Executive Summary

Despite the rapid rise of digital technologies, we are observing a rise in demand for physical, nondigital children’s and adult toys. In particular, children and adults alike have regained interest in tangible entertainment products and toys such as fidget spinners, Lego, Play-Doh, table top board games, physical dolls and figurines, and outdoor toys.

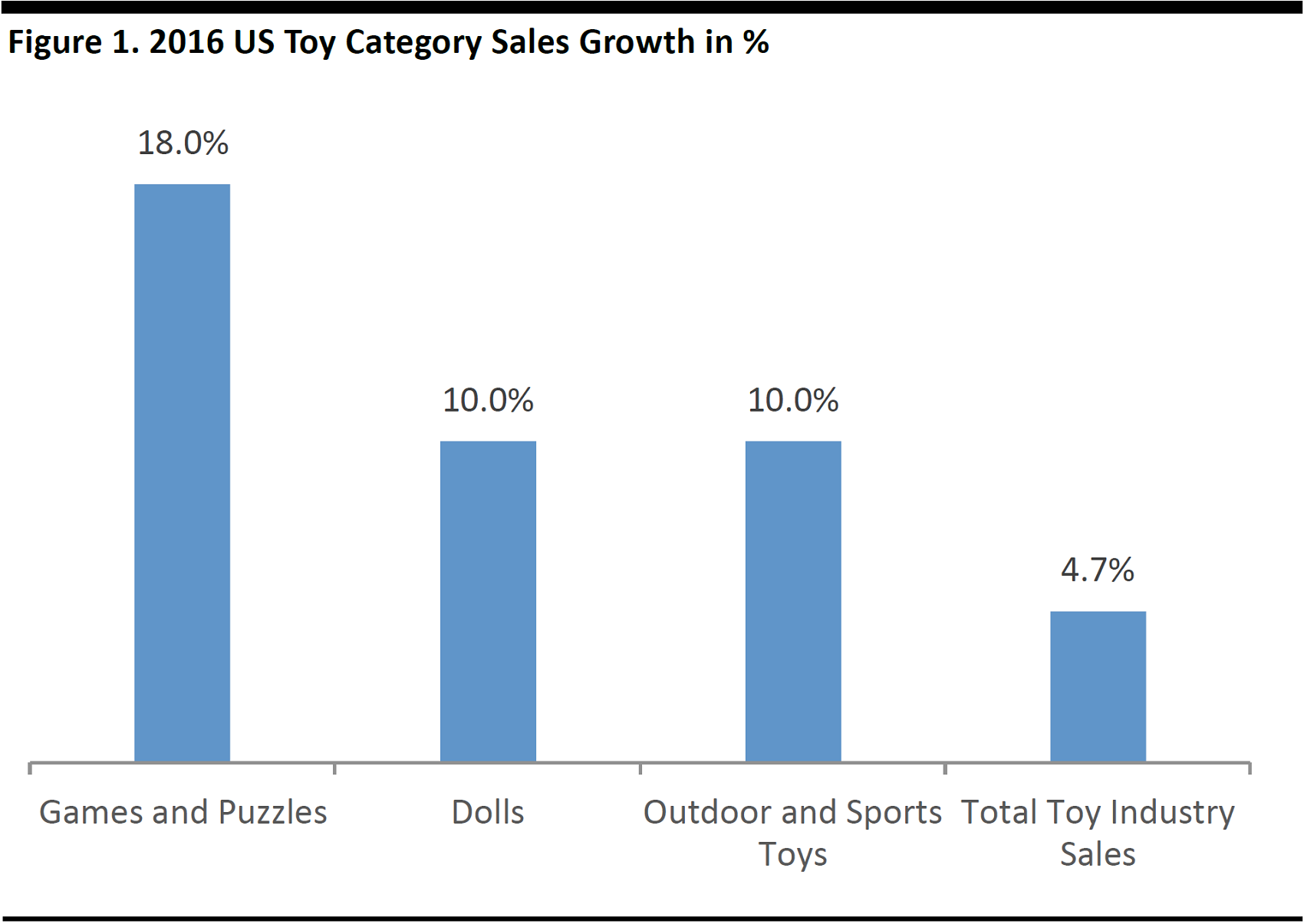

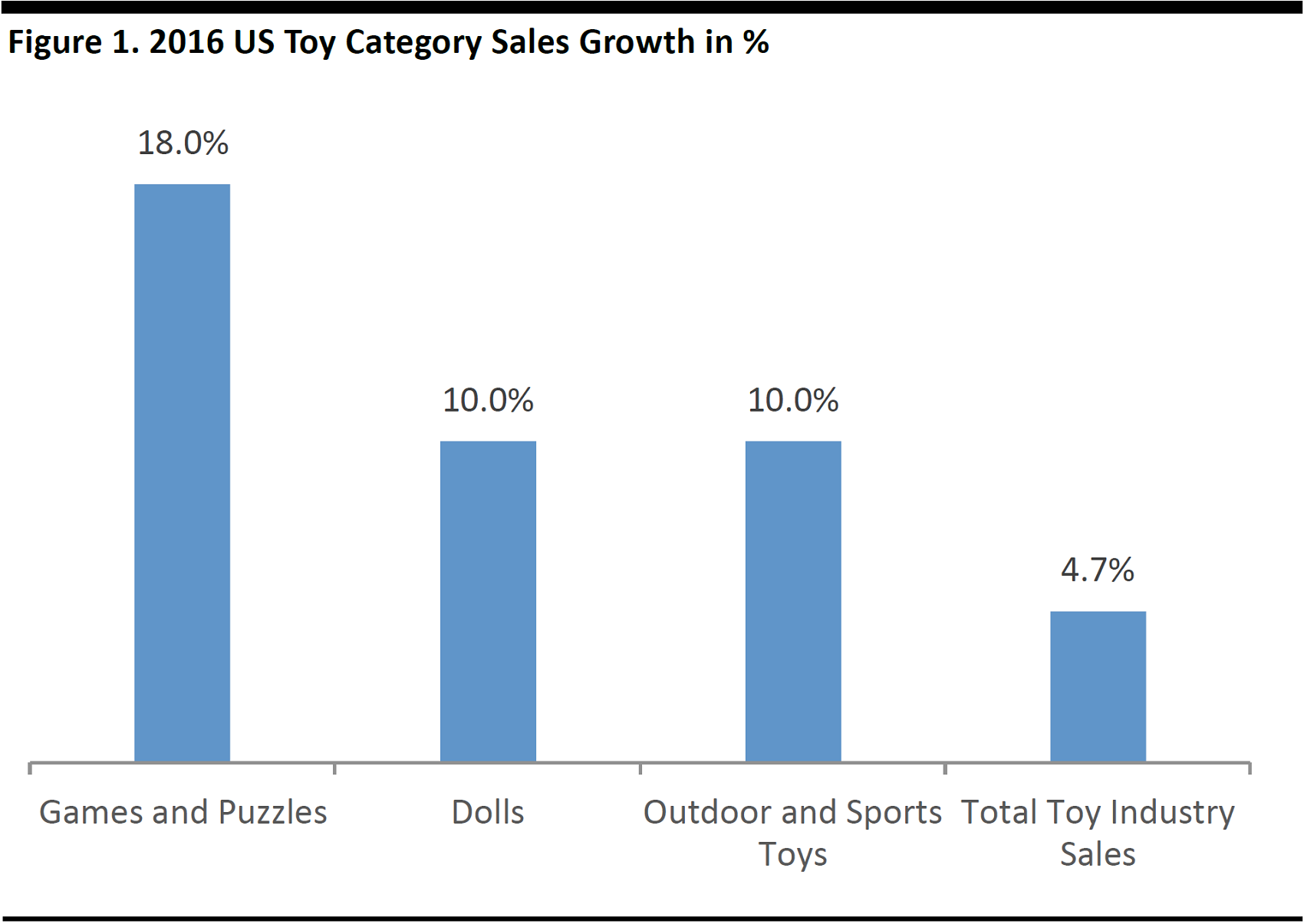

Despite the hype around robotic toys and the Internet of Things, sales of technology-based toys have not dominated the best-seller charts. Most items on the toy best-seller list are old-fashioned games, dolls and Lego sets. Moreover, in 2016, the fastest-growing categories in the US were physical toys such as games and puzzles.

The toy sector is highly cyclical and it is hard to predict the next big toy or gadget craze, especially as these can appear out of nowhere and are accelerated by the Internet and social media. Toy fads are also driven by new unique product launches and toy companies are speeding up design-to-market and product supply cycles.

We expect that for the Holiday 2017 season, parents will seek to purchase toys that are not just entertaining but also designed to teach children new skills and enhance creativity through play time. Mind-building and educational toys will be front of center. Collectibles, table top board games and Lego will also continue to be popular.

Source: iStockphoto

Toy purchases are high around releases of new movie box office and new TV series launches. Cinema box office sales are usually correlated with toy product demand. Multiple toy-based movies are coming out in the second half of 2017, which will drive demand for action figurines amongst kids and adults alike.

Numerous catalysts are driving the growth in physical toys and games. Adults are more frequently purchasing toys for themselves and smaller toy manufacturers that sell through Amazon and other Internet retailers enable the launching of new products and toy fads to spread like wildfire. The power of blogs, online video and social networks has created word-of-mouth buzz for the toy industry.

Tangible goods still provide consumers with aesthetic pleasure, which cannot be achieved by digital screens. Many consumers still crave the authenticity of tangible products that can be collected. The fan economy for movie and cartoon characters is stimulating sales of toys and collectible products.

There is a surge of new, innovative games with artistic and creative designs and themes being launched on the market. The growth of the video games industry has paradoxically contributed to the proliferation of modern and innovatively designed board games. Numerous mobile games have physical version and vice versa.

Due to so many digital distractions, parents seek to spend time with their children, in an “unplugged” family environment, driving the growth in physical games and puzzles. Gen Zers and millennials are playing a lot more games and they like social table top games because it is easy to get together and play board games and have fun, and share this on social media.

Source: iStockphoto

Introduction

Despite the rapid rise of digital technologies, we are observing a rise in demand for physical, nondigital children’s and adult toys. In particular, children and adults alike have regained interest in tangible entertainment products and toys such as fidget spinners, Lego, Play-Doh, table top board games, physical dolls and figurines, and outdoor toys. This report will focus on these types of products in the US and the UK. We will also analyze the reasons behind the popularity of traditional toys in spite of continued technological advancement and the proliferation of digital and connected gadgets.

Despite the hype around robotic toys and the Internet of Things, sales of technology-based toys have not dominated the best-seller charts. Internet-connected toys still account for less than 1% of all toy sales, according to NPD. Most items on the toy best-seller list are old-fashioned games, dolls and Lego sets. Moreover, in 2016, the fastest-growing categories in the US were physical toys such as games and puzzles.

Source: NPD

US overall toy sales increased 4.7% to US$20.4 billion in 2016, according to NPD, marking the toy industry's most robust pace of growth in over a decade. NPD forecasts revenue to increase to nearly $21 billion in 2017. Key toy industry themes for 2017 include retro toys, board games and outdoor and sports toys, according to NPD.

Likewise, in the UK, the collectables market consisting of dolls and figurines, increased 44% year over year in 2016, accounting for almost 1 out of 4 toys sold, according to NPD. As well as collectables, the games and puzzles sector in the UK increased 21% year over year in 2016. This compares to overall toy industry growth of 6.3% year over year in the UK during the same time period.

Looking Ahead to Holiday Season 2017

The toy sector is highly cyclical and it is hard to predict the next big toy or gadget craze, especially as these can appear out of nowhere and are accelerated by the Internet and social media. Toy fads are also driven by new unique product launches and toy companies are speeding up design-to-market and product supply cycles. The majority of toy sales occurs between July and December, in anticipation of the holiday season. We expect the following classic and retro toy trends to continue in the second half of 2017:

- Parents will seek to purchase toys that are not just entertaining but also designed to teach children new skills and enhance creativity through play time. Mind-building and educational toys will be front of center. Furthermore, toys that encourage kids to be active and move around, as well as toys that encourage common family time will continue to be popular.

- Collectibles are expected to maintain their popularity, especially when children do not know which figurine from a collection they will receive, as the surprise element keeps children excited.

- We believe licensed toys and collectibles merchandise will continue to grow. In particular, toy purchases are high around releases of new movie box office and new TV series launches. Cinema box office sales are usually correlated with toy product demand. Multiple toy-based movies are coming out in the second half of 2017. These include (US release dates):

- Disney Cars 3 (June 2017)

- Transformers: The Last Knight (June 2017)

- Wonder Woman: (June 2017)

- Spider-Man: Homecoming (July 2017)

- The Lego Ninjago Movie (September 2017)

- My Little Pony: The Movie (October 2017)

- Thor: Ragnarok (November 2017)

- Star Wars: The Last Jedi (December 2017)

Action figurines tied to blockbuster movies such as Star Wars, Transformers, My Little Pony and Wonder Woman will likely be popular amongst children and adult fans alike.

- Collectible character figures and gadgets tied to the children’s TV series Paw Patrol, such as Paw Patrol Sea Patroller, will also be in demand as more seasons of the series screen in North America and Europe.

- Lego toy sets such as LEGO Friends Sunshine Catamaran and LEGO Boost, as well as any new product launches related to the Lego Ninjago movie released later this year.

- Strength in table top entertainment games will also continue. New Hasbro games such as Speak Out – Parents,Toilet Trouble and Egged On continue to sell well.

Catalysts Driving Resurgence of Physical Toys and Entertainment

We identify the following catalysts driving the growth in physical toys and games:

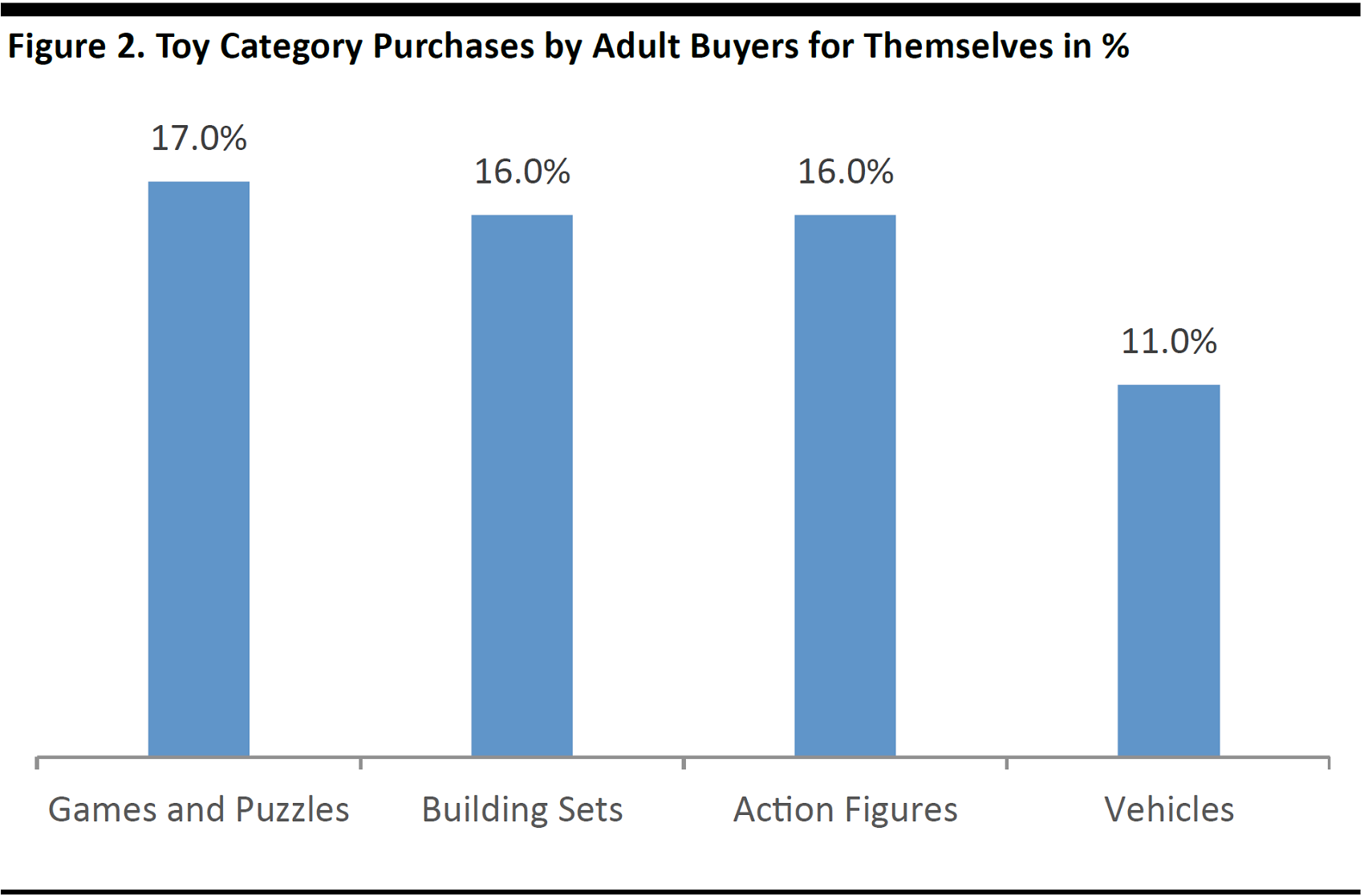

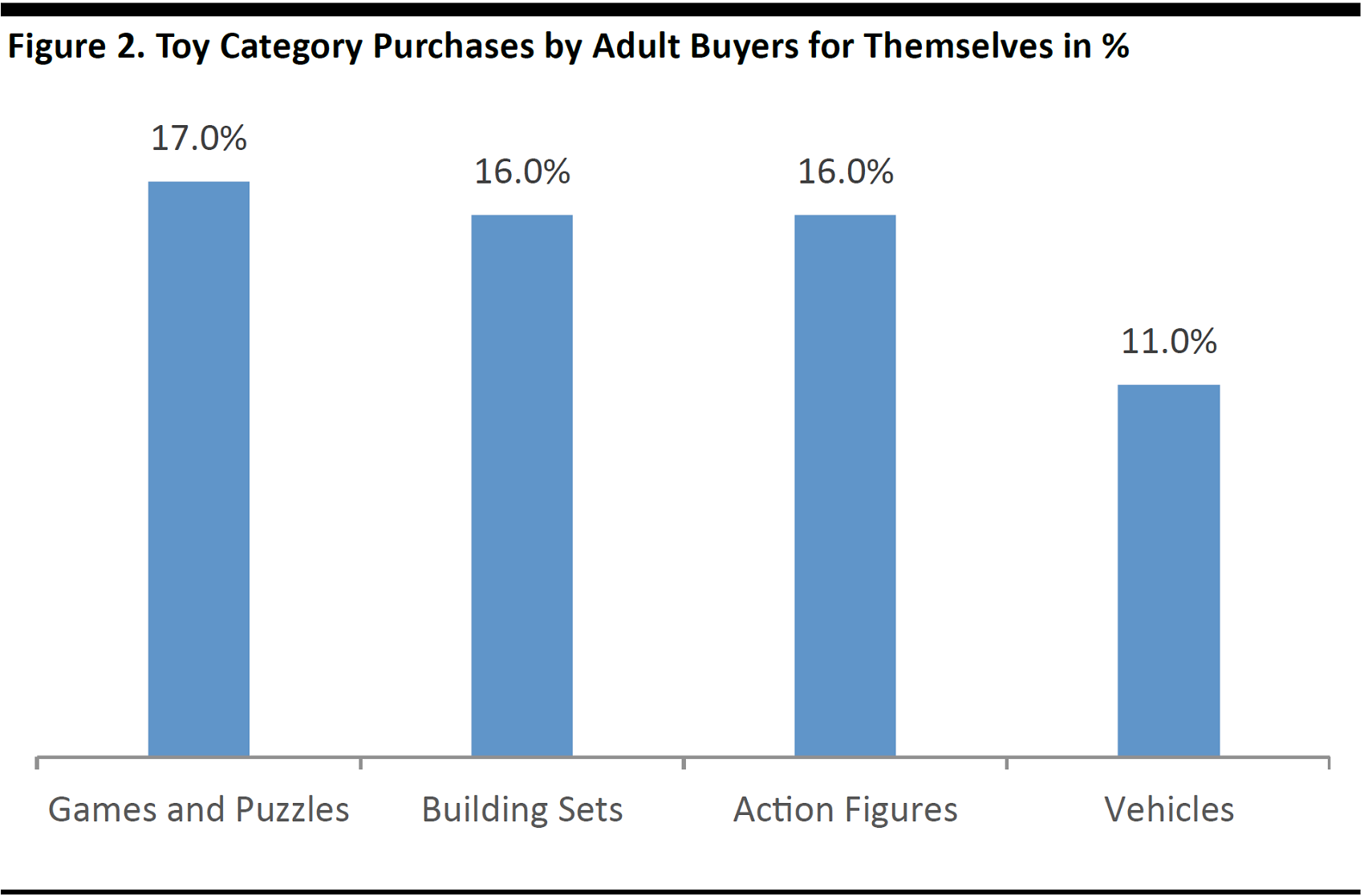

- Adults are more frequently purchasing toys for themselves, with one in every eleven toys sold in the UK in 2016 purchased by an adult for themselves, according to NPD.UK adults’ purchases increased by 21% year over year in 2016. Please see table below for the most frequent adult self-purchases.

Source: NPD

- Smaller toy manufacturers that sell through Amazon and other internet retailers enable the launching of new products and toy fads to spread like wildfire. Online retailers have made games far more easily available than in the past when many could only be bought from a small number of specialist shops. Furthermore, the power of blogs, online video, and social networks has created word-of-mouth buzz for the toy industry. About 50% of consumers are posting videos of their game-playing online and sharing their fun experiences on social media, according to Hasbro.

- Tangible goods still provide consumers with aesthetic pleasure, which cannot be achieved by digital screens. Many consumers still crave the authenticity of tangible products. In digitalized world, consumers seek tangible goods that can be collected. The fan economy (movie and cartoon characters) is stimulating sales of toys and collectible products.

- Hasbro management stated that over the last couple of years it has noticed that consumers, especially young people, are consuming more media and more experiences. The toy business is one of story-led brands. There is more storytelling around toy brands, with more movies and TV series, which is driving interest in the toy industry and collectible figurines and dolls. Children and some adults gravitate to brands and certain movie or comic book characters and they want to experience them across different mediums.

- There is a surge of new games being launched on the market. A proliferation of new and innovative games with artistic and creative designs and themes. New games such as Pandemic and Settlers of Catan are engaging consumers because they embrace a range of subjects. Thousands of titles of tabletop board games are released every year and the most popular games sell millions of copies.

- The growth of the video games industry has paradoxically contributed to the proliferation of modern and innovatively designed board games. Numerous mobile games have physical version and vice versa, such as the popular map-building game Carcassonne. Adult card game Magic: The Gathering had its eighth straight year of sales growth in 2016. The rise of smartphones and tablets has given players an inexpensive way to try digital versions of board games, and many go on to buy physical copies of the same games.

- Board games focus and inspire teamwork, something parents try to encourage through toys and leisure and entertainment activities. Building physical things can keep children engaged for longer. Physical and tactile goods, such as Play-Doh encourage learning and creativity in children.

- Toy manufacturer Hasbro has stated that it believes that as people spend more time with smartphones, they also increasingly desire more social interaction and face-to-face time becomes even more important, and board games satisfy that need. The social and physical nature of board games is behind the phenomenon, and board game cafés provide a social network. Due to so many digital distractions, parents seek to spend time with their children, in an “unplugged” family environment, driving the growth in physical games and puzzles.

- According to Hasbro, young adults are also spending more money and time on experiences. Gen Zers and millennials are playing a lot more games and they like social table top games because it is easy to get together and play board games and have fun, and share this on social media.

Brands and Categories Seeing Growing Demand

A wealth of brands and categories are attesting to the growing demand for physical toys and games.

Fidget Spinner

The latest craze to emerge in children’s toys is the fidget spinner, a simple, palm-sized gadget that consists of three blades of interlocked plastic circles that are flicked or spun around the finger like a propeller. Once the spinner is rotating, tricks can be performed. Spinner toys are gender neutral and are considered relaxation toys that supposedly increase focus.

Source: iStockphoto

- Sales have surged and a wide variety of retailers have started selling the toy to capitalize on rampant demand. Nowadays, the spinners can be found online and at virtually every mom-and-pop store.

- The devices have become so popular that toy retailers such as Smyths and Toys “R” Us have experienced product shortages. Toys “R” Us is even airfreighting tens of thousands of the units from factories in China to meet customer demand.

- The fidget spinner trend has boosted store foot traffic and accelerating sales at US discount retailer Five Below, driving robust share price performance, according to Barron’s. In the early days of the spinner fad, the gadgets were hard to find, and Five Below was one of a few big US retailers to offer them.

- Walmart executives stated that the spinners are the biggest craze for any product Walmart has seen in the past five years.

- Fresh on the footsteps of the spinner, a similar fidget toy called the Fidget Cube has surfaced. A Kickstarter online fundraising campaign for the Fidget Cube has raised US$6.4 million. The cubed device features a variety of clickable, twistable and flickable surfaces.

Play-Doh

Play-Doh has remained relevant for over 60 years and continues to perform at record levels around the world.

Source: iStockphoto

- US-based Play-Doh maker Hasbro reported that sales of Play-Doh have increased on average by 20% annually for five years and Hasbro currently produces over 500 million cans every year. Approximately 64% of 2016 Play-Doh net revenues were derived outside of the US.

- According to US discount retailer Five Below, do-it-yourself slime using Elmer’s glue, is still popular with children.

Lego

Lego, the Danish-based producer of unisex small plastic bricks has experienced performance and continues to expand rapidly.

Source: iStockphoto

- In 2016, Lego sold over 75 billion parts, 3,700 shapes and launched 335 new playsets in 2016.

- Lego executives have stated that the market for traditional toys, in which Lego operates, saw healthy growth during2016. Lego FY16 global constant currency revenues increased 5.5% year over year.

- During the coming years, LEGO expects to increase sales moderately ahead of the global toy market that is forecast to grow low to mid- single digits.

- Since 2010, the building sets toy category, which includes Lego, has increased by 121% in value terms as of September 2016, growing nearly six times faster than the overall toy market, according to NPD. Lego is one of the most frequently bought physical toys amongst UK adults, according to NPD.

Tabletop Board Games and Puzzles

We are also witnessing a resurgence of physical board games and playing cards, for both classic and new games. NPD recorded a 20% increase in UK tabletop game sales in 2016; this includes card and dice games, war games played with miniature figures and role-play titles such as Dungeons & Dragons.

- Amazon reported that the Bananagrams word game has been the UK's bestselling toy over the last 16 years, having sold more than any other toy since 2000. The game is essentially a portable word puzzle.

Source: bananagram.com

- Board game cafés have been established in the UK, US and Canada, where you can order different board games on a menu and the cafés provide for social interaction and a social network.

- Newer game titles such as The Settlers of Catan (now rebranded Catan) and Cards against Humanity are becoming increasingly popular.

Major global toy manufacturers are also riding the wave of the growing popularity of analogue toys and are expanding product introductions in these categories either through organic growth or acquisitions.

- US-based toy manufacturer Hasbro is the largest operator in the games and puzzles category in North America. The company stated that face-to-face gaming (non-digital games played by people in the same physical space) was one of the company’s fastest-growing product categories in FY16 and the category is expected to continue to perform at a high level. Hasbro's face-to-face games includes a portfolio of classic, well-known games such as Operation, Monopoly, Jenga, The Game Of Life, Twister as well as newer games such as Pie Face, Speak Out and Candy Land as well as adult games like Taboo, Cranium Dark and Trivial Pursuit.

- Hasbro’s classic games like monopoly have continued to grow through reinvention and new technologies and new form factors that allow different ways to experience the classic games.

- The company keeps launching new table top games for both children and adults using customer insights and social media scraping. Pie Face, which was launched in 2015, was the top game in the US in 2016 and Speak Out was the number two new game in the US. For 2017, Hasbro is launching a broad line of new games.

- Hasbro has launched a subscription board game service called Hasbro Gaming Crate in June 2017. The service consists of Hasbro shipping a themed box containing three brand new board games to users every three months.

Due to the rising popularity of the physical games category, Canadian toy company Spin Master has been building up its games and puzzles portfolio through acquisitions. Following its slate of several acquisitions, Spin Master is now the number two table top game and puzzle producer in North America with a portfolio of games and hands-on toys including Headbanz, Escape Room, Boom Boom Baloon, Kinetic Rock, Pottery Cool and Build-A-Bear.

- Spin Masters acquired licensed and value channel games and puzzles maker Cardinal in October 2015, obtaining classic game titles such as checkers, dominoes, card games, puzzles, bingo and licensed titles such as Uno and Othello.

- Spin Master also previously purchased Marbles which included brain-building games such as Otrio, Oh Snap!, Newton and The Sherlock, and Italian toy company EG Games, which owned some of Italy’s best-known board games including Risiko and Scarabeo.

- Spin Master management believes that the rise in physical toy popularity is more than a one-year trend and is occurring due to a resurgence of unplugged family time and a greater willingness to more consumer willing to try out new games.

- The unplugged theme is also a driver of growth in the outdoor category. Parents of children and teenagers like to have their kids go outside and move around.To have a foothold in the fast-growing outdoor category Spin Masters acquired Swimways, a manufacturer of outdoor recreation toys and products. The US outdoor sports category grew by 10% year over year in value terms in 2016, according to NPD.

Collectables and Figurines

According to NPD, the UK collectables market increased 44% year over year in 2016, accounting for almost 1 out of 4 toys sold. This compares to overall toy industry sales growth of 6.3% year over year in 2016, according to NPD. Likewise, we have witnessed similar trends in the US market.

Source: iStockphoto

Collectables include dolls such as Barbie and My Little Pony, as well as collectible figurines such as Transformers, Marvel Legends and Star Wars-themed, as well as toy cars such as Hot Wheels. Movies, games and cartoons are overwhelmingly driving demand for analog and physical collectable figurines amongst children and adults alike.

- Barbie dolls were at the National Federation of Retailers’ list of the most popular girls’ gifts in the US in 2016.

- In 2016, the miniature Shopkins dolls were the most popular collectible, according to the British Toy and Hobby Association. Star Wars action figures and Lego minifigures were also among the most popular ranges, especially for adult buyers for themselves.

- Hasbro’s girls’ division posted revenues of 50% year over year growth in FY16. Sales were flattered by shipments of Disney figurines such as Disney Princess and Frozen fashion dolls, as well as Trolls and Baby Alive baby figures.

- New companies with innovative educational product and fine craftsmanship are also entering the market. For example, London-based Papinee produces upscale collectible plush toys and story-telling kits.

Key Takeaways

- Despite an increasingly digitalized world and plethora of digital entertainment, such as drones, video game consoles and smartphone games, we are witnessing a revival of interest in traditional, non-digitized children’s and adult toys and gadgets.

- Physical toys and games target gamers of all ages and provide a nostalgic and soothing antidote to an increasingly technological world.

- Global appetite for entertainment is growing driven by new content and new platforms. Toy purchases are strongly inspired by strong media content cycles.