Introduction

Traditional brick-and-mortar retailers’ challenges over the past decade have created numerous opportunities for less-conventional retailers to thrive both offline and online. This report focuses on DX, a nontraditional off-price retailer in China, and examines its approach to success in a new shopping era. The young, fast-growing company began as an experimental foray into off-price retail in the controlled environment of the Fung Group’s Shanghai Explorium, a testing space for innovative retail strategies that is open only to Fung employees. At the Explorium, DX sought to discover whether multibrand, multicategory stores offering heavy discounts could succeed in China. DX’s success at the Explorium allowed it to expand to all regions of China in just a matter of months after its inception in January 2016.

Today, DX uses a combination of pop-up stores, permanent locations and a developing mobile retail presence to sell name-brand goods at up to 85% off standard retail price (SRP). Here, we detail and analyze DX’s business model, and examine how it fits into the larger context of retail developments in both China and the US.

An Introduction to DX Quality Outlet

The Beginning

DX began not simply as a clothing store, but as a venue for marketing experiments and observation of customer behavior. Conceived and owned by the Fung Group, DX first opened inside the Shanghai Explorium, the Fung Group’s testing ground for experimental new retail strategies and products. In this controlled environment, which is open only to Fung Group employees, the developers of DX sought to determine whether off-price retail, a sector so successful in the US and so underdeveloped in China, would be attractive to Chinese consumers. At the Explorium, DX was able to experiment with different social media marketing techniques, discount strategies and product mixes to find the most suitable approach and products for selling off-price in China.

After a successful and informative tenure at the Explorium, DX expanded quickly to other locations in China, amassing more than 70 stores across two dozen Chinese cities within only a year.

The Products

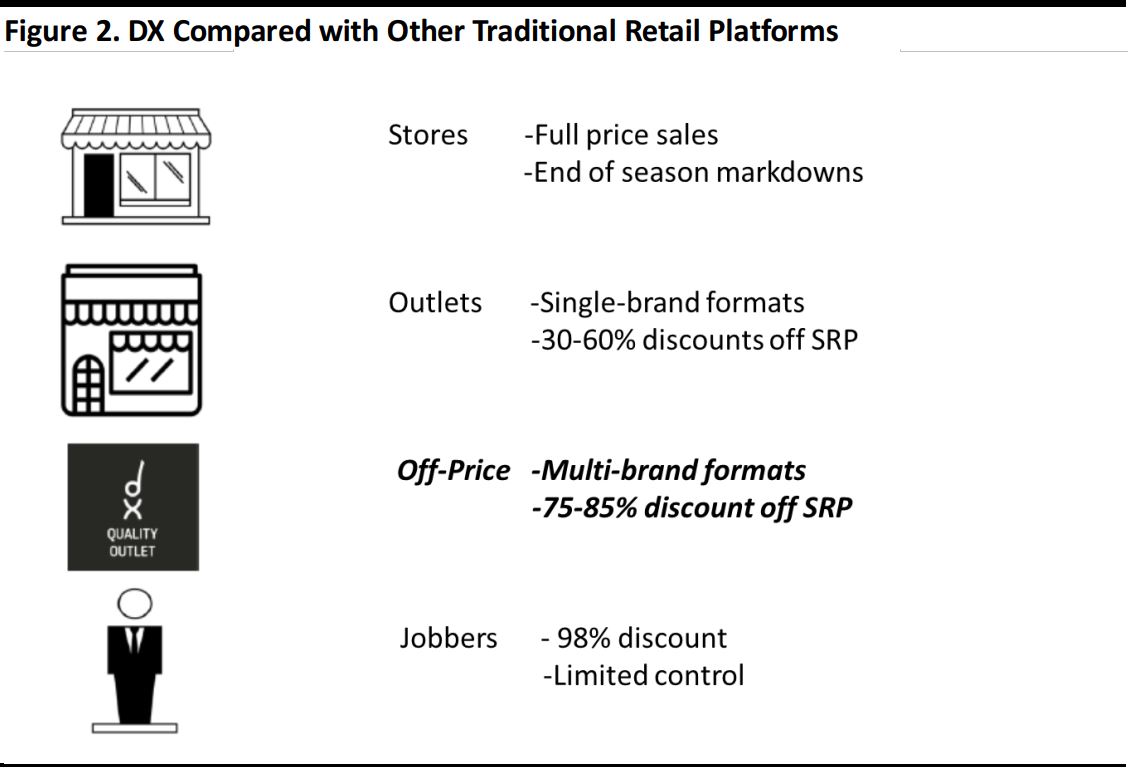

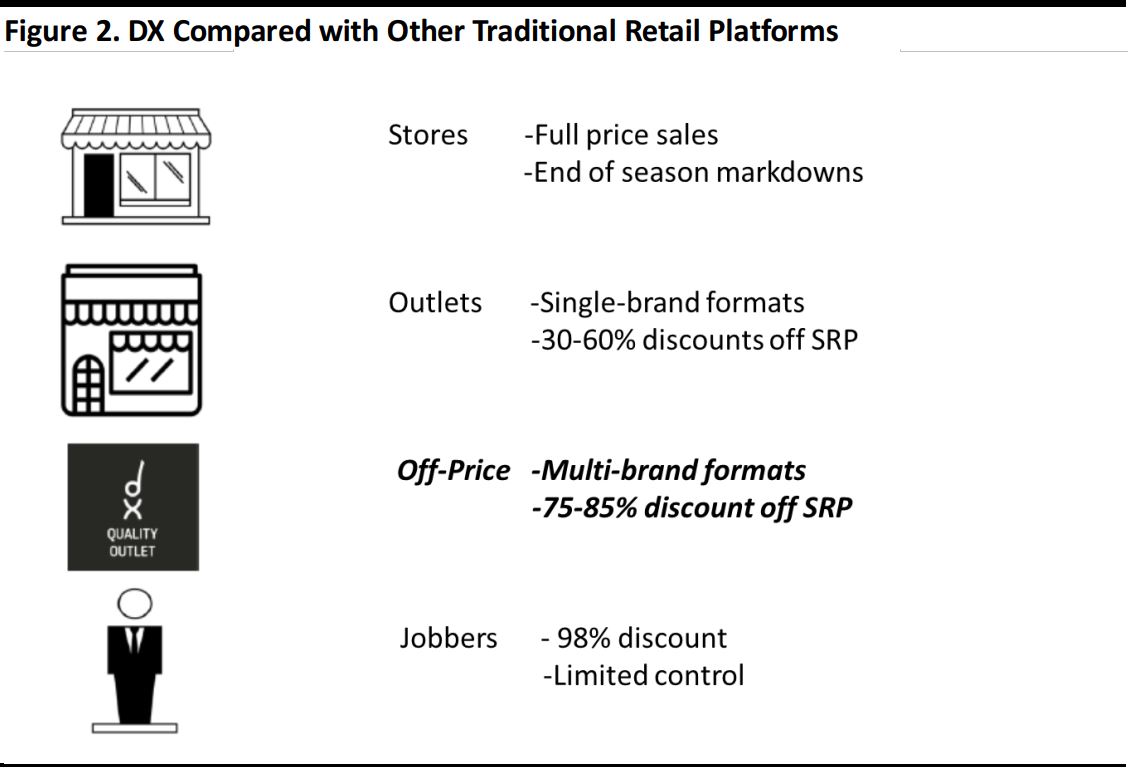

DX sells apparel, footwear, luggage, bags and accessories, like many other fashion retailers. It differentiates itself in how it acquires its merchandise and the price and variety it offers to consumers. DX sells goods purchased from midmarket and upscale brands that transfer canceled orders, overmakes, excess end-of-season stock, aged inventory and distributor returns to DX at a 90%–95% discount to SRP (Suggested Retail Price). Unlike traditional outlet stores, DX can offer a wide variety of brands at each of its locations, broadening its potential customer base. DX’s ability to purchase heavily discounted, high-quality items enables it to offer consumers discounts of 75%–85% off SRP, providing outlet-level prices with department-store variety. The figure below details how DX’s business model differs from other traditional retail platforms.

Source: DX Quality Outlet

Source: DX Quality Outlet

The Sales Platform

DX offers its products through a variety of platforms: pop-up stores, permanent stores and a growing mobile retail presence.

Pop-Up Stores

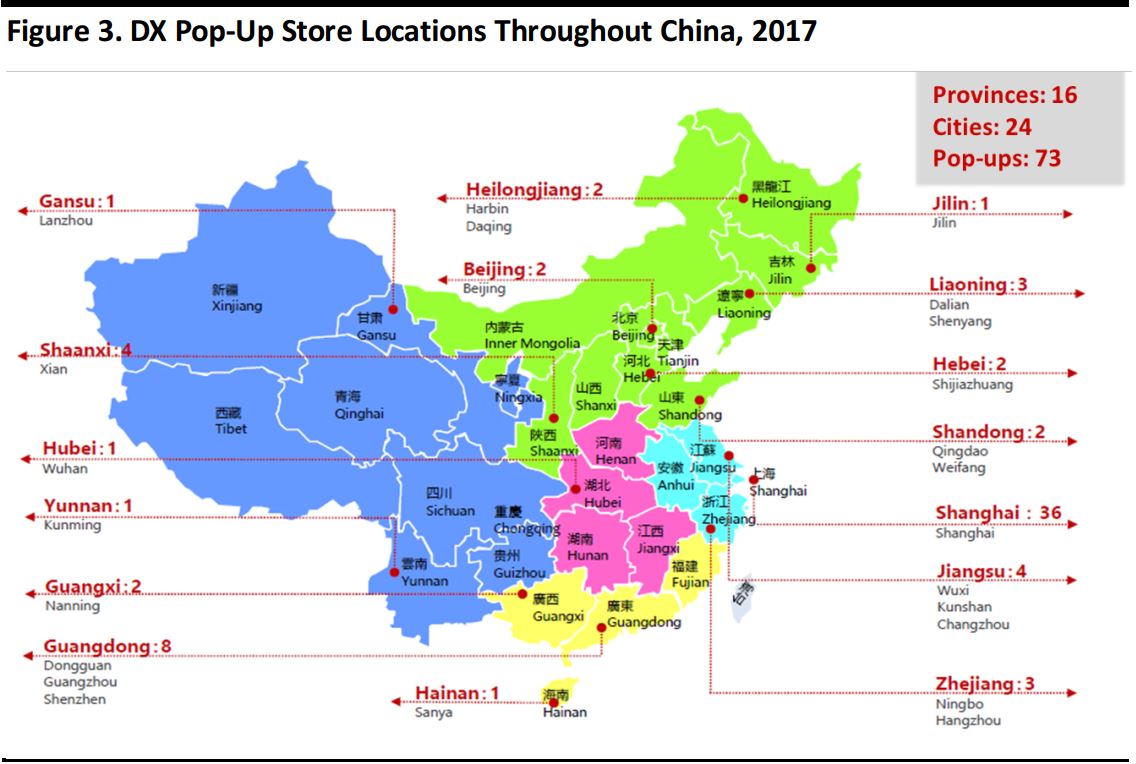

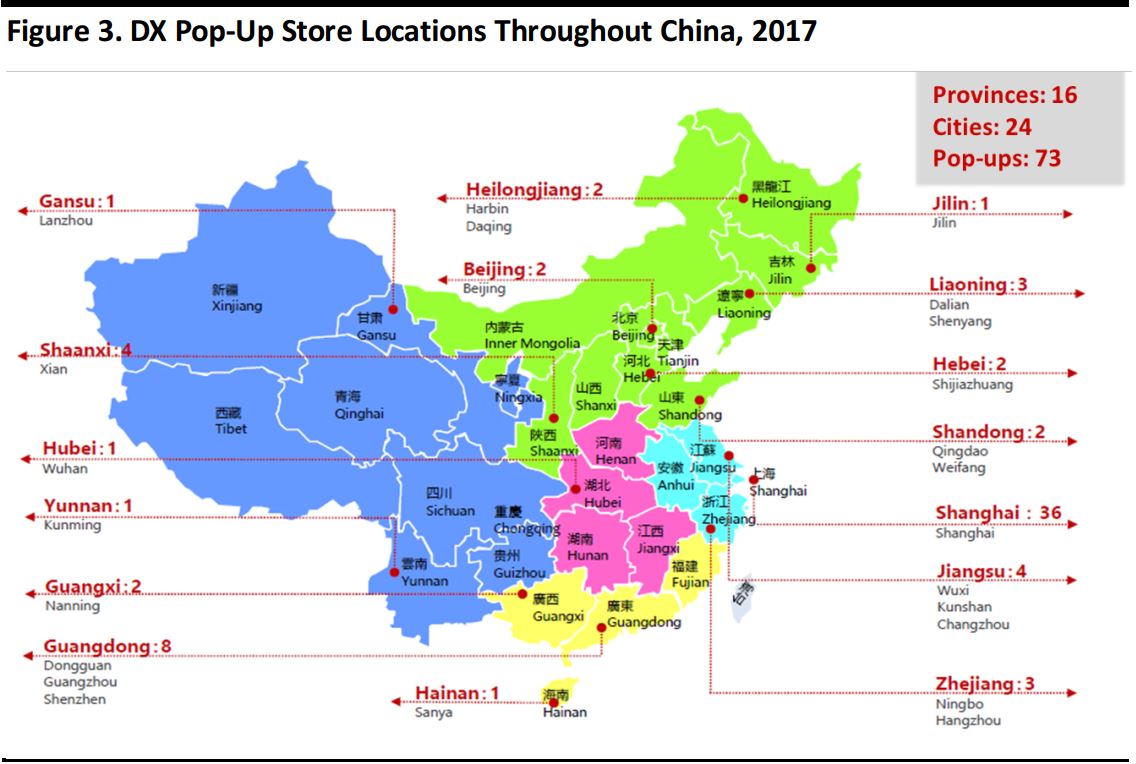

Although DX has expanded to include several permanent stores and is making a concerted effort to expand its online presence, the backbone of the company’s business model remains its network of pop-up stores. In 2017 alone, DX launched 73 pop-ups across China, reaching 16 provinces and 24 cities. The figure below shows DX’s pop-up locations in 2017.

Source: DX Quality Outlet

In 2018, DX has already launched 38 more pop-up locations in 14 provinces and 18 cities. DX pop-ups come in several different formats: temporary stores, shops-in-shops and shops in department store atriums. The stores generally remain open for a period ranging from three weeks to three months.

Another unique aspect of DX is the location of its stores. In an effort to minimize the costs involved with luring customers to its stores, DX operates its pop-ups in urban locations with high foot traffic. The company believes this strategy gives it an edge over off-price retailers emulating the T.J.Maxx model of 10,000-square-foot stores in subprime locations far from city centers. Off-pricers that operate such locations often have to spend heavily on marketing campaigns to attract shoppers to their stores.

DX also emphasizes the flexibility and opportunities for cost savings that its pop-up model provides. While some of DX’s off-price competitors commit to renting store space before acquiring the merchandise they will sell, DX first acquires the goods, then secures a suitable location. This method enables DX to pick optimal selling locations for the specific items it plans to sell at any given time.

While DX may pay higher rent per square foot than suburban megastores do, the company believes that it saves in marketing costs more than it spends in rent. This year, DX is targeting 11,000 total pop-up store days, which is equivalent to operating about 30 permanent stores all year round (i.e., for 365 days each).

In the next few years, DX plans to begin elongating the average duration its pop-up stores remain in the same location and begin opening some stores that will operate for one to two years, in order to be able to sell greater volumes of merchandise. In this same vein, DX plans to increase the total number of pop-up days to further boost growth.

A temporary DX Quality Outlet store

Source: DX Quality Outlet

Permanent Stores

Although DX conducts the majority of its business through pop-up stores, it has recently expanded its business model to include the operation of several permanent stores. Thus far in 2018, DX has established 13 permanent stores across China, covering six different cities, including Shanghai and Guangzhou, two of the nation’s largest metropolises. The company plans to open two more permanent stores by the end of this year.

While opening permanent stores is a diversion from DX’s initial business model, the stores help increase customer attachment, which should prove a useful tool in securing a long-term customer base.

WeChat Platform

DX is in the nascent stages of developing an e-commerce platform on which it can sell the same off-price products it sells in its pop-up and permanent stores. Currently, the company operates online only on Ai Ku Cun, a supplier-to-business-to-consumer (S2B2C) mobile platform where businesses can purchase inventory from suppliers and redistributors at low cost. On Ai Ku Cun, DX sells the same products it sells in its outlets on a larger scale to businesses across China.

In order to take advantage of the rapidly growing e-commerce market in China, DX is also developing its own B2C platform on WeChat, China’s leading social media platform. With roughly 1 billion users and a wide range of functions, WeChat has become an integral part of life for many Chinese people. As of October 2017, 60% of Chinese consumers used WeChat to make purchases online, according to a survey conducted by YouGov. Companies ranging from Nike to Starbucks have stores (called Mini Programs) on the WeChat app, where users can purchase items with just a tap of a finger. By joining this online mobile marketplace, DX plans to expand its consumer base beyond customers that happen to live near DX pop-up locations to include potential buyers from all corners of the country.

DX also plans to use its online presence to direct more business to its offline shops and vice versa. With the arrival of the WeChat platform, DX customers will be able to scan a QR code at a pop-up location to join a DX community of users on WeChat who have also visited that DX location. This will enable the company to retain a customer base, even after the pop-up store is gone, and send targeted advertisements to members of each WeChat group. Thus, DX will be able to maintain a connection online with visitors to its physical stores and direct online users to new pop-up stores opening in their area.

The Results

DX is still a relatively small company, operating the equivalent of only 30 permanent stores. Although the company does not disclose revenue figures publicly, it has experienced rapid growth over the past two years. DX is satisfied with its performance so far, and is targeting even faster growth for 2019.

How DX Fits into the Current Retail Market and Its Role in the Future Market

The Pop-Up Craze

Consumers in China are increasingly choosing to visit pop-up stores rather than permanent retail locations. Since 2015, pop-up retail has been growing at a rapid rate in the country, doubling in market size three times over the past three years. According to a report by Chinese commercial real estate firm RET, retailers will open more than 3,000 pop-up stores in China by 2020.

A Chanel pop-up store in Hong Kong

Source: Jing Daily

Jing Daily

Many pop-up stores offer a much more unique shopping experience than DX does. From Alibaba to Chanel, major international companies have opened pop-ups that offer visitors the chance to play brand-related games or check out the latest products under development. Since pop-up stores are DX’s main vehicle for sales, the company does not use them primarily to increase brand awareness, as some other companies do, but to actually sell products. Its stores are built for functionality, not extravagance.

The temporary nature and relative scarcity of DX stores makes them a hot commodity among Chinese consumers. By offering deals for only a short period of time in any one location, DX’s pop-ups can achieve a similar must-visit status that flashy name-brand pop-ups attain, albeit on a much smaller scale.

Perhaps more important to DX, however, is the flexibility that its pop-up stores provide. By operating primarily through small pop-ups in urban locations, DX is able to reach a wide variety of Chinese consumers without spending heavily on large retail spaces or marketing campaigns. Pop-ups also enable the company to find short-term locations that it considers best suited to the particular products and brands it has in stock at any particular moment.

Chinese Retail Trends

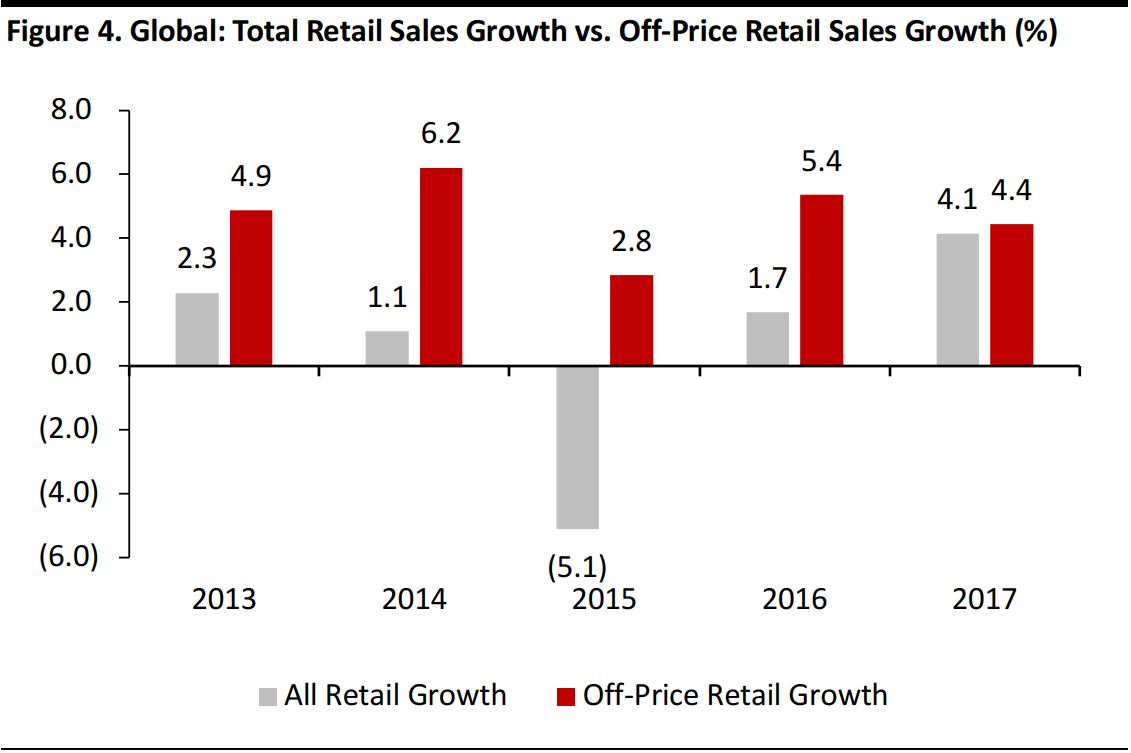

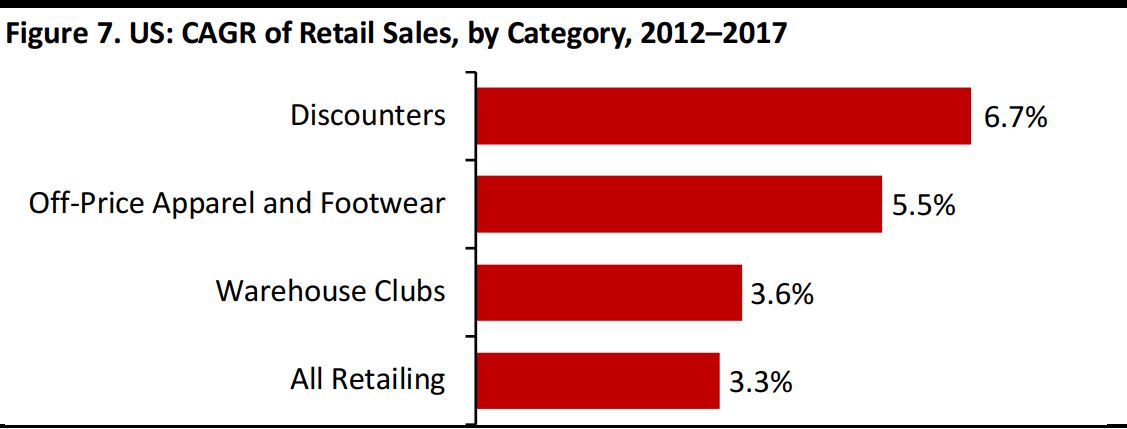

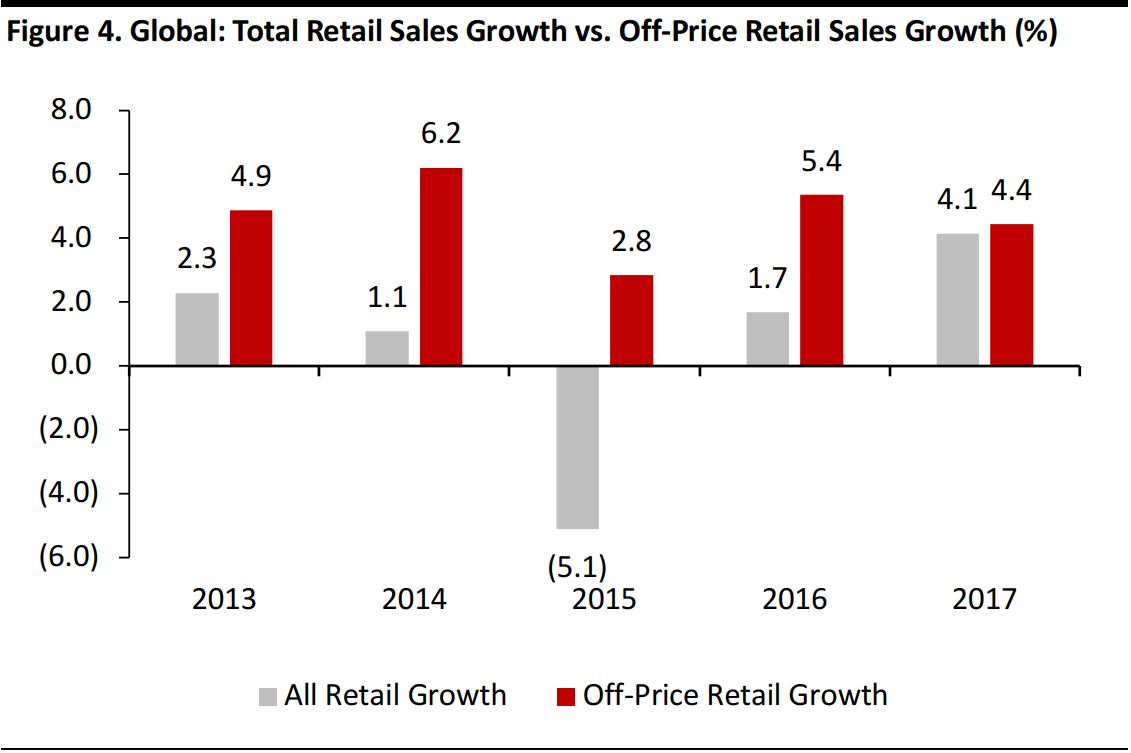

DX has made a timely entry into the off-price market. As shown in the figure below, the global off-price retail market has grown at a significantly higher rate than the global retail market as a whole in each of the past five years.

Source: Euromonitor International/Coresight Research

In addition to entering the expanding off-price market, DX also joins a growing Chinese retail market that is well suited to the company’s business model. As previously mentioned, DX operates through a network of pop-up and permanent stores and is planning to expand onto WeChat. In China, the outlook for both in-store retail and mobile retail is positive, even while brick-and-mortar retail is facing challenges in the US.

Store-Based Retail

Store-based retail sales in China grew at almost three times the rate of those in the US in 2017, as shown in the figure below. Although projections from Euromonitor International indicate that China’s store-based retail growth will begin to moderate, it is still expected to grow at more than 1.25 times the rate of store-based retail in the US over the next five years.

Source: Euromonitor International/Coresight Research

Even with online retail giants such as Amazon and Alibaba snapping up ever-larger shares of the retail market, strong brick-and-mortar retail growth rates in China indicate that DX and other retailers have a much greater opportunity for continued growth in China than they have in the US. Combine this with consumers’ increased preference for off-price retailers and pop-up stores, and DX appears to be in one of the best positions of any up-and-coming brick-and-mortar retailer worldwide.

Mobile Retail

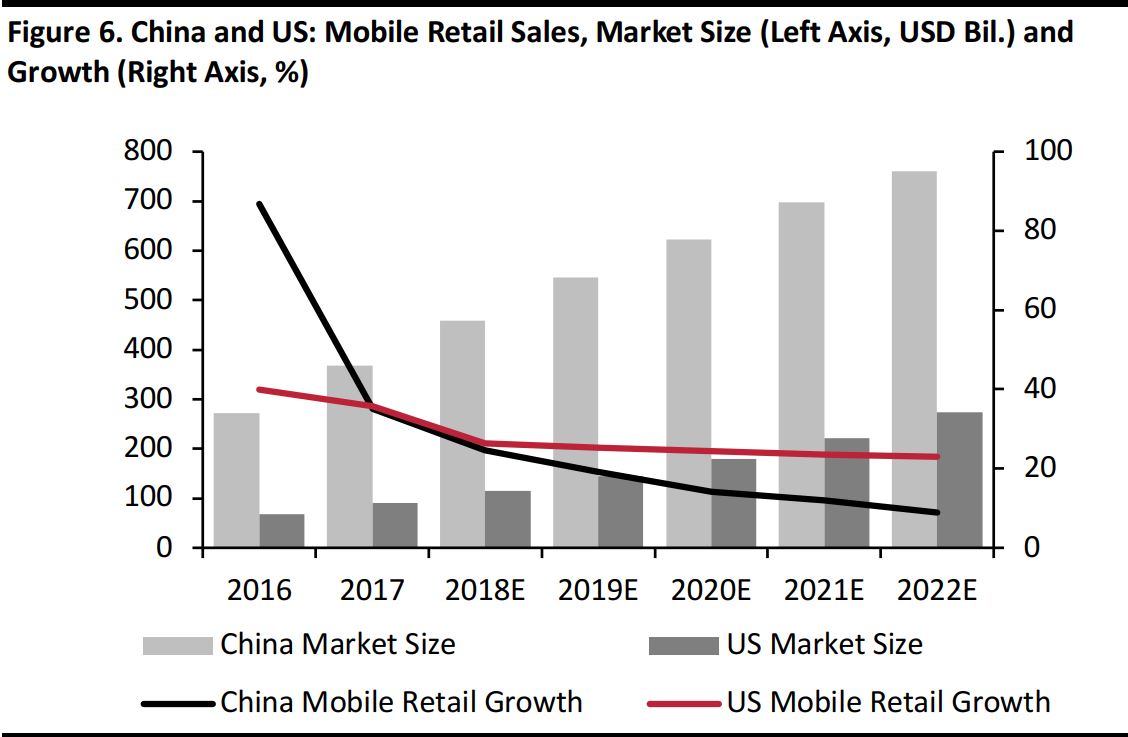

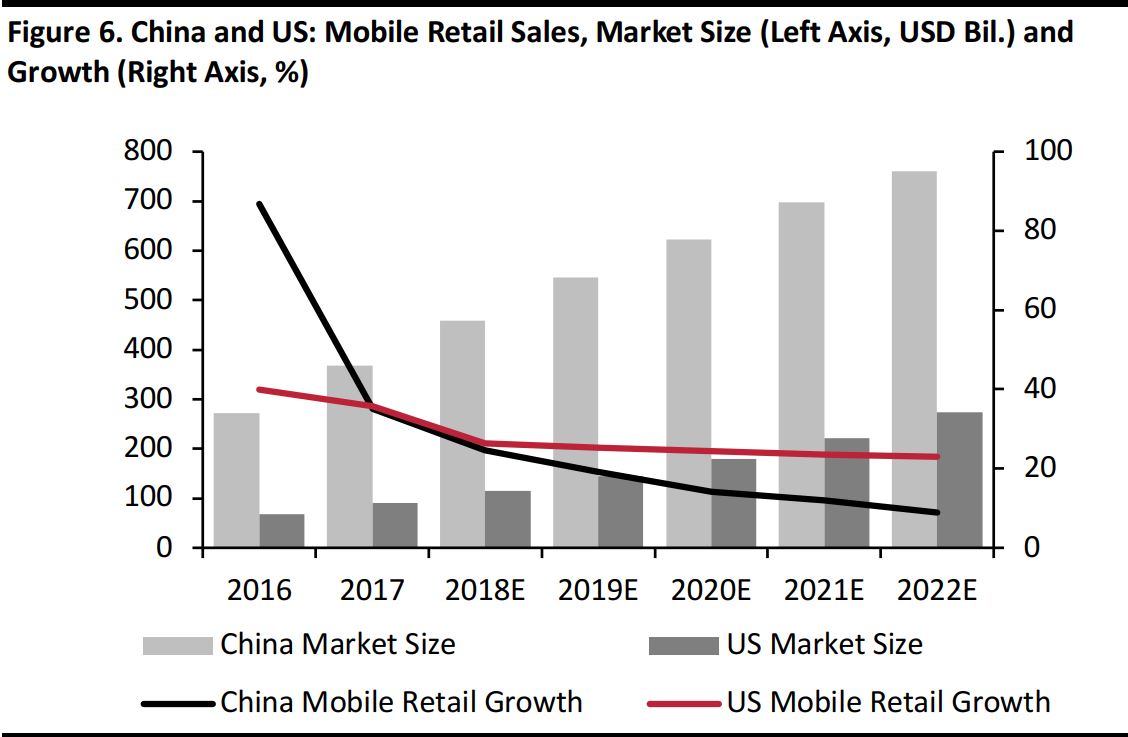

The development of DX’s WeChat platform could be key to its future success. In China, mobile retail is already a $360 billion industry, more than triple the size of the market in the US. The projected development of the Chinese and American mobile retail markets is shown in the figure below.

Source: Euromonitor International/Coresight Research

In 2017, the mobile retail market in China grew by 35% year over year. This growth rate is expected to moderate over the next five years, but the market is still forecast to double in size over that period. And the reach of mobile e-commerce platforms in China is already extensive: as of January 2018, WeChat Mini Programs had a total of 170 million daily active users, according to WeChat owner Tencent. So, successfully entering China’s mobile commerce marketplace would certainly serve DX well in the coming years.

Challenges and Opportunities for DX

Fierce Competition in China

DX has significant competition in the pop-up store segment of Chinese retail. Although it is one of only a few retailers to operate primarily through pop-ups, many other Chinese and international brands are also embracing the pop-up frenzy. Tech and e-commerce giant Alibaba has taken note of the pop-up store trend, and has begun opening such stores around China, as seen particularly during its annual 11.11 Global Shopping Festival (Singles’ Day) event.

One attraction of the pop-up format is the unique customer experience it provides. As younger generations continue to prioritize spending on experiences over spending on physical goods, many brick-and-mortar retailers are finding it necessary to create unique shopping experiences in their stores. DX has not yet experimented with this technique, but pop-up stores provide a great opportunity to do so. DX and other pop-up store operators are likely to continue to innovate in terms of providing new ways to shop.

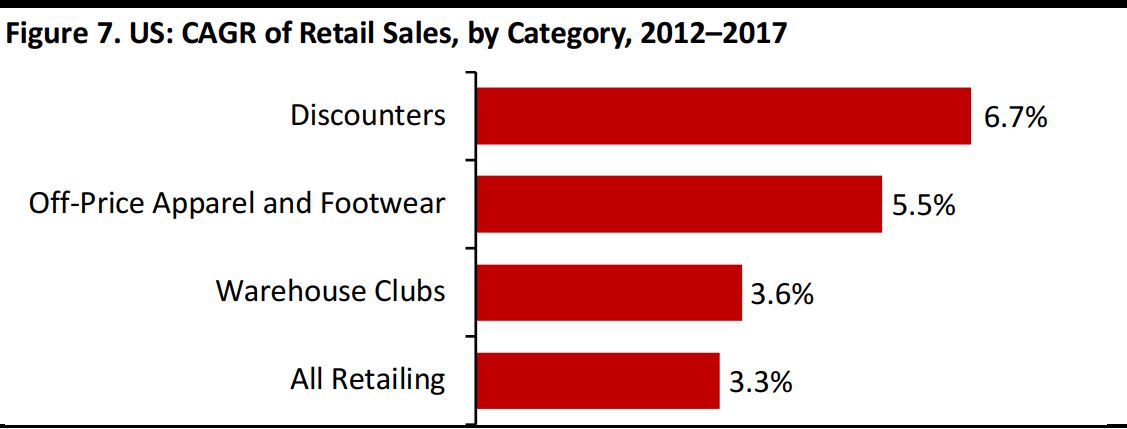

Implications in the US

In the US off-price retail market, there might still be room for up-and-coming off-pricers such as DX, despite the presence of retail giants T.J.Maxx and Ross Stores.. The rise of job-insecure and student-debt-burdened millennials as an important US consumer group has driven consumer spending toward off-price retailers such as T.J.Maxx and Ross Stores, as has millennials’ preference for spending on leisure activities. In 2007, only 10% of apparel purchases were made through off-price retail channels, but by 2017, that number had risen to 15%, according to fashion resale company ThredUP. US consumers’ increased preference for off-price has enabled the industry to grow at a much faster rate than US retail as a whole, as shown in the figure below.

Source: Euromonitor International/Coresight Research

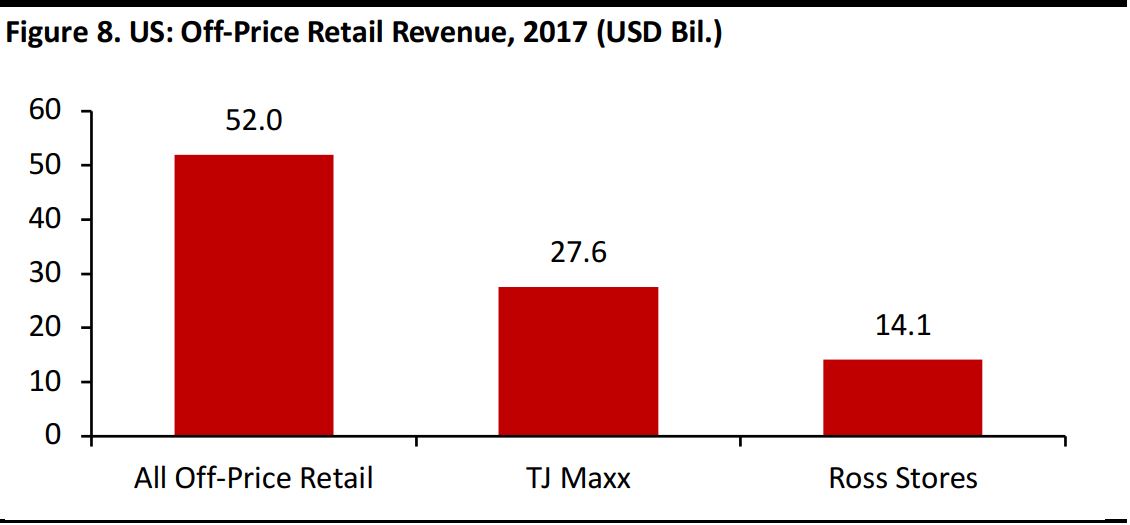

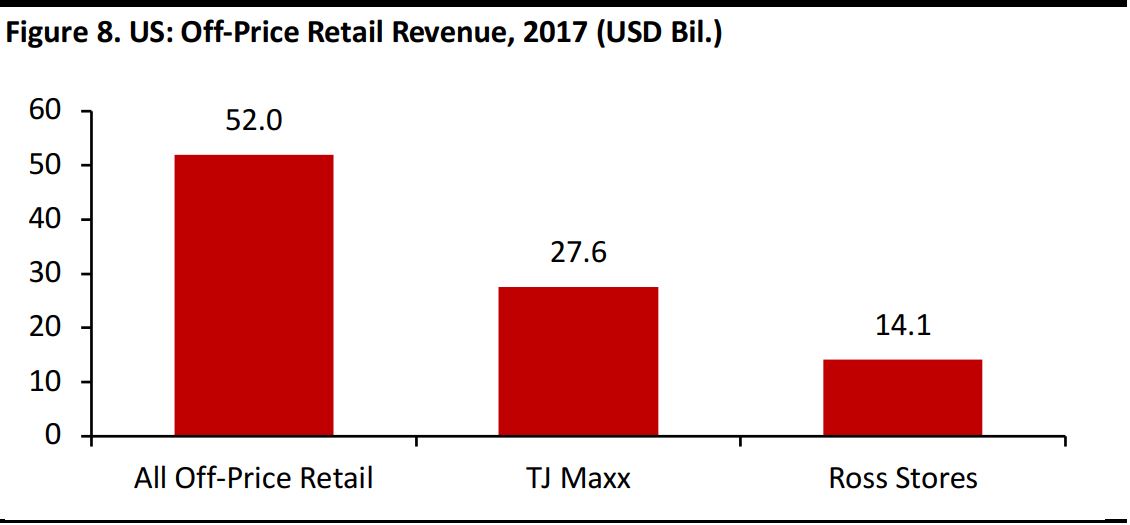

Still, DX would likely face challenges entering the US brick-and-mortar off-price sector, where the top five players control more than 92% of the market, according to data from Euromonitor. T.J.Maxx and Ross stores alone account for 41.7 billion dollars of revenue in the US, more than 80% of the country’s total off price revenue.

Source: Euromonitor International

Where DX and other enterprising companies

can find ample opportunity is in the mobile retail market. Although commonplace in China, mobile retail is still in its infancy in the US. Store-based retail sales remain much higher in the US than in China, but the mobile retail market is roughly four times larger in China than it is in the US. However, mobile retail in the US has nearly tripled in size in the past three years. Euromonitor projects that by 2022, the US mobile retail market will triple in size again, to nearly $300 billion. That growth would still leave the US mobile retail market at less than half the size of the projected market in China, but would mean that the US market was growing at a much faster rate.

Off-price retail giants in the US have yet to capitalize on the growing mobile retail market. Although T.J.Maxx has an app for iPhone and Android phones, it has earned poor reviews on the Apple App Store and does not connect with social media platforms such as Facebook and Instagram in the way that WeChat Mini Programs do. Ross Stores, which owns a 20% share of the US off-price retail market, does not have a mobile app. DX and other emerging off-price retailers could capitalize on this opportunity in the US by prominently featuring mobile e-commerce shopping options in their business models.

Looking to Europe

European retailers can learn from DX as well, perhaps even more than their US counterparts. Europe does not have nearly as developed an off-price market as the US does. TJX Companies, the parent company of T.K. Maxx (T.J.Maxx’s off-price sister chain in Europe), holds more than 80% of the off-price market in Western Europe. However, European off-price retail remains underdeveloped. While the segment accounts for 1.70% of all retail in the US, it represents only 0.16% of the total European retail market, according to Euromonitor. Since off-price retail in Europe is still in its infancy, there is an opportunity for new players to enter the market. European consumers are likely to embrace pop-up stores and off-price retailers just as their American and Chinese counterparts have, so companies such as DX could be poised for success in Europe.

Conclusion

In an increasingly crowded retail market, DX manages to differentiate itself through its business model and methods of distribution. Sitting at the intersection of off-price retail and pop-up stores should help DX continue to appeal to deal-hunting consumers in China and, potentially, around the world. The company’s foray into mobile retail through its store on WeChat could be a tactic that other off-price retailers will soon follow, and mobile retail may prove to be the most valuable segment of DX’s business if properly executed in the coming years.