and create products and services with the best experience for them. Retailers will redesign touch points with consumers according to their needs.

- Combination of physical and digital retail (omnichannel): Physical and digital retail will be perfectly integrated and the retail value chain will be reshaped.

- Highly diversified retail formats: Multiple retail touch points will emerge in terms of logistics, culture and recreation, restaurants, etc. More retail formats will emerge, supported by data technology.

About Intime Retail Group

Intime Retail (Group) Company Limited operates a department-store chain in China. As of the end of 2016, Intime operated 49 stores (29 department stores and 20 shopping malls) and has a strong presence in Zhejiang Province where Alibaba is headquartered. On January 10, 2017, Intime announced that Alibaba had offered to privatize the company for HK$19.8 billion. The move is intended to give Intime greater control over long-term strategic decisions.

For more details, see our recent reports on the topic:

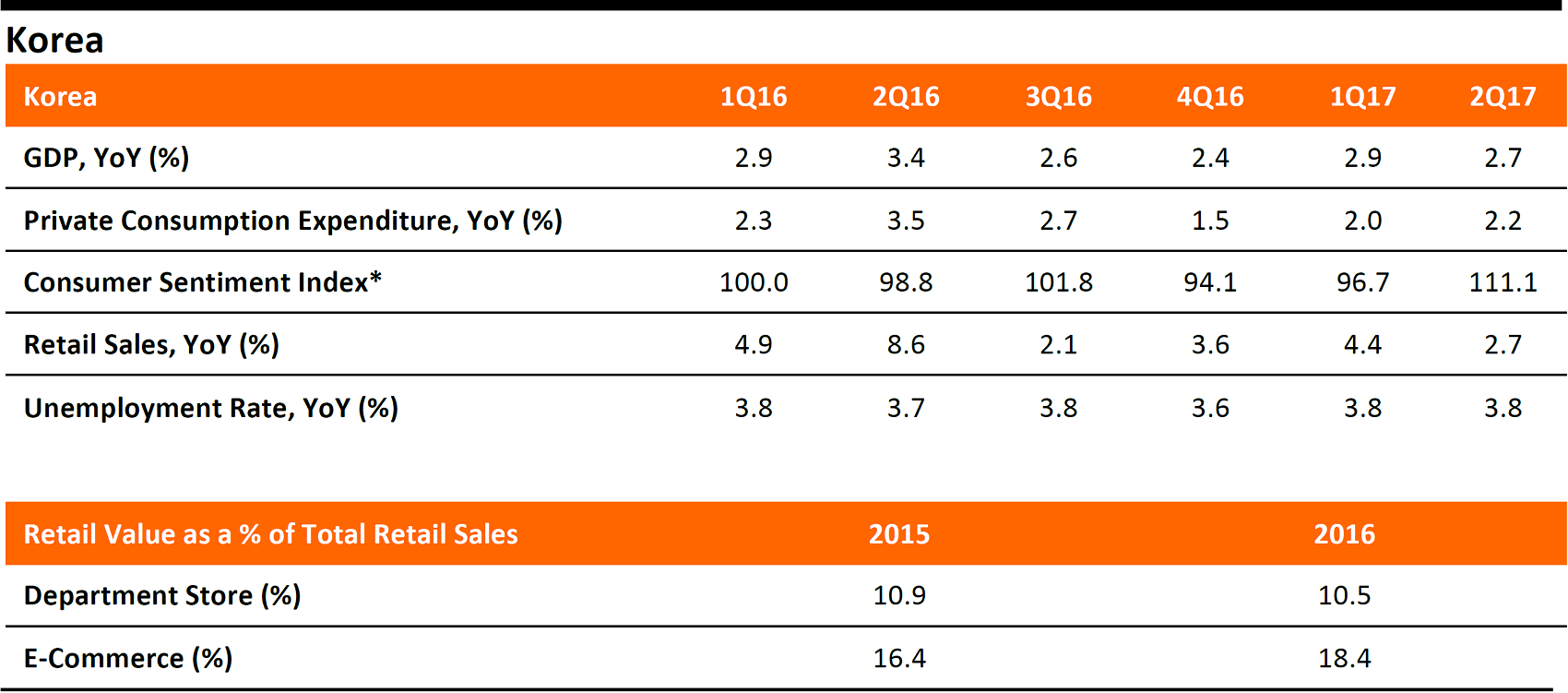

South Korea

The online retail market in South Korea is also relatively mature, with e-commerce accounting for 18.4% of total retail in Korea.

Source: English.11st.co.kr

Japan

Online retail accounts for 7.1% of total retail in Japan.

- Isetan launched its flagship store on Tmall Global in November 2016, in an effort to reach Chinese consumers.

What Will the Future Department Store Look Like?

We outline three primary characteristics of the department store of the future as it adapts to the new norm in retail:

- Retail technology will be extensively used as a means to increase store productivity.

- Department stores will come in all shapes and sizes.

- The store will provide an immersive shopping experience and a community for consumers.

1. Retail Technology as a Means to Increase Store Productivity

Future department stores can better deliver the retail experience to channel-agnostic consumers through effective use of retail and in-store technology.

- Beacon-based technology and Internet of Things (IoT) can allow store operators to better understand consumers’ shopping behavior.

- Adding gamification features, virtual reality and augmented reality (VR/AR) technology and strengthening loyalty programs can help drive engagement.

- Technologies that empower store associates and provide seamless checkout can also be introduced to smooth out customer service and increase the efficiency of store operations.

- Against the backdrop of increasing popularity of m-commerce, many department stores have adopted mobile payment, which is conducive to a frictionless payment experience. In Japan, Marui is the first department store to accept bitcoin payments at its stores, through its partnership with cryptocurrency exchange bitFlyer.

Source: 0101.co.jp

Truly Omnichannel

By reallocating resources to digital, future department stores can introduce technological improvements along the value chain that can help level the playing field against e-tailers.

Example: Intime Department Stores

In an effort to drive future growth, Intime will cooperate closely with Alibaba on the integration and development of an online-to-offline (O2O) business model.

Intime seeks to establish itself as a consumption solutions provider, driven by big data to enhance consumers’ shopping experiences. The group operates under the key tenets of “customer orientation, staff wellbeing, innovation and reform” through “digitalization, omnichannelization, platformization and entertainmentization.”

Intime's Key Initiatives: Digitalization, Omnichannelization, Platformization and Entertainmentization

Below, we summarize the four key O2O initiatives that will continue under the Alibaba-Intime partnership.

1. Digitalization of Supply Chain Operations and Channels

Intime will overhaul its operating model, with a particular focus on redefining the brand and supply chain. By digitalizing its supply chain, the company seeks to reduce the layers of suppliers and improve efficiency. The group will also step up its efforts to integrate its CRM system and monitor store activities, sales and shopping preferences, and improve the merchandise mix to increase its competitiveness.

2. Omnichannelization with Big Data and Personalization

Intime will continue to leverage Alibaba’s big data capabilities and internet mindset to emphasize customers’ needs and enhance the omnichannel experience. Intime will further enhance its O2O initiatives, including Miaojie, Miaohuo, Choice, I Choice and Miaoke, which have been performing well. Intime has also introduced new O2O integration platforms, namely Jihood and InJunior.

Personalized in-store promotions with mobile technology: Intime has leveraged Alibaba’s mobile technology to provide consumers with more targeted promotions and membership benefits in-store. The in-store technology has enabled consumers to use virtual prepaid cards and pay with Alipay at mobile points of sale (POS).

3. Platformization to Expand Product Selection and Improve Fulfilment

Intime plans to further integrate Alibaba’s data platform by unifying the online and offline information of customers, products and services. Alibaba’s Tmall has access to Intime’s offline inventory database, which will lead to a broader product selection and drive fulfilment of online orders at Intime’s physical stores. Intime’s physical stores display and sell online brands supported by Alibaba, and Alibaba’s platforms have onboarded Intime’s offline brands.

4. Entertainmentization

Intime has integrated leading fashion, art and lifestyle icons into its malls, as consumers increasingly prefer experiential retail. Intime has been promoting entertainment activities to create a relaxing shopping environment and increase brand awareness.

LINE: In summer 2016, Intime partnered with LINE Friends, the Korean company, to launch a cartoon-themed café and theme park in its Beijing mall.

Source: Company reports

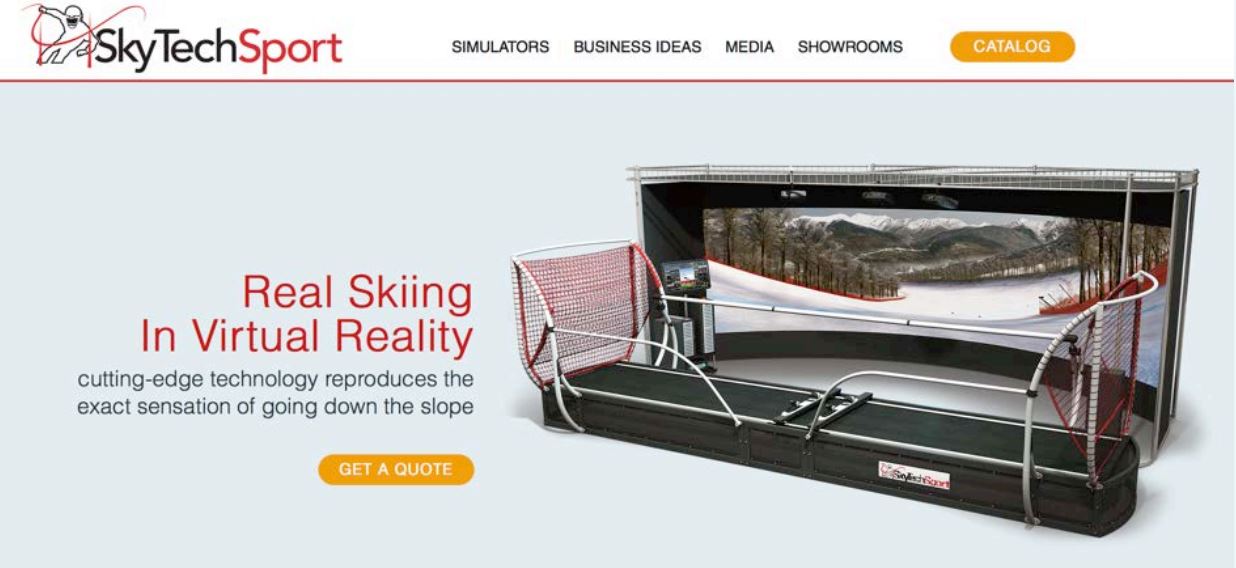

SkyTechSport: Intime also introduced its “in SPORTS” brand, jointly developed by Intime and German company SkyTechSport, to appeal to consumers with active lifestyles. “in SPORTS” experience stores use virtual reality (VR) technology to simulate sporting experiences. It opened its first “in SPORTS” experience store in its Beijing mall and plans to introduce more branches in other cities in China.

Source: Skytechsport.com

Jihood Stores

Jihood is a series of O2O stores launched by Intime in 2015, which embody experiential social retail. Jihood stores curate high-quality products through the use of online sales data. Products on display at various stores can differ by 30%, as products are curated according to analytics on consumer preferences in each location. This essentially guarantees that prices at Jihood stores will be consistent with online marketplaces.

In-Store Magic Mirror

Jihood provides a “magic mirror” based on radio-frequency identification (RFID) and augmented reality (AR) technology. The magic mirror automatically displays different types of information, including product information, inventory, available sizes and suggestions for similar products. Each product in the store has a RFID tag. Online payment is also supported through the magic mirror.

Source: Sohu

Jihood Resonates with Intime’s O2O Vision

With the Jihood stores, Intime strives to implement its vision of O2O. The aim of the big-data application is to improve the quality and efficiency of the interaction between customers and products. Customers can enjoy low prices, high quality and convenience at the Jihood stores. Intime expects this to be the new norm going forward.

Source: Winshang

2. Stores Will Come in all Shapes and Sizes

Future department stores will encompass a variety of store formats to cater to the needs of different segments of customers. Department stores operators will likely seek to improve the performance of their brick-and-mortar stores by overhauling the design and layout, in addition to shuttering excess or non-profitable stores. Some retailers are moving to the following new store formats in order to raise store productivity:

- Store-in-stores: With store-in-store (which is not a new concept), department stores can increase traffic and attract a new consumer segment into their stores. Brands can now provide consumers with a full brand experience, without bearing the heavy financial and operational burden of a standalone store.

- Pop-up stores: This is a similar concept to the store-in-store, with the difference being a store-in-store has a designated space within a retailer. Pop-ups usually appear for a short while inside a department store or shopping mall, attracting consumers with time-limited offerings and eye-catching store design.

- Multi-brand stores: Department store operators are opening smaller and targeted outlets to capture those younger consumers who do not have a habit of visiting department stores.

- Duty-free stores: Asian department store operators can position themselves to cash in on inbound tourist volumes by turning to duty-free store formats.

- Convenience stores: Convenience stores can provide convenience for consumers and higher flexibility in curating product and service offerings.

- Discount outlets: Asian department store operators are starting to deploy an off-price model, which is common in the US. Shinsegae’s Starfield Goyang retail theme park has a “Shinsegae Factory Store,” an off-price store with 5,600 sqm of floor space that Shinsegae is presenting for the first time in Korea.

Source: Annual report

Department stores are changing their approach to store formats, with a tendency toward either big lifestyle centers or small-sized store formats.

- Small-sized store format: Department stores, known for their huge floor space, have been experimenting with small-size formats and finding success. Huge stores have proven to be inefficient and increasingly costly under the current retail environment. We expect their future expansion plans will likely continue to focus on smaller stores in urban areas, to complement their large flagship stores.

- Large lifestyle centers: On the other end of the spectrum, department stores will also take the form of large complexes that offer a theme-park-like experience, making shopping more fun.

3. A Destination for an Immersive Shopping Experience

Department stores of the future will provide an immersive shopping experience for increasingly sophisticated consumers. Unique in-store experiences and services that customers can enjoy on the spot are effective ways to achieve that. More store space will be allocated to F&B and lifestyle experiences.

The concept of retail community has been gaining traction in recent years, as retailers actively look for means to engage consumers and increase traffic. With the threat of e-commerce looming, traditional department stores realize that brick-and-mortar stores have an advantage in fostering a sense of community, which e-tailers lack.

Source: Annual report

Appendix

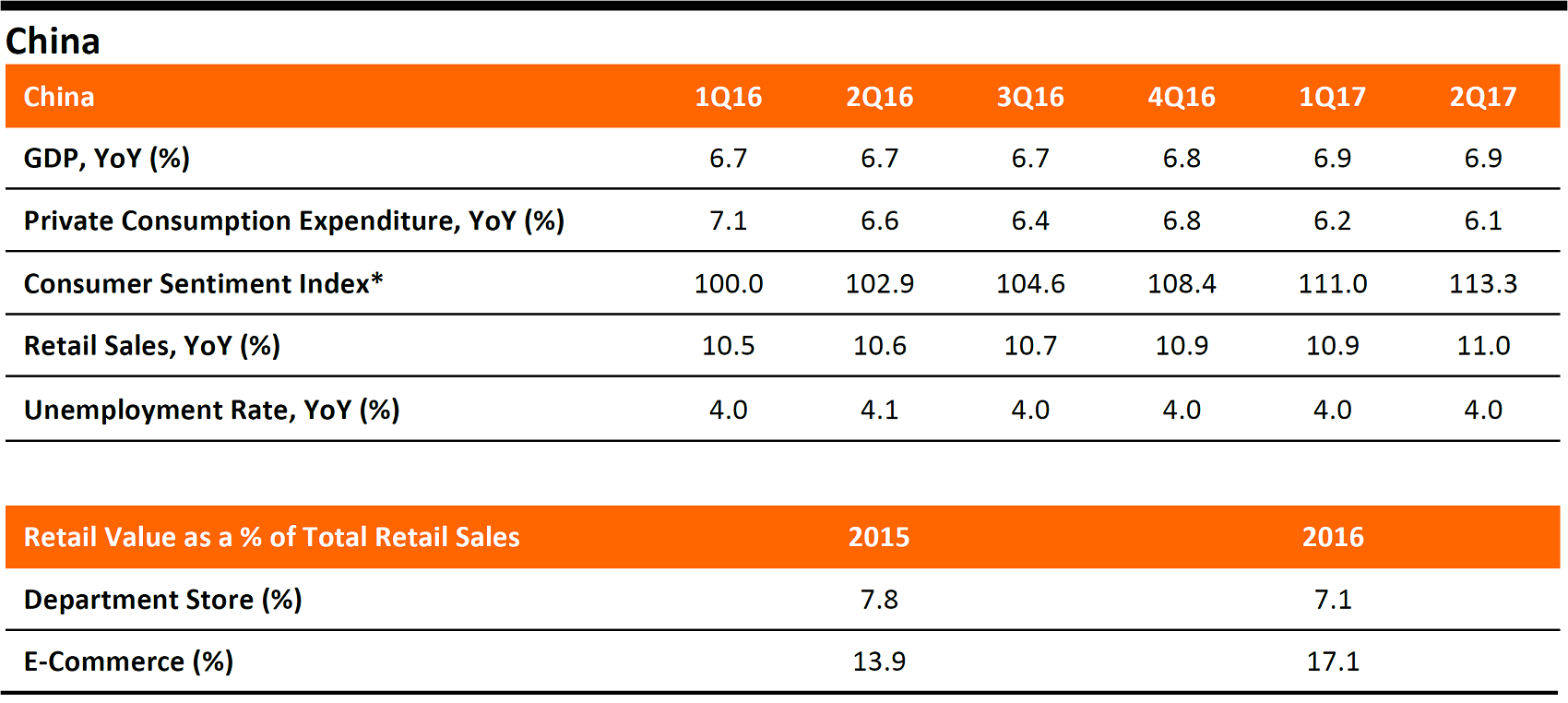

*Consumer Confidence by the National Bureau of Statistics of China, base year is 1997 = 100.

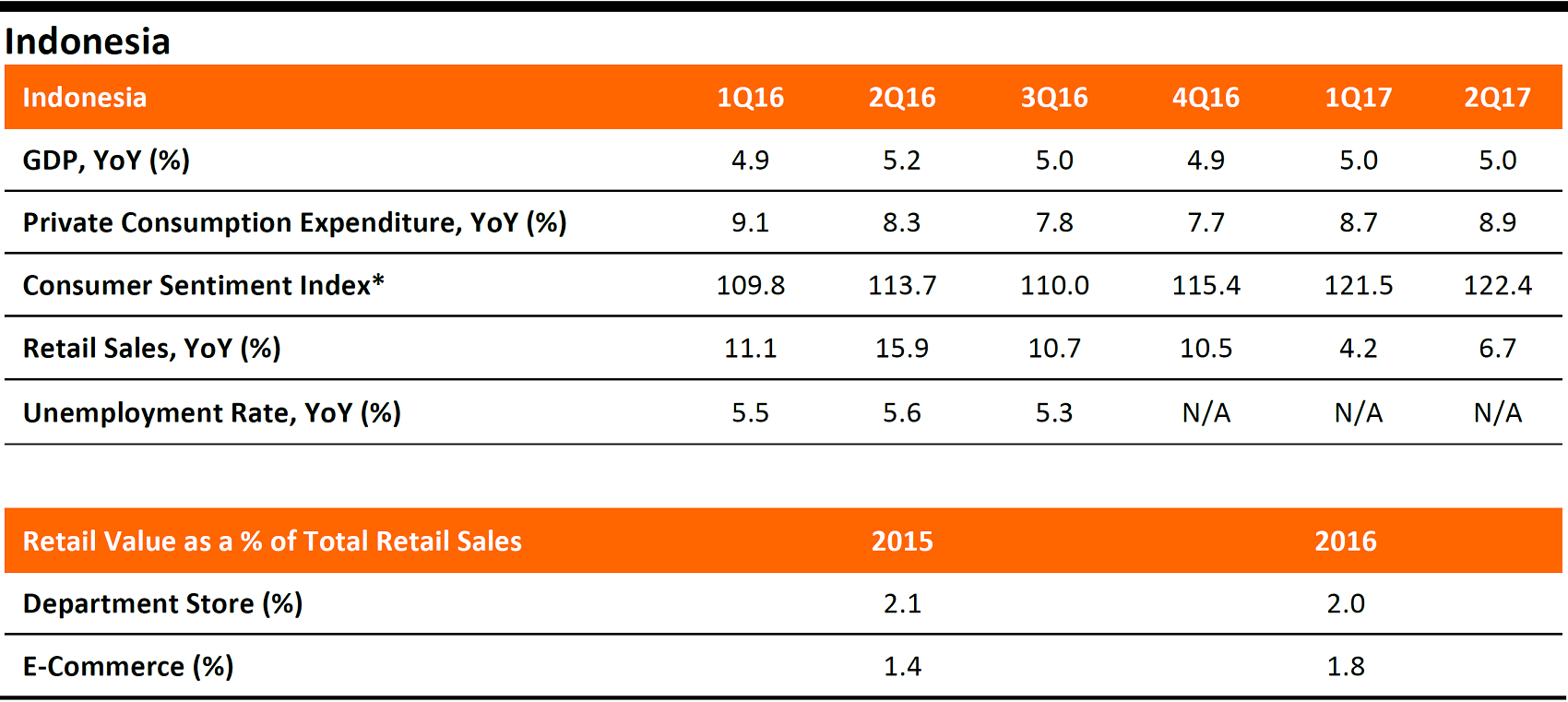

*Consumer Confidence by Bank of Indonesia, a reading above 100 indicates more households are positive, and vice versa.

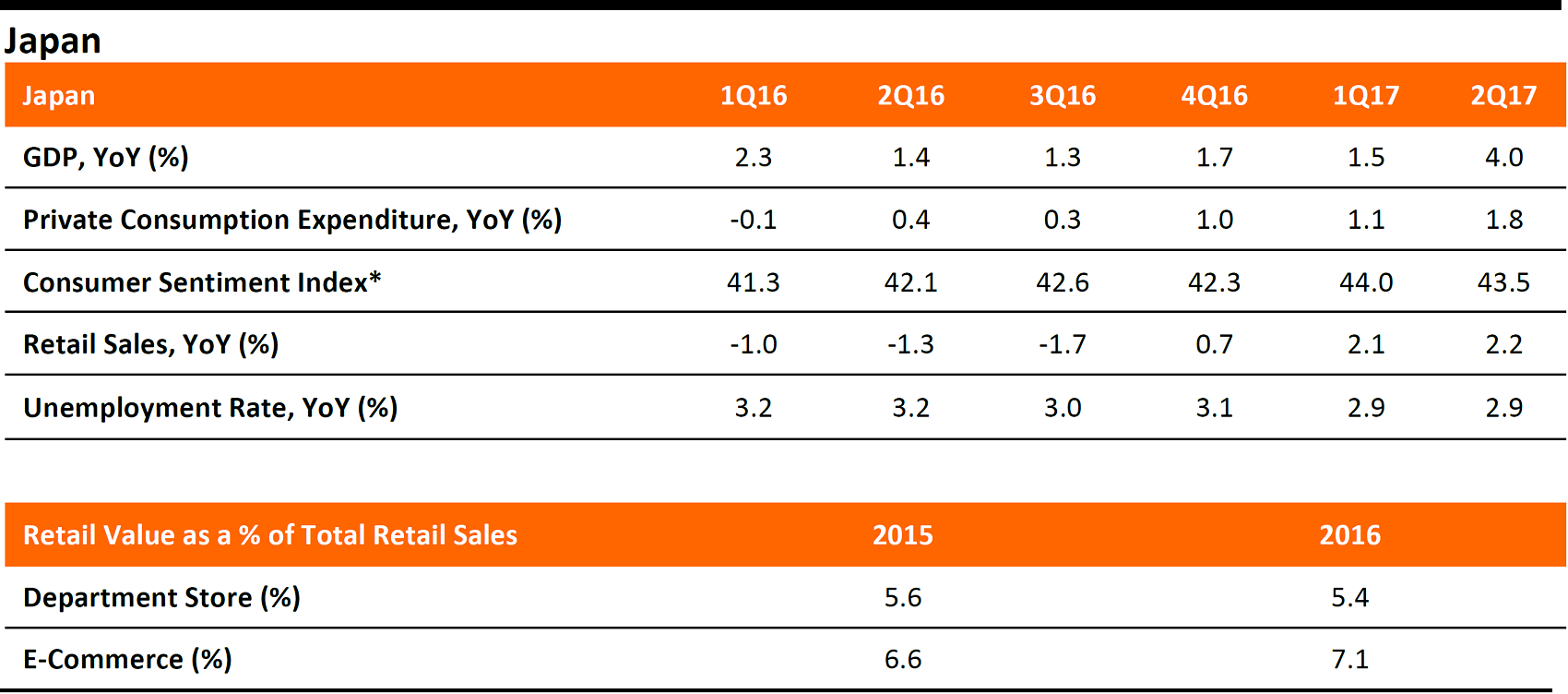

*Consumer Confidence by the Economic and Social Research Institute Japan, a reading above 50 indicates more households think economic conditions are improving, a data value below 50 indicate more households think economic conditions are worsening.

*Consumer Sentiment Index by Bank of Korea, a reading above 100 indicates more households are positive, and vice versa.

*Consumer Confidence by the University of the Thai Chamber of Commerce, a reading above 100 indicates more households think economic conditions are improving, a data value below 100 indicates more households think economic conditions are worsening.

Source: Bloomberg/ICSC/FGRT