Executive Summary

We have seen a healthy level of M&A activity in the beauty space globally since 2013. Mature beauty companies have chosen to use acquisitions as a key strategy for growth, as it has proven challenging for them to grow their businesses organically by opening stores and expanding distribution channels for their existing brands. In addition to helping beauty companies expand their businesses, acquisitions also help them optimize their product portfolios and tap into a younger customer base of millennials and GenZers.

We expect to see much continued M&A activity in the industry, given strong competition for market share among mature beauty companies. Three segments of the beauty market are likely to see more M&A attention: organic skincare brands, South Korean beauty brands and social media-endorsed independent brands.

Market Overview: Global Beauty Companies Seek to Boost Growth Through M&A

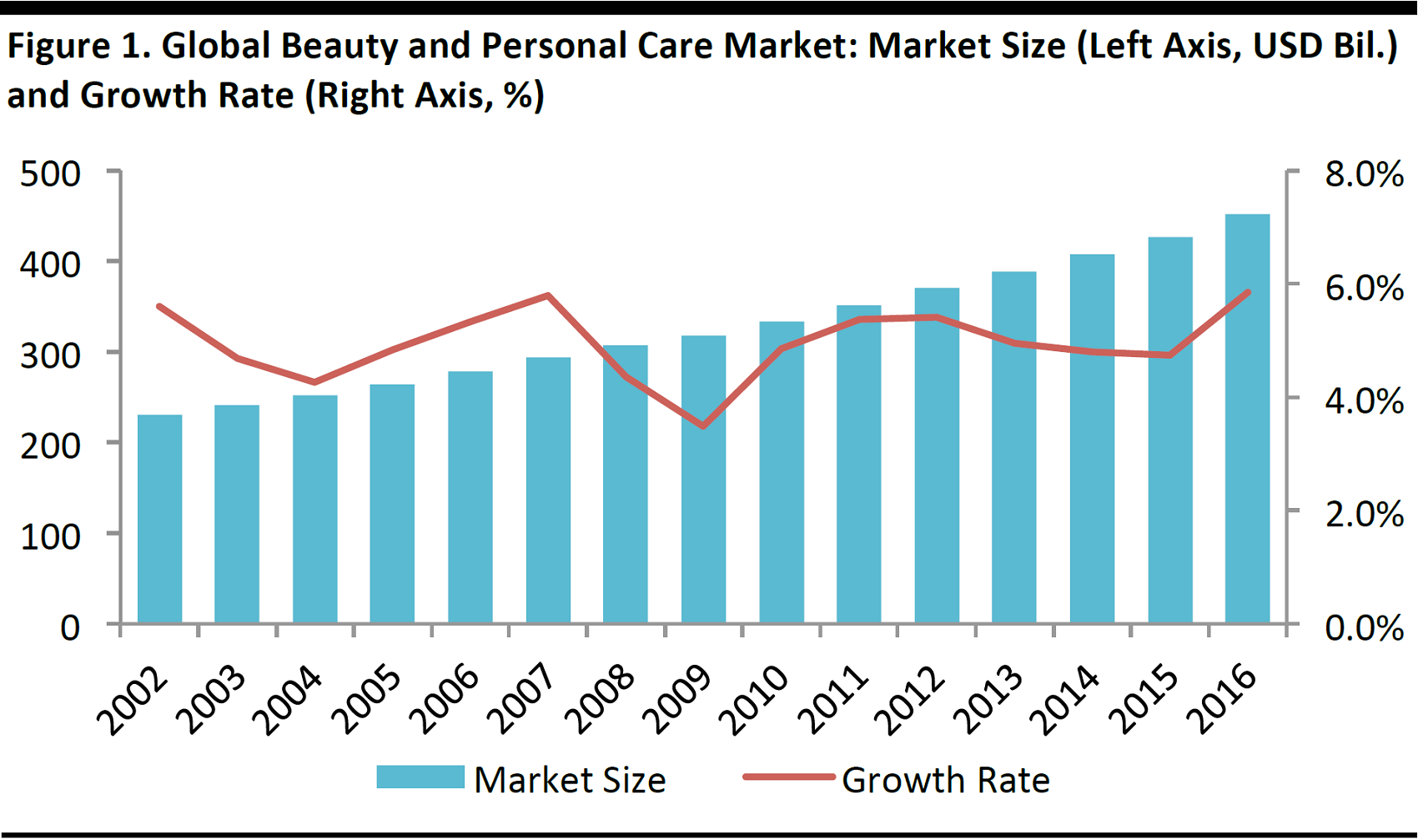

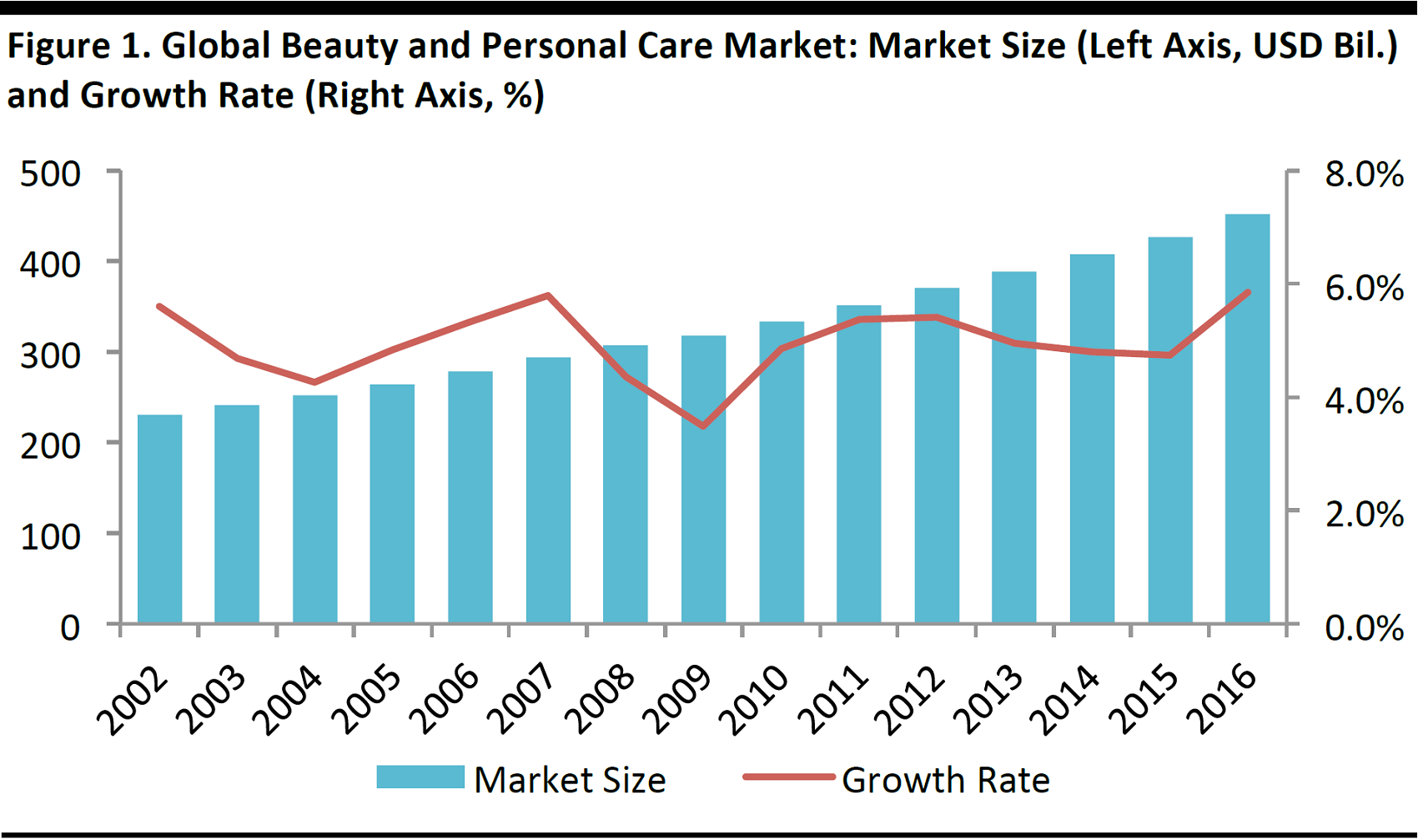

Mature beauty companies have sought ways to continue to expand their market share, as they have not enjoyed the same level of growth as the overall beauty market. Top global beauty companies have grown by 3%–4% in the past five years, while the overall global beauty market averaged 5% growth.

Due to their maturity, it is challenging for large beauty companies to grow their businesses organically by opening stores that feature their current brands. Growth opportunities are also limited in traditional distribution channels such as department stores, where traffic and sales have faced headwinds. In addition, there is increasing competition from emerging independent beauty brands at specialty stores such as Sephora and Ulta.

Source: Euromonitor International

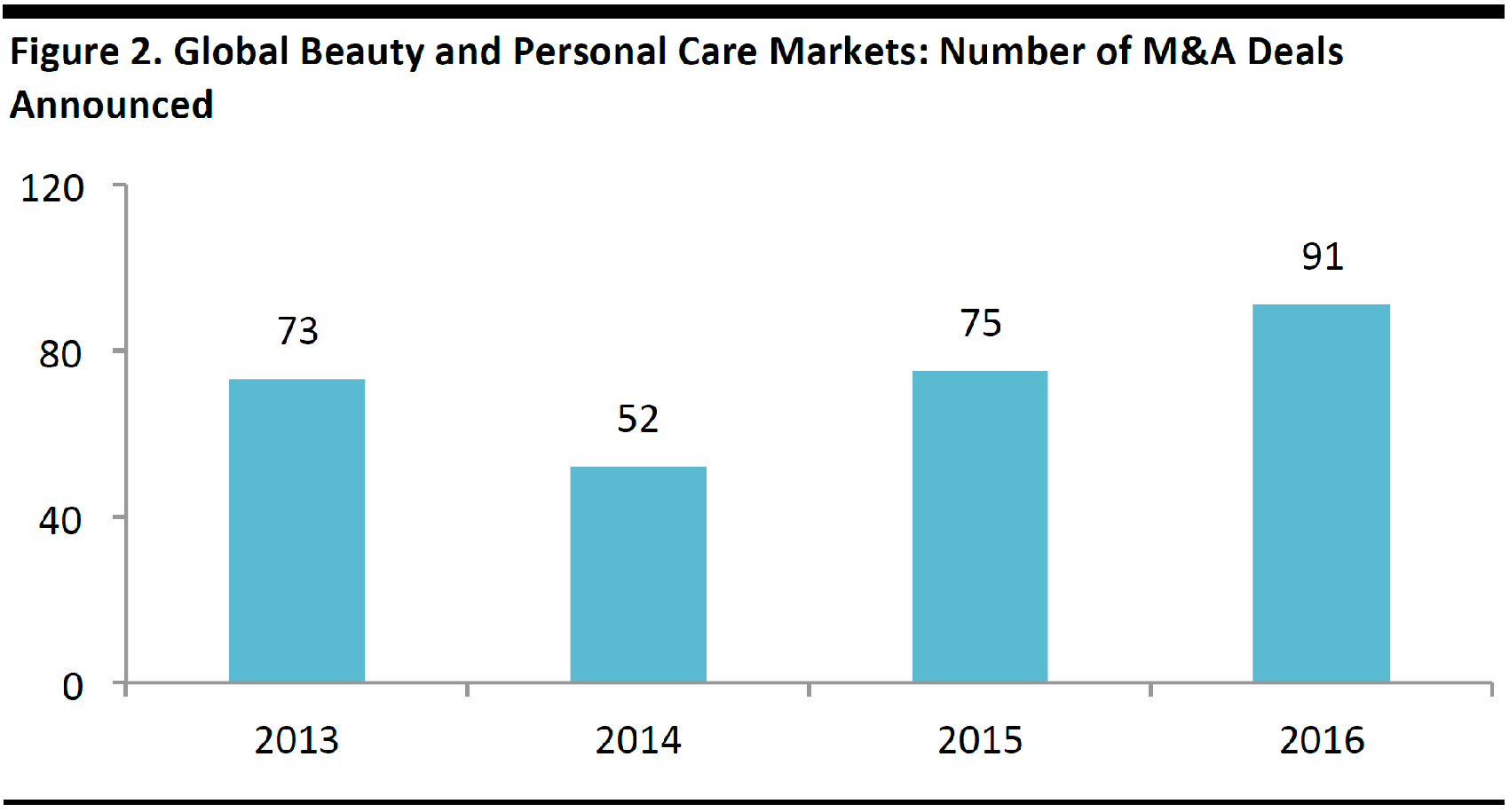

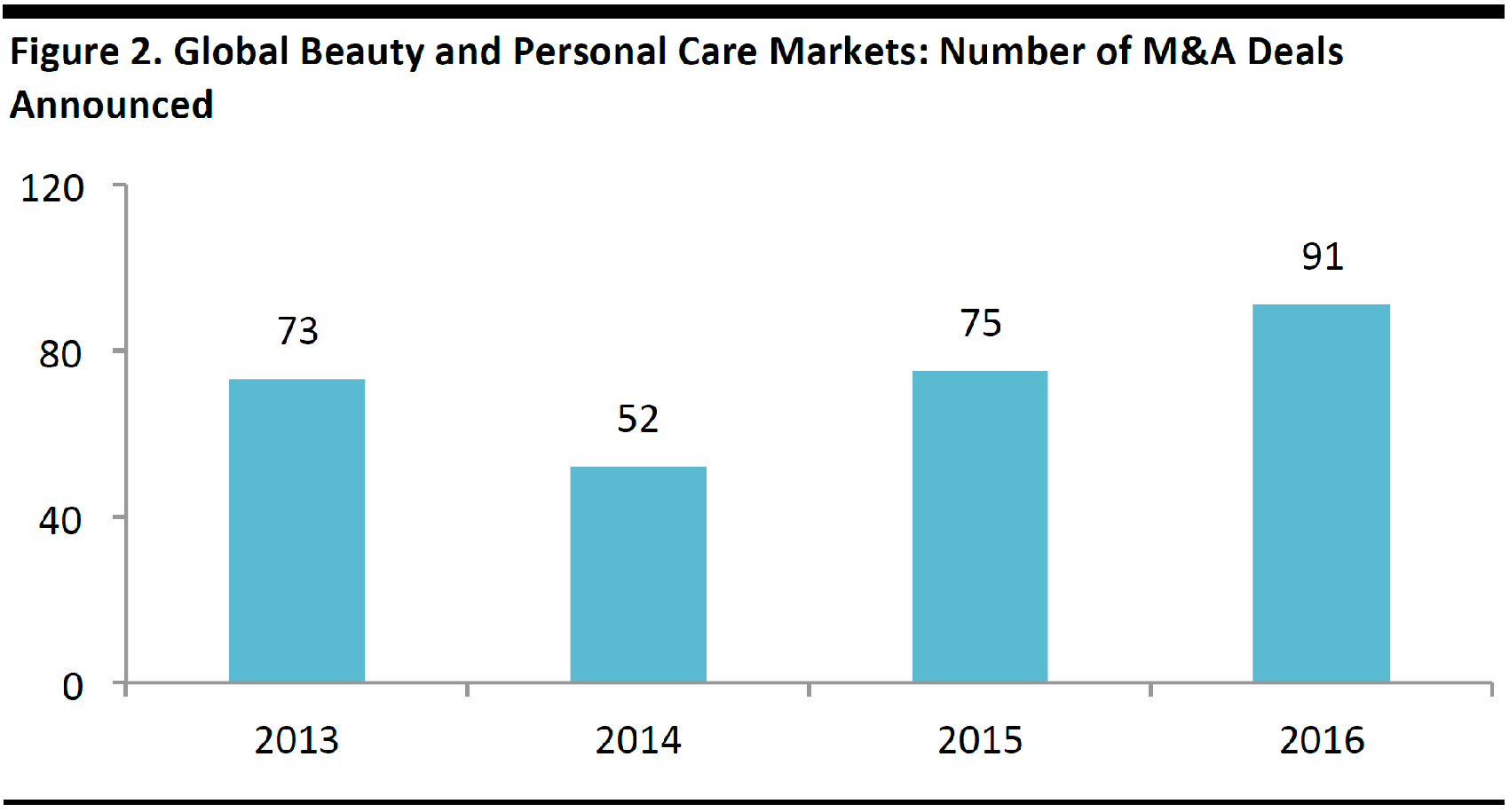

Because intense competition among major beauty companies makes organic growth more difficult, many global companies have chosen to focus on acquisitions as their primary strategy for growth. Acquisitions represent an attractive strategy for gaining market share, particularly in areas that target millennial consumers. As a result, we have seen a healthy level of M&A activity since 2013. There were 91 beauty industry deals announced in 2016 globally, up 25% from 75 deals in 2013.

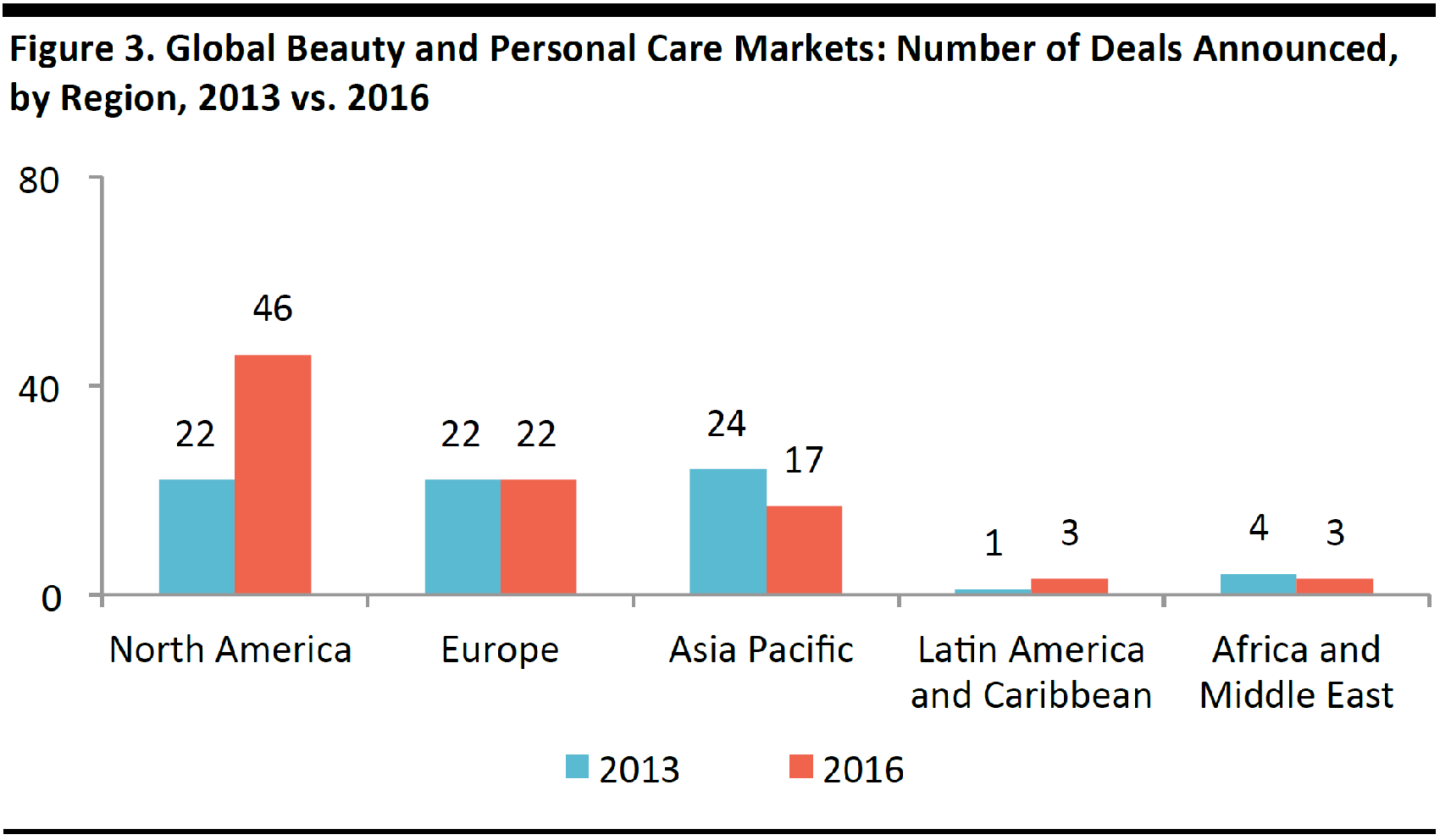

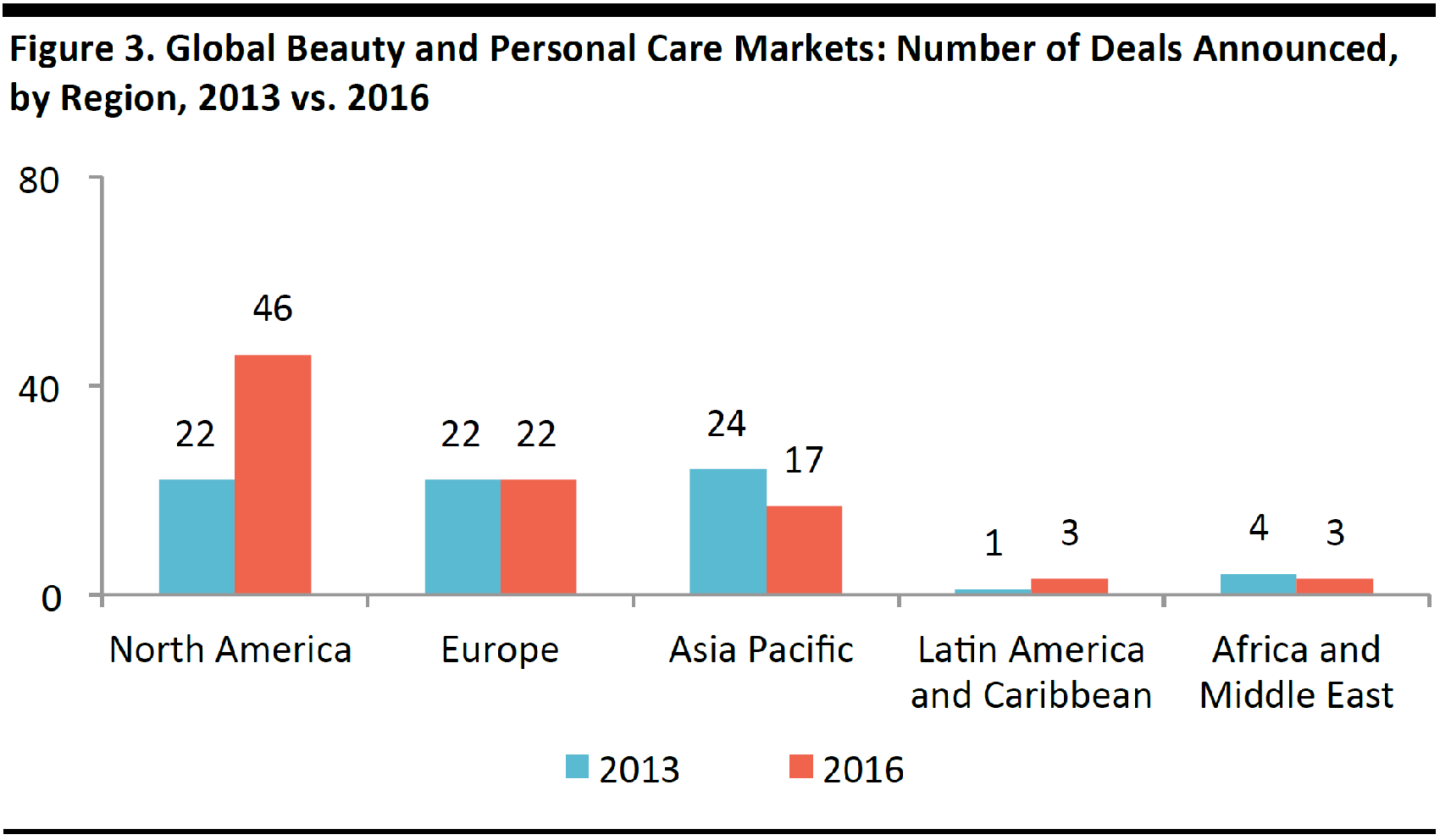

The most active regions for beauty industry M&A are also the largest beauty markets. North America was the most active region in 2016, with 46 announced beauty industry deals, up 40% from 33 in 2015. Europe remained the second-most-active market in 2016, while M&A activity in the Asia-Pacific region grew at the fastest rate last year, reflecting both rising demands for beauty products and notable industry innovation in the region.

Source: S&P Capital IQ/Fung Global Retail & Technology

Small and medium-sized companies have been the most popular targets for strategic and financial acquirers seeking growth potential. About 75% of recent beauty industry deals for which transaction values were disclosed were valued at less than $100 million. Strategic acquirers have been the dominant players in the market, participating in 376 of 411 announced transactions from 2012 through 2016. The largest beauty industry players have been the most active acquirers in the space. Financial buyers have represented a small percentage of active acquirers due to increased competition for deals.

Source: S&P Capital IQ/Fung Global Retail & Technology

Acquisitions Are a Growth Driver for Beauty Companies

Global beauty companies are hunting for growth via acquisitions in high-growth niches of the beauty market such as independent cosmetics brands and sustainable brands. Many of the targets have recorded growth rates in the high double digits in recent years.

Global beauty companies have a long history of acquiring brands in the early-growth stage and benefiting from their high growth potential post-acquisition. For example, L’Oréal acquired color cosmetics company Urban Decay in 2012 for an estimated $350 million. At the time of the acquisition, Urban Decay generated only $130 million in net sales, but the brand helped L’Oréal add offerings to compete in a niche, accessible-luxury market that targets young consumers. By 2016, L’Oréal’s management named Urban Decay as one of three key pillar brands driving its top-performing L’Oréal Luxe division, which reported 6.9% like-for-like yearly growth in 2016.

More recent beauty deals demonstrate global beauty companies’ continued confidence in using acquisition as a growth strategy. L’Oréal acquired IT Cosmetics for $1.2 billion in 2016, thereby adding more than 300 products to the L’OréalLuxe makeup portfolio. At the time of the acquisition announcement, IT Cosmetics had reported $182 million in annual revenue, an increase of 56% year-over-year, and it showed strong potential to drive growth for L’Oréal. Estée Lauder added makeup brands Becca and Too Faced to its brand portfolio in 2016. A Bloomberg article estimates that the two brands saw combined revenue of $340 million and 70% year-over-year growth in 2016. Too Faced posted more than $270 million in annual revenue in 2016.

Source: TooFaced.com

Coty is another prominent example of a beauty company utilizing acquisitions to grow market share. The company has been the most active buyer in the global beauty market and has become the world’s third-largest beauty company through 12 acquisitions in the past 10 years. From 2007 through 2016, Coty almost tripled its annual revenue, growing sales from $3.3 billion to $9 billion.

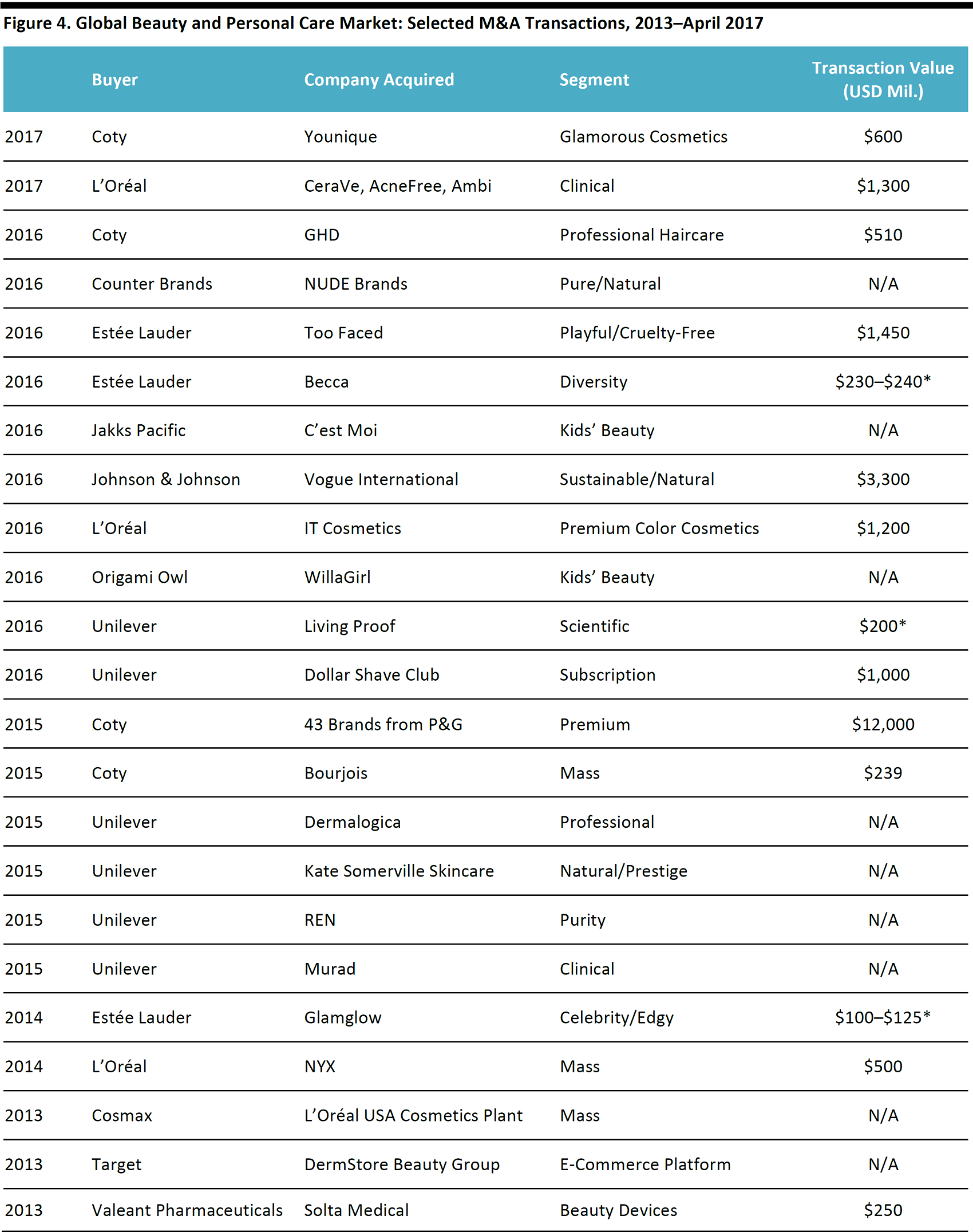

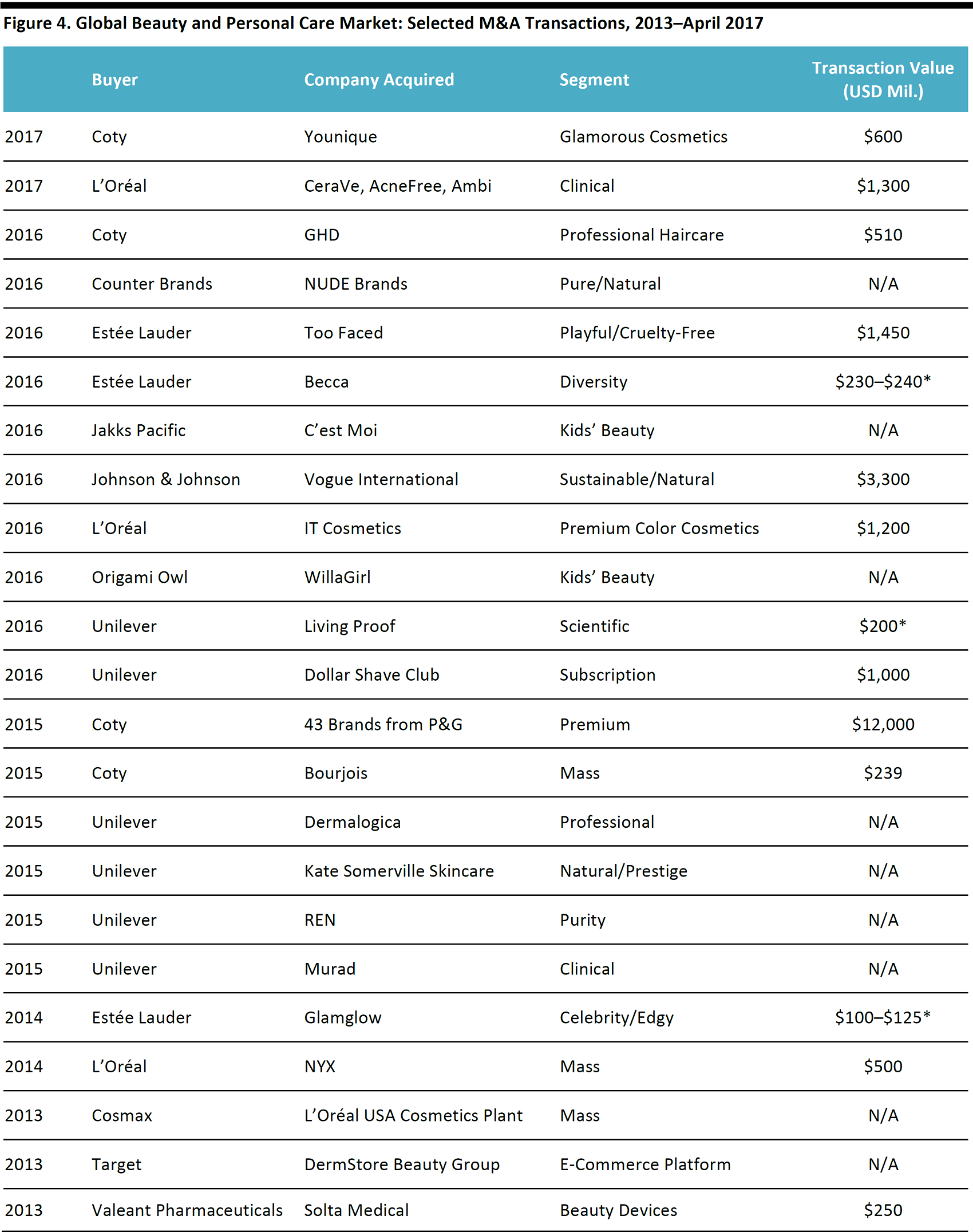

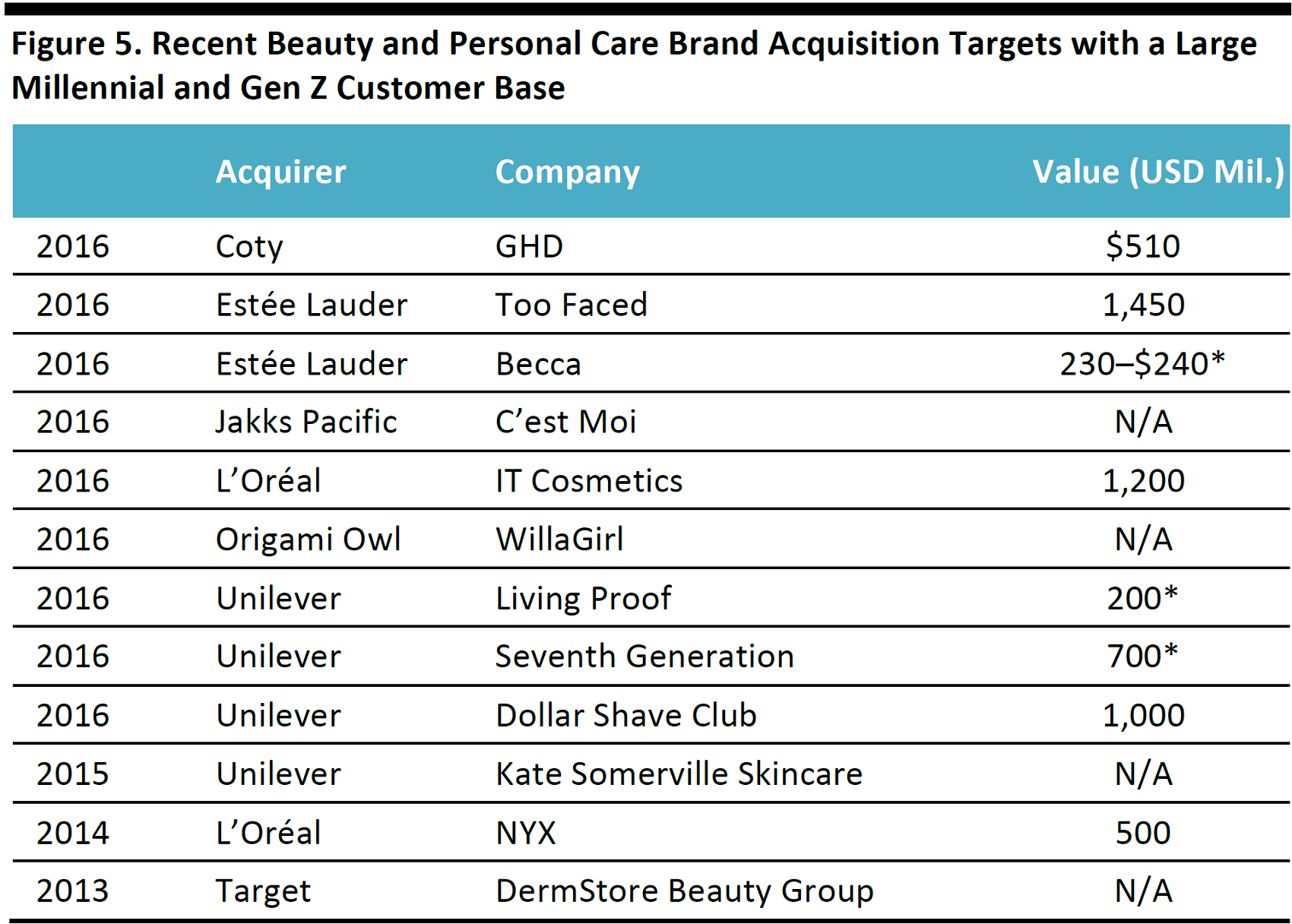

The table below highlights selected recent acquisitions by large beauty and personal care companies seeking high-growth opportunities.

*Third-party estimate

Source: Bloomberg/company reports

Acquisitions Help Beauty Companies Optimize Product Portfolios

Beauty companies make acquisitions to optimize their portfolios or enter new business areas where they see growth opportunities. The additions of Atelier Cologne and IT Cosmetics have helped L’Oréal strengthen its position in the premium beauty market, where its portfolio includes outperforming brands such as Urban Decay and Yves Saint Laurent. In April 2016, Johnson &Johnson added US brand NeoStrata to its outperforming dermocosmetics portfolio, which already included established brands Aveeno and Neutrogena.

Coty has used acquisitions to diversify its business, expanding from its core fragrance business to a balanced, three-pillar portfolio that includes fragrances, skincare and color cosmetics. Following 12acquisitions in 10 years, Coty now has the largest fragrances business in the world, as well as the second-largest professional hair products business and the third-largest color cosmetics business. The company also built a solid skincare brand portfolio through its acquisitions of Del Laboratories, Philosophy, TJoy Holdings and Lena White in recent years.

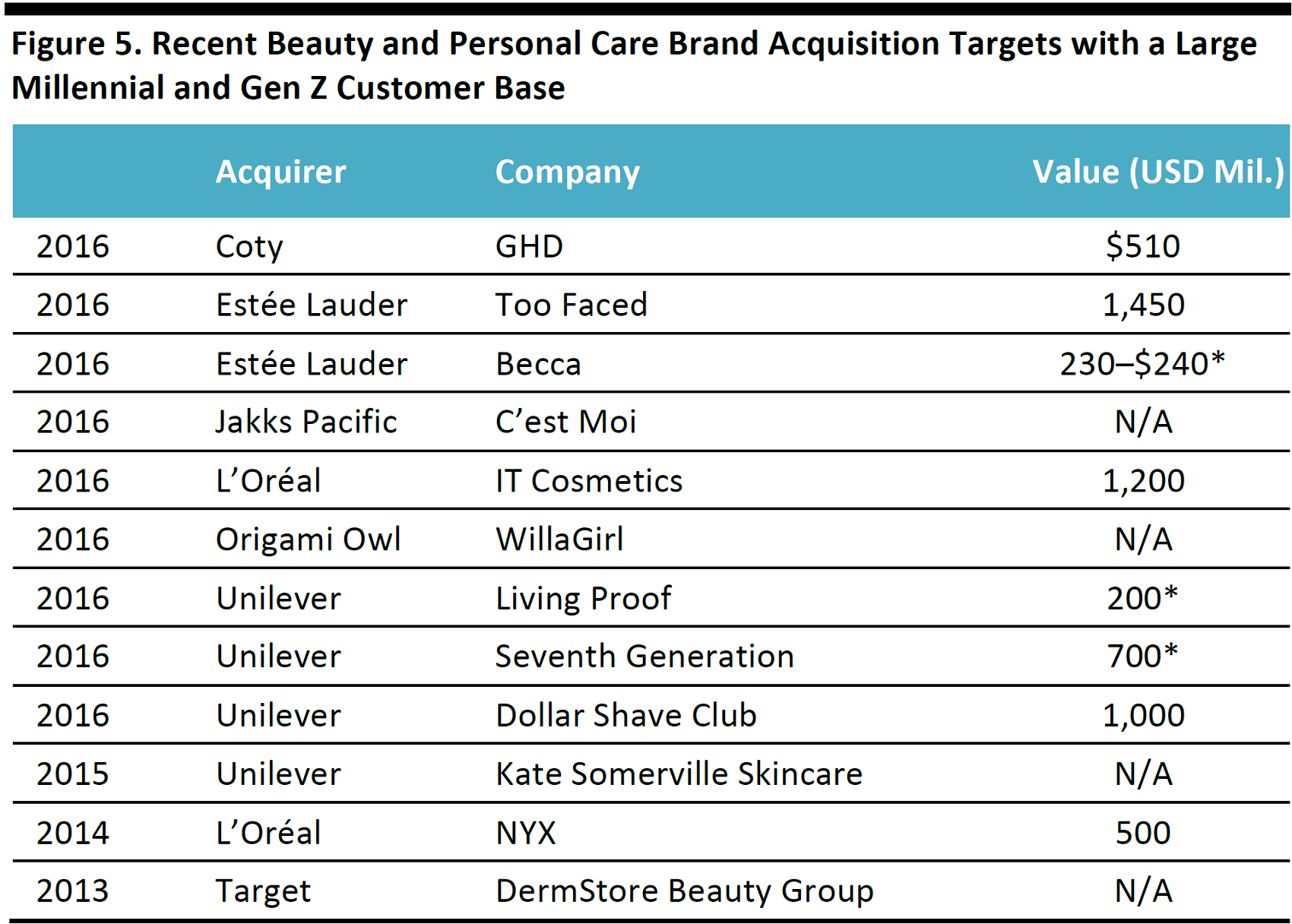

Beauty and Personal Care Companies Tap into Millennial and GenZ Customer Base Through Acquisitions

Beauty companies’ recent M&A activity indicates that the companies are looking to tap into a younger customer base. For example, in 2016, Estée Lauder acquired cosmetics brand Too Faced, 85% of whose customers are under the age of 40. The brand has built up a solid community of young, digitally-savvy customers who often seek recommendations from their peers and from social media influencers. At the time of acquisition, Too Faced had more than7 million Instagram followers and relationships with more than 900 influencers.

Unilever’s acquisition of Seventh Generation, an eco-friendly household and personal care company, demonstrated Unilever’s effort to target millennial and GenZ consumers, who tend to be highly conscious of the environmental and social impact of their consumption. Unilever has also experimented with the subscription model through its acquisition of Dollar Shave Club, a men’s razor subscription e-commerce business that has a strong millennial customer base.

Source: DollarShaveClub.com

*Third-party estimate

Source: Bloomberg/company reports/Fung Global Retail & Technology

Continued M&A in High-Growth Areas Expected

Strong competition for market share among the top beauty companies is expected to continue to drive M&A activity. We see three particular high-growth pockets within the beauty and personal care market as likely to attract more M&A attention: organic skincare brands, South Korean beauty brands and social media-endorsed independent cosmetics brands. These segments have gained traction in recent years and have potential to outperform the market. For example, the global organic beauty and personal care market is expected to grow at a CAGR of 10.2% from 2016 through 2022, according to Allied Market Research. South Korean beauty brands, also known as K-beauty brands, have become a global phenomenon, and have found significant customer bases across the Western world.

On the supply side, there is also a healthy number of emerging beauty brands that could become M&A targets. Below, we cover some potential targets in these high-growth areas.

Organic Skincare and Personal Care Brands

Global beauty companies are likely to acquire organic and natural skincare brands in order to capitalize on the recent health and wellness lifestyle trend. The trend is driving up demand for naturally formulated skincare, as consumers are taking a holistic approach to healthy living that includes choosing natural beauty products. Emerging organic and natural brands that are likely acquisition targets include:

The Honest Company:

The Honest Company: Co-founded in 2011 by actress Jessica Alba, the nontoxic household products company reached $300 million in revenue in 2016 and owns both direct-to-consumer and third-party distribution channels. The company has allegedly been in talks with potential buyers that include Unilever.

Source: Honest.com

Goop:

Goop: A luxury organic skincare line created by Gwyneth Paltrow in 2016 in response to demand for better organic skincare products, Goop offers products that range in price from about$80 to $140. The Goop lifestyle website curated by Paltrow has developed a wide readership, and the Goop skincare line is on track to expand its product offerings and distribution channels, which may create synergies with established beauty companies.

Source: Goop.com

Emerging K-Beauty Brands

The K-beauty wave is expanding well beyond South Korea’s shores. Exports of South Korean cosmetics have been increasing by an average of 36.9% every year since 2011, and reached $2.45 billion in 2015, according to the Korea Customs Service. Last year, South Korea overtook the US and Japan to become the second-largest cosmetics exporter to China after France, with a total export value of $1.1 billion, according to the Ministry of Food and Drug Safety of Korea. Sephora US now offers a collection of K-beauty products that feature popular South Korean skincare routines. The K-beauty phenomenon is driven by cutting-edge product innovation and has a strong digital media presence.

There are limited acquisition opportunities in the K-beauty space for interested buyers because most established brands belong to South Korean beauty conglomerates such as AmorePacific and LG Household & Health Care. However, there are a number of emerging K-beauty startups that could become acquisition targets, including Neogen and COSRX.

Neogen:

Neogen: Founded in 2009, Neogen has been dubbed a rising star by Olive Young, one of the largest beauty retailers in South Korea. The company uses advanced natural science and biotechnology to develop its products. Neogen’s six-core biotechnology is said to help maximize the benefits of natural ingredients. The company has also registered several patents for its technology, covering areas such as natural whitening and antiaging materials, and anti-inflammatory and detoxification medicinal herbs.

Source: NeogenDerma.com.hk

COSRX:

COSRX: Founded in 2014 with a mission to make ingredient-oriented and high-performance cosmetics, COSRX takes a minimalistic approach to skincare by including no unnecessary ingredients in its products. This helps to lower the chance of an allergic reaction for consumers with sensitive skin. The company currently sells its products only online, in order to minimize costs, but it plans to open brick-and-mortar stores by the end of the year, due to customer demand.

Source: Cosrx.co.kr

Social Media-Endorsed Independent Cosmetics Brands

Beauty companies have been increasing their marketing budgets to expand their social media presence, as young beauty shoppers are heavily influenced by social media content. On average, an influencer marketing campaign costs between $25,000 and $50,000, according to a survey by influencer platform Linqia. According to a study by

Forbes, the top 30 social media influencers have a combined 250 million followers and charge an average of $300,000 per social media post.

For mature beauty companies seeking to capture younger beauty shoppers, acquiring brands that have a strong social media presence is important. Recent beauty acquisition targets have outperformed their peers in terms of mentions on social media and overall online presence. Some attractive potential acquisition targets, based on social media mentions and online search visibility, include Anastasia Beverly Hills (ABH) and Makeup Geek.

Anastasia Beverly Hills (ABH):

Anastasia Beverly Hills (ABH): ABH has developed a number of signature brow products that made headlines on social media platforms. The brand has a whopping 13.4 million followers on Instagram. ABH has the highest earned media value (a marketing campaign metric that measures engagement, conversion and sales) on Instagram;it is almost double that of the mature cosmetics brand MAC, according to data from 50,000 influencers collected by Tribe Dynamics. In addition, ABH has accumulated a group of loyal celebrity customers who have endorsed the brand on social media, including Naomi Campbell, Kim Kardashian, Jennifer Lopez, Heidi Klum, Victoria Beckham and Penelope Cruz.

Source: AnastasiaBeverlyHills.com

Makeup Geek:

Makeup Geek: Started by beauty vlogger Marlena Stell in 2012, Makeup Geekgrew from $500,000 in annual revenue to $22 million in five years, largely due to its social media presence. The brand is known for its associated YouTube makeup tutorial videos and direct-to-consumer distribution, which allows customers to save as much as 30%–40%. Makeup Geek’s YouTube channel has more than 1.4 million subscribers. The brand’s strong social media presence and current small size make it a significant acquisition opportunity.

Source: MakeupGeek.com

Conclusion

Acquisitions have proven to be a key growth strategy for mature beauty companies, amid challenges for them to grow their businesses organically. Acquisitions have helped beauty companies to stay relevant to a younger customer base of millennials and Gen Zers. We expect to see much continued M&A activity in the industry, given the current competitive landscape in the industry.

The Honest Company: Co-founded in 2011 by actress Jessica Alba, the nontoxic household products company reached $300 million in revenue in 2016 and owns both direct-to-consumer and third-party distribution channels. The company has allegedly been in talks with potential buyers that include Unilever.

The Honest Company: Co-founded in 2011 by actress Jessica Alba, the nontoxic household products company reached $300 million in revenue in 2016 and owns both direct-to-consumer and third-party distribution channels. The company has allegedly been in talks with potential buyers that include Unilever.

Goop: A luxury organic skincare line created by Gwyneth Paltrow in 2016 in response to demand for better organic skincare products, Goop offers products that range in price from about$80 to $140. The Goop lifestyle website curated by Paltrow has developed a wide readership, and the Goop skincare line is on track to expand its product offerings and distribution channels, which may create synergies with established beauty companies.

Goop: A luxury organic skincare line created by Gwyneth Paltrow in 2016 in response to demand for better organic skincare products, Goop offers products that range in price from about$80 to $140. The Goop lifestyle website curated by Paltrow has developed a wide readership, and the Goop skincare line is on track to expand its product offerings and distribution channels, which may create synergies with established beauty companies.

Neogen: Founded in 2009, Neogen has been dubbed a rising star by Olive Young, one of the largest beauty retailers in South Korea. The company uses advanced natural science and biotechnology to develop its products. Neogen’s six-core biotechnology is said to help maximize the benefits of natural ingredients. The company has also registered several patents for its technology, covering areas such as natural whitening and antiaging materials, and anti-inflammatory and detoxification medicinal herbs.

Neogen: Founded in 2009, Neogen has been dubbed a rising star by Olive Young, one of the largest beauty retailers in South Korea. The company uses advanced natural science and biotechnology to develop its products. Neogen’s six-core biotechnology is said to help maximize the benefits of natural ingredients. The company has also registered several patents for its technology, covering areas such as natural whitening and antiaging materials, and anti-inflammatory and detoxification medicinal herbs.

Makeup Geek: Started by beauty vlogger Marlena Stell in 2012, Makeup Geekgrew from $500,000 in annual revenue to $22 million in five years, largely due to its social media presence. The brand is known for its associated YouTube makeup tutorial videos and direct-to-consumer distribution, which allows customers to save as much as 30%–40%. Makeup Geek’s YouTube channel has more than 1.4 million subscribers. The brand’s strong social media presence and current small size make it a significant acquisition opportunity.

Makeup Geek: Started by beauty vlogger Marlena Stell in 2012, Makeup Geekgrew from $500,000 in annual revenue to $22 million in five years, largely due to its social media presence. The brand is known for its associated YouTube makeup tutorial videos and direct-to-consumer distribution, which allows customers to save as much as 30%–40%. Makeup Geek’s YouTube channel has more than 1.4 million subscribers. The brand’s strong social media presence and current small size make it a significant acquisition opportunity.