DIpil Das

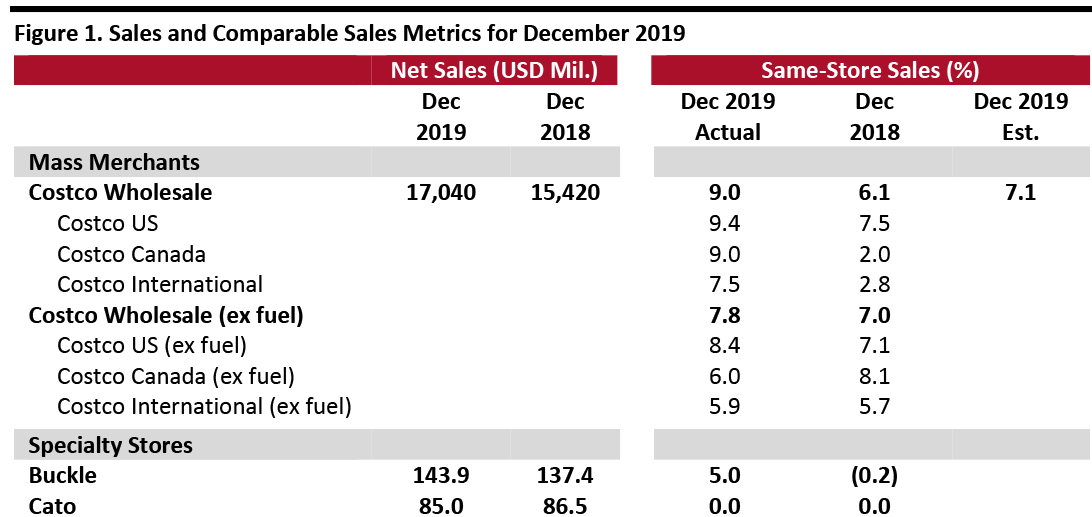

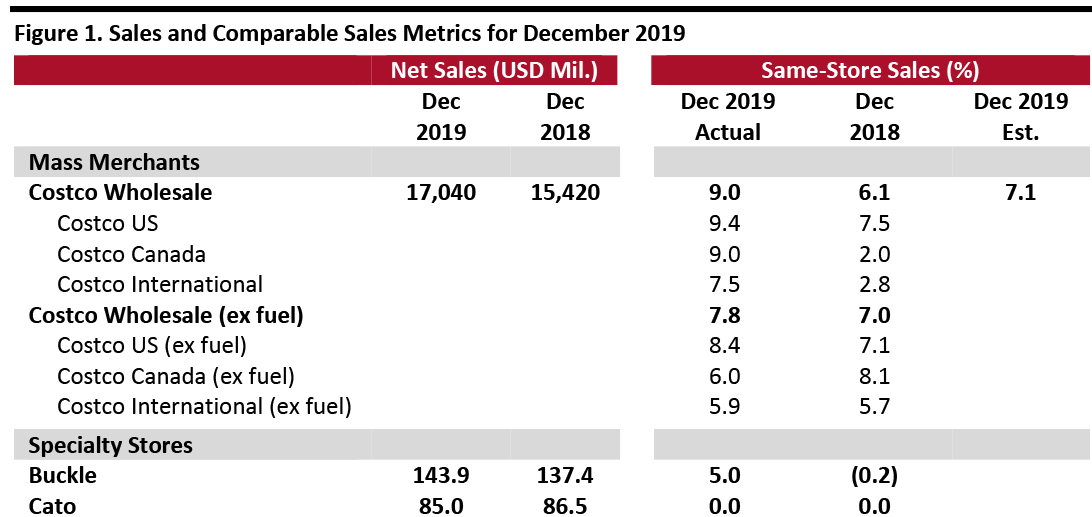

[caption id="attachment_102275" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Costco Comps Growth Accelerates, Online Comps Surge

- In December (formally, the five weeks ended January 5), Costco grew global same-store sales 9.0% year over year, faster than November’s 5.3% growth and 190 basis points above the consensus estimate recorded by StreetAccount. Ex fuel, global comps were up 7.8% in December.

- Costco online comparable sales surged 43.1% in December following November’s 3.6% decline. Growth was driven by a later Thanksgiving, Black Friday and Cyber Monday, all of which fell a week later in 2019 than in 2018, pushing Cyber Monday and its revenues into December.

- Ex fuel, Costco US comps were up 8.4% in December, following November’s 4.3% growth. Results were strongest in Texas, San Diego and US Midwest. Internationally, Costco saw strong sales growth in Australia, Taiwan and Mexico.

- Currency fluctuations positively impacted international comps by about 50 basis points (bps) overall, with Canada same-store sales growth enjoying a 230 bps foreign exchange boost while the company’s “other international” segment got a 140 bps increase.

- Cannibalization from newly opened locations negatively impacted US comps by about 20 bps and other international segments by 130 bps. Overall, cannibalization negatively impacted comparable sales by 30 bps.

- In the merchandise segment, excluding currency effects, comps for food and sundries were positive mid-single digits: liquor, candy and sundries showed the strongest results. Hardlines posted comps in the positive mid-teens: Toys and seasonal, sporting goods, garden and majors departments performed strongly. Softlines grew mid-single digits: Domestics, jewelry, apparel and housewares showed strong performance.

- Fresh-food comparable sales were up mid- to high-single digits, with service deli and meat performing better than other departments.

- In the ancillary businesses, gas, hearing aids and pharmacy saw the strongest comp sales increases.

- Gasoline price inflation positively impacted total comps by about 80 bps, with the overall average selling price increasing to $2.76 per gallon this year from $2.55 last year.

Buckle Comps Increase, Men’s and Women’s Segments Perform Well

- Buckle’s comparable sales increased 5.0% year over year in December (the five weeks ended January 4) after posting a 1.6% decline in November. December net sales increased 4.7% year over year after November’s 1.8% decline.

- The company said December’s total sales and comps were positively impacted by the late Thanksgiving.

- By business segment, total sales in men’s were up 5.0% year over year even though price points were down by about 2.5%. The men’s segment accounted for approximately 59.5% of total sales in December 2019 versus 59.0% in December 2018.

- Total sales in the women’s segment were up 3.5% year over year, while price points were down about 1.5%. The women’s segment accounted for 40.5% of total monthly sales in December 2019 versus 41.0% in December 2018.

- By product type, accessories sales were up 8.5% year over year in December and accounted for 10.5% of total sales. Footwear sales were up 32.0% year over year and accounted for 8.5% of total sales. Average accessory price points slipped about 5.5% while average footwear price points were down some 10.5%.

- December units per transaction increased about 2.5%.

Cato Same-Store Sales Growth Remains Flat

- Cato’s comparable sales were flat in December (the five weeks ended January 4), compared to a 2.0% increase in November. Cato’s total sales slipped 2.0% year over year to $85.0 million in December following November’s 1.0% fall.

- CEO John Cato said “December same store sales were below our current trend.”

- As of January 4, 2020, the company operated 1,281 stores in 31 states, down from 1,316 stores in 33 states as of January 5, 2019.