EXECUTIVE SUMMARY

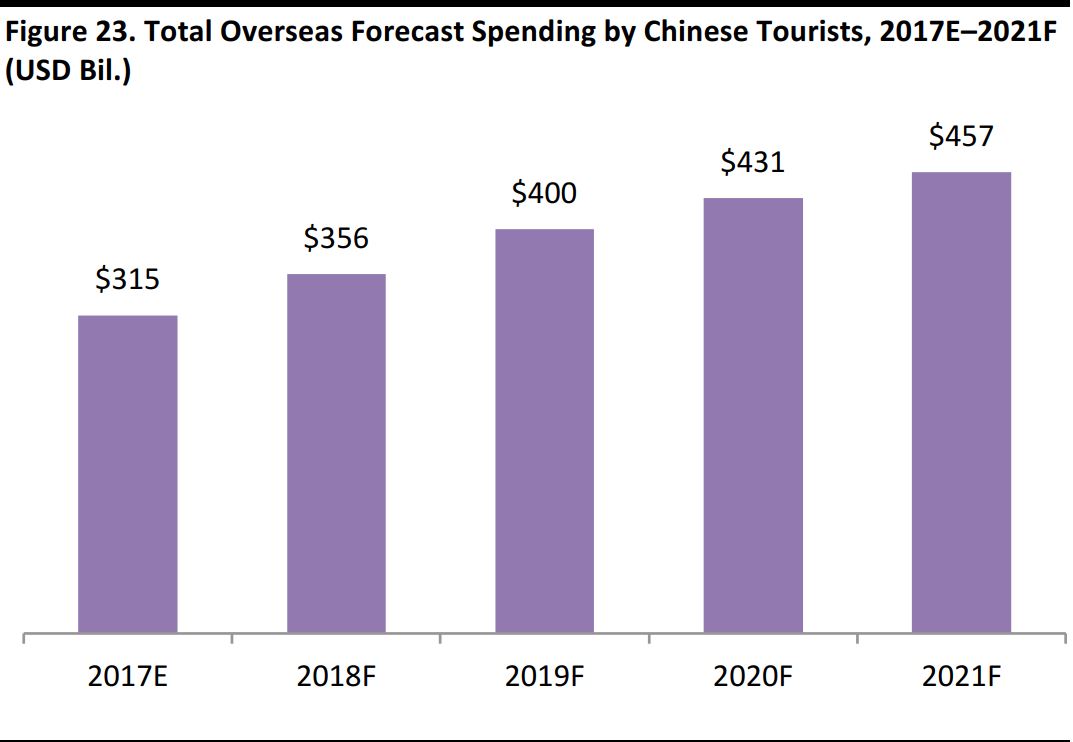

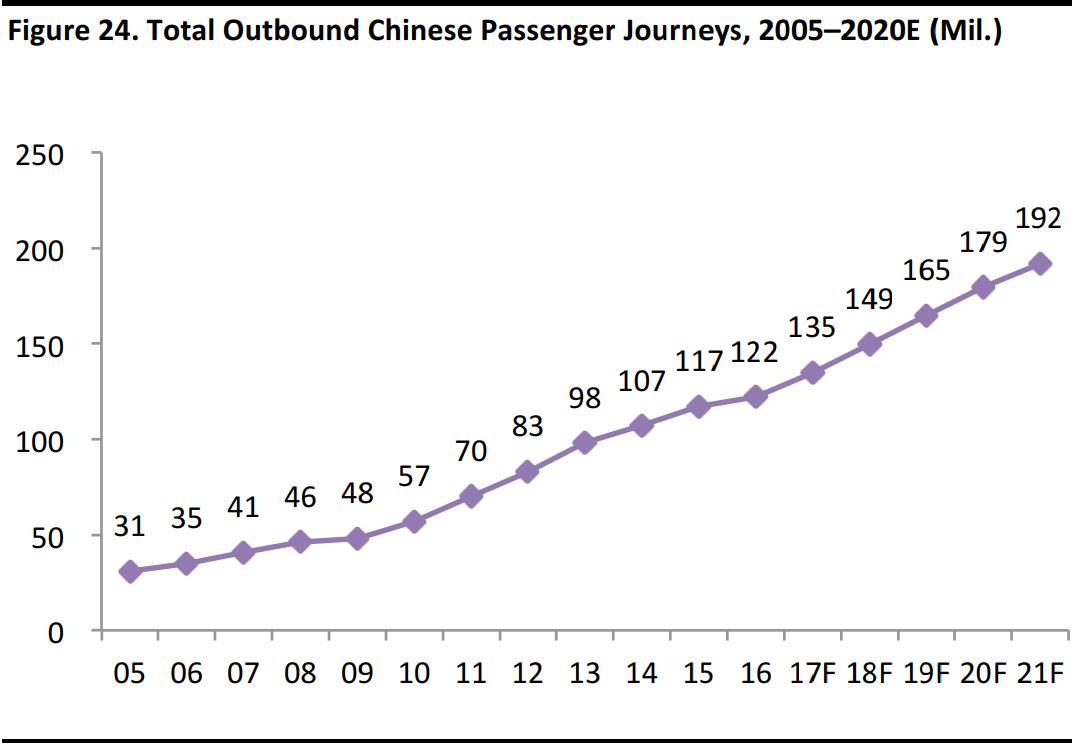

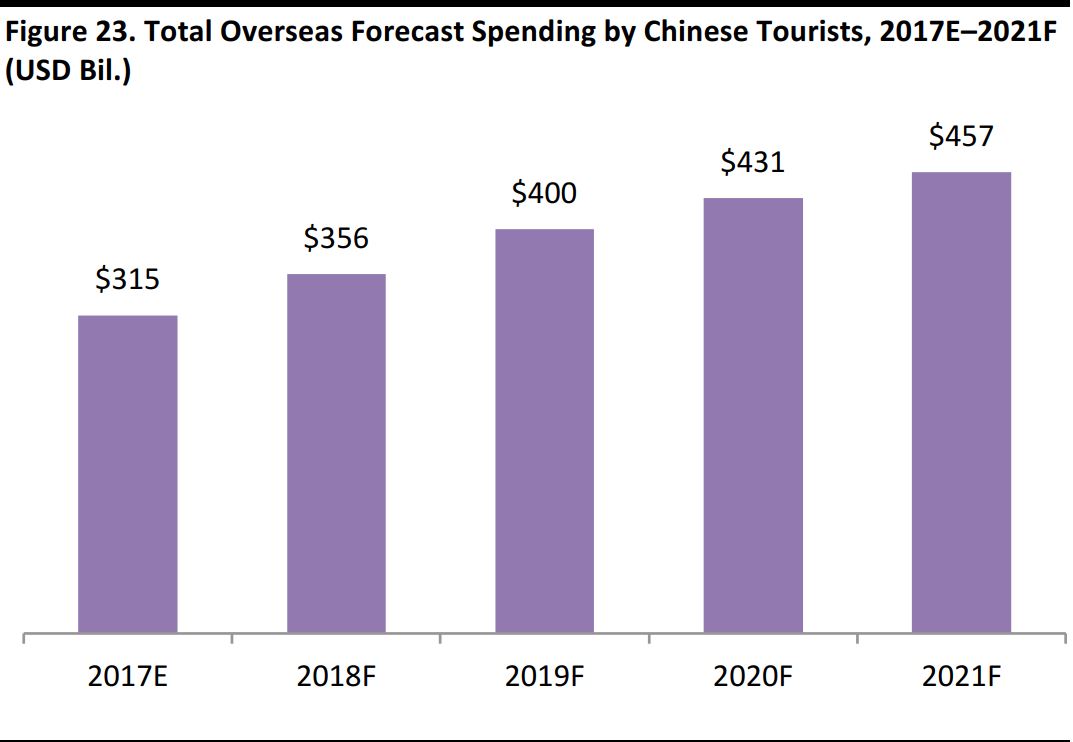

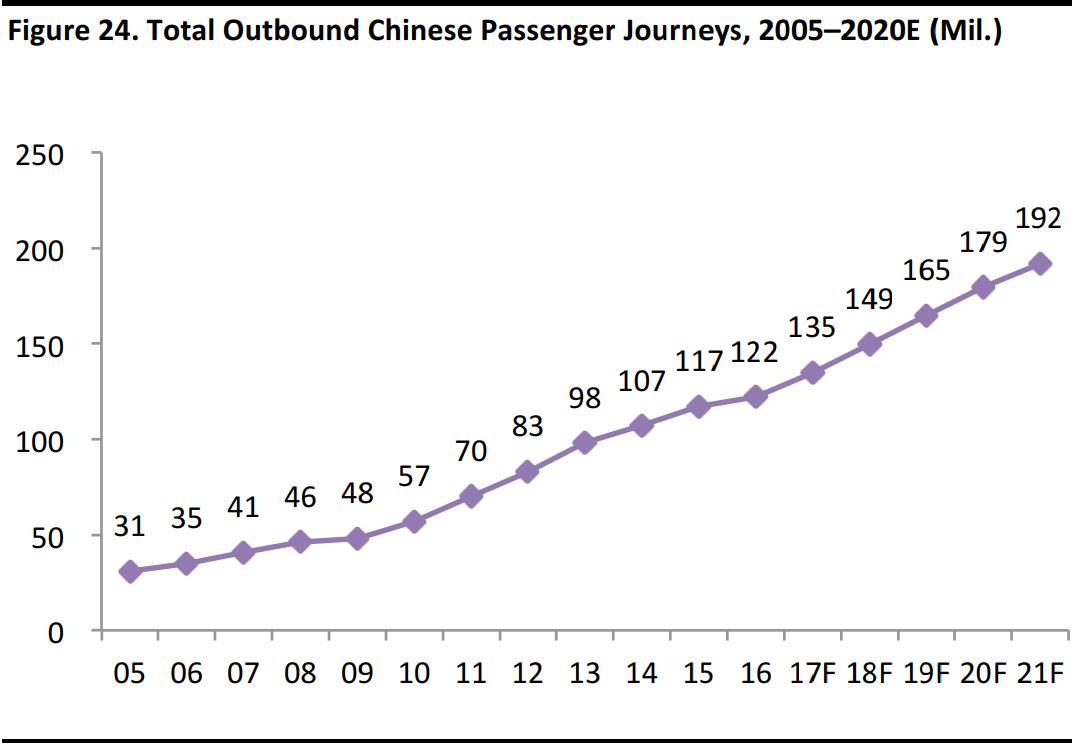

In the past 12 months, more Chinese have traveled overseas compared to the prior year and are continuing to drive retail spending at tourist destinations globally. Chinese outbound tourists will account for an estimated US$315 billion in travel revenue in 2017, according to our estimation, making them the world’s biggest spenders on foreign travel. By 2021, we estimate that 192 million Chinese tourists will travel overseas, and that their total overseas spending will reach US$458 billion.

This is our third annual proprietary survey of Chinese overseas tourists’ travel and spending, jointly conducted with China Luxury Advisors. In this report, we cover the following topics:

- Travel destinations visited in the past 12 months; reasons for selecting the destination for the most recent trip

- Spending in respective areas, products purchased and outlets visited; services used at retailers and their importance

- Frequency and purpose of overseas travel

- Travel arrangements for their most recent and upcoming overseas trip; main information source used for planning their trip

- Demographics including age, gender, income and city of residence

Key Trends Observed

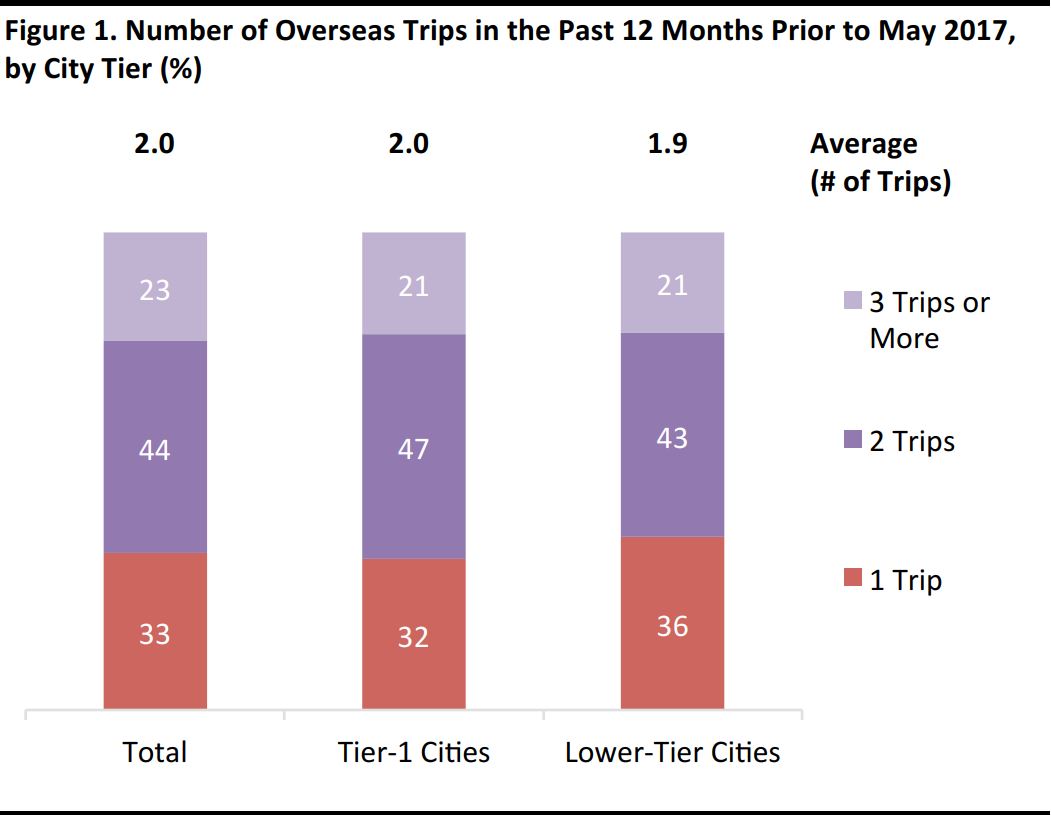

- Chinese outbound tourists have evolved into experienced and sophisticated travelers—some 67% of surveyed tourists have traveled more than once in the past 12 months, visiting an average of 2.3 destinations. Apart from shopping, they crave lifestyle experiences while traveling abroad.

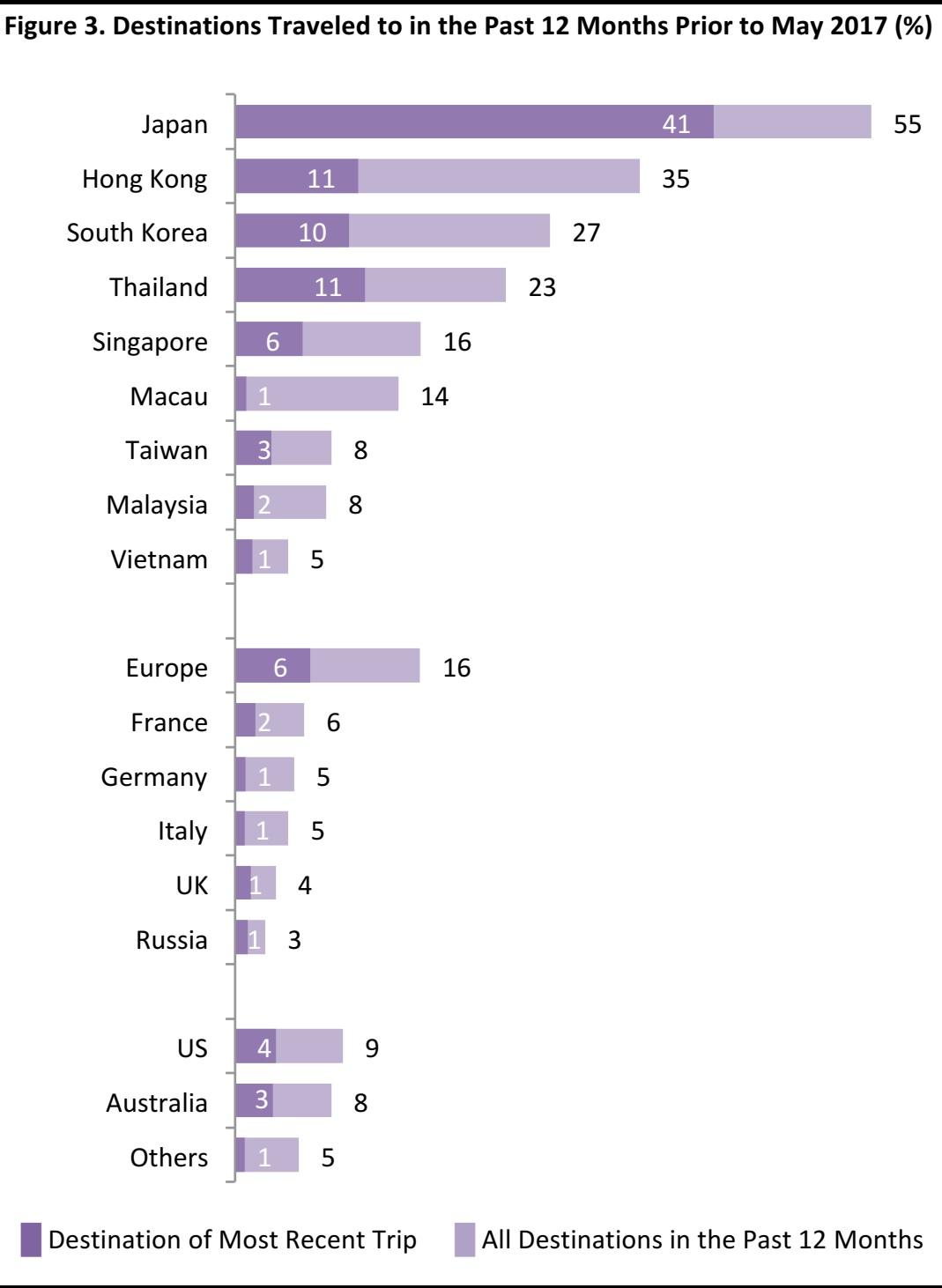

- Japan has emerged as the most popular destination, visited by 55% of surveyed tourists in the past 12 months, followed by Hong Kong (35%) and South Korea (27%).

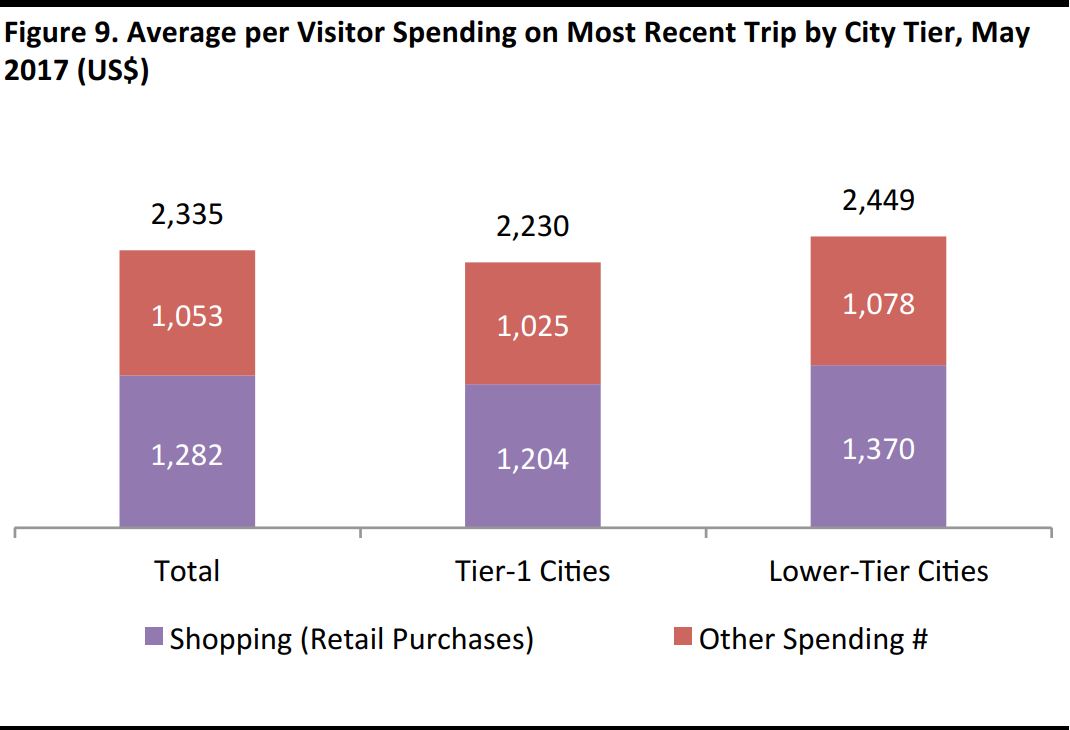

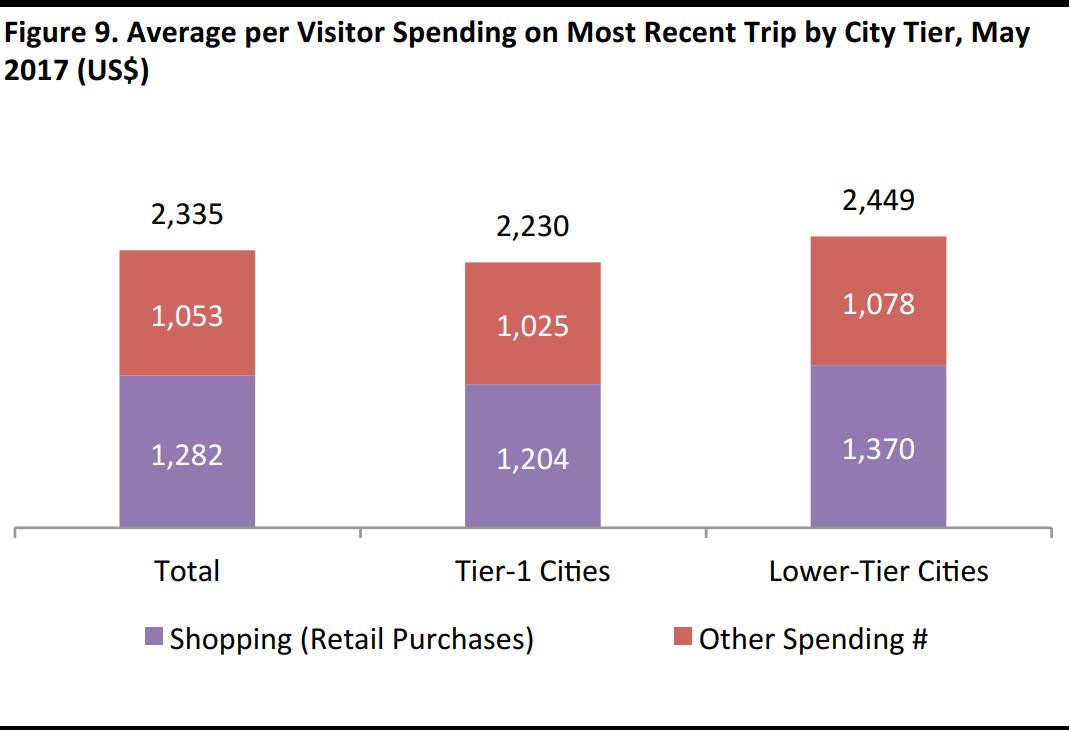

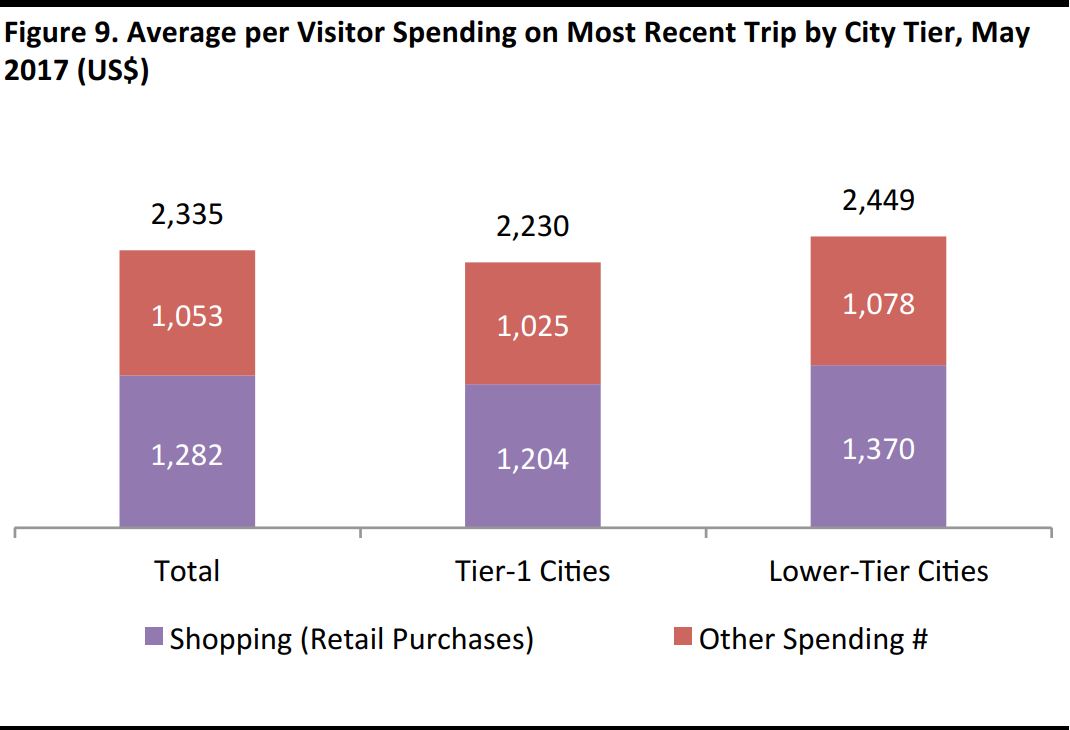

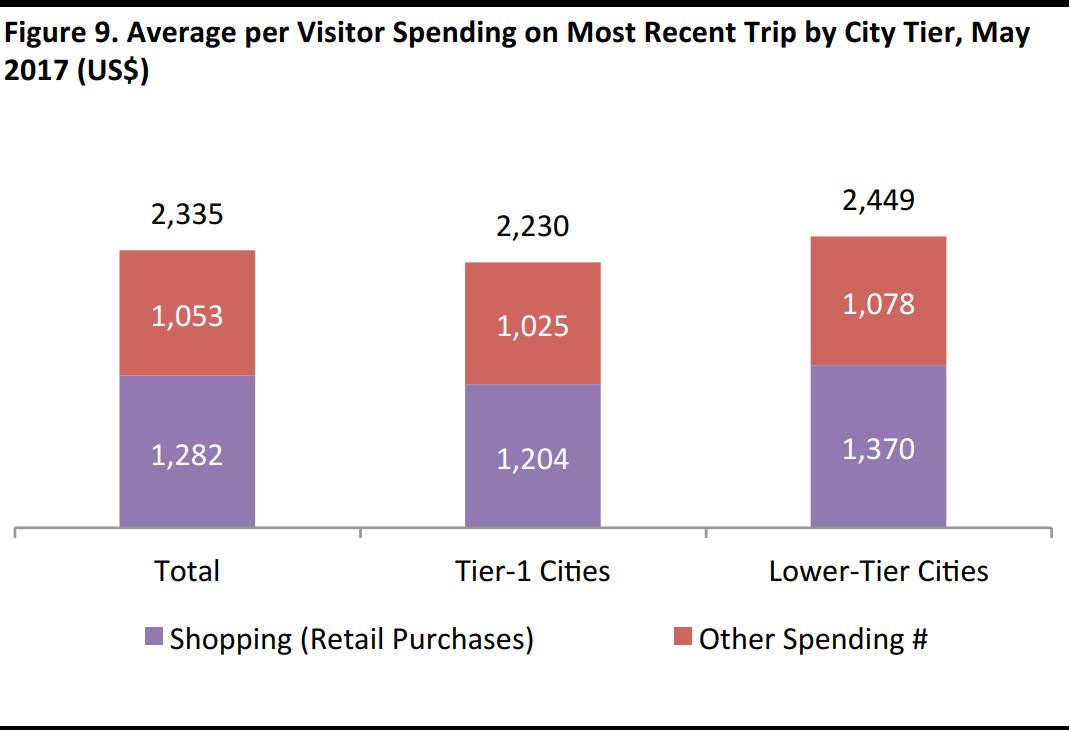

- Chinese tourists from lower-tier cities have become the growth engine of outbound tourism. Based on their most recent overseas trip, survey respondents said they spent on average US$2,449, 10% higher than tourists from tier-1 cities at US$2,330. They also travel as frequently as their counterparts from tier-one cities, at an average of 1.9 times per year.

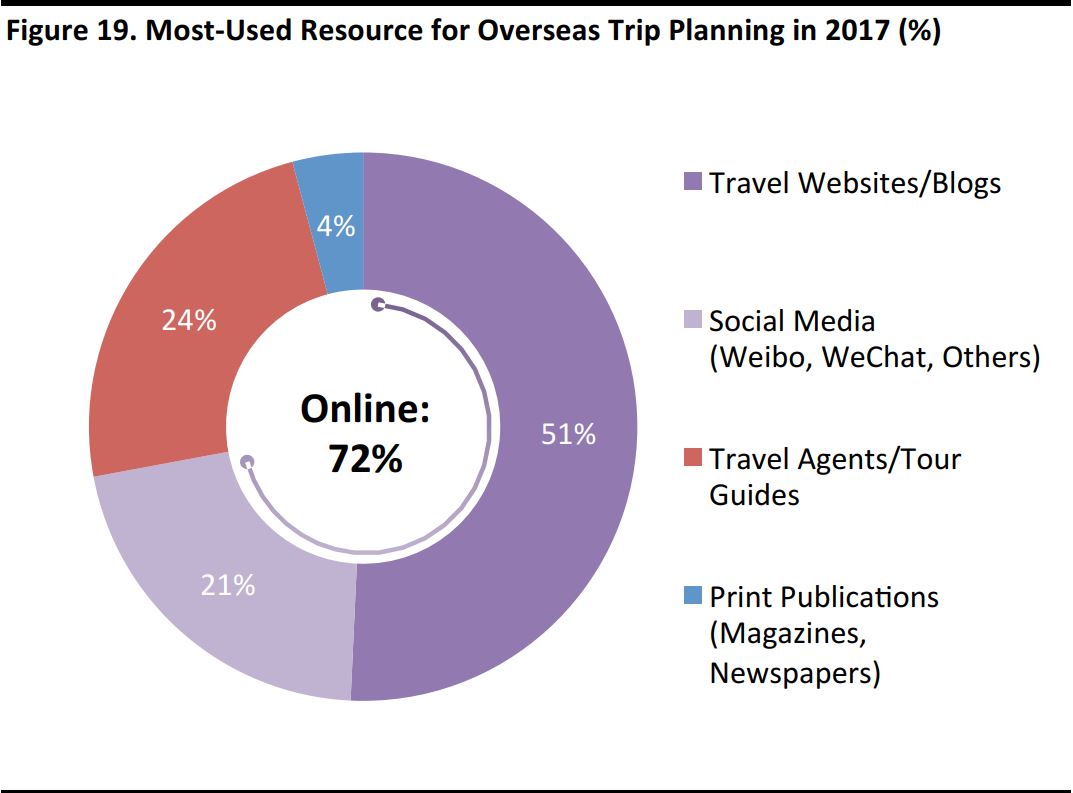

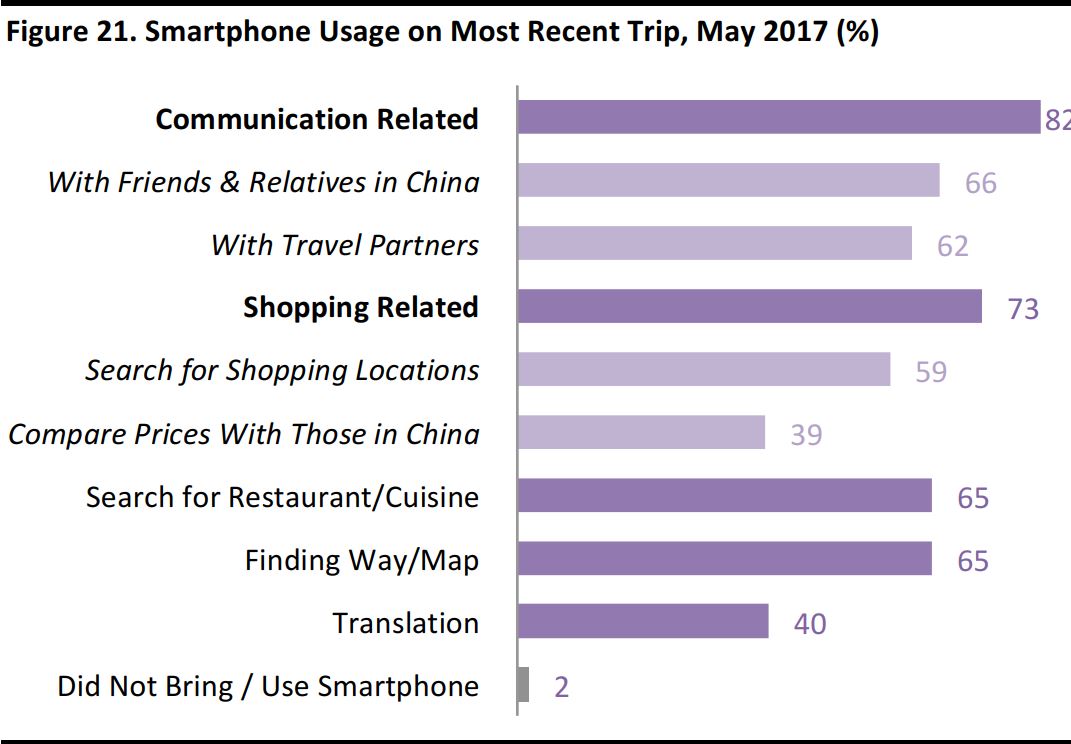

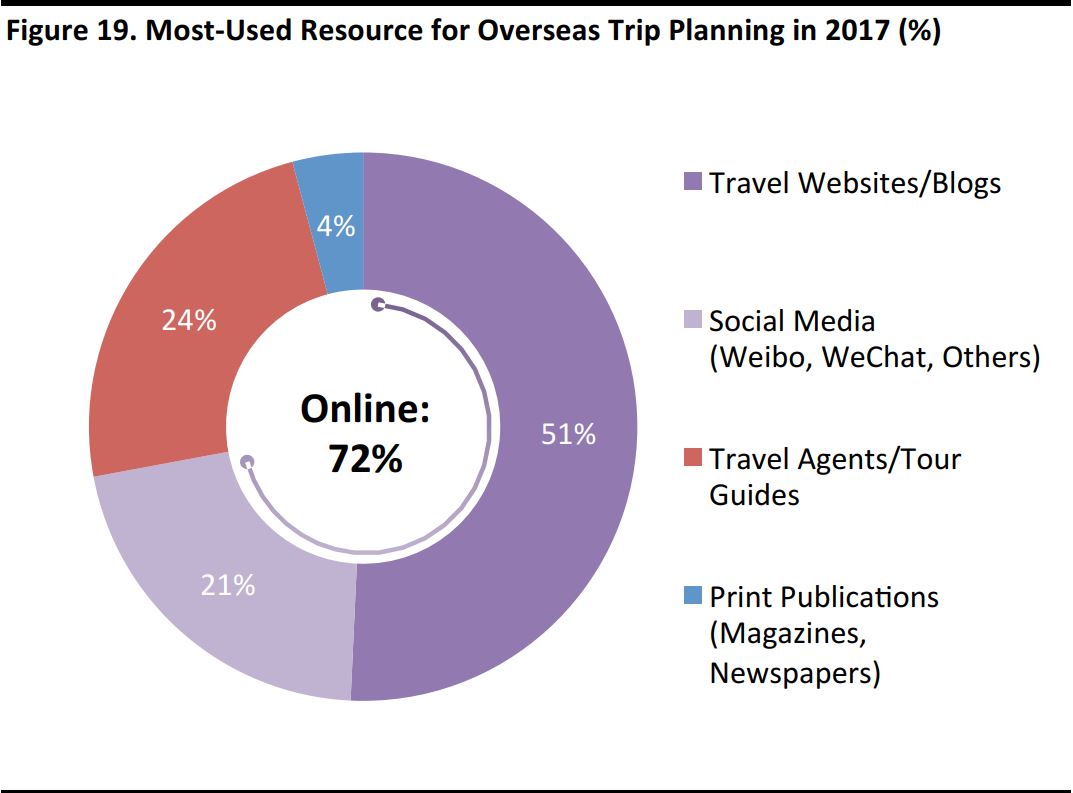

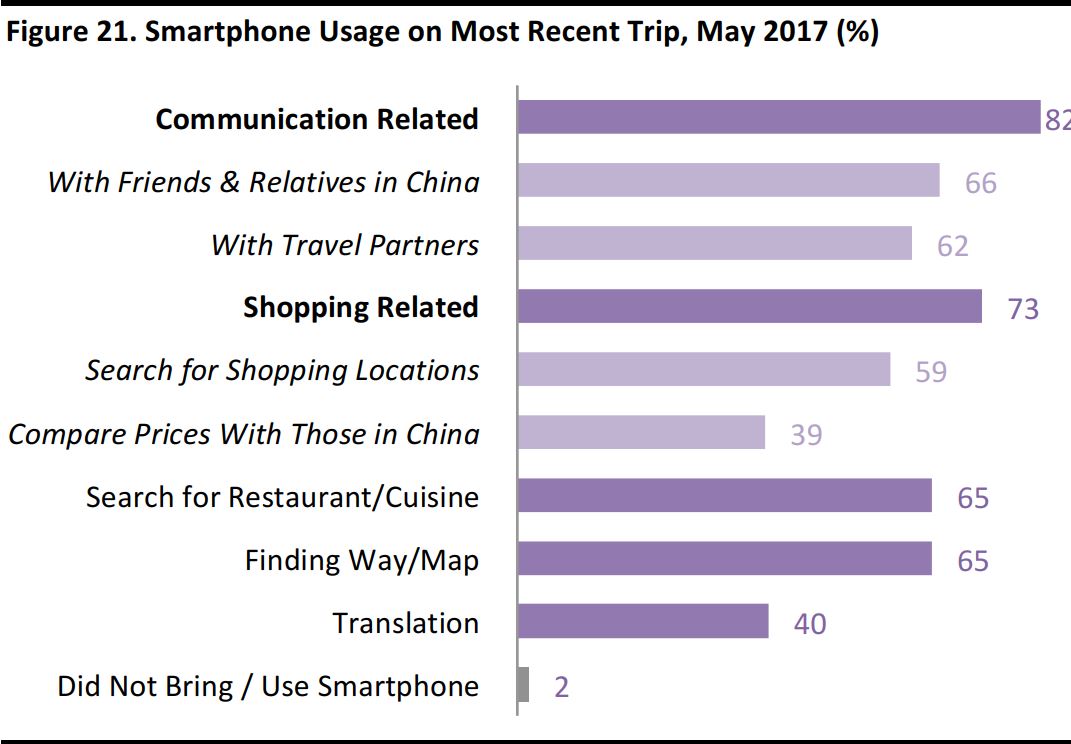

- Chinese tourists are extremely mobile-savvy, 98% of surveyed tourists used their smartphone abroad to keep in touch with others and to search for travel-related information. Some 72% of surveyed tourists use online resources such as travel websites, blogs and social media to plan their trips.

Source: iStockphoto

KEY FINDINGS

Travel Frequency and Arrangement

- The majority of Chinese tourists are now experienced overseas travelers, with 67% of those surveyed having traveled more than once in the past 12 months, visiting an average of 2.3 destinations.

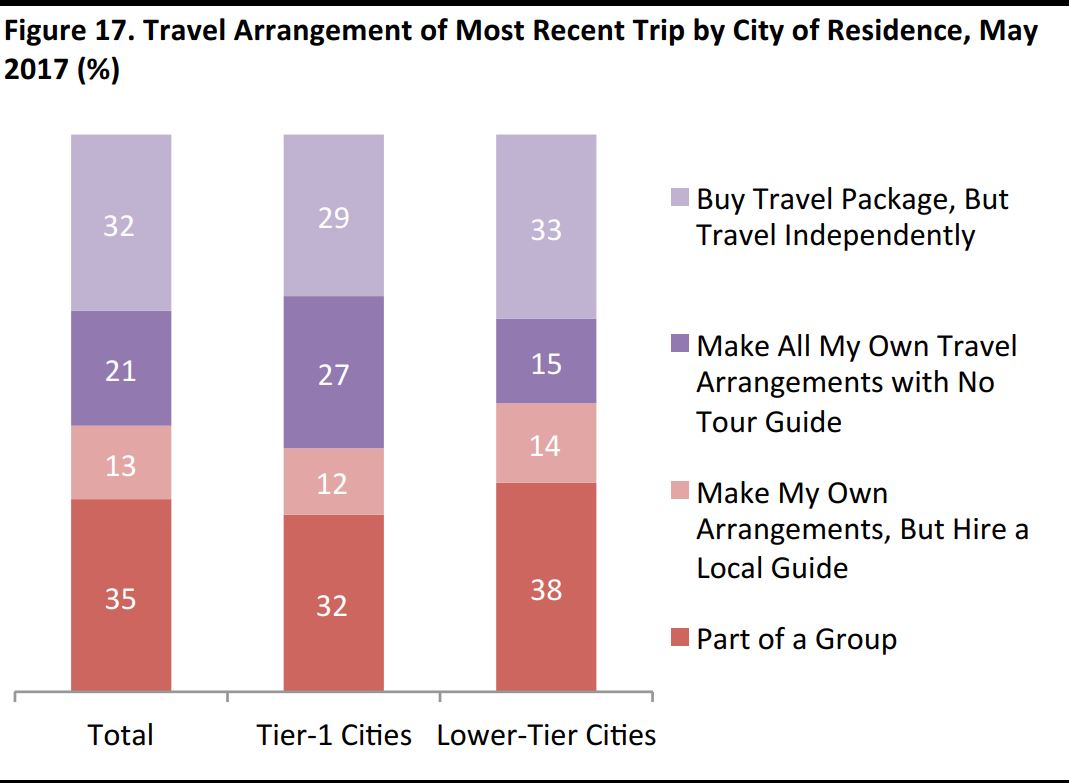

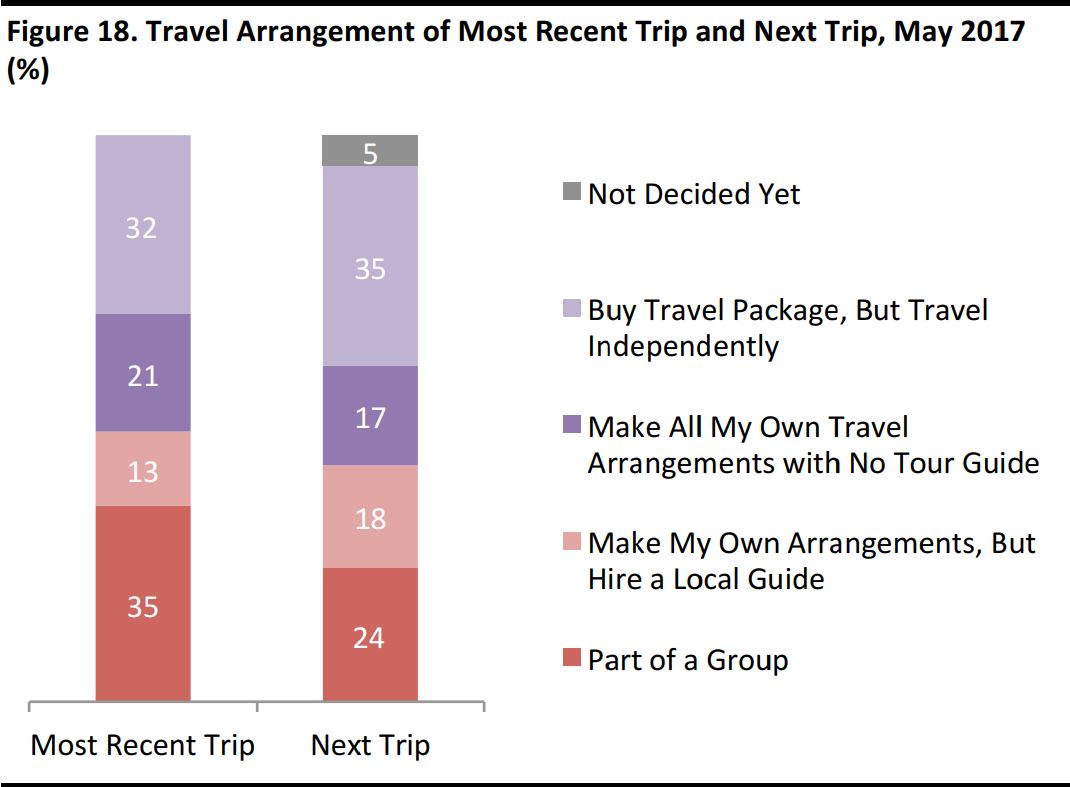

- Traveling as part of a group (35%) is still a popular form of travel arrangement. However, the majority of those surveyed traveled independently without a local guide on their most recent trip, either by buying a travel package (32%), or by making their own travel arrangements (21%).

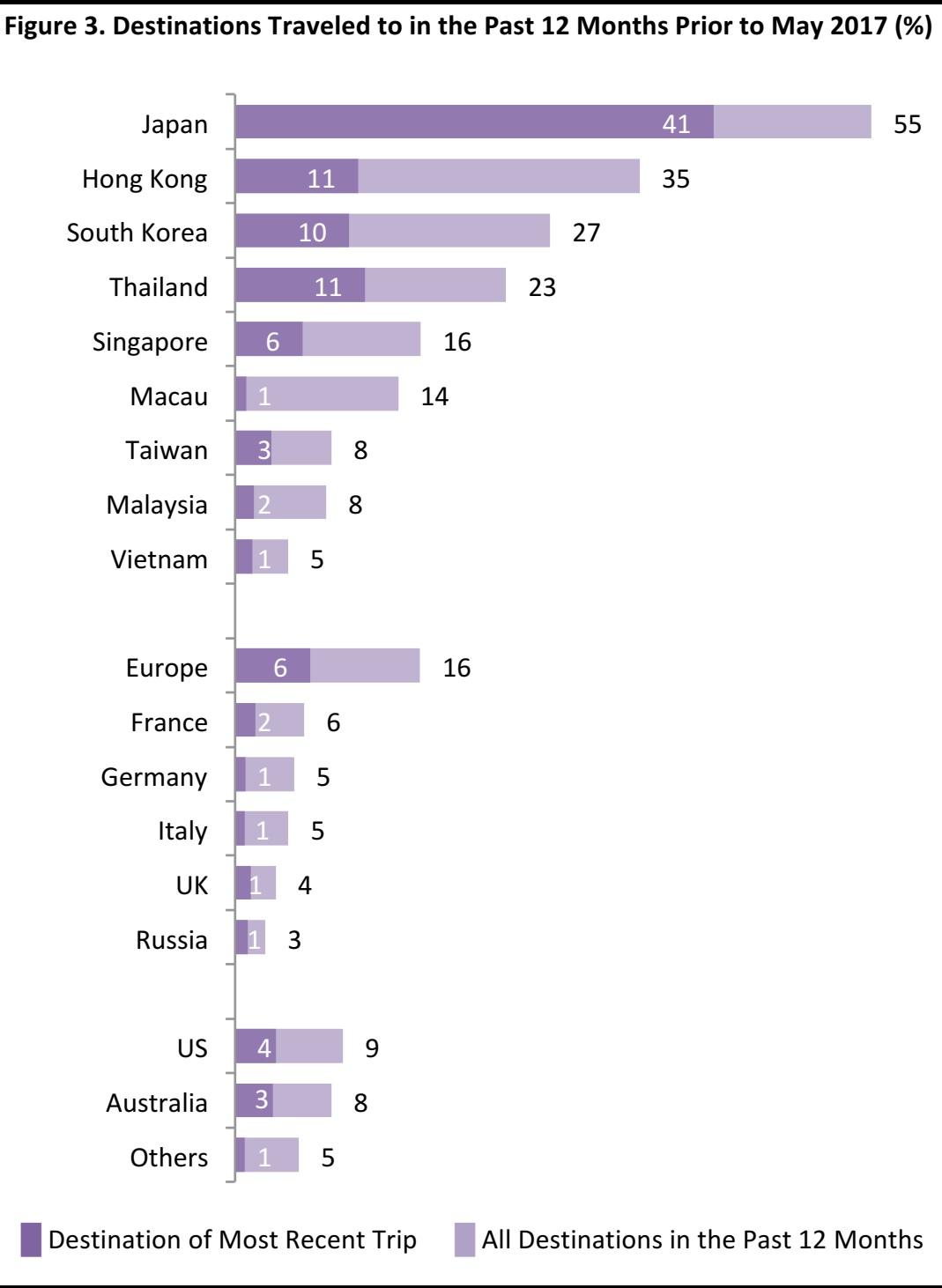

Destinations

- Japan has emerged as the most popular destination, visited by 55% of surveyed tourists in the past 12 months, followed by Hong Kong (35%) and South Korea (27%).

- Europe (16%) is the top long-haul destination for Chinese tourists, followed by the US (9%).

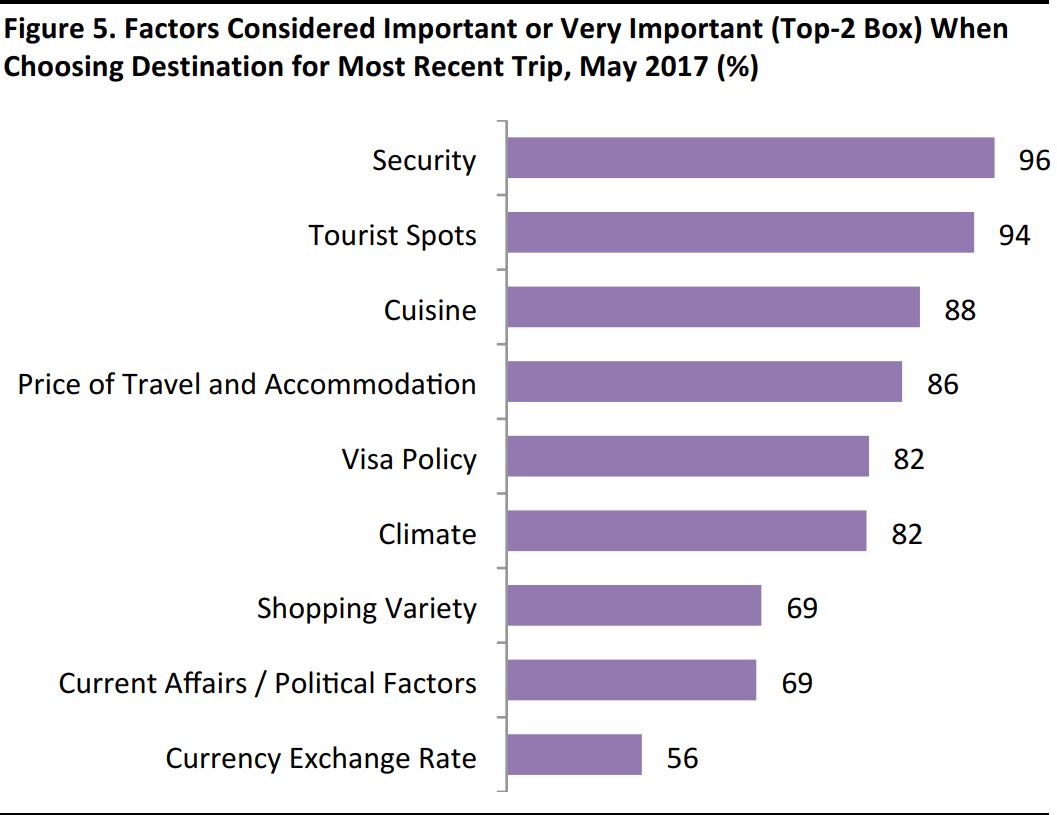

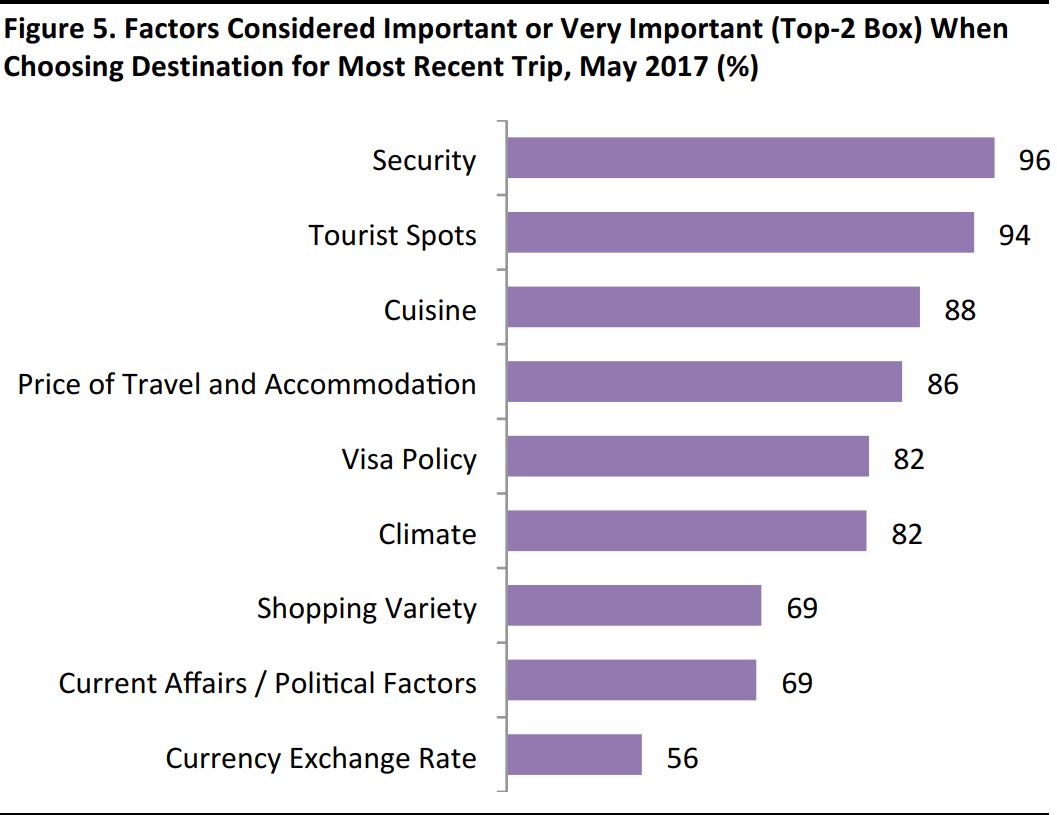

- Almost all surveyed respondents considered security (96%) as an important factor when choosing the destination for their most recent overseas trip. Tourist spots (94%) and cuisine (88%) are the other important most-mentioned factors.

Spending

- Chinese tourists spent on average US$2,335 during their most recent overseas trip; those from lower-tier cities spent an average of US$2,449, 10% higher than those from tier-1 cities at US$2,330.

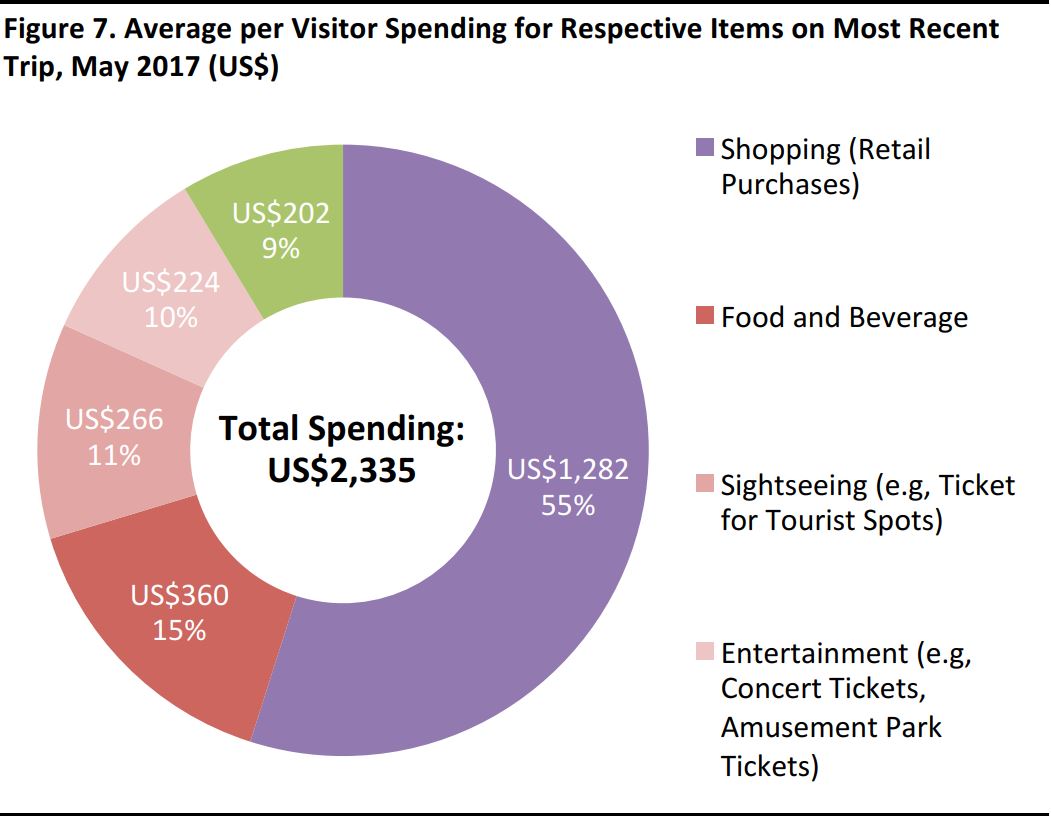

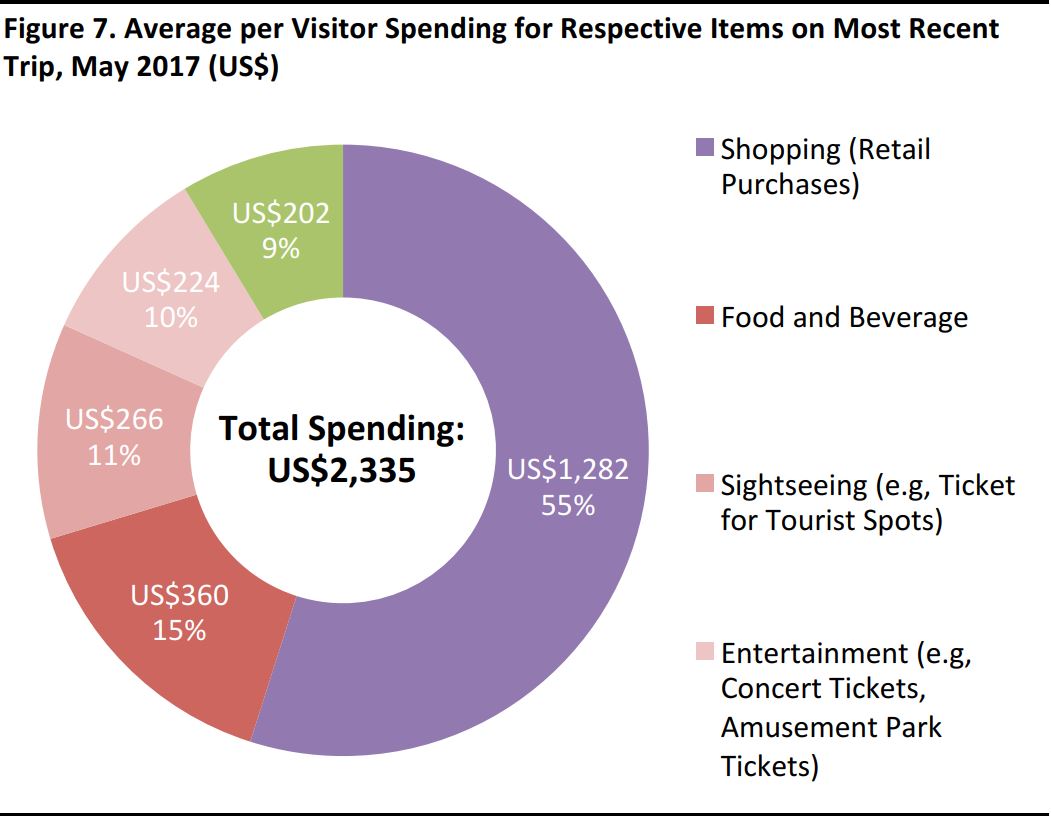

- On average, retail purchases accounted for 55% of their spending, or US$1,282 in value. Chinese tourists are craving for lifestyle and experiences as well, with experience related spending, including food and beverage (15%), sightseeing (11%) and entertainment (10%) together accounted for 36% of their expenditure.

Products and Shopping Outlets

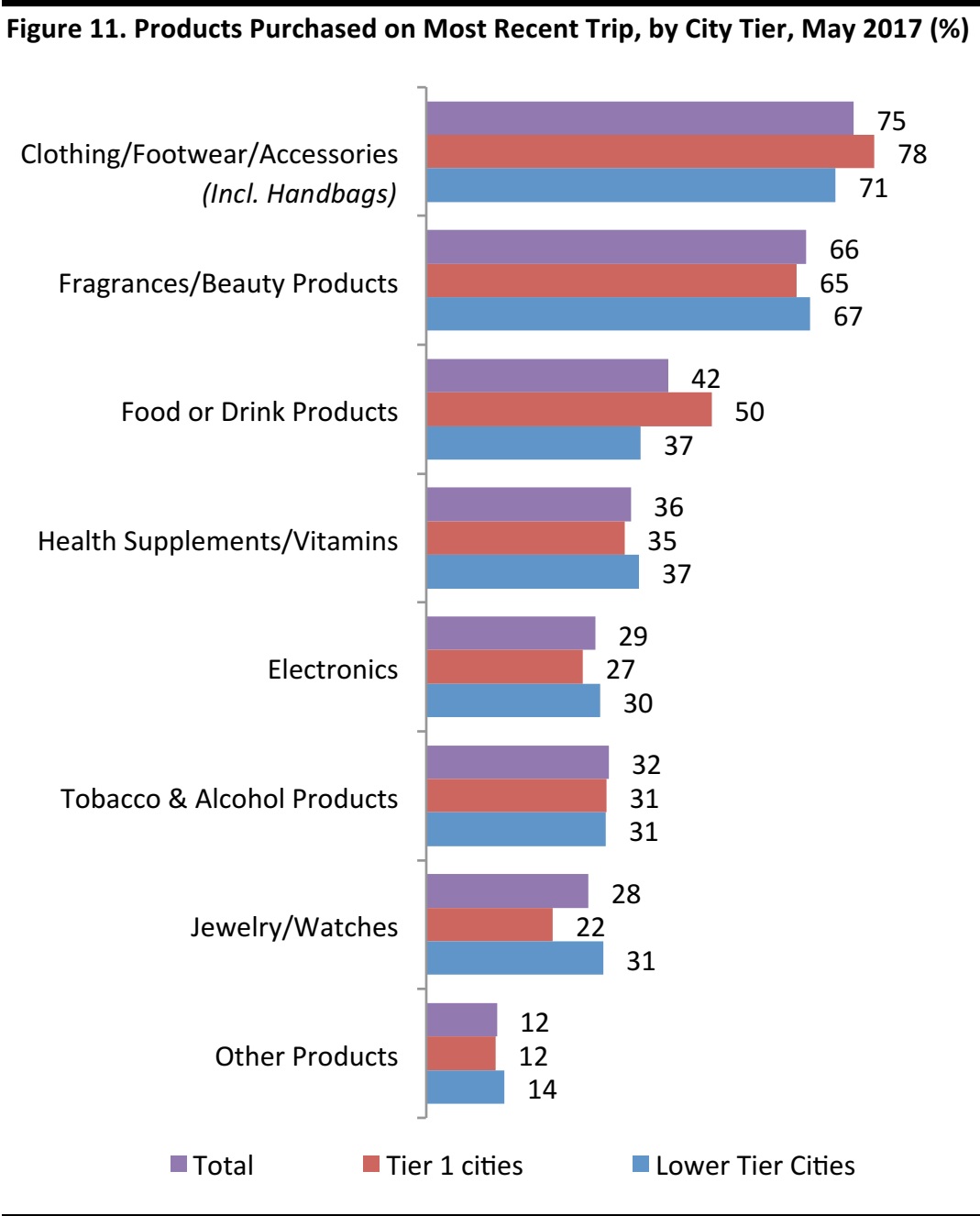

- Clothing, footwear and accessories (including handbags) is the most popular category, purchased by 75% of surveyed respondents during their most recent overseas trip. This is closely followed by fragrances and beauty products (66%), and food or drink products (50%).

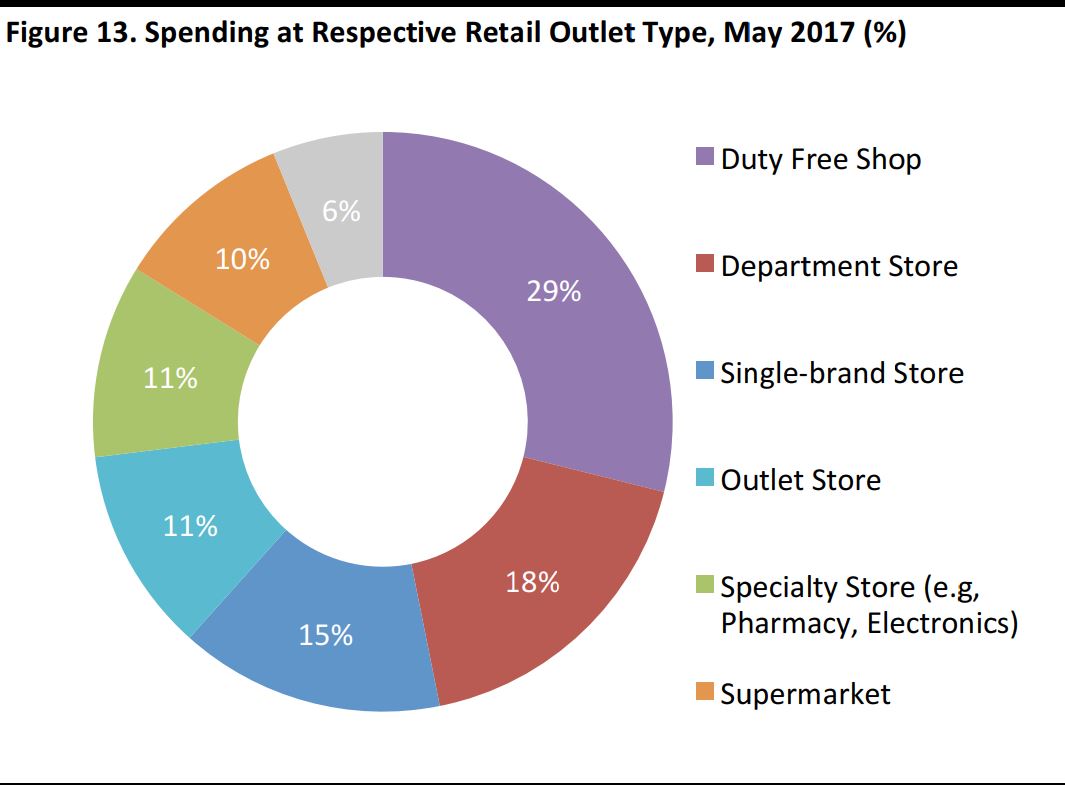

- Duty free accounts for 29% of Chinese tourists’ retail spending on average, the highest among all retail outlet types, followed by department stores at 18%. These two retail outlets together capture almost half of Chinese tourists’ retail spending.

Information Sources

- Chinese tourists are now mobile-savvy, with 98% of surveyed tourists having used their smartphone abroad to keep in touch with others and to search for travel-related information.

- Online resources such as travel websites, blogs and social media are used by 72% of surveyed respondents to plan their trips.

Implications for Brands and Retailers

- As the market landscape for Chinese tourists transforms and becomes more sophisticated, brands and retailers need to adapt and update their strategy continuously in order to engage this large and growing market of consumers.

- Chinese tourists have diversified demographics and travel experiences, thus have different needs while traveling abroad. Brands and retailers should identify their target tourist segments and cater to their needs accordingly.

- Brands and retailers should engage with Chinese tourists online at every stage of their trip, apart from conventional advertising, encouraging Chinese tourists to share their experiences at retail outlets is more influential, as it directly reaches new potential customers.

RESEARCH OVERVIEW

This is our third annual proprietary survey of Chinese overseas tourists’ travel and spending, commissioned together with China Luxury Advisors. Apart from last year’s questions including Chinese overseas traveler’s destinations, shopping behavior and future travel plans, this year, we have included additional questions which provide more in-depth information on the reasons and motivations behind their decisions and behavior when traveling overseas, helping retailers to better understand these consumers and how to best meet their needs.

Research Methodology

This year’s data was collected by an online self-completion survey conducted from May 31 to 6 June, achieving a total of n=841 samples. All respondents are mainland Chinese aged 18–59, and have taken at least one overseas trip (including Hong Kong, Macau and Taiwan) with a minimum stay of one night in the past 12 months.

Respondents were asked to answer the survey questions based on their experience in the past 12 months, except for questions related to their future travel plans.

The survey data was weighted according to the age and gender distribution in China’s urban areas, based on the latest available census by the National Bureau of Statistics of China. The survey results show the percentage of respondents who selected a certain response. All figures should be read as a percentage of the respondent base.

Exchange Rates

For our 2017 spending estimates, we used an average foreign exchange rate for May 2016 from S&P Capital IQ when converting the renminbi (CNY, yuan) to the US dollar (USD), resulting in a rate of ¥6.8839 to US$1.00 (¥1 to US$0.1453).

Source: iStockphoto

MARKET OVERVIEW

Chinese Tourists Travel Two Times per Year

Base: All respondents (N=841), tier 1 (N=371), lower tier (N=424).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841), tier 1 (N=371), lower tier (N=424).

Source: China Luxury Advisors/FGRT

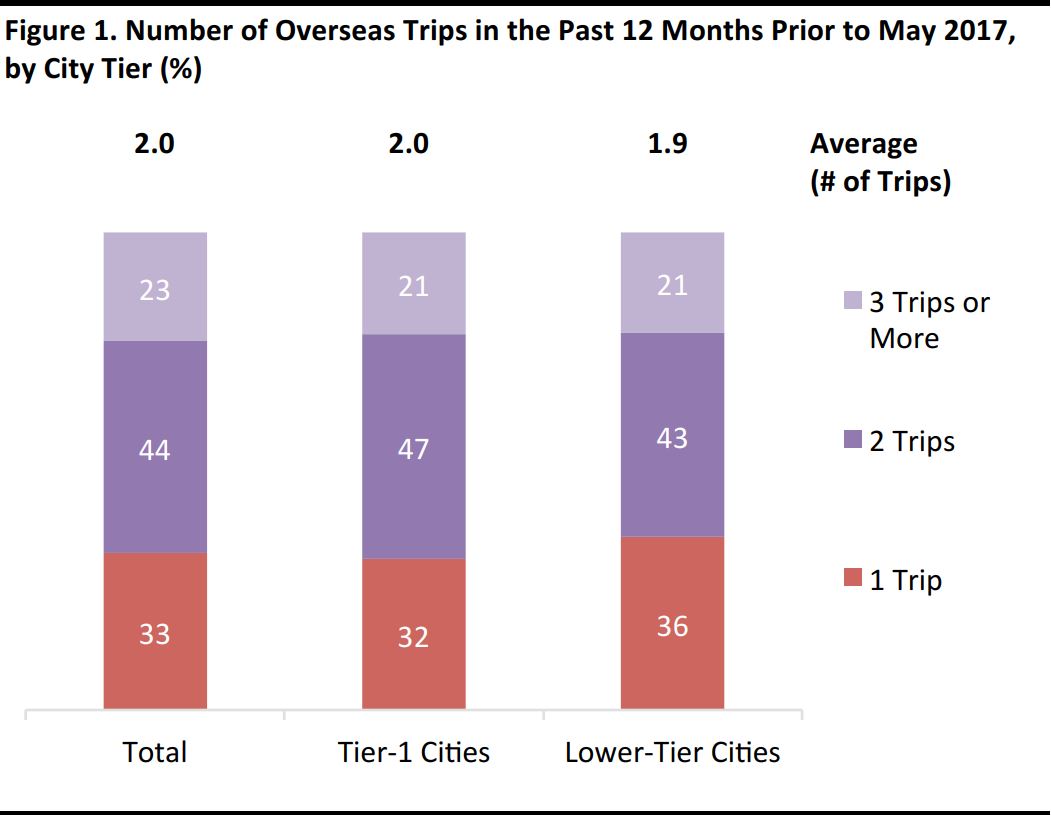

The majority of Chinese tourists are experienced travelers, with 67% of the surveyed respondents having traveled two times or more in the past 12 months. On average, Chinese tourists travel 2.0 times in one year.

As mentioned in our review on

Golden Week travel, lower-tier cities have become an important driving force in outbound traffic. Our survey results show that those from lower-tier cities travel 1.9 times per year, which is very similar to their counterparts in tier-1 cities at 2.0 times per year. With the rising affluence of citizens in the lower-tier cities and better air connectivity to overseas cities, retailers and brands should not overlook the travelers from the lower-tier cities.

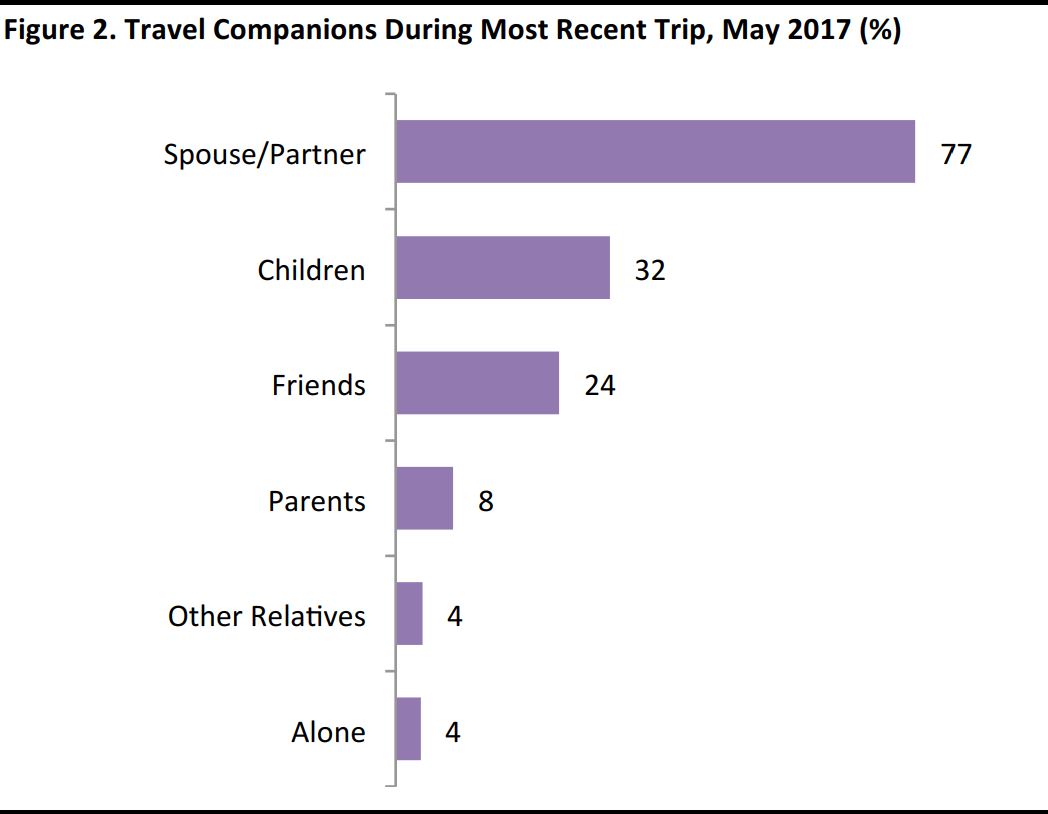

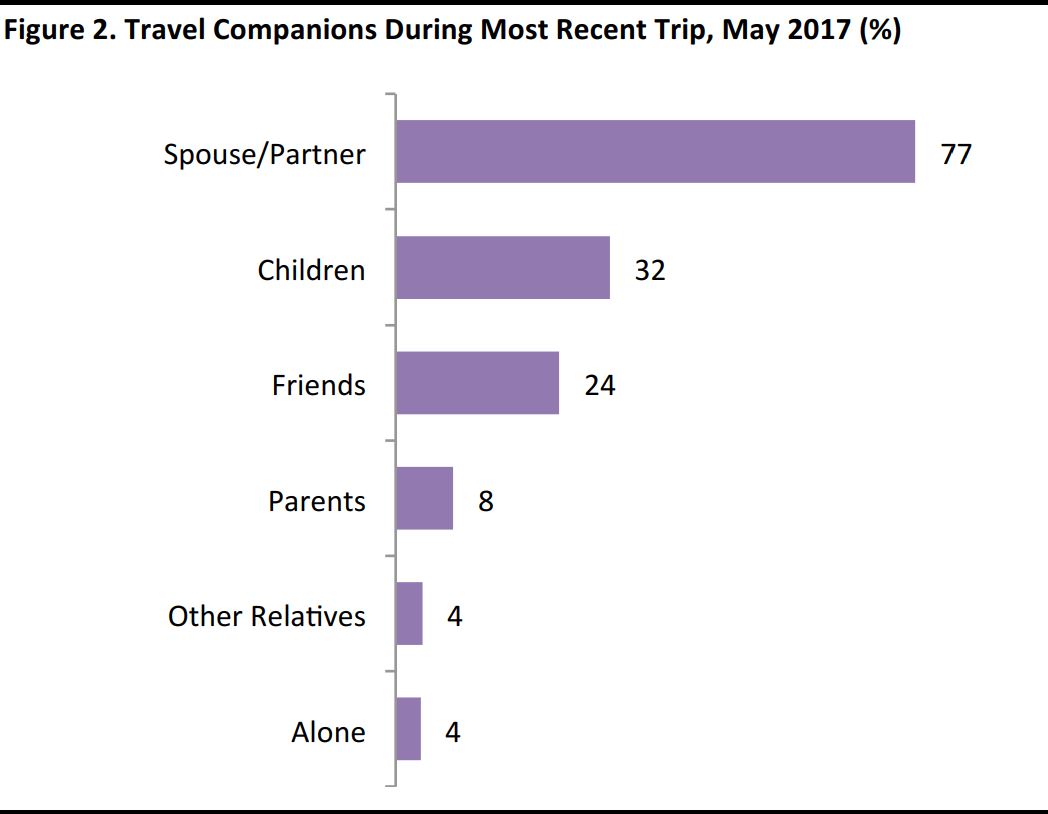

Most Chinese Tourists Travel with Family

Base: Leisure travelers (N=714).

Source: China Luxury Advisors/FGRT

Most Chinese tourists travel with their family; 77% of surveyed respondents were with their spouse or partner on their most recent trip. Those traveling with both their spouse and children constitute a significant segment, accounting for 32% of all Chinese tourists. Retailers and brands can consider designing their stores as a family-friendly location. Catering to the needs of both adults and children may help to attract these customers.

According to Jessica Zhou, The Bright Future Travel, there is strong demand from family groups. Most of them tend to be repeat visitors and are willing to spend more and have a better experience.

Chinese Tourists Love Traveling to Japan

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Japan is the most popular destination among Chinese tourists, with 55% of surveyed respondents having visited the country in the past 12 months prior to May 2017, and 41% visiting the country on their most recent trip. According to travel agency operator Jessica Zhou, Japan has reaped the benefits of the decline in travel to South Korea to become one of the fastest-growing markets in the past 12 months. Despite occasional outbreaks of tensions between China and Japan, several factors have favored the growth of Chinese tourists to Japan, such as the geographical proximity of the two countries, an increase in the number of direct flights and the relaxation of visa requirements.

Hong Kong remains a popular destination among Chinese tourists, visited by 35% of surveyed respondents in the past 12 months prior to May 2017, the second highest among all destinations. However, Chinese tourists are increasingly treating Hong Kong as a short-haul destination. According to the Hong Kong Tourism Board, Chinese tourists spent an average of 3.3 nights in Hong Kong in 2016, down from 3.9 nights in 2011.

South Korea is the third-most-popular destination, with 27% of surveyed respondents having visited the country in the past 12 months prior to May 2017. While South Korea was the top destination during the 2016 Golden Week, according to the China National Tourism Administration, Chinese economic boycott protests over South Korea earlier this year, including the reduction of the number of flights and tours, may have attributed to the plunge in Chinese tourists visiting the country—only 10% of surveyed respondents traveled to South Korea on their most recent trip.

Europe is the top long-haul destination for Chinese tourists, visited by 16% of surveyed respondents during the survey period. The

US is the second-most-popular long-haul destination, with 9% of surveyed respondents having visited the country.

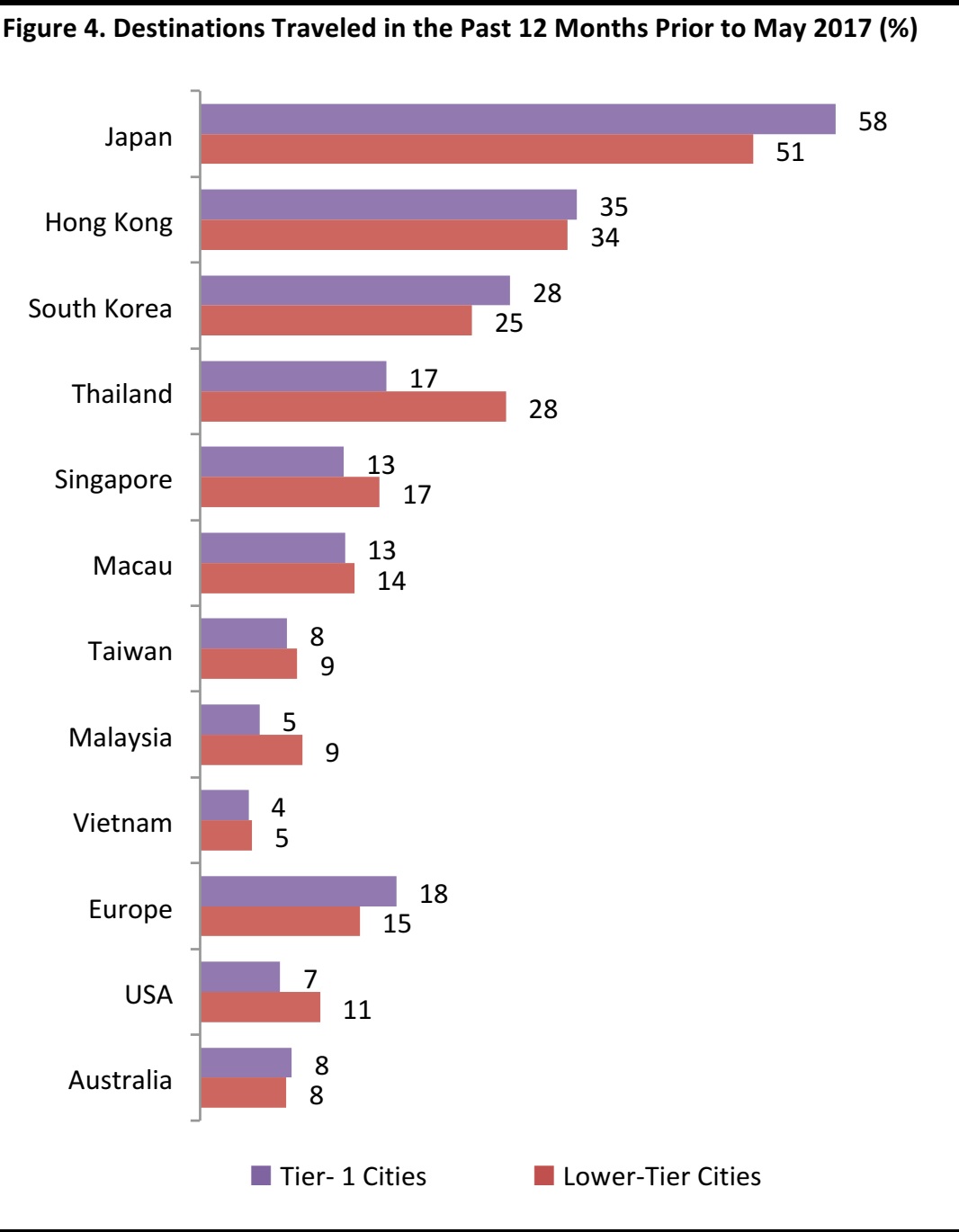

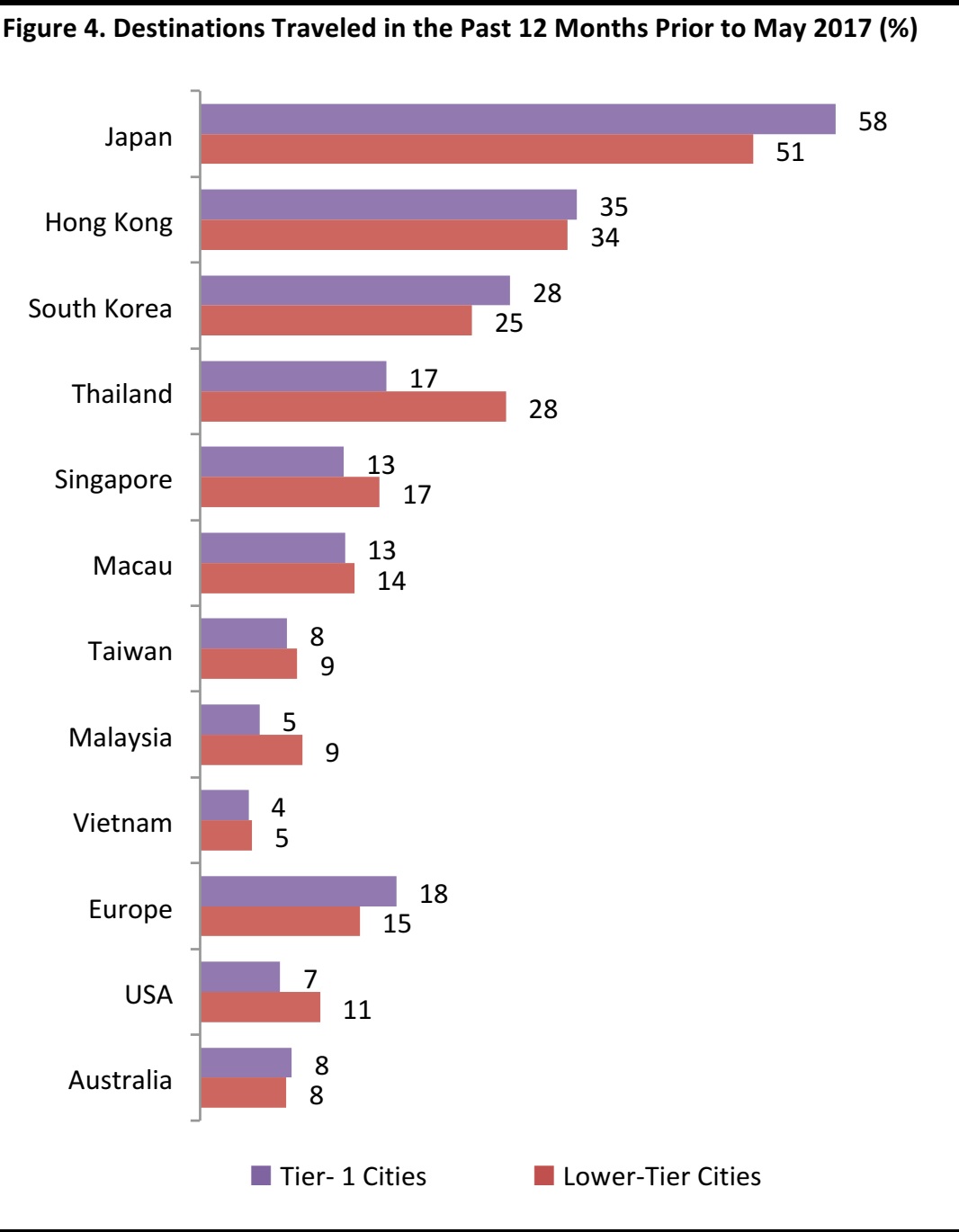

Southeast Asian Countries Are More Popular Among Chinese Tourists from Lower-Tier Cities

Base: Tier 1 (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT

Base: Tier 1 (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT

The popularity of most Asian destinations as well as long-haul destinations is similar among Chinese from different cities. However, we observed some differences for a number of destinations.

Japan is more popular among those from tier-1 cities, with 58% of citizens from tier-1 cities visiting the country, higher than those from lower-tier cities at 51%.

Source: China.org.cn

Source: China.org.cn

Southeast Asian countries are more popular among travelers from lower-tier cities, with 28% and 9% having visited Thailand and Malaysia, respectively, during the survey period, higher than that from tier-1 cities at 17% and 5%, respectively. The more lenient visa policy, as well as cheaper travel options may have attributed to the difference. The difference among tourists from tier-1 and lower-tier cities is observed for other Southeast Asian countries as well, but they are not yet statistically significant.

Security Is the Top Priority When Choosing a Destination, Followed by Tourist Spots and Cuisine

Base: Leisure Travelers (N=714).

Source: China Luxury Advisors/FGRT

Base: Leisure Travelers (N=714).

Source: China Luxury Advisors/FGRT

Almost all respondents considered

security (96%) an important factor when choosing the destination for their most recent overseas trip.

Although Chinese tourists have set records for spending overseas,

shopping variety (56%) is not a top-mentioned factor. Instead, more respondents regard factors such as

tourist spots (94%) and

cuisine(88%) as important.

While many countries offer multiple-entry visas or visa-on-arrival for Chinese tourists,

visa policies remain an important factor to consider when choosing a destination, as mentioned by 82% of surveyed respondents.

More Chinese Tourists Choose Hong Kong, Japan and South Koreadue to Shopping Variety

Base: Those who traveled to Australia (N=23), W. Europe (N=28), Hong Kong (N=81), Japan (N=286), S. Korea (N=88), Thailand (N=92) and USA (N=18) for leisure on their most recent trip.

* Indicates small base (N<30).

Source: China Luxury Advisors/FGRT

Base: Those who traveled to Australia (N=23), W. Europe (N=28), Hong Kong (N=81), Japan (N=286), S. Korea (N=88), Thailand (N=92) and USA (N=18) for leisure on their most recent trip.

* Indicates small base (N<30).

Source: China Luxury Advisors/FGRT

Shopping variety is regarded as an important factor by more Chinese tourists visiting

Hong Kong (75%),

Japan (73%) and

South Korea (73%). This indicates a wider variety of shopping locations and categories at these destinations, when compared to other countries or regions.

Only 60% of Chinese tourists who visited

Western Europe on their most recent trip mentioned shopping variety as an important factor. Indeed, our survey shows that Chinese tourists purchased on average 2.95 product categories in Western Europe, less than the global average of 3.32 categories.

SPENDING ON MOST RECENT TRIP

Chinese Tourists Spend the Most on Retail Purchases, but Experiences During the Trip Also Matter

Base: All Respondents (N=841)

Source: China Luxury Advisors/FGRT

Base: All Respondents (N=841)

Source: China Luxury Advisors/FGRT

On average, Chinese tourists spent US$2,335 on their most recent trip, with shopping accounting for over half of the spending at 55%, or US$1,282 in value.

Chinese tourists are craving a lifestyle and experiences during their trips as well—related spending, including food and beverage (15%), sightseeing (11%) and entertainment (10%), accounted for 36% of the expenditure. This resonates with our findings that 94% and 81% of surveyed respondents mentioned tourist spots and cuisine, respectively, as important factors in deciding on a travel destination.

Chinese Tourists Spend Over US$2,700 When They Travel to Long-Haul Destinations

Base: Those who traveled to Australia (N=28), W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S. Korea (N=104), Thailand (N=99) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

# Other spending includes: food and beverage, sightseeing, entertainment and local transportation. Western Europe includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Base: Those who traveled to Australia (N=28), W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S. Korea (N=104), Thailand (N=99) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

# Other spending includes: food and beverage, sightseeing, entertainment and local transportation. Western Europe includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Chinese tourists spend more when they travel to long-haul destinations.

Western Europe (US$3,080),

Australia (US$3,056) and the

US (US$2,733) are the top-three destinations in terms of average spending.

Those who visited

Hong Kong (US$1,904) spent less than those visiting other Asian destinations such as

Thailand (US$1,591),

Japan(US$1,276) and

South Korea (US$1,313). This might be attributed to more Chinese tourists treating Hong Kong as a short-haul destination and thus spending less as the stay is shorter.

Tourists from Lower-Tier Cities Earn Less, but Spend More than Those from Tier-1 Cities

Base: All respondents (N=841), Chinese tourists from tier-1 cities (N=371) and lower-tier cities (N=424).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841), Chinese tourists from tier-1 cities (N=371) and lower-tier cities (N=424).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT

Our survey shows that Chinese tourists from lower-tier cities earn an average monthly household income (MHI) of US$2,365, which is lower than those from tier-1 cities at US$3,092.

However, when traveling abroad, surveyed respondents from lower-tier cities spend more, with an average spending of US$2,449 on their most recent trip, 10% higher than those from tier-1 cities at US$2,330. In particular, they spent more on retail purchases at US$1,370, which is higher than those from tier-1 cities at US$1,204.

Typically, Chinese tourists are armed with shopping lists of things to buy on behalf of friends and family, which is one possible reason for the higher spending than their income would normally predict.

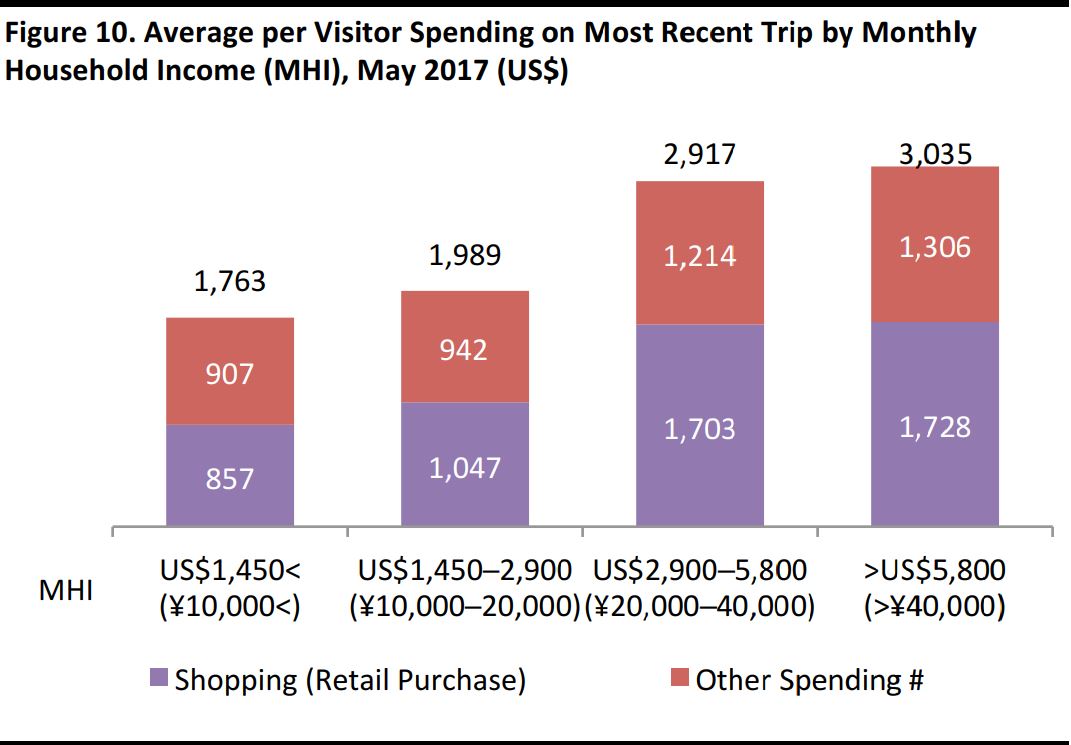

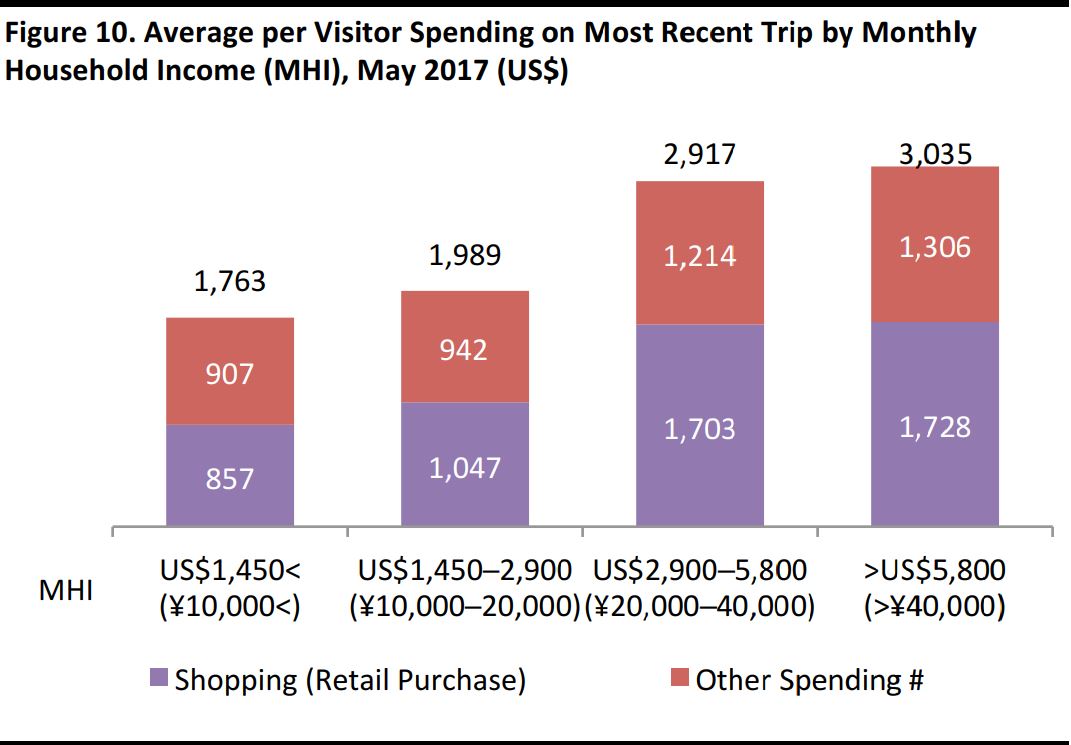

High-Income Tourists Spend 60% or More on Retail Purchases Compared to Low-Income Tourists

Base: Respondents with MHI US$1,450< (N=69), US$1,450– 2,900 (N=407), US$2,900–5,800 (N=253), >$5,800 (N=112).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT

Base: Respondents with MHI US$1,450< (N=69), US$1,450– 2,900 (N=407), US$2,900–5,800 (N=253), >$5,800 (N=112).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT

Chinese tourists with a MHI higher than US$2,900 spend significantly more overseas than those earning below this level. In particular, they spend much more on retail purchases. Those with a MHI between US$2,900 and US$5,800 spend an average of US$1,703 on shopping, 62% higher than those with a MHI between US$1,450 and US$2,900.

The highest income group, those with a MHI over US$5,000, spend only marginally more than those with incomes between US$2,900 and US$5,800. However, the increase is most notably represented by spending on experience-related items, as their average expenditure on other spending is 7% higher than those in the second-highest income group.

SHOPPING ON MOST RECENT TRIP

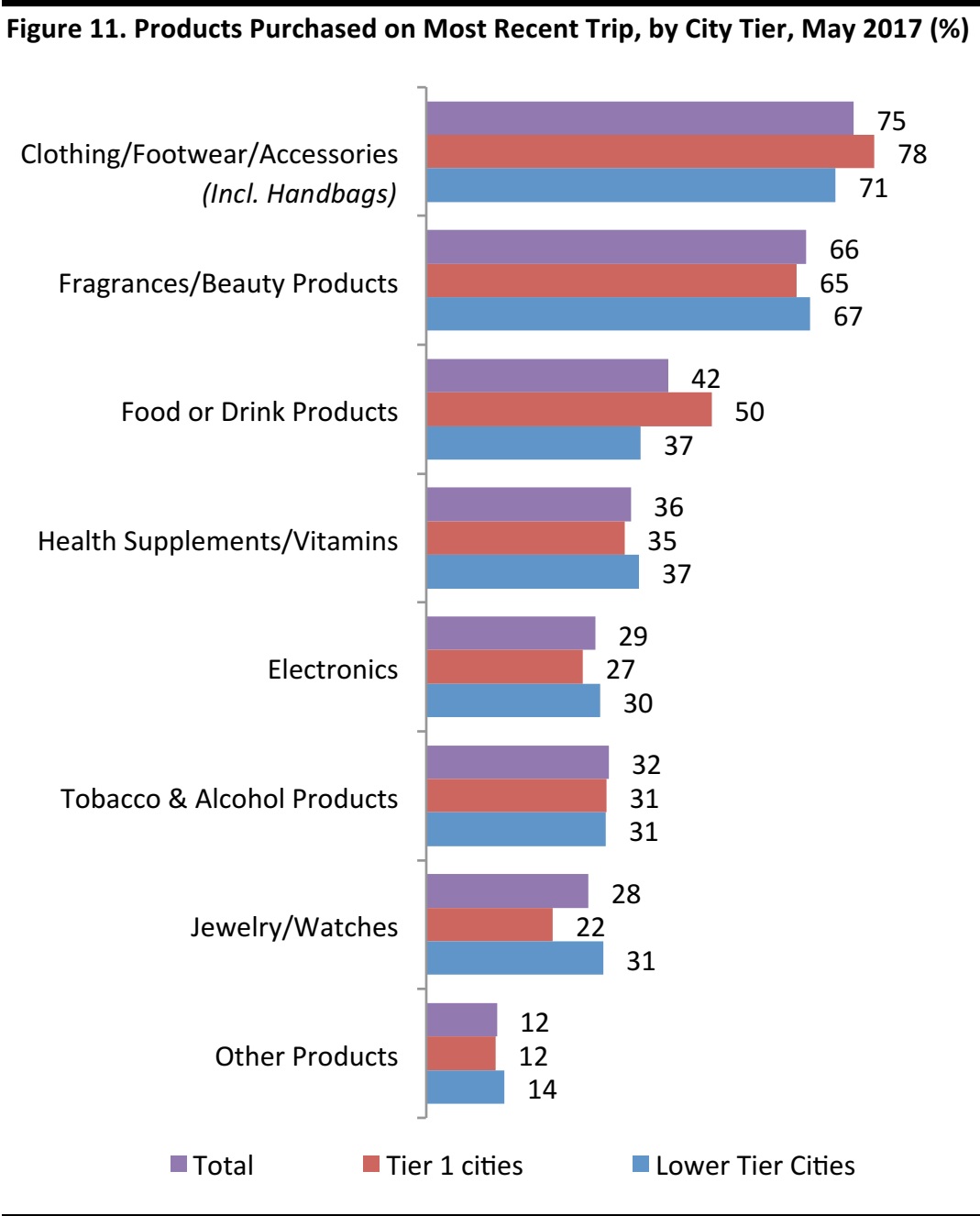

Apparel and Cosmetics Are the Most Popular Purchased Items Among Chinese Tourists

Base: All respondents (N=841), tier-1 cities (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841), tier-1 cities (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT

Clothing, footwear and accessories (including handbags) comprised the most popular category, purchased by 75% of surveyed respondents during their most recent overseas trip. This is closely followed by

fragrances and beauty products at 66%. These two categories are consistently popular among Chinese tourists, mainly due to price differences between China and overseas.

Most products are similar in popularity among Chinese tourists, but some differ in popularity among travelers from different city tiers. For instance,

food and drink products are purchased by 50% of tourists from tier-1 cities, higher than from lower-tier cities at 37%. This may be attributed to the higher affluence among survey respondents from tier-1 cities, where they start looking for high-quality everyday necessities that are difficult to find in China, such as premium rice from Japan. Recent scandals related to food safety have also led to the preference for food and drinks products from overseas, such as infant formula.

In contrast,

jewelry and watches are purchased by 31% of respondents from lower-tier cities, higher than those from tier-1 cities at 22%. In addition to the price differences between China and overseas, the higher popularity of buying jewelry and watchers overseas might be attributed to the lack of trustworthy retailers in lower-tier cities. In addition, according to Dan Wang of Shenyang Comfort Travel, people from tier-two and tier-three cities often spend more than those from tier-one cities when traveling abroad, as many luxury brands that people in tier-one cities take for granted might not be available in the lower-tier cities.

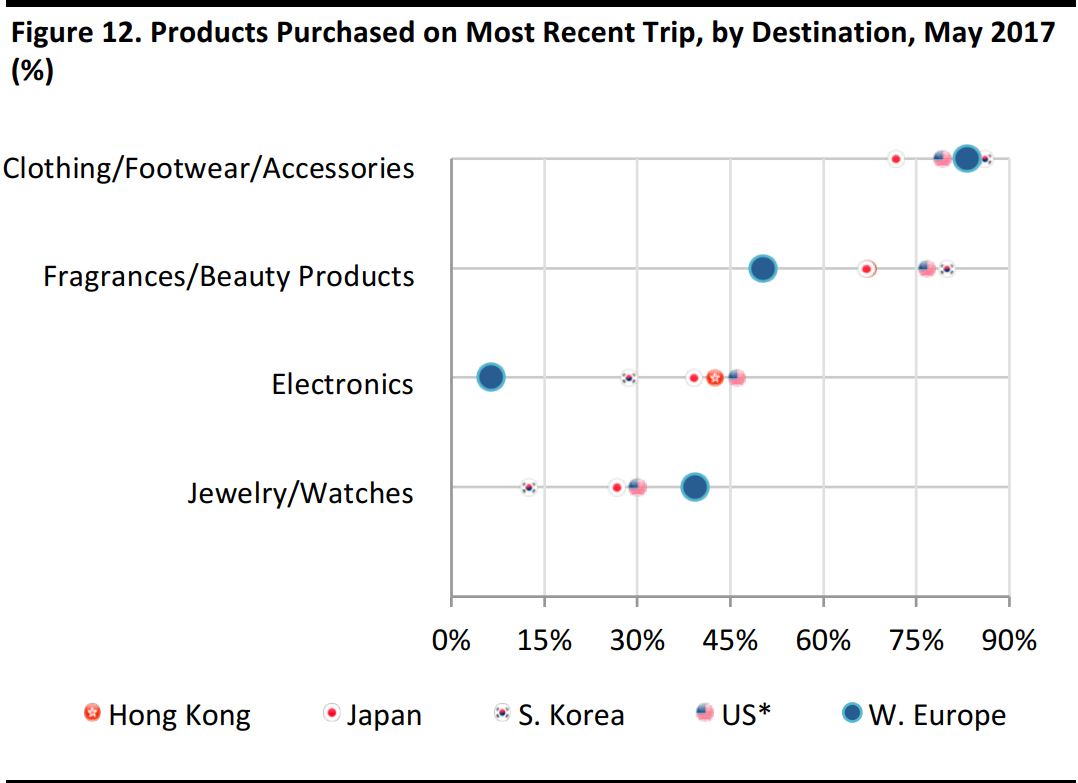

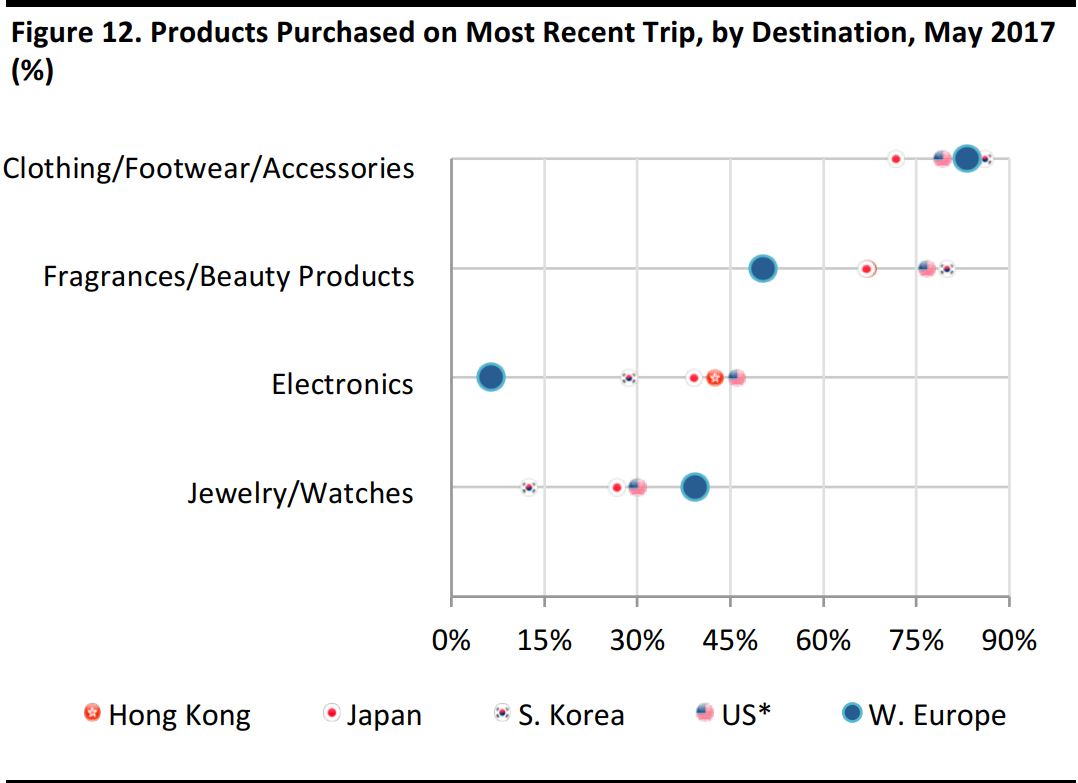

Apparel, Footwear and Accessories Is the Most-Sought-After Product Category Across all Major Destinations

Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and the US (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and the US (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Apparel, footwear and accessories is the most-sought-after product category, followed by

fragrances and beauty products across all major destinations visited by Chinese tourists on their most recent trip.

The US, Hong Kong and Japan are the more popular destinations for

electronics purchases, but less popular among those visiting Western Europe.

In contrast, Western Europe is the most popular destination for

jewelry and watch purchases, closely followed by Hong Kong. This category is less popular among Chinese tourists visiting South Korea.

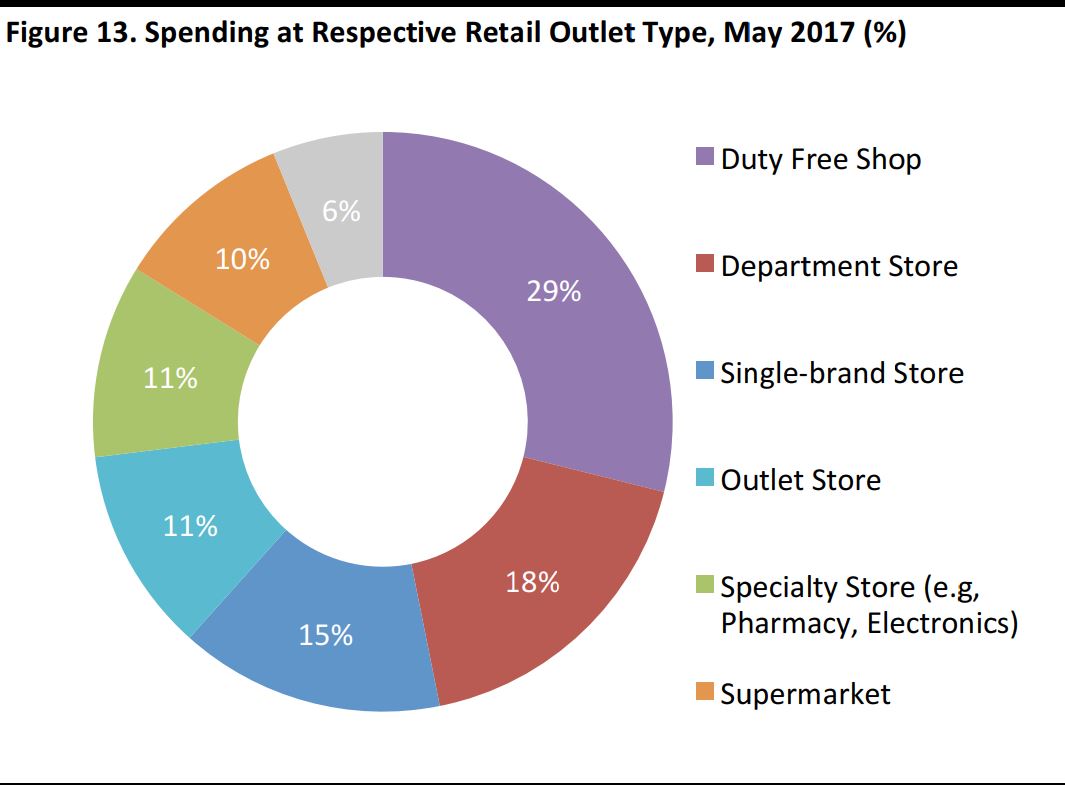

Duty Free Accounts for Almost One-Third of Chinese Tourists’ Retail Spending

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Duty free accounts for 29% of Chinese tourists’ retail spending on average, the highest among all retail outlets. This is followed by

department stores (18%). Combined, these two retail outlets capture almost half of Chinese tourists’ retail spending.

Both duty free shops and department stores offer a wide range of goods under one roof, and provide a number of services catering to the needs of Chinese tourists, such as Chinese-speaking staff and an on-site tax refund service, which makes them an appealing shopping destination for Chinese tourists.

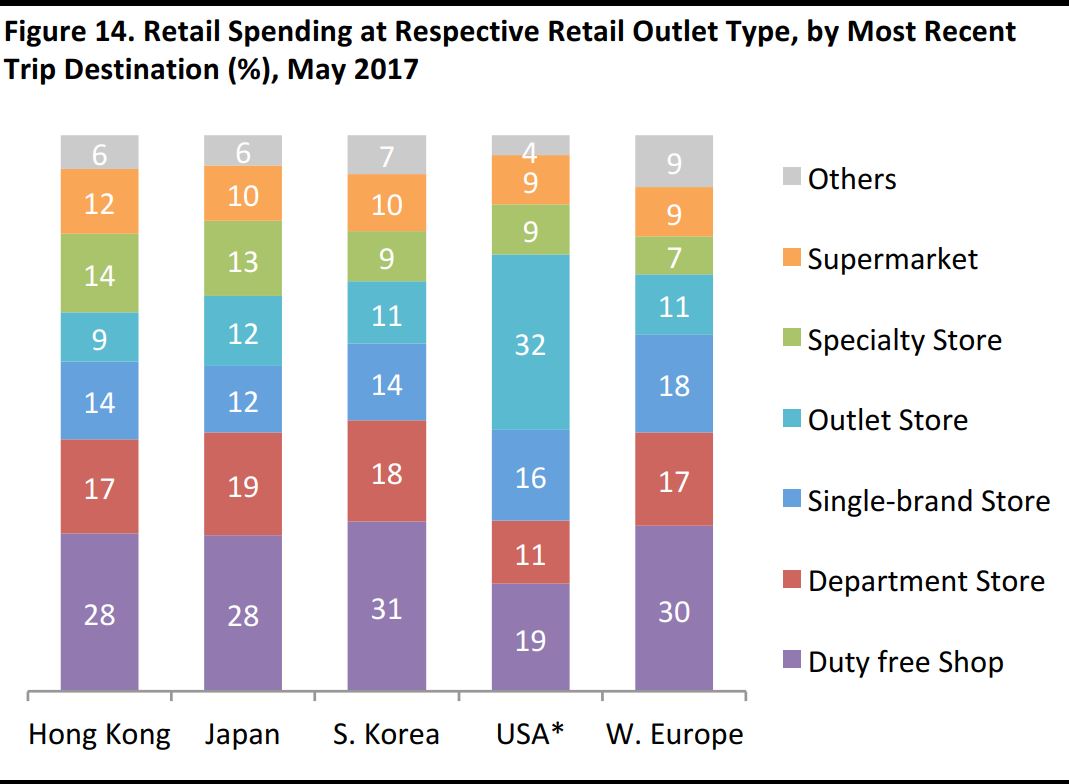

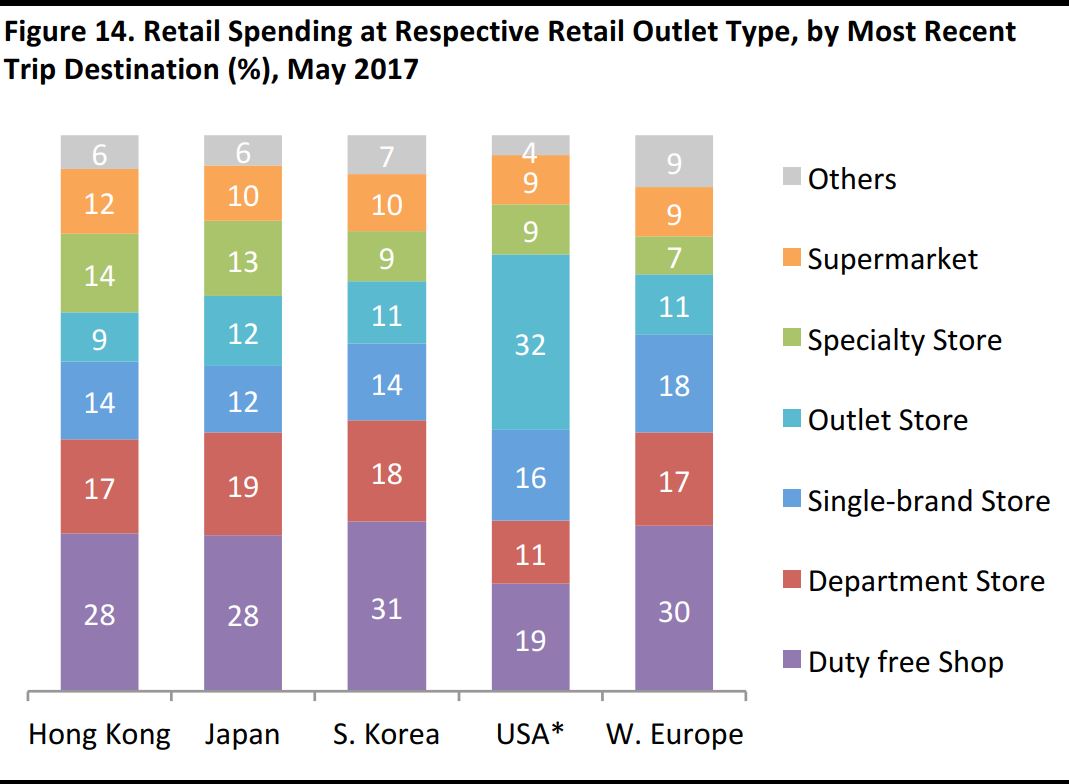

China Tourists Spent Most at Duty Free Shops, Except for Those Visiting the US

Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Across the main destinations, Chinese tourists spent the most at duty free shops, followed by department stores, except those who visited the US on their most recent trip, where they spent the most at outlet stores.

In comparison, Chinese tourists who visited Hong Kong and Japan spent more at specialty stores, such as pharmacies and electronics stores, than those who visited South Korea, the US and Western Europe. Pharmacies are a popular retail outlet among Chinese tourists, as they carry items with limited availability in China, such as medicine and infant formula.

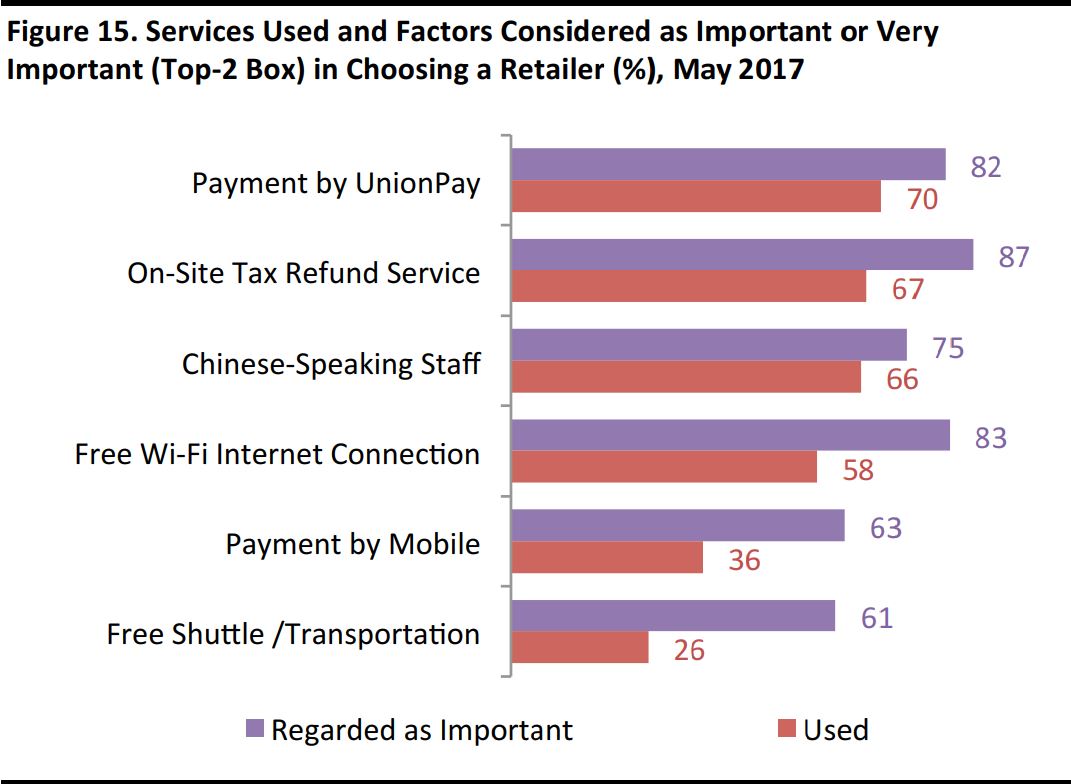

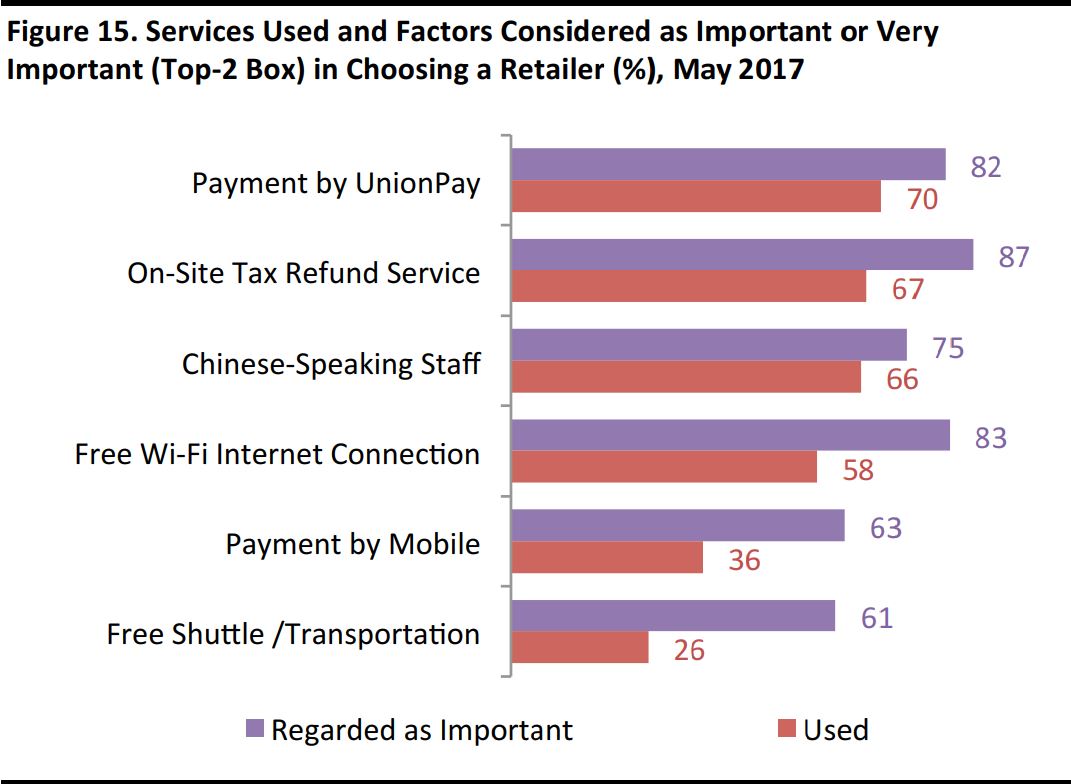

Services Offered by Retailers Are Close to Chinese Tourists’ Expectations

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Most retail outlets targeting Chinese tourists offer

payment by UnionPay, on-site tax refund services and Chinese-speaking staff. The majority of Chinese tourists regard these as important services and have used them during their most recent overseas trip.

Over half of Chinese tourists surveyed regard

payment by mobile and free transportation to retail outlets as important, too, but fewer respondents have used these services, at 36% and 26%, respectively. By offering these services, brands and retailers may differentiate from others and appeal to more Chinese tourists.

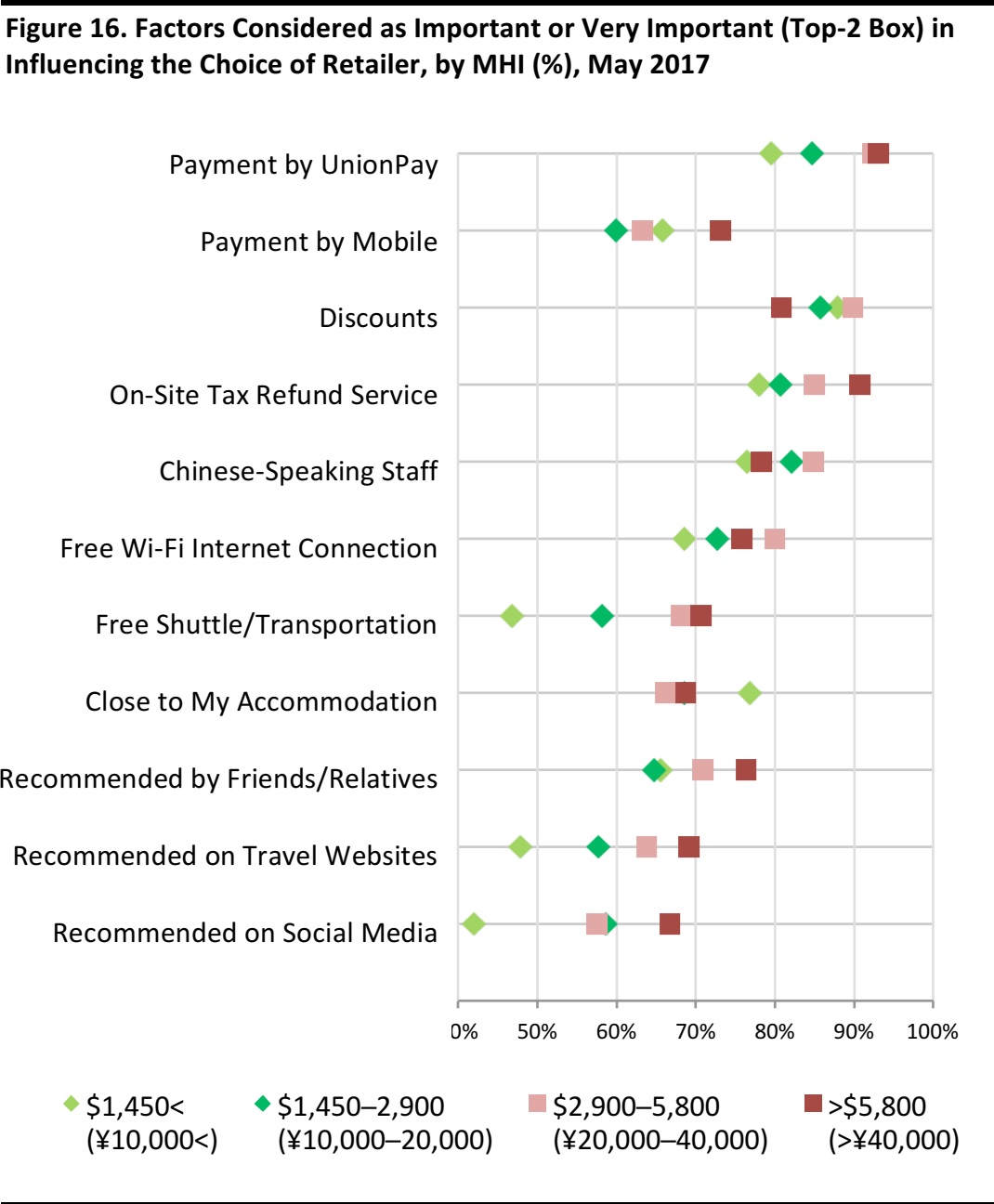

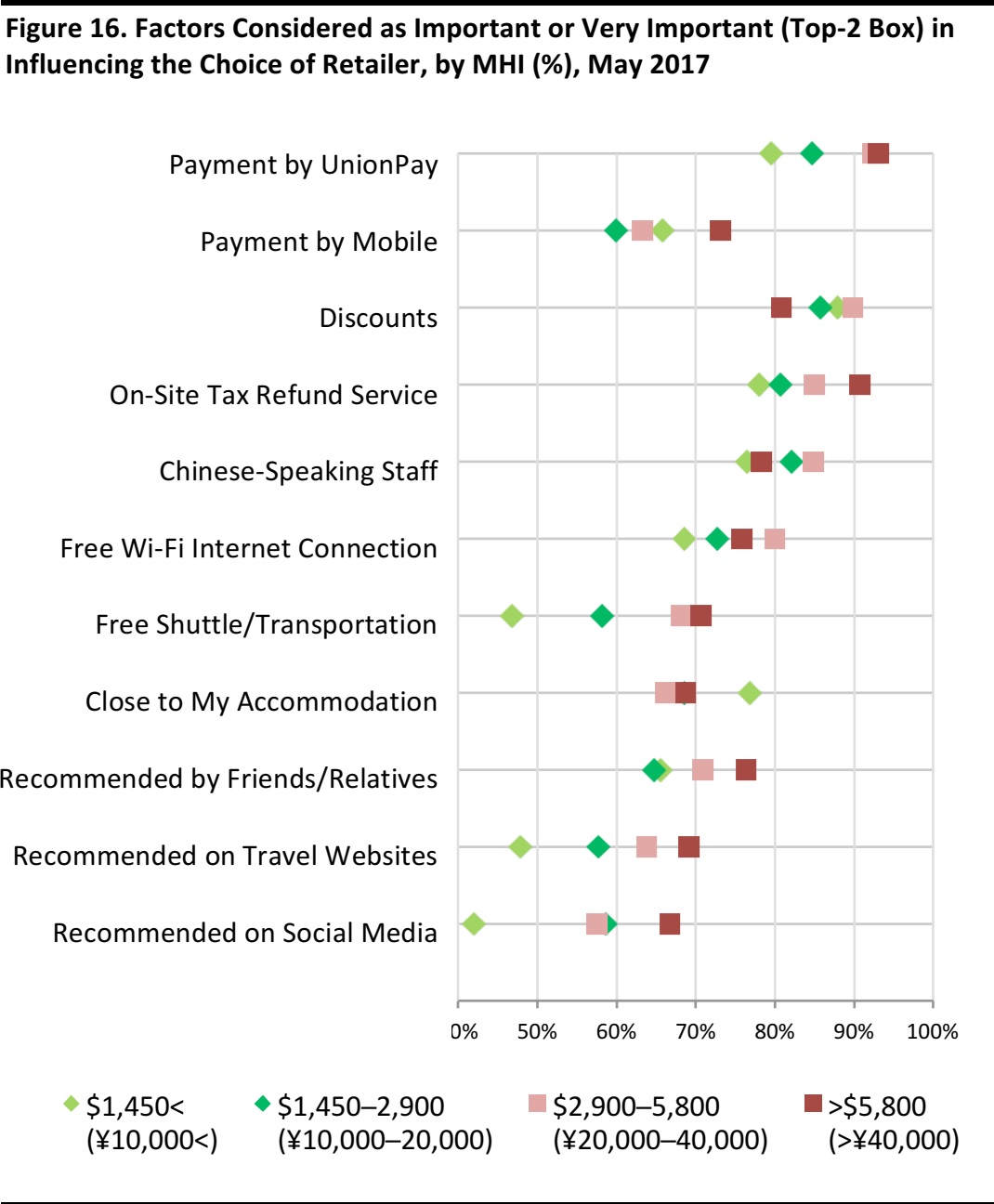

Convenient Payment, Tax Refund and Recommendations by Others Are More Influential on High-Income Tourists in Choosing a Retailer

Base: Respondents with MHI US$1,450< (N=69), US$1,450‒2,900 (N=407), US$2,900‒5,800 (N=253), >$5,800 (N=112).

Source: China Luxury Advisors/FGRT

Base: Respondents with MHI US$1,450< (N=69), US$1,450‒2,900 (N=407), US$2,900‒5,800 (N=253), >$5,800 (N=112).

Source: China Luxury Advisors/FGRT

Payment by UnionPay is regarded by most high-income Chinese tourists as an important factor. As mentioned earlier, those with a MHI between US$2,900 and US$4,360 spent an average of US$1,703 on shopping, 62% higher than those with a MHI between US$1,450 and US$2,900. For those spending more on retail purchases, it is important to provide a convenient means of payment.

Source: Retail News Asia

Source: Retail News Asia

The same applies for some additional services. Among those with a MHI above US$4,360, more respondents regard an

on-site tax refund service and

free shuttle/transportation as influential in choosing a retailer, at 91% and 78%, respectively. This is significantly higher compared to those with a MHI below US$1,450, at 78% and 47%, respectively.

High-income Chinese tourists are also more likely to be

influenced by recommendations. Among those with a MHI above US$4,360, friends/relatives (76%) are the most influential, followed by travel websites (69%) and social media.

Factors such as discounts, Chinese-speaking staff and free Wi-Fi are equally influential among Chinese tourists in the different income groups.

TRAVEL ARRANGEMENTS

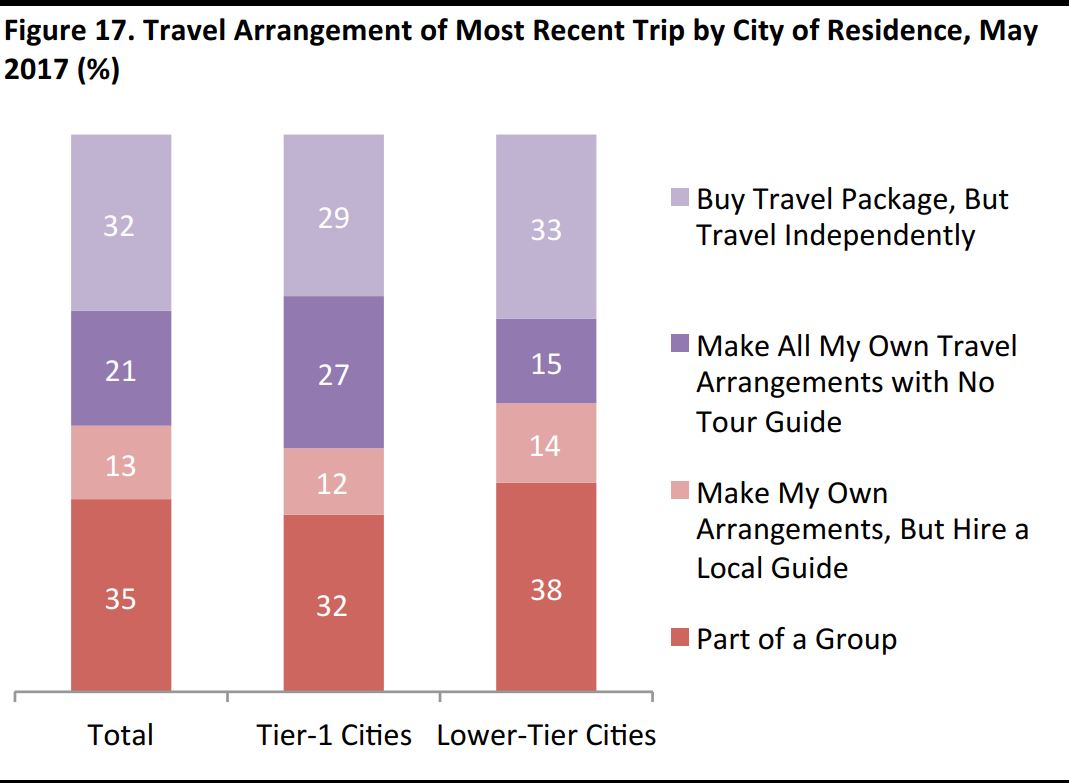

Traveling as Part of a Group Is No Longer the Norm for Chinese Tourists

Base: Leisure travelers (N=714); tier-1 cities (N=322), lower-tier cities (N=365).

Source: China Luxury Advisors/FGRT

Base: Leisure travelers (N=714); tier-1 cities (N=322), lower-tier cities (N=365).

Source: China Luxury Advisors/FGRT

Traveling as part of a group is still a popular form of travel arrangement, chosen by 35% of surveyed respondents for their most recent trip. However, the majority of surveyed Chinese tourists traveled independently on their most recent trip, either by buying a travel package (32%), or making their own travel arrangements (21%).

Chinese tourists from tier-1 cities tend to make all their own travel arrangements and travel without a tour guide, at 27%, representing a higher percentage than those from lower-tier cities at 15%.

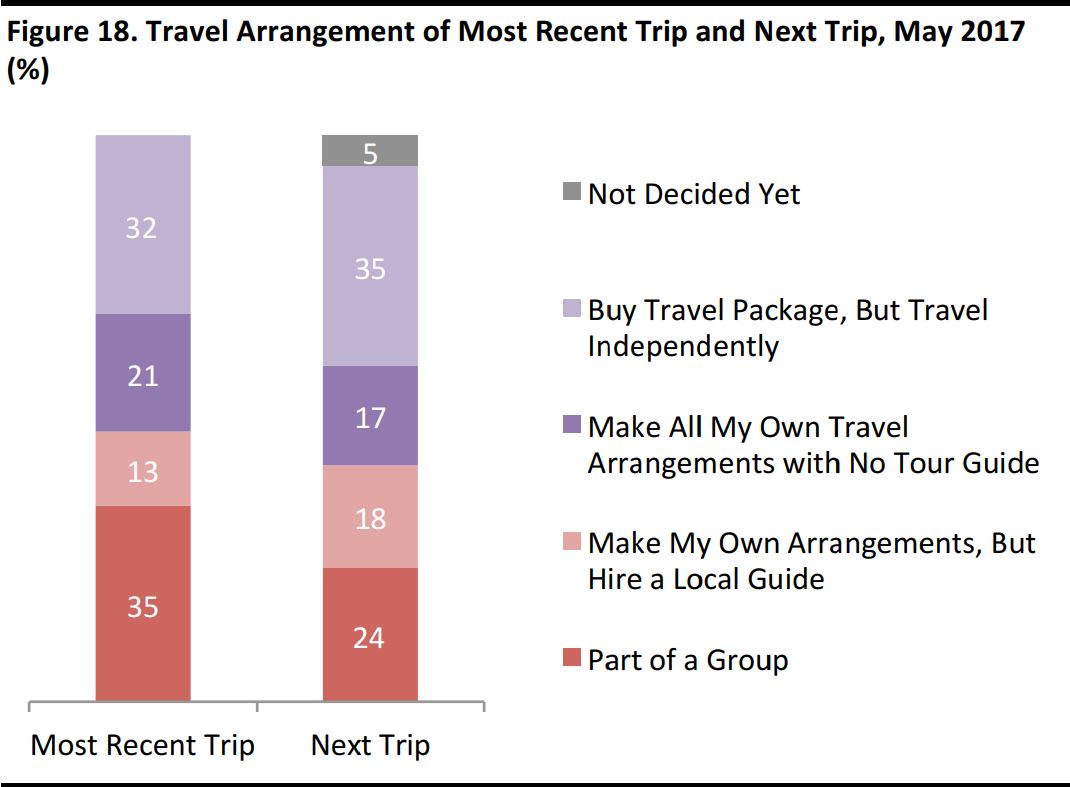

The Majority of Chinese Travelers Plan to Travel Independently on Their Next Trip

Base: Most recent trip (N=714); next trip (N=841).

Source: China Luxury Advisors/FGRT

Base: Most recent trip (N=714); next trip (N=841).

Source: China Luxury Advisors/FGRT

Buying a travel package and traveling independently is the most popular form of travel arrangement for Chinese tourists’ next overseas trip, mentioned by 35% of surveyed Chinese travelers. Together with those making their own travel arrangements with no tour guide (17%), over half of the surveyed Chinese travelers (53%) are planning to travel independently on their next trip.

According to Li Yuan of Legend Travel, FIT (free independent travel) has seen exponential growth. Increasingly more Chinese travelers prefer to explore on their own rather than in a group or accompanied by a tour guide. Group travel will continue to grow, but mostly driven by the tier-two and tier-three markets.

Chinese Tourists Plan Their Trips With Online Resources

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

The majority of Chinese tourists use online resources the most when they research their travel destination and plan their trips, as mentioned by 72% of surveyed respondents. Despite the rise of social media in recent years, travel websites or blogs remain the most popular resource, used by 51% of surveyed respondents. This can be attributed to the comprehensive information available on websites and blogs, as compared to social media.

However, social media is still a highly influential channel, as Chinese travelers share their personal experiences and recommendations with their friends and relatives on these platforms, where they might serve as a trustful reference when planning their own trips.

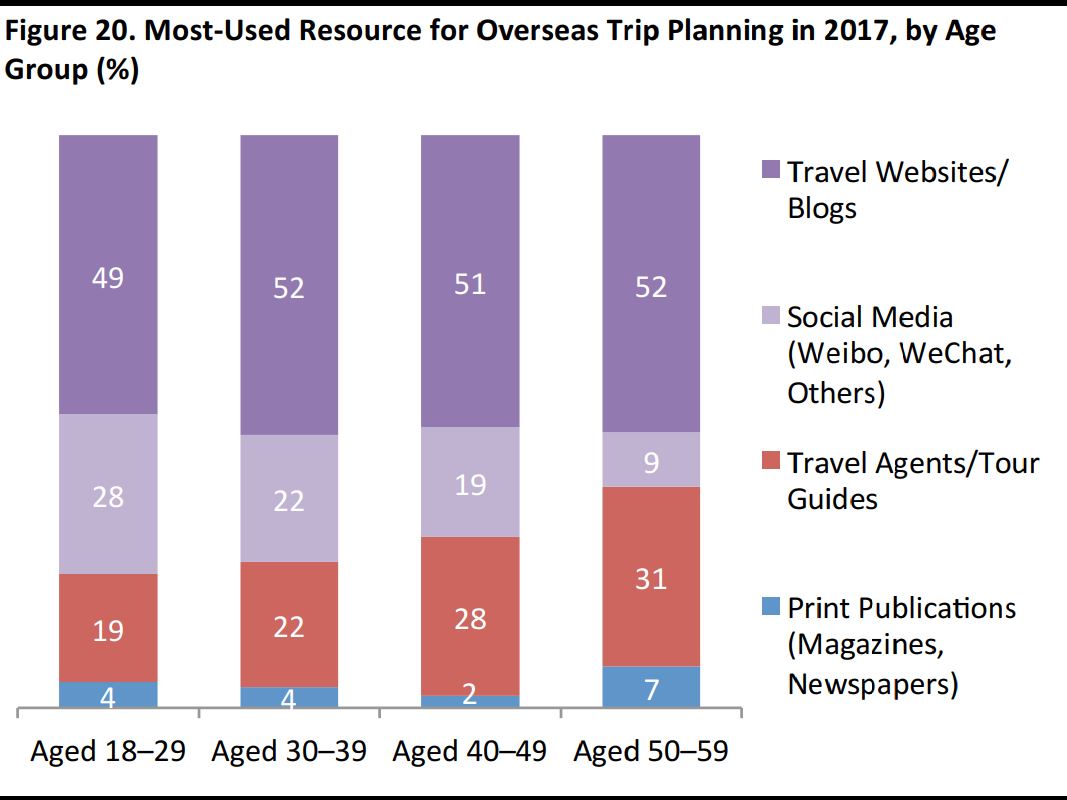

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

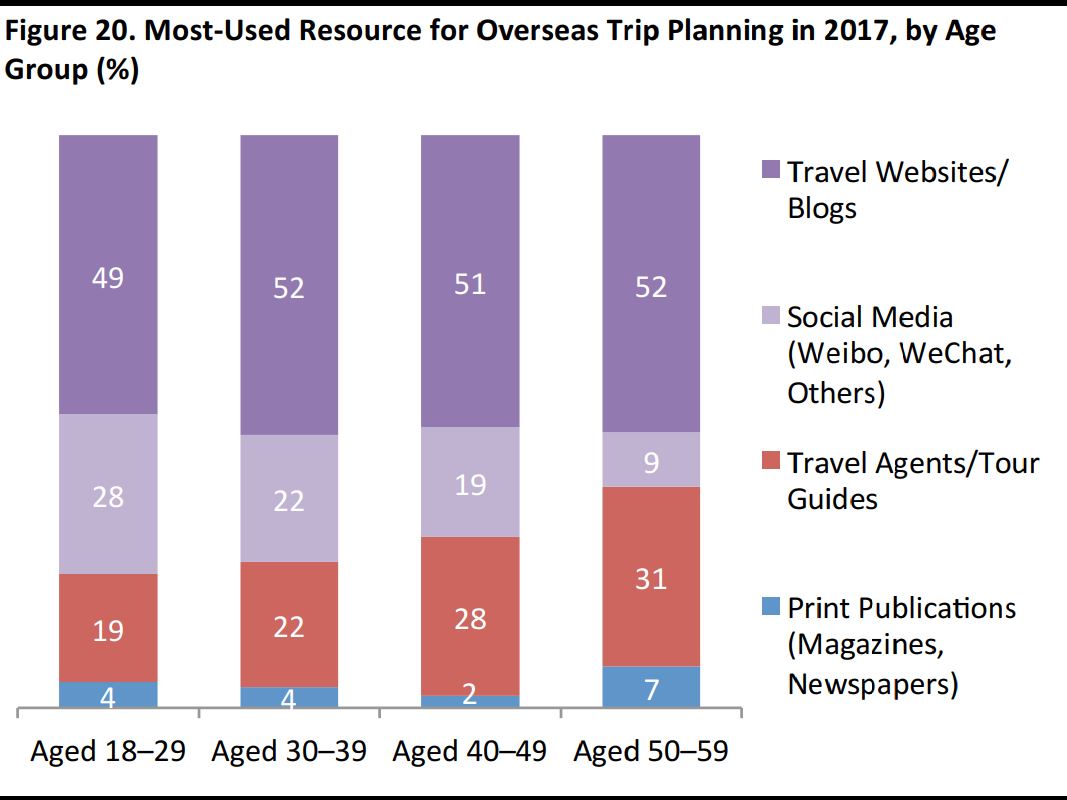

Online resources are the most popular information source among Chinese tourists of all age groups.

Young travelers tend to rely more on social media, including Weibo and WeChat. Some 28% of survey respondents aged 18–29 consider social media their major information source for trip planning, compared to 9% for respondents aged 50–59.

Travel agents and print publications are more popular among mature travelers as the main information source for trip planning—these two sources combined are used by 38% of surveyed respondents aged 50–59.

Smartphones an Effective Channel to Engage With Chinese Tourists

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

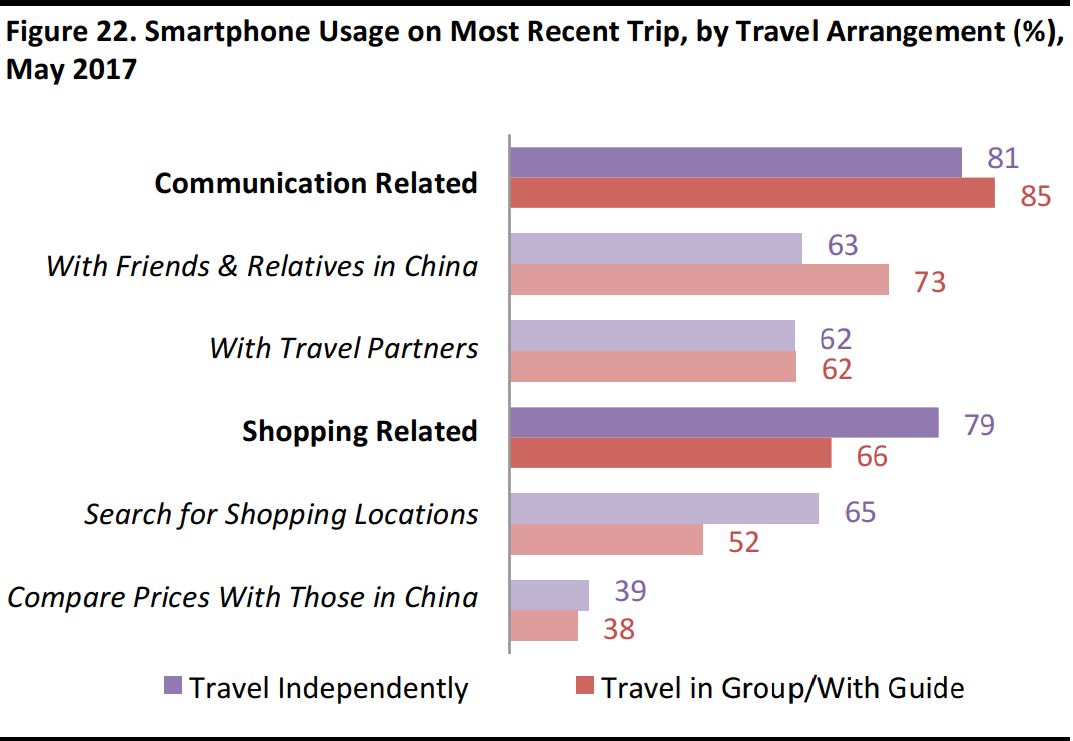

The vast majority of Chinese tourists rely on smartphones when they travel, with 98% of surveyed respondents having used their smartphone on their most recent trip. Communication-related functions (82%) are the most-mentioned usage among Chinese tourists, followed by shopping-related functions (73%).

The mobile platform is an effective touchpoint to engage with Chinese tourists. Brands and retailers can consider increasing their exposure by promoting on search platforms, as well as encouraging tourists to share their shopping experiences with their friends and relatives on social media in China.

Since Chinese tourists are subject to mobile roaming fees when they travel, free Wi-Fi is one of the most requested services by Chinese tourists so they can use their mobile phone without incurring additional charges.

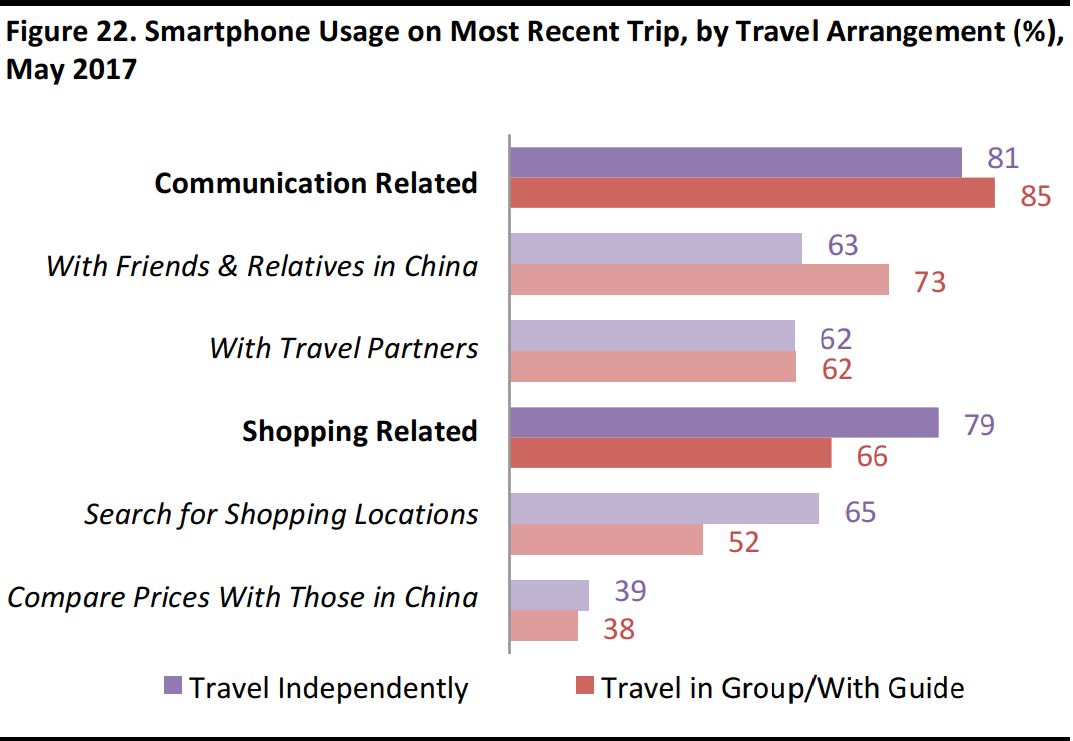

Chinese Tourists Traveling Independently Tend to Rely on Their Smartphone When They Shop

Base: Those who have used a smartphone on their most recent trip and traveled independently (N=462); travel in group/with guide (N=338).

Source: China Luxury Advisors/FGRT

Base: Those who have used a smartphone on their most recent trip and traveled independently (N=462); travel in group/with guide (N=338).

Source: China Luxury Advisors/FGRT

Over 80% of surveyed Chinese tourists, including those traveling independently and those traveling in a group, use smartphones to keep in touch with others.

However, those who travel independently are more likely to use smartphones for shopping-related functions, especially for searching for shopping locations (65%). Brands and retailers may leverage mobile platforms to target these independent travelers.

THE DYNAMIC AND GROWING CHINESE TOURIST MARKET

Chinese Travelers Set to Spend US$315 Billion Overseas in 2017

Includes business and leisure travel; excludes day trips.

Source: UN World Tourism Organization/FGRT

Includes business and leisure travel; excludes day trips.

Source: UN World Tourism Organization/FGRT

Chinese travelers are spending billions of dollars worldwide, thanks to their strong consumption power in a growing affluent economy and to their rising aspiration to possess high-quality goods. Total overseas spending by Chinese tourists is estimated at US$315 billion in 2017. By 2021, we forecast that Chinese tourists’ total overseas spending will reach US$457 billion.

In order to forecast total overseas spending of US$315 billion for 2017, we derived from the survey an average travel spending figure of US$2,335, and used that figure as the average per capita spending amount for Chinese outbound travelers for all of 2017.

Chinese Travelers to Reach 135 Million in 2017, Growing to 192 Million in 2021

Includes non-tourists such as business travelers.

Source: China Statistical Yearbook/China National Tourism Administration/FGRT

Includes non-tourists such as business travelers.

Source: China Statistical Yearbook/China National Tourism Administration/FGRT

Despite the sheer number of outbound tourists, we still see huge potential for total tourist numbers to grow, given China’s low outbound tourism penetration level of 9% (outbound tourists as a percentage of the total population). We expect the total journey number to grow to 135 million by 2017, and by a further 13 million in 2018. We estimate that total outbound tourist journeys will reach 192 million by 2021.

We lower our forecasts (

from our 2016 report), due to lower-than-expected outbound tourist numbers in 2015–16. However, we expect the growth of total outbound tourist journeys to remain intact despite the temporary slowdown. The rise of tourists from lower-tier cities will be the driving force for growth in the near future.

Trends in the Chinese Overseas Travel Market

While the number of outbound tourists and spending by tourists overseas continues to grow, the Chinese tourist market landscape is also transforming. We note the following trends from our survey:

- While group tours account for a large portion of travel arrangements, more Chinese travelers are now making their own travel arrangements in order to enjoy a more personalized travel experience. Also, as a growing number of Chinese tourists become more experienced and repeat travelers, we expect more Chinese tourists to visit offbeat destinations. We look for more tourists to stray off the well-worn path of the first wave of Chinese tourists and for more adventurous travelers to blaze a new path to new tourist destinations and attractions. Yuan Li of Legend Travel also mentioned there is strong interest in Egypt and Africa, especially for those who have already visited Europe and the US.

- Chinese tourists from the lower-tier cities will be the growth engine of outbound tourism, and indeed they are already traveling as much as their counterparts in tier-1 cities. Despite their lower average income, they spend more overseas—our survey shows that their average spending is 10% higher than those from tier-1 cities. This group tends to plan their purchases in advance, and in collaboration with friends and family.

- Foreign-exchange rate fluctuations, although not as significant as other factors when choosing a travel destination, will affect frequent travelers’ decisions when the exchange rates are unfavorable compared to other countries. Short- and long-term fluctuations might lead to swings in Chinese tourism travel patterns.

- Our survey shows that visa policies remain a key consideration in choosing a travel destination, mentioned by 82% of surveyed respondents. In order to attract Chinese tourists, we expect more countries to relax their visa policies for Chinese citizens. For instance, Japan reduced the minimum income requirement for Chinese citizens to apply for multiple-entry visas in January 2015 and the number of visas issued increased 2.9 times during the three months between the announcement date and the end of April.

Source: iStockphoto

Source: iStockphoto

HOW SECURITY AND CURRENCY AFFECTS CHINESE TOURISTS’ BEHAVIOR

Political happenings in the US and Europe have taken center stage in the global landscape in recent months, leaving experts wondering how these political changes will affect the global business climate.

China has been a particular focus of speculation, as political changes affect both the overall balance of power over the long term and global trade in the short term.

One area that is often overlooked by the media is the economic impact of Chinese tourism expenditures on the global economy.

As experts try to forecast how recent political happenings could affect the massive powerhouse of global spending that is China, they need to take into account ease of travel, visa policies and air travel to specific locations. However, perhaps the most important factor in understanding how Chinese tourism behavior will change going forward is in fact Chinese consumer behavior and preferences as they relate to travel.

In order to more accurately forecast changes in this behavior, China Luxury Advisors turned to experts in Chinese tourism—the Chinese travel trade—and interviewed Chinese tour operators around the globe, as well as Chinese tour guides on the ground in the US and Europe. These operators are on the front lines of Chinese tourist behavior on a daily basis, and the most attuned to shifts in behaviors. We asked them how the political climate is shifting consumer tourism behavior, and what they expect to happen in the future:

United States

When asked about the potential impact of the US election on Chinese tourism, many tour operators were skeptical that it would have much of an impact on the prevailing Chinese tourism trend favoring the US, unless tourism visa policies were to change. As David Wang from Galaxy Tour commented, “whoever becomes president does not matter much to Chinese tourists. Chinese still want to travel to the US. However, if tourist visa policies were to become stricter for Chinese citizens, Chinese tourists would not be able to come to the US.”

Benny Feng from NSA International added, “Sino-US tourism is an irresistible trend” and Ma Jie of Lucky Tours commented, “Chinese tourism can contribute a lot to the American economy. The trend of Chinese tourism will not stop.”

The top two concerns for continued strength in Chinese tourism to the US is the impact on the value of the yuan-US dollar exchange rate, and if the political climate were to have any impact on security concerns in the US. Safety is always the number-one concern of Chinese tourists. Any perceived instability would have a negative impact on growth.

David Li from Blue Connection commented, “the political climate itself does not affect tourism, but the currency does. Now it is more expensive to convert yuan to US dollars, so it will be more expensive for Chinese tourists to travel to the US. If this trend continues, the number of tourists coming to the US will decrease.”

Deming Zhu from Shanghai Airlines Travel reiterated this point, “Chinese consumers are more concerned about the exchange rate than the political climate. If the policy of the new president were to drive the yuan down, then it would be bad news for Chinese tourism to the US.”

Europe

While Western Europe is still adjusting to the new world political landscape, Chinese tourists have already changed their behavior significantly in Europe.

A tour operator from Comfort Travel explained, “while Western Europe still dominates the market, Eastern European destinations are gaining in popularity.”

Security issues in France, Belgium and other Western European countries have caused a dramatic shift in European itineraries, favoring locations in Eastern Europe, Northern Europe and the UK. Although Chinese tourism to Western Europe has already seen significant upticks and increases over the past few months, especially when compared to the year-ago period.

Several tour operators also cited the growing popularity of the Nordic countries, especially Denmark and Iceland. In particular, Northern Lights tours are hot products among tour operators in China right now. Chinese online travel agent, Ctrip, recently called Iceland and Hungary the “dark horses” of today’s Chinese tourism market.

Chinese tour operator Spring Tour commented, “Eastern European countries such as the Czech Republic and Russia are growing quickly. We are also seeing secondary European destinations such as Spain gaining in popularity, mostly due to the security issues in France and Belgium.”

Tour operator UTour also commented that the Eastern European destinations of Croatia, Serbia and the Czech Republic are all increasing in popularity among individual travelers.

The Brexit decision has not had a negative impact on Chinese tourism behavior. The UK has in fact experienced a recent increase in Chinese tourism since the decision, as Chinese tourists look to take advantage of the weaker pound.

Other trends that the tour operators are seeing in Europe include an increase in honeymoon tours and family trips, as well as the growing popularity of self-drive trips and photography tours.

Chinese tourists will continue to be wary of security and the euro-yuan exchange rate, both of which will have a big impact on short-term increases and decreases in travel to countries in Europe.

A representative from Spring Tour explained, “if Europe can improve regional security, the Europe market will rebound in 2017.”

A representative from UTour added, “the exchange rate has a significant impact on travel decisions. A weak yuan is likely to slow down outbound travel.”

Source: China Luxury Advisors

Source: China Luxury Advisors

THE NEW CHINESE TOURIST: SEEKING ARTS AND CULTURE

The Chinese tourist of today is uniquely different from that of five years ago. Not content to sit on a standard tour bus and visit sites recommended in conventional guide books, visitors from China are increasingly creating their own itineraries and are demanding experiences that are more local, native, cultural and distinctively art focused.

These more experienced travelers are increasingly interested in a more thorough and rounded experience, focused on a particular destination, rather than participate in a typical whirlwind bus tour which leaves little time for in-depth exploration.

Los Angeles Tourism and Convention Board President and CEO Ernest Wooden commented, “we find that 42% of Chinese travelers visit our cultural institutions such as The Getty Center, Los Angeles County Museum of Art (LACMA) and The Broad because history, heritage and iconic masterpieces appeal to them very much.”

Younger travelers who are eager to explore the world, and experience authentic local destinations are particularly inclined to seek out art and cultural experiences. Amrita Banta, Managing Director at Agility Research and Strategy, commented, “Travel experts agree that this new generation of Chinese traveler is more adventurous and wants to experience a new culture. The younger ones go out and are a lot more experimental. They do not have the inhibitions of their parents.”

“Chinese millennial travelers are seeking a much deeper connection with a destination when they travel, and museums usually capture the cultural spirit of a city,” says travel blogger Ana Coppola. “I can travel through history and acquire a much deeper understanding of the city in one afternoon at a museum.”

Kai Zhao, a Chinese tour operator from TTS Travel, remarked, “the younger generation is really interested in arts and cultural destinations that are popular on social media such as Griffith Observatory, Madame Tussauds Hollywood and LACMA.”

Different from museums in China, which are usually run by the government, many museums in the US and Europe are owned and curated privately. “Touring a private museum, whether it is a collection of vintage cars or costumes, is like having a conversation with an interesting person,” says Will Wang, former travel editor at Esquire China. “Each object on display reflects the curator’s or collector’s unique personality and opinion about the world.”

As a result, museums across the globe are seeing increased interest and visitation from Chinese tourists. This expanding demand is presenting arts and cultural destinations with an opportunity to capture the hearts and minds of a new generation of museum and arts patrons. For example, the Museum of Modern Art (MoMA) in New York has seen its visitations from China grow by over 200% in the past five years. Last year, MoMA welcomed 49% more Chinese travelers than the previous year.

Source: CAFA ART INFO

Source: CAFA ART INFO

In addition to an increase in visitations, museums are also benefiting from elevated sales at gift shops, courtesy of high-spending Chinese tourists, as well as corporate and independent donations from Chinese companies and individuals whose interest in giving back to the arts and participating in global arts initiatives has been steadily accelerating.

IMPLICATIONS FOR BRANDS AND RETAILERS

As the Chinese tourist market landscape transforms, brands and retailers need to adapt and continuously update their strategies in order to engage with this large and growing market of consumers.

Catering to the Different Needs of Chinese Tourists

Brands and retailers should avoid stereotyping Chinese tourists, as they become increasingly sophisticated. In addition to differing travel arrangements, Chinese tourists have diversified demographics and travel experience needs.

For instance, our survey shows that one-third of Chinse tourists travel with their children. Brands and retailers may consider creating a family-friendly shopping environment and provide respective facilities in order to cater to the needs of these customers.

Source: iStockphoto

Source: iStockphoto

Multi-generational family travel also continues to be popular among Chinese tourists—where grandparents, parents and children travel together, especially during the summer months and at Chinese New Year. Brands and retailers should consider providing options for both elderly and young visitors alike.

Target the Right Customers

China is an extremely large and active consumer marketplace, with a myriad of media and marketing choices that can be both overwhelming and expensive. It is critically important for overseas retailers and destinations to choose their marketing methods carefully in order to target the smaller segment of the population who is likely to travel to their tourism destination. Finding the right media and marketing opportunities that produce high return on investment (ROI) results can be tricky, but when done right, can produce impressive ROI. As retailers increasingly hone their targeting skills, they are turning to new digital opportunities to better focus on those travelers who are intending to travel to a certain destination. In order to serve this growing need, both WeChat and Weibo are launching new location-based targeting for their advertising services this summer, allowing retailers and attractions to target Chinese tourists once they have arrived at their destination. We view this as a game changer in terms of providing more accurate targeting and advertising optimization.

Focusing More on Experiences

Our survey shows that the majority of Chinese tourists expect services that enhance their shopping experience, such as Chinese-speaking staff, payment by UnionPay and on-site tax refund services. Most surveyed respondents also mentioned having used these services, indicating major retailers and brands are already offering them.

In addition to improving the shopping experience, retailers and brands can consider partnering with leading tourist attractions and restaurants, providing an all-around experience from catering to shopping to entertainment in order to differentiate themselves from competitors.

Food and dining are key areas to entice Chinese tourists, who are looking for both Chinese and Asian food options, as well as unique local experiences such as local seafood and delicacies, or fun dining experiences such as having tea and macaroons at the renowned LaDurée in Paris.

Engage with Chinese Tourists Online

Brands and retailers should engage with Chinese tourists online at every stage of their trip, as our survey shows that the majority of Chinese tourist use online resources the most when they research travel destinations and plan trips, and rely on their smartphones while abroad.

Since the majority of Chinese tourists use smartphones to keep in touch with others, brands and retailers can encourage and incentivize them to share their experiences at retail outlets, which is more influential than traditional online advertisements or sponsored content.

Create Immersive Mobile Experiences

The prevalence of mobile engagement throughout the travel journey is perhaps the primary message from our recent research. It is critical for retailers and destinations to adopt an immersive mobile experience both online and offline, including:

- Ensure that their destination provides Chinese-language information that is mobile-optimized and easily accessible in both China and in the destination market: Retailers and destinations need to make it easy for tourists to both do pre-trip research and in-destination information gathering. Brands and retailers should test their websites in China to ensure accessibility and speed is up to Chinese consumer standards.

- Mobile payment:Mobile payment is almost ubiquitous in China, but is still in its emerging stages overseas. With the recent emergence of overseas payment platforms that allow for overseas vendors to receive mobile payments in their local currency, we expect to see a rapid increase in the incidence of overseas mobile payments at key destinations for Chinese tourists. Electronics retailers in Japan have already seen tremendous growth from the adoption of mobile payment, and other retailers should expect to see similar growth upon implementation.

- Offline-to-online mobile integration:Retailers and destinations should provide an immersive offline-to-online mobile retail experience to provide on-site services to Chinese tourists and to create fun and engaging methods to connect with Chinese travelers and collect data and CRM contacts.

Provide Relevant and Engaging Content

Today’s Chinese travelers want to be inspired and excited by traveling and shopping. Some brands and retailers have already been working with Chinese social media influencers to bring their retail destination to life and create engaging and unique content to inspire these global shoppers. For example, Spanish department store El Corte Inglés brought online influencer Crystal Mu to Madrid over Chinese New Year this year, producing a photo shoot and inspiration video, along with online contest and content on Weibo, WeChat and Instagram. This allowed El Corte Inglés to not only raise awareness of their retail destination, but to inspire Chinese consumers on a more emotional level and to create desire and intent to travel via Chinese social media channels.

ABOUT FUNG GLOBAL RETAIL & TECHNOLOGY

Fung Global Retail & Technology is a think tank that follows emerging retail and technology trends. The team’s researchers and analysts, based in New York, London and Hong Kong, specialize in the ways retail and technology intersect, and in building collaborative communities.

Managing Director Deborah Weinswig leads the team. A former top Wall Street and retail technology analyst, Weinswig publishes ongoing thematic and global market research on topics such as the Internet of Things, digital payments, omnichannel retail, luxury and fashion trends, and disruptive technologies in addition to advising startups around the globe.

ABOUT CHINA LUXURY ADVISORS

China Luxury Advisors is a boutique consultancy that helps brands, retailers, tourism organizations and destinations increase their business with Chinese customers. Visit

www.chinaluxuryadvisors.com for more information or contact:

Renee Hartmann at

renee@chinaluxuryadvisors.com

+1-415-448-7179

Base: All respondents (N=841), tier 1 (N=371), lower tier (N=424).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841), tier 1 (N=371), lower tier (N=424).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT Base: Tier 1 (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT

Base: Tier 1 (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT Source: China.org.cn

Source: China.org.cn Base: Leisure Travelers (N=714).

Source: China Luxury Advisors/FGRT

Base: Leisure Travelers (N=714).

Source: China Luxury Advisors/FGRT Base: Those who traveled to Australia (N=23), W. Europe (N=28), Hong Kong (N=81), Japan (N=286), S. Korea (N=88), Thailand (N=92) and USA (N=18) for leisure on their most recent trip.

* Indicates small base (N<30).

Source: China Luxury Advisors/FGRT

Base: Those who traveled to Australia (N=23), W. Europe (N=28), Hong Kong (N=81), Japan (N=286), S. Korea (N=88), Thailand (N=92) and USA (N=18) for leisure on their most recent trip.

* Indicates small base (N<30).

Source: China Luxury Advisors/FGRT Base: All Respondents (N=841)

Source: China Luxury Advisors/FGRT

Base: All Respondents (N=841)

Source: China Luxury Advisors/FGRT Base: Those who traveled to Australia (N=28), W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S. Korea (N=104), Thailand (N=99) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

# Other spending includes: food and beverage, sightseeing, entertainment and local transportation. Western Europe includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Base: Those who traveled to Australia (N=28), W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S. Korea (N=104), Thailand (N=99) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

# Other spending includes: food and beverage, sightseeing, entertainment and local transportation. Western Europe includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT Base: All respondents (N=841), Chinese tourists from tier-1 cities (N=371) and lower-tier cities (N=424).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841), Chinese tourists from tier-1 cities (N=371) and lower-tier cities (N=424).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT Base: Respondents with MHI US$1,450< (N=69), US$1,450– 2,900 (N=407), US$2,900–5,800 (N=253), >$5,800 (N=112).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT

Base: Respondents with MHI US$1,450< (N=69), US$1,450– 2,900 (N=407), US$2,900–5,800 (N=253), >$5,800 (N=112).

# Other spending includes: Food and beverage, sightseeing, entertainment and local transportation.

Source: China Luxury Advisors/FGRT Base: All respondents (N=841), tier-1 cities (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841), tier-1 cities (N=371), lower-tier cities (N=424).

Source: China Luxury Advisors/FGRT Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and the US (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and the US (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT

Base: Those who traveled to W. Europe (N=39), Hong Kong (N=99), Japan (N=332), S.Korea (N=104) and USA (N=26) on most recent trip.

* Indicates small base (N<30).

Western Europe Includes France, Germany, Italy and the UK.

Source: China Luxury Advisors/FGRT Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT Base: Respondents with MHI US$1,450< (N=69), US$1,450‒2,900 (N=407), US$2,900‒5,800 (N=253), >$5,800 (N=112).

Source: China Luxury Advisors/FGRT

Base: Respondents with MHI US$1,450< (N=69), US$1,450‒2,900 (N=407), US$2,900‒5,800 (N=253), >$5,800 (N=112).

Source: China Luxury Advisors/FGRT Source: Retail News Asia

Source: Retail News Asia Base: Leisure travelers (N=714); tier-1 cities (N=322), lower-tier cities (N=365).

Source: China Luxury Advisors/FGRT

Base: Leisure travelers (N=714); tier-1 cities (N=322), lower-tier cities (N=365).

Source: China Luxury Advisors/FGRT Base: Most recent trip (N=714); next trip (N=841).

Source: China Luxury Advisors/FGRT

Base: Most recent trip (N=714); next trip (N=841).

Source: China Luxury Advisors/FGRT Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT

Base: All respondents (N=841).

Source: China Luxury Advisors/FGRT Base: Those who have used a smartphone on their most recent trip and traveled independently (N=462); travel in group/with guide (N=338).

Source: China Luxury Advisors/FGRT

Base: Those who have used a smartphone on their most recent trip and traveled independently (N=462); travel in group/with guide (N=338).

Source: China Luxury Advisors/FGRT Includes business and leisure travel; excludes day trips.

Source: UN World Tourism Organization/FGRT

Includes business and leisure travel; excludes day trips.

Source: UN World Tourism Organization/FGRT Includes non-tourists such as business travelers.

Source: China Statistical Yearbook/China National Tourism Administration/FGRT

Includes non-tourists such as business travelers.

Source: China Statistical Yearbook/China National Tourism Administration/FGRT Source: iStockphoto

Source: iStockphoto Source: China Luxury Advisors

Source: China Luxury Advisors Source: CAFA ART INFO

Source: CAFA ART INFO Source: iStockphoto

Source: iStockphoto