Executive Summary

This is our first report based on the ProsperChinaQuarterly Survey. Similar to our

US Consumer Survey publications, we combine our analysis with data on thousands of Chinese shoppers surveyed by ProsperChina. In this report, we focus on the apparel market in China.

Key Findings

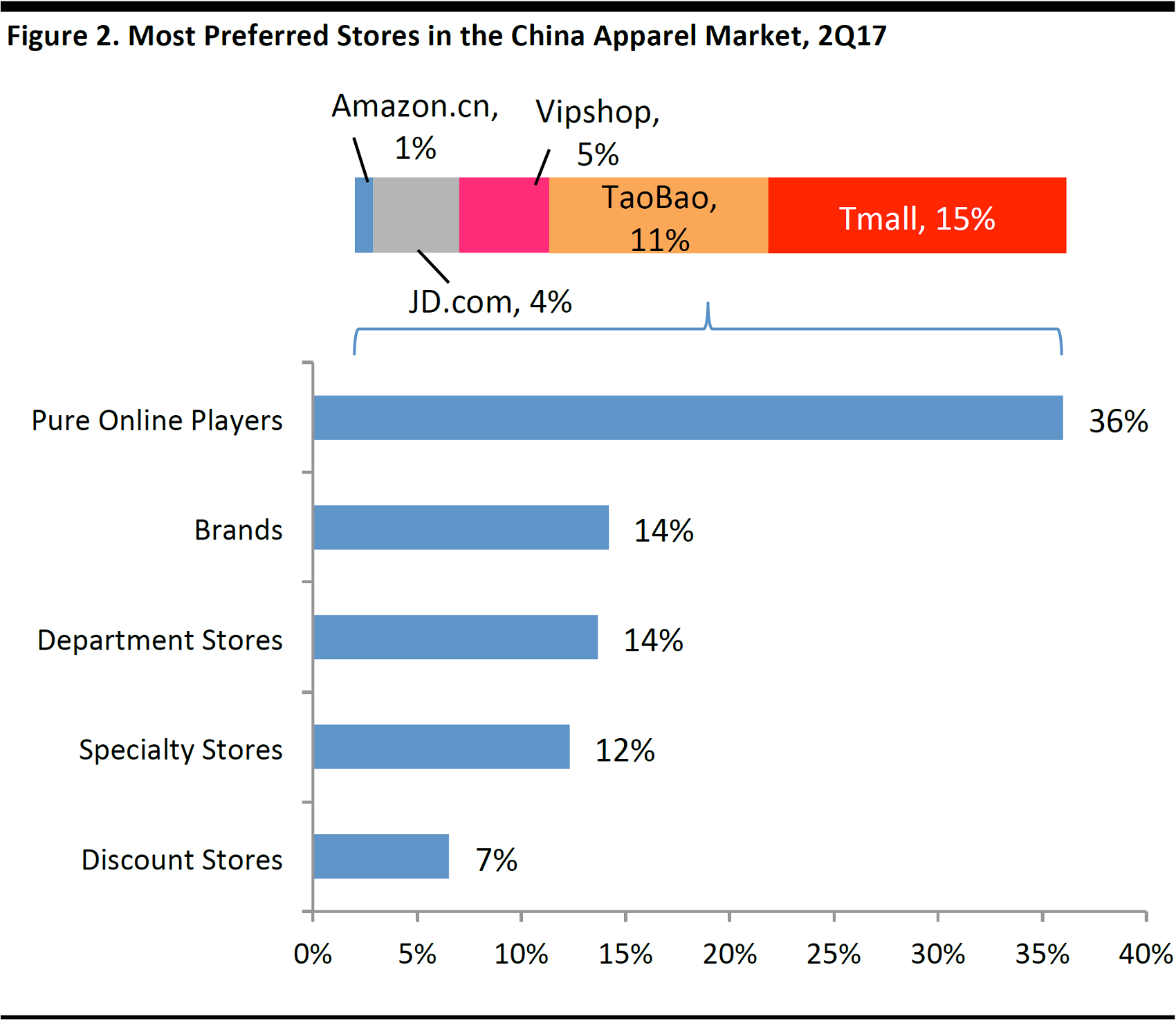

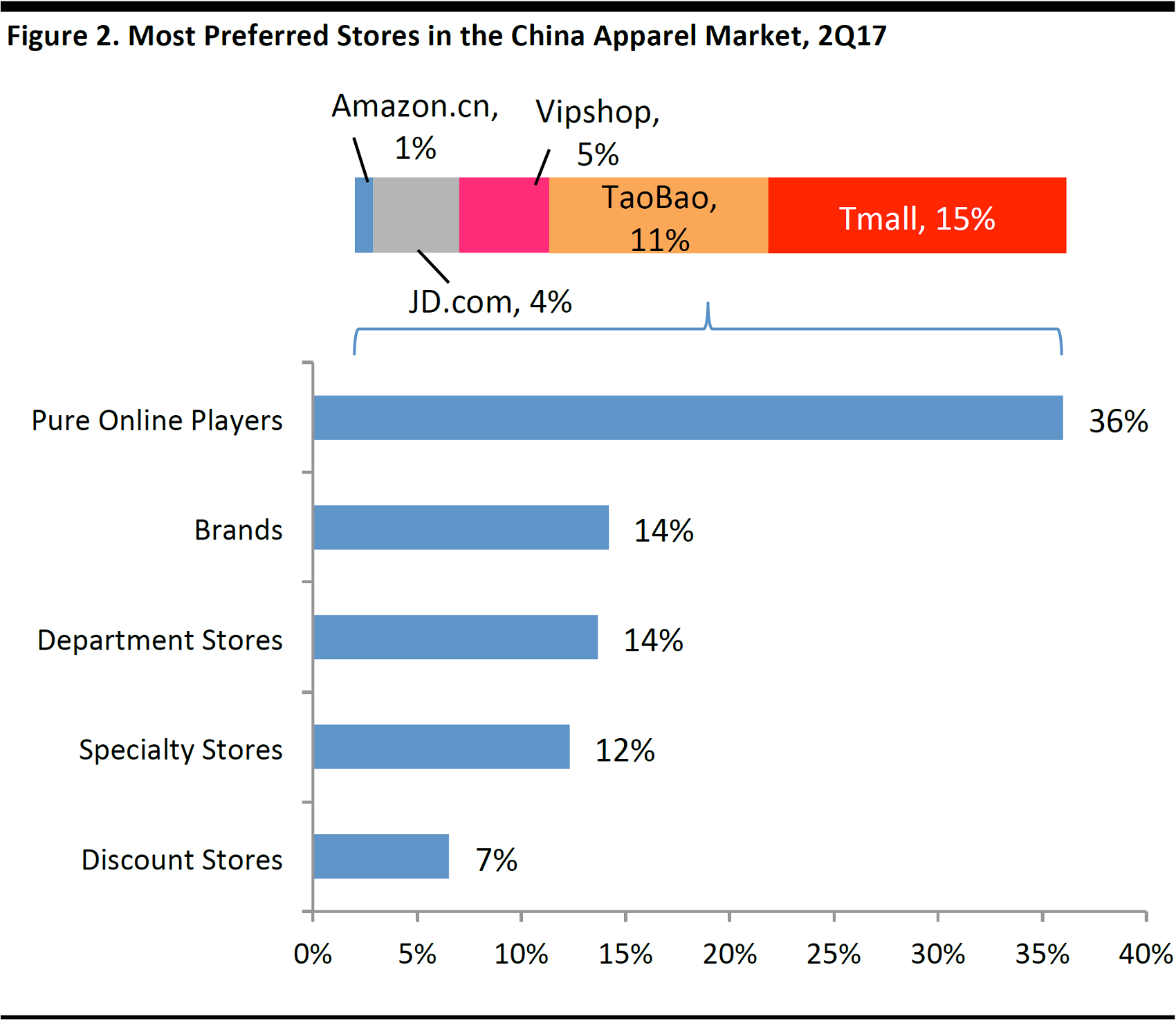

- E-commerce is the preferred shopping method among Chinese consumers, with Tmall and Taobaotopping the list as the top-two online shopping destinations.

- Although Taobao is the second-most-preferred online site for apparel, it has one of the lowest net promoter scores (NPS).

- Tmall is preferred among millennial consumers who have significant spending power.

- Vipshop excels at engaging with loyal customers, thanks to a unique shopping experience.

- JD.com lags behind Taobao and Tmall when it comes to apparel, but its best-in-class fulfillment capabilities are an asset and the platform has managed to gain some market share.

Based on our analysis of the dynamics of the apparel market in China, we conclude that:

- Taobao positions itself as a marketplace for the mass market. Stores operated by key opinion leaders (KOLs) could eventually improve Taobao’s branding and the consumer perception of the quality of products sold on the platform.

- Tmall positions itself as a higher-end marketplace. Its recently launched Luxury Pavilion could guarantee a superior experience for luxury shopping, enhancing product exclusivity.

- Vipshop positions itself in a similar price range as Tmall. Vipshop launched its super VIP program early this year and targets to strengthen its customers’shopping experience.

- Although JD.com’s price points may not be as competitive as the other players, it has managed to gain market share in the category recently. In order to boost its competitive edge, JD.com plans to focus on cross-border e-commerce.

Market Overview and Insights

The Chinese Online Apparel Market Is Still Growing Fast

The total transaction volume of the Chinese online apparel market reached ¥934billion ($142billion)in 2016, according to data from China’s E-Commerce Research Center (CECRC), with a five-year compound annual growth rate (CAGR)of 36% between 2011 and 2016.

Source:China’s E-Commerce Research Center

Source: iStockphoto

E-Commerce Is the Main Channel for Apparel, Led by Taobao and Tmall

According to data from ProsperChina, e-commerce is the preferred shopping method for apparel among Chinese consumers. Around 36% of surveyed adults choose to shop pure online players, with Tmall and Taobao the preferred online destinations. Discount stores, on the other hand, are the least preferred shopping destination, with only 7% of surveyed adults preferring to shop there.

Base: Adults aged 18+ (N=5,821).

Source:ProsperChina, Quarterly Consumer Surveys

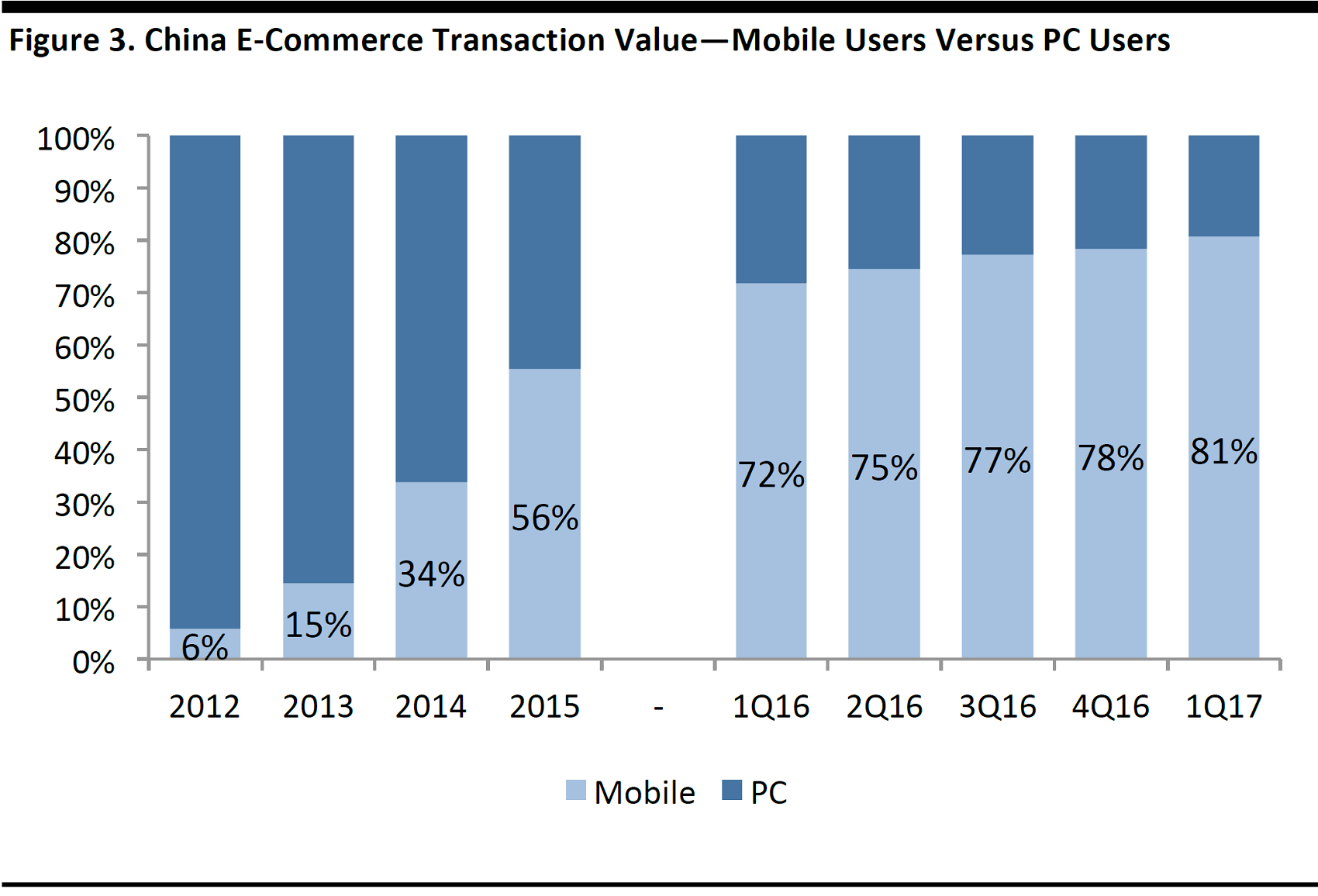

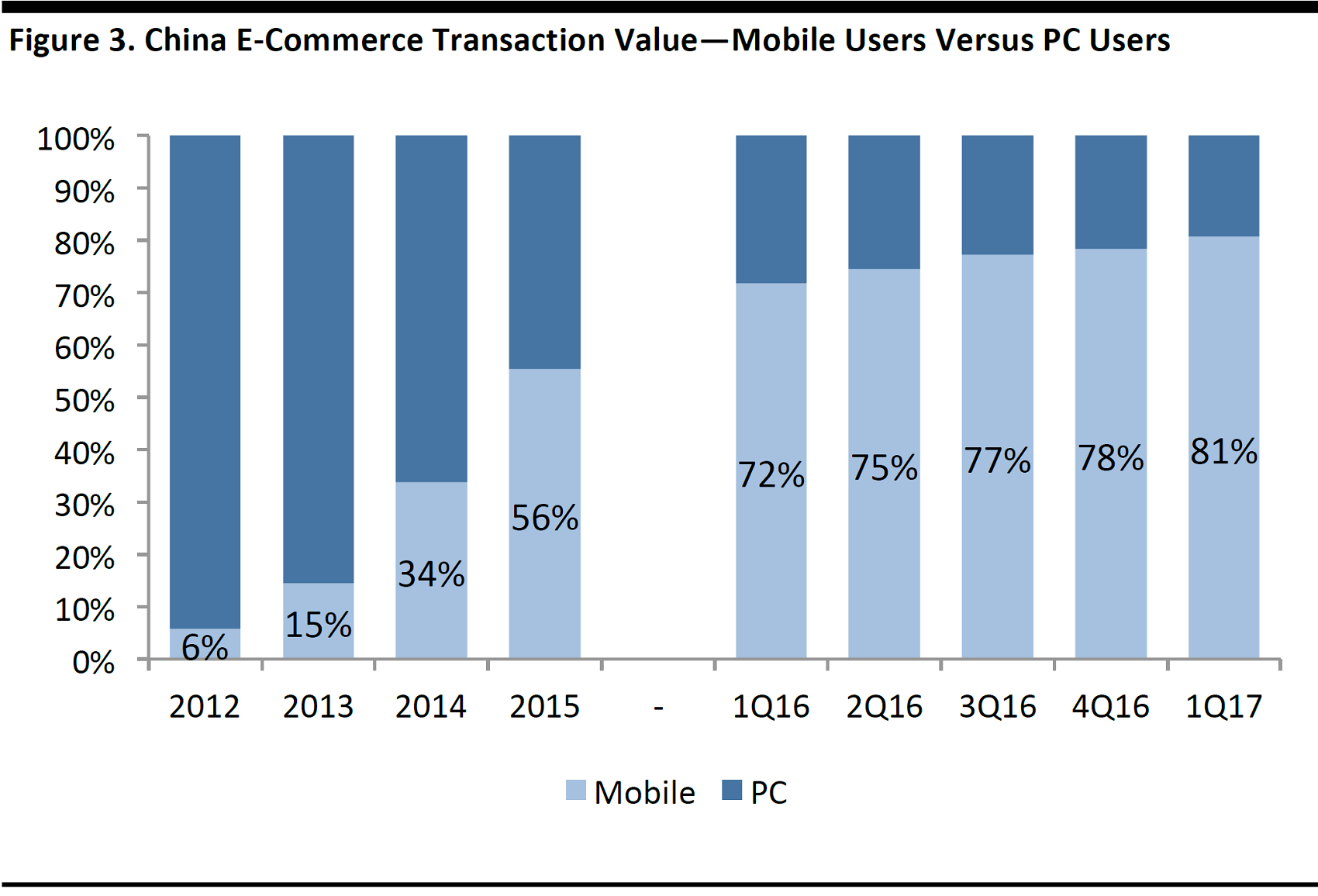

Mobile e-commerce is driving the growth of online shopping, as customers can easily access shopping platforms anywhere and at any time. More than 80% of e-commerce transaction value takes place on mobile devices, according to data from iResearch, growing 9% year over year between 1Q2016 and 1Q2017.

Source:iResearch

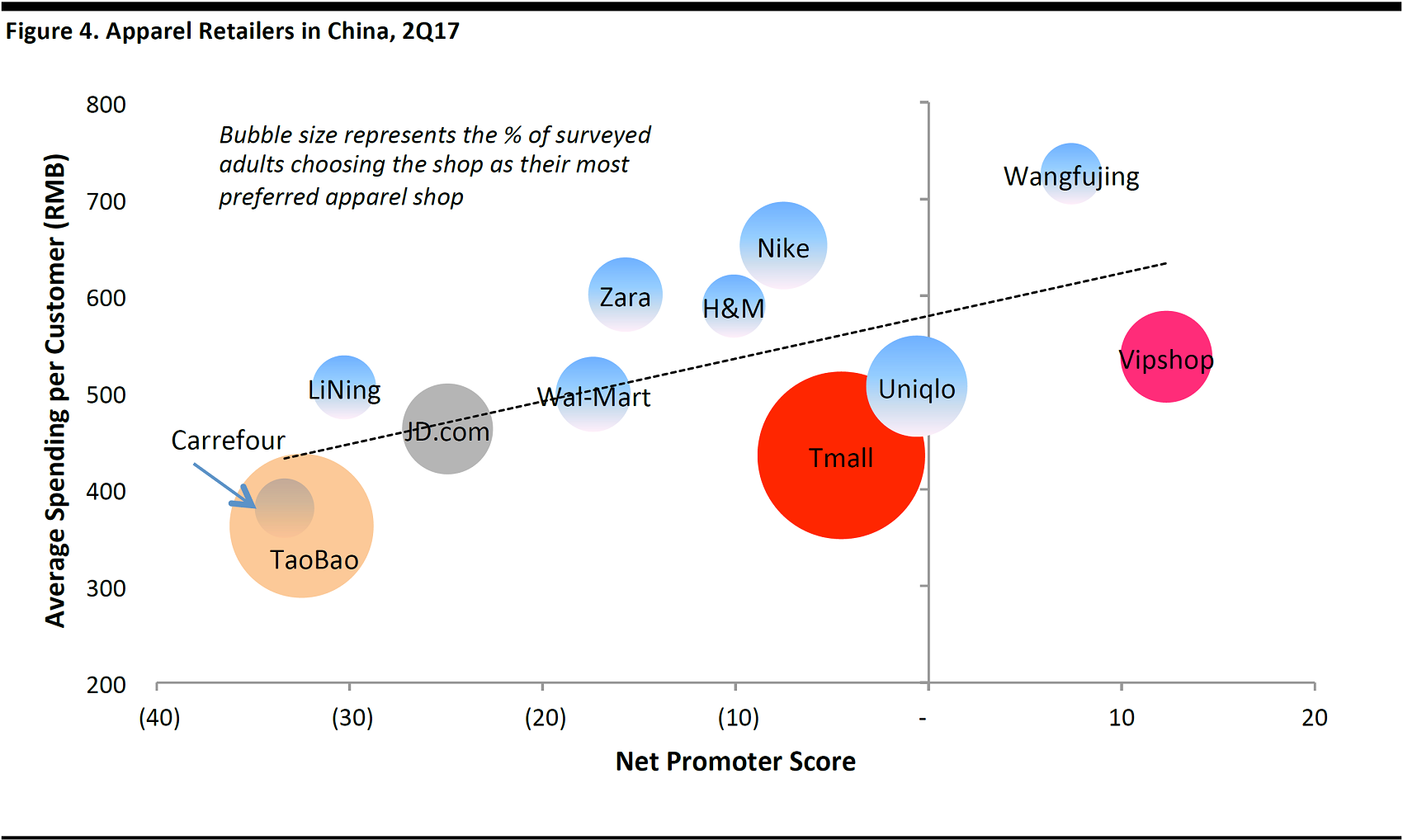

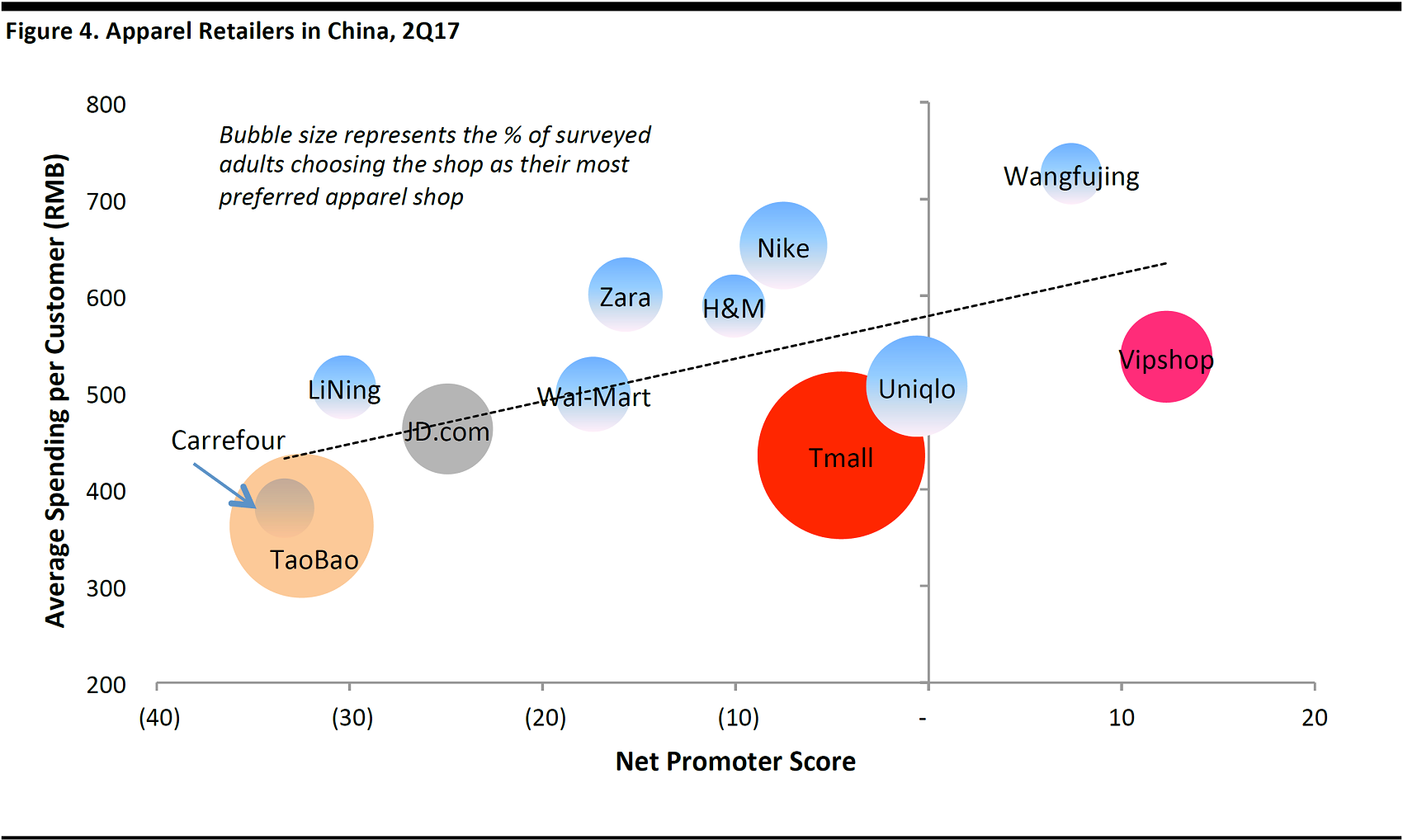

The Market Shows a Positive Relationship Between Average Spending per Customer and NPS[1]

According to data from ProsperChina, there is a positive relationship between average spending per customer and the NPS, which implies that a higher NPS leads to higher average spending.

[1]NPS stands for net promoter score, which is an index that measures the willingness of customers to recommend a company’s products or services to others. The NPS score is determined by subtracting the percentage of detractors, which is defined as respondents giving a score of 0–6, from the percentage of promoters, which is defined as respondents giving a score of 9–10.

Base: Adults aged 18+ (N=5,821).

Source:ProsperChina, Quarterly Consumer Surveys

However, NPS is not necessarily a good predictor of shopping preference. Taobao’s NPS is -32, yet the platform still ranks highly in terms of shopping preference.

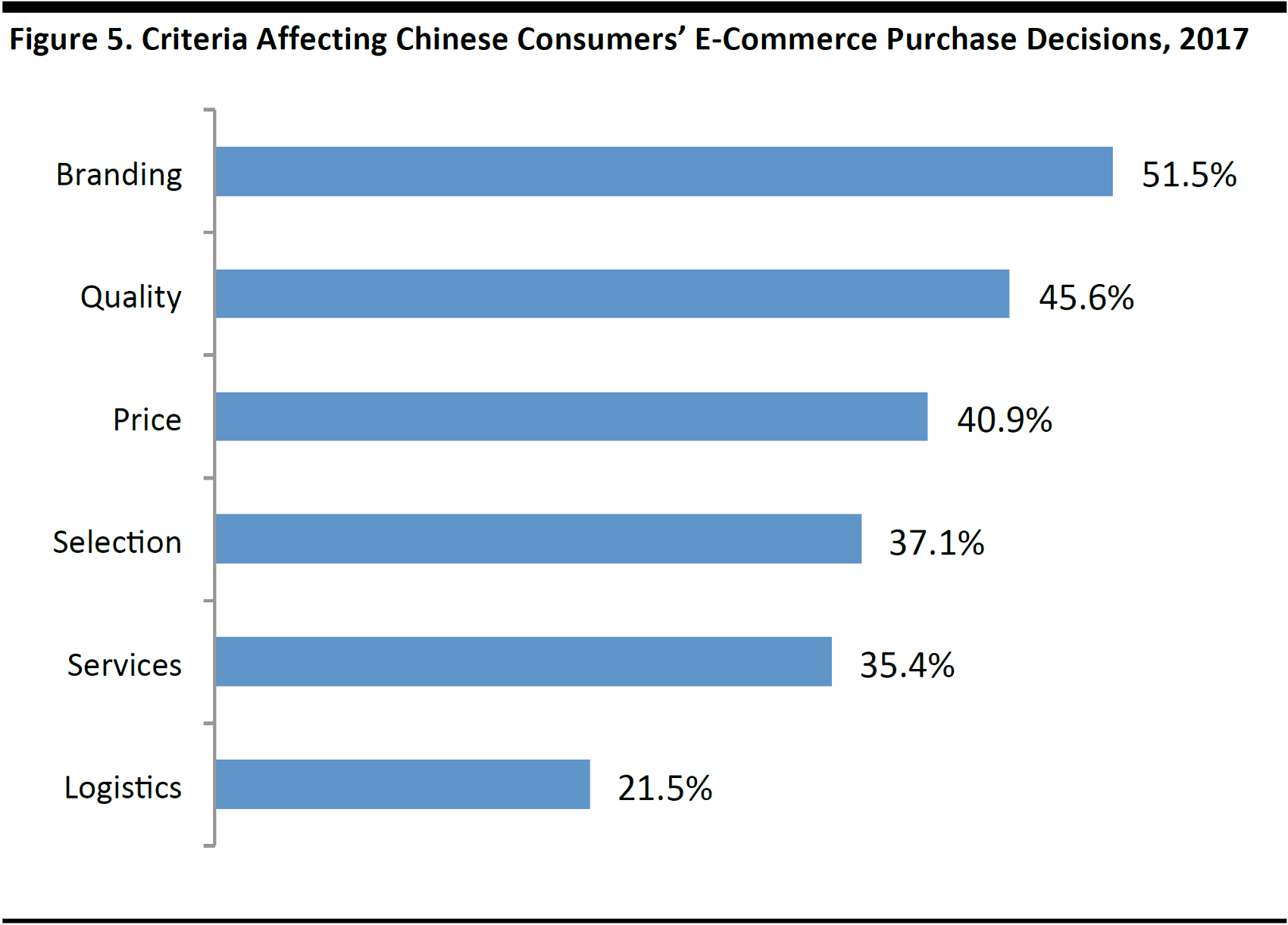

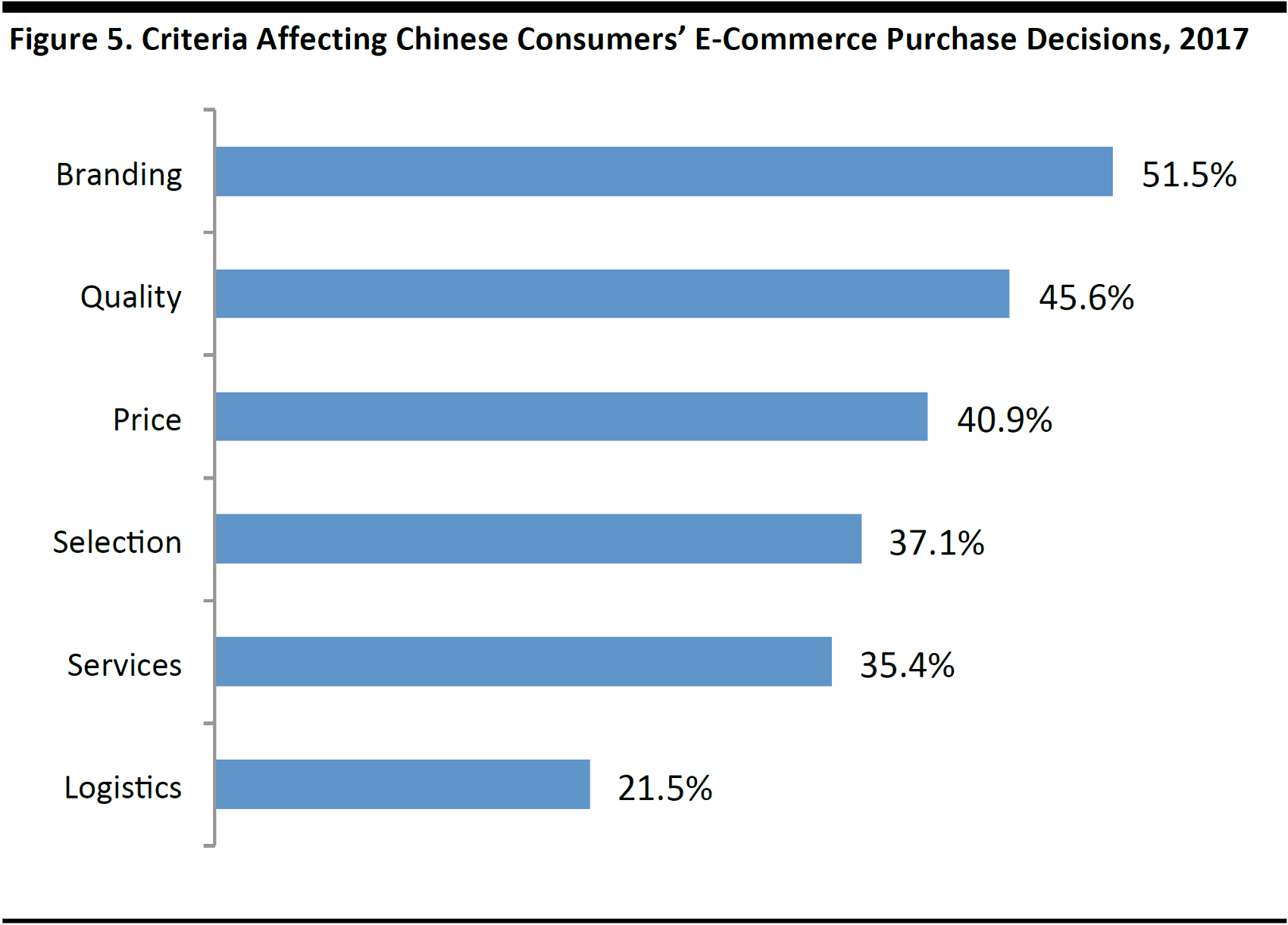

Chinese Consumers Have a Preference for Branding and Quality

Chinese consumers are becoming much more conscious about branding and quality—51.5% of surveyed consumers care about branding and 45.6% care about the quality of the product, versus 40.9% who consider price as a factor in their purchase decision, according to data from China’s E-Commerce Research

Center.

[1]NPS stands for net promoter score, which is an index that measures the willingness of customers to recommend a company’s products or services to others. The NPS score is determined by subtracting the percentage of detractors, which is defined as respondents giving a score of 0–6, from the percentage of promoters, which is defined as respondents giving a score of 9–10.

Chinese Consumers Have a Preference for Branding and Quality

Chinese consumers are becoming much more conscious about branding and quality—51.5% of surveyed consumers care about branding and 45.6% care about the quality of the product, versus 40.9% who consider price as a factor in their purchase decision, according to data from China’s E-Commerce Research Center.

Source:China’s E-Commerce Research Center

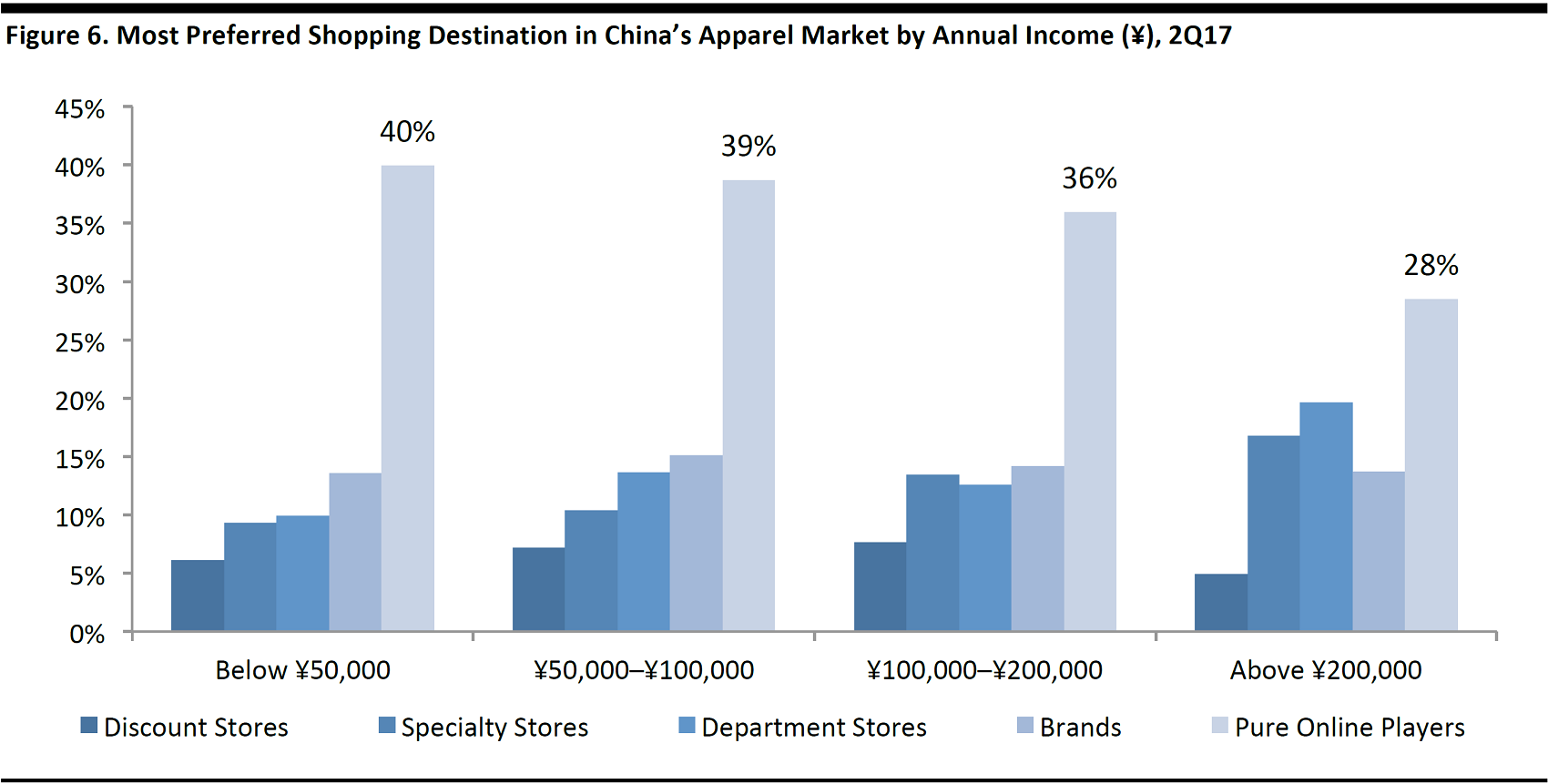

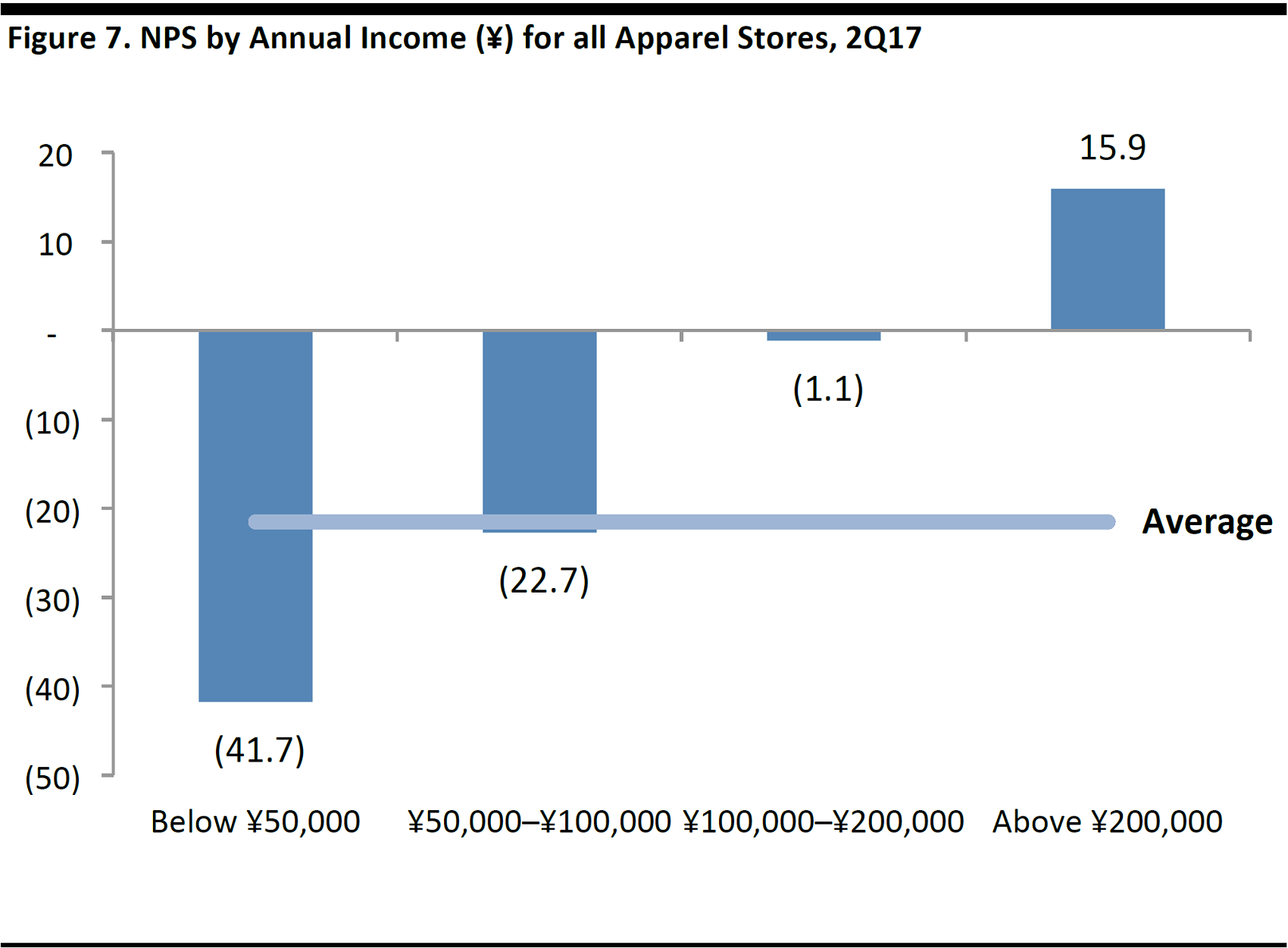

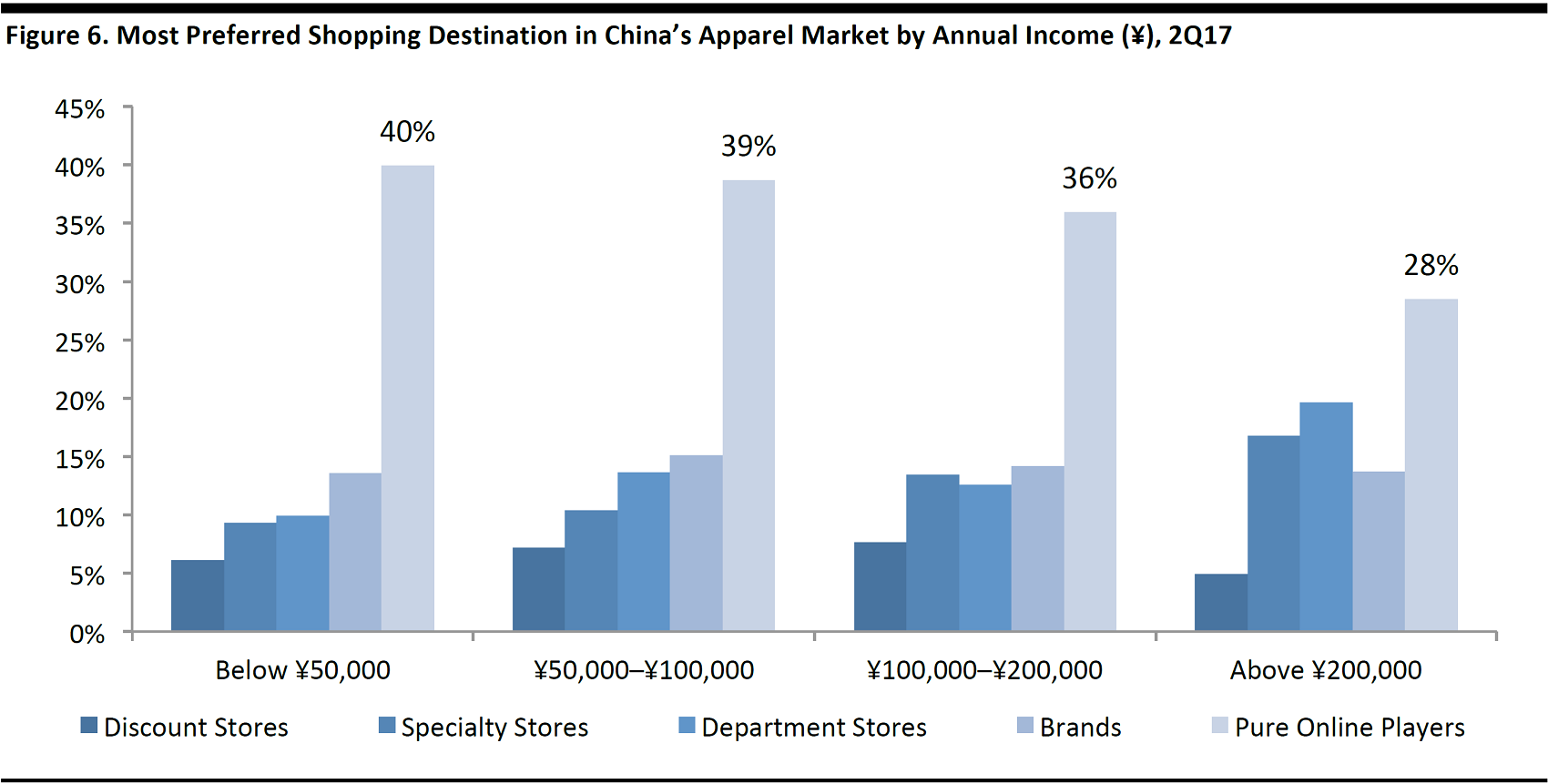

Consumers in the Lower-Income Segment Are Avid E-Commerce Shoppers, but Have a Poor Shopping Experience

According to data from ProsperChina, e-commerce is the most preferred shopping method across all income groups, however, the lower-income groups show a greater tendency to shop online. Some 40% of surveyed adults with an annual income below¥50,000 ($7,600)prefer to shop online, compared to only 28% of surveyed adults with an annual income above ¥200,000($30,400).

Base: Adults aged 18+ (N=5,792).

Source:ProsperChina, Quarterly Consumer Surveys

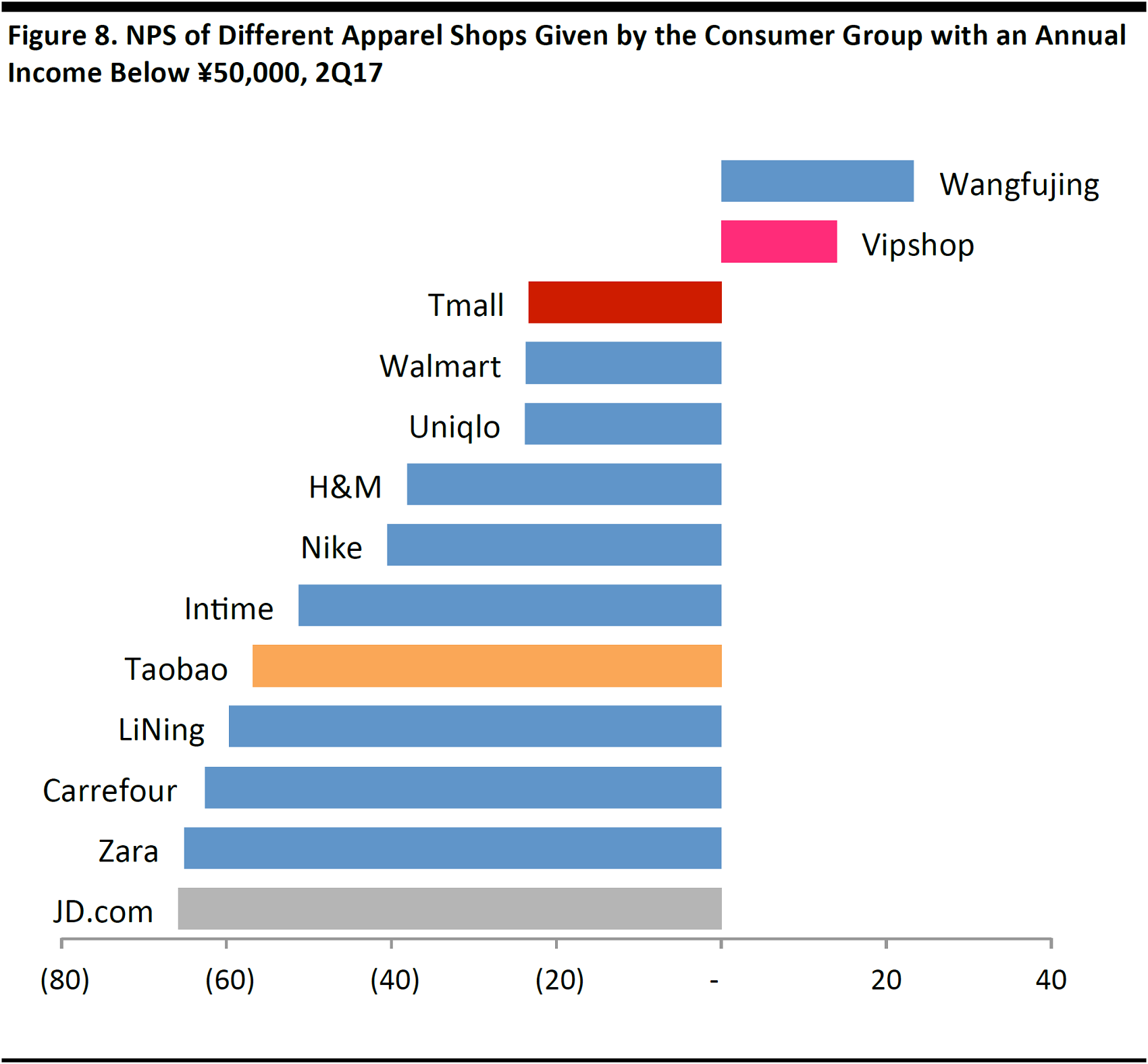

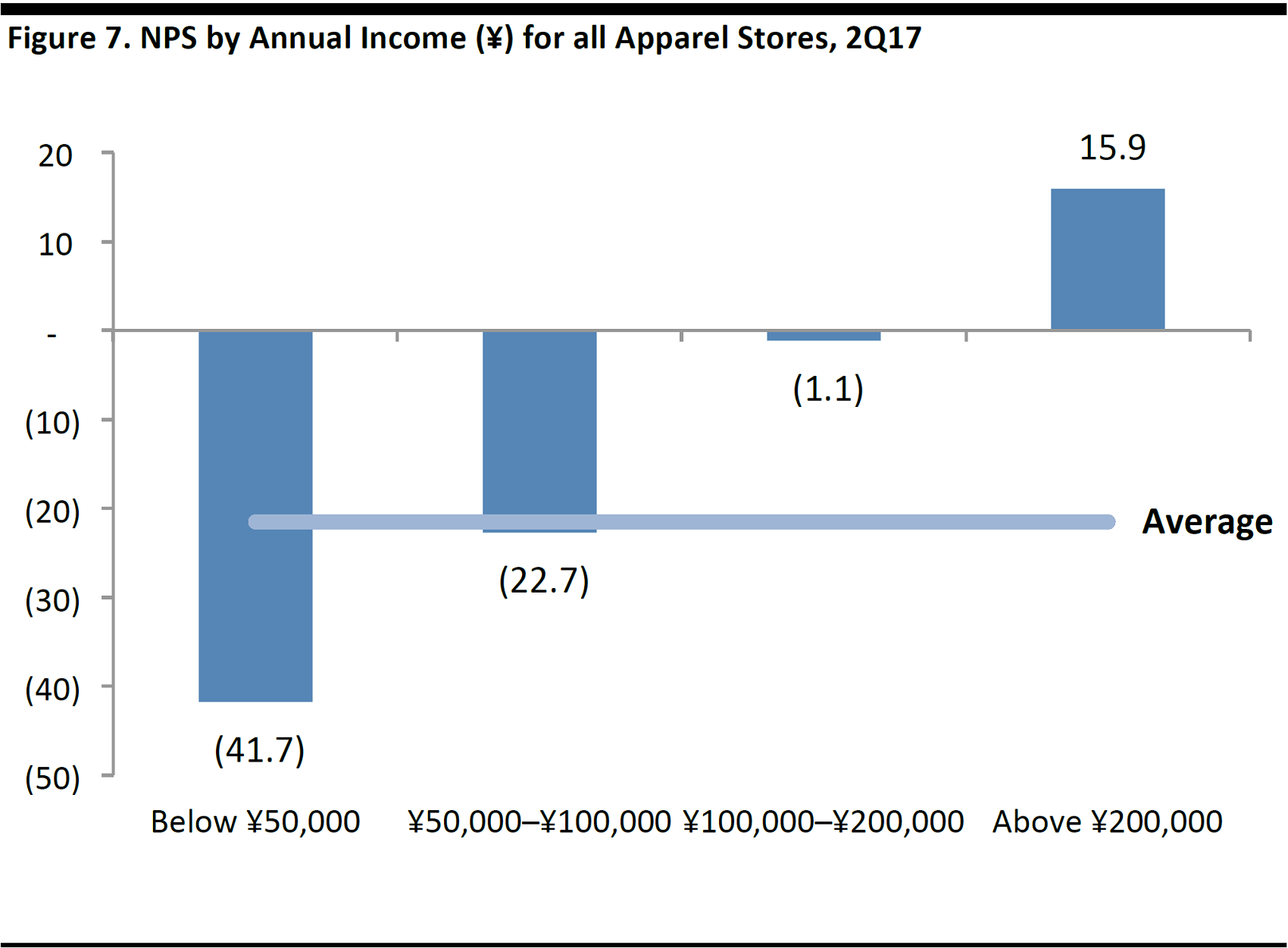

Consumers in the lower-income segment also tend to be less brand loyal, as measured by NPS: ProsperChina data show that the group with an annual income below ¥50,000scores an NPS of -42, which is significantly lower than the overall average of -22.

Base: Adults aged 18+ (N=5,792).

Source:ProsperChina, Quarterly Consumer Surveys

Base: Adults aged 18+ (N=5,792).

Source:ProsperChina, Quarterly Consumer Surveys

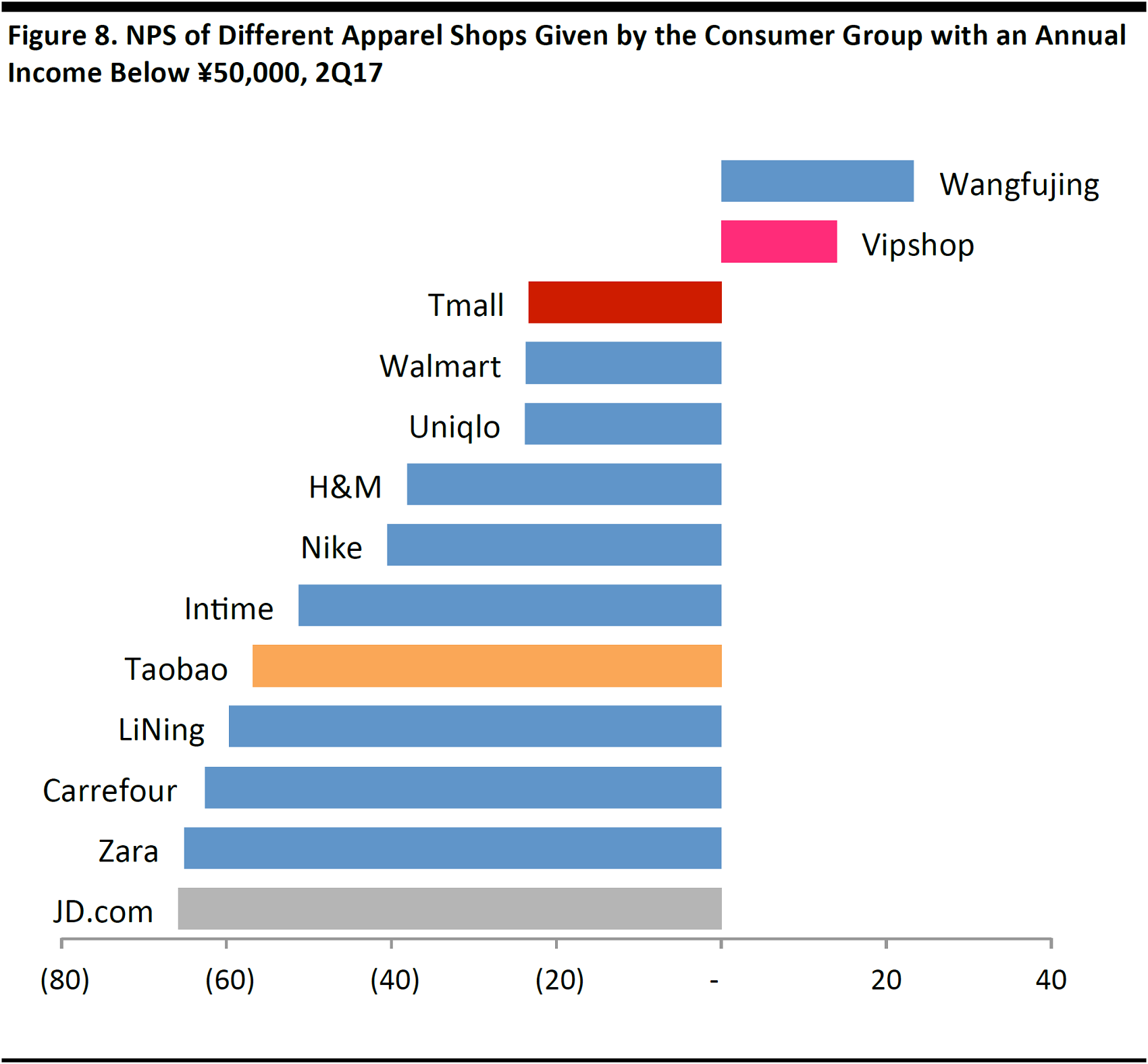

Diving deeper into the lower-income group (i.e., those with an annual income below ¥50,000), the data show that consumers in this group generally give a low NPS to most stores except Vipshop and Wangfujing, which are viewed as high-quality apparel sites. This confirms that quality and branding are important drivers of high NPS scores for apparel retailers in China.

Source: iStockphoto

Base: Adults aged 18+ (N=1,621).

Source:ProsperChina, Quarterly Consumer Surveys

Profiling the Market Leaders

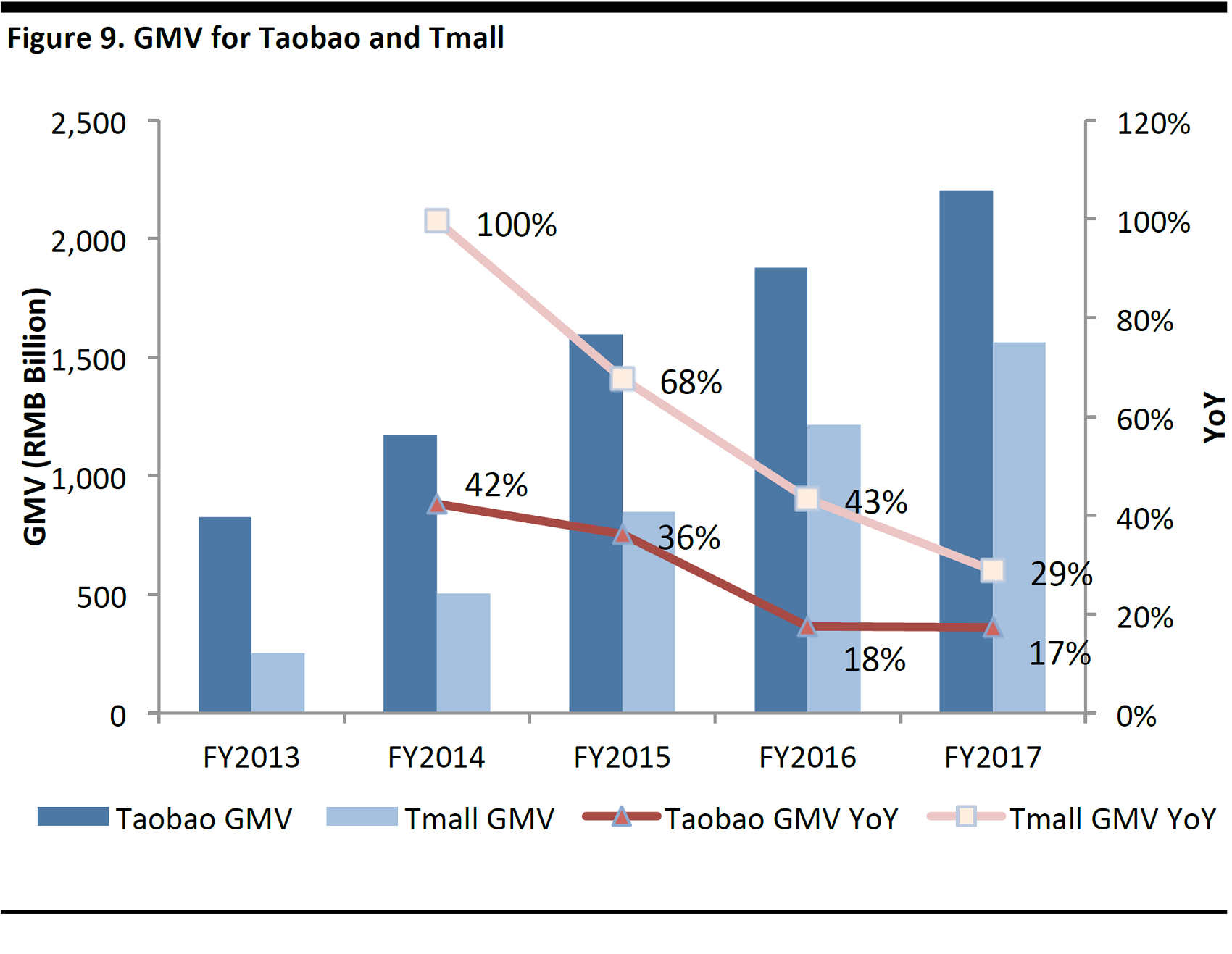

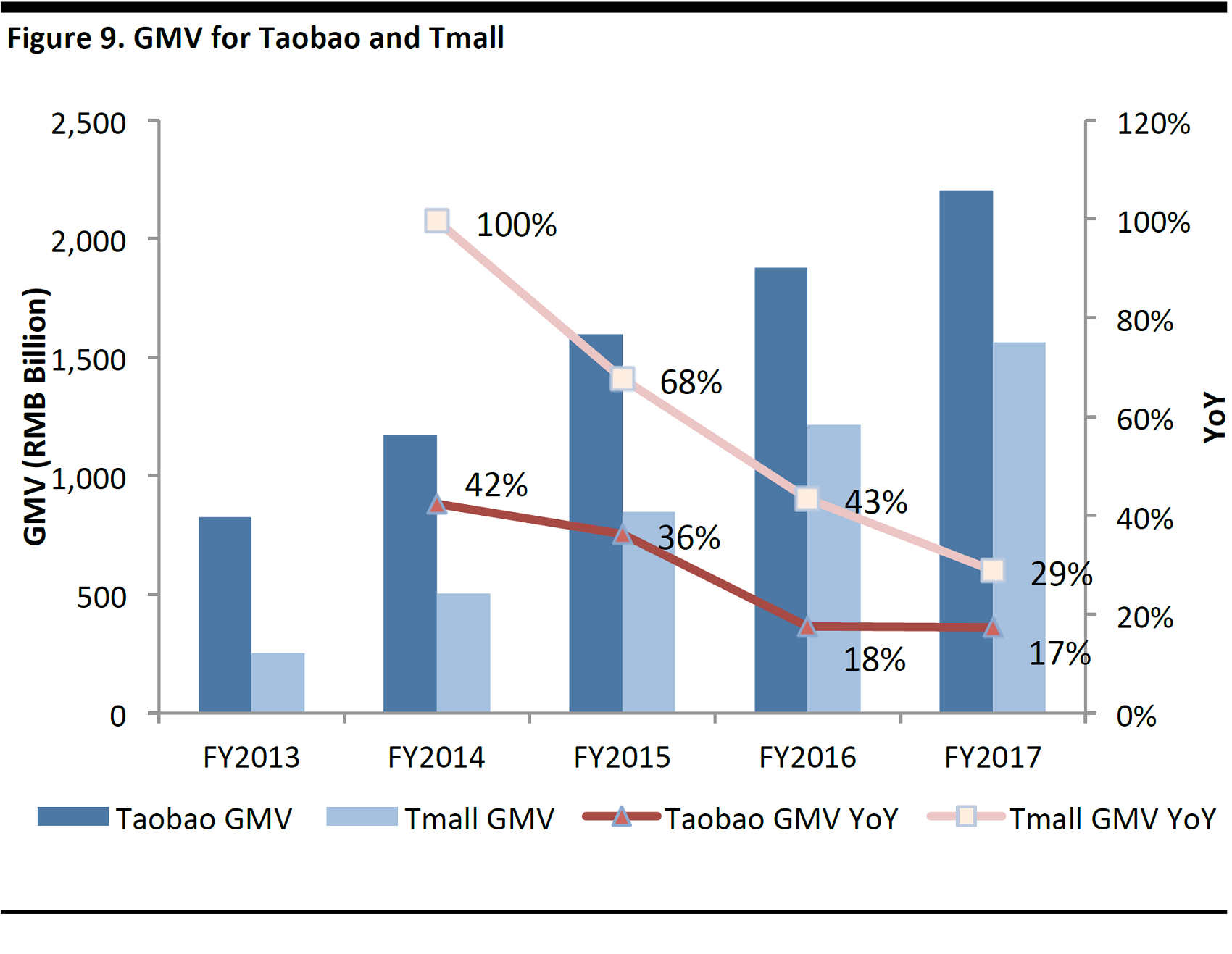

With both Taobao and Tmall in its portfolio, Alibaba is considered an e-commerce powerhouse. The two platforms are complementary—one captures the low-price consumer (Taobao), while the other (Tmall)increasingly differentiates on quality and branding and captures the high-price consumer. With the ongoing upgrade of Chinese consumption, Tmall is better positioned for sustained growth, but one cannot rule out Taobao with its low-value proposition.

A look at Alibaba’ financials confirm this statement— growth of gross merchandise value (GMV)for Taobao is plateauing at 17% year over year, compared to Tmall’s GMV growth, which is still above 29% year over year.

For the June quarter 2017, Alibaba reported year-over-year growth in GMVfor Tmallof 49%.

Source:Alibaba

Taobao: The Low-Price Marketplace

Taobao’s value proposition is clearly centered around the low prices it offers to consumers, while at the same time, its marketplace model guarantees breadth of selection and value-added services.

Source:Taobao

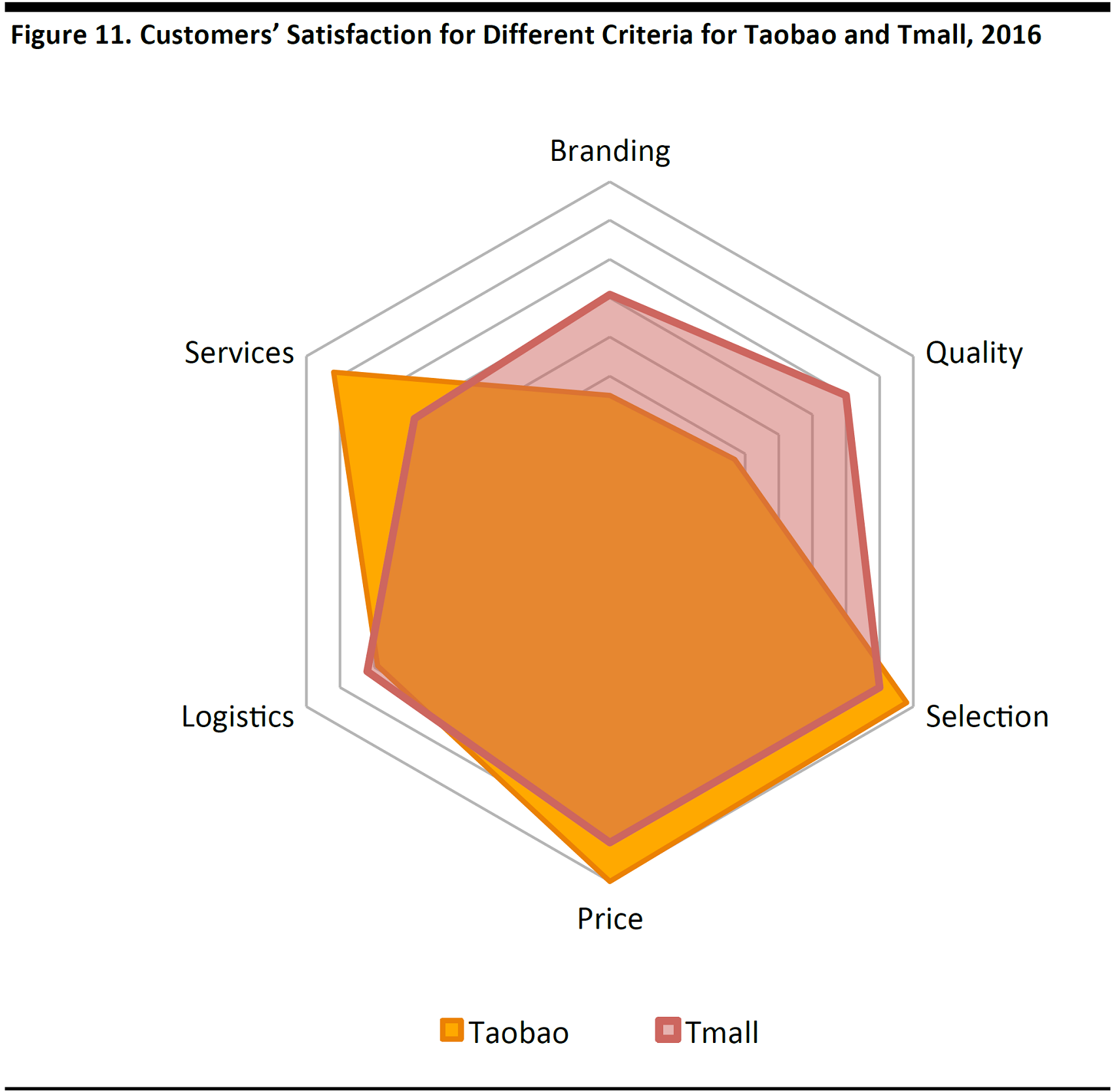

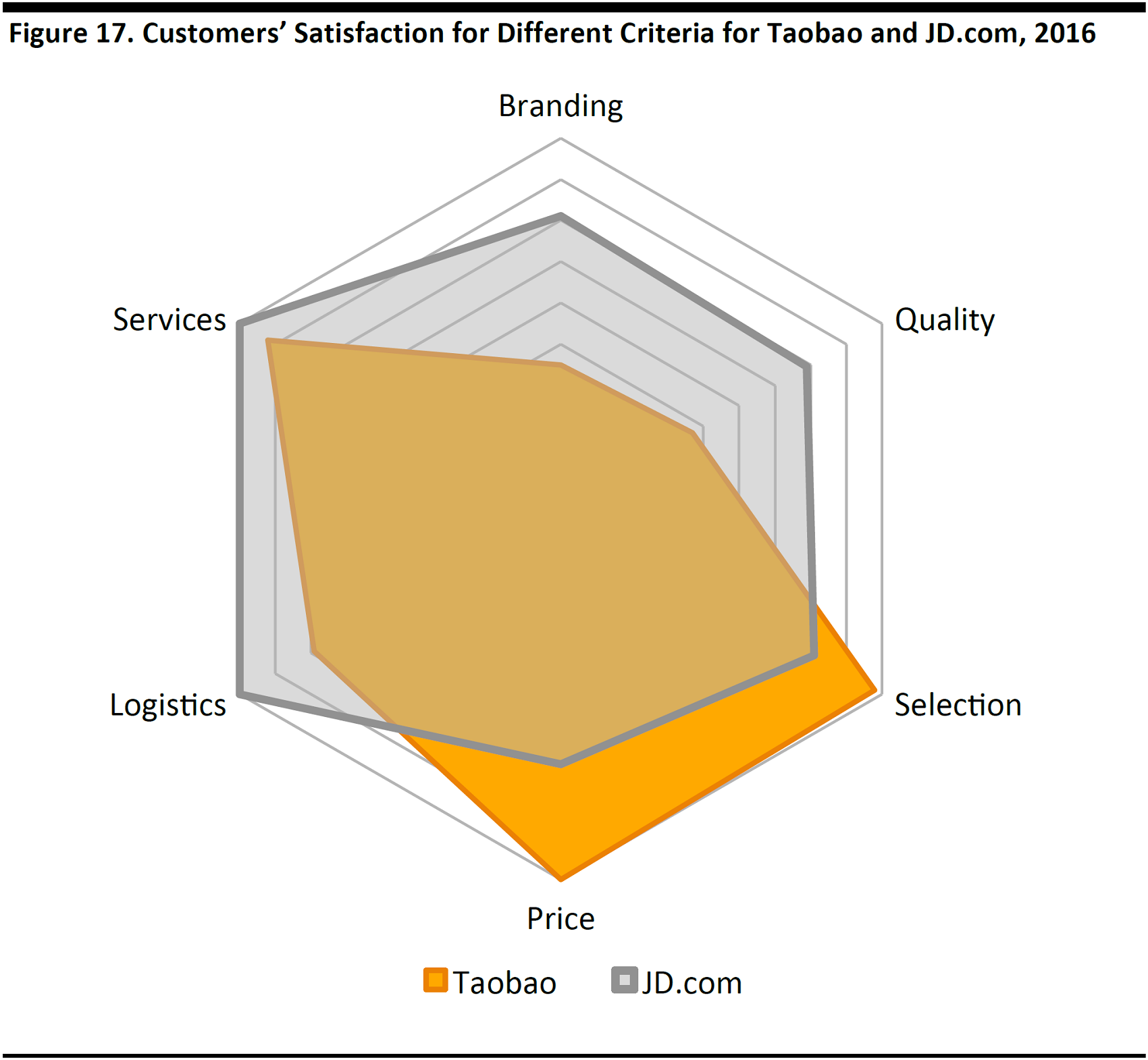

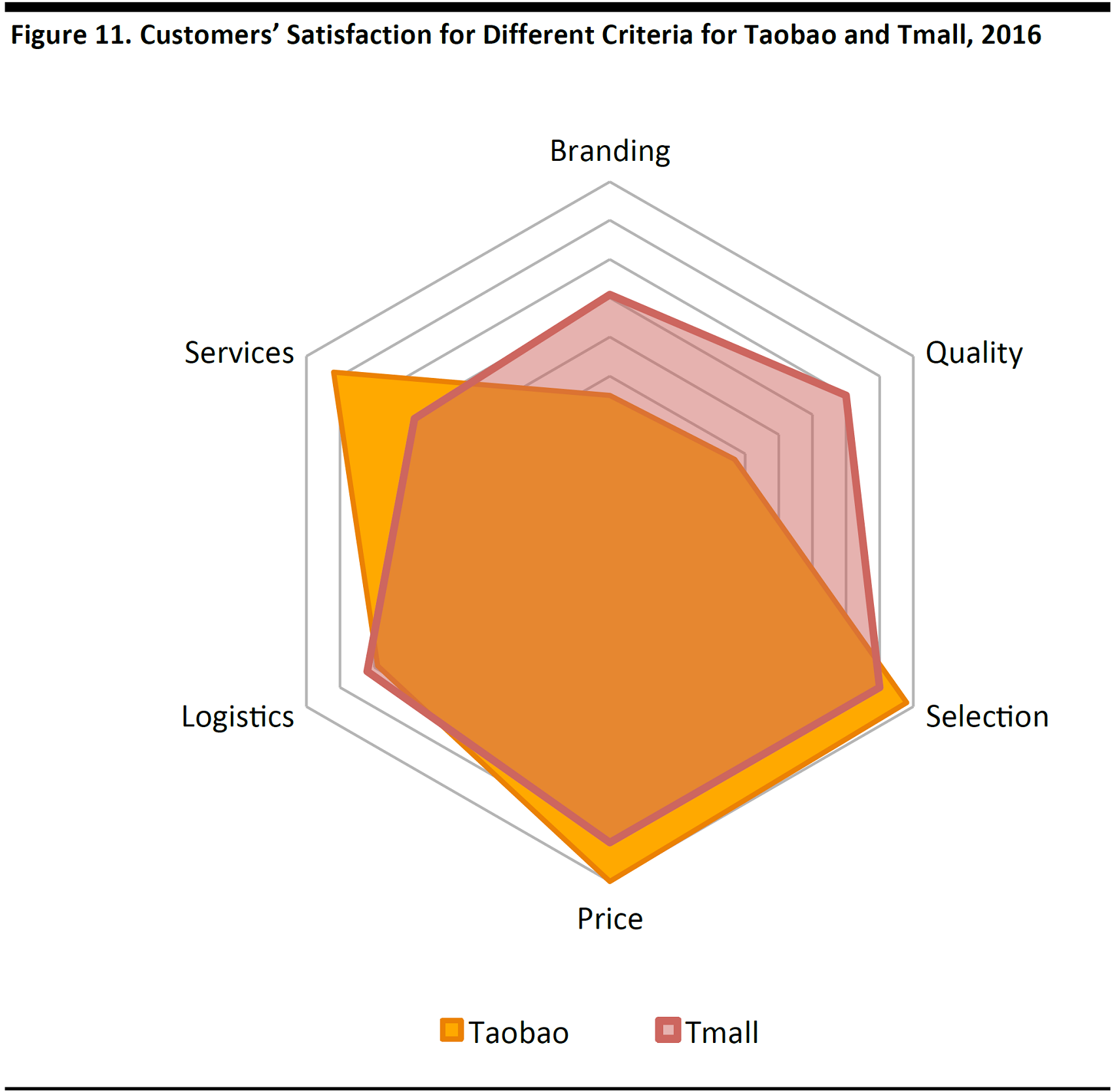

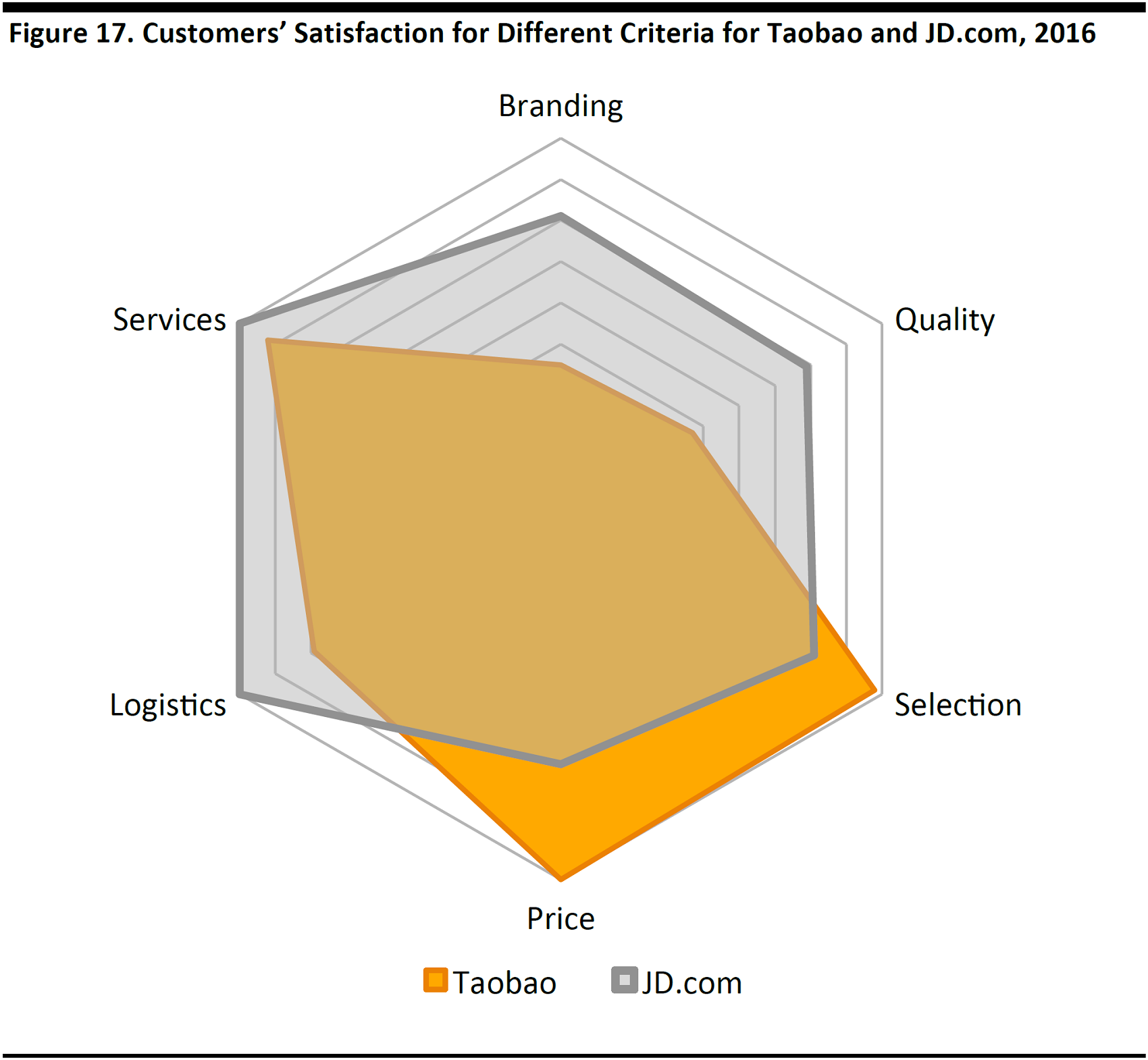

As Taobao does not charge a listing fee or take a sale commission, the products listed on its marketplace can be sold at low prices. Due to the large variety of products on offer, customers can almost always find what they need for a relatively low price on Taobao. According to survey data from China’s E-Commerce Research Center, Taobao scores high with consumers on price, selection and services, but low on branding and quality, which is a natural trade-off.

Source:China’s E-Commerce Research Center

Tmall: Entices High-Value Customers with Product Variety and Quality

Tmall is China’s largest business-to-consumer(B2C) platform, connecting global brands and retailers with Chinese consumers. For more details of its business model, please refer to our report:

Alibaba Group: From Strength to Strength.

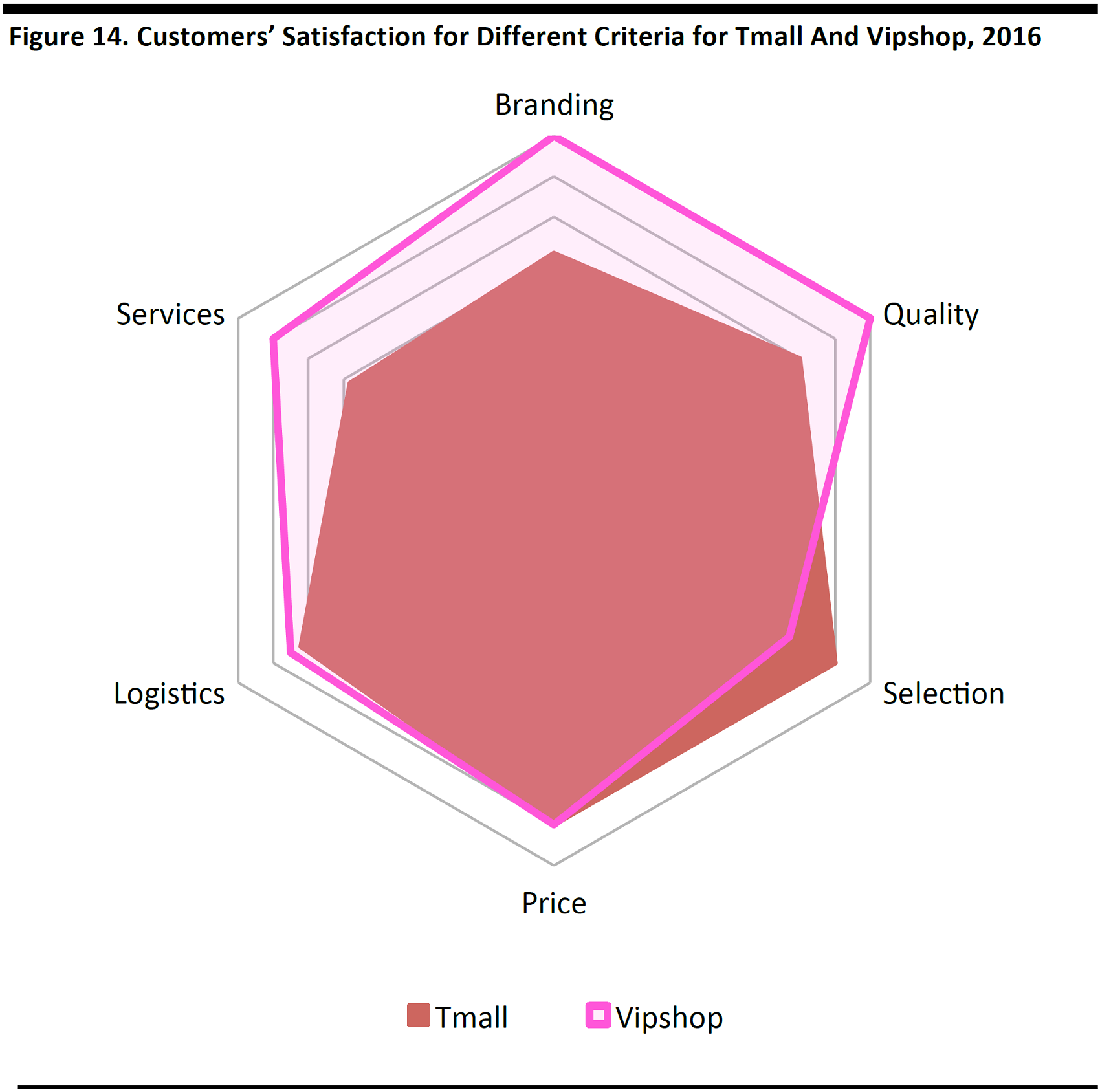

Tmall is known for affordably priced branded products. Adhering to a strict verification process and rating system, a seller must be a legal entity and offer authentic goods or services. Hence, Tmall scores higher on branding and quality compared to Taobao, according to China’s E-Commerce Research Center. Tmall is similar to Taobao in other aspects, for example, its wide product offering, affordable pricing, and efficient logistics services.

Source:Tmall

Source:China’s E-Commerce Research Center

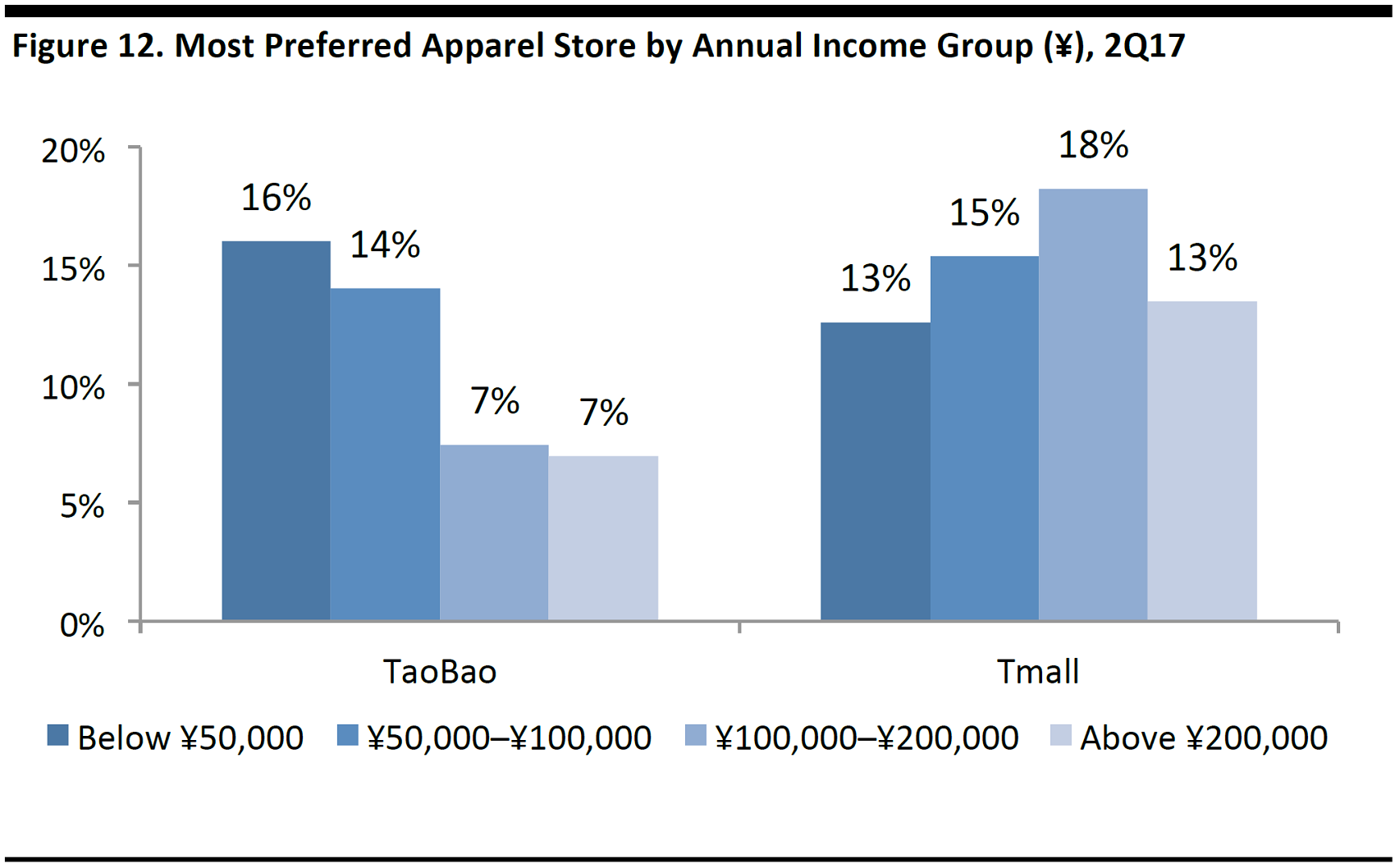

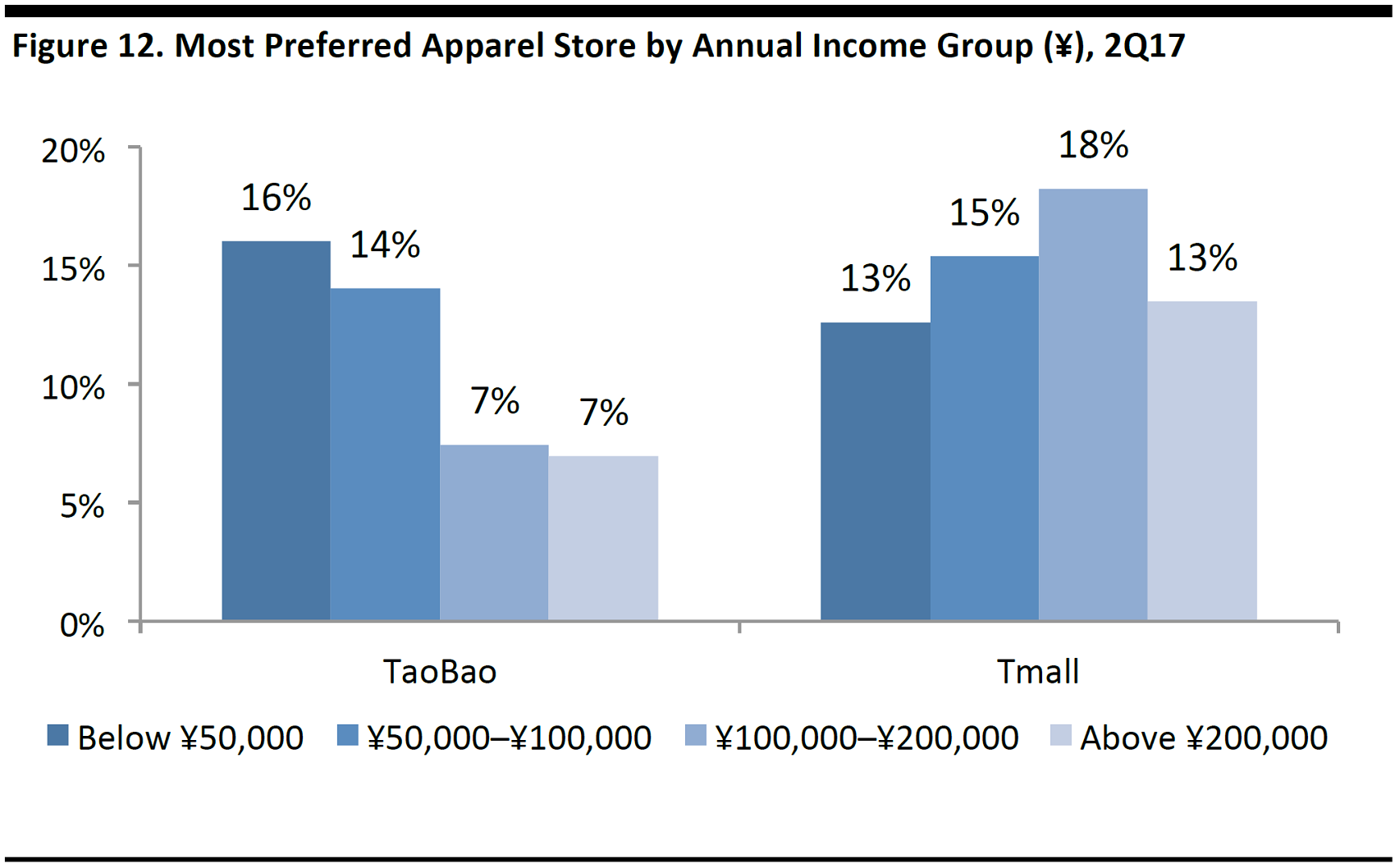

Tmall Attracts High-Income Shoppers and Consumers Born in the 1980s

According to ProsperChina data, there is no significant difference in shopping preference between Taobao and Tmall for the consumer groups with an annual income below ¥50,000 and ¥50,000–¥100,000. However, for the consumer groups with an annual income of between ¥100,000 and ¥200,000 and above ¥200,000, Tmall is the clear choice for apparel.

Base: Adults aged 18+ (N=5,792).

Source:ProsperChina, Quarterly Surveys

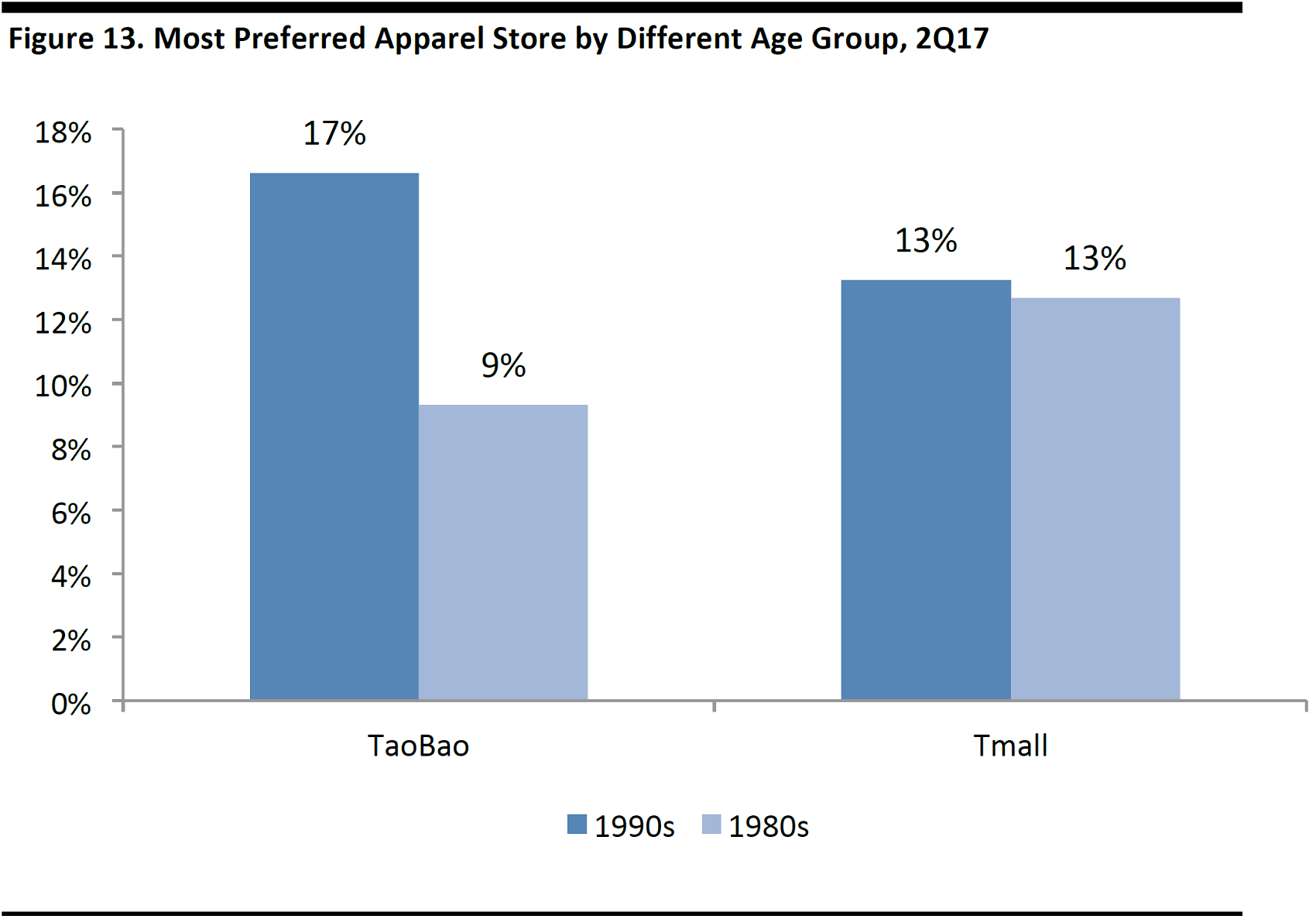

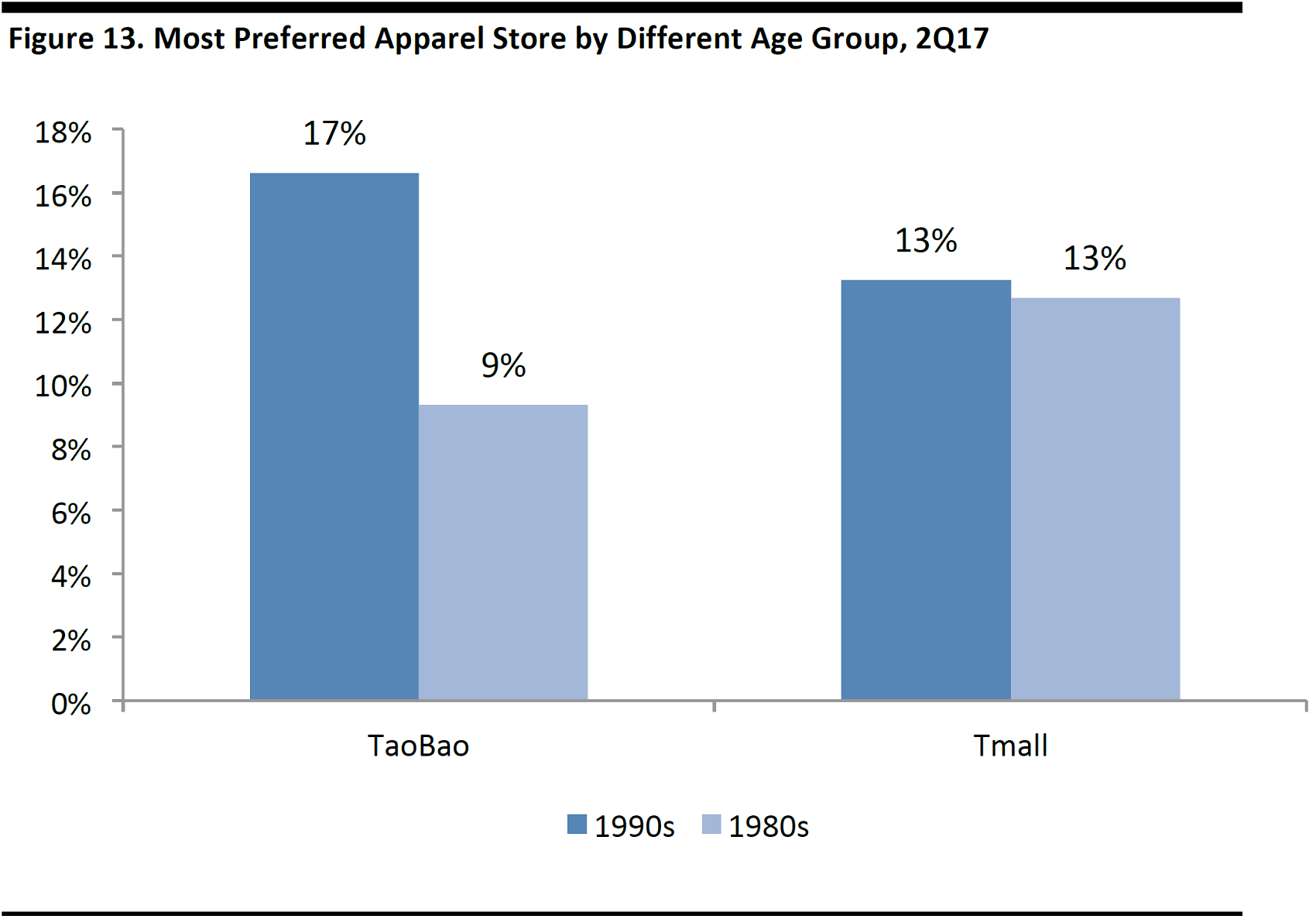

Data from ProsperChina also show that people born in the 1980s (i.e., 1980–1989), prefer Tmall over Taobao—around 12% of people born in the 1980s prefer Tmall, compared to around 9% who choose Taobao.

Base: Adults aged 18-37 (N=2,651).

Source:ProsperChina, Quarterly Consumer Surveys

We view those consumers born in the 1980s and in the high-income group as the key drivers of Tmall’s GMV growth—in general, these consumers have a stable job or steady income to support their purchasing power. In addition, Chinese consumers increasingly care more about branding and quality, areas that Tmall is better positioned in than Taobao.

Vipshop: High Engagement with Loyal Customers, Thanks to a Unique Shopping Experience

Vipshop is an online discount retailer for brands in China. Its model offers high-quality branded products at a discount to retail prices for limited time periods (i.e., flash sales). For more details of Vipshop’s business model, please refer to our report

VIP.com—Takeaways.

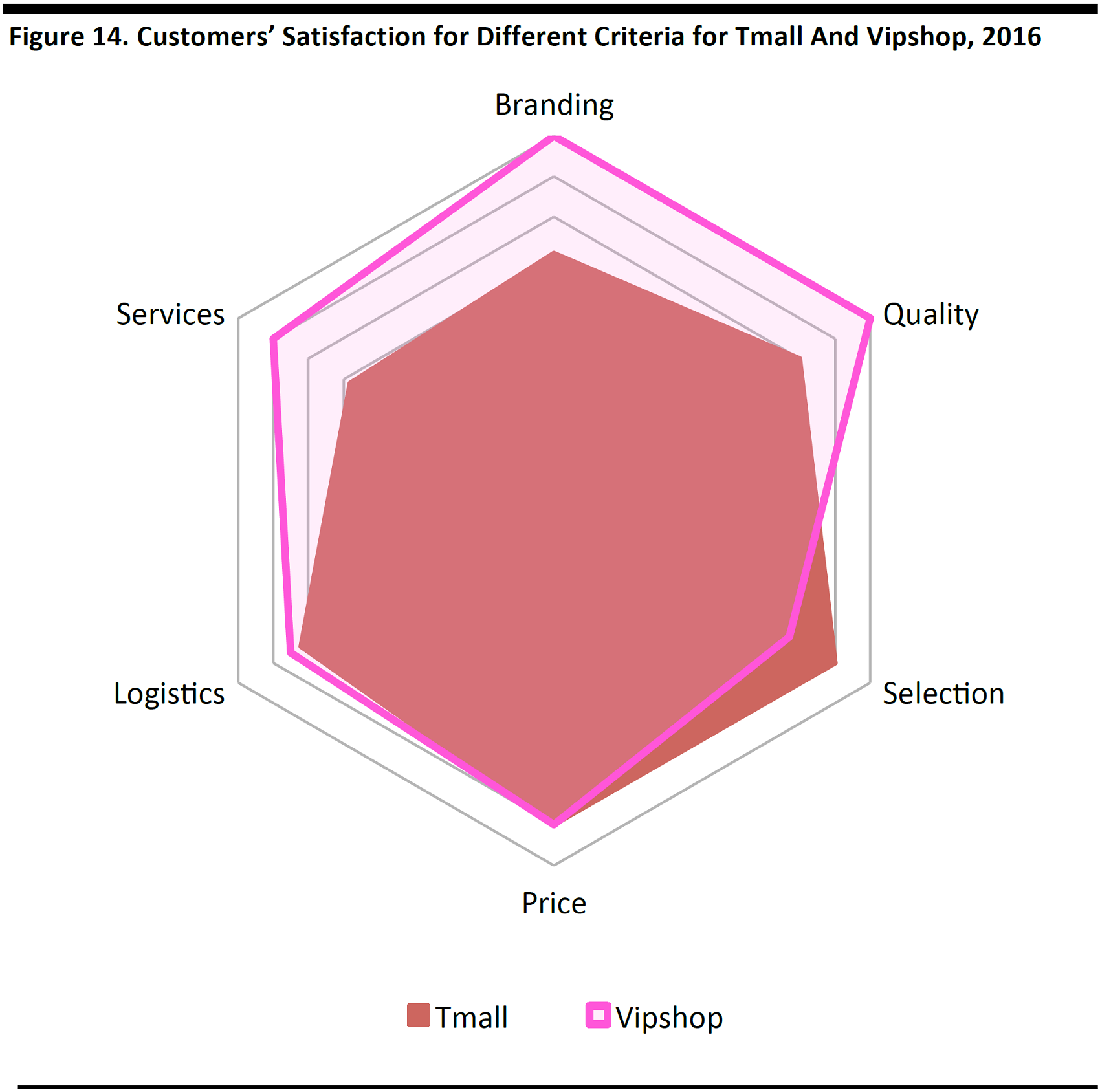

Vipshop scores the highest among the online players in terms of branding and quality, according to data from China’s E-Commerce Research Center. However, flash sales also limit the selection Vipshop can offer to customers, as not all items can be discounted at the same time. Tmall, on the other hand, focuses on offering a wide range of products at affordable prices.

Source:China’s E-Commerce Research Center

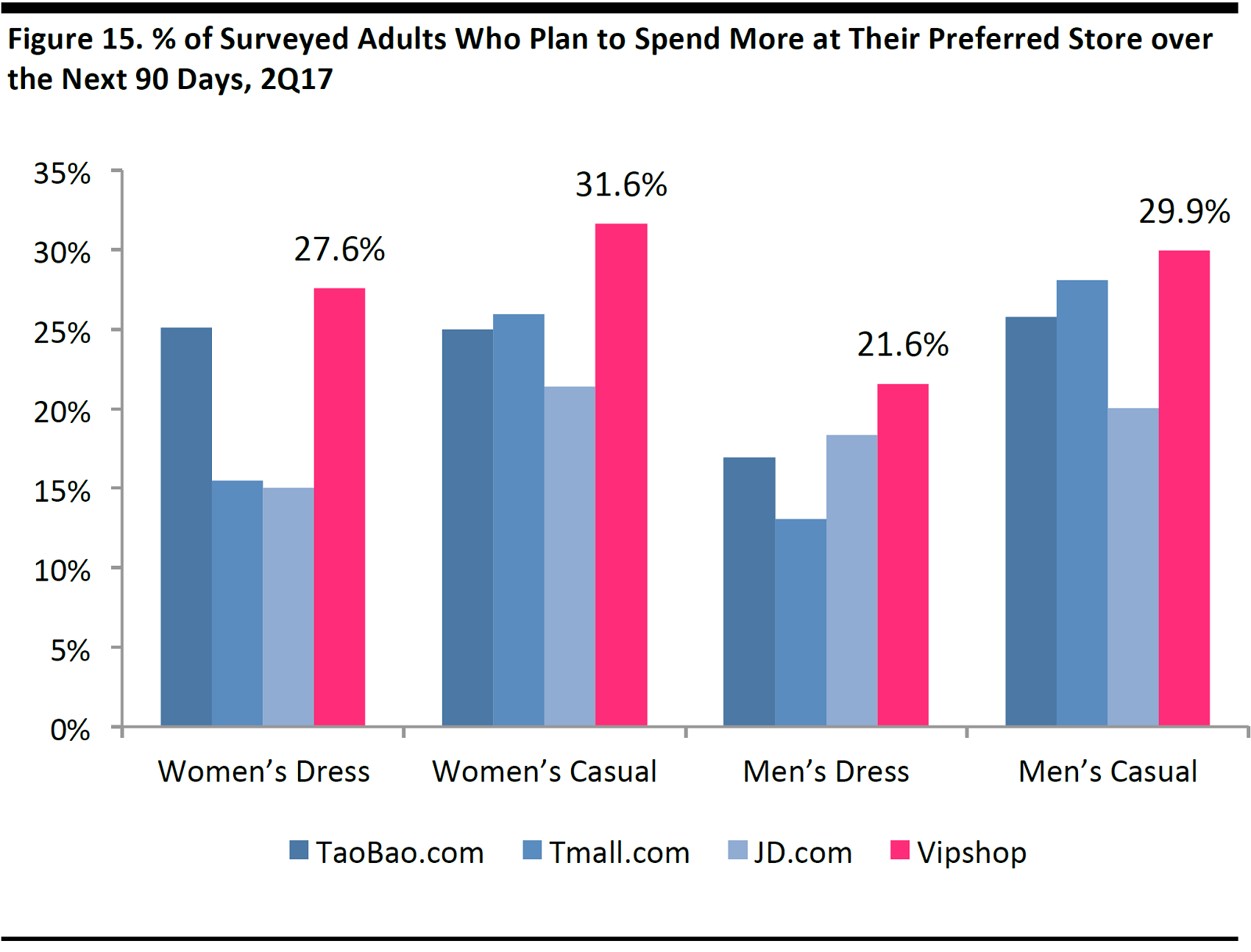

Vipshop Has High Customer Loyalty

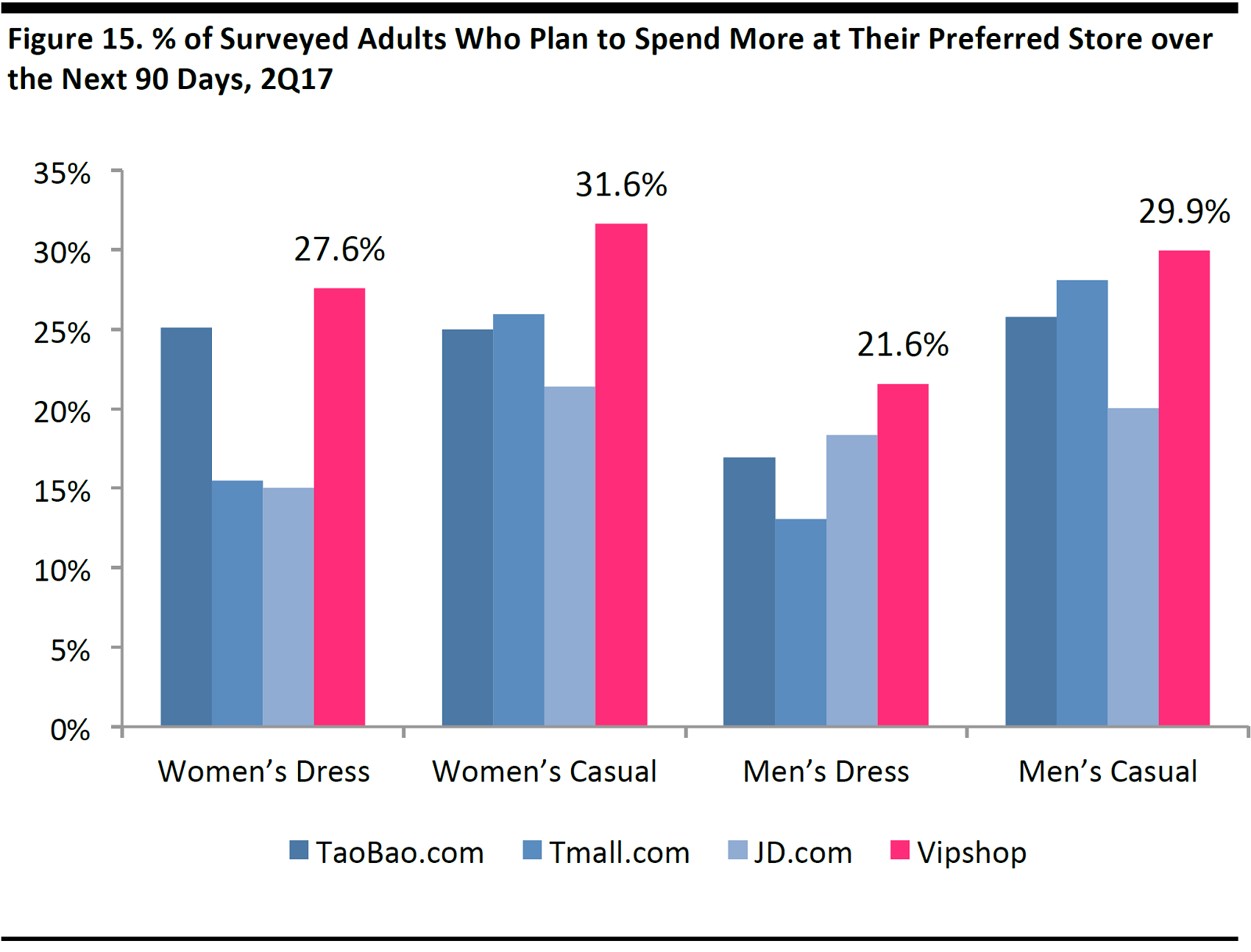

In the ProsperChina survey, the percentage of people who chose Vipshop as the most preferred shop and indicated that they are planning to spend more on the platform over the next 90 days, is higher than those who chose other online players as their preferred shopping destination.

Base: Adults aged 18+ (N=1,941).

Source:ProsperChina, Quarterly Consumer Surveys

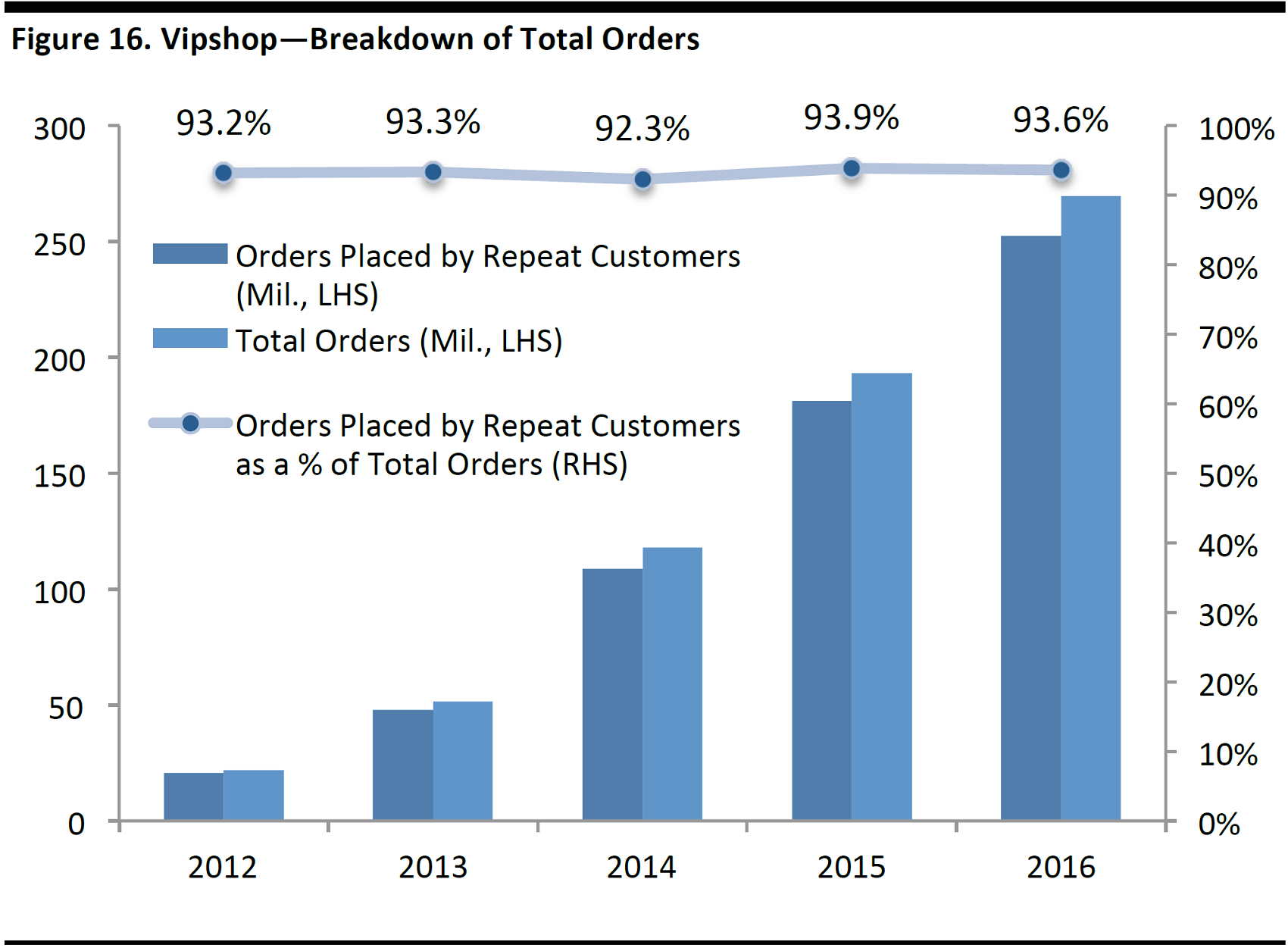

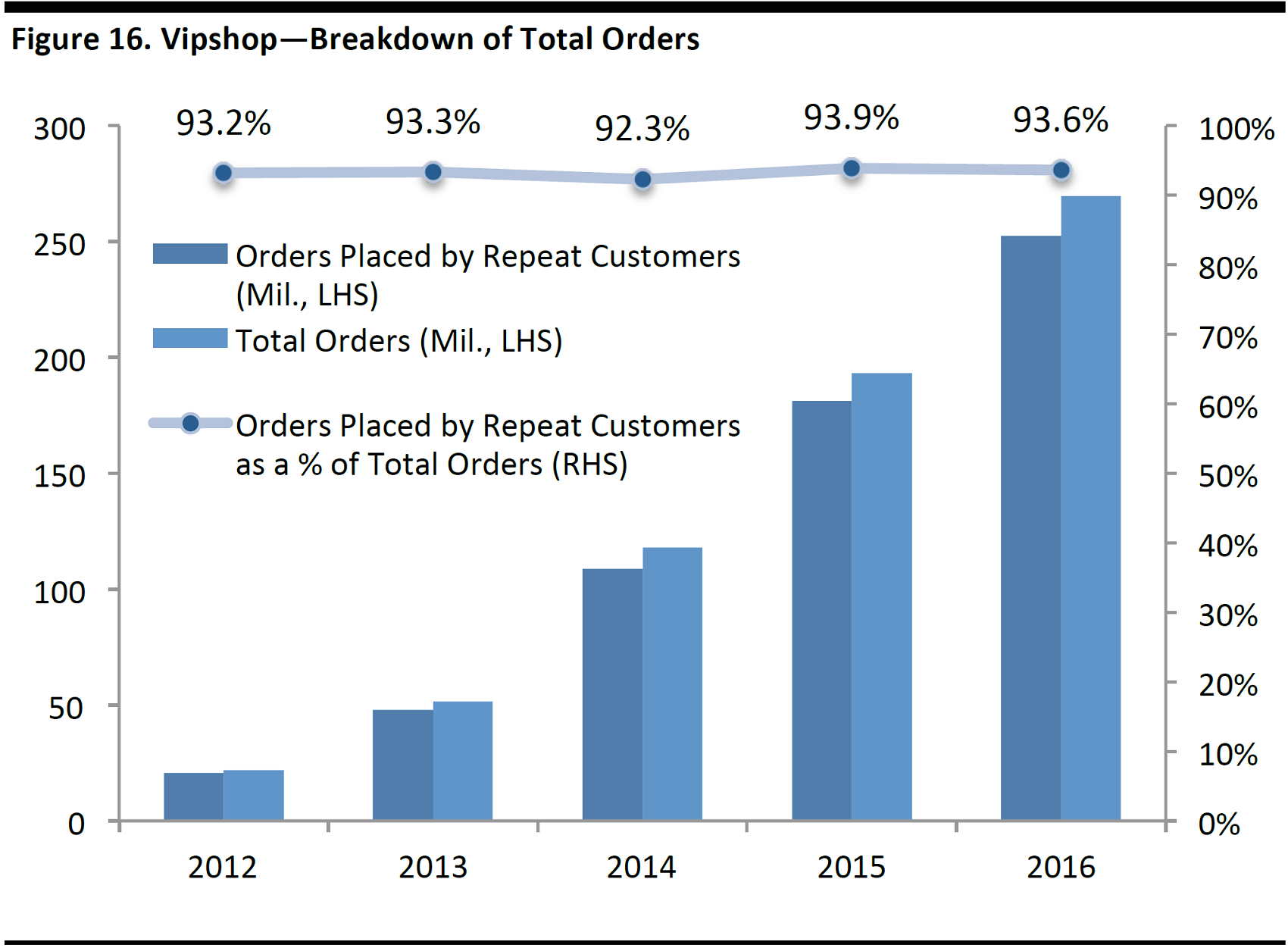

According to Vipshop’s financial reports, over93% of orders are placed by repeat customers and over 79% of its customers are repeat customers.

Source:Vipshop

JD.com: Not Hitting the Sweet Spot in the Apparel Market

JD.com is an e-commerce platform with an extensive product offering, as well as best-in-class, in-house fulfilment capabilities. For more details on JD.com’s business model, please refer to our report

JD.com—A Differentiated E-Commerce Platform.

Across all product categories, JD.com appears to be less price-competitive and has a smaller product selection compared to both Taobao and Tmall, according to data from China’s E-Commerce Research Center.

Source:China’s E-Commerce Research Center

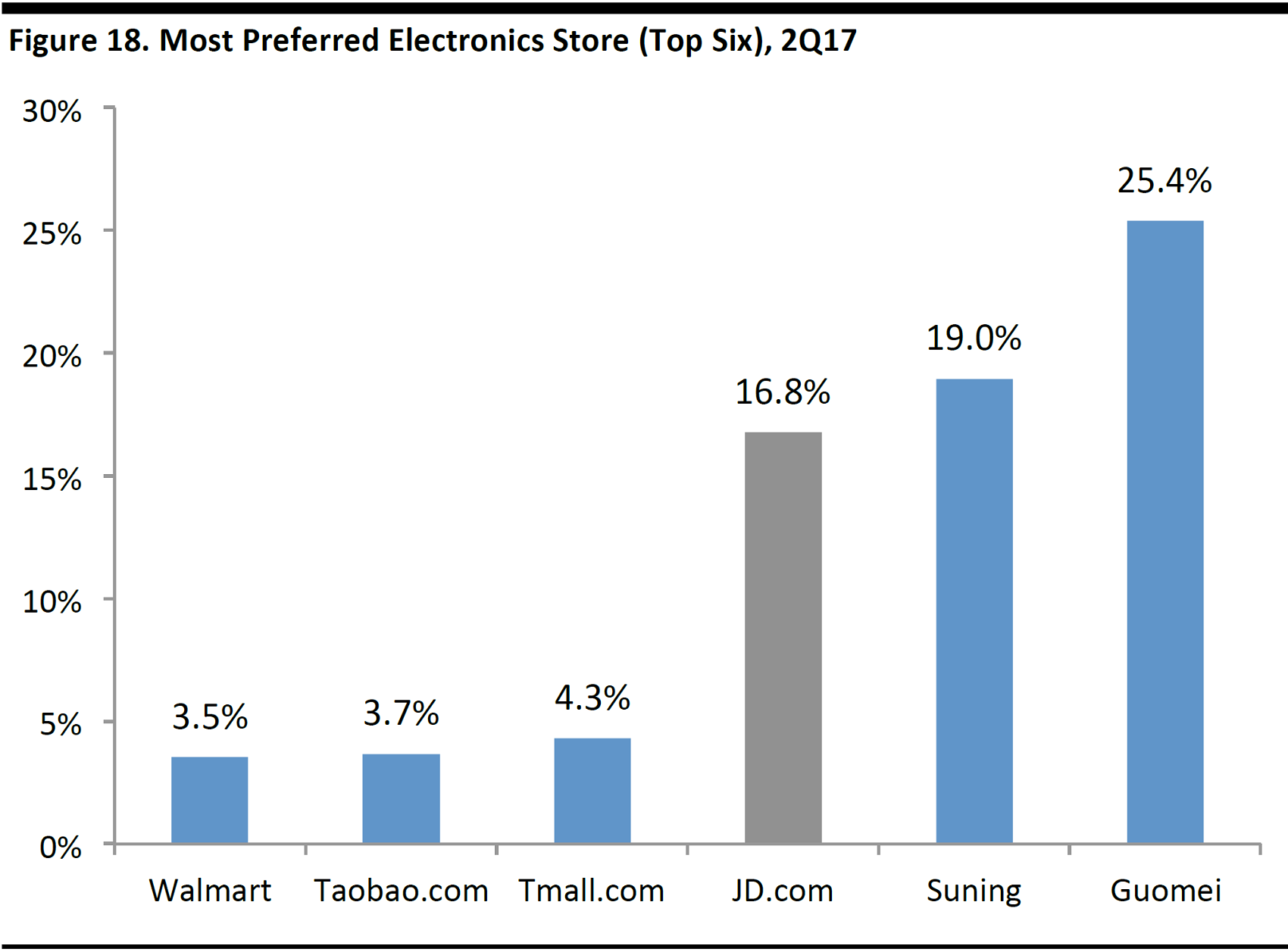

However, after Taobao and Tmall, JD.com is the third-most-popular online destination for apparel, and the company has managed to gain market share in the category over the past two years.

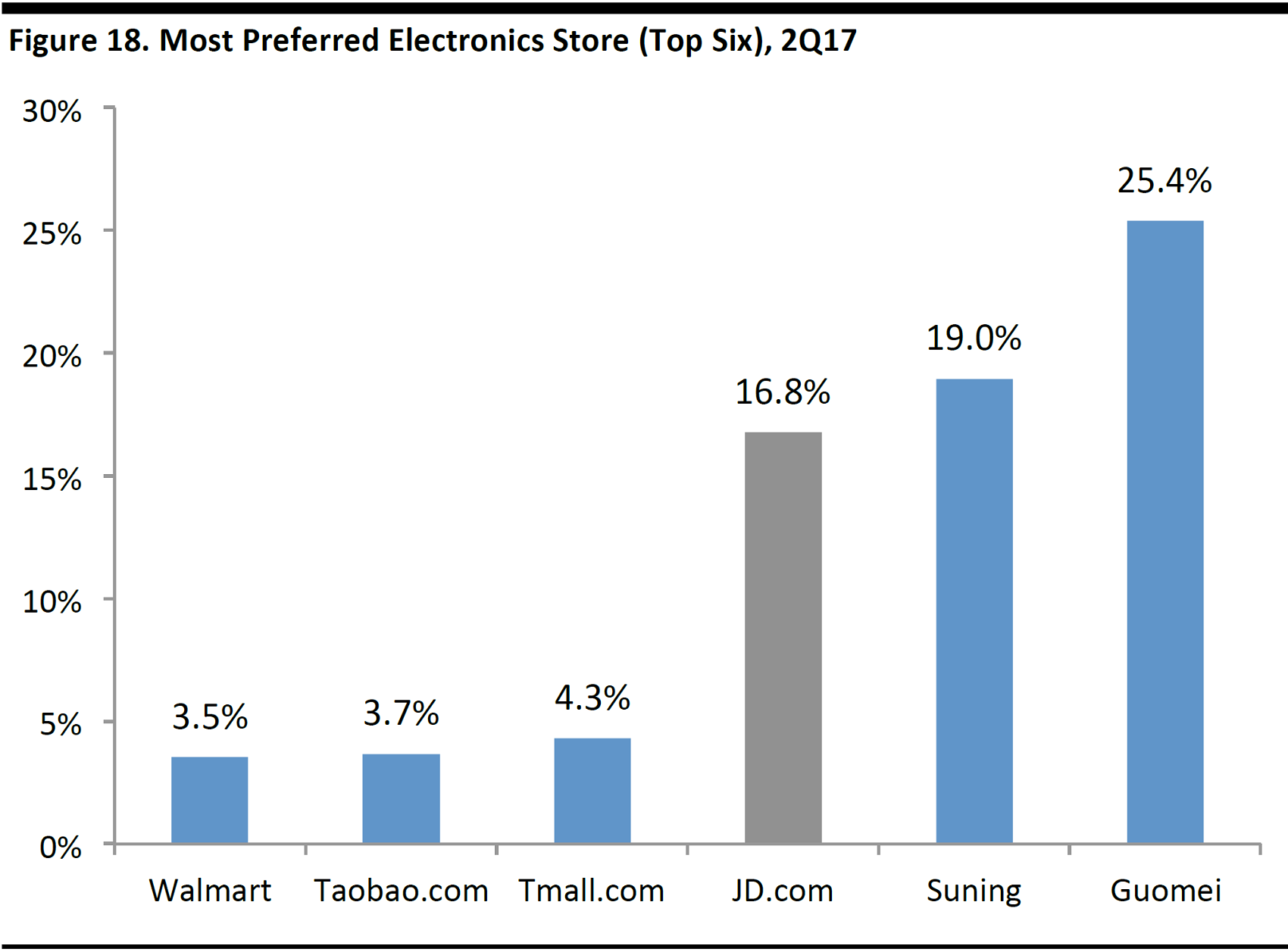

On the other hand, JD.com is the top site for electronic goods, which work best with the company’s direct sales model and in-house fulfilment capabilities.

Base: Adults aged 18+ (N=5,821).

Source:ProsperChina, Quarterly Consumer Surveys

The Dynamics of China’s Online Apparel Market

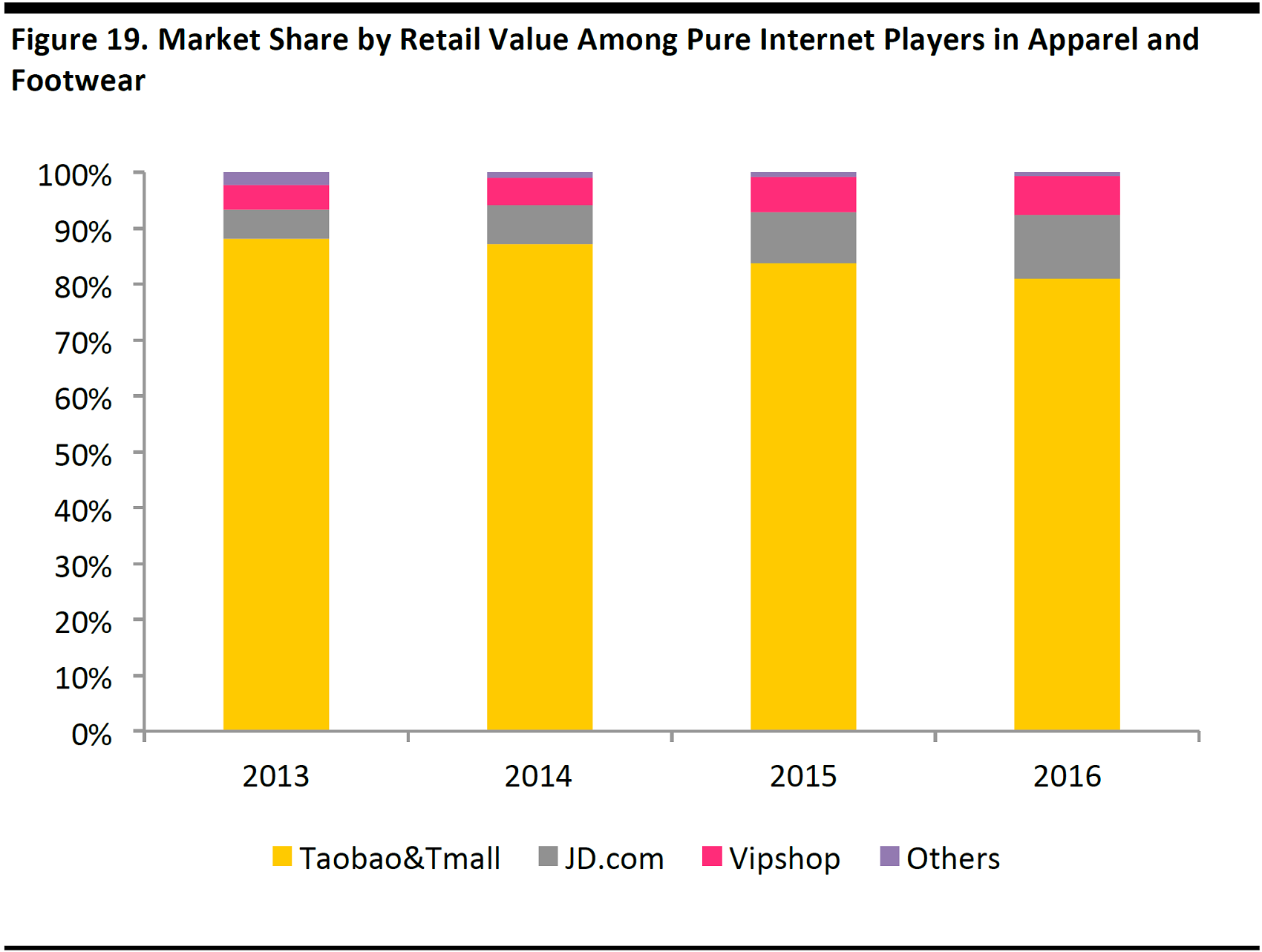

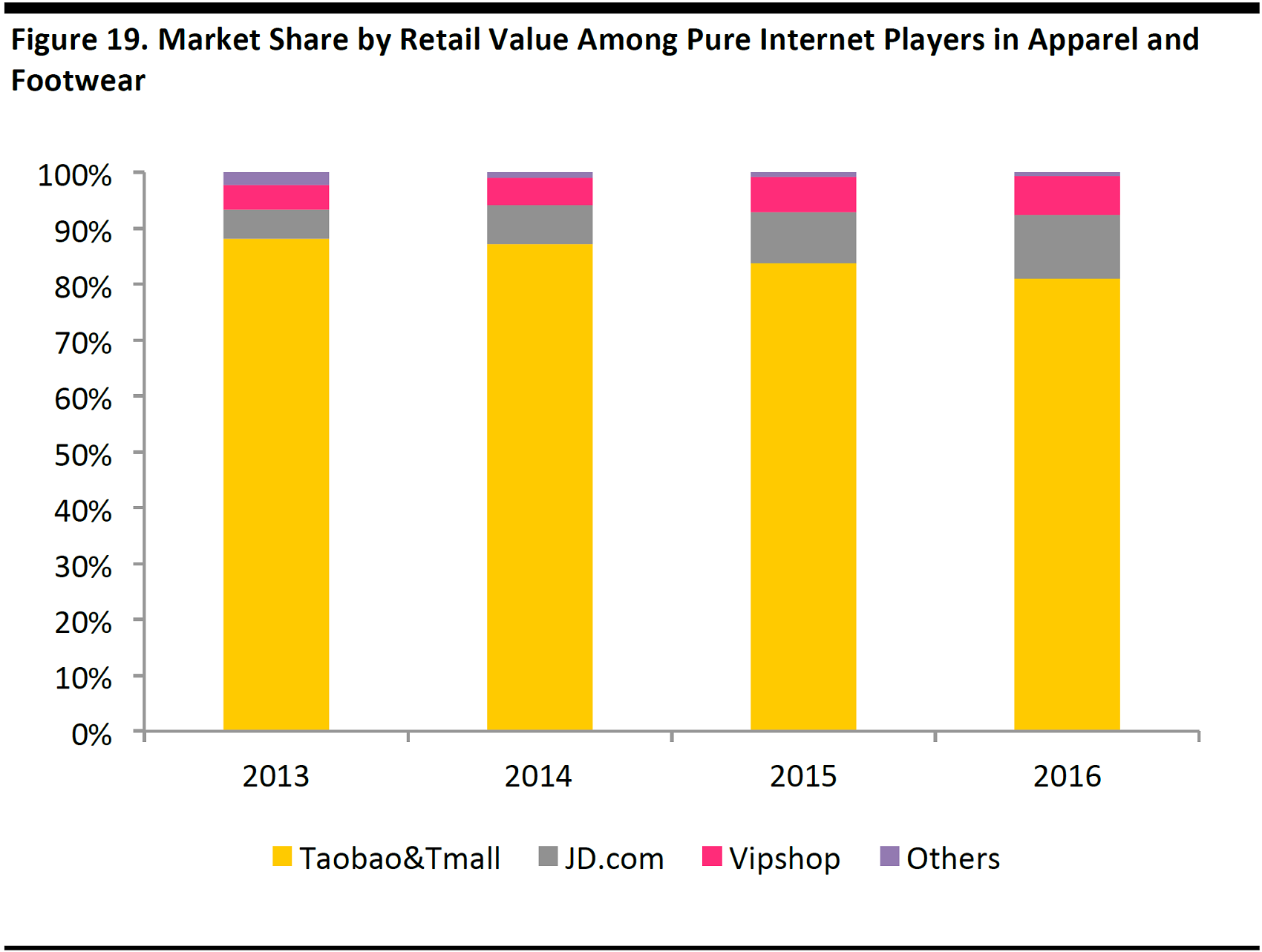

According to data compiled from Euromonitor, Taobao and Tmall are the market leaders with a dominating 74% combined market share in 2016, followed by JD.com and Vipshop.

Source:Euromonitor

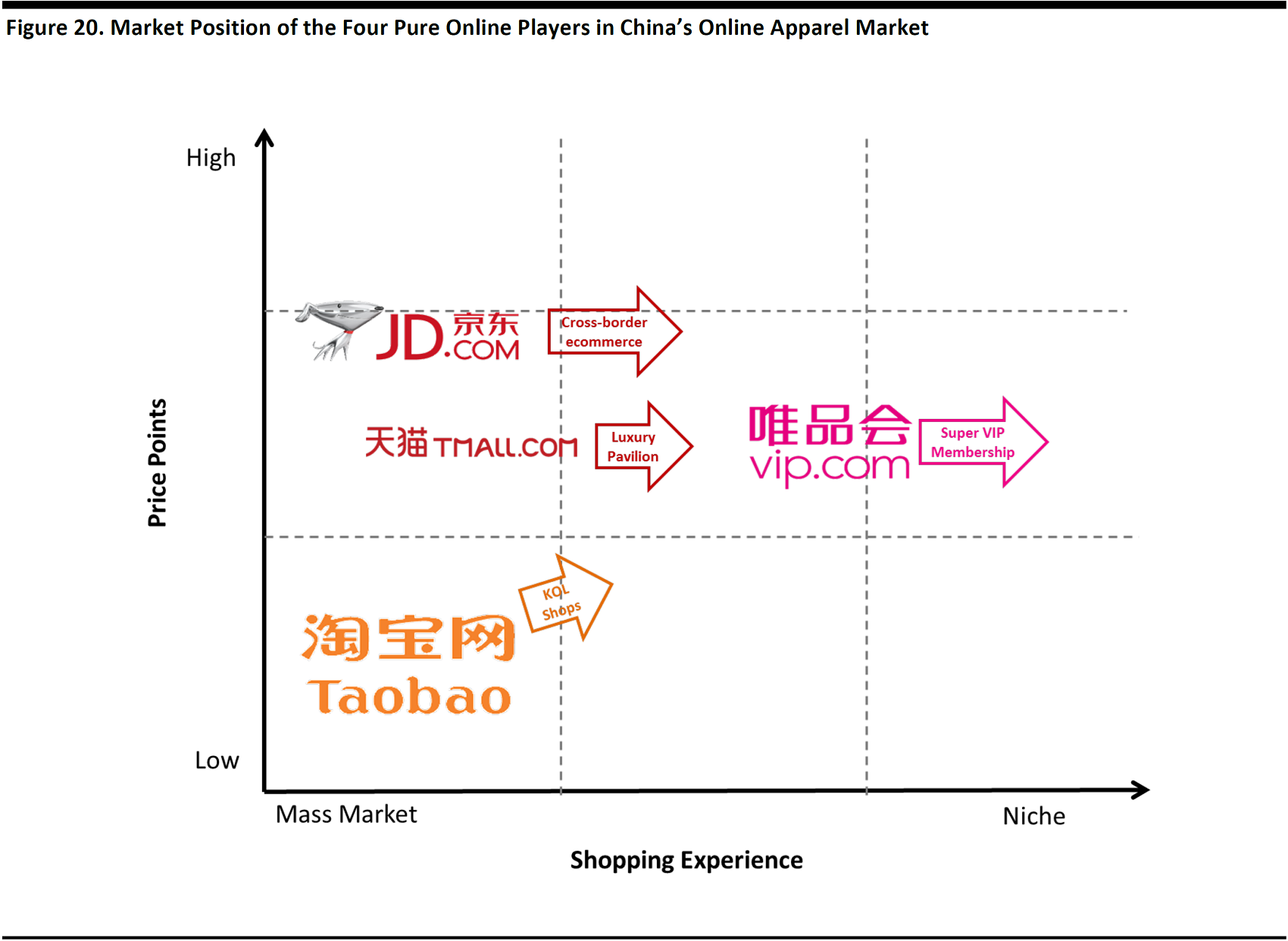

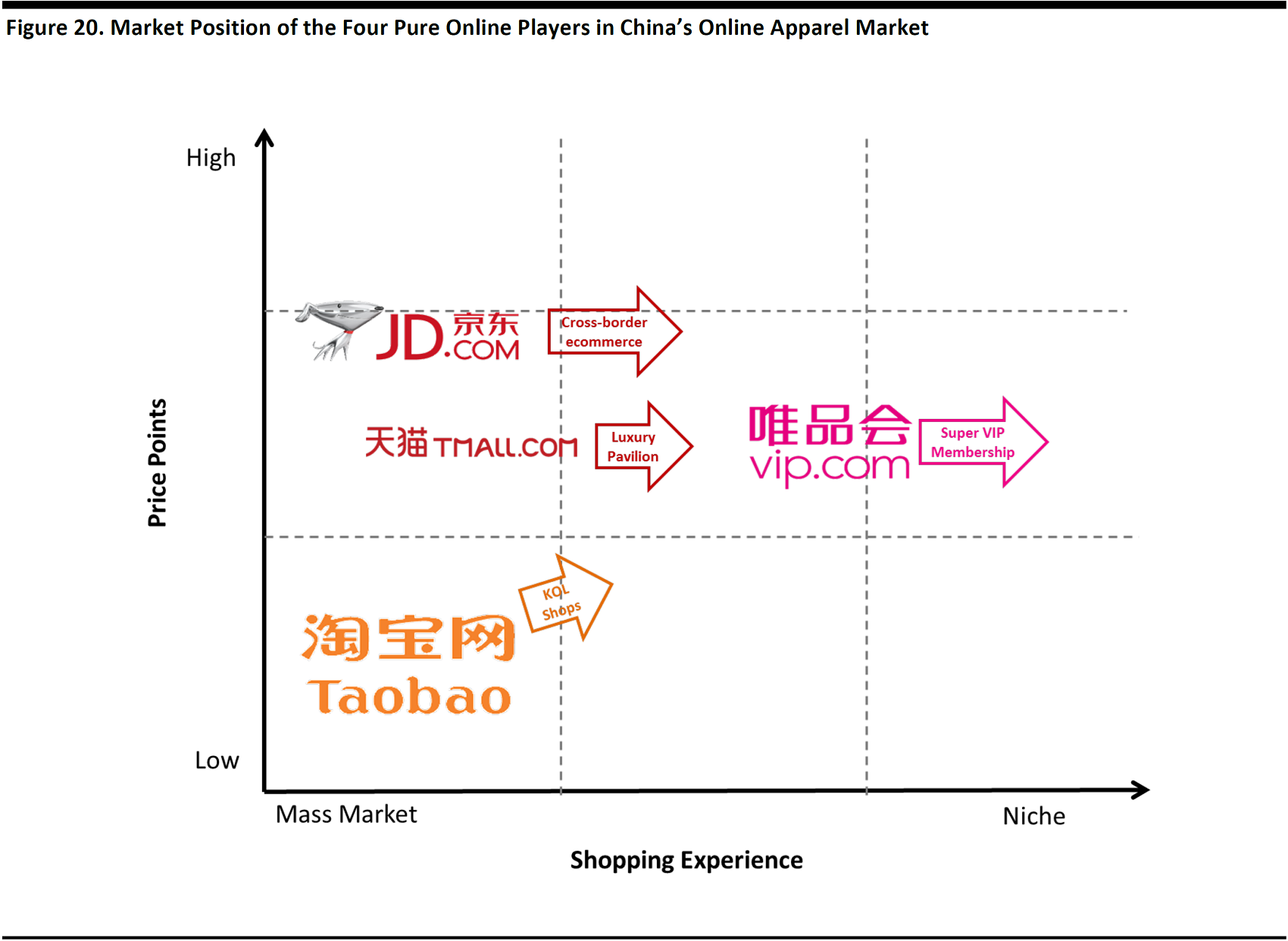

To analyze the dynamics of China’s online apparel market, we placed the four pure online Chinese players—JD.com, Taobao, Tmall and Vipshop—on a two-dimensional matrix: with price points from low to high and shopping experience from mass market to niche market.

Source:FGRT

Summary of Drivers

- Taobao: Stores operated by key opinion leaders (KOL)could eventually improve Taobao’s branding and the perceived quality of the products sold on the platform.

- Tmall: Even in the authentic stores (i.e., those selling authentic products) on Tmall, most products are still affordably priced. Tmall’s Luxury Pavilion could guarantee a superior experience for luxury shopping, which enhances product exclusivity.

- Vipshop: Vipshop launched its super VIP program early this year to improve the shopping experience for its most loyal customers.

- com: Management announced that the company will focus on cross-border e-commerce in order to boost its competitive edge.

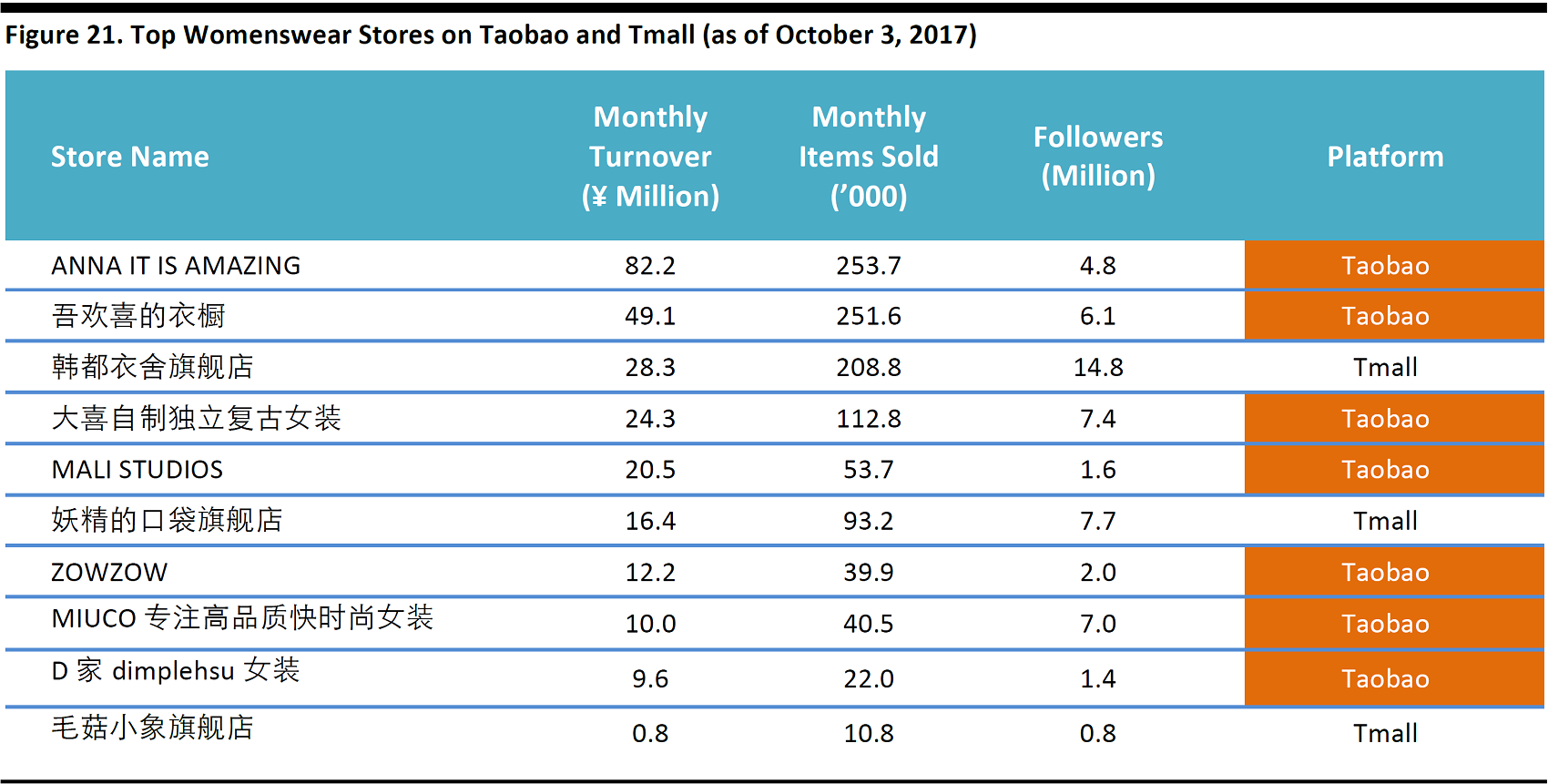

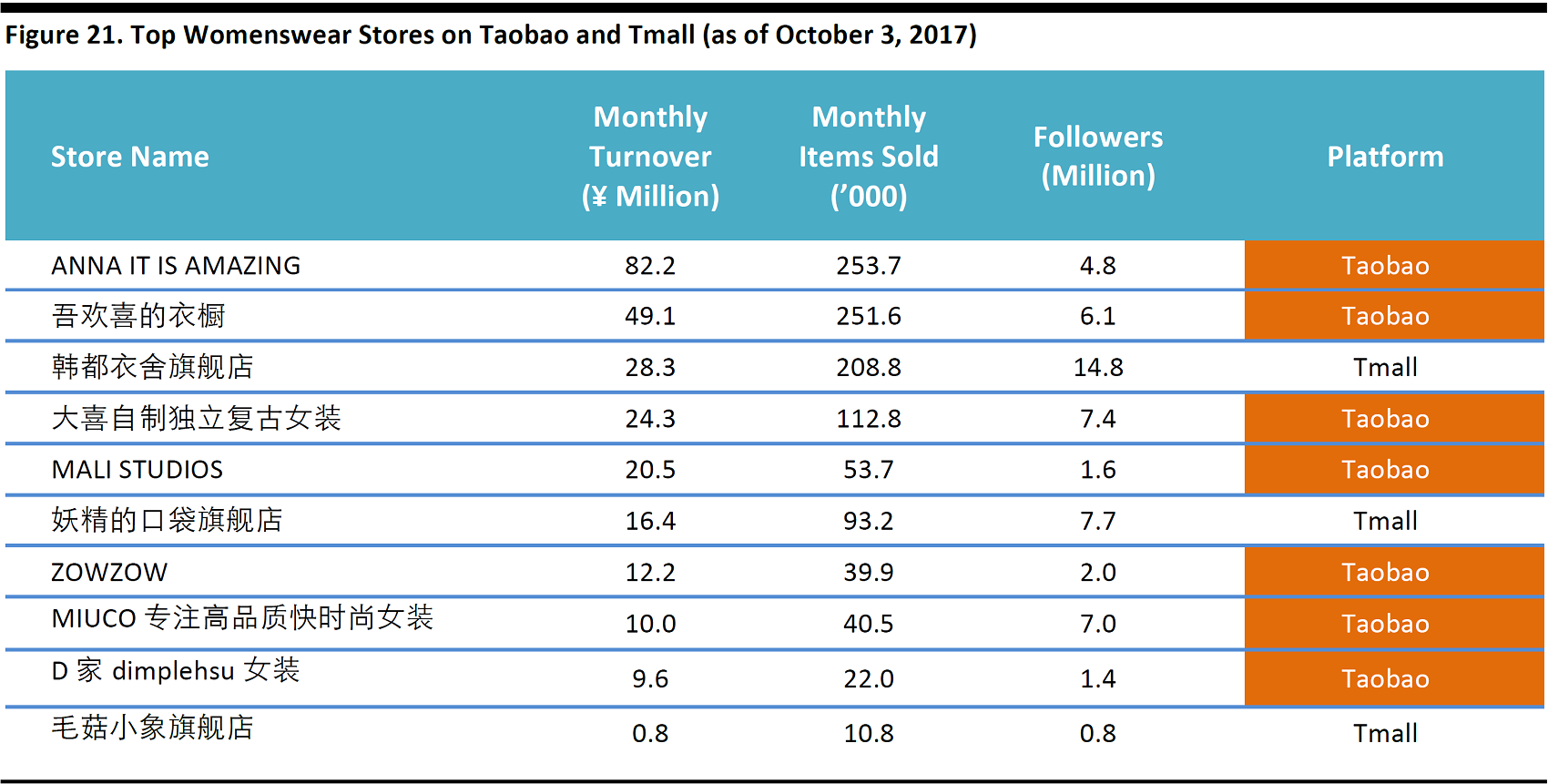

More Stores Run by KOLs Could Enhance Taobao’s Branding and Quality

KOLs or cewebrities are effective in driving apparel sales in China. Online womenswear stores run by KOLs most likely outsell comparable stores on Tmall, according to website Ahatao, which collects data on Taobao. The products offered on KOL stores are not necessarily cheaper than what Tmall offers, yet sales driven by KOLs are still trending up in China. We think that if there were more KOL stores on Taobao, this could improve the perception of branding and quality of the site, and hence raise its NPS score.

Source:ahatao/Taobao

Tmall’s Luxury Pavilion Guarantees a Superior Luxury Shopping Experience

Tmall launched a new Luxury Pavilion on its app in August this year, which aims to maintain a level of exclusivity and deliver a similar tailored shopping experience to shopping in a physical store. In the first phase of the rollout, participation by brands and consumers on the platform is by invite-only.

Tmall’s Luxury Pavilion features enhanced functionality over other Tmall sites in terms of search, storefront display, product descriptions, and recommendations. We believe the Luxury Pavilion will be able to guarantee a superior shopping experience for the coveted consumers of luxury goods and enhance the platform’s efforts to eliminate counterfeit goods sold on its sites. For more details of Luxury Pavilion, please refer to our previous publication

Five Reasons Tmall’s Luxury Pavilion Is Well Positioned to Ride China’s Consumption Wave.

Vipshop Offers a Unique Shopping Experience

Vipshop is known for its unique business model—offeringlimited-time-offer, in-season discounts and off-season clearance items for high-quality branded apparel products. Vipshop partners exclusively with more than 2,200 brands. As a result, this shopping model provides a unique shopping experience to its customers, compared to other marketplaces such as Tmall.

In the first quarter of 2017, Vipshoppiloted a new Super VIP paid membership program, which offers various features such as privileged discounts, early and exclusive access to selective sales events, and free shipping and returns. The VIP program is likely to further enhance the shopping experience for customers wanting access to exclusive products.

JD.com Is Looking for Opportunities Overseas

JD.com is an underdog in China’s online apparel market, as it competes directly with Taobao and Tmall in the mass-market segment. As of September this year, more than 44 apparel stores have left JD.com.It is possible that these stores are moving exclusively to Tmall ahead of the upcoming Singles’ Day in November.

In order to boost its competitive edge,JD.com announced early this year that it would focus on cross-border e-commerce, planning to attract more overseas brands to the JD.com platform.

In June 2017, JD.com invested $397 million to become the largest shareholder of luxury brand marketplace Farfetch. Through this new strategic partnership,JD.com will gain better access to luxury fashion brands and receive technological support to combine its online and offline channels.

As the sale of low-value items to overseas buyers is not sustainable, JD.com hopes to help quality Chinese brands sell overseas, according to management comments on the latest earnings call.

Conclusion

Based on our analysis, we conclude that e-commerce is the preferred shopping method among Chinese consumers. Although Taobao is the second-most-preferred online site for apparel, consumers are not satisfied with the shopping experience.

In order to enhance the overall shopping experience and to differentiate themselves from the competition, the online pure plays are migrating from offering mass-market products to selling exclusive and niche products.

Base: Adults aged 18+ (N=5,792).

Source:ProsperChina, Quarterly Consumer Surveys

Base: Adults aged 18+ (N=5,792).

Source:ProsperChina, Quarterly Consumer Surveys