Executive Summary

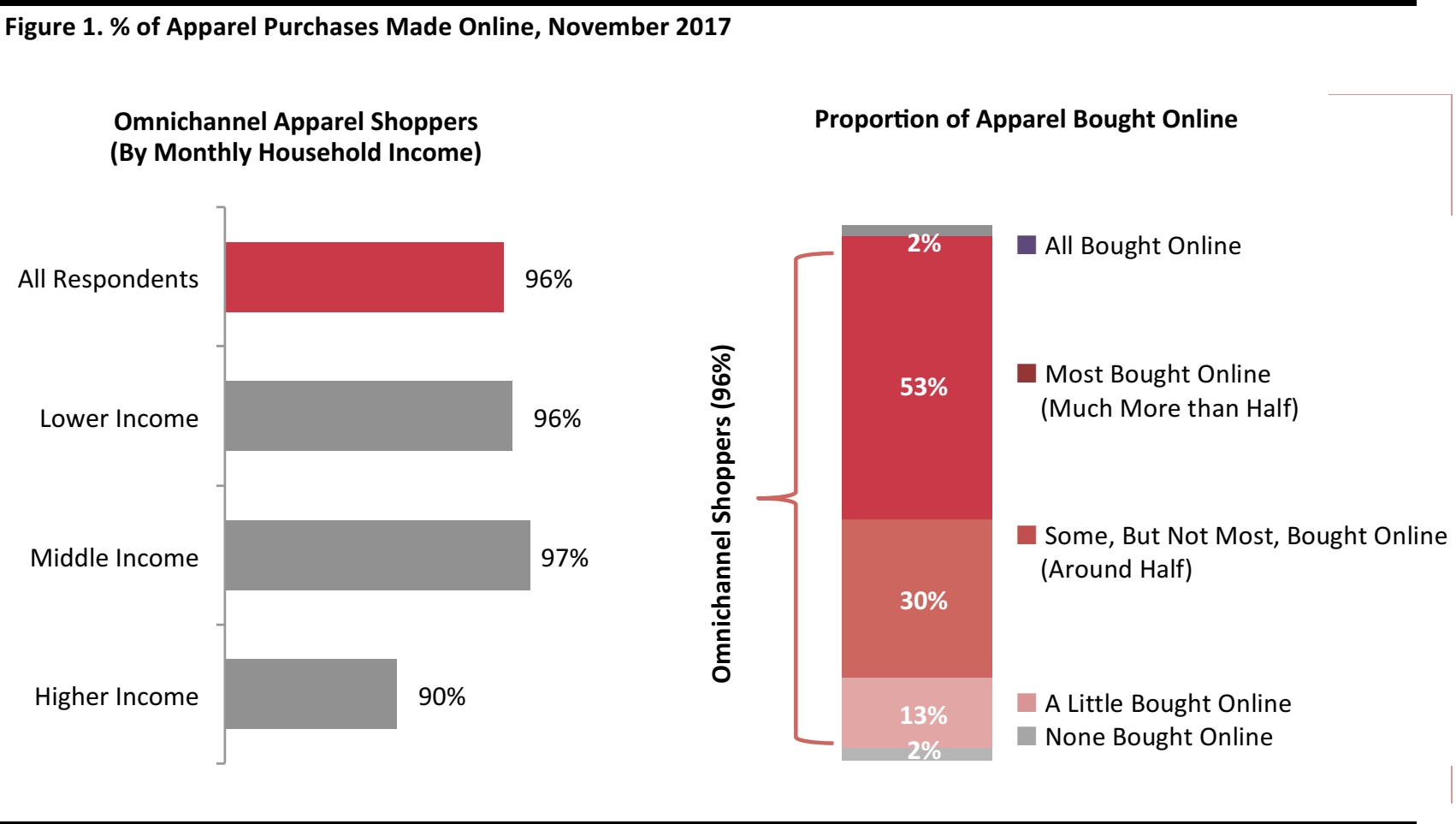

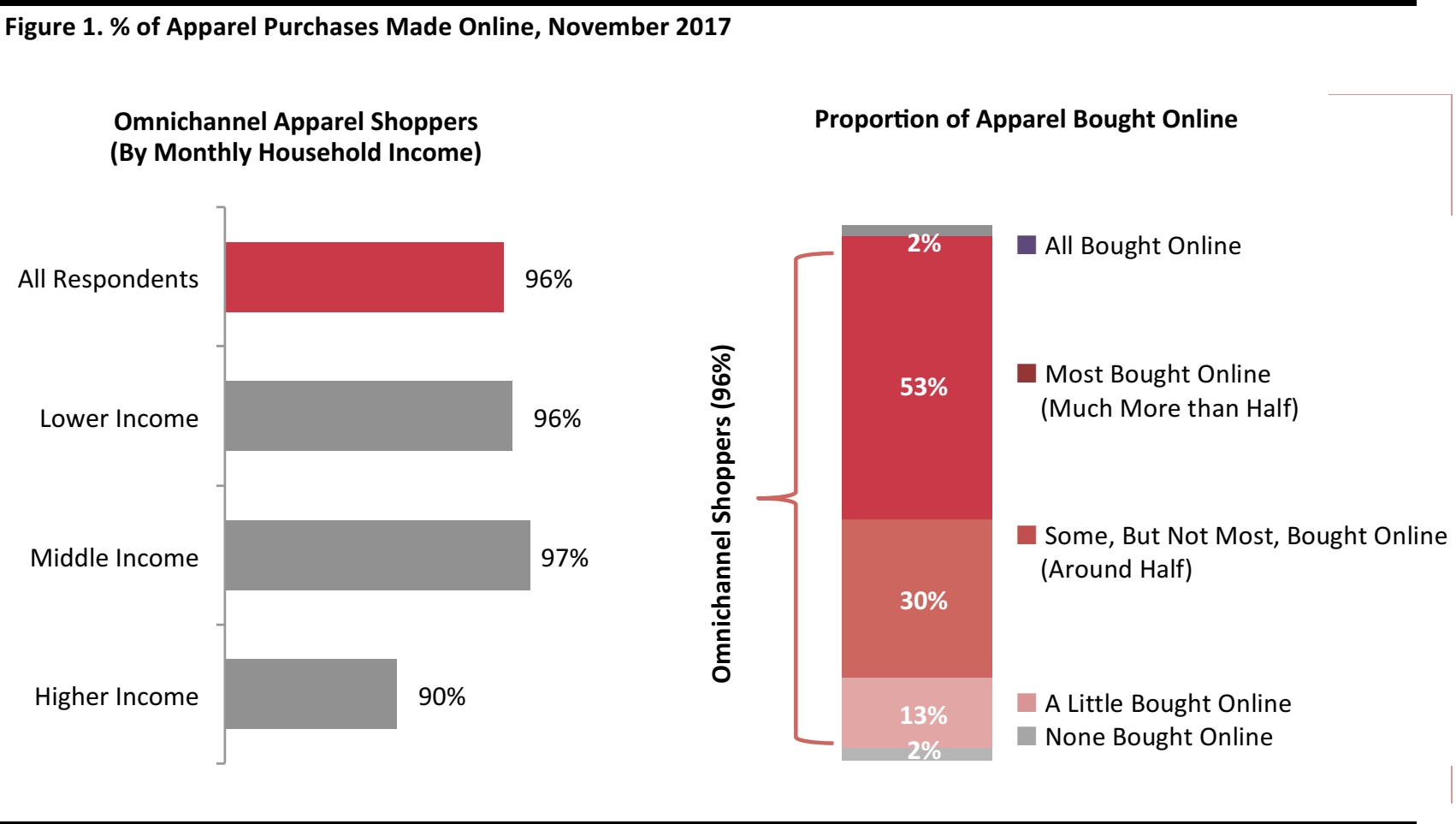

E-commerce is, without a doubt, a highly popular channel for apparel purchases in China. Some 85% of Chinese consumers who participated in our proprietary consumer survey said that over half of their apparel purchases are made online. However, brick-and-mortar stores are still very relevant. Our survey shows that the vast majority of Chinese consumers (96%) in fact purchase apparel from both online and offline channels.

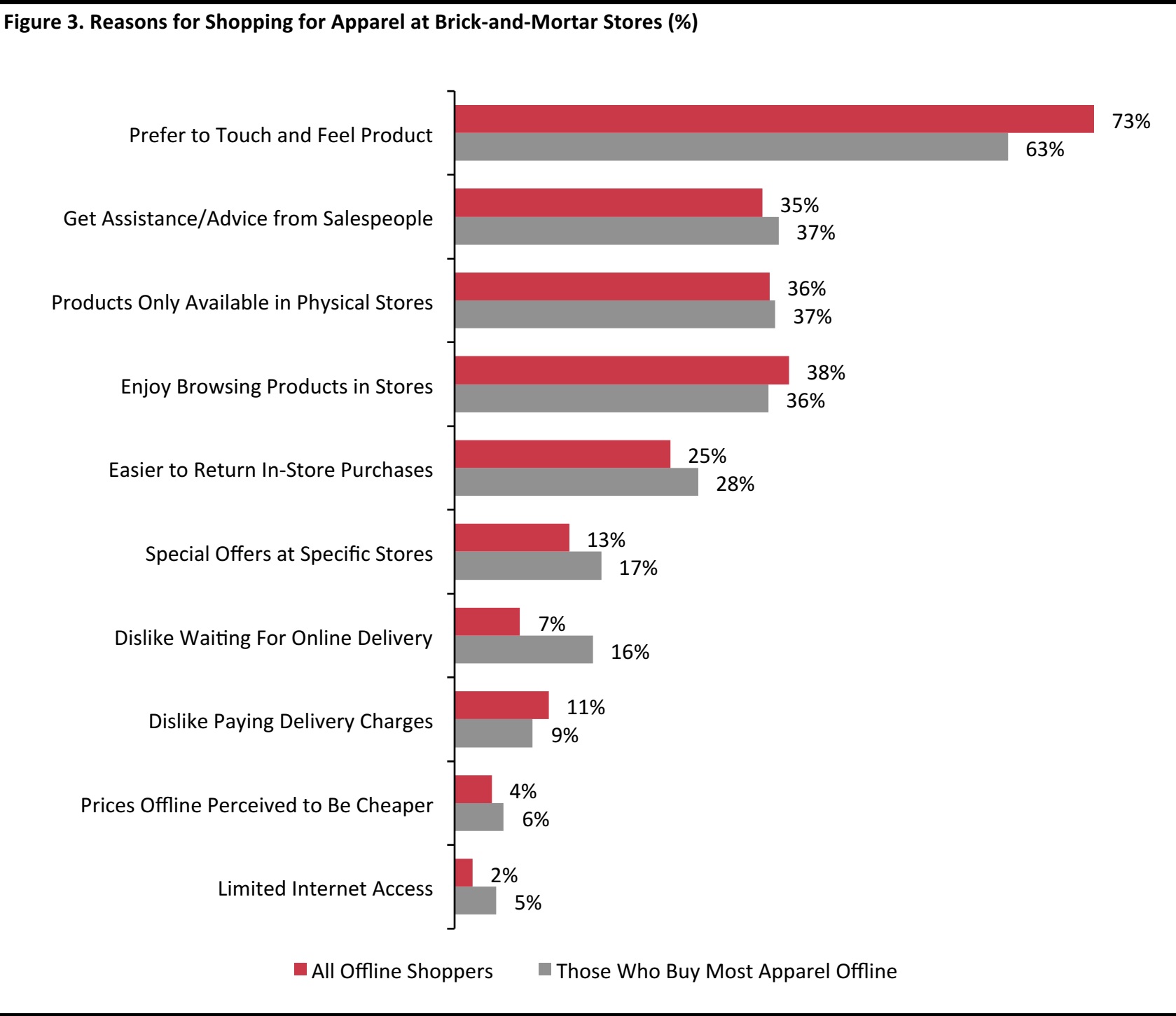

Not surprisingly, our data show that the top reason cited for purchasing apparel at physical stores is shoppers’ preference to touch and feel a product before they buy.

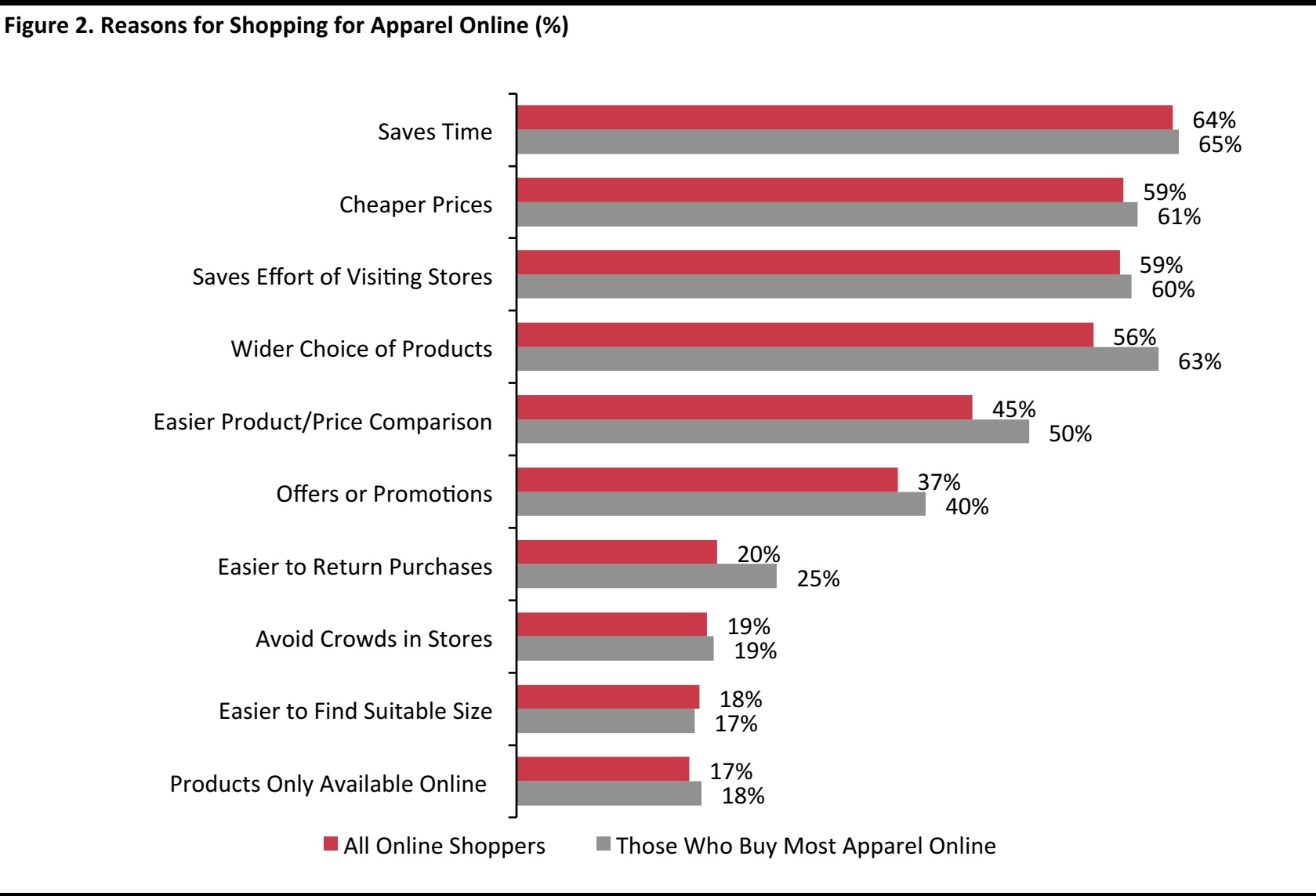

The benefits of shopping online, on the other hand, include wide product selection, convenience and easy price comparison. Chinese consumers also tend to shop online in order to find the best prices.

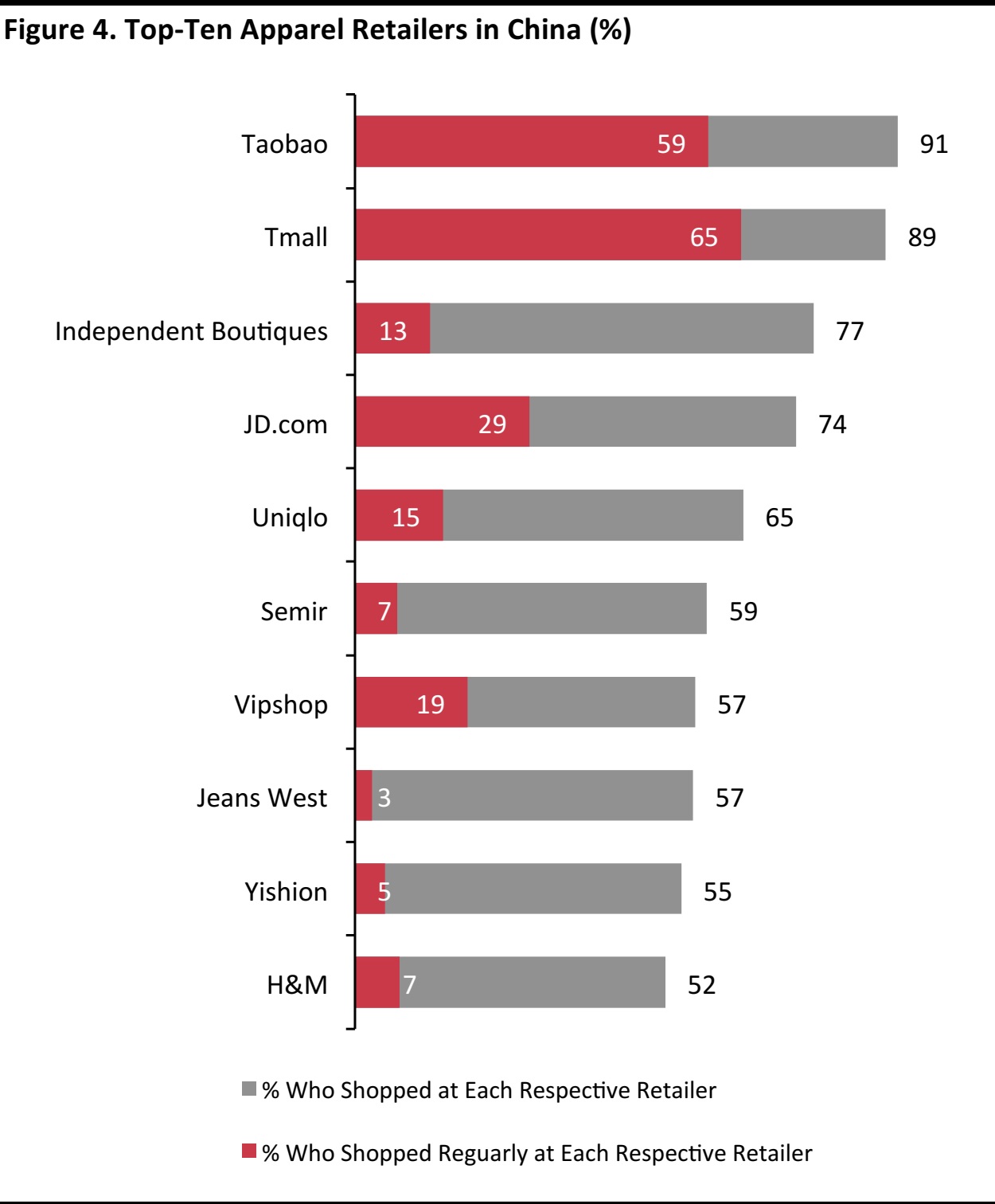

Our survey also focused on evaluating Chinese consumers’ customer satisfaction with a number of major retailers in China. Among the top-ten apparel retailers in the country, Uniqlo earned the top spot, while Taobao ranked last. Clothing fit and quality are also important drivers of customer satisfaction.

Based on our survey results, customers are much less satisfied with Taobao in terms of the fit and quality of their apparel compared to other online apparel marketplaces, indicating this is an important area that the company can work on in order to improve its customer loyalty.

Research Methodology

Our survey was carried out over a five-day period from November 2 to 7 among 1,055 mainland Chinese Internet users between the ages of 18 and 59 who had purchased apparel items in the past 12 months.

The survey data were weighted according to age and gender distribution in China’s urban areas, based on the latest available census data by the National Bureau of Statistics of China.

We believe our online survey represents the opinions of the majority of urban mainland Chinese, as Internet penetration has already reached 69%, as of June 2017, according to the China Internet Network Information Center (CNNIC).

Exchange Rates

We used an average foreign exchange rate from S&P Capital IQ for November 2017, which resulted in a rate of ¥6.6203 to $1.00 (¥1:$0.1511).

1) Chinese Shop for Apparel both Online and Offline

According to our proprietary consumer survey, when it comes to apparel, the vast majority of Chinese consumers (96%) are omnichannel shoppers. In other words, they buy apparel both online and offline.

The responses, however, show a clear preference for online shopping, with 85% of survey participants saying that more than half of their apparel purchases were made online. Of this, 53% said they bought most of their apparel online and 30% said they bought around half of their apparel online.

Those who said they purchase their apparel either entirely online or entirely offline are a niche segment, each representing only 2% of surveyed consumers.

In terms of income segmentation, slightly fewer respondents from the higher income group are omnichannel apparel shoppers, at 90%.

Base: All respondents (N=1,055); lower income (N=478); middle income (N=430); higher income (N=147).

Note: Lower income means monthly household income (MHI) of ¥10,000 or below; middle income means MHI of ¥10,000–¥19,999; higher income means MHI of ¥20,000 or above.

Source: Coresight Research

Base: All respondents (N=1,055); lower income (N=478); middle income (N=430); higher income (N=147).

Note: Lower income means monthly household income (MHI) of ¥10,000 or below; middle income means MHI of ¥10,000–¥19,999; higher income means MHI of ¥20,000 or above.

Source: Coresight Research

2) Reasons for Shopping for Apparel: Online Vs. Offline

Although e-commerce has become the preferred channel to purchase apparel in China, brick-and-mortar is still very relevant. With that in mind, we look further into the different reasons consumers choose to purchase apparel either online or offline.

Reasons for Shopping for Apparel Online

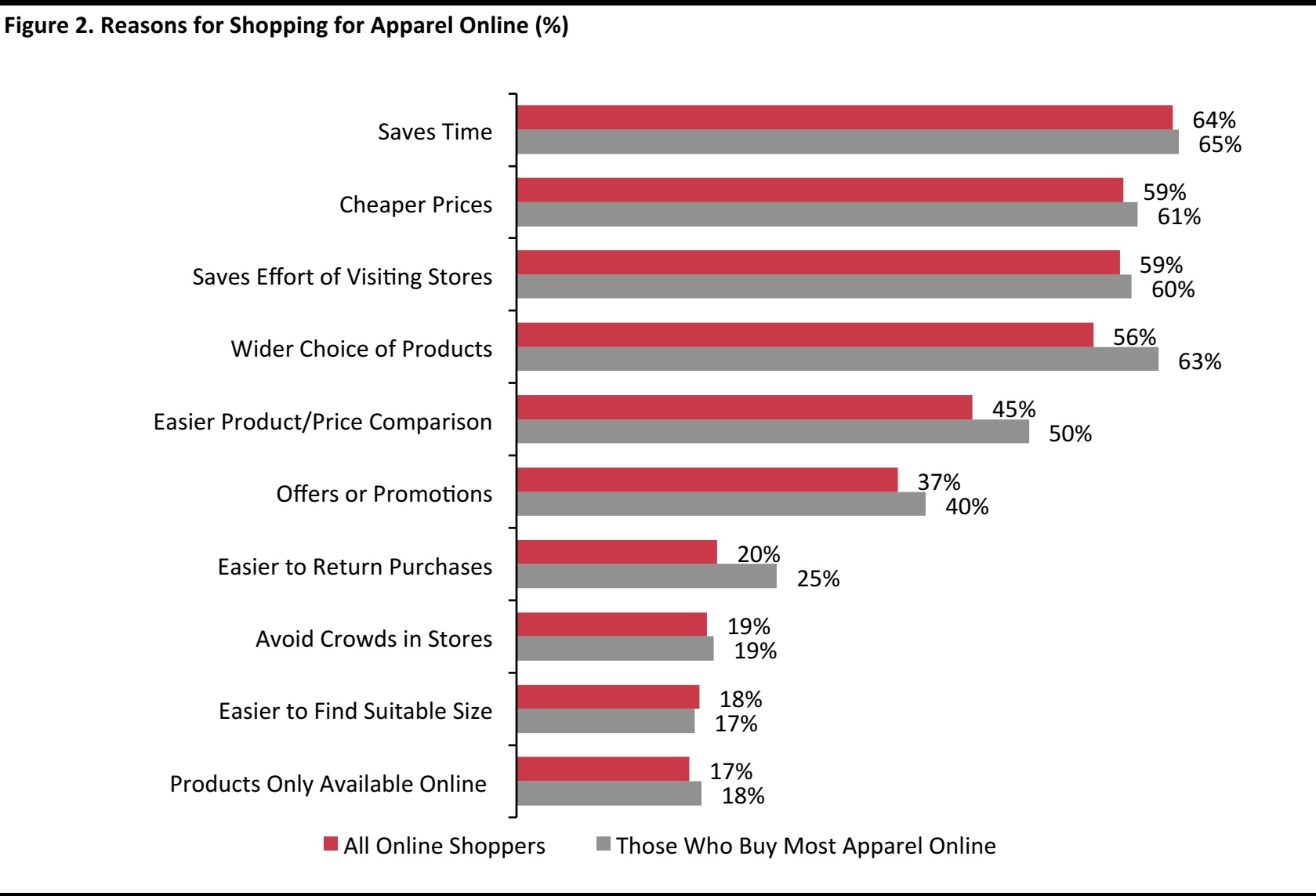

Our survey respondents indicated that the main reasons they shop for apparel online are: to save time (64%), lower prices (59)% and convenience (60%), i.e., it saves them the effort of visiting multiple stores.

Chinese consumers who said they buy most of their apparel online consider the wider product selection and ease of price comparison as the main benefits of shopping online, while this is not so important to those who purchase only some or a little of their apparel online.

For those consumers who said they buy most of their apparel online, wider product selection was the main reason cited for shopping online, at 63%, just slightly behind those who cited to save time, at 65%. This compares to 56% of all Chinese online consumers who chose wider product selection as their reason for shopping online.

The results indicate that consumers who buy most of their apparel online value the wider selection of products and ease of price comparison more than those who buy some or a little of their apparel online.

Base: Those who purchased apparel online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research

Base: Those who purchased apparel online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research

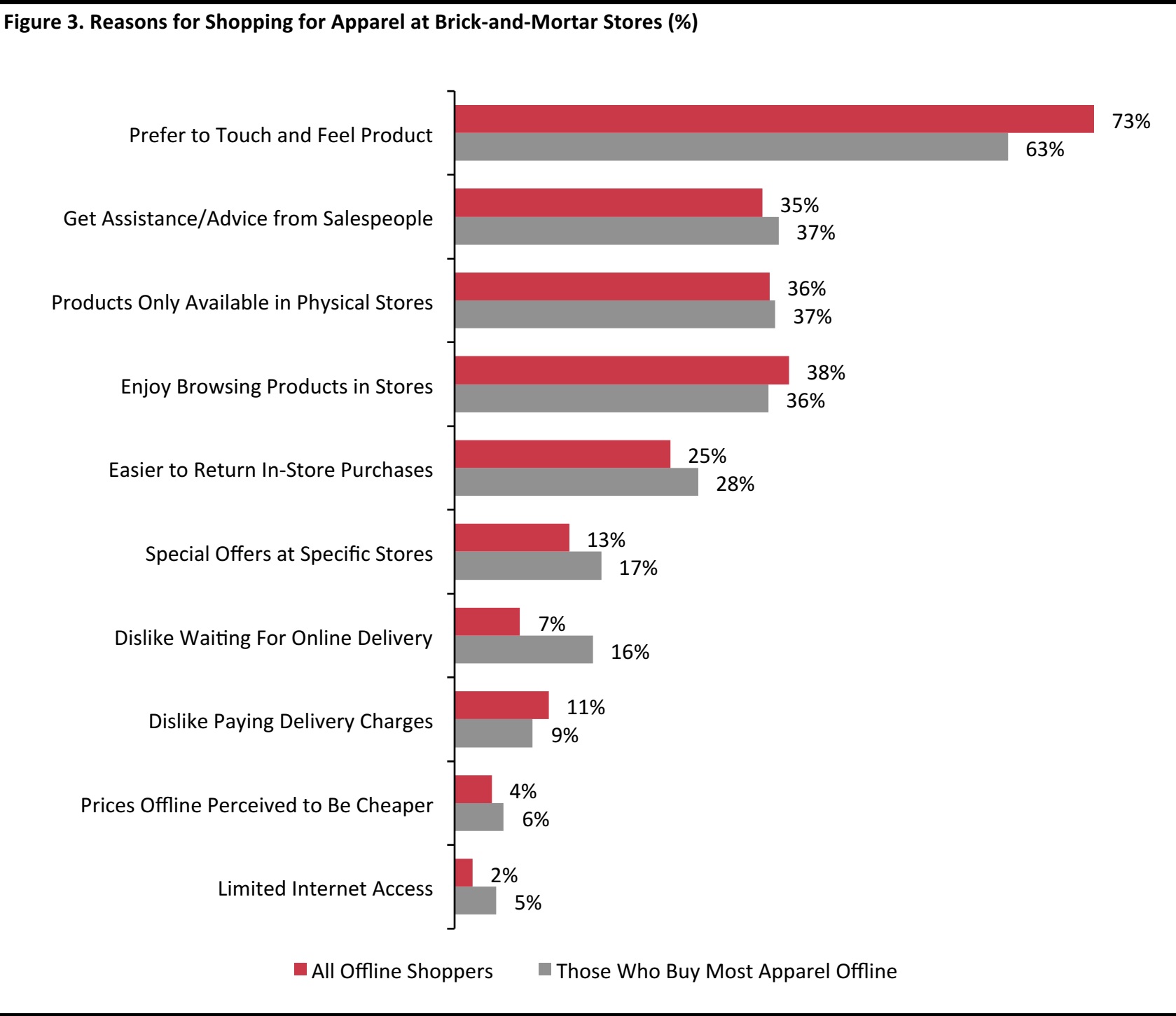

Reasons for Shopping for Apparel at Brick-and-Mortar Locations

The top reason cited for shopping for apparel at brick-and-mortar stores is consumers’ preference to touch and feel a product before they buy. Some 73% of all Chinese offline shoppers surveyed indicated this as the reason for shopping for apparel at brick-and-mortar stores.

On the other hand, 63% of Chinese shoppers who purchase most of their apparel online also chose this as their main reason for shopping at brick-and-mortar stores.

So, based on the survey results, we can see that being able to touch and feel a product before making a purchase is less important to shoppers who purchase most of their apparel online compared to all offline shoppers.

Base: Those who made an apparel purchase either online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research

Base: Those who made an apparel purchase either online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research

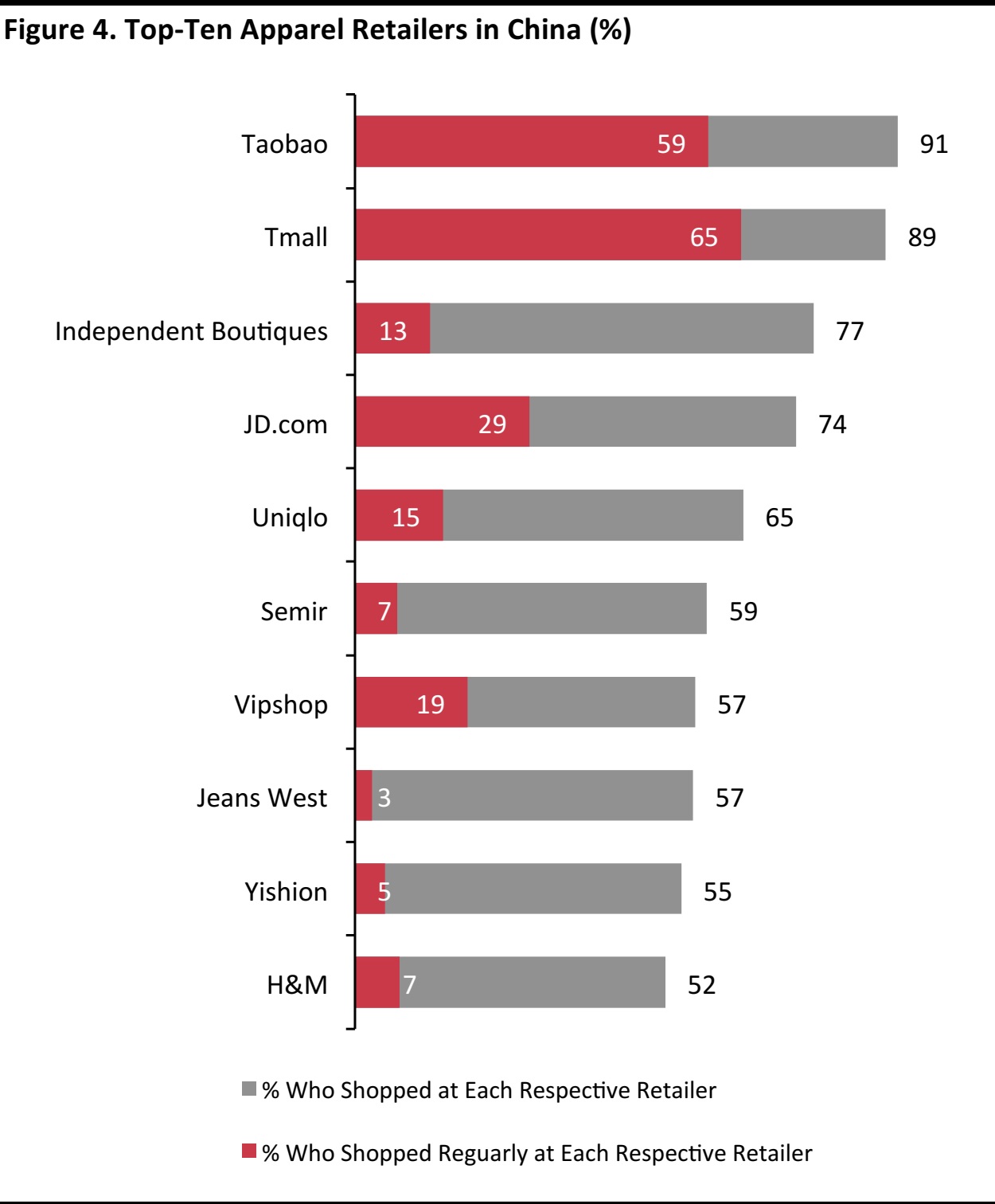

3) Top Apparel Retailers in China

Taobao and Tmall are the two-most-popular retail outlets in China, and almost every Chinese consumer has purchased apparel at one or both of these two retailers in the past 12 months. According to our survey, 91% of shoppers have purchased apparel at Taobao and 89% at Tmall. Over half of the surveyed consumers also shop regularly for apparel on these two online marketplaces.

The third-most-popular apparel outlet is independent boutiques, with 77% of surveyed consumers saying they have purchased apparel from an independent boutique in the past 12 months. However, only 13% of our survey respondents say they shop regularly at independent boutiques.

This holds true for other brick-and-mortar retailers. Over half of our survey respondents indicated they had purchased apparel at several different physical retailers, but only a small portion say they are regular customers there.

Base: Those who purchased apparel in the past 12 months (N=1,055).

Source: Coresight Research

Base: Those who purchased apparel in the past 12 months (N=1,055).

Source: Coresight Research

4) Despite Being One of the Top Apparel Outlets in China, Taobao Lags Behind in Customer Satisfaction

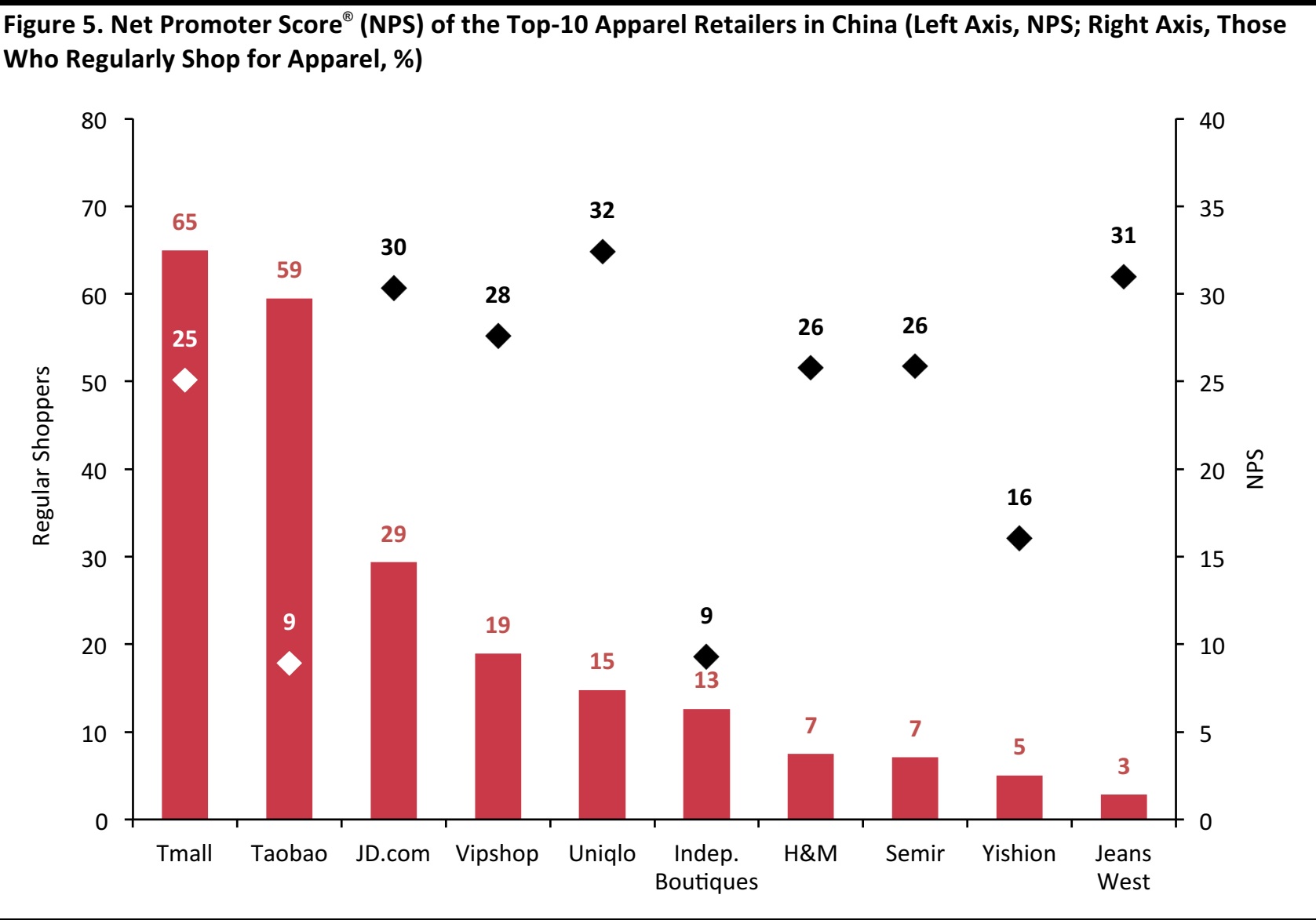

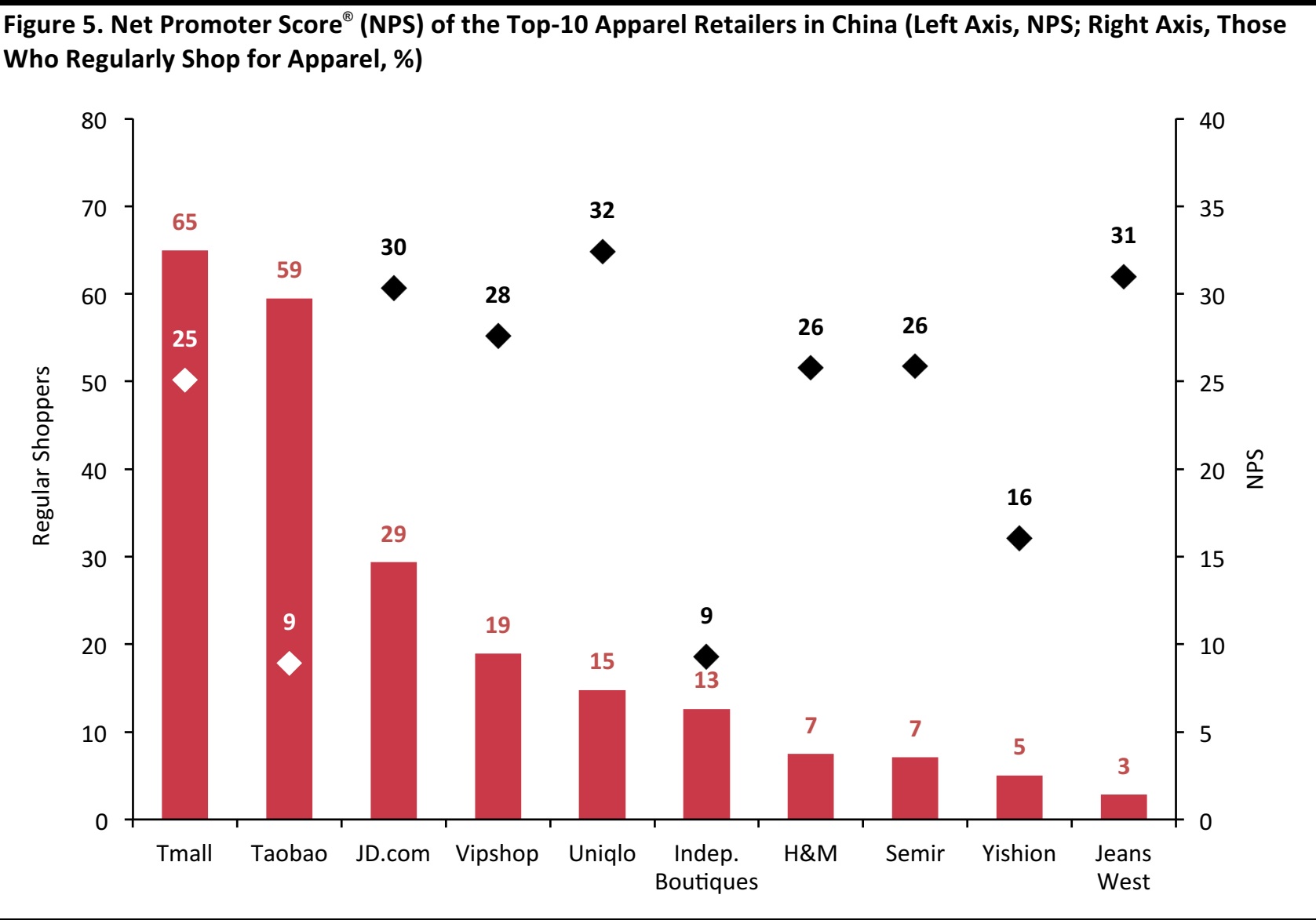

To gauge Chinese consumers’ customer satisfaction with a number of apparel retailers, we use Net Promoter Score (NPS), which also measures their willingness to recommend the respective retailer to others.

Among the top-ten apparel retailers in China, Uniqlo earned the top spot with a score of 32. The Japanese apparel retailer is renowned for its exceptional customer service. According to parent company Fast Retailing, 98% of the 3.6 million customer feedback reviews it received in China were complimentary.

Despite being the top apparel outlet in China, Taobao came last with an NPS of 9. Tmall performed better with score of 25, but was still lower than its online competitors Vipshop and JD.com.

In the next section, we look at the regular shoppers of the top-five apparel retailers, and examine the factors that drive customer satisfaction at each of the retailers.

Base: Those who purchased apparel in the past 12 months (N=1,055).

Note: Net Promoter, Net Promoter Score and NPS are registered trademarks of Bain & Company, Fred Reichheld and Satmetrix Systems.

Source: Coresight Research

Base: Those who purchased apparel in the past 12 months (N=1,055).

Note: Net Promoter, Net Promoter Score and NPS are registered trademarks of Bain & Company, Fred Reichheld and Satmetrix Systems.

Source: Coresight Research

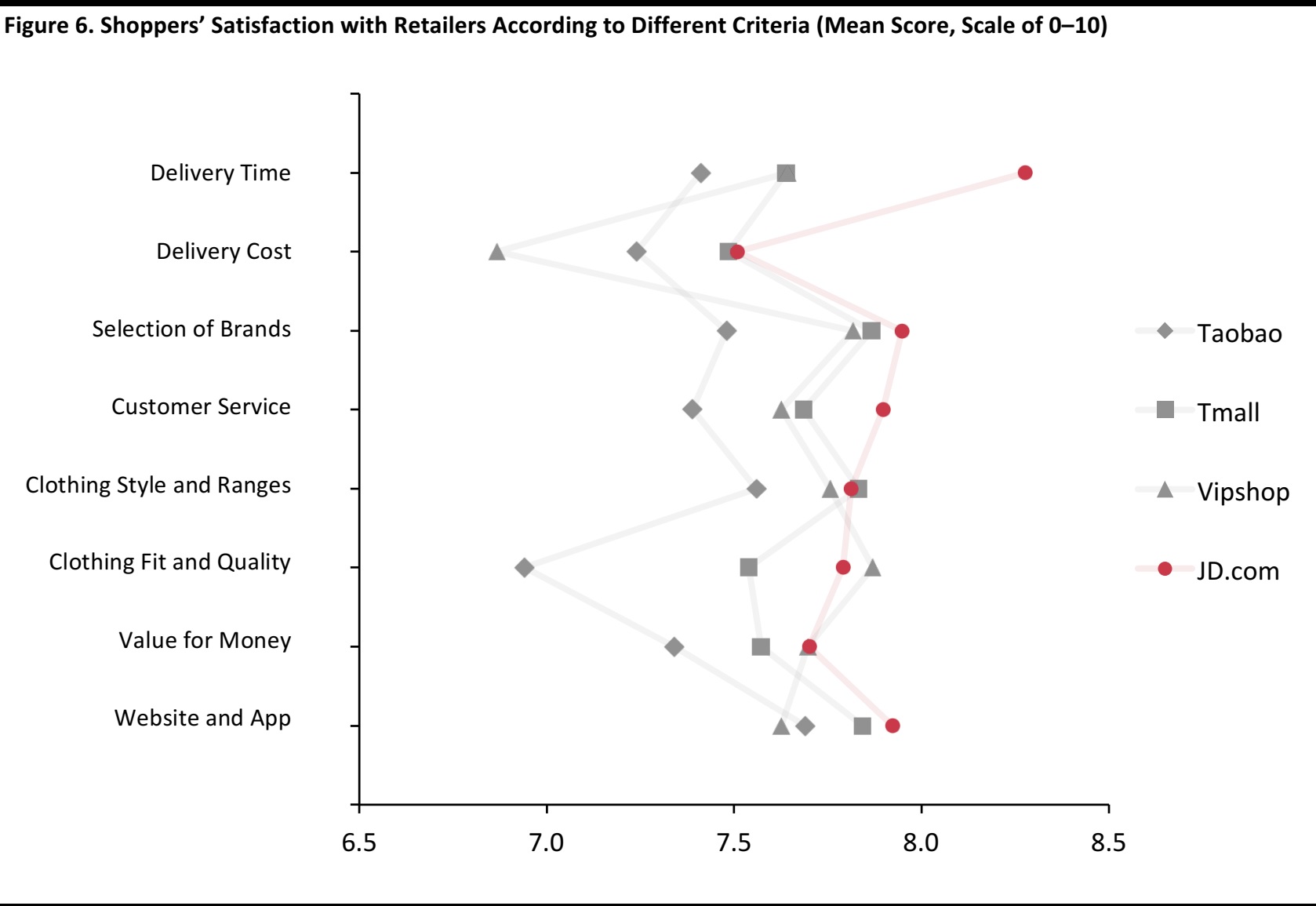

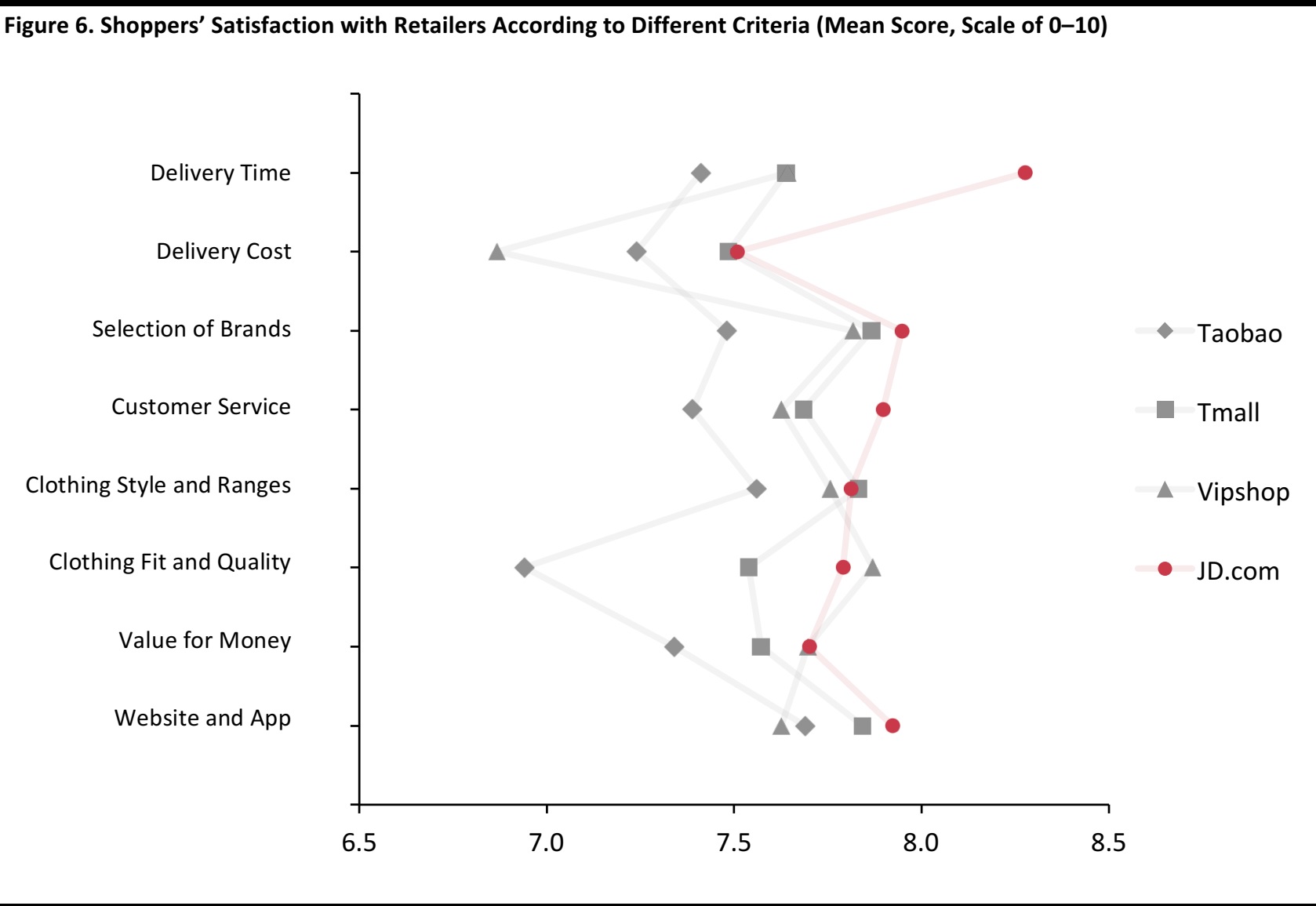

JD.com and Vipshop Outperform Taobao on Most Aspects, and Are On Par with Tmall in Most Areas

Taobao lags behind JD.com and Vipshop in terms of overall customer satisfaction, as well as on most of the service areas we surveyed. Tmall, which has a NPS similar to JD.com and Vipshop, is on par with the two online marketplaces in most service areas.

JD.com leads in many areas, including delivery time, customer service, selection of brands and website/app. Shoppers are particularly satisfied with the delivery time and customer service of JD.com, while its selection of brands and website/app are only slightly ahead of the competition.

Vipshop leads in clothing fit and quality, while JD.com is a close second. Both Tmall and Taobao lag behind in these areas.

Base: Taobao shoppers (N=627); Tmall shoppers (N=686); JD.com shoppers (N=310); Vipshop shoppers (N=200).

Source: Coresight Research

Base: Taobao shoppers (N=627); Tmall shoppers (N=686); JD.com shoppers (N=310); Vipshop shoppers (N=200).

Source: Coresight Research

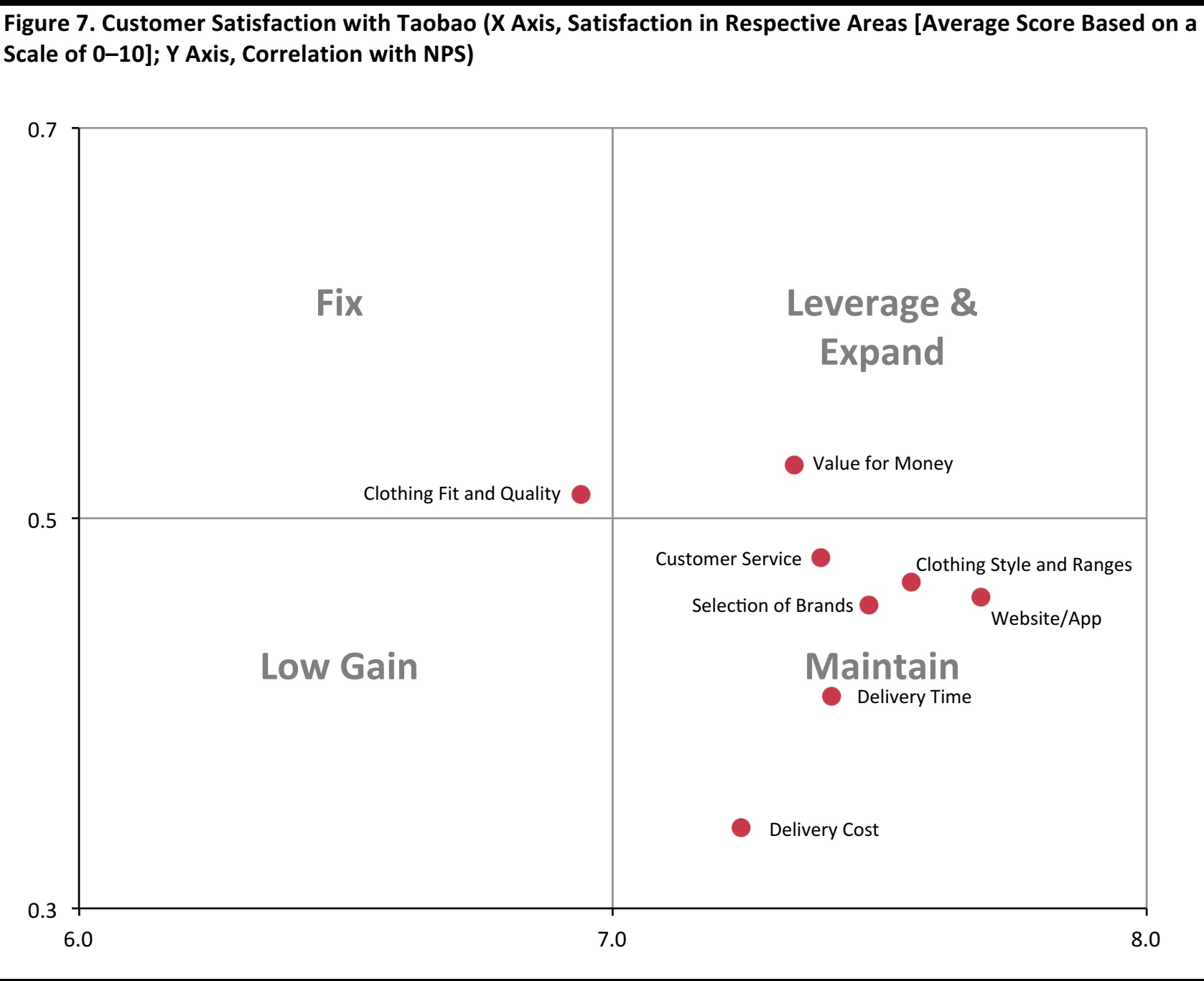

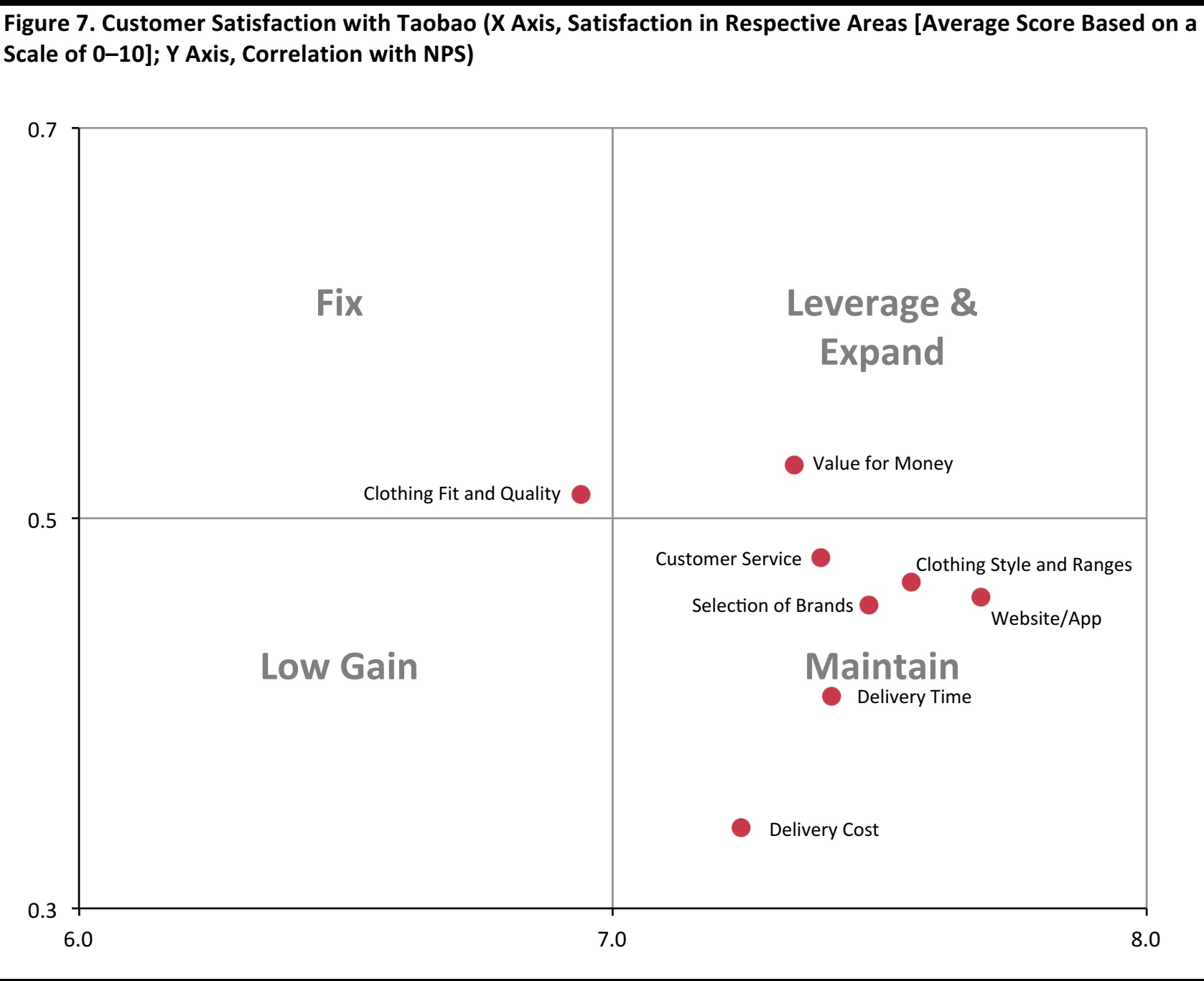

Clothing Fit and Quality Are a Key Issue for Taobao

According to our key driver analysis, the availability of value-for-money products is the key driver of customer loyalty, which a company should leverage in order to expand.

Clothing fit and quality are another key driver of customer loyalty for shoppers, with a correlation coefficient of 0.51. Taobao customers are much less satisfied with clothing fit and quality compared with other online apparel marketplaces, which indicates that this is an important area the company needs to fix in order to improve customer loyalty.

Base: Regular Taobao shoppers (N=627).

Source: Coresight Research

Base: Regular Taobao shoppers (N=627).

Source: Coresight Research

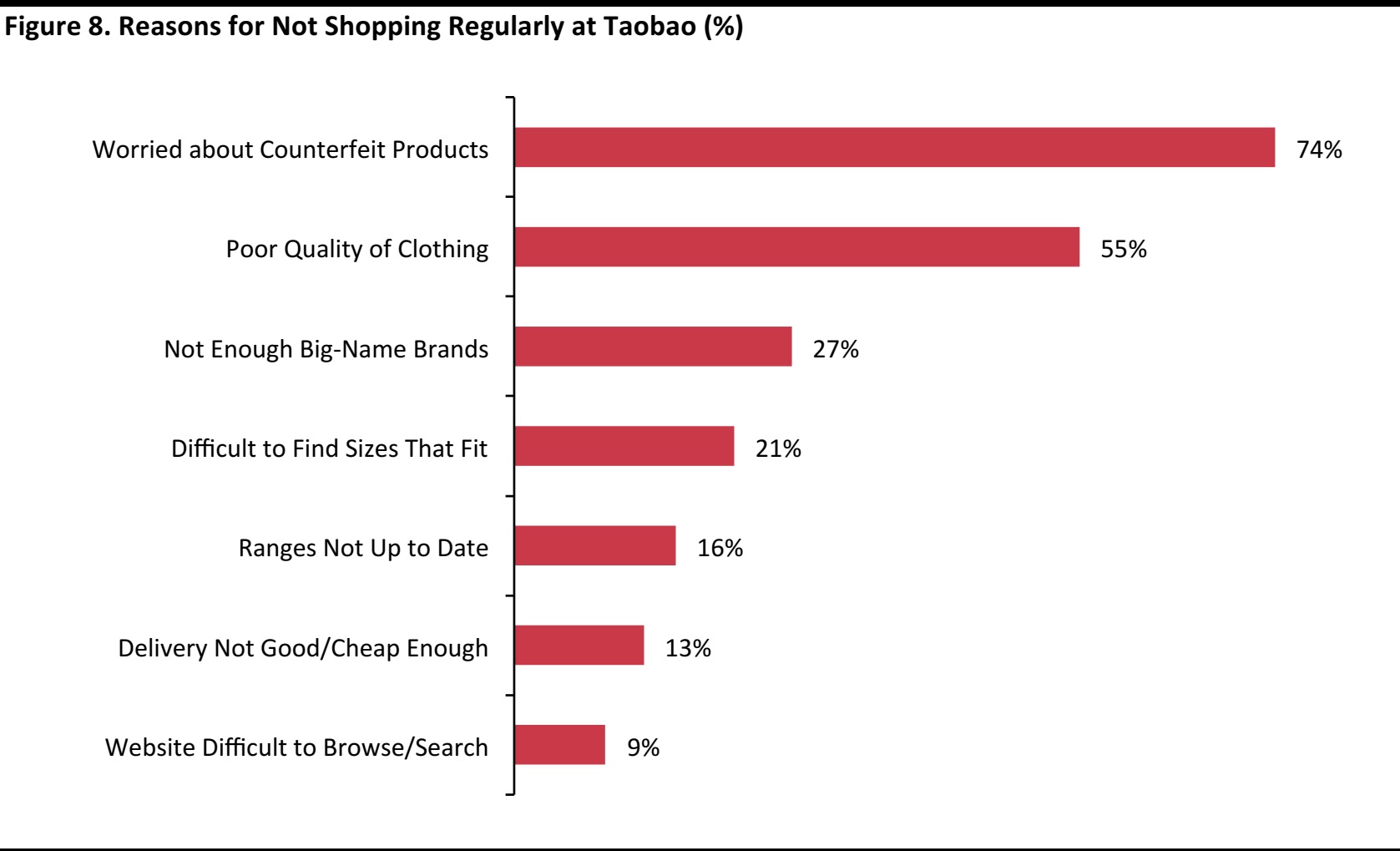

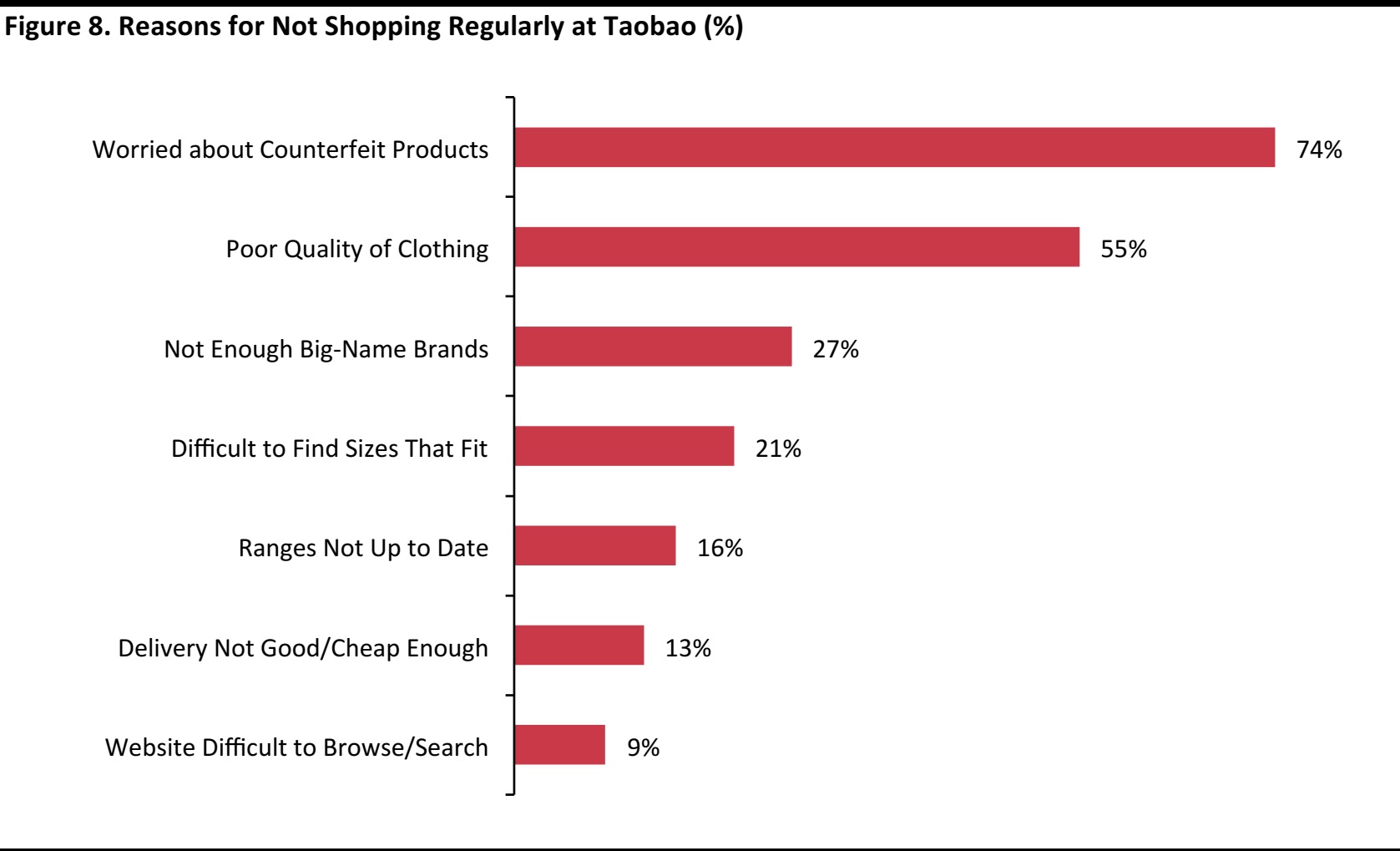

Occasional Taobao Shoppers Are Also Concerned About Product Quality

Among occasional Taobao shoppers, concerns about product quality was cited as the main reason for not purchasing apparel there regularly. Specifically, 71% of these shoppers cited concerns about product authenticity, and 55% cited poor quality of clothing.

Alibaba Group Founder Jack Ma acknowledged this issue in June last year at the Gateway ’17 event in Detroit, calling counterfeit goods the “cancer” of his company. Indeed, the e-commerce giant has been running anti-piracy campaigns, and began suing sellers of counterfeit goods in early 2017. However, this has not been an easy task. There were still numerous reports of counterfeit products emerging after the most recent Singles’ Day in November 2017.

Base: Occasional Taobao shoppers (i.e., those not shopping regularly at Taobao) (N=421).

Source: Coresight Research

Base: Occasional Taobao shoppers (i.e., those not shopping regularly at Taobao) (N=421).

Source: Coresight Research

A Recap of Our Key Findings

- Although e-commerce is the main channel for purchasing apparel in China, brick-and-mortar is still very relevant. Our proprietary consumer survey shows that the vast majority of Chinese consumers (96%) purchase apparel both online and offline.

- Brick-and-mortar purchases are driven primarily by shoppers’ ability to touch and feel a product before they buy, while online wins on product range, price and convenience.

- Among the top-ten apparel retailers in China, Uniqlo earned the top spot for customer satisfaction, while Taobao came last.

- According to our key driver analysis, the availability of value-for-money products is the key driver of customer loyalty; clothing fit and quality are also important.

Base: All respondents (N=1,055); lower income (N=478); middle income (N=430); higher income (N=147).

Note: Lower income means monthly household income (MHI) of ¥10,000 or below; middle income means MHI of ¥10,000–¥19,999; higher income means MHI of ¥20,000 or above.

Source: Coresight Research

Base: All respondents (N=1,055); lower income (N=478); middle income (N=430); higher income (N=147).

Note: Lower income means monthly household income (MHI) of ¥10,000 or below; middle income means MHI of ¥10,000–¥19,999; higher income means MHI of ¥20,000 or above.

Source: Coresight Research Base: Those who purchased apparel online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research

Base: Those who purchased apparel online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research Base: Those who made an apparel purchase either online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research

Base: Those who made an apparel purchase either online (N=1,030) or at a physical store (N=1,035).

Source: Coresight Research Base: Those who purchased apparel in the past 12 months (N=1,055).

Source: Coresight Research

Base: Those who purchased apparel in the past 12 months (N=1,055).

Source: Coresight Research Base: Those who purchased apparel in the past 12 months (N=1,055).

Note: Net Promoter, Net Promoter Score and NPS are registered trademarks of Bain & Company, Fred Reichheld and Satmetrix Systems.

Source: Coresight Research

Base: Those who purchased apparel in the past 12 months (N=1,055).

Note: Net Promoter, Net Promoter Score and NPS are registered trademarks of Bain & Company, Fred Reichheld and Satmetrix Systems.

Source: Coresight Research Base: Taobao shoppers (N=627); Tmall shoppers (N=686); JD.com shoppers (N=310); Vipshop shoppers (N=200).

Source: Coresight Research

Base: Taobao shoppers (N=627); Tmall shoppers (N=686); JD.com shoppers (N=310); Vipshop shoppers (N=200).

Source: Coresight Research Base: Regular Taobao shoppers (N=627).

Source: Coresight Research

Base: Regular Taobao shoppers (N=627).

Source: Coresight Research Base: Occasional Taobao shoppers (i.e., those not shopping regularly at Taobao) (N=421).

Source: Coresight Research

Base: Occasional Taobao shoppers (i.e., those not shopping regularly at Taobao) (N=421).

Source: Coresight Research