DIpil Das

In the US Census Bureau’s final 2020 retail sales report, it reported that US retail sales saw strong year-over-year growth as consumers continued to shift spending away from services and experiences to retail goods.

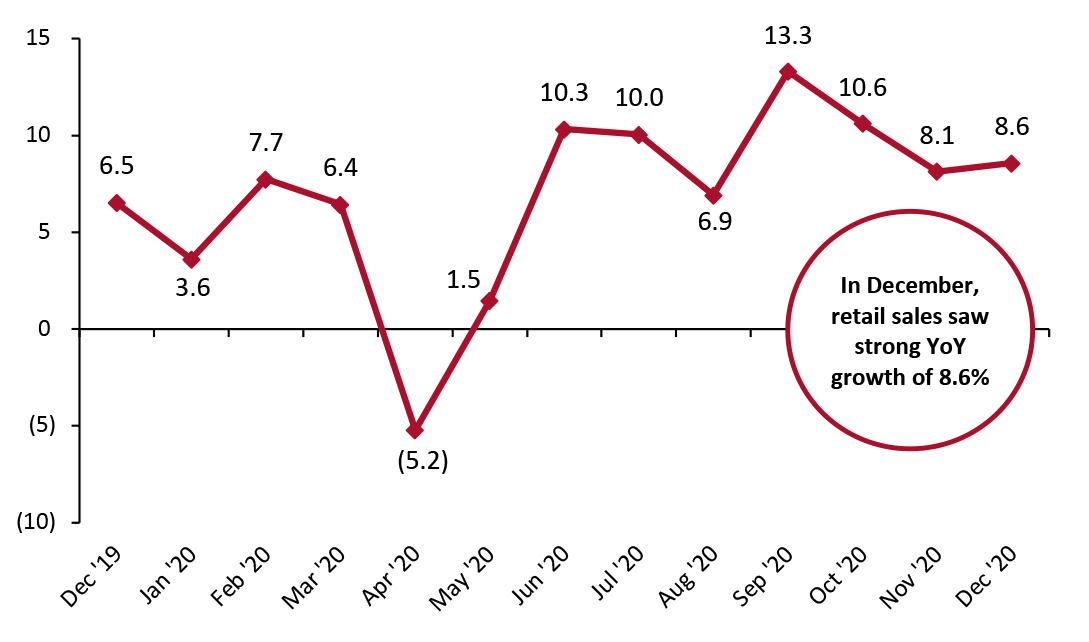

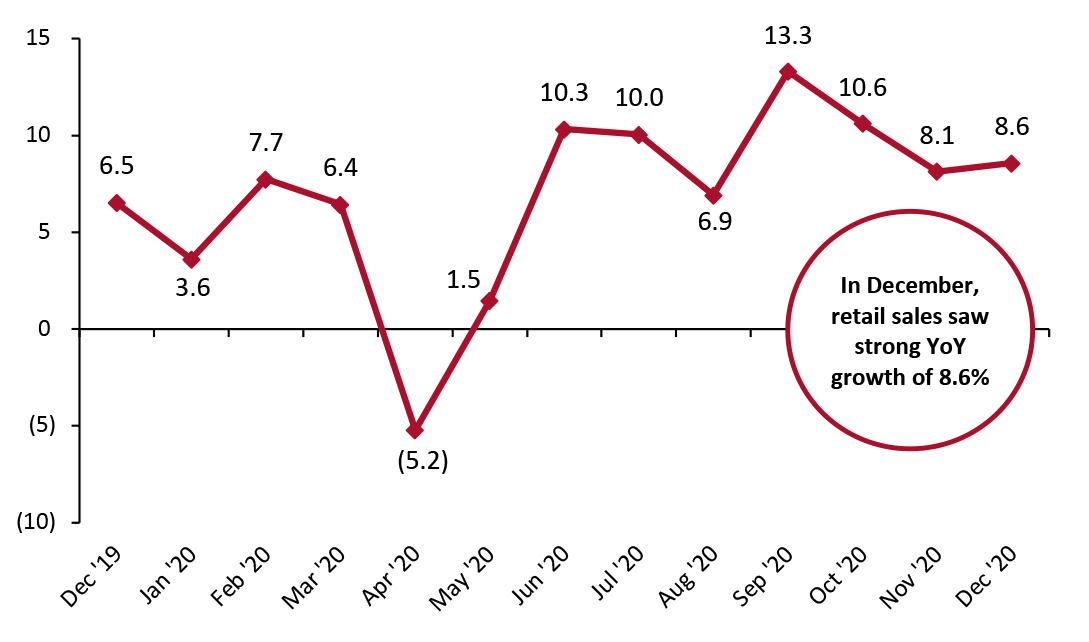

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric stood at 8.6% in December, versus a revised 8.1% in November. Nonstore retailers again saw strong growth, climbing 21.3% year over year, slightly slower growth than its more than 27% rise in November. The other sectors that saw double-digit year-over-year growth—home improvement (21.9%) and sporting goods (17.2%)—improved on their already strong growth from November. Apparel and electronics were among the hardest hit categories in December, each seeing sales decline by greater than 12% year over year.

Overall holiday-quarter retail sales grew 9.1% year over year, outpacing even our estimate of 5% growth in the holiday quarter, which was one of the most optimistic projections publicly released by a research or consulting firm.

Overall, 2020 retail sales grew 6.9%—very strong growth in light of the industry’s early struggles amid the Covid-19 pandemic, with sales having fallen more than 5% year over year in April.

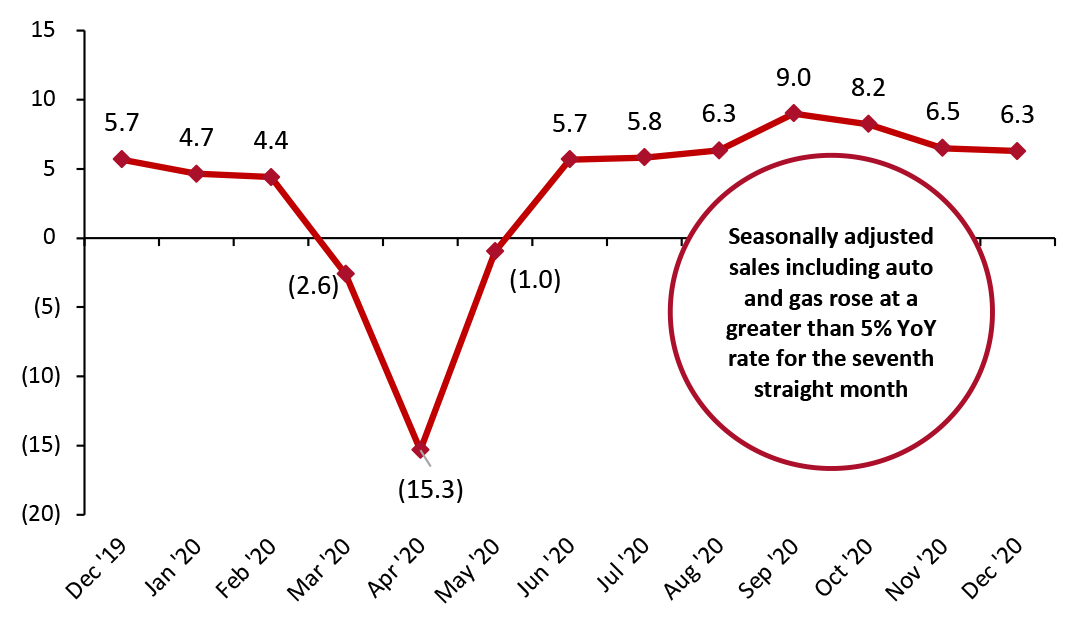

Figure 1. US Total Retail Sales ex Gasoline and Automobiles: YoY % Change [caption id="attachment_121921" align="aligncenter" width="725"] Data are not seasonally adjusted

Data are not seasonally adjusted

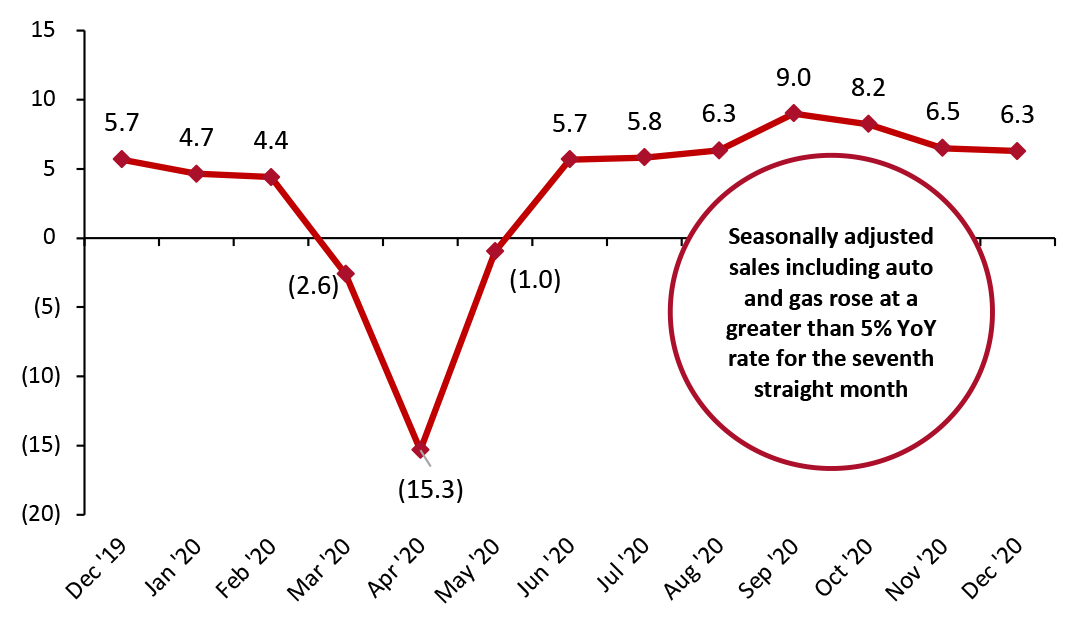

Source: US Census Bureau/Coresight Research [/caption] Seasonally adjusting retail sales data and including automobiles and gasoline paints a similarly positive picture of growth over the past several months, continuing into December, as shown in the figure below.

Figure 2. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change [caption id="attachment_121922" align="aligncenter" width="725"] Data are seasonally adjusted

Data are seasonally adjusted

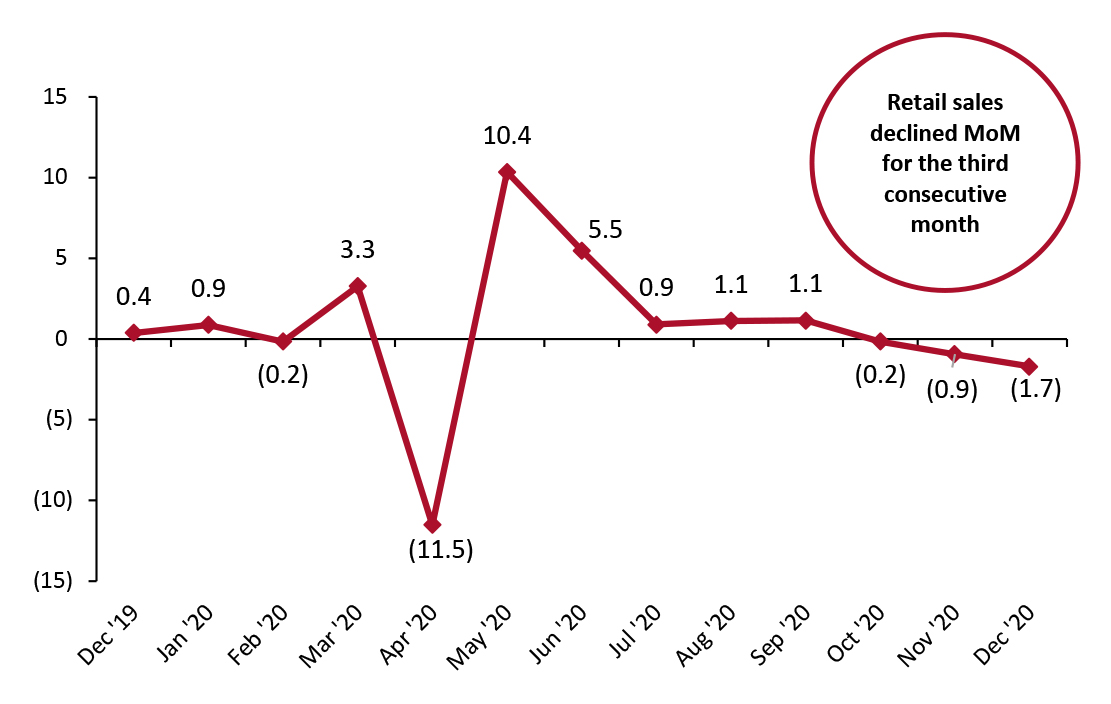

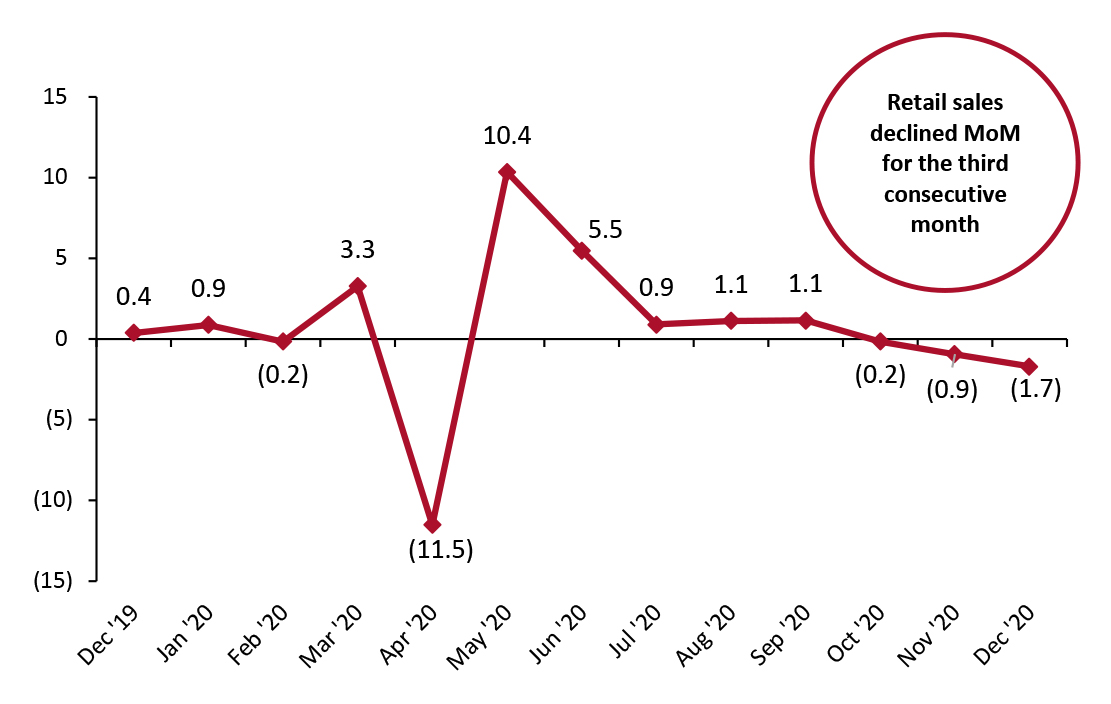

Source: US Census Bureau/Coresight Research [/caption] Adjusted Retail Sales Decrease Slightly Month over Month Seasonally adjusted retail sales excluding gasoline and automobiles declined on a month-over-month basis. December sales were down 1.7% from November, marking the third consecutive month of a deepening decline (see Figure 3). While strong year-over-year growth is encouraging, the monthly comparisons indicate that the positive impact on retail sales of a shift in consumer spending from experiences to goods amid the Covid-19 pandemic may have peaked.

Figure 3. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_121923" align="aligncenter" width="725"] Data are seasonally adjusted

Data are seasonally adjusted

Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Several sectors saw strong year-over-year sales growth:

Figure 4. US Total Retail Sales, by Sector: YoY % Change [wpdatatable id=693 table_view=regular]

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research

Figure 1. US Total Retail Sales ex Gasoline and Automobiles: YoY % Change [caption id="attachment_121921" align="aligncenter" width="725"]

Data are not seasonally adjusted

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Seasonally adjusting retail sales data and including automobiles and gasoline paints a similarly positive picture of growth over the past several months, continuing into December, as shown in the figure below.

Figure 2. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change [caption id="attachment_121922" align="aligncenter" width="725"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Adjusted Retail Sales Decrease Slightly Month over Month Seasonally adjusted retail sales excluding gasoline and automobiles declined on a month-over-month basis. December sales were down 1.7% from November, marking the third consecutive month of a deepening decline (see Figure 3). While strong year-over-year growth is encouraging, the monthly comparisons indicate that the positive impact on retail sales of a shift in consumer spending from experiences to goods amid the Covid-19 pandemic may have peaked.

Figure 3. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_121923" align="aligncenter" width="725"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Several sectors saw strong year-over-year sales growth:

- Home-improvement stores (building- material and garden-supply retailers) again saw strong growth, with sales jumping 21.9% year over year following November’s strong growth of 16.1%. A low interest rate has encouraged more consumers to buy houses this year, buoying sales, and people spending more time at home due to the pandemic appear to be continuing to focus on home-improvement projects. The continued impressive growth confirms our projection that home-improvement retailers would be the fastest-growing store-based nonfood sector in 2020.

- Sports and hobby goods retailers saw a 17.2% increase versus November’s revised 12.5% growth, continuing a demand for items like at-home fitness equipment. Our latest survey findings (see our US Consumer Tracker) also indicate a steady increase in consumers buying sporting equipment.

- Nonstore retailers saw slightly disappointing growth in December, rising 21.3% year over year but falling short of November’s 27.2% growth. This may be partly attributed to many online retailers’ fulfillment and stocking capacity constraints during the holiday season leading to some consumers purchasing fewer gifts online than they otherwise might have, as products may have been out of stock or not deliverable by Christmas. This sector also includes online sales from some store-based retailers that separate this business from their store-based operations.

- Grocery stores saw strong growth of 9.6% in December—remaining slightly below the overall food sector growth of 10.7% but backing up our assertion that strong grocery sales would help buoy retail sales in the holiday quarter.

- Health and personal care stores saw sales increase by 7.3% in December, accelerating from November’s 3.3% uptick.

- Overall, general merchandise stores saw sales fall 0.7%, down from November’s 0.6% growth. However, the sector was weighed down by the sharp decline in sales seen by department stores (see below)—excluding department stores, the general merchandise sector saw sales growth of 6.0% in December.

- Furniture and home-furnishing stores saw 5.3% growth, bouncing back from a 1.0% decline in November.

- Clothing store sales decreased by 12.1% in December—although this is a slower decline than November’s 18.9% drop.

- Sales at department stores (a subset of general merchandise stores and weighted toward apparel) declined by 22.6% versus November’s 19.8% fall.

- Electronics and appliance store sales declined at an even faster pace than apparel in December, down 15.6% year over year versus a 12.9% decline in November.

Figure 4. US Total Retail Sales, by Sector: YoY % Change [wpdatatable id=693 table_view=regular]

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research