DIpil Das

China Retail Sales: December 2021

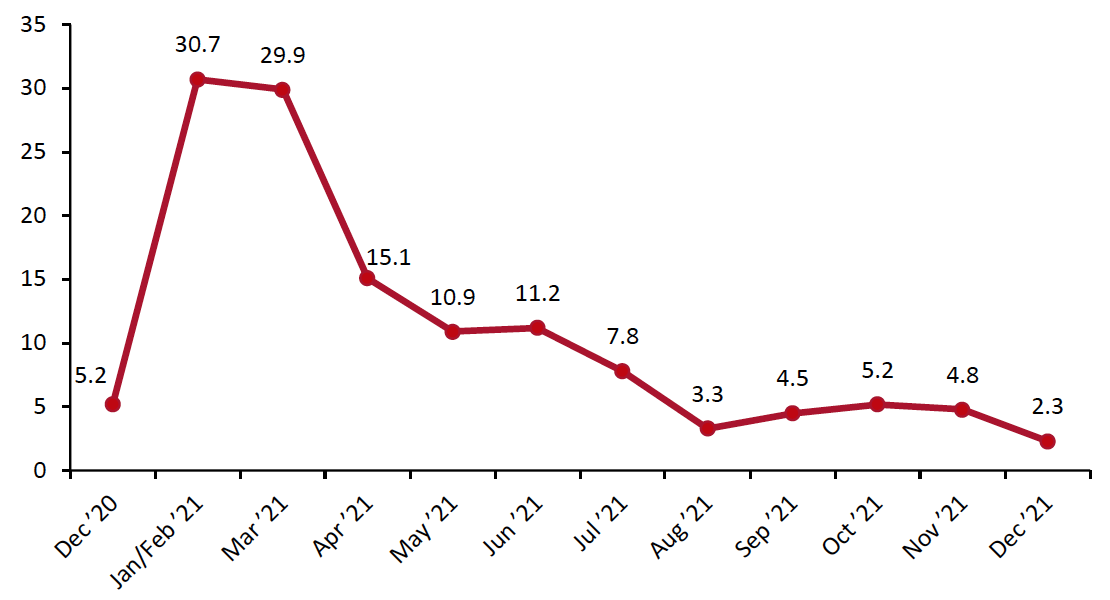

In December, China’s total retail sales growth (ex. food service, incl. automobiles and gasoline) slowed to 2.3% year over year, further indicating that recovery is losing momentum due to the country-wide spread of the new Omicron variant which has led to supply chain bottlenecks. This pace of growth was the lowest since August 2020, when the sector was still recovering from Covid-19 restrictions.

Pre-crisis, in 2019, China’s monthly retail sales were growing by between 7.0% and 9.9% year over year.

- Overall, 2021 retail sales increased by 11.8%, driven by a strong bounce in the first half as China annualized its early-2020 lockdowns. Versus 2019, total retail sales were up 7.9% in 2021.

China’s zero-tolerance approach to Covid-19 infections poses headwinds to future retail growth. Lockdowns in some areas will negatively impact travel for the Chinese New Year on February 1, in turn impacting on retail spending.

Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_139785" align="aligncenter" width="700"]

January and February figures are reported together

January and February figures are reported togetherSource: National Bureau of Statistics/Coresight Research[/caption] Retail Sales Growth by Sector

Five sectors saw negative year-over-year growth in December and sales rose at a slower pace than any other month this year for most of the remaining sectors:

- School, office supplies and computer specialists’ sales continue to be strong in 2021. In December, school and office supplies saw sales growth of 7.4% compared to 2020. Compared to 2019, school and office supplies sales were up 25.2%

- In December, the apparel and footwear sector posted its fifth consecutive month of sales declines. The sales decline accelerated in December compared to November 2021. The apparel and footwear category posted a 3.0% sales decline compared to December 2020. On a two-year basis, apparel and footwear sales declined by 0.2%.

- Auto retailers’ sales continue to feel the impacts of the global microchip shortage. Auto sales declined by 7.4% compared to December 2020. On a two-year basis, auto sales were up 5.0%.

- Furniture specialists’ sales again declined in December after seeing accelerated growth for the first time in four months in November. This month, furniture sales declined by 3.1% in December, down from November’s 6.1% sales growth. On a two-year basis, sales remained down 17.1%.

- The food sector showed continued strong performance in December, exhibiting 11.3% year-over-year growth. On a two-year basis, food retail sales increased by 13.5%. Furthermore, beverage sales grew 12.6% from December 2020, and notably grew 26.0% when compared to 2019.

- The beauty sector continued to see gains in December, seeing sales growth accelerate 2.5% compared to December 2020, but down from November’s 8.2% year-over-year growth. On a two-year basis, beauty sales grew 22.0% compared to December 2019.

- Construction and decoration sales declined in December. Compared to December 2020, construction and decoration sales grew 7.5%. On a two-year basis, sales declined by 3.8%.

- Communication equipment retailers’ sales increased only marginally, by 0.3% year over year. Still, the sector remains strong compared to 2019, growing 25.7% on a two-year basis.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY% Change and Two-Year % Change [wpdatatable id=1619]

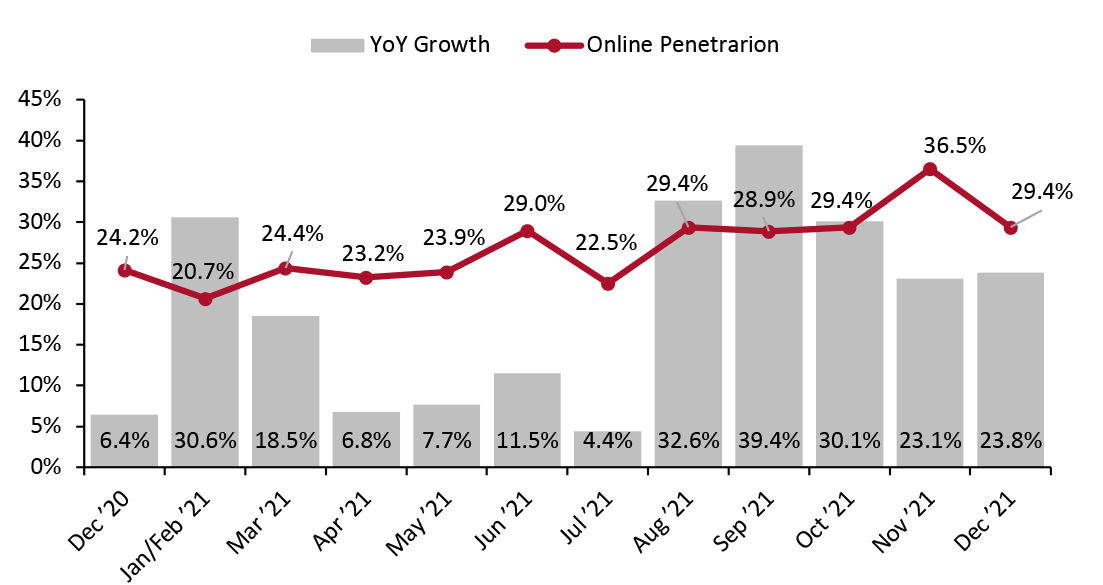

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics Online Retail Sales Account for 29.4% of All Retail Sales In December, online retail sales growth accelerated to 23.8% year over year after three consecutive months of deceleration. The channel accounted for 29.4% of total retail sales in the period, remaining in line with September and October levels of online sales penetration in 2021. Elevated online penetration in the last few months is likely related to strict Covid-19 restrictions enforced by the government to control infections. In December specifically, online sales penetration was likely boosted by the strict restrictions on movement imposed amid the spread of the new Omicron variant. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that exclude food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales (YoY % Change) as a Proportion of Total Retail Sales (%) (incl. Automobiles, Gas and Food Service) [caption id="attachment_139745" align="aligncenter" width="700"]

Online retail sales include food service

Online retail sales include food service January and February figures are reported together

Source: National Bureau of Statistics [/caption]