Executive Summary

The experience of buying and selling pre-worn clothing has evolved dramatically over the years, from thrift shops and consignment stores to eBay and finally to e-commerce websites and digital apps that offer simplicity, convenience, social interaction and some even brand authentication. US-based ThredUP has emerged as the leader in the low-to mid-price re-commerce segment and The RealReal in the premium and luxury segment.

A natural evolution has been the introduction of social-media-type, peer-to-peer re-commerce apps, which are expected to attract more young buyers and sellers to the re-commerce market. The rise of new reselling peer-to-peer marketplace apps such as OfferUp, Letgo, and Depop has facilitated a very simple listing and transaction process to trade used goods. Smaller mobile app platforms have been much more technologically innovative and are taking market share from pioneering digital secondhand marketplaces such as eBay and Craigslist.

Besides simple usability features, the new peer-to-peer marketplace apps include security features that build trust. Established sellers have a transaction history and strong ratings from customers who had previously purchased goods from them. Individuals can also consign items to established sellers to sell for them.

US full-price retailers are suffering while re-commerce is thriving, and online re-commerce is currently one of the fastest-growing sectors in retail. The total apparel resale market (brick-and-mortar and online) is expected to grow at a compounded annual growth rate (CAGR) of 13% from $18 billion in 2016 to $33 billion in 2021. Re-commerce disruptors are growing 20 times faster than the broader retail market and five times faster than off-price retailers.

Whether through online augmented resellers or through mobile peer-to-peer marketplaces, a multitude of key factors are driving continued growth of the fashion re-commerce sector. These include: millennial penetration, the desire for value and cost savings, the entertainment factor of the treasure hunt for unique items, decluttering, environmental concerns, greater interest from higher-income shoppers and male customers, as well as resellers opening physical pop-up and brick-and-mortar locations.

Introduction

Defining Re-Commerce

“Re-commerce”—buying and selling secondhand goods—is one factor reshaping the apparel market. Empowered by mobile connectivity, consumers are buying and selling pre-owned apparel online. Online re-commerce companies and peer-to-peer marketplaces have made it much easier for consumers to buy and sell secondhand clothing, footwear and accessories. Re-commerce companies have adopted a variety of different business models.

Source: iStockphoto

Online re-commerce companies such as ThredUP and The RealReal provide sellers with augmented logistics services such as item photography, pricing, posting inventory information online and customer service.

Peer-to-peer marketplaces bring buyers and sellers together within a hosted platform to perform transactions. These include OfferUp, Letgo and Depop.

An Evolving and Expanding Sector

The marketplace for online fashion resale continues to evolve and expand rapidly. US-based ThredUP has emerged as the leader in the low-to-mid price re-commerce segment and The RealReal in the premium and luxury segment. These companies are profiled in more depth in our first two re-commerce reports, Online Consignment Market and Deep Dive: Fashion ReCommerce Evolution.

ThredUP published its fifth annual resale trend report in early 2017, and this contains some interesting findings based on user data, and sheds light on changing customer shopping habits. We have used the report findings to inform our analysis of sector momentum.

In this update, we analyze the continuing evolution and growth of the apparel re-commerce segment and feature key data from ThredUP’s report. We discuss 12 factors that are driving growth in the fashion re-commerce sector. Finally, we profile two new, mobile re-commerce platforms, OfferUp, and Letgo, and provide more detail on previously featured re-commerce app Depop.

The Resale Apparel Segment has Seen Unprecedented Growth in the Past Year

While many US full-price retailers are suffering from soft consumer demand, the re-commerce sector is thriving and online resale is currently one of the fastest-growing sectors in retail. According to ThredUP:

- The total US apparel resale market (brick-and-mortar and online) will grow at a CAGR of 13% from $18 billion in 2016 to $33 billion in 2021.

- Re-commerce disruptors are growing 20 times faster than the broader retail market and five times faster than off-price retailers.

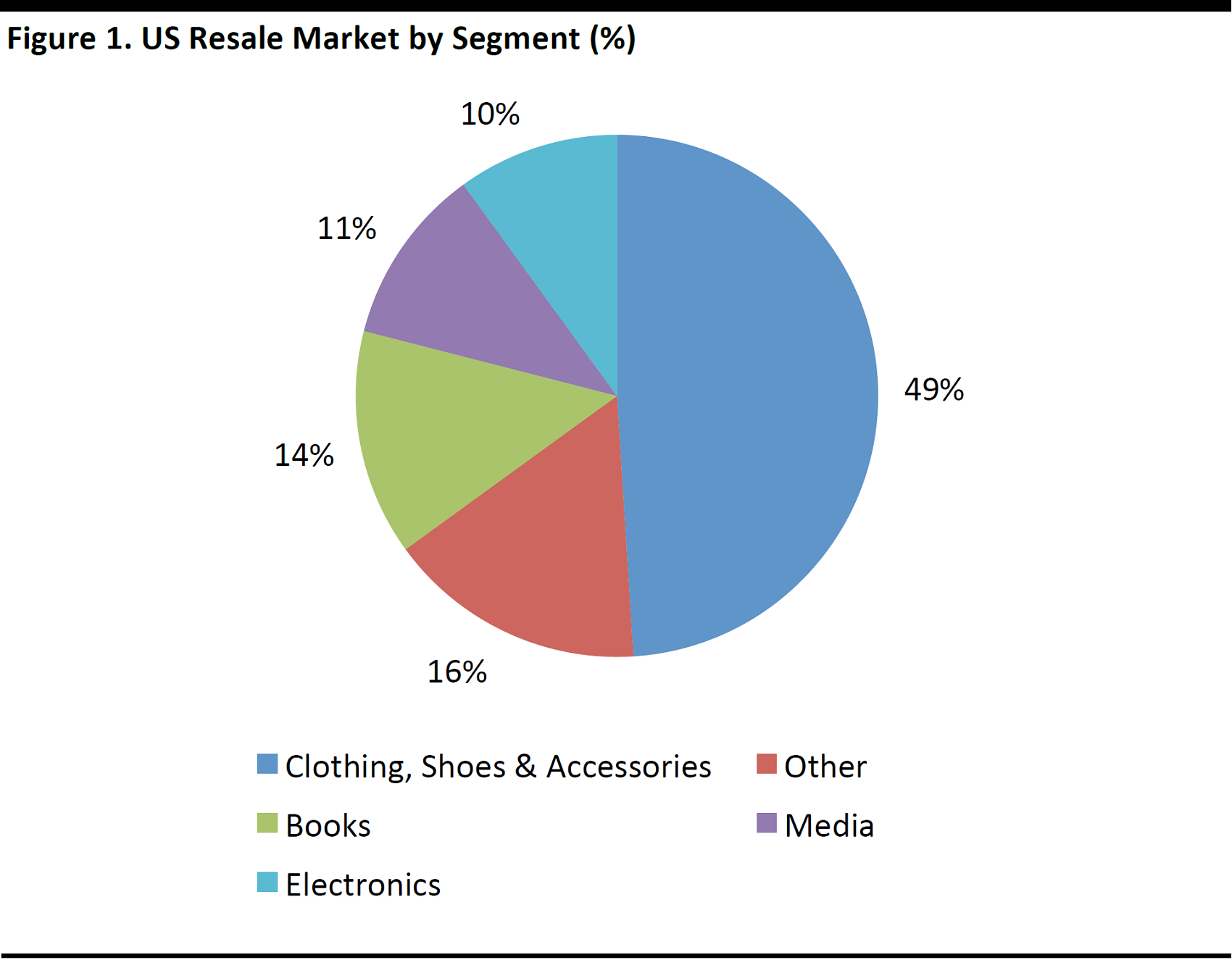

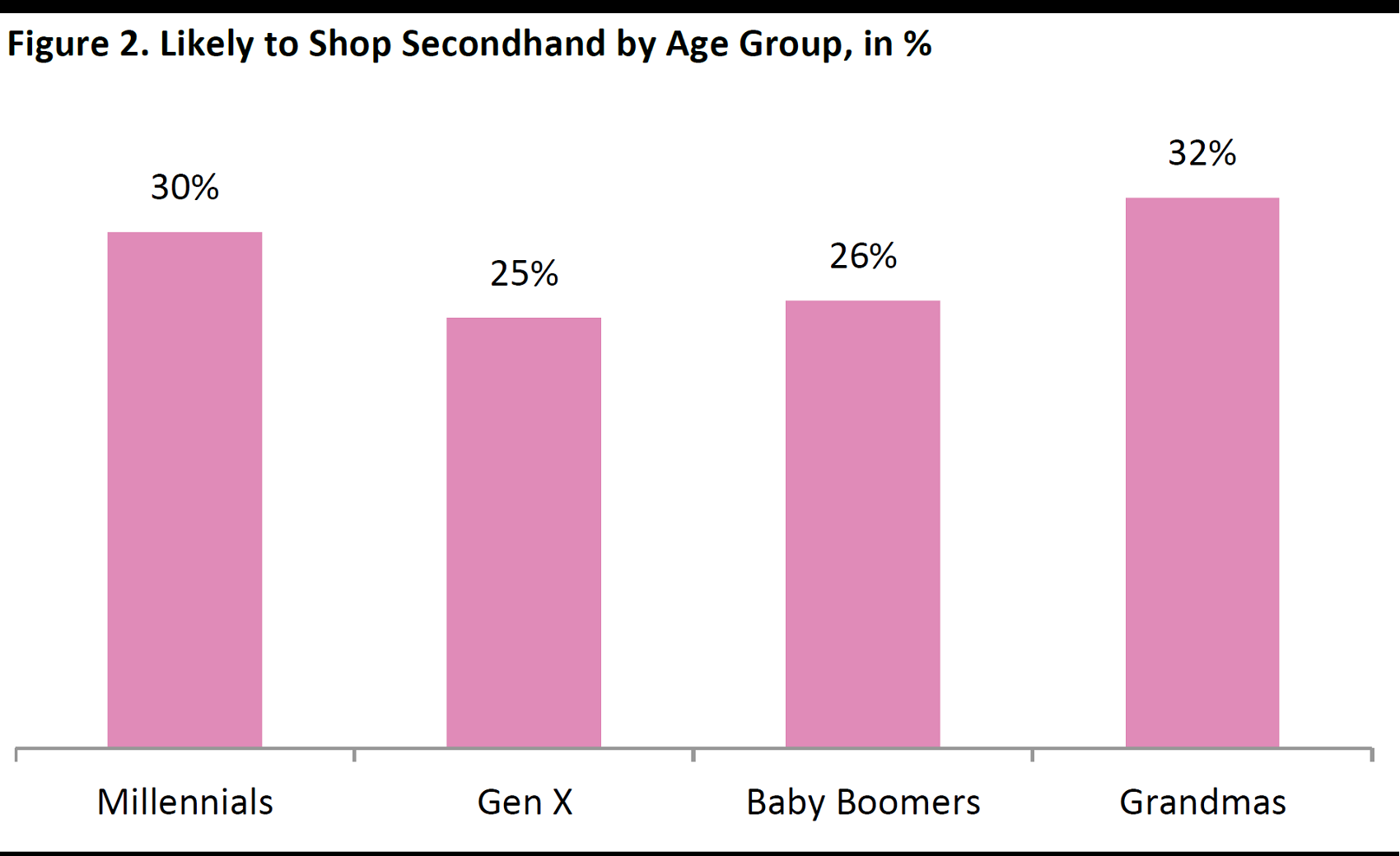

- Clothing, shoes and accessories currently make up 49% of total US resale sales.

Source: ThredUP/Fung Global Retail & Technology

The Rise of Peer-to-Peer Marketplace Re-Commerce Apps

The experience of buying and selling pre-worn clothing has evolved dramatically over the years, from thrift shops and consignment stores to eBay and Craigslist, and more recently to e-commerce websites and digital apps that offer simplicity, convenience, social interaction and, in some cases, even brand authentication.

The rise of new reselling peer-to-peer marketplace apps such as OfferUp, Letgo and Depop has facilitated a very simple listing and transaction process to trade used goods, including apparel, footwear and accessories. Smaller mobile app platforms have been more technologically innovative and are taking market share from pioneering digital secondhand marketplaces such as eBay and Craigslist. Less than 20% of items sold on eBay in the fourth quarter of 2016 were used items, and auctions account for just 13% of total eBay sales.

Besides simple usability features, the new peer-to-peer marketplace apps include security features that can build trust among shoppers. Established sellers have a transaction history and ratings from customers who have previously purchased goods from them.

Below we introduce three re-commerce disrupter mobile peer-to-peer marketplace apps.

Depop

Depop

- Depop is predominately an app platform, but can also be accessed on a desktop.

- The company was launched in 2012 and is headquartered in London. It also has a small office in New York City, as it is seeking to enlarge its presence in the US.

- Depop has six million users, including 350,000–400,000 active daily users.

- Depop appeals mainly to teenagers and millennials, and it permits users from the age of 14 years. The company stated that approximately 70% of its users are female and a majority are aged between 16 and 26. Teenagers and young adults use Depop as a business, searching vintage stores and flea markets and reselling items to make extra income.

- Transactions are made online via PayPal or by cash payment. The app charges a 10% commission on digital sales and does not charge a commission when transacting parties meet in person and exchange cash.

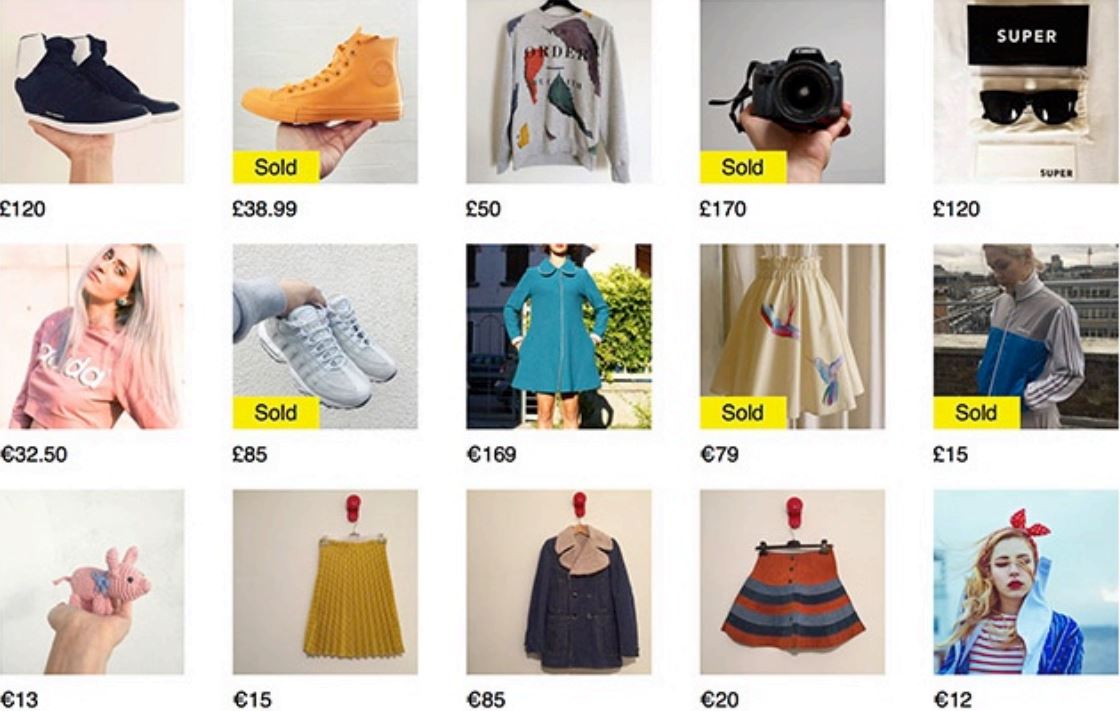

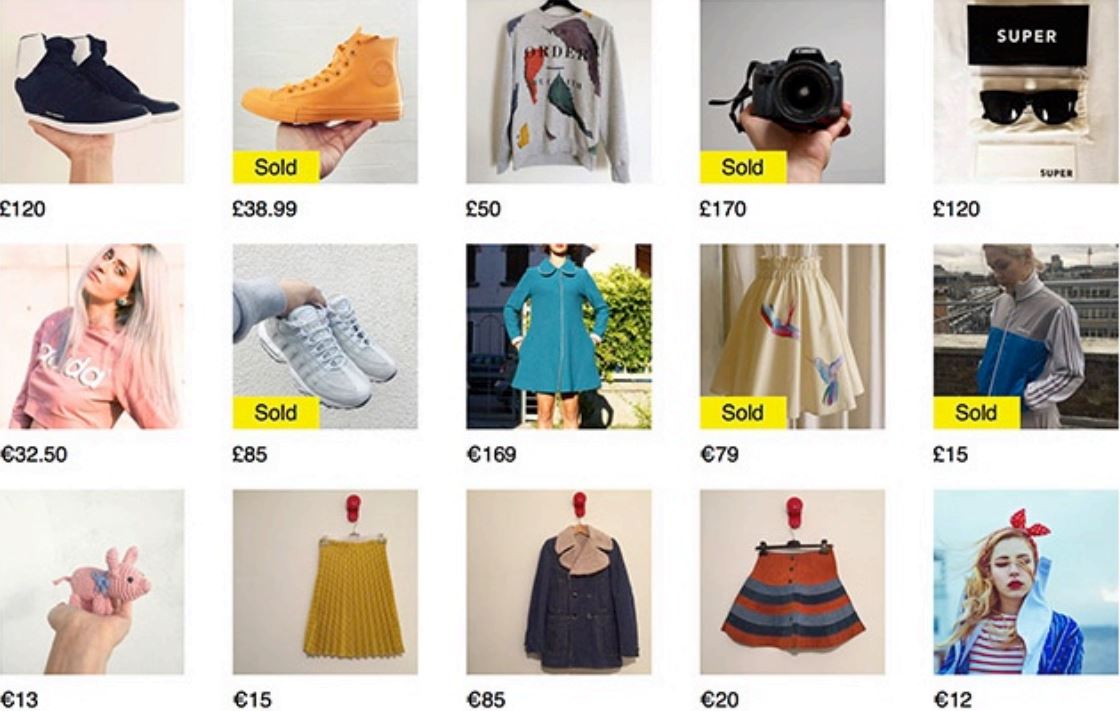

- Depop makes participation simple with a social interconnectivity aspect similar to Instagram. Vendors post images of items to be sold and sellers can leave items that they sold on their profiles, building up a retailing profile which builds a follower base. Followers can “like” and comment on products and seller profiles and independently communicate with sellers. Generally, the more followers a seller has, the easier it is to attract more buyers.

Source: www.depop.com

Letgo

Letgo

- Letgo was founded in 2015 and has raised $375 million in funding including from South African internet giant Naspers. The app’s annual transaction volume is expected to reach $23.4 billion in the

12 months from June 2016 to June 2017.

- The app has been downloaded over 45 million times and has 20 million monthly active users (MAU).

- • Letgo has offices in New York and Barcelona and is available in the US, Canada and parts of Europe and Turkey. The app is also being tested in Asia and Latin America.

- The app offers a very quick listing process, as its software automatically scans the item to be sold and categorizes it using artificial intelligence (AI) and image recognition. The seller only needs to add a photo. Buyers contact the seller through an in-app chat system.

- Currently, there is no charge to use Letgo, but in the coming years it will start trying to monetize the service, through advertising or by charging sellers to improve listing visibility, according to the company.

- In 2016, Letgo spent an estimated $100 million on television advertising in the US, according to the advertising analytics firm iSpot.

OfferUp

OfferUp

- US-based OfferUp was founded in 2011 and operates only in the US market. The app offers a similar design and experience to rival Letgo.

- OfferUp has a company valuation of approximately $1.2 billion according to the company.

- OfferUp forecasts that company sales will reach $20 billion in 2017.

- The app has been downloaded over 23 million times and, according to the company, it had 14 million MAU in March 2017.

- OfferUp markets through television advertising.

- OfferUp includes security features such as verifying accounts through Facebook and a driver’s license for identification purposes. The app features buyer and seller ratings.

- OfferUp does not currently charge buyers or sellers commissions or usage fees. This year, the company has begun experimenting with monetization strategies, including in-app payments.

12 Catalysts for Re-Commerce Growth

Whether through online augmented resellers or through mobile peer-to-peer marketplaces, we see 12 key factors driving continued growth of the fashion re-commerce sector.

Value and Cost Savings

- Approximately 94% of American women stated that they rarely buy clothing that is not discounted, according to a ThredUP survey.

- The average discount on ThredUP is 80% and the average order saves customers $177. The company stated that shopping secondhand exclusively for one year would save customers around $2,129 on average.

Digital-Savvy Millennials Market Penetration Increasing Re-Commerce

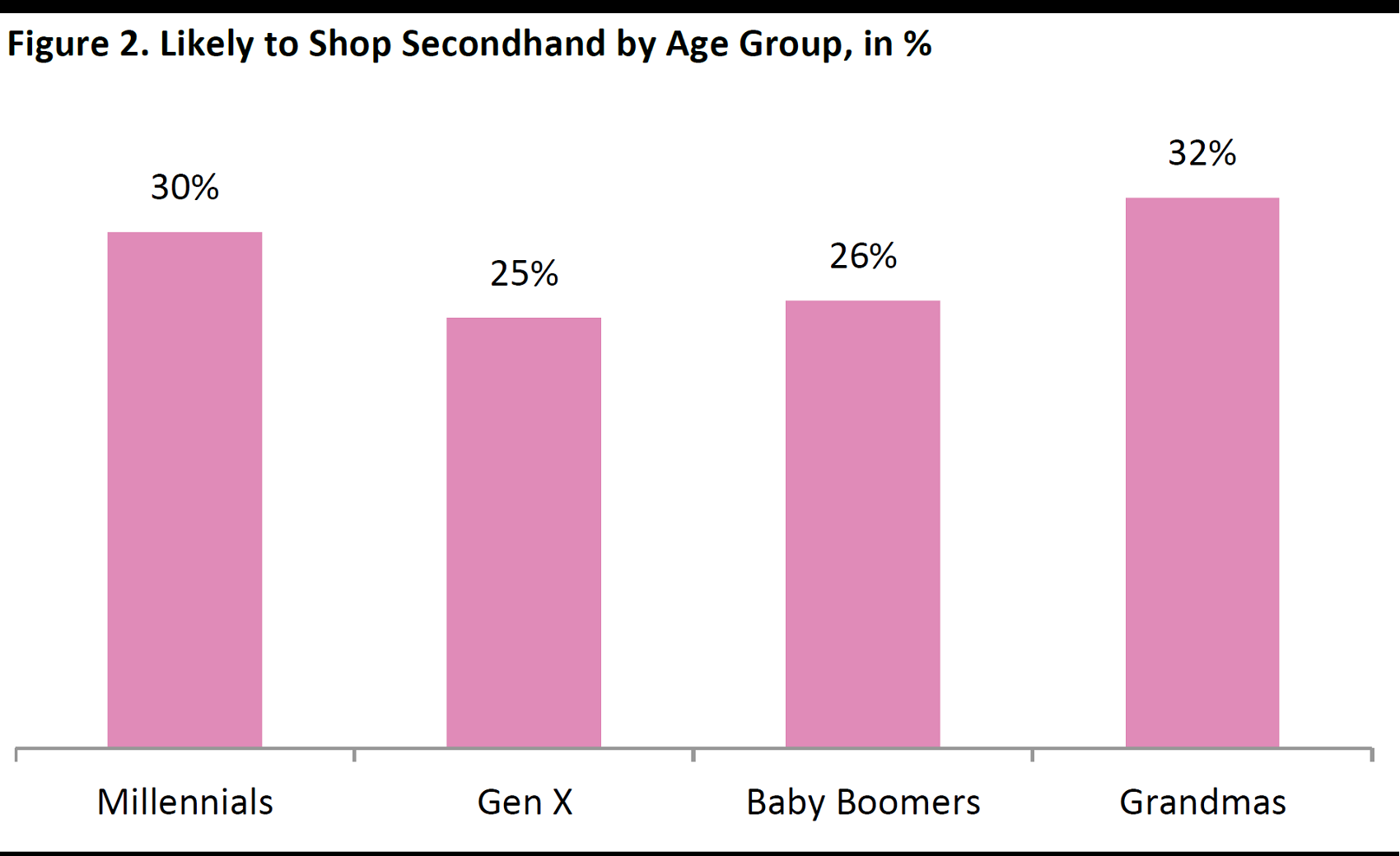

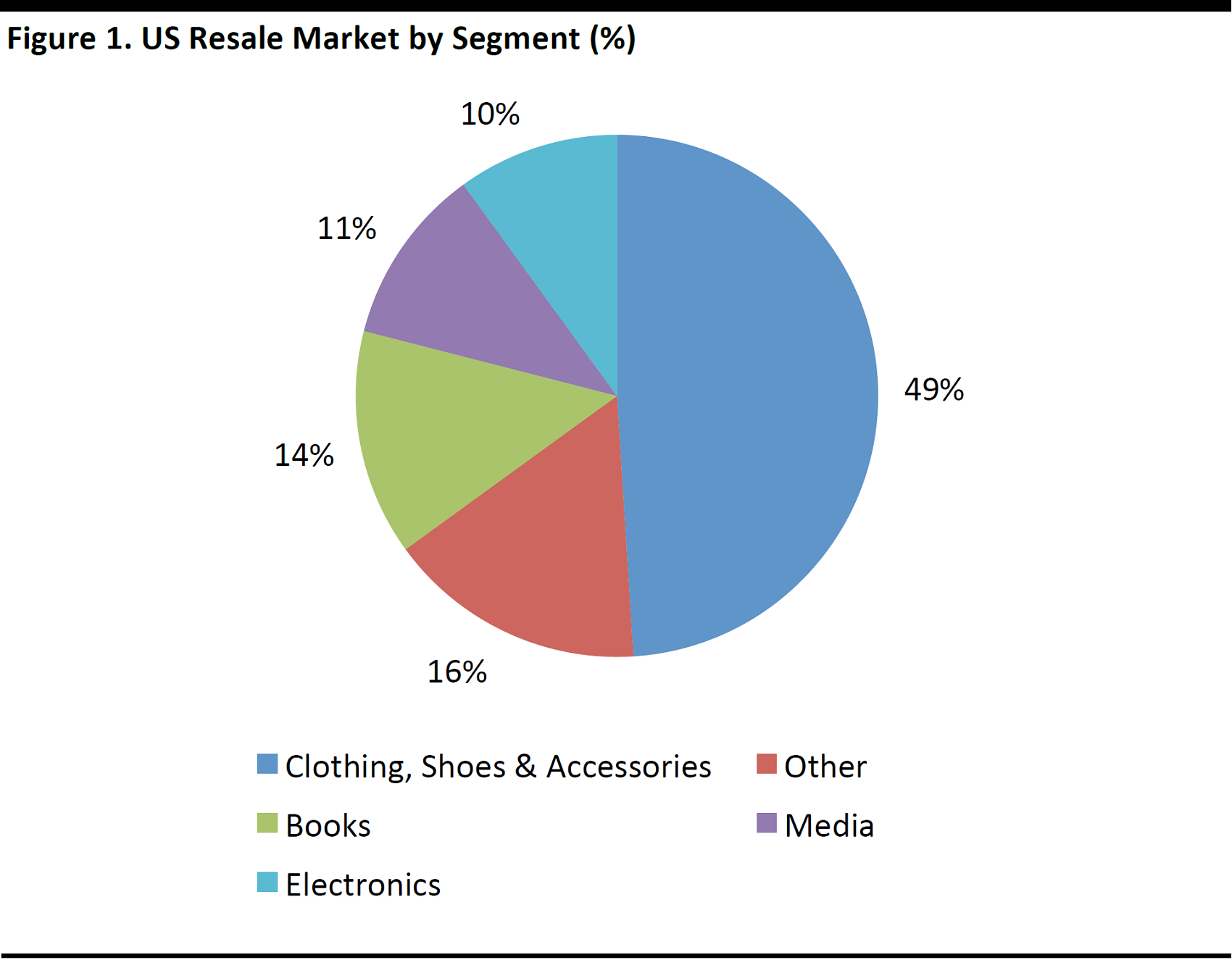

- According to ThredUP, millennials and women over 65 are the two demographic groups most likely to shop secondhand.

- Approximately, 30% of 18–24 year-olds have shopped secondhand in the past 12 months, and 21% say they intend to shop secondhand in the future.

- About 79% of ThreadUP’s sales are completed through mobile devices.

- Approximately one-third of The RealReal’s customers are millennials.

Source: ThredUP/Fung Global Retail & Technology

The Entertainment Factor of the Treasure Hunt Shopping Experience

- The number one reason for re-commerce shopping appeal is the entertainment factor of a treasure hunt shopping experience due to constant product rotation, and 76% of shoppers say the fun factor is one of the top three reasons they shop at re-commerce companies.

- Some 63% of ThredUP survey respondents claim resale shopping is thrilling because you never know what you are going to find and there is a surprise element.

Getting Over the Stigma of Used Clothing Because Quality, Cleanliness and Curation are Controlled

Re-commerce disruptors focus on higher-quality, gently-used, brand-name products and offer a more curated product assortment.

- ThredUP typically lists only 40% of the garments it receives after each passes a three-point inspection process, and 60% of the merchandise is rejected due to quality issues.

- Luxury re-commerce site The RealReal receives about 150,000 items monthly. A large portion of the items the company receives have barely been worn, and some items even have original price tags on them. Items at The RealReal are inspected and authenticated prior to being shipped to customers. The company also sends sales people to clear out closets in wealthy areas.

Decluttering and The Perception of “Having Too Much Stuff”

We have reached a point of “peak stuff” and consumers are trying to consume ever fewer resources.

- About half of Americans think they have over $1,000 worth of unused items and 41% have not decluttered in over a year, according to a recent report by OfferUp.

- The average American woman does not wear 60% of the items in her closet, representing $220 billion of unworn women’s merchandise in the US.

- As depicted in the graph below, the average number of clothing items purchased by US women declined from 51 items in 1996 to 37 in 2016. That number is forecast to fall further to 32 items by 2021, according to ThredUP.

Source: ThredUP/Fung Global Retail & Technology

Making Extra Income

- ThredUP has paid $58 million to consignors in the past five years.

- Approximately 65% of millennials spend their secondhand savings on experiences with friends and family, according to ThredUP.

- ThredUP sends buyers a box to fill with brand-name apparel. The seller can keep 5%–80% of the item's resale value, depending on the final sale price.

Concerns about Sustainability and Eco-Friendliness, Especially Among the Millennial and Gen Z Demographics

- Millennials are 2.4 times more likely to be motivated by ecoconscious factors when shopping than other consumers, and 84% prefer socially-conscious brands that share their values, according to ThreadUP. Hence, resale caters to this demand by providing the recycling of clothing and not wasting resources on production of new merchandise and filling landfills with old apparel.

Re-Commerce Offers a Very Attractive Competitive Proposition Compared to Other Retailers, Especially Off-Price Retailers such as TJX

Off-price retailers such as TJX, Burlington Stores and Ross Stores have been performing strongly, while much of the rest of the apparel retail sector in the US has suffered. The success of off-price retailers can be attributed to two factors shared with online apparel resellers: offering branded goods at a discount and providing a treasure hunt experience based on a constantly rotating array of products. However, off-price retailers do not sell online. Hence, online apparel resellers argue that they pose a viable competitive threat for off-price retailers.

- About 78% of US women state that they rarely find anything new or exciting when shopping at traditional retail stores.

- Although off-price retailers add thousands of new items weekly to their assortment, they do not have e-commerce platforms and customers cannot search or purchase product online.

- Off-price retailers offer branded in-season merchandise discounted by 20%–60% off regular retail prices, whereas ThredUP offers 75%–90% off retail prices.

- Some 50% of ThredUP shoppers claimed their secondhand purchases replaced ones they made at off-price retailers.

- Around 75% of off-price shoppers list the thrill of the bargain hunt as their primary motivation for shopping at off-price outlets, and 88% of re-commerce shoppers list the same as their primary motivation.

Sellers Become Buyers and Buyers Sellers

- Approximately 69% of ThredUP sellers also shop secondhand, and 41% of buyers also resell their clothes.

- The RealReal has stated that the company attracts four buyers for every consigner and half of consigners are also buyers on the site. Buyers purchase products that they know have a high resell value.

- Over half of millennials consider the resale value of an item before they make a purchase, according to ThredUP.

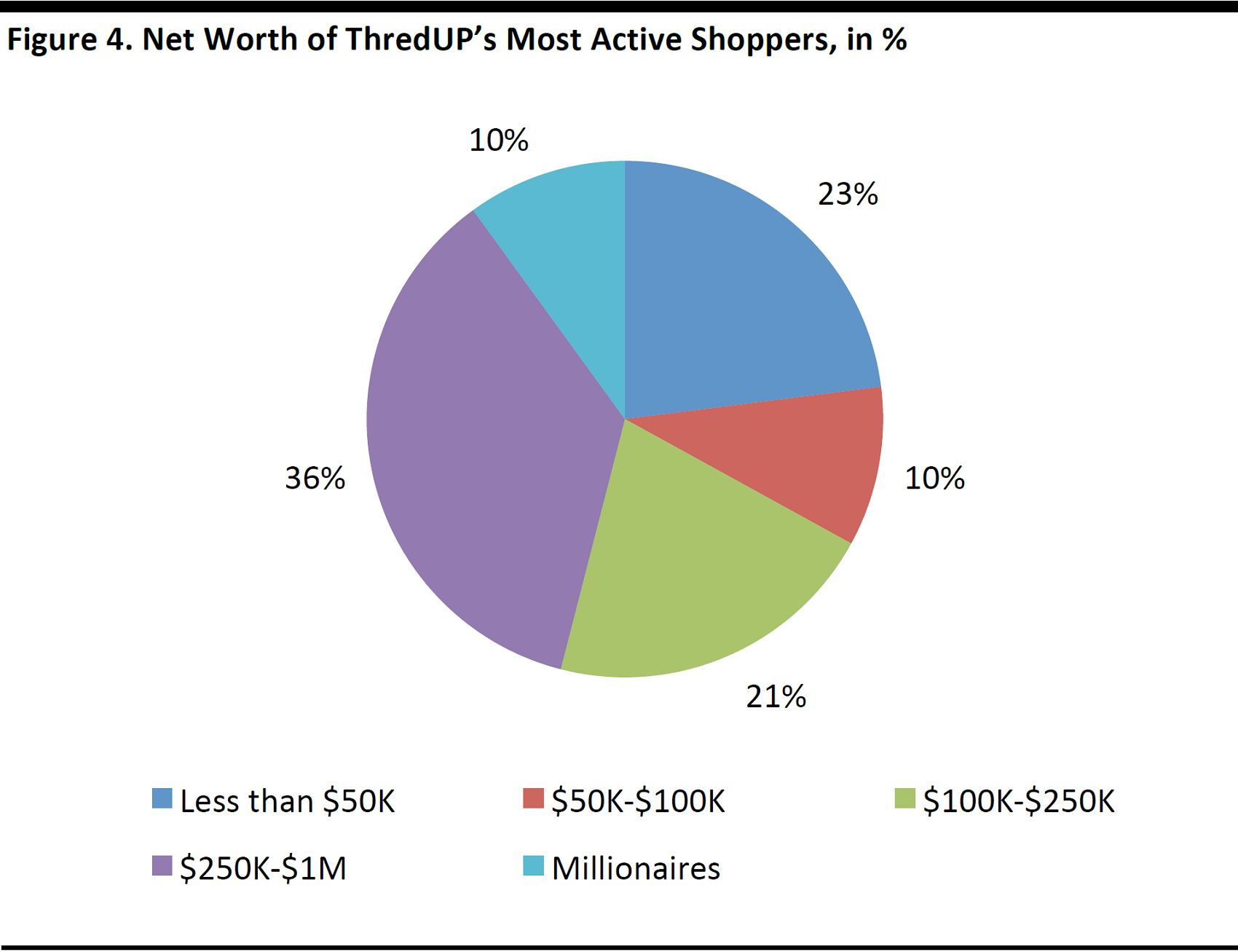

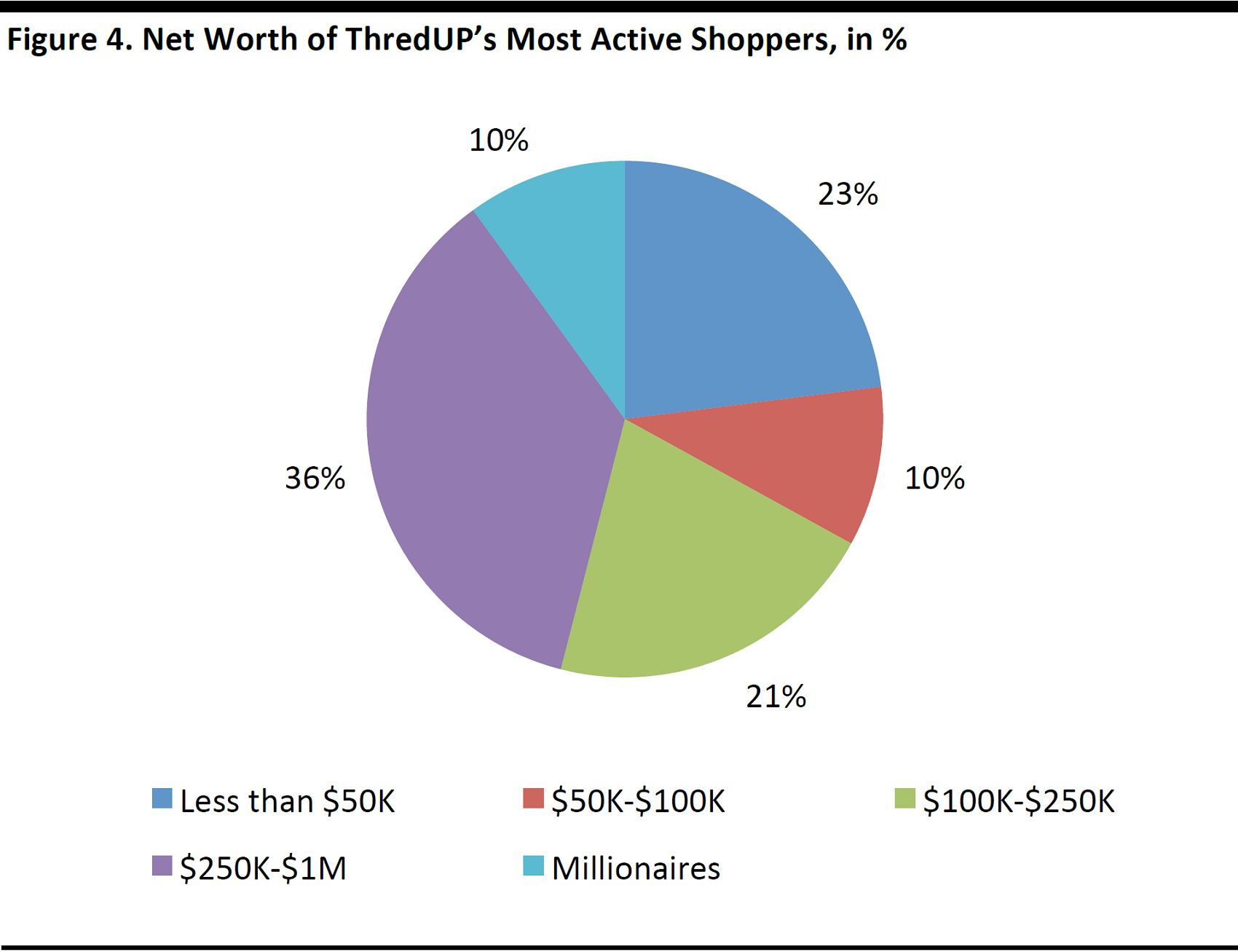

High-Income Shoppers Joining the Act

Based on ThredUP’s report, it is not just lower-income customers that tend to shop resale apparel. The data found that the website’s customers include shoppers from more affluent demographics. High-income shoppers are the most likely to shop apparel resale, according to ThredUP.

- High-income shoppers are 35% more likely to try secondhand than low-income shoppers.

- Approximately 77% of ThredUP shoppers are working professionals, 71% own a home and 73% are urban dwellers.

Source: ThredUP/Fung Global Retail & Technology

Men Are Starting to Shop Online as Well

- About 20% of The RealReal shoppers are men who are shopping for themselves, for watches, leather goods and also apparel.

- Men’s average order size on the platform is smaller than women’s, but men’s purchase return rates are lower, according to The RealReal.

Brick-and-Mortar Locations

- The RealReal is contemplating opening a series of brick-and-mortar stores, with the first store slate to open in Soho, New York. The RealReal has already operated pop-up stores in New York for a two week period to showcase merchandise. The pop-up shop generated over $2 million in revenue and half the shoppers were new customers.

- ThredUP’s founder and CEO stated that the company is considering setting up physical stores, as 85% of apparel is still purchased in stores. The company may initially test opening stores through popups.

Key Takeaways

- The marketplace for fashion re-commerce continues to evolve rapidly.

- The emergence of social-media-type, peer-to-peer fashion re-commerce apps are attracting more young buyers and sellers to the re-commerce market.

- Re-commerce disruptors are a competitive threat to off-price retailers.

Depop

Depop

Letgo

Letgo OfferUp

OfferUp