Introduction

A number of ultralow-price Europe-based retailers have been expanding in the US market. In this report, we review the progress of three of them: Primark, Aldi and Lidl.

- UK-domiciled Primark sells fast fashion and apparel basics at prices that are lower than those of most of its US competitors.

- Germany-headquartered grocery discounter Aldi has been in the US for four decades and has recently ramped up its expansion plans.

- Lidl, Aldi’s German rival and a newer entrant to the US market, emphasizes value with a proposition that is similar to Aldi’s.

Essential factors in the outcomes of these three retailers’ overseas endeavors include their expansion strategies, brand-building efforts and novelty of offerings.

Primark

US Arrival

UK-based Primark offers apparel, accessories, beauty, luggage and home goods. The retailer spans two growth sectors in fashion: discount and fast fashion. Primark can typically move products from design concept to shelf in six weeks, according to parent company Associated British Foods’ (ABF’s) 2017 annual report. Additionally, Primark offers basic clothing items sourced from Asia on longer lead times. The company’s range of private-label goods includes 13 sub-brands. Its flagship city-center stores average 40,000 square feet and are found in cities across 10 European countries as well as the US.

Primark broke into the US market in September 2015 with the opening of its flagship store at Boston’s Downtown Crossing and a distribution center of nearly 700,000 square feet in Bethlehem, Pennsylvania. The Boston store was destined for success among savings-seekers, as Primark’s prices undercut those of most incumbent discount retailers. The company underpriced H&M by 40% and Forever 21 by 20%, according to Bernstein analysts.

Primark generated $8.9 billion in global sales in the year ended September 2017. Of 345 total stores last year, 163 were located outside the UK. We calculate that those international stores each generated an average of $35.2 million in revenue in fiscal 2017, suggesting that Primark’s eight US stores could have seen a combined annual revenue run rate of $281 million.

Online Presence

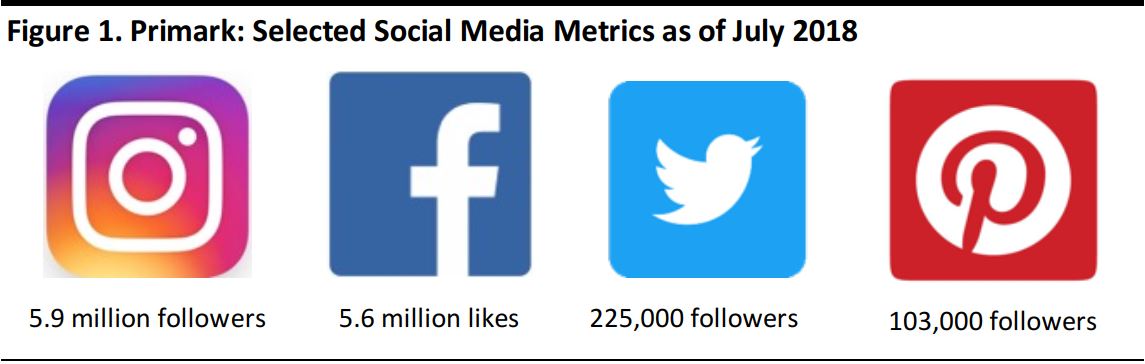

Primark is one of the few fashion retailers that have steered clear of e-commerce, but it uses its website and social media to drive brand awareness and footfall. The company’s website serves as a lookbook, featuring designs and prices but no purchasing options. Primark also does not generally advertise, relying on word-of-mouth promotion and social media marketing to connect with its follower base of over 11 million people. This approach would typically present a challenge for a company entering markets where brand awareness is minimal. However, Primark established a “new markets” team that spent two years researching and preparing before the company entered the US.

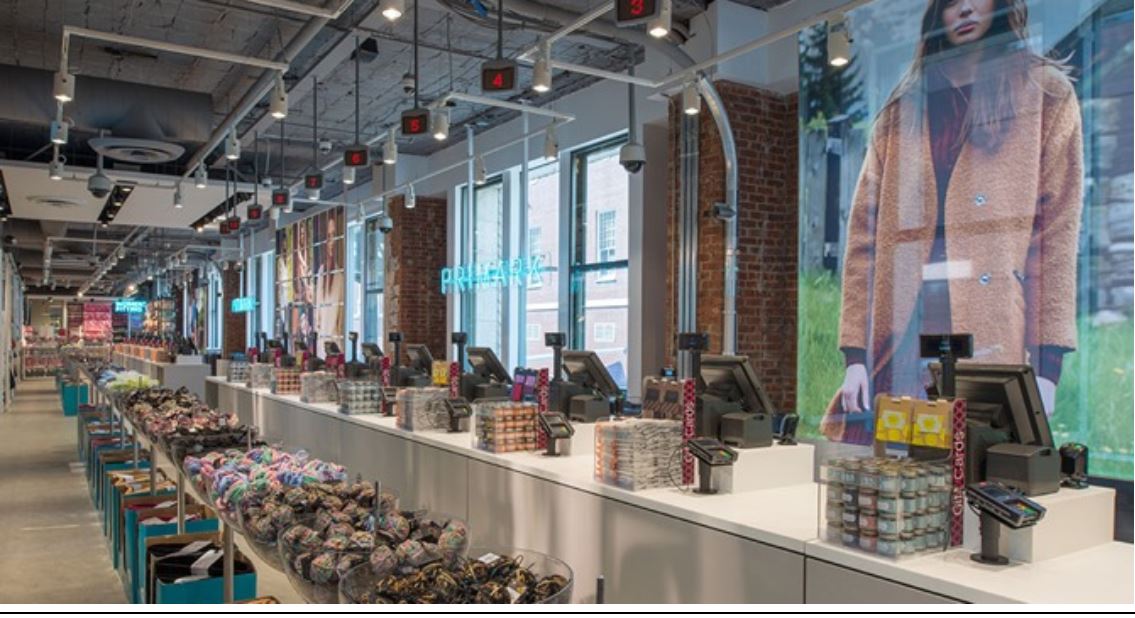

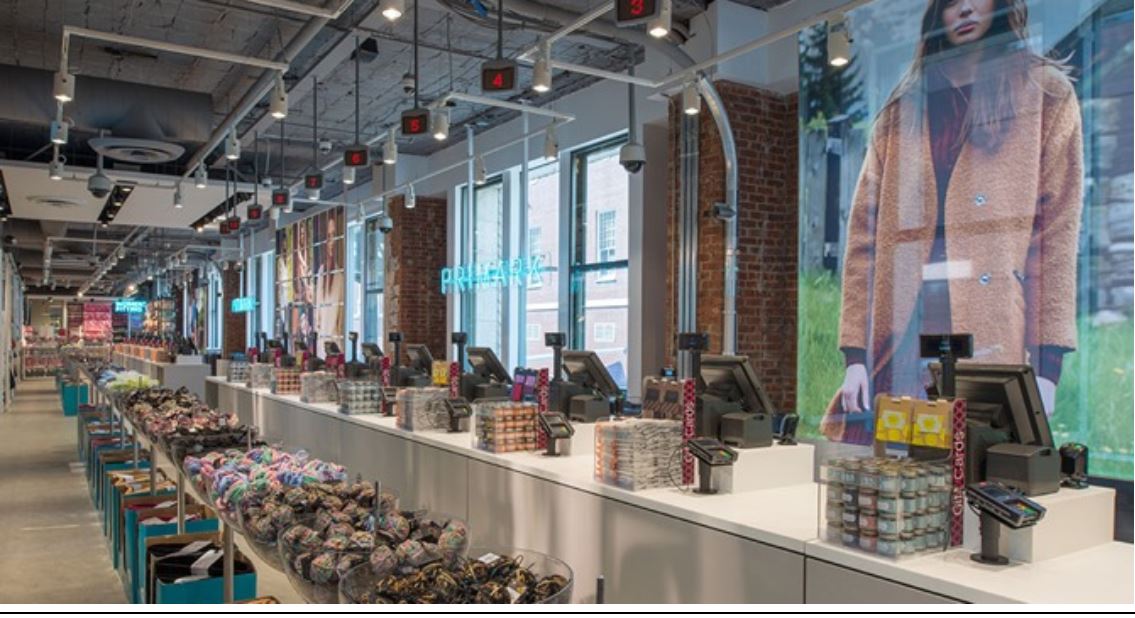

Primark’s Boston flagship store

Source: Dalziel-Pow.com

Primark’s Boston flagship store

Source: Dalziel-Pow.com

In addition to marketing through its own social media accounts, Primark established relationships with media outlets, influencers such as beauty bloggers and educational institutions to foster brand awareness. In an earnings call in April 2018, ABF CEO and Executive Director George Weston credited Primark’s overall retail sales growth to its social media engagement with customers, particularly on Instagram.

Source: Coresight Research

Source: Coresight Research

Primark’s most-liked Instagram posts 2018

Source: ABF.co.uk

Primark’s most-liked Instagram posts 2018

Source: ABF.co.uk

Store Strategy

Primark’s European markets and its US entry point of Boston share similarly dense populations, and similar cultures and climates, which simplified the company’s process of adapting to new consumers’ demands in the US. The retailer’s biggest footprint is in the UK, a market whose demands equipped the company well to serve New England. European store locations are situated on busy streets that see plenty of foot traffic, and the Northeastern US landscape provides a similar opportunity for high-street retail success. Located in Boston’s busy Downtown Crossing shopping district, the first US Primark store was well situated to attract customers.

The company maintains agility by leasing all its properties, many of them from Sears. This strategy will allow Primark to expand or contract its real estate in response to market success in the US. In 2016, the company opened four more stores in the US, bringing its US selling space to 322,000 square feet. The sustained success of the Boston flagship prompted Primark to expand the store by 20%, to 92,000 square feet, two years after opening. This expansion came as part of a company initiative to optimize, rather than solely expand, store sizes.

Around the same time, Primark announced in an earnings call that it would reduce each of three US stores to 35,000 square feet, which is slightly less than its worldwide average of 40,000 square feet (and that worldwide average includes a number of legacy smaller stores in the UK and Ireland). As of July 2018, Primark had reduced the size of its stores in Danbury, Connecticut, and Freehold, New Jersey.

Management attributed these downsizings to a desire to optimize the stores’ efficiency—which suggests a focus on driving up sales densities—and described the decision as indicative only of a newfound understanding of specific markets. The flagship location in Boston benefits from a larger store size because it is located on a high street, like most of Primark’s European stores are, and therefore draws in passersby and builds brand awareness. Other US locations are in shopping malls, where they are competing with dozens or hundreds of other stores.

The company’s square footage in the US is still increasing. Primark’s newest US store, which opened in Brooklyn, New York, in July, covers 60,000 square feet. Though this location is also in a mall, the store has great visibility from Flatbush Avenue, a major thoroughfare, and will likely benefit from its size more than other US mall locations would if they were the same size.

In addition to adjusting its real estate, the company has refined its US operating model. In lieu of European offerings that don’t resonate as strongly with US consumers, Primark stocks some different products in its American stores.

Source: Primark.com

Source: Primark.com

Primark offers different swimwear options in the UK (Ibiza) and the US (Vitamin Sea).

Source: Primark.com

Primark offers different swimwear options in the UK (Ibiza) and the US (Vitamin Sea).

Source: Primark.com

Outlook

Primark remains confident about the US market potential, although it continues to move with great caution. The company plans to venture beyond the Northeast in 2019 and open a location in Sawgrass Mills, an outlet mall in Sunrise, Florida. The location marks a significant change from the mall and city-center locations that Primark has chosen for its US stores so far. However, Sawgrass Mills is the second-biggest attraction in Florida (after Disney World) and sees 45 million shoppers per year. Primark anticipates that the store’s location, alongside other low-price stores in the outlet mall, will drive brand awareness in the new region. Given the extremely high volume of foot traffic that Sawgrass Mills sees, in a suburban location no less, this endeavor could pave the way for Primark to establish itself in the US outside the Northeast.

Sawgrass Mills, and outlet mall located in Sunrise, Florida

Source: Simon.com

Sawgrass Mills, and outlet mall located in Sunrise, Florida

Source: Simon.com

Primark appears to have timed its US foray well to establish a loyal following: American shoppers’ interest in long-standing midmarket retailers appears to be dwindling and there is a growing bifurcation in performance between the discount and luxury segments. Shoppers who visit US Primark stores often give them great reviews, but in many US regions, Primark remains unknown to shoppers, particularly those who don’t frequent malls or use social media.

The cultural and climatic similarities between Primark’s largest markets in Europe and its point of entry in the US have helped the company make the jump overseas. However, it has been cautious in the US, opening new stores slowly and only expanding the Boston location after repeated years of success. The company has recently undertaken a riskier endeavor with its plans for a Florida store, but the outlet mall format of that location should drive brand awareness in a suburban area where foot traffic is sparse.

Aldi

Discounting

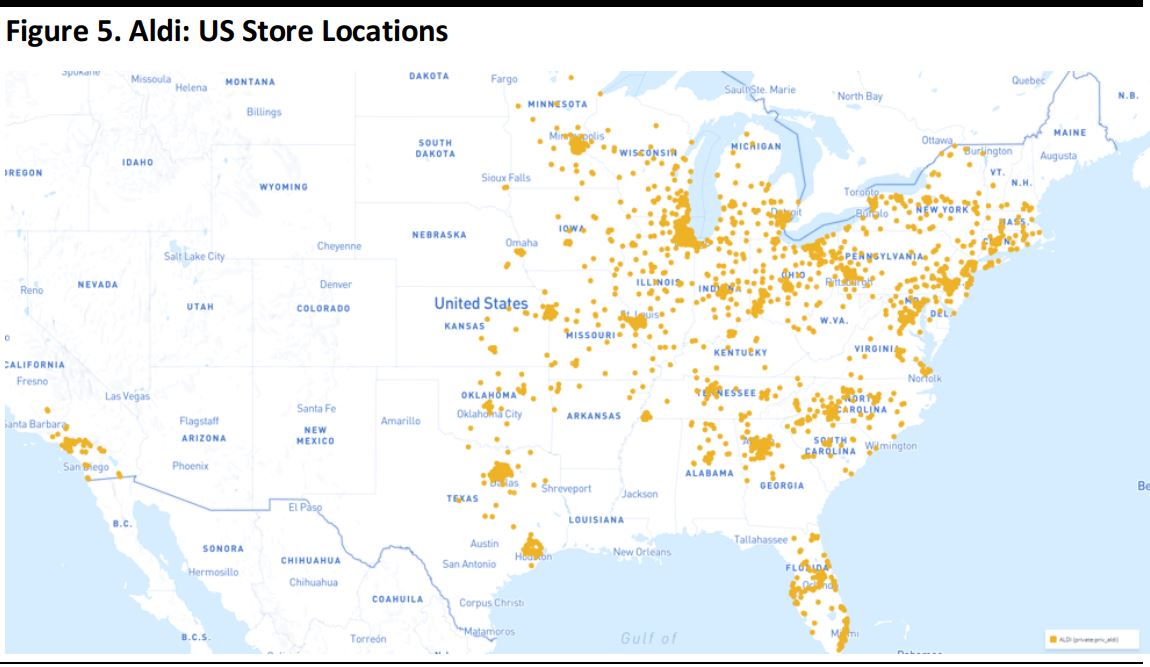

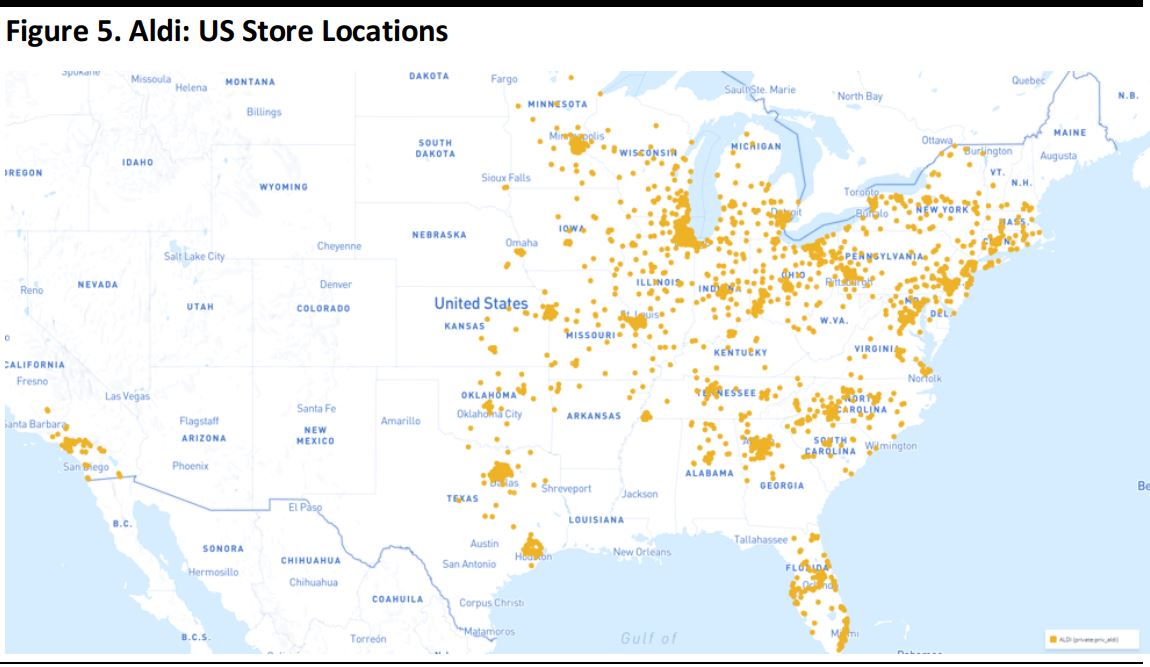

With national operations based in Illinois, Aldi entered the US in 1976, and it now operates almost 1,800 locations across 35 states. Serving over 45 million customers per month, Aldi’s no-frills setup allows the grocer to underprice its competition. It offers around 2,500 grocery and household products, including produce, baked goods, packaged foods, general merchandise and a seasonal section. Largely made up of private-label items, more than 90% of the goods Aldi carries are exclusives, according to the company.

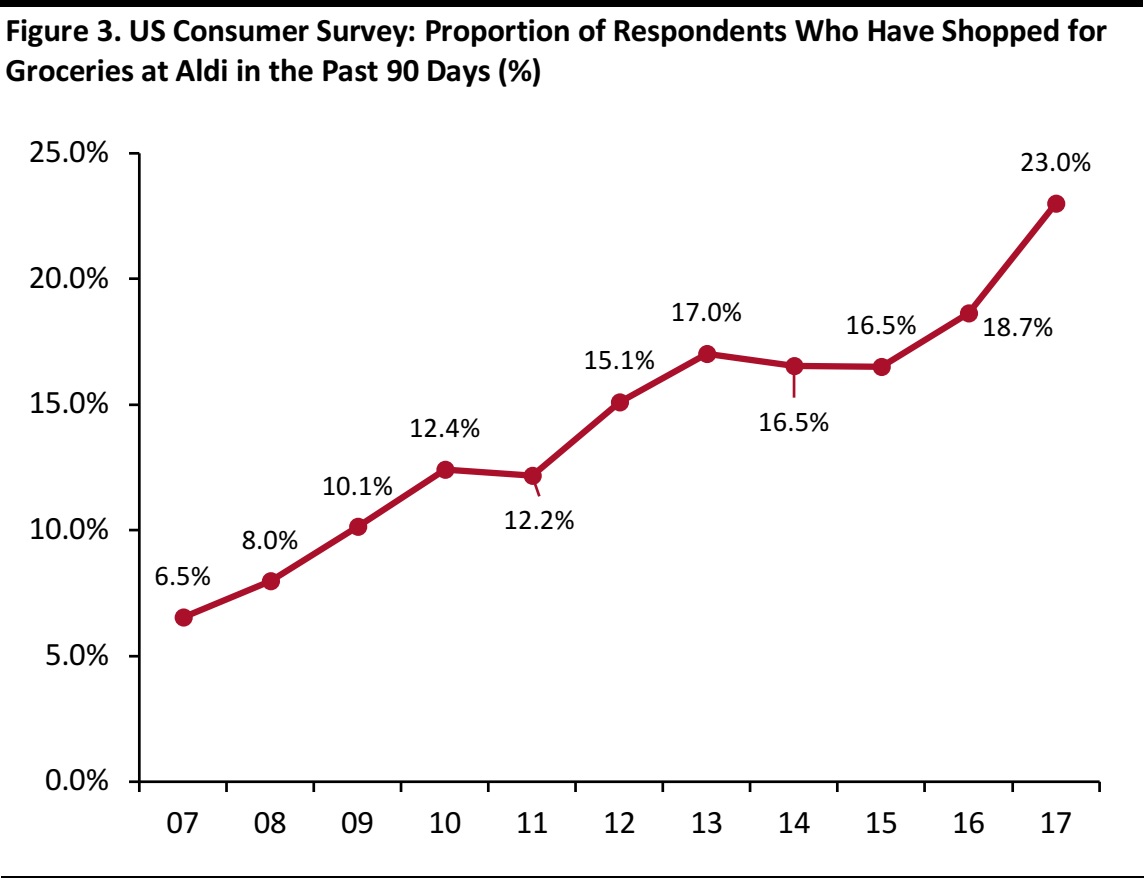

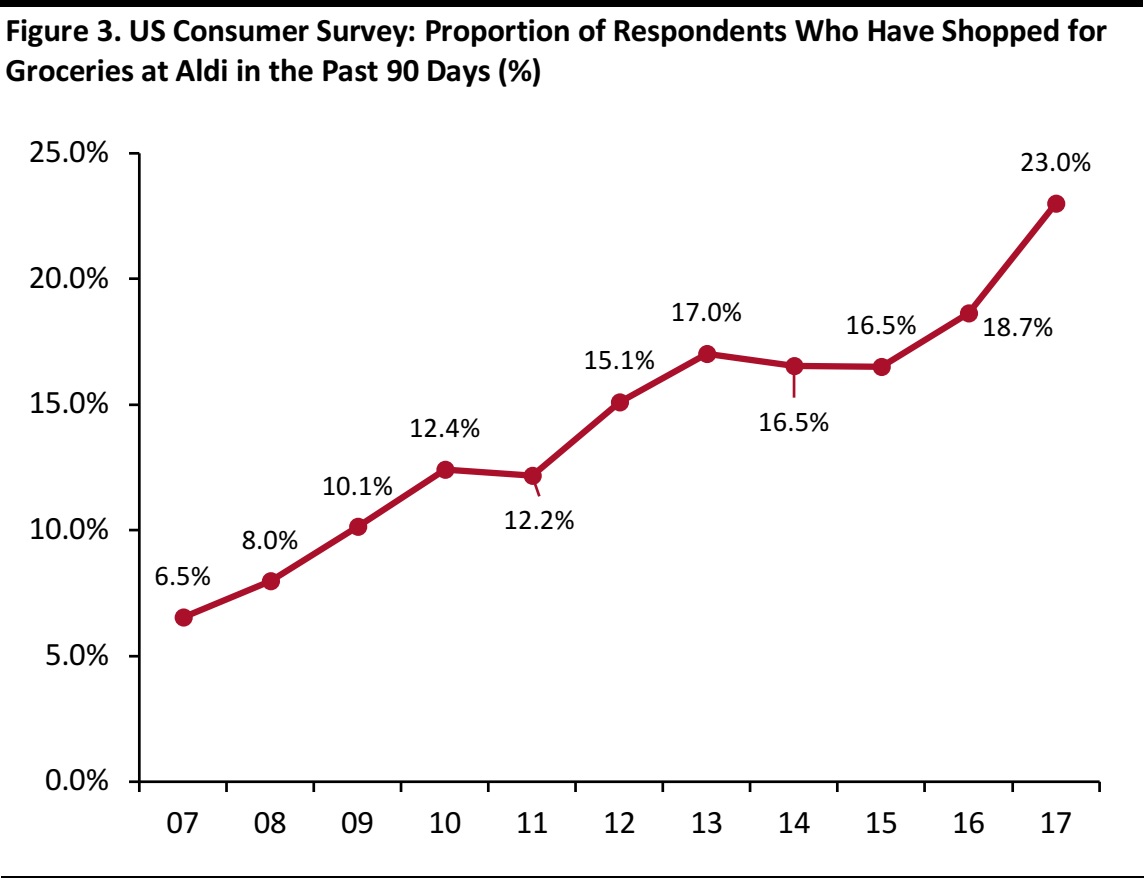

Euromonitor International estimates that Aldi generated US revenues of just under $15 billion in 2017. Prosper Insights & Analytics’ US consumer surveys indicate that Aldi is the second-most-shopped retailer for groceries in the US, behind only Walmart: in Prosper’s August 2017 survey (latest), 23% of US respondents said that they had bought groceries from Aldi in the past 90 days.

Source: Aldi.us

Source: Aldi.us

Aldi cuts costs through operational efficiencies and by eliminating traditional grocery store amenities. And those efficiencies are evident to shoppers visiting Aldi’s US stores: shoppers bag their own groceries and make a refundable deposit of $0.25 to use a grocery cart, saving Aldi from having to hire employees to gather carts from parking lots. US stores also have no deli or bakery counters, although they do sell prepackaged deli and bakery items. Many products are offered in shelf-ready packaging that cuts the time needed to refill shelves.

Source: Aldi.us

Source: Aldi.us

Aldi’s business model differs from most of its US-based competitors’ in the discount grocery space. Competitors average 40,000–50,000 SKUs versus Aldi’s roughly 2,500, the majority of which are private labels. A highly limited product offering channels volumes through a smaller number of products, allowing the retailer to offer those products at a high quality level and at very low prices. At around 10,000–11,000 square feet each, Aldi’s stores are more comparable to US drugstores than they are to grocery competitors’ stores. According to Business Insider and Aldi US, Aldi’s prices are estimated to be 30%–50% lower than competitors’ prices.

Trader Joe’s utilizes a similar low-price strategy focused on private-label products. It’s owned by the Albrecht Family Trust, which owns Aldi Nord, one half of the worldwide Aldi empire (Aldi Süd, the other half, operates US Aldi stores).

Source: Aldi.us/Kroger.com/Walmart.com/Statista

Developments

Aldi has adapted its US ranges to take them beyond traditional, basic discount offerings. In 2014, the company introduced SimplyNature, a line of organic packaged products, and LiveGfree, a collection of gluten-free goods. In 2016, Aldi unveiled a full line of private-label baby products called Little Journey. The next year, vegetarian and vegan line Earth Grown hit Aldi’s aisles. Its stores include some brand-name products, such as Gatorade, Pepperidge Farm Goldfish and Pringles.

Aldi private labels Choceur and Moser Roth sit alongside US consumers’ brand-name favorites in Aldi’s US stores.

Source: Aldi.us

Aldi private labels Choceur and Moser Roth sit alongside US consumers’ brand-name favorites in Aldi’s US stores.

Source: Aldi.us

Aldi has quickly adopted new technologies to enhance the customer experience. US stores now accept contactless payment, which speeds up checkout. A growing number of locations are also partnering with Instacart to deliver groceries to customers’ doors: shoppers in the Atlanta, Los Angeles, Dallas and Chicago areas, which encompass hundreds of stores, currently have access to this service.

Outlook

The future of Aldi in the US looks promising. The company started with a cautious approach, originally opening fewer than 25 stores a year in the US. Since 2012, the company’s US sales have been growing at a rate of 11.3%, according to Euromonitor, and, as charted below, Aldi’s shopper numbers have also grown very strongly over the past decade.

Base: 5,000+ US Internet users ages 18+, surveyed in August of each year

Base: 5,000+ US Internet users ages 18+, surveyed in August of each year

In early 2017, Aldi announced plans to open 900 new stores over the next five years, to reach a target of 2,500 US stores by 2022, which would make it the third-largest grocer in the country by number of stores. This announcement came only days before Aldi rival Lidl introduced its own plans to enter the US market.

Aldi says that it has seen a 60% increase in its monthly US customer base since 2013. Customer loyalty has continued to grow year over year for eight years in a row, according to Market Force Information’s

US Grocery Benchmark Study, conducted in April 2018. Consumers surveyed by the firm ranked Aldi as their fourth-favorite US grocery store, and Aldi is the only company out of the top five to have seen year-over-year loyalty score increases.

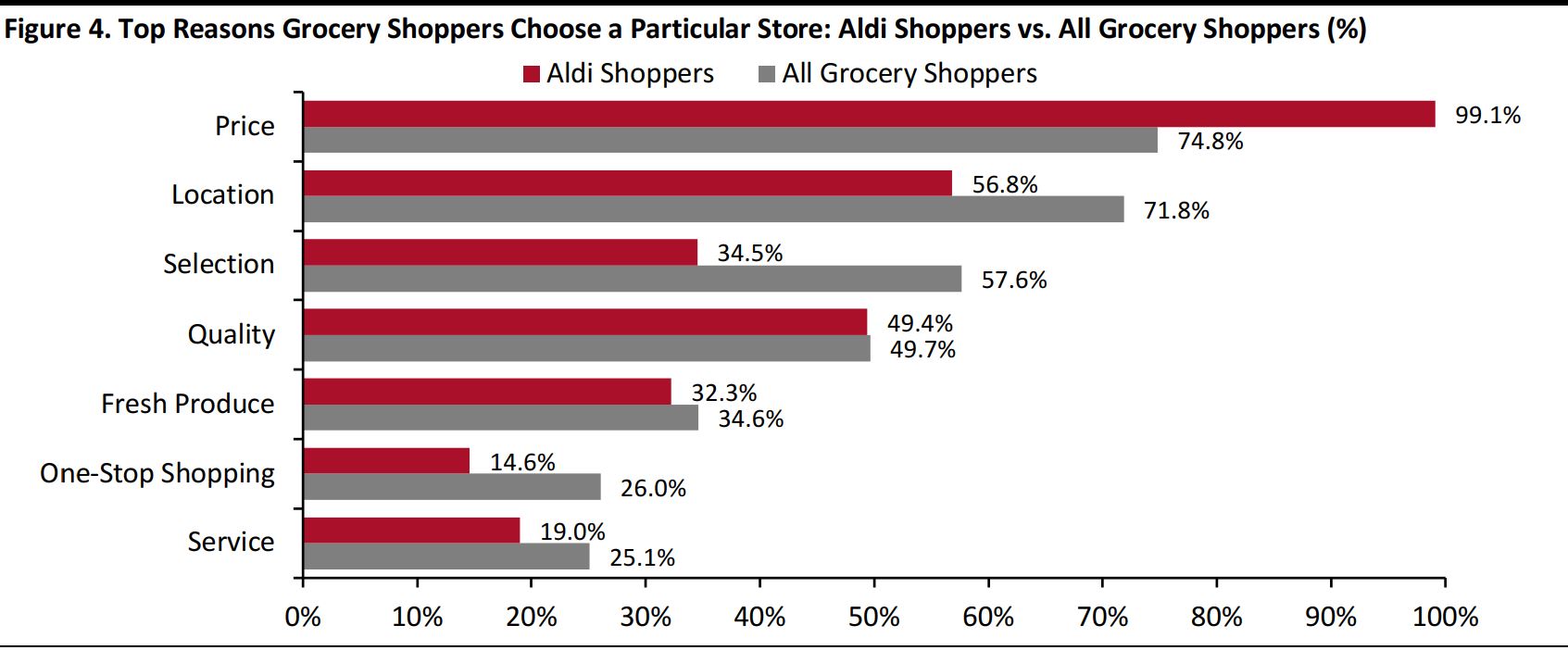

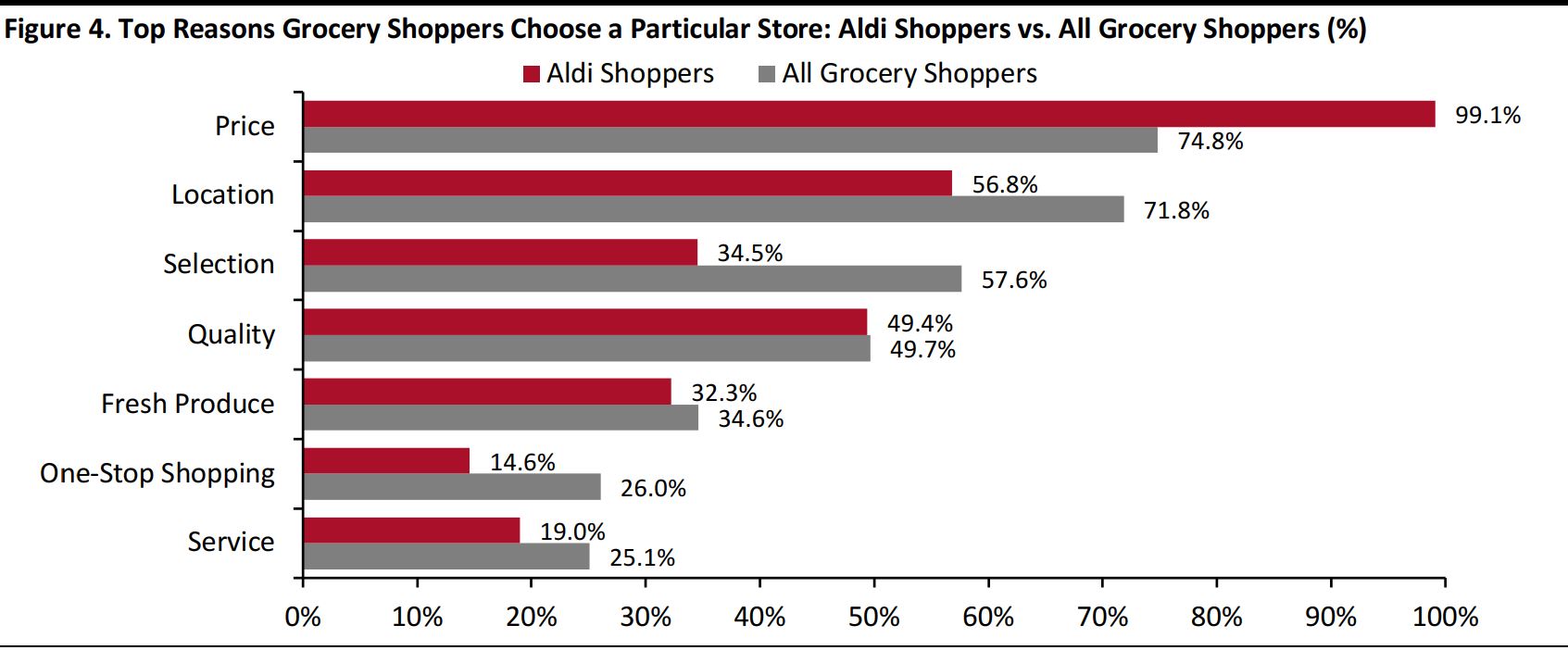

We show below the top reasons why Aldi shoppers buy groceries from the retailer, according to Prosper’s latest survey. Fully 99% of those shoppers cited price.

Survey participants responded to “What are the reasons you buy your groceries there?”

Base: 7,248 US Internet users ages 18+, surveyed in August 2017

Source: Prosper Insights & Analytics

Survey participants responded to “What are the reasons you buy your groceries there?”

Base: 7,248 US Internet users ages 18+, surveyed in August 2017

Source: Prosper Insights & Analytics

Figure 5. Aldi: US Store Locations

Source: Thinknum

Lidl

Market Entry

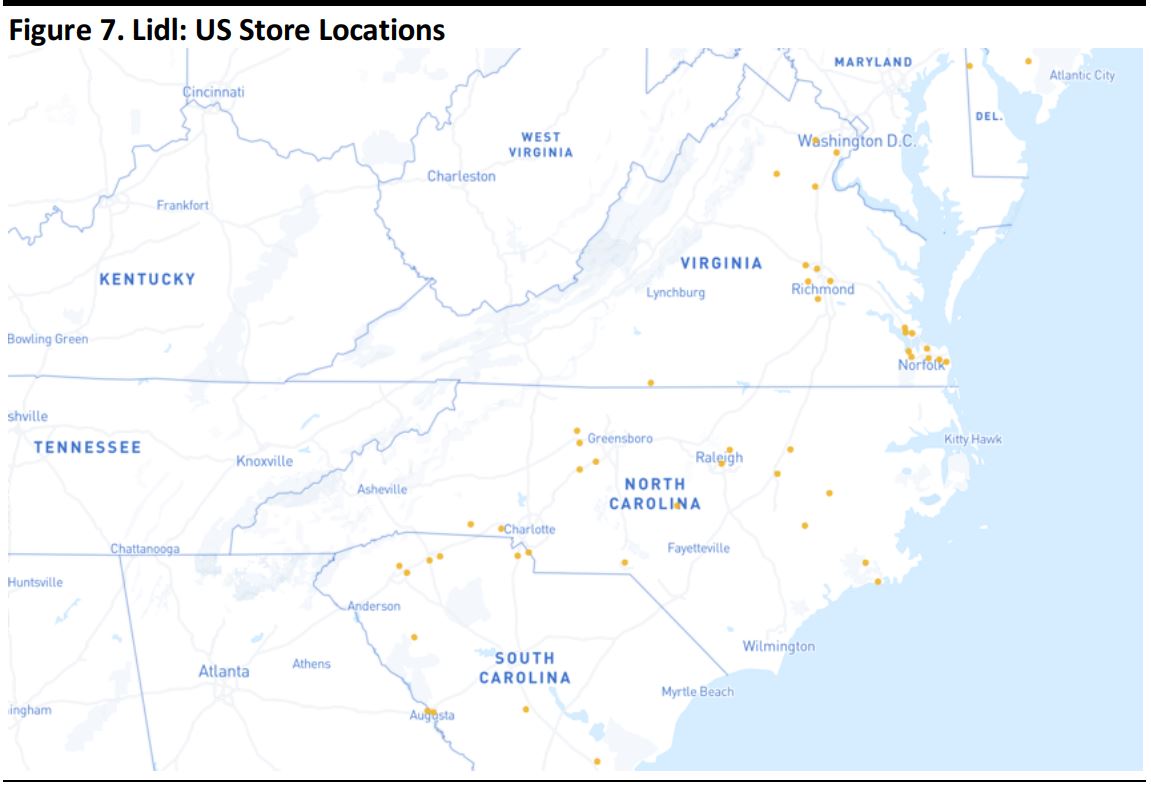

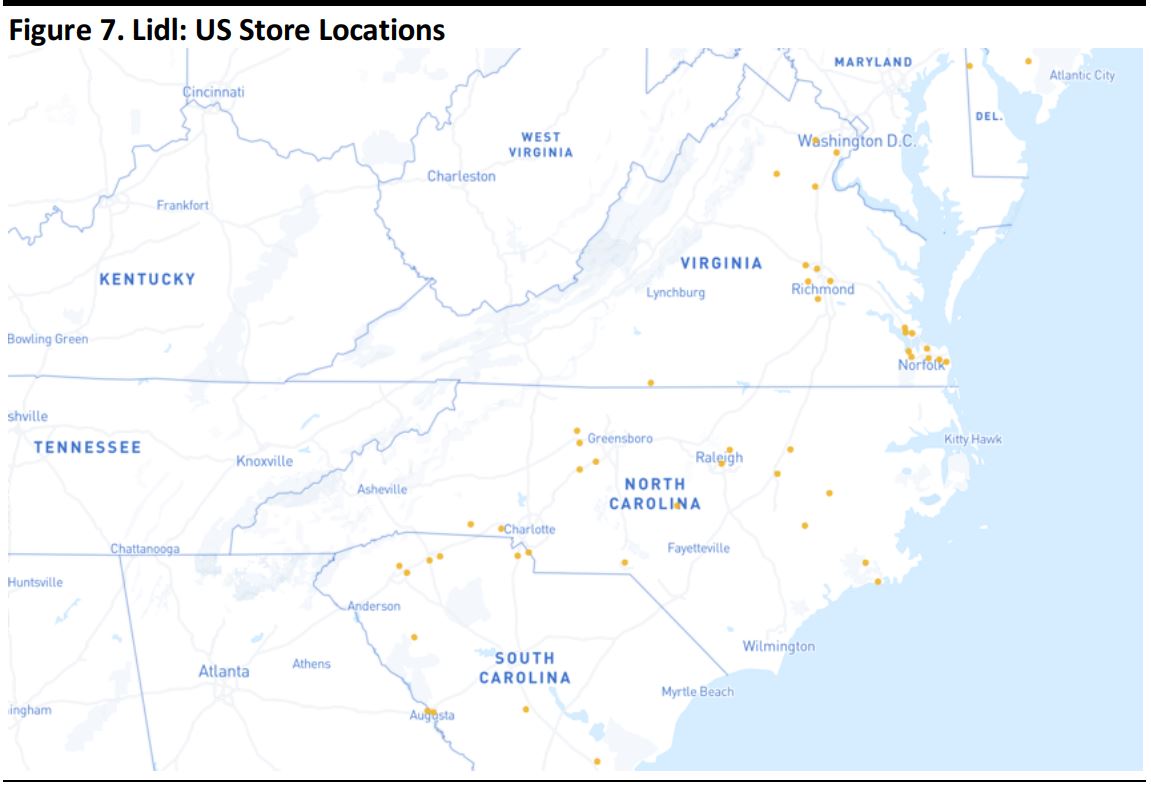

After establishing US headquarters in the summer of 2015, German grocery discounter Lidl opened its first US stores in Virginia, North Carolina and South Carolina in 2017. Like its long-standing rival Aldi, Lidl carries mostly private-label products; nearly 90% of Lidl’s products are private label, according to German news site Deutsche Welle, although it has tended to lead Aldi in terms of introducing third-party brands to the grocery discount format. Lidl’s US stores are larger than Aldi’s, and they feature more amenities, including in-store bakeries and a greater focus on fresh produce.

Source: Lidl.us

One way Lidl tries to win shopper loyalty is with its wine offerings. In many countries of operation, including the US, Lidl employs a Master of Wine who curates selections and implements a rating system to help shoppers pick wines they will like. Sold at up to 50% less than competitors’ similar products, Lidl’s US private-label wines won a number of medals at the Los Angeles International Wine Competition in 2017, its first year of operation in the US. Since it hasn’t had many years to build customer loyalty in the US, Lidl has turned to product awards to highlight the quality of its offerings in categories such as wine and dairy and, so, build a reputation.

Source: SanfordHerald.com

Source: SanfordHerald.com

When it entered the US market, Lidl strayed from its long-standing format, most notably by choosing to operate much bigger stores. Lidl’s first US stores are approximately 36,000 gross square feet and typically have 21,000 square feet of net selling space, according to a February 2017

Washington Post interview with Brendan Proctor, who was Lidl’s US CEO at the time. That means that Lidl’s US stores have approximately 40% more selling space than its biggest European stores (which are 15,000 square feet) and roughly twice as much selling space as its typical store worldwide.

These big US stores carry around 4,000 SKUs, according to Bernstein estimates, more than double the number of SKUs offered in the company’s stores in Europe. Lidl offers up to about 1,700 SKUs in countries such as the UK and Italy, and even fewer in stores elsewhere in Europe.

Relationship with Rivals

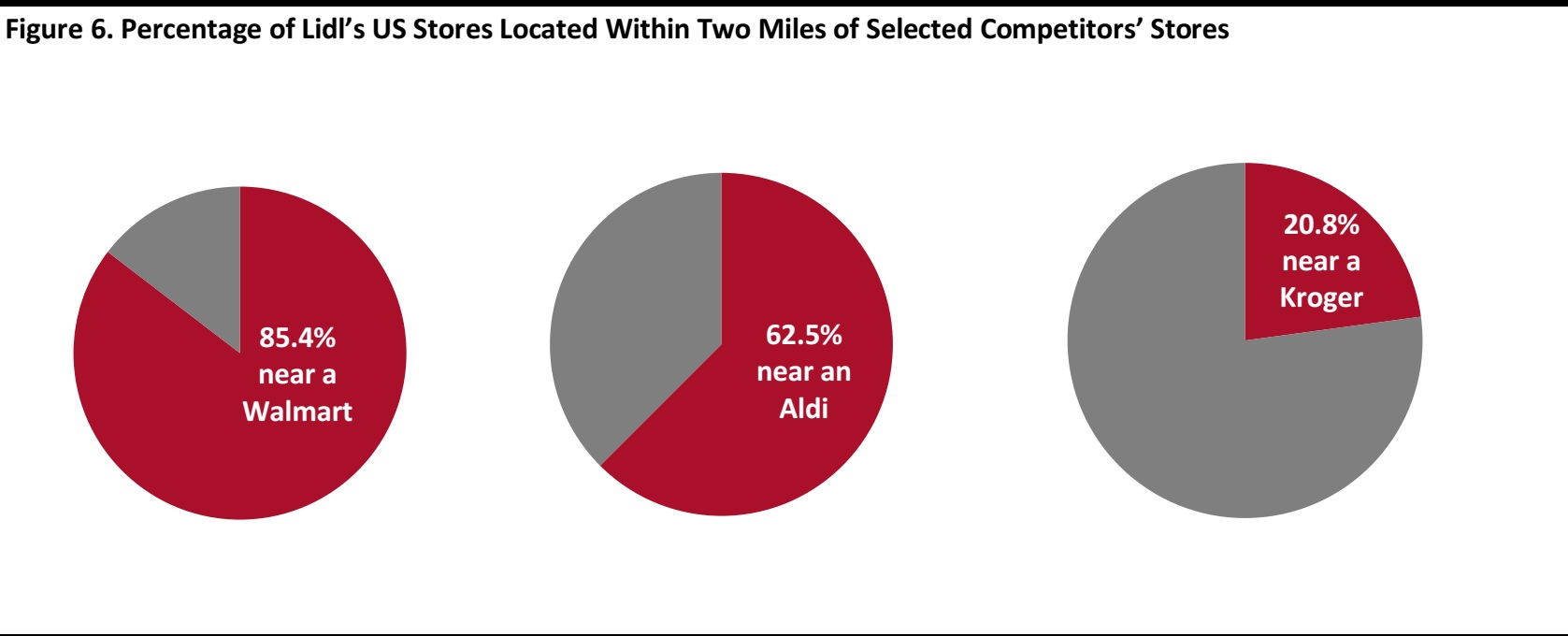

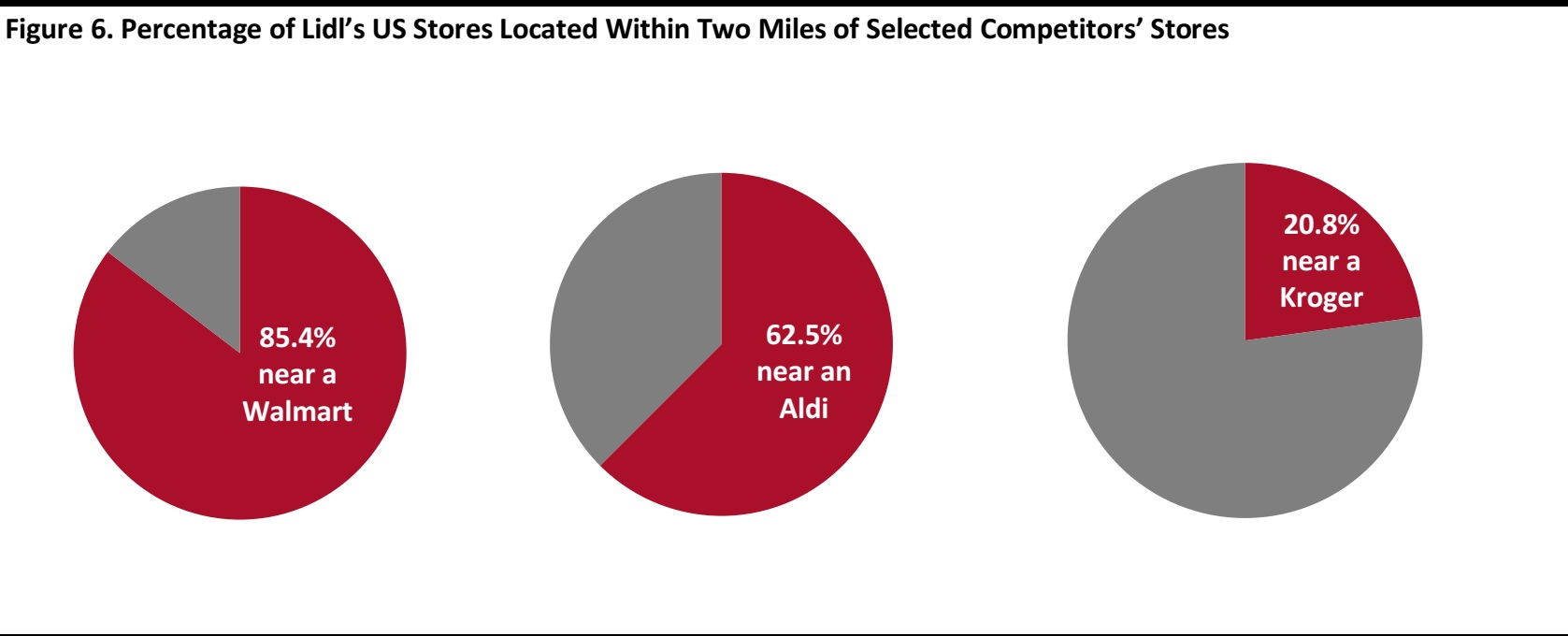

Our analysis of store-location data suggests that Lidl’s US market entry was predicated on locating stores close to those of budget retail rivals. Fully 62.5% of Lidl’s first 48 US stores were located within two miles of an Aldi store and 85.4% were within two miles of a Walmart. The high rate of proximity to Walmart stores may be partially attributable to that chain’s overall prominence, but Lidl’s proximity to Aldi stores suggests an attempt by Lidl to piggyback on consumers’ familiarity with, and demand for, Aldi’s proposition. Moreover, Lidl’s large, glossy stores could be interpreted as an attempt to upstage Aldi with an enhanced discount experience and, so, entice shoppers away from Aldi.

Lidl’s store overlap with nondiscount grocer Kroger is much less meaningful: just 20.8% of Lidl’s US stores are located within two miles of a Kroger store.

Source: Thinknum/Coresight Research

Source: Thinknum/Coresight Research

US grocery incumbents responded to Lidl’s threat when the discounter entered the US market. Kroger and Walmart immediately cut their prices at locations near Lidl stores. Attacking Lidl’s private-label strategy, Kroger sued Lidl two weeks after its US opening for trademark infringement. One of Lidl’s private-label brands, which allow the grocer to outprice competition, is called “Preferred Selection.” Kroger argued that the name resembled Kroger’s “Private Selection” and would lead consumers to think the brands were associated. After filing claims in July, Kroger dropped the case in September 2017.

Source: Prosper Insights & Analytics

Source: Prosper Insights & Analytics

Adjustments

In May 2018—less than a year after Lidl’s US launch—the company replaced its US President and CEO of two years, Brendan Proctor, with Johannes Fieber, who had been with the company across multiple countries for 10 years. In January 2018, Klaus Gehrig, the CEO of Lidl’s parent firm, Schwarz Group, told Germany’s

Manager Magazin, “If one recognizes a mistake, one must correct it.” According to German trade publication

Lebensmittel Zeitung, Gehrig had been critical of the “glass palaces” that Lidl had planned for the US since early 2017. And in the year following its US launch, the chain adjusted its real estate strategy:

- Seven months after its first store openings, Lidl switched its real estate search to smaller stores in more densely populated areas: it is now seeking sites of 15,000–25,000 square feet instead of the 36,000 square feet it originally planned.

- It is not just the size of Lidl’s planned stores that has changed, but also their locations. Lidl’s latest property advertisements ask for leased sites with “national cotenants”—in other words, the company is looking to lease stores in existing shopping centers rather than stand-alone sites. These centers include outdoor shopping centers, but Lidl is soon to open a store in the newly extended Staten Island Mall in New York.

- Lidl is also refining its catchment areas. It originally sought locations with high population densities within three miles, but it’s currently looking to locate stores that have high-density areas within two miles.

The latest store formats suggest that Lidl stores will look more familiar to existing Aldi shoppers—and smaller stores imply greater operational leverage, as sales are channeled through fewer product lines in a context of lower operating cost per store.

Source: GoUpstate.com

Source: GoUpstate.com

In the spring of 2017, Lidl US announced a plan to open 100 stores on the East Coast by the summer of 2018. The company severely undershot this target, as only 53 US locations were open as of the end of June 2018. This midyear figure is an increase of just five from the start of 2018, when Lidl had 48 US stores. The company has delayed some store openings by more than six months and has even canceled land purchases. Its competitors have capitalized on Lidl’s collapsed plans. In May 2018, when Lidl backed out of plans for a 35,000-square-foot store on 4.4 acres in Decatur, Alabama, Aldi announced a plan to expand its own Decatur store by 30%.

Outlook

Despite Lidl’s efforts to locate stores near those of its budget rivals, its large stand-alone early stores apparently struggled to pull in crowds on a continent where it had no brand recognition. Its new real estate approach of leasing stores in established shopping centers with existing shopper traffic should support footfall. Ambitious initial plans for store openings show how Lidl tried to catch up with Aldi—and even outshine it in terms of its store offering—but Aldi’s US growth began at a more sustainable pace that allowed it to establish a US customer base over several decades.

Lidl is arguably the most successful grocery discounter in the world, and that is partially due to its willingness to adapt its proposition: the company led in the introduction of branded goods and it has shown flexibility in terms of tailoring its offering to nontraditional markets in Europe. We expect Lidl to show similar flexibility in the US market and to continue to adjust its strategy as it seeks to win share over the long term.

Key Takeaways

Primark has taken a highly cautious approach to US expansion, and the downsizing of two of its stores suggests that not all of its efforts have yielded the results it had hoped for. However, its global strategy of focusing international openings on glossy, high-traffic flagships aligns with the limited number of openings seen so far in the US: Primark aims to be a destination store, rather than a retailer with a store in every mall.

Aldi has proven highly successful in the US market, but it has built its reputation over four decades. It is now leveraging that accumulated brand awareness and shopper trust with an aggressive expansion plan apparently designed in part to undercut Lidl’s move into the US.

Lidl has clearly faced challenges in the US market. What is notable is that these difficulties have come despite a significant softening of its discount proposition for American shoppers. Also, it now appears to be reverting to a more traditional small-store discount format while seeking out shopper traffic by opening stores in shopping centers. Aldi’s success suggests that there is a market for no-frills, discount grocery stores in the US. Worldwide, Lidl has been a tremendously successful grocery discounter, and much of its success has been built on the flexibility it has shown in its approach to US markets. We expect Lidl to stay the course in the US and adjust its proposition in the country just as it has in many other markets.

Primark’s Boston flagship store

Source: Dalziel-Pow.com

Primark’s Boston flagship store

Source: Dalziel-Pow.com Source: Coresight Research

Source: Coresight Research Primark’s most-liked Instagram posts 2018

Source: ABF.co.uk

Primark’s most-liked Instagram posts 2018

Source: ABF.co.uk Source: Primark.com

Source: Primark.com Primark offers different swimwear options in the UK (Ibiza) and the US (Vitamin Sea).

Source: Primark.com

Primark offers different swimwear options in the UK (Ibiza) and the US (Vitamin Sea).

Source: Primark.com Sawgrass Mills, and outlet mall located in Sunrise, Florida

Source: Simon.com

Sawgrass Mills, and outlet mall located in Sunrise, Florida

Source: Simon.com Source: Aldi.us

Source: Aldi.us Source: Aldi.us

Source: Aldi.us

Aldi private labels Choceur and Moser Roth sit alongside US consumers’ brand-name favorites in Aldi’s US stores.

Source: Aldi.us

Aldi private labels Choceur and Moser Roth sit alongside US consumers’ brand-name favorites in Aldi’s US stores.

Source: Aldi.us Base: 5,000+ US Internet users ages 18+, surveyed in August of each year

Base: 5,000+ US Internet users ages 18+, surveyed in August of each year Survey participants responded to “What are the reasons you buy your groceries there?”

Base: 7,248 US Internet users ages 18+, surveyed in August 2017

Source: Prosper Insights & Analytics

Survey participants responded to “What are the reasons you buy your groceries there?”

Base: 7,248 US Internet users ages 18+, surveyed in August 2017

Source: Prosper Insights & Analytics

Source: SanfordHerald.com

Source: SanfordHerald.com Source: Thinknum/Coresight Research

Source: Thinknum/Coresight Research Source: Prosper Insights & Analytics

Source: Prosper Insights & Analytics Source: GoUpstate.com

Source: GoUpstate.com