Introduction

Defining Re-Commerce

Fashion retail is being reshaped not only by e-commerce, but also by "re-commerce"—consumers buying and selling pre-owned apparel online. The fashion resale trend is one of a number of innovative forces impacting apparel retailing, which we are covering across our

On-Trend series of reports.

Online marketplaces have made it much easier for consumers to buy and sell secondhand clothing, footwear and accessories. Luxury goods are especially popular in the re-commerce channel, as their higher prices give consumers greater incentives to buy and resell them. Re-commerce companies have adopted a variety of different business models, including direct repurchase, consignment sales and facilitating peer-to-peer sales.

Online resale companies provide sellers with augmented services such as photographing, pricing and posting inventory information online. Sellers are paid for merchandise either up front or on consignment, which means that the seller is only paid once the merchandise is sold.

Peer-to-peer marketplace platforms facilitate the matching of inventory sellers and buyers and charge a commission on each sale. In a peer-to-peer model, buyers and sellers connect with each other directly, the way they do on eBay.

An Evolving Sector

The marketplace for fashion re-commerce continues to evolve rapidly. Following an initial wave of online fashion resale startups, weaker players have gone out of business and stronger players have grown and attracted more investment funding to propel further growth.

It is difficult to arrive at an accurate market size for this sector, since all the companies currently operating in it are private and do not disclose sales figures. However, one of the major resale players, ThredUP, has estimated that the US apparel resale market will grow at a 6% CAGR over 10 years, from $14 billion in 2015 to $25 billion in 2025.

[caption id="attachment_90844" align="aligncenter" width="407"]

Source: Thredup.com

Source: Thredup.com[/caption]

Besides ThredUP, other major companies in the online re-commerce space in the US, the UK and Europe include Poshmark, Tradesy, The RealReal and Vestiaire Collective. We published our first deep-dive report on the online resale and consignment market in January 2016. That report profiled all five of these major re-commerce companies and their business models. Readers can find that report at

bit.ly/FashionResale.

In this update, we discuss the continuing evolution and growth of the apparel re-commerce segment. We analyze market characteristics and the main players, and discuss five factors that are likely to boost the fashion re-commerce sector. Finally, we profile two new, niche-focused resale platforms, Depop and Stadium Goods.

Continued Investor Interest in Funding Apparel Re-Commerce Companies

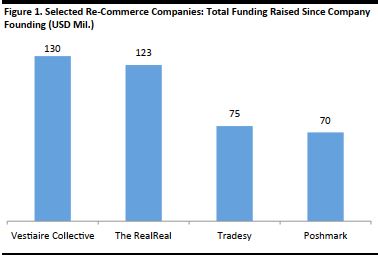

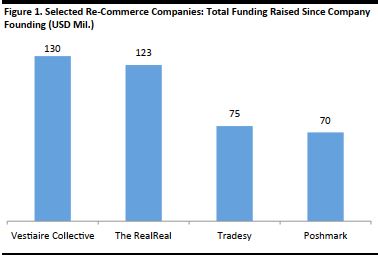

Since 2009, investors have poured more than half a billion dollars in venture funding into apparel resale companies, and re-commerce remains popular at mass market, middle market and luxury price points. According to FashInvest, a fashion investment community, investors invested more than $175 million in the online reselling industry in 2016.

- Vestiaire Collective, a France-based online reselling platform for luxury goods, secured $62 million in funding in January 2017, bringing total funds raised to $130 million in five funding rounds since the company’s founding in 2009.

- com raised $20 million in December 2016, bringing its total funding to approximately $50 million. The company currently operates a Chicago warehouse that is the size of six football fields.

- The RealReal has raised a total of $122 million since 2011 and ThredUP has raised $131 million since its founding in 2009, according to VentureBeat. Poshmark has raised more than $70 million in funding, according to Women’s Wear Daily.

[caption id="attachment_90845" align="aligncenter" width="378"]

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology[/caption]

Despite continued investor funding interest, there is room for only one or two players in each subsector of the apparel resale market, as fashion re-commerce websites have to compete fiercely for both inventory and customers in order to benefit from economies of scale and achieve adequate profitability margins.

Low-to-Mid-Price Online Resale Players

US-based ThredUP and Poshmark lead in the low-to-mid-price online resale segment.

ThredUP

ThredUP is the most mainstream and well-known online fashion reseller, and it claims to have been the first to enter the industry.

Poshmark

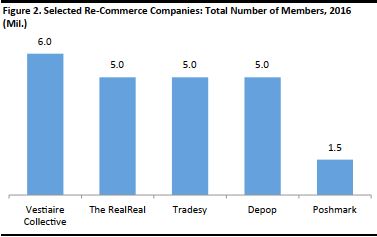

Poshmark has 1.5 million sellers that offer 4 million items daily. Shoppers on the Poshmark app spend an estimated 25 minutes daily on it and open it seven to eight times each day. According to Poshmark, one in every 50 US women sells secondhand clothing via its marketplace.

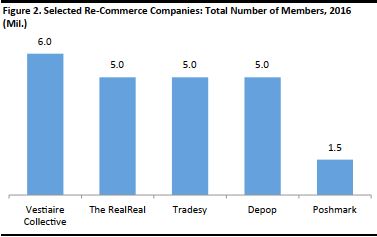

[caption id="attachment_90846" align="aligncenter" width="377"]

Source: VentureBeat/Women’s Wear Daily/Business of Fashion/Financial Times/Fung Global Retail & Technology

Source: VentureBeat/Women’s Wear Daily/Business of Fashion/Financial Times/Fung Global Retail & Technology[/caption]

Luxury Good Online Resale Players

The three main players in the premium and luxury secondhand fashion resale marketplace are The RealReal and Tradesy (both based in the US) and Vestiaire Collective (based in France). These three companies are profiled in more depth in our first resale report, at

bit.ly/FashionResale.

The RealReal

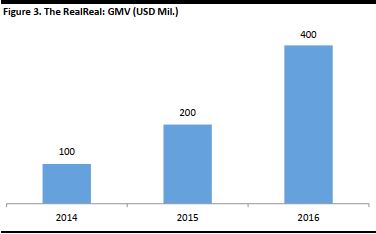

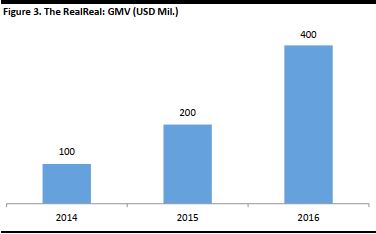

The RealReal has 5 million members worldwide and is estimated to have doubled its gross merchandise value (GMV) year over year in 2016:

- The company paid out $200 million to consignors in 2016 and is estimated to pay out $300–$350 million in 2017.

- Half of consignors that use the platform have never consigned before.

- About 98% of the items listed on the website sell within three months.

- The RealReal operates temporary physical pop-up shops, and the company plans to open one permanent physical store in the US in the future.

[caption id="attachment_90847" align="aligncenter" width="376"]

Source: Women’s Wear Daily/Fung Global Retail & Technology

Source: Women’s Wear Daily/Fung Global Retail & Technology[/caption]

Tradesy

- Tradesy has 5 million members.

- The average order value on Tradesy is $300 and the site is estimated to have reached $300 million in sales in 2016.

Vestiaire Collective

- The Vestiare Collective platform has 6 million customers across 48 countries and consignors in 17 countries. The company lists 600,000 items for sale, and 4,000 new products are listed daily on the site.

- France is Vestiaire Collective’s main market, representing 35% of total sales. The company is also a leading platform in the UK, Germany, Spain and Italy.

- Vestiaire Collective customers spent an average of $427 in 2016, versus $371 in 2015. The company’s CEO stated that annual sale growth has averaged 70%.

Five Catalysts for Re-Commerce Growth

We see five key factors conspiring to boost the fashion re-commerce sector.

1. There is room for global expansion:

- Vestiaire Collective plans to dedicate its latest round of investment financing funds to international expansion, in particular in the US and Asia.

- The RealReal plans to add more international consignment sellers. The site ships internationally, but consignors are currently based only in the US.

2. Full-price brand momentum stimulates demand in the resale market and has a significant impact on the resale value of branded products:

- The resale market tends to reflect changes and trends in the retail market.

- ThredUP reported that activewear was among the fastest-moving categories on its site in 2016, reflecting the continued momentum of the athleisure trend.

- The arrival or departure of a creative director at a luxury goods company tends to have an impact on consumer interest in a brand and to increase the resale value of current, previous and future collections. For example, the appointment of Hedi Slimane at Yves Saint Laurent resulted in a 275% increase in resales of certain of the brand’s products during his time at the fashion house. And the resale value of some Christian Dior products increased by 25% in the three months following Raf Simons’ departure from the company in October 2015, compared with the three months before.

- The RealReal says that 77% of its shoppers and consignors consider a product’s resale value when they buy at full price at retail.

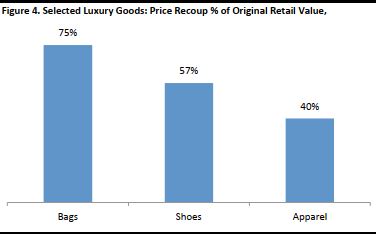

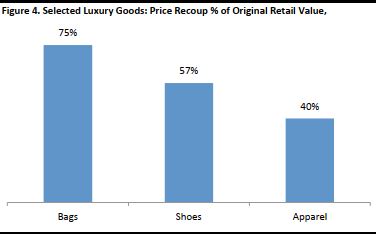

- In terms of specific luxury product categories, bag consignment sellers are generally able to recoup the highest percentage of the original retail sale price. They are followed by consignors of shoes and ready-to-wear apparel, according to Vestiaire Collective, which has also launched a resale calculator that helps sellers estimate resale income.

[caption id="attachment_90848" align="aligncenter" width="376"]

Source: Vestiaire Collective/Fung Global Retail & Technology

Source: Vestiaire Collective/Fung Global Retail & Technology[/caption]

3. Consumers see certain luxury products as investments, which supports the high-end resale segment:

- Limited-edition items are highly sought after, and some items are fashion investments that have high resale value.

- The resale business is especially popular for prestigious handbags. There is even a handbag investment index, The Rare Handbag Index from online marketplace JustCollecting. The index increased by just under 8% annually between 2004 and 2016, and one particular Chanel purse increased in value by more than 230% during the period.

4. Inventory supply and demand see seasonal increases:

- Resale inventory supply increases during April and May and again in October and November as consumers change over their seasonal wardrobes.

- Unwanted holiday gifts also increase resale merchandise inventory. In January 2016, the number of items on Swap.com marked with a new tag jumped by about 25% from the monthly average, and Swap.com executives anticipated a similar surge for 2017. Poshmark expects its consignment listings to double in February and March 2017 from the last few months of 2016 as consumers use the site to get rid of unwanted holiday gifts.

5. Millennial market penetration is likely to increase:

- Approximately one-third of The RealReal’s consumers are millennials.

- Poshmark, a peer-to-peer apparel resale marketplace founded in 2011, has approximately 1.5 million sellers. The company claims that one in 50 women in the US sell secondhand items on its marketplace. Poshmark’s largest user demographic includes college students and millennials.

[caption id="attachment_90849" align="aligncenter" width="415"]

Source: Poshmark.com

Source: Poshmark.com[/caption]

Depop: Instagram Meets eBay

As re-commerce has evolved, social-media-type, peer-to-peer fashion resale marketplace apps have emerged, enhancing the online resale marketplace for customers to trade items. Meanwhile, opportunities remain for resale marketplaces serving niche categories, such as sneaker resales, or targeting specific demographic groups. Depop is a company that combines each of these elements.

Depop is a UK secondhand fashion app that was introduced in 2012. The app has about 5 million users, lists more than 1.5 million items monthly and sells more than 500,000 items monthly. The company raised $8 million in 2015.

Depop has been described as a cross between eBay and Instagram. The app is geared to teenagers and young adults. It is designed to look and function like a social media site rather than as an online store. Users can “like” and follow other users, rate their customer experience, send messages in order to bargain over the price of an item and leave comments about items that others list for sale. The app is easy to use and pictures often show clothing for sale modeled by the sellers themselves. Depop has no listing fees for new sellers and does not charge a sales commission.

The company says that teenagers are now buying merchandise at markets and used-clothing stores and reselling it on Depop and other fashion resale apps. According to the founder of Depop, one 14-year-old girl saw a necklace on eBay that she believed was priced too low. She took a screenshot and posted an advertisement for the same necklace, at a higher price, on Depop. When someone bid for the necklace on Depop, she bought the necklace on eBay and arranged for it to be sent to the Depop purchaser.

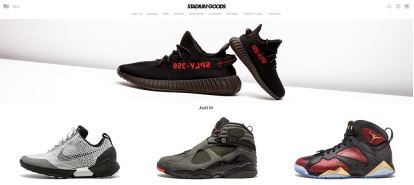

Niche Streetwear Resellers: Stadium Goods

Another growing subsection of the digital resale market is branded streetwear merchandise. The category includes baseball caps, hooded sweatshirts and sneakers; rare and limited-edition sports sneakers associated with certain athletes are especially popular.

New York–based Stadium Goods is an online reseller of rare sneakers, offering more than 15,000 pairs through its website. The company was founded in late 2015 and raised $4.6 million in its first financing round. Stadium Goods has partnerships with eBay and Tmall Global, which is an extension of Alibaba’s Tmall.com business.

[caption id="attachment_90850" align="aligncenter" width="414"]

Source: Stadiumgoods.com

Source: Stadiumgoods.com[/caption]

Key Takeaways

- The marketplace for online fashion resale continues to evolve rapidly. Following an initial wave of online fashion consignment startups, weaker players have gone out of business and stronger players have grown and attracted more investment funding to propel their further growth.

- A natural evolution has been seen in the introduction of social-media-type, peer-to-peer fashion resale apps, which are expected to attract more young buyers and sellers to the re-commerce market.

Source: Thredup.com[/caption]

Besides ThredUP, other major companies in the online re-commerce space in the US, the UK and Europe include Poshmark, Tradesy, The RealReal and Vestiaire Collective. We published our first deep-dive report on the online resale and consignment market in January 2016. That report profiled all five of these major re-commerce companies and their business models. Readers can find that report at bit.ly/FashionResale.

In this update, we discuss the continuing evolution and growth of the apparel re-commerce segment. We analyze market characteristics and the main players, and discuss five factors that are likely to boost the fashion re-commerce sector. Finally, we profile two new, niche-focused resale platforms, Depop and Stadium Goods.

Source: Thredup.com[/caption]

Besides ThredUP, other major companies in the online re-commerce space in the US, the UK and Europe include Poshmark, Tradesy, The RealReal and Vestiaire Collective. We published our first deep-dive report on the online resale and consignment market in January 2016. That report profiled all five of these major re-commerce companies and their business models. Readers can find that report at bit.ly/FashionResale.

In this update, we discuss the continuing evolution and growth of the apparel re-commerce segment. We analyze market characteristics and the main players, and discuss five factors that are likely to boost the fashion re-commerce sector. Finally, we profile two new, niche-focused resale platforms, Depop and Stadium Goods.

Source: Company reports/Fung Global Retail & Technology[/caption]

Despite continued investor funding interest, there is room for only one or two players in each subsector of the apparel resale market, as fashion re-commerce websites have to compete fiercely for both inventory and customers in order to benefit from economies of scale and achieve adequate profitability margins.

Source: Company reports/Fung Global Retail & Technology[/caption]

Despite continued investor funding interest, there is room for only one or two players in each subsector of the apparel resale market, as fashion re-commerce websites have to compete fiercely for both inventory and customers in order to benefit from economies of scale and achieve adequate profitability margins.

Source: VentureBeat/Women’s Wear Daily/Business of Fashion/Financial Times/Fung Global Retail & Technology[/caption]

Source: VentureBeat/Women’s Wear Daily/Business of Fashion/Financial Times/Fung Global Retail & Technology[/caption]

Source: Women’s Wear Daily/Fung Global Retail & Technology[/caption]

Source: Women’s Wear Daily/Fung Global Retail & Technology[/caption]

Source: Vestiaire Collective/Fung Global Retail & Technology[/caption]

3. Consumers see certain luxury products as investments, which supports the high-end resale segment:

Source: Vestiaire Collective/Fung Global Retail & Technology[/caption]

3. Consumers see certain luxury products as investments, which supports the high-end resale segment:

Source: Poshmark.com[/caption]

Source: Poshmark.com[/caption]

Source: Stadiumgoods.com[/caption]

Source: Stadiumgoods.com[/caption]