Executive Summary

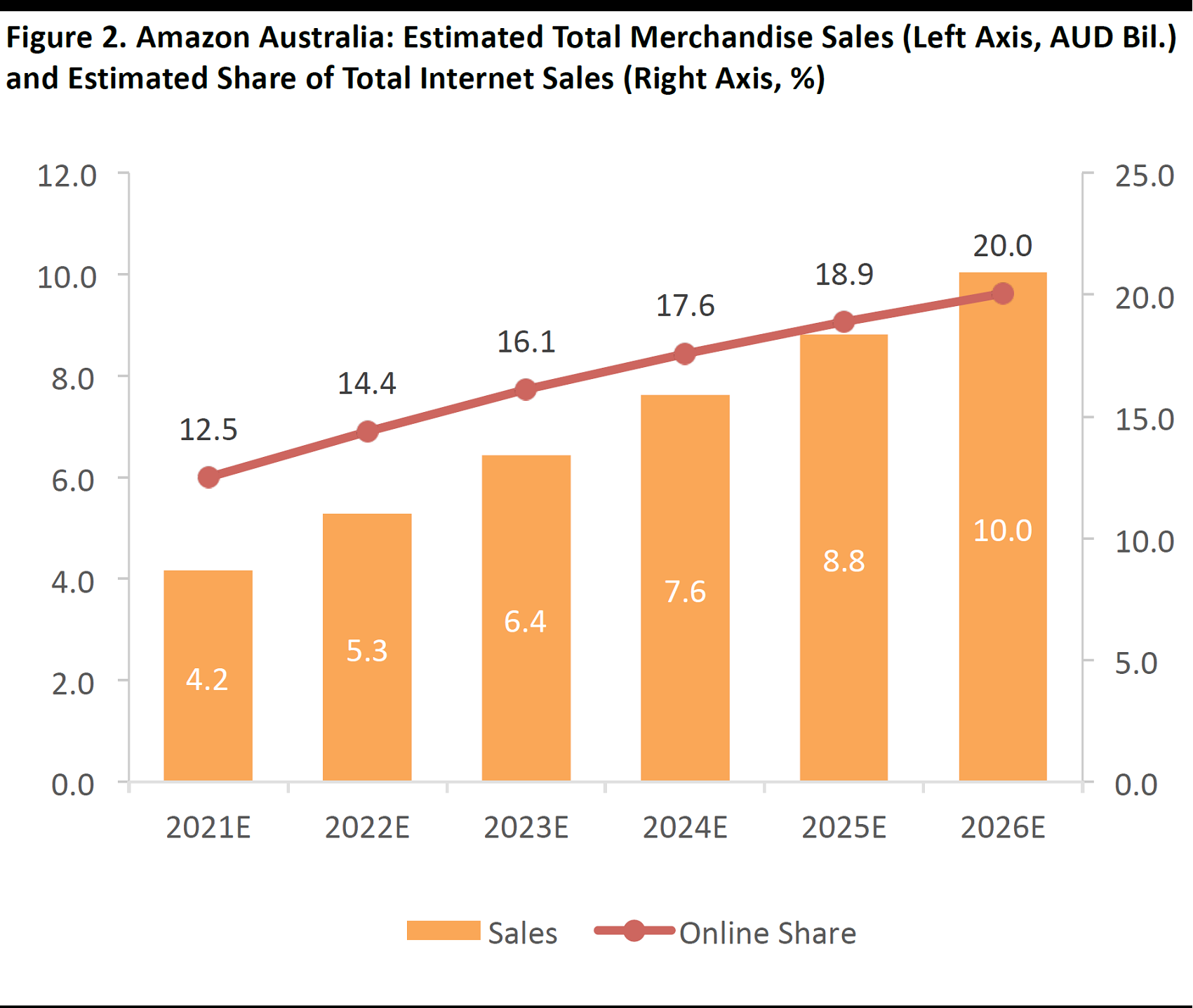

Amazon announced in April that it will launch a full offering in Australia, although it provided no specific time line for the launch. We estimate that Amazon Australia could generate total merchandise sales of around

A$4 billion in 2021 and

A$10 billion in 2026, including sales by third-party marketplace sellers. That would give Amazon a share of approximately 12.5% of Australian Internet sales in 2021, and a 20% share in 2026, equating to an average annual increase of 150 basis points in its share of online retail sales.

We see the following potential threats to incumbent retailers from Amazon’s launch in Australia:

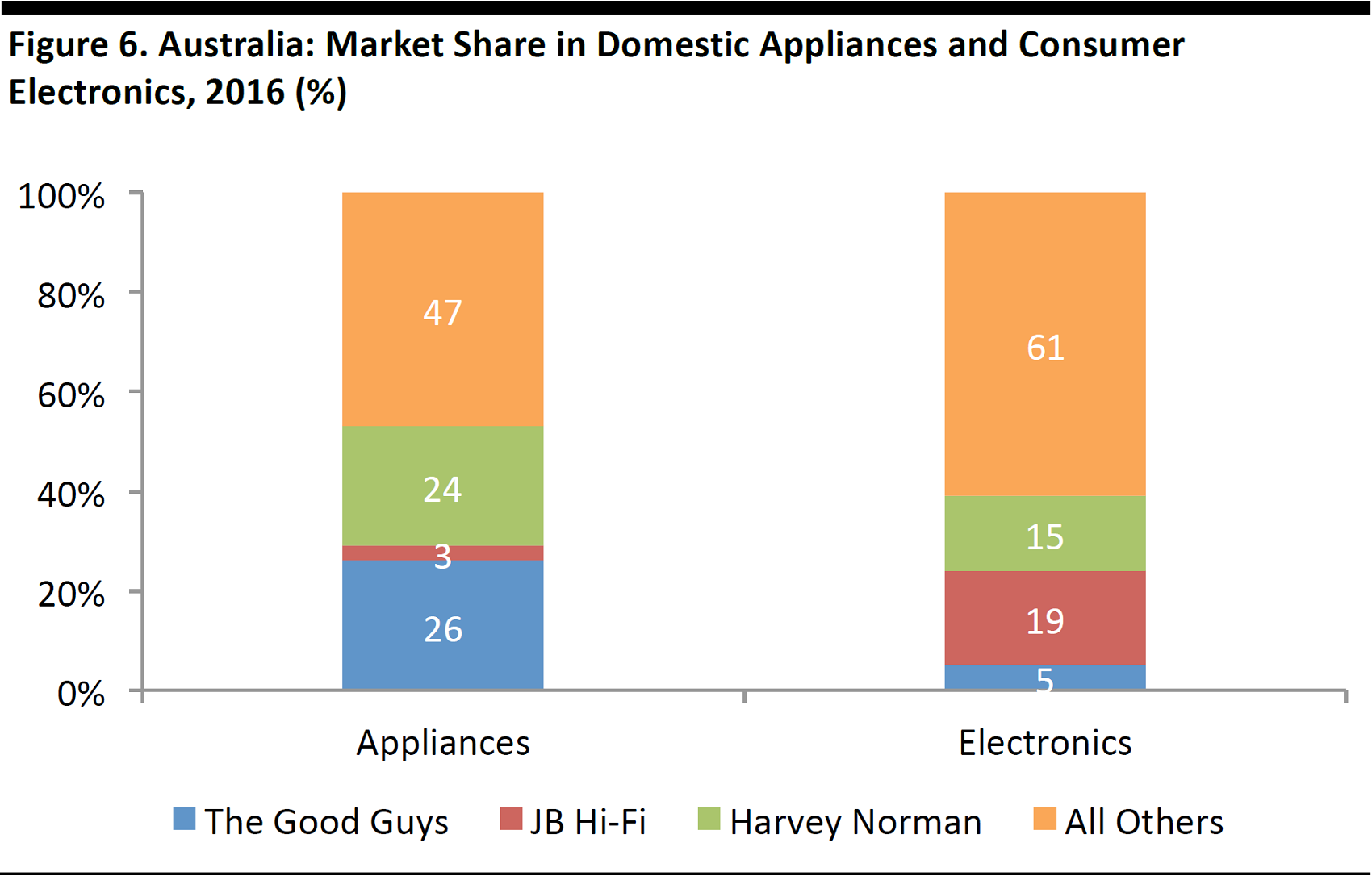

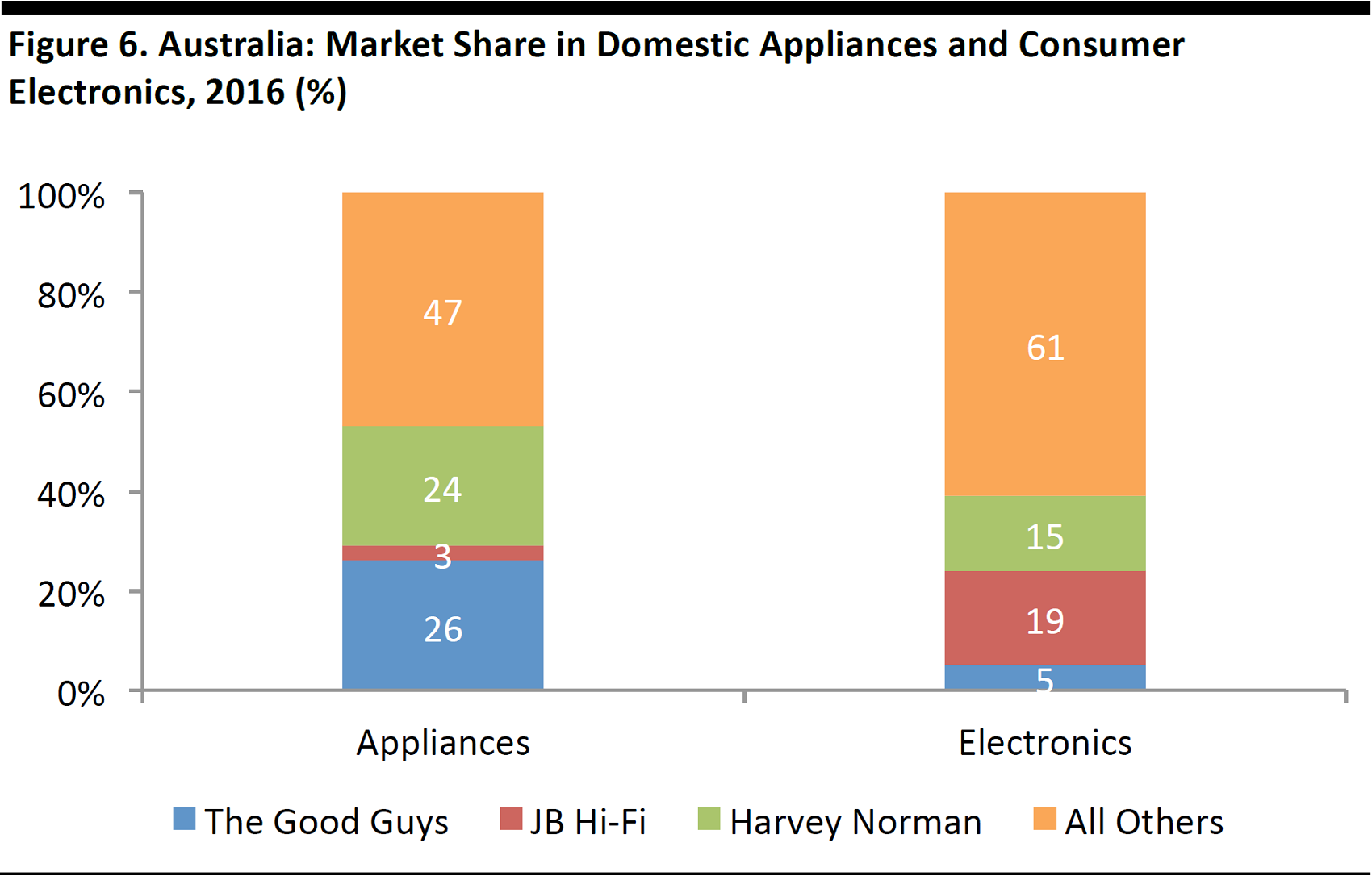

- Electronics tends to be among the first categories to migrate to the online channel, and we see Amazon as a near-term threat to specialists such as JB Hi-Fi, The Good Guys and Harvey Norman.

- Longer term, Amazon is likely to encourage more online shopping among Australians in categories such as apparel, beauty and food. Its Prime membership scheme will encourage consumers to turn to Amazon for multiple product categories, which will increase competitive pressures on undifferentiated specialists that focus on third-party brands.

- With its unique selling points (USPs) of choice and convenience, Amazon poses a particular threat to those multicategory retailers that have built their businesses on similar competitive advantages—these include midmarket and value department stores, other general-merchandise stores and mixed-category retailers such as Harvey Norman. Woolworths’ Big W chain, which has seen total sales fall in recent years, may simply be the canary in the coal mine for the Australian general-merchandise sector.

- Amazon poses a threat to competitors’ margins, too. The retailer is expected to price aggressively, which will pressure incumbents to lower their own prices. Additionally, any accelerated migration of incumbents’ own sales to the inherently less-profitable online channel will dent their profits. Plus, there will be added pressure on retailers to subsidize shipping for online purchases, given Amazon’s free shipping options and Prime membership offering.

We think Amazon has an opportunity to consolidate and grow an Australian e-commerce market that is immature, fragmented and skewed toward international shopping. And we see real appetite for Amazon’s offering in Australia, where many consumers are already shopping on Amazon’s US site and seem to perceive that domestic retailers do not always offer them good value for money.

Amazon will be joining other “international invaders” such as Aldi, H&M and TK Maxx in the Australian market. Like those retailers, it will heap further competition on incumbents—but almost certainly at greater scale.

Introduction and Key Facts

Australia is next on the list to get the Amazon treatment. The online giant has finally confirmed long-standing rumors that it will launch a full offering in the Australian market, although it has not specified when. In March and April 2017, the company was reportedly scouting for its first distribution center in the country, which could suggest a launch by mid-2018.

This report includes the following:

- Our estimates of how big Amazon could grow in Australia by 2021 and 2026.

- Our analysis of which incumbent retailers and sectors in Australia could be most threatened by the launch.

- Discussion of three trends in Australian e-commerce: the channel’s immaturity, its fragmented nature and the strong demand among consumers to buy from international e-commerce retailers.

- Discussion of three factors characterizing Australian retail: the goods and sales tax (GST) issue, the prominence of conglomerates and multicategory retailers, and consumers’ perceptions that they often get poor value for money from incumbent retailers.

- Appendices detailing the methodology behind our market estimates and key data points on Amazon Prime.

We begin with a summary of details about Amazon’s venture into Australia.

Source: amazon.com.au

Key Facts

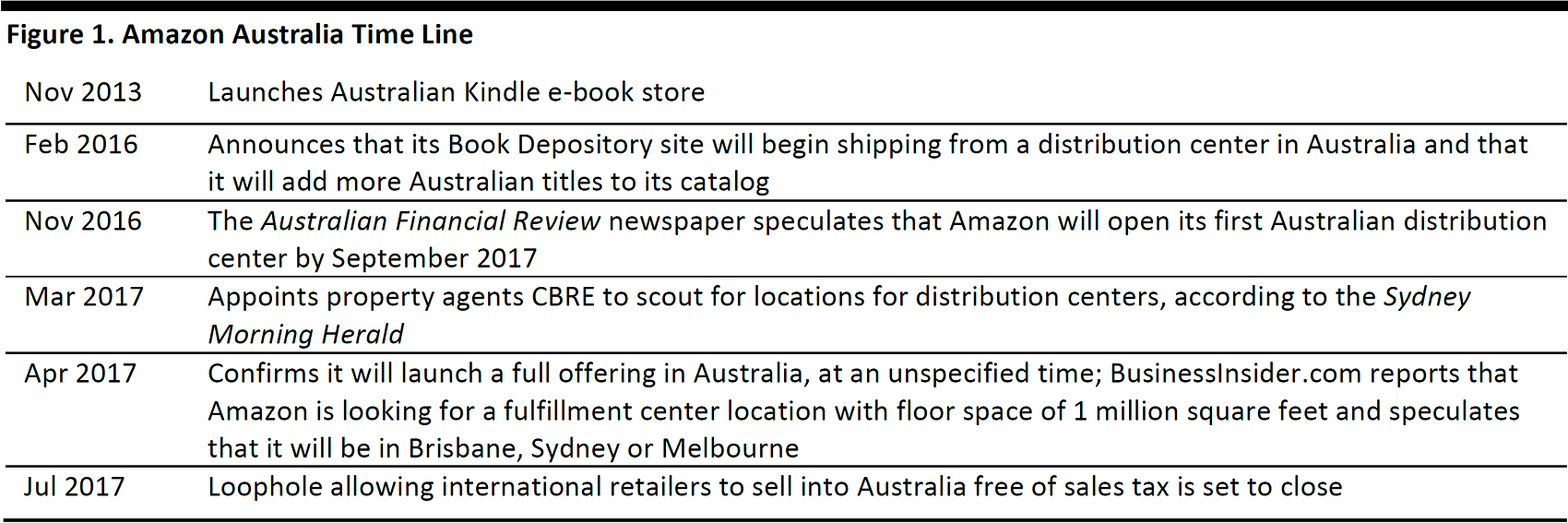

In April 2017, Amazon confirmed that it would enter the Australian market. Shortly before that, media reports appeared claiming that the company was scouting for a location for its first fulfillment center in Australia.

Amazon’s Australian offering is expected to include grocery elements such as Prime Fresh, according to reports in the

Sydney Morning Herald and on BusinessInsider.com.

Amazon already has almost 1,000employees in Australia. It has distributed books for its Book Depository site from a fulfillment center in the country since 2016.

Australian consumers already shop at Amazon through its international sites such as Amazon.com in the US, and Amazon already enjoys an 8% share of Australasian (Australia and New Zealand) Internet retail sales, according to Euromonitor International.

In the US, Amazon typically takes around one year from the date of announcement to open a fulfillment center, suggesting that it could launch a full Australian offering by mid-2018. US fulfillment centers are typically 750,000–1 million square feet in size and each employs around 1,000 full-time workers.

Source: amazon.com.au/ebooks-kindle

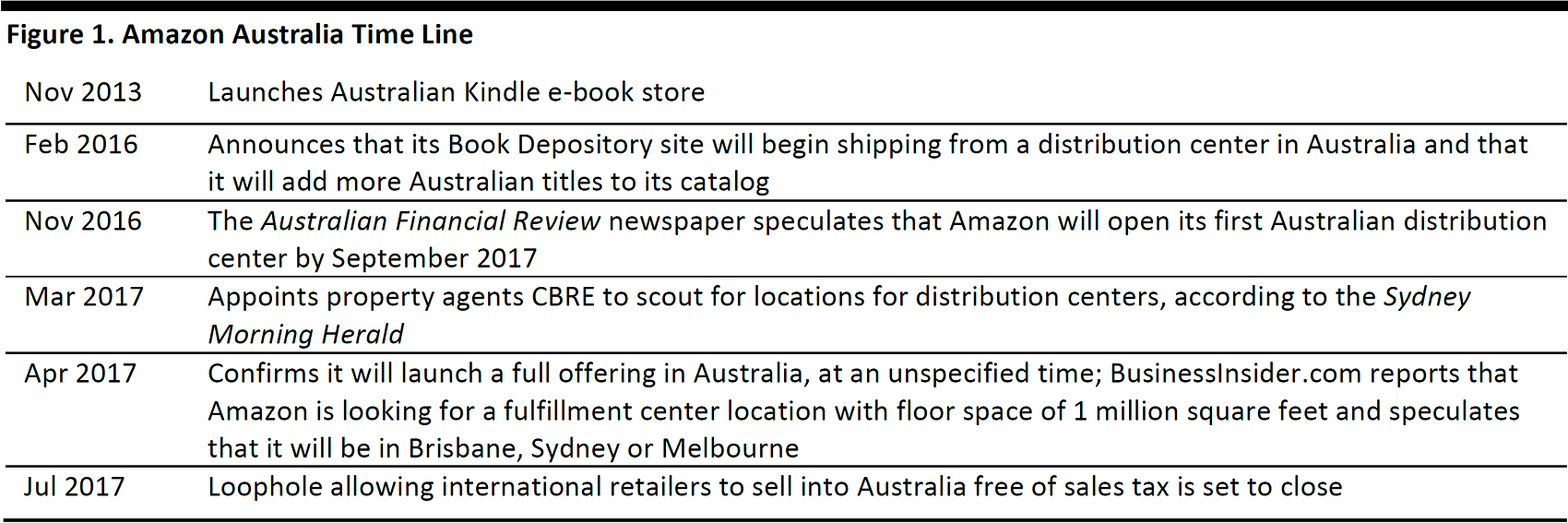

Source: Company reports

Two Key Questions: How Big?And Impacting Whom?

In the following sections, we answer two important questions:

- How big could Amazon Australia get?

- Which competing retailers could lose out?

How Big Could Amazon Australia Get?

A$10 Billion by 2026

Our review of the Australian retail landscape and our discussions with retail contacts and consumers have confirmed that Australians have a strong appetite for Amazon.

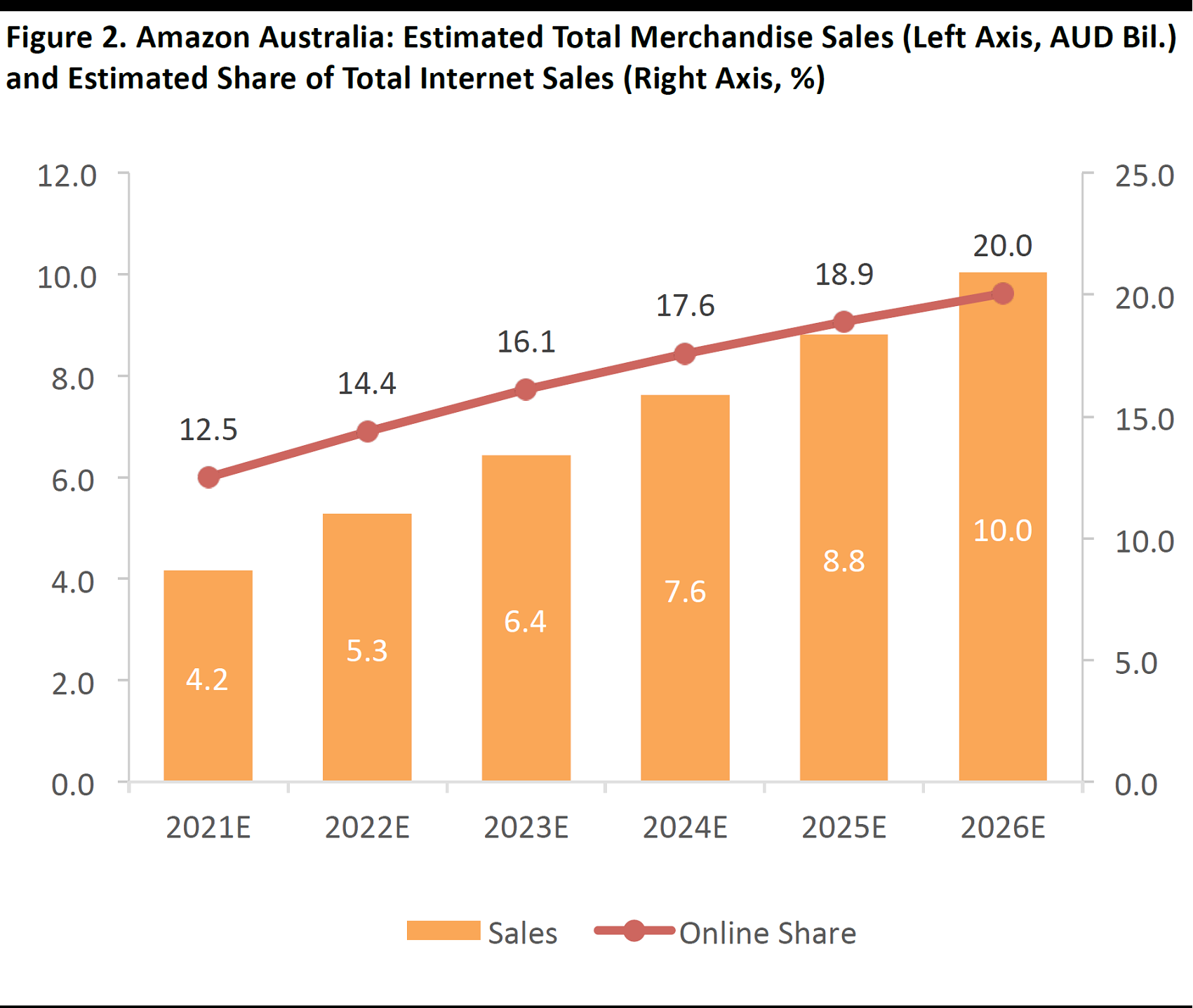

- We estimate that Amazon Australia could generate total merchandise sales of approximately A$4 billion in 2021 and A$10 billion in 2026. Our figures include sales by third-party marketplace sellers on Amazon, so they do not represent revenues booked directly by Amazon. Our figures are net of sales tax.

- These estimates translate to a share of approximately 12.5% of Australian Internet sales in 2021 and 20% in 2026, climbing by an average of 150 basis points per year.

By way of comparison, for fiscal year 2016, Australian midmarket department store Myer had sales of A$2.8 billion, while discount department store Big W had sales of A$3.8 billion and electronics chain JB Hi-Fi had sales of A$4.0 billion.

Includes sales by third-party sellers on Amazon

Source: Fung Global Retail & Technology

Euromonitor pegged Amazon’s share of Australasian (Australia and New Zealand) Internet sales at 8.4% in 2016, based on orders placed on Amazon’s overseas websites.A mazon generated total Australasian sales of around A$1.9 billion in 2016, according to Euromonitor estimates. However, only about A$900 million of that was first-party sales made by Amazon.com; the remainder consisted of third-party sales and sales on other Amazon sites, such as Book Depository.

Our estimates assume that Amazon will launch in 2018 and swiftly roll out a full offering, including products from third-party sellers on its marketplace. We outline the methodology we used to arrive at our estimates in Appendix 1 at the end of this report.

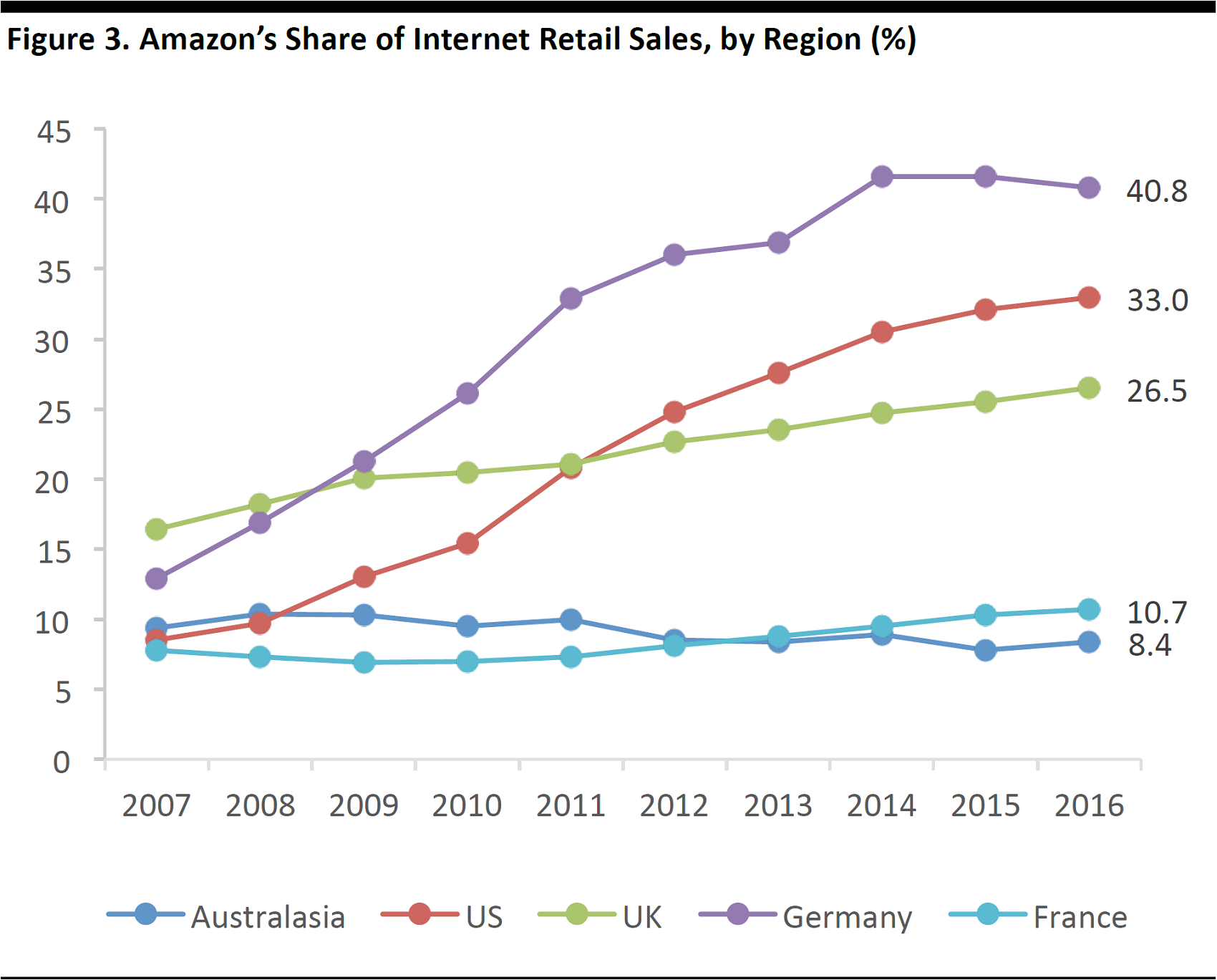

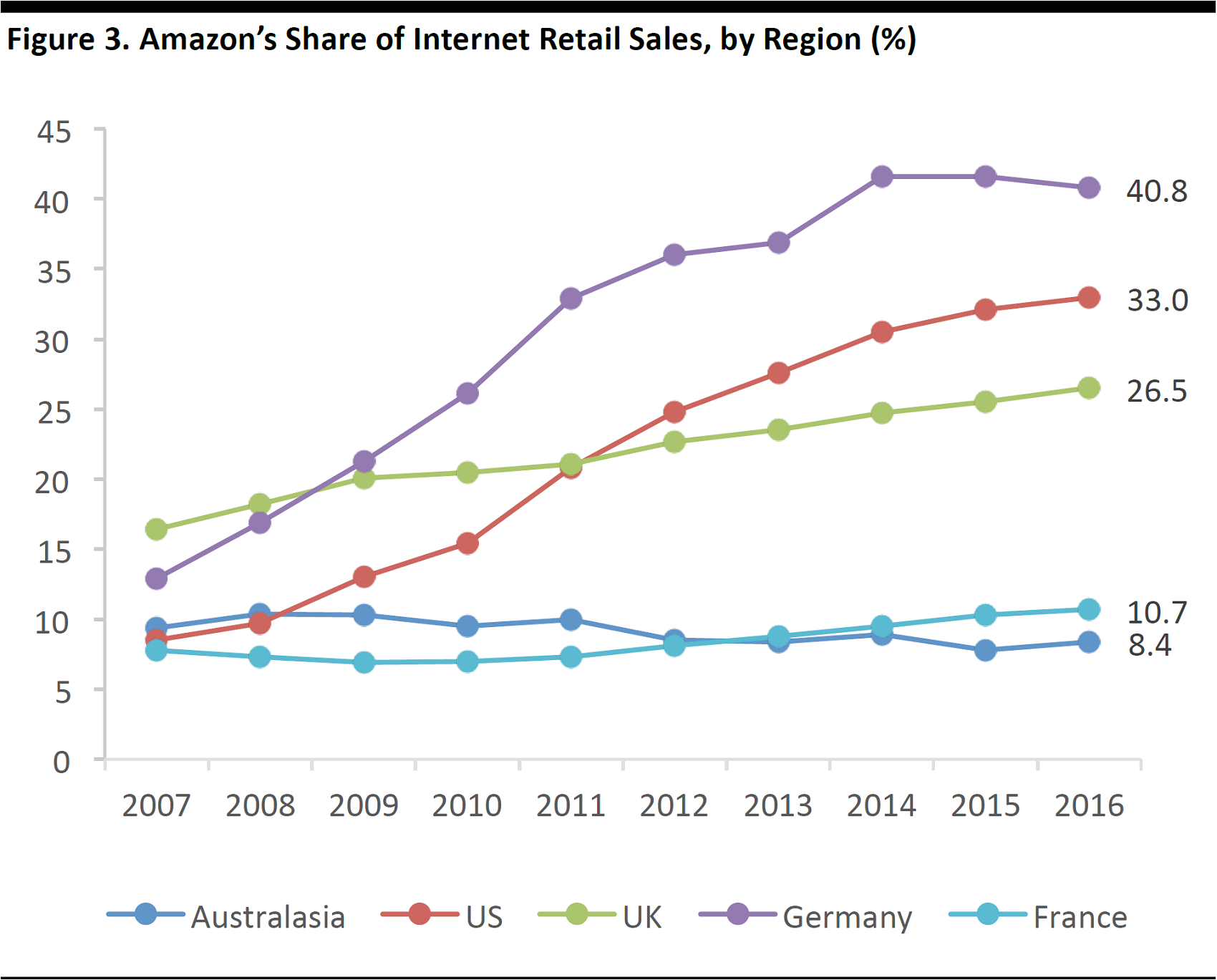

Market Share in Context

The data charted below provide further context for our estimates. In markets where there has been a considerable appetite for online shopping—notably the US and Germany—Amazon’s share of online sales has grown considerably.The drive to get more third-party sellers on Amazon’s platform helped underpin growth in these markets, and we expect to see Amazon push for third-party sellers on its site in Australia, too.

In the US, the UK, Germany and France combined, Amazon saw average annual online market share gains of 182 basis points between 2007 and 2016. We think this historical performance supports our case for Amazon growing its share of Australian online sales by approximately 150 basis points per year.

Includes sales by third-party sellers on Amazon. Australasia is the sum of Australia and New Zealand.

Source: Euromonitor International

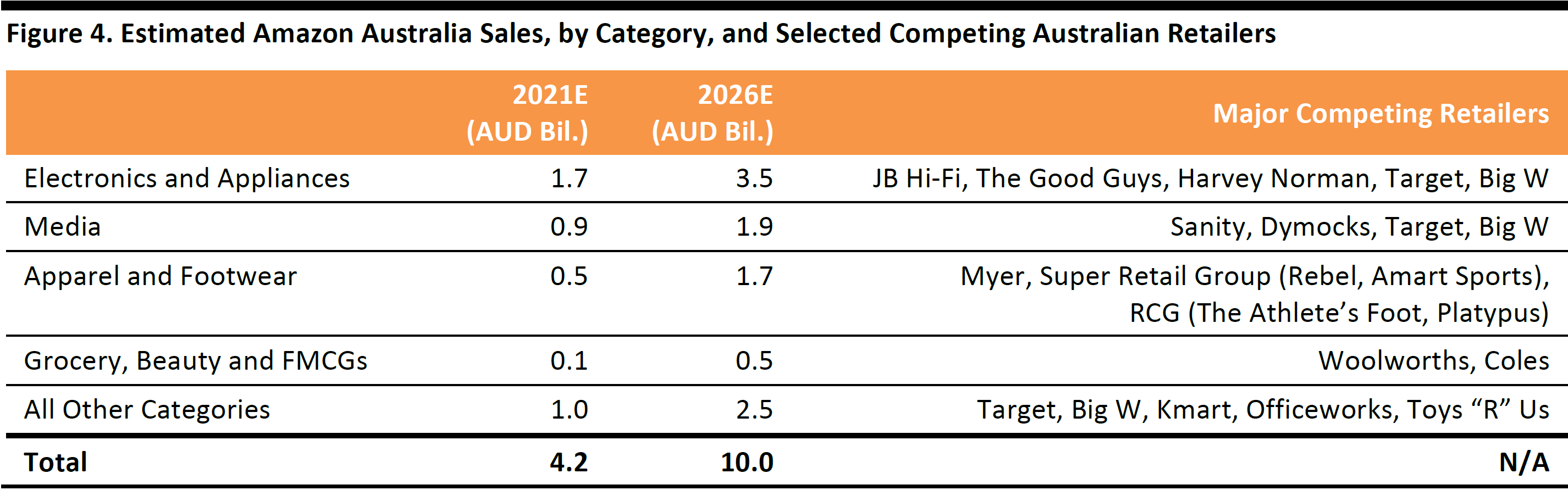

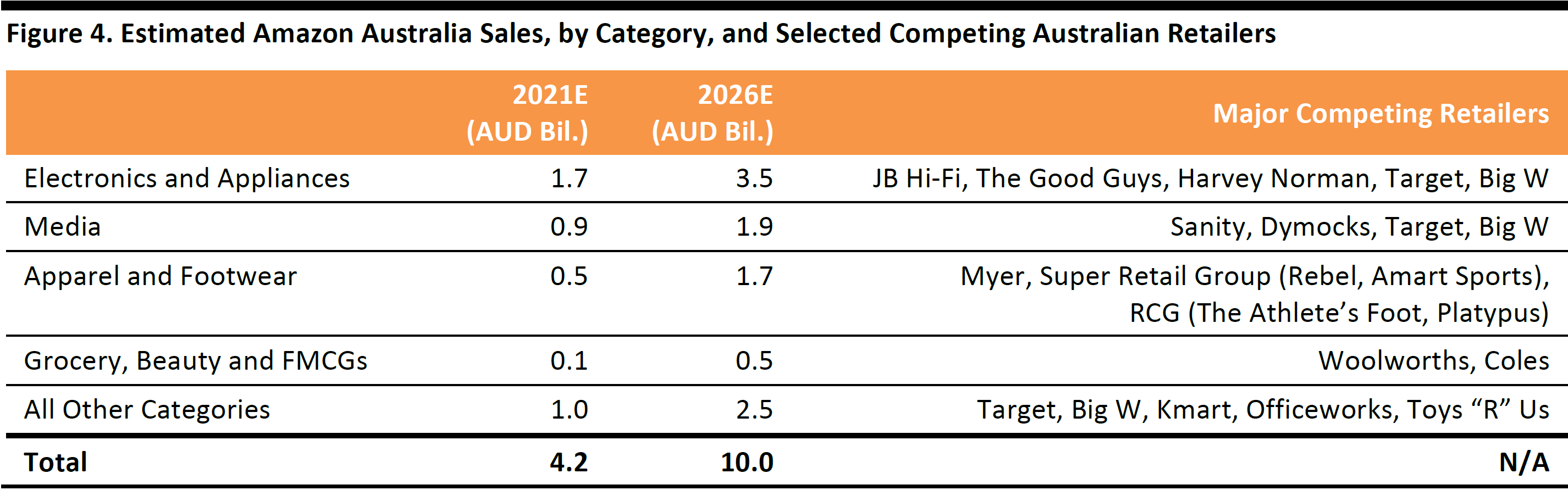

Estimated Sales by Category

Below, we provide our ballpark estimates of how those revenue figures could split out. We base these estimates in part on indications in company filings and figures from market research firms. Our estimates assume that Amazon will shift its sales mix away from electronics and media and toward apparel and grocery between 2021 and 2026.

In the table below, we also show major retailers that look likely to face competition from Amazon within each category. Retailers that focus on selling third-party brands will have the greatest overlap, as we discuss in more detail later.

Totals may not sum due to rounding.

Source: Fung Global Retail & Technology

Who Could Lose Out?

We see the following potential threats to Australian retailers from Amazon’s launch in the country:

- Electronics are among the first categories to migrate to e-commerce, so Amazon likely poses a near-term threat to the market share of incumbents in this category.

- Longer term, Amazon is likely to encourage consumers to shop more online for categories such as apparel, beauty and food, which will increase competitive pressures for undifferentiated specialists.

- With its USPs of choice and convenience, Amazon poses a particular threat to those multicategory retailers that have built their businesses on similar competitive advantages.

- The challenges are not only to rivals’ top-line numbers but also to their margins, as Amazon will provide strong competition on prices and delivery and likely accelerate consumers’ migration to e-commerce.

Despite these apparent threats, many Australian retailers appear not to be on the ball yet. A March 2017 report from Commonwealth Bank found that 49% of Australian retailers expect to see no impact from Amazon’s Australian push, while 30% were not even aware of the retailer’s imminent arrival. Only 14% of retailers surveyed said that they have a plan in place to compete with Amazon and just 11% said that they see the company as a significant threat to their business.

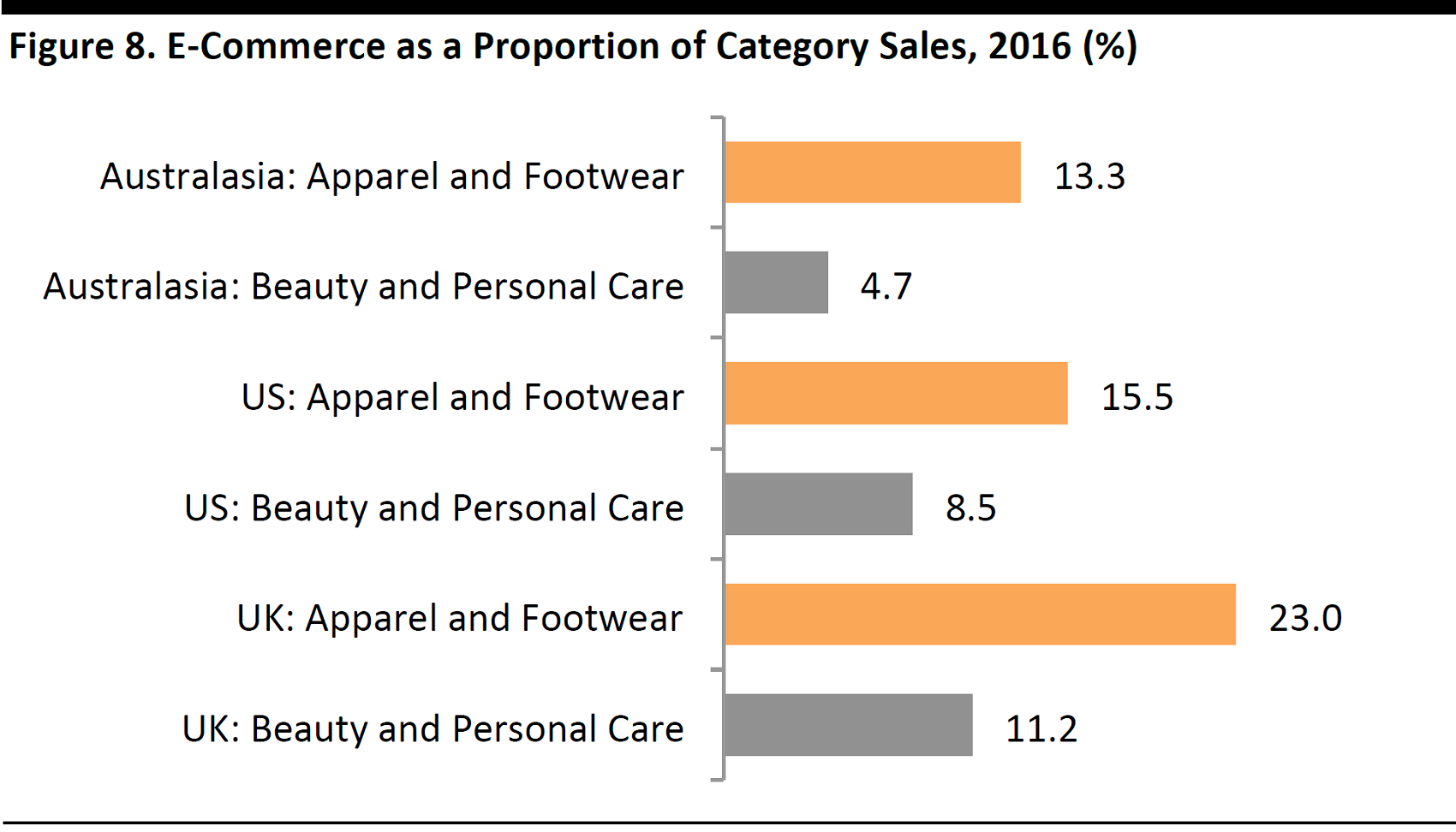

Amazon will Drive E-Commerce Penetration to Build Share

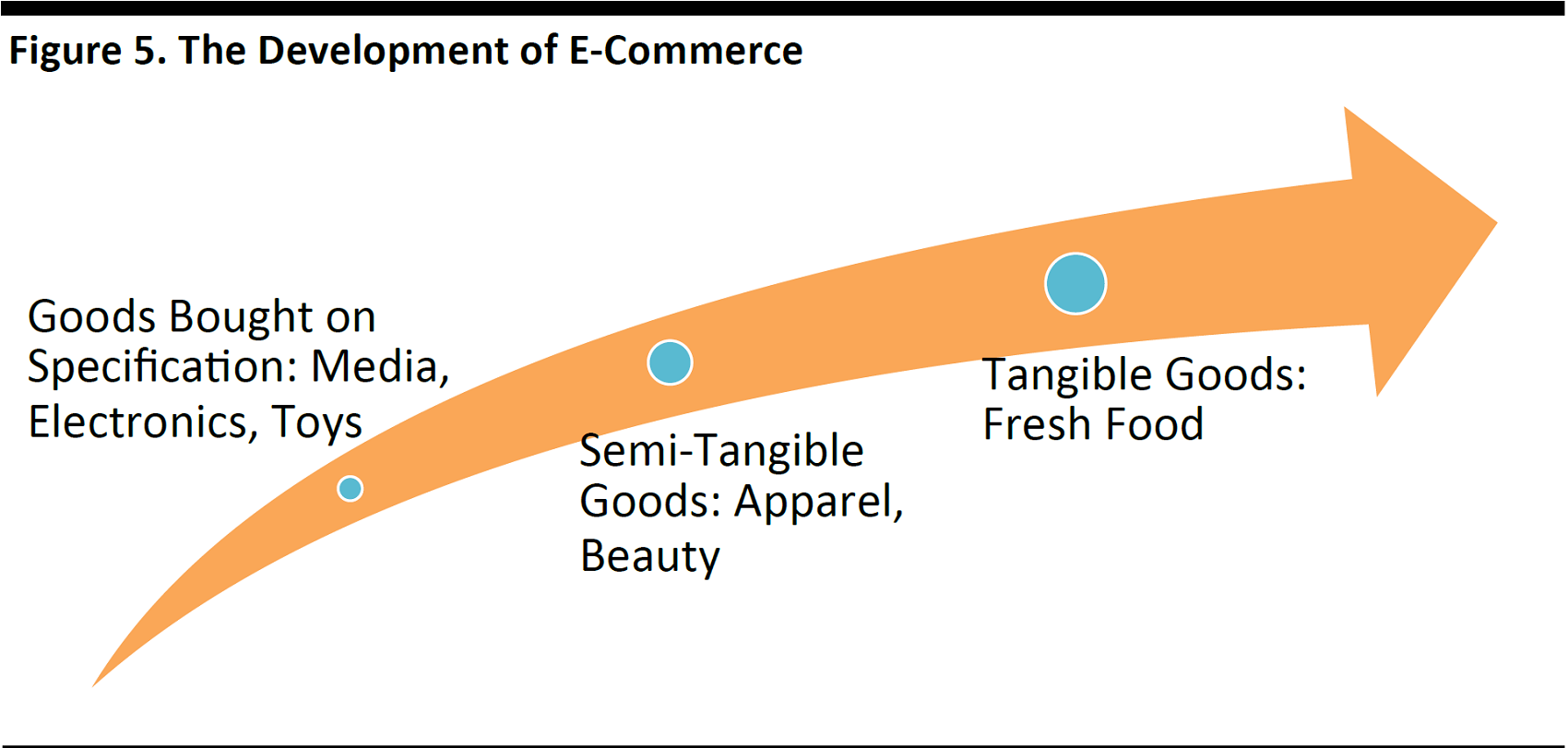

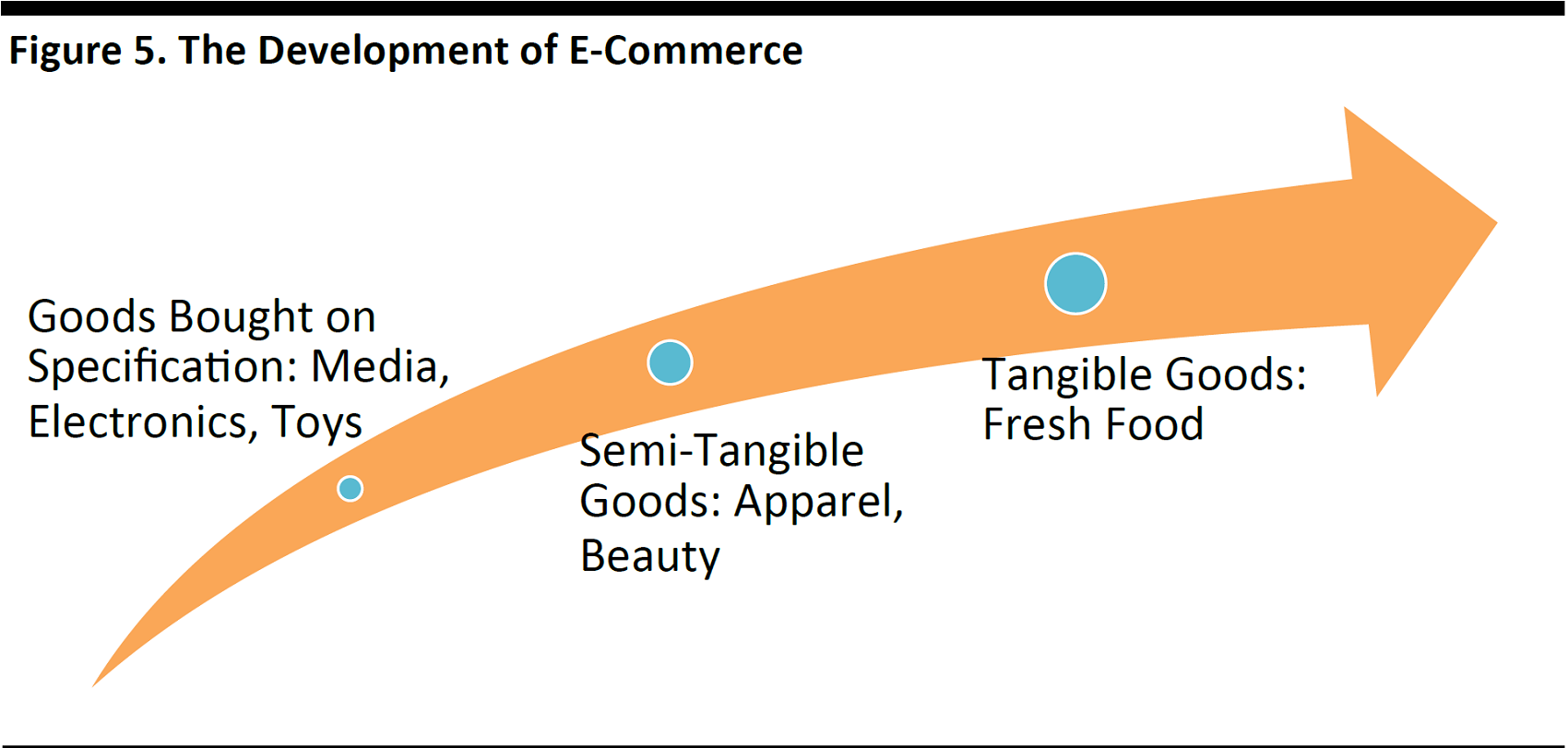

E-commerce tends to develop along a pathway that extends from products that are bought on specification, such as media players and electronics, to products that some shoppers like to touch or test before buying (such as clothing that they want to try on), to products that a large proportion of shoppers want to be able to touch and see before buying, such as fresh produce. This progression is as applicable to Australia as it is to any other market, and the country’s low e-commerce penetration reflects its laggardly position on this pathway. We expect Amazon to accelerate Australia’s progression along this pathway by enticing more shoppers to shop online for categories such as apparel.

Source: Fung Global Retail & Technology

So, what does this mean for retailers?

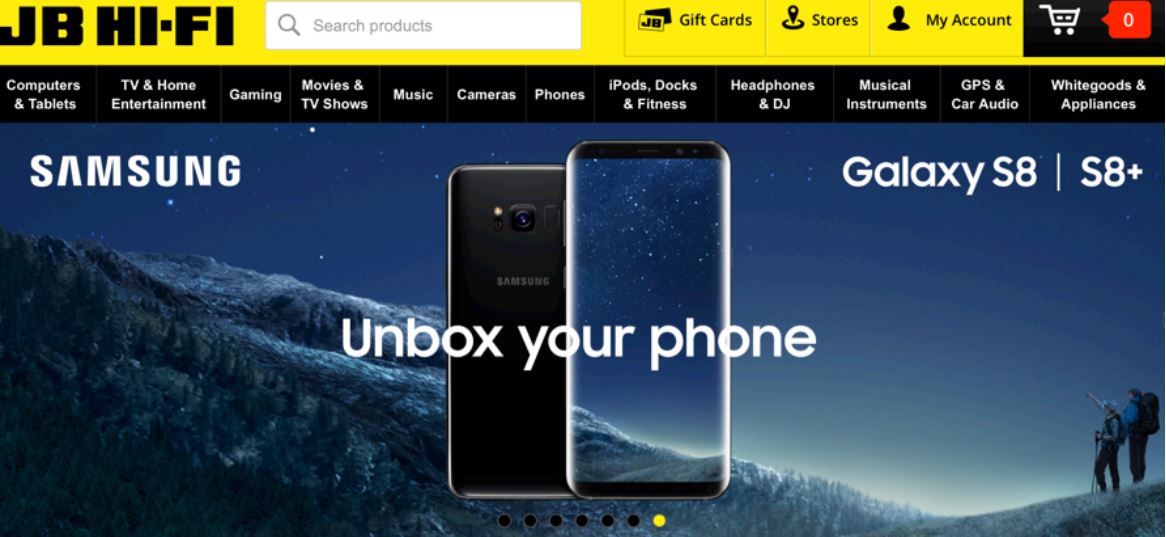

- Amazon will build scale in electronics: In the near term, Amazon can build scale through the electronics category, and we think this is likely to come at the expense of stores such as JB Hi-Fi, The Good Guys (acquired by JB Hi-Fi in 2016) and Harvey Norman; we chart their market shares below. Amazon could steal share from some rival Internet pure plays, too. A February 2017 survey by Nielsen found that electronics would be the most popular category on Amazon in Australia, with 67% of Australian consumers surveyed saying that they would be likely to buy electronics from the retailer. Moreover, the collapse of the Dick Smith chain in 2016 released market share in electronics that others, including Amazon, can mop up.

Source: jbhifi.com.au

Source: JB Hi-Fi

- Amazon will drive the migration of categories online: In the medium term, Amazon stands to gain by driving online penetration in those categories that are positioned further along the e-commerce pathway. We expect this to come primarily at the expense of store-based retailers and, in particular, undifferentiated specialists that focus on third-party brands. Amazon’s Prime membership scheme is a major lever for encouraging shoppers to switch to online buying for categories such as apparel, beauty products and groceries.

Undifferentiated Generalists Stand to Lose Market Share

We expect undifferentiated retailers that grew by selling a wide selection of other companies’ brands in big stores to be squeezed by the growth of Amazon. This is likely to include midmarket department stores such as Myer, value department stores such as Big W and Target, and mixed-category retailers such as Harvey Norman. We fear that Big W, which has seen total sales fall in recent years, may simply be the canary in the coal mine for the Australian general merchandise sector.

However, discount department store Kmart could be in a stronger position than some of its peers, given its strong private-label focus and aggressive pricing strategy.

In recent years, we have seen middle-ground generalist retailers lose market share in a number of countries. These range from Karstadt in Germany to Sears and Macy’s in the US to Big W in Australia. Not all of the share losses can be attributed to the rise of e-commerce retailers, but some can, simply because these legacy retailers’ USPs of convenience and brand choice have been duplicated by online retailers such as Amazon.

The counterpoint to this is that differentiated retailers with exclusive product and a unique experience are likely best positioned to outperform. In an era when functional shopping will migrate online, names such as Zara in fashion, Sephora in beauty and IKEA in furniture appear to tick the boxes for differentiation.

A Triple Threat to Margins

Any significant loss of sales by incumbent retailers will impact these companies’ margins. And we see other threats to their profitability, too:

- Significantly stronger price competition will pressure incumbents to lower prices, hitting gross margins.

- The migration of incumbents’ own sales to the inherently less-profitable online channel will accelerate, and this could dent operating margins across the sector.

- Retailers will be pressured to subsidize shipping for online purchases, given Amazon’s free shipping options and Prime membership offering, and this will impact operating margins. We provide more information on Amazon Primein Appendix2.

E-Commerce Context: Australian E-Commerce Is Immature, Fragmented and International in Nature

In this section, we provide greater detail about the characteristics of the Australian retail and e-commerce landscapes. In summary, we think Amazon will consolidate and grow an Australian e-commerce market that is currently immature, fragmented and skewed toward international shopping.

E-Commerce is Immature in Australia

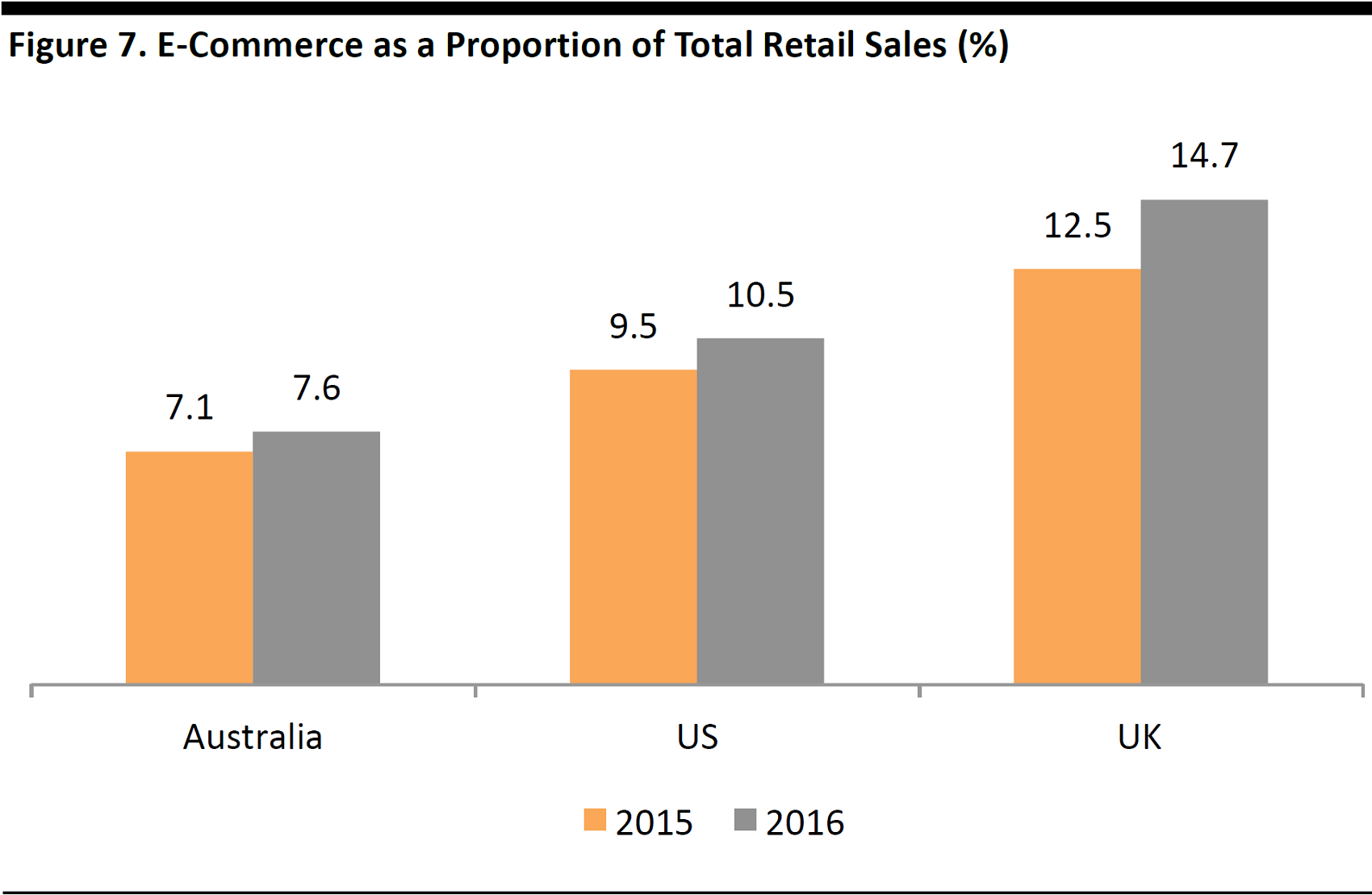

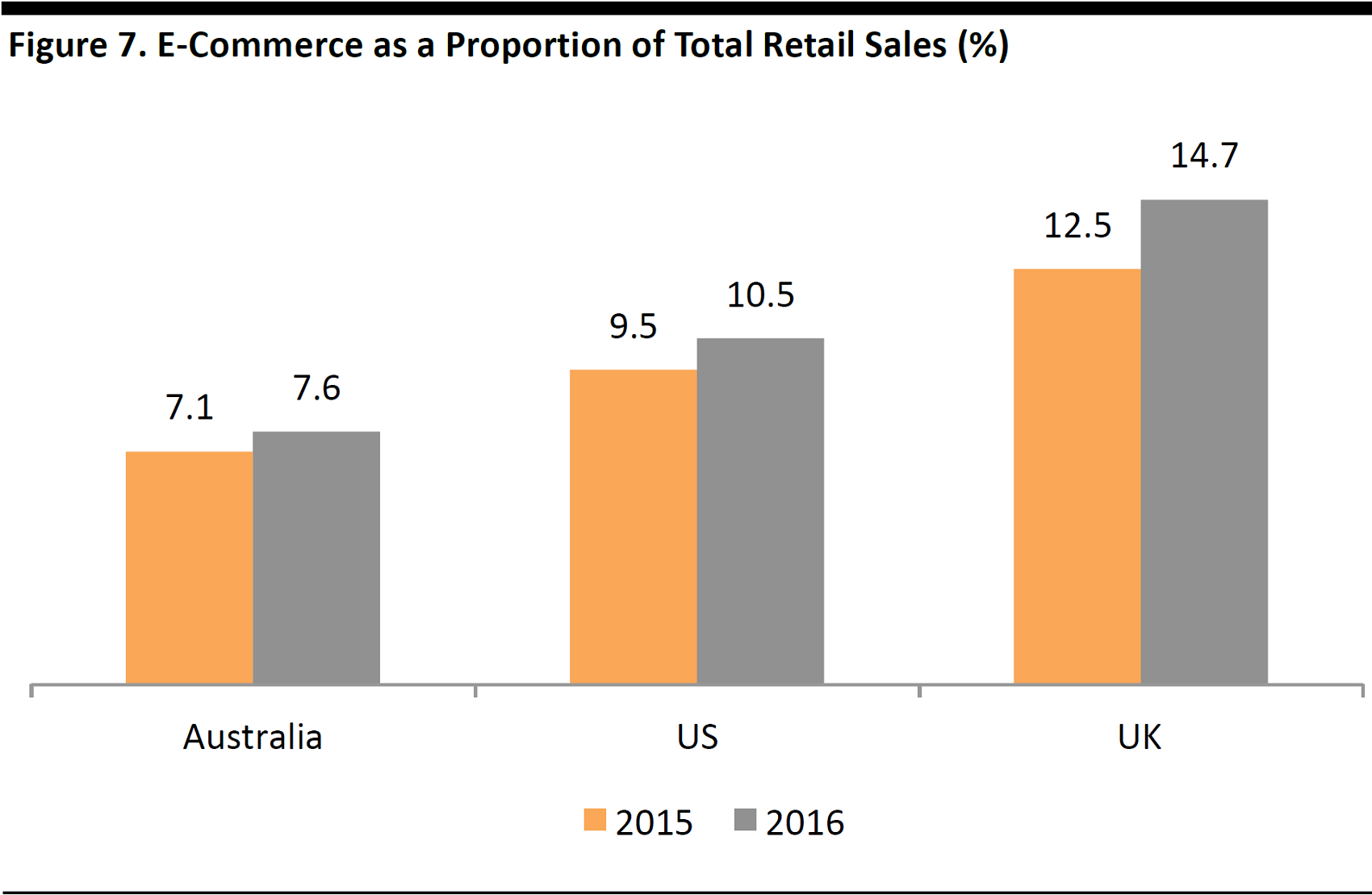

Australian retail’s migration to e-commerce lags that of comparable Western markets. In 2016, only about 7.6% of the country’s retail sales were made online, versus double-digit percentages in the US and the UK. In all countries, the total figures are dragged down by lower e-commerce penetration in nonfood categories, and so conceal higher e-commerce shares in general merchandise and apparel.

Source: National Australia Bank/Quantium/Australian Bureau of Statistics/Euromonitor International/UK Office for National Statistics/Fung Global Retail & Technology

Australia’s low e-commerce penetration rates are reflected at the company level. In fiscal 2016, e-commerce contributed 3% of sales at JB Hi-Fi and 5% of sales at The Good Guys, compared to 25% at the UK’s leading electronics specialist, Dixons Carphone.

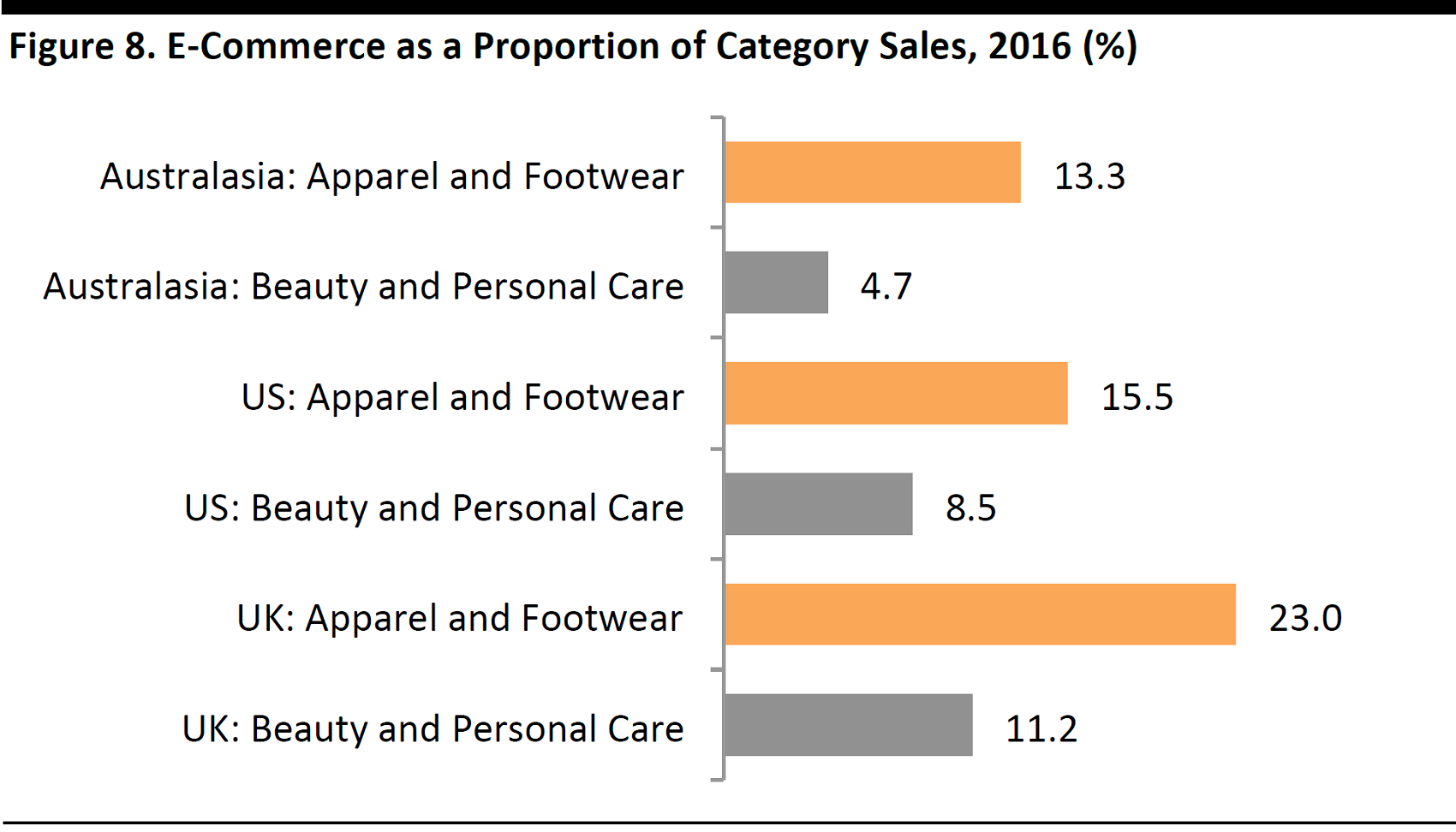

To add more color to this, we chart below e-commerce’s share of apparel and beauty sales in the Australasia region versus the US and the UK. The data for Australasia include New Zealand, but we believe they remain indicative.

Source: Euromonitor International/Kantar Worldpanel/Fung Global Retail & Technology

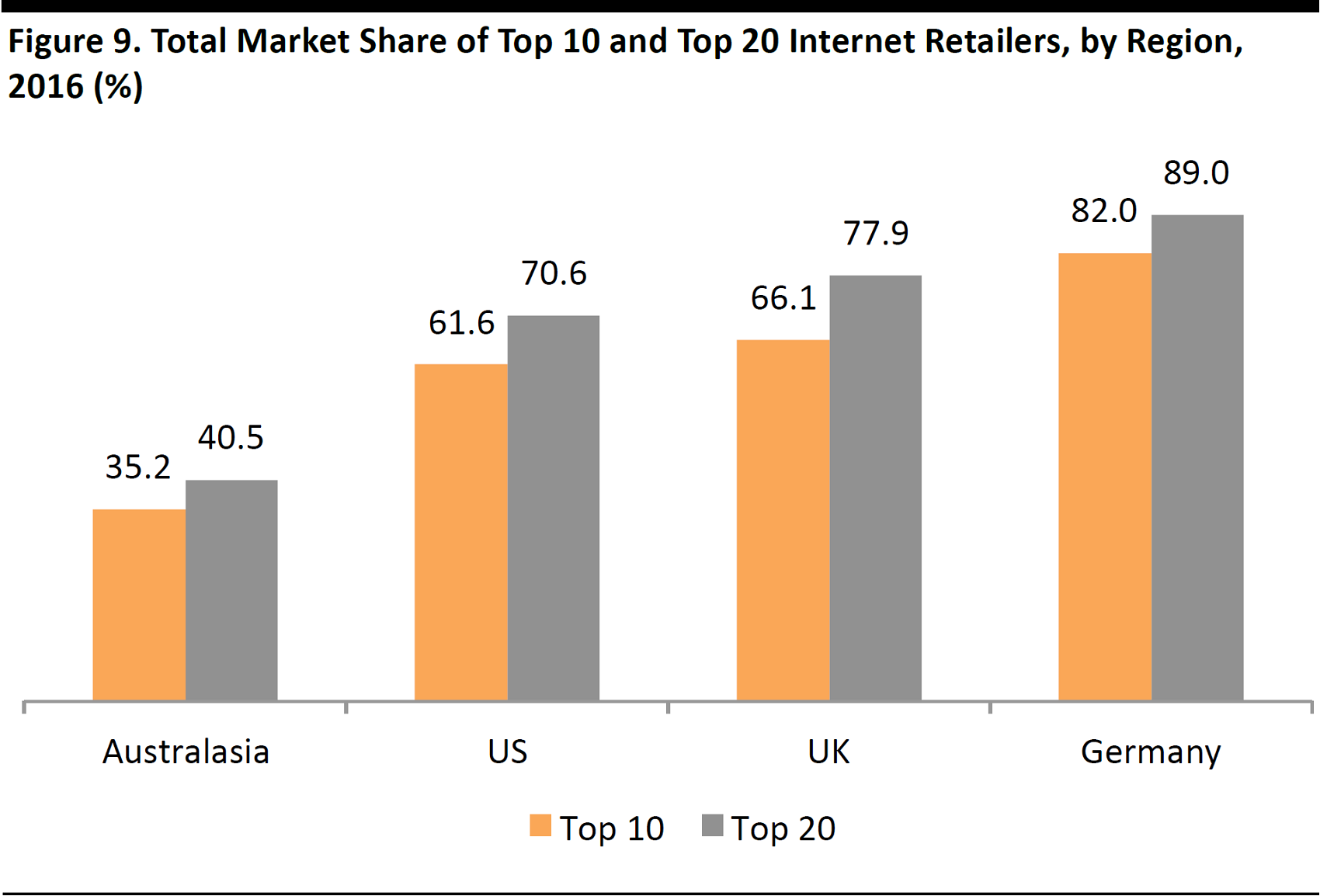

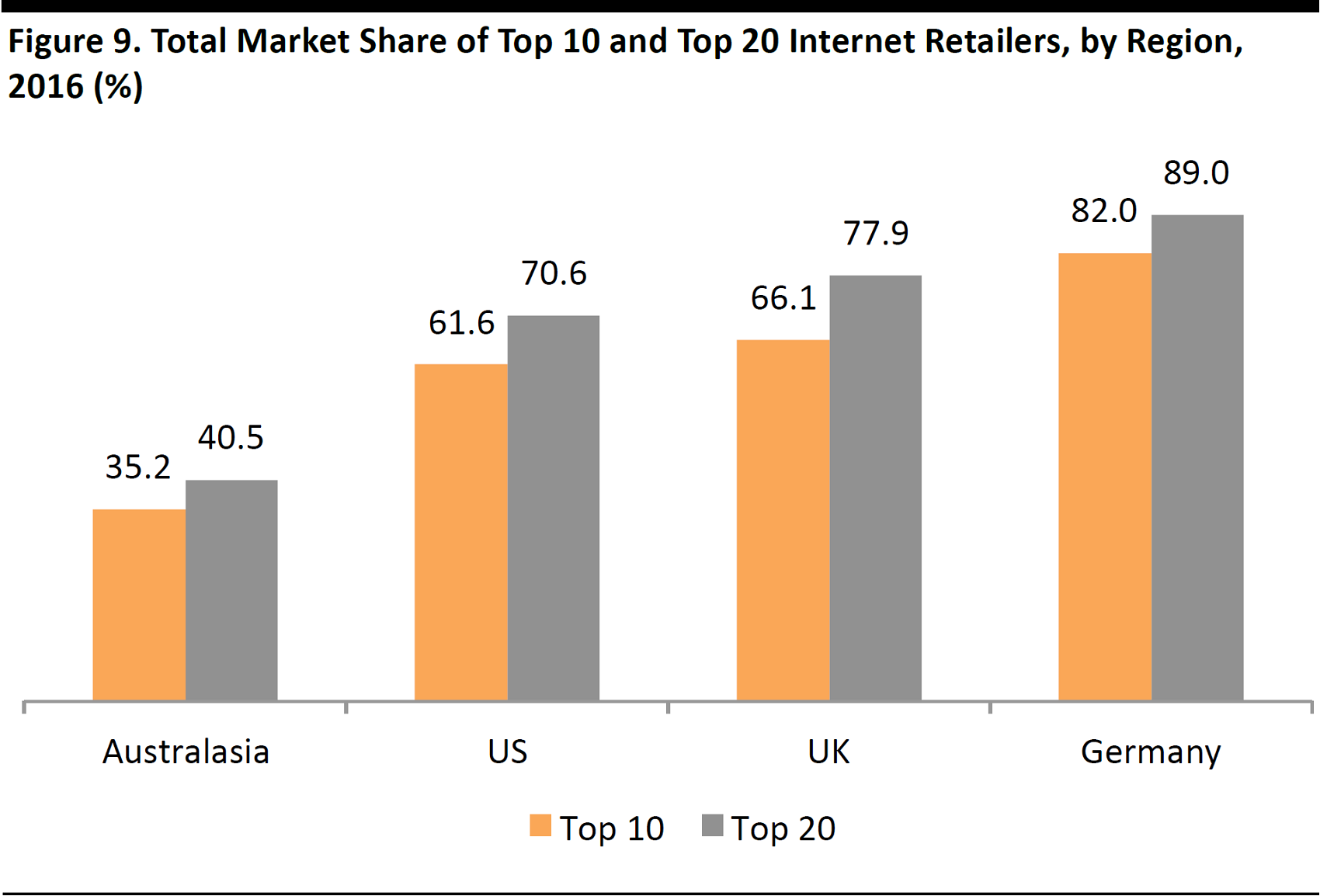

E-Commerce is Fragmented in Australia

Australia’s e-commerce landscape is fragmented, and our market share data for Australasia reflect this: the top 10Internet players in Australasia accounted for a little over one-third of online sales in 2016, versus about two-thirds for the top 10 names in the US and the UK and more than three-quarters for the top 10 names in Germany. This fragmentation is due in part to the absence of Amazon, given the sizable shares Amazon takes in countries such as the US and Germany.

Source: Euromonitor International/Fung Global Retail & Technology

The top Australasian Internet-only retailers, Catch of the Day and Kogan, enjoyed online market shares of only around 1% each in 2016, according to Euromonitor.

E-Commerce in Australia is Skewed Toward International Shopping

Australians frequently shop from overseas websites when they buy online—and one of those is Amazon’s US site. International online shopping rates are highest in toys and department store categories, according to National Australia Bank and data analytics firm Quantium. We expect Amazon’s dedicated Australian site to have a dampening effect on international shopping.

Source: National Australia Bank/Quantium

Retail Context: GST, Conglomerates and the Perception of Higher Prices

We note three further factors that characterize the broader Australian retail sector: changes in GST will impact e-commerce in 2018, conglomerates and multicategory retailers are unusually prominent, and many Australian consumers have the perception that they do not get good value for money.

The GST Issue

Australian e-commerce is international not principally because there are few domestic players, but because there are tax advantages to buying from nondomestic firms. Australian consumers have long enjoyed tax-free shopping when they spend less than $1,000 per purchase from overseas retailers.

However, two changes are expected to come into effect on July 1, 2018:

- GST will apply to low-value imported goods, meaning that the $1,000 threshold will be abandoned.

- GST will apply to digital products and services, such as video streaming and audio downloads.

These changes will effectively remove Amazon’s offshore advantage, and they follow long-standing calls from brick-and-mortar retailers for an equalization of GST rates. Gerry Harvey, Executive Chairman of Harvey Norman, has been among the most vocal in calling for such changes.

Conglomerates and Multicategory Retailers Abound

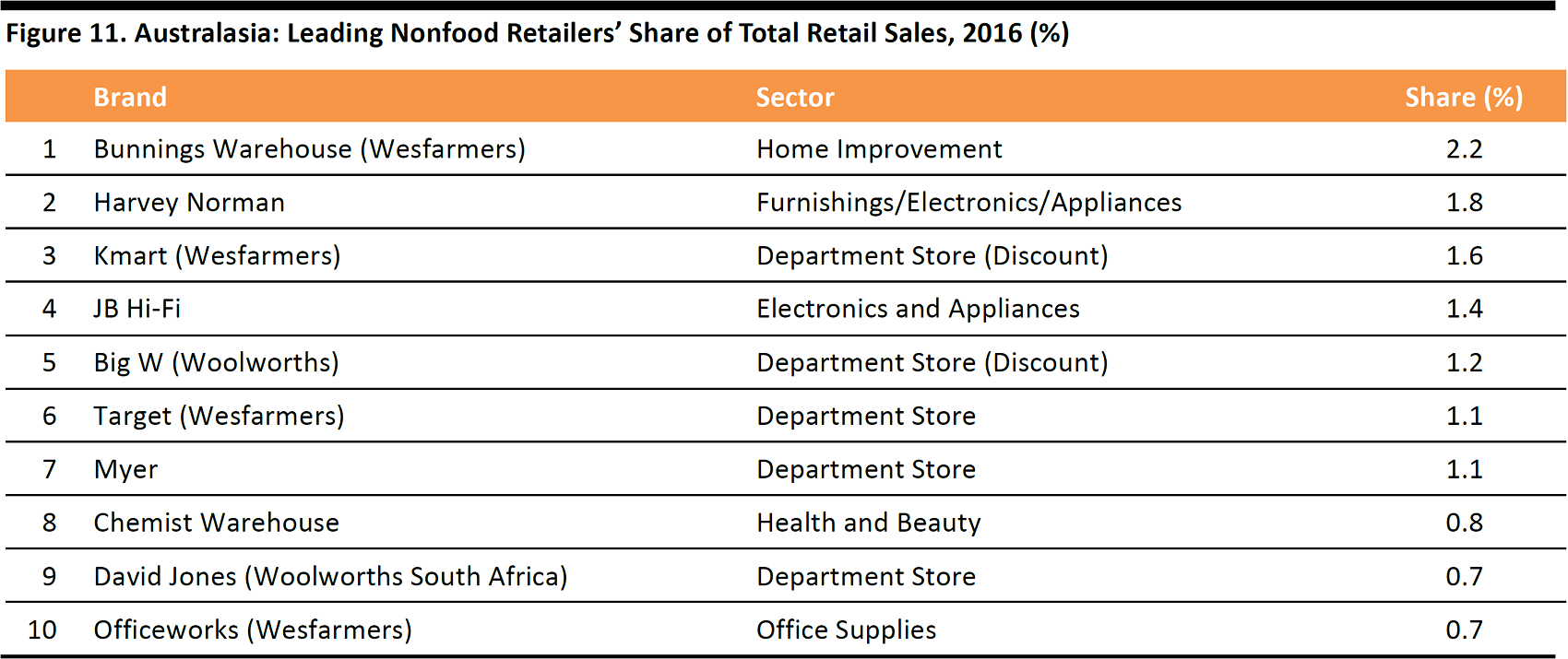

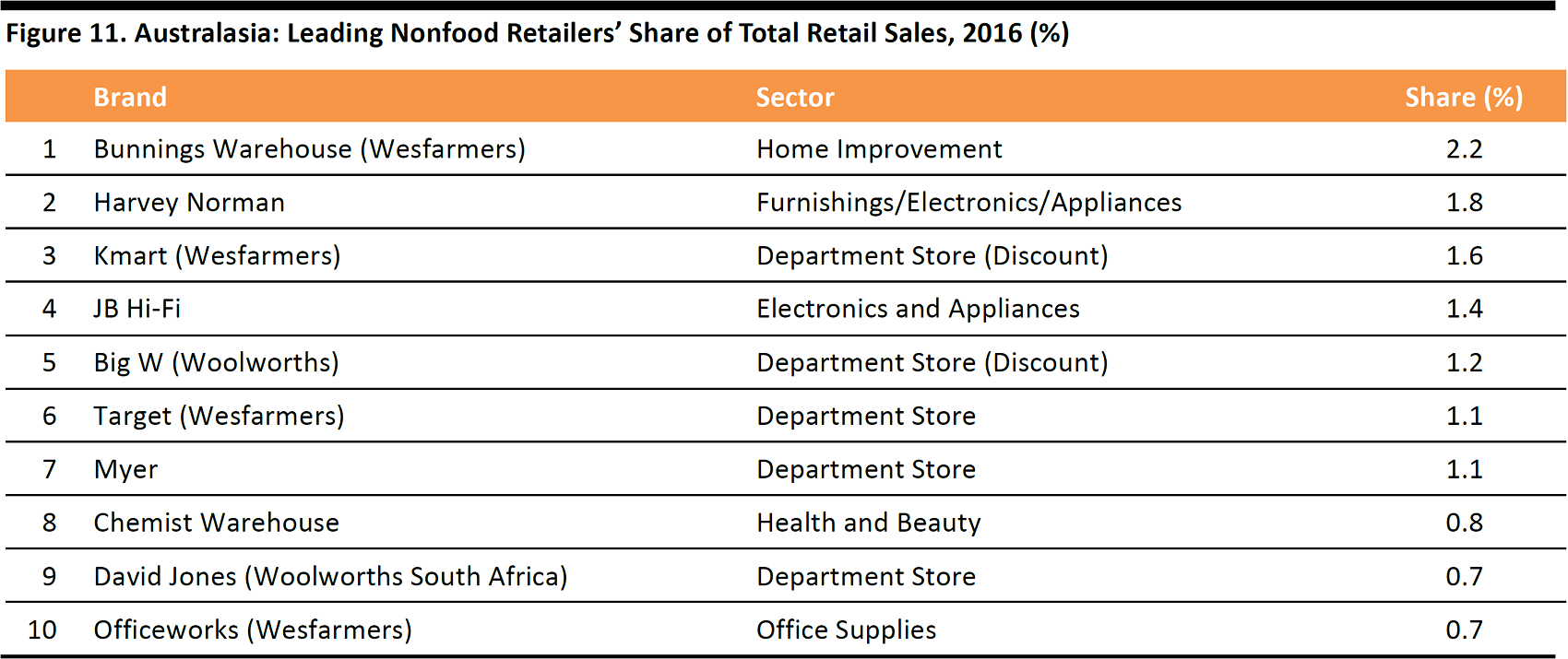

Below, we show the retail market shares of the biggest nonfood retail banners in Australia. We note two characteristics:

- Conglomerates are unusually prominent. These businesses are represented by Wesfarmers and Woolworths. Wesfarmers owns Bunnings Warehouse, Coles, Kmart, Target, Officeworks and a number of alcoholic beverage chains. Woolworths own sits eponymous supermarket chain, plus Thomas Dux, Big W, EziBuy and, like Wesfarmers, a number of chains that sell alcohol.

- Multicategory stores hold leading positions. Australia has a substantial number of department store chains, and multicategory stores are also represented by Harvey Norman, which offers a somewhat unique mix of furniture, electronics and appliances.

Why are these characteristics relevant?

First, the strength of conglomerates may reflect a paucity of competition in Australia compared with retail sectors in other countries—and, consequently, impact the prices Australian shoppers pay for goods.

Second, we think that specialized retailers with unique product and quality store experiences stand the best chance of fighting off the Amazon threat. Multicategory generalists selling other companies’ brands will overlap most with the Amazon proposition.

Source: Euromonitor International

Aussies Perceive that They Pay Higher Prices

Our conversations with a number of Australian consumers indicate that many shoppers feel that incumbent brick-and-mortar retailers do not offer good value for money. Aussie shoppers often believe that they pay higher prices for comparable products than consumers do in countries such as the US and the UK. The growth of international lower-price chains appears to have helped fuel this perception: Aldi launched in Australia in 2001, H&M entered the market in 2014and TK Maxx opened its first stores in the country in April 2017. Kaufland and Decathlon look set to open their first stores in Australia soon.

Source: kaufland.de

The consumers we spoke with tended to recognize that brand owners that charge high wholesale prices bear some responsibility for higher prices that shoppers pay. But some noted that there is relatively little competition in the domestic retail sector compared with countries such as the US and the UK. In addition, some retailers’ preference for exclusivity on certain branded ranges has further reduced competition.

We think that the price transparency enabled by e-commerce has helped drive Australian consumers’ perceptions of unfavorable pricing, and that such sentiments will underpin many shoppers’ switch to Amazon.

Key Takeaways

We think Amazon has an opportunity to consolidate and grow an Australian e-commerce market that is immature, fragmented and skewed toward international shopping. And we see real appetite for Amazon’s offering among Australians, many of whom already shop on Amazon’s US site. Furthermore, many consumers in the country believe that Australia’s domestic retailers do not always offer good value for money.

Amazon will be joining other international invaders such as Aldi, H&M, TK Maxx and Kaufland. Like those retailers, it will heap further competition on incumbents—but almost certainly at greater scale.

Appendix 1: Amazon Estimates Methodology

Our estimates for Amazon’s total Australian sales from 2021 onward are based principally on the following metrics:

- Amazon’s per-capita total merchandise sales (including third-party sales) in its core international markets of the UK and Germany. We use historical data to factor in the maturity of e-commerce in the various markets and the development of Amazon, including its marketplace offering. We then adjust for inflation and extrapolate using Australian population figures.

- Average annual absolute growth in Amazon’s per-capita total merchandise sales (including third-party sales) over the period 2011–2016 in the UK and Germany. Adjusting for inflation, we use these to extrapolate sales growth at Amazon Australia between 2021 and 2026.

We cross-reference the resulting estimates to further data, such as:

- Amazon’s estimated sales so far in the Australasian market, sourced from Euromonitor.

- Amazon’s historical annual average online market share gains across Australasia, the US, the UK, Germany and France.

We assume that Amazon will launch a full offering in Australia in 2018, and our forecasts start from 2021 to allow for two full calendar years of scaling up following this launch. We assume also that Amazon will grow its third-party seller marketplace similar to the way it has in the US, the UK and Germany. Our estimates exclude sales tax.

Appendix2: A Prime Primer

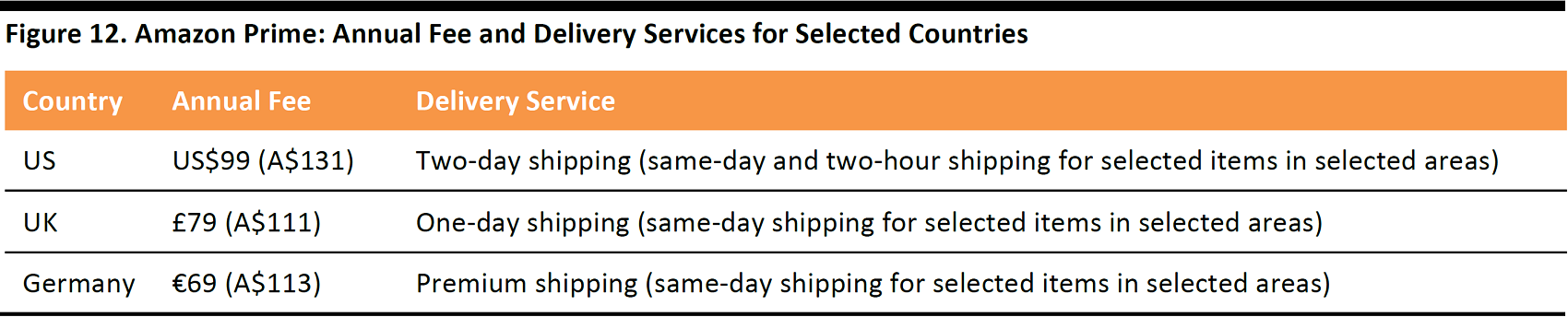

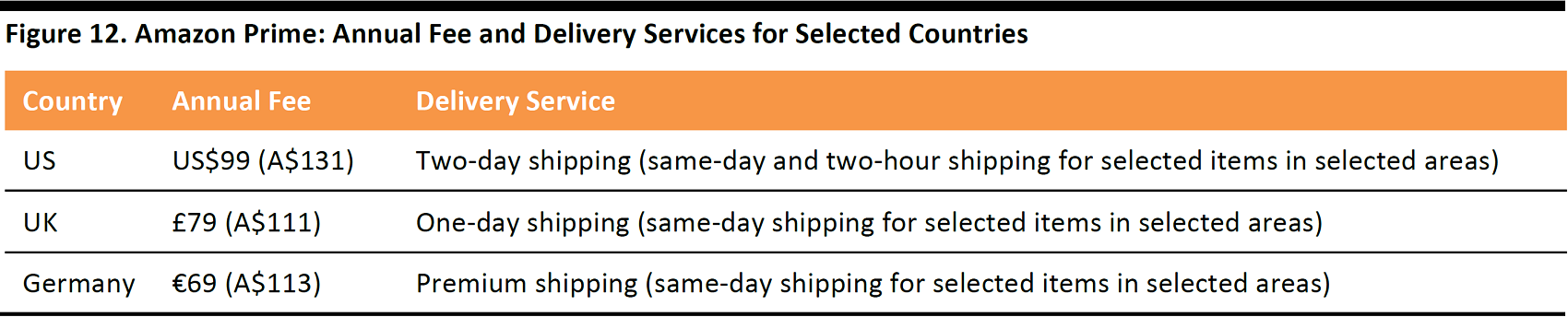

The Prime membership scheme is among Amazon’s strongest weapons. For an annual fee, customers enjoy expedited shipping at no extra cost, as well as other services such as Prime Video streaming.

Amazon Prime members spend more at Amazon than non-members do—which is logical, given that a customer would need to be a frequent shopper to justify paying the upfront charge for Prime membership. Prime also “locks in” loyalty among those who may otherwise waver over buying from Amazon versus rivals: the shipping benefit can tip the scales in favor of Amazon each time a Prime member looks to buy something.

April 2017 estimates from Consumer Intelligence Research Partners put average annual per-shopper spend at Amazon at about $1,300 for prime members in the US, compared with about $700 for nonmembers.

We expect Amazon to push Prime heavily in the Australian market, just as it has elsewhere. And it will need to: a February 2017 survey by Nielsen found that 73% of Australians were not aware of Amazon Prime.

Source: Company reports

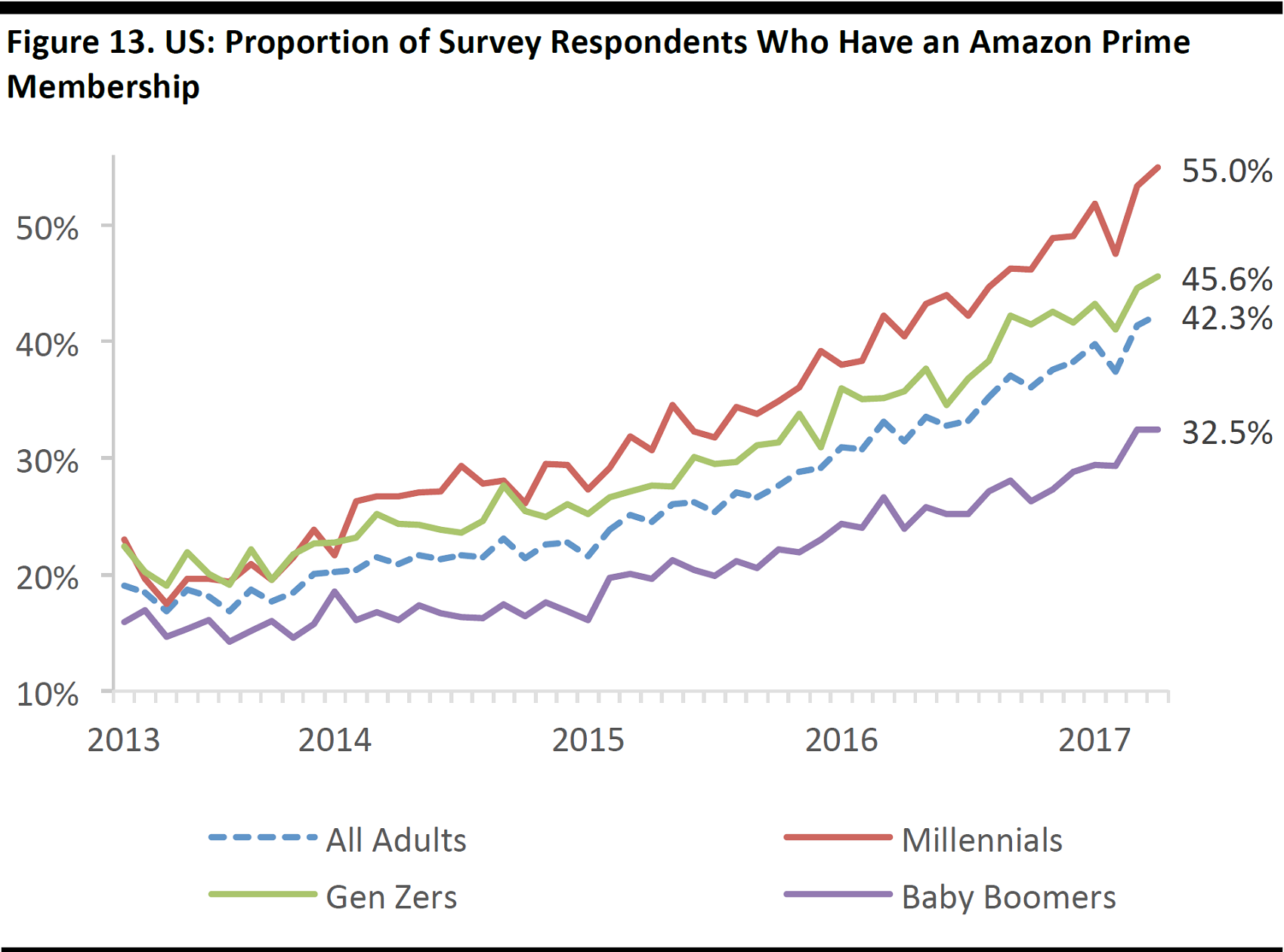

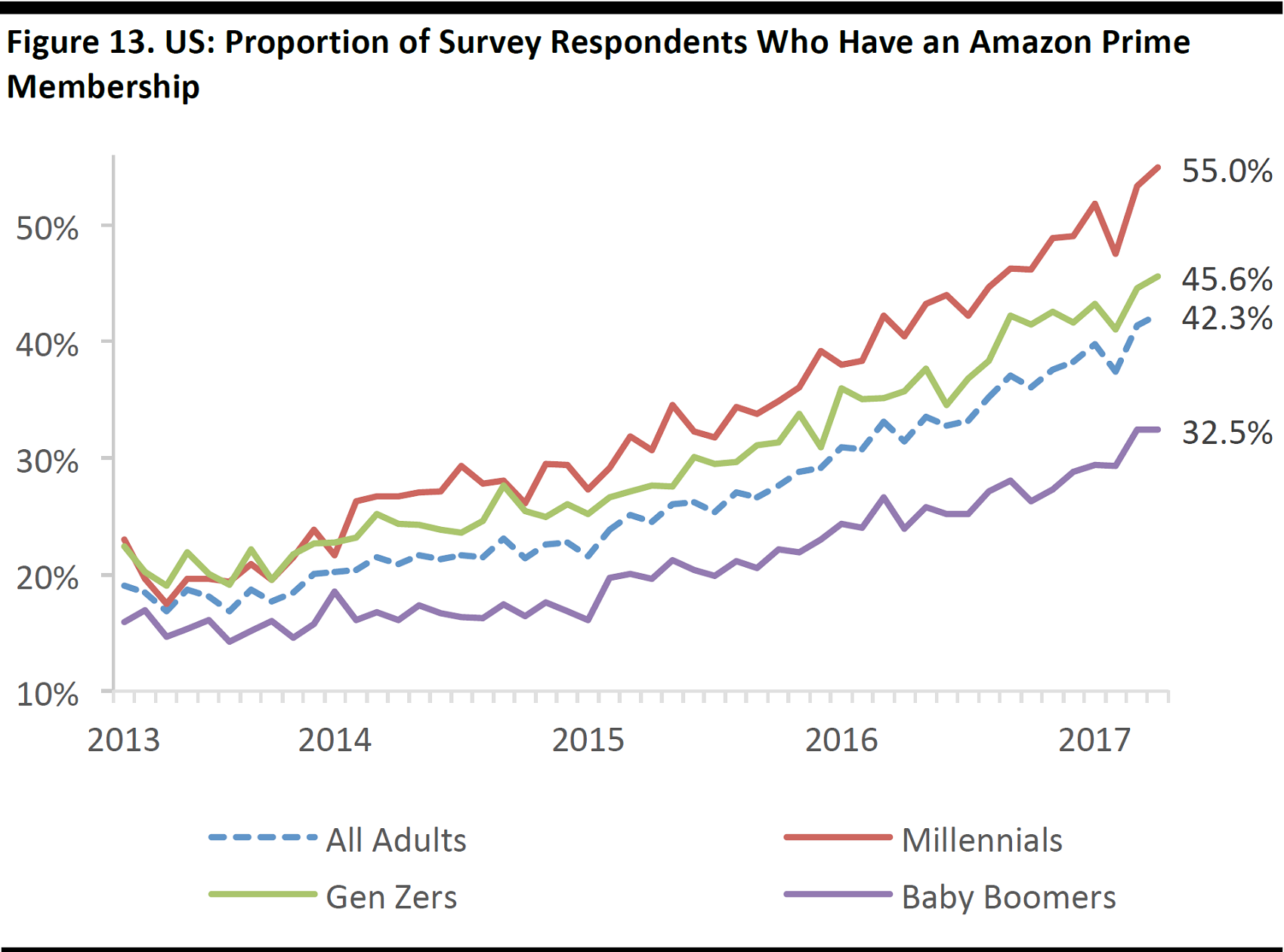

Survey data from our research partner Prosper Insights & Analytics show that total US penetration rates of Prime more than doubled, to 42%, in the four years ended April 2017. Millennials (those born 1983–1998 by Prosper’s definition) are more likely than older age groups to have Prime memberships.

The data charted below show the proportion of survey respondents who answered yes when asked, “Do you have an Amazon Prime membership?” The wording is significant because larger proportions than those charted below are likely to have

access to Prime delivery benefits through a Prime membership held by someone else in their household.

Surveys conducted March 2013 to April 2017

Base: Between 4,912 and 7,609 adults ages 18+ in each three-month period

Source: Prosper Insights & Analytics